Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WILLIAM LYON HOMES | d566144d8k.htm |

| EX-99.1 - EX-99.1 - WILLIAM LYON HOMES | d566144dex991.htm |

Board of Directors Meeting Q3 2017 2018 Q2 Earnings Call July 31, 2018, 9:00 am PT Exhibit 99.2

Forward Looking Statements and Non-GAAP Information Certain statements contained in this presentation, in the Company’s press release and the accompanying comments during our conference call that are not historical information may constitute “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995, including, but not limited to, forward-looking statements related to: anticipated pre-tax income, gross margin performance, backlog conversion rates, operating and financial results for the third quarter of 2018 and full year 2018 and beyond, community count growth and project performance, market and industry trends, the continued housing market recovery, average sale price of homes to be closed in various periods, SG&A percentage, future cash needs and liquidity, minority interest from our homebuilding joint ventures, leverage ratios and reduction strategies, land acquisition spending, financial services and ancillary business performance and strategies; the anticipated benefits to be realized from the RSI acquisition; the anticipated financial or operational performance resulting from the RSI Communities transaction, and estimated new home deliveries, home sales revenue and community count on a combined Company basis. The forward-looking statements involve risks and uncertainties and actual results may differ materially from those projected or implied. The Company makes no commitment, and disclaims any duty, to update or revise any forward-looking statements to reflect future events or changes in these expectations. Further, certain forward-looking statements are based on assumptions of future events which may not prove to be accurate. Factors that may impact such forward-looking statements include, among others: the Company’s ability to successfully integrate RSI Communities’ homebuilding operations with its existing operations; any adverse effect on the Company’s, or RSI Communities’, business operations following the acquisition; adverse weather conditions; the availability of labor and homebuilding materials and increased construction cycle times; the availability and timing of mortgage financing; our financial leverage and level of indebtedness and any inability to comply with financial and other covenants under our debt instruments; continued volatility and worsening in general economic conditions either internationally, nationally or in regions in which we operate; increased housing supply in our markets; affordability pressures; increased outside broker costs; increased costs of homebuilding materials; changes in governmental laws and regulations and compliance, increased costs, fees and delays associated therewith; government actions, policies, programs and regulations directed at or affecting the housing market (including the Tax Cuts and Jobs Act (“TCJA”), the Dodd-Frank Act, tax benefits associated with purchasing and owning a home, and the standards, fees and size limits applicable to the purchase or insuring of mortgage loans by government-sponsored enterprises and government agencies), the homebuilding industry, or construction activities; changes in existing tax laws or enacted corporate income tax rates, including pursuant to the TCJA; worsening in markets for residential housing; the impact of construction defect, product liability and home warranty claims, including the adequacy of self-insurance accruals, and the applicability and sufficiency of our insurance coverage; defects in manufactured products or other homebuilding materials; decline in real estate values resulting in impairment of our real estate assets; volatility in the banking industry, credit and capital markets; restraints on foreign investment; terrorism or other hostilities involving the United States and other geopolitical risks; building moratorium or “slow-growth” or “no-growth” initiatives that could be implemented in states in which we operate; changes in mortgage and other interest rates; conditions in the capital, credit and financial markets, including mortgage lending standards and the availability of mortgage financing; changes in generally accepted accounting principles or interpretations of those principles; competition for home sales from other sellers of new and resale homes; cancellations and our ability to realize our backlog; the occurrence of events such as landslides, soil subsidence and earthquakes that are uninsurable, not economically insurable or not subject to effective indemnification agreements; limitations on our ability to utilize our tax attributes; whether an ownership change occurred that could, under certain circumstances, have resulted in the limitation of our ability to offset prior years’ taxable income with net operating losses; the timing of receipt of regulatory approvals and the opening of projects; the availability and cost of land for future development; and additional factors discussed under the sections captioned “Risk Factors” included in our annual and quarterly reports filed with the Securities and Exchange Commission. The foregoing list is not exhaustive. New risk factors may emerge from time to time and it is not possible for management to predict all such risk factors or to assess the impact of such risk factors on our business. This presentation contains certain supplemental financial measures that are not calculated pursuant to U.S. GAAP. These non-GAAP measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. A reconciliation of non-GAAP measures to GAAP measures is contained in the Appendix to this presentation. A copy of the press release reporting the Company’s financial results for the three months ended June 30, 2018 is available on the Company's website at www.lyonhomes.com.

Management Presenters William H. Lyon Chairman of the Board and Executive Chairman Matthew R. Zaist President and Chief Executive Officer Colin T. Severn Senior Vice President and Chief Financial Officer

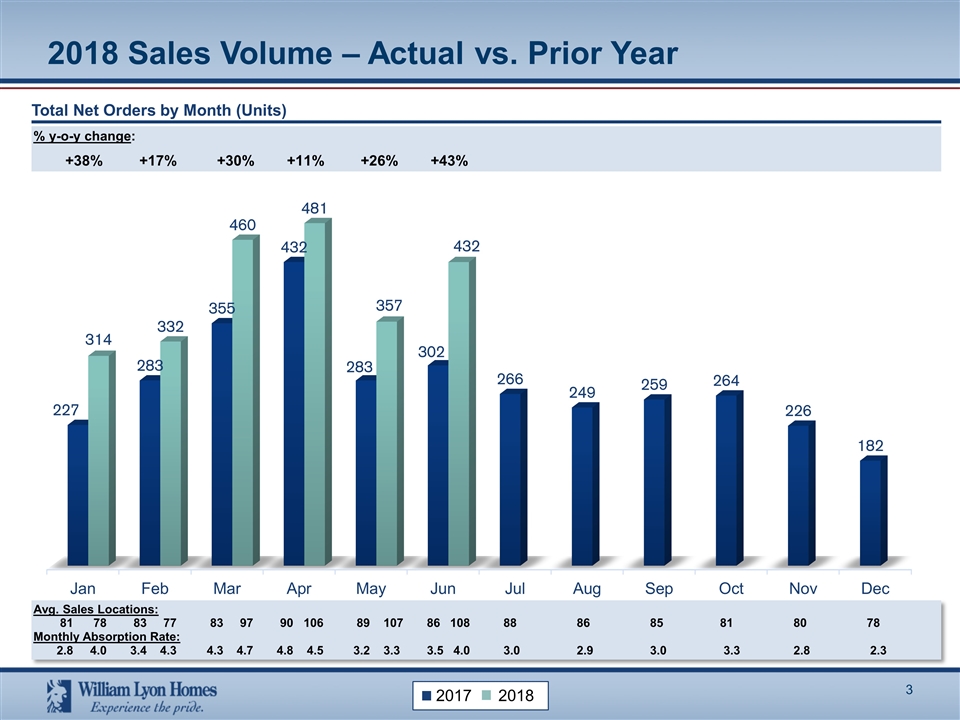

2018 Sales Volume – Actual vs. Prior Year Total Net Orders by Month (Units) % y-o-y change: +38% +17% +30% +11% +26% +43% Avg. Sales Locations: 81 78 83 77 83 97 90 106 89 107 86 108 88 86 85 81 80 78 Monthly Absorption Rate: 2.8 4.0 3.4 4.3 4.3 4.7 4.8 4.5 3.2 3.3 3.5 4.0 3.0 2.9 3.0 3.3 2.8 2.3 2017 2018

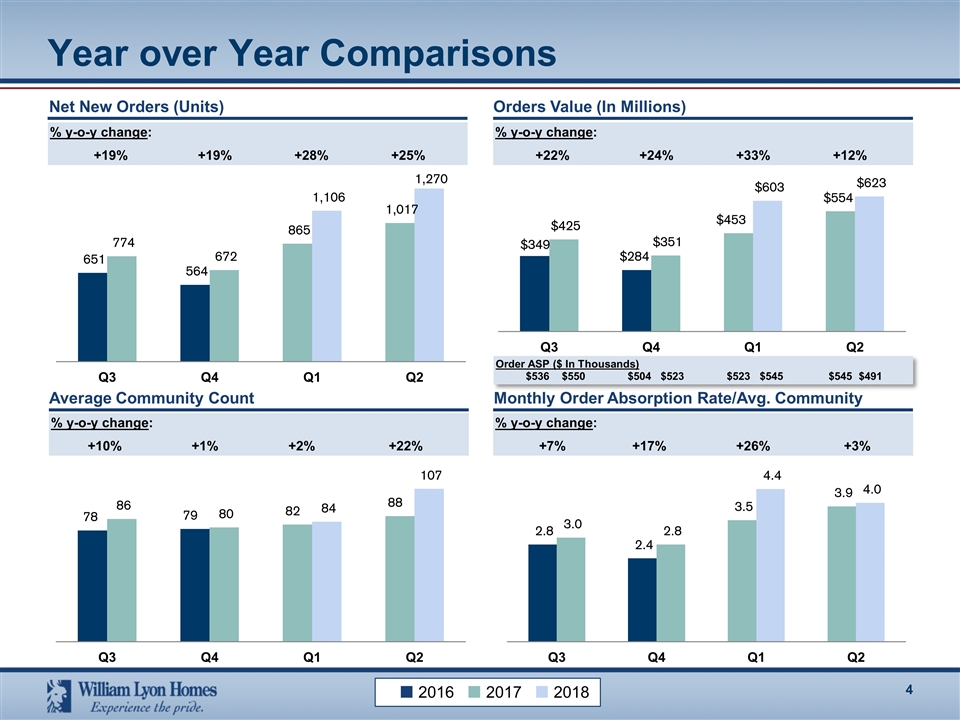

Year over Year Comparisons % y-o-y change: +19% +19% +28% +25% % y-o-y change: +10% +1% +2% +22% % y-o-y change: +7% +17% +26% +3% Net New Orders (Units) Orders Value (In Millions) Average Community Count Monthly Order Absorption Rate/Avg. Community % y-o-y change: +22% +24% +33% +12% Order ASP ($ In Thousands) $536 $550 $504 $523 $523 $545 $545 $491 ¢ 2016 ¢ 2017 ¢ 2018

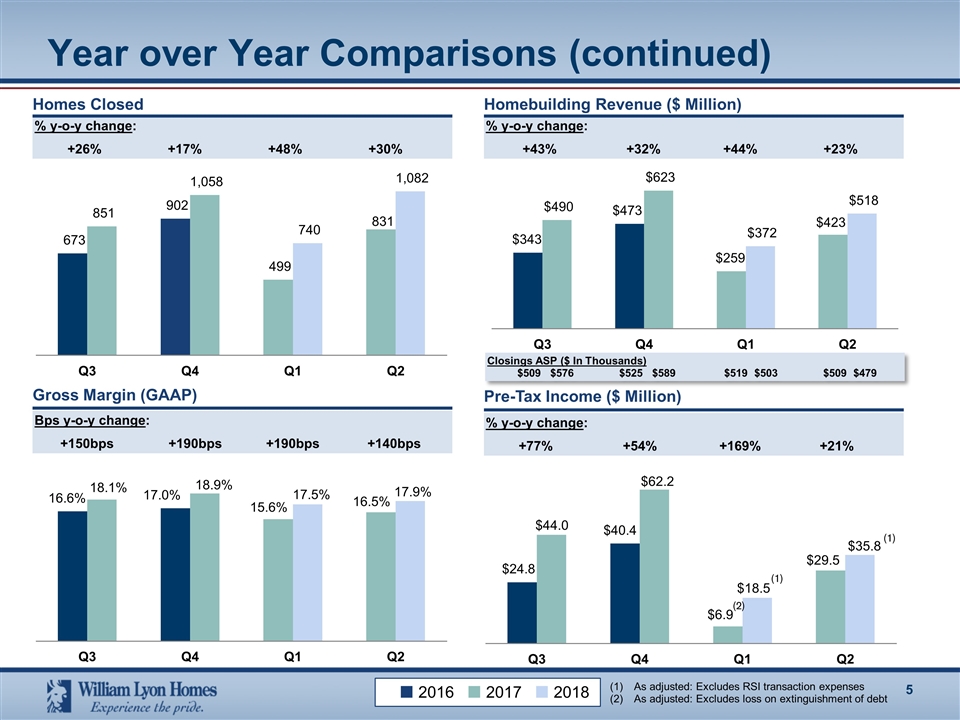

% y-o-y change: +43% +32% +44% +23% Year over Year Comparisons (continued) % y-o-y change: +26% +17% +48% +30% Homes Closed Homebuilding Revenue ($ Million) Bps y-o-y change: +150bps +190bps +190bps +140bps Gross Margin (GAAP) Closings ASP ($ In Thousands) $509 $576 $525 $589 $519 $503 $509 $479 ¢ 2016 ¢ 2017 ¢ 2018 % y-o-y change: +77% +54% +169% +21% Pre-Tax Income ($ Million) As adjusted: Excludes RSI transaction expenses As adjusted: Excludes loss on extinguishment of debt (1) (2) (1)

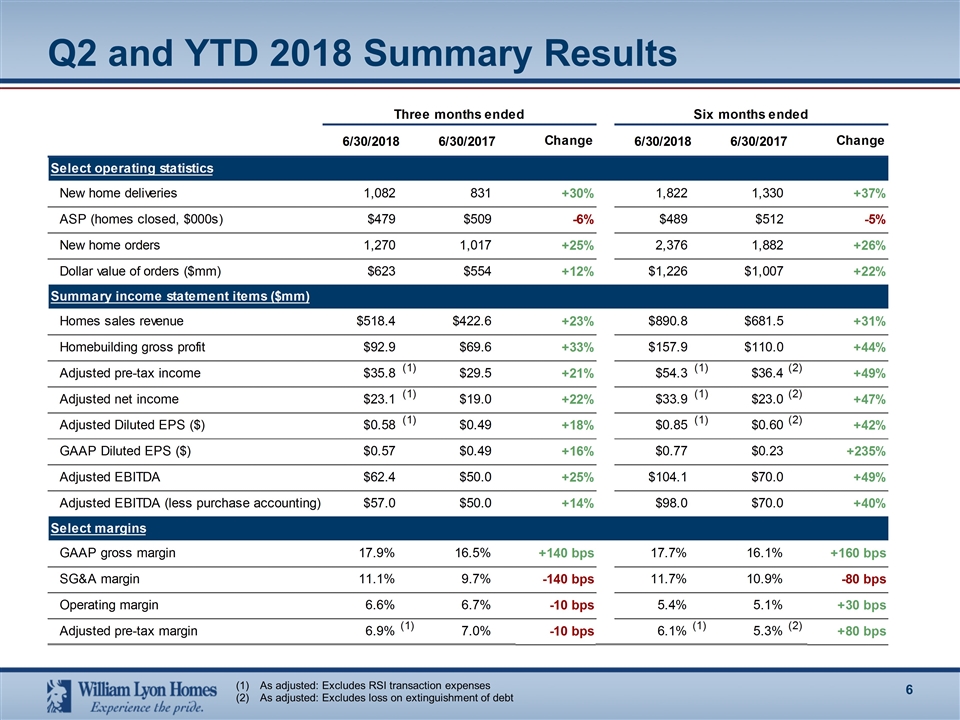

Q2 and YTD 2018 Summary Results As adjusted: Excludes RSI transaction expenses As adjusted: Excludes loss on extinguishment of debt

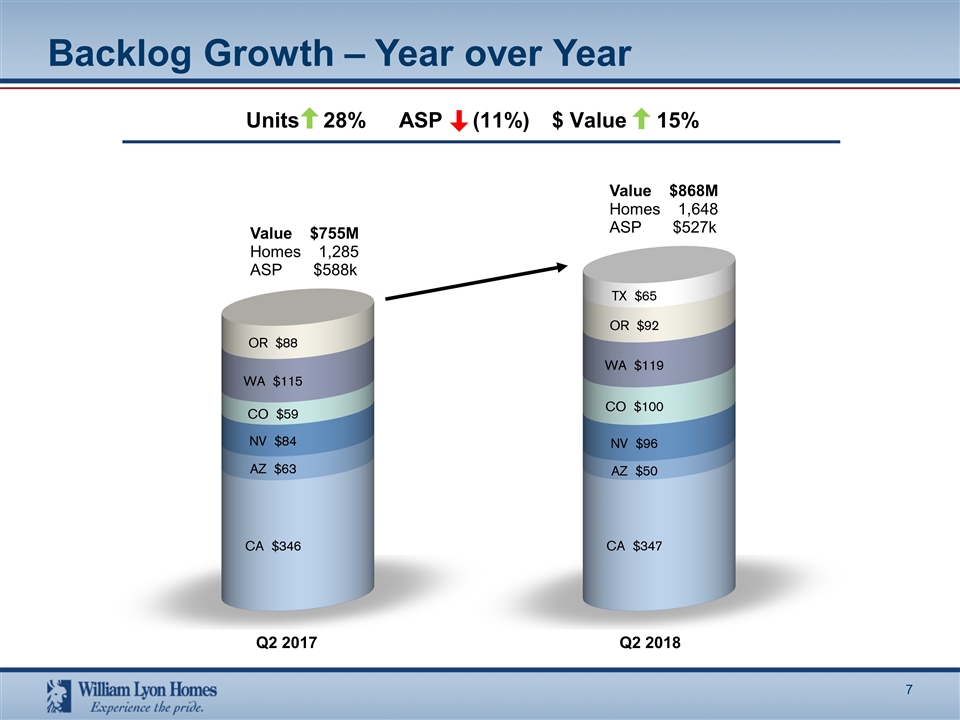

Backlog Growth – Year over Year Q2 2017 Value $868M Homes 1,648 ASP $527k Units 28% ASP (11%) $ Value 15% Q2 2018 Value $755M Homes 1,285 ASP $588k

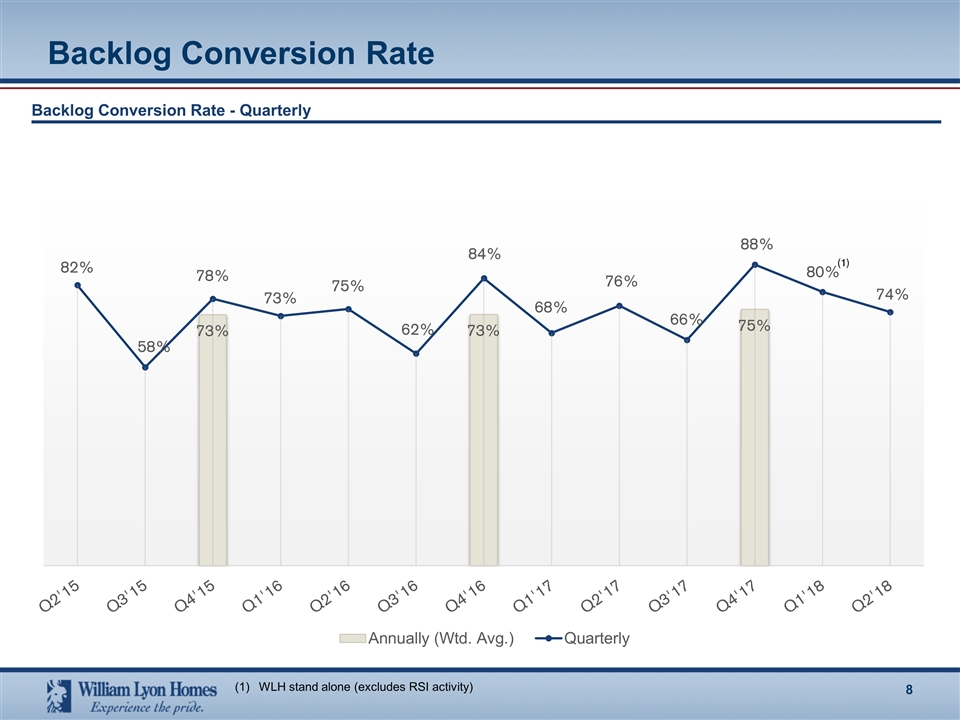

Backlog Conversion Rate Backlog Conversion Rate - Quarterly (1) WLH stand alone (excludes RSI activity)

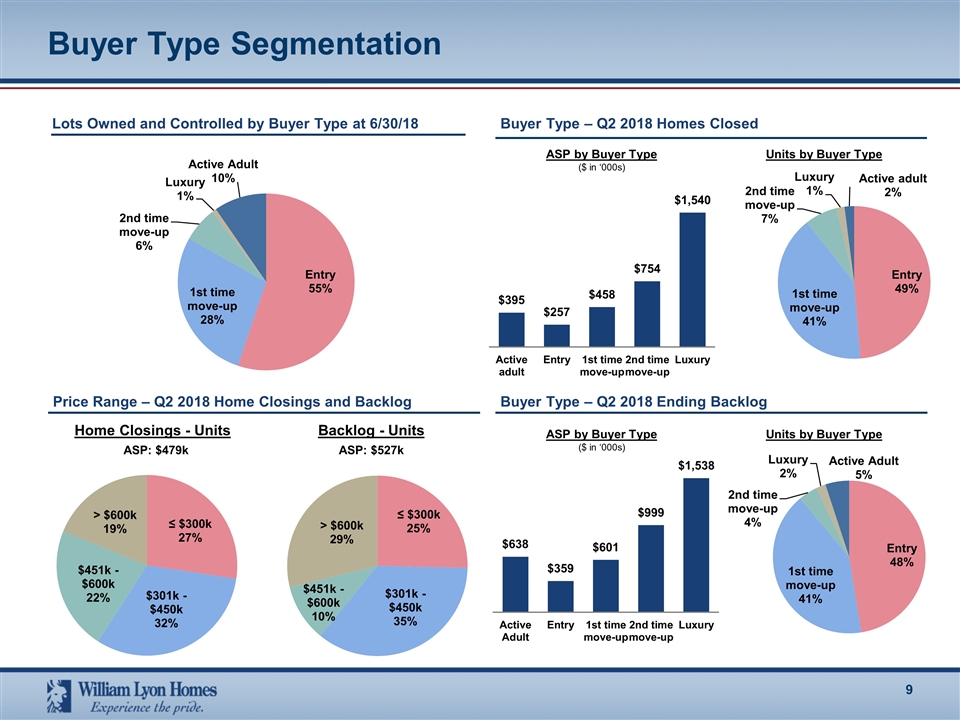

9 ASP by Buyer Type ($ in ‘000s) Units by Buyer Type Buyer Type Segmentation Buyer Type – Q2 2018 Homes Closed Price Range – Q2 2018 Home Closings and Backlog Home Closings - Units Backlog - Units ASP: $479k ASP: $527k Buyer Type – Q2 2018 Ending Backlog ASP by Buyer Type ($ in ‘000s) Units by Buyer Type Lots Owned and Controlled by Buyer Type at 6/30/18

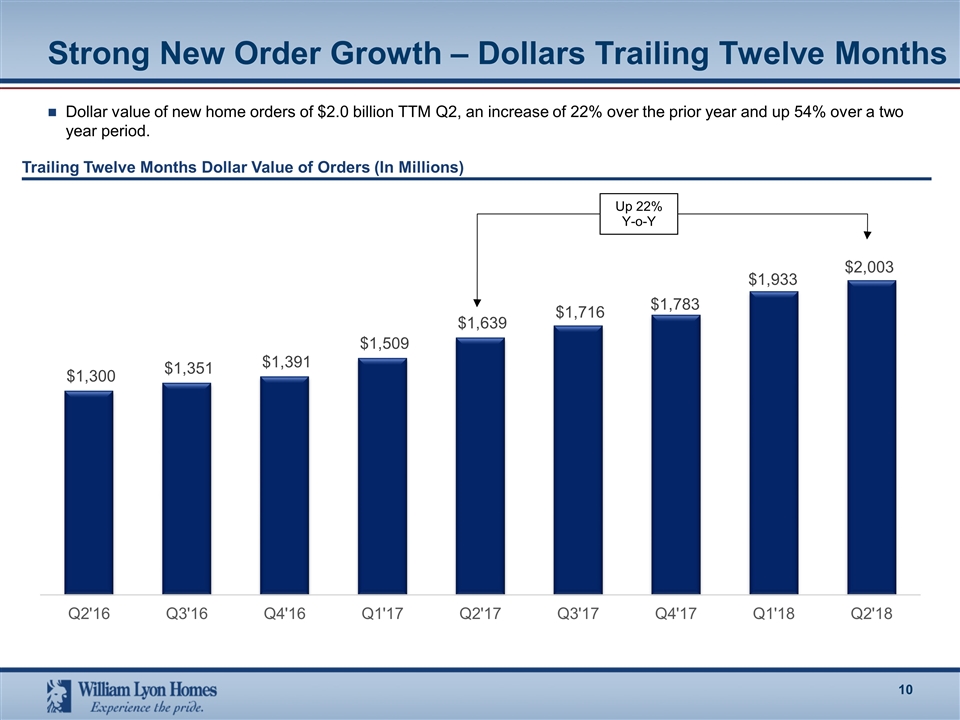

Strong New Order Growth – Dollars Trailing Twelve Months Dollar value of new home orders of $2.0 billion TTM Q2, an increase of 22% over the prior year and up 54% over a two year period. Up 22% Y-o-Y Trailing Twelve Months Dollar Value of Orders (In Millions)

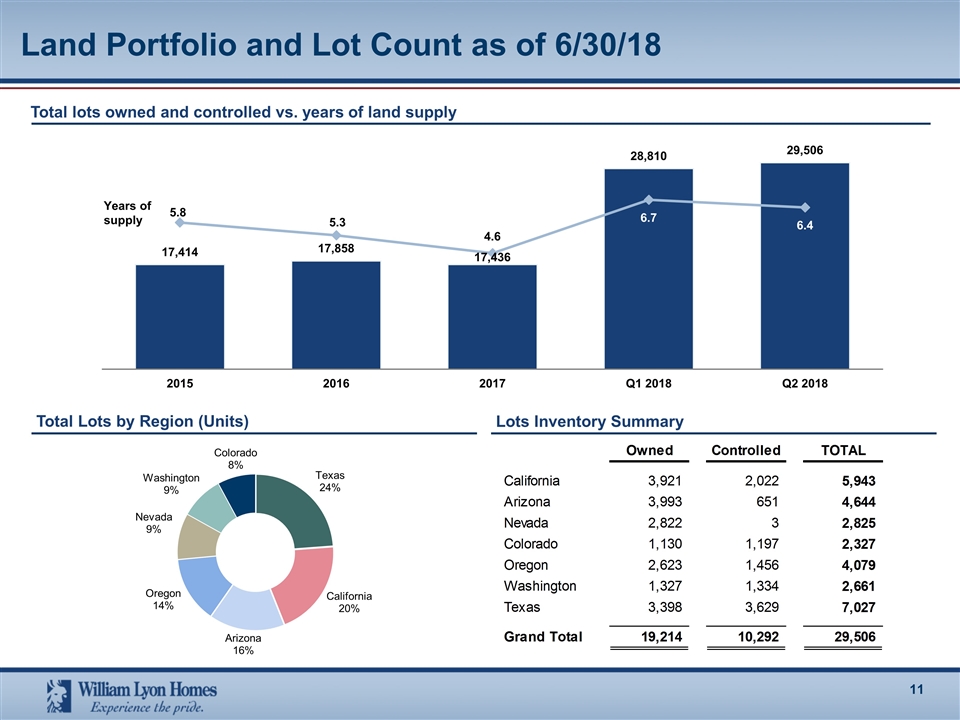

Land Portfolio and Lot Count as of 6/30/18 Total Lots by Region (Units) Lots Inventory Summary Total lots owned and controlled vs. years of land supply

Appendix

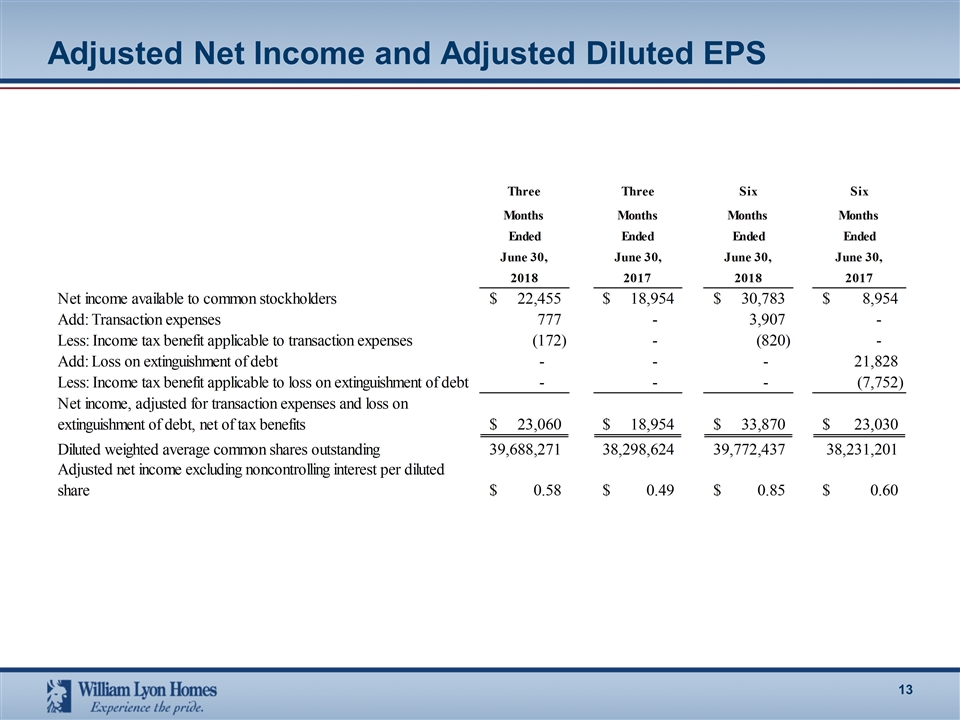

Adjusted Net Income and Adjusted Diluted EPS

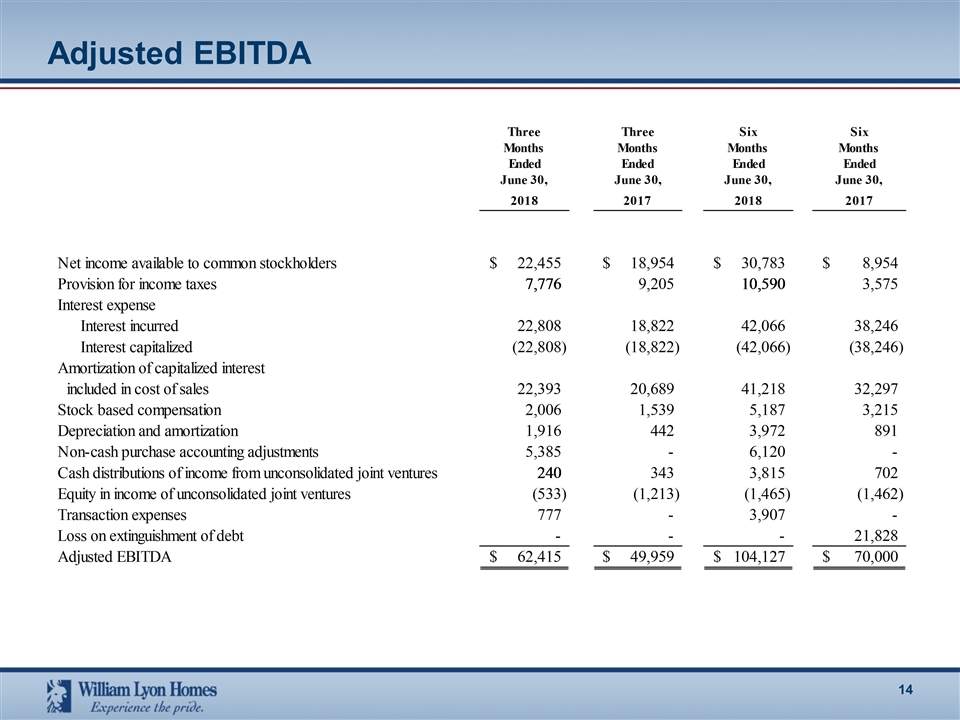

Adjusted EBITDA

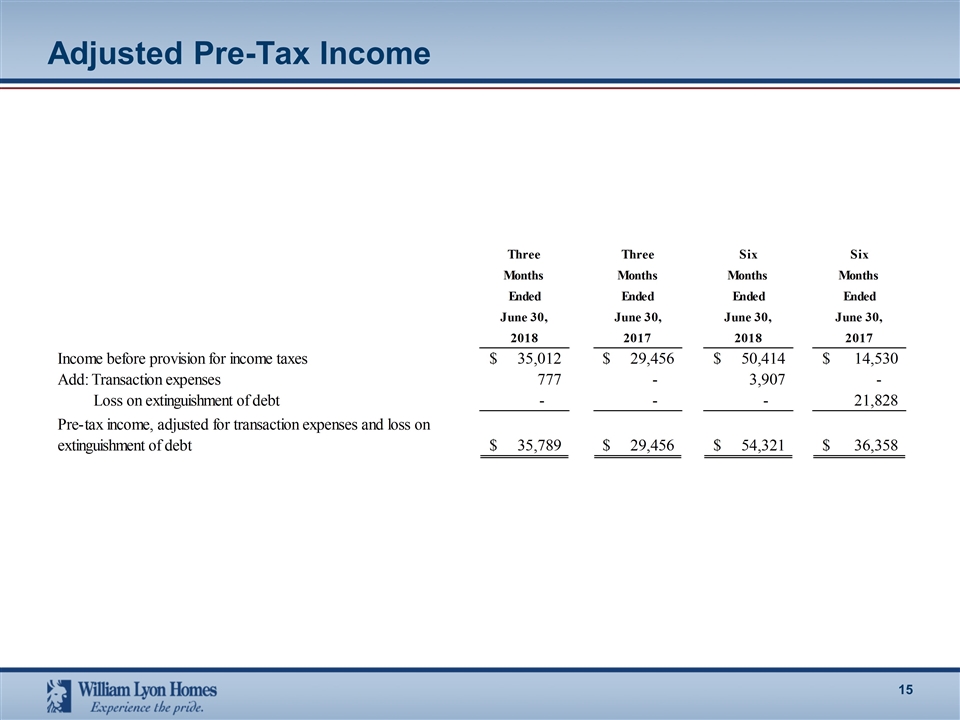

Adjusted Pre-Tax Income