Securities Act File No. 333-218263

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

(Amendment No. 2)

| Registration Statement Under the Securities Act of 1933 | |||||

| ☒ | Pre-effective Amendment No. | ||||

| ☐ | Post-effective Amendment No. | ||||

CAPE POINT HOLDINGS, INC.

(Exact Name of Registrant as Specified in Charter)

Campos Elíseos 400, 601B, Colonia PolancoReforma

Delegación Miguel Hidalgo, CP 11560

México, Ciudad de México

(Address of Principal Executive Offices)

+5255 70980527

(Registrant’s Telephone Number, Including Area Code)

Mr. Porfirio Sánchez-Talavera, Chief Executive Officer

Cape Point Holdings, Inc.

Campos Elíseos 400, 601B, Colonia PolancoReforma

Delegación Miguel Hidalgo, CP 11560

México, Ciudad de México

(Name and Address of Agent for Service)

Copies to:

John D. Thomas, Esq.

John D. Thomas, P.C.

11650 South State Street, Suite 240

Draper, UT 84020

Telephone: (801) 816-2536

Facsimile: (801) 816-2537

Approximate Date of Proposed Public Offering: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are offered on a delayed or continuous basis in reliance on Rule 415 under the Securities Act of 1933, other than securities offered in connection with a dividend reinvestment plan, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer [ ] Accelerated Filer [ ] Non-Accelerated Filer [ ] Smaller reporting company [X]

CALCULATION OF REGISTRATION FEE UNDER THE SECURITIES ACT OF 1933

Title of Securities Being Registered | Amount Being Registered (1) | Proposed Maximum Aggregate Offering Price (2) |

Amount of Registration Fee | |||||||||

| Common stock ($0.001 par value) | 1,880,000 | $ | 470,000 | $ | 54.47 | |||||||

| (1) |

Represents 1,880,000 shares of our common stock being registered for resale on behalf of the selling shareholders named in this registration statement. In accordance with Rule 416(a), this registration statement shall also cover an indeterminate number of shares that may be issued and resold resulting from stock splits, stock dividends or similar transactions.

| |

|

(2)

|

Until such time as our common shares are quoted on the OTC Markets, our shareholders will sell their shares at the price of $0.25 per share which is their purchase price.

| |

| (3) | Calculated under Section 6(b) of the Securities Act of 1933 as $.00012880 of the aggregate offering price. |

We hereby amend this registration statement on such date or dates as may be necessary to delay our effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a) may determine.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED APRIL 30, 2018

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, July ___, 2018 |

1,880,000 Shares of Common Stock

The information in this prospectus is not complete and may be changed. The Selling Stockholders may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offering to sell these securities and it is not a solicitation of an offering to buy these securities in any state where the offering or sale of such securities is not permitted.

CAPE POINT HOLDINGS, INC.

This prospectus relates to the exchange and resale of shares of Common stock of Cape Point Holdings, Inc. (hereafter, “we” “us” “our”, “CPH” or the “Company”) by certain holders of common shares (“Holders”) of the Company, at a price of $0.25 per share until our shares of common stock are quoted on the OTC Markets quotation service. We will not receive any of the proceeds from the sale of the shares by the holders.

There are no underwriting commissions involved in this offering. We have agreed to pay all the costs of this offering. Selling shareholders will pay no offering expenses.

Prior to this offering, there has been no market for our securities. Our common stock is not now listed on any national securities exchange or the NASDAQ stock market, and is not eligible to trade on the OTC Markets quotation platform. There is no guarantee that our securities will ever trade on the OTC Markets or on any listed exchange.

We are an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012 ("Jobs Act"), and will therefore be subject to reduced public company reporting requirements.

An investment in our common stock is subject to many risks and an investment in our shares will also involve a high degree of risk. See “Risk Factors” on page 4 to read about factors you should consider before purchasing shares of our common stock.

_______________________________________

Neither the SEC nor any state securities commission has approved or disapproved of these securities, or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense. The information in this prospectus is not complete and may be changed. This prospectus is included in the registration statement that was filed by us with the SEC. The selling stockholders may not sell these securities until the registration statement becomes effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The date of this prospectus is July ___, 2018

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. The selling stockholders are not offering to sell these securities in any jurisdiction where such offering or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

FORWARD-LOOKING STATEMENTS AND PROJECTIONS

All statements contained in this prospectus that are not historical facts, including statements regarding anticipated activity, are “forward-looking statements” within the meaning of the federal securities laws, involve a number of risks and uncertainties and are based on our beliefs and assumptions and information currently available to us. In some cases, you can identify forward-looking statements by words such as “may,” “will,” “should,” “expect,” “objective,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “forecast,” “continue,” “strategy,” or “position” or the negative of such terms or other variations of them or by comparable terminology. In particular, statements, express or implied, concerning future actions, conditions or events, future operating results or the ability to generate sales, income or cash flow are forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements, including:

| • | The level of competition in the telecom industry; | |

| • | Our ability to obtain additional capital to finance development, manufacturing and production of products either currently being developed or that we may hereafter acquire; | |

| • | Our reliance upon management and particularly Porfirio Sánchez-Talavera, our Chief Executive Officer, to execute our business plan; | |

| • | The price of our common; and | |

| • | The risks, uncertainties and other factors we identify in “Risk Factors” and elsewhere in this prospectus and in our filings with the SEC. |

| 1 |

This summary highlights some of the information in this prospectus. It is not complete and may not contain all of the information that you may want to consider. You should read carefully the more detailed information set forth under “Risk Factors” and the other information included in this prospectus. Except where the context suggests otherwise, the terms “we,” “us,” “our,” “CPH” and the “Company” refer to Cape Point Holdings, Inc. We refer in this prospectus to our executive officers and other members of our management team, collectively, as “Management.”

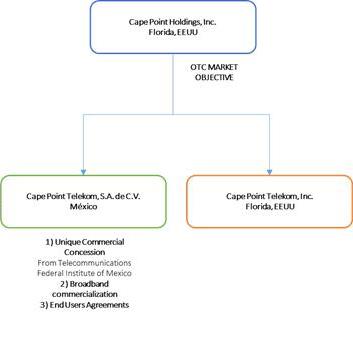

Company Organization

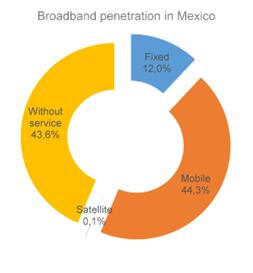

Cape Point Holdings, Inc. (“us”, “we” or “our”) is a Florida corporation formed on July 22, 2016, by our chief executive officer Porfirio Sánchez-Talavera to is an enterprise that seeks to build and operate a new satellite fleet to deliver broadband services within Mexico through strategic alliances and cutting-edge technology. Our principal executive office is located at Campos Elíseos 400, 601B, Colonia Polanco Reforma, Delegación Miguel Hidalgo, CP 11560, México, Ciudad de México. Our telephone number is +5255 70980527. Our website is www.capepointholdings.com and is not part of this prospectus.

Business

Our operations to date have been devoted primarily to start-up and development activities, which include: (i) Building strategic alliances on a revenue share basis; (ii) Development of a partnership network with leading retail, internet and telecom companies around the world in order to boost the industry development in the Americas through Ka-Band and further cutting-edge technologies. We have not sufficiently developed these strategic alliances, and joint-venture partnerships, and there is no assurance that we will be successful in developing cutting-edge technologies and strategic relationships.

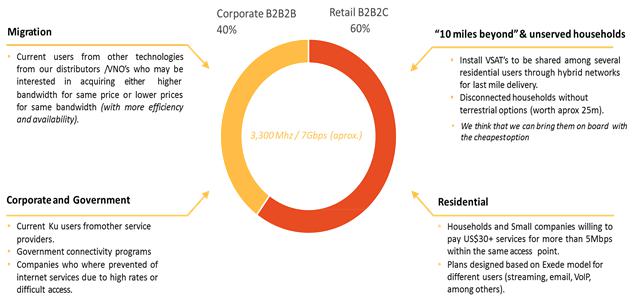

On March 15, 2017, through our 99% owned subsidiary Cape Point Telekom SociedadAnonima de Capital Variable (“Telekom Mexico”), we entered into a Joint Venture Agreement (the “Joint-Venture Agreement”) with CromSat Corp. (“CromSat”), a Florida corporation. Pursuant to the terms of the Joint-Venture Agreement, the Company planned to work with CromSat to acquire its 3,300 Mhz satellite capacity in exchange for 8,000,000 shares of Series B Preferred Stock of the Company. However, in August 2017, Cromsat Corp. received a notice of termination of its Ka-Band Satellite Capacity Lease Agreement, dated September 24, 2013 (the “Satellite Lease Agreement”) with Hispasat. The notice received from Hispasat alleges a breach of the Satellite Lease Agreement due to CromSat’s failure to convert the aforementioned Series B Preferred Stock of the Company, which was issued in the name of CromSat, but provided to Hispasat as a guarantee of CromSat’s performance under the Satellite Lease Agreement, into common stock of the Company quoted on a public exchange (the “Conversion”). CromSat disputes Hispasat’s assertions regarding the timing on the Conversion and has filed suit against Hispasat and its individual principals in the Tribunal Superior de Justicia de la Ciudad de México to enforce its rights under the Satellite Lease Agreement. However, CromSat believes that it is unlikely it will prevail in its lawsuit against Hispasat, and it is still further unlikely that its commitments pertaining to the Joint-Venture Agreement will be deliverable. Accordingly, CromSat, in January 2018 terminated the Joint-Venture, and returned the Series B Preferred Stock to the Company for return to treasury.

Despite the loss of our Hispasat contract, we still plan of finding a replacement provider for satellite delivery of internet and telecom to the Mexico region.

Business Plan

On the one hand we have formed a subsidiary of Cape Point Holdings Florida named Cape Point Telekom, Inc. that will subscribe the agreements with all the international and national telecommunications companies in charge of providing all technical infrastructure for the project, such as Teleport, Ground Station, Master Antenna, VSAT’s, Backbone and any other component needed for its technological deployment. We have also incorporated a Mexican entity named Cape Point Telekom, S.A. de C.V. to: a) acquire the MexicanTelecommunications Concession, in the understanding that the aforementioned permit is strictly needed for the delivery of broadband services, b) to acquire the satellite segment of 3,300MHz, c) subscribe all the necessary agreements with end users and d) commercialize all broadband services within Mexico.

| 2 |

Emerging Growth Company

We are an emerging growth company under the JOBS Act. We shall continue to be deemed an emerging growth company until the earliest of:

| • | The last day of the fiscal year of the issuer during which it had total annual gross revenues of $1,070,000,000 (as such amount is indexed for inflation every 5 years by the Commission to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest 1,000,000) or more; | ||

| • | The last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective IPO registration statement; | ||

| • | The date on which such issuer has, during the previous 3-year period, issued more than $1,070,000,000 in non-convertible debt; or | ||

| • | The date on which such issuer is deemed to be a ‘large accelerated filer’, as defined in section 240.12b-2 of title 17, Code of Federal Regulations, or any successor thereto. |

As an emerging growth company we are exempt from Section 404(b) of Sarbanes Oxley. Section 404(a) requires Issuers to publish information in their annual reports concerning the scope and adequacy of the internal control structure and procedures for financial reporting. This statement shall also assess the effectiveness of such internal controls and procedures. Section 404(b) requires that the registered accounting firm shall, in the same report, attest to and report on the assessment and the effectiveness of the internal control structure and procedures for financial reporting.

As an emerging growth company we are also exempt from Section 14A (a) and (b) of the Securities Exchange Act of 1934 which require the shareholder approval of executive compensation and golden parachutes. These exemptions are also available to us as a Smaller Reporting Company.

The Offering

As of the date of this prospectus, we had 22,168,000 shares of common stock issued and outstanding.

The selling stockholders are offering up to 1,880,000 shares of common stock. Because we are not currently listed on any national securities exchange or the OTC Markets trading platform, the selling shareholders will offer their shares at $0.25 per share until such time as our shares are quoted on the OTC Bulletin Board. Thereafter, the selling stockholders will sell their shares at prevailing market prices or privately negotiated prices.

We will pay all expenses of registering the securities, estimated at approximately $65,000. We will not receive any proceeds of the sale of these securities.

To be quoted on the OTC Bulletin Board, a market maker must file an application on our behalf in order to make a market for our common stock. The current absence of a public market for our common stock may make it more difficult for you to sell shares of our common stock that you own.

Financial Summary

The tables and information below are derived from our audited financial statements for the period from July 22, 2016 (Inception) to March 31, 2017. Our working capital as of March 31, 2017, was $235,252. As of March 31, 2017, we had cash on hand of $296,956.

| 3 |

| At March 31, 2017 Audited | ||||

| Financial Summary | ||||

| Cash | $ | 296,956 | ||

| Total Assets | $ | 296,956 | ||

| Total Liabilities | $ | 61,704 | ||

| Total Stockholders’ Equity | $ | 235,252 | ||

| Inception (July 22, 2016), through March 31, 2017 Audited | ||||

| Statement of Operations | ||||

| Revenue | $ | -0- | ||

| Total Expenses | $ | 159,748 | ||

| Net Loss for the Period | $ | 159,748 | ||

| Net Loss per Share | $ | (0.01 | ) | |

An investment in our securities involves certain risks relating to our business and operations. You should carefully consider these risks, together with all of the other information included in this prospectus, before you decide whether to purchase shares of our Company. If any of the following risks actually occur, our business, financial condition or results of operations could be materially adversely affected. If that happens, the trading price of our common stock could decline and you may lose all or part of your investment.

Risks Related to Our Business

Our auditors have expressed substantial doubt about our ability to continue as a going concern.

Our audited financial statements from inception until March 31, 2017, were prepared assuming that we will continue our operations as a going concern. We do not, however, have a history of operating profitably. Consequently, our independent accountants in their audit report have expressed substantial doubt about our ability to continue as a going concern. Our continued operations are highly dependent upon our ability to increase revenues, decrease operating costs, and complete equity and/or debt financings. Such financings may not be available or may not be available on reasonable terms. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty. We estimate that we will not be able to continue as a going concern after March 31, 2017 unless we are able to secure capital from one of these sources of financing. If we are unable to secure such financing, we may cease operations and investors in our common stock could lose all of their investment.

| 4 |

We have not voluntarily implemented various corporate governance measures, in the absence of which, shareholders may have more limited protections against interested director transactions, conflicts of interest and similar matters.

Federal legislation, including the Sarbanes-Oxley Act of 2002, has resulted in the adoption of various corporate governance measures designed to promote the integrity of the corporate management and the securities markets. Some of these measures have been adopted in response to legal requirements. Others have been adopted by companies in response to the requirements of national securities exchanges, such as the NYSE or the Nasdaq Stock Market, on which their securities are listed. Among the corporate governance measures that are required under the rules of national securities exchanges are those that address board of directors' independence, and audit committee oversight. We have not yet adopted any of these corporate governance measures and, since our securities are not yet listed on a national securities exchange, we are not required to do so. It is possible that if we were to adopt some or all of these corporate governance measures, stockholders would benefit from somewhat greater assurances that internal corporate decisions were being made by disinterested directors and that policies had been implemented to define responsible conduct. Prospective investors should bear in mind our current lack of corporate governance measures in formulating their investment decisions.

We are an "emerging growth company," and we cannot be certain if the reduced reporting requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an "emerging growth company," as defined in the Jumpstart Our Business Startups Act, or the JOBS Act. For as long as we continue to be an emerging growth company, we may take advantage of exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We could be an emerging growth company for up to five years, although we could lose that status sooner if our revenues exceed $1,070,000,000, if we issue more than $1,070,000,000 in non-convertible debt in a three year period, or if the market value of our common stock held by non-affiliates exceeds $100,000,000 as of any June 30 before that time, in which case we would no longer be an emerging growth company as of the following June 30. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(2) of the Jobs Act, that allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

If we are unable to retain our staff, our business and results of operations could be harmed.

Our ability to compete with other telecom companies, and develop our business is largely dependent on the services of Porfirio Sánchez-Talavera and Juan Carlos Garcia, our Chief Executive Officer and Secretary respectively, and other employees and contractors which assist them in management and operation of the business. If we are unable to retain Mr. Porfirio Sánchez-Talavera’s and Mr. Garcia’s’ services and to attract other qualified senior management and key personnel on terms satisfactory to us, our business will be adversely affected. We do not have key man life insurance covering the life of Mr. Porfirio Sánchez-Talavera and Mr. Garcia, even if we are able to afford such a key man policy, our coverage levels may not be sufficient to offset any losses we may suffer as a result of either of their death, disability, or other inability to perform services for us.

We do not presently have a diversified revenue stream.

In January, 2018, CromSat terminated the Joint-Venture Agreement, which was the Company’s only source of revenue. Presently, the Company has no alternative source of revenue. The termination of our Joint-Venture Agreement has had a substantially adverse effect upon our operations and viability as a going concern and, consequently, investors could incur a complete loss of their investment in the Company.

| 5 |

Technology changes rapidly in the telecommunications industry and if we fail to anticipate or successfully implement new technologies, our revenues will be negatively impacted.

Rapid technology changes in the telecommunications industry require us to anticipate, sometimes years in advance, which technologies we will implement and develop in order to be competitive. We must start our product and service development with a range of technical development goals that we hope to be able to achieve. We may not be able to achieve these goals, or our competition may be able to achieve them more quickly and effectively than we can. In either case, our products and services may be technologically inferior to our competitors’, less appealing to consumers, or both. If we cannot achieve our technology goals within the original development schedule of our products and services, then we may delay their release until these technology goals can be achieved, which may delay or reduce revenue and increase our development expenses. Alternatively, we may increase the resources employed in research and development in an attempt to accelerate our development of new technologies, either to preserve our product or service launch schedule or to keep up with our competition, which would increase our development expenses. Any such failure to adapt to, and appropriately allocate resources among, emerging technologies would harm our competitive position, and negatively impact our revenues.

Our operations are primarily located in Mexico, and could impede our shareholders’ ability to enforce judgments against the company or its affiliates.

Though we are organized and domiciled under the laws of Florida, the Company’s primary operations and its assets will be located in Mexico. Moreover, certain of our directors and executive officers are not residents of the United States, and all or a substantial portion of the assets of such persons are located outside the United States. As a result, it may not be possible for investors to effect service of process within the United States upon the company or its affiliates, or to enforce against them judgments obtained in U.S. courts, including judgments in actions predicated upon the civil liability provisions of the federal securities laws of the United States. We have also been advised by our corporate counsel that there is doubt as to the enforceability in Mexico of original actions, or in actions for enforcement of judgments of U.S. courts.

Foreign currency exchange rates and fluctuations in those rates may affect the Company’s ability to realize projected growth rates in its sales and earnings.

Because the Company’s financial statements are denominated in U.S. dollars and the Company’s revenues are derived from Mexico primarily, the Company’s results of operations and its ability to realize projected growth rates in sales and earnings could be adversely affected if the U.S. dollar strengthens significantly against foreign currencies.

We may acquire businesses and enter into joint ventures that will expose us to increased operating risks.

As part of our growth strategy, we intend to acquire other telecom related businesses. We cannot provide any assurance that we will find attractive acquisition candidates in the future, that we will be able to acquire such candidates on economically acceptable terms or that we will be able to finance acquisitions on economically acceptable terms. Even if we are able to acquire new businesses in the future, they could result in the incurrence of substantial additional indebtedness and other expenses or potentially dilutive issuances of equity securities and may affect the market price of our common stock or restrict our operations. We have also entered into joint venture arrangements intended to complement or expand our business and will likely continue to do so in the future. These joint ventures are subject to substantial risks and liabilities associated with their operations, as well as the risk that our relationships with our joint venture partners do not succeed in the manner that we anticipate.

We face intense competition and, if we are not able to effectively compete in our markets, our revenues may decrease.

Competitive pressures in our markets could adversely affect our competitive position, leading to a possible loss of customers or a decrease in prices, either of which could result in decreased revenues and profits. Our competitors are numerous, ranging from large multinational corporations, which have significantly greater capital resources than us, to relatively small and specialized firms. We also compete with the major manufacturers. Our business could be adversely affected because of increased competition from these telecom companies.

| 6 |

Current and future litigation could adversely affect us.

We are not currently involved in any legal proceedings. However, we may become involved in other legal proceedings in our ordinary course of business. Lawsuits and other legal proceedings can involve substantial costs, including the costs associated with investigation, litigation and possible settlement, judgment, penalty or fine. As a smaller company, the collective costs of litigation proceedings can represent a drain on our cash resources, as well as an inordinate amount of our Management’s time and addition. Moreover, an adverse ruling in respect of certain litigation could have a material adverse effect on our results of operation and financial condition.

We have limited the liability of our board of directors and management.

We have adopted provisions in our Articles of Incorporation which limit the liability of our directors and officers and have also adopted provisions in our bylaws which provide for indemnification by the Company of our officers and directors to the fullest extent permitted by Florida corporate law. Our Articles of Incorporation generally provide that our directors shall have no personal liability to the Company or its stockholders for monetary damages for breaches of their fiduciary duties as directors, except for breaches of their duties of loyalty, acts or omissions not in good faith or which involve intentional misconduct or knowing violation of law, acts involving unlawful payment of dividends or unlawful stock purchases or redemptions, or any transaction from which a director derives an improper personal benefit. Such provisions substantially limit our shareholders’ ability to hold directors liable for breaches of fiduciary duty.

Our share structure could impede a non-negotiated change of control of the Company.

Our Chief Executive Officer and Director Porfirio Sánchez-Talavera beneficially owns approximately 90.54% of the voting common shares of our company as of the date of this prospectus. Moreover, Mr. Sánchez-Talavera holds 80% of the total voting rights of all classes of capital stock by virtue of his beneficial ownership of our Series A Preferred Stock, and is able to vote together with holders of our common stock on all matters upon which our common stockholders may vote. Consequently, Mr. Sánchez-Talavera may unilaterally determine the election of our board of directors and, therefore, the direction of our business. Under our Articles of Incorporation, the vote of a majority of the shares outstanding is generally required to approve most shareholder actions. As a result, Mr. Sánchez-Talavera will be able to unilaterally control the outcome of shareholder votes for the foreseeable future, including votes concerning the election of directors, amendments to our Articles of Incorporation or proposed mergers or other significant corporate transactions. Shareholders should be aware that they may have limited ability to influence the outcome of any vote in the future.

Risks Relating To This Offering and Our Common Stock

If the selling shareholders sell a large number of shares all at once or in blocks, the market price of our shares would most likely decline.

Holders holding 2,080,000 shares of common stock may resell their shares of Common stock through this prospectus. Should the selling stockholders decide to sell their shares at a price below the market price as quoted on OTC Markets, the price may continue to decline. A steep decline in the price of our common stock upon being quoted on OTC Markets would adversely affect our ability to raise additional equity capital, and even if we were successful in raising such capital, the terms of such raise may be substantially dilutive to current shareholders.

The market price of our common stock may fluctuate significantly.

The market price and marketability of shares of our common stock may be affected significantly by numerous factors, including some over which we have no control and which may not be directly related to us. These factors include the following:

| · | Our relatively small number of outstanding shares; | |

| · | The lack of trading volume in our shares; | |

| · | Price and volume fluctuations in the stock market from time to time, which often are unrelated to our operating performance; | |

| · | Variations in our operating results; | |

| · | Any shortfall in revenue or any increase in losses from expected levels; | |

| · | Announcements of new initiatives, joint ventures, or commercial arrangements; and | |

| 7 |

| · | General economic trends and other external factors. |

If the trading price of our common stock falls significantly following completion of this offering, this may cause some of our shareholders to sell our shares, which would further adversely affect the trading market for, and liquidity of, our common stock. If we seek to raise capital through future equity financings, this volatility may adversely affect our ability to raise such equity capital.

Investors may have difficulty in reselling their shares due to the lack of market or state Blue Sky laws.

Our common stock is currently not quoted on any market. No market may ever develop for our common stock, or if developed, may not be sustained in the future. The holders of our shares of common stock and persons who desire to purchase them in any trading market that might develop in the future should be aware that there might be significant state law restrictions upon the ability of investors to resell our shares. Accordingly, even if we are successful in having the shares available for trading on the OTC Markets, investors should consider any secondary market for our common shares to be a limited one. We intend to seek coverage and publication of information regarding the company in an accepted publication, which permits a "manual exemption." This manual exemption permits a security to be distributed in a particular state without being registered if the company issuing the security has a listing for that security in a securities manual recognized by the state. However, it is not enough for the security to be listed in a recognized manual. The listing entry must contain (1) the names of issuers, officers, and directors, (2) an issuer's balance sheet, and (3) a profit and loss statement for either the fiscal year preceding the balance sheet or for the most recent fiscal year of operations. We may not be able to secure a listing containing all of this information. Furthermore, the manual exemption is a non-issuer exemption restricted to secondary trading transactions, making it unavailable for issuers selling newly issued securities. Most of the accepted manuals are those published in Standard and Poor's, Moody's Investor Service, Fitch's Investment Service, and Best's Insurance Reports, and many states expressly recognize these manuals. A smaller number of states declare that they “recognize securities manuals” but do not specify the recognized manuals. The following states do not have any provisions and therefore do not expressly recognize the manual exemption: Alabama, Georgia, Illinois, Kentucky, Louisiana, Montana, South Dakota, Tennessee, Vermont and Wisconsin.

Accordingly, our common shares should be considered totally illiquid, which inhibits investors’ ability to resell their shares.

We will be subject to penny stock regulations and restrictions and you may have difficulty selling shares of our common stock.

The SEC has adopted regulations which generally define so-called “penny stocks” to be an equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exemptions. We anticipate that our common stock will become a “penny stock”, and we will become subject to Rule 15g-9 under the Exchange Act, or the “Penny Stock Rule”. This rule imposes additional sales practice requirements on broker-dealers that sell such securities to persons other than established customers. For transactions covered by Rule 15g-9, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to sale. As a result, this rule may affect the ability of broker-dealers to sell our common shares and may affect the ability of purchasers to sell any of our common shares in the secondary market.

For any transaction involving a penny stock, unless exempt, the rules require delivery, prior to any transaction in a penny stock, of a disclosure schedule prepared by the SEC relating to the penny stock market. Disclosure is also required to be made about sales commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements are required to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stock.

We do not anticipate that our common stock will qualify for exemption from the Penny Stock Rule. In any event, even if our common stock were exempt from the Penny Stock Rule, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the SEC the authority to restrict any person from participating in a distribution of penny stock, if the SEC finds that such a restriction would be in the public interest.

| 8 |

Sales of our common stock under Rule 144 could reduce the price of our stock.

None of our outstanding common shares are currently eligible for resale under Rule 144. In general, persons holding restricted securities in a Securities & Exchange Commission reporting company, including affiliates, must hold their shares for a period of at least six months, may not sell more than one percent of the total issued and outstanding shares in any 90-day period, and must resell the shares in an unsolicited brokerage transaction at the market price. If substantial amounts of our common stock become available for resale under Rule 144, prevailing market prices for our common stock will be reduced.

If in the future we are not required to continue filing reports under Section 15(d) of the 1934 Act, for example because we have less than three hundred shareholders of record at the end of the first fiscal year in which this registration statement is declared effective, and we do not file a Registration Statement on Form 8-A upon the occurrence of such an event, our common shares can no longer be quoted on the OTC Markets, which could reduce the value of your investment.

As a result of this offering as required under Section 15(d) of the Securities Exchange Act of 1934, we will file periodic reports with the Securities and Exchange Commission as required under Section 15(d). However, if in the future we are not required to continue filing reports under Section 15(d), for example because we have less than three hundred shareholders of record at the end of the first fiscal year in which this registration statement is declared effective, and we do not file a Registration Statement on Form 8-A upon the occurrence of such an event, our common stock can no longer be quoted on the OTC Markets, which could reduce the value of your investment. Of course, there is no guarantee that we will be able to meet the requirements to be able to cease filing reports under Section 15(d), in which case we will continue filing those reports in the years after the fiscal year in which this registration statement is declared effective. Filing a registration statement on Form 8-A will require us to continue to file quarterly and annual reports with the SEC and will also subject us to the proxy rules of the SEC. In addition, our officers, directors and 10% stockholders will be required to submit reports to the SEC on their stock ownership and stock trading activity. Thus the filing of a Form 8-A in such event makes our common shares continued to be able to be quoted on the OTC Markets.

We may, in the future, issue additional securities, which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation authorize us to issue 100,000,000 shares of common stock and 10,000,000 shares of preferred stock. As of the date of this prospectus, we had 22,168,000 shares of common stock issued and outstanding. Accordingly, we may issue up to an additional 77,842,000 shares of common stock and 1,999,800 shares of preferred stock. The future issuance of common stock may result in substantial dilution in the percentage of our common stock held by our then existing shareholders. We may value any common stock issued in the future on an arbitrary basis including for services or acquisitions or other corporate actions that may have the effect of diluting the value of the shares held by our stockholders, and might have an adverse effect on any trading market for our common stock. Our board of directors may designate the rights, terms and preferences of our authorized but unissued preferred shares at its discretion including conversion and voting preferences without notice to our shareholders.

Because we do not intend to pay any cash dividends on our common stock, our stockholders will not be able to receive a return on their shares unless they sell them.

We have never paid a dividend and we intend to retain any future earnings to finance the development and expansion of our business. Consequently, we do not anticipate paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them. We cannot assure you that stockholders will be able to sell shares when desired.

The selling stockholders may offer and sell, from time to time, any or all of the Common stock registered for resale hereunder. Because the selling stockholders may offer all or only some portion of the 1,880,000 shares of Common stock to be registered, we cannot estimate the amount or percentage of these shares of common stock that will be retained by the selling stockholders. However, we have assumed, for purposes of the table below that the selling stockholders will sell all of their shares of common stock.

| 9 |

The computation of ownership in the table below is not made pursuant to the beneficial ownership rules of the Commission under “Security Ownership of Certain Beneficial Owners and Management” on page 17, but is instead based solely upon the name of the titled holder of such shares as at May 15, 2018, the most recent practicable date. Other than the relationships described below, none of the selling stockholders had or have any material relationship with us. To our knowledge, none of the selling stockholders is a broker-dealer or an affiliate of a broker-dealer.

| Number of | ||||||||||||||||||||

| Common | ||||||||||||||||||||

| Shares | Percentage | |||||||||||||||||||

| held after | held after | |||||||||||||||||||

| Offering | offering | |||||||||||||||||||

| assuming | assuming | |||||||||||||||||||

| all | all | |||||||||||||||||||

| Number | Number of | Common | Common | |||||||||||||||||

| Of Common | Percentage | Common | Shares | Shares | ||||||||||||||||

| Shares Held | owned before | Shares | being | being | ||||||||||||||||

| before the | The | Being | registered | registered | ||||||||||||||||

| Name of Beneficial Holder | Offering | Offering(1) | Offered | are Sold(2) | are sold(2) | |||||||||||||||

| ROB BINKLEY | 10,000 | 0.05 | % | 10,000 | 0 | 0.00 | % | |||||||||||||

| LEON ELSTER | 200,000 | 0.90 | % | 200,000 | 0 | 0.00 | % | |||||||||||||

| SCOTT EPPINGA | 10,000 | 0.05 | % | 10,000 | 0 | 0.00 | % | |||||||||||||

| KYLE GERBER | 100,000 | 0.45 | % | 100,000 | 0 | 0.00 | % | |||||||||||||

| SAM GERBER& MARY JO GERBER JT TEN | 100,000 | 0.45 | % | 100,000 | 0 | 0.00 | % | |||||||||||||

| JACK GIAN | 920,000 | 4.15 | % | 920,000 | 0 | 0.00 | % | |||||||||||||

| MATTHEW GIAN& ERIN GIAN JT TEN | 80,000 | 0.36 | % | 80,000 | 0 | 0.00 | % | |||||||||||||

| GUBIN FAMILY TRUST STEVE GUBIN TTEE | 10,000 | 0.05 | % | 10,000 | 0 | 0.00 | % | |||||||||||||

| GREG JEWETT | 10,000 | 0.05 | % | 10,000 | 0 | 0.00 | % | |||||||||||||

| LAHR FAMILY TRUST LANNY B LAHR TTEE | 10,000 | 0.05 | % | 10,000 | 0 | 0.00 | % | |||||||||||||

| PARADISE WIRE AND CABLE | 100,000 | 0.45 | % | 100,000 | 0 | 0.00 | % | |||||||||||||

| LAWRENCE SUCHAROW | 10,000 | 0.05 | % | 10,000 | 0 | 0.00 | % | |||||||||||||

| TSS INVESTMENT TRUST TYLER STONE TTEE | 10,000 | 0.05 | % | 10,000 | 0 | 0.00 | % | |||||||||||||

| ERIC WEINBRENNER | 10,000 | 0.05 | % | 10,000 | 0 | 0.00 | % | |||||||||||||

| JOHN D. THOMAS, P.C. | 300,000 | 1.35 | % | 300,000 | 0 | 0.00 | % | |||||||||||||

| Total | 1,880,000 | 8.48 | % | 1,880,000 | 0 | 0.00 | % | |||||||||||||

(1) For each selling stockholder, the number of shares of common stock and percentage of ownership is based upon 22,168,000 shares issued and outstanding as of August 15, 2017. As of such date there are an aggregate of 790,000 warrants issued and outstanding to the selling stockholders and are not being registered hereunder. Other than these warrants, there no shares of common stock subject to options, warrants, and/or conversion rights held directly by the selling stockholders that are currently exercisable or exercisable within 60 days. The table above attributes ownership to the named holder of the common stock and to no other person. The table also assumes that each selling stockholder will sell all of his, her, or its shares in the offering.

(2) Assuming that all 1,880,000 shares registered are sold.

Holders of Record

We have 19 shareholders of record.

| 10 |

Offers and Sales of Securities

| Total | ||||||||||||||||||||||||

| Price | Consideration | Number | ||||||||||||||||||||||

| Per | Paid by | of Shares | Payment | Offer | Sale | |||||||||||||||||||

| Name | Share Paid | Shareholder | Purchased | Method | Date | Date | ||||||||||||||||||

| ROB BINKLEY | $ | .25 | $ | 2,500 | 10,000 | Check | 02/15/2017 | 02/24/2017 | ||||||||||||||||

| LEON ELSTER | $ | .25 | $ | 50,000 | 200,000 | Check | 01/05/2017 | 01/05/2017 | ||||||||||||||||

| SCOTT EPPINGA | $ | .25 | $ | 2,500 | 10,000 | Check | 03/23/2017 | 03/23/2017 | ||||||||||||||||

| KYLE GERBER | $ | .25 | $ | 25,000 | 100,000 | Check | 01/17/2017 | 01/26/2017 | ||||||||||||||||

| SAM GERBER& MARY JO GERBER JT TEN | $ | .25 | $ | 25,000 | 100,000 | Check | 01/17/2017 | 01/30/2017 | ||||||||||||||||

| JACK GIAN | $ | .25 | $ | 230,000 | 920,000 | Check | 12/14/2017 | 12/14/2017 | ||||||||||||||||

| MATTHEW GIAN& ERIN GIAN JT TEN | $ | .25 | $ | 20,000 | 80,000 | Check | 01/25/2017 | 01/25/2017 | ||||||||||||||||

| GUBIN FAMILY TRUST STEVE GUBIN TTEE |

$ | .25 | $ | 2,500 | 10,000 | Check | 02/15/2017 | 02/24/2017 | ||||||||||||||||

| GREG JEWETT | $ | .25 | $ | 2,500 | 10,000 | Check | 02/16/2017 | 02/24/2017 | ||||||||||||||||

| LAHR FAMILY TRUST LANNY B LAHR TTEE |

$ | .25 | $ | 2,500 | 10,000 | Check | 02/17/2017 | 02/17/2017 | ||||||||||||||||

| PARADISE WIRE AND CABLE | $ | .25 | $ | 25,000 | 100,000 | Check | 02/11/2017 | 02/23/2017 | ||||||||||||||||

| LAWRENCE SUCHAROW | $ | .25 | $ | 2,500 | 10,000 | Check | 02/08/2017 | 02/23/2017 | ||||||||||||||||

| TSS INVESTMENT TRUST TYLER STONE TTEE |

$ | .25 | $ | 2,500 | 10,000 | Check | 02/17/2017 | 02/23/2017 | ||||||||||||||||

| ERIC WEINBRENNER | $ | .25 | $ | 2,500 | 10,000 | Check | 02/15/2017 | 02/24/2017 | ||||||||||||||||

| JOHN D. THOMAS, P.C. | $ | .25 | $ | 75,000 | 300,000 | Services | 08/08/2016 | 04/28/2017 | ||||||||||||||||

| Total | $ | 470,000 | 1,880,000 | |||||||||||||||||||||

Our selling stockholders hold an aggregate of 1,880,000 shares of common stock. As reflected in the chart above from our inception on July 22, 2016, to present, we sold 1,580,000 common shares for cash consideration of $395,000 and issued 300,000 common shares for services to the selling stockholders. We are registering all 1,580,000 common shares sold for cash consideration and 300,000 common shares issued for services. We are not registering common shares held by our officers, directors, or affiliates.

We relied on Section 4(2) of the Securities Act of 1933, as amended for the offer and sale of the securities below. We believe that Section 4(2) was available because:

| · | Each investor had a pre-existing relationship with our Chief Executive Officer, Porfirio Sánchez-Talavera or our Secretary, Juan Carlos Garcia at the time of the offer and sale. | |

| · | None of these issuances involved underwriters, underwriting discounts or commissions. | |

| · | Restrictive legends were and will be placed on all certificates issued as described above. | |

| · | The distribution did not involve general solicitation or advertising. | |

| · | The distributions were made only to investors who were sophisticated enough to evaluate the risks of the investment. |

In connection with the foregoing transactions, we provided the following to all investors:

| · | Access to all our books and records. | |

| · | Access to all material contracts and documents relating to our operations. | |

| · | The opportunity to obtain any additional information, to the extent we possessed such information, necessary to verify the accuracy of the information to which the investors were given access. |

Prospective investors were invited to review at our offices at any reasonable hour, after reasonable advance notice, any materials available to us concerning our business.

| 11 |

The holders of our shares of common stock and persons who desire to purchase them in any trading market that might develop in the future should be aware that there may be significant state law restrictions upon the ability of investors to resell our shares. Accordingly, even if we are successful in having the shares available for trading on the OTC Markets, investors should consider any secondary market for the Company's securities to be a limited one. We intend to seek coverage and publication of information regarding the Company in an accepted publication which permits a "manual exemption”. This manual exemption permits a security to be distributed in a particular state without being registered if the company issuing the security has a listing for that security in a securities manual recognized by the state. However, it is not enough for the security to be listed in a recognized manual. The listing entry must contain (1) the names of issuers, officers, and directors, (2) an issuer's balance sheet, and (3) a profit and loss statement for either the fiscal year preceding the balance sheet or for the most recent fiscal year of operations. We may not be able to secure a listing containing all of this information. Furthermore, the manual exemption is a non-issuer exemption restricted to secondary trading transactions, making it unavailable for issuers selling newly issued securities. Most of the accepted manuals are those published in Standard and Poor's, Moody's Investor Service, Fitch's Investment Service, and Best's Insurance Reports, and many states expressly recognize these manuals. A smaller number of states declare that they “recognize securities manuals” but do not specify the recognized manuals. The following states do not have any provisions and therefore do not expressly recognize the manual exemption: Alabama, Georgia, Illinois, Kentucky, Louisiana, Montana, South Dakota, Tennessee, Vermont and Wisconsin.

We currently do not intend to and may not be able to qualify securities for resale in other states which require shares to be qualified before they can be resold by our shareholders.

Our common stock is currently not quoted on any market. No market may ever develop for our common stock, or if developed, may not be sustained in the future. Accordingly, our shares should be considered totally illiquid, which inhibits investors’ ability to resell their shares.

Selling shareholders are offering up to 1,880,000 shares of common stock. The selling shareholders will offer their shares at $0.25 per share until our shares are quoted on the OTC Markets and thereafter at prevailing market prices or privately negotiated prices. We will not receive proceeds from the sale of shares from the selling shareholders.

The securities offered by this prospectus will be sold by the selling shareholders. Selling shareholders in this offering may be considered underwriters. We are not aware of any underwriting arrangements that have been entered into by the selling shareholders. The distribution of the securities by the selling shareholders may be effected in one or more transactions that may take place in the over-the-counter market, including broker's transactions or privately negotiated transactions.

The selling shareholders may pledge all or a portion of the securities owned as collateral for margin accounts or in loan transactions, and the securities may be resold pursuant to the terms of such pledges, margin accounts or loan transactions. Upon default by such selling shareholders, the pledge in such loan transaction would have the same rights of sale as the selling shareholders under this prospectus. The selling shareholders may also enter into exchange traded listed option transactions, which require the delivery of the securities listed under this prospectus. After our securities are qualified for quotation on the over the counter markets, the selling shareholders may also transfer securities owned in other ways not involving market makers or established trading markets, including directly by gift, distribution, or other transfer without consideration, and upon any such transfer the transferee would have the same rights of sale as such selling shareholders under this prospectus.

| 12 |

In addition to the above, each of the selling shareholders will be affected by the applicable provisions of the Securities Exchange Act of 1934, including, without limitation, Regulation M, which may limit the timing of purchases and sales of any of the securities by the selling shareholders or any such other person. We have instructed our selling shareholders that they may not purchase any of our securities while they are selling shares under this registration statement.

Upon this registration statement being declared effective, the selling shareholders may offer and sell their shares from time to time until all of the shares registered are sold; however, this offering may not extend beyond two years from the initial effective date of this registration statement.

There can be no assurances that the selling shareholders will sell any or all of the securities. In various states, the securities may not be sold unless these securities have been registered or qualified for sale in such state or an exemption from registration or qualification is available and is complied with.

All of the foregoing may affect the marketability of our securities. Pursuant to oral promises we made to the selling shareholders, we will pay all the fees and expenses incident to the registration of the securities.

Should any substantial change occur regarding the status or other matters concerning the selling shareholders or us, we will file a post-effective amendment to this registration statement disclosing such matters.

OTC Markets Considerations

To be quoted on the OTC Markets, a market maker must file an application on our behalf in order to make a market for our common stock. We anticipate that after this registration statement is declared effective, market makers will enter “piggyback” quotes and our securities will thereafter trade on the OTC Markets.

The OTC Markets is separate and distinct from the NASDAQ stock market. NASDAQ has no business relationship with issuers of securities quoted on the OTC Markets. The SEC’s order handling rules, which apply to NASDAQ-listed securities, do not apply to securities quoted on the OTC Markets.

Although the NASDAQ stock market has rigorous listing standards to ensure the high quality of its issuers, and can delist issuers for not meeting those standards, the OTC Markets has no listing standards. Rather, it is the market maker who chooses to quote a security on the system, files the application, and is obligated to comply with keeping information about the issuer in its files. FINRA cannot deny an application by a market maker to quote the stock of a company.

Although we anticipate listing on the OTC Markets will increase liquidity for our stock, investors may have greater difficulty in getting orders filled because it is anticipated that if our stock trades on a public market, it initially will trade on the OTC Markets rather than on NASDAQ. Investors’ orders may be filled at a price much different than expected when an order is placed. Trading activity in general is not conducted as efficiently and effectively as with NASDAQ-listed securities.

Investors must contact a broker-dealer to trade OTC Markets securities. Investors do not have direct access to the bulletin board service. For bulletin board securities, there only has to be one market maker.

OTC Markets transactions are conducted almost entirely manually. Because there are no automated systems for negotiating trades on the OTC, they are conducted via telephone. In times of heavy market volume, the limitations of this process may result in a significant increase in the time it takes to execute investor orders. Therefore, when investors place market orders - an order to buy or sell a specific number of shares at the current market price - it is possible for the price of a stock to go up or down significantly during the lapse of time between placing a market order and getting execution. Because OTC Markets stocks are usually not followed by analysts, there may be lower trading volume than for NASDAQ-listed securities.

Although it is not certain that we will be approved to trade on the OTC Markets, it is likely that we will receive approval after we file our 15c2-11 with FINRA. The Company plans to make this 15c2-11 filing following the effective date of this registration statement. We must have a broker submit our filing as well as have at least 35 shareholders to qualify as a public company. It is possible that other factors may delay the process of trading on OTC Markets that are unforeseen. We believe that it is highly likely that we will be trading on the OTC Markets trading platform following our 15c2-11 filing with FINRA.

| 13 |

We are not aware of any pending or threatened legal proceedings in which we are involved.

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS, AND CONTROL PERSONS

Board of Directors

Our board of directors consists of the following individuals:

| Name and Year First Elected Director(1) | Age | Background Information | ||

|

Porfirio Sánchez-Talavera (2016)

|

|

29

|

|

Porfirio Sánchez-Talavera became our Chief Executive Officer and Chairman on July 22, 2016. In addition to his role as an officer and director of the Company, Mr. Porfirio Sánchez-Talavera is presently a Senior Advisor to GrupoVelatia, an international industrial and technology group based in Bilbao, Spain, which operates in the electrical, electronics, communication, security and aerospace sectors. Mr. Porfirio Sánchez-Talavera has served in this capacity since June, 2011. Mr. Porfirio Sánchez-Talavera is also presently Senior Advisor of International Operations to EuskalIrratiTelebista, also based in Bilbao Spain. EiTB was the first telecom group in the Spanish Basque Country. The EITB group is also the leading media group in the Basque Country with five television channels and five radio stations. Running since 1982, EiTB has established itself as a major media organization, connecting with more than a million people every day. Mr. Porfirio Sánchez-Talavera has served as a Senior Advisor of EiTB since June, 2011. Mr. Porfirio Sánchez-Talavera from January, 2011, to December, 2013, served as the Assistant Vice-President for Mexico and Madrid for Haai Capital Corp., a Florida based international investment and advisory company. Mr. Porfirio Sánchez-Talavera is a graduate of EscuelaBancaria y Comercial (Mexico City), and the IPADE Business School (Mexico City) with a Certificate in Top Management for Private Equity companies.

|

|

Juan Carlos Garcia (2016) |

44 |

Juan Carlos Garcia became a member of the Board of Directors on July 22, 2016, and Secretary of the Company on September 14, 2016. In addition to his roles as Secretary and a director of the Company, Mr. Garcia is presently the Chief Financial Officer & Acting Business Development Director of TCB PAY LTD., a provider of integrated payment solutions to small and medium-sized businesses world-wide. Mr. Garcia has served in this capacity since June, 2015. Mr. Garcia is also presently a co-founder and President of NCUBO Capital, LLC, a provider of disbursement solutions for banking networks, closed-loop electronic payment networks, and merchant retail networks. Mr. Garcia has served in this capacity since August, 2010. From January 2011 until February 2015, Mr. Garcia was the Vice-President of Business Development and a co-founder of CorpoRed, a technology solutions company that allows you to sell products and services electronically, without a credit card, handling all operations by bank deposits. Mr. Garcia graduated from Anahuac University with a CPA (1997) and a Masters in Finance (1998).

|

| 14 |

|

Benjamin Haguel (2016) |

38 |

Benjamin Haguel became a member of the Board of Directors on July 22, 2016. In addition to his role as a director of the Company, Mr. Haguel is presently the Chief Executive Officer and co-founder of TCB PAY LTD., a provider of integrated payment solutions to small and medium-sized businesses world-wide. Mr. Haguel has served in this capacity since September, 2014. Mr. Haguel is also presently the Chief Executive officer of Taking Care of Business, LLC, a privately held investment company investing in the banking and technology industries. Mr. Haguel has served in this capacity since August, 2013. From June, 2013 to September, 2014, Mr. Haguel co-founded and managed Suite Pay, an independent payment solutions provider specializing in global commerce. Mr. Haguel holds a Master's degree in Law from the La Sorbone School of Law in Paris, France.

|

(1) The business address of our directors is Campos Elíseos 400, 601B, Colonia PolancoReforma, Delegación Miguel Hidalgo, CP 11560

México, Ciudad de México

Director Independence

No member of our Board of Directors is considered an “independent director” as such term is defined in the published listing requirements of the New York Stock Exchange.

Compensation of Directors

Although we anticipate compensating the members of our board of directors in the future at industry levels, current members are not paid cash compensation for their service as directors. Each director may be reimbursed for certain expenses incurred in attending board of directors and committee meetings.

Board of Directors Meetings and Committees

Although various items were reviewed and approved by the Board of Directors via unanimous written consent since inception, the Board held no in-person meetings.

We do not have Audit or Compensation Committees of our board of directors. Because of the lack of financial resources available to us, we also do not have an “audit committee financial expert” as such term is described in Item 401 of Regulation S-K promulgated by the SEC.

| 15 |

Executive Officers

Porfirio Sánchez-Talavera and Juan Carlos Garcia are our executive officers, serving as Chief Executive Officer and Secretary respectively. Mssrs. Sánchez-Talavera and Garcia’s business background is as follows:

| Name and Year First Appointed as Executive Officer | Age | Background Information | ||

|

Porfirio Sánchez-Talavera (2016) |

29 |

Porfirio Sánchez-Talavera became our Chief Executive Officer and Chairman on July 22, 2016. In addition to his role as an officer and director of the Company, Mr. Porfirio Sánchez-Talavera is presently a Senior Advisor to GrupoVelatia, an international industrial and technology group based in Bilbao, Spain, which operates in the electrical, electronics, communication, security and aerospace sectors. Mr. Porfirio Sánchez-Talavera has served in this capacity since June, 2011. Mr. Porfirio Sánchez-Talavera is also presently Senior Advisor of International Operations to EuskalIrratiTelebista, also based in Bilbao Spain. EiTB was the first telecom group in the Spanish Basque Country. The EITB group is also the leading media group in the Basque Country with five television channels and five radio stations. Running since 1982, EiTB has established itself as a major media organization, connecting with more than a million people every day. Mr. Porfirio Sánchez-Talavera has served as a Senior Advisor of EiTB since June, 2011. Mr. Porfirio Sánchez-Talavera from January, 2011, to December, 2013, served as the Assistant Vice-President for Mexico and Madrid for Haai Capital Corp., a Florida based international investment and advisory company. Mr. Porfirio Sánchez-Talavera is a graduate of EscuelaBancaria y Comercial (Mexico City), and the IPADE Business School (Mexico City) with a Certificate in Top Management for Private Equity companies.

| ||

|

Juan Carlos Garcia (2016) |

44 |

Juan Carlos Garcia became a member of the Board of Directors on July 22, 2016, and Secretary of the Company on September 14, 2016. In addition to his roles as Secretary and a director of the Company, Mr. Garcia is presently the Chief Financial Officer & Acting Business Development Director of TCB PAY LTD., a provider of integrated payment solutions to small and medium-sized businesses world-wide. Mr. Garcia has served in this capacity since June, 2015. Mr. Garcia is also presently a co-founder and President of NCUBO Capital, LLC, a provider of disbursement solutions for banking networks, closed-loop electronic payment networks, and merchant retail networks. Mr. Garcia has served in this capacity since August, 2010. From January 2011 until February 2015, Mr. Garcia was the Vice-President of Business Development and a co-founder of Corpo Red, a technology solutions company that allows you to sell products and services electronically, without a credit card, handling all operations by bank deposits. Mr. Garcia graduated from Anahuac University with a CPA (1997) and a Masters in Finance (1998).

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In connection with the formation of the Company, an entity controlled by Porfirio Sánchez-Talavera, our Chief Executive Officer and Director, was issued 20,000,000 shares of common stock and 200 shares of Series A Preferred Stock of the Company. Mr. Sánchez-Talavera beneficially acquired the shares of our capital stock in exchange for a nominal sum.

The shares so acquired are set forth under SECURITY OWNERSHIP below. Because our Series A Preferred Stock contains disproportionate voting rights, Mr. Sánchez-Talavera will have the ability to control the election of our Board and the direction of the Company. Non-affiliate shareholders will not, therefore, be able to individually or collectively determine the composition of our Board or approve any material transaction requiring the consent of our equity holders, without the consent of Mr. Sánchez-Talavera.

| 16 |

On May 5, 2017, the Company issued 288,000 shares of restricted common stock that were previously authorized but were heretofore unissued to 4 members of its Board of Directors for services rendered as a director of the Company. On the date of the grant, the shares were valued at $.25 per share.

Family Relationships and Other Matters

There are no family relationships between any of our shareholders and our officers and directors.

Legal Proceedings

No officer, director, or persons nominated for such positions, promoter or significant employee has been involved in the last ten years in any of the following:

| • | Any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; | ||

| • | Any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); | ||

| • | Being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; | ||

| • | Being found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; | ||

| • | Having any government agency, administrative agency, or administrative court impose an administrative finding, order, decree, or sanction against them as a result of their involvement in any type of business, securities, or banking activity; | ||

| • | Being the subject of a pending administrative proceeding related to their involvement in any type of business, securities, or banking activity; and/or | ||

| • | Having any administrative proceeding been threatened against you related to their involvement in any type of business, securities, or banking activity. |

Corporate Governance

We do not have any standing audit, nominating and compensation committees of the board of directors, or committees performing similar functions. We do not currently have a Code of Ethics applicable to our principal executive, financial or accounting officer. All Board actions have been taken by Written Action rather than formal meetings.

| 17 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following tables set forth the ownership, as of the date of this prospectus, of our common stock by each person known by us to be the beneficial owner of more than 5% of our outstanding common stock, our directors, and our executive officers as a group. To the best of our knowledge, the persons named have sole voting and investment power with respect to such shares, except as otherwise noted. There are not any pending or anticipated arrangements that may cause a change in control.

The information presented below regarding beneficial ownership of our voting securities has been presented in accordance with the rules of the Securities and Exchange Commission and is not necessarily indicative of ownership for any other purpose. Under these rules, a person is deemed to be a "beneficial owner" of a security if that person has or shares the power to vote or direct the voting of the security or the power to dispose or direct the disposition of the security. A person is deemed to own beneficially any security as to which such person has the right to acquire sole or shared voting or investment power within 60 days through the conversion or exercise of any convertible security, warrant, option or other right. More than one person may be deemed to be a beneficial owner of the same securities. The percentage of beneficial ownership by any person as of a particular date is calculated by dividing the number of shares beneficially owned by such person, which includes the number of shares as to which such person has the right to acquire voting or investment power within 60 days, by the sum of the number of shares outstanding as of such date. Consequently, the denominator used for calculating such percentage may be different for each beneficial owner. Except as otherwise indicated below and under applicable community property laws, we believe that the beneficial owners of our common stock listed below have sole voting and investment power with respect to the shares shown. The business address of the shareholders is Campos Elíseos 400, 601B, Colonia PolancoReforma, Delegación Miguel Hidalgo, CP 11560, México, Ciudad de México

| Name of Beneficial Owner | Number of Common Shares Currently Owned(1) | Percentage of Common Shares Prior to the Offering(2) | Percentage of Common Shares After Offering(3) | Number of Series A Preferred Shares Currently Owned(1) | Percentage of Series A Prior to the Offering(2) | Percentage of Series A After Offering(3) | Number of Series B Preferred Shares Currently Owned(1) | Percentage of Series B Prior to the Offering(2) | Percentage of Series B After Offering(3) | Total Voting Power Prior to the Offering All Classes(4) | Total Voting Power After Offering All Classes (5) | |||||||||||||||||||||||||||||||

| Porfirio Sánchez-Talavera(6) | 20,072,000 | 90.54 | % | 90.54 | % | 200 | 100 | % | 90.54 | % | 0 | * | * | 98.11 | % | 98.11 | % | |||||||||||||||||||||||||

| Juan Carlos García(7) | 72,000 | * | * | 0 | * | * | 0 | * | * | * | * | |||||||||||||||||||||||||||||||

| Benjamin Haguel(8) | 72,000 | * | * | 0 | * | * | 0 | * | * | * | * | |||||||||||||||||||||||||||||||

| EloyCarabiasPalmeiro(9) | 72,000 | * | * | 0 | * | * | 0 | * | * | * | * | |||||||||||||||||||||||||||||||

| Hispasat - CromSat Obligor(10) | 0 | * | * | 0 | * | * | 0 | * | 0 | * | * | |||||||||||||||||||||||||||||||

| Investors Participating in this Offering(11) | 1,880,000 | 8.48 | % | 8.48 | % | 0 | * | * | 0 | * | * | * | 1.7 | % | ||||||||||||||||||||||||||||

| Officers & Directors as a Group (3 Persons) | 20,216,000 | 91.19 | % | 91.19 | % | 200 | 100 | % | * | 0 | * | * | 98.24 | % | 98.24 | % | ||||||||||||||||||||||||||

* - less than one percent.

(1) The calculation of the number of shares beneficially owned by each person in the table above is based upon the number of shares, options, warrants, and other instruments convertible into shares of the so referenced class that are currently convertible/exercisable or are convertible/exercisable within the next 60 days, which are held directly by such person or through one or more intermediaries.

| 18 |

(2) The calculation of percentage ownership of each person in the table above prior to the Offering is based upon the number of shares of the so referenced class beneficially owned by such person, together with any options, warrants, notes or other instruments held by such person which are presently convertible/exercisable into the so referenced class or convertible/exercisable within the next 60 days, divided by the sum of: (i) the total number of outstanding shares of the so referenced class, and (ii) any such convertible securities held by such person.

(3) The calculation of percentage ownership of each person in the table above after completion of the offering is based upon the number of shares of the so referenced class beneficially owned by such person, together with any options, warrants, notes or other instruments held by such person which are presently convertible/exercisable into the so referenced class or convertible/exercisable within the next 60 days, divided by the sum of: (i) the total number of outstanding shares of the so referenced class of the Company following completion of the Offering, and (ii) any such convertible securities held by such person.

(4) The calculation of total voting percentage for all classes of each person in the table above prior to the Offering is based upon the number of shares of all classes of capital stock of the Company beneficially owned by such person, together with any options, warrants, notes or other instruments held by such person which are presently convertible/exercisable into any class of capital stock of the Company or convertible/exercisable within the next 60 days multiplied by the number of votes per share of their respective class, divided by the sum of: (i) the total combined number of votes for all classes of capital stock of the Company, and (ii) any such convertible securities held by such person.