Attached files

| file | filename |

|---|---|

| EX-99.2 - EIX Q2 2018 FINANCIAL RESULTS CONFERENCE CALL PREPARED REMARKS DATED 7_26_2018 - EDISON INTERNATIONAL | eix-sceexhibit99x2q22018.htm |

| EX-99.1 - EIX PRESS RELEASE DATED 7_26_2018 - EDISON INTERNATIONAL | eix-sceexhibit99x1q22018.htm |

| 8-K - 8-K EIX EARNINGS RELEASE JULY 26, 2018 - EDISON INTERNATIONAL | eix-sceform8xkre2q2018er.htm |

Exhibit 99.3 Second Quarter 2018 Financial Results July 26, 2018

Forward-Looking Statements Statements contained in this presentation about future performance, including, without limitation, operating results, capital expenditures, rate base growth, dividend policy, financial outlook, and other statements that are not purely historical, are forward- looking statements. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. These forward-looking statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to update them to reflect new information, events or circumstances. Important factors that could cause different results include, but are not limited to the: • ability of SCE to recover its costs through regulated rates, including costs related to uninsured wildfire-related and mudslide- related liabilities, spending on grid modernization and other capital spending incurred prior to explicit regulatory approval; • ability to obtain sufficient insurance at a reasonable cost, including insurance relating to SCE's nuclear facilities and wildfire- related and mudslide-related exposure, and to recover the costs of such insurance or, in the absence of insurance, the ability to recover uninsured losses; • decisions and other actions by the CPUC, the FERC, the NRC and other regulatory authorities, including determinations of authorized rates of return or return on equity, the 2018 GRC, the recoverability of wildfire-related and mudslide-related costs, and delays in regulatory actions; • ability of Edison International or SCE to borrow funds and access the bank and capital markets on reasonable terms; • actions by credit rating agencies to downgrade our credit ratings or those of our subsidiaries or to place those ratings on negative watch or outlook; • risks associated with the decommissioning of San Onofre, including those related to public opposition, permitting, governmental approvals, on-site storage of spent nuclear fuel, and cost overruns; • extreme weather-related incidents and other natural disasters (including earthquakes and events caused, or exacerbated, by climate change, such as wildfires), which could cause, among other things, public safety and operational issues; • risks associated with cost allocation resulting in higher rates for utility bundled service customers because of possible customer bypass or departure due to CCAs; and • risks inherent in SCE's transmission and distribution infrastructure investment program, including those related to project site identification, public opposition, environmental mitigation, construction, permitting, power curtailment costs (payments due under power contracts in the event there is insufficient transmission to enable acceptance of power delivery), changes in the CAISO's transmission plans, and governmental approvals. Other important factors are discussed under the headings “Forward-Looking Statements”, “Risk Factors” and “Management’s Discussion and Analysis” in Edison International’s Form 10-K and other reports filed with the Securities and Exchange Commission, which are available on our website: www.edisoninvestor.com. These filings also provide additional information on historical and other factual data contained in this presentation. July 26, 2018 1

Second Quarter Earnings Summary Q2 Q2 Variance Key SCE EPS Drivers2 2018 2017 Revenue3,4 $0.07 Basic Earnings Per Share (EPS)1 - CPUC revenue 0.05 SCE $0.91 $0.94 $(0.03) - FERC revenue 0.02 EIX Parent & Other (0.06) (0.09) 0.03 Higher O&M (0.08) Discontinued Operations Lower depreciation 0.03 Higher net financing costs (0.04) Basic EPS $0.85 $0.85 $ Income taxes4 0.01 Less: Non-Core Items Property and other taxes (0.02) SCE $ $ $ Total core drivers $(0.03) Non-core items EIX Parent & Other Total $(0.03) Discontinued Operations Total Non-Core Items $ $ $ Key EIX EPS Drivers Core Earnings Per Share (EPS)1 EIX Parent $(0.01) - IRS tax settlement in 2017 and Tax Reform (0.03) SCE $0.91 $0.94 $(0.03) - Lower corporate expenses 0.02 EIX Parent & Other (0.06) (0.09) 0.03 EEG - SoCore Energy goodwill impairment in 0.04 Core EPS1 $0.85 $0.85 $ 2017 and other Total core drivers $0.03 Non-core items Total $0.03 1. See Earnings Non-GAAP reconciliations and Use of Non-GAAP Financial Measures in Appendix 2. SCE’s 2018 core EPS drivers other than income taxes are adjusted to reflect consistent tax rates; income tax line item reflects impact of change in tax rate 3. Excludes 2017 San Onofre revenue of $(0.09), depreciation of $0.06, interest expense of $0.01 which was offset by income tax of $0.02 4. Excludes $0.07 of income tax benefits related to Tax Reform refunded to customers Note: Diluted earnings were $0.84 and $0.85 per share for the three months ended June 30, 2018 and 2017, respectively. July 26, 2018 2

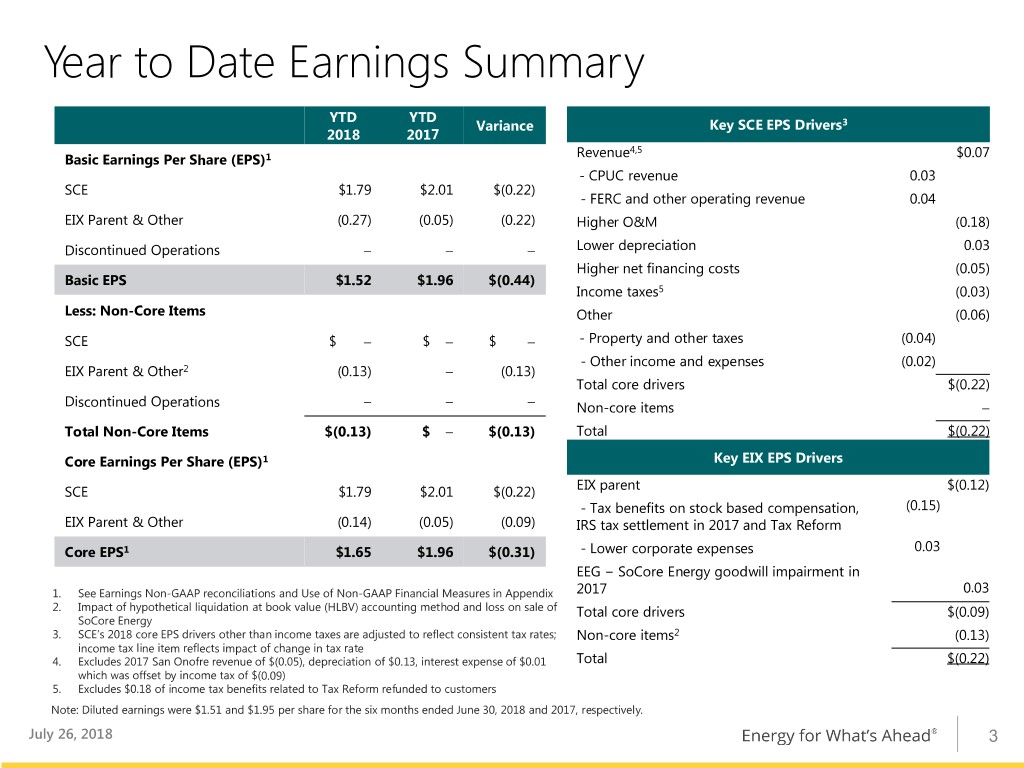

Year to Date Earnings Summary YTD YTD Variance Key SCE EPS Drivers3 2018 2017 Revenue4,5 $0.07 Basic Earnings Per Share (EPS)1 - CPUC revenue 0.03 SCE $1.79 $2.01 $(0.22) - FERC and other operating revenue 0.04 EIX Parent & Other (0.27) (0.05) (0.22) Higher O&M (0.18) Discontinued Operations Lower depreciation 0.03 Higher net financing costs (0.05) Basic EPS $1.52 $1.96 $(0.44) Income taxes5 (0.03) Less: Non-Core Items Other (0.06) SCE $ $ $ - Property and other taxes (0.04) - Other income and expenses (0.02) EIX Parent & Other2 (0.13) (0.13) Total core drivers $(0.22) Discontinued Operations Non-core items Total Non-Core Items $(0.13) $ $(0.13) Total $(0.22) Core Earnings Per Share (EPS)1 Key EIX EPS Drivers SCE $1.79 $2.01 $(0.22) EIX parent $(0.12) - Tax benefits on stock based compensation, (0.15) EIX Parent & Other (0.14) (0.05) (0.09) IRS tax settlement in 2017 and Tax Reform Core EPS1 $1.65 $1.96 $(0.31) - Lower corporate expenses 0.03 EEG − SoCore Energy goodwill impairment in 1. See Earnings Non-GAAP reconciliations and Use of Non-GAAP Financial Measures in Appendix 2017 0.03 2. Impact of hypothetical liquidation at book value (HLBV) accounting method and loss on sale of Total core drivers $(0.09) SoCore Energy 3. SCE’s 2018 core EPS drivers other than income taxes are adjusted to reflect consistent tax rates; Non-core items2 (0.13) income tax line item reflects impact of change in tax rate 4. Excludes 2017 San Onofre revenue of $(0.05), depreciation of $0.13, interest expense of $0.01 Total $(0.22) which was offset by income tax of $(0.09) 5. Excludes $0.18 of income tax benefits related to Tax Reform refunded to customers Note: Diluted earnings were $1.51 and $1.95 per share for the six months ended June 30, 2018 and 2017, respectively. July 26, 2018 3

SCE Capital Expenditure Forecast ($ billions) $13.7 Billion 2018-2020 Capital Program Traditional Capital Spending: • Capital expenditure forecast incorporates GRC, FERC and non- Distribution1 Transmission Generation GRC CPUC spending Grid Modernization Capital Spending: Grid Modernization 2 GRC decision pending; 2018 capital plan will allow SCE to ramp up its spending program over the three-year GRC $4.8 $4.7 period to meet ultimately authorized capital 3 2018 Grid Modernization spending focused on safety and $4.2 reliability2 $3.8 Includes $119 million of non-GRC CPUC capital for mobile home pilot program, charge ready pilot, and priority review medium- and heavy-duty (MD/HD) Transportation Electrification projects in 2018-2019 Does not reflect final decision on MD/HD Transportation Electrification resulting in capital spend increases of $38 million in 2019 and $78 million in 2020 Does not reflect proposed decisions for Alberhill construction license which would result in a reduction to FERC capital spend of $35 million in 2019 and $51 million in 2020 • Authorized/Actual may differ from forecast Since the 2009 GRC, CPUC has approved 81%, 89%, and 92% of capital requested, respectively 2017 (Actual) 2018 2019 2020 SCE has no prior approval experience on grid modernization Prior $3.8 $4.2 $4.8 $4.7 capital spending and, therefore, prior results may not be Forecast predictive Delta ‒ ‒ ‒ ‒ Forecasted FERC capital spending subject to timely receipt of permitting, licensing, and regulatory approvals 1. Includes 2018 – 2020 capital expenditures of $105 million for Mobile Home Park, $49 million for Energy Storage, $10 million for MD/HD Transportation Electrification Priority Review, and $4 million for Charge Ready 2. 2017 and 2018 capital expenditures related to grid modernization are included in distribution capital expenditures 3. 2018 spending at budget levels Note: Forecasted capital spending includes CPUC, FERC and other spending. 2019-2020 based on 2018 CPUC GRC Tax Reform February Update testimony. See Capital Expenditure/Rate Base Detailed Forecast for further information, including potential investment excluded in forecasts. Delta represents change from May 2018 Business Update. July 26, 2018 4

SCE Rate Base Forecast – Request Level ($ billions) 3-year CAGR of 9.7% Traditional Grid Modernization CPUC $34.6 • Rate base based on request levels from $31.8 2018 GRC Tax Reform February Update $29.1 FERC $26.2 • FERC rate base, including Construction Work in Progress (CWIP), is approximately 19% of SCE’s rate base by 2020 • Reflects latest capital forecast; including the Alberhill System project Other • Includes Tax Reform impact • Includes mobile home pilot program, Charge Ready pilot, and MD/HD Transportation Electrification priority review projects 2017 2018 2019 2020 • Excludes MD/HD Transportation (Authorized) Electrification standard review project and Prior $26.2 $29.1 $31.8 $34.6 Forecast Charge Ready Phase 2 application Delta ‒ ‒ ‒ ‒ • Excludes SONGS regulatory asset Note: Weighted-average year basis. 2017 based on 2015 GRC decision. 2018-2020 CPUC based on 2018 GRC Tax Reform February Update testimony, FERC based on latest forecast and current tax law, “rate-base offset” for the 2015 GRC decision excluded because of write off of regulatory asset related to 2012-2014 incremental tax repairs. Delta represents change from May 2018 Business Update. July 26, 2018 5

2018 Financial Assumptions ($ billions) SCE Capital Expenditures SCE Weighted Average Rate Base Distribution $3.4 Traditional $28.8 Transmission 0.6 Grid Mod 0.3 Generation 0.2 2018 Request $29.1 2018 Plan $4.2 • Based on 2018 budgeted expenditures at SCE • FERC comprises about 20% of total rate base in 2018 • Based on GRC update submitted February 2018; incorporates impact of tax reform SCE Authorized Cost of Capital Other Items CPUC Return on Equity 10.3% • Incremental wildfire insurance costs expected to be $0.38 per CPUC Capital Structure 48% equity share relative to our current GRC request; continuing to assess probability of recovery; expect to defer $0.30 per share as a 43% debt regulatory asset if the premiums are deemed probable of recovery 9% preferred • Energy efficiency of $0.03 per share FERC Return on Equity 11.5% with incentives • Revenues recorded at 2017 levels until 2018 GRC decision is (subject to refund pending received (decision retroactive to January 1, 2018) FERC decision) • 2018 EIX Parent and Other core EPS guidance range: ($0.25) to ($0.30) per share Holding company drag of 2 cents per share per month Includes EPS estimate for Edison Energy; continue to target breakeven run rate by year-end 2019 EIX will provide 2018 earnings guidance after a final decision in the SCE 2018 General Rate Case Note: All tax-affected information on this slide is based on our current combined statutory tax rate of approximately 28%. July 26, 2018 6

Appendix July 26, 2018 7

Earnings Non-GAAP Reconciliations ($ millions) Reconciliation of EIX GAAP Earnings to EIX Core Earnings Q2 Q2 YTD YTD Earnings Attributable to Edison International 2018 2017 2018 2017 SCE $297 $307 $583 $656 EIX Parent & Other (21) (29) (89) (16) Basic Earnings $276 $278 $494 $640 Non-Core Items SCE $ – $ – $ – $ – EIX Parent & Other1 2 – (42) 1 Total Non-Core $ 2 $ – $(42) $ 1 Core Earnings SCE $297 $307 $583 $656 EIX Parent & Other (23) (29) (47) (17) Core Earnings $274 $278 $536 $639 Note: See Use of Non-GAAP Financial Measures. 1. Non-core income of $3 million ($2 million after-tax) and non-core loss of $57 million ($42 million after-tax) for the three and six months ended June 30, 2018, respectively, related to the sale of SoCore Energy. The non-core loss for the six months ended June 31, 2018 was partially offset by income related to losses (net of distributions) allocated to tax equity investors under the HLBV accounting method. July 26, 2018 8

EIX Core EPS Non-GAAP Reconciliations Reconciliation of Edison International Basic Earnings Per Share to Edison International Core Earnings Per Share Earnings Per Share Attributable to Edison International 2015 2016 2017 CAGR Basic EPS 3.13 $4.02 $1.73 (26%) Non-Core Items SCE Write down, impairment and other charges (1.18) — (1.38) Re-measurement of deferred taxes — — (0.10) Insurance recoveries 0.04 — — Edison International Parent and Other Re-measurement of deferred taxes — — (1.33) Edison Capital sale of affordable housing portfolio 0.03 — — Income from allocation of losses to tax equity investor 0.03 0.02 0.04 Discontinued operations 0.11 0.03 — Less: Total Non-Core Items (0.97) 0.05 (2.77) Core EPS $4.10 $3.97 $4.50 5% Note: See Use of Non-GAAP Financial Measures. July 26, 2018 9

Use of Non-GAAP Financial Measures Edison International's earnings are prepared in accordance with generally accepted accounting principles used in the United States. Management uses core earnings internally for financial planning and for analysis of performance. Core earnings are also used when communicating with investors and analysts regarding Edison International's earnings results to facilitate comparisons of the Company's performance from period to period. Core earnings are a non-GAAP financial measure and may not be comparable to those of other companies. Core earnings (or losses) are defined as earnings or losses attributable to Edison International shareholders less income or loss from discontinued operations and income or loss from significant discrete items that management does not consider representative of ongoing earnings, such as: exit activities, including sale of certain assets, and other activities that are no longer continuing; asset impairments and certain tax, regulatory or legal settlements or proceedings. A reconciliation of Non-GAAP information to GAAP information is included either on the slide where the information appears or on another slide referenced in this presentation. EIX Investor Relations Contact Sam Ramraj, Vice President (626) 302-2540 sam.ramraj@edisonintl.com Allison Bahen, Senior Manager (626) 302-5493 allison.bahen@edisonintl.com July 26, 2018 10