Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Usio, Inc. | pyds_8-kx2018x07x09present.htm |

July 2018 Investor Presentation

Forward looking statements These slides and any accompanying oral presentation contain forward- information presently available to the Company’s management. looking statements within the meaning of the Private Securities The Company disclaims any obligation to update these forward- Litigation Reform Act of 1995 and other Federal securities laws. These looking statements, except as required by law. The Company has forward-looking statements are identified by the use of words such as filed a Registration Statement (including a preliminary prospectus) “believe,” “expect,” “prepare,” “anticipate,” “target,” “launch,” and with the Securities and Exchange Commission (SEC) for the offering “create,” or similar expressions are used, including statements about for which this presentation relates. Before you invest, you should commercial operations, technology progress, growth and future read the preliminary prospectus contained in the Company’s financial performance of Payment Data Systems, Inc. and its Registration Statement, any amendments or supplements thereto subsidiaries (the “Company”). Forward-looking statements in this and other documents the Company has filed with the SEC for more presentation are subject to certain risks and uncertainties inherent in complete information about the Company and this offering. The the Company’s business that could cause actual results to vary, preliminary prospectus and the Registration Statement may be including such risks that the Company’s security applications may be accessed through the SEC’s website at www.sec.gov. Alternatively, insufficient; the Company’s ability to adapt to rapid technological the Company, any underwriter or any dealer participating in the change; adverse effects on the Company’s relationships with offering will arrange to send you the preliminary prospectus and Automated Clearing House, bank sponsors and credit card associations; any amendments or supplements thereto if you request it through the Company’s ability to comply with federal or state regulations; the Maxim Group LLC, 405 Lexington Ave, New York, NY 10174, Attn: Company’s exposure to credit risks, data breaches, fraud or software Prospectus Department or by Tel: (800) 724-0761. This failures, and other risks detailed from time to time in the company’s presentation contains statistics and other data that has been filings with the Securities and Exchange Commission including its obtained from or compiled from information made available by annual report on Form 10-K for the year ended December 31, 2017. third parties service providers. The Company has not One or more of these factors have affected, and in the future could independently verified such statistics or data. The information affect, the Company’s businesses and financial results and could cause presented in this presentation is as of December 19, 2017 unless actual results to differ materially from plans and projections. All indicated otherwise. forward-looking statements made in this release are based on 7/9/2018 Payment Data Systems | paymentdata.com 2

Payment Data Systems is a leading integrated payment solutions provider, offering a wide range of payment solutions to merchants, billers, banks, service bureaus, and card issuers. We operate credit, Overview debit/prepaid and ACH payment processing platforms to deliver convenient, world-class payment solutions and service to our clients. Our strength lies in our ability to provide tailored solutions for card issuance, payment acceptance, and bill payments as well as in our unique technology in the prepaid sector. 7/9/2018 Payment Data Systems | paymentdata.com 3

Investor Highlights PRICE (7/5/2018) $1.69 52 WEEK RANGE $1.21 - $4.10 MARKET CAP $26.8 M SHARES 16.2 mm OUTSTANDING DEBT $0 CASH $4.8 mm 12/31/17 FISCAL YEAR END December 31 Year Founded 1998 Headquarters San Antonio, TX & office in Franklin, TN Number of Employees 33 Website www.paymentdata.com 4 7/9/2018 Payment Data Systems | paymentdata.com 4

Investor Highlights • NACHA (National Automated • Blue chip customers; laser focus on Clearing House Association) Certified three main vertices with consistent – Meeting the standards for sounds payment streams (healthcare, real estate, practices relative to ACH payment utilities). processing. • Sustainable competitive advantages in • Strong Balance sheet and clean technology and custom solutions. capital structure with no debt. • Senior management with a combined 50 • Recurring revenues and attractive plus years of experience in the payment margins. processing industry. • Record credit card transaction processing volumes for Q1 2018. 7/9/2018 Payment Data Systems | paymentdata.com 5

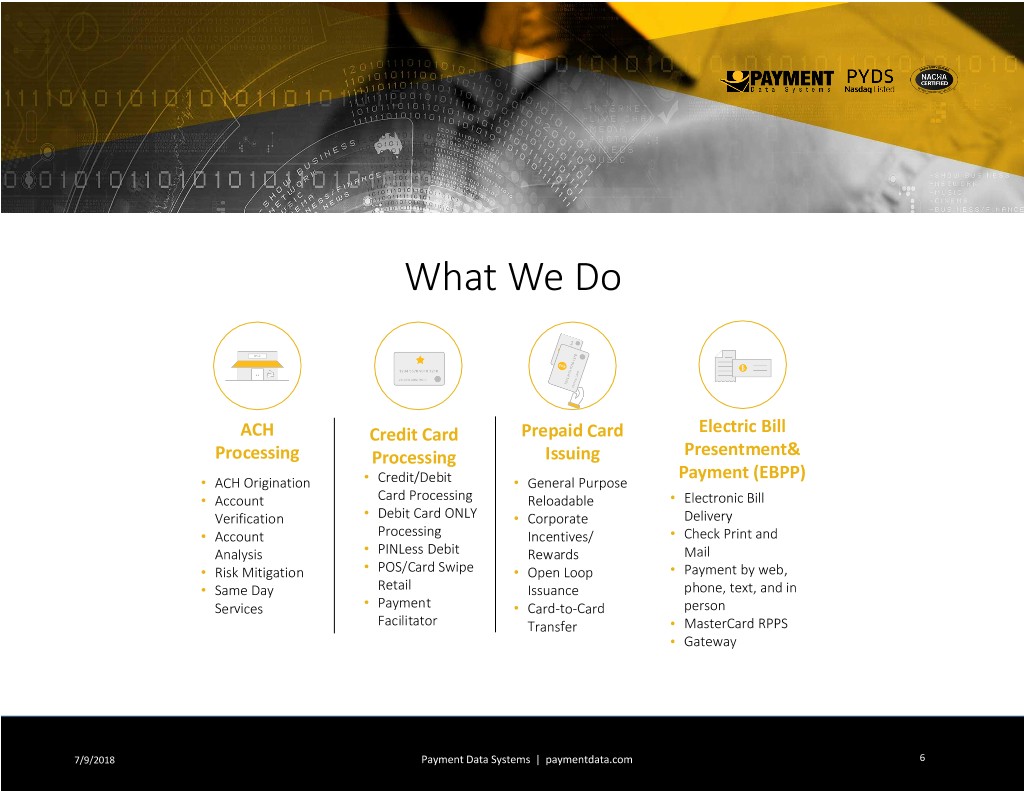

What We Do ACH Credit Card Prepaid Card Electric Bill Processing Processing Issuing Presentment& Payment (EBPP) • ACH Origination • Credit/Debit • General Purpose • Account Card Processing Reloadable • Electronic Bill Verification • Debit Card ONLY • Corporate Delivery • Account Processing Incentives/ • Check Print and Analysis • PINLess Debit Rewards Mail • Risk Mitigation • POS/Card Swipe • Open Loop • Payment by web, • Same Day Retail Issuance phone, text, and in Services • Payment • Card-to-Card person Facilitator Transfer • MasterCard RPPS • Gateway 7/9/2018 Payment Data Systems | paymentdata.com 6

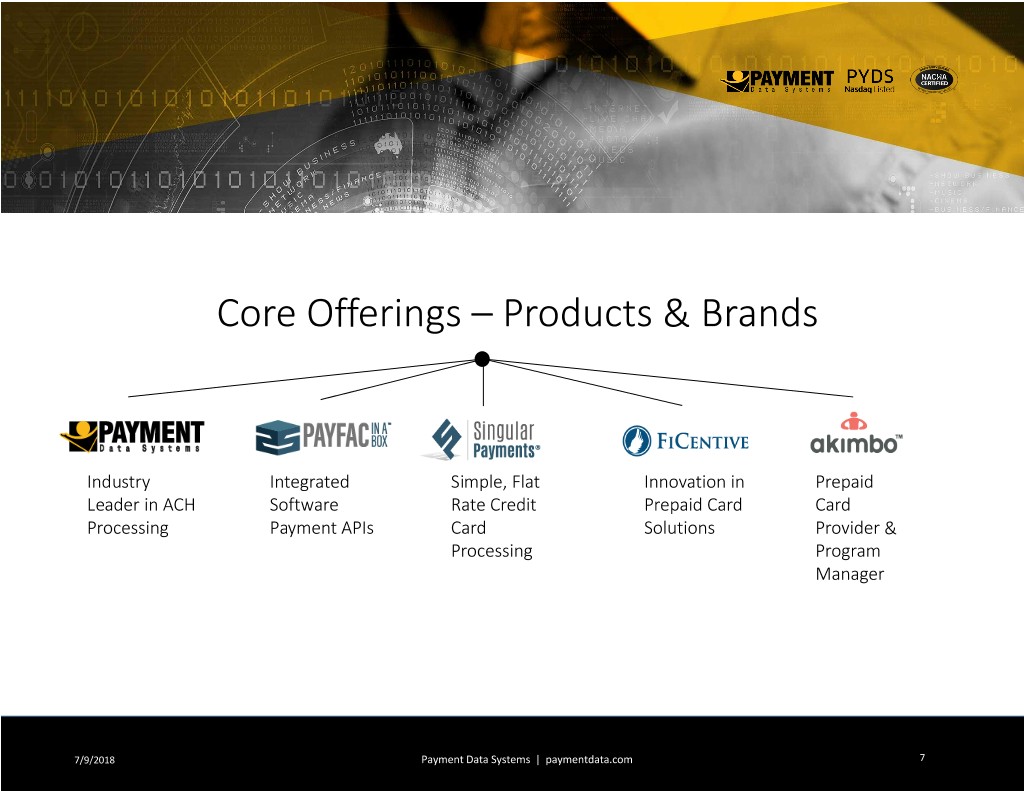

Core Offerings – Products & Brands Industry Integrated Simple, Flat Innovation in Prepaid Leader in ACH Software Rate Credit Prepaid Card Card Processing Payment APIs Card Solutions Provider & Processing Program Manager 7/9/2018 Payment Data Systems | paymentdata.com 7

Revenue Model How We Make Money ACH Credit Card Prepaid Card Processing Processing Issuing We get paid per We get paid a % of Service Fees + transaction Card Volume Network Interchange Revenue 7/9/2018 Payment Data Systems | paymentdata.com 8

Sample Revenue Model Credit Card Acceptance - $100 Sale Merchant Interchange Card Brands Processor Fee Net Spread Discount Fee 2.15% .11% + $.02 $.08/txn .48% Rate 2.75% The MDR is the rate This is the fee paid to Dues and In a credit card or After all costs associated charged to a merchant the banks who issue Assessments are debit card transaction, with processing a card for payment processing cards to cardholders paid directly to the the Processor charges transaction have been services on debit and who purchase goods Card Associations for a fee to authorize and satisfied, Payment Data credit card transactions. and services from the use of the Card settle the funds from Systems is left with the The merchant must setup merchants either on- Brand, and the ability the transaction to the net spread, in this this service and agree to line or in brick & to process credit and merchant or PayFac example, .48%, or $.48 the rate prior to mortar locations. debit card who ultimately may out of $2.75 charged to accepting debit and transactions of the have responsibility for the merchant. credit cards as payment. Visa, MasterCard, getting funds to and Discover merchants net of payment networks.. costs. Payment Data Systems | paymentdata.com 9 7/9/2018 Payment Data Systems | paymentdata.com 9

Revenue Components Electronic Bill Presentment & Payment (EBPP) The cost for mail is job Card Flat % fee is charged Mail against all card payment dependent and is in $1 + Payments volume processed addition to a postage pass- 3% - 5% thru ACH/ Flat $ amount is charged A fee is applied for all bills Email eCheck for each ACH/eCheck delivered via email $.07 - $.10 Payments payment $.25 - $1 Additional fee is charged on A fee is applied for all bills IVR the flat % or/and for each delivered via SMS/text SMS Text Payments card or ACH/eCheck $.07 - $.10 $.50 - $1 payment made via IVR 7/9/2018 Payment Data Systems | paymentdata.com 10

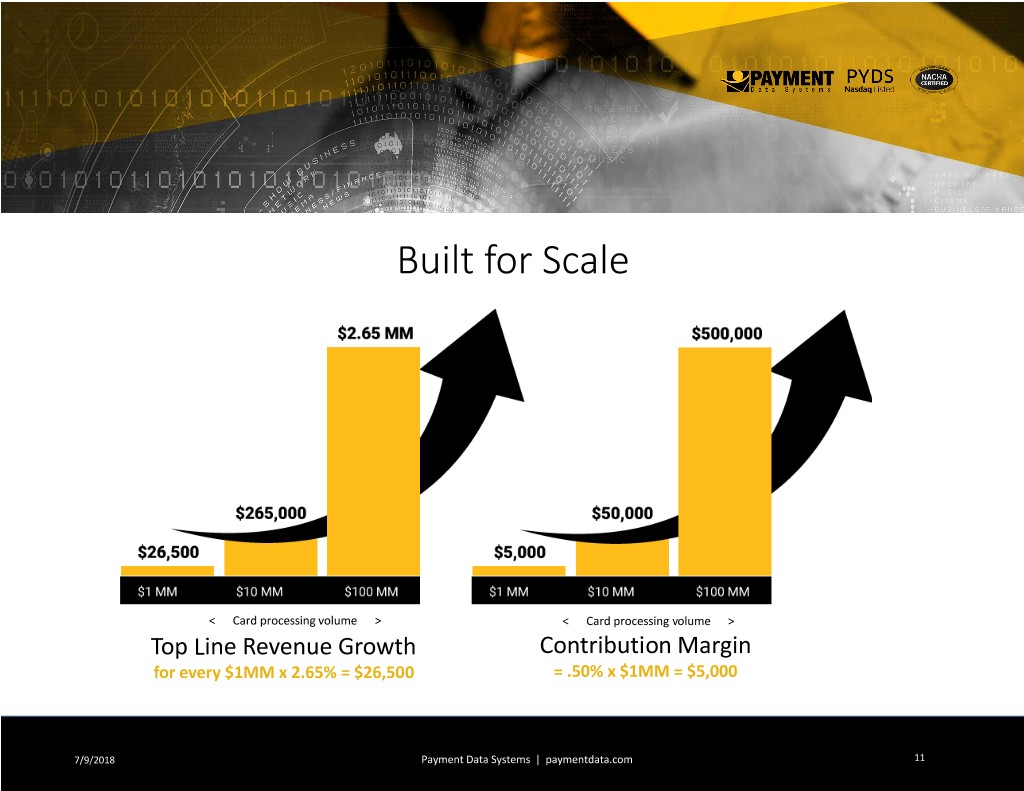

Built for Scale < Card processing volume > < Card processing volume > Top Line Revenue Growth Contribution Margin for every $1MM x 2.65% = $26,500 = .50% x $1MM = $5,000 7/9/2018 Payment Data Systems | paymentdata.com 11

Tomorrow Today 10x increase Market Sizing Industry research shows 3B+ 30B that “payment enablement” cards ways to pay of software platforms and “internet connected” devices will dramatically expand the size of the 44M 400M payment landscape and merchant locations ways to pay growth opportunities over the next decade. Source: Visa Investor Day 7/9/2018 Payment Data Systems | paymentdata.com 12

ACH Transaction Flow ACH payments are electronic payments that are created when the customer gives an originating institution, corporation, or other customer (originator) authorization to debit directly from the customer's checking or saving account for the purpose of bill payment. Overall volume in 2016 amounted to 25.6 billion transactions and $43 Trillion in value.¹ ([1] Includes direct-send and on-us transactions reported to NACHA.) 7/9/2018 Payment Data Systems | paymentdata.com 13

• Strong sales pipeline which should result in improved revenues for the rest of 2018 • Launched Same Day ACH Debits in September 2017 (ideal for urgent bill pay, payroll, etc.) • Late in 2017 PDS became only the 2nd processor to be NACHA Certified, the first was TeleCheck ACH Payment Summary Investment Highlights • Electronic check transaction volumes during the first quarter of 2018 were up 5% over the fourth quarter of 2017, representing the third consecutive quarter of growth. • Returned check transactions processed during first quarter of 2018 were up 6% as compared to the fourth quarter of 2017. 7/9/2018 Payment Data Systems | paymentdata.com 14

Digital card platform, period. And, the first gift and incentive card available on Apple Pay, Android Pay, and Samsung. 7/9/2018 Payment Data Systems | paymentdata.com 15

Custom Prepaid Program Management – Prepaid Card True Processor • Allows companies to launch their own next-generation Services prepaid card solution Incentive, Promotional and Disbursement Cards • A fully digital way to send cards instantly by email or text, 90% cheaper than plastic cards, first prepaid card integrated with Apple Pay, Samsung Pay and Google Wallet Akimbo: Consumer Card Program • Allows consumer to share money instantly with other card holders, manage sub cards compatible with Apple Pay, Samsung Pay and Google Wallet 7/9/2018 Payment Data Systems | paymentdata.com 16

Innovated Digital Platform Deliver cards Card is immediately available Cards can be instantly by text Customer online or with Apple Pay, branded with or email collects card Android Pay & Samsung Pay logos 7/9/2018 Payment Data Systems | paymentdata.com 17

Refunds & Per Loan Sales Rebates Diems Disbursements Incentives There’s Really a Prepaid Card for Everything! Customer Corporate Insurance Employee Rewards Expenses Payments Appreciation Sales Contractor Focus Group Referral Promotions Payments Payments Rewards 7/9/2018 Payment Data Systems | paymentdata.com 18

Sample Prepaid Clients 7/9/2018 Payment Data Systems | paymentdata.com 19

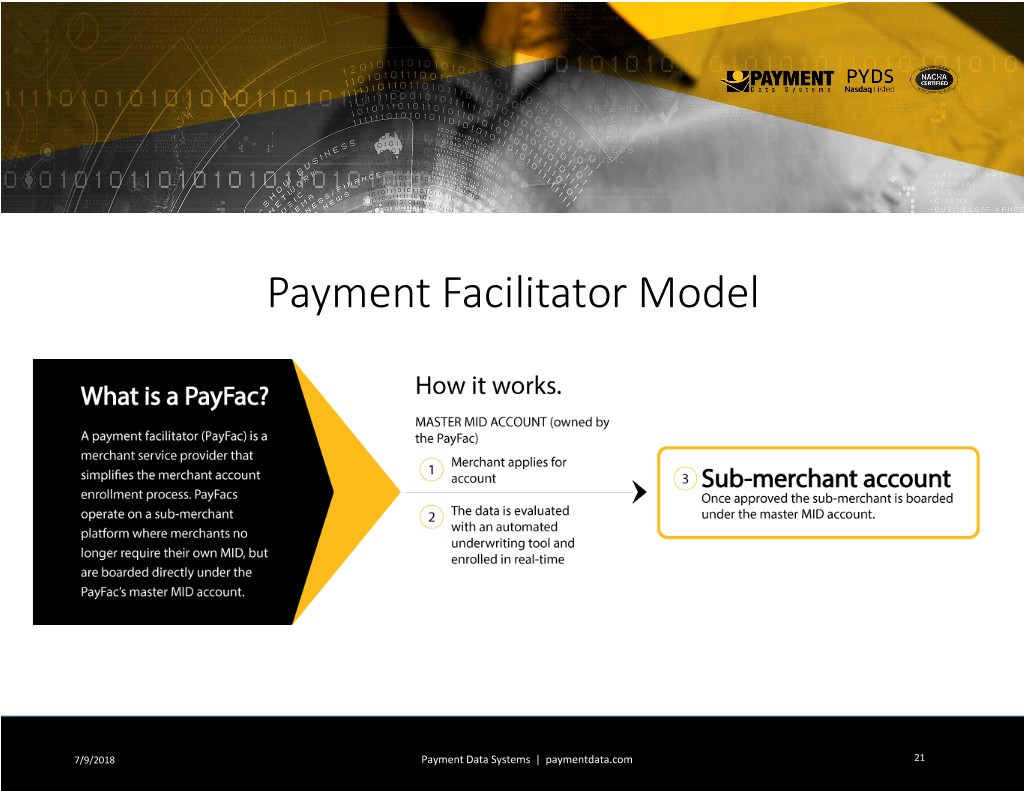

▪ Merchants rely on software to run their business, and increasingly to facilitate payment acceptance ▪ The future of payments is integrated!! PayFac Competitive ▪ PayFac does away with all the disparate systems in billing and streamlines the process of on- boarding customers (lengthy paper Value Proposition agreement down to a short click to accept). ▪ Software providers like our solutions because we allow them to participate in the revenue stream with a revenue share agreement from us, generating a stream of income where there was none before. ▪ We get walked into customers because of our capabilities in customizing solutions. 7/9/2018 Payment Data Systems | paymentdata.com 20

Payment Facilitator Model 7/9/2018 Payment Data Systems | paymentdata.com 21

Upstream $30k+ monthly processing volume - Retail and Virtual Payments In-store On-line Retail Micro Ecommerce Micro merchants = merchants = $3k/month $3k/month sales sales volume volume 7/9/2018 Payment Data Systems 22 7/9/2018 Payment Data Systems | paymentdata.com 22

Key Differentiators Frictionless onboarding and enrollment Integrated payments into everyday solutions Mitigating double data entry Streamlined back office efficiencies Full bill presentment and payment solution 7/9/2018 Payment Data Systems | paymentdata.com 23

Growth Opportunity – Integrated Software Vendors (ISV’s) The U.S. has tens of < +122% / > Thousands of ISVS According to TSG’s database of The U.S. market holds a treasure 3.5 million merchants, trove of ISVs that are sought after processing through ISV by merchant acquirers for relationships grew 122% from partnership and acquisition 2010 to 2017, and that trend is expected to continue. 7/9/2018 Payment Data Systems | paymentdata.com 24

Our Vertical Focus Healthcare Insurance Utility/Government Other Bill Pay Verticals Property Management 7/9/2018 Payment Data Systems | paymentdata.com 25

Integration Environment Software providers are able to access needed payment solutions and technology through the PDS “Integration Layer”, providing for the most seamless, user-friendly, and cost-effective payment acceptance experience. 7/9/2018 Payment Data Systems | paymentdata.com 26

Competitive Landscape Setup Cost $0 $0 $0 $0 $0 Monthly Cost $0 $0 $0 $0 $0 Transaction Fees 2.9% + 2.9% + $0.30 3.5% + $0.15 3% + $0.12 $0.00 $0.30 Total Monthly Cost $117 $117 $120 $102 $87 Effective Rate 3.90% 3.90% 4% 3.4% 2.89% FLAT Prepaid X X X X ACH X 0.8% · $5 cap X $0.37 $0.15 - $1.00* Batch Board X X X X Interface Total Monthly Cost is based on a $30 average ticket and $3k monthly sales volume. 7/9/2018 7/9/2018 Payment Data Systems | paymentdata.com 27

Traditional Customer Acquisition Model (ISO) 7/9/2018 Payment Data Systems | paymentdata.com 28

PayFac Model 7/9/2018 Payment Data Systems | paymentdata.com 29

Growth Strategies Organic Strategic M&A 1. Expand ACH banking 1. Acquire accretive credit card relationships processing portfolios 2. Continuous innovation of our 2. Acquire companies that have payment processing platform complimentary or differentiated products and services 3. Increase brand-awareness for Akimbo (B2B and B2C) 3. Singular Acquisition closed in September 2017 7/9/2018 Payment Data Systems | paymentdata.com 30

Transactions Processed per year 3500 3300 16 Millions 2978 2916 3000 2830 14 2500 12 10 2000 8 1500 *Over $2.8 6 Billion dollars 1000 630 4 processed in 500 2 2017 and over 10.8 million in 0 0 transactions 2013 2014 2015 2016 2017 Dollars Processed Transactions Processed 7/9/2018 Payment Data Systems | paymentdata.com 31

Revenue Run Rate $25.00 *USD millions $24.00 $20.00 $14.38 $14.57 $15.00 $13.40 $12.08 $10.00 $7.34 $5.18 $5.00 $- 2012 2013 2014 2015 2016 2017 2018 Revenue Run Rate (Million) 7/9/2018 Payment Data Systems | paymentdata.com 32

Management Louis A. Hoch, Co-founder, Vice-Chairman, Chief Executive Officer, COO 25 years of senior management experience, expert in payment processing and service bureau operations. Previously co-founded Billserv, Inc., (the industry leader in Electronic Bill Presentment and Payment, acquired by American Express). Held various key management positions with U.S. Long Distance (NASDAQ:USLD), Billing Concepts (NASDAQ:BILL) and Andersen Consulting (NYSE:ACN). Holds inventor status on U.S. Patent “System and method for managing and processing stored-value cards and bill payment therefrom”. Mr. Hoch holds a BBA in computer information systems and a MBA in international business management, both from Our Lady of the Lake University. Vaden Landers, Executive Vice President, Chief Revenue Officer 30+ years of experience in the payments industry. Former Chairman of Singular Payments, currently serves as Strategic Advisor for MAPP Advisors. Held executive and board positions in multiple companies, including as director for SparkBase, as CEO for ProfitPoint, Inc., as Chief Marketing Officer for iPayment, Inc. (NASDAQ: IPMT), as President for Global Payments (NYSE: GPN) and as President and CEO for Bancard Consulting Group 7/9/2018 Payment Data Systems | paymentdata.com 33

Management Tom Jewell, CPA, Senior Vice President, Chief Financial Officer 35 years of business leadership experience focused on management, auditing, accounting, internal controls, and finance. Founder of LTJ Financial Consulting, formerly served as CFO for a multi-state photography studio chain, provided financial leadership to divisional units of RadioShack, Verizon and Kentucky Fried Chicken. Began his career at Touche Ross (Deloitte). Mr. Jewell holds a BBA in accounting from Marshall University and MBA in finance from Bellarmine University. Houston Frost, PhD Senior Vice President, Corporate and Prepaid Development Prior to joining PDS in December 2014, Mr. Frost served as President, Chief Executive Officer and Director of Akimbo Financial, Inc. since its inception in January 2010, worked on the fixed-income strategy team at JPMorgan Chase & Co., Ph.D. in Chemical and Biological Engineering from Northwestern University 7/9/2018 Payment Data Systems | paymentdata.com 34

APPENDIX 7/9/2018 Payment Data Systems | paymentdata.com 35

USD Millions Account 12/31/17 Cash $4.8 Balance Sheet Restricted cash & Settlement funds $53.0 Total Assets $67.4 Highlights Short-term/long-term debt - Total Liabilities $54.3 Total Equity $13.1 ~$41 million in unused tax NOL carry-forward 7/9/2018 Payment Data Systems | paymentdata.com 36

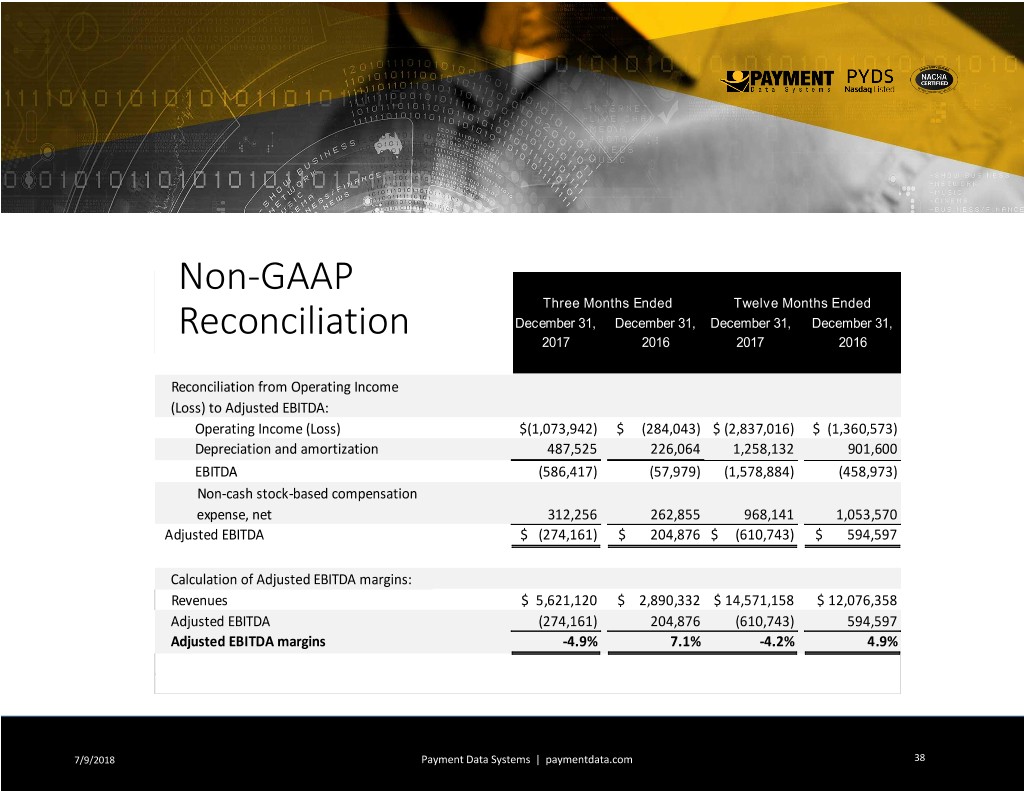

Income Statement Highlights USD Millions Q4 2017 Annual 2017 Revenues $5.6 $14.6 Cost of sales 4.3 10.8 Gross Profit $1.3 $3.7 SG&A 1.9 4.3 Depreciation & Amortization .4 1.3 Income tax benefit (expense) (0.2) (.3) Net Loss $(1.3) $(3.0) Adjusted EBITDA $(274k) $(611k) See Non-GAAP Reconciliation in the Appendix 7/9/2018 Payment Data Systems | paymentdata.com 37

Non-GAAP Three Months Ended Twelve Months Ended December 31, December 31, December 31, December 31, Reconciliation 2017 2016 2017 2016 Reconciliation from Operating Income (Loss) to Adjusted EBITDA: Operating Income (Loss) $(1,073,942) $ (284,043) $ (2,837,016) $ (1,360,573) Depreciation and amortization 487,525 226,064 1,258,132 901,600 EBITDA (586,417) (57,979) (1,578,884) (458,973) Non-cash stock-based compensation expense, net 312,256 262,855 968,141 1,053,570 Adjusted EBITDA $ (274,161) $ 204,876 $ (610,743) $ 594,597 Calculation of Adjusted EBITDA margins: Revenues $ 5,621,120 $ 2,890,332 $ 14,571,158 $ 12,076,358 Adjusted EBITDA (274,161) 204,876 (610,743) 594,597 Adjusted EBITDA margins -4.9% 7.1% -4.2% 4.9% 7/9/2018 Payment Data Systems | paymentdata.com 38

• Established provider of ACH and credit card payment processing in niche verticals • Credit card transaction processing volumes continue to be at highest levels in the history of the company • Record last quarter $5.6MM – annual revenue run rate of $24 million Summary • Recurring revenues and attractive margins (23.2% gross margins, - 4.2% EBTIDA margins) • Blue chip customers • Senior management with a combined 50 plus years of experience in the payment processing industry. • Strong balance sheet, clean capital structure, $41 million NOL 7/9/2018 Payment Data Systems | paymentdata.com 39

Louis Hoch Co-founder, Vice-Chairman, President, Chief Executive Officer, Chief Operating Officer Vaden Landers Senior Vice President, Chief Revenue Officer Tom Jewell Senior Vice President, Chief Financial Officer 7/9/2018 Payment Data Systems | paymentdata.com 40