Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CONNECTICUT WATER SERVICE INC / CT | d668654dex991.htm |

| 8-K - FORM 8-K - CONNECTICUT WATER SERVICE INC / CT | d668654d8k.htm |

| Exhibit 99.2

|

Investor Materials July 13, 2018

Forward Looking Statements This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Some of these forward-looking statements can be identified by the use of forward-looking words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” “projects,” “strategy,” or “anticipates,” or the negative of those words or other comparable terminology. The accuracy of such statements is subject to a number of risks, uncertainties and assumptions including, but not limited to, the following factors: (1) the risk that the conditions to the closing of the transaction are not satisfied, including the risk that required approvals from the shareholders of CTWS or the stockholders of SJW Group for the transaction are not obtained; (2) the risk that the regulatory approvals required for the transaction are not obtained, or that in order to obtain such regulatory approvals, conditions are imposed that adversely affect the anticipated benefits from the proposed transaction or cause the parties to abandon the proposed transaction; (3) the risk that the anticipated tax treatment of the transaction is not obtained; (4) the effect of water, utility, environmental and other governmental policies and regulations; (5) litigation relating to the transaction; (6) uncertainties as to the timing of the consummation of the transaction and the ability of each party to consummate the transaction; (7) risks that the proposed transaction disrupts the current plans and operations of SJW Group or CTWS; (8) the ability of SJW Group and CTWS to retain and hire key personnel; (9) competitive responses to the proposed transaction; (10) unexpected costs, charges or expenses resulting from the transaction; (11) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction; (12) the combined companies’ ability to achieve the growth prospects and synergies expected from the transaction, as well as delays, challenges and expenses associated with integrating the combined companies’ existing businesses; and (13) legislative and economic developments. These risks, as well as other risks associated with the proposed transaction, are more fully discussed in the joint proxy statement/prospectus that is included in the Registration Statement on Form S-4 filed by SJW Group with the Securities and Exchange Commission (the “SEC”) on April 25, 2018 in connection with the proposed transaction, as amended by that Amendment No. 1 to Form S-4 filed with the SEC on June 7, 2018 and that Amendment No. 2 to Form S-4 filed with the SEC on June 25, 2018, and CTWS’s quarterly report on Form 10-Q for the period ended March 31, 2018 filed with the SEC on May 9, 2018. In addition, actual results are subject to other risks and uncertainties that relate more broadly to CTWS’s overall business and financial condition, including those more fully described in CTWS’s filings with the SEC including its annual report on Form 10-K for the fiscal year ended December 31, 2017 and SJW Group’s overall business, including those more fully described in SJW Group’s filings with the SEC including its annual report on Form 10-K for the fiscal year ended December 31, 2017. Forward looking statements are not guarantees of performance, and speak only as of the date made, and neither CTWS or its management nor SJW Group or its management undertakes any obligation to update or revise any forward-looking statements. 2

|

|

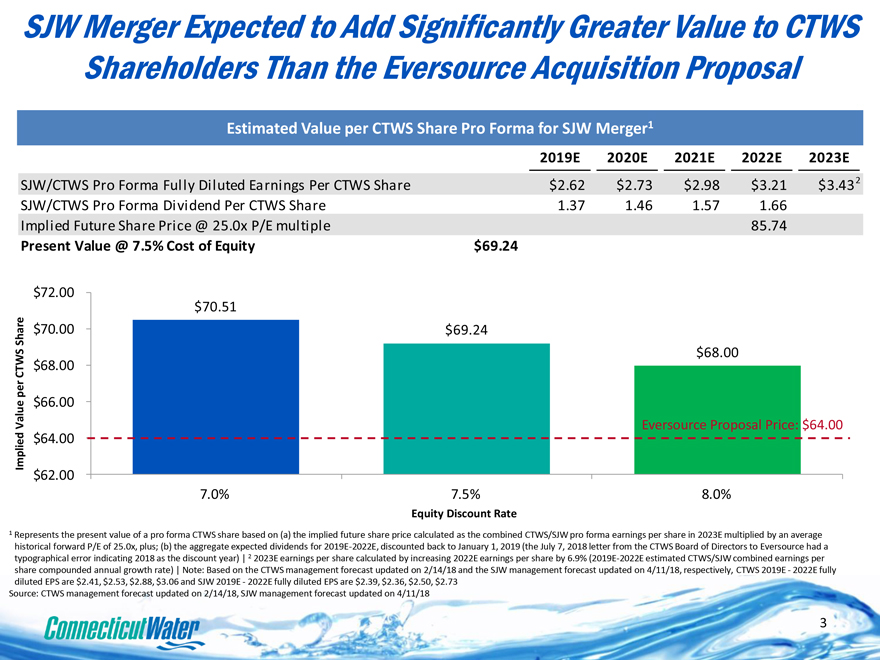

3 $70.51 $69.24 $68.00 $62.00 $64.00 $66.00 $68.00 $70.00 $72.00 7.0% 7.5% 8.0% SJW Merger Expected to Add Significantly Greater Value to CTWS Shareholders Than the EversourceAcquisition Proposal 1Represents the present value of a pro forma CTWS share based on (a) the implied future share price calculated as the combined CTWS/SJW pro forma earnings per share in 2023E multiplied by an average historical forward P/E of 25.0x, plus; (b) the aggregate expected dividends for 2019E-2022E, discounted back to January 1, 2019 (the July 7, 2018 letter from the CTWS Board of Directors to Eversourcehad a typographical error indicating 2018 as the discount year) | 22023E earnings per share calculated by increasing 2022E earnings per share by 6.9% (2019E-2022E estimated CTWS/SJW combined earnings per share compounded annual growth rate) | Note: Based on the CTWS management forecast updated on 2/14/18 and the SJW management forecast updated on 4/11/18, respectively, CTWS 2019E -2022E fully diluted EPS are $2.41, $2.53, $2.88, $3.06and SJW 2019E -2022E fully diluted EPS are $2.39, $2.36, $2.50, $2.73 Source: CTWS management forecast updated on 2/14/18, SJW management forecast updated on 4/11/18 Equity Discount Rate Implied Value per CTWS Share EversourceProposal Price: $64.00 Estimated Value per CTWS Share Pro Forma for SJW Merger1201 9E 202 0E 202 1E 202 2E 202 3E SJW/CTWS Pro Forma Fully Diluted Earnings Per CTWS Share $2.62 $2.73 $2.98 $3.21 $3.43 SJW/CTWS Pro Forma Dividend Per CTWS Share 1.37 1.46 1.57 1.66 Implied Future Share Price @ 25.0x P/E multiple 85.74 Present Value @ 7.5% Cost of Equity $69.24 23

|

|

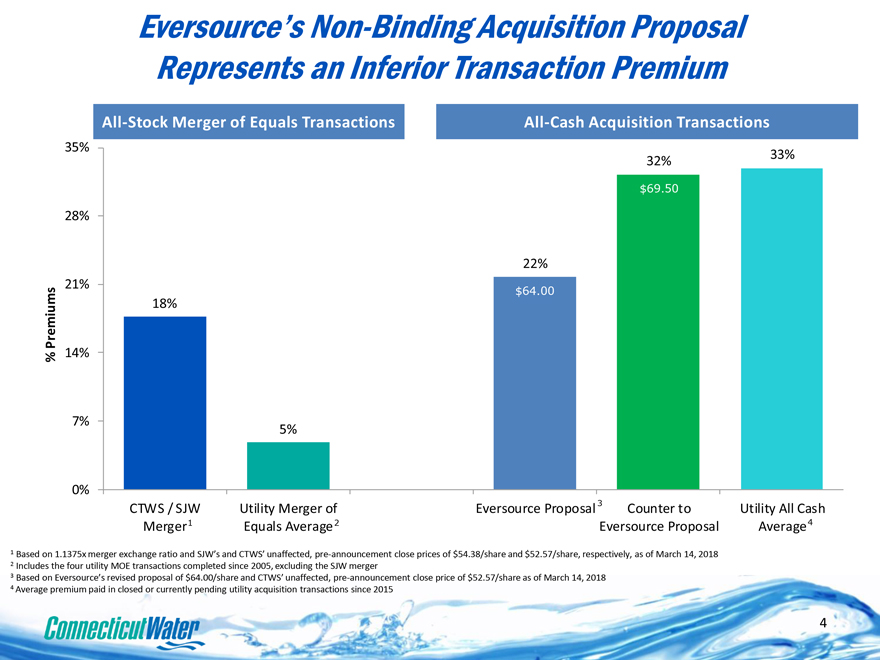

4 Eversource’sNon-Binding Acquisition Proposal Represents an Inferior Transaction Premium 1Based on 1.1375x merger exchange ratio and SJW’s and CTWS’ unaffected, pre-announcement close prices of $54.38/share and $52.57/share, respectively, as of March 14, 2018 2Includes the four utility MOE transactions completed since 2005, excluding the SJW merger 3Based on Eversource’srevised proposal of $64.00/share and CTWS’ unaffected, pre-announcement close price of $52.57/share as of March 14, 2018 4 Average premium paid in closed or currently pending utility acquisition transactions since 2015 All-Cash Acquisition Transactions All-Stock Merger of Equals Transactions18% 5% 22% 32% 33% 0% 7% 14% 21% 28% 35% CTWS / SJW Merger Utility Merger of Equals Average Eversource Proposal Counter to Eversource Proposal Utility All Cash Average % Premiums $64.00 $69.50 4 3 2 1

|

|

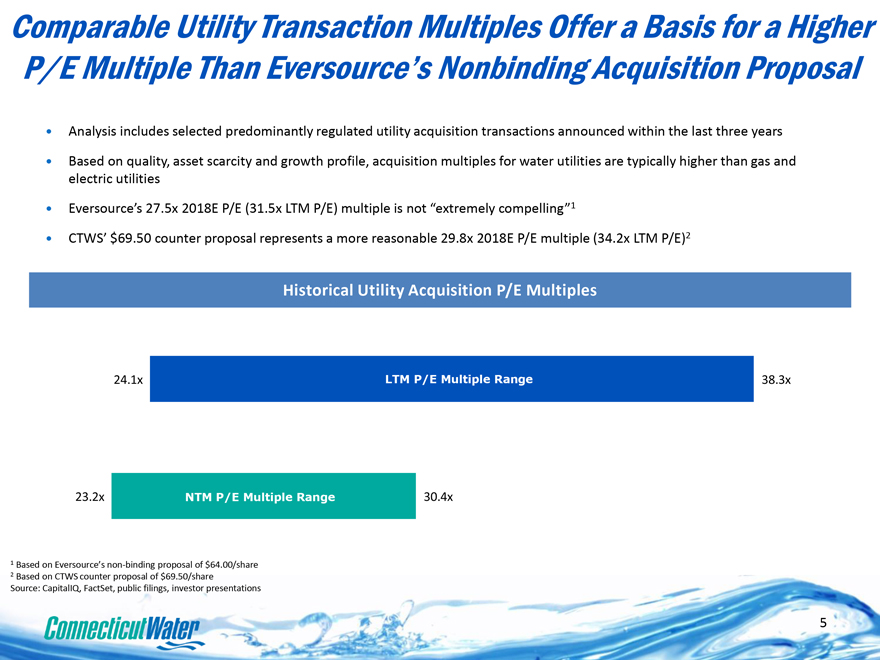

Comparable Utility Transaction Multiples Offer a Basis for a Higher P/E Multiple Than Eversource’s Nonbinding Acquisition Proposal Analysis includes selected predominantly regulated utility acquisition transactions announced within the last three years Based on quality, asset scarcity and growth profile, acquisition multiples for water utilities are typically higher than gas and electric utilities Eversource’s 27.5x 2018E P/E (31.5x LTM P/E) multiple is not “extremely compelling”1 CTWS’ $69.50 counter proposal represents a more reasonable 29.8x 2018E P/E multiple (34.2x LTM P/E)2 Historical Utility Acquisition P/E Multiples 24.1x LTM P/E Multiple Range 38.3x 23.2x NTM P/E Multiple Range 30.4x 1 Based on Eversource’s non-binding proposal of $64.00/share 2 Based on CTWS counter proposal of $69.50/share Source: CapitalIQ, FactSet, public filings, investor presentations 5

Additional Information About the Merger and Where to Find It Additional Information and Where to Find It In connection with the proposed transaction between CTWS and SJW Group, SJW Group filed with the SEC a Registration Statement on Form S-4, as amended by that Amendment No. 1 to Form S-4 filed with the SEC on June 7, 2018 and that Amendment No. 2 to Form S-4 filed with the SEC on June 25, 2018, that includes a joint proxy statement of CTWS and SJW Group that also constitutes a prospectus of SJW Group. CTWS will also file a GREEN proxy card with the SEC, and CTWS and SJW Group may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus, Form S-4 or any other document which CTWS or SJW Group has filed or may file with the SEC. INVESTORS AND SECURITY HOLDERS OF CTWS AND SJW GROUP ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the Form S-4 and joint proxy statement/prospectus and any other documents filed with the SEC by CTWS or SJW Group through the website maintained by the SEC at www.sec.gov. Copies of documents filed with the SEC by CTWS will be made available free of charge on CTWS’s investor relations website at https://ir.ctwater.com. Copies of documents filed with the SEC by SJW Group will be made available free of charge on SJW Group’s investor relations website at https://sjwgroup.com/investor_relations. No Offer or Solicitation This communication is for informational purposes only and is not intended to and does not constitute an offer to sell, or the solicitation of an offer to subscribe for or buy, or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, sale or solicitation would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law. Participants in the Solicitation CTWS, SJW Group and certain of their respective directors and officers, and other members of management and employees, may be deemed to be participants in the solicitation of proxies from the holders of CTWS and SJW Group securities in respect of the proposed transaction between CTWS and SJW Group. Information regarding CTWS’s directors and officers is available in CTWS’s annual report on Form 10-K for the fiscal year ended December 31, 2017 and its proxy statement for its 2018 annual meeting dated April 6, 2018, which are filed with the SEC. Information regarding the SJW Group’s directors and officers is available in SJW Group’s annual report on Form 10-K for the fiscal year ended December 31, 2017 and its proxy statement for its 2018 annual meeting dated March 6, 2018, which are filed with the SEC. Investors may obtain additional information regarding the interest of such participants by reading the Form S-4 and the joint proxy statement/prospectus and other documents filed with the SEC by CTWS and SJW Group. These documents will be available free of charge from the sources indicated above. 6