Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BEASLEY BROADCAST GROUP INC | d541775d8k.htm |

CAROLINE BEASLEY Chief Executive Officer MARIE TEDESCO Chief Financial Officer Exhibit 99.1

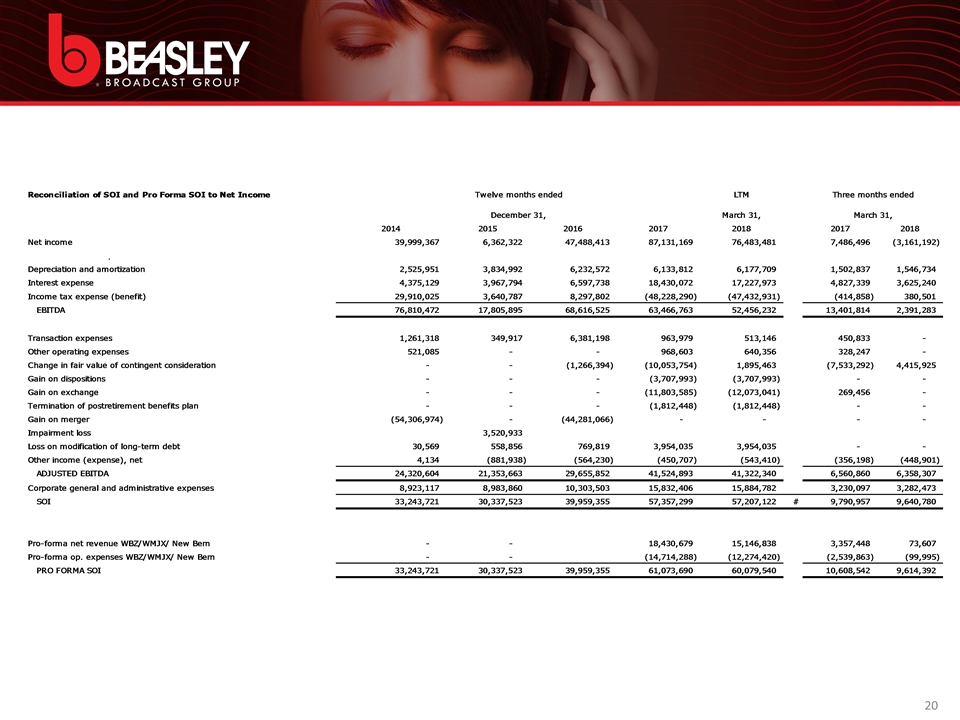

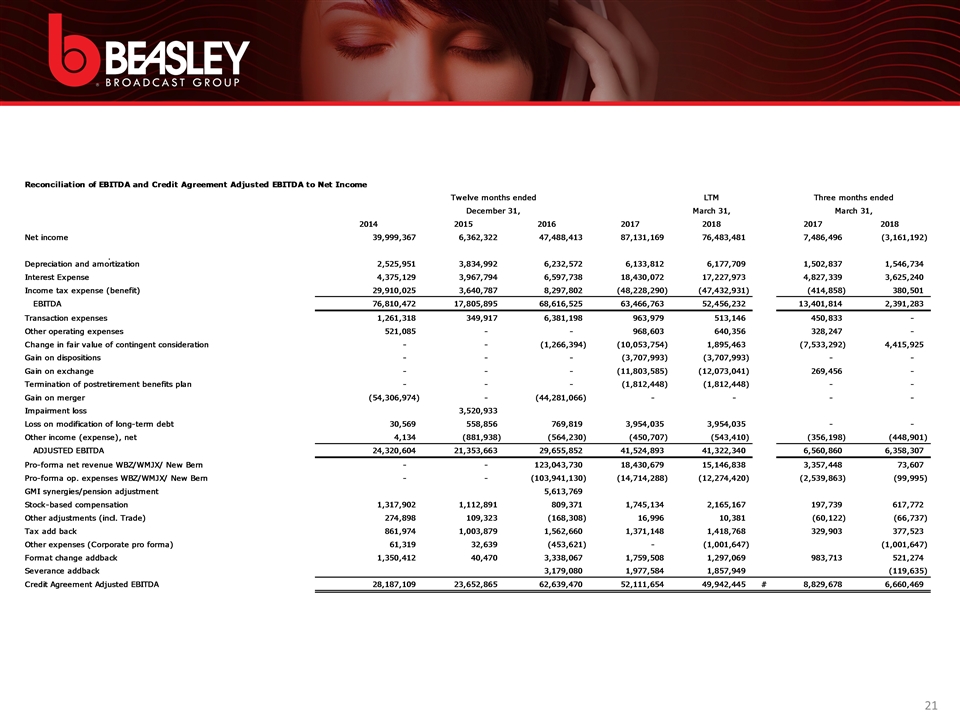

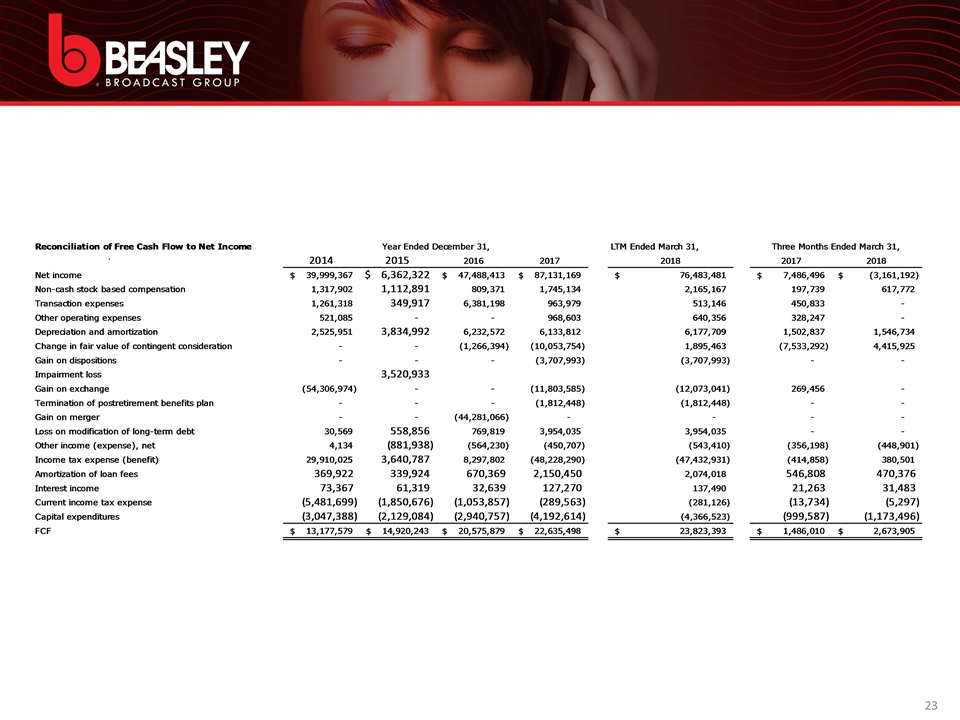

This presentation includes certain financial measures that have not been prepared in a manner that complies with generally accepted accounting principles in the United States (“GAAP”), including EBITDA, Credit Agreement Adjusted EBITDA, Free Cash Flow and Station Operating Income (collectively, the “non-GAAP financial measures”).Please note that Credit Agreement Adjusted EBITDA includes certain calculations provided for under the financial maintenance covenants contained in the Company’s senior credit facility. These non-GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing the Company’s financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income from operations, net revenue, cash flows from operations, earnings per fully-diluted share or other measures of profitability, liquidity or performance under GAAP. Management believes that these non-GAAP financial measures provide meaningful information to investors because they provide insight into how effectively we operate our business. You should be aware that these non-GAAP financial measures may not be comparable to similarly-titled measures used by other companies. See the Appendix for a reconciliation of each of the non-GAAP financial measures to the most directly comparable financial measure calculated and presented in accordance with GAAP. Statements in this presentation that are “forward-looking statements” are based upon current expectations and assumptions, and involve certain risks and uncertainties within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Words or expressions such as “believe,” “plan,” “intends,” “expects,” “expected,” “anticipates” or variations of such words and similar expressions are intended to identify such forward-looking statements. Key risks are described in our reports filed with the SEC including in our annual report on Form 10-K and quarterly reports on Form 10-Q. Readers should note that forward-looking statements are subject to change and to inherit risks and uncertainties and may be impacted by several facts including: external economic forces that could have a material adverse impact on our advertising revenues and results of operations; the ability of our radio stations to compete effectively in their respective markets for advertising revenues; our ability to respond to changes in technology, standards and services that affect the radio industry; audience acceptance of our content, particularly our radio programs; our substantial debt levels and the potential effect of restrictive debt covenants on our operational flexibility and ability to pay dividends; our dependence on federally issued licenses subject to extensive federal regulation; the risk that our FCC broadcasting licenses and/or goodwill could become impaired; the failure or destruction of the internet, satellite systems and transmitter facilities that we depend upon to distribute our programming; disruptions or security breaches of our information technology infrastructure; actions by the FCC or new legislation affecting the radio industry; the loss of key personnel; the fact that we are controlled by the Beasley family, which creates difficulties for any attempt to gain control of us; the effect of future sales of Class A common stock by the Beasley family or the former stockholders of Greater Media; and other economic, business, competitive, and regulatory factors affecting our businesses. Our actual performance and results could differ materially because of these factors and other factors discussed in the “Management’s Discussion and Analysis of Results of Operations and Financial Condition” in our SEC filings, including but not limited to our annual reports on Form 10-K or quarterly reports on Form 10-Q, copies of which can be obtained from the SEC, www.sec.gov, or our website, www.bbgi.com. All information in this presentation is as of July 13, 2018, and we undertake no obligation to update the information contained herein to actual results or changes to our expectations. FORWARD-LOOKING STATEMENTS, NON-GAAP FINANCIAL MEASURES AND OTHER DISCLOSURES

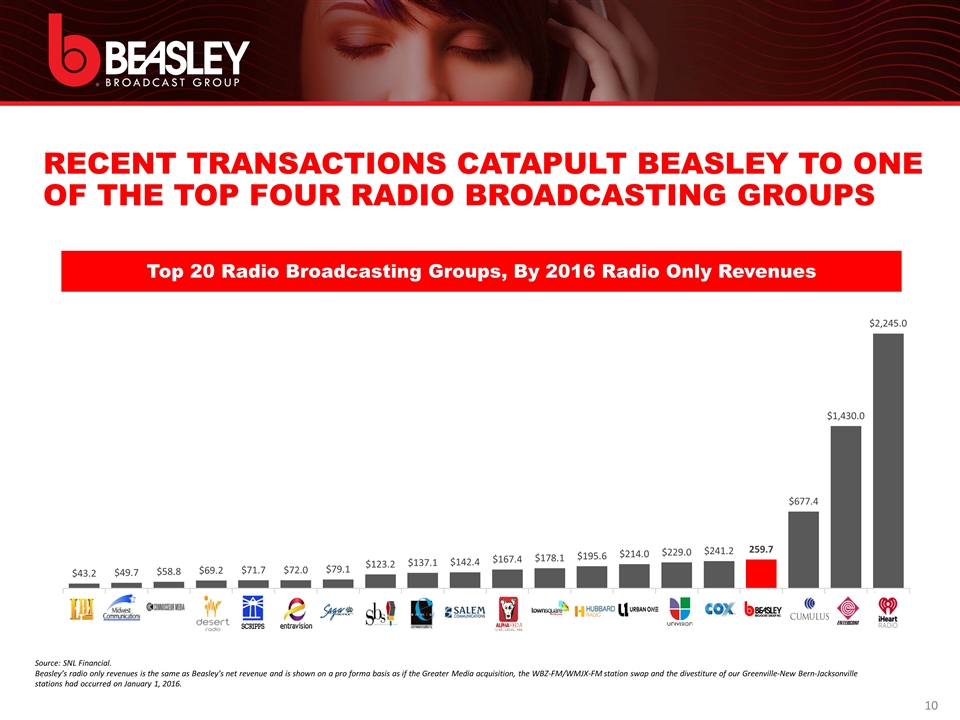

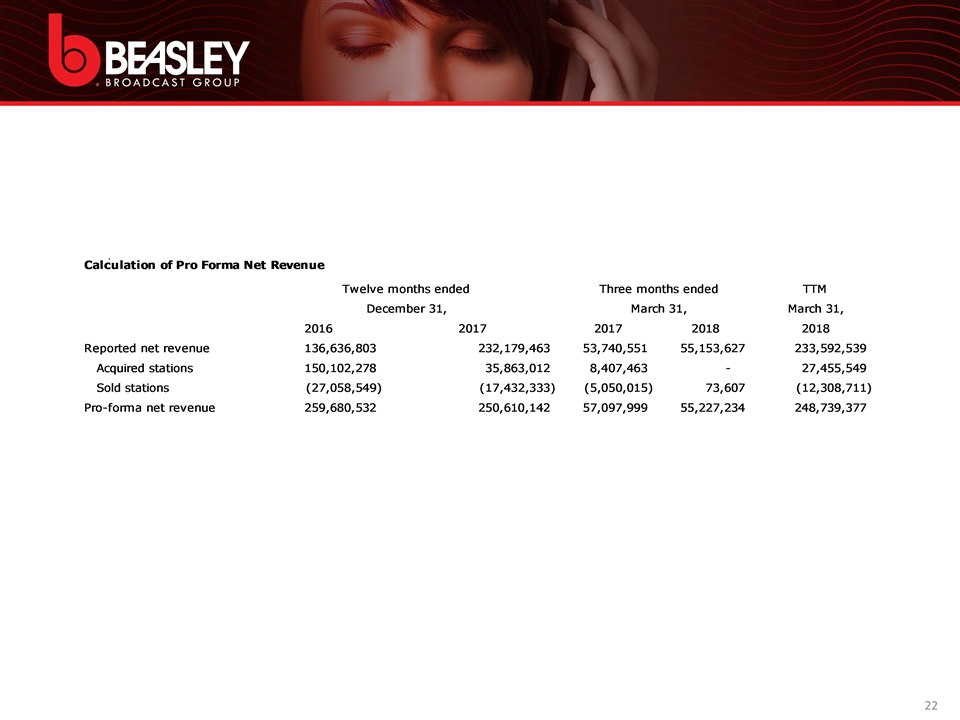

EXECUTIVE SUMMARY Leading Local Audio-Focused Media Company #4 ranked radio group based on 2016 radio-only revenues with 18.6 million listeners weekly (three month average) Beasley radio clusters ranked top 3 in market share in 13 of 14 markets that are rated (1), driven by compelling power ratios Focused on Accretive Consolidation Opportunities Asset exchange with Entercom provided net incremental Credit Agreement Adjusted EBITDA of $3.8 million in 2017 and increased original content Acquired Greater Media for cash and stock in 2016 Uniquely positioned in the larger radio markets Robust Free Cash Flow Track record of free cash flow growth Low CapEx results in strong free cash flow of $23.8 million LTM 3/31/2018 Modest Leverage LTM 3/31/18 Pro Forma Net Revenue(2) and LTM 3/31/2018 Credit Agreement Adjusted EBITDA are $248.7 million and $49.9 million respectively. Target Net leverage of < 4.0x, supported by conservative capital structure History of deleveraging while returning capital to shareholders Disciplined and Experienced Management Team Experienced management team (35 years average) with a proven track record of performance and acquisition integration Management team economically aligned with financial performance, given significant equity stake Digital Initiatives Strong digital presence with 14.3 million online streaming sessions per month (six month average ending 6/30/2018) and 68 million page views in 2017 Expanding presence in voice search, podcasting and mobile apps (1) According to Nielsen Audio Ratings. (2) Net Revenue is pro forma as if the WBZ-FM/WMJX-FM station swap and the divestiture of our Greenville-New Bern-Jacksonville stations had occurred on April 1, 2017.

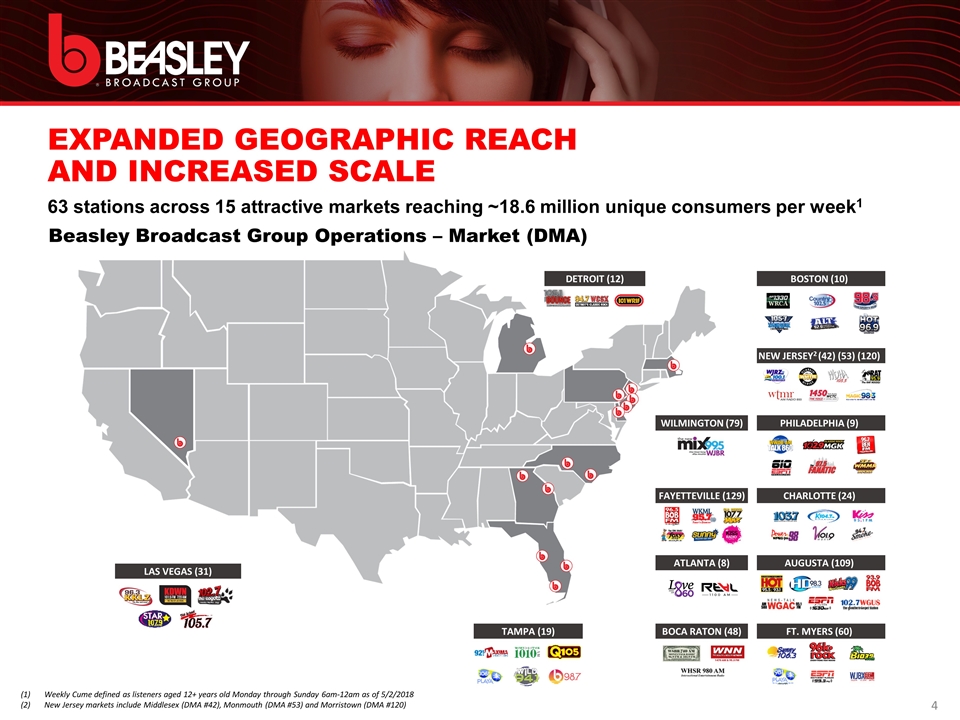

EXPANDED GEOGRAPHIC REACH AND INCREASED SCALE 63 stations across 15 attractive markets reaching ~18.6 million unique consumers per week1 ATLANTA (8) AUGUSTA (109) BOCA RATON (48) BOSTON (10) CHARLOTTE (24) FAYETTEVILLE (129) DETROIT (12) FT. MYERS (60) LAS VEGAS (31) NEW JERSEY2 (42) (53) (120) WILMINGTON (79) PHILADELPHIA (9) TAMPA (19) Weekly Cume defined as listeners aged 12+ years old Monday through Sunday 6am-12am as of 5/2/2018 New Jersey markets include Middlesex (DMA #42), Monmouth (DMA #53) and Morristown (DMA #120) Beasley Broadcast Group Operations – Market (DMA)

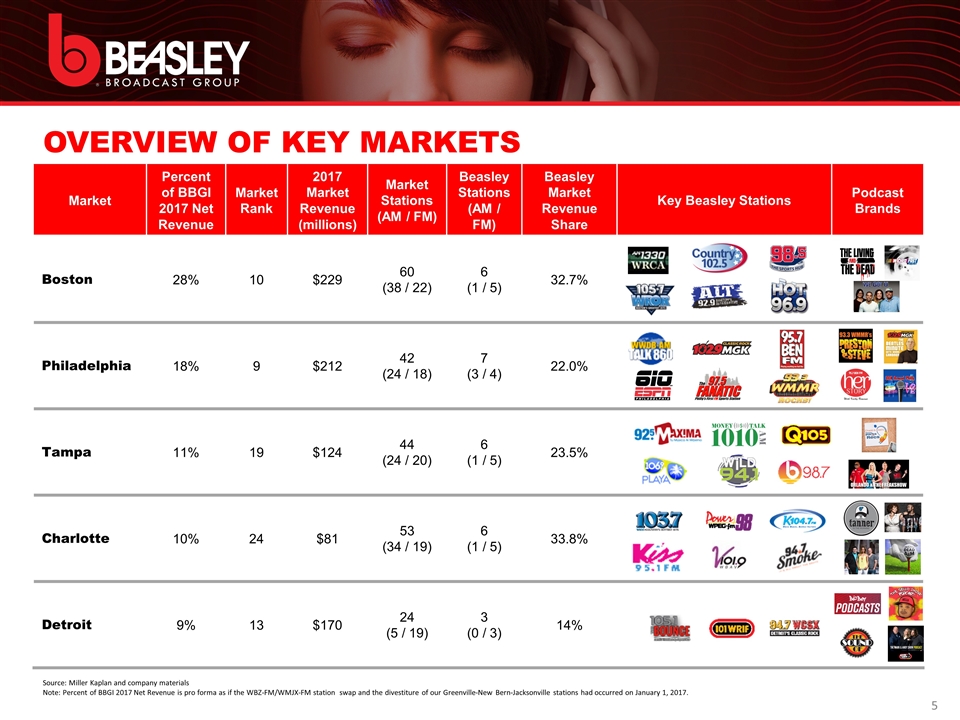

OVERVIEW OF KEY MARKETS Source: Miller Kaplan and company materials Note: Percent of BBGI 2017 Net Revenue is pro forma as if the WBZ-FM/WMJX-FM station swap and the divestiture of our Greenville-New Bern-Jacksonville stations had occurred on January 1, 2017. Market Percent of BBGI 2017 Net Revenue Market Rank 2017 Market Revenue (millions) Market Stations (AM / FM) Beasley Stations (AM / FM) Beasley Market Revenue Share Key Beasley Stations Podcast Brands Boston 28% 10 $229 60 (38 / 22) 6 (1 / 5) 32.7% Philadelphia 18% 9 $212 42 (24 / 18) 7 (3 / 4) 22.0% Tampa 11% 19 $124 44 (24 / 20) 6 (1 / 5) 23.5% Charlotte 10% 24 $81 53 (34 / 19) 6 (1 / 5) 33.8% Detroit 9% 13 $170 24 (5 / 19) 3 (0 / 3) 14%

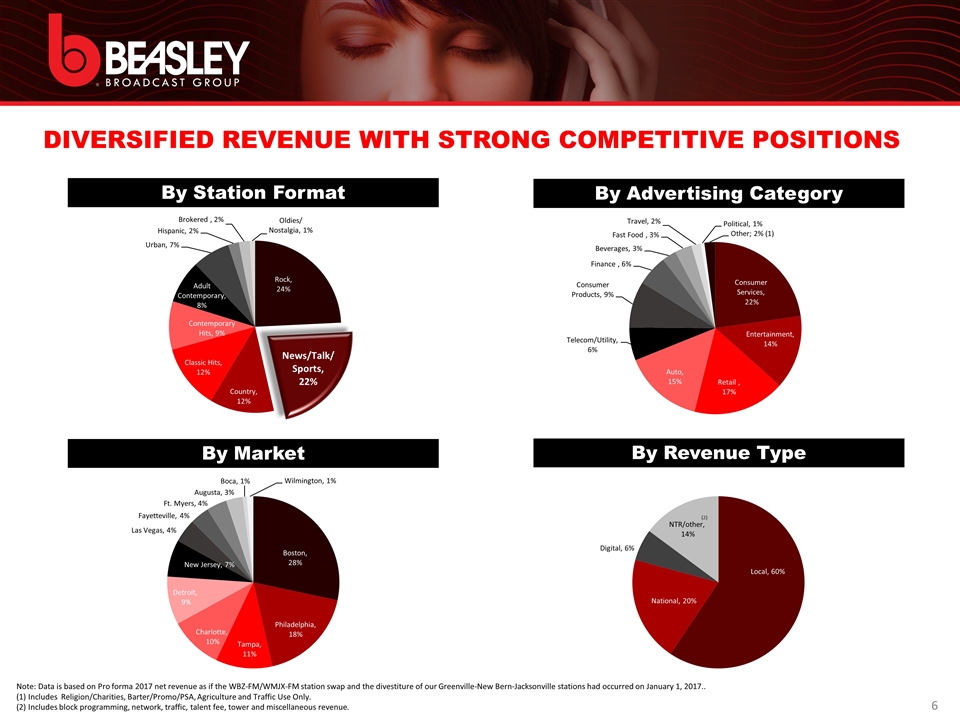

By Advertising Category By Station Format DIVERSIFIED REVENUE WITH STRONG COMPETITIVE POSITIONS Note: Data is based on Pro forma 2017 net revenue as if the WBZ-FM/WMJX-FM station swap and the divestiture of our Greenville-New Bern-Jacksonville stations had occurred on January 1, 2017.. (1) Includes Religion/Charities, Barter/Promo/PSA, Agriculture and Traffic Use Only. (2) Includes block programming, network, traffic, talent fee, tower and miscellaneous revenue. By Market By Revenue Type (2)

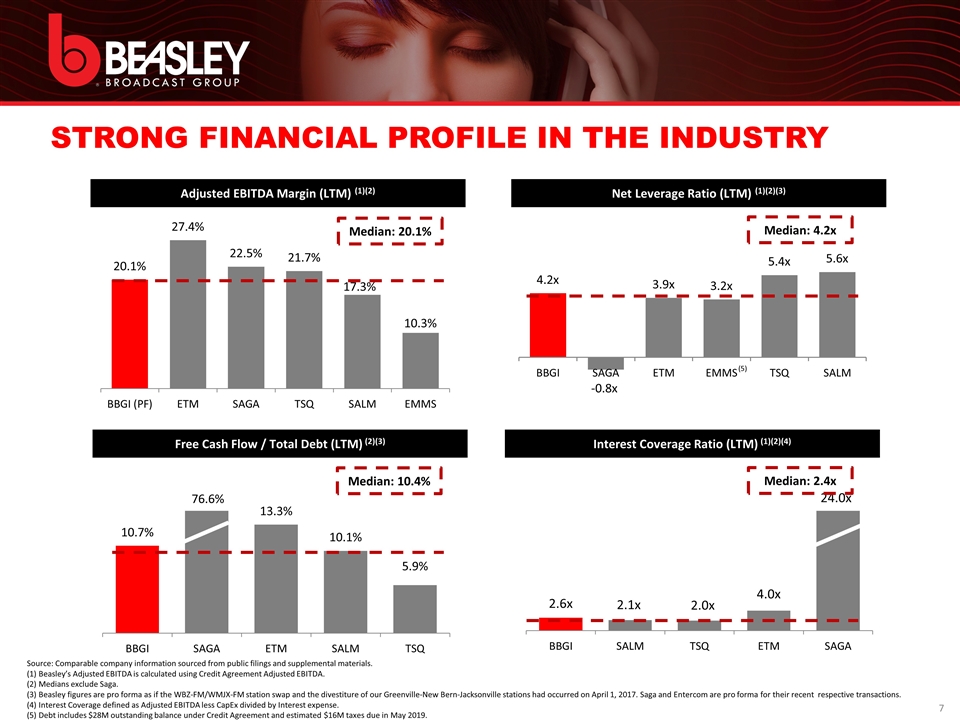

STRONG FINANCIAL PROFILE IN THE INDUSTRY Source: Comparable company information sourced from public filings and supplemental materials. (1) Beasley’s Adjusted EBITDA is calculated using Credit Agreement Adjusted EBITDA. (2) Medians exclude Saga. (3) Beasley figures are pro forma as if the WBZ-FM/WMJX-FM station swap and the divestiture of our Greenville-New Bern-Jacksonville stations had occurred on April 1, 2017. Saga and Entercom are pro forma for their recent respective transactions. (4) Interest Coverage defined as Adjusted EBITDA less CapEx divided by Interest expense. (5) Debt includes $28M outstanding balance under Credit Agreement and estimated $16M taxes due in May 2019. Median: 2.4x Interest Coverage Ratio (LTM) (1)(2)(4) Adjusted EBITDA Margin (LTM) (1)(2) Median: 20.1% Median: 10.4% Free Cash Flow / Total Debt (LTM) (2)(3) Net Debt Net Leverage Ratio (LTM) (1)(2)(3) Median: 4.2x 76.6% (5)

BEASLEY STRATEGIC OBJECTIVES Robust Free Cash Flow Return Shareholder Value Modest Leverage Focus on Accretive Consolidation Opportunities Leading Local Audio/Digital Focused Media Company

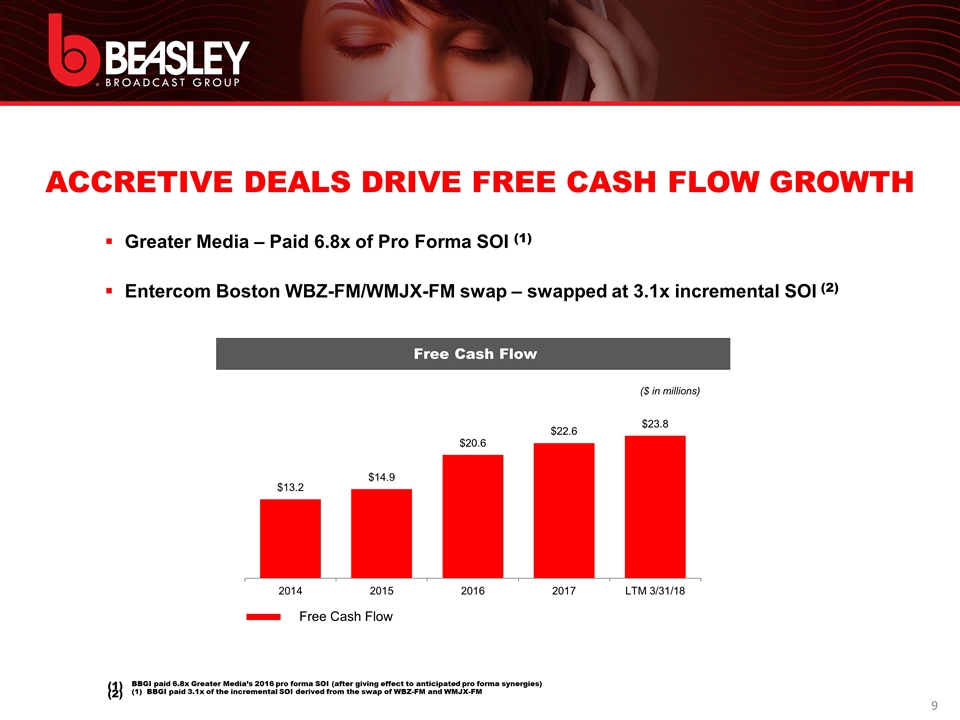

ACCRETIVE DEALS DRIVE FREE CASH FLOW GROWTH Greater Media – Paid 6.8x of Pro Forma SOI (1) Entercom Boston WBZ-FM/WMJX-FM swap – swapped at 3.1x incremental SOI (2) Free Cash Flow ($ in millions) Free Cash Flow 6 BBGI paid 6.8x Greater Media’s 2016 pro forma SOI (after giving effect to anticipated pro forma synergies) (1) BBGI paid 3.1x of the incremental SOI derived from the swap of WBZ-FM and WMJX-FM

RECENT TRANSACTIONS CATAPULT BEASLEY TO ONE OF THE TOP FOUR RADIO BROADCASTING GROUPS Source: SNL Financial. Beasley’s radio only revenues is the same as Beasley’s net revenue and is shown on a pro forma basis as if the Greater Media acquisition, the WBZ-FM/WMJX-FM station swap and the divestiture of our Greenville-New Bern-Jacksonville stations had occurred on January 1, 2016.

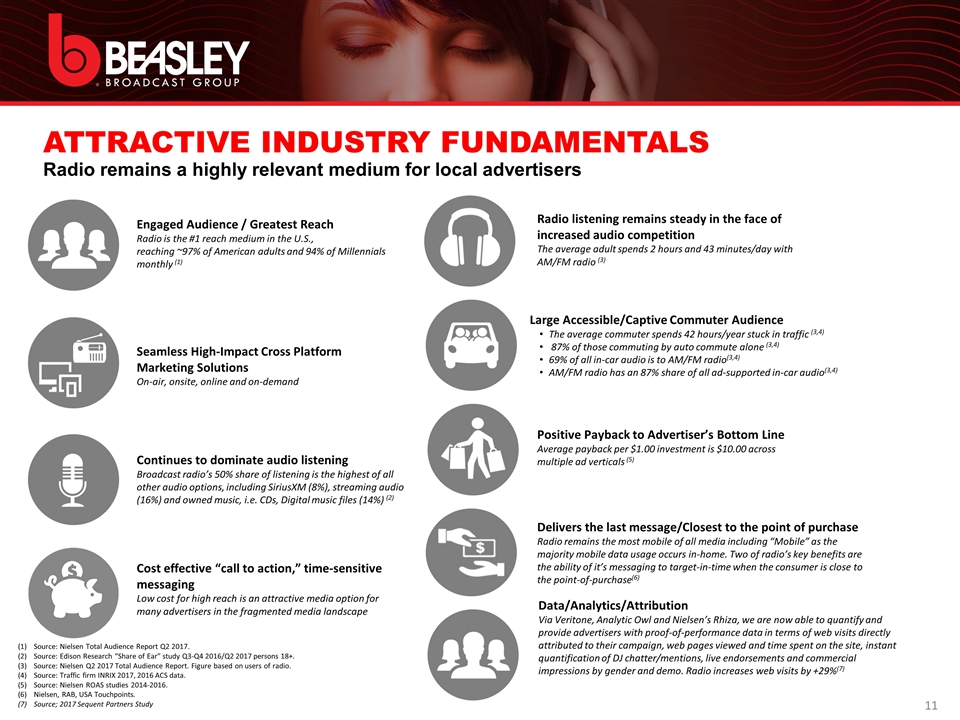

ATTRACTIVE INDUSTRY FUNDAMENTALS Radio remains a highly relevant medium for local advertisers Source: Nielsen Total Audience Report Q2 2017. Source: Edison Research “Share of Ear” study Q3-Q4 2016/Q2 2017 persons 18+. Source: Nielsen Q2 2017 Total Audience Report. Figure based on users of radio. Source: Traffic firm INRIX 2017, 2016 ACS data. Source: Nielsen ROAS studies 2014-2016. Nielsen, RAB, USA Touchpoints. Source; 2017 Sequent Partners Study Engaged Audience / Greatest Reach Radio is the #1 reach medium in the U.S., reaching ~97% of American adults and 94% of Millennials monthly (1) Seamless High-Impact Cross Platform Marketing Solutions On-air, onsite, online and on-demand Continues to dominate audio listening Broadcast radio’s 50% share of listening is the highest of all other audio options, including SiriusXM (8%), streaming audio (16%) and owned music, i.e. CDs, Digital music files (14%) (2) Cost effective “call to action,” time-sensitive messaging Low cost for high reach is an attractive media option for many advertisers in the fragmented media landscape Radio listening remains steady in the face of increased audio competition The average adult spends 2 hours and 43 minutes/day with AM/FM radio (3) Large Accessible/Captive Commuter Audience The average commuter spends 42 hours/year stuck in traffic (3,4) 87% of those commuting by auto commute alone (3,4) 69% of all in-car audio is to AM/FM radio(3,4) AM/FM radio has an 87% share of all ad-supported in-car audio(3,4) Positive Payback to Advertiser’s Bottom Line Average payback per $1.00 investment is $10.00 across multiple ad verticals (5) Delivers the last message/Closest to the point of purchase Radio remains the most mobile of all media including “Mobile” as the majority mobile data usage occurs in-home. Two of radio’s key benefits are the ability of it’s messaging to target-in-time when the consumer is close to the point-of-purchase(6) Data/Analytics/Attribution Via Veritone, Analytic Owl and Nielsen’s Rhiza, we are now able to quantify and provide advertisers with proof-of-performance data in terms of web visits directly attributed to their campaign, web pages viewed and time spent on the site, instant quantification of DJ chatter/mentions, live endorsements and commercial impressions by gender and demo. Radio increases web visits by +29%(7)

Online Presence and Streaming Ranked 7th among all radio broadcasters in the U.S., with 14.3 million streaming sessions per month (based on six-month average ending 6/30/2018) 37 million page views to 63 station websites YTD 6/30/2018 (compared to 68 million for the full year 2017); mobile devices accounts for ~54.6% of all website visits over the same period We are averaging 3 million unique visitors to our websites each month with more than 120 million listening hours YTD 6/30/2018 (compared to 88 million listening hours full year 2017) Mobile Apps Approximately 158,000 listeners use a Beasley station app to access station streams each month (three-month average ending on 6/30/2018) We are working on new app features designed to inform, entertain and engage our audiences in ways that are personally relevant to them. We are now able to use non personally identifiable data to better understand consumer behaviors and deliver relevant, timely and action driven information to app users Social Media Engagement Stations have sold approximately $1.3 million YTD 6/30/2018 in social media campaigns Stations had approximately $6 million social referrals from Facebook/Instagram to our websites YTD 6/30/2018 As of today, stations have been “liked” or “followed” more than 2.8 million times across three social media platforms (Facebook, Twitter and Instagram) 5.0 million people engaged with our content on social media YTD 6/30/2018 Podcasting We are averaging approximately 3.5 million podcast downloads per month from 159 podcasts (three month average as of 6/30/2018) 14.3mm Streaming Sessions Per Month 158k Mobile App users monthly 37mm Station Page Views YTD 6/30/2018 BBGI Digital Platform Positioned for Growth Pro forma Beasley has an established digital presence with digital revenues of $13 million in 2017

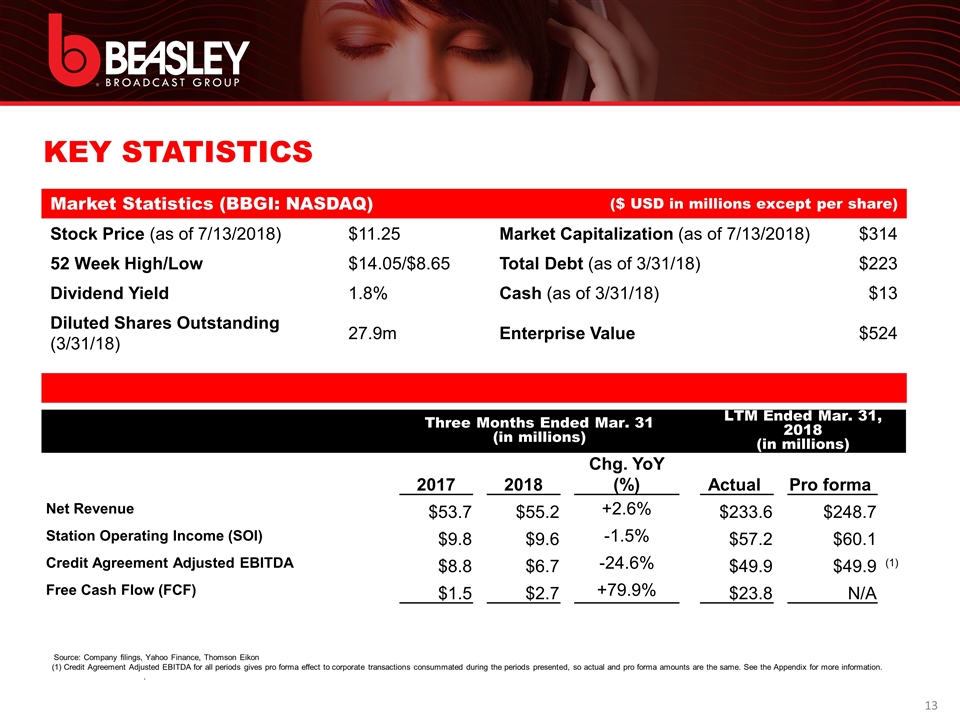

KEY STATISTICS Market Statistics (BBGI: NASDAQ) ($ USD in millions except per share) Stock Price (as of 7/13/2018) $11.25 $11.30 Market Capitalization (as of 7/13/2018) $314 52 Week High/Low $14.05/$8.65 $16.55/$8.40 Total Debt (as of 3/31/18) $223 Dividend Yield 1.8% $8.40 Cash (as of 3/31/18) $13 Diluted Shares Outstanding (3/31/18) 27.9m 27.9m Enterprise Value $524 Source: Company filings, Yahoo Finance, Thomson Eikon (1) Credit Agreement Adjusted EBITDA for all periods gives pro forma effect to corporate transactions consummated during the periods presented, so actual and pro forma amounts are the same. See the Appendix for more information. . Three Months Ended Mar. 31 (in millions) LTM Ended Mar. 31, 2018 (in millions) 2017 2018 Chg. YoY (%) Actual Pro forma Net Revenue $53.7 $55.2 +2.6% $233.6 $248.7 Station Operating Income (SOI) $9.8 $9.6 -1.5% $57.2 $60.1 Credit Agreement Adjusted EBITDA $8.8 $6.7 -24.6% $49.9 $49.9 (1) Free Cash Flow (FCF) $1.5 $2.7 +79.9% $23.8 N/A

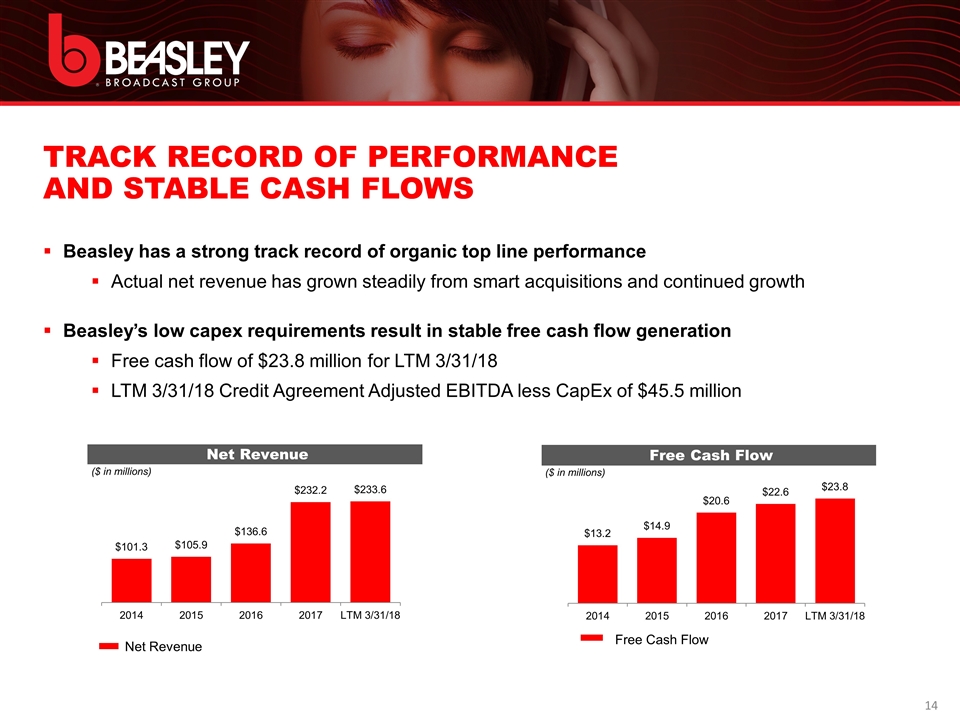

TRACK RECORD OF PERFORMANCE AND STABLE CASH FLOWS Beasley has a strong track record of organic top line performance Actual net revenue has grown steadily from smart acquisitions and continued growth Beasley’s low capex requirements result in stable free cash flow generation Free cash flow of $23.8 million for LTM 3/31/18 LTM 3/31/18 Credit Agreement Adjusted EBITDA less CapEx of $45.5 million Net Revenue ($ in millions) Free Cash Flow ($ in millions) Net Revenue Free Cash Flow 6

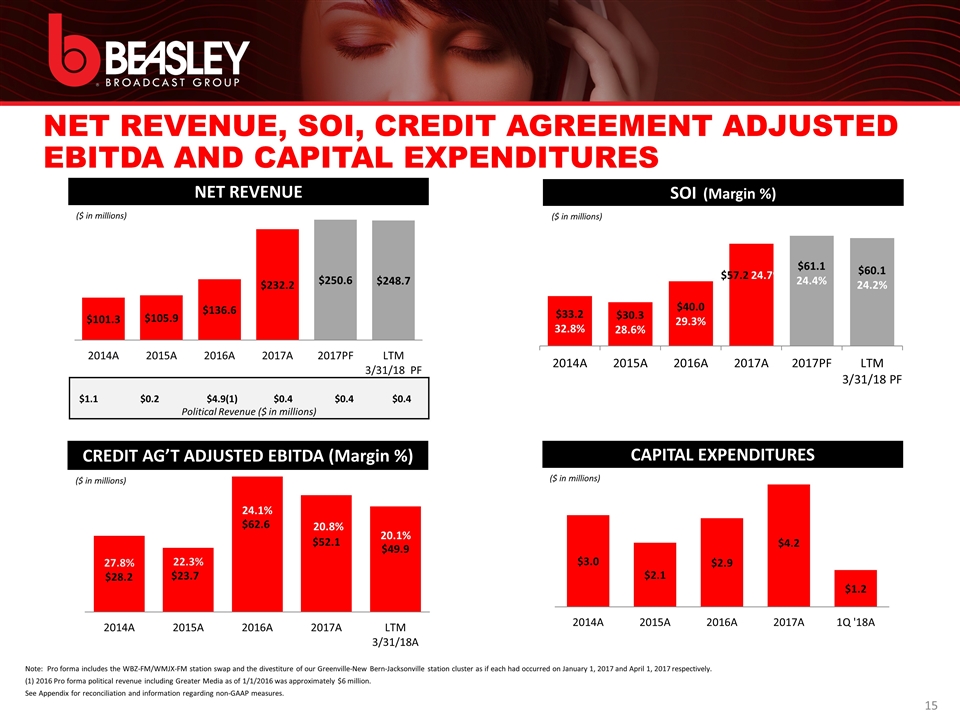

NET REVENUE, SOI, CREDIT AGREEMENT ADJUSTED EBITDA AND CAPITAL EXPENDITURES $1.1 $0.2 $4.9(1) $0.4 $0.4 $0.4 Political Revenue ($ in millions) NET REVENUE ($ in millions) SOI (Margin %) ($ in millions) 30.3% 30.6% 28.6% 29.3% 22.2% 22.6% CREDIT AG’T ADJUSTED EBITDA (Margin %) ($ in millions) $28.2 2 $23.7 24.1% $62.6 CAPITAL EXPENDITURES ($ in millions) 20.8% 20.1% 1.8% Note: Pro forma includes the WBZ-FM/WMJX-FM station swap and the divestiture of our Greenville-New Bern-Jacksonville station cluster as if each had occurred on January 1, 2017 and April 1, 2017 respectively. (1) 2016 Pro forma political revenue including Greater Media as of 1/1/2016 was approximately $6 million. See Appendix for reconciliation and information regarding non-GAAP measures.

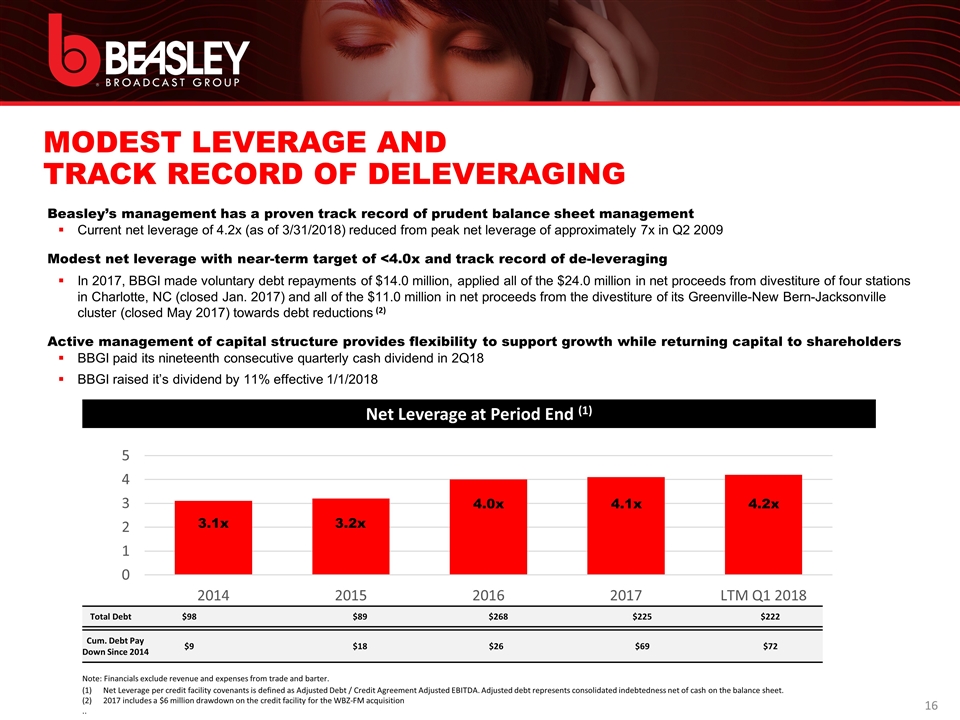

MODEST LEVERAGE AND TRACK RECORD OF DELEVERAGING Beasley’s management has a proven track record of prudent balance sheet management Current net leverage of 4.2x (as of 3/31/2018) reduced from peak net leverage of approximately 7x in Q2 2009 Modest net leverage with near-term target of <4.0x and track record of de-leveraging In 2017, BBGI made voluntary debt repayments of $14.0 million, applied all of the $24.0 million in net proceeds from divestiture of four stations in Charlotte, NC (closed Jan. 2017) and all of the $11.0 million in net proceeds from the divestiture of its Greenville-New Bern-Jacksonville cluster (closed May 2017) towards debt reductions (2) Active management of capital structure provides flexibility to support growth while returning capital to shareholders BBGI paid its nineteenth consecutive quarterly cash dividend in 2Q18 BBGI raised it’s dividend by 11% effective 1/1/2018 Net Leverage at Period End (1) Total Debt $98 $89 $268 $225 $222 Cum. Debt Pay Down Since 2014 $9 $18 $26 $69 $72 Note: Financials exclude revenue and expenses from trade and barter. Net Leverage per credit facility covenants is defined as Adjusted Debt / Credit Agreement Adjusted EBITDA. Adjusted debt represents consolidated indebtedness net of cash on the balance sheet. 2017 includes a $6 million drawdown on the credit facility for the WBZ-FM acquisition .. 3.1x 3.2x 4.0x 4.1x 4.2x

INVESTOR HIGHLIGHTS Disciplined and Experienced Management Team 6 Leading Local Broadcast Media Company 1 Attractive Industry and Scaled Digital Platform 5 Sizeable Clusters with Strong In-Market Competitive Positioning 2 Modest Leverage and a Track Record of De-Leveraging 4 Strong Financial Profile with Robust Free Cash Flow 3

Purchase Price of $38 million Revenue and proforma SOI of approximately $9 million and $5 million, respectively Transaction is expected to be immediately accretive to FCF No material change expected to LTM Net Leverage on a pro forma basis after accounting for this acquisition . BBGI Announces the acquisition of Philadelphia’s Heritage Country station from Entercom Communications!

.

.

.

.