Attached files

| file | filename |

|---|---|

| EX-32.B - EXHIBIT 32.B - HERMAN MILLER INC | exhibit32b_060218.htm |

| EX-32.A - EXHIBIT 32.A - HERMAN MILLER INC | exhibit32a_060218.htm |

| EX-31.B - EXHIBIT 31.B - HERMAN MILLER INC | exhibit31b_060218.htm |

| EX-31.A - EXHIBIT 31.A - HERMAN MILLER INC | exhibit31a_060218.htm |

| EX-23.A - EXHIBIT 23.A - HERMAN MILLER INC | exhibit23a_060218.htm |

| EX-21 - EXHIBIT 21 - HERMAN MILLER INC | exhibit21_060218.htm |

| EX-10.V - EXHIBIT 10.V - HERMAN MILLER INC | exhibit10v_060218.htm |

| EX-10.T - EXHIBIT 10.T - HERMAN MILLER INC | exhibit10t_060218.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

[ X ] | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

[__] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For Fiscal Year Ended June 2, 2018 | Commission File No. 001-15141 |

Herman Miller, Inc.

(Exact name of registrant as specified in its charter)

Michigan | 38-0837640 | |||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||

855 East Main Avenue | ||||

PO Box 302 | ||||

Zeeland, Michigan | 49464-0302 | |||

(Address of principal executive offices) | (Zip Code) | |||

Registrant's telephone number, including area code: (616) 654 3000 | |

Securities registered pursuant to Section 12(b) of the Act: None | |

Securities registered pursuant to Section 12(g) of the Act: | |

Common Stock, $.20 Par Value (Title of Class) | Name of exchange on which registered NASDAQ Stock Market LLC |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | |

Yes [ X ] No [__] | |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | |

Yes [__] No [ X ] | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | |

Yes [ X ] No [__] | |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | |

Yes [ X ] No [__] | |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ X ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” "accelerated filer," "smaller reporting company," and “emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ X ] Accelerated filer [__] Non-accelerated filer [__] Smaller reporting company [__] Emerging growth company [__]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act [__]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | |

Yes [__] No [ X ] | |

The aggregate market value of the voting stock held by “nonaffiliates” of the registrant (for this purpose only, the affiliates of the registrant have been assumed to be the executive officers and directors of the registrant and their associates) as of December 2, 2017, was $2,040,363,044 (based on $34.55 per share which was the closing sale price as reported by NASDAQ).

The number of shares outstanding of the registrant's common stock, as of July 26, 2018: Common stock, $.20 par value - 59,694,316 shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the Registrant's Proxy Statement for the Annual Meeting of Stockholders to be held on October 8, 2018, are incorporated into Part III of this report.

Herman Miller, Inc. Form 10-K

Table of Contents

Page No. | |

Part I | |

Item 1 Business | |

Item 1A Risk Factors | |

Item 1B Unresolved Staff Comments | |

Item 2 Properties | |

Item 3 Legal Proceedings | |

Additional Item: Executive Officers of the Registrant | |

Item 4 Mine Safety Disclosures | |

Part II | |

Item 5 Market for the Registrant's Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities | |

Item 6 Selected Financial Data | |

Item 7 Management's Discussion and Analysis of Financial Condition and Results of Operations | |

Item 7A Quantitative and Qualitative Disclosures about Market Risk | |

Item 8 Financial Statements and Supplementary Data | |

Item 9 Changes in and Disagreements with Accountants on Accounting and Financial Disclosures | |

Item 9A Controls and Procedures | |

Item 9B Other Information | |

Part III | |

Item 10 Directors, Executive Officers, and Corporate Governance | |

Item 11 Executive Compensation | |

Item 12 Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

Item 13 Certain Relationships and Related Transactions, and Director Independence | |

Item 14 Principal Accountant Fees and Services | |

Part IV | |

Item 15 Exhibits and Financial Statement Schedule | |

Exhibit Index | |

Signatures | |

Schedule II Valuation and Qualifying Accounts | |

PART I

Item 1 Business

General Development of Business

Herman Miller's mission statement is Inspiring Designs to Help People Do Great Things. To this end, the company researches, designs, manufactures, and distributes interior furnishings for use in various environments including office, healthcare, educational, and residential settings and provides related services that support organizations and individuals all over the world. Through research, the company seeks to understand, define and clarify customer needs and problems existing in its markets and to design products, systems and services that serve as innovative solutions to such needs and problems. The company's products are sold primarily through the following channels: Owned and independent contract furniture dealers, direct customer sales, owned and independent retailers, direct-mail catalogs, and the company's online stores.

Herman Miller, Inc. was incorporated in Michigan in 1905. One of the company's major plants and its corporate offices are located at 855 East Main Avenue, PO Box 302, Zeeland, Michigan, 49464-0302, and its telephone number is (616) 654-3000. Unless otherwise noted or indicated by the context, the term “company” includes Herman Miller, Inc., its predecessors, and majority-owned subsidiaries. Further information relating to principles of consolidation is provided in Note 1 to the Consolidated Financial Statements included in Item 8 of this report.

Financial Information about Segments

Information relating to segments is provided in Note 13 to the Consolidated Financial Statements included in Item 8 of this report.

Narrative Description of Business

The company's principal business consists of the research, design, manufacture, selling and distribution of office furniture systems, seating products, other freestanding furniture elements, textiles, home furnishings and related services. Most of these systems and products are designed to be used together.

The company's ingenuity and design excellence create award-winning products and services, which have made us a leader in design and development of furniture, furniture systems, textiles and technology solutions. This leadership is exemplified by the innovative concepts introduced by the company in its modular systems (including Canvas Office Landscape®, Locale®, Public Office Landscape®, Layout Studio®, Action Office®, Ethospace®, Arras®, Overlay™ and Resolve®). The company also offers a broad array of seating (including Embody®, Aeron®, Mirra2™, Setu®, Sayl®, Verus®, Cosm™, Lino™, Verus®, Celle®, Equa®, Taper™ and Ergon® office chairs), storage (including Meridian® and Tu® products), wood casegoods (including Geiger® products), freestanding furniture products (including Abak™, Intent®, Sense™ and Envelop®), healthcare products (including Palisade™, Compass™, Nala®, Ava® and other Nemschoff® products), the Thrive portfolio of ergonomic solutions and the textiles of Maharam Fabric Corporation (Maharam). The Live OSSM system of cloud-connected furnishings, applications and dashboards provides a data analytics solution for the company's customers.

The company also offers products for residential settings, including Eames®, Eames (lounge chair configuration)®, Eames (management chair configuration)®, Eames Soft Pad™, Nelson™ basic cabinet series, Nelson™ end table, Nelson™ lanterns, Nelson™ marshmallow sofa, Nelson™ miniature chests, Nelson™ platform bench, Nelson™ swag leg group, Nelson™ tray table, Bubble Lamps®, Airia™, Ardea®, Bumper™, Burdick Group™, Everywhere™ tables, Claw™, Caper®, Distil™, Envelope™, Formwork®, Full Round™, H Frame™, I Beam™, Landmark™, Logic Mini™, Logic Power Access Solutions™, Renew™, Rolled Arm™, Scissor™, Sled™, Soft Pad™, Swoop™, Tone™, Twist™, Ward Bennett™ and Wireframe™.

The company's products are marketed worldwide by its own sales staff, independent dealers and retailers, its owned dealer network, via its e-commerce website and through its owned Design Within Reach ("DWR") retail studios. Salespeople work with dealers, the architecture and design community, and directly with end-users. Independent dealerships concentrate on the sale of Herman Miller products and some complementary product lines of other manufacturers. It is estimated that approximately 78 percent of the company's sales in the fiscal year ended June 2, 2018, were made to or through independent dealers. The remaining sales were made directly to end-users, including federal, state and local governments and several business organizations by the company's own sales staff, its owned dealer network, its DWR retail studios or independent dealers and retailers.

The company is a recognized leader within its industry for the use, development and integration of customer-centered technologies that enhance the reliability, speed and efficiency of our customers' operations. This includes proprietary sales tools, interior design and product specification software; order entry and manufacturing scheduling and production systems; and direct connectivity to the company's suppliers.

The company's furniture systems, seating, freestanding furniture, storage, casegood and textile products, and related services are used in (1) institutional environments including offices and related conference, lobby, and lounge areas and general public areas including transportation terminals; (2) health/science environments including hospitals, clinics and other healthcare facilities; (3) industrial and educational settings; and (4) residential and other environments.

Herman Miller, Inc. and Subsidiaries 3

Raw Materials

The company's manufacturing materials are available from a significant number of sources within the United States, Canada, Europe and Asia. To date, the company has not experienced any difficulties in obtaining its raw materials. The costs of certain direct materials used in the company's manufacturing and assembly operations are sensitive to shifts in commodity market prices. In particular, the costs of steel, plastic, aluminum components and particleboard are sensitive to the market prices of commodities such as raw steel, aluminum, crude oil, lumber and resins. Increases in the market prices for these commodities can have an adverse impact on the company's profitability. Further information regarding the impact of direct material costs on the company's financial results is provided in Management's Discussion and Analysis in Item 7 of this report, "Management's Discussion and Analysis of Financial Condition and Results of Operations”.

Patents, Trademarks, Licenses, Etc.

The company has active utility and design patents in the United States. Many of the inventions covered by these patents also have been patented in a number of foreign countries. Various trademarks, including the name and stylized “Herman Miller” and the “Herman Miller Circled Symbolic M” trademark are registered in the United States and many foreign countries. The company does not believe that any material part of its business depends on the continued availability of any one or all of its patents or trademarks, or that its business would be materially adversely affected by the loss of any such marks, except for the following trademarks: Herman Miller®, Herman Miller Circled Symbolic M®, Maharam®, Geiger®, Design Within Reach®, DWR®, Nemschoff®, Action Office®, Living Office®, Ethospace®, Aeron®, Mirra®, Embody®, Setu®, Sayl®, Eames®, PostureFit®, Meridian®, and Canvas Office Landscape®. It is estimated that the average remaining life of the company's patents and trademarks is approximately 6 years.

Working Capital Practices

Information concerning the company's inventory levels relative to its sales volume can be found under the Executive Overview section in Item 7 of this report “Management's Discussion and Analysis of Financial Condition and Results of Operations”. Beyond this discussion, the company does not believe that it or the industry in general has any special practices or special conditions affecting working capital items that are significant for understanding the company's business.

Customer Base

The company estimates that no single dealer accounted for more than 4 percent of the company's net sales in the fiscal year ended June 2, 2018. The company estimates that the largest single end-user customer accounted for $109.8 million, $102.3 million and $95.7 million of the company's net sales in fiscal 2018, 2017, and 2016, respectively. This represents approximately 5 percent, 5 percent and 4 percent of the company's net sales in fiscal 2018, 2017 and 2016, respectively. The company's 10 largest customers in the aggregate accounted for approximately 19 percent, 18 percent, and 18 percent of net sales in fiscal 2018, 2017, and 2016, respectively.

Backlog of Unfilled Orders

As of June 2, 2018, the company's backlog of unfilled orders was $344.5 million. At June 3, 2017, the company's backlog totaled $322.6 million. It is expected that substantially all the orders forming the backlog at June 2, 2018, will be filled during the next fiscal year. Many orders received by the company are reflected in the backlog for only a short period while other orders specify delayed shipments and are carried in the backlog for up to one year. Accordingly, the amount of the backlog at any particular time does not necessarily indicate the level of net sales for a particular succeeding period.

Government Contracts

Other than standard provisions contained in contracts with the United States Government, the company does not believe that any significant portion of its business is subject to material renegotiation of profits or termination of contracts or subcontracts at the election of various government entities. The company sells to the U.S. Government both through a General Services Administration ("GSA") Multiple Award Schedule Contract and through competitive bids. The GSA Multiple Award Schedule Contract pricing is principally based upon the company's commercial price list in effect when the contract is initiated, rather than being determined on a cost-plus-basis. The company is required to receive GSA approval to apply list price increases during the term of the Multiple Award Schedule Contract period.

Competition

All aspects of the company's business are highly competitive. From an office furniture perspective, the company competes largely on design, product and service quality, speed of delivery and product pricing. Although the company is one of the largest office furniture manufacturers in the world, it competes with manufacturers that have significant resources and sales as well as many smaller companies. The company's most significant competitors are Haworth, HNI Corporation, Kimball International, Knoll and Steelcase.

The company also competes in the home furnishings industry, primarily against regional and national independent home furnishings retailers who market high-craft furniture to the interior design community. Similar to our office furniture product offerings, the company competes primarily on design, product and service quality, speed of delivery and product pricing in this consumer market.

4 2018 Annual Report

Research, Design and Development

The company believes it draws great competitive strength from its research, design and development programs. Accordingly, the company believes that its research and design activities are of significant importance. Through research, the company seeks to understand, define and clarify customer needs and problems they are trying to solve. The company designs innovative products and services that address customer needs and solve their problems. The company uses both internal and independent research resources and independent design resources. Exclusive of royalty payments, the company spent approximately $57.1 million, $58.6 million and $62.4 million on research and development activities in fiscal 2018, 2017 and 2016, respectively. Generally, royalties are paid to designers of the company's products as the products are sold and are included in the Design and Research line item within the Consolidated Statements of Comprehensive Income.

Environmental Matters

For over 50 years, respecting the environment has been more than good business practice for us - it is the right thing to do. Our 10-year sustainability strategy - Earthright - begins with three principles: positive transparency, products as living things, and becoming greener together. Our goals are focused around the smart use of resources, eco-inspired design, and becoming community driven. Based on current facts known to management, the company does not believe that existing environmental laws and regulations have had or will have any material effect upon the capital expenditures, earnings or competitive position of the company. However, there can be no assurance that environmental legislation and technology in this area will not result in or require material capital expenditures or additional costs to our manufacturing process.

Human Resources

The company considers its employees to be another of its major competitive strengths. The company stresses individual employee participation and incentives, believing that this emphasis has helped attract and retain a competent and motivated workforce. The company's human resources group provides employee recruitment, education and development, as well as compensation planning and counseling. Additionally, there have been no work stoppages or labor disputes in the company's history. As of June 2, 2018, approximately 5 percent of the company's employees are covered by collective bargaining agreements, most of whom are employees of its Nemschoff and Herman Miller Holdings Limited subsidiaries.

As of June 2, 2018, the company had 7,681 employees, representing a 3 percent increase as compared with June 3, 2017. In addition to its employee workforce, the company uses temporary labor to meet uneven demand in its manufacturing operations.

Information about International Operations

The company's sales in international markets are made primarily to office/institutional customers. Foreign sales consist mostly of office furniture products such as Aeron®, Mirra®, Sayl®, Setu®, Layout Studio®, POSH Imagine Desking System®, Ratio®, other seating and storage products and ergonomic accessories Colebrook, Bosson and Saunders. The company conducts business in the following major international markets: Canada, Europe, the Middle East, Africa, Latin America, and the Asia/Pacific region.

The company's products currently sold in international markets are manufactured by wholly owned subsidiaries in the United States, the United Kingdom, China, Brazil and India. Sales are made through wholly owned subsidiaries or branches in Canada, France, Germany, Italy, Japan, Korea, Mexico, Australia, Singapore, China (including Hong Kong), India, Brazil and the Netherlands. The company's products are offered in Europe, the Middle East, Africa, Latin America and the Asia/Pacific region through dealers.

Additional information with respect to operations by geographic area appears in Note 13 of the Consolidated Financial Statements included in Item 8 of this report. Fluctuating exchange rates and factors beyond the control of the company, such as tariff and foreign economic policies, may affect future results of international operations. Refer to Item 7A, Quantitative and Qualitative Disclosures about Market Risk, for further discussion regarding the company's foreign exchange risk.

Available Information

The company's annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports are made available free of charge through the “Investors” section of the company's internet website at www.hermanmiller.com, as soon as practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission (SEC). The company's filings with the SEC are also available for the public to read via the SEC's internet website at www.sec.gov. You may read and copy any materials we file with the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

Herman Miller, Inc. and Subsidiaries 5

Item 1A Risk Factors

The following risk factors and other information included in this Annual Report on Form 10-K should be carefully considered. The risks and uncertainties described below are not the only ones we face; others, either unforeseen or currently deemed less significant, may also have a negative impact on our company. If any of the following actually occurs, our business, operating results, cash flows, and financial condition could be materially adversely affected.

We may not be successful in implementing and managing our growth strategy.

We have established a growth strategy for the business based on a changing and evolving world. Through this strategy we are focused on taking advantage of the changing composition of the office floor plate, the greater desire for customization from our customers, new technologies and trends towards urbanization.

To that end, we intend to grow in certain targeted ways. First, we intend to scale the Consumer business by continuing to transform the DWR retail studio footprint, which will be complemented by a continued focus on improving margins through the development of exclusive product designs and leveraging additional sales in our contract, catalog and digital channels. Second, we intend to elevate our research-based Living Office framework to the next level by accelerating its evolution, through adding new products and technology solutions, as well as performing research that quantifies the positive impact to organizations from applying these concepts. Third, we intend to leverage the dealer eco-system through a focused selling effort with enhanced digital platforms that will make it easier for our contract customers and dealer partners to find, specify and order products from any brand within the company. Fourth, we intend to implement a range of initiatives aimed at optimizing profitability. These include implementing targeted cost reductions as well as actions aimed at optimizing product pricing and promotions, product and component sourcing, logistics, and distribution. Finally, we intend to continue to deliver innovation. With the alignment of creative direction and new product commercialization under common leadership, we will further reduce our time to market and ensure design and development at Herman Miller responds to our customers most critical needs through a robust pipeline of new products and solutions.

While we have confidence that our strategic plan reflects opportunities that are appropriate and achievable and that we have anticipated and will manage the associated risks, there is the possibility that the strategy may not deliver the projected results due to inadequate execution, incorrect assumptions, sub-optimal resource allocation, or changing customer requirements.

To meet these goals, we believe we will be required to continually invest in the research, design, and development of new products and services, and there is no assurance that such investments will have commercially successful results.

Certain growth opportunities may require us to invest in acquisitions, alliances, and the startup of new business ventures. These investments may not perform according to plan and may involve the assumption of business, operational, or other risks that are new to our business.

Future efforts to expand our business within developing economies, particularly within China and India, may expose us to the effects of political and economic instability. Such instability may impact our ability to compete for business. It may also put the availability and/or value of our capital investments within these regions at risk. These expansion efforts expose us to operating environments with complex, changing, and in some cases, inconsistently-applied legal and regulatory requirements. Developing knowledge and understanding of these requirements poses a significant challenge and failure to remain compliant with them could limit our ability to continue doing business in these locations.

Pursuing our strategic plan in new and adjacent markets, as well as within developing economies, will require us to find effective new channels of distribution. There is no assurance that we can develop or otherwise identify these channels of distribution.

Tariffs imposed by the U.S. government could have a material adverse effect on our results of operations.

Earlier this year, the U.S. recently announced tariffs of 25 percent on steel and 10 percent on aluminum imported from several countries where we conduct business. These tariffs were met with countering tariffs from trade partners of the U.S. as well as increased, broader tariffs to be levied by the U.S. on targeted countries, including China. These tariffs and the possibility of broader trade conflicts stemming from the tariffs could negatively impact our business in the future. The tariffs on imports have significantly impacted the cost of domestic U.S. steel in recent months, a key commodity that we consume in producing our products, which will negatively impact our future gross margin and our operating performance if U.S. costs do not stabilize. Additionally, there is a risk that the U.S. tariffs on imports and the countering tariffs on U.S. produced exports will trigger a broader global trade conflict. This has the potential to significantly impact global trade and economic conditions in many of the regions where we do business.

Adverse economic and industry conditions could have a negative impact on our business, results of operations, and financial condition.

Customer demand within the contract office furniture industry is affected by various macro-economic factors; general corporate profitability, white-collar employment levels, new office construction rates, and existing office vacancy rates are among the most influential factors. History has shown that declines in these measures can have an adverse effect on overall office furniture demand. Additionally, factors and changes

6 2018 Annual Report

specific to our industry, such as developments in technology, governmental standards and regulations, and health and safety issues can influence demand. There are current and future economic and industry conditions that could adversely affect our business, operating results, or financial condition.

Other macroeconomic developments, such as the United Kingdom referendum on European Union membership (commonly known as Brexit), the debt crisis in certain countries in the European Union, and the economic slow down in oil producing regions such as the Middle East could negatively affect the company's ability to conduct business in those geographies. The current political and economic uncertainty in the United Kingdom surrounding European Union membership and ongoing debt pressures in certain European countries could cause the value of the British Pound and/or the Euro to further deteriorate, reducing the purchasing power of customers in these regions and potentially undermining the financial health of the company's suppliers and customers in other parts of the world. Financial difficulties experienced by the company's suppliers and customers, including distributors, could result in product delays and inventory issues; risks to accounts receivable could result in delays in collection and greater bad debt expense.

The markets in which we operate are highly competitive and we may not be successful in winning new business.

We are one of several companies competing for new business within the furniture industry. Many of our competitors offer similar categories of products, including office seating, systems and freestanding office furniture, casegoods, storage as well as residential, education and healthcare furniture solutions. Although we believe that our innovative product design, functionality, quality, depth of knowledge, and strong network of distribution partners differentiate us in the marketplace, increased market pricing pressure could make it difficult for us to win new business with certain customers and within certain market segments at acceptable profit margins.

The retail furnishings market is highly competitive. We compete with national and regional furniture retailers and department stores. In addition, we compete with mail order catalogs and online retailers focused on home furnishings. We compete with these and other retailers for customers, suitable retail locations, vendors, qualified employees, and management personnel. Some of our competitors have significantly greater financial, marketing and other resources than we possess. This may result in our competitors being quicker at the following: adapting to changes, devoting greater resources to the marketing and sale of their products, generating greater national brand recognition, or adopting more aggressive pricing and promotional policies. In addition, increased catalog mailings by our competitors may adversely affect response rates to our own catalog mailings. As a result, increased competition may adversely affect our future financial performance.

Our business presence outside the United States exposes us to certain risks that could negatively affect our results of operations and financial condition.

We have significant manufacturing and sales operations in the United Kingdom, which represents our largest marketplace outside the United States. We also have manufacturing operations in China, India and Brazil. Additionally, our products are sold internationally through wholly-owned subsidiaries or branches in various countries including Canada, Mexico, Brazil, France, Germany, Italy, Netherlands, Japan, Australia, Singapore, China, Hong Kong and India. In certain other regions of the world, our products are offered primarily through independent dealerships.

Doing business internationally exposes us to certain risks, many of which are beyond our control and could potentially impact our ability to design, develop, manufacture, or sell products in certain countries. These factors could include, but would not necessarily be limited to:

• | Political, social, and economic conditions |

• | Global trade conflicts and trade policies |

• | Legal and regulatory requirements |

• | Labor and employment practices |

• | Cultural practices and norms |

• | Natural disasters |

• | Security and health concerns |

• | Protection of intellectual property |

• | Changes in foreign currency exchange rates |

In some countries, the currencies in which we import and export products can differ. Fluctuations in the rate of exchange between these currencies could negatively impact our business and our financial performance. Additionally, tariff and import regulations, international tax policies and rates, and changes in U.S. and international monetary policies may have an adverse impact on results of operations and financial condition.

We are subject to risks and costs associated with protecting the integrity and security of our systems and confidential information.

We collect certain customer-specific data, including credit card information, in connection with orders placed through our e-commerce websites, direct-mail catalog marketing program, and DWR retail studios. For these sales channels to function and develop successfully, we and other parties involved in processing customer transactions must be able to transmit confidential information, including credit card information and other personal information regarding our customers, securely over public and private networks. Third parties may have or develop the technology

Herman Miller, Inc. and Subsidiaries 7

or knowledge to breach, disable, disrupt or interfere with our systems or processes or those of our vendors. Although we take the security of our systems and the privacy of our customers’ confidential information seriously and we believe we take reasonable steps to protect the security and confidentiality of the information we collect, we cannot guarantee that our security measures will effectively prevent others from obtaining unauthorized access to our information and our customers’ information. The techniques used to obtain unauthorized access to systems change frequently and are not often recognized until after they have been launched.

Any person who circumvents our security measures could destroy or steal valuable information or disrupt our operations. Any security breach could cause consumers to lose confidence in the security of our information systems, including our e-commerce websites or stores and choose not to purchase from us. Any security breach could also expose us to risks of data loss, litigation, regulatory investigations, and other significant liabilities. Such a breach could also seriously disrupt, slow or hinder our operations and harm our reputation and customer relationships, any of which could harm our business.

A security breach includes a third party wrongfully gaining unauthorized access to our systems for the purpose of misappropriating assets or sensitive information, loading corrupting data, or causing operational disruption. These actions may lead to a significant disruption of the company’s IT systems and/or cause the loss of business and business information resulting in an adverse business impact, including: (1) an adverse impact on future financial results due to theft, destruction, loss misappropriation, or release of confidential data or intellectual property; (2) operational or business delays resulting from the disruption of IT systems, and subsequent clean-up and mitigation activities; and (3) negative publicity resulting in reputation or brand damage with customers, partners or industry peers.

In addition, states and the federal government are increasingly enacting laws and regulations to protect consumers against identity theft. Also, as our business expands globally, we are subject to data privacy and other similar laws in various foreign jurisdictions. If we are the target of a cybersecurity attack resulting in unauthorized disclosure of our customer data, we may be required to undertake costly notification procedures. Compliance with these laws will likely increase the costs of doing business. If we fail to implement appropriate safeguards or to detect and provide prompt notice of unauthorized access as required by some of these laws, we could be subject to potential claims for damages and other remedies, which could harm our business.

A sustained downturn in the economy could adversely impact our access to capital.

The disruptions in the global economic and financial markets of the last decade adversely impacted the broader financial and credit markets, at times reducing the availability of debt and equity capital for the market as a whole. Conditions such as these could re-emerge in the future. Accordingly, our ability to access the capital markets could be restricted at a time when we would like, or need, to access those markets, which could have an impact on our flexibility to react to changing economic and business conditions. The resulting lack of available credit, increased volatility in the financial markets and reduced business activity could materially and adversely affect our business, financial condition, results of operations, our ability to take advantage of market opportunities and our ability to obtain and manage our liquidity. In addition, the cost of debt financing and the proceeds of equity financing may be materially and adversely impacted by these market conditions. The extent of any impact would depend on several factors, including our operating cash flows, the duration of tight credit conditions and volatile equity markets, our credit capacity, the cost of financing, and other general economic and business conditions. Our credit agreements contain performance covenants, such as a limit on the ratio of debt to earnings before interest, taxes, depreciation and amortization, and limits on subsidiary debt and incurrence of liens. Although we believe none of these covenants is currently restrictive to our operations, our ability to meet the financial covenants can be affected by events beyond our control.

Disruptions in the supply of raw and component materials could adversely affect our manufacturing and assembly operations.

We rely on outside suppliers to provide on-time shipments of the various raw materials and component parts used in our manufacturing and assembly processes. The timeliness of these deliveries is critical to our ability to meet customer demand. Any disruptions in this flow of delivery may have a negative impact on our business, results of operations, and financial condition.

Increases in the market prices of manufacturing materials may negatively affect our profitability.

The costs of certain manufacturing materials used in our operations are sensitive to shifts in commodity market prices, include the impact of the U.S. and retaliatory tariffs previously noted. In particular, the costs of steel, plastic, aluminum components, and particleboard are sensitive to the market prices of commodities such as raw steel, aluminum, crude oil, lumber, and resins. Increases in the market prices of these commodities, such as what we experienced throughout fiscal 2018 for steel, may have an adverse impact on our profitability if we are unable to offset them with strategic sourcing, continuous improvement initiatives or increased prices to our customers.

Disruptions within our dealer network could adversely affect our business.

Our ability to manage existing relationships within our network of independent dealers is crucial to our ongoing success. Although the loss of any single dealer would not have a material adverse effect on the overall business, our business within a given market could be negatively affected by disruptions in our dealer network caused by the termination of commercial working relationships, ownership transitions, or dealer financial difficulties.

8 2018 Annual Report

If dealers go out of business or restructure, we may suffer losses because they may not be able to pay for products already delivered to them. Also, dealers may experience financial difficulties, creating the need for outside financial support, which may not be easily obtained. In the past, we have, on occasion, agreed to provide direct financial assistance through term loans, lines of credit, and/or loan guarantees to certain dealers. Those activities increase our financial exposure.

We are unable to control many of the factors affecting consumer spending, and declines in consumer spending on furnishings could reduce demand for our products.

The operations of our Consumer segment are sensitive to a number of factors that influence consumer spending, including general economic conditions, consumer disposable income, unemployment, inclement weather, availability of consumer credit, consumer debt levels, conditions in the housing market, interest rates, sales tax rates and rate increases, inflation, and consumer confidence in future economic conditions. Adverse changes in these factors may reduce consumer demand for our products, resulting in reduced sales and profitability.

A number of factors that affect our ability to successfully implement our retail studio strategy, including opening new locations and closing existing studios, are beyond our control. These factors may harm our ability to increase the sales and profitability of our retail operations.

Approximately 53 percent of the sales within our Consumer segment are transacted within our DWR retail studios. Additionally, we believe our retail studios have a direct influence on the volume of business transacted through other channels, including our consumer e-commerce and direct-mail catalog platforms, as many customers utilize these physical spaces to view and experience products prior to placing an order online or through the catalog call center. Our ability to open additional studios or close existing studios successfully will depend upon a number of factors beyond our control, including:

• | General economic conditions |

• | Identification and availability of suitable studio locations |

• | Success in negotiating new leases and amending or terminating existing leases on acceptable terms |

• | The success of other retailers in and around our retail locations |

• | Ability to secure required governmental permits and approvals |

• | Hiring and training skilled studio operating personnel |

• | Landlord financial stability |

Increasing competition for highly skilled and talented workers could adversely affect our business.

The successful implementation of our business strategy depends, in part, on our ability to attract and retain a skilled workforce. The increasing competition for highly skilled and talented employees could result in higher compensation costs, difficulties in maintaining a capable workforce, and leadership succession planning challenges.

Costs related to product defects could adversely affect our profitability.

We incur various expenses related to product defects, including product warranty costs, product recall and retrofit costs, and product liability costs. These expenses relative to product sales vary and could increase. We maintain reserves for product defect-related costs based on estimates and our knowledge of circumstances that indicate the need for such reserves. We cannot, however, be certain that these reserves will be adequate to cover actual product defect-related claims in the future. Any significant increase in the rate of our product defect expenses could have a material adverse effect on operations.

We are subject to risks associated with self-insurance related to health benefits.

We are self-insured for our health benefits and maintain per employee stop loss coverage; however, we retain the insurable risk at an aggregate level. Therefore unforeseen or catastrophic losses in excess of our insured limits could have a material adverse effect on the company’s financial condition and operating results. See Note 1 of the Consolidated Financial Statements for information regarding the company’s retention level.

Government and other regulations could adversely affect our business.

Government and other regulations apply to the manufacture and sale of many of our products. Failure to comply with these regulations or failure to obtain approval of products from certifying agencies could adversely affect the sales of these products and have a material negative impact on operating results.

Herman Miller, Inc. and Subsidiaries 9

Our business could be adversely impacted if we do not successfully manage the transition associated with the retirement of our Chief Executive Officer and the appointment of a new Chief Executive Officer.

On February 5, 2018, we announced that Brian C. Walker plans to retire as President and Chief Executive Officer of the Company by August 31, 2018. Our Board of Directors has initiated a search for his successor and expects that search to be completed relatively soon. Such leadership transitions can be difficult to manage and could present challenges associated with our relationships with our dealers, suppliers and employees.

Item 1B Unresolved Staff Comments

None

10 2018 Annual Report

Item 2 Properties

The company owns or leases facilities located throughout the United States and several foreign countries. The location, square footage and use of the most significant facilities at June 2, 2018 were as follows:

Owned Locations | Square Footage | Use | ||

Zeeland, Michigan | 750,800 | Manufacturing, Warehouse, Office | ||

Spring Lake, Michigan | 582,700 | Manufacturing, Warehouse, Office | ||

Holland, Michigan | 357,400 | Warehouse | ||

Holland, Michigan | 293,100 | Manufacturing, Office | ||

Holland, Michigan | 238,200 | Office, Design | ||

Dongguan, China* | 431,600 | Manufacturing, Office | ||

Sheboygan, Wisconsin | 207,700 | Manufacturing, Warehouse, Office | ||

Melksham, United Kingdom | 170,000 | Manufacturing, Warehouse, Office | ||

Hildebran, North Carolina | 93,000 | Manufacturing, Office | ||

Leased Locations | Square Footage | Use | ||

Hebron, Kentucky | 423,700 | Warehouse | ||

Dongguan, China* | 422,600 | Manufacturing, Office | ||

Atlanta, Georgia | 180,200 | Manufacturing, Warehouse, Office | ||

Bangalore, India | 104,800 | Manufacturing, Warehouse | ||

Ningbo, China* | 185,100 | Manufacturing, Warehouse, Office | ||

Yaphank, New York | 92,000 | Warehouse, Office | ||

New York City, New York | 59,000 | Office, Retail | ||

Hong Kong, China | 54,400 | Warehouse | ||

Brooklyn, New York | 39,400 | Warehouse, Retail | ||

Stamford, Connecticut | 35,300 | Office, Retail | ||

As of June 2, 2018, the company leased 32 DWR retail studios, including the Herman Miller Flagship store in New York that totaled approximately 360,000 square feet of selling space. The company also maintains administrative and sales offices and showrooms in various other locations throughout North America, Europe, Asia/Pacific and Latin America. The company considers its existing facilities to be in good condition and adequate for its design, production, distribution, and selling requirements.

* On March 14, 2018, the company announced a facilities consolidation plan related to its China Manufacturing facilities. Plans are underway to close and consolidate the owned Dongguan and leased Ningbo facilities into a new leased facility in Dongguan. The company expects the facilities consolidation to be completed by the first quarter of fiscal 2020.

Herman Miller, Inc. and Subsidiaries 11

Item 3 Legal Proceedings

The company is involved in legal proceedings and litigation arising in the ordinary course of business. In the opinion of management, the outcome of such proceedings and litigation currently pending will not materially affect the company’s consolidated operations, cash flows and financial condition.

Additional Item: Executive Officers of the Registrant

Certain information relating to Executive Officers of the company as of June 2, 2018 is as follows:

Name | Age | Year Elected an Executive Officer | Position with the Company |

Brian C. Walker | 56 | 1996 | President and Chief Executive Officer |

Andrew J. Lock | 64 | 2003 | President, Herman Miller International |

Gregory J. Bylsma | 53 | 2009 | President, North America Contract |

Steven C. Gane | 63 | 2009 | President, Specialty Brands |

Jeffrey M. Stutz | 47 | 2009 | Executive Vice President, Chief Financial Officer |

B. Ben Watson | 53 | 2010 | Chief Creative Officer |

H. Timothy Lopez | 47 | 2014 | Senior Vice President of Legal Services, General Counsel and Secretary |

John McPhee | 55 | 2015 | President, Herman Miller Consumer |

John Edelman | 51 | 2015 | Chief Executive Officer, Herman Miller Consumer |

Kevin Veltman | 43 | 2015 | Vice President, Investor Relations & Treasurer |

Jeremy Hocking | 57 | 2017 | Executive Vice President, Strategy and Business Development |

Except as discussed below, each of the named officers has served the company in an executive capacity for more than five years.

Mr. Edelman joined Herman Miller, Inc. in 2015 subsequent to the company's acquisition of DWR. Prior to joining DWR as President and Chief Executive Officer in 2010, he served as President and CEO of Edelman Leather and Sam & Libby, Inc., where he was responsible for its U.S. business.

Mr. McPhee joined Herman Miller, Inc. in 2015 subsequent to the company's acquisition of DWR. Prior to that, he served in various roles at DWR including Chief Operating Officer and President from 2010. Mr. McPhee previously held senior management positions with Edelman Leather, Candie's, Inc. and Sam & Libby, Inc.

Mr. Veltman joined Herman Miller in 2014 and serves as Vice President - Investor Relations and Treasurer. Prior to joining Herman Miller, he spent 8 years at BISSELL, Inc, most recently as Vice President - Finance.

There are no family relationships between or among the above-named executive officers. There are no arrangements or understandings between any of the above-named officers pursuant to which any of them was named an officer.

Item 4 Mine Safety Disclosures - Not applicable

12 2018 Annual Report

PART II

Item 5 Market for the Registrant's Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities

Share Price, Earnings, and Dividends Summary

Herman Miller, Inc. common stock is traded on the NASDAQ-Global Select Market System (Symbol: MLHR). As of July 26, 2018, there were approximately 19,500 record holders, including individual participants in security position listings, of the company's common stock.

The high and low market prices of the company's common stock, dividends and diluted earnings per share for each quarterly period during the past two years were as follows:

Per Share and Unaudited | Market Price High (at close) | Market Price Low (at close) | Market Price Close | Earnings Per Share- Diluted | Dividends Declared Per Share | ||||||||||||||

Year ended June 2, 2018: | |||||||||||||||||||

First quarter | $ | 35.30 | $ | 29.25 | $ | 34.00 | $ | 0.55 | $ | 0.1800 | |||||||||

Second quarter | 37.00 | 32.05 | 34.55 | 0.55 | 0.1800 | ||||||||||||||

Third quarter | 41.84 | 33.65 | 36.75 | 0.49 | 0.1800 | ||||||||||||||

Fourth quarter | 39.20 | 29.95 | 32.85 | 0.53 | 0.1800 | ||||||||||||||

Year | $ | 41.84 | $ | 29.25 | $ | 32.85 | $ | 2.12 | $ | 0.7200 | |||||||||

Year ended June 3, 2017: | |||||||||||||||||||

First quarter | $ | 36.46 | $ | 27.87 | $ | 35.94 | $ | 0.60 | $ | 0.1700 | |||||||||

Second quarter | 36.14 | 26.99 | 32.65 | 0.53 | 0.1700 | ||||||||||||||

Third quarter | 36.45 | 29.75 | 30.45 | 0.37 | 0.1700 | ||||||||||||||

Fourth quarter | 34.05 | 28.55 | 32.70 | 0.55 | 0.1700 | ||||||||||||||

Year | $ | 36.46 | $ | 26.99 | $ | 32.70 | $ | 2.05 | $ | 0.6800 | |||||||||

Dividends were declared and paid quarterly during fiscal 2018 and 2017 as approved by the Board of Directors.

On July 2, 2018, the company's board of directors approved an increase in the quarterly dividend to $0.1975 per share. This payment will be made on October 15, 2018 to shareholders of record at the close of business on September 1, 2018. While it is anticipated that the company will continue to pay quarterly cash dividends, the amount and timing of such dividends is subject to the discretion of the Board depending on the company's future results of operations, financial condition, capital requirements and other relevant factors.

Issuer Purchases of Equity Securities

The following is a summary of share repurchase activity during the company's fourth fiscal quarter ended June 2, 2018:

Period | Total Number of Shares (or Units) Purchased | Average Price Paid per Share or Unit | Total Number of Share (or Units) Purchased as Part of Publicly Announced Plans or Programs | Maximum Number (or Approximate Dollar Value) of Shares(or Units) that May Yet be Purchased Under the Plans or Programs (1) | ||||||||

3/4/18 - 3/31/18 | 65,767 | 32.24 | 65,767 | $ | 76,324,290 | |||||||

4/1/18 - 4/28/18 | 301,500 | 32.10 | 301,500 | $ | 66,647,521 | |||||||

4/29/18 - 6/2/18 | 143,566 | 31.75 | 143,566 | $ | 62,088,967 | |||||||

Total | 510,833 | 510,833 | ||||||||||

(1) Amounts are as of the end of the period indicated

The company has a share repurchase plan authorized by the Board of Directors on September 28, 2007, which provided share repurchase authorization of $300.0 million with no specified expiration date. The company may purchase up to an additional $62.1 million of shares under its existing common stock repurchase program.

No repurchase plans expired or were terminated during the fourth quarter of fiscal 2018. During the period covered by this report, the company did not sell any shares of common stock that were not registered under the Securities Act of 1933.

Herman Miller, Inc. and Subsidiaries 13

Stockholder Return Performance Graph

Set forth below is a line graph comparing the yearly percentage change in the cumulative total stockholder return on the company's common stock with that of the cumulative total return of the Standard & Poor's 500 Stock Index and the NASD Non-Financial Index for the five-year period ended June 2, 2018. The graph assumes an investment of $100 on June 2, 2013 in the company's common stock, the Standard & Poor's 500 Stock Index and the NASD Non-Financial Index, with dividends reinvested.

2013 | 2014 | 2015 | 2016 | 2017 | 2018 | ||||||||||||||||||

Herman Miller, Inc. | $ | 100 | $ | 113 | $ | 102 | $ | 119 | $ | 125 | $ | 129 | |||||||||||

S&P 500 Index | $ | 100 | $ | 118 | $ | 129 | $ | 129 | $ | 150 | $ | 168 | |||||||||||

NASD Non-Financial | $ | 100 | $ | 124 | $ | 150 | $ | 148 | $ | 192 | $ | 228 | |||||||||||

Information required by this item is also contained in Item 12 of this report.

14 2018 Annual Report

Item 6 Selected Financial Data

Review of Operations | ||||||||||||||||||||

(In millions, except key ratios and per share data) | 2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||

Operating Results | ||||||||||||||||||||

Net sales | $ | 2,381.2 | $ | 2,278.2 | $ | 2,264.9 | $ | 2,142.2 | $ | 1,882.0 | ||||||||||

Gross margin | 873.0 | 864.2 | 874.2 | 791.4 | 631.0 | |||||||||||||||

Selling, general, and administrative (8) | 622.4 | 600.3 | 585.6 | 556.6 | 590.8 | |||||||||||||||

Design and research | 73.1 | 73.1 | 77.1 | 71.4 | 65.9 | |||||||||||||||

Operating earnings (loss) | 177.5 | 190.8 | 211.5 | 163.4 | (25.7 | ) | ||||||||||||||

Earnings (loss) before income taxes | 168.1 | 177.6 | 196.6 | 145.2 | (43.4 | ) | ||||||||||||||

Net earnings (loss) | 128.7 | 124.1 | 137.5 | 98.1 | (22.1 | ) | ||||||||||||||

Cash flow from operating activities | 166.5 | 202.1 | 210.4 | 167.7 | 90.1 | |||||||||||||||

Cash flow used in investing activities | (62.7 | ) | (116.3 | ) | (80.8 | ) | (213.6 | ) | (48.2 | ) | ||||||||||

Cash flow (used in) provided by financing activities | 2.5 | (74.6 | ) | (106.5 | ) | 6.8 | (22.4 | ) | ||||||||||||

Depreciation and amortization | 66.9 | 58.9 | 53.0 | 49.8 | 42.4 | |||||||||||||||

Capital expenditures | 70.6 | 87.3 | 85.1 | 63.6 | 40.8 | |||||||||||||||

Common stock repurchased plus cash dividends paid | 88.9 | 63.2 | 49.0 | 37.0 | 43.0 | |||||||||||||||

Key Ratios | ||||||||||||||||||||

Sales growth | 4.5 | % | 0.6 | % | 5.7 | % | 13.8 | % | 6.0 | % | ||||||||||

Gross margin (1) | 36.7 | 37.9 | 38.6 | 36.9 | 33.5 | |||||||||||||||

Selling, general, and administrative (1) (8) | 26.1 | 26.3 | 25.9 | 26.0 | 31.4 | |||||||||||||||

Design and research (1) | 3.1 | 3.2 | 3.4 | 3.3 | 3.5 | |||||||||||||||

Operating earnings (1) | 7.5 | 8.4 | 9.3 | 7.6 | (1.4 | ) | ||||||||||||||

Net earnings growth (decline) | 3.7 | (9.7 | ) | 40.2 | 543.9 | (132.4 | ) | |||||||||||||

After-tax return on net sales (4) | 5.4 | 5.4 | 6.1 | 4.6 | (1.2 | ) | ||||||||||||||

After-tax return on average assets (5) | 9.2 | 9.8 | 11.3 | 9.0 | (2.3 | ) | ||||||||||||||

After-tax return on average equity (6) | 20.5 | % | 22.3 | % | 29.1 | % | 25.0 | % | (6.5 | )% | ||||||||||

Share and Per Share Data | ||||||||||||||||||||

Earnings (loss) per share-diluted | $ | 2.12 | $ | 2.05 | $ | 2.26 | $ | 1.62 | $ | (0.37 | ) | |||||||||

Cash dividends declared per share | 0.72 | 0.68 | 0.59 | 0.56 | 0.53 | |||||||||||||||

Book value per share at year end (9) | 11.22 | 9.82 | 8.76 | 7.04 | 6.14 | |||||||||||||||

Market price per share at year end | 32.85 | 32.70 | 31.64 | 27.70 | 31.27 | |||||||||||||||

Weighted average shares outstanding-diluted | 60.3 | 60.6 | 60.5 | 60.1 | 59.0 | |||||||||||||||

Financial Condition | ||||||||||||||||||||

Total assets | $ | 1,479.5 | $ | 1,306.3 | $ | 1,235.2 | $ | 1,192.7 | $ | 995.6 | ||||||||||

Working capital (3) | 231.6 | 106.2 | 90.5 | 110.1 | 83.2 | |||||||||||||||

Current ratio (2) | 1.6 | 1.3 | 1.2 | 1.3 | 1.2 | |||||||||||||||

Interest-bearing debt and related swap agreements (10) | 265.1 | 197.8 | 221.9 | 290.0 | 250.0 | |||||||||||||||

Stockholders' equity | 664.8 | 587.7 | 524.7 | 420.3 | 364.3 | |||||||||||||||

Total capital (7) | 929.9 | 785.5 | 746.6 | 710.3 | 614.3 | |||||||||||||||

(1) Shown as a percent of net sales.

(2) Calculated using current assets divided by current liabilities.

(3) Calculated using current assets less non-interest bearing current liabilities.

(4) Calculated as net earnings (loss) divided by net sales.

(5) Calculated as net earnings (loss) divided by average assets.

(6) Calculated as net earnings (loss) divided by average equity.

(7) Calculated as interest-bearing debt plus stockholders' equity.

(8) Selling, general, and administrative expenses include restructuring and impairment expenses in years that are applicable.

(9) Calculated as total stockholders' equity divided by common shares of stock outstanding.

(10) Amounts shown include the fair market value of the company’s interest rate swap arrangement(s). The net fair value of this/these arrangement(s) was/were $(9.9) million at June 3, 2018, $(2.1) million at June 3, 2017, $1.2 million at May 29, 2010, $2.4 million at May 30, 2009, and $0.5 million at May 31, 2008.

Herman Miller, Inc. and Subsidiaries 15

Review of Operations | |||||||||||||||||||||||

(In millions, except key ratios and per share data) | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||||||||

Operating Results | |||||||||||||||||||||||

Net sales | $ | 1,774.9 | $ | 1,724.1 | $ | 1,649.2 | $ | 1,318.8 | $ | 1,630.0 | $ | 2,012.1 | |||||||||||

Gross margin | 605.2 | 590.6 | 538.1 | 428.5 | 527.7 | 698.7 | |||||||||||||||||

Selling, general, and administrative (8) | 430.4 | 400.3 | 369.0 | 334.4 | 359.2 | 400.9 | |||||||||||||||||

Design and research | 59.9 | 52.7 | 45.8 | 40.5 | 45.7 | 51.2 | |||||||||||||||||

Operating earnings | 114.9 | 137.6 | 123.3 | 53.6 | 122.8 | 246.6 | |||||||||||||||||

Earnings before income taxes | 97.2 | 119.5 | 102.5 | 34.8 | 98.9 | 230.4 | |||||||||||||||||

Net earnings | 68.2 | 75.2 | 70.8 | 28.3 | 68.0 | 152.3 | |||||||||||||||||

Cash flow from operating activities | 136.5 | 90.1 | 89.0 | 98.7 | 91.7 | 213.6 | |||||||||||||||||

Cash flow used in investing activities | (209.7 | ) | (58.4 | ) | (31.4 | ) | (77.6 | ) | (29.5 | ) | (51.0 | ) | |||||||||||

Cash flow used in financing activities | (16.0 | ) | (1.6 | ) | (50.2 | ) | (78.9 | ) | (16.5 | ) | (86.5 | ) | |||||||||||

Depreciation and amortization | 37.5 | 37.2 | 39.1 | 42.6 | 41.7 | 43.2 | |||||||||||||||||

Capital expenditures | 50.2 | 28.5 | 30.5 | 22.3 | 25.3 | 40.5 | |||||||||||||||||

Common stock repurchased plus cash dividends paid | 22.7 | 7.9 | 6.0 | 5.7 | 19.5 | 287.9 | |||||||||||||||||

Key Ratios | |||||||||||||||||||||||

Sales growth (decline) | 2.9 | % | 4.5 | % | 25.1 | % | (19.1 | )% | (19.0 | )% | 4.9 | % | |||||||||||

Gross margin (1) | 34.1 | 34.3 | 32.6 | 32.5 | 32.4 | 34.7 | |||||||||||||||||

Selling, general, and administrative (1) (8) | 24.3 | 23.2 | 22.4 | 25.4 | 22.0 | 19.9 | |||||||||||||||||

Design and research (1) | 3.4 | 3.1 | 2.8 | 3.1 | 2.8 | 2.5 | |||||||||||||||||

Operating earnings (1) | 6.5 | 8.0 | 7.5 | 4.1 | 7.5 | 12.3 | |||||||||||||||||

Net earnings growth (decline) | (9.3 | ) | 6.2 | 150.2 | (58.4 | ) | (55.4 | ) | 18.0 | ||||||||||||||

After-tax return on net sales (4) | 3.8 | 4.4 | 4.3 | 2.1 | 4.2 | 7.6 | |||||||||||||||||

After-tax return on average assets (5) | 7.6 | 9 | 8.9 | 3.7 | 8.7 | 20.9 | |||||||||||||||||

After-tax return on average equity (6) | 24.7 | % | 34.4 | % | 52.5 | % | 78.1 | % | 860.8 | % | 186.4 | % | |||||||||||

Share and Per Share Data | |||||||||||||||||||||||

Earnings per share-diluted | $ | 1.16 | $ | 1.29 | $ | 1.06 | $ | 0.43 | $ | 1.25 | $ | 2.56 | |||||||||||

Cash dividends declared per share | 0.43 | 0.09 | 0.09 | 0.09 | 0.29 | 0.35 | |||||||||||||||||

Book value per share at year end (9) | 5.31 | 4.13 | 3.42 | 1.27 | — | 0.28 | |||||||||||||||||

Market price per share at year end | 28.11 | 17.87 | 24.56 | 19.23 | 14.23 | 24.80 | |||||||||||||||||

Weighted average shares outstanding-diluted | 58.8 | 58.5 | 57.7 | 57.5 | 54.5 | 59.6 | |||||||||||||||||

Financial Condition | |||||||||||||||||||||||

Total assets | $ | 951.2 | $ | 843.8 | $ | 819.1 | $ | 775.3 | $ | 772.0 | $ | 787.9 | |||||||||||

Working capital (3) | 96.8 | 189.1 | 193.4 | 69.2 | 155.2 | 170.2 | |||||||||||||||||

Current ratio (2) | 1.3 | 1.7 | 1.7 | 1.2 | 1.5 | 1.5 | |||||||||||||||||

Interest-bearing debt and related swap agreement (10) | 250.0 | 250.0 | 250.0 | 301.2 | 377.4 | 375.5 | |||||||||||||||||

Stockholders' equity | 311.7 | 240.5 | 197.2 | 72.3 | 0.2 | 15.6 | |||||||||||||||||

Total capital (7) | 561.7 | 490.5 | 447.2 | 373.5 | 377.6 | 391.1 | |||||||||||||||||

16 2018 Annual Report

Item 7 Management's Discussion and Analysis of Financial Condition and Results of Operations

You should read the issues discussed in Management's Discussion and Analysis in conjunction with the company's Consolidated Financial Statements and the Notes to the Consolidated Financial Statements included in this Annual Report on Form 10-K.

Executive Overview

Herman Miller’s mission statement is Inspiring Designs to Help People Do Great Things. At present, most customers come to the company for furnishing interior environments in corporate offices, healthcare settings, higher education institutions and residential spaces. The company's primary products include furniture systems, seating, storage, freestanding furniture, healthcare environment products, casegoods, textiles and related technologies and services.

More than 100 years of innovative business practices and a commitment to social responsibility have established Herman Miller as a recognized global company. A past recipient of the Smithsonian Institution's Cooper Hewitt National Design Award, Herman Miller designs can be found in the permanent collections of museums worldwide. Herman Miller maintains its listing in the Human Rights Campaign Foundation’s top rating in its annual Corporate Equality Index. The company trades on the NASDAQ Global Select Market under the symbol MLHR.

Herman Miller's products are sold internationally through wholly-owned subsidiaries or branches in various countries including the United Kingdom, Canada, France, Germany, Italy, Japan, Korea, Mexico, Australia, Singapore, China, Hong Kong, India, Brazil and the Netherlands. The company's products are offered elsewhere in the world primarily through independent dealerships or joint ventures with customers in over 100 countries.

The company is globally positioned in terms of manufacturing operations. In the United States, manufacturing operations are located in Michigan, Georgia, Wisconsin and North Carolina. In Europe, its manufacturing presence is located in the United Kingdom. Manufacturing operations globally also include facilities located in China, Brazil and India. The company manufactures products using a system of lean manufacturing techniques collectively referred to as the Herman Miller Performance System (HMPS). Herman Miller strives to maintain efficiencies and cost savings by minimizing the amount of inventory on hand. Accordingly, production is order-driven with direct materials and components purchased as needed to meet demand. The standard manufacturing lead time for the majority of our products is 10 to 20 days. These factors result in a high rate of inventory turns related to our manufactured inventories.

A key element of the company's manufacturing strategy is to limit fixed production costs by sourcing component parts from strategic suppliers. This strategy has allowed the company to increase the variable nature of its cost structure, while retaining proprietary control over those production processes that the company believes provide a competitive advantage. As a result of this strategy, the company's manufacturing operations are largely assembly-based.

A key element of the company's growth strategy is to scale the Consumer business through the company's subsidiary, Design Within Reach (DWR). The Consumer business provides a channel to bring Herman Miller's iconic and design-centric products to retail customers along with other proprietary and third party products with a focus on design. The company continues to transform the DWR retail studio footprint, which will be complemented by a continued focus on improving margins through the development of exclusive product designs and leveraging additional sales in DWR's contract, catalog and digital channels.

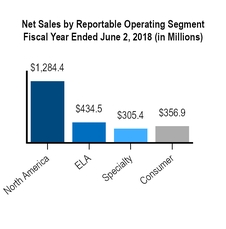

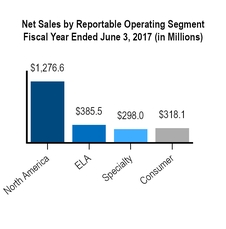

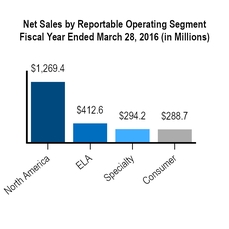

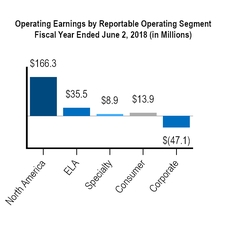

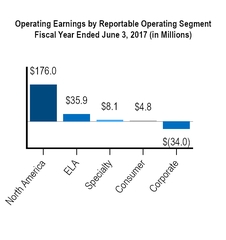

The business is comprised of various operating segments as defined by generally accepted accounting principles in the United States (U.S. GAAP). The operating segments are determined on the basis of how the company internally reports and evaluates financial information used to make operating decisions. The company has identified the following reportable segments:

• | North American Furniture Solutions — Includes the operations associated with the design, manufacture, and sale of furniture products for work-related settings, including office, education, and healthcare environments, throughout the United States and Canada. |

• | ELA Furniture Solutions — ELA Furniture Solutions includes the operations associated with the design, manufacture and sale of furniture products, primarily for work-related settings, in the Europe, Middle East and Africa (EMEA), Latin America and Asia-Pacific geographic regions. |

• | Specialty — Includes the operations associated with design, manufacture and sale of high-craft furniture products and textiles including Geiger wood products, Maharam textiles, Nemschoff and Herman Miller Collection products. |

• | Consumer — Includes the operations associated with the sale of modern design furnishings and accessories to third party retail distributors, as well as direct to consumer sales through e-commerce, direct mailing catalogs and Design Within Reach (DWR) studios. |

Herman Miller, Inc. and Subsidiaries 17

The company also reports a corporate category consisting primarily of unallocated corporate expenses including acquisition-related costs and other unallocated corporate costs.

Core Strengths

The company relies on the following core strengths in delivering solutions to customers:

• | Portfolio of Leading Brands - Herman Miller is a globally-recognized, authentic brand known for working with some of the most outstanding designers in the world. Within the industries in which the company operates, Herman Miller, DWR, Geiger, Maharam, POSH, Nemschoff, Colbrook Bosson Saunders ("CBS") and Naughtone are acknowledged as leading brands that inspire architects and designers to create their best design solutions. This portfolio has enabled Herman Miller to connect with new audiences, channels, geographies and product categories. Leveraging the company's brand equity across the lines of business is an important element of the company's business strategy. |

• | Problem-Solving Design and Innovation - The company is committed to developing research-based functionality and aesthetically innovative new products and has a history of doing so, in collaboration with a global network of leading independent designers. The company believes its skills and experience in matching problem-solving design with the workplace needs of customers provide the company with a competitive advantage in the marketplace. An important component of the company's business strategy is to actively pursue a program of new product research, design and development. The company accomplishes this through the use of an internal research and engineering staff that engages with third party design resources generally compensated on a royalty basis. |

• | Operational Excellence - The company was among the first in the industry to embrace the concepts of lean manufacturing. HMPS provides the foundation for all of the company's manufacturing operations. The company is committed to continuously improving both product quality and production and operational efficiency. The company has extended this lean process work to its non-manufacturing processes as well as externally to its manufacturing supply chain and distribution channel. The company believes these concepts hold significant promise for further gains in reliability, quality and efficiency. |

• | Leading Networks - The company values relationships in all areas of the business. The company considers its network of innovative designers, owned and independent dealers and suppliers to be among the most important competitive factors and vital to the long-term success of the business. |

• | Multi-Channel Reach - The company has built a multi-channel distribution capability that it considers unique. Through contract furniture dealers, direct customer sales, retail studios, e-Commerce, catalogs and independent retailers, the company serves contract and residential customers across a range of channels and geographies. |

Channels of Distribution

The company's products and services are offered to most of its customers under standard trade credit terms between 30 and 45 days and are sold through the following distribution channels:

• | Independent and Owned Contract Furniture Dealers - Most of the company's product sales are made to a network of independently owned and operated contract furniture dealerships doing business in many countries around the world. These dealers purchase the company's products and distribute them to end customers. The company recognizes revenue on product sales through this channel once products are shipped and title passes to the dealer. Many of these dealers also offer furniture-related services, including product installation. |

• | Direct Customer Sales - The company also sells products and services directly to end customers without an intermediary (e.g., sales to the U.S. federal government). In most of these instances, the company contracts separately with a dealership or third-party installation company to provide sales-related services. The company recognizes revenue on these sales once the related product is shipped to the end customer and installation, if applicable, is substantially complete. |

• | DWR Retail Studios - At the end of fiscal 2018, the Consumer business unit included 32 retail studios (including 31 operating under the DWR brand and a Herman Miller Flagship store in New York City). This business also operates two outlet studios. The retail studios are located in metropolitan areas throughout North America. Revenue on sales from these studios is recognized upon shipment and transfer to the customer of both title and risk of loss. |

• | E-Commerce - The company sells products through its online stores, in which products are available for sale via the company's website, hermanmiller.com, global e-commerce platforms, as well as through the DWR online store, dwr.com. These sites complement our existing methods of distribution and extend the company's brand to new customers. The company recognizes revenue on these sales upon shipment and transfer to the customer of both title and risk of loss. |

18 2018 Annual Report

• | DWR Direct-Mail Catalogs - The company’s consumer business unit utilizes a direct-mail catalog program through its DWR subsidiary. A regular schedule of catalog mailings is maintained throughout the fiscal year and these serve as a key driver of sales across each of DWR’s channels, including retail studios and e-commerce websites. Revenue on sales transacted through this catalog program is recognized upon shipment and transfer to the customer of both title and risk of loss. |

• | Independent Retailers - Certain products are sold to end customers through independent retail operations. Revenue is recognized on these sales once products are shipped and title and risk of loss passes to the independent retailer. |

Challenges Ahead

Like all businesses, the company is faced with a host of challenges and risks. The company believes its core strengths and values, which provide the foundation for its strategic direction, have well prepared the company to respond to the inevitable challenges it will face in the future. While the company is confident in its direction, it acknowledges the risks specific to the business and industry. Refer to Item 1A for discussion of certain of these risk factors and Item 7A for disclosures of market risk. In particular, the company has recently experienced the negative impact of higher steel costs and increased pressures from competitive price discounting, particularly in the North America and ELA markets.

Areas of Strategic Focus

Despite a number of risks and challenges, the company believes it is well positioned to successfully pursue its mission of inspiring designs to help people do great things. As our business and industry continue to evolve, we are constantly focused on staying ahead of the curve. With the composition of the office floor plate moving toward a broader variety of furnishings, a greater desire for customization from our customers, new technologies, and trends towards urbanization and more seamless transactions in the retail world, we have centered our overall value creation strategy on five key priorities.

Scaling Consumer - The company has an ambition to expand the connection of its powerful brand more directly with the consumers of its products. The transformation of the Design Within Reach retail studio footprint will continue to add incremental selling space from a combination of new and repositioned studios. Studio expansions will be complemented by a continued focus on improving margins and profitability through the development of exclusive product designs and leveraging additional sales in our contract, catalog and digital channels.

Realizing the Living Office - In fiscal 2014, the company introduced Living Office, a research-based framework for designing high-performing workplaces that deliver an elevated experience of work for people and help organizations achieve their strategic goals. The company is now focusing on taking the framework to the next level by accelerating the evolution of Living Office with new products and technology solutions, along with research that quantifies the positive impact to organizations from applying these concepts.

Delivering Innovation - Product innovation has been a traditional strength at Herman Miller, and the company is determined to keep this dimension of its business as a competitive edge. With creative direction and new product commercialization under common leadership, the company is focused on reducing its time to market and meeting our customers' most critical needs through a robust pipeline of new products and solutions.