Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Dell Technologies Inc. | d880259dex992.htm |

| EX-99.1 - EX-99.1 - Dell Technologies Inc. | d880259dex991.htm |

| EX-10.2 - EX-10.2 - Dell Technologies Inc. | d880259dex102.htm |

| EX-10.1 - EX-10.1 - Dell Technologies Inc. | d880259dex101.htm |

| EX-2.1 - EX-2.1 - Dell Technologies Inc. | d880259dex21.htm |

| 8-K - 8-K - Dell Technologies Inc. | d880259d8k.htm |

Exhibit 99.3

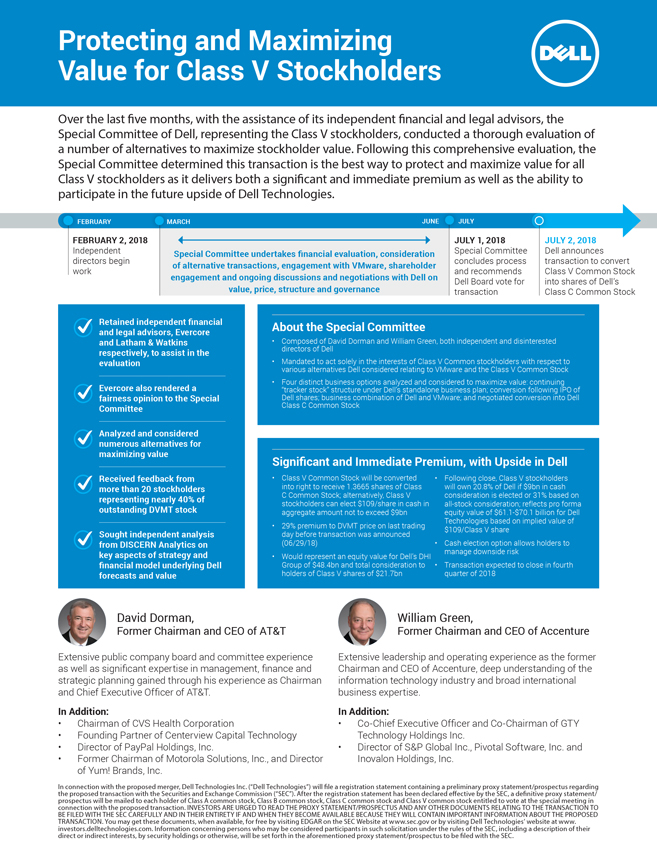

Value Protecting for Class and Maximizing V Stockholders

Over the last five months, with the assistance of its independent financial and legal advisors, the Special Committee of Dell, representing the Class V stockholders, conducted a

thorough evaluation of a number of alternatives to maximize stockholder value. Following this comprehensive evaluation, the Special Committee determined this transaction is the best way to protect and maximize value for all Class V stockholders as

it delivers both a significant and immediate premium as well as the ability to participate in the future upside of Dell Technologies.

FEBRUARY MARCH JUNE JULY

FEBRUARY 2, 2018 JULY 1, 2018 JULY 2, 2018 Independent Special Committee undertakes financial evaluation, consideration Special Committee Dell announces directors

begin concludes process transaction to convert of alternative transactions, engagement with VMware, shareholder work and recommends Class V Common Stock engagement and ongoing discussions and negotiations with Dell on Dell Board vote for into shares

of Dell’s value, price, structure and governance transaction Class C Common Stock

Retained independent financial and legal advisors, Evercore and Latham &

Watkins respectively, to assist in the evaluation

Evercore also rendered a fairness opinion to the Special

Committee

Analyzed and considered numerous alternatives for maximizing value

Received feedback from more than 20 stockholders representing nearly 40% of outstanding DVMT stock

Sought independent analysis from DISCERN Analytics on key aspects of strategy and financial model underlying Dell forecasts and value

About the Special Committee

• Composed directors of of Dell David Dorman and William

Green, both independent and disinterested

• Mandated various alternatives to act solely Dell in considered the interests relating of Class to VMware V Common

and stockholders the Class V Common with respect Stock to

• Four “tracker distinct stock” business structure options under analyzed Dell’s

standalone and considered business to plan; maximize conversion value: following continuing IPO of

Dell Class shares; C Common business Stock combination of Dell

and VMware; and negotiated conversion into Dell

Significant and Immediate Premium, with Upside in Dell

• Class V Common Stock will be converted • Following close, Class V stockholders into right to receive 1.3665 shares of Class will own 20.8% of Dell if $9bn in cash C

Common Stock; alternatively, Class V consideration is elected or 31% based on stockholders can elect $109/share in cash in all-stock consideration; reflects pro forma aggregate amount not to exceed $9bn equity value of $61.1-$70.1 billion for Dell

Technologies based on implied value of

• 29% premium to DVMT price on last trading $109/Class V share day before transaction was announced

(06/29/18) • Cash election option allows holders to manage downside risk

• Would

represent an equity value for Dell’s DHI

Group of $48.4bn and total consideration to • Transaction expected to close in fourth holders of Class V shares

of $21.7bn quarter of 2018

David Dorman,

Former Chairman and CEO of AT&T

Extensive public company board and committee experience as well as significant expertise in management, finance and strategic planning gained through his

experience as Chairman and Chief Executive Officer of AT&T.

In Addition:

• Chairman of CVS Health Corporation

• Founding Partner of

Centerview Capital Technology

• Director of PayPal Holdings, Inc.

•

Former Chairman of Motorola Solutions, Inc., and Director of Yum! Brands, Inc.

Extensive leadership and operating experience as the former

Chairman and CEO of Accenture, deep understanding of the information technology industry and broad international business expertise.

In Addition:

• Co-Chief Executive Officer and Co-Chairman of GTY Technology Holdings Inc.

• Director of S&P Global Inc., Pivotal Software, Inc. and Inovalon Holdings, Inc.

In connection with the proposed merger, Dell Technologies Inc. (“Dell Technologies”) will file a registration statement containing a preliminary proxy

statement/prospectus regarding the proposed transaction with the Securities and Exchange Commission (“SEC”). After the registration statement has been declared effective by the SEC, a definitive proxy statement/prospectus will be mailed to

each holder of Class A common stock, Class B common stock, Class C common stock and Class V common stock entitled to vote at the special meeting in connection with the proposed transaction. INVESTORS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS

AND ANY OTHER DOCUMENTS RELATING TO THE TRANSACTION TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. You may get these

documents, when available, for free by visiting EDGAR on the SEC Website at www.sec.gov or by visiting Dell Technologies’ website at www. investors.delltechnologies.com. Information concerning persons who may be considered participants in such

solicitation under the rules of the SEC, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the aforementioned proxy statement/prospectus to be filed with the SEC.