Attached files

| file | filename |

|---|---|

| EX-31.4 - DORIAN LPG LTD. | d7951492_ex31-4.htm |

| EX-31.3 - DORIAN LPG LTD. | d7951492_ex31-3.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2018

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 001-36437

Dorian LPG Ltd.

(Exact name of registrant as specified in its charter)

|

Marshall Islands

|

66-0818228

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

27 Signal Road, Stamford, CT

|

06902

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including area code: (203) 674-9900

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

|

Common stock, par value $0.01 per share

|

New York Stock Exchange

|

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

Accelerated filer ☒

|

Non-accelerated filer ☐

|

|||

|

Smaller reporting company ☐

|

Emerging growth company ☒

|

||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No ☒

The aggregate market value of the registrant's common stock held by non-affiliates, based upon the closing price of common stock as reported on the New York Stock Exchange as of September 30, 2017, was approximately $213,530,640. For this purpose, all outstanding shares of common stock have been considered held by non-affiliates, other than the shares beneficially owned by directors, officers and shareholders of 10% or more of the registrant's outstanding common shares, without conceding that any of the excluded parties are "affiliates" of the registrant for purposes of the federal securities laws. As of July 27, 2018, there were 55,157,193 shares of the registrant's common stock outstanding.

EXPLANATORY NOTE

Dorian LPG Ltd. and its consolidated subsidiaries ("we," "our," "us," the "Company" or "Dorian") is filing this Amendment No. 1 on Form 10-K/A for the fiscal year ended March 31, 2018 (this "Amendment") to amend our Form 10-K for the fiscal year ended March 31, 2018, filed with the U.S. Securities and Exchange Commission (the "Commission") on June 28, 2018 (the "Original Form 10-K"). We are filing this Amendment to (i) present the information required by Part II (Item 5) of Form 10-K that was previously omitted from the Original Form 10-K and (ii) present the information required by Part III of Form 10-K that was previously omitted from the Original Form 10-K in reliance on General Instruction G(3) to Form 10-K. The Company is hereby amending the Original Form 10-K as follows:

| · |

On the cover page, to (i) delete the reference in the Original Form 10-K to the incorporation by reference of the Company's proxy statement for its 2018 annual stockholders' meeting and (ii) update the date as of which the number of outstanding shares of the Company's common stock is being provided;

|

| · |

To present the information required by Part II (Item 5) and Part III of Form 10-K, which information was originally expected to be incorporated by reference to our definitive proxy statement to be delivered to our stockholders in connection with our 2018 annual meeting of stockholders; and

|

| · |

In Part IV, to amend and restate Item 15(b). The amended certifications of the Company's principal executive officer and principal financial officer are attached to this Amendment as Exhibits 31.3 and 31.4. The Exhibit Index has also been amended and restated in its entirety to include the certifications as exhibits.

|

Except as described above, no other changes have been made to the Original Form 10-K. This Amendment does not otherwise update information in the Original Form 10-K to reflect facts or events occurring subsequent to the filing date of the Original Form 10-K. This Amendment should be read in conjunction with the Original Form 10-K and with any of our filings made with the Commission subsequent to filing of the Original Form 10-K. Except as otherwise specifically defined herein, all defined terms used in the Original Form 10-K shall have the same meanings in this Amendment.

|

PART II.

|

|||

|

ITEM 5

|

MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

1 |

|

|

PART III.

|

|||

|

ITEM 10.

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

3

|

|

|

ITEM 11.

|

EXECUTIVE COMPENSATION

|

6

|

|

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDERS MATTERS

|

11

|

|

|

ITEM 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

13

|

|

|

ITEM 14.

|

PRINCIPAL ACCOUNTING FEES AND SERVICES

|

16

|

|

|

PART IV.

|

|||

|

ITEM 15.

|

EXHIBITS, FINANCIAL STATEMENT SCHEDULES

|

17

|

|

|

Signatures

|

21

|

|

ITEM 5.

|

Our common shares have traded on the New York Stock Exchange, or NYSE, since May 9, 2014, under the symbol "LPG." As of July 27, 2018, we had 168 registered holders of our common shares, including Cede & Co., the nominee for the Depository Trust Company. This number excludes shareholders whose stock is held in nominee or street name by brokers.

The following tables set forth the high and low prices for our common shares as reported on the NYSE for the calendar periods listed below.

|

NYSE

|

||||||||

|

High

|

Low

|

|||||||

|

For the Quarter Ended

|

(US$)

|

(US$)

|

||||||

|

June 30, 2016

|

10.83

|

6.90

|

||||||

|

September 30, 2016

|

7.74

|

5.07

|

||||||

|

December 31, 2016

|

9.85

|

5.63

|

||||||

|

March 31, 2017

|

12.50

|

8.35

|

||||||

|

June 30, 2017

|

10.85

|

7.01

|

||||||

|

September 30, 2017

|

8.73

|

6.20

|

||||||

|

December 31, 2017

|

8.72

|

6.78

|

||||||

|

March 31, 2018

|

8.50

|

7.15

|

||||||

Stock Repurchase Program

See Note 10 to our consolidated financial statements included in the Original Form 10-K for a discussion of our stock repurchase program that expired on December 31, 2016.

Equity Compensation Plans

The information set forth in this Amendment under "Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters—Equity Compensation Plan Information" is incorporated herein by reference.

Dividends

We have not paid any dividends since our inception in July 2013. In general, under the terms of our credit facility, we are not permitted to pay dividends if there is a default or a breach of a loan covenant. Further, under the 2015 Debt Facility Amendment, we are temporarily restricted from paying dividends and repurchasing shares of our common stock until the earlier of (i) when we complete a common stock offering with net proceeds of at least $50.0 million and (ii) May 31, 2019.

In the future, we will evaluate the potential level and timing of dividends as soon as profits and capital expenditure requirements allow. In addition, since we are a holding company with no material assets other than the shares of our subsidiaries through which we conduct our operations, our ability to pay dividends will depend on our subsidiaries' distributing to us their earnings and cash flows. The timing and amount of any dividend payments will always be subject to the discretion of our board of directors and will depend on, among other things, earnings, potential future capital expenditure commitments, market prospects, current capital expenditure programs, investment opportunities, the provisions of Marshall Islands law affecting the payment of distributions to shareholders, and the terms and restrictions of our existing and future credit facilities. Marshall Islands law generally prohibits the payment of dividends other than from operating surplus or while a company is insolvent or would be rendered insolvent upon the payment of such dividend.

1

Taxation

Please see "Item 1. Business—Taxation" of the Original Form 10-K for a discussion of certain tax considerations related to holders of our common shares.

Issuer Purchases of Equity Securities

The table below sets forth information regarding our purchases of our common stock during the quarterly period ended March 31, 2018:

|

Period

|

Total

Number

of Shares

Purchased

|

Average

Price Paid

Per Share

|

Total

Number of

Shares

Purchased as

Part of

Publicly

Announced

Plans or

Programs

|

Maximum Dollar

Value of Shares

that May Yet Be

Purchased Under the

Plan or Programs

|

||||||||||||

|

January 1 to 31, 2018

|

5,539

|

$

|

7.70

|

—

|

$

|

—

|

||||||||||

|

February 1 to 28, 2018

|

—

|

—

|

—

|

—

|

||||||||||||

|

March 1 to 31, 2018

|

26,407

|

7.47

|

—

|

—

|

||||||||||||

|

Total

|

31,946

|

$

|

7.51

|

—

|

$

|

—

|

||||||||||

Purchases of our common stock during the quarterly period ended March 31, 2018 represent our shares of common stock withheld in satisfaction of tax withholding obligations upon vesting of employee restricted equity awards.

Stock Performance Graph

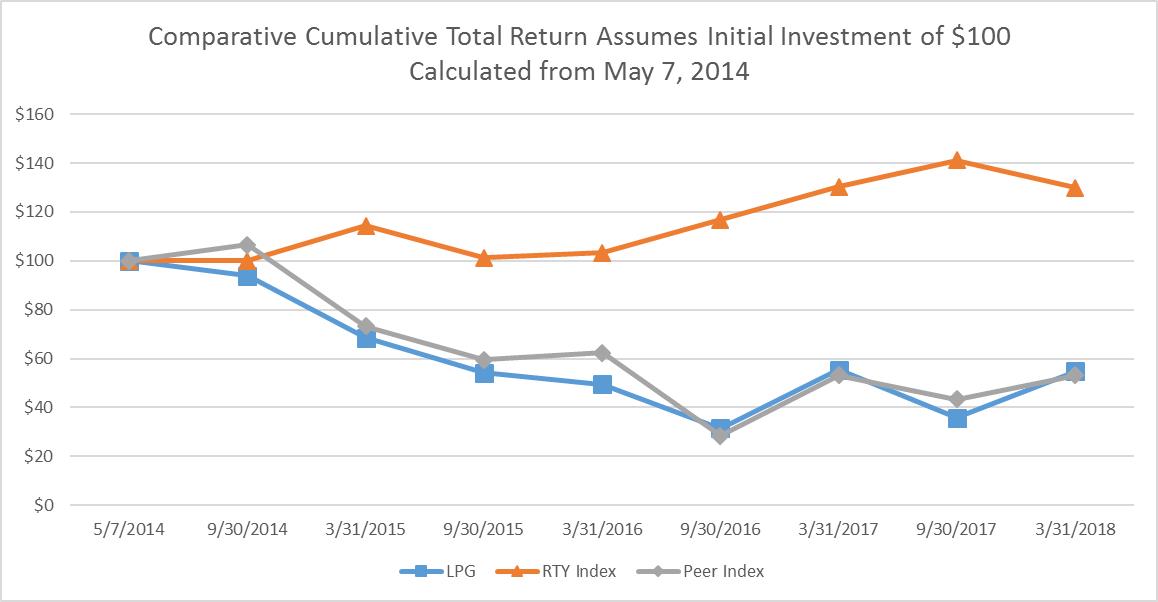

The performance graph below shows the cumulative total return to shareholders of our common stock relative to the cumulative total returns of the Russell 2000 Index and the Dorian Peer Group Index (defined below). The graph tracks the performance of a $100 investment in our common stock and in each of the indices (with the reinvestment of dividends) from May 7, 2014 (the date our common stock was listed on the NYSE) to March 31, 2018. The stock price performance included in this graph is not necessarily indicative of future stock price performance.

The Dorian Peer Group Index is a self-constructed peer group that consists of the following direct competitors on a line-of-business basis: BWLPG, Navigator Holdings Ltd., or NVGS, and Avance. NVGS's common stock trades on the NYSE, while the common stock of Avance and BWLPG trade on the Oslo Stock Exchange. For the purposes of the below comparison, the cumulative total returns for Avance and BWLPG were converted into U.S. dollars based on the relevant NOK to one USD exchange rate prevailing on the dates listed below.

|

5/7/14

|

9/30/14

|

3/31/15

|

9/30/15

|

3/31/16

|

9/30/16

|

3/31/17

|

9/30/17

|

3/31/18

|

||||||||||||||||||||||||||||

|

Dorian LPG Ltd. ("LPG")

|

100.00

|

93.79

|

68.58

|

54.26

|

49.47

|

31.58

|

55.42

|

35.89

|

54.84

|

|||||||||||||||||||||||||||

|

Russell 2000 Index ("RTY Index")

|

100.00

|

99.95

|

114.41

|

101.20

|

103.24

|

116.84

|

130.27

|

141.05

|

129.94

|

|||||||||||||||||||||||||||

|

Peer Index

|

100.00

|

106.57

|

73.33

|

59.45

|

62.47

|

28.34

|

53.12

|

43.28

|

53.13

|

|||||||||||||||||||||||||||

|

NOK to USD exchange conversion rate

|

5.9098

|

6.4261

|

8.0608

|

8.5155

|

8.2685

|

7.9846

|

8.5985

|

7.9626

|

7.8413

|

|||||||||||||||||||||||||||

This performance graph shall not be deemed "soliciting material" or to be "filed" with the Commission for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, or otherwise subject to the liabilities under that Section, and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Securities Act.

2

|

ITEM 10.

|

John C. Hadjipateras, 68, has served as Chairman of the Company's Board of Directors and as our President and Chief Executive Officer and as President of Dorian LPG (USA) LLC since our inception in July 2013. Mr. Hadjipateras has been actively involved in the management of shipping companies since 1972. From 1972 to 1992, Mr. Hadjipateras was the Managing Director of Peninsular Maritime Ltd. in London and subsequently served as President of Eagle Ocean Transport Inc. ("Eagle Ocean"), which provides chartering, sale and purchase, protection and indemnity insurance and shipping finance services. Mr. Hadjipateras has served as a member of the boards of the Greek Shipping Co-operation Committee and of the Council of INTERTANKO, and has been a member of the Baltic Exchange since 1972 and of the American Bureau of Shipping since 2011. Mr. Hadjipateras also served on the Board of Advisors of the Faculty of Languages and Linguistics of Georgetown University and is a trustee of Kidscape, a leading U.K. charity organization. Mr. Hadjipateras was a director of SEACOR Holdings Inc., a global provider of marine transportation equipment and logistics services, from 2000 to 2013. We believe that Mr. Hadjipateras' expertise in the maritime and shipping industries provides him the qualifications and skills to serve as a member of our Board of Directors.

Malcolm McAvity, 67, has served as a director of the Company since January 2015 and is currently the Chairman of the Company's nominating and corporate governance committee (the "Nominating and Corporate Governance Committee") and a member of the Company's compensation committee (the "Compensation Committee"). Mr. McAvity formerly served as Vice Chairman of Phibro LLC, one of the world's leading international commodities trading firms, from 1986 through 2012. Mr. McAvity has held various positions trading crude oil and other commodities. Mr. McAvity earned a BA from Stanford University and an MBA from Harvard University. We believe that Mr. McAvity's experience in commodities trading provides him the qualifications and skills to serve as a member of our Board of Directors.

Class II Directors — Terms expiring at the Company's 2018 Annual Meeting of Shareholders

Øivind Lorentzen, 68, has served as a director of the Company since July 2013. Mr. Lorentzen is currently Managing Director of Northern Navigation, LLC. Mr. Lorentzen has been Non-Executive Vice Chairman of SEACOR Holdings Inc. since early 2015, prior to which he was its Chief Executive Officer. From 1990 until September 2010, Mr. Lorentzen was President of Northern Navigation America, Inc., an investment management and ship-owning agency company concentrating in specialized marine transportation and ship finance. From 1979 to 1990, Mr. Lorentzen was Managing Director of Lorentzen Empreendimentos S.A., an industrial and shipping group in Brazil, and he served on its board of directors until December 2005. From 2001 to 2008, Mr. Lorentzen was Chairman of NFC Shipping Funds, a leading private equity fund in the maritime industry. Mr. Lorentzen is a director of Blue Danube, Inc., a privately owned inland marine service provider, and a director of Genessee & Wyoming Inc., an owner and operator of short line and regional freight railroads. Mr. Lorentzen earned his undergraduate degree at Harvard College and his MBA from Harvard Business School. Mr. Lorentzen's expertise in the maritime and shipping industries provides him the important qualifications and skills to serve as a member of our Board of Directors.

John C. Lycouris, 68, has served as Chief Executive Officer of Dorian LPG (USA) LLC and a director of the Company since our inception in July 2013. In 1993, Mr. Lycouris joined Eagle Ocean. At Eagle Ocean, Mr. Lycouris has attended to a multitude of sale and purchase contracts and pre- and post-delivery financing of newbuilding and secondhand vessels in the tanker, LPG, and dry bulk sectors. Before joining Eagle Ocean, Mr. Lycouris served as Director of Peninsular Maritime Ltd., a ship brokerage firm, which he joined in 1974, and managed the Finance and Accounts departments. Mr. Lycouris is a member of the Lloyd's Register North American Advisory Committee and a member of the DNV GL North American Committee. Mr. Lycouris graduated from Cornell University, where he earned an MBA, and from Ithaca College with a BS. Mr. Lycouris's successful leadership and executive experience, along with his deep knowledge of the commercial, technical and operational aspects of shipping in general and LPG shipping in particular, provide him the qualifications and skills to serve as a member of our Board of Directors.

Ted Kalborg, 67, has served as a director of the Company since December 12, 2014 and is currently the Chairman of the Company's audit committee (the "Audit Committee") and a member of the Compensation Committee. Mr. Kalborg is the founder of the Tufton Group, a fund management group he founded in 1985 that specializes in the shipping and energy sectors. The group manages hedge funds and private equity funds. Mr. Kalborg's primary focus has been corporate reorganizations and he also serves on the board of Hafnia Tankers, a Norwegian OTC-listed tanker company, since 2014. Mr. Kalborg holds a BA from Stockholm School of Economics and received an MBA from Harvard Business School. Mr. Kalborg's diversified experience in the oil drilling, shipping, and investment industries, his specialty in maritime and transportation fund management, and his extensive background serving as director of several other companies equip him with the qualifications and skills to act as a member of our Board of Directors.

3

Class I Directors — Terms expiring at the Company's 2020 Annual Meeting of Shareholders

Thomas J. Coleman, 52, has served as a director of the Board since September 2013 and is currently the Chairman of the Compensation Committee and a member of the Nominating and Corporate Governance and Audit Committees. Mr. Coleman has served as co-Founder and co-President of Kensico Capital Management Corporation ("Kensico") since 2000. Mr. Coleman is also the co-principal of each of Kensico's affiliates. Prior to working with Kensico and its affiliates, Mr. Coleman was employed by Halo Capital Partners ("Halo"). Prior to his employment at Halo, Mr. Coleman founded and served as Chief Executive Officer and a director of PTI Holding Inc. from 1990 until 1995. From October 2012 until January 2014, Mr. Coleman served as a director of WebMD. From February 2011 until its sale in January 2012, Mr. Coleman served as a director of Tekelec, a publicly traded global provider of core network solutions. We believe that Mr. Coleman's deep knowledge of corporate finance provides him the qualifications and skills to serve as a member of our Board of Directors.

Christina Tan, 65, has served as a director of the Company since May 1, 2015 and is currently a member of the Audit and Nominating and Corporate Governance Committees. Ms. Tan is an Executive Director of the MT Maritime Management Group ("MTM Group"), a position she has held since 1991. Ms. Tan has been an officer with the MTM Group for over 30 years, performing in a variety of capacities, including finance and chartering, and was also a board member of Northern Shipping Funds from 2008 to 2015, at which point she remained as a member of the Limited Partnership Advisory Committee (LPAC). For eight years prior to joining MTM Group, Ms. Tan was Vice President of Finance and Trading for Socoil Corporation, a major Malaysian palm oil refiner and trading company. Ms. Tan earned a BA in Economics and Mathematics from Western State College of Colorado. We believe that Ms. Tan's long-standing experience in the shipping industry and in maritime investments provide her the qualifications and skills to serve as a member of our Board of Directors.

Information about Executive Officers Who Are Not Directors

Theodore B. Young, 50, has served as our Chief Financial Officer, Treasurer and Principal Financial and Accounting Officer since July 2013, as Chief Financial Officer and Treasurer of Dorian LPG (USA) LLC since July 2013, and as head of corporate development for Eagle Ocean from 2011 to 2013. From 2004 to 2011, Mr. Young was a Senior Managing Director and member of the Investment Committee at Irving Place Capital ("IPC"), where he worked on investments in the industrial, transportation and business services sectors. Prior to joining IPC, Mr. Young was a principal at Harvest Partners, a New York-based middle market buyout firm, from 1997 to 2004. There, Mr. Young was active in industrial transactions and played a key role in the firm's multinational investment strategy. Prior to his career in private equity, Mr. Young was an investment banker with Merrill Lynch & Co., Inc. and SBC Warburg Dillon Read and its predecessors in New York, Zurich, and London. Mr. Young holds an AB from Dartmouth College and an MBA from the Wharton School of the University of Pennsylvania with a major in accounting.

Alexander C. Hadjipateras, 39, has served as our Executive Vice President of Business Development since July 2013 and is the son of John C. Hadjipateras, the Chairman of the Board of Directors and President and Chief Executive Officer of the Company. Mr. Alexander C. Hadjipateras' main areas of focus are business development, vessel sales and purchases, and assisting in the management of the Company's operations in Athens, Greece. Since joining Eagle Ocean in 2006, Mr. Alexander C. Hadjipateras has been involved in its newbuilding program at Sumitomo Shipyard in Japan and Hyundai Heavy Industries in South Korea and has also participated in its Aframax spot chartering. Prior to joining Eagle Ocean, Mr. Alexander C. Hadjipateras worked as a Business Development Manager at Avenue A/ Razorfish, a leading digital consultancy and advertising agency based in San Francisco. Since November 2016, Mr. Alexander C. Hadjipateras has served as a Director on the Members Committee of the UK P&I Club. Mr. Alexander C. Hadjipateras graduated from Georgetown University with a BA in history in 2001.

The Audit Committee, established in accordance with Section 3(a)(58)(A) of the Exchange Act, currently consists of Messrs. Coleman and Kalborg and Ms. Tan, with Mr. Kalborg serving as its chairperson. The Audit Committee meets a minimum of four times a year, and periodically meets with the Company's management, internal auditors and independent external auditors separately from the Board.

4

Under the Audit Committee charter, the Audit Committee assists the Board in overseeing the quality of the Company's financial statements and its financial reporting practices. To that end, the Audit Committee has direct responsibility for the appointment, replacement, compensation, retention, termination and oversight of the work of the independent registered public accounting firm engaged to prepare an audit report, to perform other audits and to perform review or attest services for us. The Audit Committee confers directly with the Company's independent registered public accounting firm. The Audit Committee also assesses the outside auditors' qualifications and independence. The Audit Committee is responsible for the pre-approval of all audit and non-audit services performed by our independent registered public accounting firm. The Audit Committee acts on behalf of the Board in reviewing the scope of the audit of the Company's financial statements and results thereof. Our Chief Financial Officer has direct access to the Audit Committee. The Audit Committee also oversees the operation of our internal controls covering the integrity of our financial statements and reports, compliance with laws, regulations and corporate policies, and the qualifications, performance and independence of our independent registered public accounting firm. Based on this oversight, the Audit Committee advises the Board on the adequacy of the Company's internal controls, accounting systems, financial reporting practices and the maintenance of the Company's books and records. The Audit Committee is also responsible for determining whether any waiver of our Code of Ethics will be permitted and for reviewing and determining whether to approve any related party transactions required to be disclosed pursuant to Item 404(a) of Regulation S-K. Annually, the Audit Committee recommends that the Board request shareholder ratification of the appointment of the independent registered public accounting firm. The responsibilities and activities of the Audit Committee are further described in the Audit Committee charter.

Our Board of Directors has determined that the Audit Committee consists entirely of directors who meet the independence requirements of the NYSE listing standards and Rule 10A-3 of the Exchange Act. The Board has also determined that each member of the Audit Committee has sufficient knowledge and understanding of the Company's financial statements to serve on the Audit Committee and is financially literate within the meaning of the NYSE listing standards as interpreted by the Board. The Board has further determined that Messrs. Kalborg and Coleman satisfy the definition of "audit committee financial expert" as defined under federal securities laws.

Code of Conduct and Ethics

We have adopted a Code of Ethics applicable to officers, directors and employees (the "Code of Ethics"), which fulfills applicable guidelines issued by the Commission. Our Code of Ethics can be found on our website at http://www.dorianlpg.com/investor-center/corporate-governance/. We will also provide a hard copy of our Code of Ethics free of charge upon written request to Dorian LPG Ltd. c/o Dorian LPG (USA) LLC, 27 Signal Road, Stamford, Connecticut 06902. Any waiver that is granted, and the basis for granting the waiver, will be publicly communicated as appropriate, including through posting on our website, as soon as practicable. We granted no waivers under our Code of Ethics during the fiscal year ended March 31, 2018. We intend to post any amendments to and any waivers of our Code of Ethics on our website within four business days.

Shareholder Nominations

There have been no material changes to the procedures by which security holders may recommend nominees to our board of directors.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors and executive officers, and beneficial owners of more than ten percent of any class of our registered equity securities including our common stock, to file with the Commission initial reports of beneficial ownership and reports of changes in beneficial ownership of common stock and other equity securities of the Company, and to provide the Company with a copy of those reports.

To the Company's knowledge, based solely on a review of copies of such reports furnished to the Company, and written representations that no reports were required, during the fiscal year ended March 31, 2018, all Section 16(a) filing requirements applicable to the Company's officers, directors, and greater than ten percent beneficial owners were complied with.

5

Introduction

Our named executive officers, consisting of our principal executive officer and our two most highly compensated executive officers other than our principal executive officer for the fiscal year ended March 31, 2018 are:

| · |

John C. Hadjipateras, our Chief Executive Officer, President, and Chairman of the Board of Directors;

|

| · |

John C. Lycouris, Chief Executive Officer of Dorian LPG (USA) LLC and a Director on our Board of Directors; and

|

| · |

Theodore B. Young, our Chief Financial Officer.

|

Mr. Lycouris is employed and compensated by our subsidiary Dorian LPG (USA) LLC but is considered one of our executive officers because he performs policy making functions for us.

As an emerging growth company, we have opted to comply with the executive compensation rules applicable to "smaller reporting companies," as such term is defined under the Securities Act of 1933, as amended, which require compensation disclosure for our principal executive officer and our next two most highly compensated executive officers other than our principal executive officer (collectively, the "named executive officers"). Also as an emerging growth company, we are not required to include, and have not included, a compensation discussion and analysis (CD&A) of our executive compensation programs in this Amendment.

The table below sets forth the compensation earned by our named executive officers during the years indicated.

|

Name and Principal Position

|

Fiscal Year

Ended March 31,

|

Salary

|

Bonus(1)

|

Stock Awards(2)

|

All Other

Compensation(3)

|

Total

|

||||||||||||||||

|

John C. Hadjipateras(4)

|

2018

|

$

|

550,000

|

$

|

601,500

|

$

|

549,000

|

$

|

8,100

|

$

|

1,708,600

|

|||||||||||

|

Chief Executive Officer

|

2017

|

$

|

550,000

|

$

|

751,500

|

$

|

586,500

|

$

|

10,275

|

$

|

1,898,275

|

|||||||||||

|

John C. Lycouris(5)

|

2018

|

$

|

450,000

|

$

|

251,500

|

$

|

219,600

|

$

|

8,100

|

$

|

929,200

|

|||||||||||

|

Chief Executive Officer, Dorian

|

2017

|

$

|

450,000

|

$

|

301,500

|

$

|

234,600

|

$

|

9,525

|

$

|

995,625

|

|||||||||||

|

Theodore B. Young

|

2018

|

$

|

400,000

|

$

|

251,500

|

$

|

201,300

|

$

|

8,100

|

$

|

860,900

|

|||||||||||

|

Chief Financial Officer

|

2017

|

$

|

400,000

|

$

|

276,500

|

$

|

215,050

|

$

|

9,150

|

$

|

900,700

|

|||||||||||

|

|

(1) |

Represents cash bonuses to each of the named executive officers awarded by the Compensation Committee. The table above excludes cash bonuses awarded by the Compensation Committee after March 31, 2018 to each of Mr. Hadjipateras, Mr. Lycouris and Mr. Young in the amounts of $300,000, $200,000, and $200,000, respectively.

|

| (2) |

The amounts set forth next to each award represent the aggregate grant date fair value of awards computed in accordance with FASB ASC Topic 718. The assumptions used in calculating the grant date fair value reported in these columns are set forth in Note 11 of the Notes to the Consolidated Financial Statements included in the Original Form 10-K. The table above excludes one-time restricted share awards granted by the Compensation Committee after March 31, 2018 to each of Mr. Hadjipateras, Mr. Lycouris and Mr. Young in the amounts of 64,700 restricted shares, 20,000 restricted shares, and 20,000 restricted shares, respectively, with the restricted shares vesting in equal installments on the grant date and on the first, second, and third anniversary of the grant date.

|

| (3) |

The amounts set forth represent contributions by the Company to each of the named executive officer's 401(k) defined contribution plan.

|

| (4) |

As our Chief Executive Officer, Mr. Hadjipateras does not receive any additional compensation for his services as a director.

|

| (5) |

As the Chief Executive Officer of our subsidiary, Dorian LPG (USA) LLC, Mr. Lycouris does not receive any additional compensation for his services as a director.

|

6

Narrative Disclosure to the Summary Compensation Table

Pursuant to management agreements entered into by each of our then vessel owning subsidiaries on July 26, 2013, as amended, with Dorian (Hellas) S.A. ("DHSA"), the technical, crew and commercial management as well as insurance and accounting services of our vessels was outsourced to DHSA. In addition, under these management agreements, strategic and financial services had also been outsourced to DHSA. DHSA had entered into agreements with each of Eagle Ocean and Highbury Shipping Services Limited ("HSSL"), to provide certain of these services on behalf of our then vessel owning companies. Mr. John C. Hadjipateras, our Chairman, President and Chief Executive Officer, owns 100% of Eagle Ocean, and our Vice President of Chartering, Insurance and Legal, Nigel Grey Turner, owns 100% of HSSL. As of July 1, 2014, vessel management services and the associated agreements for our fleet were transferred from DHSA and are now provided through our wholly owned subsidiaries Dorian LPG (USA) LLC, Dorian LPG (UK) Ltd. and Dorian LPG Management Corp. Eagle Ocean continues to incur related travel costs for certain transitioned employees as well as office-related costs, for which we reimbursed Eagle Ocean $0.1 million, $0.4 million and $0.8 million for the years ended March 31, 2018, 2017, and 2016, respectively. Such expenses are reimbursed based on their actual cost.

None of our members of senior management, including Mr. Hadjipateras, Mr. Lycouris and Mr. Young, are subject to an employment agreement with us or our subsidiaries.

Equity Compensation

On June 30, 2014, Mr. Hadjipateras, Mr. Lycouris and Mr. Young received 350,000 shares, 185,000 and 90,000 shares of restricted stock, respectively, vesting in equal installments on the third, fourth and fifth anniversary of the grant date. On June 15, 2016, Mr. Hadjipateras, Mr. Lycouris and Mr. Young received 75,000 shares, 30,000 and 27,500 shares of restricted stock, respectively, vesting in equal installments on the grant date and the first, second and third anniversary of the grant date. On June 15, 2017, Mr. Hadjipateras, Mr. Lycouris and Mr. Young received 75,000 shares, 30,000 and 27,500 shares of restricted stock, respectively, vesting in equal installments on the grant date and the first, second and third anniversary of the grant date. On June 15, 2018, Mr. Hadjipateras, Mr. Lycouris and Mr. Young received 64,700 shares, 20,000 shares and 20,000 shares of restricted stock, respectively, vesting in equal installments on the grant date and the first, second and third anniversary of the grant date. All restricted shares of a named executive officer will vest (i) if such named executive officer's employment terminates other than for Cause (as defined in the Severance and CIC Plan (defined below)—see "—2014 Executive Severance and Change in Control Severance Plan" below) or on account of death or Disability or (ii) upon a Change of Control (as defined in the Equity Incentive Plan (defined below) and related restricted stock award agreements) that occurs while such named executive officer is still employed with us.

7

The following table sets forth certain information concerning outstanding equity awards as of March 31, 2018, for each named executive officer:

|

Stock Awards

|

||||||||

|

Name

|

Grant Date

|

Number of shares or units of stock that have not vested(1)

|

Market value of shares or units of stock that have not vested(2)

|

|||||

|

John C. Hadjipateras

|

6/15/2017

|

56,250(3)

|

$421,313

|

|||||

|

6/15/2016

|

37,500(4)

|

$280,875

|

||||||

|

6/30/2014

|

233,333(5)

|

$1,747,664

|

||||||

|

John C. Lycouris

|

6/15/2017

|

22,500(3)

|

$168,525

|

|||||

|

6/15/2016

|

15,000(4)

|

$112,350

|

||||||

|

6/30/2014

|

123,333(5)

|

$923,764

|

||||||

|

Theodore B. Young

|

6/15/2017

|

20,625(3)

|

$154,481

|

|||||

|

6/15/2016

|

13,750(4)

|

$102,988

|

||||||

|

6/30/2014

|

60,000(5)

|

$449,400

|

||||||

| (1) |

The table above excludes one-time restricted share awards granted by the Compensation Committee after March 31, 2018, to each of Mr. Hadjipateras, Mr. Lycouris and Mr. Young in the amounts of 64,700 restricted shares, 20,000 restricted shares, and 20,000 restricted shares, respectively, with the restricted shares vesting in equal installments on the grant date and on the first, second, and third anniversary of the grant date.

|

| (2) |

Fair market value of our common stock on March 31, 2018. The amount listed in this column represents the product of the closing market price of the Company's stock as of March 31, 2018 ($7.49) multiplied by the number of shares of stock subject to the award.

|

| (3) |

Granted on June 15, 2017 and vested or vests ratably on each of the grant date and first, second and third anniversaries of the date of grant.

|

| (4) |

Granted on June 15, 2016 and vested or vests ratably on each of the grant date and first, second and third anniversaries of the date of grant.

|

| (5) |

Granted on June 30, 2014 and vested or vests ratably on each of the third, fourth and fifth anniversaries of the date of grant.

|

8

We pay each non-executive director annual compensation of $100,000 (50% in cash and 50% as an equity award in a form determined by our Compensation Committee), paid quarterly in arrears. The chairman of the Compensation Committee, the Audit Committee and the Nominating and Corporate Governance Committee each receive additional annual cash compensation of $15,000. Further, any director serving on a committee of the Board, other than a chairman of a committee, receives additional annual cash compensation of $10,000 per committee.

Each director is also reimbursed for out-of-pocket expenses in connection with attending meetings of the board of directors or committees. Each director will be fully indemnified by us for actions associated with being a director to the extent permitted under Marshall Islands law. Further, none of the members of our board of directors will receive any benefits upon termination of their directorship positions. Our directors are eligible to receive awards under an equity incentive plan that we adopted prior to the completion of our initial public offering and which is described below under "—2014 Equity Incentive Plan." Our Compensation Committee reviews director compensation annually and makes recommendations to the Board with respect to compensation and benefits provided to the members of the Board. Our Corporate Governance Guidelines provide that director compensation should be fair and equitable to enable the Company to attract qualified members to serve on its Board.

The following table provides certain information concerning the compensation earned by each of our non-employee directors serving on our Board for the year ended March 31, 2018, for services rendered in all capacities:

|

Name

|

Fees earned or

paid in cash ($)(1)

|

Stock

Awards ($)(2)

|

Total ($)

|

|||||||||

|

Thomas J. Coleman

|

85,000

|

48,691

|

133,691

|

|||||||||

|

Ted Kalborg

|

75,000

|

48,691

|

123,691

|

|||||||||

|

Øivind Lorentzen

|

50,000

|

48,691

|

98,691

|

|||||||||

|

Malcolm McAvity

|

75,000

|

48,691

|

123,691

|

|||||||||

|

Christina Tan

|

70,000

|

48,691

|

118,691

|

|||||||||

____________________

| (1) |

Represents cash compensation earned for services rendered as a director for the fiscal year ended March 31, 2018.

|

| (2) |

Represents equity compensation for services rendered as a director for the fiscal year ended March 31, 2018. The value of each stock award equals the grant date fair values of $8.18, $6.82, $8.22, and $7.49 per share on June 30, 2017, September 29, 2017, December 29, 2017 and March 29, 2018, respectively.

|

Our 2014 equity incentive plan (the "2014 Equity Incentive Plan"), which was unanimously adopted by our Board of Directors in April 2014, was approved by a shareholder vote at the 2015 annual meeting of shareholders. Pursuant to the terms of the 2014 Equity Incentive Plan, we expect that directors, officers, and employees (including any prospective officer or employee) of the Company and its subsidiaries and affiliates, and consultants and service providers to (including persons who are employed by or provide services to any entity that is itself a consultant or service provider to) the Company and its subsidiaries and affiliates, as well as entities wholly-owned or generally exclusively controlled by such persons, may be eligible to receive stock appreciation rights, stock awards, restricted stock units and performance compensation awards that the plan administrator determines are consistent with the purposes of the plan and the interests of the Company. The maximum number of shares of common stock that may be granted under the 2014 Equity Incentive Plan shall not exceed 2,850,000 in the aggregate. In June 2014, we granted 655,000 shares of restricted stock to certain of our officers. In March 2015, we granted 274,000 shares of restricted stock to certain of our directors, employees and non-employee consultants, of which 8,506 shares were subsequently forfeited by a former employee and are again available for issuance. In June 2016, we issued 250,000 shares of restricted stock to certain of our executive officers and employees, of which 3,054 shares were subsequently forfeited by three former employees and are again available for issuance. In June 2016, we granted 6,950 shares of stock to certain of our directors. In September 2016, we granted 10,130 shares of stock to certain of our directors. In December 2016, we granted 10,434 shares of stock to certain of our directors and non-employee consultants. In March 2017, we granted 7,194 shares of stock to certain of our directors and non-employee consultants. In June 2017, we issued 259,800 shares of restricted stock to certain of our executive officers and employees, of which 3,018 shares were subsequently forfeited by a former employee and are again available for issuance. In June 2017, we granted 8,664 shares of stock to certain of our directors and non-employee consultants. In September 2017, we granted 10,062 shares of stock to certain of our directors. In December 2017, we granted 9,714 shares of stock to certain of our directors and non-employee consultants. In March 2018, we granted 9,720 shares of stock to certain of our directors and non-employee consultants. In June 2018, we issued 200,000 shares of restricted stock to certain of our executive officers and employees, of which 50,000 restricted shares vested on the grant date. In June 2018, we granted 9,552 shares of stock to certain of our directors and non-employee consultants. As of July 27, 2018, there were 725,685 shares of restricted stock that were issued and outstanding, but not yet vested. As of that date, there were 1,143,358 shares of common stock remaining available for future grants under the 2014 Equity Incentive Plan.

9

Upon a "Change in Control" (as defined in the 2014 Equity Inventive Plan) of the Company, all unvested restricted stock awards granted under the 2014 Equity Inventive Plan and related restricted stock award agreements will become fully vested.

We provide retirement plan benefits, discussed in this section below, that we believe are customary in our industry. We provide them to remain competitive in retaining talent and attracting new talent to join us.

We provide all qualifying full-time employees with the opportunity to participate in our tax-qualified 401(k) savings plan. The plan allows employees to defer receipt of earned salary, up to tax law limits, on a tax-advantaged basis. Accounts may be invested in a wide range of mutual funds. Up to tax law limits, we provide a 3% of salary safe harbor contribution for U.S. employees.

Our Greece-based employees have a statutory required defined benefit pension plan according to provisions of Greek law 4093/2012 covering all eligible employees.

We contribute to retirement accounts for certain United Kingdom-based employees based on a percentage of their annual salaries.

Except as set forth under "―2014 Equity Incentive Plan" above and as provided under our Executive Severance and Change in Control Severance Plan (the "Severance and CIC Plan"), none of our members of senior management, including Mr. Hadjipateras, Mr. Lycouris and Mr. Young, will receive any benefits as a result of change in control.

We adopted our Severance and CIC Plan in June 2014, under which we expect that certain executive officers of the Company and our subsidiaries and affiliates, may be eligible to receive severance benefits in connection with termination by the Company without Cause (as defined below) or termination by such officer for Good Reason (as defined below). Mr. Hadjipateras, Mr. Lycouris and Mr. Young are participants to the Severance and CIC Plan. A dismissed officer may be eligible for additional severance benefits when dismissed during the period within two years following a change in control of the Company, or in certain cases, during the six-month period prior to a "Change in Control" (as generally defined under the Equity Incentive Plan with the addition of any transaction the board determines to be a Change in Control).

In the event of termination without Cause or for Good Reason, officers subject to the Severance and CIC Plan will be eligible to receive a lump-sum payment equal to two times the sum of such officer's base salary plus bonus, a pro rata annual bonus for the year of termination, a cash payment equal to 18 months of COBRA continuation coverage and one year's outplacement services (not to exceed $10,000). Should such termination take place within two years following a Change in Control of the Company, or in certain cases, during the six-month period prior to a Change in Control (the "CIC Termination Period"), all outstanding equity awards of a terminated officer subject to the Severance and CIC Plan shall vest and the lump-sum payment to the officer will be increased to 2.99 times the sum of the officer's base salary plus bonus. The participant will receive payments and pay the excise tax or the payments will be reduced so that no excise tax applies, whatever puts the participant in a better after-tax position. For purposes of the Severance and CIC Plan, "Cause" is generally defined to mean: (i) the willful and continued failure to substantially perform his or her duties, (ii) the willful engaging in illegal conduct or gross misconduct which is demonstrably and materially injurious to the Company or its affiliates, (iii) engaging in conduct or misconduct that materially harms the reputation or financial position of the Company, (iv) the participant (x) obstructs or impedes, (y) endeavors to influence, obstruct or impede or (z) fails to materially cooperate with, an investigation, (v) the participant withholds, removes, conceals, destroys, alters or by other means falsifies any material which is requested in connection with an investigation, (vi) conviction of, or the entering of a plea of nolo contendere to, a felony or (vii) being found liable in any SEC or other civil or criminal securities law action. For purposes of the Severance and CIC Plan, "Good Reason" generally means (A) with respect to the Chief Executive Officer, Chief Financial Officer and Chief Operating Officer, a material diminution in the nature and scope of the participant's duties, responsibilities or status, (B) a material diminution in current annual base salary or annual performance bonus target opportunities; or (C) an involuntary relocation to a location more than 25 miles from a participant's principal place of business, provided that, during the CIC Termination Period, "Good Reason" shall mean (A) (1) any material change in the duties, responsibilities or status (including reporting responsibilities); provided, however, that good reason shall not be deemed to occur upon a change in duties, responsibilities (other than reporting responsibilities) or status that is solely and directly a result of the Company no longer being a publicly traded entity or (2) a material and adverse change in titles or offices (including, if applicable, membership on the board); (B) a more than 10% reduction in the participant's rate of annual base salary or annual performance bonus or equity incentive compensation target opportunities (including any material and adverse change in the formula for such targets) as in effect immediately prior to such change in control; (C) the failure to continue in effect any employee benefit plan, compensation plan, welfare benefit plan or fringe benefit plan in which the participant is participating immediately prior to such change in control or the taking of any action by the Company, in each case which would materially adversely affect the participant, unless the participant is permitted to participate in other plans providing the participant with materially equivalent benefits in the aggregate; (D) the failure of the Company to obtain the assumption of the Company's obligations under the plan from any successor; (E) an involuntary relocation of the principal place of business to a location more than 25 miles from the principal place of business immediately prior to such change in control; or (F) a material breach by the Company of the terms of an employment agreement.

During our last fiscal year, Messrs. Coleman, Kalborg and McAvity served on the Compensation Committee. Each of them is not, nor have any of them ever been, an officer or employee of the Company or any of its subsidiaries. In addition, during the last fiscal year, no executive officer of the Company served as a member of the board of directors or the compensation committee of any other entity that has one or more executive officers serving on our Board or our Compensation Committee.

10

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information known to the Company regarding the beneficial ownership of its common stock as of July 27, 2018 unless otherwise indicated below by (i) each person, group or entity known by the Company to be the beneficial owner of more than 5% of the outstanding shares of its common stock, (ii) each of our directors and director nominees, (iii) each of our named executive officers and (iv) all of our executive officers and directors as a group. Unless otherwise stated, the address of each named executive officer and director is c/o Dorian LPG Ltd., c/o Dorian LPG (USA) LLC, 27 Signal Road, Stamford, Connecticut 06902.

|

Name and Address of Beneficial Owner

|

Common Shares

Beneficially Owned(1)

|

Percent of Class

Beneficially Owned(2)

|

||||||

|

5% Shareholders

|

||||||||

|

Kensico Capital Management Corp.(3)

|

8,014,837

|

14.5

|

%

|

|||||

|

BW Group Ltd(4)

|

7,826,560

|

14.2

|

%

|

|||||

|

Wellington Management Group LLP(5)

|

6,333,772

|

11.5

|

%

|

|||||

|

SEACOR Holdings Inc.(6)

|

5,200,000

|

9.4

|

%

|

|||||

|

Directors and Executive Officers

|

||||||||

|

Thomas J. Coleman(7)

|

8,029,143

|

14.6

|

%

|

|||||

|

John C. Hadjipateras(8)

|

5,995,680

|

10.9

|

%

|

|||||

|

John C. Lycouris(9)

|

490,513

|

*

|

||||||

|

Theodore B. Young(10)

|

149,494

|

*

|

||||||

|

Alexander C. Hadjipateras

|

71,817

|

*

|

||||||

|

Christina Tan

|

54,306

|

*

|

||||||

|

Ted Kalborg(11)

|

34,306

|

*

|

||||||

|

Øivind Lorentzen

|

33,453

|

*

|

||||||

|

Malcolm McAvity

|

14,306

|

*

|

||||||

|

All directors and executive officers as a group (9 persons)(12)

|

14,579,907

|

26.4

|

%

|

|||||

____________________

| * |

The percentage of shares beneficially owned by such director or executive officer does not exceed one percent of the outstanding shares of common stock.

|

| (1) |

Each share of common stock is entitled to one vote on matters on which common shareholders are eligible to vote. Beneficial ownership described in the table above has been obtained by the Company only from public filings and information provided to the Company by the listed shareholders for inclusion herein. Beneficial ownership is required to be determined by the shareholder in accordance with the rules under the Exchange Act and consists of either or both voting or investment power with respect to securities. Except as otherwise indicated by footnote, and subject to community property laws where applicable, the persons named in the table have reported that they have sole voting and sole investment power with respect to all shares of common stock shown as beneficially owned by them.

|

| (2) |

Percentages based on a total of 55,157,193 shares of common stock outstanding and entitled to vote at the Annual Meeting as of July 27, 2018.

|

| (3) |

According to filings made with the Commission on July 14, 2014 and June 6, 2014, Kensico possesses shared voting and dispositive power over 8,014,837 shares. According to filings made with the Commission on July 14, 2014 and June 6, 2014, the principal business address of Kensico is 55 Railroad Avenue, 2nd Floor, Greenwich CT, 06830. Kensico provides investment management services to certain affiliated funds, including Kensico Partners, L.P., Kensico Associates, L.P., Kensico Offshore Fund Master, Ltd. and Kensico Offshore Fund II Master, Ltd. (collectively, the "Investment Funds"). As Kensico's co-presidents, Mr. Coleman and Michael B. Lowenstein may be deemed to be controlling persons of Kensico. By virtue of these relationships, Messrs. Coleman and Lowenstein may be deemed to beneficially own the entire number of Dorian shares held by the Investment Funds; however, each disclaims beneficial ownership of any Dorian shares, and proceeds thereof, except to the extent of his pecuniary interest therein. Kensico may have made additional transactions in our common stock since its most recent filings with the Commission. Accordingly, the information presented may not reflect all of the shares currently beneficially owned by Kensico.

|

11

| (4) |

According to a filing made with the Commission on July 16, 2018, BW Euroholdings Limited, a wholly-owned subsidiary of BW Group Ltd. (the "BW Group"), possesses shared voting and dispositive power over 7,826,560 shares. According to a filing made with the Commission on July 16, 2018, the principal registered address of the BW Group is Mapletree Business City, #18-01, 10 Pasir Panjang Road, Singapore 117438. The Sohmen Family Foundation (the "Foundation") holds 93.25% of the BW Group. The BW Group and/or the Foundation may have, either by way of their subsidiaries or on their own, made additional transactions in our common stock since their most recent filings with the Commission. Accordingly, the information presented may not reflect all of the shares currently beneficially owned by the BW Group or the Foundation.

|

| (5) |

According to a filing made with the Commission on February 12, 2018, Wellington Management Group LLP ("Wellington Management Group") possesses shared voting power over 4,488,439 shares and shared dispositive power over 6,333,772 shares. According to the filing made with the Commission on February 12, 2018, all shares are owned of record by clients of one or more investment advisers directly or indirectly owned by Wellington Management Group. Those clients have the right to receive, or the power to direct the receipt of, dividends from, or the proceeds from the sale of, such securities. No such client is known to have such right or power with respect to more than 5% of this class of shares. According to the filing made with the Commission on February 12, 2018, the principal business address of Wellington Management Group is c/o Wellington Management Company LLP, 280 Congress Street, Boston, Massachusetts 02210. Wellington Management Group may have made additional transactions in our common stock since its most recent filing with the Commission. Accordingly, the information presented may not reflect all of the shares currently beneficially owned by Wellington Management Group.

|

| (6) |

According to the filing made with the Commission on January 30, 2018, SEACOR Holdings Inc. ("SEACOR") possesses sole voting and dispositive power over 5,200,000 shares. According to the filing made with the Commission on January 30, 2018, the principal business address of SEACOR is 2200 Eller Drive, PO Box 13038, Fort Lauderdale, Florida 33316. SEACOR indirectly holds the shares by way of its wholly-owned subsidiary, SeaDor Holdings LLC ("SeaDor Holdings"), which directly holds the shares. SEACOR may have, either by way of its subsidiary or on its own, made additional transactions in our common stock since its most recent filing with the Commission. Accordingly, the information presented may not reflect all of the shares currently beneficially owned by SEACOR.

|

| (7) |

According to filings made with the Commission, Mr. Coleman beneficially owns 14,306 Dorian common shares. According to filings made with the Commission, Mr. Coleman serves as co-President of Kensico alongside Mr. Lowenstein. As a controlling person of Kensico, Mr. Coleman thus may be deemed to also beneficially own the entire number of the Company's common shares held by the Investment Funds discussed above. Mr. Coleman disclaims beneficial ownership of the reported Dorian shares held by the Investment Funds, and the proceeds thereof, except to the extent of any pecuniary interest therein.

|

| (8) |

Mr. Hadjipateras possesses sole voting power over 2,035,678 shares, shared voting power over 3,960,002 shares, sole dispositive power over 2,035,678 shares and shared dispositive power over 72,080 shares. Specifically, Mr. Hadjipateras may be deemed to beneficially own (i) 2,035,678 shares over which he has sole voting and dispositive power; (ii) 26,166 shares by virtue of pledges of such shares given under funding and security agreements with each of Theodore B. Young and Alexander J. Ciaputa, pursuant to which Mr. Hadjipateras may be deemed to share the power to vote and dispose of such shares; (iii) 25,000 shares through Mr. Hadjipateras' spouse, 250 shares through Mr. Hadjipateras' son, and 20,664 through the LMG Trust (Mr. Hadjipateras and his wife are trustees of the LMG Trust and the beneficiary of the LMG Trust is one of their children), pursuant to which Mr. Hadjipateras may be deemed to share the power to vote and dispose of such shares; and (iv) 3,887,922 shares by virtue of a revocable proxy granted to Mr. Hadjipateras by each of Mark C. Hadjipateras, Angeliki C. Hadjipateras, Aikaterini C. Hadjipateras, Konstantinos Markakis, Olympia Kedrou, Chrysanthi Xyla, Scott M. Sambur, as Trustee of the Kyveli Trust, and George J. Dambassis, pursuant to which Mr. Hadjipateras may be deemed to share the power to vote such shares. Mr. Hadjipateras disclaims beneficial ownership of the reported Dorian shares, and the proceeds thereof, except to the extent of any pecuniary interest therein.

|

(9) Mr. Lycouris beneficially owns 210,485 common shares. Mr. Lycouris may also be deemed to indirectly beneficially own 280,028 common of our common shares through the Kyveli Trust, of which Mr. Lycouris and other members of his family are beneficiaries. Mr. Lycouris disclaims all beneficial ownership of the common shares beneficially owned by the Kyveli Trust except to the extent of his pecuniary interest therein.

(10) According to filings made with the Commission, Mr. Young has pledged 13,083 shares to John C. Hadjipateras as security under a funding and security agreement.

(11) According to filings made with the Commission, Mr. Kalborg beneficially owns 14,306 Dorian common shares. According to filings made with the Commission, Christmas Common Investments Ltd., of which Kalborg Trust is the sole shareholder, currently holds 20,000 common shares (the "Trust Shares"). Mr. Kalborg and other members of his family are the beneficiaries of the Kalborg Trust and Mr. Kalborg may be deemed to also beneficially own the Trust Shares. Mr. Kalborg disclaims all beneficial ownership of the Trust Shares except to the extent of his pecuniary interest therein.

(12) To avoid double counting: (i) the 280,028 common shares that may be deemed to be indirectly beneficially owned by Mr. Lycouris through the Kyveli Trust and Mr. Hadjipateras by virtue of a revocable proxy (see Notes 8 and 9 above) are included only once in the total and (ii) the 13,083 common shares that may be deemed to be beneficially owned by Theodore B. Young and John C. Hadjipateras (see Notes 8 and 10 above) are included only once in the total.

The following table shows information relating to the number of shares authorized for issuance under our equity compensation plans as of March 31, 2018.

|

March 31, 2018

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights

|

Weighted average exercise price of outstanding

options, warrants

and rights

|

Number of securities remaining available

for future issuance

under equity

compensation plans

|

|||||||||||||

|

Equity compensation plans

|

||||||||||||||||

|

Approved by shareholders

|

—

|

(1) |

|

$

|

—

|

1,352,910

|

(2) |

|

||||||||

|

Not approved by shareholders

|

—

|

$

|

—

|

–

|

||||||||||||

|

Total

|

—

|

$

|

—

|

1,352,910

|

||||||||||||

_________________

|

(1)

|

Does not include 918,344 issued restricted shares, which are subject to vesting, and the 200,000 restricted shares granted by the Compensation Committee after March 31, 2018 to certain of our executive officers and employees, of which 50,000 shares vested on the grant date. See "?Outstanding Equity Awards At Fiscal Year End" and "—2014 Equity Incentive Plan."

|

|

(2)

|

Represents available shares for future issuance under the 2014 Equity Incentive Plan as of March 31, 2018. The above table does not reflect the 200,000 restricted shares granted by the Compensation Committee and 9,552 shares granted to certain directors and non-employee consultants after March 31, 2018. See "—2014 Equity Incentive Plan" above.

|

12

|

ITEM 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE.

|

We describe below transactions and series of similar transactions, since the beginning of our last fiscal year, to which we were and are a party, in which:

| · |

the amounts involved exceeded or will exceed $120,000; and

|

| · |

any of our directors, executive officers or holders of more than 5% of our common stock, or an affiliate or immediate family member thereof, had or will have a direct or indirect material interest.

|

Except as noted otherwise, the Audit Committee or the Board of Directors approved or ratified each arrangement described below (other than arrangements that were entered into prior to the adoption of the related party transaction policy by the Board of Directors).

Business Relationships and Related Person Transactions Policy

We have policies and procedures in place regarding referral of related person transactions to our Audit Committee for consideration and approval. Compensation matters involving any related persons are reviewed and approved by our Compensation Committee. Our Chief Financial Officer, in consultation with our outside counsel, is primarily responsible for the development and implementation of processes and controls to obtain information from the directors and executive officers with respect to related person transactions and for determining, based on the relevant facts and circumstances, whether a related person has a direct or indirect material interest in the transaction. Under our policy, transactions that (i) involve directors, director nominees, executive officers, significant shareholders or other "related persons" in which the Company is or will be a participant and (ii) are of the type that must be disclosed under the Commission's rules must be referred by the Chief Financial Officer, after consultation with our outside counsel, to our Audit Committee for the purpose of determining whether such transactions are in the best interests of the Company. Under our policy, it is the responsibility of the individual directors, director nominees, executive officers and holders of five percent or more of the Company's common stock to promptly report to our Chief Financial Officer all proposed or existing transactions in which the Company and they, or any related person of theirs, are parties or participants. The Chief Financial Officer (or the Chief Executive Officer, in the event the transaction in question involves the Chief Financial Officer or a related person of the Chief Financial Officer) is then required to furnish to the chairperson of the Audit Committee reports relating to any transaction that, in the Chief Financial Officer's judgment with advice of outside counsel, may require reporting pursuant to the Commission's rules or may otherwise be the type of transaction that should be brought to the attention of the Audit Committee. The Audit Committee considers material facts and circumstances concerning the transaction in question, consults with counsel and other advisors as it deems advisable and makes a determination or recommendation to the Board of Directors and appropriate officers of the Company with respect to the transaction in question. In its review, the Audit Committee considers the nature of the related person's interest in the transaction, the material terms of the transaction, the relative importance of the transaction to the related person, the relative importance of the transaction to the Company and any other matters deemed important or relevant. Upon receipt of the Audit Committee's recommendation, the Board of Directors or officers, excluding in all such instances the related party, take such action as deemed appropriate and necessary in light of their respective responsibilities under applicable laws and regulations.

Related Party Transactions

Shareholders Agreement

Pursuant to the shareholders agreement dated November 26, 2013 (the "Shareholder Agreement"), SeaDor Holdings (which is a wholly-owned subsidiary of SEACOR) and Dorian Holdings LLC (which is owned by Astromar LLC, of which Mr. John C. Hadjipateras, our Chairman, President, and Chief Executive Officer, is a shareholder and director) have the right, subject to certain terms and conditions, to require us, on up to three separate occasions beginning 180 days following the closing of our initial public offering, to register under the Securities Act of 1933, as amended, our common shares held by them for offer and sale to the public, including by way of underwritten public offering (provided that each such shareholder shall be entitled to request one additional demand registration to the extent such shareholder has not been included or did not participate in any demand registration). In addition, SeaDor Holdings and Dorian Holdings LLC may require us to make available shelf registration statements permitting sales of shares into the market from time to time over an extended period. SeaDor Holdings and Dorian Holdings LLC also have the ability to exercise certain piggyback registration rights permitting participation in certain registrations of common shares by us. All expenses relating to our registration will be borne by us. On July 10, 2015, the Commission declared effective our registration statement on Form S-3 that permits SeaDor Holdings and Dorian Holdings LLC, or their respective donees, pledgees, transferees or other successors in interest, to offer their shares for resale from time to time pursuant to the Shareholders Agreement.

Registration Rights Agreement

We entered into a registration rights agreement dated June 3, 2014 (the "Registration Rights Agreement") with Kensico granting Kensico the right, subject to certain terms and conditions, to require us, on up to three separate occasions beginning 180 days following the closing of our initial public offering, to register under the Securities Act of 1933, as amended, our common shares held by Kensico for offer and sale to the public, including by way of an underwritten public offering. In addition, the registration rights agreement grants Kensico the right to require us to make available shelf registration statements permitting sales of shares into the market from time to time over an extended period, and to exercise certain piggyback registration rights permitting participation in certain registrations of common shares by us. All expenses relating to our registration have been and will be borne by us. On July 10, 2015, the Commission declared effective our registration statement on Form S-3 that permits Kensico to offer its shares for resale from time to time, pursuant to the Registration Rights Agreement.

13

Management Agreements

See "Item 11. Executive Compensation—Narrative Disclosure to the Summary Compensation Table" for a discussion of related travel costs for certain transitioned employees as well as office-related costs for which we reimbursed Eagle Ocean, a company 100% owned by Mr. John C. Hadjipateras, the Chairman of the Board, our President and our Chief Executive Officer, during the fiscal year ended March 31, 2018.

Dorian LPG (USA) LLC and its subsidiaries entered into an agreement with DHSA, retroactive to July 2014 and superseding an agreement between Dorian LPG (UK) Ltd. and DHSA, for the provision by Dorian LPG (USA) LLC and its subsidiaries of certain chartering and marine operation services to DHSA, for which income was earned and included in other income totaling $0.4 million for the year ended March 31, 2018. Mr. John C. Hadjipateras, the Chairman of the Board, our President and our Chief Executive Officer, has an indirect economic interest in the transaction.

As of March 31, 2018, $0.9 million was due from DHSA.

Arrangements Involving Family Members

In respect of the year ended March 31, 2018, we paid $396,500 in salary and cash bonus to Mr. Alexander C. Hadjipateras, a son of Mr. John C. Hadjipateras, the Chairman of the Board, our President and our Chief Executive Officer, for his service as Executive Vice President of Business Development of Dorian LPG (USA) LLC. In the year ended March 31, 2018, Mr. Alexander C. Hadjipateras was also eligible to participate in all benefit programs generally available to employees, including supplemental health care benefits for coverage outside of the United States, and his compensation is commensurate with that of his peers.

In respect of the year ended March 31, 2018, we paid $161,500 in salary and cash bonus to Peter Hadjipateras, a son of Mr. John C. Hadjipateras, the Chairman of the Board, our President and our Chief Executive Officer, for his service as Corporate Development Manager. In the year ended March 31, 2018, Mr. Peter Hadjipateras was also eligible to participate in all benefit programs generally available to employees and his compensation is commensurate with that of his peers.

For further information regarding our transactions with related parties, please see Note 3 to our audited consolidated financial statements included in the Original Form 10-K.

Director Independence

The Board of Directors has determined that, as of the date hereof, each of the following members of our Board of Directors is an "independent director" as defined under the applicable NYSE standards, Commission rules and the Company's Corporate Governance Guidelines: Messrs. Thomas J. Coleman, Ted Kalborg, Øivind Lorentzen and Malcolm McAvity, and Ms. Christina Tan. Therefore, our Board of Directors has satisfied its objective as set forth in the Company's Corporate Governance Guidelines as well as NYSE listing standards, requiring that at least a majority of the Board consist of independent directors. As required under the NYSE listing standards, in making its determinations, our Board of Directors has considered whether any director has a direct or indirect material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. In addition, our Board of Directors considered a series of certain specific transactions, relationships and arrangements expressly enumerated in the NYSE independence definition. Specifically, a member of our Board of Directors may be considered independent if such member:

| · |

has not been employed by the Company within the last three years (other than as interim Chairman of the Board of Directors or interim Chief Executive Officer);

|

| · |

does not have an immediate family member who is, or has been, employed by the Company as an executive officer within the last three years;

|

| · |