Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FEDERAL HOME LOAN MORTGAGE CORP | a20182q8kwrapper.htm |

| EX-99.1 - EXHIBIT 99.1 - FEDERAL HOME LOAN MORTGAGE CORP | a20182qerexhibit991.htm |

Exhibit 99.2 Second Quarter 2018 Financial Results Supplement July 31, 2018

Corporate Highlights Financial highlights $ Billions $4.7 ▪ 2Q18 comprehensive income of $2.4 billion was driven by strong business $2.0 $2.9 $2.2 $2.4 $0.2 revenues and a $334 million (pre-tax), $2.1 $2.2 $1.8 or $264 million (after-tax), litigation judgment. $(5.4) ▪ 2Q18 comprehensive income, $(3.3)-$3.3 2Q17 3Q17 4Q17 1Q18 2Q18 excluding the effect of the litigation judgment, was $2.2 billion. Comprehensive income (loss) Litigation settlements/judgments DTA Write-down ▪ Adjusted net interest income was substantially unchanged from the $1.7 $1.8 $1.8 $1.7 $1.8 prior quarter. $1.2 $1.1 $1.1 $1.1 $1.2 ▪ Adjusted guarantee fee income increased from the prior quarter primarily driven by higher 2Q17 3Q17 4Q17 1Q18 2Q18 amortization of single-family upfront fees resulting from an increase in Adjusted net interest income1 Adjusted guarantee fee income1 loan prepayments. Note: Totals may not add due to rounding. © Freddie Mac 2

Total Portfolio Balances 2 Total guarantee portfolio Portfolio balance highlights $ Billions +6% ▪ Total guarantee portfolio: $2,049 $2,075 $1,958 $1,984 $2,032 • Single-family - grew $71 billion, or 4% year-over- $220 $174 $184 $203 $213 year. • Multifamily - grew $46 billion, or 26% year-over- year. $1,784 $1,800 $1,829 $1,836 $1,855 ▪ Total investments portfolio: 6/30/2017 9/30/2017 12/31/2017 3/31/2018 6/30/2018 • Mortgage-related investments portfolio - decreased $48 billion, or 17% year-over-year. Single-family credit guarantee portfolio Multifamily guarantee portfolio3 Total investments portfolio Total debt outstanding4,5 $ Billions $ Billions $407 $346 -15% $366 $340 $349 $343 $321 $317 $82 $311 $310 $6 $282 $279 $82 $90 $9 $10 $70 $74 $10 $12 $334 $284 PSPA $312 $306 $267 $253 $241 $236 2018 Limit $271 $266 $250B 6/30/2017 9/30/2017 12/31/2017 3/31/2018 6/30/2018 6/30/2017 9/30/2017 12/31/2017 3/31/2018 6/30/2018 2,4 Mortgage-related investments portfolio Unsecured debt Secured debt Other investments and cash portfolio Indebtedness limit Note: Totals may not add due to rounding. © Freddie Mac 3

Conservatorship and Regulatory Matters Treasury draw requests and dividend payments DFAST7 - Additional draws needed under $ Billions severely adverse scenario $ Billions $140.5 $112.4 $96.5 6 $71.3 $71.6 $62 $53 $43 $34 $26 $21 $10.9 $5.0 $0.3 2008-2015 2016 2017 2018 YTD Cumulative 2015 2016 2017 Remaining Total PSPA Funding* Draw Requests from Treasury Dividend Payments to Treasury with DTA valuation allowance without DTA valuation allowance Note: Totals may not add due to rounding. © Freddie Mac 4 *As of December 31, 2017.

Interest-rate Risk Measures GAAP Adverse Scenario8 (Before-Tax) PMVS-Level9 and Average Duration Gap10 $ Billions ($0.5) ($0.6) ($0.5) $35 $17 $23 ($1.2) $9 $8 ($1.5) 2Q17 3Q17 4Q17 1Q18 2Q18 ($2.8) ($3.1) ($3.3) ($3.3) ($3.4) PMVS-L (50 bps) ($ Millions) 84% 83% 86% 55% 58% 0 0 0 0 0 06/30/17 09/30/17 12/31/17 03/31/18 06/30/18 2Q17 3Q17 4Q17 1Q18 2Q18 Pre-Hedge Accounting Post-Hedge Accounting Average Duration Gap (Months) % Change © Freddie Mac 5

Key Economic Indicators National home prices increased by an average of 6.8% Quarterly ending interest rates over the past year 4.44% 4.55% 3.99% 3.88% 3.83% 2.78% 2.93% 2.27% 2.28% 2.39% 6/30/2017 9/30/2017 12/31/2017 3/31/2018 6/30/2018 30-year PMMS 10-year LIBOR Unemployment rate and job creation 4.3% 4.2% 4.1% 4.1% 4.0% 221,000 National home prices have surpassed the 2006 peak 190,000 218,000 211,000 142,000 (2006 Peak) 190 168 2Q17 3Q17 4Q17 1Q18 2Q18 Freddie Mac House Price Index (December 2000 = 100) Average monthly net new jobs (non-farm) 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 National unemployment rate (as of the last month in United States (Not Seasonally Adjusted) each quarter) © Freddie Mac 6

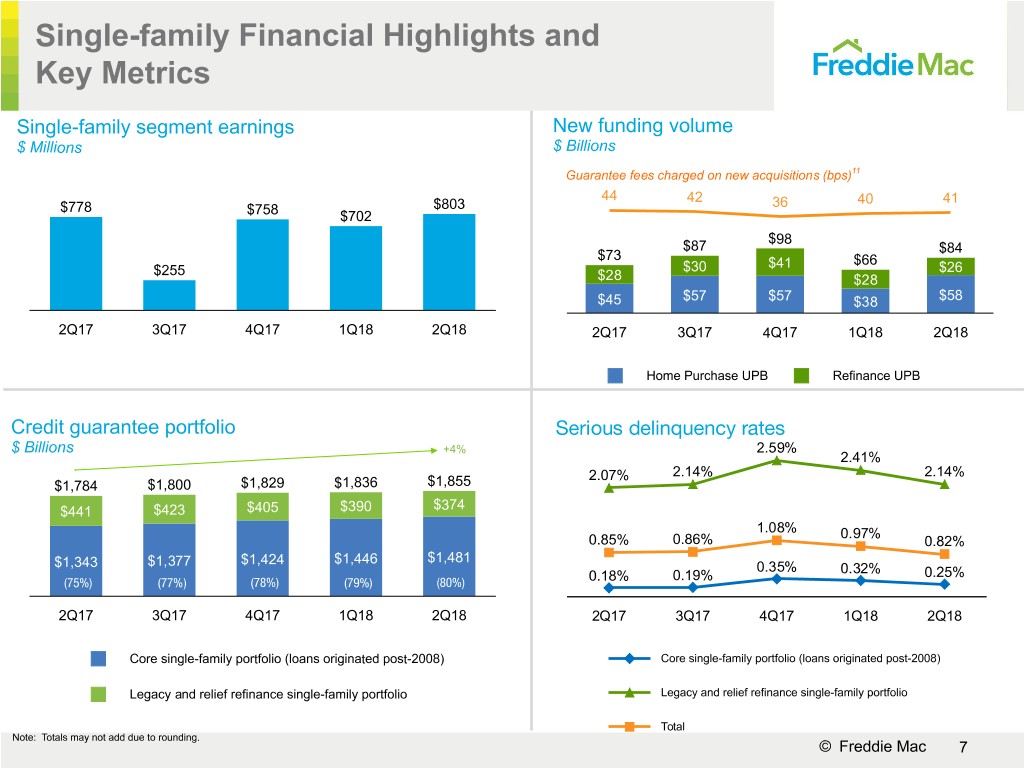

Single-family Financial Highlights and Key Metrics Single-family segment earnings New funding volume $ Millions $ Billions Guarantee fees charged on new acquisitions (bps)11 44 42 40 41 $778 $803 36 $758 $702 $98 $87 $84 $73 $41 $66 $255 $30 $26 $28 $28 $45 $57 $57 $38 $58 2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 3Q17 4Q17 1Q18 2Q18 Home Purchase UPB Refinance UPB Credit guarantee portfolio Serious delinquency rates $ Billions +4% 2.59% 2.41% 2.07% 2.14% 2.14% $1,784 $1,800 $1,829 $1,836 $1,855 $374 $441 $423 $405 $390 1.08% 0.97% 0.85% 0.86% 0.82% $1,377 $1,424 $1,446 $1,481 $1,343 0.35% 0.32% 0.18% 0.19% 0.25% (75%) (77%) (78%) (79%) (80%) 2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 3Q17 4Q17 1Q18 2Q18 Core single-family portfolio (loans originated post-2008) Core single-family portfolio (loans originated post-2008) Legacy and relief refinance single-family portfolio Legacy and relief refinance single-family portfolio Total Note: Totals may not add due to rounding. © Freddie Mac 7

Single-family Credit Risk Transfer – STACR / ACIS / Deep MI Total Single-family credit guarantee portfolio with Cumulative Single-family transferred credit risk transferred credit risk based on outstanding balance at period end $ Billions $ Billions Outstanding reference pool UPB as a percentage of total Single-family portfolio 42% 35% $24.5 $23.4 26% $22.0 $21.1 19% $20.5 12% $1,042 $858 $782 $1.9 $1.5 $1.7 $598 $643 $1.4 $1.1 $5.6 $457 $4.7 $5.1 $385 $329 $4.2 $4.1 $3.9 $205 $193 $2.2 $2.3 $2.8 $3.1 2014 2015 2016 2017 YTD 2018* 6/30/17 9/30/17 12/31/17 3/31/18 6/30/2018 Reference pool UPB at issuance First loss positions: Retained by Freddie Mac Reference pool UPB outstanding Mezzanine loss positions: Retained by Freddie Mac First loss positions: Transferred to third parties Mezzanine loss positions: Transferred to third parties *As of June 30, 2018. © Freddie Mac 8

Multifamily Financial Highlights and Key Metrics Multifamily comprehensive income Multifamily acquisitions of units by area median $ Millions income (% of eligible units acquired) $660 10% 12% 14% 17% 13% $524 $462 $404 $370 90% 88% 86% 83% 87% 2Q17 3Q17 4Q17 1Q18 2Q18 2014 2015 2016 2017 YTD 2018* ≤100% AMI >100% AMI Total portfolio +53% Multifamily market and Freddie Mac delinquency $ Billions rates (%) $249 $259 $213 $39 $32 $188 $7 $169 $42 $7 $49 $13 $53 $19 $25 $203 $220 $158 $91 $120 0.93 (54%) (64%) (74%) (82%) (85%) 1Q18 0.15 12/31/14 12/31/15 12/31/16 12/31/17 6/30/18 0.01 2Q14 2Q15 2Q16 2Q17 2Q18 Guarantee Portfolio Mortgage-related Securities Freddie Mac (60+ day) FDIC Insured Institutions (90+ day) Unsecuritized Loans MF CMBS Market (60+ day) Note: Totals may not add due to rounding. *As of June 30, 2018. © Freddie Mac 9

Multifamily Key Metrics, continued New funding volume Multifamily securitization volume12 $ Billions $ Billions Cap = $36.5 Cap = $35.0 Cap = $30.0 $71.5 $73.2 $62.2 Cap = $25.9 $5.5 $56.8 $51.2 $3.9 $47.3 $39.5 $20.3 $37.4 $1.8 $17.3 $29.9 $28.3 $28.9 $56.7 $3.1 $2.4 $21.3 $47.3 $17.6 $35.6 $36.5 $33.7 $25.9 $30.0 $26.8 $11.3 2014 2015 2016 2017 YTD 2018* 2009-2013 2014 2015 2016 2017 YTD 2018* 13 Purchase Volume Subject to Cap K Certificate UPB SB Certificate UPB Purchase Volume Not Subject to Cap Note: Totals may not add due to rounding. *As of June 30, 2018. © Freddie Mac 10

Capital Markets Financial Highlights and Key Metrics Capital Markets comprehensive income Capital Markets investments portfolio $ Billions $ Billions -14% $4.0 $304 $289 $285 $260 $261 $82 $82 $89 $70 $73 $1.0 $1.1 $0.7 $0.6 $222 $207 $196 $190 $188 2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 3Q17 4Q17 1Q18 2Q18 Mortgage Investments Portfolio Other Investments and Cash Portfolio Capital Markets cash window securitization Capital Markets mortgage investments portfolio $ Billions $ Billions -15% $222 $38 $207 $196 $190 $188 $35 $73 $32 $64 $29 $56 $53 $51 $25 $12 $13 $10 $11 $13 $124 $137 $129 $130 $126 (62%) (62%) (66%) (66%) (66%) 2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 3Q17 4Q17 1Q18 2Q18 Liquid Securitization Pipeline Less Liquid Note: Totals may not add due to rounding. © Freddie Mac 11

Housing Market Support Number of families Freddie Mac helped Number of single-family loan workouts15 to own or rent a home14 In Thousands In Thousands 2,421 2,311 2,237 937 663 94 910 13 6 75 69 5 828 21 9 15 745 1,024 986 5 51 677 12 10 2 343 245 12 35 5 23 349 399 54 6 45 739 820 43 650 32 24 332 342 2015 2016 2017 YTD 2017* YTD 2018* 2015 2016 2017 YTD 2017* YTD 2018* Multifamily rental units Purchase borrowers Loan modifications16 Home Refinance borrowers Repayment plans16 Retention Actions Forbearance agreements16 Short sales and deed-in-lieu Foreclosure of foreclosure transactions16 Alternatives Note: Totals may not add due to rounding. *As of June 30. © Freddie Mac 12

Endnotes 1 For additional information regarding Freddie Mac’s non-GAAP financial measures and reconciliations to the comparable amounts under GAAP, see the company’s Press Release for the quarter ended June 30, 2018. 2 Based on unpaid principal balances (UPB) of loans and securities. Excludes mortgage-related securities traded, but not yet settled. 3 Primarily Freddie Mac’s K Certificate and SB (Small Balance) Certificate transactions. 4 The company’s Purchase Agreement with Treasury limits the amount of mortgage assets the company can own and indebtedness it can incur. See the company’s Annual Report on Form 10-K for the year ended December 31, 2017 for more information. 5 Represents the company’s aggregate indebtedness for purposes of the Purchase Agreement debt cap and primarily includes the par value of other short-term and long-term debt used to fund its business activities. 6 Excludes the initial $1 billion liquidation preference of senior preferred stock issued to Treasury in September 2008 as consideration for Treasury’s funding commitment and the $3.0 billion increase in the aggregate liquidation preference of the senior preferred stock pursuant to the December 21, 2017 Letter Agreement. The company received no cash proceeds as a result of issuing the initial $1 billion liquidation preference of senior preferred stock or the $3.0 billion increase on December 31, 2017. 7 For additional information, see Regulation and Supervision / Federal Housing Finance Agency / Capital Standards in the company’s Annual Report on Form 10-K for the year ended December 31, 2017. (DFAST: Dodd-Frank Act Stress Test) 8 The company evaluates the potential benefits of fair value hedge accounting by evaluating a range of interest rate scenarios and identifying which of those scenarios produces the most adverse GAAP earnings outcome. At June 30, 2018, the GAAP adverse scenario before and after fair value hedge accounting was a non-parallel shift in which long-term rates decrease by 100 basis points. 9 Portfolio Market Value Sensitivity (PMVS) is the company's estimate of the change in the market value of its financial assets and liabilities from an instantaneous shock to interest rates, assuming spreads are held constant and no rebalancing actions are undertaken. PMVS-Level or PMVS-L measures the estimated sensitivity of the company’s portfolio market value to parallel movements in interest rates. 10 Duration gap measures the difference in price sensitivity to interest rate changes between our financial assets and liabilities and is expressed in months relative to the market value of assets. 11 Represents the estimated average rate of guarantee fees for new acquisitions during the period assuming amortization of upfront fees using the estimated life of the related loans rather than the original contractual maturity date of the related loans. Includes the effect of fee adjustments that are based on the price performance of Freddie Mac’s PCs relative to comparable Fannie Mae securities. Net of legislated 10 basis point guarantee fee remitted to Treasury as part of the Temporary Payroll Tax Cut Continuation Act of 2011. 12 Excludes other types of Multifamily securitization products. 13 Includes K Certificates without subordination, which are fully guaranteed and issued without subordinate or mezzanine securities. 14 Based on the company’s purchases of loans and issuances of mortgage-related securities. For the periods presented, a borrower may be counted more than once if the company purchased more than one loan (purchase or refinance mortgage) relating to the same borrower. 15 Consists of both home retention actions and foreclosure alternatives. 16 Categories are not mutually exclusive, and a borrower in one category may also be included in another category in the same or another period. For example, a borrower helped through a home retention action in one period may subsequently lose his or her home through a foreclosure alternative in a later period. © Freddie Mac 13

Safe Harbor Statements Freddie Mac obligations Freddie Mac’s securities are obligations of Freddie Mac only. The securities, including any interest or return of discount on the securities, are not guaranteed by and are not debts or obligations of the United States or any federal agency or instrumentality other than Freddie Mac. No offer or solicitation of securities This presentation includes information related to, or referenced in the offering documentation for, certain Freddie Mac securities, including offering circulars and related supplements and agreements. Freddie Mac securities may not be eligible for offer or sale in certain jurisdictions or to certain persons. This information is provided for your general information only, is current only as of its specified date and does not constitute an offer to sell or a solicitation of an offer to buy securities. The information does not constitute a sufficient basis for making a decision with respect to the purchase or sale of any security. All information regarding or relating to Freddie Mac securities is qualified in its entirety by the relevant offering circular and any related supplements. Investors should review the relevant offering circular and any related supplements before making a decision with respect to the purchase or sale of any security. In addition, before purchasing any security, please consult your legal and financial advisors for information about and analysis of the security, its risks and its suitability as an investment in your particular circumstances. Forward-looking statements Freddie Mac's presentations may contain forward-looking statements, which may include statements pertaining to the conservatorship, the company’s current expectations and objectives for its Single-family Guarantee, Multifamily and Capital Markets segments, its efforts to assist the housing market, liquidity and capital management, economic and market conditions and trends, market share, the effect of legislative and regulatory developments and new accounting guidance, credit quality of loans the company owns or guarantees, the costs and benefits of the company’s credit risk transfer transactions, and results of operations and financial condition on a GAAP, Segment Earnings, non-GAAP and fair value basis. Forward-looking statements involve known and unknown risks and uncertainties, some of which are beyond the company’s control. Management’s expectations for the company’s future necessarily involve a number of assumptions, judgments and estimates, and various factors, including changes in market conditions, liquidity, mortgage spreads, credit outlook, actions by the U.S. government (including FHFA, Treasury and Congress), and the impacts of legislation or regulations and new or amended accounting guidance, could cause actual results to differ materially from these expectations. These assumptions, judgments, estimates and factors are discussed in the company’s Annual Report on Form 10-K for the year ended December 31, 2017, Quarterly Reports on Form 10-Q for the quarters ended March 31, 2018 and June 30, 2018 and Current Reports on Form 8-K, which are available on the Investor Relations page of the company’s Web site at www.freddiemac.com/investors and the SEC’s Web site at www.sec.gov. The company undertakes no obligation to update forward-looking statements it makes to reflect events or circumstances occurring after the date of this presentation. © Freddie Mac 14