Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Axalta Coating Systems Ltd. | a20186308-kxexhibit991.htm |

| 8-K - 8-K - Axalta Coating Systems Ltd. | a20186308-k.htm |

Exhibit 99.2 Q2 2018 Financial Results July 26, 2018

Legal Notices Forward-Looking Statements This presentation and the oral remarks made in connection herewith may contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, including those relating to our 2018 financial projections, which include net sales, net sales excluding FX, Adjusted EBITDA, interest expense, tax rate, as adjusted, free cash flow, capital expenditures, depreciation and amortization, diluted shares outstanding, contributions from acquisitions, and related assumptions. Any forward-looking statements involve risks, uncertainties and assumptions. These statements often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “target,” “project,” “forecast,” “seek,” “will,” “may,” “should,” “could,” “would,” or similar expressions. These statements are based on certain assumptions that we have made in light of our experience in the industry and our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances as of the date hereof. Although we believe that the assumptions and analysis underlying these statements are reasonable as of the date hereof, investors are cautioned not to place undue reliance on these statements. We do not have any obligation to and do not intend to update any forward-looking statements included herein, which speak only as of the date hereof. You should understand that these statements are not guarantees of future performance or results. Actual results could differ materially from those described in any forward-looking statements contained herein or the oral remarks made in connection herewith as a result of a variety of factors, including known and unknown risks and uncertainties, many of which are beyond our control including, but not limited to, the risks and uncertainties described in "Non-GAAP Financial Measures," and "Forward-Looking Statements" as well as "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2017 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2018. Non-GAAP Financial Measures The historical financial information included in this presentation includes financial information that is not presented in accordance with generally accepted accounting principles in the United States (“GAAP”), including net sales excluding FX, Adjusted Net Income, EBITDA, Adjusted EBITDA, Free Cash Flow, tax rate, as adjusted, and Net Debt. Management uses these non- GAAP financial measures in the analysis of our financial and operating performance because they assist in the evaluation of underlying trends in our business. Adjusted EBITDA consists of EBITDA adjusted for (i) non-cash items included within net income, (ii) items Axalta does not believe are indicative of ongoing operating performance or (iii) nonrecurring, unusual or infrequent items that have not occurred within the last two years or Axalta believes are not reasonably likely to recur within the next two years. We believe that making such adjustments provides investors meaningful information to understand our operating results and ability to analyze financial and business trends on a period-to-period basis. Adjusted net income shows the adjusted value of net income attributable to controlling interests after removing the items that are determined by management to be items that we do not consider indicative of our ongoing operating performance unusual or nonrecurring in nature. Our use of the terms net sales excluding FX, Adjusted Net Income, EBITDA, Adjusted EBITDA, Free Cash Flow, tax rate, as adjusted, and Net Debt may differ from that of others in our industry. Net sales excluding FX, Adjusted Net Income, EBITDA, Adjusted EBITDA and Free Cash Flow should not be considered as alternatives to net sales, net income, operating income or any other performance measures derived in accordance with GAAP as measures of operating performance or operating cash flows or as measures of liquidity. Net sales excluding FX, Adjusted Net Income, EBITDA, Adjusted EBITDA, Free Cash Flow, tax rate, as adjusted, and Net Debt have important limitations as analytical tools and should be considered in conjunction with, and not as substitutes for, our results as reported under GAAP. This presentation includes a reconciliation of certain non-GAAP financial measures with the most directly comparable financial measures calculated in accordance with GAAP. Axalta does not provide a reconciliation for non-GAAP estimates for net sales excluding FX, Adjusted Net Income, EBITDA, Adjusted EBITDA, Free Cash Flow or tax rate, as adjusted, as-reported on a forward-looking basis because the information necessary to calculate a meaningful or accurate estimation of reconciling items is not available without unreasonable effort. For example, such reconciling items include the impact of foreign currency exchange gains or losses, gains or losses that are unusual or nonrecurring in nature, as well as discrete taxable events. We cannot estimate or project those items and they may have a substantial and unpredictable impact on our US GAAP results. Segment Financial Measures The primary measure of segment operating performance is Adjusted EBITDA, which is a key metric that is used by management to evaluate business performance in comparison to budgets, forecasts and prior year financial results, providing a measure that management believes reflects Axalta’s core operating performance. As we do not measure segment operating performance based on Net Income, a reconciliation of this non-GAAP financial measure with the most directly comparable financial measure calculated in accordance with GAAP is not available. Defined Terms All capitalized terms contained within this presentation have been previously defined in our filings with the United States Securities and Exchange Commission. PROPRIETARY 2

Q2 2018 Highlights ▪ Q2 2018 financial results ▪ Net sales of $1,206.5 million up 10.8% YoY; acquisition contribution of 5.6% ▪ Net income (attributable to Axalta) of $74.9 million versus a loss of $20.8 million in Q2 2017 ▪ Adjusted net income of $87.1 million versus $75.4 million in Q2 2017 ▪ Adjusted EBITDA of $247.6 million versus $227.2 million in Q2 2017 ▪ End-market observations ▪ Refinish: Continued price momentum; mid single-digit YoY increase ▪ Industrial: Double-digit organic growth; significant acquisition-driven growth; ongoing positive price contribution ▪ Light Vehicle: Flat overall volumes, including one-time customer production interruptions; inflation offsets not yet accomplished ▪ Commercial Vehicle: Consistent global trends; robust global demand continues ▪ Continued productivity savings from Axalta Way on track ▪ Balance sheet & cash flow highlights ▪ Operating cash flow of $142.0 million versus $98.8 million in Q2 2017 ▪ Free cash flow of $106.9 million versus $73.7 million in Q2 2017 ▪ Capital deployment update ▪ Ramped up share repurchases in Q2; $100.5 million repurchased at a weighted average price of $30.73 PROPRIETARY 3

Q2 Consolidated Results Financial Performance Commentary Q2 % Change Double-digit net sales growth; positive ($ in million) 2018 2017 Incl. F/X Excl. F/X price-mix momentum Performance 785 663 18.3 % 15.4 % ▪ Acquisitions contributed 5.6% to growth, Transportation 422 426 (0.8)% (2.4)% largely from Industrial Net Sales 1,207 1,089 10.8 % 8.4 % ▪ Continued price momentum in Refinish Net Income (Loss) (1) 75 (21) and Industrial; Light Vehicle average Adjusted EBITDA 248 227 9.0 % price remains static; recapture efforts (1) Represents Net Income (loss) attributable to controlling interests continuing ▪ 2.4% favorable currency impact Net Sales Variance principally driven by stronger Euro 0.9% 1.9% 2.4% 5.6% 10.8% ▪ Strong volume growth in Industrial and $1,207 consistent volume in Commercial and Light Vehicle, partially offset by Refinish $1,089 Q2 2017 Volume Price FX Acq. Q2 2018 PROPRIETARY 4

Q2 Performance Coatings Results Financial Performance Commentary Q2 % Change Strong net sales growth driven by ($ in million) 2018 2017 Incl. F/X Excl. F/X acquisition contribution, solid Industrial Refinish 447 421 6.1% 3.4% organic growth, and accelerated pricing Industrial 337 242 39.6% 36.3% ▪ Double-digit Industrial volume growth; Net Sales 785 663 18.3% 15.4% Refinish volumes lower as expected Adjusted EBITDA 177 147 20.2% ▪ 9.2% growth from acquisitions % margin 22.5% 22.1% ▪ Positive price contribution across both end-markets and in all regions ▪ 2.9% currency tailwind led by strong Net Sales Variance Euro and Renminbi 1.4% 4.8% 2.9% 9.2% 18.3% $785 Adjusted EBITDA margin slightly higher ▪ Margin slightly higher led by positive pricing; offset partially by raw material $663 inflation Q2 2017 Volume Price FX Acq. Q2 2018 PROPRIETARY 5

Q2 Transportation Coatings Results Financial Performance Commentary Q2 % Change Net sales impacted by price-mix, ($ in million) 2018 2017 Incl. F/X Excl. F/X including customer specific production Light Vehicle 329 334 (1.5)% (3.1)% impacts Commercial Vehicle 93 91 1.4 % 0.2 % ▪ Light Vehicle volume decline in North Net Sales 422 426 (0.8)% (2.4)% America offset partially by growth in other regions Adjusted EBITDA 71 80 (11.6)% % margin 16.8% 18.9% ▪ Volumes somewhat pressured by temporary production interruptions at select OEM plants Net Sales Variance ▪ Ongoing discussions with customers to 0.2% (2.6)% 1.6% 0.0% (0.8)% recapture inflation ▪ 1.6% currency tailwind mainly from the $426 Euro and Renminbi $422 Adjusted EBITDA margin lower ▪ Margin impact from inflation headwinds and lower average selling prices, partially offset by reduced operating Q2 2017 Volume Price FX Acq. Q2 2018 costs PROPRIETARY 6

Debt and Liquidity Summary Capitalization Comments ($ in millions) @ 6/30/2018 Maturity ▪ Reduction in leverage ratio compared to Q1 2018 due to Cash and Cash Equivalents $ 551 ▪ Improved LTM EBITDA Debt: ▪ Lower Euro debt balances due to stronger Revolver ($400 million capacity) - 2021 Dollar-Euro FX rate First Lien Term Loan (USD) 2,399 2024 Total Senior Secured Debt $ 2,399 ▪ Long term debt interest rates are 72% Senior Unsecured Notes (USD) 491 2024 effectively fixed Senior Unsecured Notes (EUR)(1) 382 2024 ▪ $850 million of variable rate debt protected Senior Unsecured Notes (EUR)(1) 512 2025 from rising interest rates with 3 month USD Capital Leases 55 LIBOR capped at 1.50% Other Borrowings 43 ▪ $475 million is swapped to Euro/Fixed rate Total Debt $ 3,882 of ~1.95% Total Net Debt (2) $ 3,331 LTM Adjusted EBITDA $ 923 Total Net Leverage (3) 3.6x (1) Assumes exchange rate of $1.156 USD/Euro (2) Total Net Debt = Total Debt minus Cash and Cash Equivalents (3) Total Net Leverage = Total Net Debt / LTM Adjusted EBITDA PROPRIETARY 7

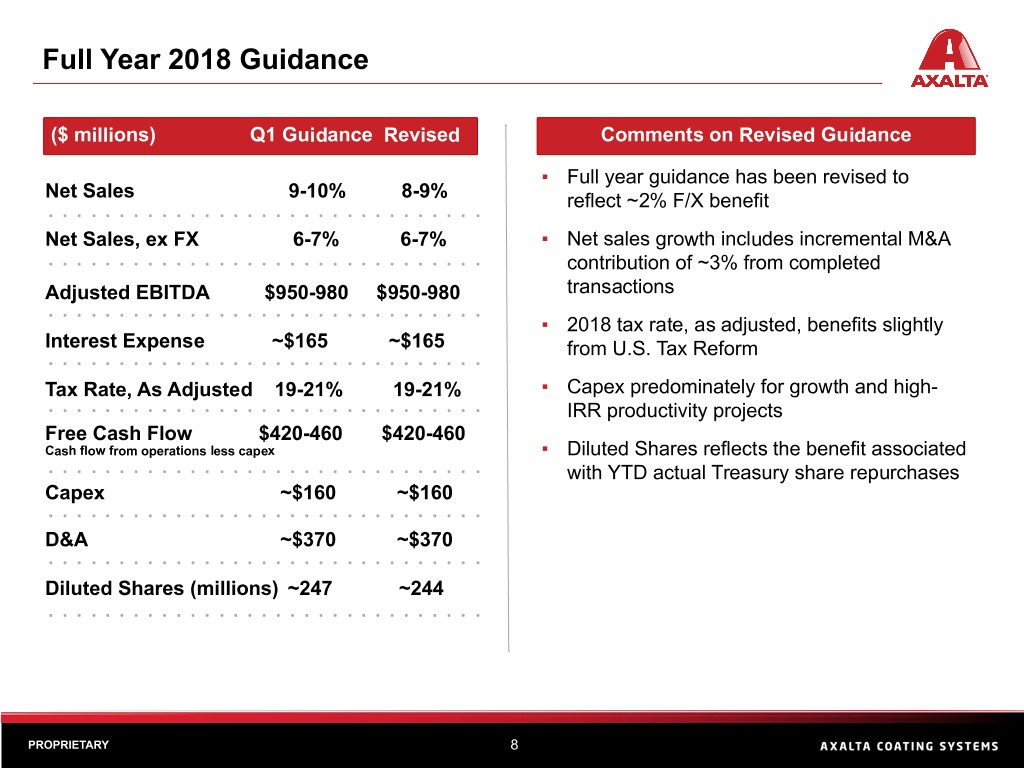

Full Year 2018 Guidance ($ millions) Q1 Guidance Revised Comments on Revised Guidance ▪ Full year guidance has been revised to Net Sales 9-10% 8-9% reflect ~2% F/X benefit Net Sales, ex FX 6-7% 6-7% ▪ Net sales growth includes incremental M&A contribution of ~3% from completed Adjusted EBITDA $950-980 $950-980 transactions ▪ 2018 tax rate, as adjusted, benefits slightly Interest Expense ~$165 ~$165 from U.S. Tax Reform Tax Rate, As Adjusted 19-21% 19-21% ▪ Capex predominately for growth and high- IRR productivity projects Free Cash Flow $420-460 $420-460 Cash flow from operations less capex ▪ Diluted Shares reflects the benefit associated with YTD actual Treasury share repurchases Capex ~$160 ~$160 D&A ~$370 ~$370 Diluted Shares (millions) ~247 ~244 PROPRIETARY 8

Appendix

Full Year 2018 Assumptions Macroeconomic Assumptions Currency Assumptions ▪ Global GDP growth of 2017 2018 USD % Impact approximately 3.3% Currency % Axalta 2017 Average Average of F/X Rate Net Sales Rate Rate Change ▪ Global industrial production Assumption growth of approximately 3.4% US$ per Euro ~28% 1.13 1.20 6.3% ▪ Global auto build growth of approximately 2.1% Chinese Yuan per US$ ~12% 6.76 6.40 5.6% ▪ Higher feedstock pricing Mexican Peso per driven by elevated crude oil US$ ~5% 18.92 19.33 (2.1%) prices combined with capacity ramp downs in China have Brazilian Real per ~3% 3.19 3.54 (9.8%) impacted supply and price for US$ several key raw materials US$ per British Pound ~2% 1.29 1.36 5.6% ▪ Additionally, driver shortages in the United States and Russian Ruble per Europe and on-going trade US$ ~1% 58.32 60.62 (3.8%) tensions between the US & Turkish Lira per ~1% 3.65 4.34 (16.0%) China is expected to further US$ impact pricing of raw materials Other ~48% N/A N/A 0.0% PROPRIETARY 10

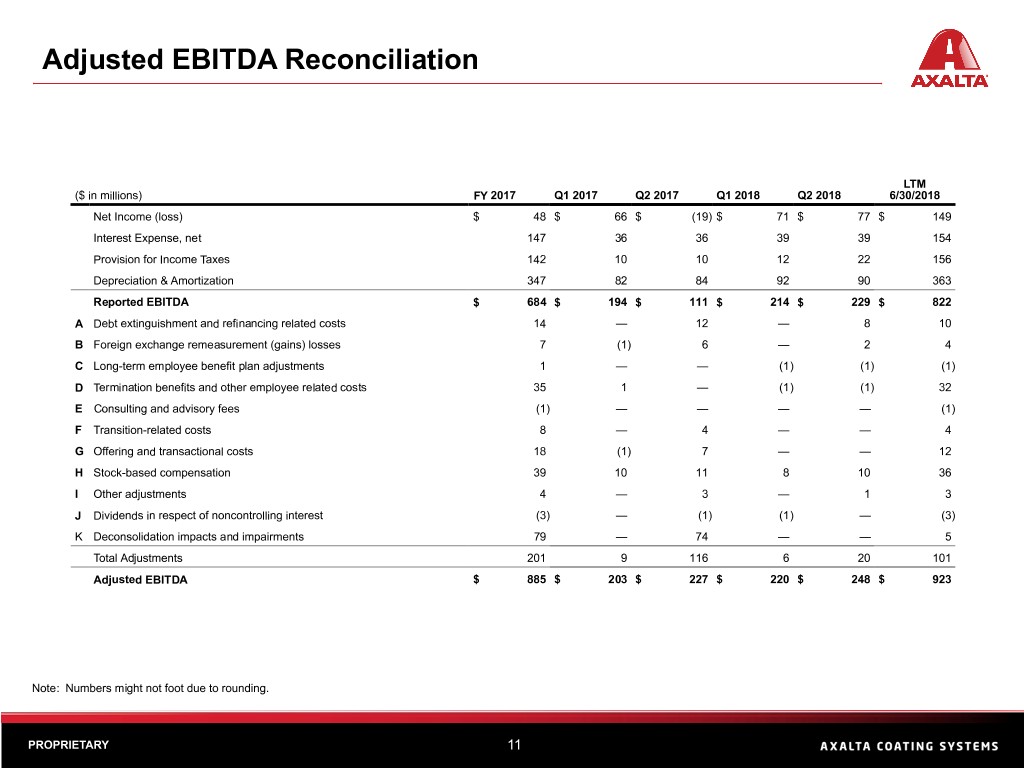

Adjusted EBITDA Reconciliation LTM ($ in millions) FY 2017 Q1 2017 Q2 2017 Q1 2018 Q2 2018 6/30/2018 Net Income (loss) $ 48 $ 66 $ (19) $ 71 $ 77 $ 149 Interest Expense, net 147 36 36 39 39 154 Provision for Income Taxes 142 10 10 12 22 156 Depreciation & Amortization 347 82 84 92 90 363 Reported EBITDA $ 684 $ 194 $ 111 $ 214 $ 229 $ 822 A Debt extinguishment and refinancing related costs 14 — 12 — 8 10 B Foreign exchange remeasurement (gains) losses 7 (1) 6 — 2 4 C Long-term employee benefit plan adjustments 1 — — (1) (1) (1) D Termination benefits and other employee related costs 35 1 — (1) (1) 32 E Consulting and advisory fees (1) — — — — (1) F Transition-related costs 8 — 4 — — 4 G Offering and transactional costs 18 (1) 7 — — 12 H Stock-based compensation 39 10 11 8 10 36 I Other adjustments 4 — 3 — 1 3 J Dividends in respect of noncontrolling interest (3) — (1) (1) — (3) K Deconsolidation impacts and impairments 79 — 74 — — 5 Total Adjustments 201 9 116 6 20 101 Adjusted EBITDA $ 885 $ 203 $ 227 $ 220 $ 248 $ 923 Note: Numbers might not foot due to rounding. PROPRIETARY 11

Adjusted EBITDA Reconciliation (cont’d) A. During Q2 2017 and Q2 2018 we refinanced our term loans, resulting in losses of $12 million and $8 million, respectively. In addition, during 2017, we prepaid outstanding principal on our term loans, resulting in non-cash extinguishment losses of $2 million. We do not consider these items to be indicative of our ongoing operative performance. B. Eliminates foreign exchange gains and losses resulting from the remeasurement of assets and liabilities denominated in foreign currencies, net of impacts of our foreign currency instruments used to hedge our balance sheet exposures. C. Eliminates the non-cash, non-service components of long-term employee benefit costs. D. Represents expenses and associated changes to estimates primarily related to employee termination benefits and other employee-related costs associated with our Axalta Way initiatives, which are not considered indicative of our ongoing operating performance. E. Represents expenses and associated changes to estimates for professional services primarily related to our Axalta Way initiatives, which are not considered indicative of our ongoing operating performance. F. Represents integration costs and associated changes to estimates related to the 2017 acquisition of the Industrial Wood business that was a carve-out business from Valspar. These amounts are not considered indicative of our ongoing operating performance. G. Represents acquisition-related expenses, including changes in the fair value of contingent consideration, which are not considered indicative of our ongoing operating performance. H. Represents non-cash costs associated with stock-based compensation. I. Represents certain non-operational or non-cash gains and losses unrelated to our core business and which we do not consider indicative of ongoing operations, including indemnity losses associated with the acquisition by Axalta of the DuPont Performance Coatings business, gains and losses from the sale and disposal of property, plant and equipment, from the remaining foreign currency derivative instruments and from non-cash fair value inventory adjustments associated with our business combinations. J. Represents the payment of dividends to our joint venture partners by our consolidated entities that are not 100% owned, which are reflected to show the cash operating performance of these entities on Axalta’s financial statements. K. During Q2 2017, we recorded a loss in conjunction with the deconsolidation of our Venezuelan subsidiary of $71 million as well as non-cash impairment charges related to a manufacturing facility previously announced for closure of $3 million and $8 million during Q2 2017 and FY 2017, respectively. We do not consider these to be indicative of our ongoing operating performance. PROPRIETARY 12

Adjusted Net Income Reconciliation ($ in millions) Q2 2017 Q2 2018 Net Income (loss) $ (19) $ 77 Less: Net income attributable to noncontrolling interests 2 2 Net income (loss) attributable to controlling interests (21) 75 A Debt extinguishment and refinancing related costs 12 8 B Foreign exchange remeasurement losses 6 2 C Termination benefits and other employee related costs — (1) D Consulting and advisory fees — — E Transition-related costs 4 — F Offering and transactional costs 7 — G Deconsolidation impacts and impairments 77 — H Other 3 — Total adjustments $ 108 $ 9 I Income tax (benefit) provision impacts $ 12 $ (3) Adjusted net income $ 75 $ 87 Note: Numbers might not foot due to rounding. PROPRIETARY 13

Adjusted Net Income Reconciliation (cont’d) A. During Q2 2017 and Q2 2018 we refinanced our term loans, resulting in losses of $12 million and $8 million, respectively. We do not consider these items to be indicative of our ongoing operative performance. B. Eliminates foreign exchange losses resulting from the remeasurement of assets and liabilities denominated in foreign currencies, net of the impacts of our foreign currency instruments used to hedge our balance sheet exposures. C. Represents expenses and associated changes to estimates primarily related to employee termination benefits and other employee-related costs associated with our Axalta Way initiatives, which are not considered indicative of our ongoing operating performance. D. Represents expenses and associated changes to estimates for professional services primarily related to our Axalta Way initiatives, which are not considered indicative of our ongoing operating performance. E. Represents integration costs and associated changes to estimates related to the 2017 acquisition of the Industrial Wood business that was a carve-out business from Valspar. We do not consider these items to be indicative of our ongoing operating performance. F. Represents acquisition-related expenses, including changes in the fair value of contingent consideration, which are not considered indicative of our ongoing operating performance. G. During Q2 2017, we recorded a loss in conjunction with the deconsolidation of our Venezuelan subsidiary of $71 million as well as non-cash impairment charges related to a manufacturing facility previously announced for closure of $3 million and an abandoned research and development asset of $1 million. In connection with the manufacturing facilities announced for closure, we recorded accelerated depreciation of $2 million in Q2 2017. We do not consider these to be indicative of our ongoing operating performance. H. Represents costs for non-cash fair value inventory adjustments associated with our business combinations, which are not considered indicative of our ongoing operating performance. I. The income tax impacts are determined using the applicable rates in the taxing jurisdictions in which expense or income occurred and includes both current and deferred income tax expense (benefit) based on the nature of the non-GAAP performance measure. PROPRIETARY 14

Thank you Investor Relations Contact: Chris Mecray Christopher.Mecray@axaltacs.com 215-255-7970