Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - FRANKLIN RESOURCES INC | exhibit991q3fy18.htm |

| 8-K - FORM 8-K - FRANKLIN RESOURCES INC | form8kq3fy18.htm |

FRANKLIN RESOURCES, INC. Q3 2018 Executive Quarterly Earnings Commentary Exhibit 99.2 Highlights • Investment performance improved as several of our flagship products outperformed over the quarter and year-to-date periods, leading to Greg Johnson stronger longer-term performance. Chairman of the Board Chief Executive Officer • Several of our U.S. and international growth funds continue to generate very strong performance, outperforming over multiple time periods. • Strengthening U.S. equity sales rose to its highest level since the third quarter of 2015. Kenneth A. Lewis • Diluted earnings per share of $0.75 was up 3% from the same quarter Executive Vice President Chief Financial Officer a year ago despite lower assets under management and revenues. • Retail redemptions were down about 10% with the improvement coming from both the U.S. and international sales regions. • Repurchased 13 million shares, at a total cost of $446 million, driving a 2.3% net reduction in shares outstanding. • Retired $350 million of long-term debt due in 2020 with a coupon of Contents Page(s) 4.625%. 2 Investment Performance Assets Under 3-5 Conference Call Details: Management and Flows Johnson and Lewis will lead a live teleconference today at 11:00 a.m. Eastern Time to answer questions of a material nature. Access to the Flows by Investment 6-8 teleconference will be available via investors.franklinresources.com or by Objective dialing (877) 407-8293 in the U.S. and Canada or (201) 689-8349 Financial Results 9 internationally. A replay of the teleconference can also be accessed by calling (877) 660-6853 in the U.S. and Canada or (201) 612-7415 Operating Revenues and 9-10 internationally using access code 13678488, after 2:00 p.m. Eastern Expenses Time on July 27, 2018 through August 27, 2018. Other Income 11 Analysts and investors are encouraged to review the Company’s recent filings with the U.S. Securities and Exchange Commission and to contact Capital Management 12-13 Investor Relations at (650) 312-4091 before the live teleconference for Appendix 14-15 any clarifications or questions related to the earnings release or written commentary.

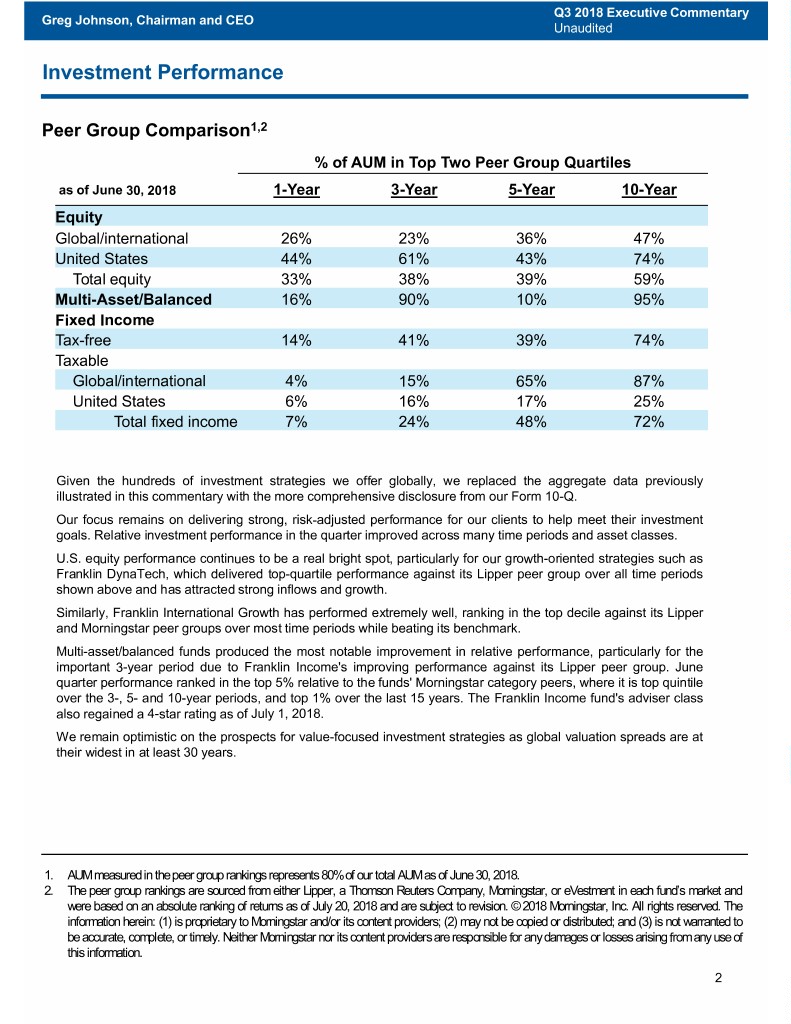

Q3 2018 Executive Commentary Greg Johnson, Chairman and CEO Unaudited Investment Performance Peer Group Comparison1,2 % of AUM in Top Two Peer Group Quartiles as of June 30, 2018 1-Year 3-Year 5-Year 10-Year Equity Global/international 26% 23% 36% 47% United States 44% 61% 43% 74% Total equity 33% 38% 39% 59% Multi-Asset/Balanced 16% 90% 10% 95% Fixed Income Tax-free 14% 41% 39% 74% Taxable Global/international 4% 15% 65% 87% United States 6% 16% 17% 25% Total fixed income 7% 24% 48% 72% Given the hundreds of investment strategies we offer globally, we replaced the aggregate data previously illustrated in this commentary with the more comprehensive disclosure from our Form 10-Q. Our focus remains on delivering strong, risk-adjusted performance for our clients to help meet their investment goals. Relative investment performance in the quarter improved across many time periods and asset classes. U.S. equity performance continues to be a real bright spot, particularly for our growth-oriented strategies such as Franklin DynaTech, which delivered top-quartile performance against its Lipper peer group over all time periods shown above and has attracted strong inflows and growth. Similarly, Franklin International Growth has performed extremely well, ranking in the top decile against its Lipper and Morningstar peer groups over most time periods while beating its benchmark. Multi-asset/balanced funds produced the most notable improvement in relative performance, particularly for the important 3-year period due to Franklin Income's improving performance against its Lipper peer group. June quarter performance ranked in the top 5% relative to the funds' Morningstar category peers, where it is top quintile over the 3-, 5- and 10-year periods, and top 1% over the last 15 years. The Franklin Income fund's adviser class also regained a 4-star rating as of July 1, 2018. We remain optimistic on the prospects for value-focused investment strategies as global valuation spreads are at their widest in at least 30 years. 1. AUM measured in the peer group rankings represents 80% of our total AUM as of June 30, 2018. 2. The peer group rankings are sourced from either Lipper, a Thomson Reuters Company, Morningstar, or eVestment in each fund’s market and were based on an absolute ranking of returns as of July 20, 2018 and are subject to revision. © 2018 Morningstar, Inc. All rights reserved. The information herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. 2

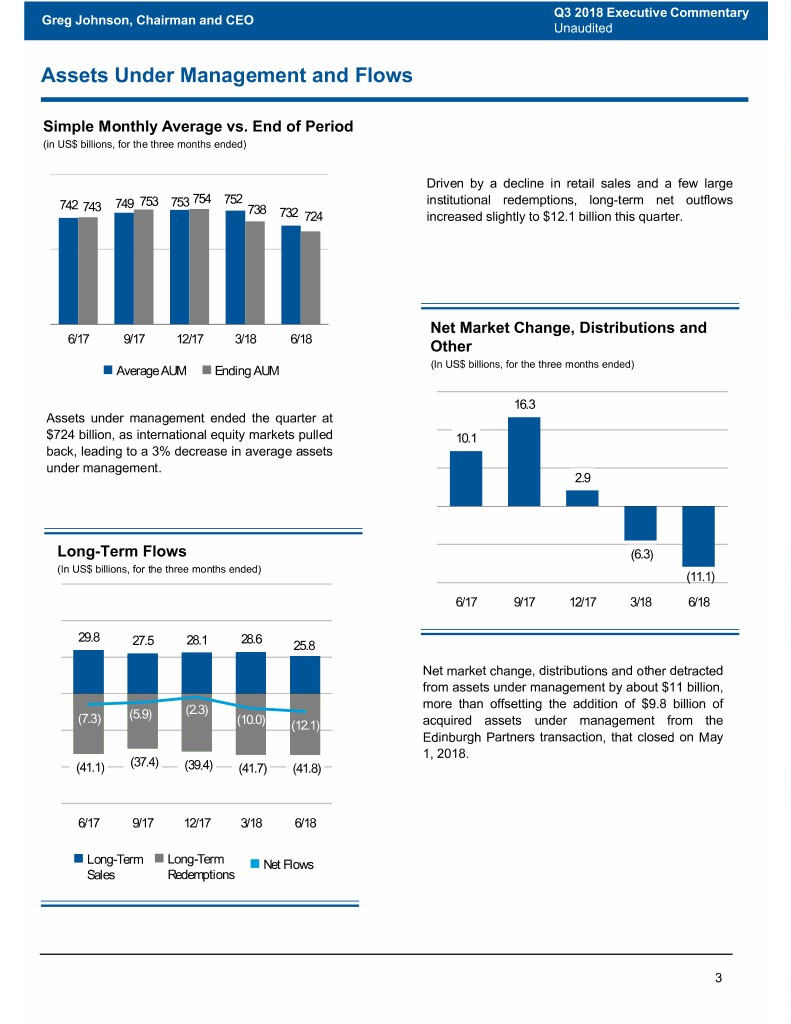

Q3 2018 Executive Commentary Greg Johnson, Chairman and CEO Unaudited Assets Under Management and Flows Simple Monthly Average vs. End of Period (in US$ billions, for the three months ended) Driven by a decline in retail sales and a few large 753 753 754 752 institutional redemptions, long-term net outflows 742 743 749 738 732 724 increased slightly to $12.1 billion this quarter. Net Market Change, Distributions and 6/17 9/17 12/17 3/18 6/18 Other (In US$ billions, for the three months ended) Average AUM Ending AUM 16.3 Assets under management ended the quarter at $724 billion, as international equity markets pulled 10.1 back, leading to a 3% decrease in average assets under management. 2.9 Long-Term Flows (6.3) (In US$ billions, for the three months ended) (11.1) 6/17 9/17 12/17 3/18 6/18 29.8 28.6 27.5 28.1 25.8 Net market change, distributions and other detracted from assets under management by about $11 billion, (2.3) more than offsetting the addition of $9.8 billion of (7.3) (5.9) (10.0) (12.1) acquired assets under management from the Edinburgh Partners transaction, that closed on May 1, 2018. (41.1) (37.4) (39.4) (41.7) (41.8) 6/17 9/17 12/17 3/18 6/18 Long-Term Long-Term Net Flows Sales Redemptions 3

Q3 2018 Executive Commentary Greg Johnson, Chairman and CEO Unaudited Long-Term Flows: Retail¹ (In US$ billions, for the three months ended) International United States 12.5 12.4 11.6 11.6 11.6 9.6 8.9 10.3 8.9 9.2 2.1 2.0 0.6 (2.4) (0.6) (3.2) (0.9) (1.2) (6.2) (5.5) (11.3) (11.2) (11.8) (10.8) (17.1) (16.0) (13.4) (17.4) (18.4) (17.7) 6/17 9/17 12/17 3/18 6/18 6/17 9/17 12/17 3/18 6/18 Long-Term Long-Term Net Flows Long-Term Long-Term Net Flows Sales Redemptions Sales Redemptions We continue to work hard on the distribution front as Additionally, we entered into a strategic partnership our strategic relationship team achieved 28 last year to develop collective investment trusts recommended list placements across broker dealer ("CITs") to offer investors in the defined contribution distribution platforms so far in fiscal 2018, and we investment only space a lower cost option for several have implemented some new initiatives to remain key strategies. CITs are also an easier vehicle to competitive from a pricing perspective. customize particularly in the creation of multi- manager solutions. This means retirement plan As part of our ongoing evaluation of existing investors can customize strategies specifically products, some changes to "A" share distribution fees designed for their retirement plans at lower price were approved in the quarter and are expected to be points. implemented this September. These changes include lower sales charges at multiple breakpoints across This partnership has created more operational asset classes, lower breakpoints for fixed income efficiencies including, reduced expenses, improved products and standardized 12b-1 fees of 25 basis time to market with new product launches and, most points. importantly, product development partnerships with many of our clients as well as broader distribution of our existing CITs. We have started to generate notable interest here, particularly within our Templeton Foreign and Franklin Growth strategies, and CITs under the Dynatech and Small Cap Value strategies are currently under development. 1. Graphs do not include high net-worth client flows. 4

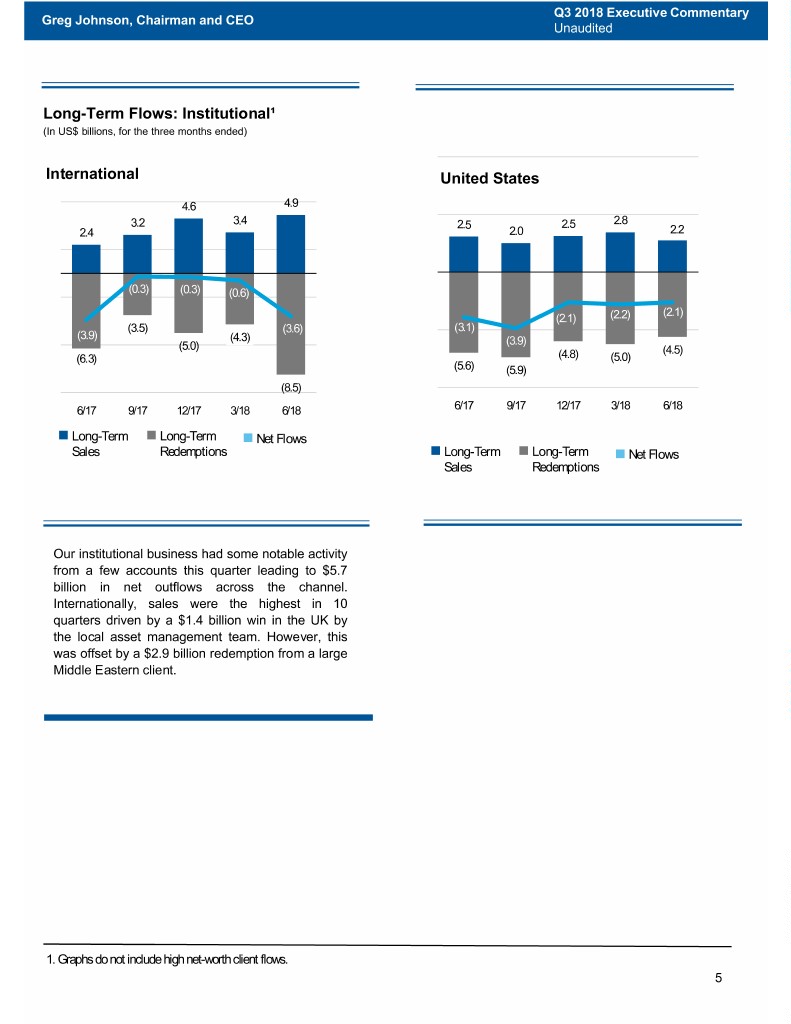

Q3 2018 Executive Commentary Greg Johnson, Chairman and CEO Unaudited Long-Term Flows: Institutional¹ (In US$ billions, for the three months ended) International United States 4.6 4.9 3.2 3.4 2.5 2.5 2.8 2.4 2.0 2.2 (0.3) (0.3) (0.6) (2.1) (2.1) (2.2) (3.5) (3.6) (3.1) (3.9) (4.3) (3.9) (5.0) (4.5) (6.3) (4.8) (5.0) (5.6) (5.9) (8.5) 6/17 9/17 12/17 3/18 6/18 6/17 9/17 12/17 3/18 6/18 Long-Term Long-Term Net Flows Sales Redemptions Long-Term Long-Term Net Flows Sales Redemptions Our institutional business had some notable activity from a few accounts this quarter leading to $5.7 billion in net outflows across the channel. Internationally, sales were the highest in 10 quarters driven by a $1.4 billion win in the UK by the local asset management team. However, this was offset by a $2.9 billion redemption from a large Middle Eastern client. 1. Graphs do not include high net-worth client flows. 5

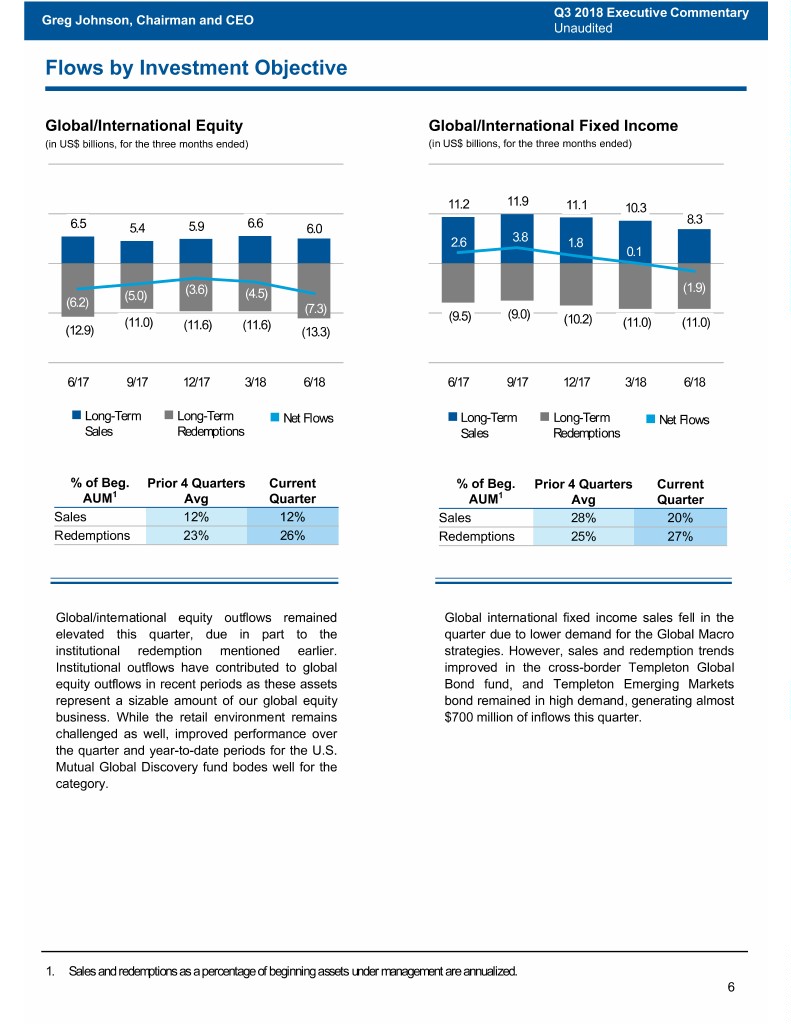

Q3 2018 Executive Commentary Greg Johnson, Chairman and CEO Unaudited Flows by Investment Objective Global/International Equity Global/International Fixed Income (in US$ billions, for the three months ended) (in US$ billions, for the three months ended) 11.9 11.2 11.1 10.3 8.3 6.5 5.4 5.9 6.6 6.0 2.6 3.8 1.8 0.1 (1.9) (5.0) (3.6) (4.5) (6.2) (7.3) (9.5) (9.0) (11.0) (11.6) (11.6) (10.2) (11.0) (11.0) (12.9) (13.3) 6/17 9/17 12/17 3/18 6/18 6/17 9/17 12/17 3/18 6/18 Long-Term Long-Term Net Flows Long-Term Long-Term Net Flows Sales Redemptions Sales Redemptions % of Beg. Prior 4 Quarters Current % of Beg. Prior 4 Quarters Current AUM1 Avg Quarter AUM1 Avg Quarter Sales 12% 12% Sales 28% 20% Redemptions 23% 26% Redemptions 25% 27% Global/international equity outflows remained Global international fixed income sales fell in the elevated this quarter, due in part to the quarter due to lower demand for the Global Macro institutional redemption mentioned earlier. strategies. However, sales and redemption trends Institutional outflows have contributed to global improved in the cross-border Templeton Global equity outflows in recent periods as these assets Bond fund, and Templeton Emerging Markets represent a sizable amount of our global equity bond remained in high demand, generating almost business. While the retail environment remains $700 million of inflows this quarter. challenged as well, improved performance over the quarter and year-to-date periods for the U.S. Mutual Global Discovery fund bodes well for the category. 1. Sales and redemptions as a percentage of beginning assets under management are annualized. 6

Q3 2018 Executive Commentary Greg Johnson, Chairman and CEO Unaudited U.S. Equity Multi-Asset/Balanced (in US$ billions, for the three months ended) (In US$ billions, for the three months ended) 4.1 4.4 4.6 4.0 4.0 3.6 3.1 3.6 3.5 4.0 1.5 (0.2) (0.6) (0.5) (0.2) (1.8) (1.1) (1.1) (1.9) (2.5) (5.9) (5.6) (5.5) (5.5) (5.8) (5.7) (6.7) (6.8) (6.2) (6.3) 6/17 9/17 12/17 3/18 6/18 6/17 9/17 12/17 3/18 6/18 Long-Term Long-Term Net Flows Long-Term Long-Term Net Flows Sales Redemptions Sales Redemptions % of Beg. Prior 4 Quarters Current % of Beg. Prior 4 Quarters Current 1 AUM Avg Quarter AUM1 Avg Quarter Sales 13% 17% Sales 11% 12% Redemptions 22% 21% Redemptions 18% 17% U.S. Equity was a bright spot, with increased Similarly, multi-asset/balanced flows nearly broke sales of $4.4 billion, its highest level in three even, due to lower redemptions in a convertible years, and lower redemptions leading to net securities fund and our high net worth business. outflows of only $200 million. A number Additionally, K2 has enjoyed success this year with strategies, including some technology focused interest in their offshore products continuing to funds and growth strategies, continue to perform increase. The cross-border K2 Alternative Strategies well, driving improved flows in the category. fund generated almost $300 million in net flows this quarter, and total assets are closing in on $2.5 billion. 1. Sales and redemptions as a percentage of beginning assets under management are annualized. 7

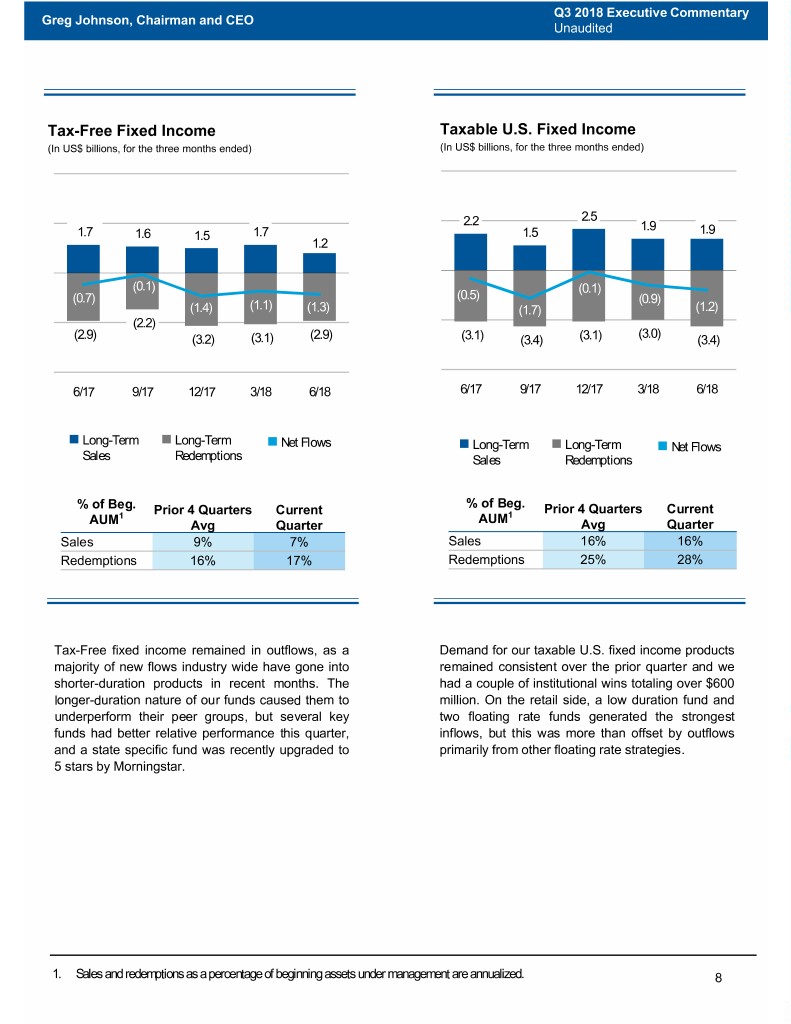

Q3 2018 Executive Commentary Greg Johnson, Chairman and CEO Unaudited Tax-Free Fixed Income Taxable U.S. Fixed Income (In US$ billions, for the three months ended) (In US$ billions, for the three months ended) 2.2 2.5 1.9 1.9 1.7 1.6 1.5 1.7 1.5 1.2 (0.1) (0.1) (0.7) (0.5) (0.9) (1.4) (1.1) (1.3) (1.7) (1.2) (2.2) (3.0) (2.9) (3.2) (3.1) (2.9) (3.1) (3.4) (3.1) (3.4) 6/17 9/17 12/17 3/18 6/18 6/17 9/17 12/17 3/18 6/18 Long-Term Long-Term Net Flows Long-Term Long-Term Net Flows Sales Redemptions Sales Redemptions % of Beg. % of Beg. Prior 4 Quarters Current Prior 4 Quarters Current 1 AUM1 AUM Avg Quarter Avg Quarter Sales 9% 7% Sales 16% 16% Redemptions 16% 17% Redemptions 25% 28% Tax-Free fixed income remained in outflows, as a Demand for our taxable U.S. fixed income products majority of new flows industry wide have gone into remained consistent over the prior quarter and we shorter-duration products in recent months. The had a couple of institutional wins totaling over $600 longer-duration nature of our funds caused them to million. On the retail side, a low duration fund and underperform their peer groups, but several key two floating rate funds generated the strongest funds had better relative performance this quarter, inflows, but this was more than offset by outflows and a state specific fund was recently upgraded to primarily from other floating rate strategies. 5 stars by Morningstar. 1. Sales and redemptions as a percentage of beginning assets under management are annualized. 8

Q3 2018 Executive Commentary Ken Lewis, CFO Unaudited Financial Results (in US$ millions, except per share data, for the three months ended) Operating and Net Income (Loss)1 Diluted Earnings (Loss) Per Share 564 558 581 556 503 $0.73 $0.76 $0.78 $0.75 411 425 443 402 (583) $(1.06) 6/17 9/17 12/17 3/18 6/18 6/17 9/17 12/17 3/18 6/18 Operating Income Net Income (Loss) 1 Operating income for the quarter was $503 million, a decrease of 9% from the prior quarter, due principally to the decrease in assets under management and related revenue. Net income was $402 million, also a 9% decrease from last quarter, and earnings per share was $0.75, a 4% decrease, as we benefited from increased share repurchases. Operating Revenues and Expenses (In US$ millions, for the three months ended) Jun-18 vs. Jun-18 vs. Jun-18 Mar-18 Dec-17 Sep-17 Jun-17 Mar-18 Jun-17 Investment management fees $ 1,077.9 $ 1,117.1 (4%) $ 1,113.6 $ 1,109.8 $ 1,097.0 (2%) Sales and distribution fees 391.4 409.8 (4%) 417.8 421.8 433.3 (10%) Shareholder servicing fees 53.9 61.3 (12%) 54.9 56.0 56.7 (5%) Other 35.4 29.6 20% 29.2 29.3 26.9 32% Total Operating Revenues $ 1,558.6 $ 1,617.8 (4%) $ 1,615.5 $ 1,616.9 $ 1,613.9 (3%) Investment management fee revenue decreased 4% this quarter and was $1.1 billion due mostly to lower average assets under management and periodic revenue sources in the prior quarter that did not recur. Sales and distribution revenue was $391 million this quarter. Lower commissionable sales in both the U.S. and internationally drove most of the decrease, as the impact of lower assets under management was partially offset by the impact of the longer quarter. Shareholder servicing fees were down 12% this quarter due to lower transaction based fees that are seasonally highest in the March quarter. Other revenue, net of the impact of consolidated investment products was $4 million. 1. Net income (loss) attributable to Franklin Resources, Inc. 9

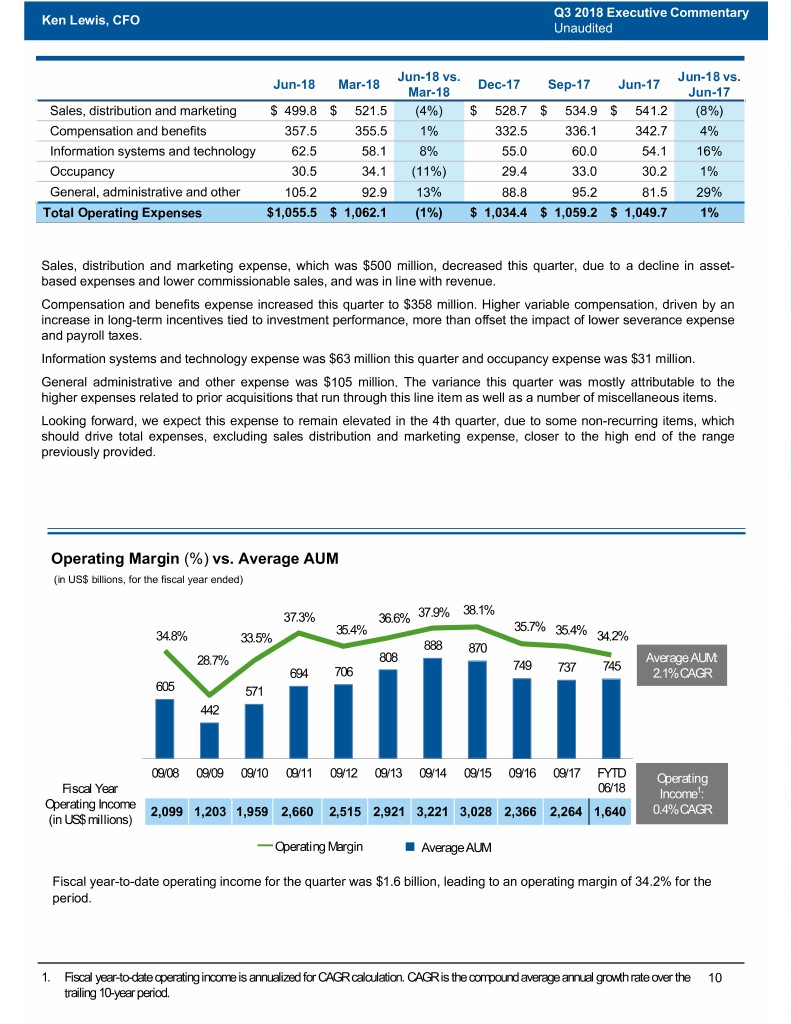

Q3 2018 Executive Commentary Ken Lewis, CFO Unaudited Jun-18 vs. Jun-18 vs. Jun-18 Mar-18 Dec-17 Sep-17 Jun-17 Mar-18 Jun-17 Sales, distribution and marketing $ 499.8 $ 521.5 (4%) $ 528.7 $ 534.9 $ 541.2 (8%) Compensation and benefits 357.5 355.5 1% 332.5 336.1 342.7 4% Information systems and technology 62.5 58.1 8% 55.0 60.0 54.1 16% Occupancy 30.5 34.1 (11%) 29.4 33.0 30.2 1% General, administrative and other 105.2 92.9 13% 88.8 95.2 81.5 29% Total Operating Expenses $1,055.5 $ 1,062.1 (1%) $ 1,034.4 $ 1,059.2 $ 1,049.7 1% Sales, distribution and marketing expense, which was $500 million, decreased this quarter, due to a decline in asset- based expenses and lower commissionable sales, and was in line with revenue. Compensation and benefits expense increased this quarter to $358 million. Higher variable compensation, driven by an increase in long-term incentives tied to investment performance, more than offset the impact of lower severance expense and payroll taxes. Information systems and technology expense was $63 million this quarter and occupancy expense was $31 million. General administrative and other expense was $105 million. The variance this quarter was mostly attributable to the higher expenses related to prior acquisitions that run through this line item as well as a number of miscellaneous items. Looking forward, we expect this expense to remain elevated in the 4th quarter, due to some non-recurring items, which should drive total expenses, excluding sales distribution and marketing expense, closer to the high end of the range previously provided. Operating Margin (%) vs. Average AUM (in US$ billions, for the fiscal year ended) 38.1% 37.3% 36.6% 37.9% 35.4% 35.7% 35.4% 34.8% 33.5% 34.2% 888 870 808 Average AUM: 28.7% 749 745 694 706 737 2.1% CAGR 605 571 442 09/08 09/09 09/10 09/11 09/12 09/13 09/14 09/15 09/16 09/17 FYTD Operating Fiscal Year 06/18 Income1: Operating Income 2,099 1,203 1,959 2,660 2,515 2,921 3,221 3,028 2,366 2,264 1,640 0.4% CAGR (in US$ millions) ━ Operating Margin Average AUM Fiscal year-to-date operating income for the quarter was $1.6 billion, leading to an operating margin of 34.2% for the period. 1. Fiscal year-to-date operating income is annualized for CAGR calculation. CAGR is the compound average annual growth rate over the 10 trailing 10-year period.

Q3 2018 Executive Commentary Ken Lewis, CFO Unaudited Other Income and Taxes Other Income (In US$ millions, for the three months ended June 30, 2018) 0.2 32.0 (4.1) (2.4) (22.1) 5.5 10.4 (69.9) (55.9) 61.4 Interest and Equity method Available-for- Trading Interest Foreign Consolidated Total other Noncontrolling Other income, dividend investments sale investments expense exchange and Investment income interests¹ net of income investments other Products (CIPs) noncontrolling interests Other income, net of noncontrolling interests was $5.5 million this quarter. As always, there were several moving parts that we've illustrated above. The biggest factors this quarter were strong interest and dividend income of $32 million, and elevated interest expense of $22 million driven by the extinguishment of $350 million of debt due in 2020. This expense, net of the benefit of lower interest expense was $10.7 million. There were some discrete items impacting the tax rate this quarter, which came in at 20.5%, the most significant being a reduction in the estimated transition tax of almost $10 million. We now anticipate a fiscal year rate in the range of 23%-24%, excluding the one-time impacts from the Tax Act. 1. Reflects the portion of noncontrolling interests, attributable to third-party investors, related to CIPs included in Other income. 11

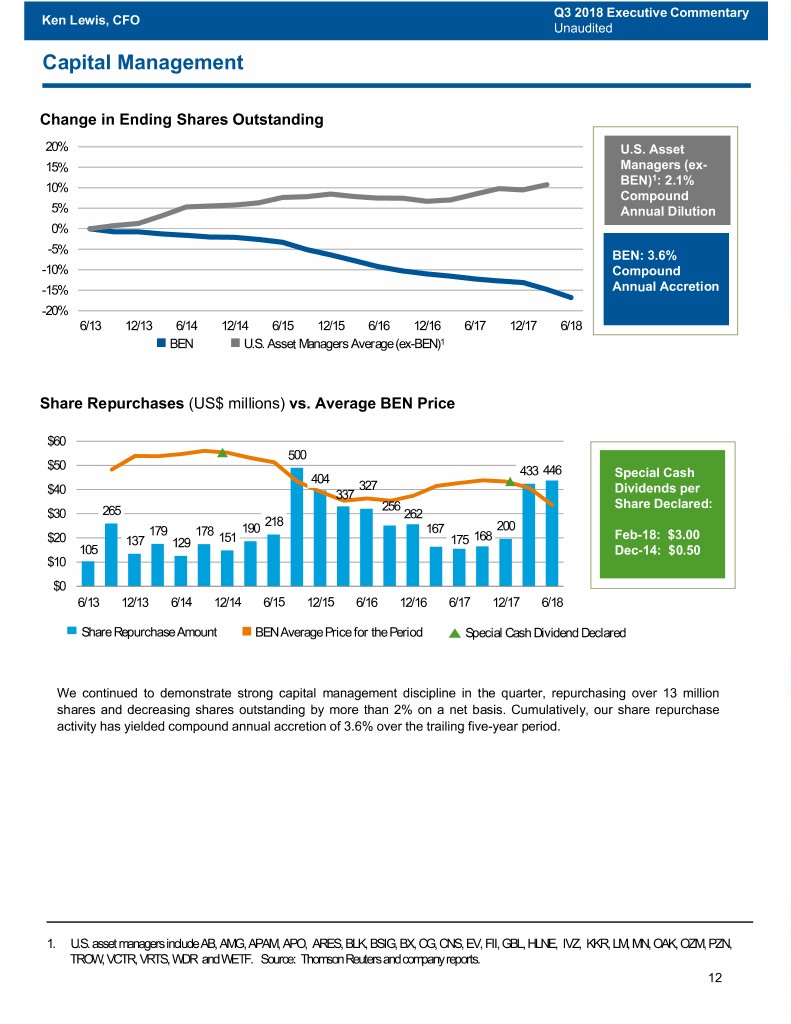

Q3 2018 Executive Commentary Ken Lewis, CFO Unaudited Capital Management Change in Ending Shares Outstanding 20% U.S. Asset 15% Managers (ex- BEN)1: 2.1% 10% Compound 5% Annual Dilution 0% -5% BEN: 3.6% -10% Compound -15% Annual Accretion -20% 6/13 12/13 6/14 12/14 6/15 12/15 6/16 12/16 6/17 12/17 6/18 BEN U.S. Asset Managers Average (ex-BEN)1 Share Repurchases (US$ millions) vs. Average BEN Price $60 500 $50 433 446 404 Special Cash 327 Dividends per $40 337 256 Share Declared: $30 265 262 218 190 167 200 179 178 168 Feb-18: $3.00 $20 137 129 151 175 105 Dec-14: $0.50 $10 $0 6/13 12/13 6/14 12/14 6/15 12/15 6/16 12/16 6/17 12/17 6/18 Share Repurchase Amount BEN Average Price for the Period Special Cash Dividend Declared We continued to demonstrate strong capital management discipline in the quarter, repurchasing over 13 million shares and decreasing shares outstanding by more than 2% on a net basis. Cumulatively, our share repurchase activity has yielded compound annual accretion of 3.6% over the trailing five-year period. 1. U.S. asset managers include AB, AMG, APAM, APO, ARES, BLK, BSIG, BX, CG, CNS, EV, FII, GBL, HLNE, IVZ, KKR, LM, MN, OAK, OZM, PZN, TROW, VCTR, VRTS, WDR and WETF. Source: Thomson Reuters and company reports. 12

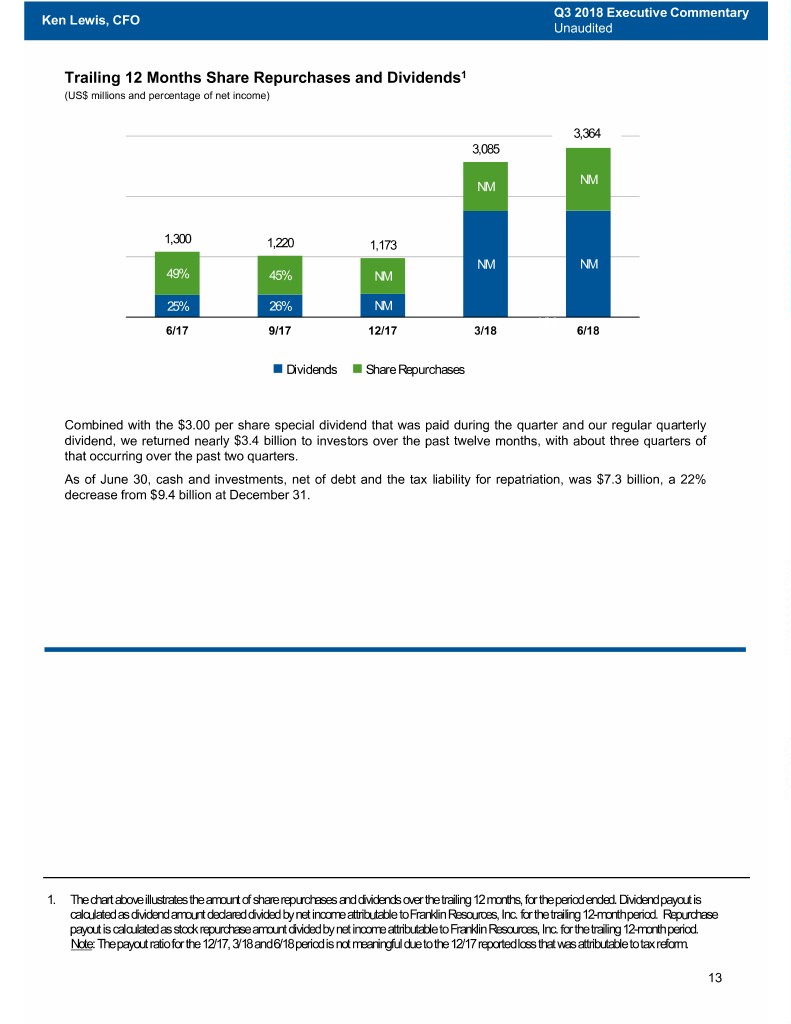

Q3 2018 Executive Commentary Ken Lewis, CFO Unaudited Trailing 12 Months Share Repurchases and Dividends1 (US$ millions and percentage of net income) 3,364 3,085 NM NM 1,300 1,220 1,173 NM NM 49% 45% NM 25% 26% NM NM 6/17 9/17 12/17 3/18 6/18 Dividends Share Repurchases Combined with the $3.00 per share special dividend that was paid during the quarter and our regular quarterly dividend, we returned nearly $3.4 billion to investors over the past twelve months, with about three quarters of that occurring over the past two quarters. As of June 30, cash and investments, net of debt and the tax liability for repatriation, was $7.3 billion, a 22% decrease from $9.4 billion at December 31. 1. The chart above illustrates the amount of share repurchases and dividends over the trailing 12 months, for the period ended. Dividend payout is calculated as dividend amount declared divided by net income attributable to Franklin Resources, Inc. for the trailing 12-month period. Repurchase payout is calculated as stock repurchase amount divided by net income attributable to Franklin Resources, Inc. for the trailing 12-month period. Note: The payout ratio for the 12/17, 3/18 and 6/18 period is not meaningful due to the 12/17 reported loss that was attributable to tax reform. 13

Q3 2018 Executive Commentary Ken Lewis, CFO Unaudited Appendix Mix of Ending Assets Under Management (as of June 30, 2018) Investment Objective (US$ billions) Jun-18 Equity $ 310.6 43% 1% Multi Asset/Balanced 137.7 Fixed Income 266.7 2% Cash Management 9.1 4% 67% Total $ 724.1 13% 37% Sales Region 14% (US$ billions) Jun-18 19% United States $ 482.3 Europe, Middle East 101.4 and Africa Asia-Pacific 93.4 Canada 30.6 Latin America 16.4 Total $ 724.1 Sales and Distribution Summary (in US$ millions, for the three months ended) Jun-18 Mar-18 Change % Change Asset-based fees $ 324.0 $ 331.5 (7.5) (2%) Asset-based expenses (420.4) (431.2) 10.8 (3%) Asset-based fees, net $ (96.4) $ (99.7) $ 3.3 (3%) Sales-based fees 63.3 73.5 (10.2) (14%) Contingent sales charges 4.1 4.8 (0.7) (15%) Sales-based expenses (59.4) (68.9) 9.5 (14%) Sales-based fees, net $ 8.0 $ 9.4 $ (1.4) (15%) Amortization of deferred sales commissions (20.0) (21.4) 1.4 (7%) Sales and Distribution Fees, Net $ (108.4) $ (111.7) $ 3.3 (3%) 14

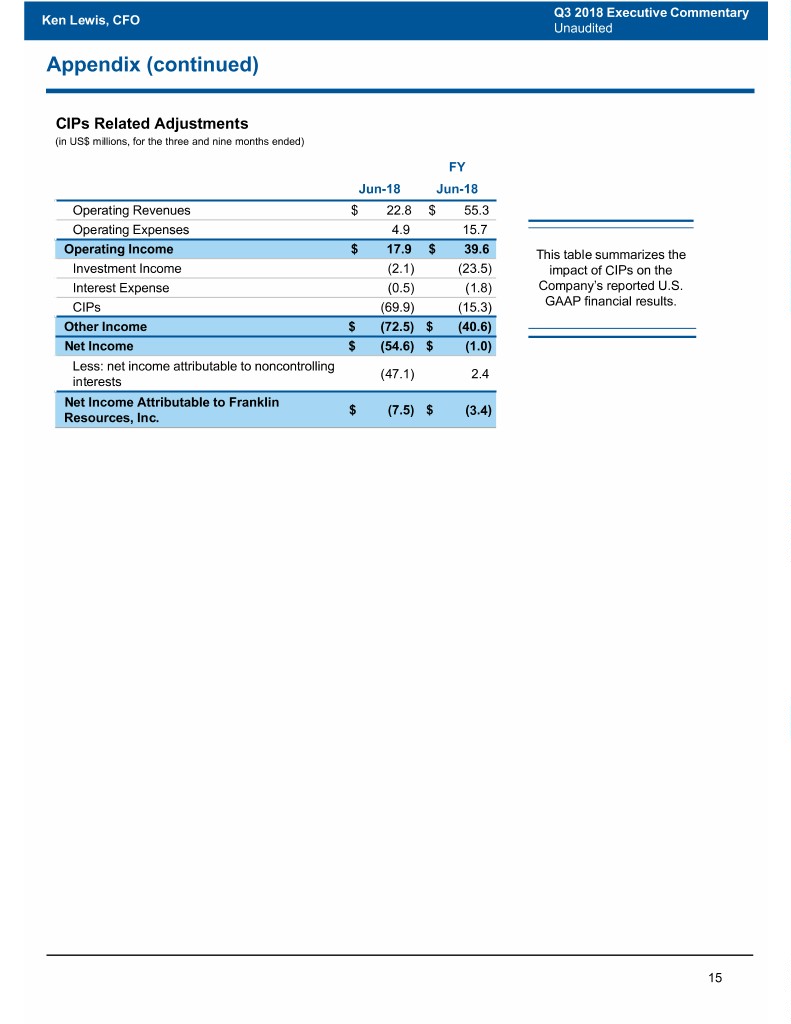

Q3 2018 Executive Commentary Ken Lewis, CFO Unaudited Appendix (continued) CIPs Related Adjustments (in US$ millions, for the three and nine months ended) FY Jun-18 Jun-18 Operating Revenues $ 22.8 $ 55.3 Operating Expenses 4.9 15.7 Operating Income $ 17.9 $ 39.6 This table summarizes the Investment Income (2.1) (23.5) impact of CIPs on the Interest Expense (0.5) (1.8) Company’s reported U.S. CIPs (69.9) (15.3) GAAP financial results. Other Income $ (72.5) $ (40.6) Net Income $ (54.6) $ (1.0) Less: net income attributable to noncontrolling (47.1) 2.4 interests Net Income Attributable to Franklin $ (7.5) $ (3.4) Resources, Inc. 15

Forward-Looking Statements Statements in this commentary regarding Franklin Resources, Inc. (“Franklin”) and its subsidiaries, which are not historical facts, are "forward-looking statements" within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. When used in this commentary, words or phrases generally written in the future tense and/or preceded by words such as “will,” “may,” “could,” “expect,” “believe,” “anticipate,” “intend,” “plan,” “seek,” “estimate” or other similar words are forward-looking statements. Forward-looking statements involve a number of known and unknown risks, uncertainties and other important factors, some of which are listed below, that could cause actual results and outcomes to differ materially from any future results or outcomes expressed or implied by such forward-looking statements. While forward-looking statements are our best prediction at the time that they are made, you should not rely on them and are cautioned against doing so. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. They are neither statements of historical fact nor guarantees or assurances of future performance. These and other risks, uncertainties and other important factors are described in more detail in Franklin’s recent filings with the U.S. Securities and Exchange Commission, including, without limitation, in Risk Factors and Management’s Discussion and Analysis of Financial Condition and Results of Operations in Franklin’s Annual Report on Form 10-K for the fiscal year ended September 30, 2017 and Franklin’s subsequent Quarterly Reports on Form 10-Q: • Volatility and disruption of the capital and credit markets, and adverse changes in the global economy, may significantly affect our results of operations and may put pressure on our financial results. • The amount and mix of our assets under management (“AUM”) are subject to significant fluctuations. • We are subject to extensive, complex, overlapping and frequently changing rules, regulations, policies, and legal interpretations. • Global regulatory and legislative actions and reforms have made the regulatory environment in which we operate more costly and future actions and reforms could adversely impact our financial condition and results of operations. • Failure to comply with the laws, rules or regulations in any of the jurisdictions in which we operate could result in substantial harm to our reputation and results of operations. • Changes in tax laws or exposure to additional income tax liabilities could have a material impact on our financial condition, results of operations and liquidity. • Any significant limitation, failure or security breach of our information and cyber security infrastructure, software applications, technology or other systems that are critical to our operations could disrupt our business and harm our operations and reputation. • Our business operations are complex and a failure to properly perform operational tasks or the misrepresentation of our products and services, or the termination of investment management agreements representing a significant portion of our AUM, could have an adverse effect on our revenues and income. • We face risks, and corresponding potential costs and expenses, associated with conducting operations and growing our business in numerous countries. • We depend on key personnel and our financial performance could be negatively affected by the loss of their services. • Strong competition from numerous and sometimes larger companies with competing offerings and products could limit or reduce sales of our products, potentially resulting in a decline in our market share, revenues and income. • Changes in the third-party distribution and sales channels on which we depend could reduce our income and hinder our growth. • Our increasing focus on international markets as a source of investments and sales of our products subjects us to increased exchange rate and market-specific political, economic or other risks that may adversely impact our revenues and income generated overseas. • Harm to our reputation or poor investment performance of our products could reduce the level of our AUM or affect our sales, and negatively impact our revenues and income. • Our future results are dependent upon maintaining an appropriate level of expenses, which is subject to fluctuation. • Our ability to successfully manage and grow our business can be impeded by systems and other technological limitations. • Our inability to successfully recover should we experience a disaster or other business continuity problem could cause material financial loss, loss of human capital, regulatory actions, reputational harm, or legal liability. 16

Forward-Looking Statements (continued) • Regulatory and governmental examinations and/or investigations, litigation and the legal risks associated with our business, could adversely impact our AUM, increase costs and negatively impact our profitability and/or our future financial results. • Our ability to meet cash needs depends upon certain factors, including the market value of our assets, operating cash flows and our perceived creditworthiness. • We are dependent on the earnings of our subsidiaries. Any forward-looking statement made by us in this commentary speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. The information in this commentary is provided solely in connection with this commentary, and is not directed toward existing or potential investment advisory clients or fund shareholders. Investor Relations Contacts Brian Sevilla +1 (650) 312‐3326 17