Attached files

| file | filename |

|---|---|

| 8-K - LIMESTONE BANCORP, INC. 8-K - LIMESTONE BANCORP, INC. | a51838013.htm |

Exhibit 99.1

July 18, 2018

FORWARD LOOKING STATEMENTS: This presentation contains forward-looking statements that involve risks and uncertainties. These forward-looking statements are based on management’s current expectations. Limestone Bancorp’s actual results in future periods may differ materially from those currently expected due to various factors, including those risk factors described in documents that the Company files with the Securities and Exchange Commission, including the Company’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q. The forward-looking statements in this presentation are made as of the date of the presentation and Limestone Bancorp does not assume any responsibility to update these statements.NON-GAAP FINANCIAL MEASURES: These slides contain non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of the registrant’s historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the issuer; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirements of Regulation G, Limestone Bancorp, Inc. has provided reconciliations within the slides, as necessary, of the non-GAAP financial measure to the most directly comparable GAAP financial measure. 2

Limestone Bancorp is a Kentucky-based bank holding company – Nasdaq: LMSTLimestone Bank is the 13th largest bank domiciled in Kentucky based on total assets Corporate headquarters in Louisville, Ky.Approximately $1.04 billion in assets and 217 associates (fte) at June 30, 2018Broad scope of high-quality retail and business banking products & servicesManagement team assembled under leadership of John T. Taylor, President & CEO with extensive market knowledge and community relationships About Limestone Bancorp and Limestone Bank 3

Management Team John T. Taylor

President & CEO, Limestone Bancorp

Chairman, President & CEO, Limestone BankJoined July 2012Over 30 years in industryAmerican Founders Bank – Lexington, KYPNC Bank, NA – President of Ohio & N. KY Region Phillip W. Barnhouse

CFO, Limestone Bancorp since January 2012

CFO & COO, Limestone BankJoined Ascencia Bank (Limestone Subsidiary) inSeptember 1998Previous Experience:Arthur Andersen LLP – Chattanooga, TN Stephanie Renner

Senior Vice President, General Counsel, Limestone BankJoined August 2012Previous experience:American Founders BankStites & Harbison, PLLC – Lexington, KYBryan Cave, LLP – Los Angeles, CA John R. Davis

Executive Vice President, Chief Credit Officer, Limestone BankJoined August 201225 Years Previous Experience:American Founders Bank – Lexington, KYNational City Bank – Louisville, KY andDayton & Cleveland, OHJoseph C. Seiler

Executive Vice President, Head of Commercial Banking, Limestone BankJoined April 201325 Years Previous Experience:PNC Bank, NA – Louisville, KYNational City Bank – Louisville, KYTom Swink

Senior Vice President, Head of Community Banking,Limestone BankJoined June 201325 Years Previous Experience:Fifth Third Bank – Lexington, KY,Cincinnati, OH, and Charlotte, NC 4

Board of Directors W. Glenn Hogan

Founder, CEO and PresidentHogan Real EstateLouisville, KYDirector since 2006 Michael T. Levy

President MuirfieldInsurance LLCLexington, KYDirector since 2014 James M. Parsons

Chief Financial Officer Ball Homes LLCLexington, KYDirector since 2015 Bradford T. Ray

Retired CEO and ChairmanSteel Technologies, Inc.Louisville, KYDirector since 2014 W. Kirk WycoffManaging PartnerPatriot Financial Partners LPPhiladelphia, PADirector since 2010Dr. Edmond J. Seifried

Principal S&B West LLCBethlehem, PADirector since 2015 John T. Taylor

President & CEO, Limestone Bancorp

Chairman, President & CEO, Limestone BankJoined July 2012Over 30 years in industryAmerican Founders Bank – Lexington, KYPNC Bank, NA – President of Ohio & N. KY Region 5

Highlights and Accomplishments Talent acquisition – Board, management, and production teamEnterprise Risk Management system implementationCredit adjudication and centralized operationsRegulatory relations; Consent Order terminated 10.31.17; Written Agreement terminated 4.10.18Compliance management systemsNonperforming asset reduction and return to profitabilityQuality loan production and deposit mix shiftFinancial transactions:Q1-18: Issued 1.15 million shares of common stock raising $15 million in new capital for BancorpQ4-17: Reversed deferred tax asset valuation allowance restoring $31.3 million net dtaQ2-17: Completed $10 million senior borrowing and contributed $9 million in new capital to BankQ2-16: Issued 800,000 shares of common stock raising $5 million in new capital for BancorpQ3-15: Converted $4 million of TRUPS to common equity at $2.6 million discount 6

Our Locations Twelve counties across the Commonwealth of Kentucky with 15 banking centersMetro Louisville, Bullitt and Henry countiesLexingtonSouth central and southern Kentucky 7

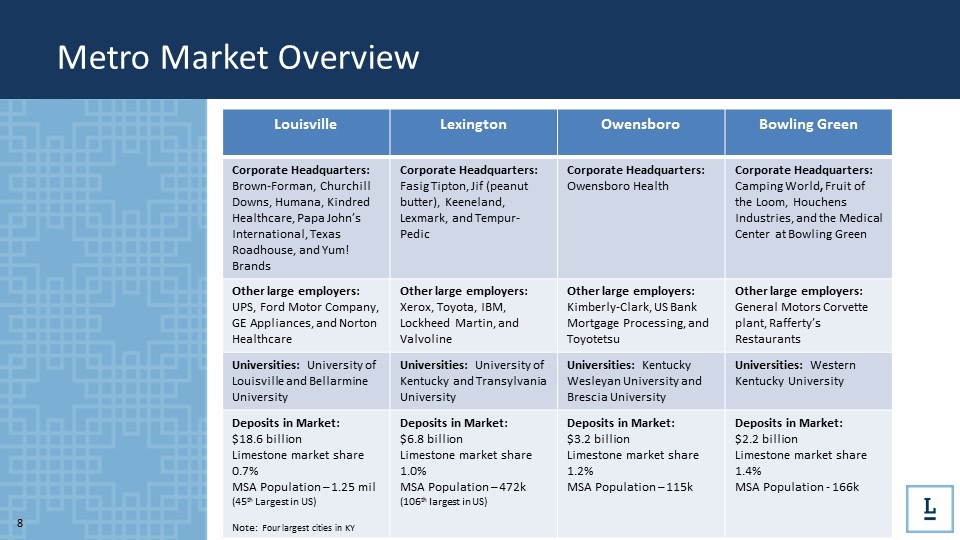

Metro Market Overview Louisville Lexington Owensboro Bowling Green Corporate Headquarters: Brown-Forman, Churchill Downs, Humana, Kindred Healthcare, Papa John’s International, Texas Roadhouse, and Yum! Brands Corporate Headquarters: Fasig Tipton, Jif (peanut butter), Keeneland, Lexmark, and Tempur-Pedic Corporate Headquarters: Owensboro Health Corporate Headquarters: Camping World, Fruit of the Loom, Houchens Industries, and the Medical Center at Bowling Green Other large employers: UPS, Ford Motor Company, GE Appliances, and Norton Healthcare Other large employers: Xerox, Toyota, IBM, Lockheed Martin, and Valvoline Other large employers: Kimberly-Clark, US Bank Mortgage Processing, and Toyotetsu Other large employers: General Motors Corvette plant, Rafferty’s Restaurants Universities: University of Louisville and Bellarmine University Universities: University of Kentucky and Transylvania University Universities: Kentucky Wesleyan University and Brescia University Universities: Western Kentucky University Deposits in Market:$18.6 billionLimestone market share 0.7%MSA Population – 1.25 mil (45th Largest in US)Note: Four largest cities in KY Deposits in Market:$6.8 billionLimestone market share 1.0%MSA Population – 472k (106th largest in US) Deposits in Market:$3.2 billionLimestone market share 1.2%MSA Population – 115k Deposits in Market:$2.2 billionLimestone market share 1.4%MSA Population - 166k 8

Financial Summary 9

Financial Summary 10

Loan and Yield Detail YTD Yield 4.94%Total Loans $749.2 million 11

Loan Portfolio and Asset Quality Trends 12

Investment Portfolio YTD Tax Equivalent Yield 2.88%Unrealized gains AFS $ 0.461 millionUnrealized losses AFS $(3.494) million 13

Deposit Trends 14

Net Interest Margin 15

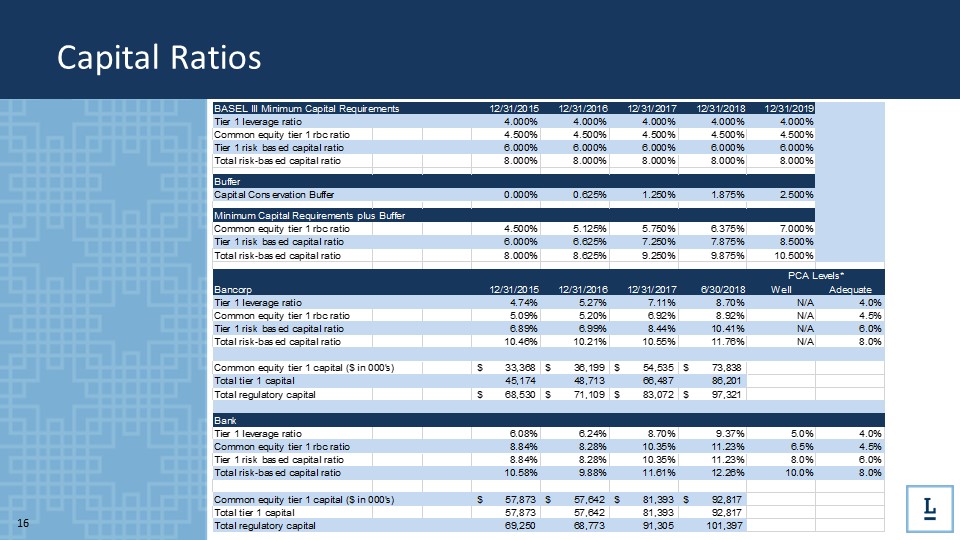

Capital Ratios 16

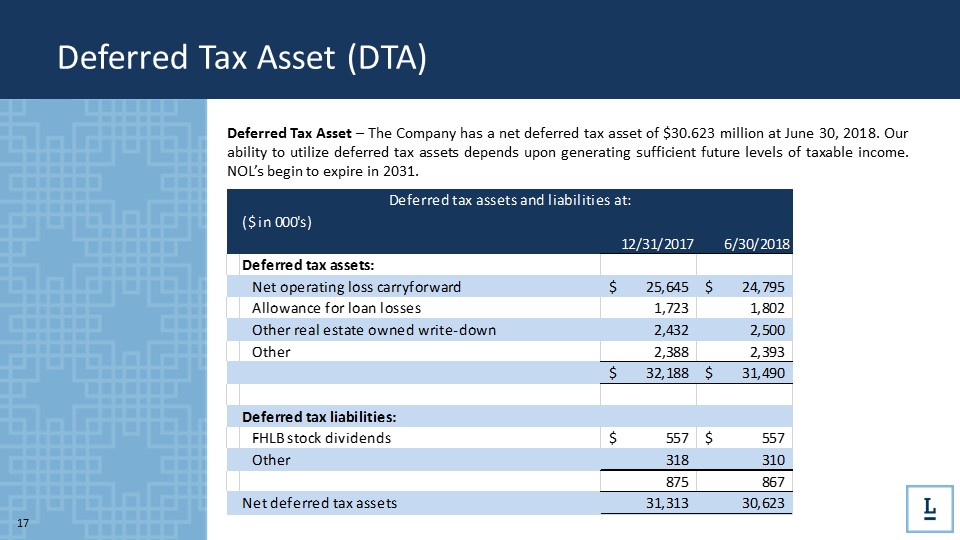

Deferred Tax Asset (DTA) Deferred Tax Asset – The Company has a net deferred tax asset of $30.623 million at June 30, 2018. Our ability to utilize deferred tax assets depends upon generating sufficient future levels of taxable income. NOL’s begin to expire in 2031. 17

Deferred Tax Asset (DTA) As of 6.30.2018, LMST’s net DTA totaled approximately $30.623 million. Deferred tax assets and liabilities are measured using current enacted tax rates (currently 21%).Section 382 of the Internal Revenue Code governs DTA impairment and “ownership change”.An “ownership change” is defined as a more than 50% change in ownership – complex assessment .382 imposes an annual ceiling on future use of the Company’s NOLs, credit carry-forwards and built-in losses.Tends to slow rate of NOL utilization (reducing present value of tax savings).Some NOLs and other tax benefits could expire before utilization is allowed if the Company does not generate sufficient taxable income.In May 2018, LMST extended a tax benefits preservation plan to June 30, 2021.Under Section 382 of the IRS Code, a permanent impairment of a substantial portion of the DTA could be triggered if shareholders owning 5% or more of the Company increase their ownership by more than 50 percentage points over a defined period of time.The tax benefits preservation plan is designed to reduce the likelihood of an “ownership change”.Any shareholder or group that acquires ownership of 5% or more of the Company could be subject to significant dilution in its holdings if our Board does not approve such acquisition.Existing shareholders of 5% or more are also subject to dilution if they increase their holdings without Board approval.In May 2018, shareholders approved an amendment to the articles of incorporation to further protect the long-term value of the Company’s NOLs.The amendment provides a means to block transfers of our common shares that could result in an ownership change under Section 382. 18

Senior Debt Loan amount: $10.0 million – Issued June 30, 2017 Term: 5 years Rate: Three-month libor + 2.50% Repay terms: Interest only quarterly; principal in the amount of $250,000 per quarter beginning at end of quarter 13 (September 2020) through quarter 20 with all unpaid principal due at maturity. Prepayment: Pre-payable without penalty Collateral: 100% of Limestone Bank, Inc. common stock 19

Limestone Bancorp, Inc. - Junior Subordinated Debt Quarterly interest payments are paid current and no longer in deferral. 20

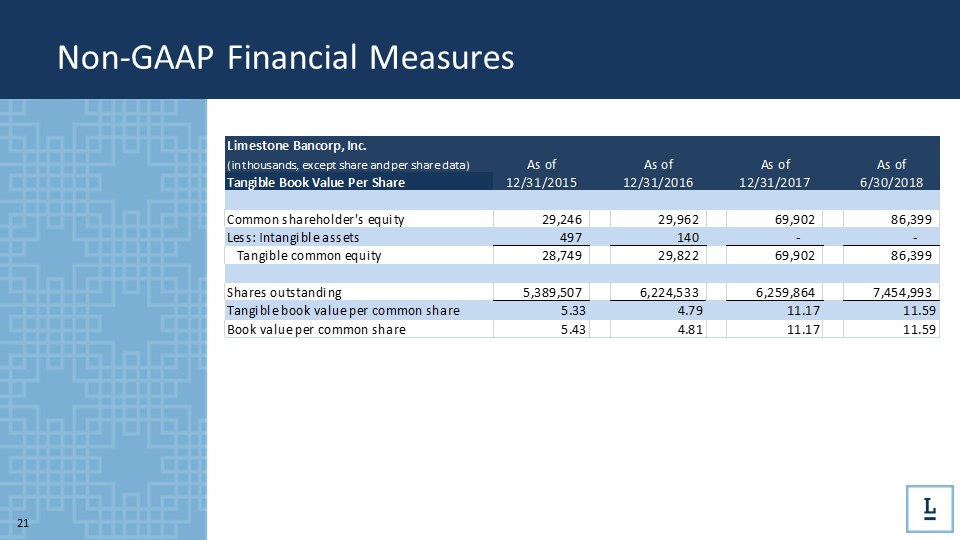

Non-GAAP Financial Measures 21