Attached files

| file | filename |

|---|---|

| 8-K - HOWARD BANCORP, INC. 8-K - Howard Bancorp Inc | a51844895.htm |

Exhibit 99.1

Investor PresentationJuly 2018

Forward-Looking Statements This presentation contains estimates, predictions, opinions, projections and other "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements often use words such as “anticipate,” “believe,” “contemplate,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “project,” “should” “will,” or other words of similar meaning. You can also identify them by the fact that they do not relate strictly to historical or current facts. Such statements include, without limitation, references to Howard Bancorp, Inc.'s (“Howard”) beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates, intensions and future performance, including our growth strategy and expansion plans, including potential acquisitions. Forward-looking statements involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements.

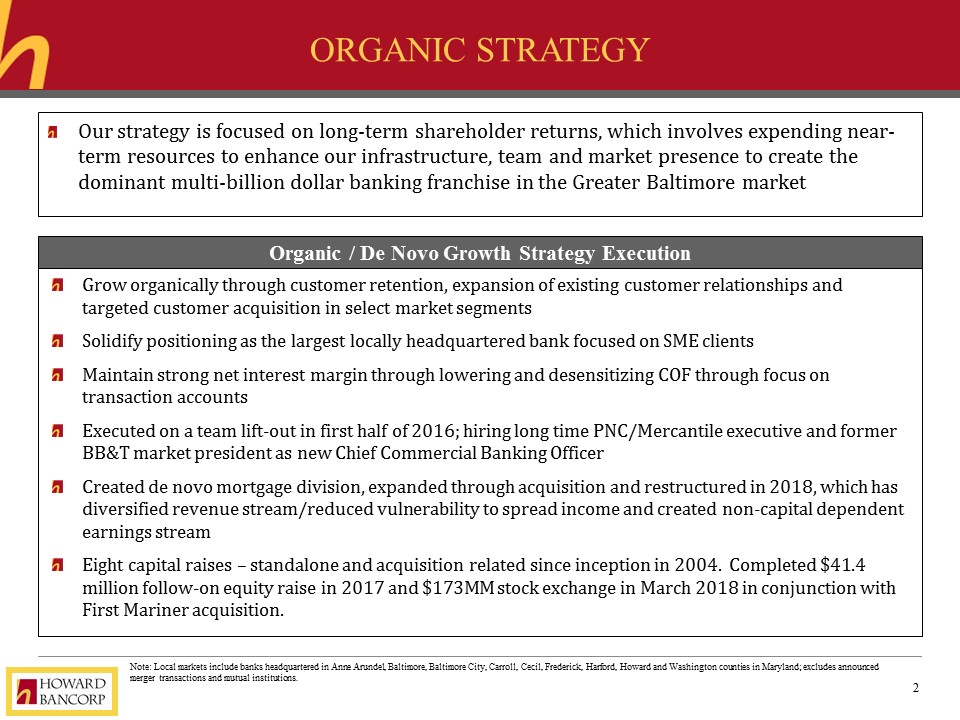

Organic Strategy Grow organically through customer retention, expansion of existing customer relationships and targeted customer acquisition in select market segmentsSolidify positioning as the largest locally headquartered bank focused on SME clientsMaintain strong net interest margin through lowering and desensitizing COF through focus on transaction accounts Executed on a team lift-out in first half of 2016; hiring long time PNC/Mercantile executive and former BB&T market president as new Chief Commercial Banking OfficerCreated de novo mortgage division, expanded through acquisition and restructured in 2018, which has diversified revenue stream/reduced vulnerability to spread income and created non-capital dependent earnings streamEight capital raises – standalone and acquisition related since inception in 2004. Completed $41.4 million follow-on equity raise in 2017 and $173MM stock exchange in March 2018 in conjunction with First Mariner acquisition. Organic / De Novo Growth Strategy Execution Our strategy is focused on long-term shareholder returns, which involves expending near-term resources to enhance our infrastructure, team and market presence to create the dominant multi-billion dollar banking franchise in the Greater Baltimore market Note: Local markets include banks headquartered in Anne Arundel, Baltimore, Baltimore City, Carroll, Cecil, Frederick, Harford, Howard and Washington counties in Maryland; excludes announced merger transactions and mutual institutions.

Acquisition Strategy Extend market presence through strategic M&A, including whole institutions, branches, team lift outs and divisions Assumed Aberdeen branch deposits funded with commercial loans Assumed Havre de Grace branch deposits funded with commercial loans NBRS FDIC transaction innovatively structured Patapsco acquisition1st Mariner acquisitionTarget rich environment with 51 targets / 15 meeting core criteria in targeted geographies with assets $400MM to $1.5BNon-bank acquisition and lift-out opportunities to enhance fee income Note: Local markets include banks headquartered in Anne Arundel, Baltimore, Baltimore City, Carroll, Cecil, Frederick, Harford, Howard and Washington counties in Maryland; excludes announced merger transactions and mutual institutions. Our strategy is to supplement organic growth with targeted, strategic acquisitions now focused on core deposit expansion to further lower COF, and/or excess capital and/or overlapping expense structures and/or specialized lending Acquisition Strategy Execution

Rationale / Objectives of the HBMD/FMB Transaction Create a stronger and more sustainable double digit commercial growth engine to permit expansion of existing relationships at both companies, penetration of new segments and customer by combining two companies uniquely focused on SME companies in Greater BaltimoreDeliver sophisticated Treasury Management products based on the selection of the “best of both” product sets and operating processes, and utilize larger, more efficient branch network to focus on small business deposits to ensure higher than average NIM in a compressing spread environment.Reduce the reliance of both companies on slightly oversized mortgage operations while maintaining an attractive level of non-spread income.Improve the efficiency of two sub-optimal operations through utilization of in market merger economics to rapidly improve scale.

Summary of Transaction Terms (1) Based on HBMD’s closing stock price of $18.00 as of February 28, 2018.(2) Based on 1st Mariner’s common shares outstanding of 3,725,893, convertible preferred shares outstanding of 1,774,125, 700,000 in-the-money options with weighted average exercise price of $20.54 and 75,000 in-the-money warrants with weighted average exercise price of $20.00 as of June 30, 2017, cashed out at $32.50 per share. Acquirer: Howard Bancorp, Inc. (Nasdaq: HBMD) Target: 1st Mariner Bank Price Per Share:(1) $29.92 Aggregate Transaction Value:(1)(2) $173.3 million Consideration Mix: 100% Stock / Options & Warrants cashed out at $32.50 Fully Diluted Ownership: Approximately 52% HBMD / 48% 1st Mariner Board Seats: Eight Seats (HBMD) / Six Seats (1st Mariner) Approvals Received: Customary regulatory approval; Howard & 1st Mariner shareholders Date Closed: March 1, 2018

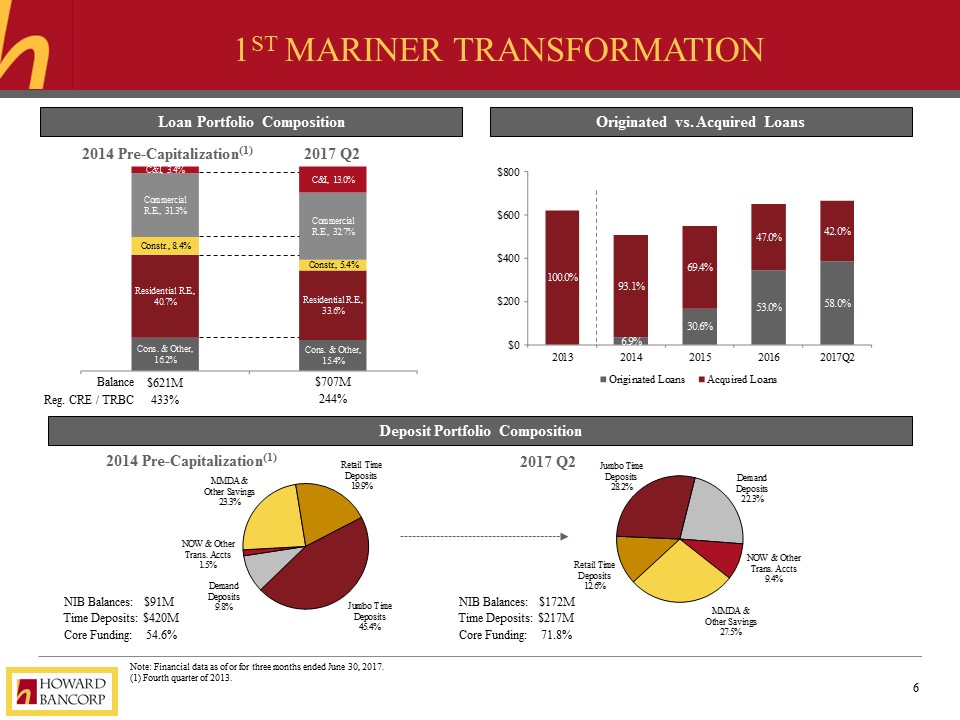

1st Mariner Transformation Note: Financial data as of or for three months ended June 30, 2017.(1) Fourth quarter of 2013. Loan Portfolio Composition Deposit Portfolio Composition $621M $707M Reg. CRE / TRBC 433% 244% Originated vs. Acquired Loans Q2 2017 2014 Pre-Capitalization(1) 2017 Q2 Balance 2017 Q2 2014 Pre-Capitalization(1) NIB Balances: $91M 54.6% Core Funding: Time Deposits: $420M NIB Balances: $172M 71.8% Core Funding: Time Deposits: $217M

Howard’s Proven Track Record Source: Pricing data from SNL Financial. 3 Year Stock Price Performance Acquisitions Recent Capital Offerings

Future results driven by operating leverage Efficiency Ratio Trend Core ROAA Future results driven by operating leverage Project BBBB Pro Forma Franchise Future results Will be driven by operating leverage * 2018 Data is YTD net of Merger Expenses

Future results driven by operating leverage Revenue Growth Trend Future results driven by operating leverage Project BBBB Pro Forma Franchise And strong Revenue growth * 2018 Data is YTD

Deposit summary Data as of June 30, 2018*Second Quarter NIM Total Deposits - $1.6 Billion Net Interest Margin 41% Transaction Accounts

Loan Summary Data as of June 30, 2018 Total Loans HFI - $1.6 Billion Historical Loans HFI ($M) 51% Commercial Accounts

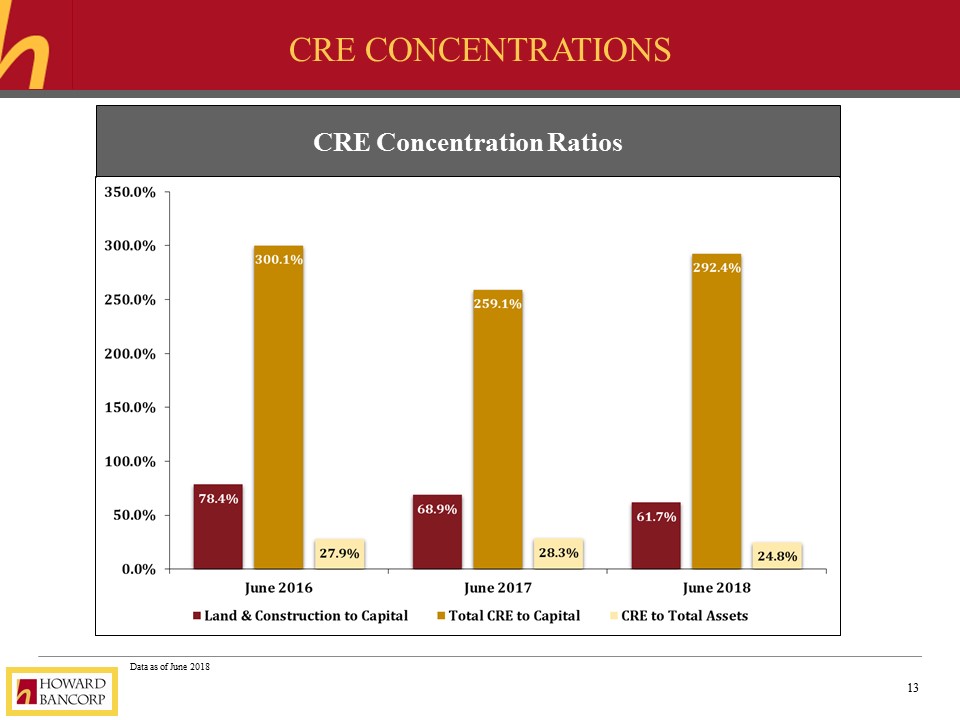

Data as of June 2018 CRE Concentrations CRE NOO Asset Classes

Data as of June 2018 CRE Concentrations CRE Concentration Ratios

Data as of June 2018 NPA Trends Total NPAs & NPA Ratio *The June 2018 NPAs include $15.2MM acquired from 1st Mariner *

Howard footprint TBU: Update for most recent financials TBU: New map that fits onto whle right side HeadquartersBranchesLPO

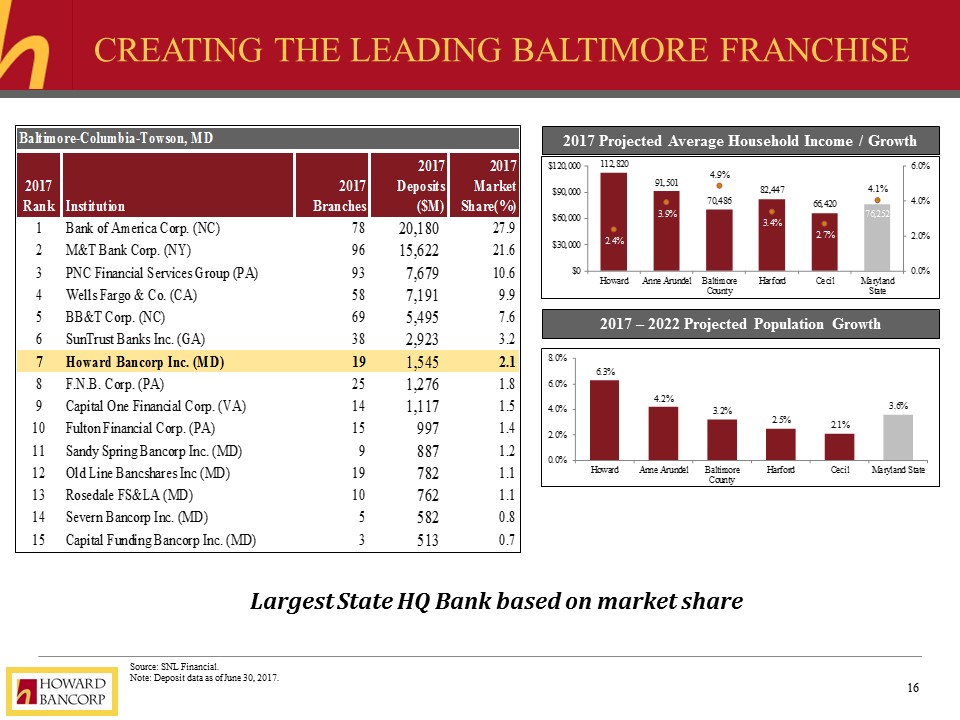

Future results driven by operating leverage Source: SNL Financial. Note: Deposit data as of June 30, 2017. Future results driven by operating leverage Project BBBB Pro Forma Franchise Creating the leading Baltimore franchise 2017 – 2022 Projected Population Growth 2017 Projected Average Household Income / Growth Largest State HQ Bank based on market share

Expanded commercial presence (1) Source: SNL Financial. Bank level data as of March 2018. Pro forma for pending acquisitions.Does not include purchase accounting adjustments.(1) Local peers include Maryland based banks with a presence in the Baltimore-Columbia-Townson MSA. Commercial Lending vs. Local Peers(1)

Concluding Remarks #1 local bank in the Baltimore MSABuilding on a story of consistent growth – balance sheet, revenue, returns – since founding Strong commercial bank focused on SME’s with significant market share after the 1st Mariner transaction provides excellent growth platform with significant acquisition and cross sell opportunitiesAccelerating EPS growth due to in market merger economics recently realized will continue to generate strong shareholder returnsGrowth built on differentiation from the average community banking model – customer segment focus; geographic selection; relentless focus on both organic and acquired; focus on transaction account funding; meaningful but controlled non-interest income sources Post capital raise and acquisition close: Russell index plus expected efficiencies from more scale and improved operating leverage position the currency well