Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CORPORATE OFFICE PROPERTIES TRUST | copt06302018earnings8k.htm |

Exhibit 99.1

Corporate Office Properties Trust

Summary Description

The Company: Corporate Office Properties Trust (the “Company” or “COPT”) is a self-managed real estate investment trust (“REIT”). COPT is listed on the New York Stock Exchange under the symbol “OFC” and is an S&P MidCap 400 Company. We own, manage, lease, develop and selectively acquire office and data center properties. The majority of our portfolio is in locations that support the United States Government and its contractors, most of whom are engaged in national security, defense and information technology (“IT”) related activities servicing what we believe are growing, durable, priority missions; we refer to these properties as Defense/IT Locations (sometimes also referred to as “Mission-Centric”). We also own a portfolio of office properties located in select urban/urban-like submarkets in the Greater Washington, DC/Baltimore region with durable Class-A office fundamentals and characteristics; these properties are included in a segment referred to as Regional Office Properties (sometimes also referred to as “Urban-Centric”). As of June 30, 2018, we derived 88% of our core portfolio annualized revenue from Defense/IT Locations and 12% from our Regional Office Properties. As of June 30, 2018, our core portfolio of 157 office and data center shell properties, including six owned through an unconsolidated joint venture, encompassed 17.5 million square feet and was 93.4% leased. As of the same date, we also owned a wholesale data center with a critical load of 19.25 megawatts in operations.

Management: | Investor Relations: |

Stephen E. Budorick, President & CEO | Stephanie M. Krewson-Kelly, VP of IR |

Paul R. Adkins, EVP & COO | 443-285-5453, stephanie.kelly@copt.com |

Anthony Mifsud, EVP & CFO | Michelle Layne, Manager of IR |

443-285-5452, michelle.layne@copt.com | |

Corporate Credit Rating: Fitch: BBB- Stable; Moody’s: Baa3 Positive; and S&P: BBB- Stable

Disclosure Statement: This supplemental package contains forward-looking statements within the meaning of the Federal securities laws. Forward-looking statements can be identified by the use of words such as “may,” “will,” “should,” “could,” “believe,” “anticipate,” “expect,” “estimate,” “plan” or other comparable terminology. Forward-looking statements are inherently subject to risks and uncertainties, many of which we cannot predict with accuracy and some of which we might not even anticipate. Although we believe that the expectations, estimates and projections reflected in such forward-looking statements are based on reasonable assumptions at the time made, we can give no assurance that these expectations, estimates and projections will be achieved. Future events and actual results may differ materially from those discussed in the forward-looking statements. Important factors that may affect these expectations, estimates and projections include, but are not limited to: general economic and business conditions, which will, among other things, affect office property and data center demand and rents, tenant creditworthiness, interest rates, financing availability and property values; adverse changes in the real estate markets, including, among other things, increased competition with other companies; governmental actions and initiatives, including risks associated with the impact of a prolonged government shutdown or budgetary reductions or impasses, such as a reduction in rental revenues, non-renewal of leases and/or a curtailment of demand for additional space by our strategic customers; our ability to borrow on favorable terms; risks of real estate acquisition and development activities, including, among other things, risks that development projects may not be completed on schedule, that tenants may not take occupancy or pay rent or that development or operating costs may be greater than anticipated; risks of investing through joint venture structures, including risks that our joint venture partners may not fulfill their financial obligations as investors or may take actions that are inconsistent with our objectives; changes in our plans for properties or views of market economic conditions or failure to obtain development rights, either of which could result in recognition of impairment losses; our ability to satisfy and operate effectively under Federal income tax rules relating to real estate investment trusts and partnerships; the dilutive effects of issuing additional common shares; our ability to achieve projected results; and environmental requirements. We undertake no obligation to update or supplement any forward-looking statements. For further information, refer to our filings with the Securities and Exchange Commission, particularly the section entitled “Risk Factors” in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2017.

1

Corporate Office Properties Trust

Equity Research Coverage

Firm | Senior Analyst | Phone | Email | |||

Bank of America Merrill Lynch | Jamie Feldman | 646-855-5808 | james.feldman@baml.com | |||

BTIG | Tom Catherwood | 212-738-6410 | tcatherwood@btig.com | |||

Capital One Securities | Chris Lucas | 571-633-8151 | christopher.lucas@capitalone.com | |||

Citigroup Global Markets | Manny Korchman | 212-816-1382 | emmanuel.korchman@citi.com | |||

Evercore ISI | Steve Sakwa | 212-446-9462 | steve.sakwa@evercoreisi.com | |||

Green Street Advisors | Jed Reagan | 949-640-8780 | jreagan@greenstreetadvisors.com | |||

Jefferies & Co. | Jonathan Petersen | 212-284-1705 | jpetersen@jefferies.com | |||

JP Morgan | Tony Paolone | 212-622-6682 | anthony.paolone@jpmorgan.com | |||

KeyBanc Capital Markets | Craig Mailman | 917-368-2316 | cmailman@key.com | |||

Mizuho Securities USA Inc. | Richard Anderson | 212-205-8445 | richard.anderson@us.mizuho-sc.com | |||

Raymond James | Bill Crow | 727-567-2594 | bill.crow@raymondjames.com | |||

Robert W. Baird & Co., Inc. | Dave Rodgers | 216-737-7341 | drodgers@rwbaird.com | |||

Stifel Financial Corp. | John Guinee | 443-224-1307 | jwguinee@stifel.com | |||

SunTrust Robinson Humphrey, Inc. | Michael Lewis | 212-319-5659 | michael.lewis@suntrust.com | |||

Wells Fargo Securities | Blaine Heck | 443-263-6529 | blaine.heck@wellsfargo.com | |||

With the exception of Green Street Advisors, the above-listed firms are those whose analysts publish research material on the Company and whose estimates of our FFO per share can be tracked through Thomson’s First Call Corporation. Any opinions, estimates, or forecasts the above analysts make regarding COPT’s future performance are their own and do not represent the views, estimates, or forecasts of COPT’s management.

2

Corporate Office Properties Trust

Selected Financial Summary Data

(in thousands, except per share data)

Page | Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||

SUMMARY OF RESULTS | Refer. | 6/30/18 | 3/31/18 | 12/31/17 | 9/30/17 | 6/30/17 | 6/30/18 | 6/30/17 | ||||||||||||||||||||||

Net income | 6 | $ | 21,085 | $ | 18,780 | $ | 11,008 | $ | 22,334 | $ | 18,859 | $ | 39,865 | $ | 41,599 | |||||||||||||||

NOI from real estate operations | 13 | $ | 80,918 | $ | 78,526 | $ | 81,439 | $ | 82,065 | $ | 80,867 | $ | 159,444 | $ | 160,317 | |||||||||||||||

Same Properties NOI | 16 | $ | 71,937 | $ | 69,840 | $ | 72,246 | $ | 71,640 | $ | 72,099 | $ | 141,777 | $ | 143,798 | |||||||||||||||

Same Properties Cash NOI | 17 | $ | 71,809 | $ | 68,905 | $ | 71,711 | $ | 71,616 | $ | 71,102 | $ | 140,714 | $ | 141,143 | |||||||||||||||

Adjusted EBITDA | 10 | $ | 75,572 | $ | 73,707 | $ | 76,862 | $ | 77,241 | $ | 75,499 | $ | 149,279 | $ | 149,288 | |||||||||||||||

Diluted AFFO avail. to common share and unit holders | 9 | $ | 39,742 | $ | 38,218 | $ | 31,920 | $ | 41,359 | $ | 43,687 | $ | 77,960 | $ | 82,034 | |||||||||||||||

Dividend per common share | N/A | $ | 0.275 | $ | 0.275 | $ | 0.275 | $ | 0.275 | $ | 0.275 | $ | 0.550 | $ | 0.550 | |||||||||||||||

Per share - diluted: | ||||||||||||||||||||||||||||||

EPS | 8 | $ | 0.19 | $ | 0.17 | $ | 0.10 | $ | 0.21 | $ | 0.08 | $ | 0.36 | $ | 0.26 | |||||||||||||||

FFO - NAREIT | 8 | $ | 0.51 | $ | 0.49 | $ | 0.47 | $ | 0.54 | $ | 0.42 | $ | 1.00 | $ | 0.92 | |||||||||||||||

FFO - as adjusted for comparability | 8 | $ | 0.51 | $ | 0.50 | $ | 0.53 | $ | 0.53 | $ | 0.49 | $ | 1.01 | $ | 0.96 | |||||||||||||||

Numerators for diluted per share amounts: | ||||||||||||||||||||||||||||||

Diluted EPS | 6 | $ | 19,317 | $ | 17,033 | $ | 9,509 | $ | 20,484 | $ | 7,523 | $ | 36,350 | $ | 25,237 | |||||||||||||||

Diluted FFO available to common share and unit holders | 7 | $ | 53,720 | $ | 51,537 | $ | 48,824 | $ | 55,871 | $ | 42,671 | $ | 105,257 | $ | 94,475 | |||||||||||||||

Diluted FFO available to common share and unit holders, as adjusted for comparability | 7 | $ | 53,941 | $ | 51,738 | $ | 54,065 | $ | 54,662 | $ | 50,562 | $ | 105,679 | $ | 98,629 | |||||||||||||||

Payout ratios: | ||||||||||||||||||||||||||||||

Diluted FFO | N/A | 54.3 | % | 56.0 | % | 58.7 | % | 50.4 | % | 66.0 | % | 55.1 | % | 59.6 | % | |||||||||||||||

Diluted FFO - as adjusted for comparability | N/A | 54.1 | % | 55.8 | % | 53.0 | % | 51.5 | % | 55.7 | % | 54.9 | % | 57.1 | % | |||||||||||||||

Diluted AFFO | N/A | 73.4 | % | 75.5 | % | 89.7 | % | 68.1 | % | 64.5 | % | 74.4 | % | 68.7 | % | |||||||||||||||

CAPITALIZATION | ||||||||||||||||||||||||||||||

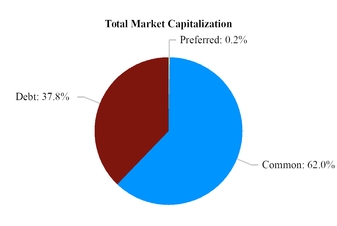

Total Market Capitalization | 28 | $ | 4,979,083 | $ | 4,598,028 | $ | 4,903,623 | $ | 5,272,960 | $ | 5,524,727 | |||||||||||||||||||

Total Equity Market Capitalization | 28 | $ | 3,095,017 | $ | 2,729,913 | $ | 3,061,456 | $ | 3,385,759 | $ | 3,612,511 | |||||||||||||||||||

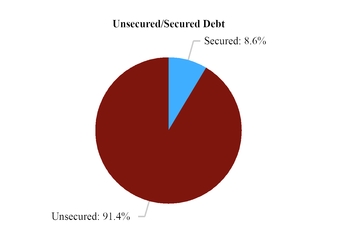

Gross debt | 29 | $ | 1,914,066 | $ | 1,898,115 | $ | 1,872,167 | $ | 1,917,201 | $ | 1,942,216 | |||||||||||||||||||

Net debt to adjusted book | 31 | 41.1 | % | 41.2 | % | 40.8 | % | 41.7 | % | 42.3 | % | N/A | N/A | |||||||||||||||||

Net debt plus preferred equity to adjusted book | 31 | 41.3 | % | 41.3 | % | 41.0 | % | 41.9 | % | 42.5 | % | N/A | N/A | |||||||||||||||||

Adjusted EBITDA fixed charge coverage ratio | 31 | 3.6 | x | 3.5 | x | 3.7 | x | 3.6 | x | 3.2 | x | 3.6 | x | 3.1 | x | |||||||||||||||

Net debt to in-place adjusted EBITDA ratio | 31 | 6.3 | x | 6.4 | x | 6.1 | x | 6.2 | x | 6.4 | x | N/A | N/A | |||||||||||||||||

Net debt plus pref. equity to in-place adj. EBITDA ratio | 31 | 6.3 | x | 6.4 | x | 6.1 | x | 6.2 | x | 6.4 | x | N/A | N/A | |||||||||||||||||

OTHER | ||||||||||||||||||||||||||||||

Revenue from early termination of leases | N/A | $ | 874 | $ | 1,246 | $ | 634 | $ | 749 | $ | 467 | $ | 2,120 | $ | 1,079 | |||||||||||||||

Capitalized interest costs | N/A | $ | 1,397 | $ | 1,374 | $ | 1,032 | $ | 1,055 | $ | 1,611 | $ | 2,771 | $ | 3,142 | |||||||||||||||

3

Corporate Office Properties Trust

Selected Portfolio Data (1)

6/30/18 (2) | 3/31/18 (2) | 12/31/17 | 9/30/17 | 6/30/17 | ||||||||||

Operating Office and Data Center Shell Properties | ||||||||||||||

# of Properties | ||||||||||||||

Total Portfolio | 159 | 159 | 159 | 159 | 165 | |||||||||

Consolidated Portfolio | 153 | 153 | 153 | 153 | 159 | |||||||||

Core Portfolio | 157 | 157 | 156 | 153 | 153 | |||||||||

Same Properties | 147 | 147 | 147 | 147 | 147 | |||||||||

% Occupied | ||||||||||||||

Total Portfolio | 91.4 | % | 91.0 | % | 93.6 | % | 93.4 | % | 93.0 | % | ||||

Consolidated Portfolio | 90.9 | % | 90.5 | % | 93.2 | % | 93.0 | % | 92.6 | % | ||||

Core Portfolio (2) | 91.5 | % | 91.1 | % | 94.5 | % | 94.3 | % | 93.8 | % | ||||

Same Properties | 91.2 | % | 90.9 | % | 92.1 | % | 91.8 | % | 91.5 | % | ||||

% Leased | ||||||||||||||

Total Portfolio | 93.3 | % | 91.8 | % | 94.2 | % | 94.2 | % | 94.0 | % | ||||

Consolidated Portfolio | 92.9 | % | 91.3 | % | 93.9 | % | 93.8 | % | 93.7 | % | ||||

Core Portfolio (2) | 93.4 | % | 91.9 | % | 95.1 | % | 95.1 | % | 94.8 | % | ||||

Same Properties | 93.3 | % | 91.7 | % | 92.8 | % | 92.7 | % | 92.7 | % | ||||

Square Feet (in thousands) | ||||||||||||||

Total Portfolio | 17,655 | 17,613 | 17,345 | 17,376 | 17,323 | |||||||||

Consolidated Portfolio | 16,694 | 16,651 | 16,383 | 16,413 | 16,361 | |||||||||

Core Portfolio | 17,498 | 17,456 | 17,059 | 16,737 | 16,568 | |||||||||

Same Properties | 16,233 | 16,233 | 16,233 | 16,233 | 16,233 | |||||||||

Wholesale Data Center (in megawatts (“MWs”)) | ||||||||||||||

MWs Operational | 19.25 | 19.25 | 19.25 | 19.25 | 19.25 | |||||||||

MWs Leased (3) | 16.86 | 16.86 | 16.86 | 16.86 | 16.86 | |||||||||

(1) | Our total portfolio, core portfolio and Same Properties reporting included six properties owned through an unconsolidated joint venture totaling 962,000 square feet that were 100% occupied and leased. |

(2) | The data above reflects the effect of two properties reported as fully placed in service during the first quarter of 2018 that were previously reported as construction projects since they were held for future lease to the United States Government. If these two properties were reported as fully placed in service as of 12/31/17, our Core Portfolio would have been 92.8% occupied and 93.3% leased as of 12/31/17. Our Same Properties data is reported as if these two properties were fully placed in service as of 1/1/17. |

(3) | Leased to tenants with further expansion rights of up to a combined 17.92 megawatts as of 6/30/18. |

4

Corporate Office Properties Trust

Consolidated Balance Sheets

(dollars in thousands)

6/30/18 | 3/31/18 | 12/31/17 | 9/30/17 | 6/30/17 | |||||||||||||||

Assets | |||||||||||||||||||

Properties, net | |||||||||||||||||||

Operating properties, net | $ | 2,760,632 | $ | 2,740,264 | $ | 2,737,611 | $ | 2,690,712 | $ | 2,688,174 | |||||||||

Construction and redevelopment in progress, including land (1) | 91,630 | 61,844 | 50,316 | 70,202 | 107,910 | ||||||||||||||

Land held (1) | 331,275 | 356,171 | 353,178 | 336,117 | 338,475 | ||||||||||||||

Total properties, net | 3,183,537 | 3,158,279 | 3,141,105 | 3,097,031 | 3,134,559 | ||||||||||||||

Assets held for sale (2) | 42,226 | 42,226 | 42,226 | 74,415 | 51,291 | ||||||||||||||

Cash and cash equivalents | 8,472 | 8,888 | 12,261 | 10,858 | 10,606 | ||||||||||||||

Investment in unconsolidated real estate joint venture | 40,806 | 41,311 | 41,787 | 42,263 | 42,752 | ||||||||||||||

Accounts receivable, net | 23,656 | 23,982 | 31,802 | 27,624 | 42,742 | ||||||||||||||

Deferred rent receivable, net | 89,606 | 87,985 | 86,710 | 84,743 | 89,832 | ||||||||||||||

Intangible assets on real estate acquisitions, net | 50,586 | 54,600 | 59,092 | 64,055 | 69,205 | ||||||||||||||

Deferred leasing costs, net | 48,183 | 47,886 | 48,322 | 47,033 | 40,506 | ||||||||||||||

Investing receivables | 54,427 | 58,800 | 57,493 | 56,108 | 54,598 | ||||||||||||||

Prepaid expenses and other assets, net | 70,863 | 72,281 | 74,407 | 72,711 | 56,213 | ||||||||||||||

Total assets | $ | 3,612,362 | $ | 3,596,238 | $ | 3,595,205 | $ | 3,576,841 | $ | 3,592,304 | |||||||||

Liabilities and equity | |||||||||||||||||||

Liabilities: | |||||||||||||||||||

Debt | $ | 1,871,445 | $ | 1,854,886 | $ | 1,828,333 | $ | 1,873,291 | $ | 1,897,734 | |||||||||

Accounts payable and accrued expenses | 88,885 | 95,721 | 108,137 | 121,483 | 95,267 | ||||||||||||||

Rents received in advance and security deposits | 24,905 | 26,569 | 25,648 | 26,223 | 25,444 | ||||||||||||||

Dividends and distributions payable | 29,449 | 29,146 | 28,921 | 28,462 | 28,462 | ||||||||||||||

Deferred revenue associated with operating leases | 10,783 | 11,246 | 11,682 | 12,047 | 13,172 | ||||||||||||||

Deferred property sale (2) | 43,377 | 43,377 | 43,377 | — | — | ||||||||||||||

Capital lease obligation | 640 | 11,778 | 15,853 | 16,347 | 16,177 | ||||||||||||||

Other liabilities | 9,849 | 17,643 | 41,822 | 43,866 | 56,076 | ||||||||||||||

Total liabilities | 2,079,333 | 2,090,366 | 2,103,773 | 2,121,719 | 2,132,332 | ||||||||||||||

Redeemable noncontrolling interests | 24,544 | 23,848 | 23,125 | 23,269 | 23,731 | ||||||||||||||

Equity: | |||||||||||||||||||

COPT’s shareholders’ equity: | |||||||||||||||||||

Common shares | 1,033 | 1,022 | 1,013 | 996 | 995 | ||||||||||||||

Additional paid-in capital | 2,254,430 | 2,221,427 | 2,201,047 | 2,150,067 | 2,146,119 | ||||||||||||||

Cumulative distributions in excess of net income | (822,270 | ) | (813,302 | ) | (802,085 | ) | (783,848 | ) | (777,049 | ) | |||||||||

Accumulated other comprehensive income (loss) | 9,012 | 7,204 | 2,167 | (859 | ) | (1,163 | ) | ||||||||||||

Total COPT’s shareholders’ equity | 1,442,205 | 1,416,351 | 1,402,142 | 1,366,356 | 1,368,902 | ||||||||||||||

Noncontrolling interests in subsidiaries | |||||||||||||||||||

Common units in the Operating Partnership | 44,651 | 44,327 | 45,097 | 44,716 | 46,871 | ||||||||||||||

Preferred units in the Operating Partnership | 8,800 | 8,800 | 8,800 | 8,800 | 8,800 | ||||||||||||||

Other consolidated entities | 12,829 | 12,546 | 12,268 | 11,981 | 11,668 | ||||||||||||||

Total noncontrolling interests in subsidiaries | 66,280 | 65,673 | 66,165 | 65,497 | 67,339 | ||||||||||||||

Total equity | 1,508,485 | 1,482,024 | 1,468,307 | 1,431,853 | 1,436,241 | ||||||||||||||

Total liabilities, redeemable noncontrolling interests and equity | $ | 3,612,362 | $ | 3,596,238 | $ | 3,595,205 | $ | 3,576,841 | $ | 3,592,304 | |||||||||

(1) | Refer to pages 24, 25 and 27 for detail. |

(2) | As of 12/31/17 and each subsequent reporting date, these lines represent the carrying amount and sale proceeds pertaining to a property sale not recognized for accounting purposes that we expect to recognize by 6/30/19. |

5

Corporate Office Properties Trust

Consolidated Statements of Operations

(in thousands, except per share data)

Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||

6/30/18 | 3/31/18 | 12/31/17 | 9/30/17 | 6/30/17 | 6/30/18 | 6/30/17 | |||||||||||||||||||||

Revenues | |||||||||||||||||||||||||||

Rental revenue | $ | 101,121 | $ | 100,834 | $ | 101,485 | $ | 102,275 | $ | 101,347 | $ | 201,955 | $ | 201,962 | |||||||||||||

Tenant recoveries and other real estate operations revenue | 28,041 | 27,444 | 26,200 | 24,956 | 26,950 | 55,485 | 53,102 | ||||||||||||||||||||

Construction contract and other service revenues | 17,581 | 27,198 | 36,882 | 29,786 | 23,138 | 44,779 | 36,172 | ||||||||||||||||||||

Total revenues | 146,743 | 155,476 | 164,567 | 157,017 | 151,435 | 302,219 | 291,236 | ||||||||||||||||||||

Expenses | |||||||||||||||||||||||||||

Property operating expenses | 49,446 | 50,951 | 47,449 | 46,368 | 48,628 | 100,397 | 97,147 | ||||||||||||||||||||

Depreciation and amortization associated with real estate operations | 33,190 | 33,512 | 33,938 | 34,438 | 32,793 | 66,702 | 65,852 | ||||||||||||||||||||

Construction contract and other service expenses | 16,941 | 26,216 | 36,029 | 28,788 | 22,315 | 43,157 | 34,801 | ||||||||||||||||||||

Impairment losses (recoveries) | — | — | 13,659 | (161 | ) | 1,625 | — | 1,625 | |||||||||||||||||||

General and administrative expenses | 6,067 | 5,861 | 5,552 | 5,692 | 6,017 | 11,928 | 12,764 | ||||||||||||||||||||

Leasing expenses | 1,561 | 1,431 | 1,447 | 1,676 | 1,842 | 2,992 | 3,706 | ||||||||||||||||||||

Business development expenses and land carry costs | 1,234 | 1,614 | 1,646 | 1,277 | 1,597 | 2,848 | 3,290 | ||||||||||||||||||||

Total operating expenses | 108,439 | 119,585 | 139,720 | 118,078 | 114,817 | 228,024 | 219,185 | ||||||||||||||||||||

Operating income | 38,304 | 35,891 | 24,847 | 38,939 | 36,618 | 74,195 | 72,051 | ||||||||||||||||||||

Interest expense | (18,945 | ) | (18,784 | ) | (19,211 | ) | (19,615 | ) | (19,163 | ) | (37,729 | ) | (38,157 | ) | |||||||||||||

Interest and other income | 1,439 | 1,359 | 1,501 | 1,508 | 1,583 | 2,798 | 3,309 | ||||||||||||||||||||

Loss on early extinguishment of debt | — | — | — | — | (513 | ) | — | (513 | ) | ||||||||||||||||||

Income before equity in income of unconsolidated entities and income taxes | 20,798 | 18,466 | 7,137 | 20,832 | 18,525 | 39,264 | 36,690 | ||||||||||||||||||||

Equity in income of unconsolidated entities | 373 | 373 | 372 | 371 | 370 | 746 | 747 | ||||||||||||||||||||

Income tax expense | (63 | ) | (55 | ) | (953 | ) | (57 | ) | (48 | ) | (118 | ) | (88 | ) | |||||||||||||

Income before gain on sales of real estate | 21,108 | 18,784 | 6,556 | 21,146 | 18,847 | 39,892 | 37,349 | ||||||||||||||||||||

Gain on sales of real estate | (23 | ) | (4 | ) | 4,452 | 1,188 | 12 | (27 | ) | 4,250 | |||||||||||||||||

Net income | 21,085 | 18,780 | 11,008 | 22,334 | 18,859 | 39,865 | 41,599 | ||||||||||||||||||||

Net income attributable to noncontrolling interests | |||||||||||||||||||||||||||

Common units in the Operating Partnership | (608 | ) | (544 | ) | (314 | ) | (693 | ) | (261 | ) | (1,152 | ) | (883 | ) | |||||||||||||

Preferred units in the Operating Partnership | (165 | ) | (165 | ) | (165 | ) | (165 | ) | (165 | ) | (330 | ) | (330 | ) | |||||||||||||

Other consolidated entities | (878 | ) | (921 | ) | (908 | ) | (897 | ) | (907 | ) | (1,799 | ) | (1,841 | ) | |||||||||||||

Net income attributable to COPT | 19,434 | 17,150 | 9,621 | 20,579 | 17,526 | 36,584 | 38,545 | ||||||||||||||||||||

Preferred share dividends | — | — | — | — | (3,039 | ) | — | (6,219 | ) | ||||||||||||||||||

Issuance costs associated with redeemed preferred shares | — | — | — | — | (6,847 | ) | — | (6,847 | ) | ||||||||||||||||||

Net income attributable to COPT common shareholders | $ | 19,434 | $ | 17,150 | $ | 9,621 | $ | 20,579 | $ | 7,640 | $ | 36,584 | $ | 25,479 | |||||||||||||

Amount allocable to share-based compensation awards | (117 | ) | (117 | ) | (112 | ) | (95 | ) | (117 | ) | (234 | ) | (242 | ) | |||||||||||||

Numerator for diluted EPS | $ | 19,317 | $ | 17,033 | $ | 9,509 | $ | 20,484 | $ | 7,523 | $ | 36,350 | $ | 25,237 | |||||||||||||

6

Corporate Office Properties Trust

Funds from Operations

(in thousands)

Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||

6/30/18 | 3/31/18 | 12/31/17 | 9/30/17 | 6/30/17 | 6/30/18 | 6/30/17 | |||||||||||||||||||||

Net income | $ | 21,085 | $ | 18,780 | $ | 11,008 | $ | 22,334 | $ | 18,859 | $ | 39,865 | $ | 41,599 | |||||||||||||

Real estate-related depreciation and amortization | 33,190 | 33,512 | 33,938 | 34,438 | 32,793 | 66,702 | 65,852 | ||||||||||||||||||||

Impairment losses (recoveries) on previously depreciated operating properties | — | — | 9,004 | (159 | ) | 1,610 | — | 1,610 | |||||||||||||||||||

Gain on sales of previously depreciated operating properties | 23 | 4 | (4,452 | ) | (8 | ) | (12 | ) | 27 | (31 | ) | ||||||||||||||||

Depreciation and amortization on unconsolidated real estate JV (1) | 564 | 563 | 563 | 563 | 563 | 1,127 | 1,126 | ||||||||||||||||||||

FFO - per NAREIT (2)(3) | 54,862 | 52,859 | 50,061 | 57,168 | 53,813 | 107,721 | 110,156 | ||||||||||||||||||||

Preferred share dividends | — | — | — | — | (3,039 | ) | — | (6,219 | ) | ||||||||||||||||||

Issuance costs associated with redeemed preferred shares | — | — | — | — | (6,847 | ) | — | (6,847 | ) | ||||||||||||||||||

Noncontrolling interests - preferred units in the Operating Partnership | (165 | ) | (165 | ) | (165 | ) | (165 | ) | (165 | ) | (330 | ) | (330 | ) | |||||||||||||

FFO allocable to other noncontrolling interests (4) | (753 | ) | (944 | ) | (874 | ) | (917 | ) | (906 | ) | (1,697 | ) | (1,884 | ) | |||||||||||||

Basic and diluted FFO allocable to share-based compensation awards | (224 | ) | (213 | ) | (198 | ) | (215 | ) | (185 | ) | (437 | ) | (401 | ) | |||||||||||||

Basic and Diluted FFO available to common share and common unit holders (3) | 53,720 | 51,537 | 48,824 | 55,871 | 42,671 | 105,257 | 94,475 | ||||||||||||||||||||

Gain on sales of non-operating properties | — | — | — | (1,180 | ) | — | — | (4,219 | ) | ||||||||||||||||||

Impairment losses (recoveries) on non-operating properties | — | — | 4,655 | (2 | ) | 15 | — | 15 | |||||||||||||||||||

Income tax expense associated with FFO comparability adjustments | — | — | 800 | — | — | — | — | ||||||||||||||||||||

(Gain) loss on interest rate derivatives | — | — | (191 | ) | (34 | ) | 444 | — | (9 | ) | |||||||||||||||||

Loss on early extinguishment of debt | — | — | — | — | 513 | — | 513 | ||||||||||||||||||||

Issuance costs associated with redeemed preferred shares | — | — | — | — | 6,847 | — | 6,847 | ||||||||||||||||||||

Demolition costs on redevelopment and nonrecurring improvements | 9 | 39 | — | — | 72 | 48 | 294 | ||||||||||||||||||||

Executive transition costs | 213 | 163 | — | 2 | 31 | 376 | 730 | ||||||||||||||||||||

Diluted FFO comparability adjustments allocable to share-based compensation awards | (1 | ) | (1 | ) | (23 | ) | 5 | (31 | ) | (2 | ) | (17 | ) | ||||||||||||||

Diluted FFO avail. to common share and common unit holders, as adj. for comparability (3) | $ | 53,941 | $ | 51,738 | $ | 54,065 | $ | 54,662 | $ | 50,562 | $ | 105,679 | $ | 98,629 | |||||||||||||

(1) | FFO adjustment pertaining to COPT’s share of an unconsolidated real estate joint venture reported on page 33. |

(2) | See reconciliation on page 34 for components of FFO per NAREIT. |

(3) | Refer to the section entitled “Definitions” for a definition of this measure. |

(4) | Pertains to noncontrolling interests in consolidated real estate joint ventures reported on page 32. |

7

Corporate Office Properties Trust

Diluted Share and Unit Computations

(in thousands)

Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||

6/30/18 | 3/31/18 | 12/31/17 | 9/30/17 | 6/30/17 | 6/30/18 | 6/30/17 | |||||||||||||||||||||

EPS Denominator: | |||||||||||||||||||||||||||

Weighted average common shares - basic | 101,789 | 100,999 | 99,304 | 99,112 | 99,036 | 101,397 | 98,725 | ||||||||||||||||||||

Dilutive effect of forward equity sale agreements and share-based compensation awards | 119 | 144 | 283 | 146 | 160 | 131 | 158 | ||||||||||||||||||||

Weighted average common shares - diluted | 101,908 | 101,143 | 99,587 | 99,258 | 99,196 | 101,528 | 98,883 | ||||||||||||||||||||

Diluted EPS | $ | 0.19 | $ | 0.17 | $ | 0.10 | $ | 0.21 | $ | 0.08 | $ | 0.36 | $ | 0.26 | |||||||||||||

Weighted Average Shares for period ended: | |||||||||||||||||||||||||||

Common Shares Outstanding | 101,789 | 100,999 | 99,304 | 99,112 | 99,036 | 101,397 | 98,725 | ||||||||||||||||||||

Dilutive effect of forward equity sale agreements and share-based compensation awards | 119 | 144 | 283 | 146 | 160 | 131 | 158 | ||||||||||||||||||||

Common Units | 3,197 | 3,221 | 3,252 | 3,350 | 3,405 | 3,208 | 3,425 | ||||||||||||||||||||

Denominator for diluted FFO per share and as adjusted for comparability | 105,105 | 104,364 | 102,839 | 102,608 | 102,601 | 104,736 | 102,308 | ||||||||||||||||||||

Weighted average common units | (3,197 | ) | (3,221 | ) | (3,252 | ) | (3,350 | ) | (3,405 | ) | (3,208 | ) | (3,425 | ) | |||||||||||||

Denominator for diluted EPS | 101,908 | 101,143 | 99,587 | 99,258 | 99,196 | 101,528 | 98,883 | ||||||||||||||||||||

Diluted FFO per share - NAREIT | $ | 0.51 | $ | 0.49 | $ | 0.47 | $ | 0.54 | $ | 0.42 | $ | 1.00 | $ | 0.92 | |||||||||||||

Diluted FFO per share - as adjusted for comparability | $ | 0.51 | $ | 0.50 | $ | 0.53 | $ | 0.53 | $ | 0.49 | $ | 1.01 | $ | 0.96 | |||||||||||||

8

Corporate Office Properties Trust

Adjusted Funds from Operations

(in thousands)

Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||

6/30/18 | 3/31/18 | 12/31/17 | 9/30/17 | 6/30/17 | 6/30/18 | 6/30/17 | |||||||||||||||||||||

Diluted FFO available to common share and common unit holders, as adjusted for comparability | $ | 53,941 | $ | 51,738 | $ | 54,065 | $ | 54,662 | $ | 50,562 | $ | 105,679 | $ | 98,629 | |||||||||||||

Straight line rent adjustments and lease incentive amortization | (1,195 | ) | (828 | ) | (1,343 | ) | (561 | ) | 1,517 | (2,023 | ) | 1,950 | |||||||||||||||

Amortization of intangibles included in NOI | 231 | 356 | 342 | 318 | 325 | 587 | 684 | ||||||||||||||||||||

Share-based compensation, net of amounts capitalized | 1,550 | 1,485 | 1,523 | 1,272 | 1,309 | 3,035 | 2,558 | ||||||||||||||||||||

Amortization of deferred financing costs | 468 | 468 | 443 | 554 | 922 | 936 | 1,931 | ||||||||||||||||||||

Amortization of net debt discounts, net of amounts capitalized | 358 | 354 | 350 | 347 | 343 | 712 | 682 | ||||||||||||||||||||

Accum. other comprehensive loss on derivatives amortized to expense | 34 | 34 | 54 | 53 | 36 | 68 | 36 | ||||||||||||||||||||

Replacement capital expenditures (1) | (15,613 | ) | (15,520 | ) | (23,475 | ) | (15,233 | ) | (11,269 | ) | (31,133 | ) | (24,318 | ) | |||||||||||||

Other diluted AFFO adjustments associated with real estate JVs (2) | (32 | ) | 131 | (39 | ) | (53 | ) | (58 | ) | 99 | (118 | ) | |||||||||||||||

Diluted AFFO available to common share and common unit holders (“diluted AFFO”) | $ | 39,742 | $ | 38,218 | $ | 31,920 | $ | 41,359 | $ | 43,687 | $ | 77,960 | $ | 82,034 | |||||||||||||

Replacement capital expenditures (1) | |||||||||||||||||||||||||||

Tenant improvements and incentives | $ | 8,117 | $ | 8,615 | $ | 14,804 | $ | 11,342 | $ | 6,148 | $ | 16,732 | $ | 10,888 | |||||||||||||

Building improvements | 5,775 | 1,921 | 9,241 | 3,865 | 5,972 | 7,696 | 9,202 | ||||||||||||||||||||

Leasing costs | 1,822 | 1,280 | 3,242 | 2,428 | 1,666 | 3,102 | 2,817 | ||||||||||||||||||||

Net additions to (exclusions from) tenant improvements and incentives | 1,315 | 3,289 | (2,929 | ) | (1,509 | ) | 626 | 4,604 | 7,422 | ||||||||||||||||||

Excluded building improvements | (1,370 | ) | 415 | (853 | ) | (893 | ) | (3,143 | ) | (955 | ) | (6,011 | ) | ||||||||||||||

Excluded leasing costs | (46 | ) | — | (30 | ) | — | — | (46 | ) | — | |||||||||||||||||

Replacement capital expenditures | $ | 15,613 | $ | 15,520 | $ | 23,475 | $ | 15,233 | $ | 11,269 | $ | 31,133 | $ | 24,318 | |||||||||||||

(1) Refer to the section entitled “Definitions” for a definition of this measure. | |||||||||||||||||||||||||||

(2) AFFO adjustments pertaining to noncontrolling interests on consolidated joint ventures reported on page 32 and COPT’s share of an unconsolidated real estate joint venture reported on page 33. | |||||||||||||||||||||||||||

9

Corporate Office Properties Trust

EBITDAre and Adjusted EBITDA

(in thousands)

Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||

6/30/18 | 3/31/18 | 12/31/17 | 9/30/17 | 6/30/17 | 6/30/18 | 6/30/17 | |||||||||||||||||||||

Net income | $ | 21,085 | $ | 18,780 | $ | 11,008 | $ | 22,334 | $ | 18,859 | $ | 39,865 | $ | 41,599 | |||||||||||||

Interest expense | 18,945 | 18,784 | 19,211 | 19,615 | 19,163 | 37,729 | 38,157 | ||||||||||||||||||||

Income tax expense | 63 | 55 | 953 | 57 | 48 | 118 | 88 | ||||||||||||||||||||

Depreciation of furniture, fixtures and equipment | 459 | 523 | 600 | 577 | 585 | 982 | 1,096 | ||||||||||||||||||||

Real estate-related depreciation and amortization | 33,190 | 33,512 | 33,938 | 34,438 | 32,793 | 66,702 | 65,852 | ||||||||||||||||||||

Impairment losses (recoveries) on previously depreciated operating properties | — | — | 9,004 | (159 | ) | 1,610 | — | 1,610 | |||||||||||||||||||

Gain on sales of previously depreciated operating properties | 23 | 4 | (4,452 | ) | (8 | ) | (12 | ) | 27 | (31 | ) | ||||||||||||||||

Adjustments from unconsolidated real estate JV (1) | 828 | 824 | 829 | 830 | 827 | 1,652 | 1,651 | ||||||||||||||||||||

EBITDAre | 74,593 | 72,482 | 71,091 | 77,684 | 73,873 | $ | 147,075 | $ | 150,022 | ||||||||||||||||||

Impairment losses (recoveries) on non-operating properties | — | — | 4,655 | (2 | ) | 15 | — | 15 | |||||||||||||||||||

Loss on early extinguishment of debt | — | — | — | — | 513 | — | 513 | ||||||||||||||||||||

Gain on sales of non-operating properties | — | — | — | (1,180 | ) | — | — | (4,219 | ) | ||||||||||||||||||

Business development expenses | 757 | 1,023 | 1,116 | 737 | 995 | 1,780 | 1,933 | ||||||||||||||||||||

Demolition costs on redevelopment and nonrecurring improvements | 9 | 39 | — | — | 72 | 48 | 294 | ||||||||||||||||||||

Executive transition costs | 213 | 163 | — | 2 | 31 | 376 | 730 | ||||||||||||||||||||

Adjusted EBITDA | 75,572 | 73,707 | 76,862 | 77,241 | 75,499 | $ | 149,279 | $ | 149,288 | ||||||||||||||||||

Proforma NOI adjustment for property changes within period | 418 | — | (578 | ) | (410 | ) | 421 | ||||||||||||||||||||

In-place adjusted EBITDA | $ | 75,990 | $ | 73,707 | $ | 76,284 | $ | 76,831 | $ | 75,920 | |||||||||||||||||

(1) Includes COPT’s share of adjusted EBITDA adjustments in an unconsolidated real estate joint venture (see page 33).

10

Corporate Office Properties Trust

Office and Data Center Shell Properties by Segment (1) - 6/30/18

(square feet in thousands)

# of Properties | Operational Square Feet | Occupancy % | Leased % | |||||||||

Core Portfolio: (2) | ||||||||||||

Defense/IT Locations: | ||||||||||||

Fort Meade/Baltimore Washington (“BW”) Corridor: | ||||||||||||

National Business Park | 31 | 3,820 | 88.6 | % | 88.9 | % | ||||||

Howard County | 34 | 2,662 | 91.9 | % | 94.4 | % | ||||||

Other | 21 | 1,563 | 94.7 | % | 94.9 | % | ||||||

Total Fort Meade/BW Corridor | 86 | 8,045 | 90.9 | % | 91.9 | % | ||||||

Northern Virginia (“NoVA”) Defense/IT | 13 | 2,000 | 82.9 | % | 91.3 | % | ||||||

Lackland AFB (San Antonio, Texas) | 7 | 953 | 100.0 | % | 100.0 | % | ||||||

Navy Support | 21 | 1,253 | 88.2 | % | 91.6 | % | ||||||

Redstone Arsenal (Huntsville, Alabama) | 7 | 651 | 98.2 | % | 99.0 | % | ||||||

Data Center Shells | ||||||||||||

Consolidated Properties | 10 | 1,626 | 100.0 | % | 100.0 | % | ||||||

Unconsolidated JV Properties (3) | 6 | 962 | 100.0 | % | 100.0 | % | ||||||

Total Defense/IT Locations | 150 | 15,490 | 92.0 | % | 94.0 | % | ||||||

Regional Office | 7 | 2,008 | 87.2 | % | 88.8 | % | ||||||

Core Portfolio | 157 | 17,498 | 91.5 | % | 93.4 | % | ||||||

Other Properties | 2 | 157 | 82.2 | % | 82.2 | % | ||||||

Total Portfolio | 159 | 17,655 | 91.4 | % | 93.3 | % | ||||||

Consolidated Portfolio | 153 | 16,694 | 90.9 | % | 92.9 | % | ||||||

(1) | This presentation sets forth Core Portfolio data by segment followed by data for the remainder of the portfolio. |

(2) | Represents Defense/IT Locations and Regional Office properties. |

(3) | See page 33 for additional disclosure regarding an unconsolidated real estate joint venture. |

11

Corporate Office Properties Trust

NOI from Real Estate Operations and Occupancy by Property Grouping

(dollars and square feet in thousands)

6/30/18 | |||||||||||||||||||||||||

# of Office and Data Center Shell Properties | Operational Square Feet | Office and Data Center Shell Properties Annualized Rental Revenue (2) | Percentage of Total Office and Data Center Shell Properties Annualized Rental Revenue (2) | NOI from Real Estate Operations for Three Months Ended | NOI from Real Estate Operations for Six Months Ended | ||||||||||||||||||||

Property Grouping | % Occupied (1) | % Leased (1) | 6/30/18 | 6/30/18 | |||||||||||||||||||||

Core Portfolio: | |||||||||||||||||||||||||

Same Properties (3) | |||||||||||||||||||||||||

Consolidated properties | 139 | 15,114 | 90.8% | 93.0% | $ | 446,331 | 92.9 | % | $ | 70,147 | $ | 138,362 | |||||||||||||

Unconsolidated real estate JV (4) | 6 | 962 | 100.0% | 100.0% | 5,448 | 1.1 | % | 1,202 | 2,401 | ||||||||||||||||

Total Same Properties in Core Portfolio (3) | 145 | 16,076 | 91.3% | 93.4% | 451,779 | 94.0 | % | 71,349 | 140,763 | ||||||||||||||||

Properties Placed in Service (5) | 12 | 1,422 | 93.0% | 93.2% | 25,688 | 5.3 | % | 4,810 | 9,093 | ||||||||||||||||

Wholesale Data Center and Other | N/A | N/A | N/A | N/A | N/A | N/A | 4,174 | 8,464 | |||||||||||||||||

Total Core Portfolio | 157 | 17,498 | 91.5% | 93.4% | 477,467 | 99.3 | % | 80,333 | 158,320 | ||||||||||||||||

Disposed Office Properties | N/A | N/A | N/A | N/A | N/A | N/A | (3 | ) | 110 | ||||||||||||||||

Other Properties (Same Properties) | 2 | 157 | 82.2% | 82.2% | 3,133 | 0.7 | % | 588 | 1,014 | ||||||||||||||||

Total Portfolio | 159 | 17,655 | 91.4% | 93.3% | $ | 480,600 | 100.0 | % | $ | 80,918 | $ | 159,444 | |||||||||||||

Consolidated Portfolio | 153 | 16,694 | 90.9% | 92.9% | $ | 475,152 | 98.9 | % | $ | 79,716 | $ | 157,043 | |||||||||||||

6/30/18 | |||||||||||||||||||||||||

# of Office and Data Center Shell Properties | Operational Square Feet | Office and Data Center Shell Properties Annualized Rental Revenue (2) | Percentage of Core Office and Data Center Shell Properties Annualized Rental Revenue (2) | NOI from Real Estate Operations for Three Months Ended | NOI from Real Estate Operations for Six Months Ended | ||||||||||||||||||||

Property Grouping | % Occupied (1) | % Leased (1) | 6/30/18 | 6/30/18 | |||||||||||||||||||||

Core Portfolio: | |||||||||||||||||||||||||

Defense/IT Locations | |||||||||||||||||||||||||

Consolidated properties | 144 | 14,528 | 91.5% | 93.6% | $ | 416,378 | 87.2 | % | $ | 66,991 | $ | 132,643 | |||||||||||||

Unconsolidated real estate JV (4) | 6 | 962 | 100.0% | 100.0% | 5,448 | 1.1 | % | 1,202 | 2,401 | ||||||||||||||||

Total Defense/IT Locations | 150 | 15,490 | 92.0% | 94.0% | 421,826 | 88.3 | % | 68,193 | 135,044 | ||||||||||||||||

Regional Office | 7 | 2,008 | 87.2% | 88.8% | 55,641 | 11.7 | % | 8,127 | 15,442 | ||||||||||||||||

Wholesale Data Center and Other | N/A | N/A | N/A | N/A | N/A | N/A | 4,013 | 7,834 | |||||||||||||||||

Total Core Portfolio | 157 | 17,498 | 91.5% | 93.4% | $ | 477,467 | 100.0 | % | $ | 80,333 | $ | 158,320 | |||||||||||||

(1) | Percentages calculated based on operational square feet. |

(2) | Excludes Annualized Rental Revenue from our wholesale data center, DC-6, of $22.7 million as of 6/30/18. With regard to properties owned through an unconsolidated real estate joint venture, we include the portion of Annualized Rental Revenue allocable to COPT’s ownership interest. |

(3) | Includes office and data center shell properties continually owned and 100% operational since at least 1/1/17. |

(4) | Represents total information pertaining to properties owned through an unconsolidated real estate joint venture except for the amounts reported for Annualized Rental Revenue and NOI from real estate operations, which represent the portion allocable to COPT’s ownership interest. See page 33 for additional disclosure regarding this joint venture. |

(5) | Newly constructed or redeveloped properties placed in service that were not fully operational by 1/1/17. |

12

Corporate Office Properties Trust

Consolidated Real Estate Revenues and NOI by Segment

(dollars in thousands)

Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||

6/30/18 | 3/31/18 | 12/31/17 | 9/30/17 | 6/30/17 | 6/30/18 | 6/30/17 | |||||||||||||||||||||

Consolidated real estate revenues | |||||||||||||||||||||||||||

Defense/IT Locations: | |||||||||||||||||||||||||||

Fort Meade/BW Corridor | $ | 61,993 | $ | 62,782 | $ | 62,220 | $ | 61,254 | $ | 61,284 | $ | 124,775 | $ | 122,139 | |||||||||||||

NoVA Defense/IT | 13,118 | 12,561 | 12,126 | 12,190 | 11,095 | 25,679 | 22,802 | ||||||||||||||||||||

Lackland Air Force Base | 12,382 | 11,443 | 11,522 | 11,024 | 13,029 | 23,825 | 24,663 | ||||||||||||||||||||

Navy Support | 8,127 | 7,870 | 7,587 | 7,494 | 7,449 | 15,997 | 14,459 | ||||||||||||||||||||

Redstone Arsenal | 3,652 | 3,633 | 3,706 | 3,532 | 3,624 | 7,285 | 7,084 | ||||||||||||||||||||

Data Center Shells-Consolidated | 5,955 | 5,831 | 6,322 | 6,676 | 5,800 | 11,786 | 11,322 | ||||||||||||||||||||

Total Defense/IT Locations | 105,227 | 104,120 | 103,483 | 102,170 | 102,281 | 209,347 | 202,469 | ||||||||||||||||||||

Regional Office | 15,296 | 15,284 | 15,868 | 16,656 | 17,462 | 30,580 | 35,738 | ||||||||||||||||||||

Wholesale Data Center | 8,105 | 8,077 | 7,674 | 7,398 | 7,033 | 16,182 | 13,803 | ||||||||||||||||||||

Other | 534 | 797 | 660 | 1,007 | 1,521 | 1,331 | 3,054 | ||||||||||||||||||||

Consolidated real estate revenues | $ | 129,162 | $ | 128,278 | $ | 127,685 | $ | 127,231 | $ | 128,297 | $ | 257,440 | $ | 255,064 | |||||||||||||

NOI | |||||||||||||||||||||||||||

Defense/IT Locations: | |||||||||||||||||||||||||||

Fort Meade/BW Corridor | $ | 41,894 | $ | 41,178 | $ | 41,880 | $ | 41,546 | $ | 41,155 | $ | 83,072 | $ | 81,490 | |||||||||||||

NoVA Defense/IT | 8,209 | 7,838 | 8,202 | 7,847 | 6,876 | 16,047 | 14,131 | ||||||||||||||||||||

Lackland Air Force Base | 4,888 | 4,845 | 4,835 | 4,831 | 4,899 | 9,733 | 9,731 | ||||||||||||||||||||

Navy Support | 4,696 | 4,566 | 4,359 | 4,337 | 4,424 | 9,262 | 8,225 | ||||||||||||||||||||

Redstone Arsenal | 2,143 | 2,193 | 2,217 | 2,100 | 2,133 | 4,336 | 4,222 | ||||||||||||||||||||

Data Center Shells | |||||||||||||||||||||||||||

Consolidated properties | 5,156 | 5,037 | 5,486 | 6,039 | 5,223 | 10,193 | 10,086 | ||||||||||||||||||||

COPT’s share of unconsolidated real estate JV (1) | 1,202 | 1,199 | 1,203 | 1,202 | 1,198 | 2,401 | 2,400 | ||||||||||||||||||||

Total Defense/IT Locations | 68,188 | 66,856 | 68,182 | 67,902 | 65,908 | 135,044 | 130,285 | ||||||||||||||||||||

Regional Office | 8,127 | 7,406 | 8,860 | 9,250 | 10,380 | 15,533 | 21,170 | ||||||||||||||||||||

Wholesale Data Center | 3,955 | 3,819 | 4,164 | 4,223 | 3,532 | 7,774 | 6,937 | ||||||||||||||||||||

Other | 648 | 445 | 233 | 690 | 1,047 | 1,093 | 1,925 | ||||||||||||||||||||

NOI from real estate operations | $ | 80,918 | $ | 78,526 | $ | 81,439 | $ | 82,065 | $ | 80,867 | $ | 159,444 | $ | 160,317 | |||||||||||||

(1) See page 33 for additional disclosure regarding an unconsolidated real estate joint venture.

13

Corporate Office Properties Trust

Cash NOI by Segment

(dollars in thousands)

Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||

6/30/18 | 3/31/18 | 12/31/17 | 9/30/17 | 6/30/17 | 6/30/18 | 6/30/17 | |||||||||||||||||||||

Cash NOI | |||||||||||||||||||||||||||

Defense/IT Locations: | |||||||||||||||||||||||||||

Fort Meade/BW Corridor | $ | 41,338 | $ | 40,212 | $ | 41,685 | $ | 41,630 | $ | 40,343 | $ | 81,550 | $ | 80,617 | |||||||||||||

NoVA Defense/IT | 7,312 | 7,218 | 7,426 | 8,206 | 7,090 | 14,530 | 14,031 | ||||||||||||||||||||

Lackland Air Force Base | 5,067 | 5,024 | 5,016 | 4,886 | 4,943 | 10,091 | 9,819 | ||||||||||||||||||||

Navy Support | 4,933 | 4,577 | 4,341 | 4,266 | 4,450 | 9,510 | 8,303 | ||||||||||||||||||||

Redstone Arsenal | 2,200 | 2,167 | 2,165 | 2,098 | 2,019 | 4,367 | 4,048 | ||||||||||||||||||||

Data Center Shells | |||||||||||||||||||||||||||

Consolidated properties | 4,755 | 4,297 | 4,646 | 5,412 | 5,172 | 9,052 | 9,995 | ||||||||||||||||||||

COPT’s share of unconsolidated real estate JV (1) | 1,134 | 1,132 | 1,130 | 1,120 | 1,109 | 2,266 | 2,219 | ||||||||||||||||||||

Total Defense/IT Locations | 66,739 | 64,627 | 66,409 | 67,618 | 65,126 | 131,366 | 129,032 | ||||||||||||||||||||

Regional Office | 7,465 | 6,894 | 8,428 | 8,942 | 10,046 | 14,359 | 19,830 | ||||||||||||||||||||

Wholesale Data Center | 3,479 | 3,374 | 3,470 | 3,352 | 3,211 | 6,853 | 6,593 | ||||||||||||||||||||

Other | 673 | 469 | 263 | 580 | 839 | 1,142 | 1,463 | ||||||||||||||||||||

Cash NOI from real estate operations | 78,356 | 75,364 | 78,570 | 80,492 | 79,222 | $ | 153,720 | $ | 156,918 | ||||||||||||||||||

Straight line rent adjustments and lease incentive amortization | 1,209 | 519 | 1,027 | 244 | (1,832 | ) | 1,728 | (2,607 | ) | ||||||||||||||||||

Amortization of acquired above- and below-market rents | (176 | ) | (300 | ) | (287 | ) | (263 | ) | (270 | ) | (476 | ) | (573 | ) | |||||||||||||

Amortization of below-market cost arrangements | (148 | ) | (149 | ) | (149 | ) | (148 | ) | (149 | ) | (297 | ) | (298 | ) | |||||||||||||

Lease termination fees, gross | 771 | 1,155 | 828 | 860 | 517 | 1,926 | 1,223 | ||||||||||||||||||||

Tenant funded landlord assets and lease incentives | 838 | 1,870 | 1,377 | 798 | 3,290 | 2,708 | 5,473 | ||||||||||||||||||||

Cash NOI adjustments in unconsolidated real estate JV | 68 | 67 | 73 | 82 | 89 | 135 | 181 | ||||||||||||||||||||

NOI from real estate operations | $ | 80,918 | $ | 78,526 | $ | 81,439 | $ | 82,065 | $ | 80,867 | $ | 159,444 | $ | 160,317 | |||||||||||||

(1) | See page 33 for additional disclosure regarding an unconsolidated real estate joint venture. |

14

Corporate Office Properties Trust

Same Properties (1) Average Occupancy Rates by Segment

(square feet in thousands)

Number of Buildings | Rentable Square Feet | Three Months Ended | Six Months Ended | |||||||||||||||||||||||

6/30/18 | 3/31/18 | 12/31/17 | 9/30/17 | 6/30/17 | 6/30/18 | 6/30/17 | ||||||||||||||||||||

Core Portfolio: | ||||||||||||||||||||||||||

Defense/IT Locations: | ||||||||||||||||||||||||||

Fort Meade/BW Corridor | 81 | 7,759 | 91.3 | % | 91.4 | % | 93.7 | % | 92.9 | % | 92.6 | % | 91.3 | % | 92.5 | % | ||||||||||

NoVA Defense/IT | 12 | 1,760 | 80.5 | % | 80.0 | % | 79.5 | % | 78.9 | % | 78.4 | % | 80.2 | % | 78.2 | % | ||||||||||

Lackland Air Force Base | 7 | 953 | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | ||||||||||

Navy Support | 21 | 1,253 | 88.3 | % | 87.7 | % | 85.6 | % | 82.5 | % | 80.9 | % | 88.0 | % | 79.0 | % | ||||||||||

Redstone Arsenal | 6 | 632 | 99.2 | % | 99.2 | % | 99.2 | % | 99.7 | % | 100.0 | % | 99.2 | % | 98.8 | % | ||||||||||

Data Center Shells | 11 | 1,711 | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | ||||||||||

Total Defense/IT Locations | 138 | 14,068 | 91.7 | % | 91.6 | % | 92.6 | % | 91.9 | % | 91.5 | % | 91.6 | % | 91.2 | % | ||||||||||

Regional Office | 7 | 2,008 | 87.3 | % | 87.3 | % | 90.0 | % | 92.5 | % | 92.8 | % | 87.3 | % | 93.2 | % | ||||||||||

Core Portfolio Same Properties | 145 | 16,076 | 91.1 | % | 91.1 | % | 92.3 | % | 92.0 | % | 91.7 | % | 91.1 | % | 91.5 | % | ||||||||||

Other Same Properties | 2 | 157 | 80.6 | % | 79.9 | % | 59.0 | % | 62.2 | % | 79.8 | % | 80.2 | % | 79.8 | % | ||||||||||

Total Same Properties | 147 | 16,233 | 91.0 | % | 91.0 | % | 92.0 | % | 91.7 | % | 91.5 | % | 91.0 | % | 91.4 | % | ||||||||||

Corporate Office Properties Trust Same Properties (1) Period End Occupancy Rates by Segment (square feet in thousands) | ||||||||||||||||||||||||||

Number of Buildings | Rentable Square Feet | Three Months Ended | ||||||||||||||||||||||||

6/30/18 | 3/31/18 | 12/31/17 | 9/30/17 | 6/30/17 | ||||||||||||||||||||||

Core Portfolio: | ||||||||||||||||||||||||||

Defense/IT Locations: | ||||||||||||||||||||||||||

Fort Meade/BW Corridor | 81 | 7,759 | 91.7 | % | 91.3 | % | 93.6 | % | 93.4 | % | 92.4 | % | ||||||||||||||

NoVA Defense/IT | 12 | 1,760 | 80.6 | % | 80.3 | % | 79.5 | % | 79.1 | % | 78.6 | % | ||||||||||||||

Lackland Air Force Base | 7 | 953 | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | ||||||||||||||

Navy Support | 21 | 1,253 | 88.3 | % | 88.0 | % | 87.7 | % | 82.5 | % | 81.9 | % | ||||||||||||||

Redstone Arsenal | 6 | 632 | 99.2 | % | 99.2 | % | 99.2 | % | 99.2 | % | 100.0 | % | ||||||||||||||

Data Center Shells | 11 | 1,711 | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | ||||||||||||||

Total Defense/IT Locations | 138 | 14,068 | 91.9 | % | 91.6 | % | 92.8 | % | 92.1 | % | 91.5 | % | ||||||||||||||

Regional Office | 7 | 2,008 | 87.2 | % | 86.8 | % | 89.5 | % | 92.4 | % | 92.5 | % | ||||||||||||||

Core Portfolio Same Properties | 145 | 16,076 | 91.3 | % | 91.0 | % | 92.4 | % | 92.1 | % | 91.6 | % | ||||||||||||||

Other Same Properties | 2 | 157 | 82.2 | % | 80.1 | % | 62.3 | % | 53.3 | % | 79.8 | % | ||||||||||||||

Total Same Properties | 147 | 16,233 | 91.2 | % | 90.9 | % | 92.1 | % | 91.8 | % | 91.5 | % | ||||||||||||||

(1) | Includes office and data center shell properties continually owned and 100% operational since at least 1/1/17. |

15

Corporate Office Properties Trust

Same Properties Real Estate Revenues and NOI by Segment

(dollars in thousands)

Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||

6/30/18 | 3/31/18 | 12/31/17 | 9/30/17 | 6/30/17 | 6/30/18 | 6/30/17 | |||||||||||||||||||||

Same Properties real estate revenues | |||||||||||||||||||||||||||

Defense/IT Locations: | |||||||||||||||||||||||||||

Fort Meade/BW Corridor | $ | 59,940 | $ | 60,542 | $ | 60,135 | $ | 59,010 | $ | 59,104 | $ | 120,482 | $ | 118,640 | |||||||||||||

NoVA Defense/IT | 11,458 | 11,107 | 11,030 | 11,120 | 11,096 | 22,565 | 22,100 | ||||||||||||||||||||

Lackland Air Force Base | 12,382 | 11,443 | 11,523 | 11,024 | 13,029 | 23,825 | 24,663 | ||||||||||||||||||||

Navy Support | 8,127 | 7,870 | 7,586 | 7,494 | 7,449 | 15,997 | 14,459 | ||||||||||||||||||||

Redstone Arsenal | 3,281 | 3,328 | 3,390 | 3,247 | 3,288 | 6,609 | 6,488 | ||||||||||||||||||||

Data Center Shells | 3,186 | 3,217 | 3,021 | 3,007 | 2,956 | 6,403 | 6,045 | ||||||||||||||||||||

Total Defense/IT Locations | 98,374 | 97,507 | 96,685 | 94,902 | 96,922 | 195,881 | 192,395 | ||||||||||||||||||||

Regional Office | 15,294 | 15,168 | 15,871 | 16,201 | 15,777 | 30,462 | 32,340 | ||||||||||||||||||||

Other Properties | 528 | 783 | 658 | 924 | 1,146 | 1,311 | 2,349 | ||||||||||||||||||||

Same Properties real estate revenues | $ | 114,196 | $ | 113,458 | $ | 113,214 | $ | 112,027 | $ | 113,845 | $ | 227,654 | $ | 227,084 | |||||||||||||

Same Properties NOI | |||||||||||||||||||||||||||

Defense/IT Locations: | |||||||||||||||||||||||||||

Fort Meade/BW Corridor | $ | 40,246 | $ | 39,653 | $ | 40,448 | $ | 40,014 | $ | 39,707 | $ | 79,899 | $ | 79,439 | |||||||||||||

NoVA Defense/IT | 7,179 | 6,775 | 7,152 | 6,802 | 6,872 | 13,954 | 13,661 | ||||||||||||||||||||

Lackland Air Force Base | 4,888 | 4,845 | 4,835 | 4,831 | 4,899 | 9,733 | 9,731 | ||||||||||||||||||||

Navy Support | 4,696 | 4,566 | 4,360 | 4,337 | 4,424 | 9,262 | 8,225 | ||||||||||||||||||||

Redstone Arsenal | 2,296 | 2,398 | 2,394 | 2,295 | 2,369 | 4,694 | 4,669 | ||||||||||||||||||||

Data Center Shells | |||||||||||||||||||||||||||

Consolidated properties | 2,717 | 2,665 | 2,623 | 2,622 | 2,610 | 5,382 | 5,258 | ||||||||||||||||||||

COPT’s share of unconsolidated real estate JV (1) | 1,202 | 1,199 | 1,203 | 1,202 | 1,198 | 2,401 | 2,400 | ||||||||||||||||||||

Total Defense/IT Locations | 63,224 | 62,101 | 63,015 | 62,103 | 62,079 | 125,325 | 123,383 | ||||||||||||||||||||

Regional Office | 8,125 | 7,313 | 8,909 | 8,898 | 9,167 | 15,438 | 18,714 | ||||||||||||||||||||

Other Properties | 588 | 426 | 322 | 639 | 853 | 1,014 | 1,701 | ||||||||||||||||||||

Same Properties NOI | $ | 71,937 | $ | 69,840 | $ | 72,246 | $ | 71,640 | $ | 72,099 | $ | 141,777 | $ | 143,798 | |||||||||||||

(1) See page 33 for additional disclosure regarding an unconsolidated real estate joint venture.

16

Corporate Office Properties Trust

Same Properties Cash NOI by Segment

(dollars in thousands)

Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||

6/30/18 | 3/31/18 | 12/31/17 | 9/30/17 | 6/30/17 | 6/30/18 | 6/30/17 | |||||||||||||||||||||

Same Properties cash NOI | |||||||||||||||||||||||||||

Defense/IT Locations: | |||||||||||||||||||||||||||

Fort Meade/BW Corridor | $ | 39,906 | $ | 38,850 | $ | 40,090 | $ | 40,207 | $ | 39,308 | $ | 78,756 | $ | 78,886 | |||||||||||||

NoVA Defense/IT | 7,770 | 7,212 | 7,433 | 7,204 | 7,086 | 14,982 | 13,801 | ||||||||||||||||||||

Lackland Air Force Base | 5,067 | 5,024 | 5,016 | 4,886 | 4,943 | 10,091 | 9,819 | ||||||||||||||||||||

Navy Support | 4,934 | 4,577 | 4,342 | 4,266 | 4,449 | 9,511 | 8,302 | ||||||||||||||||||||

Redstone Arsenal | 2,364 | 2,384 | 2,351 | 2,293 | 2,254 | 4,748 | 4,492 | ||||||||||||||||||||

Data Center Shells | |||||||||||||||||||||||||||

Consolidated properties | 2,558 | 2,476 | 2,521 | 2,511 | 2,491 | 5,034 | 6,103 | ||||||||||||||||||||

COPT’s share of unconsolidated real estate JV (1) | 1,134 | 1,132 | 1,130 | 1,120 | 1,109 | 2,266 | 1,109 | ||||||||||||||||||||

Total Defense/IT Locations | 63,733 | 61,655 | 62,883 | 62,487 | 61,640 | 125,388 | 122,512 | ||||||||||||||||||||

Regional Office | 7,463 | 6,801 | 8,476 | 8,602 | 8,824 | 14,264 | 17,389 | ||||||||||||||||||||

Other Properties | 613 | 449 | 352 | 527 | 638 | 1,062 | 1,242 | ||||||||||||||||||||

Same Properties cash NOI | 71,809 | 68,905 | 71,711 | 71,616 | 71,102 | $ | 140,714 | $ | 141,143 | ||||||||||||||||||

Straight line rent adjustments and lease incentive amortization | (1,005 | ) | (1,556 | ) | (1,050 | ) | (1,298 | ) | (662 | ) | (2,561 | ) | (460 | ) | |||||||||||||

Amortization of acquired above- and below-market rents | (176 | ) | (300 | ) | (287 | ) | (263 | ) | (270 | ) | (476 | ) | (573 | ) | |||||||||||||

Amortization of below-market cost arrangements | (148 | ) | (147 | ) | (147 | ) | (148 | ) | (147 | ) | (295 | ) | (295 | ) | |||||||||||||

Lease termination fees, gross | 558 | 1,008 | 828 | 860 | 517 | 1,566 | 1,223 | ||||||||||||||||||||

Tenant funded landlord assets and lease incentives | 831 | 1,863 | 1,118 | 791 | 1,470 | 2,694 | 2,579 | ||||||||||||||||||||

Cash NOI adjustments in unconsolidated real estate JV | 68 | 67 | 73 | 82 | 89 | 135 | 181 | ||||||||||||||||||||

Same Properties NOI | $ | 71,937 | $ | 69,840 | $ | 72,246 | $ | 71,640 | $ | 72,099 | $ | 141,777 | $ | 143,798 | |||||||||||||

Percentage change in total Same Properties cash NOI (2) | 1.0 | % | (0.3 | )% | |||||||||||||||||||||||

Percentage change in Defense/IT Locations Same Properties cash NOI (2) | 3.4 | % | 2.3 | % | |||||||||||||||||||||||

(1) | See page 33 for additional disclosure regarding an unconsolidated real estate joint venture. |

(2) | Represents the change between the current period and the same period in the prior year. |

17

Corporate Office Properties Trust

Leasing - Office and Data Center Shell Portfolio (1)

Quarter Ended 6/30/18

(square feet in thousands)

Defense/IT Locations | |||||||||||||||||||||||||||||||||||

Ft Meade/BW Corridor | NoVA Defense/IT | Navy Support | Redstone Arsenal | Data Center Shells | Total Defense/IT Locations | Regional Office | Other | Total | |||||||||||||||||||||||||||

Renewed Space | |||||||||||||||||||||||||||||||||||

Leased Square Feet | 43 | — | 135 | 242 | — | 421 | 84 | — | 504 | ||||||||||||||||||||||||||

Expiring Square Feet | 83 | — | 142 | 242 | — | 468 | 130 | — | 598 | ||||||||||||||||||||||||||

Vacating Square Feet | 40 | — | 7 | — | — | 47 | 47 | — | 94 | ||||||||||||||||||||||||||

Retention Rate (% based upon square feet) | 52.1 | % | — | % | 95.0 | % | 100.0 | % | — | % | 90.0 | % | 64.2 | % | — | % | 84.4 | % | |||||||||||||||||

Statistics for Completed Leasing: | |||||||||||||||||||||||||||||||||||

Average Committed Cost per Square Foot (2) | $ | 4.08 | $ | — | $ | 0.10 | $ | 0.43 | $ | — | $ | 0.70 | $ | 13.49 | $ | — | $ | 2.82 | |||||||||||||||||

Weighted Average Lease Term in Years | 1.4 | — | 1.8 | 1.0 | — | 1.3 | 2.9 | — | 1.6 | ||||||||||||||||||||||||||

Average Rent Per Square Foot | |||||||||||||||||||||||||||||||||||

Renewal Average Rent | $ | 35.60 | $ | — | $ | 40.94 | $ | 21.46 | $ | — | $ | 29.17 | $ | 30.25 | $ | — | $ | 29.35 | |||||||||||||||||

Expiring Average Rent | $ | 31.78 | $ | — | $ | 37.44 | $ | 20.94 | $ | — | $ | 27.36 | $ | 28.62 | $ | — | $ | 27.57 | |||||||||||||||||

Change in Average Rent | 12.0 | % | — | % | 9.3 | % | 2.5 | % | — | % | 6.6 | % | 5.7 | % | — | % | 6.5 | % | |||||||||||||||||

Cash Rent Per Square Foot | |||||||||||||||||||||||||||||||||||

Renewal Cash Rent | $ | 36.43 | $ | — | $ | 40.56 | $ | 21.46 | $ | — | $ | 29.14 | $ | 29.34 | $ | — | $ | 29.17 | |||||||||||||||||

Expiring Cash Rent | $ | 35.53 | $ | — | $ | 39.86 | $ | 20.94 | $ | — | $ | 28.52 | $ | 30.58 | $ | — | $ | 28.86 | |||||||||||||||||

Change in Cash Rent | 2.5 | % | — | % | 1.7 | % | 2.5 | % | — | % | 2.2 | % | (4.0 | )% | — | % | 1.1 | % | |||||||||||||||||

Average escalations per year | 3.0 | % | — | % | 2.1 | % | — | % | — | % | 2.2 | % | 2.5 | % | — | % | 2.3 | % | |||||||||||||||||

New Leases | |||||||||||||||||||||||||||||||||||

Development and Redevelopment Space (3) | |||||||||||||||||||||||||||||||||||

Leased Square Feet | 13 | 159 | — | — | 432 | 604 | — | — | 604 | ||||||||||||||||||||||||||

Statistics for Completed Leasing: | |||||||||||||||||||||||||||||||||||

Average Committed Cost per Square Foot (2) | $ | 66.40 | $ | 78.41 | $ | — | $ | — | $ | — | $ | 22.06 | $ | — | $ | — | $ | 22.06 | |||||||||||||||||

Weighted Average Lease Term in Years | 9.3 | 10.0 | — | — | 12.0 | 11.4 | — | — | 11.4 | ||||||||||||||||||||||||||

Average Rent Per Square Foot | $ | 27.85 | $ | 35.15 | $ | — | $ | — | $ | 17.60 | $ | 22.44 | $ | — | $ | — | $ | 22.44 | |||||||||||||||||

Cash Rent Per Square Foot | $ | 25.27 | $ | 35.15 | $ | — | $ | — | $ | 15.70 | $ | 21.03 | $ | — | $ | — | $ | 21.03 | |||||||||||||||||

Other New Leases (4) | |||||||||||||||||||||||||||||||||||

Leased Square Feet | 74 | 5 | 24 | — | — | 103 | 12 | 1 | 116 | ||||||||||||||||||||||||||

Statistics for Completed Leasing: | |||||||||||||||||||||||||||||||||||

Average Committed Cost per Square Foot (2) | $ | 27.27 | $ | 61.41 | $ | 32.56 | $ | — | $ | — | $ | 30.04 | $ | 81.18 | $ | 1.96 | $ | 35.06 | |||||||||||||||||

Weighted Average Lease Term in Years | 8.4 | 5.4 | 6.1 | — | — | 7.7 | 6.4 | 1.0 | 7.5 | ||||||||||||||||||||||||||

Average Rent Per Square Foot | $ | 20.27 | $ | 29.60 | $ | 24.41 | $ | — | $ | — | $ | 21.66 | $ | 32.59 | $ | 23.50 | $ | 22.82 | |||||||||||||||||

Cash Rent Per Square Foot | $ | 19.15 | $ | 30.00 | $ | 24.33 | $ | — | $ | — | $ | 20.85 | $ | 30.87 | $ | 23.50 | $ | 21.93 | |||||||||||||||||

Total Square Feet Leased | 130 | 164 | 159 | 242 | 432 | 1,128 | 96 | 1 | 1,224 | ||||||||||||||||||||||||||

Average escalations per year | 2.6 | % | — | % | 2.5 | % | — | % | 2.5 | % | 2.0 | % | 2.5 | % | — | % | 2.0 | % | |||||||||||||||||

Average escalations excl. data center shells | 1.2 | % | |||||||||||||||||||||||||||||||||

(1) | Activity is exclusive of owner occupied space and leases with less than a one-year term. Retention rate excludes the effect of 108,000 square feet vacated in a property in the Ft Meade/BW Corridor that was removed from service for redevelopment in June 2018; our retention rate would be 65.9% if the effect of this vacancy was included. Weighted average lease term is based on the non-cancelable term of tenant leases determined in accordance with GAAP. Committed costs for leasing are reported above in the period of lease execution. Actual capital expenditures for leasing are reported on page 9 in the period such costs are incurred. |

(2) | Committed costs include tenant improvements and leasing commissions and exclude free rent concession. |

(3) | Excludes a long-term contract executed in June 2018 to use an asset at a confidential Defense/IT Location, the economics of which are equivalent to that of a 115,000 square foot office property or 190,000 data center shell lease. |

(4) | Other New Leases includes acquired first generation space and vacated second generation space. |

18

Corporate Office Properties Trust

Leasing - Office and Data Center Shell Portfolio (1)

Six Months Ended 6/30/18

(square feet in thousands)

Defense/IT Locations | |||||||||||||||||||||||||||||||||||

Ft Meade/BW Corridor | NoVA Defense/IT | Navy Support | Redstone Arsenal | Data Center Shells | Total Defense/IT Locations | Regional Office | Other | Total | |||||||||||||||||||||||||||

Renewed Space | |||||||||||||||||||||||||||||||||||

Leased Square Feet | 590 | 44 | 221 | 242 | — | 1,098 | 118 | — | 1,216 | ||||||||||||||||||||||||||

Expiring Square Feet | 858 | 47 | 231 | 242 | — | 1,379 | 200 | — | 1,579 | ||||||||||||||||||||||||||

Vacating Square Feet | 268 | 3 | 10 | — | — | 281 | 82 | — | 363 | ||||||||||||||||||||||||||

Retention Rate (% based upon square feet) | 68.8 | % | 93.1 | % | 95.7 | % | 100.0 | % | — | % | 79.6 | % | 59.2 | % | — | % | 77.0 | % | |||||||||||||||||

Statistics for Completed Leasing: | |||||||||||||||||||||||||||||||||||

Average Committed Cost per Square Foot (2) | $ | 9.36 | $ | 21.90 | $ | 0.79 | $ | 0.43 | $ | — | $ | 6.16 | $ | 19.52 | $ | — | $ | 7.46 | |||||||||||||||||

Weighted Average Lease Term in Years | 4.3 | 3.0 | 2.0 | 1.0 | — | 3.1 | 4.9 | — | 3.2 | ||||||||||||||||||||||||||

Average Rent Per Square Foot | |||||||||||||||||||||||||||||||||||

Renewal Average Rent | $ | 35.80 | $ | 27.96 | $ | 32.76 | $ | 21.46 | $ | — | $ | 31.71 | $ | 30.15 | $ | — | $ | 31.56 | |||||||||||||||||

Expiring Average Rent | $ | 32.41 | $ | 25.78 | $ | 29.79 | $ | 20.94 | $ | — | $ | 29.08 | $ | 26.98 | $ | — | $ | 28.88 | |||||||||||||||||

Change in Average Rent | 10.5 | % | 8.5 | % | 10.0 | % | 2.5 | % | — | % | 9.0 | % | 11.7 | % | — | % | 9.3 | % | |||||||||||||||||

Cash Rent Per Square Foot | |||||||||||||||||||||||||||||||||||

Renewal Cash Rent | $ | 34.83 | $ | 27.00 | $ | 32.34 | $ | 21.46 | $ | — | $ | 31.06 | $ | 28.78 | $ | — | $ | 30.84 | |||||||||||||||||

Expiring Cash Rent | $ | 34.40 | $ | 28.40 | $ | 32.08 | $ | 20.94 | $ | — | $ | 30.72 | $ | 28.47 | $ | — | $ | 30.50 | |||||||||||||||||

Change in Cash Rent | 1.3 | % | (4.9 | )% | 0.8 | % | 2.5 | % | — | % | 1.1 | % | 1.1 | % | — | % | 1.1 | % | |||||||||||||||||

Average escalations per year | 2.7 | % | 2.8 | % | 2.0 | % | — | % | — | % | 2.6 | % | 2.5 | % | — | % | 2.6 | % | |||||||||||||||||

New Leases | |||||||||||||||||||||||||||||||||||

Development and Redevelopment Space (3) | |||||||||||||||||||||||||||||||||||

Leased Square Feet | 84 | 159 | — | — | 432 | 675 | — | — | 675 | ||||||||||||||||||||||||||

Statistics for Completed Leasing: | |||||||||||||||||||||||||||||||||||

Average Committed Cost per Square Foot (2) | $ | 56.93 | $ | 78.41 | $ | — | $ | — | $ | — | $ | 25.54 | $ | — | $ | — | $ | 25.54 | |||||||||||||||||

Weighted Average Lease Term in Years | 9.2 | 10.0 | — | — | 12.0 | 11.2 | — | — | 11.2 | ||||||||||||||||||||||||||

Average Rent Per Square Foot | $ | 29.59 | $ | 35.15 | $ | — | $ | — | $ | 17.60 | $ | 23.22 | $ | — | $ | — | $ | 23.22 | |||||||||||||||||

Cash Rent Per Square Foot | $ | 28.53 | $ | 35.15 | $ | — | $ | — | $ | 15.70 | $ | 21.88 | $ | — | $ | — | $ | 21.88 | |||||||||||||||||

Other New Leases (4) | |||||||||||||||||||||||||||||||||||

Leased Square Feet | 100 | 22 | 42 | 5 | — | 169 | 13 | 5 | 187 | ||||||||||||||||||||||||||

Statistics for Completed Leasing: | |||||||||||||||||||||||||||||||||||

Average Committed Cost per Square Foot (2) | $ | 30.12 | $ | 51.36 | $ | 32.95 | $ | 46.17 | $ | — | $ | 34.07 | $ | 82.23 | $ | 20.96 | $ | 37.00 | |||||||||||||||||

Weighted Average Lease Term in Years | 7.6 | 5.2 | 5.7 | 6.3 | — | 6.8 | 6.6 | 2.5 | 6.7 | ||||||||||||||||||||||||||

Average Rent Per Square Foot | $ | 22.93 | $ | 29.03 | $ | 23.75 | $ | 24.37 | $ | — | $ | 23.97 | $ | 32.30 | $ | 25.60 | $ | 24.58 | |||||||||||||||||

Cash Rent Per Square Foot | $ | 21.83 | $ | 28.07 | $ | 23.87 | $ | 22.50 | $ | — | $ | 23.17 | $ | 30.24 | $ | 24.95 | $ | 23.69 | |||||||||||||||||

Total Square Feet Leased | 774 | 226 | 263 | 247 | 432 | 1,943 | 131 | 5 | 2,078 | ||||||||||||||||||||||||||

Average escalations per year | 2.7 | % | 0.4 | % | 2.3 | % | 2.5 | % | 2.5 | % | 2.2 | % | 2.5 | % | 3.5 | % | 2.3 | % | |||||||||||||||||

Average escalations excl. data center shells | 2.1 | % | |||||||||||||||||||||||||||||||||

(1) | Activity is exclusive of owner occupied space and leases with less than a one-year term. Retention rate excludes the effect of 108,000 square feet vacated in a property in the Ft Meade/BW Corridor that was removed from service for redevelopment in June 2018; our retention rate would be 70.0% if the effect of this vacancy was included. Weighted average lease term is based on the non-cancelable term of tenant leases determined in accordance with GAAP. Committed costs for leasing are reported above in the period of lease execution. Actual capital expenditures for leasing are reported on page 9 in the period such costs are incurred. |

(2) | Committed costs include tenant improvements and leasing commissions and exclude free rent concession. |

(3) | Excludes a long-term contract executed in June 2018 to use an asset at a confidential Defense/IT Location, the economics of which are equivalent to that of a 115,000 square foot office property or 190,000 data center shell lease. |

(4) | Other New Leases includes acquired first generation space and vacated second generation space. |

19

Corporate Office Properties Trust

Lease Expiration Analysis as of 6/30/18 (1)

(dollars and square feet in thousands, except per square foot amounts)

Office and Data Center Shells

Segment of Lease and Year of Expiration (2) | Square Footage of Leases Expiring | Annualized Rental Revenue of Expiring Leases (3) | Percentage of Core/Total Annualized Rental Revenue Expiring (3)(4) | Annualized Rental Revenue of Expiring Leases per Occupied Sq. Foot | |||||||||||

Core Portfolio | |||||||||||||||

Ft Meade/BW Corridor | 592 | $ | 21,627 | 4.5 | % | $ | 36.48 | ||||||||

NoVA Defense/IT | 21 | 617 | 0.1 | % | 28.73 | ||||||||||

Navy Support | 164 | 3,983 | 0.8 | % | 24.34 | ||||||||||

Redstone Arsenal | 11 | 235 | — | % | 21.85 | ||||||||||

Regional Office | 14 | 453 | 0.1 | % | 31.99 | ||||||||||

2018 | 802 | 26,915 | 5.6 | % | 33.52 | ||||||||||

Ft Meade/BW Corridor | 1,633 | 55,168 | 11.6 | % | 33.73 | ||||||||||

NoVA Defense/IT | 346 | 13,048 | 2.7 | % | 37.72 | ||||||||||

Navy Support | 167 | 4,467 | 0.9 | % | 26.77 | ||||||||||

Redstone Arsenal | 43 | 986 | 0.2 | % | 23.03 | ||||||||||

Data Center Shells-Consolidated properties | 155 | 2,675 | 0.6 | % | 17.26 | ||||||||||

Regional Office | 122 | 3,789 | 0.8 | % | 30.90 | ||||||||||

2019 | 2,466 | 80,133 | 16.8 | % | 32.46 | ||||||||||

Ft Meade/BW Corridor | 1,032 | 34,978 | 7.3 | % | 33.90 | ||||||||||

NoVA Defense/IT | 175 | 5,165 | 1.1 | % | 29.50 | ||||||||||

Lackland Air Force Base | 250 | 11,437 | 2.4 | % | 45.69 | ||||||||||

Navy Support | 224 | 8,873 | 1.9 | % | 39.61 | ||||||||||

Redstone Arsenal | 253 | 5,306 | 1.1 | % | 20.94 | ||||||||||

Regional Office | 81 | 2,583 | 0.5 | % | 31.93 | ||||||||||

2020 | 2,015 | 68,342 | 14.3 | % | 33.91 | ||||||||||

Ft Meade/BW Corridor | 840 | 28,617 | 6.0 | % | 34.03 | ||||||||||

NoVA Defense/IT | 107 | 2,954 | 0.6 | % | 27.56 | ||||||||||

Navy Support | 222 | 6,383 | 1.3 | % | 28.73 | ||||||||||

Redstone Arsenal | 161 | 3,628 | 0.8 | % | 22.53 | ||||||||||

Regional Office | 39 | 1,196 | 0.3 | % | 30.72 | ||||||||||

2021 | 1,369 | 42,778 | 9.0 | % | 31.22 | ||||||||||

Ft Meade/BW Corridor | 651 | 20,482 | 4.3 | % | 31.40 | ||||||||||

NoVA Defense/IT | 67 | 2,077 | 0.4 | % | 30.89 | ||||||||||

Navy Support | 133 | 2,953 | 0.6 | % | 22.13 | ||||||||||

Redstone Arsenal | 2 | 55 | — | % | 29.31 | ||||||||||

Regional Office | 489 | 15,905 | 3.3 | % | 32.46 | ||||||||||

2022 | 1,342 | 41,472 | 8.7 | % | 30.84 | ||||||||||

Thereafter | |||||||||||||||

Consolidated Properties | 7,050 | 212,379 | 44.5 | % | 30.09 | ||||||||||

Unconsolidated JV Properties | 962 | 5,448 | 1.1 | % | 11.33 | ||||||||||

Core Portfolio | 16,006 | $ | 477,467 | 100.0 | % | $ | 30.14 | ||||||||

20

Segment of Lease and Year of Expiration (2) | Square Footage of Leases Expiring | Annualized Rental Revenue of Expiring Leases (3) | Percentage of Core/Total Annualized Rental Revenue Expiring (3)(4) | Annualized Rental Revenue of Expiring Leases per Occupied Sq. Foot | |||||||||||

Core Portfolio | 16,006 | $ | 477,467 | 99.3 | % | $ | 30.14 | ||||||||

Other Properties | 129 | 3,133 | 0.7 | % | 24.23 | ||||||||||

Total Portfolio | 16,135 | $ | 480,600 | 100.0 | % | $ | 30.09 | ||||||||

Consolidated Portfolio | 15,173 | $ | 475,152 | ||||||||||||

Unconsolidated JV Properties | 962 | $ | 5,448 | ||||||||||||

Note: As of 6/30/18, the weighted average lease term is 4.7 years for the Core Portfolio, 4.7 years for the Total Portfolio and 4.6 years for the Consolidated Portfolio.

Wholesale Data Center

Year of Lease Expiration | Critical Load(MW) | Total Annualized Rental Revenue of Expiring Leases (3)(000's) | |||

2018 | 0.11 | $ | 218 | ||

2019 | 2.00 | 4,114 | |||

2020 | 11.55 | 14,194 | |||

2021 | 0.05 | 113 | |||

2022 | 3.00 | 1,929 | |||

Thereafter | 0.15 | 2,167 | |||

16.86 | $ | 22,735 | |||

(1) | This expiration analysis reflects occupied space of our total portfolio (including consolidated and unconsolidated properties) and includes the effect of early renewals completed on existing leases but excludes the effect of new tenant leases on square feet yet to commence as of 6/30/18 of 331,000 for the Core Portfolio. With regard to properties owned through an unconsolidated real estate joint venture, the amounts reported above reflect 100% of the properties’ square footage but only reflect the portion of Annualized Rental Revenue that was allocable to COPT’s ownership interest. |

(2) | A number of our leases are subject to certain early termination provisions. The year of lease expiration is based on the non-cancelable term of tenant leases determined in accordance with GAAP. |

(3) | Total Annualized Rental Revenue is the monthly contractual base rent as of 6/30/18 (ignoring free rent then in effect) multiplied by 12 plus the estimated annualized expense reimbursements under existing leases. The amounts reported above for Annualized Rental Revenue include the portion of properties owned through an unconsolidated real estate joint venture that was allocable to COPT’s ownership interest. |

(4) | Amounts reported represent the percentage of our Core Portfolio for components of such portfolio while other amounts represent the percentage of our total portfolio. |

21

Corporate Office Properties Trust

2018 Core Portfolio Quarterly Lease Expiration Analysis as of 6/30/18 (1)

(dollars and square feet in thousands, except per square foot amounts)

Segment of Lease and Quarter of Expiration (2) | Square Footage of Leases Expiring | Annualized Rental Revenue of Expiring Leases (3) | Percentage of Core Annualized Rental Revenue Expiring (3)(4) | Annualized Rental Revenue of Expiring Leases per Occupied Sq. Foot | ||||||||||

Core Portfolio | ||||||||||||||

Ft Meade/BW Corridor | 256 | $ | 8,291 | 1.7 | % | $ | 32.28 | |||||||

NoVA Defense/IT | 13 | 269 | 0.1 | % | 20.55 | |||||||||

Navy Support | 134 | 3,338 | 0.7 | % | 25.02 | |||||||||

Redstone Arsenal | 2 | 39 | — | % | 23.16 | |||||||||

Regional Office | 3 | 111 | — | % | 33.76 | |||||||||

Q3 2018 | 408 | 12,048 | 2.5 | % | 29.50 | |||||||||

Ft Meade/BW Corridor | 336 | 13,336 | 2.8 | % | 39.68 | |||||||||

NoVA Defense/IT | 8 | 348 | 0.1 | % | 41.51 | |||||||||

Navy Support | 30 | 645 | 0.1 | % | 21.34 | |||||||||

Redstone Arsenal | 9 | 196 | — | % | 21.60 | |||||||||

Regional Office | 11 | 342 | 0.1 | % | 31.44 | |||||||||

Q4 2018 | 394 | 14,867 | 3.1 | % | 37.68 | |||||||||

802 | $ | 26,915 | 5.6 | % | $ | 33.52 | ||||||||

(1) | This expiration analysis reflects occupied space of our total portfolio and includes the effect of early renewals completed on existing leases but excludes the effect of new tenant leases on square feet yet to commence as of 6/30/18. |

(2) | A number of our leases are subject to certain early termination provisions. The period of lease expiration is based on the non-cancelable term of tenant leases determined in accordance with GAAP. |

(3) | Total Annualized Rental Revenue is the monthly contractual base rent as of 6/30/18 (ignoring free rent then in effect) multiplied by 12 plus the estimated annualized expense reimbursements under existing leases. |

(4) | Amounts reported represent the percentage of our Core Portfolio. |

22

Corporate Office Properties Trust

Top 20 Tenants as of 6/30/18 (1)

(dollars and square feet in thousands)

Tenant | Total Annualized Rental Revenue (2) | Percentage of Total Annualized Rental Revenue (2) | Occupied Square Feet in Office and Data Center Shells (3) | Weighted Average Remaining Lease Term in Office and Data Center Shells (3) | |||||||||

United States Government | (4) | $ | 163,289 | 32.4 | % | 4,065 | 5.1 | ||||||

VADATA, Inc. | 40,277 | 8.0 | % | 2,433 | 8.1 | ||||||||

General Dynamics Corporation | (5) | 29,161 | 5.8 | % | 764 | 3.3 | |||||||

The Boeing Company | 19,700 | 3.9 | % | 688 | 2.3 | ||||||||

Northrop Grumman Corporation | 10,981 | 2.2 | % | 420 | 1.7 | ||||||||

Booz Allen Hamilton, Inc. | 10,593 | 2.1 | % | 294 | 3.1 | ||||||||

CareFirst, Inc. | 10,492 | 2.1 | % | 313 | 4.6 | ||||||||

CACI Technologies, Inc. | 7,507 | 1.5 | % | 224 | 2.4 | ||||||||

Wells Fargo & Company | 6,891 | 1.4 | % | 183 | 9.5 | ||||||||

KEYW Corporation | 6,281 | 1.2 | % | 211 | 5.5 | ||||||||

The Raytheon Company | 5,539 | 1.1 | % | 147 | 1.2 | ||||||||

University of Maryland | 5,474 | 1.1 | % | 182 | 3.9 | ||||||||

Miles and Stockbridge, PC | 5,472 | 1.1 | % | 160 | 9.2 | ||||||||

Kratos Defense and Security Solutions | 5,063 | 1.0 | % | 131 | 1.8 | ||||||||

Transamerica Life Insurance Company | 4,712 | 0.9 | % | 141 | 3.5 | ||||||||

Science Applications International Corp. | 4,533 | 0.9 | % | 129 | 2.8 | ||||||||

The MITRE Corporation | 4,309 | 0.9 | % | 122 | 4.2 | ||||||||

Accenture Federal Services, LLC | 3,786 | 0.8 | % | 128 | 1.4 | ||||||||

AT&T Corporation | 3,734 | 0.7 | % | 153 | 2.0 | ||||||||

Pandora Jewelry Inc. | 3,526 | 0.7 | % | 145 | 7.7 | ||||||||

Subtotal Top 20 Tenants | 351,320 | 69.8 | % | 11,033 | 5.1 | ||||||||

All remaining tenants | 152,015 | 30.2 | % | 5,102 | 3.8 | ||||||||

Total/Weighted Average | $ | 503,335 | 100.0 | % | 16,135 | 4.7 | |||||||

(1) | Includes Annualized Rental Revenue (“ARR”) in our portfolio of operating office and data center shells and our wholesale data center. For six properties owned through an unconsolidated real estate joint venture, includes COPT’s share of those properties’ ARR of $5.4 million (see page 33 for additional information). |

(2) | Total ARR is the monthly contractual base rent as of 6/30/18, multiplied by 12, plus the estimated annualized expense reimbursements under existing leases. With regard to properties owned through unconsolidated real estate joint ventures, the amounts reported above reflect 100% of the properties’ square footage but only reflect the portion of ARR that was allocable to COPT’s ownership interest. |

(3) | Weighted average remaining lease term is based on the non-cancelable term of tenant leases determined in accordance with GAAP for our office and data center shell properties (i.e., excluding the effect of our wholesale data center leases). The weighting of the lease term was computed based on occupied square feet. |

(4) | Substantially all of our government leases are subject to early termination provisions which are customary in government leases. As of 6/30/18, $2.0 million in ARR (or 1.0% of our ARR from the United States Government and 0.4% of our total ARR) was through the General Services Administration (GSA). |

(5) | Includes CSRA Inc. as a result of its acquisition by General Dynamics Corporation effective 4/3/18. |

23

Corporate Office Properties Trust

Summary of Construction Projects as of 6/30/18 (1)

(dollars and square feet in thousands)

Property Segment | Total Rentable Square Feet | Percentage Leased as of 7/25/18 | as of 6/30/18 (2) | Actual or Anticipated Shell Completion Date | Anticipated Operational Date (3) | |||||||||

Anticipated Total Cost | Cost to Date | |||||||||||||

Property and Location | ||||||||||||||

Under Construction | ||||||||||||||

BLC 2 Northern Virginia | Data Center Shells | 149 | 100% | $ | 31,600 | $ | 28,372 | 3Q 18 | 3Q 18 | |||||

Project EX (4) Confidential | Defense/IT Locations | N/A | 100% | 24,324 | 11,177 | 4Q 18 | 4Q 18 | |||||||