Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Phunware, Inc. | f8k062818_stellaracq3inc.htm |

Exhibit 99.1

Investor Presentation June 2018

Disclaimer and Important Notices © 2018 Phunware, Inc. This Investor Presentation (the “Investor Presentation”) is for informational purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any equity, debt or other financial instruments of Phunware, Inc . (“Phunware” or the "Company") or Stellar Acquisition III Inc . (“Stellar”) or any of Phunware’s or Stellar’s affiliates' securities (as such term is defined under the U . S . federal securities laws) . This Investor Presentation has been prepared to assist interested parties in making their own evaluation with respect to the proposed business combination of Phunware and Stellar and for no other purpose . The information contained herein does not purport to be all - inclusive . The data contained herein is derived from various internal and external sources . No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections, modelling or back - testing or any other information contained herein . All levels, multiples, prices and spreads are historical and do not represent current market levels, prices, multiples or spreads, some or all of which may have changed since the issuance of this document . Any data on past performance, modeling or back - testing contained herein is no indication as to future performance . Phunware and Stellar assume no obligation to update the information in this Investor Presentation . CAUTIONARY NOTE REGARDING FORWARD - LOOKING STATEMENTS This Investor Presentation includes financial forecasts, projections, and other forward - looking statements regarding Phunware, its business and prospects that are within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 . Forward - looking statements may be identified by the use of words such as “anticipate”, “may”, “believe”, “expect”, “estimate”, “plan”, “outlook”, “target”, “continue”, “intend” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters and are intended to identify forward - looking statements . Such forward - looking statements with respect to revenues, earnings, performance, strategies, prospects and other aspects of the businesses of Stellar, Phunware and the combined company after completion of the proposed business combination are based on current expectations that are subject to risks and uncertainties . Accordingly, actual results and performance may materially differ from results or performance expressed or implied by the forward - looking statements . These factors include, but are not limited to : ( 1 ) the occurrence of any event, change or other circumstances that could give rise to the termination of the Agreement and Plan of Merger for the business combination (the “Business Combination Agreement”) ; ( 2 ) the outcome of any legal proceedings that may be instituted against Stellar, Phunware or others following announcement of the Business Combination Agreement and transactions contemplated therein ; ( 3 ) the inability to complete the transactions contemplated by the Business Combination Agreement due to the failure to obtain approval of the stockholders of either Phunware or Stellar, or other conditions to closing in the Business Combination Agreement ; ( 4 ) the risk that the proposed transaction disrupts current plans and operations as a result of the announcement and consummation of the transactions described herein ; ( 5 ) the ability of Phunware to meet its financial and strategic goals, due to, among other things, competition, the ability of the combined company to grow and manage growth profitability, maintain relationships with suppliers and obtain adequate supply of products and retain its key employees ; ( 6 ) costs related to the proposed business combination ; ( 7 ) changes in applicable laws or regulations ; ( 8 ) the possibility that Phunware, or the combined company going forward, may be adversely affected by other economic, business, and/or competitive factors ; ( 9 ) the ability of the combined company to meet Nasdaq’s continued listing requirements and ( 10 ) other risks and uncertainties indicated from time to time in the proxy statement, including those under “Risk Factors” therein, and other filings with the Securities and Exchange Commission by Stellar . You are cautioned not to place undue reliance upon any forward - looking statements, which speak only as of the date made, and Stellar and Phunware undertake no obligation to update or revise the forward - looking statements, whether as a result of new information, future events or otherwise . If the risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward - looking statements . This Investor Presentation may not be distributed, reproduced or forwarded, or its contents or existence published, to any other person, in whole or in part, in any form . You must comply with your obligations under the U . S . federal securities laws and all other applicable securities, including with respect to any applicable restrictions on trading . Continued review of this Investor Presentation constitutes agreement with the foregoing instructions . ADDITIONAL INFORMATION ABOUT THE MERGER AND WHERE TO FIND IT In connection with the proposed business combination, Stellar has filed a preliminary proxy statement with the SEC and will mail a definitive proxy statement and other relevant documents to its shareholders . Investors and security holders of Stellar are advised to read, when available, the preliminary proxy statement, and amendments thereto, and the definitive proxy statement in connection with Stellar’s solicitation of proxies for its extraordinary shareholders’ meeting to be held to approve the proposed business combination with Phunware and related matters because the proxy statement will contain important information about the proposed business combination and the parties thereto . The definitive proxy statement will be mailed to stockholders of Stellar as of a record date to be established for voting on the proposed business combination . Stockholders will also be able to obtain copies of the proxy statement, without charge, once available, at the SEC’s website at www . sec . gov . PARTICIPANTS IN SOLICITATION Stellar, Phunware , and their respective directors, executive officers and other members of their management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of Stellar shareholders in connection with the proposed business combination . Investors and security holders may obtain more detailed information regarding the names, affiliations and interests in Stellar of directors and officers of Stellar in Stellar’s proxy statement as described above . Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to the Stellar’s shareholders in connection with the proposed business combination will be set forth in the proxy statement for the proposed business combination . Information concerning the interests of Stellar’s and Phunware’s participants in the solicitation, which may, in some cases, be different than those of Stellar’s and Phunware’s equity holders generally, will be set forth in the proxy statement relating to the proposed business combination . 2

TRANSACTION SUMMARY © 2018 Phunware, Inc. 3

Parties to the Business Combination Stellar Acquisition III, Inc. (“Stellar”, NASDAQ: STLR), a special purpose acquisition company (SPAC), completed a $70.4 million IPO (1) in September 2016 Stellar’s management team has successfully completed two prior SPAC transactions Announced business combination with Phunware on February 28, 2018 Cash in Trust: $ 37.1 million post - extension, Redemption price: $ 10.445/share (2 ) Phunware, Inc. (“Phunware” or the “Company”) is the only fully integrated software platform that equips Fortune 500 companies to engage, manage, and monetize their mobile application portfolios globally at scale 2+ billion Phunware IDs, 1 billion monthly active unique devices (MAUDs) Hundreds of mobile apps; platform touches 1 in 10 devices worldwide Founded in 2009, the Company is headquartered in Austin, Texas and has 178 employees Highly experienced management team led by Co - Founder and Chief Executive Officer, Alan S. Knitowski − Founder and CEO, Vovida Networks (acquired by Cisco Systems) − Founder and Director, Telverse Communications (acquired by Level 3 Communications) − Director, vCIS (acquired first by Internet Security Systems and subsequently by IBM) Phunware has initiated the launch of the PhunCoin token rights sale for $ 100 million to build a data - driven value exchange connecting consumers, developers, and brands 4 Closed a business combination to create Star Bulk Carriers Corp. (NASDAQ: SBLK) in December 2007; acquired a fleet of dry - bulk carriers for a purchase price of $345 million ▪ Produced ~104% arbitrage SBLK’s current NASDAQ market capitalization is ~$850 million SPAC I – Star Maritime Acquisition Corp. (AMEX:SEA) SPAC II – Nautilus Marine Acquisition Corp. (NASDAQ:NMAR) Closed a business combination to create Nautilus Offshore Inc. in February 2013; acquired a fleet of offshore vessels and contracts with Brazilian oil company Petrobras Produced ~64% arbitrage Nautilus merged into DryShips (NASDAQ: DRYS) in October 2015 Investors achieved 60%+ IRR © 2018 Phunware, Inc. (NASD: SBLK) (NASD: DRYS) (1) Includes partial exercise of the over - allotment option and proceeds from the private placements with Stellar Sponsors. (2) As of June 25, 2018.

Board of Directors – Post - Transaction © 2018 Phunware, Inc. 5 Executive Directors Founder and CEO, Vovida Networks (acquired by Cisco Systems) Founder and Director, Telverse Communications (acquired by Level 3 Communications) Director, vCIS (acquired first by Internet Security Systems and then IBM) Cisco Systems, Nortel Networks, US Army, Curo Capital, Ecewa Capital Group MSIE, Georgia Tech, MBA, UC Berkeley and BSIE, University of Miami (FL) Alan S. Knitowski CEO, Phunware Akis Tsirigakis Chairman, President and Co - CEO, Stellar Co - Founder, President, and ex - CEO of Star Bulk Carriers Corp, (NASDAQ:SBLK) and Star Maritime (AMEX:SEAS), Co - Founder and ex - CEO of Nautilus Marine Acquisition (NASDAQ:NMAR) Ex - Board member of NASDAQ:ORIG and NASDAQ:DRYS 35 - year veteran in maritime/energy, 13 years in corporate finance and SPACs General Partner/CEO, Seven Seas Investment Fund, Luxembourg M.S. and B.Sc., University of Michigan , Ann Arbor Three(3) additional Directors to be nominated by Phunware, at least two (2) of which will be independent Directors under Nasdaq requirements (selection in process) Independent Directors Note: Prior to the stockholder vote, Phunware will designate another three (3) directors, at least two (2) of whom will be in dep endent directors under NASDAQ requirements. Co - Founder and ex - CFO of Star Bulk Carriers Corp, (NASDAQ:SBLK) and Star Maritime (AMEX:SEAS), Co - Founder and ex - CFO of Nautilus Marine Acquisition (NASDAQ:NMAR) Director and ex - President, CEO of BTHGX Inc, (data encryption / georeplication ) 25 years in corporate finance and transportation/energy management, 13 years of SPAC experience MBA, Northwestern University (Kellogg) and B.Sc. Industrial Engineering, Roosevelt University George Syllantavos , Co - CEO and CFO, Stellar Co - Founder and Managing Partner, TEXO Ventures Sole Founder and Managing Partner, Novē Ventures Executive Director, Central Texas Angel Network (CTAN) BS, United States Military Academy at West Point and MBA, McCombs School of Business at UT - Austin Kauffman Fellow and member of the Young Entrepreneur Council (YEC) Randall Crowder COO, Phunware

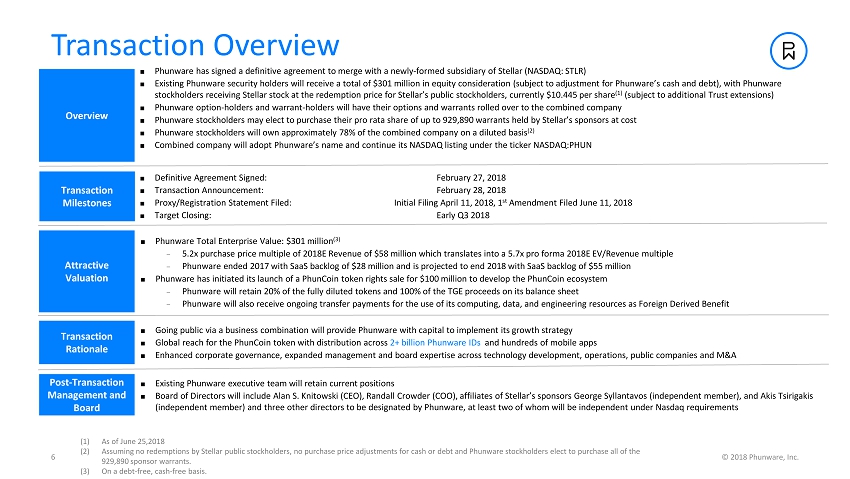

Transaction Overview Overview Attractive Valuation Phunware Total Enterprise Value: $301 million (3) − 5.2x purchase price multiple of 2018E Revenue of $58 million which translates into a 5.7x pro forma 2018E EV/Revenue multiple − Phunware ended 2017 with SaaS backlog of $28 million and is projected to end 2018 with SaaS backlog of $55 million Phunware has initiated its launch of a PhunCoin token rights sale for $100 million to develop the PhunCoin ecosystem − Phunware will retain 20% of the fully diluted tokens and 100% of the TGE proceeds on its balance sheet − Phunware will also receive ongoing transfer payments for the use of its computing, data, and engineering resources as Foreign De rived Benefit Transaction Rationale Going public via a business combination will provide Phunware with capital to implement its growth strategy Global reach for the PhunCoin token with distribution across 2+ billion Phunware IDs and hundreds of mobile apps Enhanced corporate governance, expanded management and board expertise across technology development, operations, public comp ani es and M&A 6 © 2018 Phunware, Inc. Post - Transaction Management and Board Existing Phunware executive team will retain current positions Board of Directors will include Alan S. Knitowski (CEO), Randall Crowder (COO), affiliates of Stellar’s sponsors George Syllantavos (independent member), and Akis Tsirigakis (independent member) and three other directors to be designated by Phunware, at least two of whom will be independent under N asd aq requirements (1) As of June 25,2018 (2) Assuming no redemptions by Stellar public stockholders, no purchase price adjustments for cash or debt and Phunware stockholders elect to purchase all of the 929,890 sponsor warrants. (3) On a debt - free, cash - free basis. Phunware has signed a definitive agreement to merge with a newly - formed subsidiary of Stellar (NASDAQ: STLR) Existing Phunware security holders will receive a total of $301 million in equity consideration (subject to adjustment for Ph unw are’s cash and debt), with Phunware stockholders receiving Stellar stock at the redemption price for Stellar’s public stockholders, currently $10.445 per share (1) (subject to additional Trust extensions) Phunware option - holders and warrant - holders will have their options and warrants rolled over to the combined company Phunware stockholders may elect to purchase their pro rata share of up to 929,890 warrants held by Stellar’s sponsors at cost Phunware stockholders will own approximately 78% of the combined company on a diluted basis (2) Combined company will adopt Phunware’s name and continue its NASDAQ listing under the ticker NASDAQ:PHUN Transaction Milestones Definitive Agreement Signed: February 27, 2018 Transaction Announcement: February 28, 2018 Proxy/Registration Statement Filed: Initial Filing April 11, 2018, 1 st Amendment Filed June 11, 2018 Target Closing: Early Q3 2018

Pro Forma Capitalization and Ownership 7 © 2018 Phunware, Inc. Note: No additional funds are included other than existing cash; Phunware cash, net of debt, at closing increases rollover equity. Certain Phunware stockholders (including officers, directors, and holders of more than one percent (1%) of the outstanding eq uit y of Phunware as of immediately prior to the Closing) and Sponsors shall enter into lock - up agreements, whereby each such indivi dual or entity agrees not to, during the period commencing from the Closing and ending on the earlier of (x) one hundred and eighty (180) days after the date of the Closing, an d (y) the date after the Closing on which the combined company consummates a liquidation, merger, share exchange or other sim ila r transaction with an unaffiliated third party that results in all of the combined company’s stockholders having the right to exchange their equity holdings in Purchaser for cash, secur iti es or other property, enter into certain transfer transactions, which are subject to customary exclusions. (1) Equity consideration issued to existing Phunware stockholders, option holders and warrant holders rolled over as a part of $3 01 million enterprise value; Phunware cash, net of debt, at closing increases the rollover equity. (2) As of June 25, 2018. (3) Stellar is currently seeking additional financing which may be in the form of convertible preferred equity. Assumes that addi tio nal financing is issued at the redemption price per share (4) Excludes (i) warrants to purchase 6,900,610 shares of Stellar common stock issued in the IPO (ii) 7,970,488 Sponsor Warrants; each holder of Phunware Stock shall be entitled to elect to receive such holder's pro rata share of up to an aggregate of 929,890 warrants to purchase shares of Stellar common stock that are currently held by Stellar's sponsors (the "Transferred Sponsor Warrants"), and (iii) Underwriter purchase option for 130,000 units. Phunware shareholder information based on $301 million enterprise value divided by $10.445 liquidation value. Actual values will differ based, among other things, on the number and exercise prices of outstanding warrants and options of Phunware. (5) Based on trust value per share of $ 10.445 (as of June 25, 2018). ($ and shares in millions) Proposed Sources Pro Forma Ownership (Diluted) (4) Shares % Ownership Rollover Equity (1) $301.0 Phunware Securityholders 28.8 78.2% SPAC Cash in Trust (2) 37.1 Stellar Shareholders 5.7 15.3% Expected Phunware Cash at Closing 0.0 New Shareholders (3) 2.4 6.5% Additional Financing (3) 25.0 Pro Forma Outstanding Shares 36.9 100.0% Total Sources $363.1 Pro Forma Capitalization (Diluted) Proposed Uses Pro Forma Cash $53.0 Stock Consideration $301.0 Debt 1.8 Cash to Balance Sheet 53.0 Net Debt ($51.2) Estimated Transaction Costs 9.1 Equity Capitalization at Closing (5) $385.1 Total Uses $363.1 Pro Forma Enterprise Value $333.9 Pro Forma Transaction Multiples (Diluted) Enterprise Value / 2018E Revenue 5.8x Enterprise Value / 2019E Revenue 4.2x

Attractive Valuation Relative to Peers 8 © 2018 Phunware, Inc. (1) Analysis of the share price performance of Advanced Micro Devices, Overstock.com, Square, and NVIDIA. Source: SEC filings, CapIQ (data as of June 12, 2018). A sum of the parts analysis of comparable SaaS and Media / DaaS companies including expected proceeds from the Company’s TGE implies an enterprise valuation of $ 473 million, which is at a 57 % premium to the deal value of $ 301 million The addition of the Phuncoin ecosystem is expected to add up to $ 100 million, as well as 20 % of the fully diluted tokens to Phunware’s balance sheet without diluting shareholders Public Comparable Companies Price as of % 52-week Δ Equity Enterprise Revenue Growth EV / Revenue Company Name Ticker 6/12/2018 Low High Value Value CY17-CY18 CY18-CY19 CY18E CY19E ($ in millions) SaaS Proofpoint, Inc. PFPT $125.63 52% (4%) $6,388 $6,472 37% 28% 9.2x 7.2x Zendesk, Inc. ZEN 58.26 132% (0%) 6,091 5,793 33% 29% 10.1x 7.9x Okta, Inc. OKTA 52.94 146% (13%) 5,644 5,414 37% 31% 15.2x 11.6x Twilio Inc. TWLO 59.97 158% (0%) 5,744 5,453 36% 23% 10.0x 8.1x Coupa Software Incorporated COUP 62.07 118% (1%) 3,538 3,288 26% 24% 14.0x 11.3x Alteryx, Inc. AYX 39.64 118% (4%) 2,402 2,209 41% 32% 11.9x 9.0x AppFolio, Inc. APPF 62.50 103% (2%) 2,136 2,090 27% 23% 11.5x 9.3x Talend S.A. TLND 58.40 73% (2%) 1,730 1,642 37% 28% 8.1x 6.3x Mean 34% 27% 11.2x 8.8x Media / DaaS The Trade Desk, Inc. TTD $90.77 123% (1%) $3,823 $3,694 41% 27% 8.5x 6.7x Criteo S.A. CRTO 29.39 40% (45%) 1,950 1,539 8% 12% 1.5x 1.3x QuinStreet, Inc. QNST 13.83 312% (6%) 652 605 30% 7% 1.4x 1.3x SITO Mobile, Ltd. SITO 3.13 17% (64%) 79 75 9% 45% 1.6x 1.1x Mean 22% 23% 3.3x 2.6x Phunware $301 117% 36% 5.2x 3.8x Sum of the Parts Analysis ($ in millions) Statistic Mean Multiples Implied Valuation 2018E Revenue - SaaS $23 11.24x $259 2018E Revenue - Media / DaaS $35 3.26x $114 TGE Proceeds $100 Total Enterprise Value $473 Implied 2018E Revenue Multiple 8.1x Deal Value $301 Implied 2018E Revenue Multiple 5.2x Arbitrage 57%

WHO IS PHUNWARE? © 2018 Phunware, Inc. 9

Phunware Executive Team © 2018 Phunware, Inc. 10 Global Technology Finance Lead, Sony Computer Entertainment Head of Worldwide Financial Planning and Analysis, Midway Games MBA, San Diego State University and BA, UC San Diego Matt Aune CFO, Phunware Co - Founder and Managing Partner, TEXO Ventures Sole Founder and Managing Partner, Novē Ventures Executive Director, Central Texas Angel Network (CTAN) BS, United States Military Academy at West Point and MBA, McCombs School of Business at UT - Austin Kauffman Fellow and member of the Young Entrepreneur Council (YEC) Randall Crowder COO, Phunware Founder and CEO, Vovida Networks (acquired by Cisco Systems) Founder and Director, Telverse Communications (acquired by Level 3 Communications) Director, vCIS (acquired first by I nternet Security Systems and t hen IBM) Cisco Systems, Nortel Networks, US Army, Curo Capital, Ecewa Capital Group MSIE, Georgia Tech, MBA, UC Berkeley and BSIE, University of Miami (FL) Alan S. Knitowski CEO, Phunware Founder, EVP and CTO, Vovida Networks (acquired by Cisco Systems) Advisor and Architect, Telverse Communications (acquired by Level 3 Communications) Advisor, Bitfone (acquired by Hewlett - Packard) Cisco Systems, Nortel Networks, Unisys, Curo Capital, Sagoso Capital MSCS, Stanford and BSCE, UC San Diego Luan Dang CTO, Phunware CEO, Simplikate Systems (acquired by Phunware) 25 - year veteran of technology - based solutions Merged web company he founded with other web shops into USWeb , culminating in IPO valuation over $1B within 2 years BBA Marketing, UT - Austin Tushar Patel EVP Corporate Development, Phunware President and CTO, Simplikate Systems (acquired by Phunware) 15+ years of leadership and innovation in technology architecture, management, implementation and maintenance of cloud - based SaaS platforms (ERP/CRM, PMS, VoIP, etc.) Developed groundbreaking patent pending mobile solutions for the real estate industry BS, DePaul University, Chicago Matt Lindenberger VP Engineering, Phunware

Global investor and customer base provides unmatched distribution for Phunware’s platform Top - Tier Investors and Customers © 2018 Phunware, Inc. Investors Indicative Customers by Industry 11 Real Estate Gaming Healthcare Retail Aviation Sports Media & Ent. 6 Financing Rounds Raised >$100 million

PHUNWARE’s Services Phunware, Inc. is the only fully integrated software platform that equips companies with the products, solutions and services necessary to engage, manage and monetize their mobile application portfolios globally at scale. • Licenses - out enterprise mobile software via period contracts. Services include content management, location - based services, marketing automation, business intelligence and analytics, alerts, notifications and messaging, audience engagement, audience monetization, vertical solutions and crypto - networking • Application Framework in modular form for developers and publishers building their own mobile applications in - house; • Transactional Media Services for mobile audience building and activation, application discovery, brand awareness, user engagement, user monetization and more; and • Data for audience insights, campaign engagement and business process optimization. © 2018 Phunware, Inc. 12 PHUNWARE is the only integrated service provider of its kind

Mobile Application Lifecycle Management 13 STRATEGIZE Application experience definition: devices, operating systems, feature sets and use cases LAUNCH Application discovery: user acquisition and audience building CREATE Application portfolio completion: build, buy or lease DISTRIBUTE + MONETIZE Data - driven value exchange 1 BILLION active devices © 2018 Phunware, Inc. Phunware’s Multiscreen as a Service ( MaaS ) platform provides the entire mobile lifecycle of applications, media and data in one login through one procurement relationship.

Customer Highlights 14 © 2018 Phunware, Inc. • Develop, manage and support streaming capabilities for 500+ hours of live Olympics content (vs. 200 across all TV networks) • First mobile application to include Nielsen tags • Over 7 million iOS and 2.5 million Android users during the event • Downtime of less than 0.01% achieved for entire duration of coverage • Set record for largest live event mobile viewing audience (2+ million) at the time • Phunware vertical solution application uses Wi - Fi and beacons to help patients, visitors, employees, physicians and volunteers navigate hospital facilities • Provides directions within the hospital, physician and department information and an up - to - date news feed • Deploying across all 39 facilities of this nationwide hospital system Dignity Health Compass NBC Live: Sochi Olympic Games

Customer Highlights (cont’d) 15 © 2018 Phunware, Inc. • iOS and Android app for billion - dollar mixed - use development using Phunware vertical solution and platform SDKs • Shoppers: access directory and transportation info, receive turn - by - turn directions to any point of interest, reserve amenities and more • Residents: view and reserve property amenities, manage work orders and visitors and receive package delivery notifications • Staff: manage deliveries, calendars, resident communication, visitors, work orders and more • Develop, manage and support application portfolio for streaming full episodes of FOX, FX, FXX Originals and National Geographic shows live or on demand • Over 2 million users in 2017 • Multi - platform availability: iOS, Android, TVOS and fireTV (Kindle) • 2017 Cablefax Digital Awards “App for Smartphone” Winner FOX NOW Brickell City Centre (BCC)

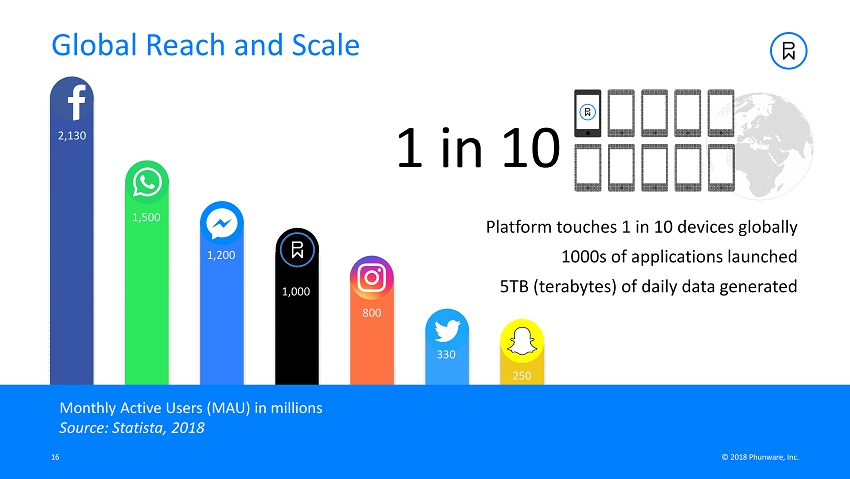

Monthly Active Users (MAU) in millions Source: Statista , 2018 Global Reach and Scale 16 Platform touches 1 in 10 devices globally 1000s of applications launched 5TB (terabytes) of daily data generated 1 in 10 2,130 © 2018 Phunware, Inc. 1,500 1,200 1,000 800 330 250

Over 90% of revenue derived from recurring multi - year software and data subscriptions (SaaS/ DaaS ) and reoccurring transactions 2017 Backlog: $27.8M $ 8 .4M Deferred Revenue $18.7M Deferred Revenue Financial Highlights and Estimates 17 © 2018 Phunware, Inc. Revenue Mix Backlog 2018 Backlog: $55.4M $17 $23 $40 $59 $10 $35 $39 $52 $27 $58 $79 $111 $0 $20 $40 $60 $80 $100 $120 $140 2017 2018E 2019E 2020E SaaS Media/DaaS (Fiscal year ending December 31; $ in millions)

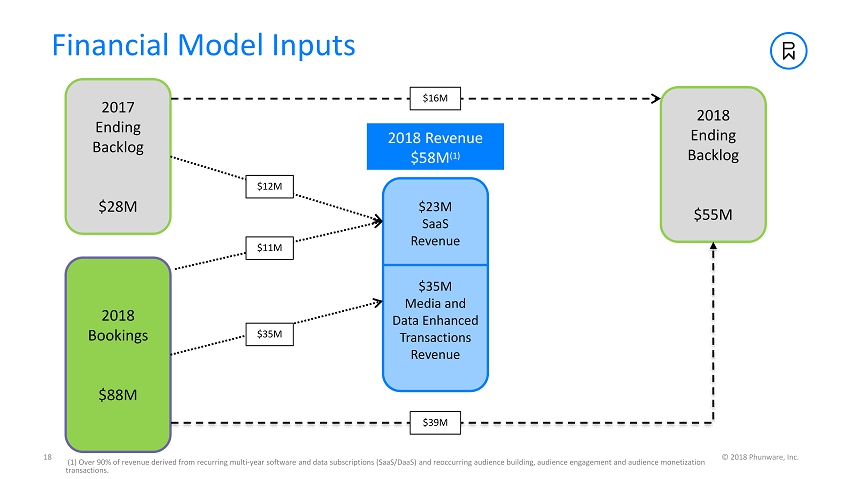

(1) Over 90% of revenue derived from recurring multi - year software and data subscriptions (SaaS/ DaaS ) and reoccurring audience building, audience engagement and audience monetization transactions. Financial Model Inputs 18 2017 Ending Backlog $28M 2018 Bookings $88M 2018 Revenue $58M (1) $23M SaaS Revenue $35M Media and Data Enhanced Transactions Revenue $12M $11M $35M 2018 Ending Backlog $55M $16M $39M © 2018 Phunware, Inc.

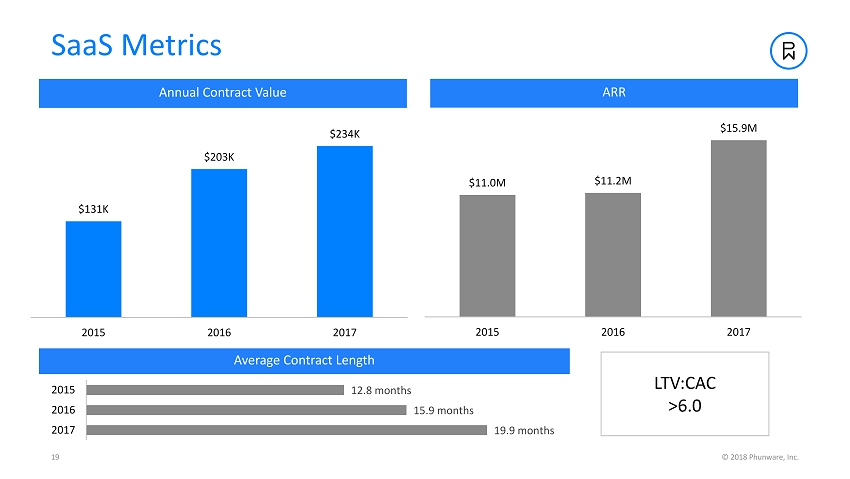

SaaS Metrics © 2018 Phunware, Inc. 19 $131K $203K $234K 2015 2016 2017 12.8 months 15.9 months 19.9 months 2015 2016 2017 $11.0M $11.2M $15.9M 2015 2016 2017 LTV:CAC >6.0 Annual Contract Value ARR Average Contract Length

EVOLUTION THROUGH PHUNCOIN © 2018 Phunware, Inc. 20

PhunCoin: a Real Token with Real Utility Phunware intends to raise capital via a token generation event (TGE) and launch PhunCoin − Secure, transparent and incentive - based way to connect businesses and target consumers directly − Neutralizes centralized intermediaries such as Facebook and Google Leveraging Phunware’s global MaaS platform, PhunCoin believes that it will be able to launch with tens of millions of crypto wallets in place on day one Because the PhunCoin Software Development Kit (SDK) would be embedded in Phunware’s App Framework, it could be embedded in applications licensed from Phunware, running a Phunware SDK or custom - built by Phunware Phunware’s corporate strategic investors and millions of users would provide a global PhunCoin distribution channel 21 © 2018 Phunware, Inc. ( Philippine Long Distance Telephone Company) Phunware would retain 20% of the fully diluted tokens and 50% of the TGE proceeds on its balance sheet Phunware would also receive ongoing transfer payments for the use of its computing, data and engineering resources as Foreign Derived Benefit

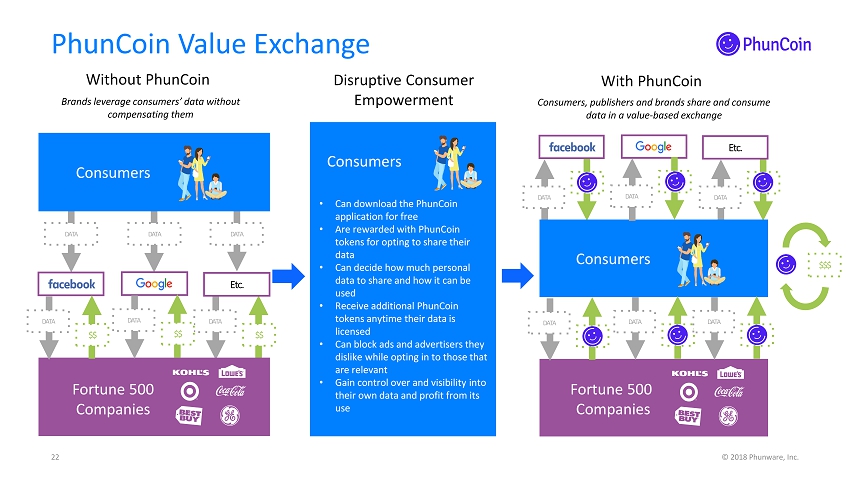

PhunCoin Value Exchange Without PhunCoin With PhunCoin DATA $$ DATA Etc. Consumers DATA DATA Fortune 500 Companies $$ DATA $$ DATA DATA DATA Etc. Fortune 500 Companies Consumers DATA DATA DATA DATA 22 © 2018 Phunware, Inc. Brands leverage consumers’ data without compensating them Consumers, publishers and brands share and consume data in a value - based exchange Disruptive Consumer Empowerment Consumers • Can download the PhunCoin application for free • Are rewarded with PhunCoin tokens for opting to share their data • Can decide how much personal data to share and how it can be used • Receive additional PhunCoin tokens anytime their data is licensed • Can block ads and advertisers they dislike while opting in to those that are relevant • Gain control over and visibility into their own data and profit from its use $$$

Token Rights Sale Launch Initiated in June 2018 23 © 2018 Phunware, Inc. Phunware Initiated the Launch of a $100 Million PhunCoin Token Rights Sale “The PhunCoin ecosystem is intended to complement and accelerate Phunware’s core business as an enterprise cloud platform for mobile …” “New token ecosystem boasts early crypto investors BlockTower Capital, DNA, Draper Venture Network, Wavemaker Genesis, Strong Ventures and Hazoor Partners …” “We look to invest in projects like PhunCoin that bridge the gap between cryptocurrency and real - world users …” Ari Paul, CIO & Managing Partner, BlockTower Capital PhunCoin is a Regulation D, Rule 506(c) offering for accredited investors who have successfully completed third - party KYC / AML process via CoinList at https://complyapi.coinlist.co/phuncoin .

PhunCoin Leverages Phunware’s Enormous Ecosystem Today, the system allows intermediaries such as Facebook and Google to profit from consumer data provided to them for free by users PhunCoin tokens would enable consumers to regain control of their data by creating a value - based exchange Consumers, along with mobile users and publishers, would receive PhunCoin payouts based on how much data they choose to share Brands would get direct, real - time access to deterministic and intent - based data for their target customers Immediate scale based on existing 1 billion monthly active unique devices (MAUDs) 24 © 2018 Phunware, Inc. PhunCoin Market Opportunity PhunCoin will be a secure, transparent, and incentive - based way to connect brands and consumers directly, without third - party intermediaries such as Facebook and Google PhunCoin will provide a global rewards - based ecosystem of mobile applications and data that empowers and compensates consumers and app developers for the use of data related to their identity, behaviors and intent PhunCoin Benefits

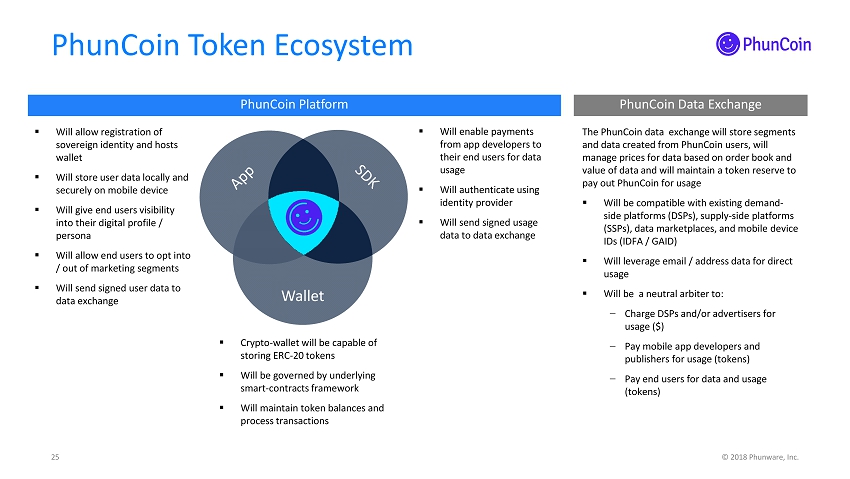

▪ Crypto - wallet will be capable of storing ERC - 20 tokens ▪ Will be governed by underlying smart - contracts framework ▪ Will maintain token balances and process transactions PhunCoin Token Ecosystem 25 © 2018 Phunware, Inc. ▪ Will allow registration of sovereign identity and hosts wallet ▪ Will store user data locally and securely on mobile device ▪ Will give end users visibility into their digital profile / persona ▪ Will allow end users to opt into / out of marketing segments ▪ Will send signed user data to data exchange ▪ Will enable payments from app developers to their end users for data usage ▪ Will authenticate using identity provider ▪ Will send signed usage data to data exchange The PhunCoin data exchange will store segments and data created from PhunCoin users, will manage prices for data based on order book and value of data and will maintain a token reserve to pay out PhunCoin for usage ▪ Will be compatible with existing demand - side platforms (DSPs), supply - side platforms (SSPs), data marketplaces, and mobile device IDs (IDFA / GAID) ▪ Will leverage email / address data for direct usage ▪ Will be a neutral arbiter to: − Charge DSPs and/or advertisers for usage ($) − Pay mobile app developers and publishers for usage (tokens) − Pay end users for data and usage (tokens) PhunCoin Data Exchange PhunCoin Platform Wallet

VISION AND STRATEGY © 2018 Phunware, Inc. 26

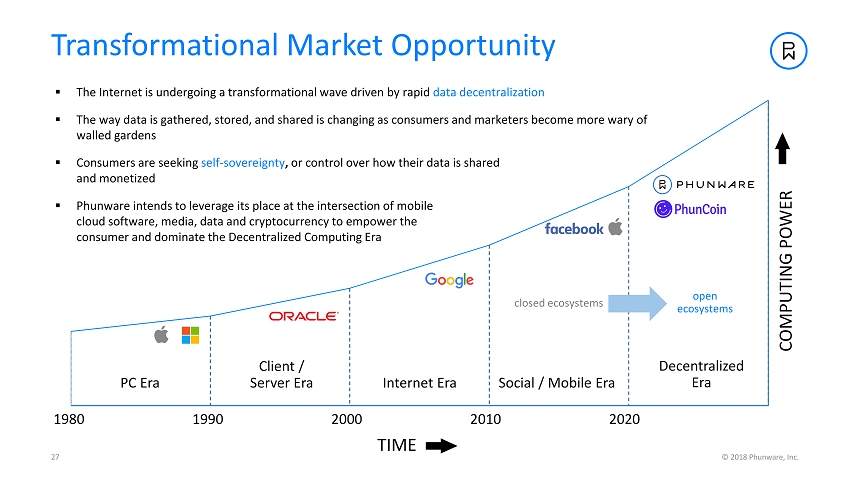

Transformational Market Opportunity 27 ▪ The Internet is undergoing a transformational wave driven by rapid data decentralization ▪ The way data is gathered, stored, and shared is changing as consumers and marketers become more wary of walled gardens ▪ Consumers are seeking self - sovereignty , or control over how their data is shared and monetized ▪ Phunware intends to leverage its place at the intersection of mobile cloud software, media, data and cryptocurrency to empower the consumer and dominate the Decentralized Computing Era COMPUTING POWER TIME PC Era Client / Server Era Internet Era Social / Mobile Era 1980 1990 2000 2010 2020 © 2018 Phunware, Inc. Decentralized Era closed ecosystems open ecosystems

Inorganic Growth Strategy ▪ Continue to identify, target and acquire value - enhancing platforms – Phunware is an experienced acquirer with 5 completed acquisitions to date ▪ Areas of acquisition interest include AI, big data, and mobile software (SaaS) ▪ Intend to utilize Transaction cash and public company shares for acquisitions Growth Strategy © 2018 Phunware, Inc. 28 Organic Growth Strategy ▪ Expand mobile products and services ▪ Deepen existing customer relationships and aggressively expand customer base through direct and indirect channels ▪ Continue growing domestic footprint and expand internationally ▪ Increase investment in sales and marketing post - closing to drive revenue growth − Per sector standard: every $1 to sales and marketing translates to over $6 of revenue − $20 million sales and marketing spend could add in excess of $120 million in incremental revenue, or $3.20/share (1) Opportunity to take part in creating a mobile technology bellwether with strong upside return potential based on growth strategy and transaction structure (1) Based on 38.2 million of pro forma shares outstanding post merger.

Users spend 66% of online time on mobile devices (2) Mobile advertising revenue now 54% of all digital ad revenues (2) Big data market growing from $130 billion in 2016 to $203 billion in 2020 (3) (11.7% CAGR) 175 billion app downloads annually (1) (+60% since 2015) $86 billion in worldwide mobile app spending (1) (+105% since 2015) The average user spends 43 days per year in apps (1) The average user accesses ~40 apps per month (1) Global cryptocurrency market cap currently $369 billion (4) $15 billion average daily trading volume across all cryptocurrencies (4) Altcoins (ex - bitcoin) now make up 59% of total cryptocurrency market cap (up from 15% a year ago) (4) MAUs for the largest cryptocurrency mobile app quadrupled in 2H - 2018 to 8 million (1) CRYPTOCURRENCY MEDIA AND DATA Massive Addressable Market 29 © 2018 Phunware, Inc. Additive and rapidly expanding multi - billion dollar addressable markets (1) AppAnnie (2) IAB (3) IDC (4) Coinmarketcap.com APPLICATIONS

MEDIA AND DATA Global mobile footprint Platform touches 1 in 10 devices worldwide 2+ billion Phunware IDs 1 billion monthly active unique devices (MAUDs) 1 trillion database events APPLICATIONS Fortune 500 customer base Over 5,000 apps deployed Embedded within core customer business processes Recurring, multi - year contracts 141% net dollar retention rate for CY 2017 $28M backlog CRYPTOCURRENCY Self - sovereign identity Decentralized data Distributed compute 1 - to - 1 consumer and marketer value exchange PhunCoin ecosystem The Phunware Multiscreen as a Service (MaaS) Platform © 2018 Phunware, Inc. 30 Phunware’s goal is to touch every connected device on Earth

PhunCoin Ecosystem The Phunware MaaS Platform (cont’d) 31 Vertical Application Solutions Horizontal Application Platform Products Location - Based Services Alerts and Notifications Analytics Content Management Marketing Automation Audience Building, Engagement and Monetization Branded Mobile Applications WWE, CW, Fox, Revolt, NBC Sports, NASCAR, Etc. Application Portfolio Services BIG DATA Virtual Applications Live Event F lagship Portfolios Physical Applications Venue Portfolios Phunware IDs Indoors and Outdoors Aviation (Airports) Retail (Malls / Shopping Centers) Healthcare (Hospitals / Health Systems) Real Estate (Resorts / Hotels / Condos) Sports (Stadiums / Arenas) Other (Museums / Schools / etc.) © 2018 Phunware, Inc.

RECAP © 2018 Phunware, Inc. 32

Investment Highlights © 2018 Phunware, Inc. 33 World Scale Mobile Platform Pioneering Multiscreen as a Service (MaaS) platform, the only fully integrated software platform that equips the Fortune 500 to engage, manage and monetize their mobile application portfolios globally at scale Provides everything brands need to create “sticky” experiences throughout the entire mobile application lifecycle Inventory of more than 2 billion Phunware IDs across hundreds of mobile application portfolios, more than 1 billion monthly a cti ve devices and more than 1 trillion database events Experienced Management Team and Board Experienced senior team of industry experts with experience in scaling high - growth tech companies Top - tier board of directors with complementary domain and operational expertise Strong Financial Profile Over 90% of revenue derived from recurring multi - year software and data subscriptions (SaaS/DaaS) and reoccurring audience build ing, audience engagement and audience monetization transactions Strong revenue visibility – SaaS backlog of $28 million at the end of 2017 and $ 58 million projected for 2018 141% net dollar retention rate for CY 2017 Massive Market Opportunity Mobile Applications : The mobile application market is enormous, with worldwide smartphone users downloading more than 175 billion apps — and spending over $86 billion on them — in 2017 alone (Source: App Annie , 2017) Media : Users spend 66% of their online time on a mobile device and mobile advertising revenue now makes up 54% of all digital ad revenues (Source: IAB , 2017) Big Data : According to IDC, the big data and business analytics market will grow from $130 billion in 2016 to more than $203 billion in 2020 (Source: IDC , 2016) World - Class Financial Sponsors and Backers Phunware is backed by blue chip strategic and financial investors including Cisco, PLDT ( Philippine Long Distance Telephone Company) , Samsung, Wavemaker Partners and WWE The Stellar team has completed two successful SPAC transactions and has significant public company experience

Appendix 34 © 2018 Phunware, Inc.

Resources and Geography of Staff AUSTIN MIAMI CANADA REMOTE SAN DIEGO NEWPORT BEACH 75 1 9 30 53 9 1 LONDON CREATIVE QA / QC OTHER PROD & ENG SALES & MKT OPS 178 Employees 35 12 33 84 14 26 9 © 2018 Phunware, Inc. Employees

Intellectual Property Summary

© 2018 Phunware, Inc. ISSUED PATENTS 1. Method and System for Accessing Wireless Account Information (Patent # 7,979,350) 2. Server - Side Wireless Communications Link Support for Mobile Handheld Devices (Patent # 8,009,619) 3. Client - Side Wireless Communications Link Support for Mobile Handheld Devices (Patent # 8,060,594) 4. Server Method and System for Rendering Content on a Wireless Device (Patent # 8,103,865) 5. Method and System for Rendering Content on a Wireless Device (Patent # 8,478,245 & Patent # 8,989,715) 6. Server Method and System for Executing Applications on a Wireless Device (Patent # 8,560,601) 7. Methods and Systems for Interactive User Interface Objects (Patent # 8,732,619) 8. Enterprise Branded Application Frameworks for Mobile and Other Environments (Patent # 8,788,358) 9. Geo - Fence Entry and Exit Notification System (Patent # 8,812,024 & Patent # 8,812,027) 10. Method and System for Customizing Content on a Server for Rendering on a Wireless Device (Patent # 9,015,692) 11. [ALLOWED] Systems and Methods for Indoor and Outdoor Mobile Device navigation (US Patent App. # 15/061,933) (unpublished) PENDING PATENTS 1. System and Method for Leveraging Device Location for Targeting Hyper - Localized Mobile Advertisements (Application # 13/943,746) 2. Location Based Coupon Delivery System (Application # 12/477,220) 3. System and Method for Adaptive Use of Geofence Parameters (Application # 14/216,729) 4. System and Methods for Device Identification (Provisional Application # 62/060,402) (Application # 14/874,352) 5. Monitoring Outdoor and Indoor Regions with Mobile Devices (Provisional Application # 62/091,120) (Application # 14/968,240) 6. Systems and Methods for Enterprise Branded Application Frameworks for Mobile and Other Environments (Application # 14/336,960) 7. Methods and Systems for Interactive User Interface Objects (Application # 14/279,269) 8. Mobile Device Localization Based on Relative Received Signal Strength Indicators (Provisional Patent Application # 62/358,465)