Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DTE ENERGY CO | a8-kearningsrelease2ndquar.htm |

| EX-99.1 - EXHIBIT 99.1 - DTE ENERGY CO | exhibit991-06302018.htm |

EXHIBIT 99.2 2nd Quarter 2018 Earnings Conference Call July 25, 2018

Safe Harbor Statement Many factors impact forward-looking statements including, but not limited to, the following: impact of regulation by the EPA, the FERC, the MPSC, the NRC, and for DTE Energy, the CFTC, as well as other applicable governmental proceedings and regulations, including any associated impact on rate structures; the amount and timing of cost recovery allowed as a result of regulatory proceedings, related appeals, or new legislation, including legislative amendments and retail access programs; economic conditions and population changes in our geographic area resulting in changes in demand, customer conservation, and thefts of electricity and, for DTE Energy, natural gas; environmental issues, laws, regulations, and the increasing costs of remediation and compliance, including actual and potential new federal and state requirements; health, safety, financial, environmental, and regulatory risks associated with ownership and operation of nuclear facilities; the cost of protecting assets against, or damage due to, cyber crime and terrorism; volatility in the short-term natural gas storage markets impacting third-party storage revenues related to DTE Energy; impact of volatility of prices in the oil and gas markets on DTE Energy's gas storage and pipelines operations; impact of volatility in prices in the international steel markets on DTE Energy's power and industrial projects operations; volatility in commodity markets, deviations in weather, and related risks impacting the results of DTE Energy's energy trading operations; changes in the cost and availability of coal and other raw materials, purchased power, and natural gas; advances in technology that produce power or reduce power consumption; changes in the financial condition of DTE Energy's significant customers and strategic partners; the potential for losses on investments, including nuclear decommissioning and benefit plan assets and the related increases in future expense and contributions; access to capital markets and the results of other financing efforts which can be affected by credit agency ratings; instability in capital markets which could impact availability of short and long-term financing; the timing and extent of changes in interest rates; the level of borrowings; the potential for increased costs or delays in completion of significant capital projects; changes in, and application of, federal, state, and local tax laws and their interpretations, including the Internal Revenue Code, regulations, rulings, court proceedings, and audits; the effects of weather and other natural phenomena on operations and sales to customers, and purchases from suppliers; unplanned outages; employee relations and the impact of collective bargaining agreements; the risk of a major safety incident at an electric distribution or generation facility and, for DTE Energy, a gas storage, transmission, or distribution facility; the availability, cost, coverage, and terms of insurance and stability of insurance providers; cost reduction efforts and the maximization of plant and distribution system performance; the effects of competition; changes in and application of accounting standards and financial reporting regulations; changes in federal or state laws and their interpretation with respect to regulation, energy policy, and other business issues; contract disputes, binding arbitration, litigation, and related appeals; and the risks discussed in our public filings with the Securities and Exchange Commission. New factors emerge from time to time. We cannot predict what factors may arise or how such factors may cause results to differ materially from those contained in any forward-looking statement. Any forward- looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. This presentation should also be read in conjunction with the Forward-Looking Statements section of the joint DTE Energy and DTE Electric 2017 Form 10-K and 2018 Forms 10-Q (which section is incorporated by reference herein), and in conjunction with other SEC reports filed by DTE Energy and DTE Electric. 2

Participants • Gerry Anderson – Chairman and CEO • Jerry Norcia – President and COO • Peter Oleksiak – Senior Vice President and CFO • Barbara Tuckfield – Director, Investor Relations 3

• Overview • Financial Update • Long-Term Growth Update 4

Increasing operating EPS* guidance; regulatory filings progressing well • Increasing 2018 operating EPS guidance midpoint by $0.35 to $6.13 – Both utilities are on track – GSP and P&I having an exceptional year • Increasing 2018 cash flow guidance – Reduces future equity needs • Regulatory proceedings progressing well – Recent electric case outcome increased by ~$10 million – 1,100 MW CCGT approved – $1.7 billion renewable plan filed – July electric case filed includes IRM – Gas rate case outcome in September 5 * Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix

Strong future growth supported by opportunities across all business units • Utilities evaluating additional investments – Voluntary renewable program for large customers – Acceleration of gas main replacement • GSP positioning for strong future growth – NEXUS construction 80% complete – Board approved ~$250 million Link expansion – 3 other laterals/expansions complete or underway – Evaluating acquisitions that are “Link scale” • P&I has a large queue of projects to deliver growth – Expect to close 1-2 additional cogen/RNG deals in 2018 – 2022 earnings to be materially greater than $70 million • Continue to target 5% - 7% operating EPS* growth through 2022 6 * Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix

Strong track record of beating 5-year forward operating EPS* growth target Actual EPS vs 5-Year Plan 17.2% 12.5% $6.13 13.8% 3.9% $5.59 $5.28 $5.23 $4.97 $4.82 $4.64 $4.64 5-year Actual 5-year Actual 5-year Actual 5-year Guidance Plan** Plan** Plan** Plan** Midpoint 2015 2016 2017 2018 * Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 7 ** 5-year plan calculated using stated targeted operating EPS annual growth rate from original guidance midpoint.

• Overview • Financial Update • Long-Term Growth Update 8

2nd quarter 2018 operating earnings* variance (millions, except EPS) Operating Earnings Primary Drivers DTE Electric 2Q 2017 2Q 2018 Change Rate implementation and favorable DTE Electric $ 148 $ 163 $ 15 weather in 2018, offset by higher O&M DTE Gas 1 14 13 expense and rate base growth DTE Gas Gas Storage & Pipelines 40 60 20 Favorable weather in 2018 and other Power & Industrial Projects 30 43 13 margin favorability, offset by higher O&M expense Corporate & Other (32) (41) (9) Gas Storage & Pipelines Growth segments** $ 187 $ 239 $ 52 Lower tax rate and increased gathering Growth segments operating EPS $ 1.05 $ 1.32 $ 0.27 and transport volumes Energy Trading Power & Industrial Projects 4 8 4 Higher REF volumes and renewable DTE Energy $ 191 $ 247 $ 56 earnings Operating EPS $ 1.07 $ 1.36 $ 0.29 Corporate & Other Lower tax rate and higher interest Avg. Shares Outstanding 179 181 expense Energy Trading * Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 9 ** Growth segments exclude Energy Trading Stronger gas portfolio performance

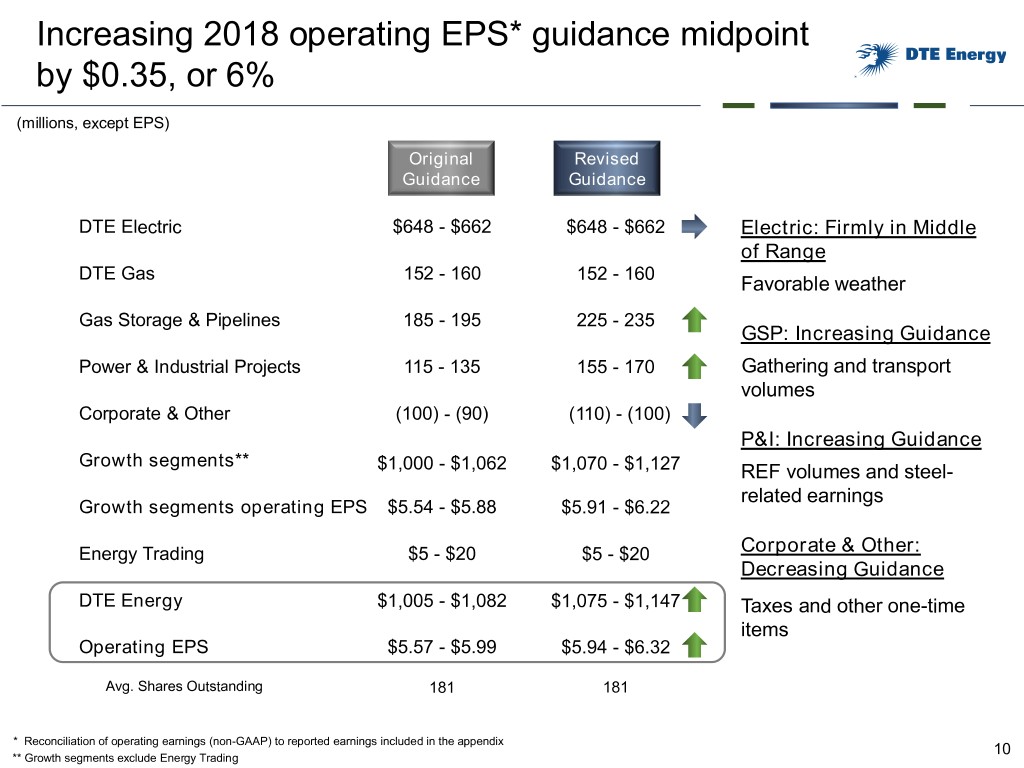

Increasing 2018 operating EPS* guidance midpoint by $0.35, or 6% (millions, except EPS) Original Revised Guidance Guidance DTE Electric $648 - $662 $648 - $662 Electric: Firmly in Middle of Range DTE Gas 152 - 160 152 - 160 Favorable weather Gas Storage & Pipelines 185 - 195 225 - 235 GSP: Increasing Guidance Power & Industrial Projects 115 - 135 155 - 170 Gathering and transport volumes Corporate & Other (100) - (90) (110) - (100) P&I: Increasing Guidance Growth segments** $1,000 - $1,062 $1,070 - $1,127 REF volumes and steel- related earnings Growth segments operating EPS $5.54 - $5.88 $5.91 - $6.22 Energy Trading $5 - $20 $5 - $20 Corporate & Other: Decreasing Guidance DTE Energy $1,005 - $1,082 $1,075 - $1,147 Taxes and other one-time items Operating EPS $5.57 - $5.99 $5.94 - $6.32 Avg. Shares Outstanding 181 181 * Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 10 ** Growth segments exclude Energy Trading

Guidance update puts DTE on track to meet or exceed guidance for 11th consecutive year Operating EPS* 7.8% CAGR 8.4% CAGR $6.13 E $5.59 $5.28 $4.82 $4.60 $4.09 $3.94 $3.60 $3.73 $3.30 $2.90 Actual Original guidance midpoint 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 11 * Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix

Updating 2018 cash flow guidance (billions) Cash Flow Prior Revised • Increasing cash flow guidance Guidance Guidance by $200 million this year Cash From Operations* $2.0 $2.2 Capital Expenditures (3.6) (3.6) • Reducing 2018-2020 equity Free Cash Flow ($1.6) ($1.4) needs from $800 million to $700 million Asset Sales & Other - - – Reducing 2018 equity Dividends (0.6) (0.6) issuances from $300 Net Cash ($2.2) ($2.0) million to $250 million – Targeting $100 million to Debt Financing: $200 million in 2019 Issuances $2.3 $2.1 – Continuing to evaluate Redemptions (0.1) (0.1) further equity reductions Change in Debt $2.2 $2.0 12 * Includes $0.25 billion of equity issued for employee benefit programs

• Overview • Financial Update • Long-Term Growth Update 13

Reliability investments at utilities support long-term growth and increase customer satisfaction DTE Electric • $1 billion natural gas plant approved ‒ Breaking ground August 2018 and beginning construction mid-2019 • Renewable energy plan ‒ Acceleration of renewables (300 MW) ‒ Voluntary renewable program for large customers • Filed rate case in July including ‒ 3 year IRM covering ~$1 billion annual investment DTE Gas • Reduced rates in July to incorporate impact of tax reform benefit on customers • Rate case proceedings progressing ‒ Proposed to increase the pace of main renewal from 25 to 15 years ‒ Includes tax reform refund 14

GSP is positioning for strong future growth Gas Storage & Pipelines • NEXUS Pipeline ‒ On budget and on schedule for late 3Q in-service ‒ 16 of 18 HDDs complete ‒ Mainline welding complete • Link expansion ‒ Volumes and investments faster than pro-forma • Evaluating acquisitions ‒ Multiple assets under consideration ‒ One in detailed evaluation phase • Progressing on other GSP projects ‒ Millennium Valley Lateral placed in-service; Eastern System Upgrade expansion in-service 4Q ‒ Bluestone expansion on track for 3Q completion ‒ Birdsboro began construction for 4Q in-service 15

P&I is positioning for strong future growth Power & Industrial • Industrial Energy Services ‒ Constructing new Ford central energy plant ‒ Finalizing agreement on large industrial cogeneration project • Renewable Natural Gas ‒ Constructing new project in Wisconsin • Evaluating ~10 cogeneration / RNG projects ‒ Expect to close 1-2 deals in 2018 • Project queue beyond 2018 is strong 16

Summary • Increasing 2018 operating EPS* and cash guidance given strong financial performance • Targeting 5% - 7% operating EPS growth through 2022 • Driving utility growth through infrastructure investments focused on improving reliability and the customer experience • Continuing strategic and sustainable growth in non-utility businesses • Delivering strong EPS and dividend growth that drive premium total shareholder returns 17 * Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix

Contact us DTE Energy Investor Relations www.dteenergy.com/investors (313) 235-8030 18

Appendix 19

Maintaining strong cash flow and balance sheet Leverage* Target 50% - 54% • Issue equity of $700 million in 2018-2020 51% ‒ $250 million in 2018 using internal mechanisms ‒ Strong cash flows this year reduces equity needs 2017 2018-2020E • $1.6 billion of available liquidity at June 30, 2018 Funds from Operations** / Debt* • Maintain strong investment-grade Target credit rating 18% - 19% 20% • One of the first energy companies in the nation to issue green bonds 2017 2018-2020E * Debt excludes a portion of DTE Gas’ short-term debt and considers 50% of the junior subordinated notes and 100% of the convertible equity units as equity 20 ** Funds from Operations (FFO) is calculated using operating earnings, reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix

DTE Electric variance analysis (millions) Operating Earnings* Variance Primary Drivers $30 ($8) $12 ($6) ($13) $163 $148 • Warmer weather in May and June 2018 Variance to normal weather – 2Q 2017: $1 – 2Q 2018: $31 2Q 2017 Weather Storm Rate Case Rate Base O&M 2Q 2018 Operating Impact Growth and Operating Earnings Other Earnings 21 * Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix

Weather and DTE Electric weather normal sales Cooling degree days – DTE Electric service territory Heating degree days – DTE Gas service territory 2Q 2017 2Q 2018 % change 2Q 2017 2Q 2018 % change Actuals 232 323 39% Actuals 668 860 29% Normal 215 215 0% Normal 786 774 (2%) Deviation from normal 8% 50% Deviation from normal (15%) 11% YTD 2017 YTD 2018 % change YTD 2017 YTD 2018 % change Actuals 232 323 39% Actuals 3,461 4,047 17% Normal 215 215 0% Normal 4,049 4,025 (1%) Deviation from normal 8% 50% Deviation from normal (15%) 1% Earnings impact of weather – DTE Electric Earnings impact of weather – DTE Gas Variance from normal weather Variance from normal weather ($ millions, after-tax) 2Q YTD ($ millions, after-tax) 2Q YTD 2017 $1 ($12) 2017 ($5) ($26) 2018 $31 $31 2018 $6 $2 ($ per share) 2Q YTD ($ per share) 2Q YTD 2017 $0.01 ($0.06) 2017 ($0.03) ($0.15) 2018 $0.17 $0.17 2018 $0.03 $0.01 Weather normal sales – DTE Electric service area (GWh) YTD 2017 YTD 2018 % change Residential 7,121 7,063 (1%) Business & Other* 15,828 15,959 1% TOTAL SALES 22,949 23,022 0% 22 * Includes choice of 2,393 YTD 2017 and 2,336 YTD 2018

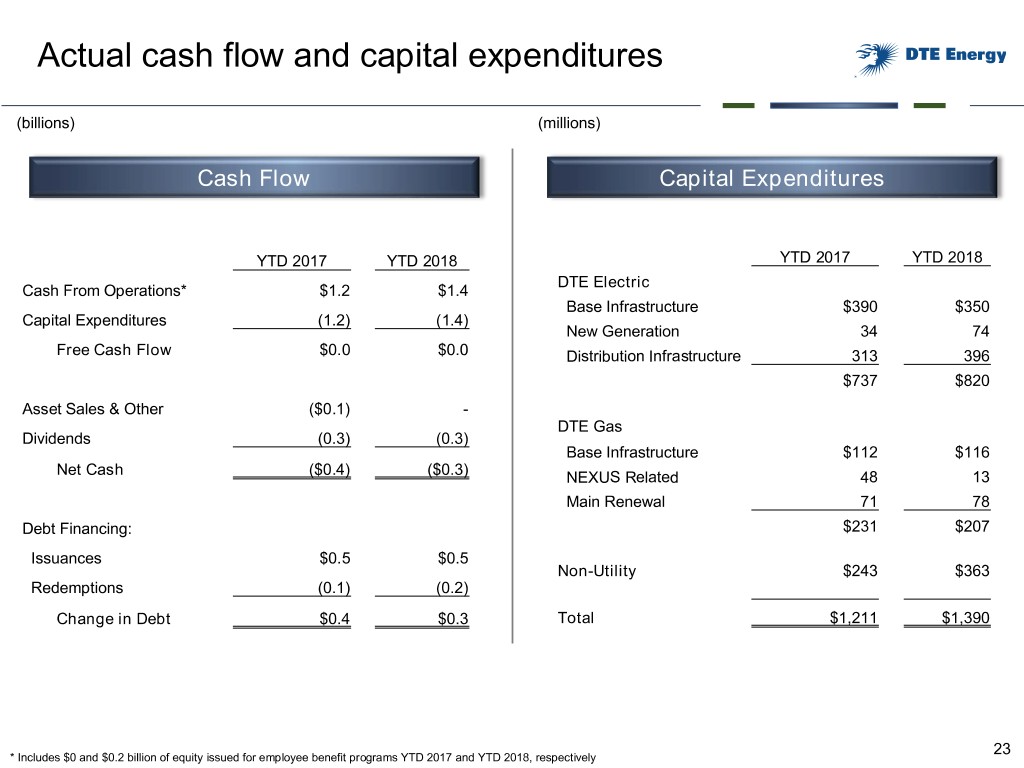

Actual cash flow and capital expenditures (billions) (millions) Cash Flow Capital Expenditures YTD 2017 YTD 2018 YTD 2017 YTD 2018 DTE Electric Cash From Operations* $1.2 $1.4 Base Infrastructure $390 $350 Capital Expenditures (1.2) (1.4) New Generation 34 74 Free Cash Flow $0.0 $0.0 Distribution Infrastructure 313 396 $737 $820 Asset Sales & Other ($0.1) - DTE Gas Dividends (0.3) (0.3) Base Infrastructure $112 $116 Net Cash ($0.4) ($0.3) NEXUS Related 48 13 Main Renewal 71 78 Debt Financing: $231 $207 Issuances $0.5 $0.5 Non-Utility $243 $363 Redemptions (0.1) (0.2) Change in Debt $0.4 $0.3 Total $1,211 $1,390 23 * Includes $0 and $0.2 billion of equity issued for employee benefit programs YTD 2017 and YTD 2018, respectively

2018 capital expenditures guidance (millions) Capital Expenditures Current Guidance DTE Electric Base Infrastructure $750 New Generation 340 Distribution infrastructure 810 $1,900 DTE Gas Base Infrastructure $257 NEXUS Related 13 Main Renewal 190 $460 Non-Utility $1,100-$1,300 Total $3,460-$3,660 24

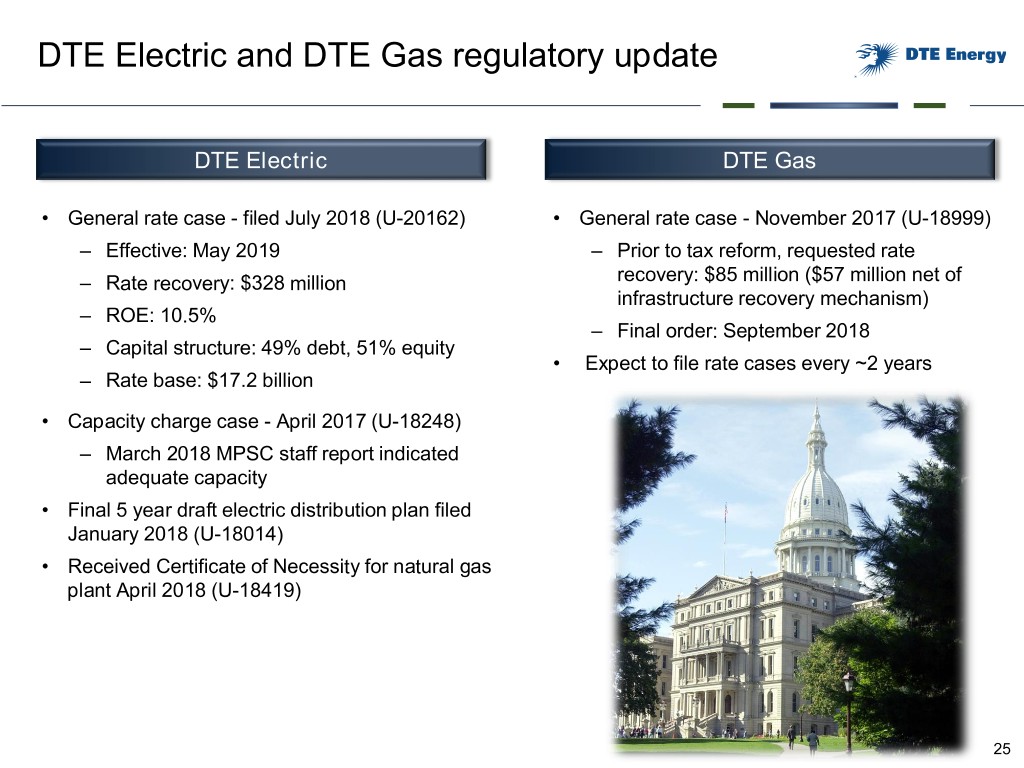

DTE Electric and DTE Gas regulatory update DTE Electric DTE Gas • General rate case - filed July 2018 (U-20162) • General rate case - November 2017 (U-18999) – Effective: May 2019 – Prior to tax reform, requested rate – Rate recovery: $328 million recovery: $85 million ($57 million net of infrastructure recovery mechanism) – ROE: 10.5% – Final order: September 2018 – Capital structure: 49% debt, 51% equity • Expect to file rate cases every ~2 years – Rate base: $17.2 billion • Capacity charge case - April 2017 (U-18248) – March 2018 MPSC staff report indicated adequate capacity • Final 5 year draft electric distribution plan filed January 2018 (U-18014) • Received Certificate of Necessity for natural gas plant April 2018 (U-18419) 25

2nd quarter and YTD Energy Trading reconciliation of operating earnings* to economic net income 2Q • Economic net income equals economic gross margin*** minus O&M expenses and 2017 2018 taxes Operating Earnings $4 $8 • DTE Energy management uses economic Accounting Adjustments** (2) 7 net income as one of the performance measures for external communications with Economic Net Income $2 $15 analysts and investors • Internally, DTE Energy uses economic net income as one of the measures to review performance against financial targets and YTD budget 2017 2018 Operating Earnings $22 $9 Accounting Adjustments** 0 14 Economic Net Income $22 $23 * Reconciliation of operating earnings (non-GAAP) to reported earnings also included in the appendix ** Consists of 1) the income statement effect of not recognizing changes in the fair market value of certain non-derivative contracts including physical inventory and capacity contracts for transportation, transmission and storage. These contracts are not marked-to-market, instead are recognized for accounting purposes on an accrual basis; and 2) operating adjustments for unrealized marked-to-market changes of certain derivative contracts 26 *** Economic gross margin is the change in net fair value of realized and unrealized purchase and sale contracts including certain non-derivative contract costs

2nd quarter 2018 reconciliation of reported to operating earnings (non-GAAP) Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. Operating earnings are presented both with and without Energy Trading. The term “Growth Segments” refers to DTE Energy without Energy Trading and represents the business segments that management expects to generate earnings growth going forward. Net Income (millions)* Gas Power & 2Q 2018 DTE Storage & Industrial Corporate Growth Energy DTE After tax items: Electric DTE Gas Pipelines Projects & Other Segments Trading Energy Reported Earnings $163 $14 $60 $43 ($41) $239 ($5) $234 Certain mark-to-market transactions 13 13 Operating Earnings $163 $14 $60 $43 ($41) $239 $8 $247 EPS Gas Power & 2Q 2018 DTE Storage & Industrial Corporate Growth Energy DTE After tax items: Electric DTE Gas Pipelines Projects & Other Segments Trading Energy Reported Earnings $0.90 $0.08 $0.33 $0.24 ($0.23) $1.32 ($0.03) $1.29 Certain mark-to-market transactions 0.07 0.07 Operating Earnings $0.90 $0.08 $0.33 $0.24 ($0.23) $1.32 $0.04 $1.36 27 * Total tax impact of adjustments to reported earnings: $4 million

2nd quarter 2017 reconciliation of reported to operating earnings (non-GAAP) Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. Operating earnings are presented both with and without Energy Trading. The term “Growth Segments” refers to DTE Energy without Energy Trading and represents the business segments that management expects to generate earnings growth going forward. 2Q 2017 Net Income (millions)* Gas Power & DTE Storage & Industrial Corporate Growth Energy DTE After-tax items: Electric DTE Gas Pipelines Projects & Other Segments Trading Energy Reported Earnings $138 $1 $40 $30 ($32) $177 $0 $177 PSCR disallowance 10 10 10 Certain mark-to-market 4 4 transactions Operating Earnings $148 $1 $40 $30 ($32) $187 $4 $191 2Q 2017 EPS Gas Power & DTE Storage & Industrial Corporate Growth Energy DTE After-tax items: Electric DTE Gas Pipelines Projects & Other Segments Trading Energy Reported Earnings $0.77 $0.01 $0.22 $0.17 ($0.18) $0.99 $0.00 $0.99 PSCR disallowance 0.06 0.06 0.06 Certain mark-to-market 0.02 0.02 transactions Operating Earnings $0.83 $0.01 $0.22 $0.17 ($0.18) $1.05 $0.02 $1.07 28 * Total tax impact of adjustments to reported earnings: $9 million

2008 – 2012 Full Year Reconciliation of Reported to Operating Earnings Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. Net Income (millions)* EPS 2008 2009 2010 2011 2012 2008 2009 2010 2011 2012 DTE Energy Reported Earnings $ 546 $ 532 $ 630 $ 711 $ 610 $ 3.36 $ 3.24 $ 3.74 $ 4.18 $ 3.55 DTE Electric Chrysler bad debt 4 0.02 Settlement with Detroit Thermal (3) (0.02) Fermi 1 asset retirement obligation 9 0.05 DTE Gas Performance excellence process 4 (20) 0.03 (0.12) Power & Industrial Projects Chrysler bad debt 1 0.01 General Motors bad debt 3 0.02 Coke oven gas settlement 7 0.04 Chicago Fuels Terminal sale 2 0.01 Pet coke mill impairment 1 0.01 Performance excellence process 1 0.01 Energy Trading Performance excellence process 1 0.01 Corporate & Other Antrim hedge 13 3 0.08 0.01 Tax true-up from sale of joint venture - Crete 2 0.01 Michigan corporate income tax adj. (87) (0.50) Unconventional Gas Discontinued operations (76) 56 (0.47) 0.33 Synfuel Discontinued operations (20) (0.13) DTE Energy Operating Earnings $ 471 $ 543 $ 607 $ 633 $ 676 $ 2.90 $ 3.30 $ 3.60 $ 3.73 $ 3.94 29 * Total tax impact of adjustments to reported earnings: 2008 ($44 million), 2009 $8 million, 2010 ($14 million), 2011 $4 million, 2012 $35 million

2013 – 2017 Full Year Reconciliation of Reported to Operating Earnings Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. Net Income (millions)* EPS 2013 2014 2015 2016 2017 2013 2014 2015 2016 2017 DTE Energy Reported Earnings $ 661 $ 905 $ 727 $ 868 $ 1,134 $ 3.76 $ 5.10 $ 4.05 $ 4.83 $ 6.32 DTE Electric PSCR disallowance 12 10 0.07 0.06 System implementation costs 6 0.03 Deferred tax remeasurement (5) (0.03) Tree trimming disallowance 8 0.05 DTE Gas System implementation costs 3 0.02 Gas Storage & Pipelines Link 8 0.05 Deferred tax remeasurement (115) (0.64) Power & Industrial Projects Asset impairment 4 7 0.02 0.04 Contract termination 10 0.05 Plant closure 69 0.39 Deferred tax remeasurement (21) (0.12) Energy Trading Certain mark-to-market transactions 55 (102) 47 70 (54) 0.31 (0.57) 0.26 0.39 (0.30) Natural gas pipeline refund (10) (0.05) Deferred tax remeasurement 2 0.01 Corporate & Other Investment impairment 5 0.03 NY state tax law change 8 0.04 Link 2 0.01 Deferred tax remeasurement 34 0.20 DTE Energy Operating Earnings $ 720 $ 816 $ 863 $ 948 $ 1,001 $ 4.09 $ 4.60 $ 4.82 $ 5.28 $ 5.59 30 * Total tax impact of adjustments to reported earnings: 2013 $38 million, 2014 ($58 million), 2015 $81 million, 2016 ($38 million), 2017 ($17 million)

Reconciliation of reported to operating earnings (non-GAAP) Use of Operating Earnings Information – Operating earnings exclude non-recurring items, certain mark-to- market adjustments and discontinued operations. DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. In this presentation, DTE Energy provides guidance for future period operating earnings. It is likely that certain items that impact the company’s future period reported results will be excluded from operating results. A reconciliation to the comparable future period reported earnings is not provided because it is not possible to provide a reliable forecast of specific line items (i.e. future non-recurring items, certain mark-to- market adjustments and discontinued operations). These items may fluctuate significantly from period to period and may have a significant impact on reported earnings. For comparative purposes, operating earnings excluded the Unconventional Gas Production segment that was classified as a discontinued operation on 12/31/2012. 31