Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - COMERICA INC /NEW/ | cma-20180630ex991.htm |

| 8-K - 8-K - COMERICA INC /NEW/ | cma-20180630form8k.htm |

Comerica Incorporated Second Quarter 2018 Financial Review July 17, 2018 Safe Harbor Statement Any statements in this presentation that are not historical facts are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Words such as “anticipates,” “believes,” “contemplates,” “feels,” “expects,” “estimates,” “seeks,” “strives,” “plans,” “intends,” “outlook,” “forecast,” “position,” “target,” “mission,” “assume,” “achievable,” “potential,” “strategy,” “goal,” “aspiration,” “opportunity,” “initiative,” “outcome,” “continue,” “remain,” “maintain,” “on track,” “trend,” “objective,” “looks forward,” “projects,” “models” and variations of such words and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” “may” or similar expressions, as they relate to Comerica or its management, are intended to identify forward-looking statements. These forward-looking statements are predicated on the beliefs and assumptions of Comerica's management based on information known to Comerica's management as of the date of this presentation and do not purport to speak as of any other date. Forward-looking statements may include descriptions of plans and objectives of Comerica's management for future or past operations, products or services, including the Growth in Efficiency and Revenue initiative (“GEAR Up”), and forecasts of Comerica's revenue, earnings or other measures of economic performance, including statements of profitability, business segments and subsidiaries as well as estimates of the economic benefits of the GEAR Up initiative, estimates of credit trends and global stability. Such statements reflect the view of Comerica's management as of this date with respect to future events and are subject to risks and uncertainties. Should one or more of these risks materialize or should underlying beliefs or assumptions prove incorrect, Comerica's actual results could differ materially from those discussed. Factors that could cause or contribute to such differences are changes in general economic, political or industry conditions; changes in monetary and fiscal policies; whether Comerica may achieve opportunities for revenue enhancements and efficiency improvements under the GEAR Up initiative, or changes in the scope or assumptions underlying the GEAR Up initiative; operational difficulties, failure of technology infrastructure or information security incidents; reliance on other companies to provide certain key components of business infrastructure; Comerica's ability to maintain adequate sources of funding and liquidity; the effects of more stringent capital or liquidity requirements; declines or other changes in the businesses or industries of Comerica's customers; unfavorable developments concerning credit quality; changes in regulation or oversight; changes in the financial markets, including fluctuations in interest rates and their impact on deposit pricing; transitions away from LIBOR towards new interest rate benchmarks; reductions in Comerica's credit rating; damage to Comerica's reputation; Comerica's ability to utilize technology to efficiently and effectively develop, market and deliver new products and services; competitive product and pricing pressures among financial institutions within Comerica's markets; the interdependence of financial service companies; the implementation of Comerica's strategies and business initiatives; changes in customer behavior; management's ability to maintain and expand customer relationships; the effectiveness of methods of reducing risk exposures; the effects of catastrophic events including, but not limited to, hurricanes, tornadoes, earthquakes, fires, droughts and floods; the effects of recent tax reform and potential legislative, administrative or judicial changes or interpretations related to these and other tax regulations; any future strategic acquisitions or divestitures; management's ability to retain key officers and employees; the impact of legal and regulatory proceedings or determinations; the effects of terrorist activities and other hostilities; changes in accounting standards; the critical nature of Comerica's accounting policies and the volatility of Comerica’s stock price. Comerica cautions that the foregoing list of factors is not all-inclusive. For discussion of factors that may cause actual results to differ from expectations, please refer to our filings with the Securities and Exchange Commission. In particular, please refer to “Item 1A. Risk Factors” beginning on page 11 of Comerica's Annual Report on Form 10-K for the year ended December 31, 2017. Forward-looking statements speak only as of the date they are made. Comerica does not undertake to update forward-looking statements to reflect facts, circumstances, assumptions or events that occur after the date the forward-looking statements are made. For any forward-looking statements made in this presentation or in any documents, Comerica claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. 2

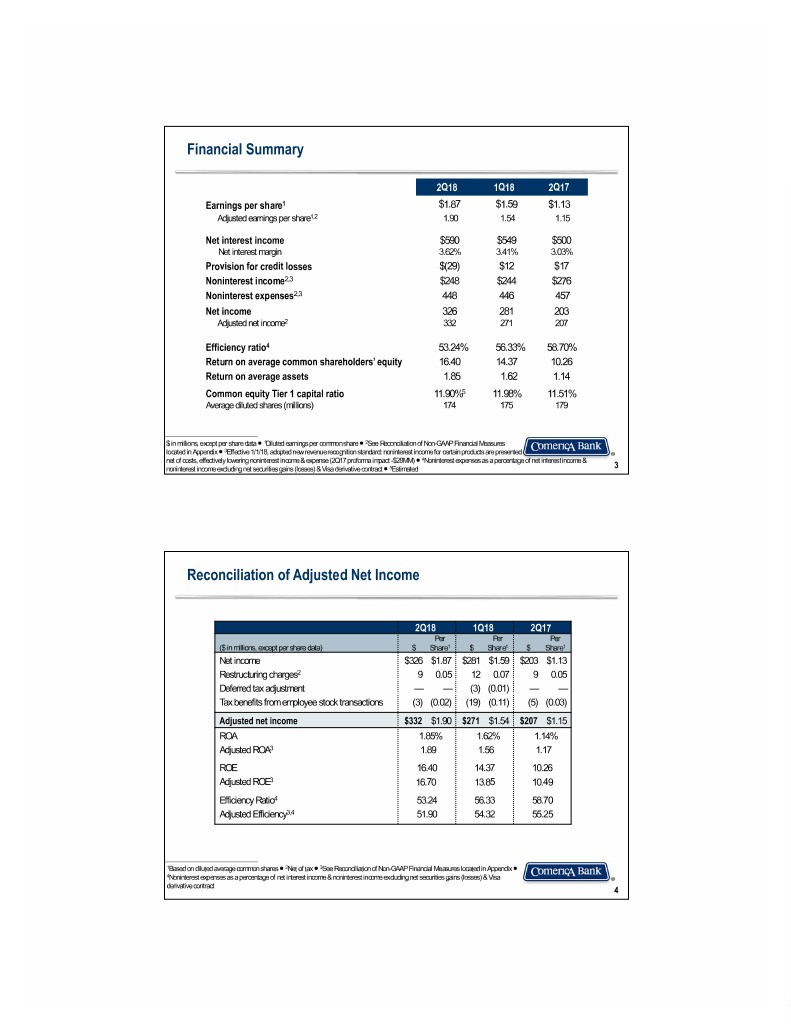

Financial Summary 2Q18 1Q18 2Q17 Earnings per share1 $1.87 $1.59 $1.13 Adjusted earnings per share1,2 1.90 1.54 1.15 Net interest income $590 $549 $500 Net interest margin 3.62% 3.41% 3.03% Provision for credit losses $(29) $12 $17 Noninterest income2,3 $248 $244 $276 Noninterest expenses2,3 448 446 457 Net income 326 281 203 Adjusted net income2 332 271 207 Efficiency ratio4 53.24% 56.33% 58.70% Return on average common shareholders’ equity 16.40 14.37 10.26 Return on average assets 1.85 1.62 1.14 Common equity Tier 1 capital ratio 11.90%5 11.98% 11.51% Average diluted shares (millions) 174 175 179 $ in millions, except per share data ● 1Diluted earnings per common share ● 2See Reconciliation of Non-GAAP Financial Measures located in Appendix ● 3Effective 1/1/18, adopted new revenue recognition standard: noninterest income for certain products are presented net of costs, effectively lowering noninterest income & expense (2Q17 proforma impact -$28MM) ● 4Noninterest expenses as a percentage of net interest income & noninterest income excluding net securities gains (losses) & Visa derivative contract ● 5Estimated 3 Reconciliation of Adjusted Net Income 2Q18 1Q18 2Q17 Per Per Per ($ in millions, except per share data) $ Share1 $ Share1 $ Share1 Net income $326 $1.87 $281 $1.59 $203 $1.13 Restructuring charges2 90.05120.0790.05 Deferred tax adjustment — — (3) (0.01) — — Tax benefits from employee stock transactions (3) (0.02) (19) (0.11) (5) (0.03) Adjusted net income $332 $1.90 $271 $1.54 $207 $1.15 ROA 1.85% 1.62% 1.14% Adjusted ROA3 1.89 1.56 1.17 ROE 16.40 14.37 10.26 Adjusted ROE3 16.70 13.85 10.49 Efficiency Ratio4 53.24 56.33 58.70 Adjusted Efficiency3,4 51.90 54.32 55.25 1Based on diluted average common shares ● 2Net of tax ● 3See Reconciliation of Non-GAAP Financial Measures located in Appendix ● 4Noninterest expenses as a percentage of net interest income & noninterest income excluding net securities gains (losses) & Visa derivative contract 4

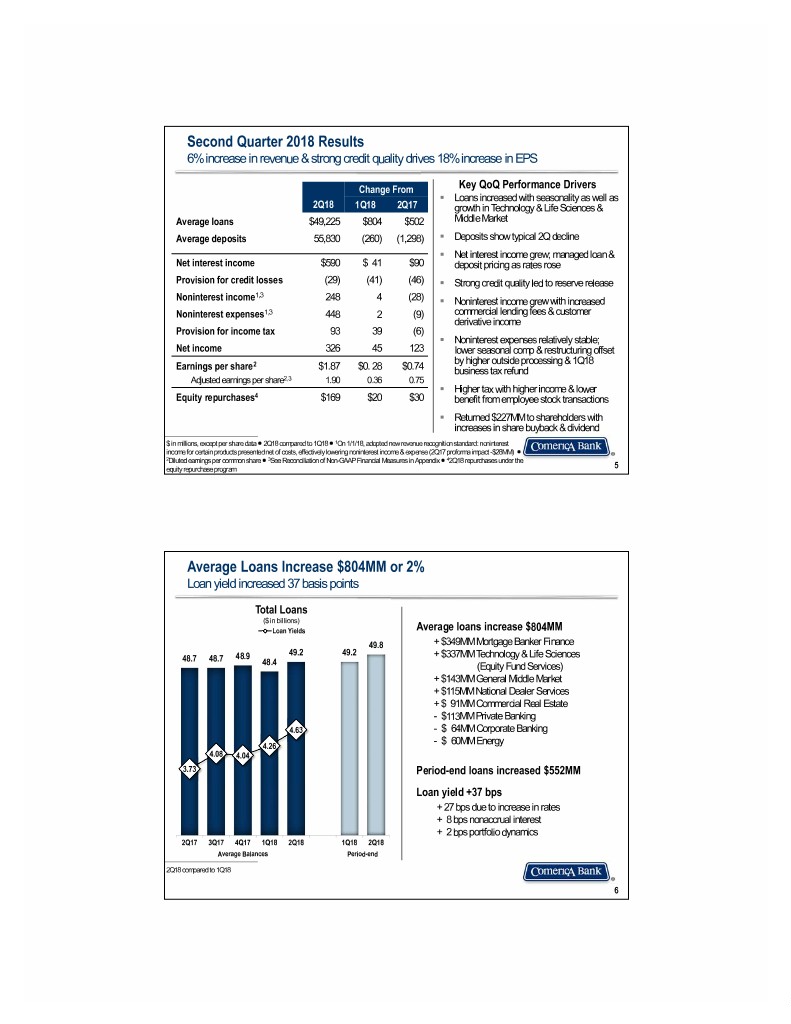

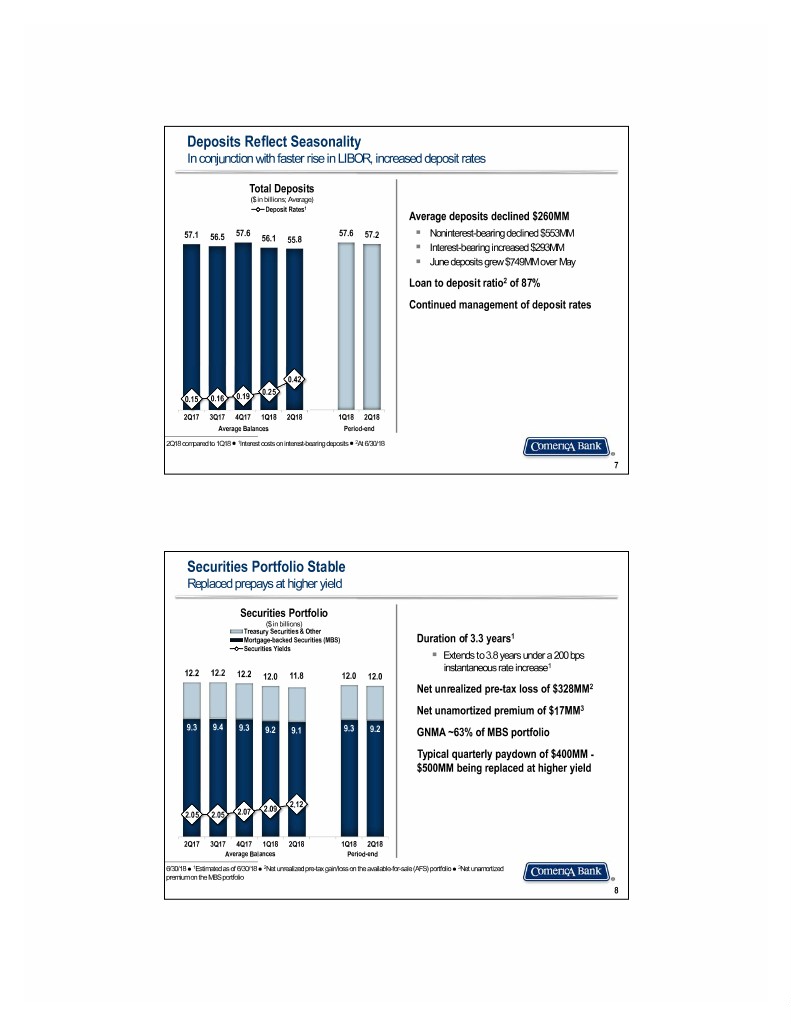

Second Quarter 2018 Results 6% increase in revenue & strong credit quality drives 18% increase in EPS Change From Key QoQ Performance Drivers . Loans increased with seasonality as well as 2Q18 1Q18 2Q17 growth in Technology & Life Sciences & Average loans $49,225 $804 $502 Middle Market Average deposits 55,830 (260) (1,298) . Deposits show typical 2Q decline . Net interest income grew; managed loan & Net interest income $590 $ 41 $90 deposit pricing as rates rose Provision for credit losses (29) (41) (46) . Strong credit quality led to reserve release 1,3 Noninterest income 248 4 (28) . Noninterest income grew with increased Noninterest expenses1,3 448 2 (9) commercial lending fees & customer derivative income Provision for income tax 93 39 (6) . Noninterest expenses relatively stable; Net income 326 45 123 lower seasonal comp & restructuring offset 2 by higher outside processing & 1Q18 Earnings per share $1.87 $0. 28 $0.74 business tax refund Adjusted earnings per share2,3 1.90 0.36 0.75 . Higher tax with higher income & lower Equity repurchases4 $169 $20 $30 benefit from employee stock transactions . Returned $227MM to shareholders with increases in share buyback & dividend $ in millions, except per share data ● 2Q18 compared to 1Q18 ● 1On 1/1/18, adopted new revenue recognition standard: noninterest income for certain products presented net of costs, effectively lowering noninterest income & expense (2Q17 proforma impact -$28MM) ● 2Diluted earnings per common share ● 3See Reconciliation of Non-GAAP Financial Measures in Appendix ● 42Q18 repurchases under the equity repurchase program 5 Average Loans Increase $804MM or 2% Loan yield increased 37 basis points Total Loans ($ in billions) Loan Yields Average loans increase $804MM 49.8 + $349MM Mortgage Banker Finance 49.2 49.2 48.7 48.7 48.9 + $337MM Technology & Life Sciences 48.4 (Equity Fund Services) + $143MM General Middle Market + $115MM National Dealer Services + $ 91MM Commercial Real Estate - $113MM Private Banking 4.63 - $ 64MM Corporate Banking - $ 60MM Energy 4.26 4.08 4.04 3.73 Period-end loans increased $552MM Loan yield +37 bps + 27 bps due to increase in rates + 8 bps nonaccrual interest + 2 bps portfolio dynamics 2Q17 3Q17 4Q17 1Q18 2Q18 1Q18 2Q18 Average Balances Period-end 2Q18 compared to 1Q18 6

Deposits Reflect Seasonality In conjunction with faster rise in LIBOR, increased deposit rates Total Deposits ($ in billions; Average) Deposit Rates1 Average deposits declined $260MM 57.1 57.6 57.6 57.2 . Noninterest-bearing declined $553MM 56.5 56.1 55.8 . Interest-bearing increased $293MM . June deposits grew $749MM over May Loan to deposit ratio2 of 87% Continued management of deposit rates 0.42 0.25 0.15 0.16 0.19 2Q17 3Q17 4Q17 1Q18 2Q18 1Q18 2Q18 Average Balances Period-end 2Q18 compared to 1Q18 ● 1Interest costs on interest-bearing deposits ● 2At 6/30/18 7 Securities Portfolio Stable Replaced prepays at higher yield Securities Portfolio ($ in billions) Treasury Securities & Other 1 Mortgage-backed Securities (MBS) Duration of 3.3 years Securities Yields . Extends to 3.8 years under a 200 bps instantaneous rate increase1 12.2 12.2 12.2 12.0 11.8 12.0 12.0 Net unrealized pre-tax loss of $328MM2 Net unamortized premium of $17MM3 9.3 9.4 9.3 9.2 9.1 9.3 9.2 GNMA ~63% of MBS portfolio Typical quarterly paydown of $400MM - $500MM being replaced at higher yield 2.12 2.09 2.05 2.05 2.07 2Q17 3Q17 4Q17 1Q18 2Q18 1Q18 2Q18 Average Balances Period-end 6/30/18 ● 1Estimated as of 6/30/18 ● 2Net unrealized pre-tax gain/loss on the available-for-sale (AFS) portfolio ● 3Net unamortized premium on the MBS portfolio 8

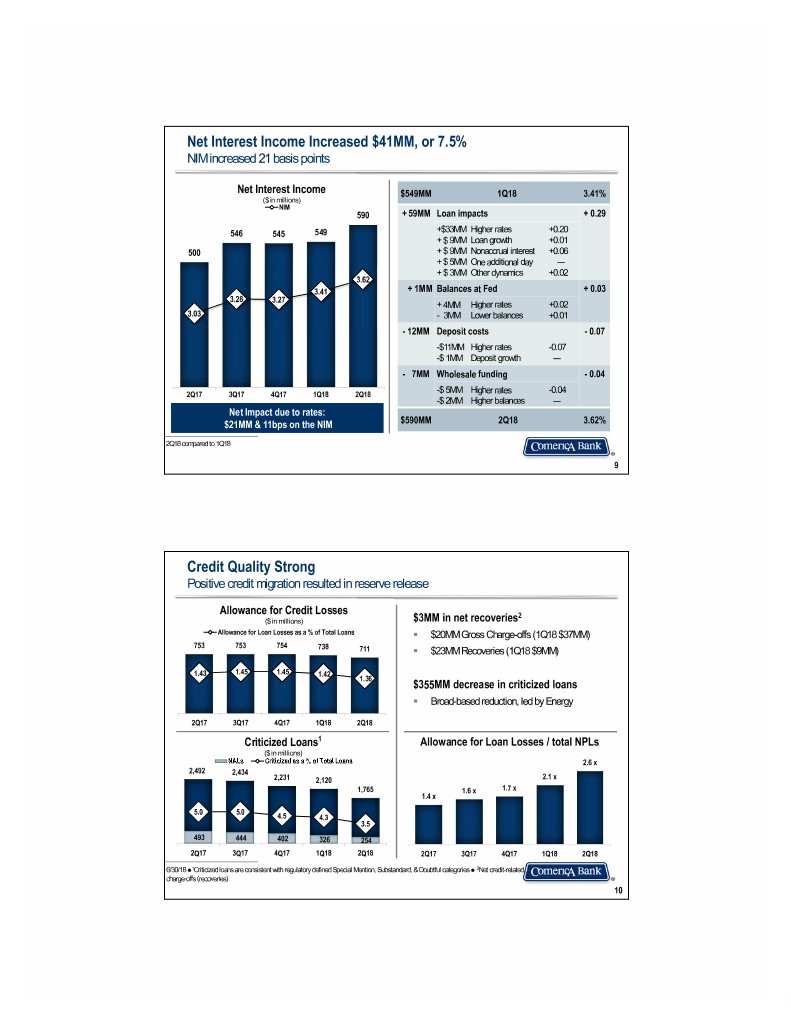

Net Interest Income Increased $41MM, or 7.5% NIM increased 21 basis points Net Interest Income $549MM 1Q18 3.41% ($ in millions) NIM 590 + 59MM Loan impacts + 0.29 +$33MM Higher rates +0.20 546 545 549 + $ 9MM Loan growth +0.01 500 + $ 9MM Nonaccrual interest +0.06 + $ 5MM One additional day --- + $ 3MM Other dynamics +0.02 3.62 3.41 + 1MM Balances at Fed + 0.03 3.28 3.27 + 4MM Higher rates +0.02 3.03 -3MM Lower balances +0.01 - 12MM Deposit costs - 0.07 -$11MM Higher rates -0.07 -$ 1MM Deposit growth --- - 7MM Wholesale funding - 0.04 -$ 5MM Higher rates -0.04 2Q17 3Q17 4Q17 1Q18 2Q18 -$ 2MM Higher balances --- Net Impact due to rates: $21MM & 11bps on the NIM $590MM 2Q18 3.62% 2Q18 compared to 1Q18 9 Credit Quality Strong Positive credit migration resulted in reserve release Allowance for Credit Losses 2 ($ in millions) $3MM in net recoveries Allowance for Loan Losses as a % of Total Loans . $20MM Gross Charge-offs (1Q18 $37MM) 753 753 754 738 711 . $23MM Recoveries (1Q18 $9MM) 1.43 1.45 1.45 1.42 1.36 $355MM decrease in criticized loans . Broad-based reduction, led by Energy 2Q17 3Q17 4Q17 1Q18 2Q18 Criticized Loans1 Allowance for Loan Losses / total NPLs ($ in millions) NALs Criticized as a % of Total Loans 2.6 x 2,492 2,434 2,231 2,120 2.1 x 1,765 1.6 x 1.7 x 1.4 x 5.0 5.0 4.5 4.3 3.5 493 444 402 326 254 2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 3Q17 4Q17 1Q18 2Q18 6/30/18 ●1Criticized loans are consistent with regulatory defined Special Mention, Substandard, & Doubtful categories ● 2Net credit-related charge-offs (recoveries) 10

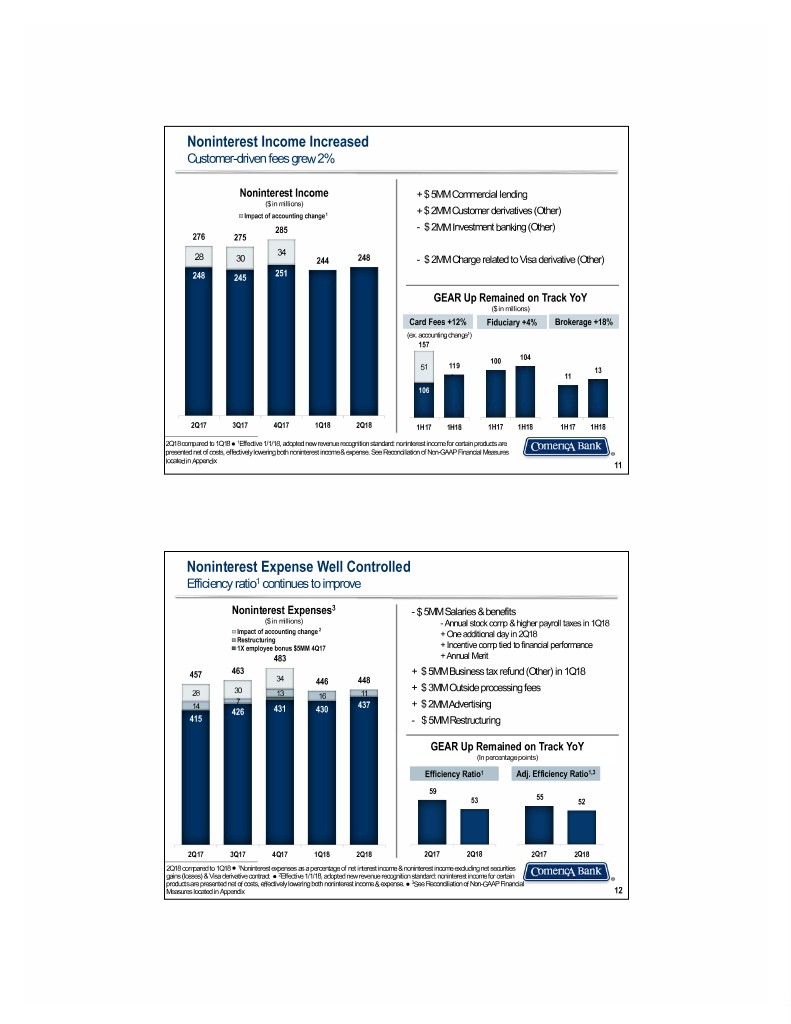

Noninterest Income Increased Customer-driven fees grew 2% Noninterest Income + $ 5MM Commercial lending ($ in millions) Impact of accounting change 1 + $ 2MM Customer derivatives (Other) 285 - $ 2MM Investment banking (Other) 276 275 34 28 30 244 248 - $ 2MM Charge related to Visa derivative (Other) 248 245 251 GEAR Up Remained on Track YoY ($ in millions) Card Fees +12% Fiduciary +4% Brokerage +18% (ex. accounting change1) 157 100 104 119 - 51 13 - 11 - 106 2Q17 3Q17 4Q17 1Q18 2Q18 1H17 1H18 1H17 1H18 1H17 1H18 2Q18 compared to 1Q18 ● 1Effective 1/1/18, adopted new revenue recognition standard: noninterest income for certain products are presented net of costs, effectively lowering both noninterest income & expense. See Reconciliation of Non-GAAP Financial Measures located in Appendix 11 Noninterest Expense Well Controlled Efficiency ratio1 continues to improve Noninterest Expenses3 - $ 5MM Salaries & benefits ($ in millions) - Annual stock comp & higher payroll taxes in 1Q18 2 Impact of accounting change + One additional day in 2Q18 Restructuring 1X employee bonus $5MM 4Q17 + Incentive comp tied to financial performance 483 + Annual Merit 457 463 + $ 5MM Business tax refund (Other) in 1Q18 34 446 448 30 + $ 3MM Outside processing fees 28 13 16 11 7 14 437 + $ 2MM Advertising 426 431 430 415 - $ 5MM Restructuring GEAR Up Remained on Track YoY (In percentage points) Efficiency Ratio1 Adj. Efficiency Ratio1,3 59 55 53 52 2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 2Q18 2Q17 2Q18 2Q18 compared to 1Q18 ● 1Noninterest expenses as a percentage of net interest income & noninterest income excluding net securities gains (losses) & Visa derivative contract ● 2Effective 1/1/18, adopted new revenue recognition standard: noninterest income for certain products are presented net of costs, effectively lowering both noninterest income & expense. ● 3See Reconciliation of Non-GAAP Financial Measures located in Appendix 12

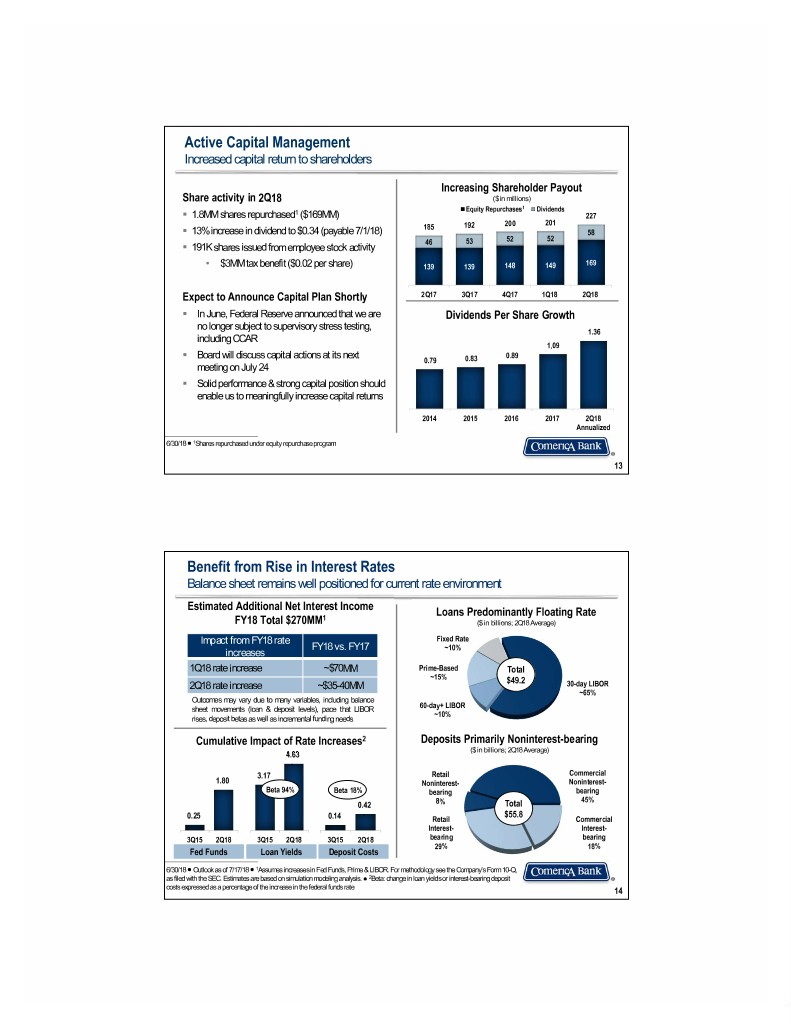

Active Capital Management Increased capital return to shareholders Increasing Shareholder Payout Share activity in 2Q18 ($ in millions) Equity Repurchases1 Dividends . 1.8MM shares repurchased1 ($169MM) 227 200 201 185 192 . 13% increase in dividend to $0.34 (payable 7/1/18) 58 53 52 52 . 191K shares issued from employee stock activity 46 169 • $3MM tax benefit ($0.02 per share) 139 139 148 149 Expect to Announce Capital Plan Shortly 2Q17 3Q17 4Q17 1Q18 2Q18 . In June, Federal Reserve announced that we are Dividends Per Share Growth no longer subject to supervisory stress testing, 1.36 including CCAR 1.09 . Board will discuss capital actions at its next 0.89 0.79 0.83 meeting on July 24 . Solid performance & strong capital position should enable us to meaningfully increase capital returns 2014 2015 2016 2017 2Q18 Annualized 6/30/18 ● 1Shares repurchased under equity repurchase program 13 Benefit from Rise in Interest Rates Balance sheet remains well positioned for current rate environment Estimated Additional Net Interest Income 1 Loans Predominantly Floating Rate FY18 Total $270MM ($ in billions; 2Q18 Average) Impact from FY18 rate Fixed Rate FY18 vs. FY17 ~10% increases 1Q18 rate increase ~$70MM Prime-Based Total ~15% $49.2 2Q18 rate increase ~$35-40MM 30-day LIBOR ~65% Outcomes may vary due to many variables, including balance sheet movements (loan & deposit levels), pace that LIBOR 60-day+ LIBOR ~10% rises, deposit betas as well as incremental funding needs Cumulative Impact of Rate Increases2 Deposits Primarily Noninterest-bearing ($ in billions; 2Q18 Average) 4.63 - 3.17 Retail Commercial 1.80 Noninterest- Noninterest- Beta 94% Beta 18% bearing bearing 45% 0.42 8% Total - $55.8 0.25 0.14 Retail Commercial Interest- Interest- 3Q15 2Q18 3Q15 2Q18 3Q15 2Q18 bearing bearing 29% 18% Fed Funds Loan Yields Deposit Costs 6/30/18 ● Outlook as of 7/17/18 ● 1Assumes increases in Fed Funds, Prime & LIBOR. For methodology see the Company’s Form 10-Q, as filed with the SEC. Estimates are based on simulation modeling analysis. ● 2Beta: change in loan yields or interest-bearing deposit costs expressed as a percentage of the increase in the federal funds rate 14

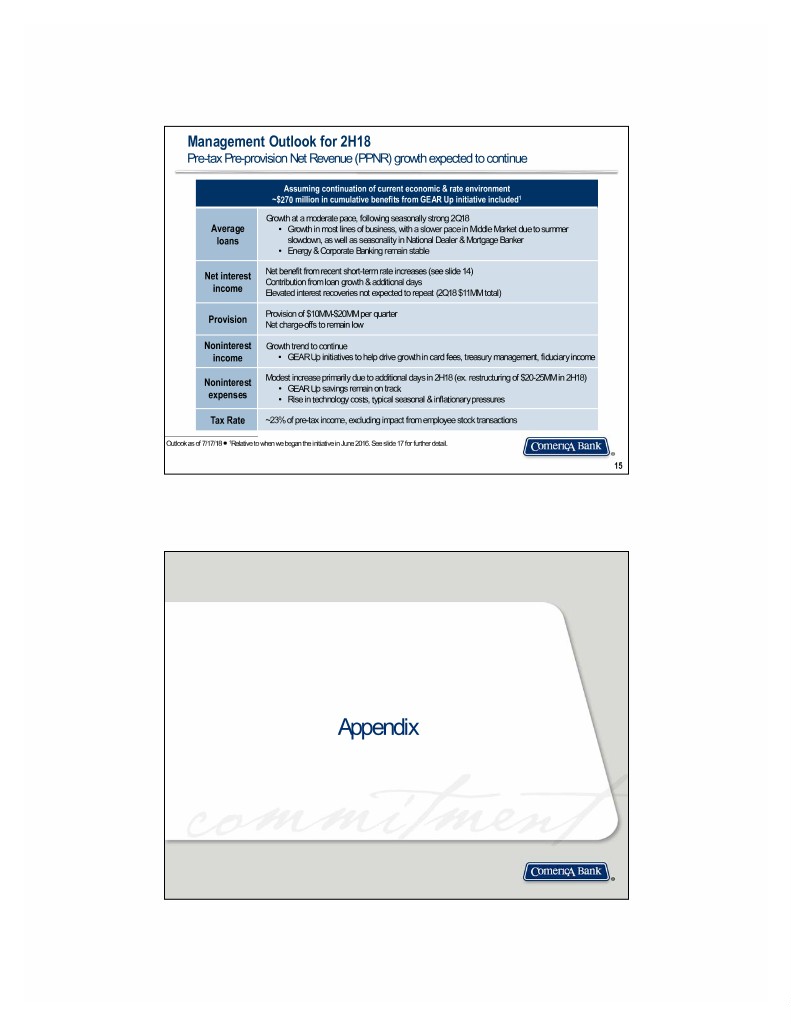

Management Outlook for 2H18 Pre-tax Pre-provision Net Revenue (PPNR) growth expected to continue Assuming continuation of current economic & rate environment ~$270 million in cumulative benefits from GEAR Up initiative included1 Growth at a moderate pace, following seasonally strong 2Q18 Average • Growth in most lines of business, with a slower pace in Middle Market due to summer loans slowdown, as well as seasonality in National Dealer & Mortgage Banker • Energy & Corporate Banking remain stable Net interest Net benefit from recent short-term rate increases (see slide 14) Contribution from loan growth & additional days income Elevated interest recoveries not expected to repeat (2Q18 $11MM total) Provision of $10MM-$20MM per quarter Provision Net charge-offs to remain low Noninterest Growth trend to continue income • GEAR Up initiatives to help drive growth in card fees, treasury management, fiduciary income Noninterest Modest increase primarily due to additional days in 2H18 (ex. restructuring of $20-25MM in 2H18) • GEAR Up savings remain on track expenses • Rise in technology costs, typical seasonal & inflationary pressures Tax Rate ~23% of pre-tax income, excluding impact from employee stock transactions Outlook as of 7/17/18 ● 1Relative to when we began the initiative in June 2016. See slide 17 for further detail. 15 Appendix

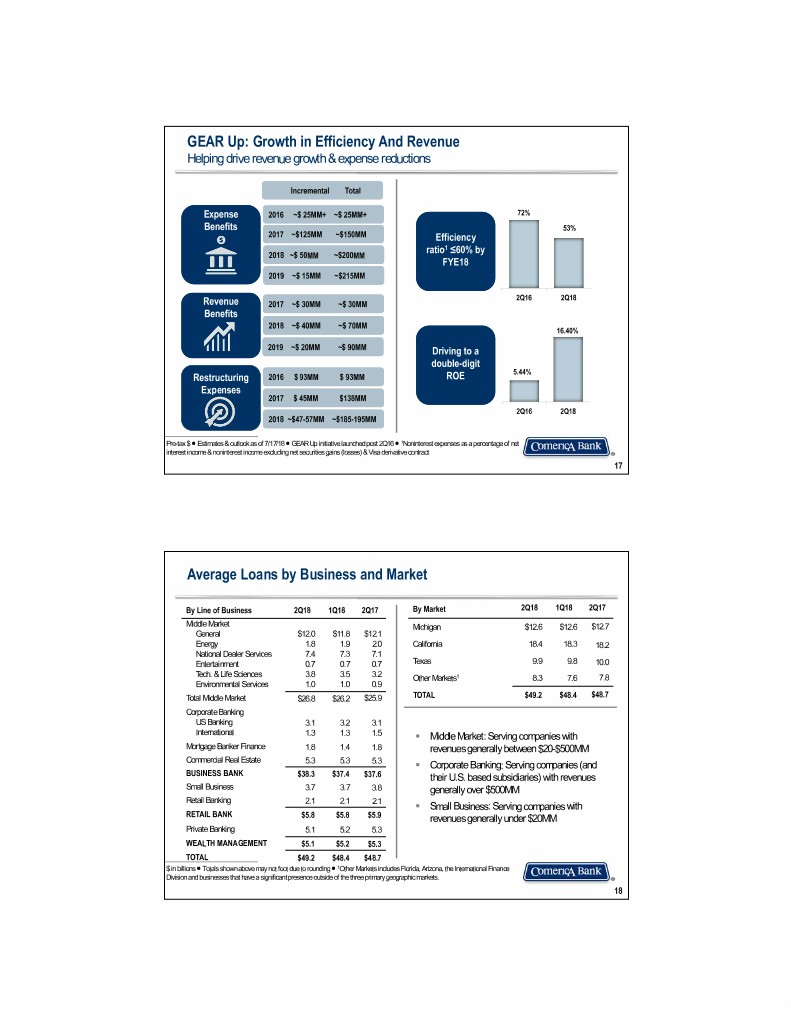

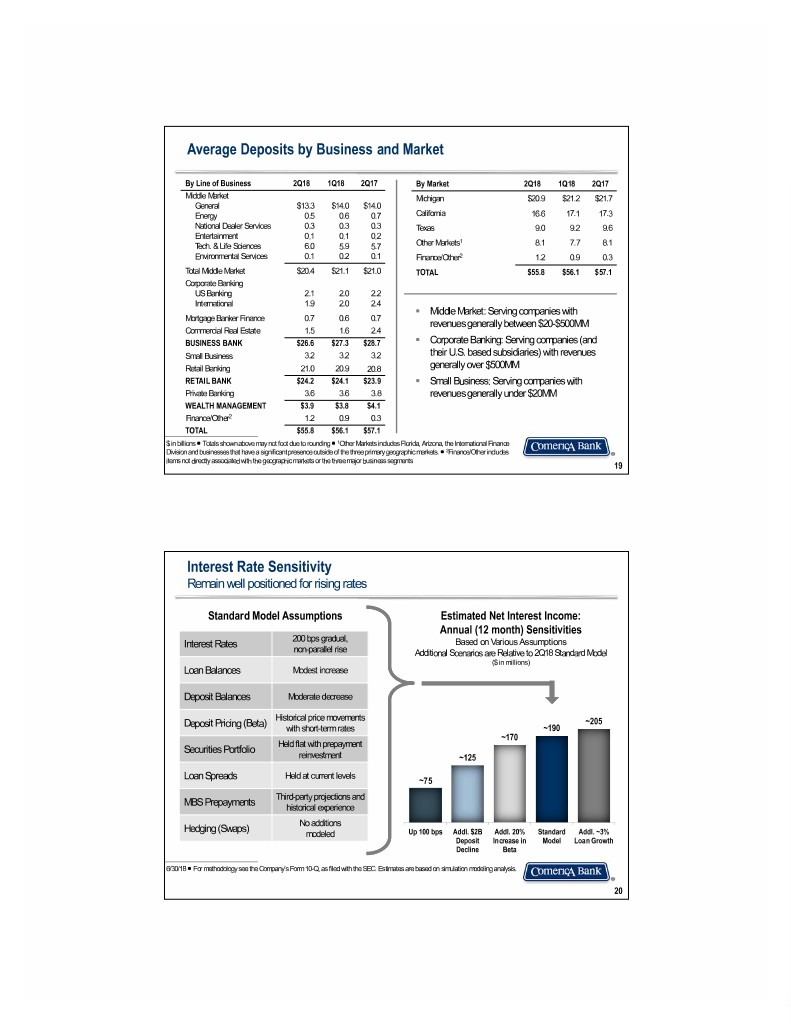

GEAR Up: Growth in Efficiency And Revenue Helping drive revenue growth & expense reductions Incremental Total Expense 2016 ~$ 25MM+ ~$ 25MM+ 72% Benefits 53% 2017 ~$125MM ~$150MM Efficiency ratio1 ≤60% by 2018 ~$ 50MM ~$200MM FYE18 2019 ~$ 15MM ~$215MM 2Q16 2Q18 Revenue 2017 ~$ 30MM ~$ 30MM Benefits 2018 ~$ 40MM ~$ 70MM 16.40% 2019 ~$ 20MM ~$ 90MM Driving to a double-digit 5.44% Restructuring 2016 $ 93MM $ 93MM ROE Expenses 2017 $ 45MM $138MM 2Q16 2Q18 2018 ~$47-57MM ~$185-195MM Pre-tax $ ● Estimates & outlook as of 7/17/18 ● GEAR Up initiative launched post 2Q16 ● 1Noninterest expenses as a percentage of net interest income & noninterest income excluding net securities gains (losses) & Visa derivative contract 17 Average Loans by Business and Market By Line of Business 2Q18 1Q18 2Q17 By Market 2Q18 1Q18 2Q17 Middle Market Michigan $12.6 $12.6 $12.7 General $12.0 $11.8 $12.1 Energy 1.8 1.9 2.0 California 18.4 18.3 18.2 National Dealer Services 7.4 7.3 7.1 Entertainment 0.7 0.7 0.7 Texas 9.9 9.8 10.0 Tech. & Life Sciences 3.8 3.5 3.2 Other Markets1 8.3 7.6 7.8 Environmental Services 1.0 1.0 0.9 Total Middle Market $26.8 $26.2 $25.9 TOTAL $49.2 $48.4 $48.7 Corporate Banking US Banking 3.1 3.2 3.1 International 1.3 1.3 1.5 . Middle Market: Serving companies with Mortgage Banker Finance 1.8 1.4 1.8 revenues generally between $20-$500MM Commercial Real Estate 5.3 5.3 5.3 . Corporate Banking: Serving companies (and BUSINESS BANK $38.3 $37.4 $37.6 their U.S. based subsidiaries) with revenues Small Business 3.7 3.7 3.8 generally over $500MM Retail Banking 2.1 2.1 2.1 . Small Business: Serving companies with RETAIL BANK $5.8 $5.8 $5.9 revenues generally under $20MM Private Banking 5.1 5.2 5.3 WEALTH MANAGEMENT $5.1 $5.2 $5.3 TOTAL $49.2 $48.4 $48.7 $ in billions ● Totals shown above may not foot due to rounding ● 1Other Markets includes Florida, Arizona, the International Finance Division and businesses that have a significant presence outside of the three primary geographic markets. 18

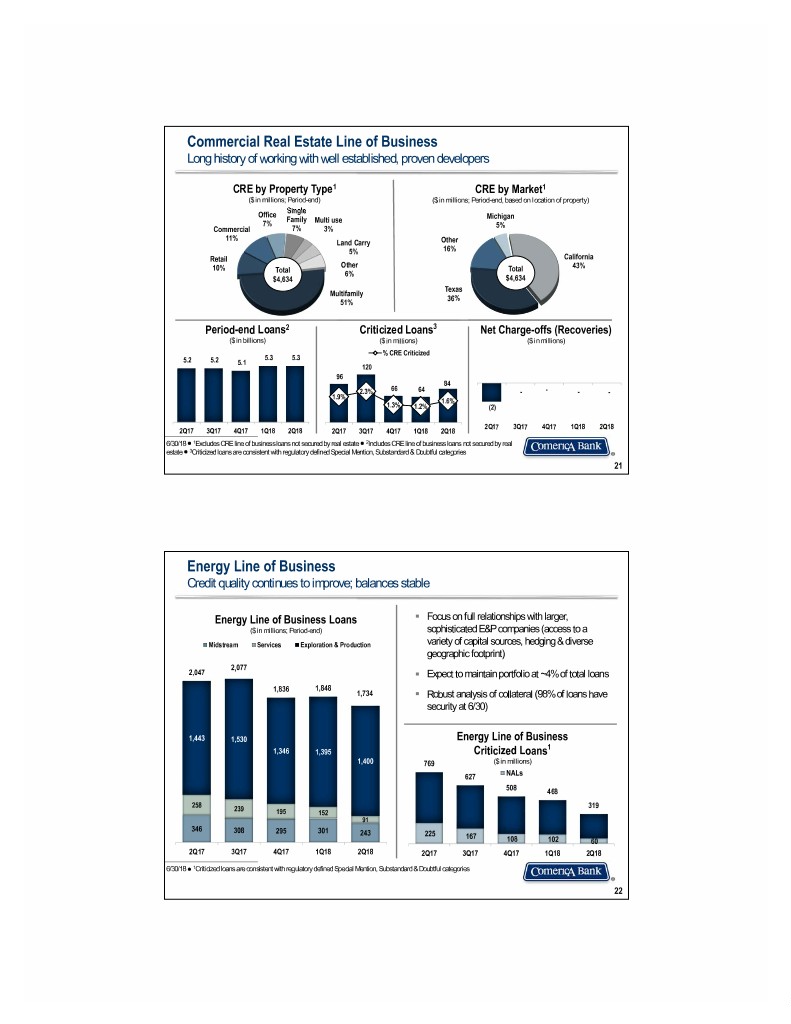

Average Deposits by Business and Market By Line of Business 2Q18 1Q18 2Q17 By Market 2Q18 1Q18 2Q17 Middle Market Michigan $20.9 $21.2 $21.7 General $13.3 $14.0 $14.0 Energy 0.5 0.6 0.7 California 16.6 17.1 17.3 National Dealer Services 0.3 0.3 0.3 Texas 9.0 9.2 9.6 Entertainment 0.1 0.1 0.2 1 Tech. & Life Sciences 6.0 5.9 5.7 Other Markets 8.1 7.7 8.1 Environmental Services 0.1 0.2 0.1 Finance/Other2 1.2 0.9 0.3 Total Middle Market $20.4 $21.1 $21.0 TOTAL $55.8 $56.1 $57.1 Corporate Banking US Banking 2.1 2.0 2.2 International 1.9 2.0 2.4 . Middle Market: Serving companies with Mortgage Banker Finance 0.7 0.6 0.7 revenues generally between $20-$500MM Commercial Real Estate 1.5 1.6 2.4 BUSINESS BANK $26.6 $27.3 $28.7 . Corporate Banking: Serving companies (and Small Business 3.2 3.2 3.2 their U.S. based subsidiaries) with revenues Retail Banking 21.0 20.9 20.8 generally over $500MM RETAIL BANK $24.2 $24.1 $23.9 . Small Business: Serving companies with Private Banking 3.6 3.6 3.8 revenues generally under $20MM WEALTH MANAGEMENT $3.9 $3.8 $4.1 Finance/Other2 1.2 0.9 0.3 TOTAL $55.8 $56.1 $57.1 $ in billions ● Totals shown above may not foot due to rounding ● 1Other Markets includes Florida, Arizona, the International Finance Division and businesses that have a significant presence outside of the three primary geographic markets. ● 2Finance/Other includes items not directly associated with the geographic markets or the three major business segments 19 Interest Rate Sensitivity Remain well positioned for rising rates 0.1 Standard Model Assumptions Estimated Net Interest Income: Annual (12 month) Sensitivities 200 bps gradual, Interest Rates Based on Various Assumptions non-parallel rise Additional Scenarios are Relative to 2Q18 Standard Model ($ in millions) Loan Balances Modest increase Deposit Balances Moderate decrease Historical price movements Deposit Pricing (Beta) ~205 with short-term rates ~190 ~170 Held flat with prepayment Securities Portfolio reinvestment ~125 Held at current levels Loan Spreads ~75 Third-party projections and MBS Prepayments historical experience No additions Hedging (Swaps) modeled Up 100 bps Addl. $2B Addl. 20% Standard Addl. ~3% Deposit Increase in Model Loan Growth Decline Beta 6/30/18 ● For methodology see the Company’s Form 10-Q, as filed with the SEC. Estimates are based on simulation modeling analysis. 20

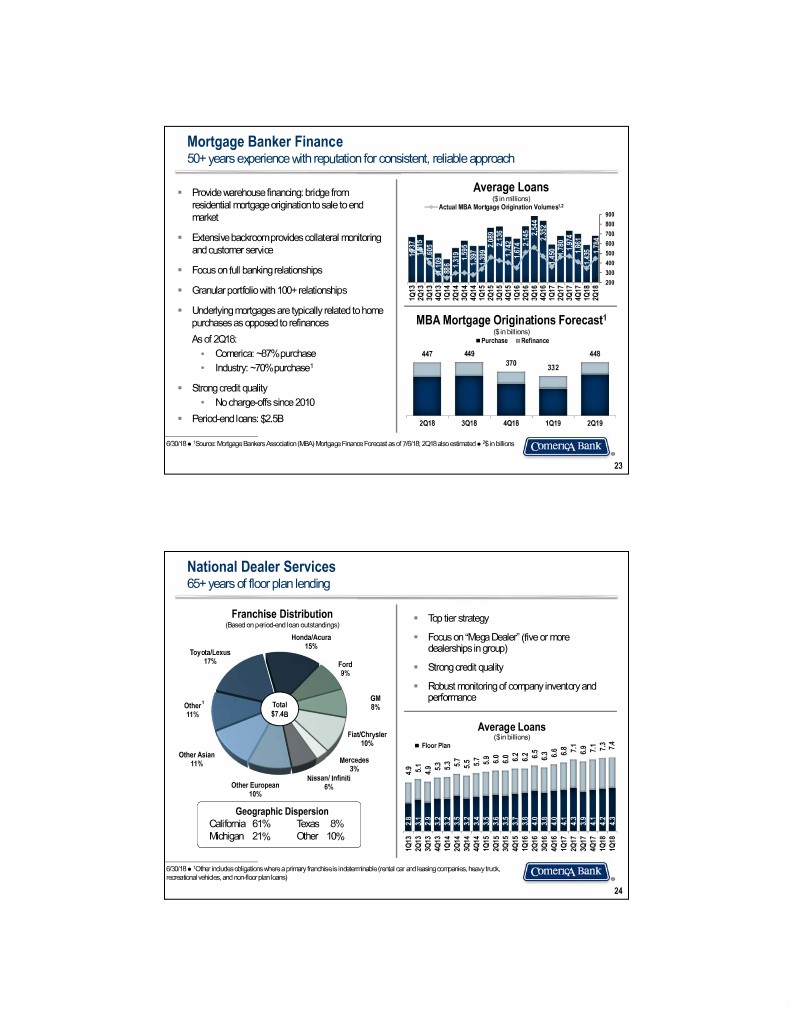

Commercial Real Estate Line of Business Long history of working with well established, proven developers CRE by Property Type1 CRE by Market1 ($ in millions; Period-end) ($ in millions; Period-end, based on location of property) Single Office Michigan Family Multi use 7% 5% Commercial 7% 3% 11% Land Carry Other 5% 16% Retail California 10% Other Total 43% Total 6% $4,634 $4,634 Texas Multifamily 36% 51% Period-end Loans2 Criticized Loans3 Net Charge-offs (Recoveries) ($ in billions) ($ in millions) ($ in millions) % CRE Criticized 5.3 5.3 5.2 5.2 5.1 120 96 84 2.3% 66 64 - - - - 1.9% 1.6% 1.3% 1.2% (2) 2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 3Q17 4Q17 1Q18 2Q18 6/30/18 ● 1Excludes CRE line of business loans not secured by real estate ● 2Includes CRE line of business loans not secured by real estate ● 3Criticized loans are consistent with regulatory defined Special Mention, Substandard & Doubtful categories 21 Energy Line of Business Credit quality continues to improve; balances stable Energy Line of Business Loans . Focus on full relationships with larger, ($ in millions; Period-end) sophisticated E&P companies (access to a Midstream Services Exploration & Production variety of capital sources, hedging & diverse geographic footprint) 2,077 2,047 . Expect to maintain portfolio at ~4% of total loans 1,836 1,848 1,734 . Robust analysis of Mixedcollateral (98% of loans have security at 6/30) 18% 1,443 1,530 Energy Line of Business 1 1,346 1,395 Criticized Loans 1,400 769 ($ in millions) 627 NALs 508 468 258 239 319 195 152 91 346 308 295 301 243 225 167 108 102 60 2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 3Q17 4Q17 1Q18 2Q18 6/30/18 ● 1Criticized loans are consistent with regulatory defined Special Mention, Substandard & Doubtful categories 22

recreational vehicles, non-floor planloans) and 6/30/18 6/30/18 . . . . . . . Other Asian Other 11% 65+ years of floor plan lending of floorplan years 65+ National DealerServices 50+ years experiencewith reputati Finance Mortgage Banker ● ● Toyota/Lexus 11% As of 2Q18: Period-end loans: $2.5B Period-end loans: Strong credit qualityStrong credit purchases as opposed to refinances Underlying mortgages related toare typically home Granular portfolio100+ with relationships banking Focus onfull relationships service and customer Extensive backroomprovides collateral monitoring market end toresidential mortgagesale origination to Provide warehouse financ 1 1 Other includes primary franchisei obligations is a where Source: MortgageBankersAssociation MortgageFinanc (MBA) • • • 1 17% ihgn2%Other 10% Texas 8% 21% Michigan 61% California No charge-offsNo since2010 Industry: ~70% purchase Comerica: ~87%purchase (Based onperiod-endloanoutstandings) Other European Franchise Distribution Geographic Dispersion 10% $7.4B Total Total ing: bridge from ing: bridge Honda/Acura 15% Nissan/ Infiniti 1 6% Ford ndeterminableand leasingcompanies, car heavy truck, (rental Mercedes 9% Fiat/Chrysler on for consistent, reliable approach reliable on forconsistent, 3% e Forecast as of 7/6/18; 2Q18alsoestimated e of Forecast as 10% GM 8% 1Q13 2.8 4.9 . . . . MBA Mortgage Originations Forecast 1Q13 1,737 Q831 Q811 2Q19 1Q19 4Q18 3Q18 2Q18 FloorPlan 2Q13 3.1 5.1 447 2Q13 1,815 3Q13 2.9 4.9 performance Robust monitoring of company inventory and qualityStrong credit group) dealerships in more or Focus on“MegaDealer”(five Top tierstrategy 3Q13 1,605 4Q13 3.2 5.3 4Q13 1,109 Actual MBA Mortgage Origination Volumes 1Q14 3.2 5.3 1Q14 886 2Q14 3.5 5.7 2Q14 1,319 3Q14 3.2 5.5 449 3Q14 1,595 Average Loans ● 4Q14 1,397 4Q14 3.4 5.7 Average Loans Purchase 2 $ in billions 1Q15 1,399 1Q15 3.5 5.9 ($ in millions) ($ in ($ in billions) ($ in ($ in billions) ($ in 2Q15 2,089 2Q15 3.6 6.0 3Q15 2,136 3Q15 3.5 6.0 370 4Q15 1,742 4Q15 3.7 6.2 1Q16 1,674 Refinance 1Q16 3.8 6.2 2Q16 2,145 2Q16 4.0 6.5 3Q16 2,544 4Q16 2,352 3Q16 3.8 6.3 332 1Q17 1,450 4Q16 4.0 6.6 1,2 1Q17 4.1 6.8 2Q17 1,780 3Q17 1,974 2Q17 4.3 7.1 4Q17 1,861 3Q17 3.9 6.9 448 1Q18 1,435 4Q17 4.1 7.1 2Q18 1,784 1 1Q18 4.2 7.3 200 300 400 500 600 700 800 900 24 1Q18 4.3 7.4 23

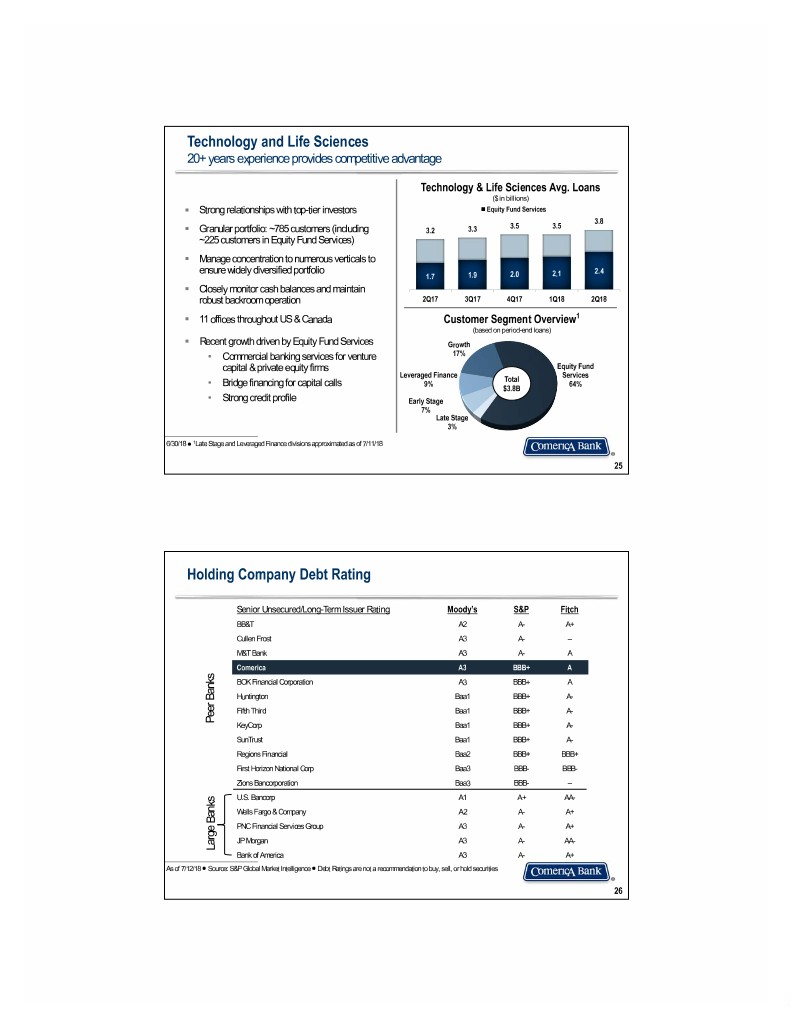

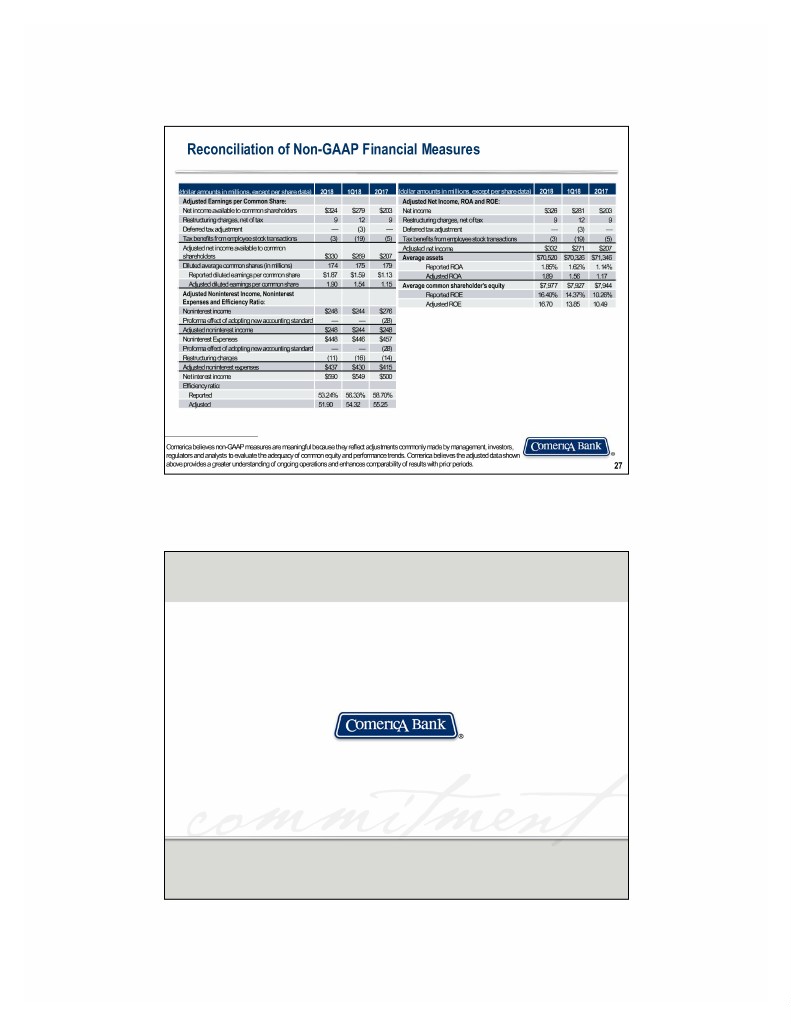

Technology and Life Sciences 20+ years experience provides competitive advantage Technology & Life Sciences Avg. Loans ($ in billions) . Strong relationships with top-tier investors Equity Fund Services 3.8 3.5 3.5 . Granular portfolio: ~785 customers (including 3.2 3.3 ~225 customers in Equity Fund Services) . Manage concentration to numerous verticals to ensure widely diversified portfolio 2.4 1.7 1.9 2.0 2.1 . Closely monitor cash balances and maintain robust backroom operation 2Q17 3Q17 4Q17 1Q18 2Q18 . 11 offices throughout US & Canada Customer Segment Overview1 (based on period-end loans) . Recent growth driven by Equity Fund Services Growth • Commercial banking services for venture 17% capital & private equity firms Equity Fund Leveraged Finance Services Total • Bridge financing for capital calls 9% 64% $3.8B • Strong credit profile Early Stage 7% Late Stage 3% 6/30/18 ● 1Late Stage and Leveraged Finance divisions approximated as of 7/11/18 25 Holding Company Debt Rating Senior Unsecured/Long-Term Issuer Rating Moody’s S&P Fitch BB&T A2 A- A+ Cullen Frost A3 A- -- M&T Bank A3 A- A Comerica A3 BBB+ A BOK Financial Corporation A3 BBB+ A Huntington Baa1 BBB+ A- Fifth Third Baa1 BBB+ A- Peer Banks KeyCorp Baa1 BBB+ A- SunTrust Baa1 BBB+ A- Regions Financial Baa2 BBB+ BBB+ First Horizon National Corp Baa3 BBB- BBB- Zions Bancorporation Baa3 BBB- -- U.S. Bancorp A1 A+ AA- Wells Fargo & Company A2 A- A+ PNC Financial Services Group A3 A- A+ JP Morgan A3 A- AA- Large Banks Bank of America A3 A- A+ As of 7/12/18 ● Source: S&P Global Market Intelligence ● Debt Ratings are not a recommendation to buy, sell, or hold securities 26

Reconciliation of Non-GAAP Financial Measures (dollar amounts in millions, except per share data) 2Q18 1Q18 2Q17 (dollar amounts in millions, except per share data) 2Q18 1Q18 2Q17 Adjusted Earnings per Common Share: Adjusted Net Income, ROA and ROE: Net income available to common shareholders $324 $279 $203 Net income $326 $281 $203 Restructuring charges, net of tax 9 12 9 Restructuring charges, net of tax 9 12 9 Deferred tax adjustment — (3) — Deferred tax adjustment — (3) — Tax benefits from employee stock transactions (3) (19) (5) Tax benefits from employee stock transactions (3) (19) (5) Adjusted net income available to common Adjusted net income $332 $271 $207 shareholders $330 $269 $207 Average assets $70,520 $70,326 $71,346 Diluted average common shares (in millions) 174 175 179 Reported ROA 1.85% 1.62% 1.14% Reported diluted earnings per common share $1.87 $1.59 $1.13 Adjusted ROA 1.89 1.56 1.17 Adjusted diluted earnings per common share 1.90 1.54 1.15 Average common shareholder's equity $7,977 $7,927 $7,944 Adjusted Noninterest Income, Noninterest Reported ROE 16.40% 14.37% 10.26% Expenses and Efficiency Ratio: Adjusted ROE 16.70 13.85 10.49 Noninterest income $248 $244 $276 Proforma effect of adopting new accounting standard — — (28) Adjusted noninterest income $248 $244 $248 Noninterest Expenses $448 $446 $457 Proforma effect of adopting new accounting standard — — (28) Restructuring charges (11) (16) (14) Adjusted noninterest expenses $437 $430 $415 Net interest income $590 $549 $500 Efficiency ratio: Reported 53.24% 56.33% 58.70% Adjusted 51.90 54.32 55.25 Comerica believes non-GAAP measures are meaningful because they reflect adjustments commonly made by management, investors, regulators and analysts to evaluate the adequacy of common equity and performance trends. Comerica believes the adjusted data shown above provides a greater understanding of ongoing operations and enhances comparability of results with prior periods. 27