Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Element Solutions Inc | d563563dex992.htm |

| EX-99.1 - EX-99.1 - Element Solutions Inc | d563563dex991.htm |

| EX-2.1 - EX-2.1 - Element Solutions Inc | d563563dex21.htm |

| 8-K - 8-K - Element Solutions Inc | d563563d8k.htm |

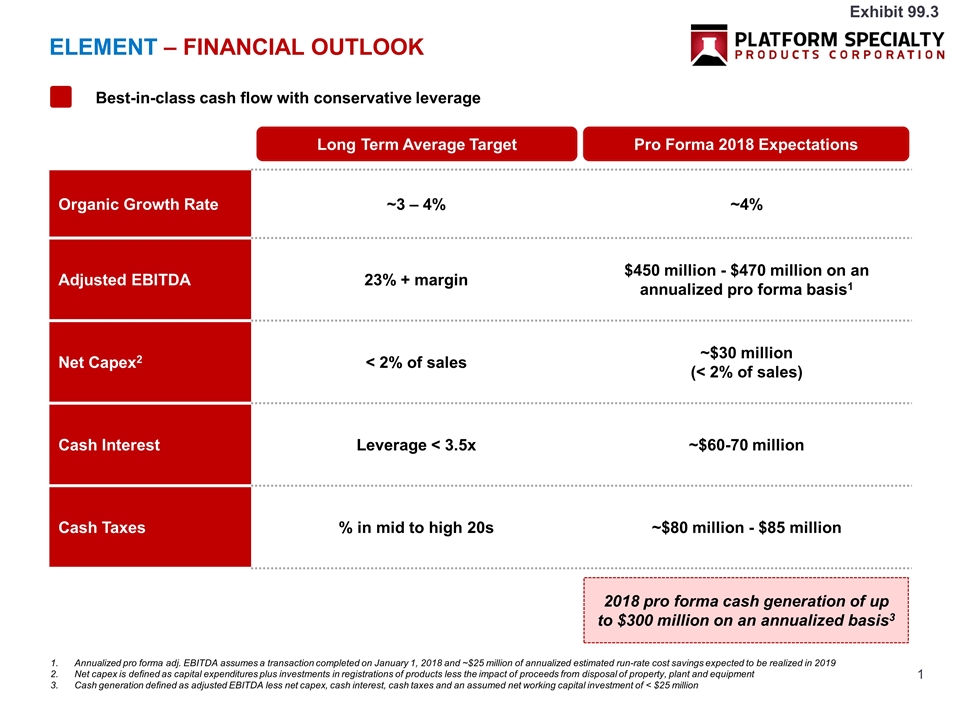

Element – Financial Outlook Annualized pro forma adj. EBITDA assumes a transaction completed on January 1, 2018 and ~$25 million of annualized estimated run-rate cost savings expected to be realized in 2019 Net capex is defined as capital expenditures plus investments in registrations of products less the impact of proceeds from disposal of property, plant and equipment Cash generation defined as adjusted EBITDA less net capex, cash interest, cash taxes and an assumed net working capital investment of < $25 million Organic Growth Rate ~3 – 4% ~4% Adjusted EBITDA 23% + margin $450 million - $470 million on an annualized pro forma basis1 Net Capex2 < 2% of sales ~$30 million (< 2% of sales) Cash Interest Leverage < 3.5x ~$60-70 million Cash Taxes % in mid to high 20s ~$80 million - $85 million Long Term Average Target Pro Forma 2018 Expectations 2018 pro forma cash generation of up to $300 million on an annualized basis3 Best-in-class cash flow with conservative leverage Exhibit 99.3

EBITDA and Adjusted EBITDA: EBITDA represents earnings before interest, provision for income taxes, depreciation and amortization. Adjusted EBITDA is defined as EBITDA, excluding the impact of additional items, which are not representative or indicative of the Company’s ongoing business as described in the footnotes to the non-GAAP measures reconciliations. Adjusted EBITDA for each segment also includes an allocation of corporate costs, such as compensation expense and professional fees. Management believes adjusted EBITDA and adjusted EBITDA margin provide investors with a more complete understanding of the long-term profitability trends of Platform’s business, and facilitate comparisons of its profitability to prior and future periods. However, these measures, which do not consider certain cash requirements, should not be construed as an alternative to net income or cash flow from operations as a measure of profitability or liquidity. Organic Sales Growth: Organic sales growth is defined as net sales excluding the impact of foreign currency translation, changes due to the price of certain metals, and acquisitions and/ or divestitures, as applicable. Management believes this non-GAAP financial measure provides investors with a more complete understanding of the underlying net sales trends by providing comparable sales over differing periods on a consistent basis. Pro Forma: “Pro forma” information excludes the results of the Arysta business by assuming a transaction closing on January 1, 2018 and includes the full benefit of approximately $25 million of estimated run-rate cost savings expected to be delivered in 2019. This pro forma information, however, should not necessarily be, and should not be assumed to be, an indication of the results that may have been achieved had the Arysta transaction been completed on January 1, 2018, or results that may be achieved in the future. This pro forma information may also not be comparable to the pro forma information required to be provided in connection with the transaction closing. Non-GAAP Definitions