Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CAMBRIDGE BANCORP | catc-8k_20180731.htm |

Investor Presentation July 31, 2018 Parent of Cambridge Trust Company NASDAQ: CATC Cambridge Bancorp Exhibit 99.1

Forward Looking Statements This presentation contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements about Cambridge Bancorp (together with its bank subsidiary unless the context otherwise requires, the “Company”) and its industry involve substantial risks and uncertainties. Statements other than statements of current or historical fact, including statements regarding the Company’s future financial condition, results of operations, business plans, liquidity, cash flows, projected costs, and the impact of any laws or regulations applicable to the Company, are forward-looking statements. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “may,” “will,” “should,” and other similar expressions are intended to identify these forward-looking statements. Such statements are subject to factors that could cause actual results to differ materially from anticipated results. Such factors are described within the Company’s filings with the Securities & Exchange Commission. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements. You are cautioned not to place undue reliance on these forward-looking statements.

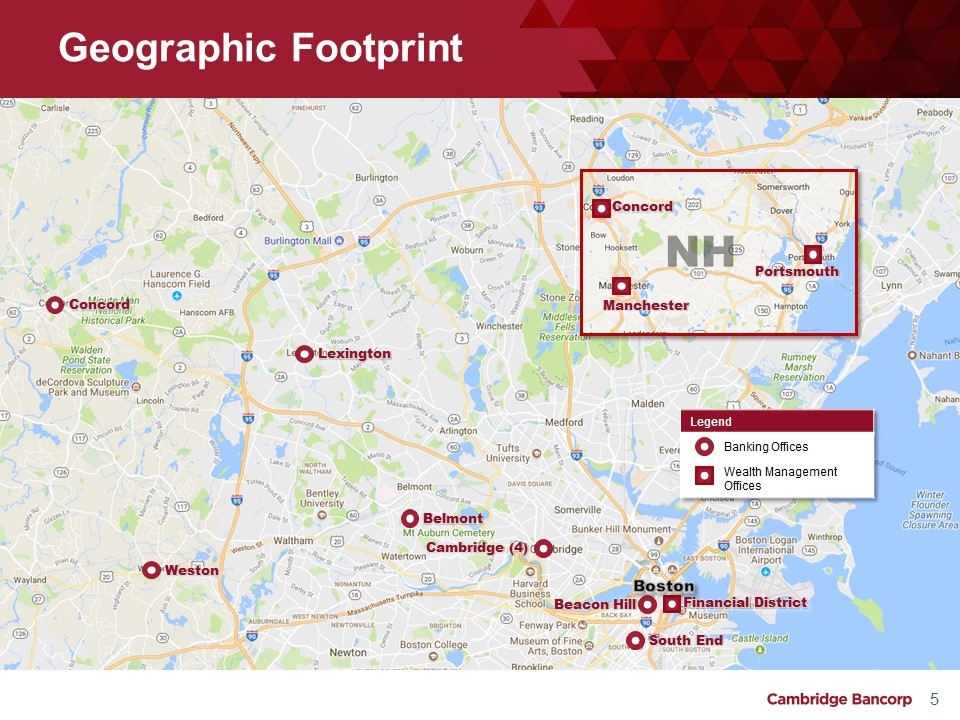

Company Profile (as of June 30, 2018) Banking subsidiary: Cambridge Trust Company, founded 1890: Total assets: $2.0 billion Loans: $1.4 billion Deposits: $1.8 billion Non-interest income: 34% of total revenue Wealth Management AUM $3.0 billion, AUM & AUA $3.1 billion Headquartered in Harvard Square, Cambridge Massachusetts 10 full-service banking offices located in Middlesex and Suffolk counties of Massachusetts Wealth Management offices located in Boston’s financial district, and Concord, Manchester and Portsmouth, New Hampshire

Why Cambridge Trust? Continued focus on client service while investing for growth 4 Business Model Attractive geographic markets Focused private banking business model Culture Client-centric service culture Loyal client base Performance Strong asset quality Sound underwriting acumen and risk management practices Credit Investing for future growth Consistently profitable Experienced, conservative leadership Commitment to our community Core deposit-funded Well-capitalized Affluent client base

Geographic Footprint Cambridge (4) Beacon Hill Legend Banking Offices Wealth Management Offices Weston Concord Lexington Belmont South End Financial District NH Manchester Portsmouth Concord Boston

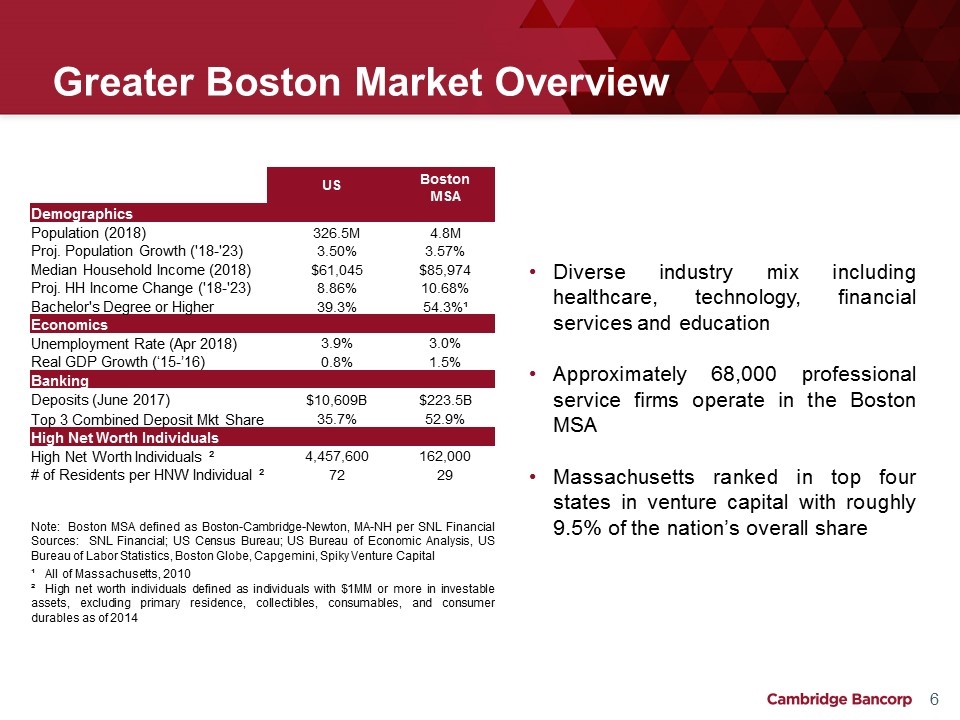

Greater Boston Market Overview US Boston MSA Demographics Population (2018) 326.5M 4.8M Proj. Population Growth ('18-'23) 3.50% 3.57% Median Household Income (2018) $61,045 $85,974 Proj. HH Income Change ('18-'23) 8.86% 10.68% Bachelor's Degree or Higher 39.3% 54.3%¹ Economics Unemployment Rate (Apr 2018) 3.9% 3.0% Real GDP Growth (‘15-’16) 0.8% 1.5% Banking Deposits (June 2017) $10,609B $223.5B Top 3 Combined Deposit Mkt Share 35.7% 52.9% High Net Worth Individuals High Net Worth Individuals ² 4,457,600 162,000 # of Residents per HNW Individual ² 72 29 Note: Boston MSA defined as Boston-Cambridge-Newton, MA-NH per SNL Financial Sources: SNL Financial; US Census Bureau; US Bureau of Economic Analysis, US Bureau of Labor Statistics, Boston Globe, Capgemini, Spiky Venture Capital ¹ All of Massachusetts, 2010 ² High net worth individuals defined as individuals with $1MM or more in investable assets, excluding primary residence, collectibles, consumables, and consumer durables as of 2014 Diverse industry mix including healthcare, technology, financial services and education Approximately 68,000 professional service firms operate in the Boston MSA Massachusetts ranked in top four states in venture capital with roughly 9.5% of the nation’s overall share

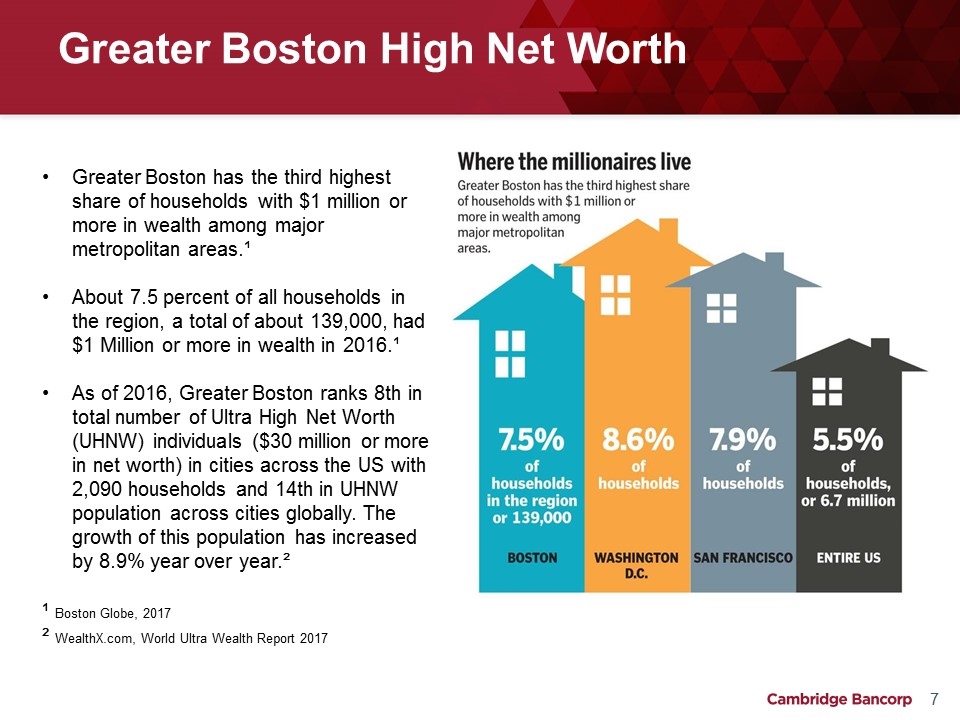

Greater Boston High Net Worth Greater Boston has the third highest share of households with $1 million or more in wealth among major metropolitan areas.¹ About 7.5 percent of all households in the region, a total of about 139,000, had $1 Million or more in wealth in 2016.¹ As of 2016, Greater Boston ranks 8th in total number of Ultra High Net Worth (UHNW) individuals ($30 million or more in net worth) in cities across the US with 2,090 households and 14th in UHNW population across cities globally. The growth of this population has increased by 8.9% year over year.² ¹ Boston Globe, 2017 ² WealthX.com, World Ultra Wealth Report 2017

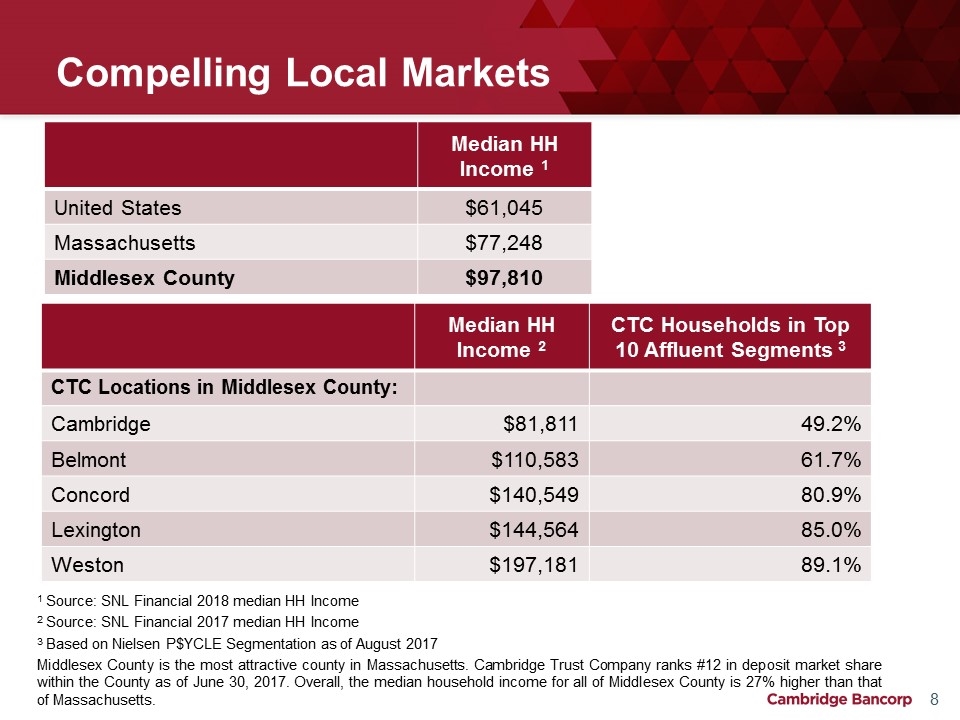

Compelling Local Markets 1 Source: SNL Financial 2018 median HH Income 2 Source: SNL Financial 2017 median HH Income 3 Based on Nielsen P$YCLE Segmentation as of August 2017 Middlesex County is the most attractive county in Massachusetts. Cambridge Trust Company ranks #12 in deposit market share within the County as of June 30, 2017. Overall, the median household income for all of Middlesex County is 27% higher than that of Massachusetts. Median HH Income 2 CTC Households in Top 10 Affluent Segments 3 CTC Locations in Middlesex County: Cambridge $81,811 49.2% Belmont $110,583 61.7% Concord $140,549 80.9% Lexington $144,564 85.0% Weston $197,181 89.1% Median HH Income 1 United States $61,045 Massachusetts $77,248 Middlesex County $97,810

Strategic Focus Be recognized as the premier private bank in the Greater Boston & New Hampshire region Increase brand awareness Expand Wealth Management assets under management Grow and diversify Commercial Banking relationships Deepen client relationships to grow deposit base

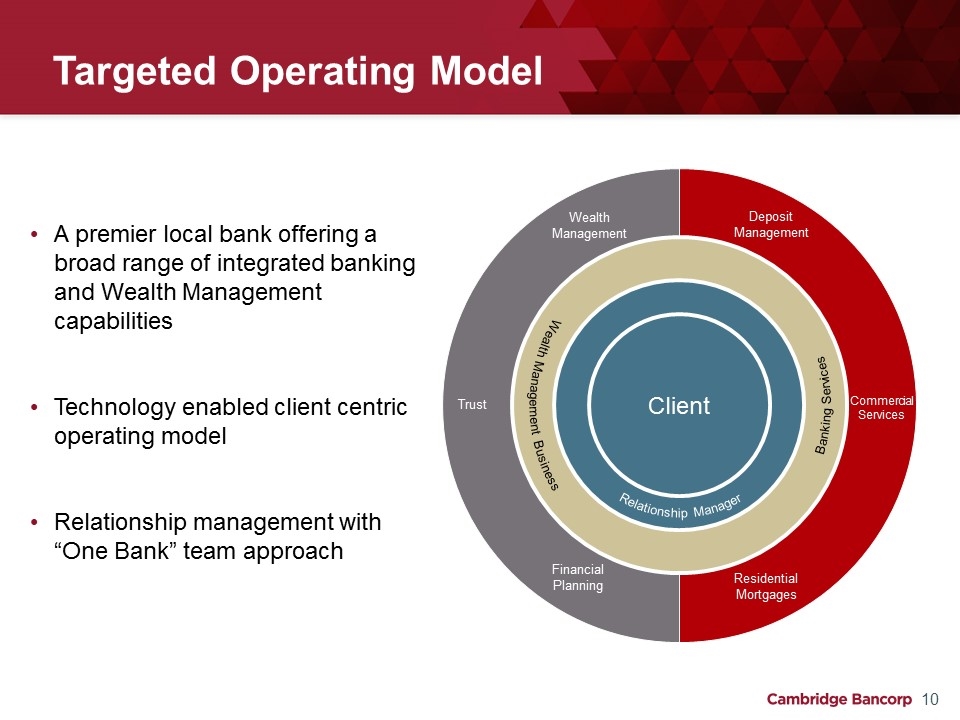

Targeted Operating Model Client Relationship Manager Wealth Management Business Banking Services Wealth Management Financial Planning Trust Deposit Management Residential Mortgages Commercial Services A premier local bank offering a broad range of integrated banking and Wealth Management capabilities Technology enabled client centric operating model Relationship management with “One Bank” team approach

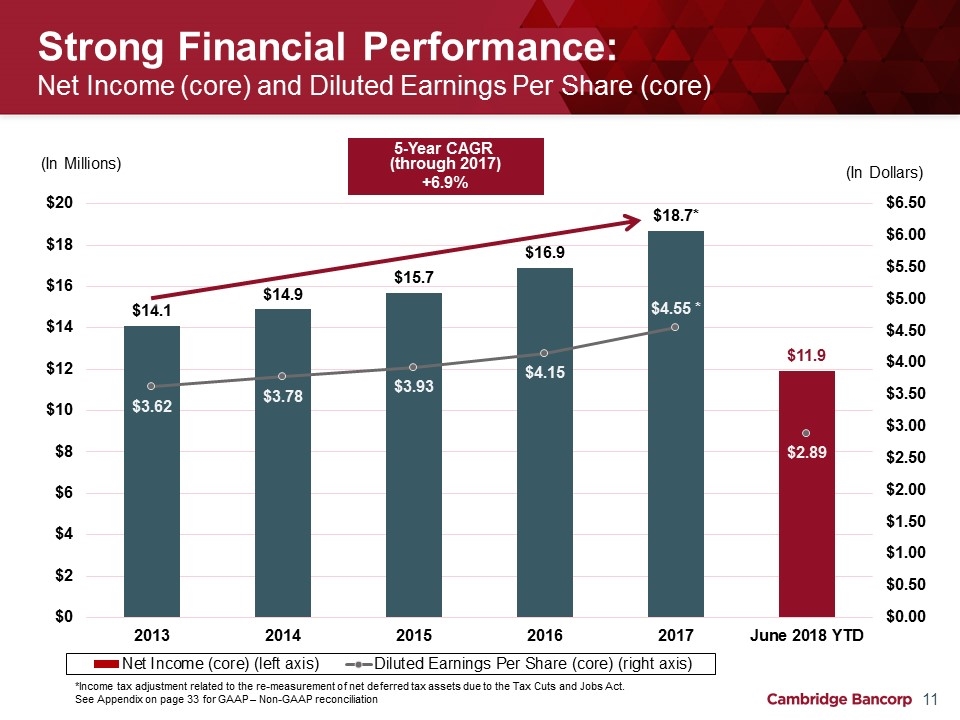

Strong Financial Performance: Net Income (core) and Diluted Earnings Per Share (core) (In Millions) 5-Year CAGR (through 2017) +6.9% (In Dollars) *Income tax adjustment related to the re-measurement of net deferred tax assets due to the Tax Cuts and Jobs Act. See Appendix on page 33 for GAAP – Non-GAAP reconciliation

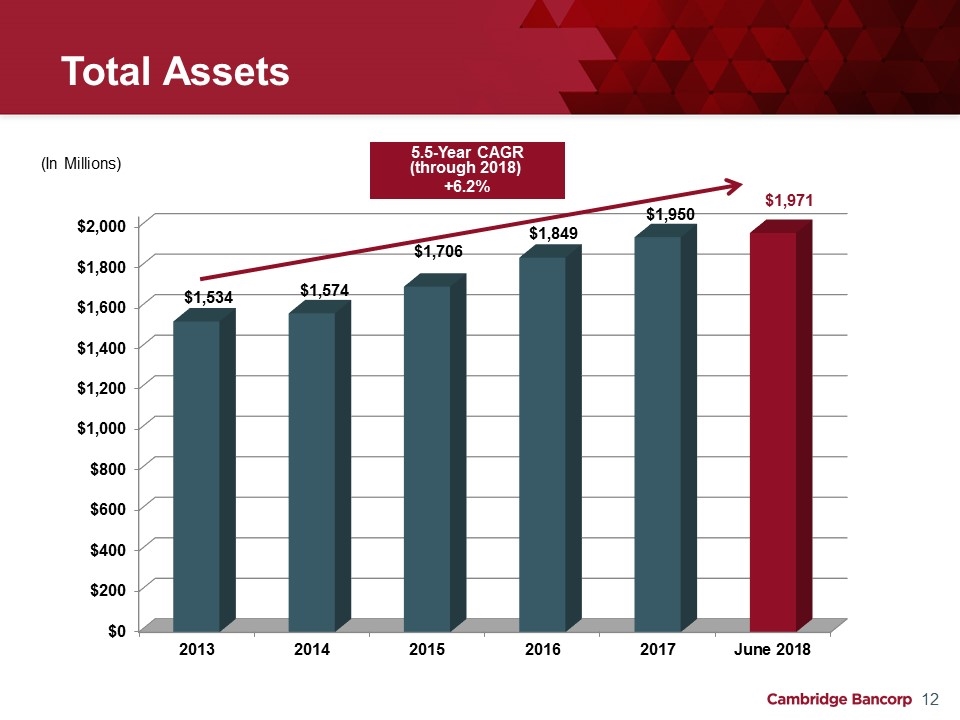

Total Assets 5.5-Year CAGR (through 2018) +6.2% (In Millions)

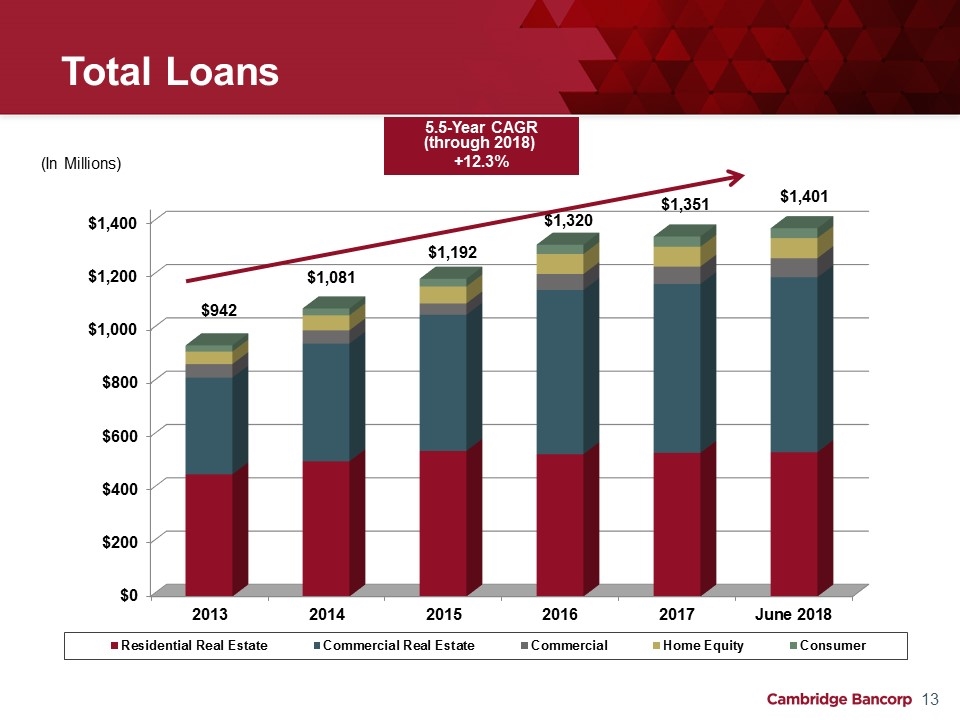

Total Loans 5.5-Year CAGR (through 2018) +12.3% (In Millions)

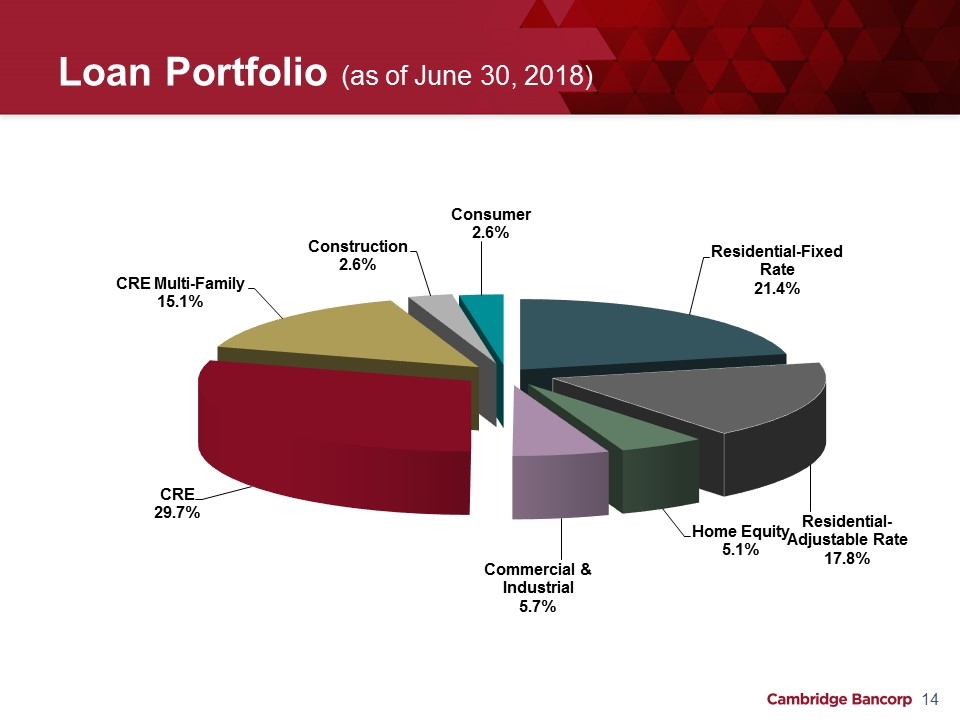

Loan Portfolio (as of June 30, 2018)

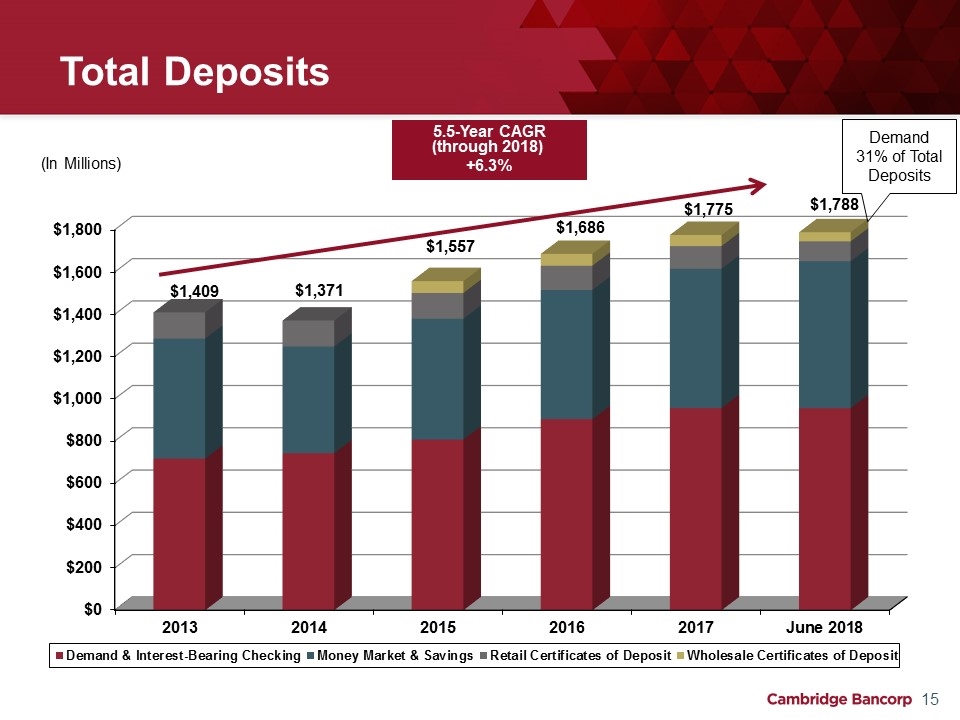

Total Deposits 5.5-Year CAGR (through 2018) +6.3% (In Millions) Demand 31% of Total Deposits

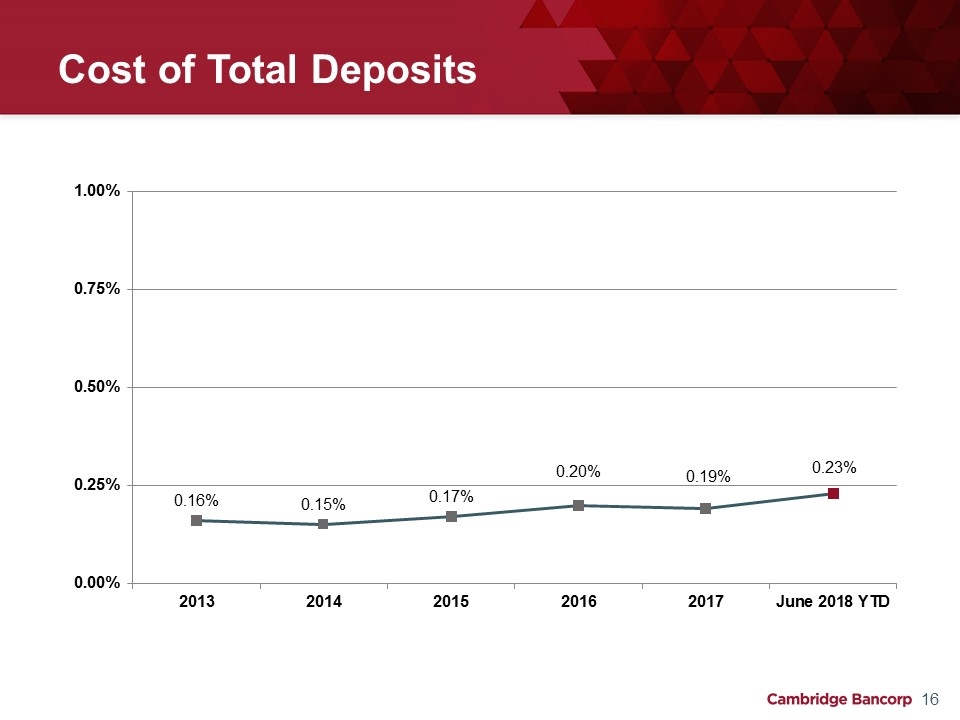

Cost of Total Deposits

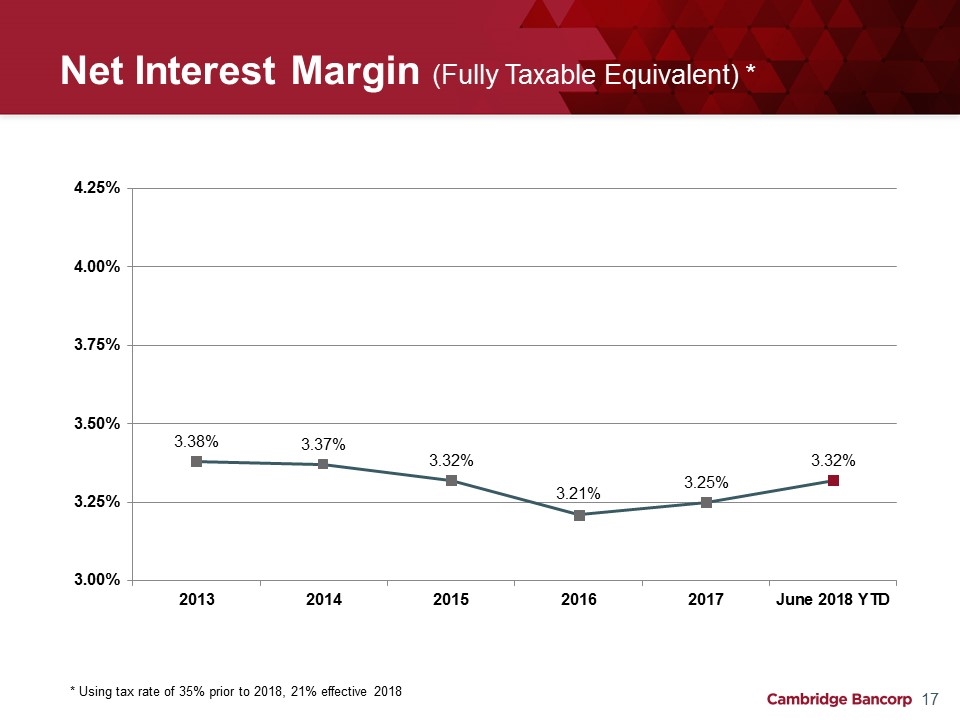

Net Interest Margin (Fully Taxable Equivalent) * * Using tax rate of 35% prior to 2018, 21% effective 2018

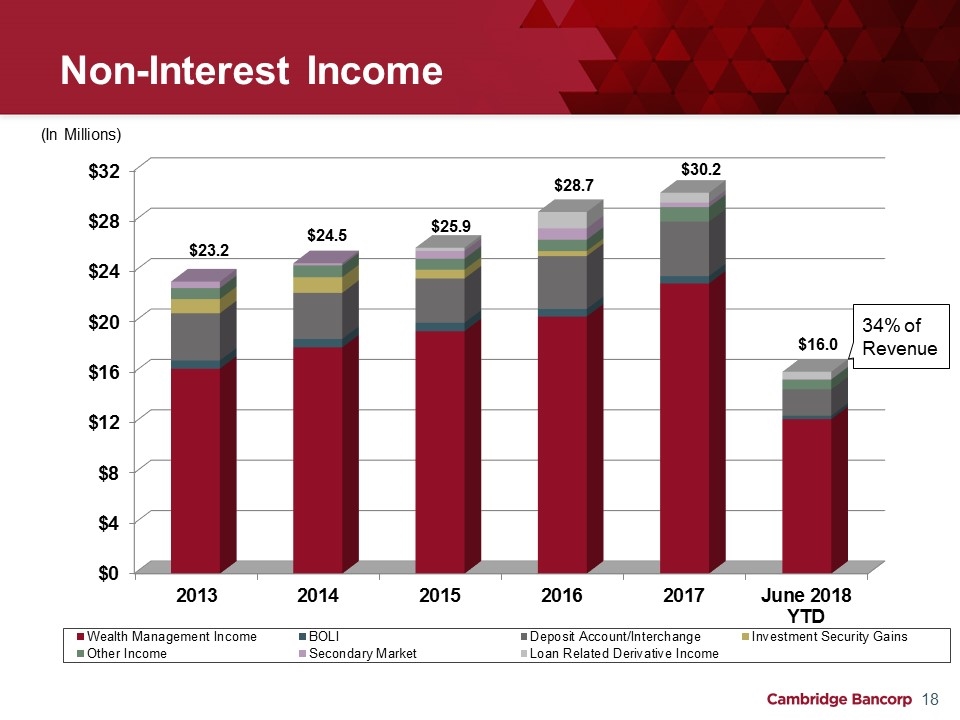

Non-Interest Income (In Millions) 34% of Revenue

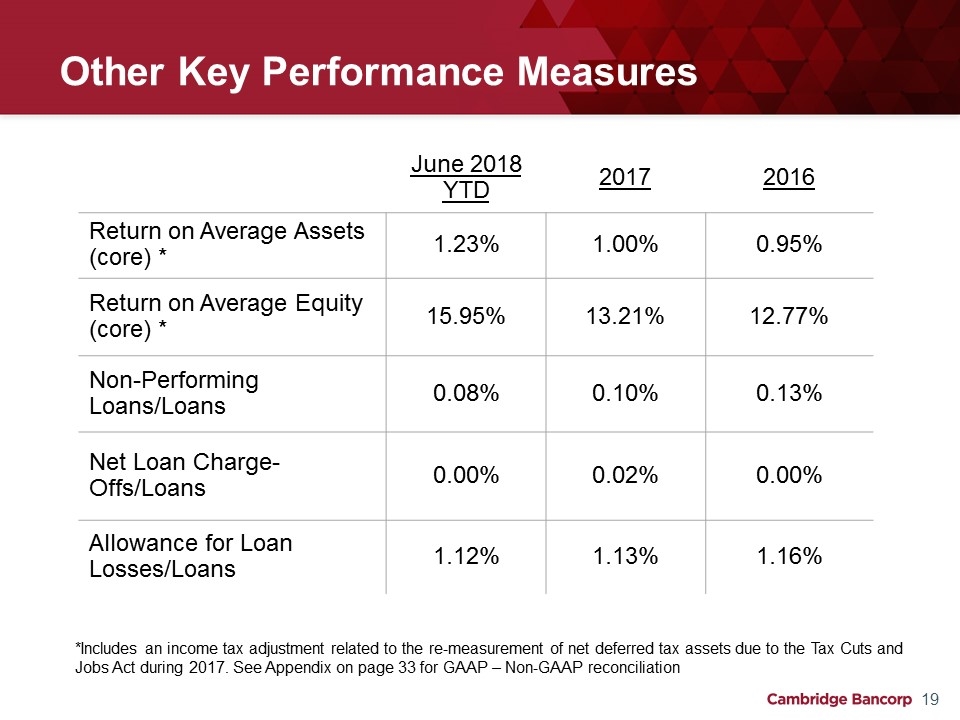

Other Key Performance Measures June 2018 YTD 2017 2016 Return on Average Assets (core) * 1.23% 1.00% 0.95% Return on Average Equity (core) * 15.95% 13.21% 12.77% Non-Performing Loans/Loans 0.08% 0.10% 0.13% Net Loan Charge-Offs/Loans 0.00% 0.02% 0.00% Allowance for Loan Losses/Loans 1.12% 1.13% 1.16% *Includes an income tax adjustment related to the re-measurement of net deferred tax assets due to the Tax Cuts and Jobs Act during 2017. See Appendix on page 33 for GAAP – Non-GAAP reconciliation

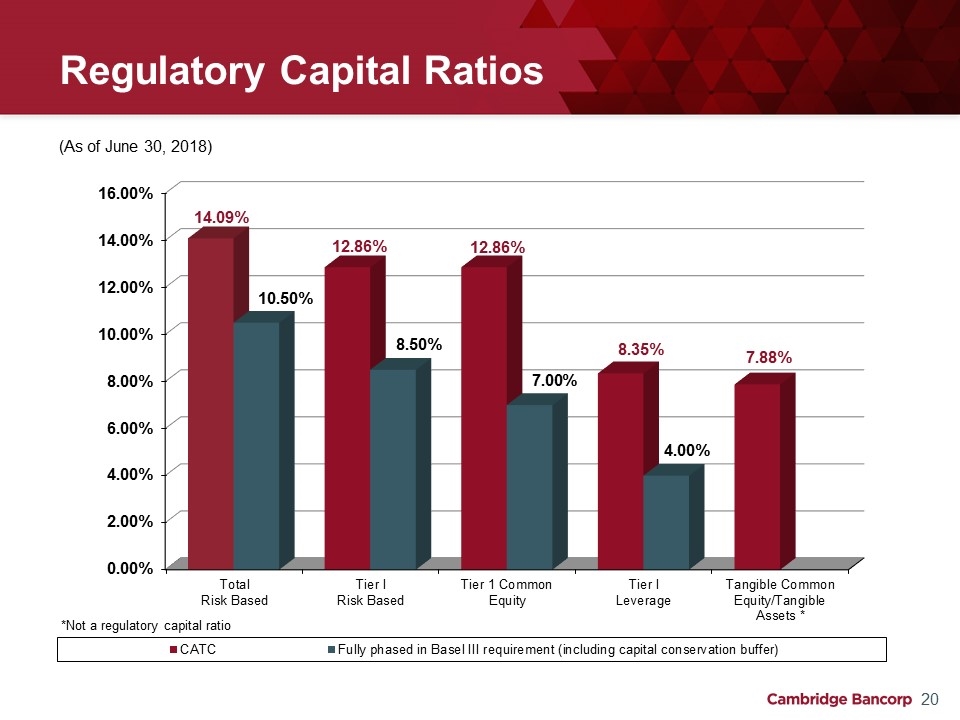

Regulatory Capital Ratios (As of June 30, 2018)

Growing the Franchise – Wealth Management 2018 Results: Wealth assets under management and administration increased by $50.2 million to $3.1 billion, driven by market performance and new business generation. New Hampshire assets under management at $1.1 billion, or 35% of total managed assets. Investments & Growth Opportunities: Invest in Business Development: Add additional Private Banking Officers in 2018 & 2019 Complement current global investment strategy with a more structured and analytical Asset Allocation process Deepen existing manager selection process Increase the opportunity set for clients by adding access to a broader list of mutual funds and ETFs where appropriate

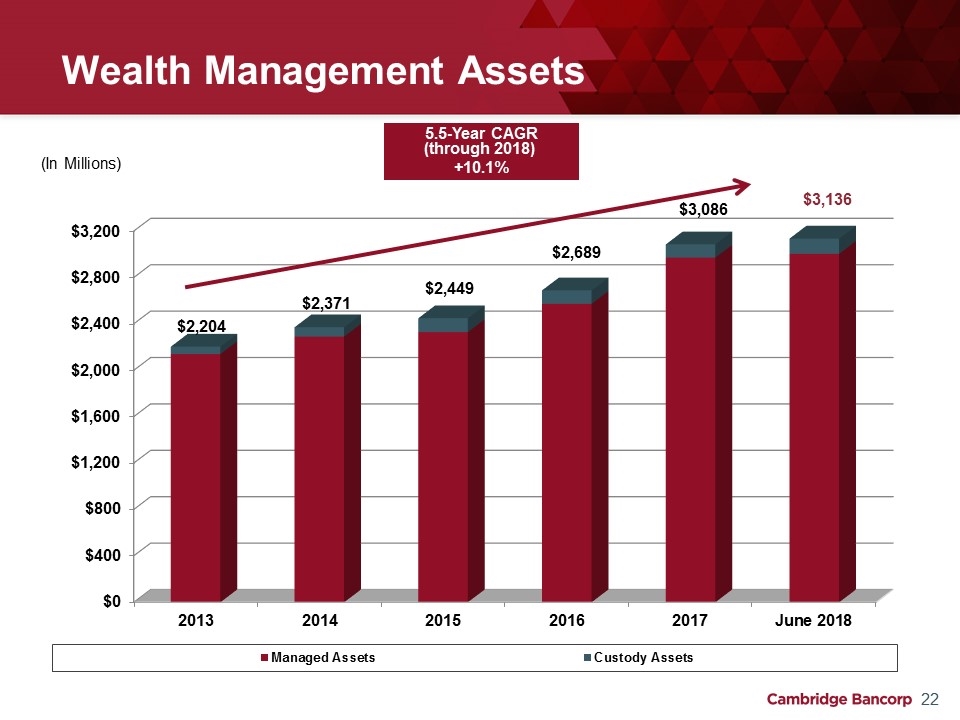

Wealth Management Assets $2,449 $2,204 5.5-Year CAGR (through 2018) +10.1% (In Millions) $3,136

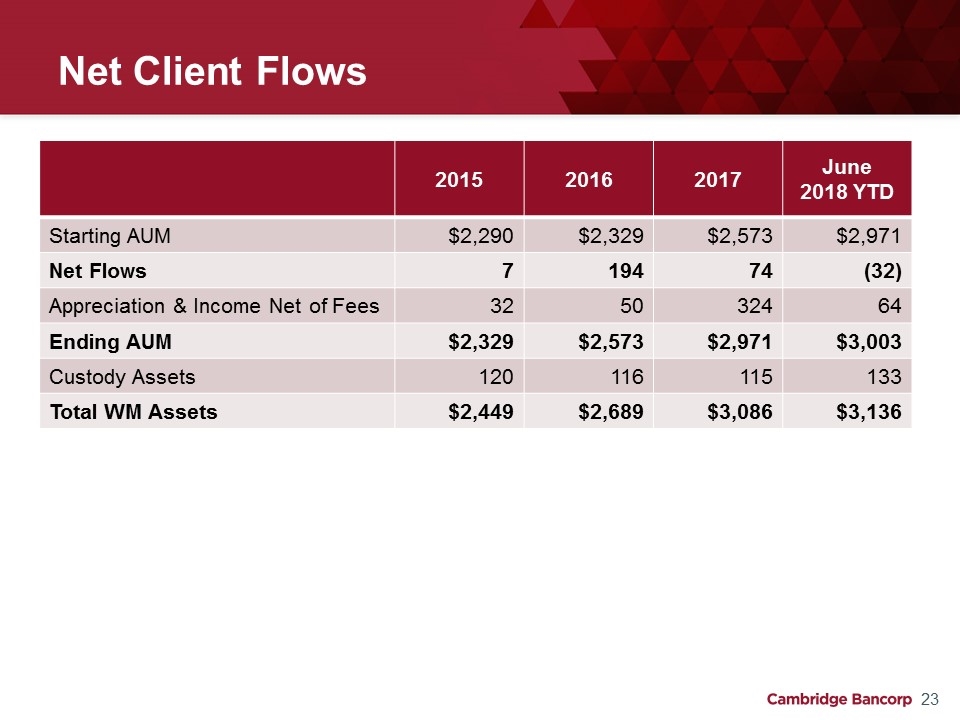

Net Client Flows 2015 2016 2017 June 2018 YTD Starting AUM $2,290 $2,329 $2,573 $2,971 Net Flows 7 194 74 (32) Appreciation & Income Net of Fees 32 50 324 64 Ending AUM $2,329 $2,573 $2,971 $3,003 Custody Assets 120 116 115 133 Total WM Assets $2,449 $2,689 $3,086 $3,136

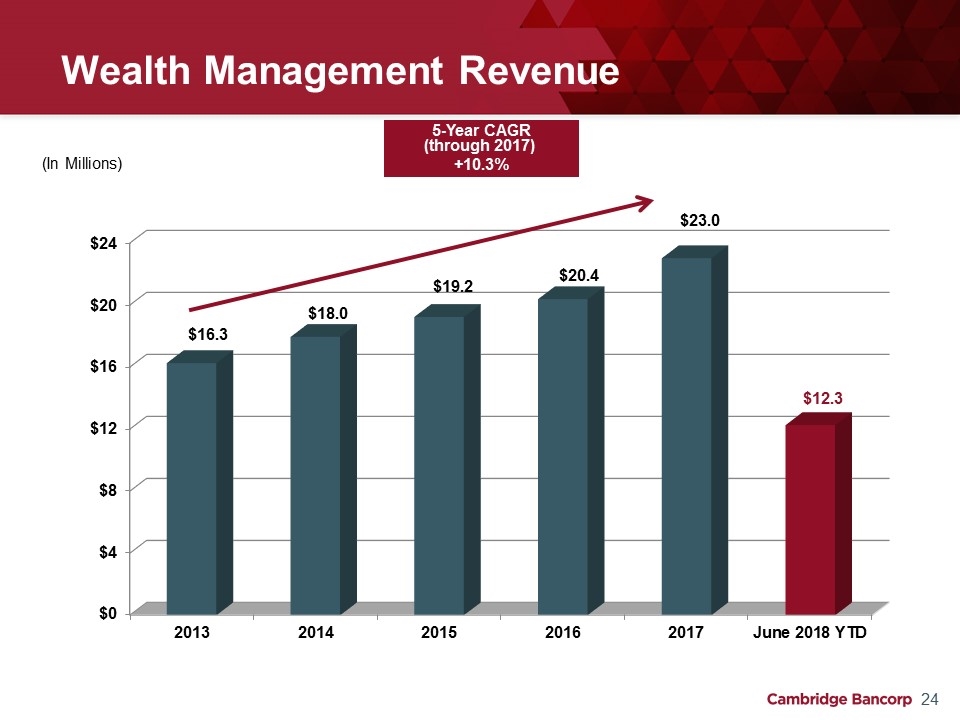

Wealth Management Revenue 5-Year CAGR (through 2017) +10.3% (In Millions)

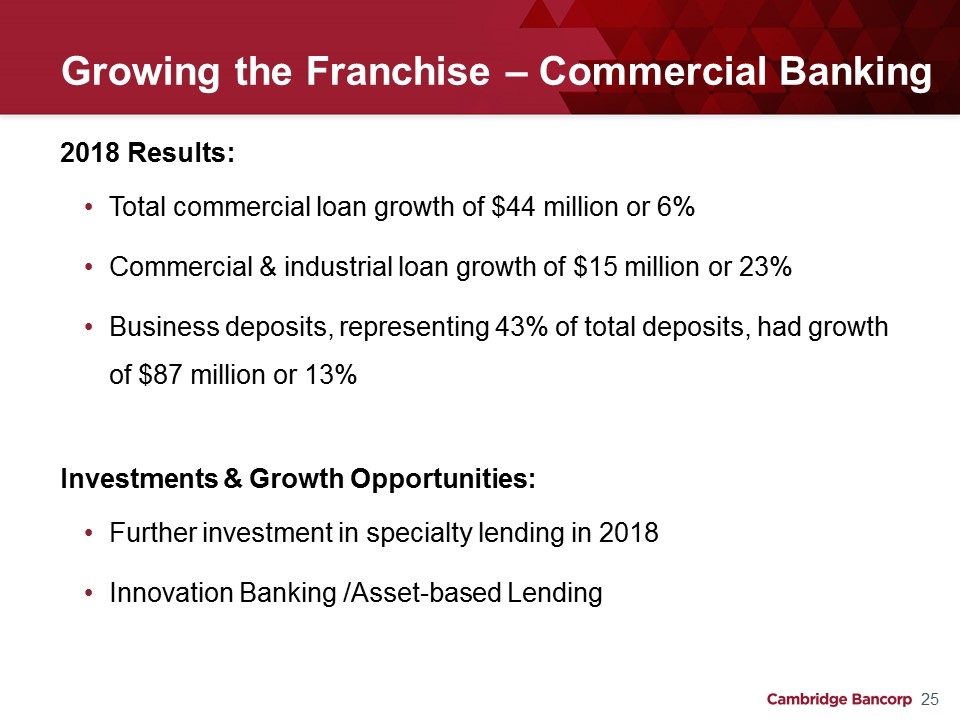

Growing the Franchise – Commercial Banking 2018 Results: Total commercial loan growth of $44 million or 6% Commercial & industrial loan growth of $15 million or 23% Business deposits, representing 43% of total deposits, had growth of $87 million or 13% Investments & Growth Opportunities: Further investment in specialty lending in 2018 Innovation Banking /Asset-based Lending

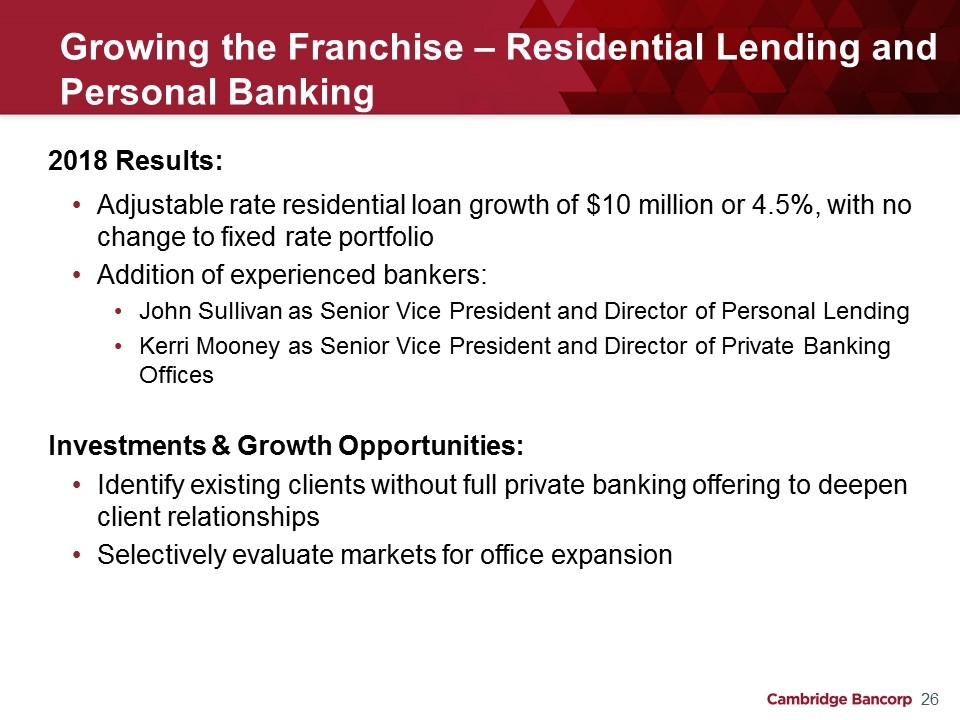

Growing the Franchise – Residential Lending and Personal Banking 2018 Results: Adjustable rate residential loan growth of $10 million or 4.5%, with no change to fixed rate portfolio Addition of experienced bankers: John Sullivan as Senior Vice President and Director of Personal Lending Kerri Mooney as Senior Vice President and Director of Private Banking Offices Investments & Growth Opportunities: Identify existing clients without full private banking offering to deepen client relationships Selectively evaluate markets for office expansion

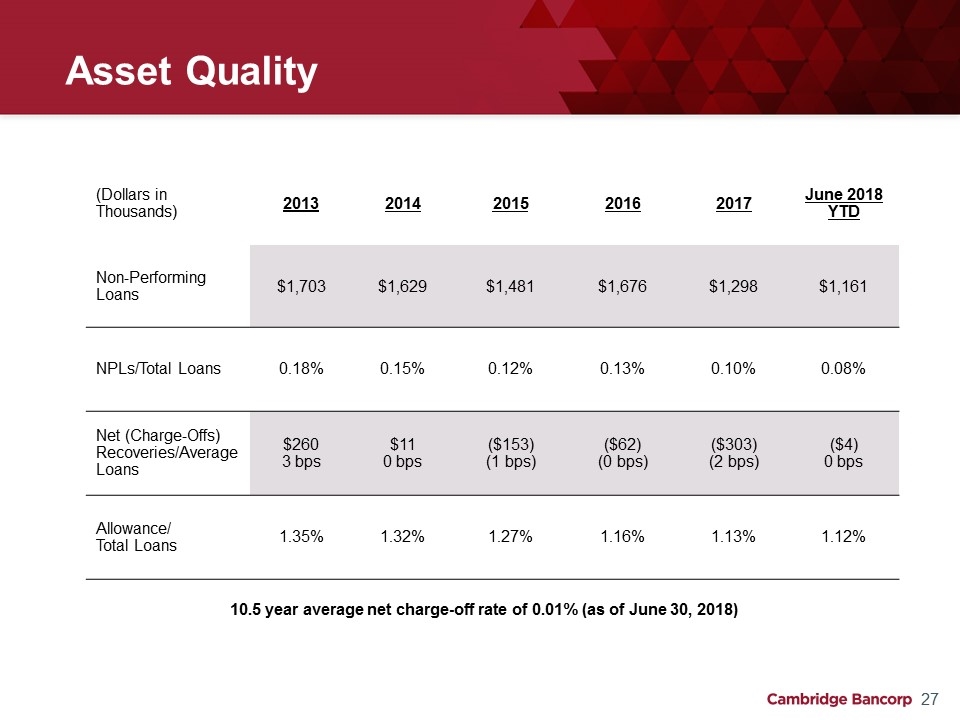

Asset Quality (Dollars in Thousands) 2013 2014 2015 2016 2017 June 2018 YTD Non-Performing Loans $1,703 $1,629 $1,481 $1,676 $1,298 $1,161 NPLs/Total Loans 0.18% 0.15% 0.12% 0.13% 0.10% 0.08% Net (Charge-Offs) Recoveries/Average Loans $260 3 bps $11 0 bps ($153) (1 bps) ($62) (0 bps) ($303) (2 bps) ($4) 0 bps Allowance/ Total Loans 1.35% 1.32% 1.27% 1.16% 1.13% 1.12% 10.5 year average net charge-off rate of 0.01% (as of June 30, 2018)

Demonstrating Our Commitment to the Community Diversity and Inclusion: Greater Boston’s 15 companies with the most racially and gender diverse corporate boards (March 2017) Community Development: Affirmative Housing LLC – Financed renovation of 83 affordable housing units in Roxbury, MA Hildebrand – Line of credit facility and loan for a family shelter Boston Community Capital - $5MM line of credit to support low/moderate income housing Financial Support: To almost 160 non-profit and community organizations throughout Greater Boston and New Hampshire in 2017 Community Service: Caspar Womanplace program - provided financial literacy training to residents ReVision Urban Farm, Dorchester YMCA, Family Aid (May 2018 Corporate Volunteer Events)

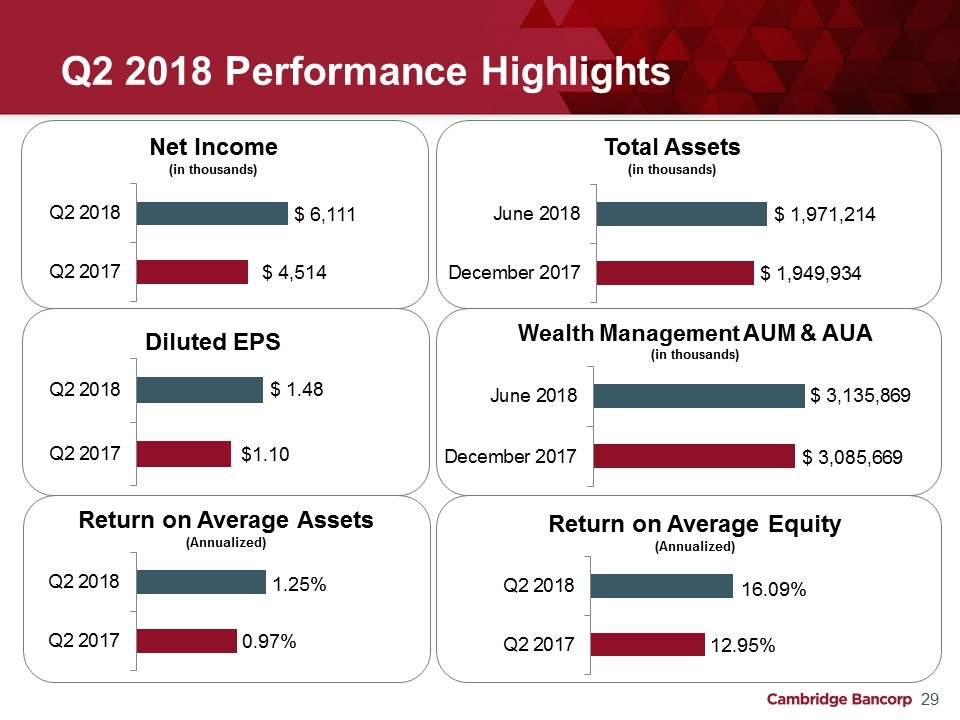

Q2 2018 Performance Highlights Net Income (in thousands) Diluted EPS Return on Average Assets (Annualized) Total Assets (in thousands) Wealth Management AUM & AUA (in thousands) Return on Average Equity (Annualized)

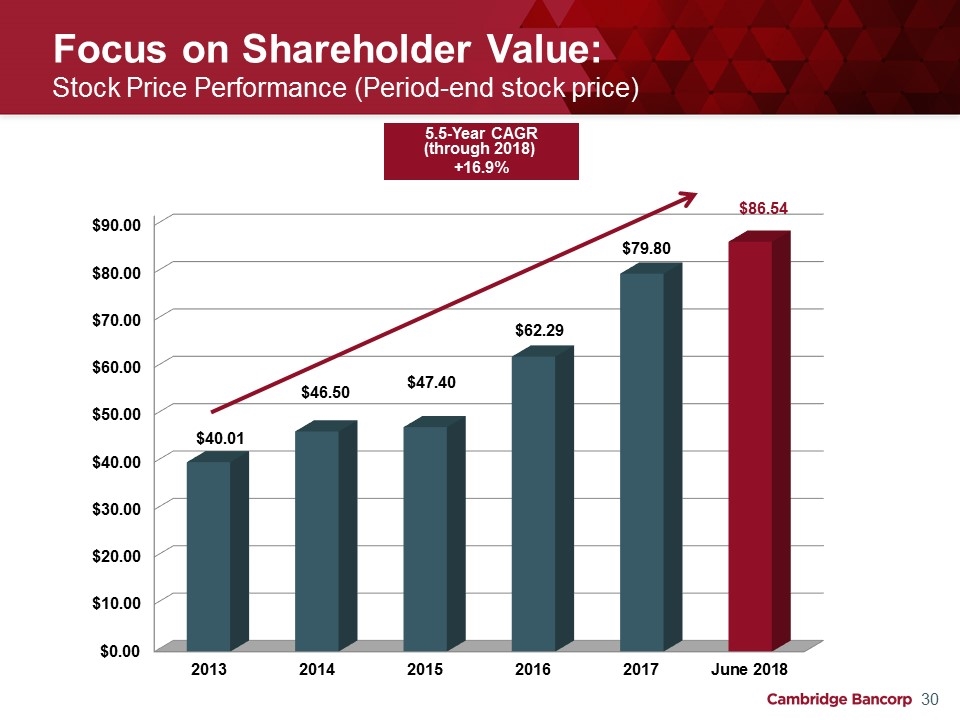

Focus on Shareholder Value: Stock Price Performance (Period-end stock price) 5.5-Year CAGR (through 2018) +16.9%

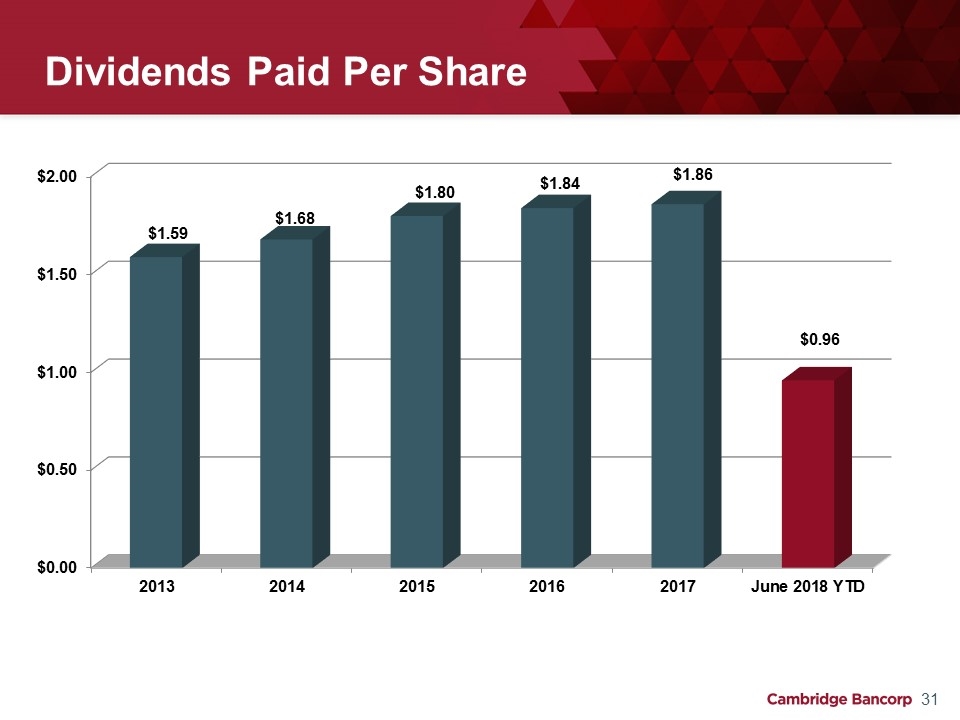

Dividends Paid Per Share

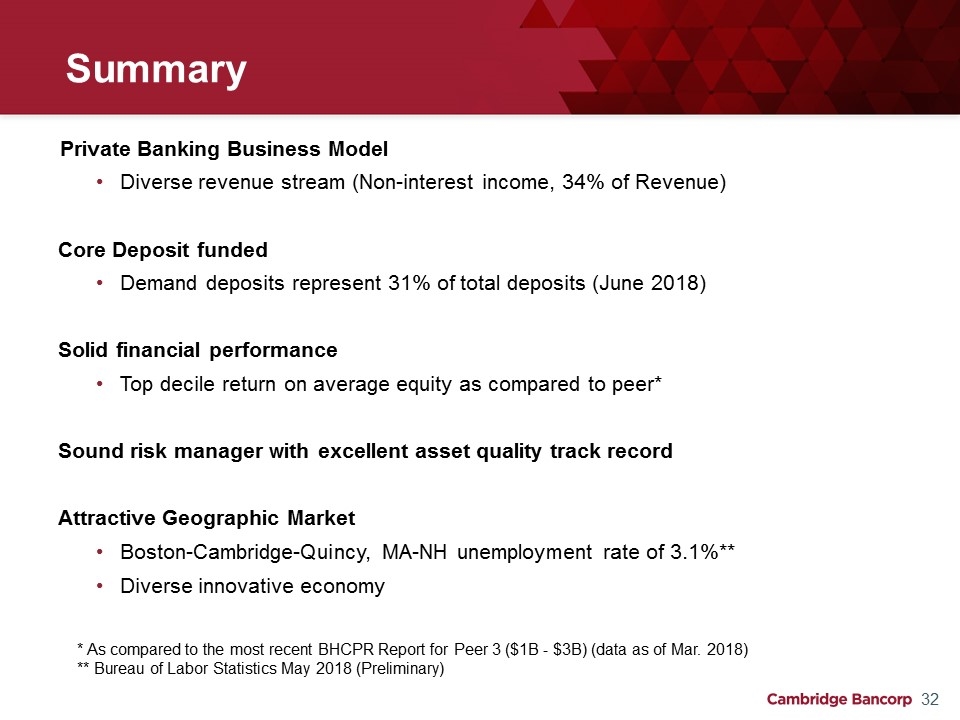

Summary Private Banking Business Model Diverse revenue stream (Non-interest income, 34% of Revenue) Core Deposit funded Demand deposits represent 31% of total deposits (June 2018) Solid financial performance Top decile return on average equity as compared to peer* Sound risk manager with excellent asset quality track record Attractive Geographic Market Boston-Cambridge-Quincy, MA-NH unemployment rate of 3.1%** Diverse innovative economy * As compared to the most recent BHCPR Report for Peer 3 ($1B - $3B) (data as of Mar. 2018) ** Bureau of Labor Statistics May 2018 (Preliminary)

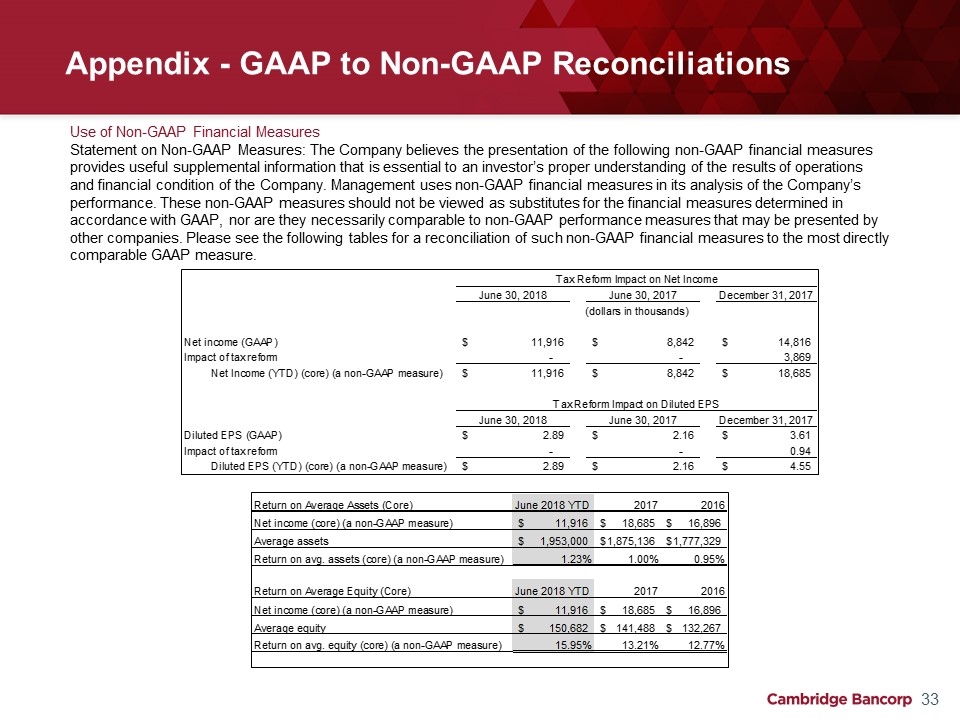

Appendix - GAAP to Non-GAAP Reconciliations Use of Non-GAAP Financial Measures Statement on Non-GAAP Measures: The Company believes the presentation of the following non-GAAP financial measures provides useful supplemental information that is essential to an investor’s proper understanding of the results of operations and financial condition of the Company. Management uses non-GAAP financial measures in its analysis of the Company’s performance. These non-GAAP measures should not be viewed as substitutes for the financial measures determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Please see the following tables for a reconciliation of such non-GAAP financial measures to the most directly comparable GAAP measure. Return on Average Assets (Core) June 2018 YTD 2017 2016 Net income (core) (a non-GAAP measure) $11,916 $18,685 $16,896 Average assets $1,953,000 $1,875,136 $1,777,329 Return on avg. assets (core) (a non-GAAP measure) 1.2303892863507904E-2 9.9646105669135461E-3 9.5063997717923926E-3 Return on Average Equity (Core) June 2018 YTD 2017 2016 Net income (core) (a non-GAAP measure) $11,916 $18,685 $16,896 Average equity $,150,682 $,141,488 $,132,267 Return on avg. equity (core) (a non-GAAP measure) 0.1594716207803914 0.13206066945606695 0.12774161355440133 Tax Reform Impact on Net Income (Dollars in thousands) 43281 43100 Net income (GAAP) $ 11916 $ 14816 Impact of tax reform - 3869 Net Income (YTD) (core) (a non-GAAP measure) $ 11916 $ 18685 Tax Reform Impact on Diluted EPS 43281 43100 Diluted EPS (GAAP) $ 2.89 $ 3.61 Impact of tax reform - 0.94 Diluted EPS (YTD) (core) (a non-GAAP measure) $ 2.89 $ 4.55 Tax Reform Impact on Net Income June 30, 2018 June 30, 2017 December 31, 2017 (dollars in thousands) Net income (GAAP) $11,916 $8,842 $14,816 Impact of tax reform - - 3869 Net Income (YTD) (core) (a non-GAAP measure) $11,916 $8,842 $18,685 Tax Reform Impact on Diluted EPS June 30, 2018 June 30, 2017 December 31, 2017 Diluted EPS (GAAP) $2.89 $2.16 $3.61 Impact of tax reform - - 0.94 Diluted EPS (YTD) (core) (a non-GAAP measure) $2.89 $2.16 $4.55

Denis K. Sheahan Chairman and Chief Executive Officer 617-441-1533 34 Michael F. Carotenuto Senior Vice President and Chief Financial Officer 617-520-5520 Mark D. Thompson President 617-441-1505 Cambridge Bancorp Parent of Cambridge Trust Company