Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CHART INDUSTRIES INC | julyinvestorpresentation8-k.htm |

Exhibit 99.1 Investor Presentation – Q3 2018 © 2018 Chart Industries, Inc. Confidential and Proprietary

Forward-Looking Statements Certain statements made in this presentation are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning Chart Industries’ plans, objectives, future orders, revenues, margins, tax rates and tax planning, earnings or performance, liquidity and cash flow, capital expenditures, business trends, and other information that is not historical in nature. Forward-looking statements may be identified by terminology such as "may," "will," "should," "could," "expects," "anticipates," "believes," "projects," "forecasts," “outlook,” “guidance,” "continue," or the negative of such terms or comparable terminology. Forward-looking statements contained in this presentation or in other statements made by the Company are made based on management's expectations and beliefs concerning future events impacting the Company and are subject to uncertainties and factors relating to the Company's operations and business environment, all of which are difficult to predict and many of which are beyond the Company's control, that could cause the Company's actual results to differ materially from those matters expressed or implied by forward-looking statements. Factors that could cause the Company’s actual results to differ materially from those described in the forward-looking statements include those found in Item 1A (Risk Factors) in the Company’s most recent Annual Report on Form 10-K filed with the SEC, which should be reviewed carefully, as well as risks and uncertainties related to the integration of the Hudson businesses with the Company’s, and risks and uncertainties associated with the strategic review process underway with respect to the BioMedical segment, and the results of such process, including any possible divestiture or transaction, and the uncertainty whether any such possible transaction is completed, and if so, the terms, structure and timing of any such transaction. The Company undertakes no obligation to update or revise any forward-looking statement. Chart Industries is a leading diversified global manufacturer of highly engineered equipment for the industrial gas, energy, and biomedical industries. The majority of Chart Industries' products are used throughout the liquid gas supply chain for purification, liquefaction, distribution, storage and end- use applications, a large portion of which are energy-related. Chart Industries has domestic operations located across the United States and an international presence in Asia, Australia, Europe and Latin America. For more information, visit: http://www.chartindustries.com. © 2018 Chart Industries, Inc. Confidential and Proprietary

Leading Supplier of Mission Critical Equipment 1 Energy & Chemical 2 Distribution & Storage 3 BioMedical ▪ Supply Brazed Aluminum Heat ▪ Offer a complete portfolio of cryogenic ▪ Serve as end-to-end provider of Exchangers (BAHX), Air Cooled Heat distribution and storage equipment respiratory therapy equipment Exchangers (ACHX) and Cold Boxes ▪ Spearhead innovation in cryogenic ▪ Set the standard for storage of ▪ Provide integrated systems and packaged gas and MicroBulk systems biological materials at low aftermarket services for gas temperatures ▪ Excel with over 20 years of processing, LNG and petrochemical experience in LNG applications ▪ Specialize in reliable, high quality applications solutions for environmental market ▪ Lead in technological advancements applications 3 © 2018 Chart Industries, Inc. Confidential and Proprietary

Broad End-Market Exposure Sales by Geography* $226M $540M $223M $989M 8% 6% 12% 7% 4% 2% 19% 16% 9% 17% 4% 26% 22% 30% 75% 49% 53% 41% E&C D&S BioMed Total Rest of World Middle East Europe Asia United States * FY 2017 as per SEC filings 4 © 2018 Chart Industries, Inc. Confidential and Proprietary

Broad End-Market Exposure Sales by Industry & Highlights * 1 Energy & Chemical 2 Distribution & Storage 3 BioMedical Natural Gas Processing/ Manufacturing/ Fabrication Petrochemical HVAC, power and Healthcare refining 58% 55% 9% Electronics Industrial 5% Environ- 10% 68% $226M Gas $540M $223M 10% mental 8% Healthcare 13% 7% Food/ LNG Beverage Life 22% 35% Sciences LNG 23% $211M 55% $228M 22% $23M of Total Chart Sales Backlog at 12/31/17 of Total Chart Sales Backlog at 12/31/17 of Total Chart Sales Backlog at 12/31/17 20% 27% 36% Gross Margin Gross Margin Gross Margin * FY 2017 as per SEC filings 5 © 2018 Chart Industries, Inc. Confidential and Proprietary

Track Record of Execution Increased inorganic and Deployed capital toward four organic sales by 15% transformational acquisitions and 5%, respectively(1) Delivered on FY 2017 Realized synergies guidance objectives ahead of schedule Optimized shared Refinanced convertible service project launched debt at attractive rates (1) Sales increases for the twelve months ended December 31, 2017 vs. twelve months ended December 31, 2016. 6 © 2018 Chart Industries, Inc. Confidential and Proprietary

5-Year History of Portfolio-Shaping Acquisitions Exploration, Value Processing/ Re- Lifecycle Production & Treatment Transportation Storage Proposition/ Pipeline Liquefaction gasification Services Application Xinye $18.0M Wuxi $9.5M $1.5M $22.0M $27.0M $4.3M $205M $8.4M Forecasted revenue for first full year of acquisition 7 © 2018 Chart Industries, Inc. Confidential and Proprietary

Hudson: Strategic Rationale ▪ Adds highly-complementary Fans business Product Split* End Market Split* Aftermarket Split* ▪ Strengthens aftermarket presence Chemical 6% ▪ Industrial / Consistent with core strategy to enhance LNG Aftermarket Other / OEM 37% Fans 22% Air Cooled Heat Exchanger (ACHX) 38% HVAC 63% business 23% ▪ Expected to be accretive to growth, margins and EPS Refining ▪ Power 20% Significant cost synergies 10% ▪ ACHEs Oil & Gas Efficient use of Chart’s strong balance 62% 19% sheet position Chart Product Offerings Key Products Integrated Process ACHEs Brazed Aluminum Axial Flow Fans Systems Heat Exchangers Natural Gas Industrial Gas LNG End Market Mix Power HVAC Refining Denotes Chart offering pre-acquisition Oil & Gas Petrochemical * Hudson stand-alone Expands Industrial Gas Offerings Maximizes LNG Opportunity 8 © 2018 Chart Industries, Inc. Confidential and Proprietary

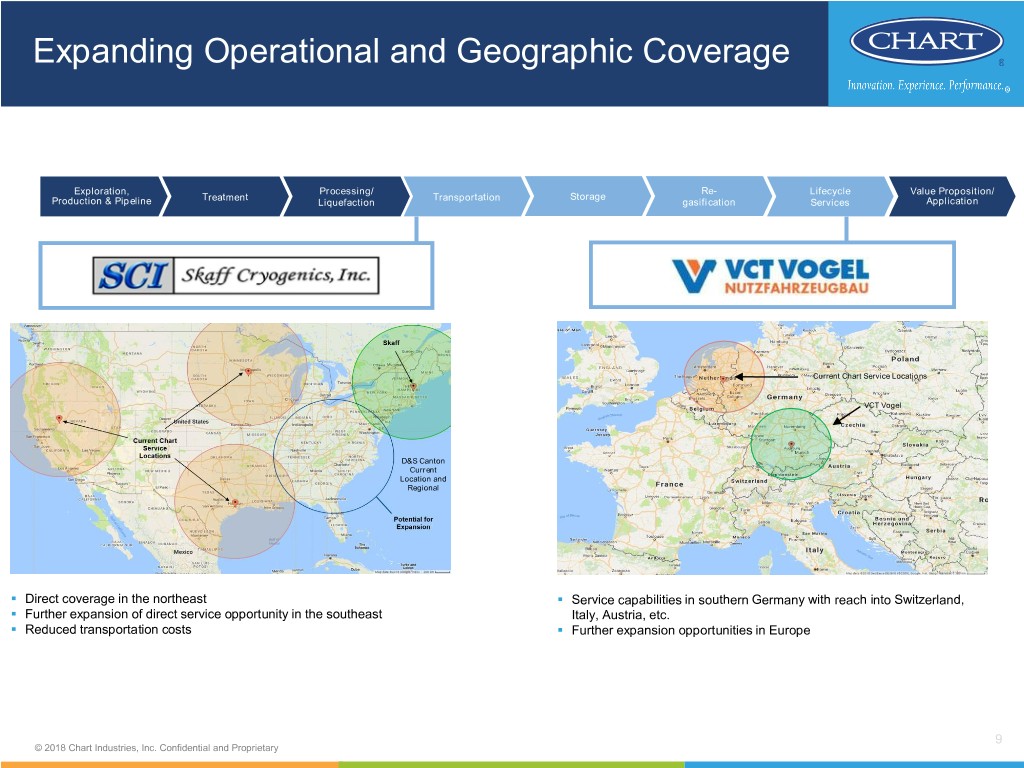

Expanding Operational and Geographic Coverage Exploration, Processing/ Re- Lifecycle Value Proposition/ Treatment Transportation Storage Production & Pipeline Liquefaction gasification Services Application Current Chart Service Locations VCT Vogel D&S Canton Current Location and Regional ▪ Direct coverage in the northeast ▪ Service capabilities in southern Germany with reach into Switzerland, ▪ Further expansion of direct service opportunity in the southeast Italy, Austria, etc. ▪ Reduced transportation costs ▪ Further expansion opportunities in Europe 9 © 2018 Chart Industries, Inc. Confidential and Proprietary

Oxygen-Related Product Strategic Review ▪ Conducting strategic review and evaluation of possible divestiture of the oxygen- related product lines within Biomedical segment ▪ Excludes those portions of the BioMedical segment that utilize and align with our cryogenic technological expertise (Cryobiological) ▪ There can be no assurance that this evaluation will result in any transaction being announced or consummated 10 © 2018 Chart Industries, Inc. Confidential and Proprietary

Second Quarter 2018 Financial Results Q2 Highlights Sales & Revenue Adjusted 1 ($USD Million) Earnings Per Share Earnings Per Share • Sales increase of 34% over the second quarter of 2017, $320 $0.38 $0.55 14% excluding Hudson Products • Reported earnings per diluted share increased $320 $0.55 $0.29 compared to the second quarter 2017, and adjusted EPS grew $0.34 in the same comparative period $238 $0.38 • Orders of $360 million compared to $253 million in the first quarter of 2017, and $0.21 increased 6% organically $0.09 Q2 2017 Q2 2018 Q2 2017 Q2 2018 Q2 2017 Q2 2018 1. Adjusted earnings per share is a non-GAAP measure, see reconciliation to the comparable GAAP measure on page 10. © 2018 Chart Industries, Inc. Confidential and Proprietary 11 11

2018 YTD Financial Results YTD Q2 2018 Highlights Sales & Revenue Adjusted 1 ($USD Million) Earnings Per Share Earnings Per Share • Sales increase of 36% over the first half of 2017, 15% $600 $0.57 $0.78 excluding Hudson Products • Reported earnings per diluted share increased $0.57 compared to the first $0.78 half of 2017, and adjusted $600 EPS grew $0.56 in the same comparative period $442 $0.57 • Orders of $681 million compared to $462 million in the first half of 2017, and increased 19% organically $0.22 $0.00 1H 2017 1H 2018 1H 2017 1H 2018 1H 2017 1H 2018 1. Adjusted earnings per share is a non-GAAP measure, see reconciliation to the comparable GAAP measure on page 10. © 2018 Chart Industries, Inc. Confidential and Proprietary 12 12

Adjusted Earnings Per Diluted Share (EPS) $ millions, except per share amounts Q2 Q2 Change V. 1H 1H Change V. 2018 2017 PY 2018 2017 PY Net income (loss) $12.3 $2.8 $9.5 $18.1 ($0.1) $18.2 EPS (1) $0.38 $0.09 $0.29 $0.57 $0.00 $0.57 Restructuring and transaction- 0.04 0.12 (0.08) 0.09 0.22 (0.13) related costs Aluminum cryobiological tank 0.09 - 0.09 0.09 - 0.09 recall reserve expense CEO departure net costs 0.03 - 0.03 0.03 - 0.03 Dilution impact of convertible 0.01 - 0.01 - - 0.01 notes Adjusted EPS (2,3) $0.55 $0.21 $0.34 $0.78 $0.22 $0.56 Foreign exchange impact (0.02) 0.00 (0.02) 0.02 0.01 0.01 Normalized Adjusted EPS on a $0.53 $0.21 $0.32 $0.80 $0.23 $0.57 Comparable Basis (3,4) (1) On January 1, 2018, we adopted ASC 606 which resulted in a timing related EPS impact of $0.00 Q2 2018, and $0.04 YTD 2018. (2) Adjusted EPS (a non-GAAP measure) is as reported on a historical basis. (3) Tax effected adjustments are at normalized statutory quarterly rates. (4) “Normalized Adjusted EPS on a Comparable Basis” is not recognized under generally accepted accounting principles (“GAAP”) and is referred to as a “non- GAAP financial measure” in Regulation G under the Exchange Act. The Company believes this figure is of interest to investors and facilitates useful period-to- period comparisons of the Company’s operating results. © 2018 Chart Industries, Inc. Confidential and Proprietary 13

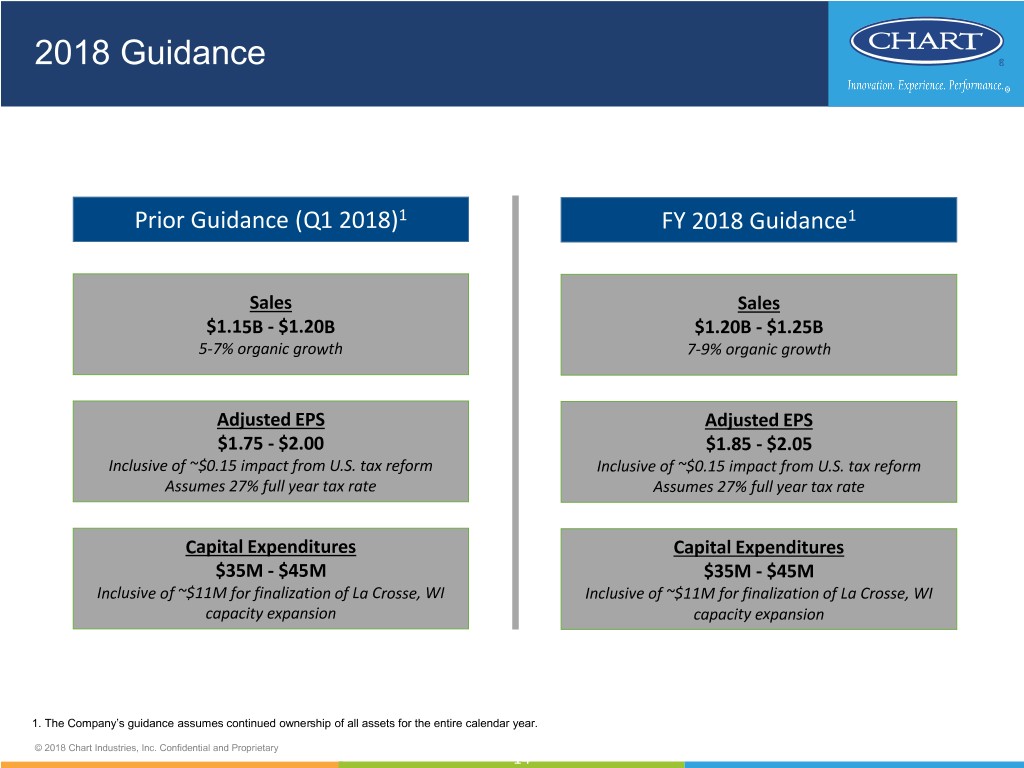

2018 Guidance Prior Guidance (Q1 2018)1 FY 2018 Guidance1 Sales Sales $1.15B - $1.20B $1.20B - $1.25B 5-7% organic growth 7-9% organic growth Adjusted EPS Adjusted EPS $1.75 - $2.00 $1.85 - $2.05 Inclusive of ~$0.15 impact from U.S. tax reform Inclusive of ~$0.15 impact from U.S. tax reform Assumes 27% full year tax rate Assumes 27% full year tax rate Capital Expenditures Capital Expenditures $35M - $45M $35M - $45M Inclusive of ~$11M for finalization of La Crosse, WI Inclusive of ~$11M for finalization of La Crosse, WI capacity expansion capacity expansion 1. The Company’s guidance assumes continued ownership of all assets for the entire calendar year. © 2018 Chart Industries, Inc. Confidential and Proprietary 14

Chart Investment Highlights Leading diversified industrial global manufacturer with diverse Operate in attractive, growing and broad product offering markets Innovative technical expertise Cross-operating segment scale and and reputation collaboration Longstanding relationships with industry leading and global customers 15 © 2018 Chart Industries, Inc. Confidential and Proprietary

www.chartindustries.com © 2018 Chart Industries, Inc. Confidential and Proprietary