Attached files

As filed with the Securities and Exchange Commission on July 24, 2018

Registration No. 333-

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

—————

FORM S-1

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

—————

AGEAGLE AERIAL SYSTEMS INC.

(Exact name of registrant as specified in its charter)

| Nevada | 3721 | 88-0422242 |

(State or other jurisdiction of incorporation or organization) |

(Primary standard industrial classification code number) |

(I.R.S. employer identification number) |

117

South 4th Street

Neodesha, Kansas 66757

(316) 202-2076

(Address,

including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Barrett

Mooney, Chief Executive Officer

AgEagle Aerial Systems Inc.

117 South 4th Street

Neodesha, Kansas 66757

Phone: (316) 202-2076

(Name,

address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

| Mitchell

S. Nussbaum, Esq. Tahra Wright, Esq. David J. Levine, Esq. Loeb & Loeb LLP 345 Park Avenue New York, NY 10154 (212) 407-4000 - Telephone (212) 407-4990 – Facsimile |

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer (Do not check if smaller reporting company) |

Smaller reporting company | ☒ | |

| Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| Title of Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Aggregate Price Per Share (2) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee (3) |

| Common Stock, $0.001 par value per share | 4,249,469 | $1.86 | $7,904,012.34 | $984.05 |

| (1) Pursuant to Rule 416 of the Securities Act of 1933, as amended, the shares of Common Stock offered hereby also include such presently indeterminate number of shares of our Common Stock as shall be issued by us to the selling stockholder as a result of stock splits, stock dividends or similar transactions. | |

| (2) Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) under the Securities Act of 1933, as amended, based on the average of the high and low prices of our common stock reported on the NYSE American on July 20, 2018. | |

| (3) Paid herewith. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The

information in this Preliminary Prospectus is not complete and may be changed. We may not sell these securities until the Registration

Statement filed with the Securities and Exchange Commission is effective. This Preliminary Prospectus is not an offer to sell

these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 24, 2018

PRELIMINARY PROSPECTUS

This prospectus relates to the public offering of up to 4,249,469 shares of common stock, par value $0.001 per share (the “Shares”), of AgEagle Aerial Systems Inc., by the selling stockholder set forth in the Selling Stockholder table on page 55 (the “Selling Stockholder”). The Shares are issuable upon the conversion of outstanding shares of our Series C Convertible Preferred Stock held by the Selling Stockholder. The Shares may be sold from time to time by the Selling Stockholder. The Shares were issued to the Selling Stockholder in private transactions, which were exempt from the registration and prospectus delivery requirements of the Securities Act of 1933, as amended.

We will not receive any proceeds from the sale of the shares by the Selling Stockholder. See “Use of Proceeds” on page 18. We have agreed to pay the expenses in connection with the registration of these shares.

Our common stock is listed on the NYSE American under the symbol “UAVS.” The closing price of our common stock on July 20, 2018 was $1.81.

INVESTMENT IN THE COMMON STOCK INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CONSIDER CAREFULLY THE RISK FACTORS BEGINNING ON PAGE 8 OF THIS PROSPECTUS BEFORE PURCHASING ANY OF THE SHARES OFFERED BY THIS PROSPECTUS.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Prospectus dated , 2018.

i

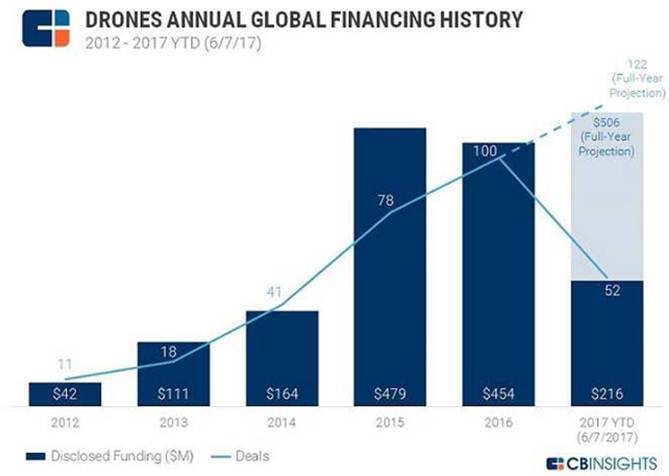

INDUSTRY AND MARKET DATA

Industry and market data used throughout this prospectus was obtained through Company research, surveys and studies conducted by third parties and industry and general publications. Certain information contained in “Description of Business” is based on studies, analyses and surveys prepared by the United Nations Food and Agriculture Organization, ABI Research, the Association for Unmanned Vehicle Systems International, The Teal Group, CB Insights, Goldman Sachs and Markets and Markets. While we are not aware of any misstatements regarding the industry data presented herein, estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors.”

ii

The following summary highlights information contained elsewhere in this prospectus and is qualified in its entirety by the more detailed information and financial statements included elsewhere in this prospectus. This summary does not contain all of the information that may be important to you. You should read and carefully consider the following summary together with the entire prospectus, including our financial statements and the notes thereto appearing elsewhere in this prospectus and the matters discussed in the sections in this prospectus entitled “Risk Factors,” “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” before deciding to invest in our units. Some of the statements in this prospectus constitute forward-looking statements that involve risks and uncertainties. See “Special Note Regarding Forward-Looking Statements.” Our actual results could differ materially from those anticipated in such forward-looking statements as a result of certain factors, including those discussed in the “Risk Factors” section and other sections of this prospectus.

Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “we,” “us,” “our,” “Company,” and “AgEagle” refer to AgEagle Aerial Systems Inc., a Nevada corporation.

Overview

We design, produce, distribute and support technologically-advanced small unmanned aerial vehicles (UAVs or drones) that we offer for sale commercially to the precision agriculture industry. Additionally, we recently announced a new service offering using our UAVs and associated data processing services for the sustainable agriculture industry.

Our first commercially available product was the AgEagle Classic which was followed shortly thereafter by the RAPID System. As we improved and matured our product we launched the RX-60 and subsequently our current products, the RX-47 and RX-48. In February 2016, we signed a worldwide distribution agreement with Raven Industries, Inc. (“Raven”) under which Raven would purchase the RX-60 for the agriculture markets for resale through their network of dealers worldwide. The first shipment of our RX-60 system to Raven occurred in March 2016. In 2017, we amended our agreement with Raven to make it non-exclusive and to allow us to sell our products directly into the market. As a result, we began selling our products directly to farmers and agronomists and we do not anticipate sales to, or through Raven in the near future.

The success we have achieved with our products, which we believe has carried over into the new RX-47 and RX-48, stems from our ability to invent and deliver advanced solutions utilizing our proprietary technologies and trade secrets that help farmers, agronomists and other precision agricultural professionals operate more effectively and efficiently. Our core technological capabilities, developed over five years of innovation, include a lightweight laminated shell that allows the UAV platform to perform under challenging flying conditions, a camera with a Near Infrared (NIR) filter, a rugged foot launcher (RX-60), and high end software provided by third parties that automates drone flights and provides geo-referenced data.

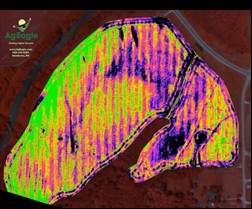

Our UAV is an advanced fixed wing model UAV whose design is based upon the years of experience our management has with aircraft and composite parts construction. We design all of our UAVs to be man-portable, thereby allowing one person to launch and operate them through a hand-held control unit or tablet. All of our UAVs are electrically powered, weigh approximately six pounds fully loaded, are capable of flying over approximately 400 acres (roughly 60 minutes of airtime) per flight from their launch location, and are configured to carry a camera with our NIR filter that uses near infrared images to capture crop data. We believe that these characteristics make our UAVs well suited for providing a complete aerial view of a farmer’s field to help precisely identify crop health and field conditions faster than any other method available.

Our UAVs were initially specifically designed to help farmers increase profits by pinpointing areas where nutrients or chemicals need to be applied, as opposed to traditional widespread land application processes, thus decreasing input costs, reducing the amount of chemicals applied and potentially increasing yields. Our products were designed for busy agriculture professionals who do not have the time to process images on their computers, which some of our competitors require, and our first generation product, the AgEagle Classic used to do. Through a relationship with our strategic partner, Botlink, our UAV can be programmed using a tablet device to overlay a flight path over a farmer’s specific crop area. The software can automatically take pictures from the camera, stitch the photos together through the cloud, and deliver a geo-referenced, high quality aerial map to the user’s desktop or tablet device using specialty precision agriculture software such as SST Software or SMS Software. The result is a prescription or zone map that can then be used in a field computer that can typically be found in a sprayer or applicator that has been designed to drive through fields to precisely apply the amount of nutrients or chemicals required to continue or restore the production of healthy yields.

Research and development activities are integral to our business and we follow a disciplined approach to investing our resources to create new technologies and solutions.

1

Our Growth Strategy

We intend to grow our business by establishing our leadership position in the growing precision agriculture marketplace, launching a new service targeting the sustainable agriculture marketplace for the 2019 growing season, and by creating new, easier to use and higher value products that enable us to remain a leading platform available to our customers. We may also elect to pursue additional opportunities in different industries outside of agriculture and its related areas. Key components of this strategy include the following:

Build a strong worldwide distribution network to offer a best-in-class precision agriculture platform.

We believe we can establish our flying wing product and systems as leading technologies in the precision agriculture marketplace. We will work to identify and establish relationships with dealers and customers in key agricultural regions worldwide, which will help make it possible for every farmer in those markets to have access to the AgEagle platform. Potential distributors are spread across six continents, covering a majority of the world’s major regions including the U.S., Canada, South America, Eastern and Western Europe, Southeast Asia, and Oceania.

Launch and market our new UAV based monitoring service for large food manufacturers desiring to monitor sustainability practices on their farms

We are in the process of launching a new service for the 2019 grow season targeted towards large food manufacturers that are being pressured by consumers to create food products with less chemicals that are more sustainably sourced. We believe our current technology, combined with other third-party technologies will allow us to offer a product to these food manufacturers and could allow us to accelerate business growth faster than if we just focused on the precision agriculture marketplace.

Continue to explore partnerships with companies that can expand our offerings.

We intend to expand our product offerings by building relationships and partnerships with companies that have vertical, synergistic technologies. In addition, other technology alliances may include the acquisition or development of other electronics, software, sensors or more advanced aerial platforms. We are constantly meeting and in discussions with groups that could fill these roles and help with additional development ideas.

Deliver new and innovative solutions in the precision agriculture space.

Our research and development efforts are the foundation of our Company, and we plan to continue to invest in R&D. We plan to continue innovating new and enhanced products that enable us to satisfy our customers through better, more capable products and services, both in response to and in anticipation of their needs. We believe that by investing in research and development, we can be a leader in delivering innovative products that address market needs within our current target markets, enabling us to create new opportunities for growth.

Pursue the expansion of the AgEagle platform of products into other industries besides agriculture.

We may investigate and pursue opportunities outside of agriculture as we continue to expand and grow the AgEagle platform. We are confident in the UAV product we have today, and believe that this product could provide other industries the same kind of optimization we are currently providing the agriculture industry. These industries have yet to be identified by the AgEagle team, but may include verticals such as land surveying and scanning, insurance, inspections, and search and rescue.

2

Competitive Strengths

We believe the following attributes and capabilities provide us with long-term competitive advantages:

| • | Proprietary Technology and Trade Secrets |

We believe our unique design and assembly process differentiates our product from any competition. We are confident that our UAVs are industry-leading in durability due to the lightweight laminated shell of the wing, which is made using a proprietary manufacturing process developed by our President and CEO over five years of innovating. This process, which hardens the material used to build the shell, allows the UAV to perform in harsh weather conditions (with wind speeds up to 30 miles per hour) and bring itself to an unassisted landing, all at a total weight of about six pounds. This design is an important trade secret, and we have non-disclosure agreements with our employees in order to keep it unique to AgEagle.

| • | Product Has Global Appeal |

We believe that our technology addresses a need for better data in the agriculture industry worldwide. With our new global distribution platform, we believe that we are well-positioned for our advanced products to be a viable solution for farmers worldwide.

| • | Increased Margins for Farmers |

We believe our UAVs will directly enhance margins of our customers by reducing the amount of nutrients and chemicals needed to manage their farms. The software equipped on our UAVs deliver a high-quality aerial map upon completion of the flight, allowing the user to accurately identify the specific areas that are malnourished. This software is compatible with precision applicator tractors, which assist users in applying a precise amount of nutrients in only the necessary areas.

| • | Increased transparency for Food Manufacturers |

We believe our UAV’s and the data platform we are building offer a unique opportunity to be one of the first companies to offer major food manufacturers a way to connect to the sustainable efforts being made by the farmers from whom they purchase ingredients for their food products. This could allow food manufacturers to confidently claim their food products are made with less chemicals on their packaging and in their marketing.

| • | Empower Customers Through Our Self-Serve Platform |

Our UAVs are specially designed to provide users with a portable and easy to operate device, which can be controlled with a hand-held unit or tablet. Through our partnership with Botlink, users will be able to plan and track an efficient flight path for their UAV. The UAVs are equipped with a camera and NIR filter whose images provide a holistic aerial view of the fields along with meaningful data that is uploaded and delivered to the user within a very short time frame. As a result, this platform allows users to quickly detect any issues in their fields, which enables them to address such issues in a timely manner before any damage, or further damage affects their fields.

| • | All Manufacturing of our Products is Completed in the United States |

As of today, we manufacture all of our products at our manufacturing facility in Neodesha, Kansas, which allows us to avoid many of the potential difficulties that may arise if our manufacturing facilities were otherwise located outside the U.S. In addition, all of our research and development activities are performed in the U.S.

Risks Relating to Our Business

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this prospectus summary. Some of these risks include, but are not limited to, risks associated with:

| • | our need for additional funding; |

| • | our ability to protect our intellectual property rights; |

| • | rapid technological changes in the industry; |

| • | governmental policies and regulations regarding our industry; |

| • | our ability to maintain strong relationships with our customers, suppliers and distributors, including Raven; and |

| • | worldwide and domestic economic trends and financial market conditions, including an economic decline in the agricultural industry. |

3

Recent Development

On March 26, 2018, EnerJex Resources, Inc. (“EnerJex”), a Nevada company, consummated the transactions contemplated by that certain Agreement and Plan of Merger (the “Merger Agreement”), dated October 19, 2017, pursuant to which AgEagle Merger Sub, Inc., a Nevada corporation and a wholly-owned subsidiary of EnerJex, merged with and into AgEagle Aerial Systems, Inc., a privately held company organized under the laws of the state of Nevada (“AgEagle Sub”), with AgEagle Sub surviving as a wholly-owned subsidiary of EnerJex (the “Merger”). In connection with the Merger, EnerJex changed its name to AgEagle Aerial Systems Inc. (the “Company, “we,” “our,” or “us”) and AgEagle Sub changed its name to “Eagle Aerial Systems, Inc.” Our common stock will continue to trade on the NYSE American under its new symbol “UAVS” commencing on March 27, 2018. As a result of the Merger, through AgEagle Sub, we are now engaged in the business of designing, developing, producing, distributing and supporting technologically-advanced small unmanned aerial vehicles (UAVs or drones) that we supply to the precision agriculture industry.

Our Corporate Information

We were incorporated in the State of Nevada on April 22, 2015. Our principal executive offices are located at 117 S. 4th Street, Neodesha, Kansas 66757 and our telephone number is (316) 202-2076. Our website address is http://www.ageagle.com. The information contained on, or that can be accessed through, our website is not a part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

4

The Offering

This prospectus relates to the sale by the Selling Stockholder of up to 4,249,469 shares of our common stock.

| Common stock offered by Selling Stockholder | 4,249,469 shares |

| NYSE American Symbol | UAVS |

| Risk Factors | See “Risk Factors” beginning on page 8 and other information included in this prospectus for a discussion of factors you should consider before deciding to invest in shares of our common stock. |

5

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our units. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

Risks Related to Our Business and Industry

We may fail to realize the anticipated benefits of the Merger.

The success of the Merger will depend on, among other things, the combined company’s ability to achieve its business objectives, including the successful development of its products. If we are not able to achieve these objectives, the anticipated benefits of the Merger may not be realized fully, may take longer to realize than expected, or may not be realized at all.

Prior to the consummation of the Merger, EnerJex and AgEagle operated independently. Any delays in the integration process or inability to realize the full extent of the anticipated benefits of the Merger could have an adverse effect on the business prospects and results of operations of the combined company. Such an adverse effect may impact the value of the shares of the combined company’s common stock after the completion of the Merger.

Potential difficulties that may be encountered in the integration process include the following:

| • | using the combined company’s cash and other assets efficiently to develop the business of the combined company; |

| • | potential unknown or currently unquantifiable liabilities associated with the Merger and the operations of the combined company; and |

| • | performance shortfalls as a result of the diversion of management’s attention that was caused by completing the Merger. |

We have a limited operating history and there can be no assurance that we can achieve or maintain profitability.

Through our wholly-owned subsidiary, AgEagle Sub, we have been operating for approximately eight years. However, AgEagle Sub has only been in the UAV business for half of that time. We are currently in the business development stage and have limited commercial sales of our products and, accordingly, we cannot guarantee that we will become profitable. Moreover, even if we achieve profitability, given the competitive and evolving nature of the industry in which we operate, we may be unable to sustain or increase profitability and its failure to do so would adversely affect its business, including its ability to raise additional funds.

We will need substantial additional funding and may be unable to raise capital when needed, which would force us to delay, curtail or eliminate one or more of our research and development programs or commercialization efforts.

Our operations have consumed substantial amounts of cash since inception. We expect to continue to spend substantial amounts on product development. We will require additional funds to support continued research and development activities, as well as the costs of commercializing, marketing and selling any new products resulting from those research and development activities. We have based this estimate, however, on assumptions that may prove to be wrong, and we could spend available financial resources much faster than we currently expect.

Until such time, if ever, that we can generate a sufficient amount of product revenue and achieve profitability, we expect to seek to finance future cash needs through equity or debt financings or corporate collaboration and strategic arrangements. We currently have no other commitments or agreements relating to any of these types of transactions and cannot be certain that additional funding will be available on acceptable terms, or at all. If we are unable to raise additional capital, we may have to delay, curtail or eliminate commercializing, marketing and selling one or more of our products.

6

Product development is a long, expensive and uncertain process.

The development of both UAV software and hardware is a costly, complex and time-consuming process, and investments in product development often involve a long wait until a return, if any, can be achieved on such investment. We might face difficulties or delays in the development process that will result in our inability to timely offer products that satisfy the market, which might allow competing products to emerge during the development and certification process. We anticipate making significant investments in research and development relating to our products and services, but such investments are inherently speculative and require substantial capital expenditures. Any unforeseen technical obstacles and challenges that we encounter in the research and development process could result in delays in or the abandonment of product commercialization, may substantially increase development costs, and may negatively affect our results of operations.

Successful technical development of our products does not guarantee successful commercialization.

Although we have successfully completed the technical development of our two original UAV systems, as well as the new RX-60 and RX-47 and RX-48 systems, we may still fail to achieve commercial success for a number of reasons, including, among others, the following:

| • | failure to obtain the required regulatory approvals for their use; |

| • | rapid evolvement of the product due to new technologies; |

| • | prohibitive production costs; |

| • | competing products; |

| • | lack of product innovation; |

| • | unsuccessful distribution and marketing through our sales channels; |

| • | insufficient cooperation from our supply and distribution partners; and |

| • | product development that does not align with or meet customer needs. |

Our success in the market for the products and services we develop will depend largely on our ability to properly demonstrate their capabilities. Upon demonstration, our platform of systems may not have the capabilities they were designed to have or that we believed they would have. Furthermore, even if we do successfully demonstrate our products’ capabilities, potential customers may be more comfortable doing business with a competitor, or may not feel there is a significant need for the products we develop. As a result, significant revenue from our current and new product investments may not be achieved for a number of years, if at all.

Our software platform, offered through our partnership with Botlink, is at risk of unexpected technical failure due to the unavailability of a cellular connection or other technical issues with the software.

Botlink’s technology is relatively new and has only been active in the field for less than one year. As a result, our UAV products may experience technical difficulties that prevent customers from collecting and processing the crop data in real-time. The most common technical problem our customers may experience is the unavailability of a cellular connection, which is necessary in order to wirelessly process the collected data through the cloud. While this will not affect the performance of the UAV or the collection of the data, it could potentially prevent customers from being able to access their completed crop analysis in real-time. While these technical difficulties may be an issue for our customers in the U.S., customers outside of the U.S. will not be subject to such technical difficulties, as their product will be designed for the manual removal and downloading of files through a memory card due to the unavailability of cellular connections in certain areas of the world. We are currently in the final stages of integrating our manual and cellular connected products so that our U.S. customers will be able to access their data at all times, even in the absence of a cellular connection.

7

If we fail to protect our intellectual property rights, we could lose our ability to compete in the marketplace.

Our intellectual property and proprietary rights are important to our ability to remain competitive and successful in the development of our products and our business. Patent protection can be limited and not all intellectual property can be patented. We expect to rely on a combination of patent, trademark, copyright, and trade secret laws as well as confidentiality agreements and procedures, non-competition agreements and other contractual provisions to protect our intellectual property, other proprietary rights and our brand. As we currently do not have any granted patent, trademark or copyright protections, we must rely on trade secrets and nondisclosure agreements, which provide limited protections. Our intellectual property rights may be challenged, invalidated or circumvented by third parties. We may not be able to prevent the unauthorized disclosure or use of our technical knowledge or other trade secrets by employees or competitors.

Furthermore, our competitors may independently develop technologies and products that are substantially equivalent or superior to our technologies and products, which could result in decreased revenues. Litigation may be necessary to enforce our intellectual property rights, which could result in substantial costs to us and substantial diversion of management attention. If we do not adequately protect our intellectual property, our competitors could use it to enhance their products. Our inability to adequately protect our intellectual property rights could adversely affect our business and financial condition, and the value of our brand and other intangible assets.

Other companies may claim that we infringe their intellectual property, which could materially increase our costs and harm our ability to generate future revenue and profit.

We do not believe that our technologies infringe on the proprietary rights of any third party, but claims of infringement are becoming increasingly common and third parties may assert infringement claims against us. It may be difficult or impossible to identify, prior to receipt of notice from a third party, the trade secrets, patent position or other intellectual property rights of a third party, either in the United States or in foreign jurisdictions. Any such assertion may result in litigation or may require us to obtain a license for the intellectual property rights of third parties. If we are required to obtain licenses to use any third party technology, we would have to pay royalties, which may significantly reduce any profit on our products. In addition, any such litigation could be expensive and disruptive to its ability to generate revenue or enter into new market opportunities. If any of our products were found to infringe other parties’ proprietary rights and we are unable to come to terms regarding a license with such parties, we may be forced to modify our products to make them non-infringing or to cease production of such products altogether.

The nature of our business involves significant risks and uncertainties that may not be covered by insurance or indemnification.

We have developed and sold products and services in circumstances where insurance or indemnification may not be available; for example, in connection with the collection and analysis of various types of information. In addition, our products and services raise questions with respect to issues of civil liberties, intellectual property, trespass, conversion and similar concepts, which may create legal issues. Indemnification to cover potential claims or liabilities resulting from the failure of any technologies that we develop or deploy may be available in certain circumstances but not in others. Currently, the unmanned aerial systems industry lacks a formative insurance market. We may not be able to maintain insurance to protect against all operational risks and uncertainties that our customers confront. Substantial claims resulting from an accident, product failure, or personal injury or property liability arising from our products and services in excess of any indemnity or insurance coverage (or for which indemnity or insurance coverage is not available or is not obtained) could harm our financial condition, cash flows and operating results. Any accident, even if fully covered or insured, could negatively affect our reputation among our customers and the public, and make it more difficult for us to compete effectively.

We may incur substantial product liability claims relating to our products.

As a manufacturer of UAV products, and with aircraft and aviation sector companies under increased scrutiny, claims could be brought against us if use or misuse of one of our UAV products causes, or merely appears to have caused, personal injury or death. In addition, defects in our products may lead to other potential life, health and property risks. Any claims against us, regardless of their merit, could severely harm our financial condition, strain our management and other resources. We are unable to predict if we will be able to obtain or maintain product liability insurance for any products that may be approved for marketing.

8

If we are unable to recruit and retain key management, technical and sales personnel, our business would be negatively affected.

For our business to be successful, we need to attract and retain highly qualified technical, management and sales personnel. The failure to recruit additional key personnel when needed, with specific qualifications, on acceptable terms and with an ability to maintain positive relationships with our partners, might impede our ability to continue to develop, commercialize and sell our products and services. To the extent the demand for skilled personnel exceeds supply, we could experience higher labor, recruiting and training costs in order to attract and retain such employees. The loss of any members of our management team may also delay or impair achievement of our business objectives and result in business disruptions due to the time needed for their replacements to be recruited and become familiar with our business. We face competition for qualified personnel from other companies with significantly more resources available to them and thus may not be able to attract the level of personnel needed for our business to succeed.

If our proposed marketing efforts are unsuccessful, we may not earn enough revenue to become profitable.

Our future growth depends on our gaining market acceptance and regular production orders for our products and services. Our marketing plan includes attendance at trade shows, making private demonstrations, advertising, promotional materials and advertising campaigns in print and/or broadcast media. In the event we are not successful in obtaining a significant volume of orders for our products and services, we will face significant obstacles in expanding our business. We cannot give any assurance that our marketing efforts will be successful. If they are not, revenue may not be sufficient to cover our fixed costs and we may not become profitable.

Our operating margins may be negatively impacted by reduction in sales or products sold.

Expectations regarding future sales and expenses are largely fixed in the short term. We maintain raw materials and finished goods at a volume we feel is necessary for anticipated distribution and sales. Therefore, we may not be able to reduce costs in a timely manner to compensate for any unexpected shortfalls between forecasted and actual sales.

We face a significant risk of failure because we cannot accurately forecast our future revenues and operating results.

The rapidly changing nature of the markets in which we compete makes it difficult to accurately forecast our revenues and operating results. Furthermore, we expect our revenues and operating results to fluctuate in the future due to a number of factors, including the following:

| • | the timing of sales of our products; |

| • | unexpected delays in introducing new products; |

| • | increased expenses, whether related to sales and marketing, or administration; and |

| • | costs related to possible acquisitions of businesses. |

Rapid technological changes may adversely affect the market acceptance of our products and could adversely affect our business, financial condition and results of operations.

The market in which we compete is subject to technological changes, introduction of new products, change in customer demands and evolving industry standards. Our future success will depend upon our ability to keep pace with technological developments and to timely address the increasingly sophisticated needs of our customers by supporting existing and new technologies and by developing and introducing enhancements to our current products and new products. We may not be successful in developing and marketing enhancements to our products that will respond to technological change, evolving industry standards or customer requirements. In addition, we may experience difficulties internally or in conjunction with key vendors and partners that could delay or prevent the successful development, introduction and sale of such enhancements and such enhancements may not adequately meet the requirements of the market and may not achieve any significant degree of market acceptance. If release dates of our new products or enhancements are delayed or, if when released, they fail to achieve market acceptance, our business, operating results and financial condition may be adversely affected.

9

Our products are subject to regulations of the Federal Aviation Administration (the “FAA”).

In August 2016, regulations from the FAA relating to the commercial use of UAVs in the United States became law. As a result, users of systems like ours are only required to take a knowledge exam at an approved FAA testing station similar to an automobile driver’s license exam. Prior to the new law, users had to hold a pilot’s license, have an observer present and file various documents before flights. We saw a decrease in revenues of approximately 52% during 2016, which we believe may have been partially due to the uncertainty of the FAA regulations prior to the enactment of the new law. In the event new FAA rules or regulations are promulgated or current rules are revised that may negatively affect commercial usage of our UAVs, such rules and laws could adversely disrupt our operations and overall sales.

Our future results may be affected by various legal and regulatory proceedings and legal compliance risks, including those involving product liability, antitrust, intellectual property, environmental, regulations of the FAA, the U.S. Foreign Corrupt Practices Act and other anti-bribery, anti-corruption, or other matters.

The outcome of any future legal proceedings may differ from our expectations because the outcomes of litigation, including regulatory matters, are often difficult to reliably predict. Various factors or developments can lead us to change current estimates of liabilities and related insurance receivables where applicable, or make such estimates for matters previously not susceptible of reasonable estimates, such as a significant judicial ruling or judgment, a significant settlement, significant regulatory developments or changes in applicable law. A future adverse ruling, settlement or unfavorable development could result in future charges that could have a material adverse effect on our results of operations or cash flows in any particular period. We are not currently involved in or subject to any such legal or regulatory proceedings, but we cannot guarantee that such proceedings may not occur in the future.

If we do not receive the governmental approvals necessary for the sales or export of our products, or if our products are not compliant in other countries, our sales may be negatively impacted. Similarly, if our suppliers and partners do not receive government approvals necessary to export their products or designs to us, our revenues may be negatively impacted and we may fail to implement our growth strategy.

A license may be required in the future to initiate marketing activities. We may also be required to obtain a specific export license for any hardware exported. We may not be able to receive all the required permits and licenses for which we may apply in the future. If we do not receive the required permits for which we apply, our revenues may be negatively impacted. In addition, if government approvals required under these laws and regulations are not obtained, or if authorizations previously granted are not renewed, our ability to export our products could be negatively impacted, which may have a negative impact on our revenues and a potential material negative impact on our financial results.

We may pursue additional strategic transactions in the future, which could be difficult to implement, disrupt our business or change our business profile significantly.

We intend to consider additional potential strategic transactions, which could involve acquisitions of businesses or assets, joint ventures or investments in businesses, products or technologies that expand, complement or otherwise relate to our current or future business. We may also consider, from time to time, opportunities to engage in joint ventures or other business collaborations with third parties to address particular market segments. Should our relationships fail to materialize into significant agreements or should we fail to work efficiently with these companies, we may lose sales and marketing opportunities and its business, results of operations and financial condition could be adversely affected.

These activities, if successful, create risks such as, among others: (i) the need to integrate and manage the businesses and products acquired with our own business and products; (ii) additional demands on our resources, systems, procedures and controls; (iii) disruption of our ongoing business; and (iv) diversion of management’s attention from other business concerns. Moreover, these transactions could involve: (a) substantial investment of funds or financings by issuance of debt or equity securities; (b) substantial investment with respect to technology transfers and operational integration; and (c) the acquisition or disposition of product lines or businesses. Also, such activities could result in one-time charges and expenses and have the potential to either dilute the interests of our existing shareholders or result in the issuance of, or assumption of debt. Such acquisitions, investments, joint ventures or other business collaborations may involve significant commitments of financial and other resources. Any such activities may not be successful in generating revenue, income or other returns, and any resources we committed to such activities will not be available to us for other purposes. Moreover, if we are unable to access the capital markets on acceptable terms or at all, we may not be able to consummate acquisitions, or may have to do so on the basis of a less than optimal capital structure. Our inability to take advantage of growth opportunities or address risks associated with acquisitions or investments in businesses may negatively affect our operating results.

Additionally, any impairment of goodwill or other intangible assets acquired in an acquisition or in an investment, or charges to earnings associated with any acquisition or investment activity, may materially reduce our earnings. Future acquisitions or joint ventures may not result in their anticipated benefits and we may not be able to properly integrate acquired products, technologies or businesses with our existing products and operations or successfully combine personnel and cultures. Failure to do so could deprive us of the intended benefits of those acquisitions.

10

Breaches of network or information technology security could have an adverse effect on our business.

Cyber-attacks or other breaches of network or IT security may cause equipment failures or disrupt our systems and operations. We may be subject to attempts to breach the security of our networks and IT infrastructure through cyber-attack, malware, computer viruses and other means of unauthorized access. The potential liabilities associated with these events could exceed the insurance coverage we maintain. Our inability to operate our facilities as a result of such events, even for a limited period of time, may result in significant expenses or loss of market share to other competitors in the defense electronics market. In addition, a failure to protect the privacy of customer and employee confidential data against breaches of network or IT security could result in damage to our reputation. To date, we have not been subject to cyber-attacks or other cyber incidents which, individually or in the aggregate, resulted in a material adverse effect on our business, operating results and financial condition.

The preparation of our financial statements involves use of estimates, judgments and assumptions, and our financial statements may be materially affected if our estimates prove to be inaccurate.

Financial statements prepared in accordance with generally accepted accounting principles in the United States require the use of estimates, judgments, and assumptions that affect the reported amounts. Different estimates, judgments, and assumptions reasonably could be used that would have a material effect on the financial statements, and changes in these estimates, judgments, and assumptions are likely to occur from period to period in the future. These estimates, judgments, and assumptions are inherently uncertain, and, if they prove to be wrong, then we face the risk that charges to income will be required.

Our results could be adversely affected by natural disasters, public health crises, political crises, or other catastrophic events.

Natural disasters, such as hurricanes, tornadoes, floods, earthquakes, and other adverse weather and climate conditions; unforeseen public health crises, such as pandemics and epidemics; political crises, such as terrorist attacks, war, labor unrest, and other political instability; or other catastrophic events, such as disasters occurring at our manufacturing facilities, could disrupt our operations or the operations of one or more of our vendors. In particular, these types of events could impact our product supply chain from or to the impacted region and could impact our ability to operate. In addition, these types of events could negatively impact consumer spending in the impacted regions. Disasters occurring at our manufacturing facilities could impact our reputation and our customers’ perception of our brands. To the extent any of these events occur, our operations and financial results could be adversely affected.

Worldwide and domestic economic trends and financial market conditions, including an economic decline in the agricultural industry, may adversely affect our operating performance.

We intend to distribute in a number of countries and derive revenues from both inside and outside the United States. We expect our business will be subject to global competition and may be adversely affected by factors in the United States and other countries that are beyond our control, such as disruptions in financial markets, economic downturns in the form of either contained or widespread recessionary conditions, elevated unemployment levels, sluggish or uneven recovery, in specific countries or regions, or in the agricultural industry; social, political or labor conditions in specific countries or regions; natural and other disasters affecting our operations or our customers and suppliers; or adverse changes in the availability and cost of capital, interest rates, tax rates, or regulations in the jurisdictions in which we operate. Unfavorable global or regional economic conditions, including an economic decline in the agricultural industry, could adversely impact our business, liquidity, financial condition and results of operations.

11

For certain of the components included in our products there are a limited number of suppliers we can rely upon and if we are unable to obtain these components when needed we could experience delays in the manufacturing of our products and our financial results could be adversely affected.

We acquire most of the components for the manufacture of our products from suppliers and subcontractors. We have not entered into any agreements or arrangements with any potential suppliers or subcontractors. Suppliers of some of the components may require us to place orders with significant lead-times to assure supply in accordance with its manufacturing requirements. Our present lack of working capital may cause us to delay the placement of such orders and may result in delays in supply. Delays in supply may significantly hurt our ability to fulfill our contractual obligations and may significantly hurt our business and result of operations. In addition, we may not be able to continue to obtain such components from these suppliers on satisfactory commercial terms. Disruptions of its manufacturing operations would ensue if we were required to obtain components from alternative sources, which would have an adverse effect on our business, results of operations and financial condition.

We indemnify our officers and directors against liability to us and our security holders, and such indemnification could increase our operating costs.

Our bylaws allow us to indemnify our officers and directors against claims associated with carrying out the duties of their offices. Our bylaws also allow us to reimburse them for the costs of certain legal defenses. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our officers, directors or control persons, the SEC has advised that such indemnification is against public policy and is therefore unenforceable.

Risks Associated with our Capital Stock

One of our stockholders beneficially owns a majority of our outstanding capital stock and will have the ability to control our affairs.

Our Chairman of the Board and President, Bret Chilcott, currently owns approximately 57.1% of our issued and outstanding capital stock. By virtue of his holdings, he may influence the election of the members of our board of directors, our management and our affairs, and may make it difficult for us to consummate corporate transactions such as mergers, consolidations or the sale of all or substantially all of our assets that may be favorable from our standpoint or that of our other stockholders.

We do not know whether an active, liquid and orderly trading market will develop for our common stock.

An active trading market for our securities may not develop. The lack of an active or liquid market may impair your ability to sell our securities at the time you wish to sell them or at a price that you consider reasonable.

The market price of our securities may be volatile and may fluctuate in a way that is disproportionate to our operating performance.

Our securities may experience substantial volatility as a result of a number of factors, including, among others:

| • | sales or potential sales of substantial amounts of our common stock; |

| • | announcements about us or about our competitors or new product introductions; |

| • | developments concerning our product manufacturers; |

| • | the loss or unanticipated underperformance of our global distribution channel; |

| • | litigation and other developments relating to our patents or other proprietary rights or those of our competitors; |

| • | conditions in the UAV industry; |

| • | governmental regulation and legislation; |

| • | variations in our anticipated or actual operating results; |

| • | changes in securities analysts’ estimates of our performance, or our failure to meet analysts’ expectations; |

| • | foreign currency values and fluctuations; and |

| • | overall political and economic conditions. |

12

Many of these factors are beyond our control. The stock markets have historically experienced substantial price and volume fluctuations. These fluctuations often have been unrelated or disproportionate to the operating performance of these companies. These broad market and industry factors could reduce the market price of our securities, regardless of our actual operating performance.

We do not intend to pay cash dividends. As a result, capital appreciation, if any, will be your sole source of gain.

We intend to retain future earnings, if any, to fund the development and growth of our business. In addition, the terms of existing and future debt agreements may preclude us from paying dividends. As a result, capital appreciation, if any, our common stock will be your sole source of gain for the foreseeable future.

Provisions in our articles of incorporation, our by-laws and Nevada law might discourage, delay or prevent a change in control of our company or changes in our management and, therefore, depress the trading price of our common stock.

Provisions of our articles of incorporation, our by-laws and Nevada law may have the effect of deterring unsolicited takeovers or delaying or preventing a change in control of our company or changes in our management, including transactions in which our stockholders might otherwise receive a premium for their shares over then current market prices. In addition, these provisions may limit the ability of stockholders to approve transactions that they may deem to be in their best interests. These provisions include:

| • | the inability of stockholders to call special meetings; and |

| • | the ability of our board of directors to designate the terms of and issue new series of preferred stock without stockholder approval, which could include the right to approve an acquisition or other change in our control or could be used to institute a rights plan, also known as a poison pill, that would work to dilute the stock ownership of a potential hostile acquirer, likely preventing acquisitions that have not been approved by our board of directors. |

The existence of the forgoing provisions and anti-takeover measures could limit the price that investors might be willing to pay in the future for shares of our common stock. They could also deter potential acquirers of our company, thereby reducing the likelihood that you could receive a premium for your common stock in an acquisition.

FINRA sales practice requirements may limit a stockholder’s ability to buy and sell our securities.

The Financial Industry Regulatory Authority, Inc. (“FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives, and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for certain customers. FINRA requirements will likely make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may have the effect of reducing the level of trading activity in the shares, resulting in fewer broker-dealers may be willing to make a market in our shares, potentially reducing a stockholder’s ability to resell our securities.

13

We are eligible to be treated as an “emerging growth company,” as defined in the JOBS Act, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act. For as long as we continue to be an emerging growth company, we may take advantage of exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including (1) not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, (2) reduced disclosure obligations regarding executive compensation in this prospectus and our periodic reports and proxy statements and (3) exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. In addition, as an emerging growth company, we are only required to provide two years of audited financial statements and two years of selected financial data in this prospectus. We could be an emerging growth company for up to five years, although circumstances could cause us to lose that status earlier, including if the market value of our common stock held by non-affiliates exceeds $700.0 million as of any March 31 before that time or if we have total annual gross revenue of $1.0 billion or more during any fiscal year before that time, after which, in each case, we would no longer be an emerging growth company as of the following December 31 or, if we issue more than $1.0 billion in non-convertible debt during any three-year period before that time, we would cease to be an emerging growth company immediately.

Under the JOBS Act, emerging growth companies can also delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have irrevocably elected not to avail ourselves of this exemption from new or revised accounting standards and, therefore, will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

If securities or industry analysts do not publish research or reports about our business, if they adversely change their recommendations regarding our shares or if our results of operations do not meet their expectations, the price of our securities and trading volume could decline.

The trading market for our securities will be influenced by the research and reports that industry or securities analysts publish about us or our business. We do not have any control over these analysts. If one or more of these analyst’s cease coverage of our company or fail to publish reports on us regularly, we could lose visibility in the financial markets, which in turn could cause our share price or trading volume to decline. Moreover, if one or more of the analysts who cover us downgrade our stock, or if our results of operations do not meet their expectations, the price of our securities could decline.

14

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the information in this prospectus contains forward-looking statements within the meaning of the federal securities laws. These statements include, among others, the following:

| • | our goals and strategies; |

| • | our future business development, results of operations and financial condition; |

| • | our ability to protect our intellectual property rights; |

| • | projected revenues, profits, earnings and other estimated financial information; |

| • | our ability to maintain strong relationships with our customers and suppliers; |

| • | our planned use of proceeds; and |

| • | governmental policies regarding our industry. |

These statements may be found under “Prospectus Summary,” “Risk Factors,” Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” Forward-looking statements typically are identified by the use of terms such as “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” or “will” or the negative of these terms, although some forward-looking statements are expressed differently. You should be aware that our actual results could differ materially from those contained in the forward-looking statements due to the factors referenced above.

These risks and uncertainties are not exhaustive. Other sections of this prospectus include additional factors which could adversely impact our business and financial performance. The forward-looking statements contained in this prospectus speak only as of the date of this prospectus or, if obtained from third-party studies or reports, the date of the corresponding study or report, and are expressly qualified in their entirety by the cautionary statements in this prospectus. Since we operate in an emerging and evolving environment and new risk factors and uncertainties emerge from time to time, you should not rely upon forward-looking statements as predictions of future events. Except as otherwise required by the securities laws of the United States, we undertake no obligation to update or revise any forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events.

15

We will not receive any portion of the net proceeds by the Selling Stockholder from the sale of its shares of common stock.

16

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Our common stock trades on the NYSE American under the symbol “UAVS.” The following table lists the quotations for the high and low sales prices of our common stock for each quarter during the years ended December 31, 2016 and December 31, 2017, and through July 17, 2018.

| Year Ended December 31, 2016 | High | Low | |||||||

| Quarter ended March 31, 2016 | $ | 6.25 | $ | 6.00 | |||||

| Quarter ended June 30, 2016 | $ | 7.45 | $ | 6.75 | |||||

| Quarter ended September 30, 2016 | $ | 11.02 | $ | 9.25 | |||||

| Quarter ended December 31, 2016 | $ | 7.61 | $ | 7.25 | |||||

| Year Ended December 31, 2017 | |||||||||

| Quarter ended March 31, 2017 | $ | 9.48 | $ | 8.55 | |||||

| Quarter ended June 30, 2017 | $ | 8.38 | $ | 7.13 | |||||

| Quarter ended September 30, 2017 | $ | 7.57 | $ | 7.50 | |||||

| Quarter ended December 31, 2017 | $ | 5.75 | $ | 4.95 | |||||

| Year Ended December 31, 2018 | |||||||||

| Quarter ended March 31, 2018 | $ | 5.65 | $ | 3.55 | |||||

| Quarter ended June 30, 2018 (through July 17, 2018) | $ | 1.88 | $ | 1.75 | |||||

Holders

As of June 30, 2018, there were 349 holders of record of our common stock and one holder of our Series C preferred stock.

Dividends

We do not intend to pay cash dividends to our stockholders in the foreseeable future. We currently intend to retain all of our available funds and future earnings, if any, to finance the growth and development of our business. Any future determination related to our dividend policy will be made at the discretion of our board of directors and will depend upon, among other factors, our results of operations, financial condition, capital requirements, contractual restrictions, business prospects and other factors our board of directors may deem relevant.

Securities Authorized for Issuance under Equity Compensation Plans

The following table sets forth information as of the fiscal year ended December 31, 2017 regarding outstanding options granted under our stock option plans and options reserved for future grant under the plans.

| Plan Category | Number of shares to be issued upon exercise of outstanding options, warrants and rights (a) |

Weighted-average exercise price of outstanding options, warrants and rights (b) |

Number of shares remaining available for future issuance under equity compensation plans (excluding shares reflected in column (a) (c) |

|||||||||

| Equity compensation plans approved by stockholders | 560,100 | $ | 9.76 | 439,900 | ||||||||

17

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our results of operations and financial condition since the Company’s inception should be read in conjunction with our financial statements and the notes to those financial statements that are included elsewhere in this Prospectus. All statements, other than statements of historical facts, included in this report are forward-looking statements. When used in this report, the words “may,” “will,” “should,” “would,” “anticipate,” “estimate,” “possible,” “expect,” “plan,” “project,” “continuing,” “ongoing,” “could,” “believe,” “predict,” “potential,” “intend,” and similar expressions are intended to identify forward-looking statements. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include, but are not limited to, availability of additional equity or debt financing, changes in sales or industry trends, competition, retention of senior management and other key personnel, availability of materials or components, ability to make continued product innovations, casualty or work stoppages at our facilities, adverse results of lawsuits against us and currency exchange rates. Forward-looking statements are based on assumptions and assessments made by our management in light of their experience and their perception of historical trends, current conditions, expected future developments and other factors they believe to be appropriate. Readers of this report are cautioned not to place undue reliance on these forward-looking statements, as there can be no assurance that these forward-looking statements will prove to be accurate and speak only as of the date hereof. Management undertakes no obligation to publicly release any revisions to these forward-looking statements that may reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. This cautionary statement is applicable to all forward-looking statements contained in this report.

Overview of Business

On March 26, 2018, EnerJex Resources, Inc. (“EnerJex”), a Nevada company, consummated the transactions contemplated by the Agreement and Plan of Merger (the “Merger Agreement”), dated October 19, 2017, pursuant to which AgEagle Merger Sub, Inc., a Nevada corporation and a wholly-owned subsidiary of EnerJex, merged with and into AgEagle Aerial Systems, Inc., a privately held company organized under the laws of the state of Nevada (“AgEagle Sub”), with AgEagle Sub surviving as a wholly-owned subsidiary of EnerJex (the “Merger”). In connection with the Merger, EnerJex changed its name to AgEagle Aerial Systems Inc. (the “Company, “we,” “our,” or “us”) and AgEagle Sub changed its name to “Eagle Aerial Systems, Inc.” Our common stock will continue to trade on the NYSE American under its new symbol “UAVS” commencing on March 27, 2018. As a result of the Merger, through AgEagle Sub, we are now engaged in the business of designing, developing, producing, distributing and supporting technologically-advanced small unmanned aerial vehicles (UAVs or drones) that we supply to the precision agriculture industry as well as provide aerial imagery analytical services to the sustainability agriculture industry.

We are headquartered in Neodesha, Kansas, and are a manufacturer of unmanned aerial vehicles focused on providing actionable data to the precision agriculture industry. We design, produce, distribute and support technologically-advanced small unmanned aerial vehicles (UAVs or drones) that are offered for sale commercially to the precision agriculture industry and more recently, we launched an effort to provide aerial imagery analytical service to the sustainability agriculture industry for the 2019 grow season. AgEagle Sub was founded in 2010 by Bret Chilcott, our Chairman of the Board and President, as Solutions by Chilcott, LLC, a Kansas limited liability company. In April 2015, Solutions by Chilcott was converted into a corporation and then merged into AgEagle Sub, a newly-formed Nevada corporation. Its first commercially available product was the AgEagle Classic which was followed shortly thereafter by the RAPID System.

Historically, we have derived the majority of our revenue from the sale of our AgEagle Classic and RAPID Systems. However, as a result of the development of our new products, the RX-60, RX-47 and RX-48, we will no longer manufacture and distribute our previous two systems. We believe that the UAV industry is currently in the early stages of development and has significant growth potential. Additionally, we believe that some of the innovative potential products in our research and development pipeline will emerge and gain traction as new growth platforms in the future, creating market opportunities. The success we have achieved with our current products stems from our ability to invent and deliver advanced solutions, utilizing our proprietary technologies that help our farmers, agronomists and other precision agricultural professionals operate more effectively and efficiently. Our core technological capabilities include a lightweight, laminated Styrofoam shell that allows our UAVs to encounter challenging flying conditions such as wind, a camera with a proprietary index filter, a rugged foot launcher, and high-end software through our strategic partners that automates drone flights and provides geo-referenced data.

18

We believe the success that has been achieved with our products, stems from its ability to invent and deliver advanced solutions utilizing our proprietary technologies and trade secrets that help farmers, agronomists and other precision agricultural professionals operate more effectively and efficiently. The company’s core technological capabilities, developed over five years of innovation, include a lightweight laminated shell that allows the UAV platform to perform under challenging flying conditions, a camera with a Near Infrared (NIR) filter, a rugged foot launcher (RX-60), and high-end software provided by third parties that automates drone flights and provides geo-referenced data.

We invent and deliver advanced solutions utilizing our proprietary technologies and trade secrets that help farmers, agronomists and other precision agricultural professionals operate more effectively and efficiently. Our core technological capabilities, developed over five years of innovation, include a lightweight laminated shell that allows the UAV platform to perform under challenging flying conditions, a camera with a Near Infrared (NIR) filter, a rugged foot launcher (RX-60), and high-end software provided by third parties that automates drone flights and provides geo-referenced data. Our UAV is an advanced fixed wing model UAV. We design all of our UAVs to be man-portable, thereby allowing one person to launch and operate them through a hand-held control unit or tablet. All of our UAVs are electrically powered, weigh approximately four to six pounds fully loaded, are capable of flying over approximately 400 acres (roughly 60 minutes of airtime) per flight from their launch location, and are configured to carry a camera with our NIR filter that uses near infrared images to capture crop data.

In November 2017, we entered into a multi-agreement arrangement with Agribotix, LLC (“Agribotix”), headquartered in Boulder, Colorado, a leading agricultural information processing company providing actionable data to the agriculture industry.

Off-Balance Sheet Arrangements

Since our inception, except for standard operating leases, we have not engaged in any off-balance sheet arrangements, including the use of structured finance, special purpose entities or variable interest entities. We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

Critical Accounting Policies and Estimates

Our management’s discussion and analysis of our financial condition and results of operations are based on our unaudited condensed financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of these financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Significant estimates include, but are not limited to: collectability of receivables, realizability of inventories, warranty accruals, valuation of share-based transactions, and valuation of deferred tax assets. On an ongoing basis, we evaluate our estimates and assumptions. We base our estimates on historical experience and on various other factors that we believe are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results could differ from those estimates.

See Note 2 in the accompanying audited and unaudited financial statements for a listing of our critical accounting policies.

19

Revenue Recognition

Revenue is recognized when earned. AgEagle’s revenue recognition policies are in compliance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 605, Revenue Recognition, and the Securities and Exchange Commission Staff Accounting Bulletin No. 101 and 104.

AgEagle recognizes revenues for the sale of its products in the period when persuasive evidence of an arrangement with a customer, distributor or dealer exists, product delivery and acceptance have occurred and title has transferred to the customer, dealer or the distributor, the sales price is fixed or determinable and collectability of the resulting receivable is reasonably assured.

AgEagle generally ships FOB Shipping Point terms. Shipping documents are used to verify delivery and customer acceptance. AgEagle assesses whether the sales price is fixed or determinable based on the payment terms associated with the transaction and whether the sales price is subject to refund. AgEagle assesses collectability based on the creditworthiness of the customer as determined by evaluations and the customer’s payment history. Additionally, dealers are required to place a deposit on each drone ordered. AgEagle has executed various agreements to sell its products, including one exclusive worldwide distributor agreement 2016 whereby both the dealers and distributor agreed to purchase AgEagle drones and other related products. Under the terms of the dealer agreements except the recently executed agreement with its distributor, the dealer takes ownership of the products, and AgEagle deems the items sold upon release of shipment to the dealer. This distributorship agreement was made non-exclusive in 2017. Prior to the execution of the distributor agreement in February 2016, AgEagle sold its products through various dealers in the United States and Canada; all these agreements have since been terminated.

RESULTS OF OPERATIONS

Year ended December 31, 2017 compared to year ended December 31, 2016