Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MERCURY SYSTEMS INC | q42018earningsrelease8-k.htm |

| EX-99.1 - EXHIBIT 99.1 - MERCURY SYSTEMS INC | q42018earningsreleaseexhib.htm |

4th Quarter and Full Fiscal Year 2018 Financial Results & Germane Systems Acquisition Overview Mark Aslett President and CEO Conference call: Dial (877) 303-6977 in the USA and Canada, Michael Ruppert (760) 298-5079 in all other countries Executive Vice President and CFO Webcast login at www.mrcy.com/investor July 31, 2018, 5:00 pm ET Webcast replay available by 7:00 p.m. ET July 31, 2018 © 2018 Mercury Systems, Inc. 1

Forward-looking safe harbor statement This presentation contains certain forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995, including those relating to the acquisition described herein and to fiscal 2019 business performance and beyond and the Company’s plans for growth and improvement in profitability and cash flow. You can identify these statements by the use of the words “may,” “will,” “could,” “should,” “would,” “plans,” “expects,” “anticipates,” “continue,” “estimate,” “project,” “intend,” “likely,” “forecast,” “probable,” “potential,” and similar expressions. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected or anticipated. Such risks and uncertainties include, but are not limited to, continued funding of defense programs, the timing and amounts of such funding, general economic and business conditions, including unforeseen weakness in the Company’s markets, effects of any U.S. Federal government shutdown or extended continuing resolution, effects of continued geopolitical unrest and regional conflicts, competition, changes in technology and methods of marketing, delays in completing engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, changes in, or in the U.S. Government’s interpretation of, federal export control or procurement rules and regulations, market acceptance of the Company's products, shortages in components, production delays or unanticipated expenses due to performance quality issues with outsourced components, inability to fully realize the expected benefits from acquisitions and restructurings, or delays in realizing such benefits, challenges in integrating acquired businesses and achieving anticipated synergies, increases in interest rates, changes to cyber-security regulations and requirements, changes in tax rates or tax regulations, changes to generally accepted accounting principles, difficulties in retaining key employees and customers, unanticipated costs under fixed-price service and system integration engagements, and various other factors beyond our control. These risks and uncertainties also include such additional risk factors as are discussed in the Company's filings with the U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended June 30, 2017. The Company cautions readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made. Use of Non-GAAP (Generally Accepted Accounting Principles) Financial Measures In addition to reporting financial results in accordance with generally accepted accounting principles, or GAAP, the Company provides adjusted EBITDA, adjusted income, adjusted EPS, and free cash flow, which are non-GAAP financial measures. Adjusted EBITDA, adjusted income, and adjusted EPS exclude certain non-cash and other specified charges. The Company believes these non-GAAP financial measures are useful to help investors better understand its past financial performance and prospects for the future. However, these non-GAAP measures should not be considered in isolation or as a substitute for financial information provided in accordance with GAAP. Management believes these non-GAAP measures assist in providing a more complete understanding of the Company’s underlying operational results and trends, and management uses these measures along with the corresponding GAAP financial measures to manage the Company’s business, to evaluate its performance compared to prior periods and the marketplace, and to establish operational goals. A reconciliation of GAAP to non-GAAP financial results discussed in this presentation is contained in the Appendix hereto. © 2018 Mercury Systems, Inc. 2

Strong financial performance Q4 FY18 YoY Results Full FY18 YoY Results • Record bookings up 30% • Record bookings up 27% • Record revenue up 32% • Record revenue up 21% • Organic revenue(1) up 16% • Organic revenue(1) up 7% • GAAP net income up 15% • Record GAAP net income up 64% • Record adj. EBITDA up 36% • Record adj. EBITDA up 23% • Record backlog up 25% • Record backlog up 25% • Improved working capital • H2 free cash flow up 106% vs. H1 (1) Organic revenue represents total company revenue excluding net revenue from acquisitions for the first four full quarters since the entities’ acquisition date (which excludes any intercompany transactions). After the completion of four fiscal quarters, acquired businesses are treated as organic for current and comparable historical periods. © 2018 Mercury Systems, Inc. 3

Q4 and fiscal 2018 strategic achievements • Integration of prior acquisitions progressing well • Recently acquired businesses performance strong • Added important new capabilities at the USMO • Insourcing ramp continued; delivering substantial savings • New business capture demonstrates benefits of trusted manufacturing • Penetrated C4I market organically and via RTL, Themis acquisitions • Announcing acquisition of Germane Systems © 2018 Mercury Systems, Inc. 4

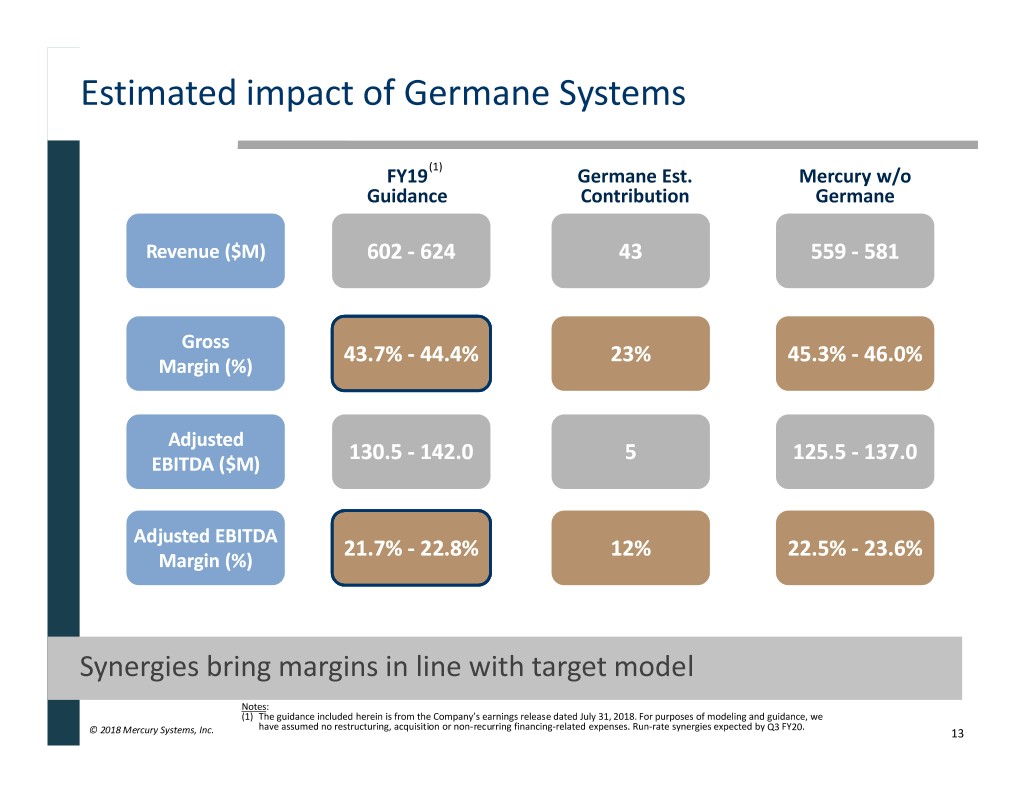

Acquisition of Germane Systems Combination with Themis presents compelling value creation opportunity • Leading provider of rugged servers for C2I applications • Will integrate Germane with recently acquired Themis Computer • Complementary market focus; strategic program portfolio • Creates $100M+ C2I rugged server business in less than 6 months • $45M purchase price(1); funded with existing revolver – Germane 10x gross purchase multiple of LTM adj. EBITDA – Germane 4x purchase multiple net of expected tax benefits(2) and cost savings(3) • Themis and Germane combined ~9x net purchase price multiple • Germane accretive to fiscal 2019 adj. EPS – Slightly dilutive to fiscal 2019 gross margin and adj. EBITDA margin • Platform expected to achieve mid-point of target adj. EBITDA margin in FY20 Notes: (1) Subject to net working capital and net debt adjustments. (2) Acquisition of Germane Systems, a limited liability company, is treated as an asset purchase for tax purposes, resulting in $7M in net present value of tax benefits. (3) Acquisition of Germane Systems is expected to yield $5M in run rate cost synergies. © 2018 Mercury Systems, Inc. 5

Business outlook remains strong • Defense budget has increased; expected continued growth 3%+ • Capitalizing on favorable industry trends – increased outsourcing, flight to quality, supply chain delayering • Grow core C4I, Sensor and Effector Mission Systems markets • High-tech business model working extremely well • Organic and M&A-driven growth outlook strong • FY19 organic revenue growth expected to increase to 8% - 9% © 2018 Mercury Systems, Inc. 6

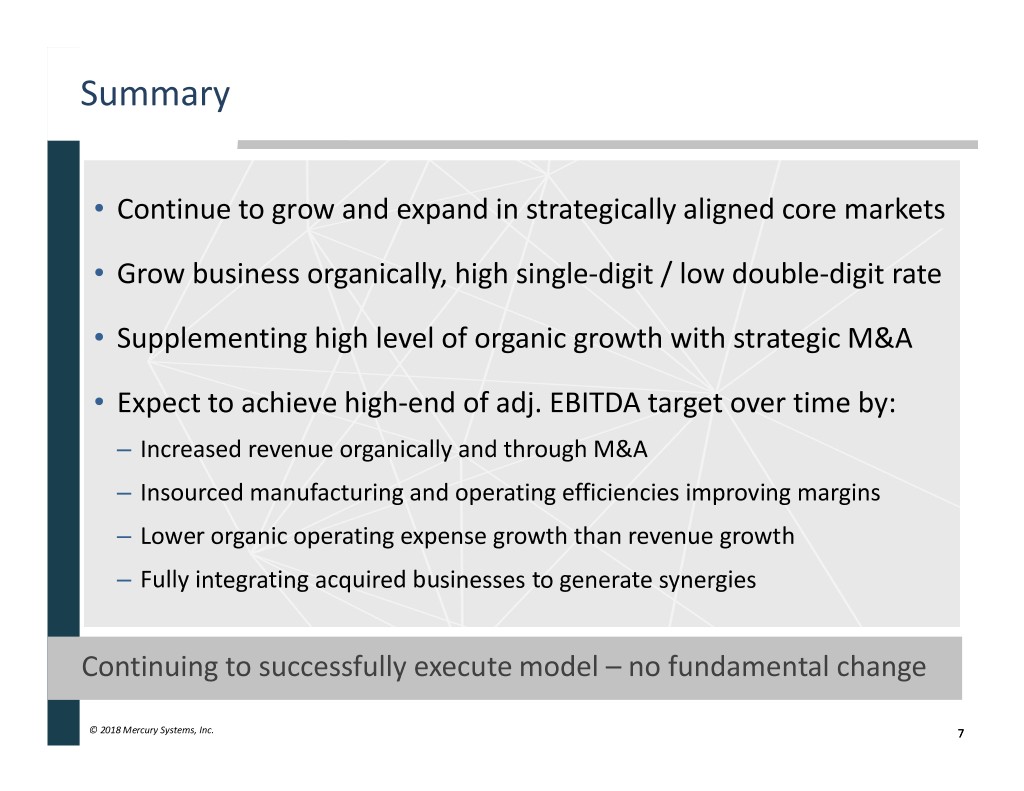

Summary • Continue to grow and expand in strategically aligned core markets • Grow business organically, high single-digit / low double-digit rate • Supplementing high level of organic growth with strategic M&A • Expect to achieve high-end of adj. EBITDA target over time by: – Increased revenue organically and through M&A – Insourced manufacturing and operating efficiencies improving margins – Lower organic operating expense growth than revenue growth – Fully integrating acquired businesses to generate synergies Continuing to successfully execute model – no fundamental change © 2018 Mercury Systems, Inc. 7

Q4 FY18 vs. Q4 FY17 In $ millions, except percentage and per share data Q4 FY17 Q4 FY18 Change Bookings $132.3 $171.7 30% Book-to-Bill 1.14 1.12 Backlog $357.0 $447.1 25% 12-Month Backlog $290.8 $328.5 Revenue $115.6 $152.9 32% Organic Revenue Growth(1) 4% 16% Gross Margin 46.6% 44.7% (1.9 pt) Operating Expenses $40.9 $49.4 21% Selling, General & Administrative 20.4 25.4 Research & Development 13.9 14.9 Amortization/Restructuring/Acquisition 6.6 9.1 GAAP Income $8.8 $10.1 15% GAAP EPS $0.19 $0.21 11% Weighted Average Diluted Shares 47.5 47.5 Adjusted EPS(2) $0.32 $0.47 47% Adj. EBITDA(2) $27.8 $37.7 36% % of revenue 24.0% 24.6% Free Cash Flow(2) $3.7 $21.6 487% Notes: (1) Organic revenue represents total company revenue excluding net revenue from acquisitions for the first four full quarters since the entities’ acquisition date (which excludes any intercompany transactions). After the completion of four fiscal quarters, acquired businesses are treated as organic for current and comparable historical periods. (2) Non-GAAP, see reconciliation table. © 2018 Mercury Systems, Inc. 8

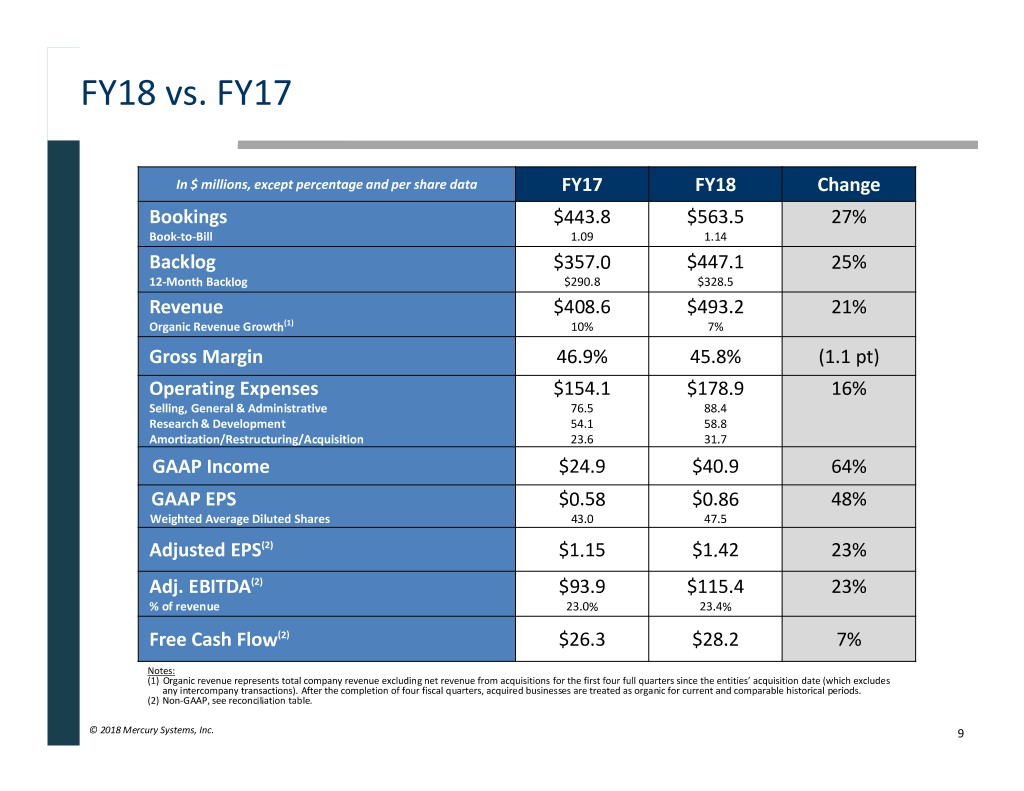

FY18 vs. FY17 In $ millions, except percentage and per share data FY17 FY18 Change Bookings $443.8 $563.5 27% Book-to-Bill 1.09 1.14 Backlog $357.0 $447.1 25% 12-Month Backlog $290.8 $328.5 Revenue $408.6 $493.2 21% Organic Revenue Growth(1) 10% 7% Gross Margin 46.9% 45.8% (1.1 pt) Operating Expenses $154.1 $178.9 16% Selling, General & Administrative 76.5 88.4 Research & Development 54.1 58.8 Amortization/Restructuring/Acquisition 23.6 31.7 GAAP Income $24.9 $40.9 64% GAAP EPS $0.58 $0.86 48% Weighted Average Diluted Shares 43.0 47.5 Adjusted EPS(2) $1.15 $1.42 23% Adj. EBITDA(2) $93.9 $115.4 23% % of revenue 23.0% 23.4% Free Cash Flow(2) $26.3 $28.2 7% Notes: (1) Organic revenue represents total company revenue excluding net revenue from acquisitions for the first four full quarters since the entities’ acquisition date (which excludes any intercompany transactions). After the completion of four fiscal quarters, acquired businesses are treated as organic for current and comparable historical periods. (2) Non-GAAP, see reconciliation table. © 2018 Mercury Systems, Inc. 9

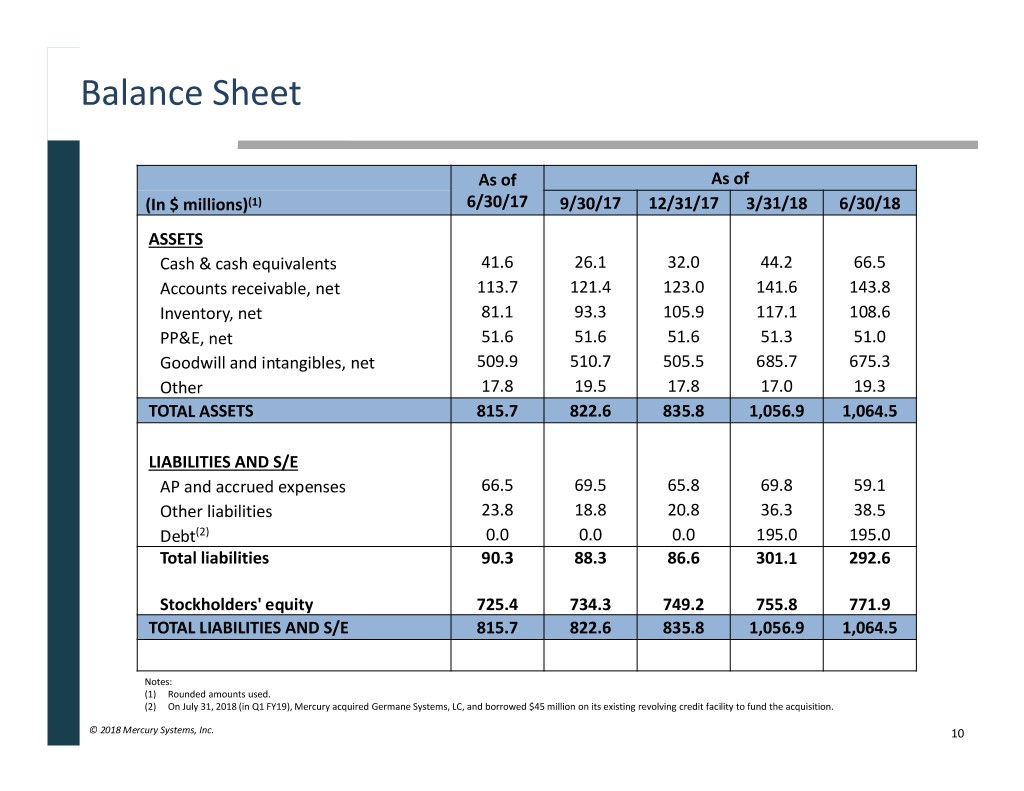

Balance Sheet As of As of (In $ millions)(1) 6/30/17 9/30/17 12/31/17 3/31/18 6/30/18 ASSETS Cash & cash equivalents 41.6 26.1 32.0 44.2 66.5 Accounts receivable, net 113.7 121.4 123.0 141.6 143.8 Inventory, net 81.1 93.3 105.9 117.1 108.6 PP&E, net 51.6 51.6 51.6 51.3 51.0 Goodwill and intangibles, net 509.9 510.7 505.5 685.7 675.3 Other 17.8 19.5 17.8 17.0 19.3 TOTAL ASSETS 815.7 822.6 835.8 1,056.9 1,064.5 LIABILITIES AND S/E AP and accrued expenses 66.5 69.5 65.8 69.8 59.1 Other liabilities 23.8 18.8 20.8 36.3 38.5 Debt(2) 0.0 0.0 0.0 195.0 195.0 Total liabilities 90.3 88.3 86.6 301.1 292.6 Stockholders' equity 725.4 734.3 749.2 755.8 771.9 TOTAL LIABILITIES AND S/E 815.7 822.6 835.8 1,056.9 1,064.5 Notes: (1) Rounded amounts used. (2) On July 31, 2018 (in Q1 FY19), Mercury acquired Germane Systems, LC, and borrowed $45 million on its existing revolving credit facility to fund the acquisition. © 2018 Mercury Systems, Inc. 10

Cash Flow summary FY18 FY18 FY17 (In $ millions)(1) Q1 Q2 Q3 Q4 Total Net Income 24.9 18.0 9.1 3.7 10.1 40.9 Depreciation and amortization 32.3 9.3 9.6 11.4 12.0 42.3 Other non-cash items, net 8.7 0.8 4.7 3.3 5.1 14.0 Change in Working Capital Accounts receivable, unbilled receivables, (14.1) (7.8) (1.4) (10.6) (2.9) (22.8) and costs in excess of billings Inventory (9.3) (11.1) (11.3) (2.5) 8.7 (16.2) Accounts payable and accrued expenses 3.5 12.8 (1.2) (8.7) (8.2) (5.3) Other 13.2 (14.0) (0.7) 4.2 0.8 (9.5) Changes in Operating Assets and Liabilities (6.7) (20.1) (14.6) (17.5) (1.6) (53.8) Operating Cash Flow 59.1 8.0 8.8 0.9 25.6 43.3 Capital expenditures (32.8) (3.6) (4.0) (3.5) (4.0) (15.1) Free Cash Flow(2) 26.3 4.4 4.8 (2.6) 21.6 28.2 Free Cash Flow(2) / Adjusted EBITDA(2) 28% 18% 18% n.a. 57% 24% Free Cash Flow(2) / GAAP Net Income 106% 24% 53% n.a. 214% 69% Notes: (1) Rounded amounts used. (2) Non-GAAP, see reconciliation table. © 2018 Mercury Systems, Inc. 11

FY19 annual guidance In $ millions, except percentage and per share data FY18(1) FY19(2) Change Revenue $493.2 $602 - $624 22% - 27% Gross Margin 45.8% 43.7% - 44.4% (2.1) - (1.4)pts Operating Expenses $178.9 $202.2 - $204.3 13% - 14% GAAP Income $40.9 $36.1 - $44.5 (12%) - 9% Effective tax rate(3) 4% 27% GAAP EPS $0.86 $0.75 - $0.93 (13%) - 8% Weighted-average diluted shares outstanding 47.5 47.9 Adjusted EPS(4) $1.42 $1.58 - $1.76 11% - 24% Adj. EBITDA(4) $115.4 $130.5 - $142.0 13% - 23% % of revenue 23.4% 21.7% – 22.8% Notes: (1) FY18 figures are as reported in the Company’s earnings release dated July 31, 2018. (2) The guidance included herein is from the Company’s earnings release dated July 31, 2018. For purposes of modeling and guidance, we have assumed no restructuring, acquisition or non-recurring financing-related expenses. (3) The effective tax rate in the guidance included herein excludes discrete items. (4) Non-GAAP, see reconciliation table. © 2018 Mercury Systems, Inc. 12

Estimated impact of Germane Systems FY19 (1) Germane Est. Mercury w/o Guidance Contribution Germane Revenue ($M) 602 - 624 43 559 - 581 Gross 43.7% - 44.4% 23% 45.3% - 46.0% Margin (%) Adjusted 130.5 - 142.0 5 125.5 - 137.0 EBITDA ($M) Adjusted EBITDA 21.7% - 22.8% 12% 22.5% - 23.6% Margin (%) Synergies bring margins in line with target model Notes: (1) The guidance included herein is from the Company’s earnings release dated July 31, 2018. For purposes of modeling and guidance, we have assumed no restructuring, acquisition or non-recurring financing-related expenses. Run-rate synergies expected by Q3 FY20. © 2018 Mercury Systems, Inc. 13

Q1 FY19 guidance In $ millions, except percentage and per share data Q1 FY18(1) Q1 FY19(2) Change Revenue $106.1 $135 - $141 27% - 33% Gross Margin 47.8% 43.1% - 43.6% (4.7) - (4.2) pts Operating Expenses $40.3 $48.9 - $49.3 21% - 22% GAAP Income $18.0 $4.9 - $7.0 (73%) - (61%) Effective tax rate(3) (88%) 27% GAAP EPS $0.38 $0.10 - $0.15 (74%) - (61%) Weighted-average diluted shares outstanding 47.5 47.8 Adjusted EPS(4) $0.37 $0.32 - $0.36 (14%) – (3%) (4) Adj. EBITDA $25.0 $27.0 - $30.0 8% - 20% % of revenue 23.6% 20.0% – 21.2% Notes: (1) Q1 FY18 figures are as reported in the Company’s earnings release dated October 24, 2017. (2) The guidance included herein is from the Company’s earnings release dated July 31, 2018. For purposes of modeling and guidance, we have assumed no restructuring, acquisition or non-recurring financing-related expenses. (3) The effective tax rate in the guidance included herein excludes discrete items. (4) Non-GAAP, see reconciliation table. © 2018 Mercury Systems, Inc. 14

Summary • Strong Q4 results with record backlog, bookings, revenue, adjusted EBITDA, operating and free cash flow • FY18 results continue to show: – 7% organic growth, 21% total growth and 23.4% adjusted EBITDA margins • Insourcing investments driving strategic and financial benefits • Additional customer-funded R&D and new programs pressure gross margins but indicate longer-term growth • Well-positioned entering FY19 with record backlog and large pipeline of design wins • FY19 guidance shows continuation of strong performance © 2018 Mercury Systems, Inc. 15

Appendix © 2018 Mercury Systems, Inc. 16

Adjusted EPS reconciliation Q1FY19 FY2019 (000's) Q1 FY17 Q2 FY17 Q3 FY17 Q4 FY17 FY17 Q1 FY18 Q2 FY18 Q3 FY18 Q4 FY18 FY18 Low High Low High Diluted net earnings (loss) per share⁽¹⁾ $ 0.10 $ 0.13 $ 0.16 $ 0.19 $ 0.58 $ 0.38 $ 0.19 $ 0.08 $ 0.21 $ 0.86 $ 0.10 $ 0.15 $ 0.75 $ 0.93 Income (loss) from continuing operations $ 3,819 $ 5,204 $ 7,048 $ 8,804 $ 24,875 $ 17,953 $ 9,133 $ 3,696 $ 10,101 $ 40,883 $ 4,900 $ 7,000 $ 36,100 $ 44,500 Amortization of intangible assets 4,602 4,888 4,732 5,458 19,680 5,637 5,827 7,104 7,436 26,004 7,200 7,200 26,900 26,900 Restructuring and other charges 297 69 459 1,127 1,952 95 313 1,384 1,367 3,159 - - - - Impairment of long-lived assets - - - - - - - - - - - - - - Acquisition and financing costs 553 1,114 569 153 2,389 854 1,366 1,909 799 4,928 500 500 2,100 2,100 Fair value adjustments from purchase accounting 2,077 870 270 462 3,679 509 84 539 860 1,992 800 800 1,600 1,600 Litigation and settlement expenses - 100 - 17 117 - - - - - - - - - Stock-based and other non-cash compensation expense 3,632 4,093 3,715 3,901 15,341 4,696 4,941 3,669 4,309 17,615 5,000 5,000 21,000 21,000 Impact to income taxes (6,085) (4,441) (3,576) (4,500) (18,602) (11,951) (8,615) (4,082) (2,621) (27,269) (3,200) (3,200) (12,000) (12,000) Adjusted income from continuing operations $ 8,895 $ 11,897 $ 13,217 $ 15,422 $ 49,431 $ 17,793 $ 13,049 $ 14,219 $ 22,251 $ 67,312 $ 15,200 $ 17,300 $ 75,700 $ 84,100 Diluted adjusted net earnings per share ⁽¹⁾ $ 0.22 $ 0.30 $ 0.29 $ 0.32 $ 1.15 $ 0.37 $ 0.28 $ 0.30 $ 0.47 $ 1.42 $ 0.32 $ 0.36 $ 1.58 $ 1.76 Weighted-average shares outstanding: Basic 38,865 39,151 43,773 46,211 41,986 46,504 46,752 46,844 46,873 46,719 Diluted 39,865 39,985 44,814 47,472 43,018 47,489 47,447 47,532 47,521 47,471 47,800 47,800 47,900 47,900 Notes: (1) Numbers shown are in cents. © 2018 Mercury Systems, Inc. 17

Adjusted EBITDA reconciliation Q1FY19 FY2019 (000'S) Q1 FY17 Q2 FY17 Q3 FY17 Q4 FY17 FY17 Q1 FY18 Q2 FY18 Q3 FY18 Q4 FY18 FY18 Low High Low High Income (loss) from continuing operations $ 3,819 $ 5,204 $ 7,048 $ 8,804 $ 24,875 $ 17,953 $ 9,133 $ 3,696 $ 10,101 $ 40,883 $ 4,900 $ 7,000 $ 36,100 $ 44,500 Interest expense (income), net 1,782 1,888 1,756 1,680 7,106 (16) 104 999 1,731 2,818 2,100 2,100 9,500 9,500 Tax provision (benefit) (1,259) 1,779 3,170 2,503 6,193 (8,381) 1,335 2,209 6,527 1,690 1,800 2,600 13,300 16,400 Depreciation 2,718 2,966 3,233 3,672 12,589 3,700 3,775 4,277 4,521 16,273 4,700 4,800 20,000 20,000 Amortization of intangible assets 4,602 4,888 4,732 5,458 19,680 5,637 5,827 7,104 7,436 26,004 7,200 7,200 26,900 26,900 Restructuring and other charges 297 69 459 1,127 1,952 95 313 1,384 1,367 3,159 - - - - Impairment of long-lived assets - - - - - - - - - - - - - - Acquisition and financing costs 553 1,114 569 153 2,389 854 1,366 1,909 799 4,928 500 500 2,100 2,100 Fair value adjustments from purchase accounting 2,077 870 270 462 3,679 509 84 539 860 1,992 800 800 1,600 1,600 Litigation and settlement expenses - 100 - 17 117 - - - - - - - - - Stock-based and other non-cash compensation expense 3,632 4,093 3,715 3,901 15,341 4,696 4,941 3,669 4,309 17,615 5,000 5,000 21,000 21,000 Adjusted EBITDA $ 18,221 $ 22,971 $ 24,952 $ 27,777 $ 93,921 $ 25,047 $ 26,878 $ 25,786 $ 37,651 $ 115,362 $ 27,000 $ 30,000 $ 130,500 $ 142,000 © 2018 Mercury Systems, Inc. 18

Free cash flow reconciliation (000's) Q1 FY17 Q2 FY17 Q3 FY17 Q4 FY17 FY17 Q1 FY18 Q2 FY18 Q3 FY18 Q4 FY18 FY18 Cash flows from operations $ 10,283 $ 14,238 $ 24,889 $ 9,736 $ 59,146 $ 8,028 $ 8,779 $ 873 $ 25,641 $ 43,321 Capital expenditures (6,050) (7,703) (13,036) (6,055) $ (32,844) (3,628) (3,964) (3,475) (4,039) $ (15,106) Free cash flow $ 4,233 $ 6,535 $ 11,853 $ 3,681 $ 26,302 $ 4,400 $ 4,815 $ (2,602) $ 21,602 $ 28,215 © 2018 Mercury Systems, Inc. 19