Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - HOME BANCSHARES INC | exh_991.htm |

| 8-K - FORM 8-K - HOME BANCSHARES INC | f8k_062918.htm |

Exhibit 99.2

NASDAQ: HOMB | July 2018 www.homebancshares.com

FORWARD LOOKING STATEMENT This presentation contains forward - looking statements which include, but are not limited to, statements about the benefits of the acquisition of the Shore Premier Finance (“SPF”) division of Union Bank & Trust by Home BancShares, Inc. (the “Company”) and its bank subsidiary, Centennial Bank, including the Company’s plans, expectations, goals and outlook for the future. Statements in this presentation that are not historical facts should be considered forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward - looking statements of this type speak only as of the date of this presentation. By nature, forward - looking statements involve inherent risk and uncertainties. Various factors could cause actual results to differ materially from those contemplated by the forward - looking statements, including, but not limited to, ( i ) the risk that the benefits from the transaction may not be fully realized or may take longer to realize than expected, including as a result of any delay in or failure to receive regulatory approval of the proposed loan production office through which SPF will be operated, changes in general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of competition in the geographic and business areas in which the Company and SPF operate; (ii) the ability to promptly and effectively integrate the business of SFP into the Company; (iii) the reaction to the transaction of the Company’s and SPF’s customers, employees and counterparties; and (iv) diversion of management time on acquisition - related issues. Additional information on factors that might affect Home’s financial results is included in its Annual Report on Form 10 - K for the year ended December 31, 2017, filed with the SEC on February 27, 2018. 2

TRANSACTION OVERVIEW Purchased substantially all assets and certain specific liabilities of Shore Premier Finance (“SPF”) from Union Bank & Trust at a 5% premium. Acquired approximately $383.4 million in consumer marine loans and dealer floor plan draws with a weighted average yield of 4.60%. The portfolio of loans will now be housed in a division of Centennial Bank known as Shore Premier Finance. 3

OVERVIEW OF SHORE PREMIER FINANCIAL Provides direct consumer loans to finance Coast Guard registered high - end sail and power boats. Referrals come from dealers and brokers. Provides inventory floor plan lines of credit to marine dealers. Total outstanding loans as of 12/31/17 were $365 million with an average loan balance of approximately $306,000 . $30 million in floor plan draws $335 million in consumer fundings Floor plan commitments peaked at $94 million in 2017 Originated $140 million of consumer loans in 2017. 4

STRATEGIC OPPORTUNITY Expands the specialty finance options currently offered. Centennial currently has 16 locations in Southeast Florida which is considered the “boating capital of the world.” Experienced lending team with proven track record, strong industry knowledge and established relationships with nationwide dealers and manufacturers will be retained. With the opening of the Chesapeake, VA loan production office, the division will continue its vision to build a national lending platform focused on commercial and consumer marine loans. 5

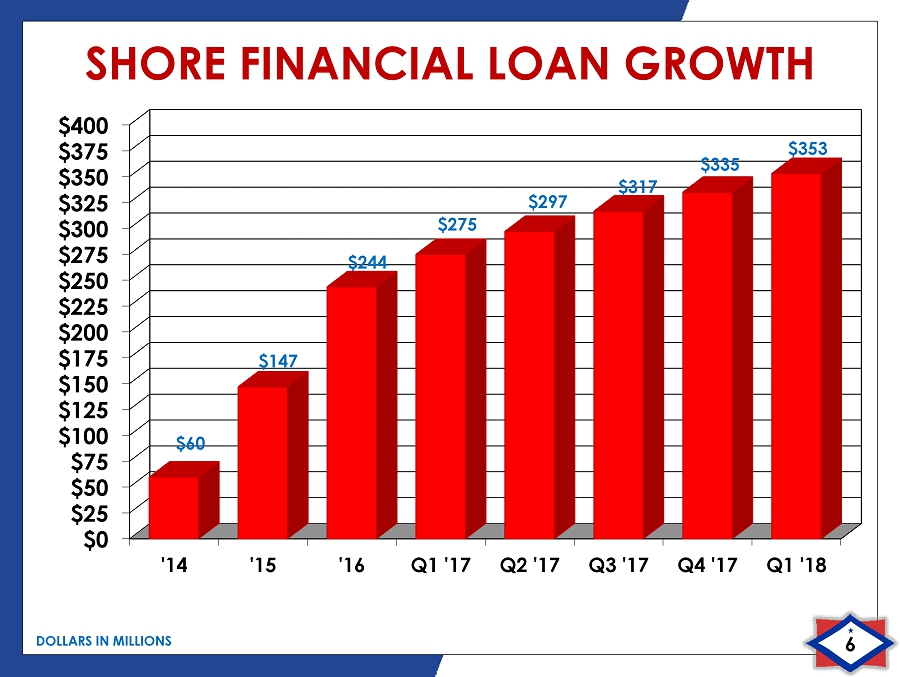

$0 $25 $50 $75 $100 $125 $150 $175 $200 $225 $250 $275 $300 $325 $350 $375 $400 '14 '15 '16 Q1 '17 Q2 '17 Q3 '17 Q4 '17 Q1 '18 $ 60 $ 147 $ 244 $ 275 $ 297 $ 317 $ 335 $ 353 SHORE FINANCIAL LOAN GROWTH DOLLARS IN MILLIONS 6

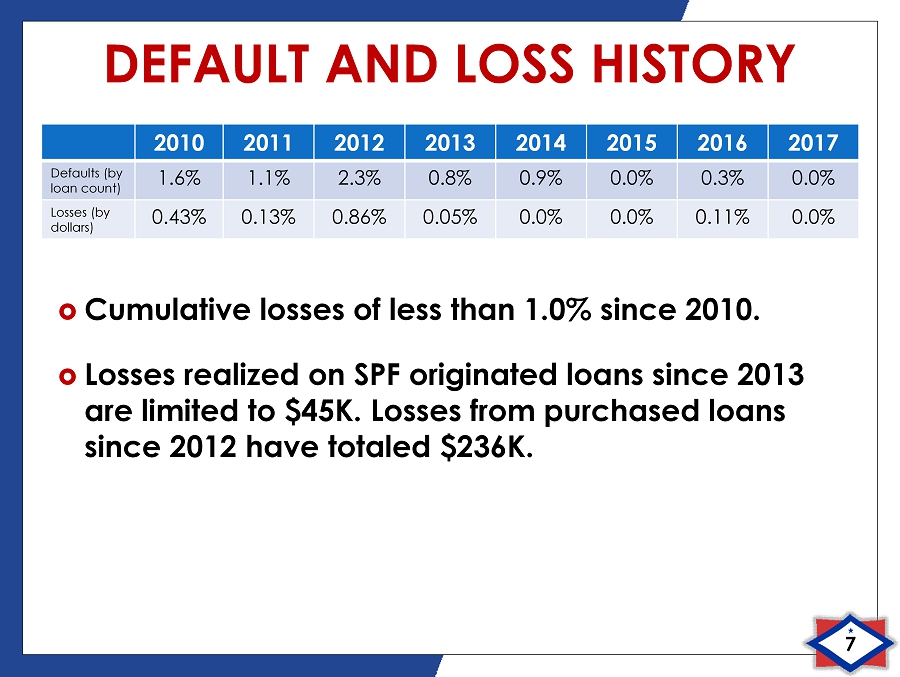

DEFAULT AND LOSS HISTORY 7 Cumulative losses of less than 1.0 % since 2010. Losses realized on SPF originated loans since 2013 are limited to $45K. Losses from purchased loans since 2012 have totaled $236K. 2010 2011 2012 2013 2014 2015 2016 2017 Defaults (by loan count) 1.6% 1.1% 2.3% 0.8% 0.9% 0.0% 0.3% 0.0% Losses (by dollars) 0.43% 0.13% 0.86% 0.05% 0.0% 0.0% 0.11% 0.0%

HISTORICAL ACQUISITIONS 8 Year Acquired Bank Acquisition Type Location Assets (1) 2003 Community Bank Market Cabot, AR $326 2005 Twin City Bank Market North Little Rock, AR $633 2005 Marine Bank Market Marathon, FL $258 2005 Bank of Mountain View Market Mountain View, AR $203 2008 Centennial Bank Market Little Rock, AR $234 2010 Old Southern Bank FDIC - assisted Orlando, FL $335 2010 Key West Bank FDIC - assisted Key West, FL $97 2010 Coastal Community Bank FDIC - assisted Panama City, FL $362 2010 Bayside Savings Bank FDIC - assisted Port Saint Joe, FL $63 2010 Wakulla Bank FDIC - assisted Crawfordville, FL $353 2010 Gulf State Community Bank FDIC - assisted Carrabelle, FL $112 2012 Vision Bank Selected Asset Purchase Panama City, FL $530 2012 Heritage Bank of Florida FDIC - assisted Lutz, FL $225 2012 Premier Bank § 363 Bankruptcy Tallahassee, FL $265 2013 Liberty Bancshares, Inc. Market Jonesboro, AR $2,819 2014 Florida Traditions Bank Market Dade City, FL $310 2014 Broward Financial Holdings, Inc. Market Ft. Lauderdale, FL $184 2015 Doral Bank Florida FDIC - assisted Panama City, FL $466 2015 Florida Business BancGroup, Inc. Market Tampa, FL $532 2017 Giant Holdings, Inc. Market Ft. Lauderdale, FL $395 2017 The Bank of Commerce § 363 Bankruptcy Sarasota, FL $183 2017 Stonegate Bank Market Pompano Beach, FL $2,887 2018 Shore Premier Financial Selected Asset Purchase Richmond, VA $384 (1) DOLLARS IN MILLIONS

TOTAL ASSETS POST ACQUISITION TOTAL PROFORMA ASSETS AS OF MARCH 31, 2018 9 $ 14.7 Billion Holding Company

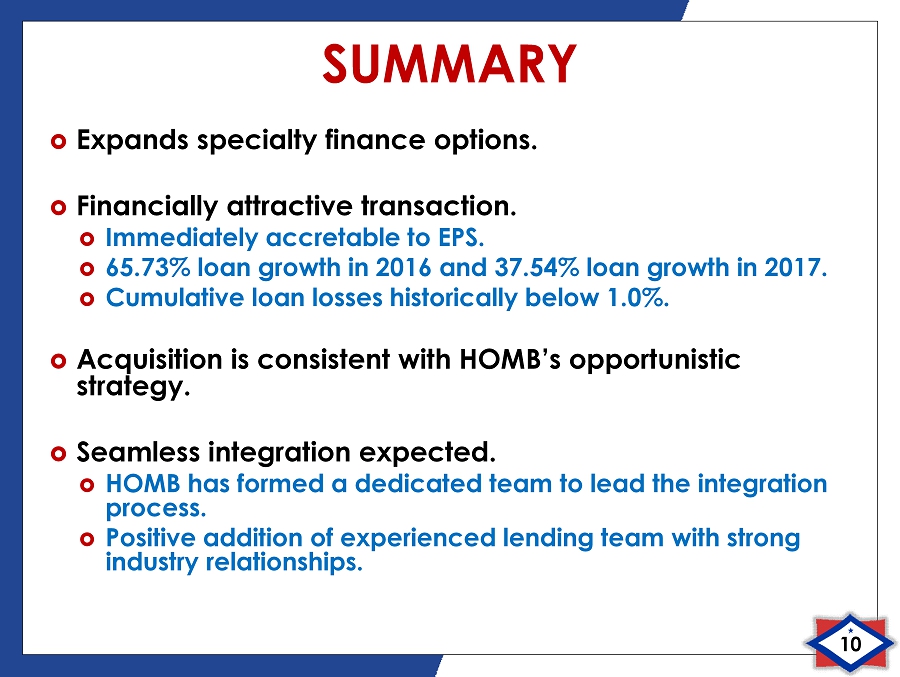

SUMMARY Expands specialty finance options. Financially attractive transaction. Immediately accretable to EPS. 65.73% loan growth in 2016 and 37.54% loan growth in 2017. Cumulative loan losses historically below 1.0%. Acquisition is consistent with HOMB’s opportunistic strategy. Seamless integration expected. HOMB has formed a dedicated team to lead the integration process. Positive addition of experienced lending team with strong industry relationships. 10

CONTACT INFORMATION 11 Corporate Headquarters Home BancShares, Inc. 719 Harkrider Street, Suite 100 P.O. Box 966 Conway, AR 72033 Financial Information Donna Townsell Director of Investor Relations (501) 328 - 4625 Website www.homebancshares.com

NASDAQ: HOMB | July 2018 www.homebancshares.com