Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - GENTHERM Inc | thrm-ex991_6.htm |

| 8-K - 8-K - GENTHERM Inc | thrm-8k_20180726.htm |

2018 Second Quarter Results Gentherm, Inc. July 26, 2018 Exhibit 99.2

Forward-Looking Statement Except for historical information contained herein, statements in this presentation are forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent Gentherm Incorporated's goals, beliefs, plans and expectations about its prospects for the future and other future events. The forward-looking statements included in this presentation are made as of the date hereof or as of the date specified and are based on management's current expectations and beliefs. Such statements are subject to a number of important assumptions, risks, uncertainties and other factors that may cause the Company's actual performance to differ materially from that described in or indicated by the forward looking statements. Those risks include, but are not limited to, risks that new products may not be feasible, sales may not increase, additional financing requirements may not be available, new competitors may arise or customers may develop their own products to replace the Company’s products, customer preferences for end products may shift, the Company may lose suppliers or customers, market acceptance of the Company’s existing or new products may decrease, cost reduction initiatives may not produce expected savings, synergies or efficiencies in its Fit-for-Growth or other initiatives, trends in electrified powertrains may decrease, the Company may not be able to protect is intellectual property rights, implementation of strategic partnerships and collaborations may be unsuccessful, currency exchange rates may change unfavorably, pricing pressures from customers may increase, the Company’s workforce and operations could be disrupted by civil or political unrest in the countries in which the Company operates, free trade agreements may be altered in a manner adverse to the Company, our customers may not accept pass-through of new tariff costs, additional tariffs may be implemented, medical device regulations could change in an unfavorable manner, commodity prices may fluctuate, legislative or regulatory changes may impact or limit the Company’s business, market conditions or regional growth may decline, general industry conditions may decline, and other adverse conditions in the industries in which the Company operates may negatively affect its results. You should review the Company's filings with the Securities and Exchange Commission (the “SEC”), including “Risk Factors”, in its most recent Annual Report on Form 10-K and subsequent quarterly reports, for a discussion of these and other risks and uncertainties. The business outlook discussed in this presentation does not include the potential impact of any business combinations, acquisitions, divestitures, strategic investments and other significant transactions that may be completed after the date hereof. Except as required by law, the Company expressly disclaims any obligation or undertaking to update any forward-looking statements to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

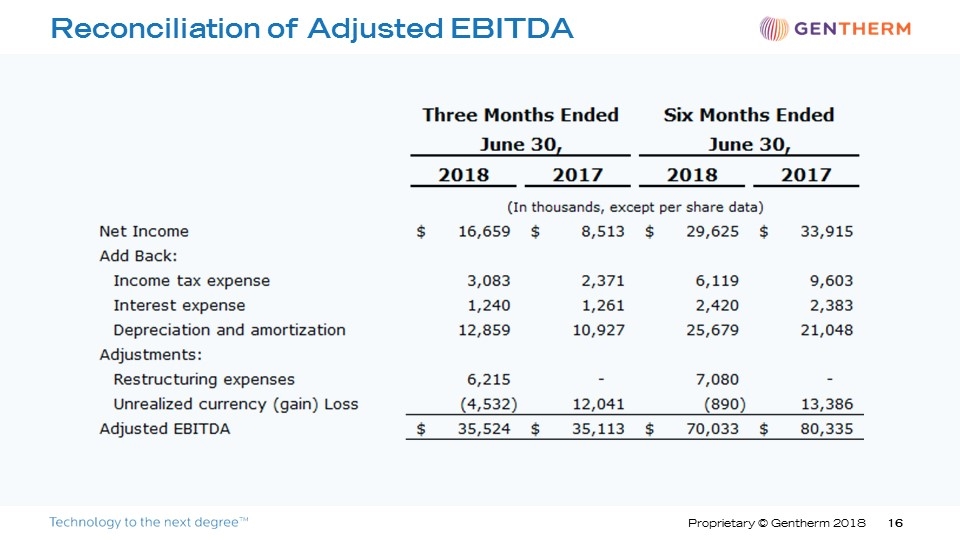

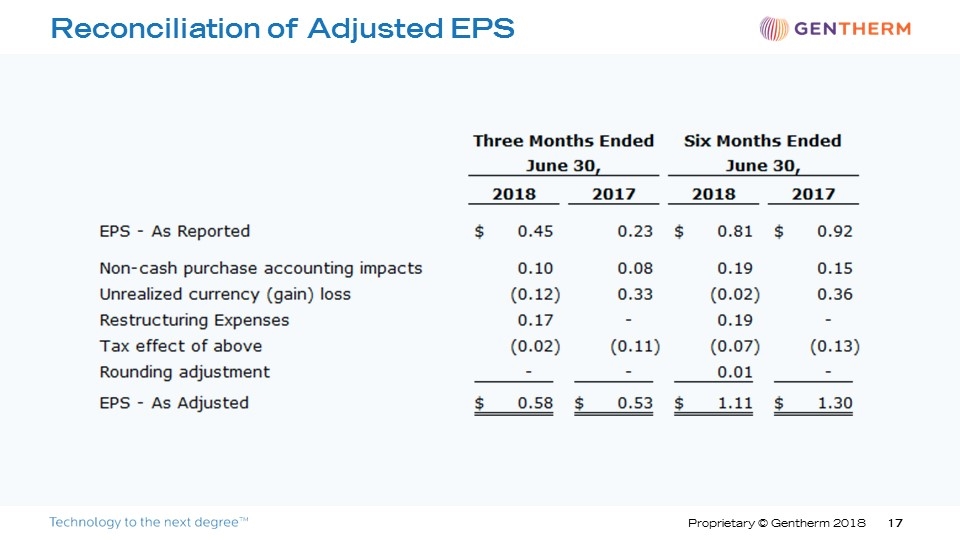

In addition to the results reported in accordance with GAAP throughout this presentation, the Company has provided information regarding “earnings before interest, taxes, depreciation and amortization, deferred financing cost amortization, transaction expenses, debt retirement expenses, restructuring expenses, unrealized currency gain or loss and unrealized revaluation of derivatives” (Adjusted EBITDA) and “Return on Invested Capital (ROIC)” (each, a non-GAAP financial measure). We define ROIC as tax-affected operating income, prior to the effect of extraordinary or unusual items, divided by Invested Capital. Invested Capital is defined as shareholders’ equity and total debt, less cash and cash equivalents. In evaluating its business, the Company considers and uses Adjusted EBITDA as a supplemental measure of its operating performance. Management provides an Adjusted EBITDA measure so that investors will have the same financial information that management uses with the belief that it will assist investors in properly assessing the Company's performance on a period-over-period basis. Additionally, management believes that ROIC provides a useful measure of how effectively the Company uses capital to generate profits. Other companies in our industry may calculate these non-GAAP financial measures differently than we do and those calculations may not be comparable to our metrics. These non-GAAP measures have limitations as analytical tools, and when assessing the Company's operating performance, investors should not consider Adjusted EBITDA or ROIC in isolation, or as a substitute for net income or other consolidated income statement data prepared in accordance with GAAP. Non-GAAP measures referenced in this presentation may include estimates of future Adjusted EBITDA and ROIC. Such forward-looking non-GAAP measures may differ significantly from the corresponding GAAP measures, due to depreciation and amortization, tax expense, and/or interest expense, some or all of which management has not quantified for the future periods. Use of Non-GAAP Financial Measures

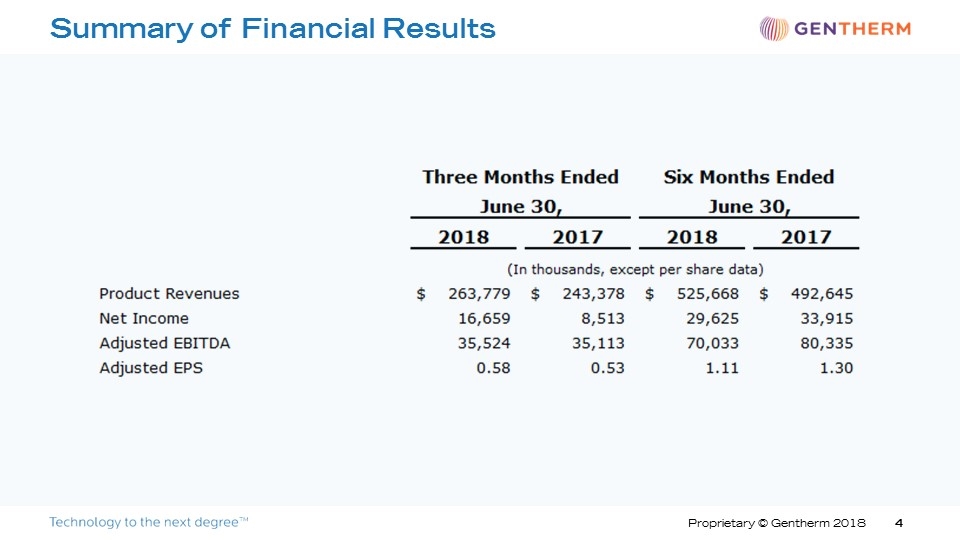

Summary of Financial Results

On pace to meeting full-year guidance 2Q 2018 Highlights Organic automotive revenue growth Record automotive awards Sequential CCSTM revenue growth Improved financial results year over year and sequentially Significant progress on Focused Growth and Margin Expansion activities $20M of share repurchases in the quarter $268M authorization remaining

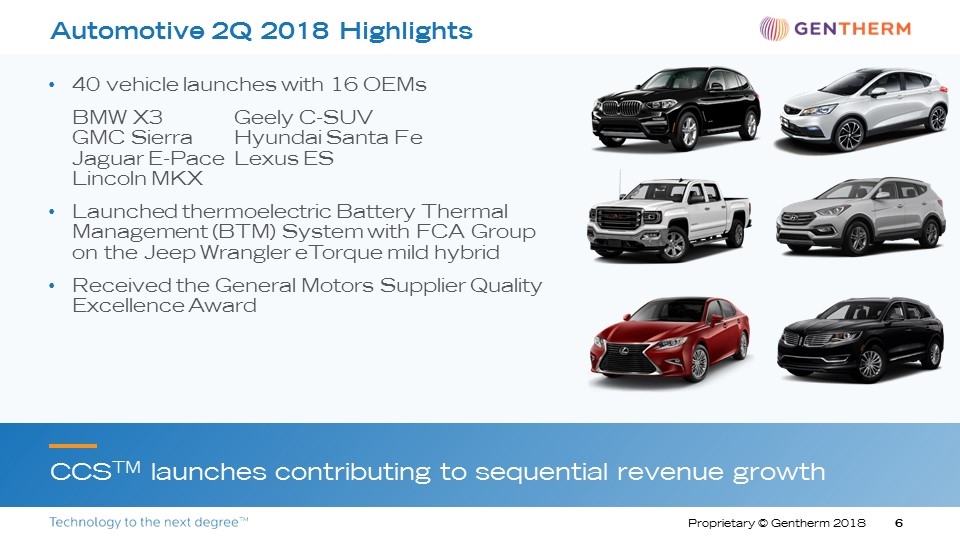

40 vehicle launches with 16 OEMs BMW X3Geely C-SUV GMC SierraHyundai Santa Fe Jaguar E-PaceLexus ESLincoln MKX Launched thermoelectric Battery Thermal Management (BTM) System with FCA Group on the Jeep Wrangler eTorque mild hybrid Received the General Motors Supplier Quality Excellence Award CCSTM launches contributing to sequential revenue growth Automotive 2Q 2018 Highlights

Over $440M in new awards across 20 customers Multiple CCSTM awards Audi A6Beijing Auto BJ8Cadillac CT5Honda PilotHyundai SonataJeep Grand Cherokee Subaru Outback New Electric Vehicles: Audi e-tron® and Porsche Mission E Heated Interior award for Mercedes S-Class First full system award in China on Changan CS75, combining CCSTM and a multi-function ECU (Climate, Memory Seat and Mirror controls) Air Cooling Battery Thermal Management award for Hyundai PDe, Geely Emgrand GS, Geely C-Sedan, and the Volkswagen Golf Two thermoelectric BTM development contracts with Asian OEMs Automotive 2Q 2018 Awards Secured $800M of new awards from global OEMs year to date

Named Jim Paloyan as Senior Vice President and General Manager for medical business Secured awards for Blanketrol®III, Hemotherm®, and Micro-Temp® devices across multiple hospital systems Mission Hospitals (North Carolina) Renown Regional (Reno, Nevada) Jackson Memorial Hospital (Miami, Florida) Continued growth with University of Pittsburgh Medical Center (UPMC), including increased hospital conversions to FilteredFlo® Secured $10.4M in industrial chamber awards from customers across 10 different industries, including NASA, GM, and Generac CSZ 2Q 2018 Highlights Direct sales force delivered revenue growth in key medical product categories

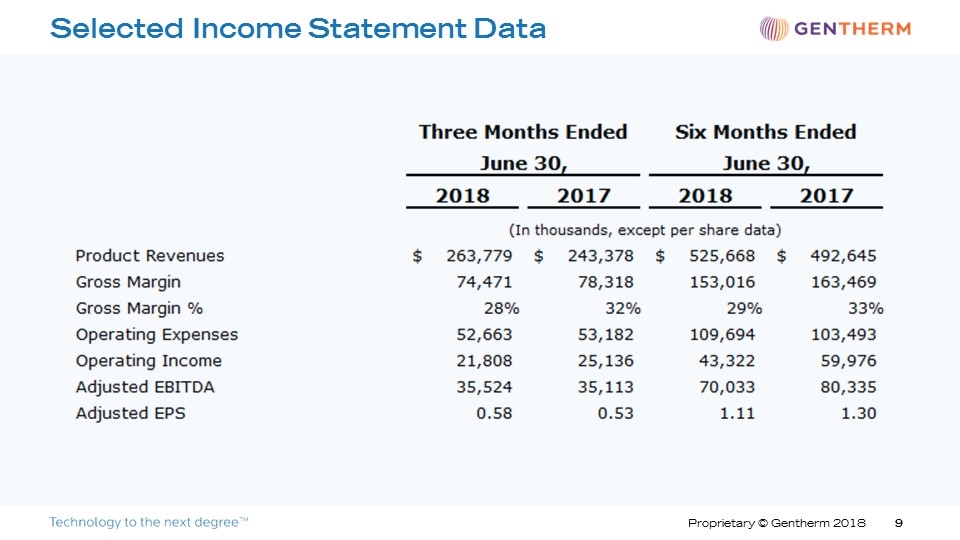

Selected Income Statement Data

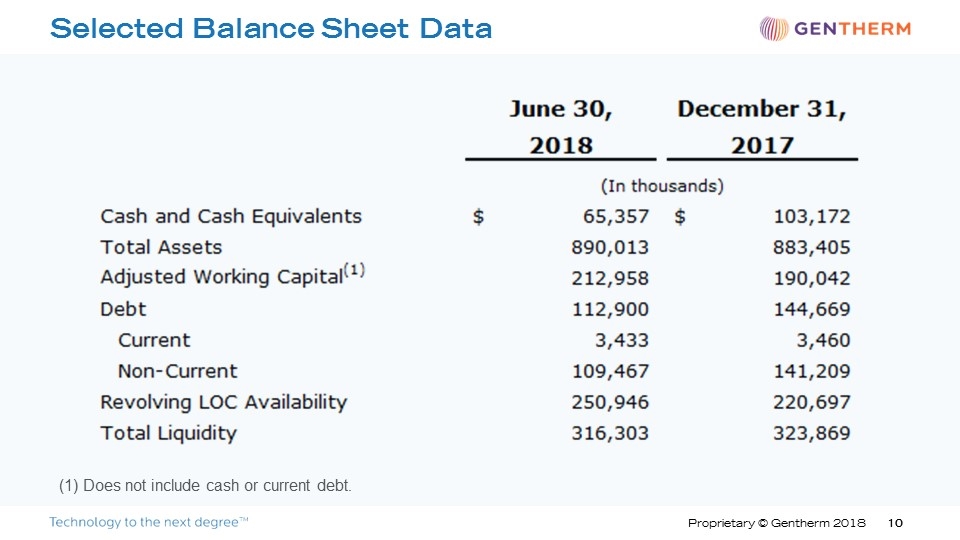

Selected Balance Sheet Data (1) Does not include cash or current debt.

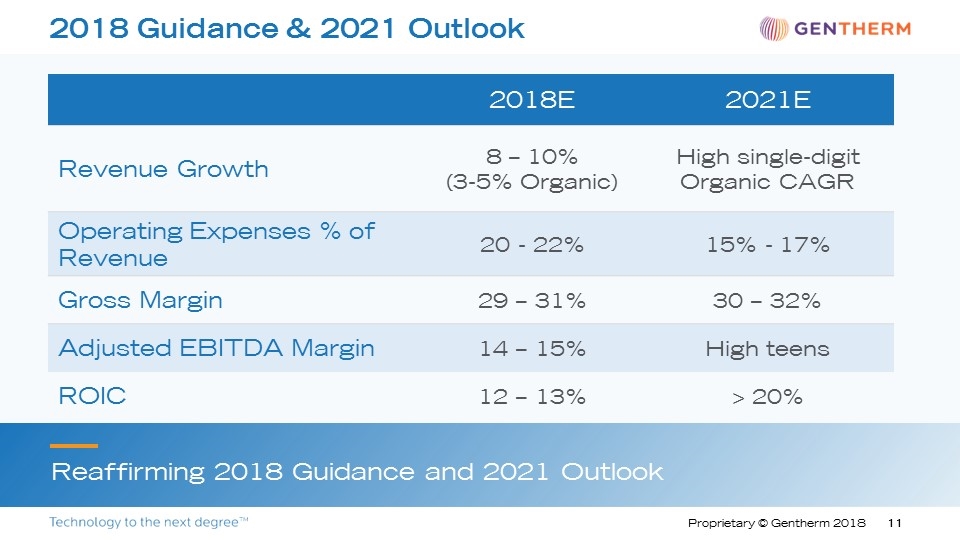

2018 Guidance & 2021 Outlook 2018E 2021E Revenue Growth 8 – 10% (3-5% Organic) High single-digit Organic CAGR Operating Expenses % of Revenue 20 - 22% 15% - 17% Gross Margin 29 – 31% 30 – 32% Adjusted EBITDA Margin 14 – 15% High teens ROIC 12 – 13% > 20% Reaffirming 2018 Guidance and 2021 Outlook

Our Strategy Focused Growth Extend Technology Leadership Expand Margins and ROIC Optimize Capital Allocation

Strategy 1 Update: Focused Growth Divest and minimize non-core investments Divest Global Power Technologies Divest CSZ® Industrial Chambers Eliminate / Minimize Investment Furniture Aviation Battery Management Electronics Industrial Battery Packs Automotive Thermoelectric Generator Non-core Electronics Reset focus to higher-growth and higher-return opportunities

Strategy 3 Update: Expand Margins and ROIC Eliminate / minimize non-core investments SG&A rationalization Engineering focus and efficiency Purchasing excellence Manufacturing optimization Fit-for-Growth $60M of the targeted $75M annual savings by 2021 now identified

Appendix

Reconciliation of Adjusted EBITDA

Reconciliation of Adjusted EPS