Attached files

| file | filename |

|---|---|

| 8-K - 2018 INVESTOR PRESENTATION - HEARTLAND FINANCIAL USA INC | form8-kinvestorpresentatio.htm |

Investor Presentation 1Q 2018 Update Lynn B. Fuller Chairman and CEO Bryan R. McKeag Chief Financial Officer Trading Symbol: HTLF | www.htlf.com

Safe Harbor This presentation may contain, and future oral and written statements of the Company and its management may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, plans, objectives, future performance and business of the Company. Forward-looking statements, which may be based upon beliefs, expectations and assumptions of the Company’s management and on information currently available to management, are generally identifiable by the use of words such as believe, expect, anticipate, plan, intend, estimate, may, will, would, could, should or similar expressions. Additionally, all statements in this release, including forward-looking statements, speak only as of the date they are made, and the Company undertakes no obligation to update any statement in light of new information or future events. A number of factors, many of which are beyond the ability of the Company to control or predict, could cause actual results to differ materially from those in its forward-looking statements. These factors include, among others, the following: (i) the strength of the local and national economy; (ii) the economic impact of past and any future terrorist threats and attacks and any acts of war or threats thereof, (iii) changes in state and federal laws, regulations and governmental policies concerning the Company’s general business; (iv) changes in interest rates and prepayment rates of the Company’s assets; (v) increased competition in the financial services sector and the inability to attract new customers; (vi) changes in technology and the ability to develop and maintain secure and reliable electronic systems; (vii) the loss of key executives or employees; (viii) changes in consumer spending; (ix) unexpected results of acquisitions; (x) unexpected outcomes of existing or new litigation involving the Company; and (xi) changes in accounting policies and practices. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. Additional information concerning the Company and its business, including other factors that could materially affect the Company’s financial results, is included in the Company’s filings with the Securities and Exchange Commission. 2

Agenda Heartland’s growth story Key tenets of Heartland’s business model Financial highlights 3

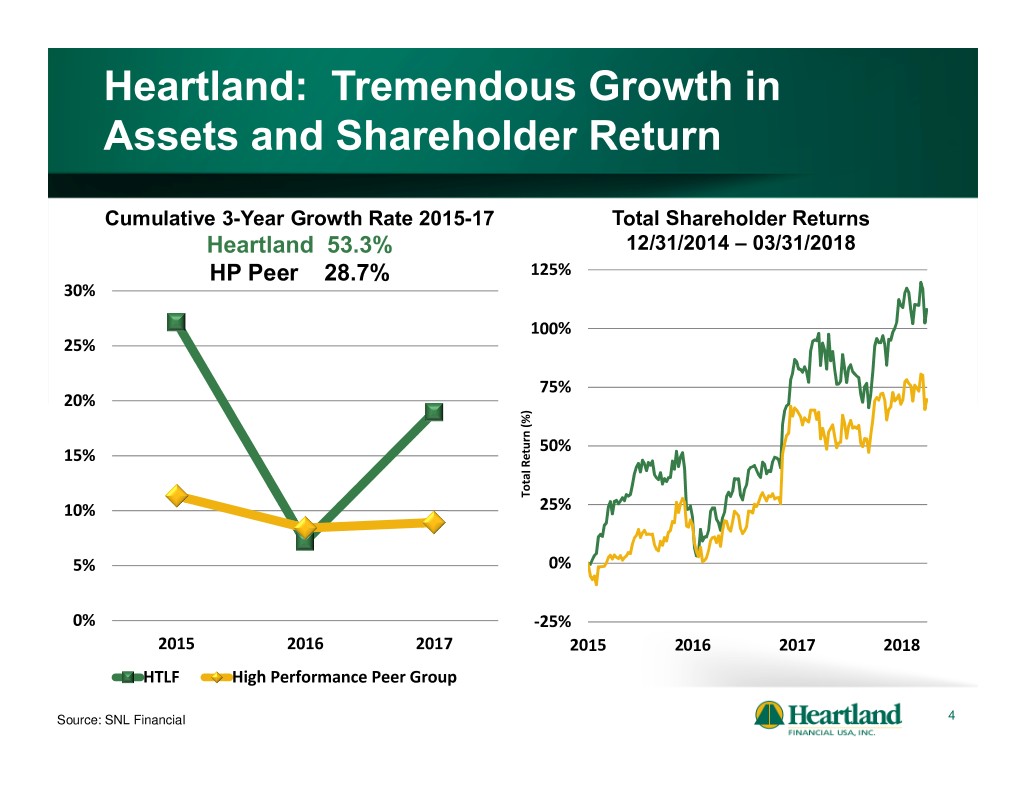

Heartland: Tremendous Growth in Assets and Shareholder Return Cumulative 3-Year Growth Rate 2015-17 Total Shareholder Returns Heartland 53.3% 12/31/2014 – 03/31/2018 HP Peer 28.7% 125% 30% 100% 25% 75% 20% 50% 15% Total Return(%) 10% 25% 5% 0% 0% -25% 2015 2016 2017 2015 2016 2017 2018 HTLF High Performance Peer Group Source: SNL Financial 4

Heartland’s Exceptional Performance is Reflected in its Stock Appreciation Total Index Total Return (%) From 12/31/2007 - 3/31/2018 300 250 200 150 100 50 Total Return(%) 0 -50 -100 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 HTLF S&P 500 SNL Small Cap U.S. Bank SNL Mid Cap U.S. Bank SNL Large Cap U.S. Bank 5 As of March 31, 2018 Source: SNL Financial

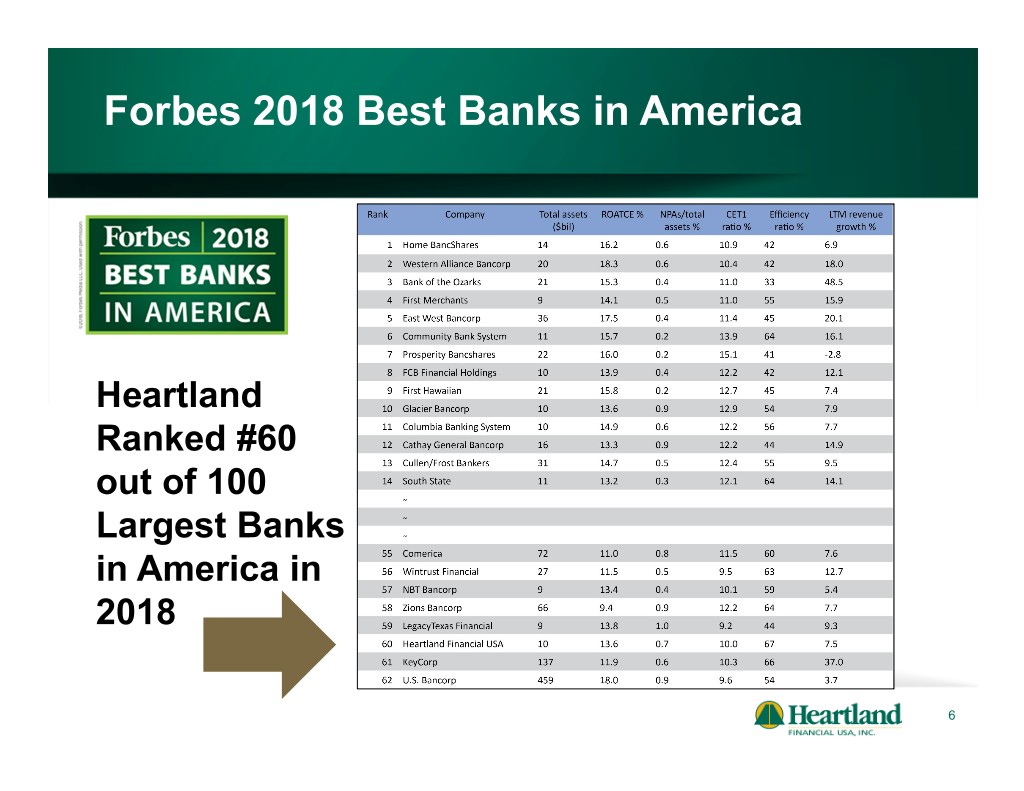

Forbes 2018 Best Banks in America Heartland Ranked #60 out of 100 Largest Banks in America in 2018 6

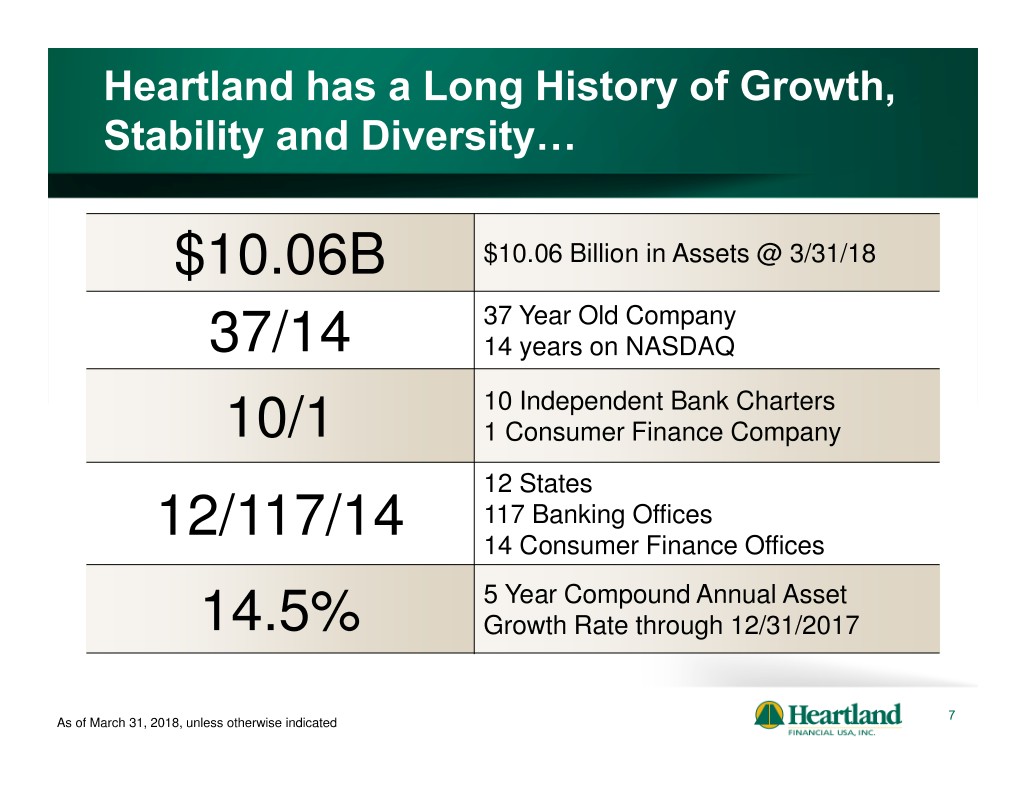

Heartland has a Long History of Growth, Stability and Diversity… $10.06B $10.06 Billion in Assets @ 3/31/18 37 Year Old Company 37/14 14 years on NASDAQ 10 Independent Bank Charters 10/1 1 Consumer Finance Company 12 States 117 Banking Offices 12/117/14 14 Consumer Finance Offices 5 Year Compound Annual Asset 14.5% Growth Rate through 12/31/2017 7 As of March 31, 2018, unless otherwise indicated

…and Heartland also has a Tremendous History of Earnings 0 Never an annual loss History of Doubling Earnings 2x and Assets Every 5 to 7 Years (1) (2) 3 Year Average Annual ROTCE through 13.5% / 14.0% 12/31/17 (1) (2) 3 Year Compound Annual EPS Growth 6.6% / 11.2% Rate through 12/31/17 37 Consecutive Years of Level 37 or Increased Dividends $1.65B Market Cap (as of 3/31/18) Significant Inside Ownership by the Board 6.6% and Executive Officers (as of 1/31/18) As of March 31, 2018 unless otherwise specified (1) As reported 8 (2) Excluding $10.4 million Deferred Tax charge in 2017

An Expanding Franchise Heartland Financial USA, Inc. 10 INDEPENDENT BANK CHARTERS 117 OFFICES 89 COMMUNITIES 9 As of March 31, 2018

Expansion Timeline Company History 10 As of May 31, 2018

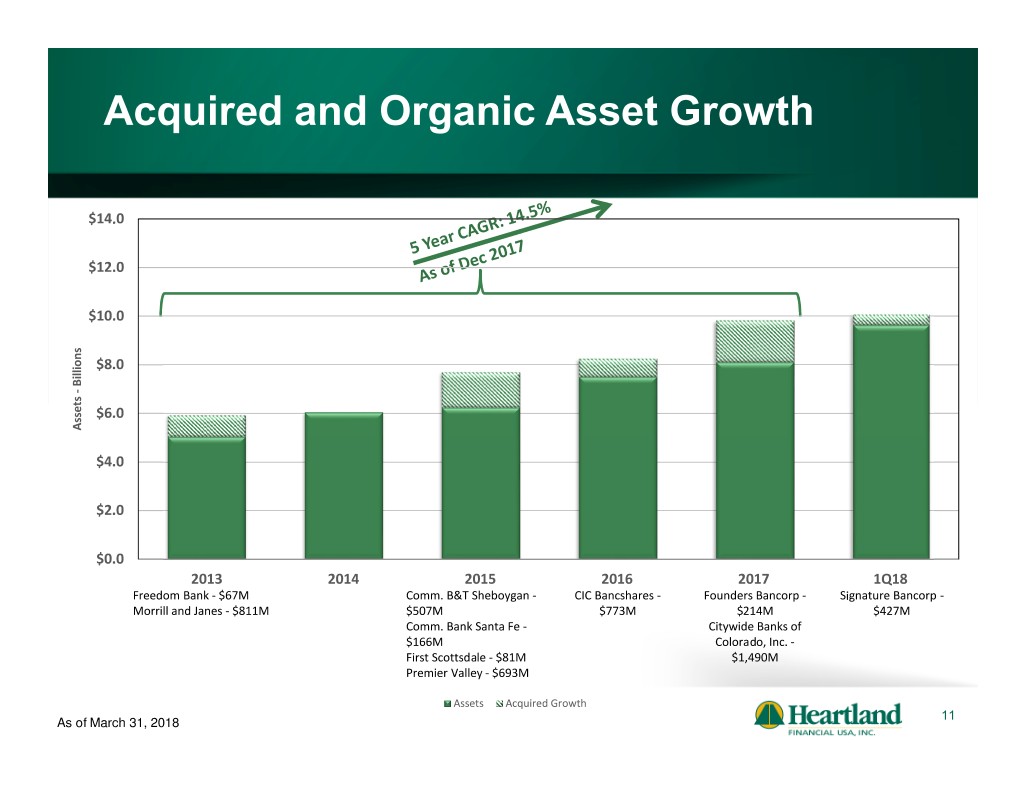

Acquired and Organic Asset Growth $14.0 $12.0 $10.0 $8.0 $6.0 Assets Assets - Billions $4.0 $2.0 $0.0 2013 2014 2015 2016 2017 1Q18 Freedom Bank - $67M Comm. B&T Sheboygan - CIC Bancshares - Founders Bancorp - Signature Bancorp - Morrill and Janes - $811M $507M $773M $214M $427M Comm. Bank Santa Fe - Citywide Banks of $166M Colorado, Inc. - First Scottsdale - $81M $1,490M Premier Valley - $693M Assets Acquired Growth 11 As of March 31, 2018

Heartland has Established Core Competencies in the M & A space 14 bank acquisitions announced and closed since 2012 Opportunities abound across entire footprint Heartland’s community bank model is attractive to sellers Focus on expanding existing markets >= $1 Billion in assets Commitment to shareholders for accretive EPS transactions Transactions that demonstrate an IRR > 15% Tangible book value earn backs of 4 years or less 12

Signature Bank Announced November 13, 2017 – closed February 23, 2018 – systems integration April 20, 2018 Assets approximately $427 million, loans approximately $325 million, and deposits approximately $357 million – at closing Located in Minnetonka, MN – a western suburb of Minneapolis Purchase price of approximately $61.4 million, stock (90%) and cash (10%) Immediate accretive to EPS in 2018 and 3% EPS accretion in 2019. IRR in excess of 15%. Tangible book value earn back of ~3.7 yrs. Combined with Minnesota Bank & Trust creates a Twin Cities based bank with assets over $630 million Signature president retained and combined bank will operate as Minnesota Bank & Trust 13

FirstBank & Trust Company Announced December 12, 2017 – closed May 18, 2018 Assets approximately $972 million, loans approximately $705 million, and deposits approximately $869 million – as of 3/31/18 Located in Lubbock, TX Includes PrimeWest Mortgage with $400 million in annual originations and a $700 million servicing portfolio Approximately 3.35 million shares of Heartland common stock and $18.7 million in cash resulting in an approximate 90% / 10% common stock and cash mix Accretive to EPS in 2018 and ~6.5% accretive to EPS in 2019. Tangible book value earn back ~3.6 yrs Significant initial expansion in the West Texas market with a well established, high growth, highly profitable market leader Retained founder & CEO Barry Orr - provides proven leadership and continuity for FirstBank & Trust Company 14

Market Overview: Expanding in High Growth Markets Projected Median Projected 3/31/2018 % of Number of State PopulationHousehold HH Income Assets Franchise Branches Change '18-'23 (%) Income Change '18-'23 (%) Iowa $1,490,100 15% 11 2.36% $59,039 6.50% Illinois $751,371 7% 10 -0.18% $64,872 8.77% Wisconsin $1,017,053 10% 17 1.32% $60,240 8.59% Minnesota $631,852 6% 2 3.26% $68,744 7.72% KS / MO / TX $648,569 6% 9 3.33% $57,785 8.23% HTLF Midwest $4,538,945 44% 49 New Mexico $1,416,788 14% 17 0.96% $48,212 6.13% Arizona $633,474 6% 8 6.02% $56,059 8.64% Montana $490,917 5% 10 4.38% $51,827 8.47% Colorado $2,299,818 23% 25 6.90% $69,546 9.54% California $805,014 8% 8 4.06% $71,061 11.62% HTLF West $5,646,011 56% 68 15 Source: SNL Financial

Asset and Earnings Growth $100 $12 $90 $85.7M $10.06B $80.3M $10 $80 $75.3M $70 $8 $60.0M $60 Billions- Assets $50 $6 $40 Net Income Income Net - Millions $4 $30 $23.3M $20 $2 $10 $0 $0 2010 2011 2012 2013 2014 2015 2016 2017 1Q 2018 Net Income in Millions Deferred Tax Change Exclusive of Impairment Charge Assets in Billions 16 As of March 31, 2018

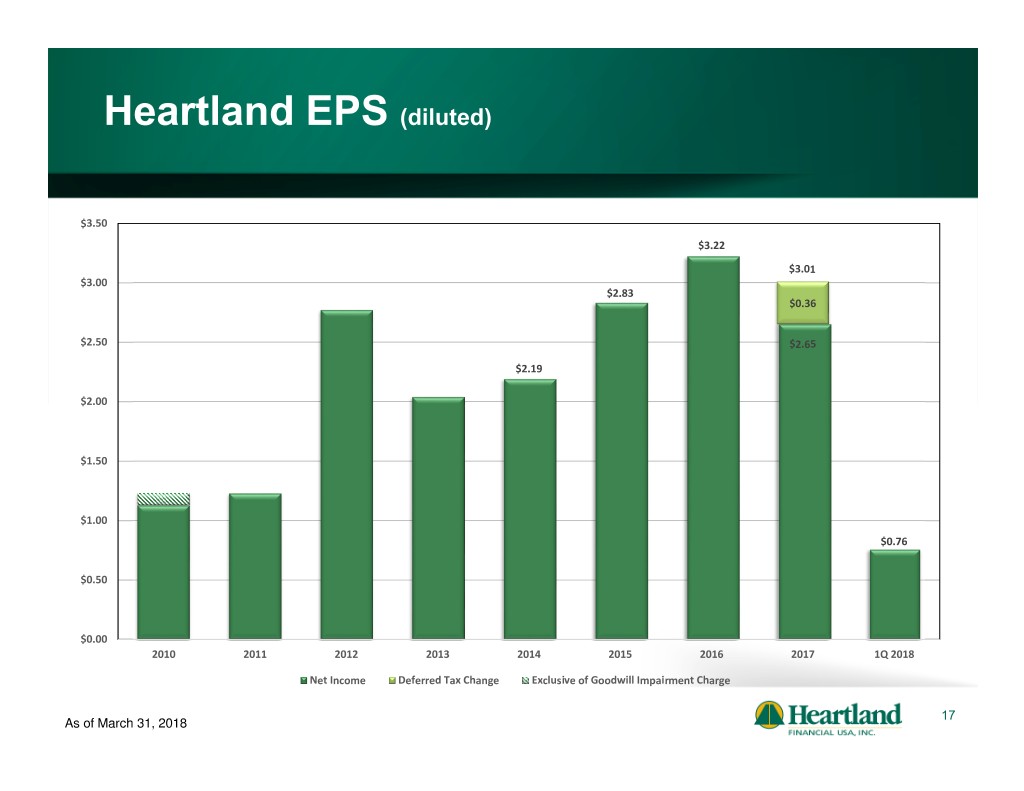

Heartland EPS (diluted) $3.50 $3.22 $3.01 $3.00 $2.83 $0.36 $2.50 $2.65 $2.19 $2.00 $1.50 $1.00 $0.76 $0.50 $0.00 2010 2011 2012 2013 2014 2015 2016 2017 1Q 2018 Net Income Deferred Tax Change Exclusive of Goodwill Impairment Charge 17 As of March 31, 2018

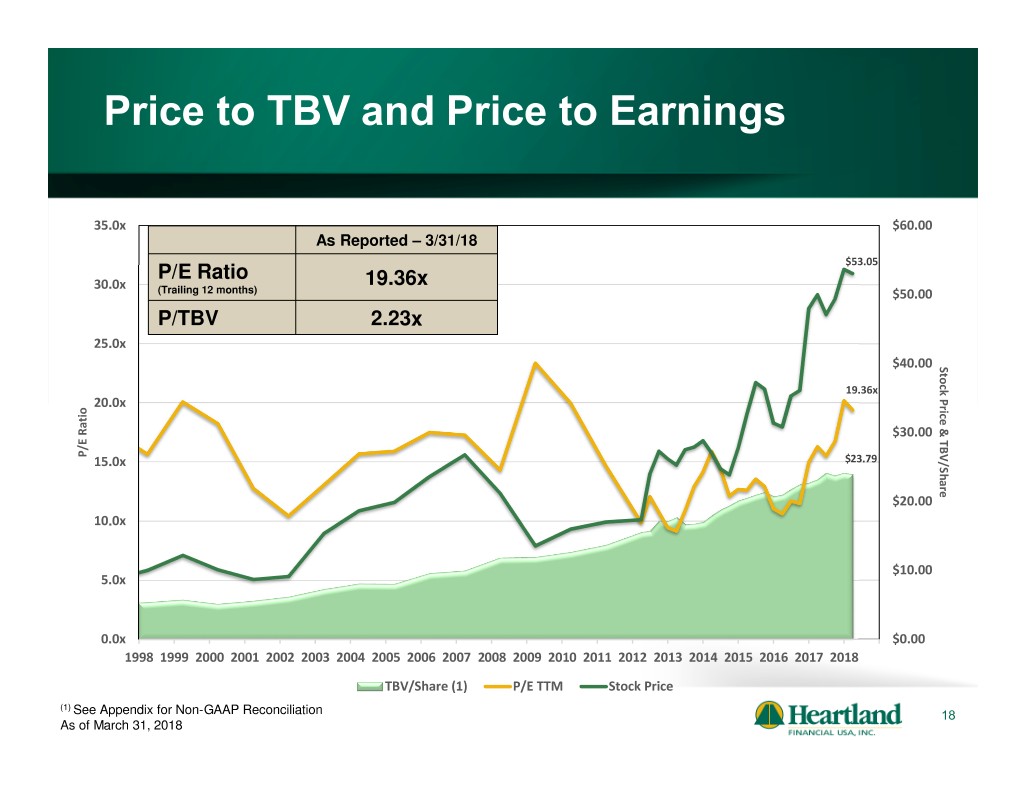

Price to TBV and Price to Earnings 35.0x $60.00 As Reported – 3/31/18 $53.05 P/E Ratio 30.0x 19.36x (Trailing 12 months) $50.00 P/TBV 2.23x 25.0x $40.00 & TBV/Share Price Stock 19.36x 20.0x $30.00 P/E P/E Ratio 15.0x $23.79 $20.00 10.0x $10.00 5.0x 0.0x $0.00 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 TBV/Share (1) P/E TTM Stock Price (1) See Appendix for Non-GAAP Reconciliation 18 As of March 31, 2018

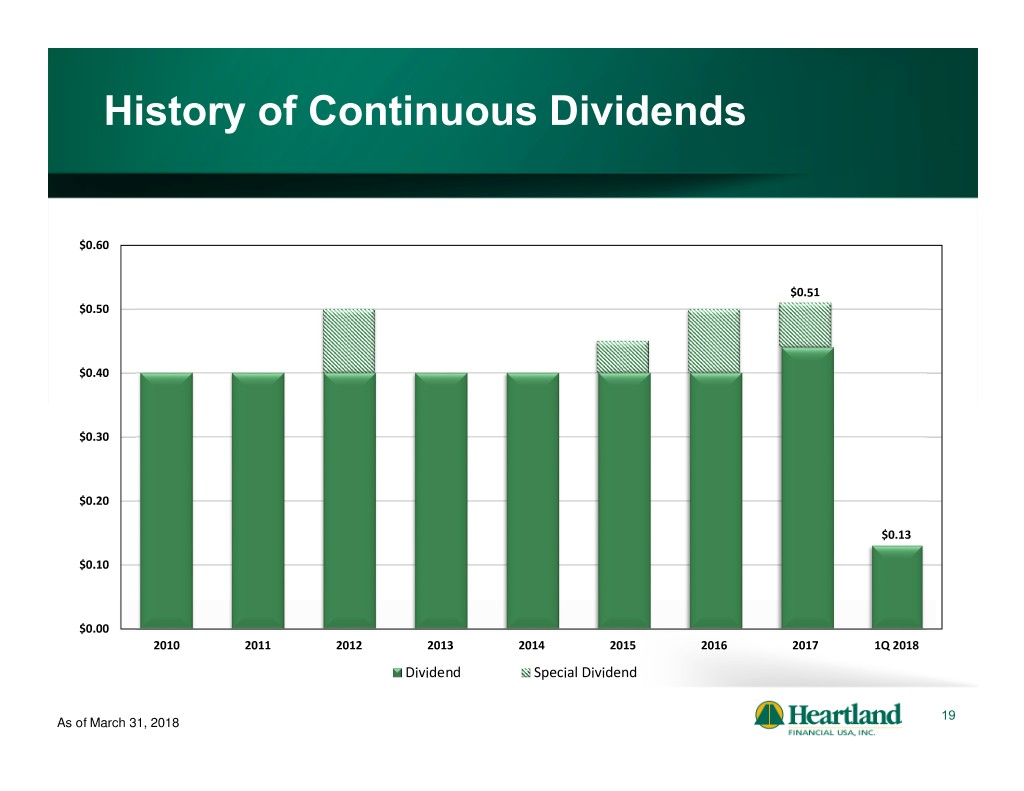

History of Continuous Dividends $0.60 $0.51 $0.50 $0.40 $0.30 $0.20 $0.13 $0.10 $0.00 2010 2011 2012 2013 2014 2015 2016 2017 1Q 2018 Dividend Special Dividend 19 As of March 31, 2018

Agenda Heartland’s growth story Key tenets of Heartland’s business model Financial highlights 20

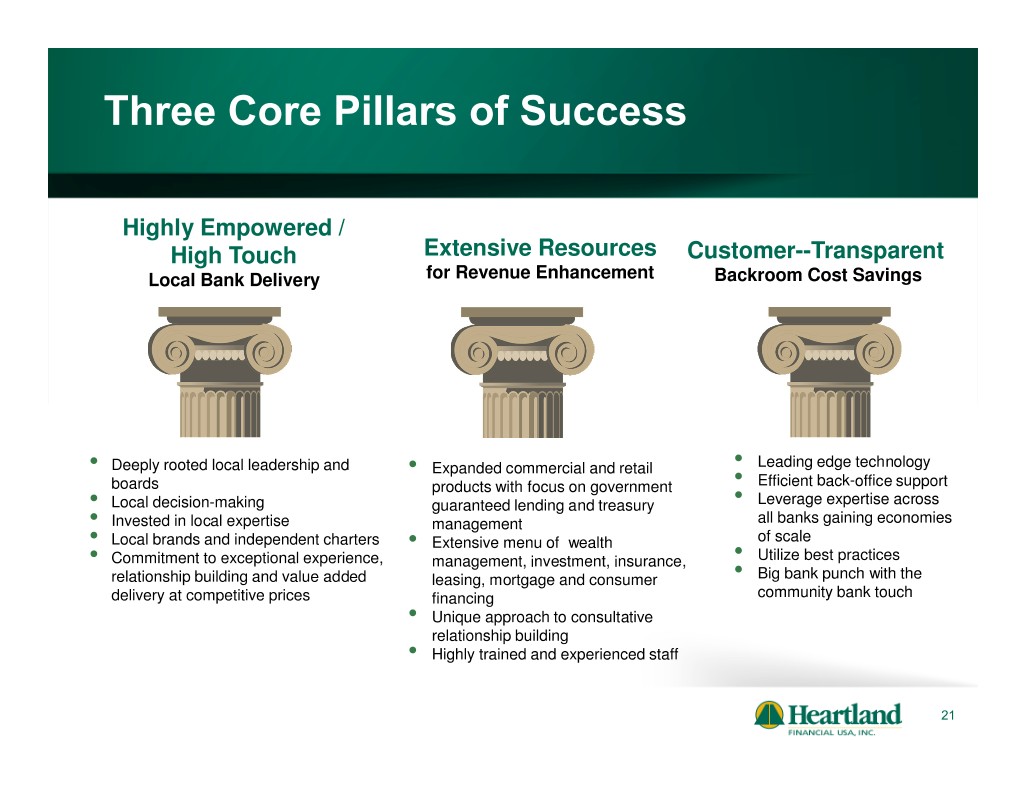

Three Core Pillars of Success Highly Empowered / High Touch Extensive Resources Customer--Transparent Local Bank Delivery for Revenue Enhancement Backroom Cost Savings • Deeply rooted local leadership and • Expanded commercial and retail • Leading edge technology boards products with focus on government • Efficient back-office support • Local decision-making guaranteed lending and treasury • Leverage expertise across • Invested in local expertise management all banks gaining economies • Local brands and independent charters • Extensive menu of wealth of scale • Commitment to exceptional experience, management, investment, insurance, • Utilize best practices relationship building and value added leasing, mortgage and consumer • Big bank punch with the delivery at competitive prices financing community bank touch • Unique approach to consultative relationship building • Highly trained and experienced staff 21

Primary Target Markets Residential Mortgage Commercial & Small Personal Retail Accounts Accounts of Business from Immediate Owners and Area Employees 22

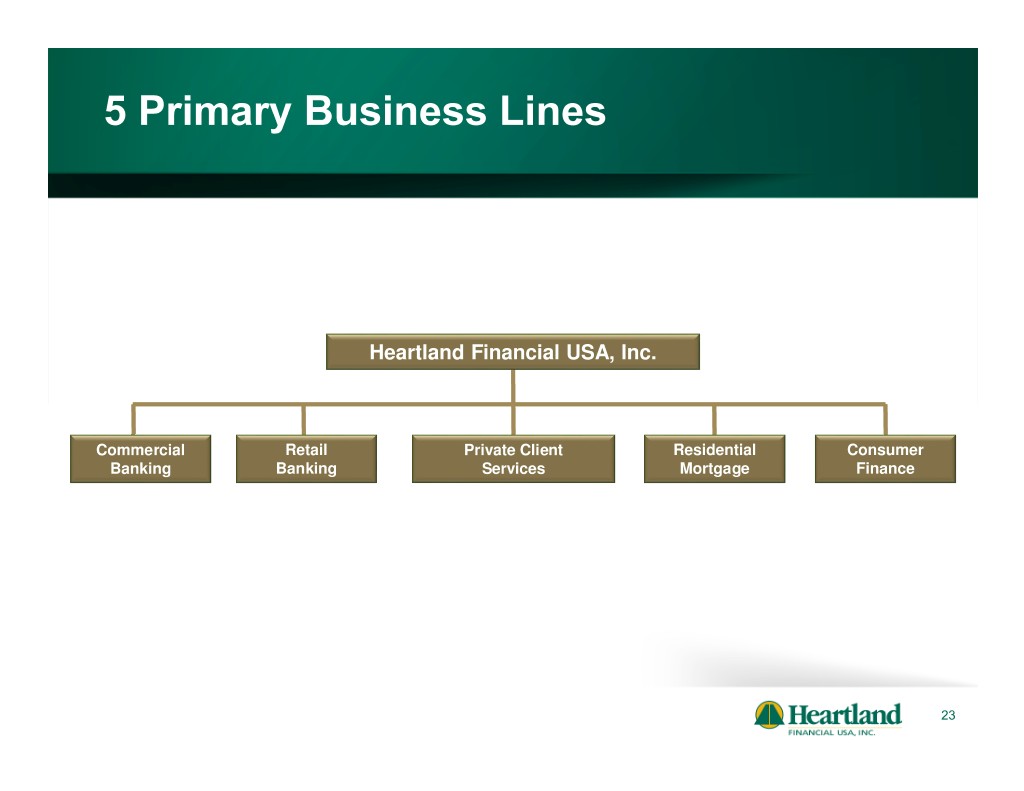

5 Primary Business Lines Heartland Financial USA, Inc. Commercial Retail Private Client Residential Consumer Banking Banking Services Mortgage Finance 23

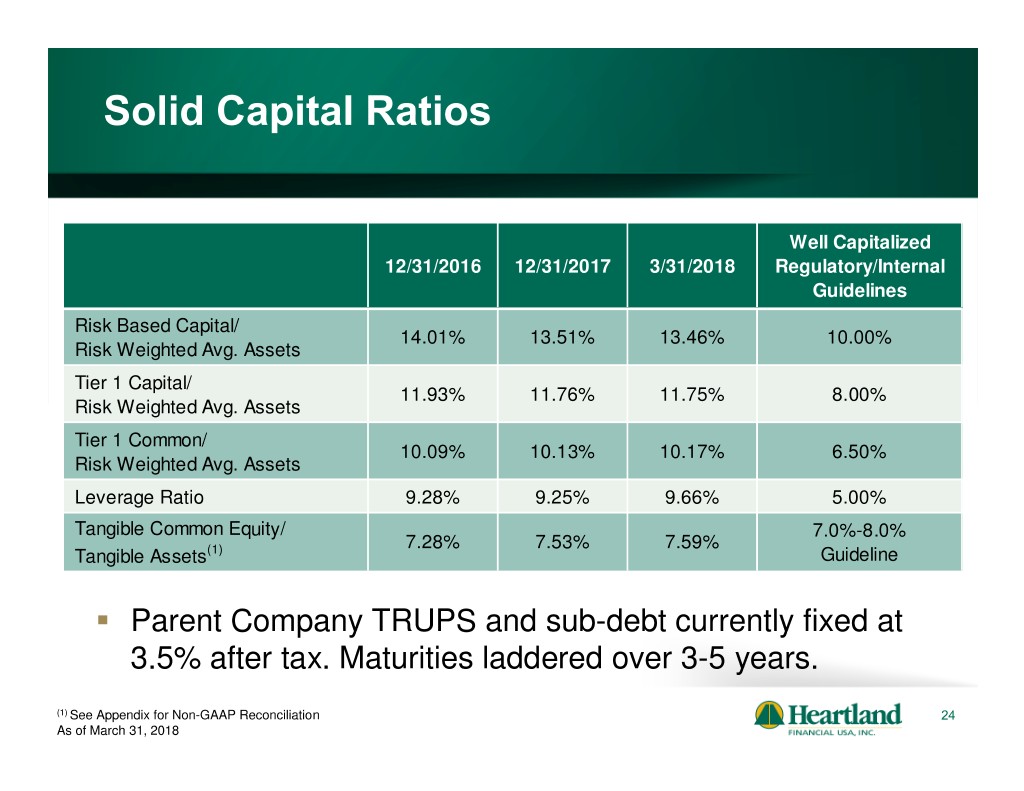

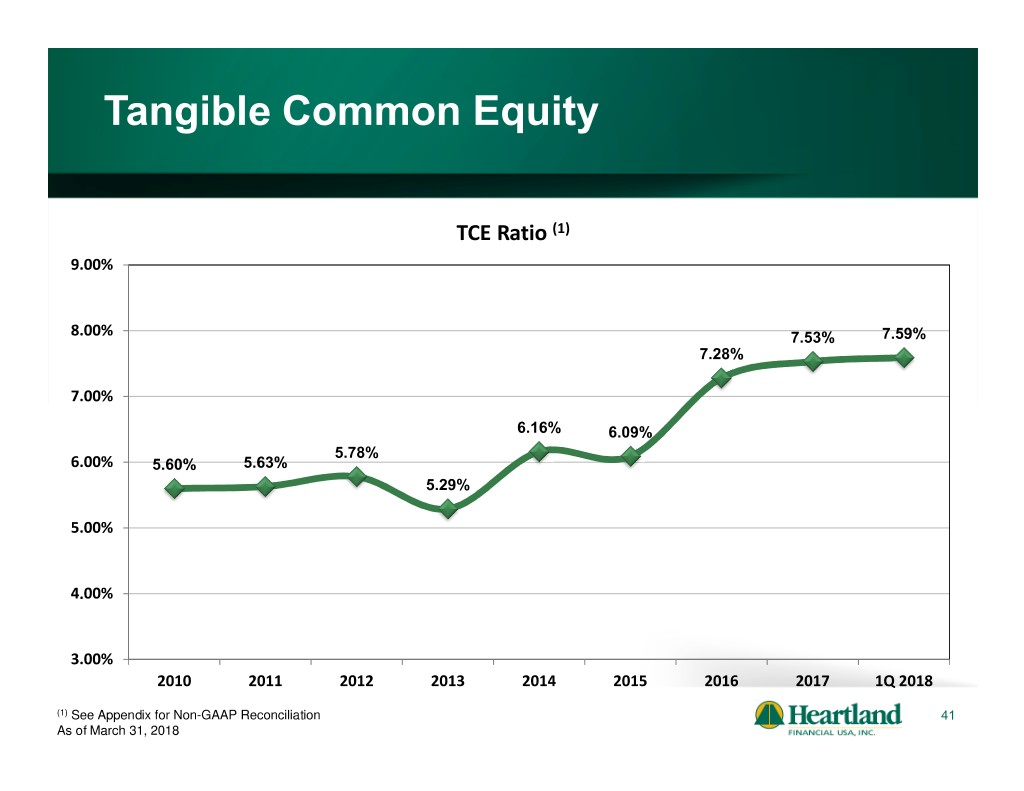

Solid Capital Ratios Well Capitalized 12/31/2016 12/31/2017 3/31/2018 Regulatory/Internal Guidelines Risk Based Capital/ 14.01% 13.51% 13.46% 10.00% Risk Weighted Avg. Assets Tier 1 Capital/ 11.93% 11.76% 11.75% 8.00% Risk Weighted Avg. Assets Tier 1 Common/ 10.09% 10.13% 10.17% 6.50% Risk Weighted Avg. Assets Leverage Ratio 9.28% 9.25% 9.66% 5.00% Tangible Common Equity/ 7.0%-8.0% 7.28% 7.53% 7.59% Tangible Assets (1) Guideline Parent Company TRUPS and sub-debt currently fixed at 3.5% after tax. Maturities laddered over 3-5 years. (1) See Appendix for Non-GAAP Reconciliation 24 As of March 31, 2018

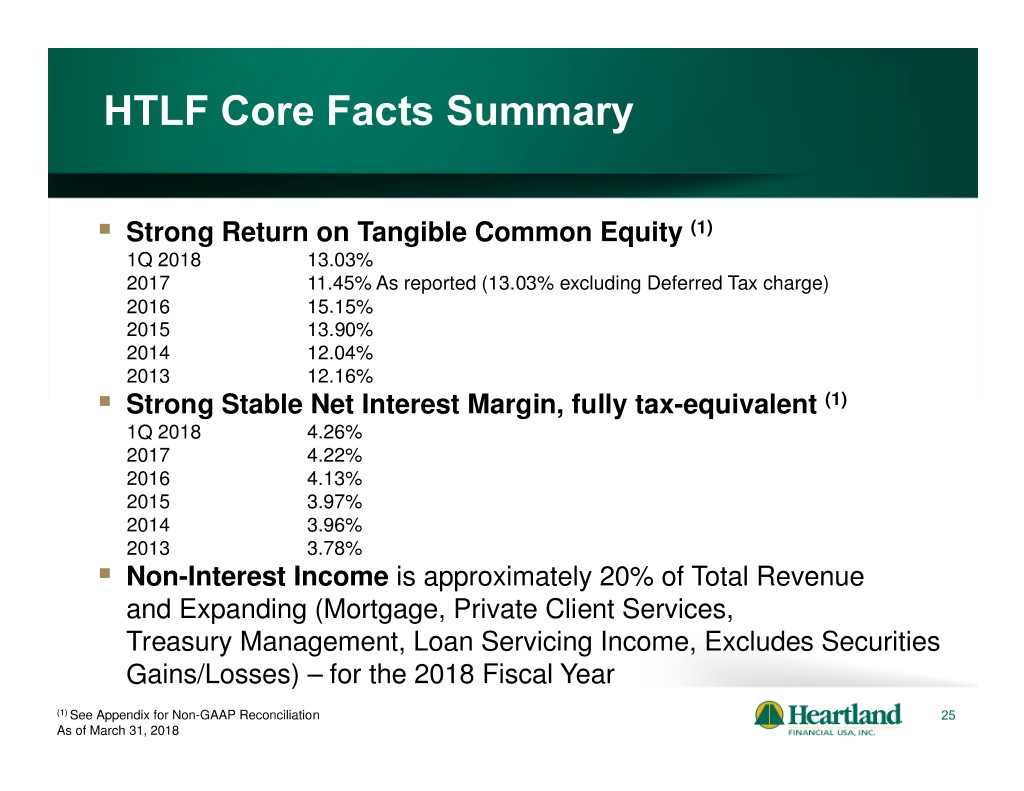

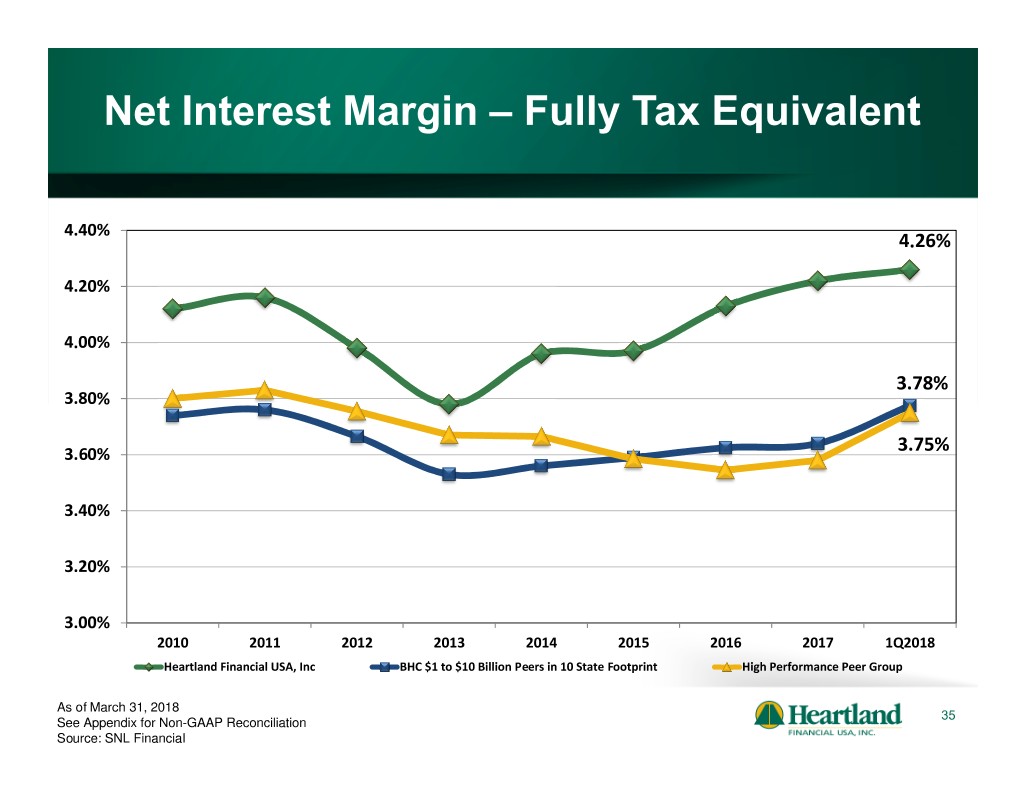

HTLF Core Facts Summary Strong Return on Tangible Common Equity (1) 1Q 2018 13.03% 2017 11.45% As reported (13.03% excluding Deferred Tax charge) 2016 15.15% 2015 13.90% 2014 12.04% 2013 12.16% Strong Stable Net Interest Margin, fully tax-equivalent (1) 1Q 2018 4.26% 2017 4.22% 2016 4.13% 2015 3.97% 2014 3.96% 2013 3.78% Non-Interest Income is approximately 20% of Total Revenue and Expanding (Mortgage, Private Client Services, Treasury Management, Loan Servicing Income, Excludes Securities Gains/Losses) – for the 2018 Fiscal Year (1) See Appendix for Non-GAAP Reconciliation 25 As of March 31, 2018

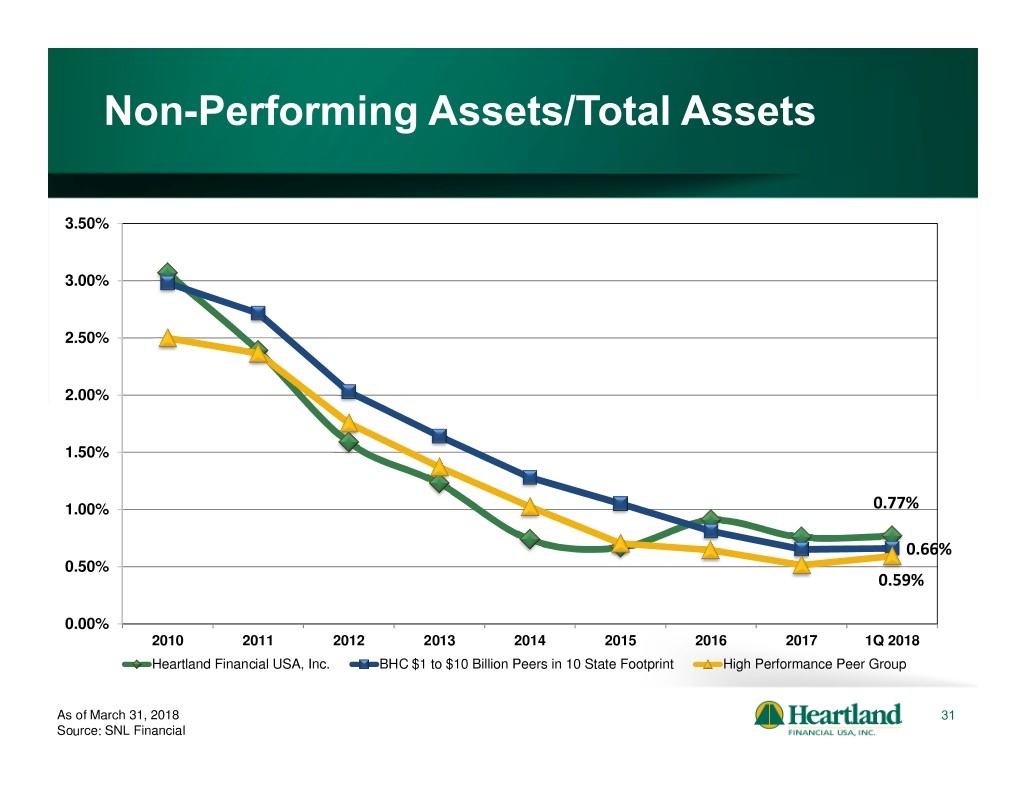

HTLF Core Facts Summary (cont.) Low and stable level of nonperforming assets to total assets (1) 03/31/18 0.77% 12/31/17 0.76% 12/31/16 0.91% 12/31/15 0.67% 12/31/14 0.74% 12/31/13 1.23% Diverse geographic footprint reduces risk Master strategy of balanced growth and profit Solid Midwest franchise balanced with a Western franchise, which will ultimately be the driver for growth Never experienced a loss year During the recession, unlike many of our peers, Heartland Financial did not do dilutive common stock issuance (1) Excludes loans covered under loss share agreements 26 As of March 31, 2018

Agenda Heartland’s growth story Key tenets of Heartland’s business model Financial highlights 27

Financial Performance AT YEAR END 1Q 2018 2017 2016 2015 2014 2013 (billions) Total Assets $10.06 $9.81 $8.25 $7.69 $6.05 $5.92 Total Loans, net $6.69 $6.34 $5.30 $4.95 $3.84 $3.46 Total Deposits $8.54 $8.15 $6.85 $6.41 $4.77 $4.67 28 As of March 31, 2018

Loans By Category 12/31/2012 3/31/2018 Yield on Loans – 5.95%* Yield on Loans – 5.41%* Residential Residential Agricultural Mortgages Mortgages Loans 16% Agricultural 16% Other 8% Loans Commercial RE Other Consumer 12% 15% Commercial RE Loans 11% Consumer Loans 19% 5% Commercial RE Construction Construction Owner 7% 9% Occupied Commercial RE 19% Owner C&I Occupied C&I 26% 16% 21% Total Loans - $2.92 Billion Total Loans - $6.77 Billion 5.25 Year C.A.G.R – 17.33% Includes loans held for sale 29 *Average loan yield YTD

Solid Risk Profile 350% 300% 288% 250% 200% 170% 150% 100% 62% 50% 0% 2010 2011 2012 2013 2014 2015 2016 2017 2018 Total CRE/Total Risk-Based Capital (Investor CRE + Const & Land)/Total Risk-Based Capital (Const & Land)/Total Risk-Based Capital 30 As of March 31, 2018

Non-Performing Assets/Total Assets 3.50% 3.00% 2.50% 2.00% 1.50% 1.00% 0.77% 0.66% 0.50% 0.59% 0.00% 2010 2011 2012 2013 2014 2015 2016 2017 1Q 2018 Heartland Financial USA, Inc. BHC $1 to $10 Billion Peers in 10 State Footprint High Performance Peer Group As of March 31, 2018 31 Source: SNL Financial

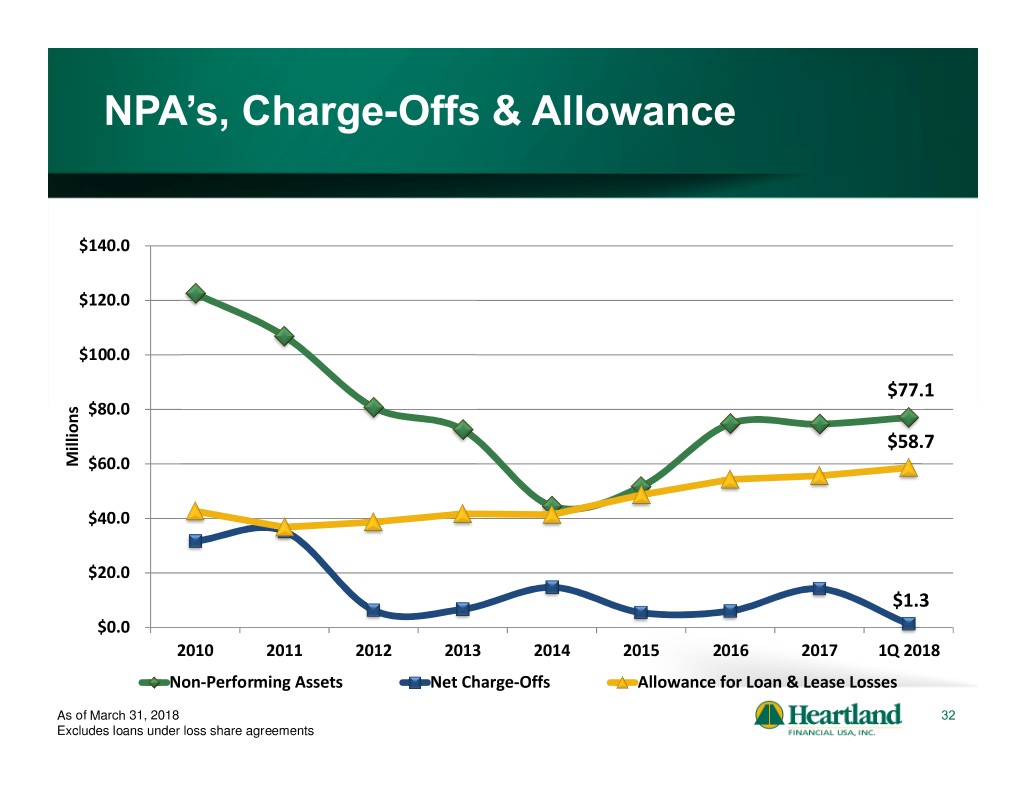

NPA’s, Charge-Offs & Allowance $140.0 $120.0 $100.0 $77.1 $80.0 $58.7 Millions $60.0 $40.0 $20.0 $1.3 $0.0 2010 2011 2012 2013 2014 2015 2016 2017 1Q 2018 Non-Performing Assets Net Charge-Offs Allowance for Loan & Lease Losses As of March 31, 2018 32 Excludes loans under loss share agreements

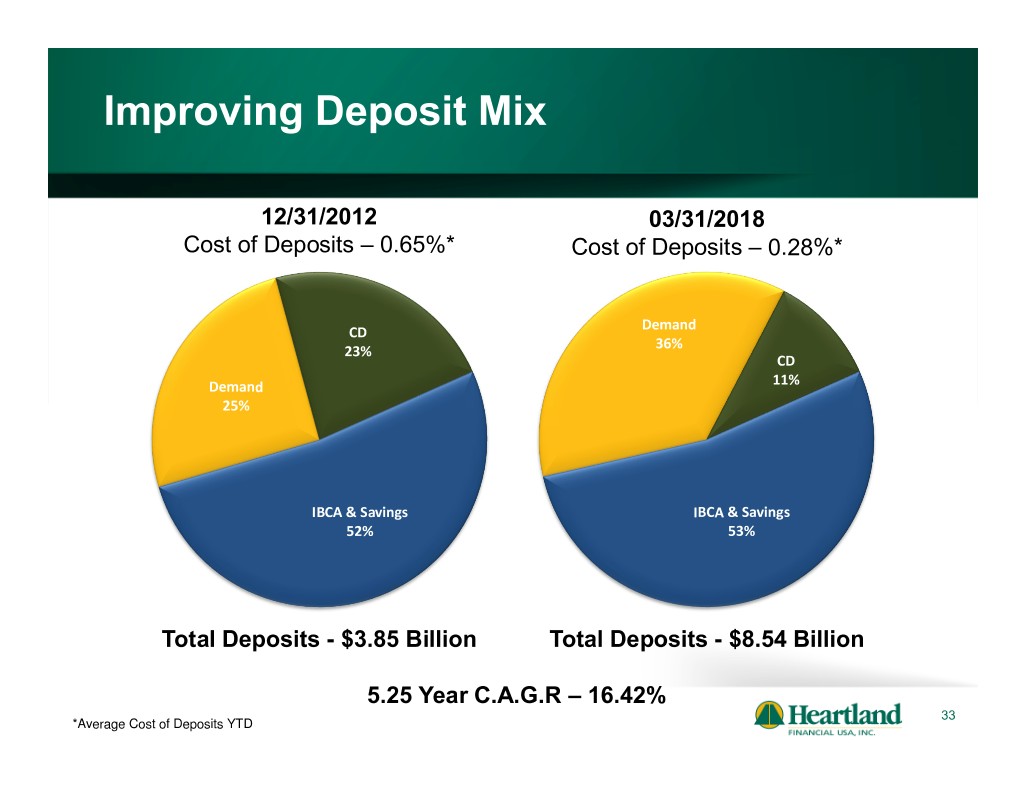

Improving Deposit Mix 12/31/2012 03/31/2018 Cost of Deposits – 0.65%* Cost of Deposits – 0.28%* Demand CD 36% 23% CD Demand 11% 25% IBCA & Savings IBCA & Savings 52% 53% Total Deposits - $3.85 Billion Total Deposits - $8.54 Billion 5.25 Year C.A.G.R – 16.42% 33 *Average Cost of Deposits YTD

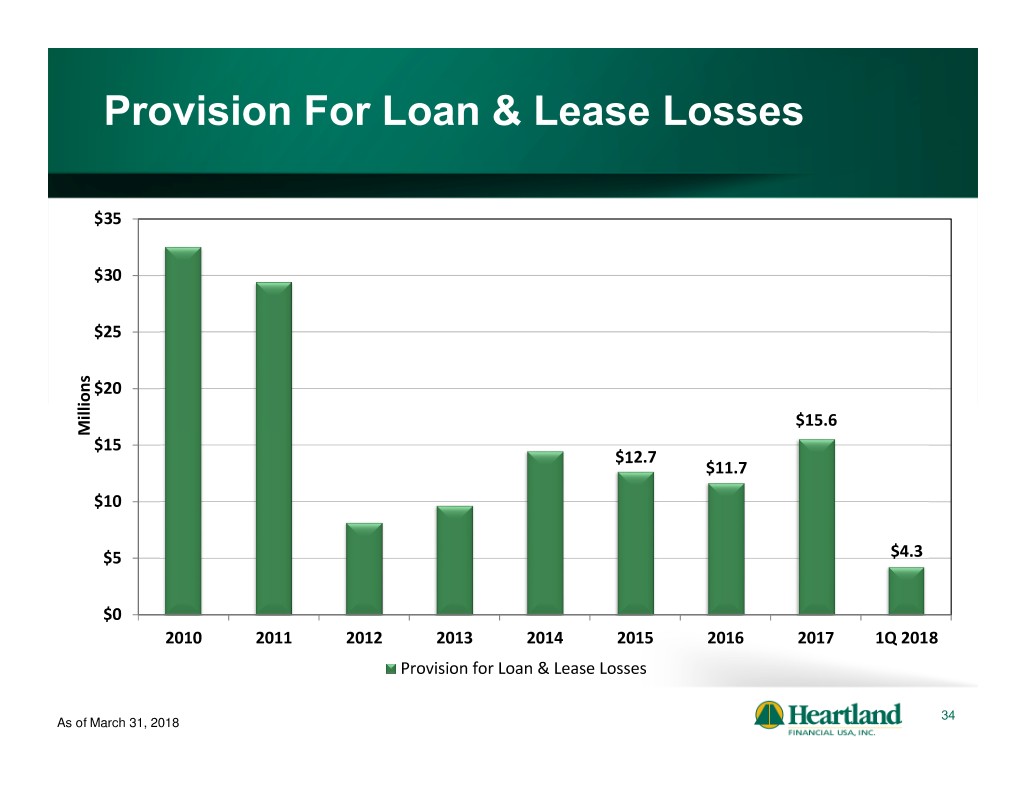

Provision For Loan & Lease Losses $35 $30 $25 $20 $15.6 Millions $15 $12.7 $11.7 $10 $5 $4.3 $0 2010 2011 2012 2013 2014 2015 2016 2017 1Q 2018 Provision for Loan & Lease Losses 34 As of March 31, 2018

Net Interest Margin – Fully Tax Equivalent 4.40% 4.26% 4.20% 4.00% 3.78% 3.80% 3.60% 3.75% 3.40% 3.20% 3.00% 2010 2011 2012 2013 2014 2015 2016 2017 1Q2018 Heartland Financial USA, Inc BHC $1 to $10 Billion Peers in 10 State Footprint High Performance Peer Group As of March 31, 2018 35 See Appendix for Non-GAAP Reconciliation Source: SNL Financial

Diversified Non-Interest Income 03/31/2018 Loan Servicing 8% Service Charges & Fees Net Interest 43% Other Non Income Interest before Income 5% Provisions 80% Non Interest Income 20% BOLI 3% Trust Fees Net Gains on Sale 20% of Loans Brokerage & 17% Insurance 4% Noninterest income exclusive of security gains YTD 36 As of March 31, 2018

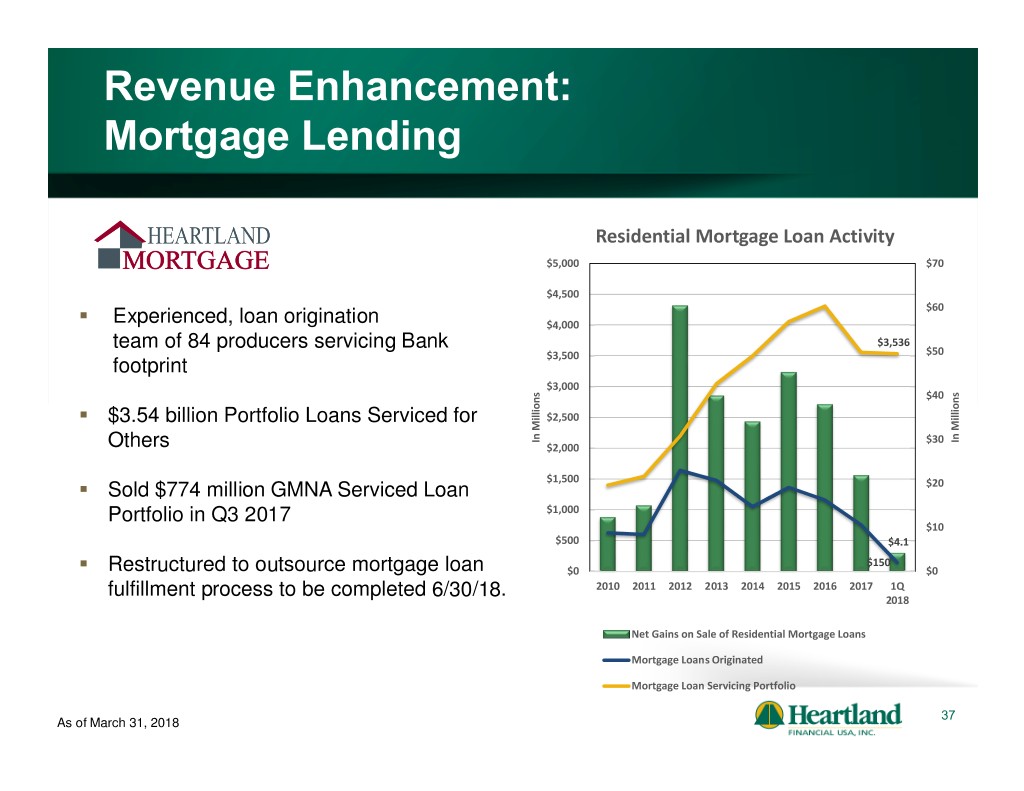

Revenue Enhancement: Mortgage Lending Residential Mortgage Loan Activity $5,000 $70 $4,500 $60 Experienced, loan origination $4,000 team of 84 producers servicing Bank $3,536 $3,500 $50 footprint $3,000 $40 $3.54 billion Portfolio Loans Serviced for $2,500 In Millions In $30 Millions In Others $2,000 $1,500 Sold $774 million GMNA Serviced Loan $20 Portfolio in Q3 2017 $1,000 $10 $500 $4.1 $150 Restructured to outsource mortgage loan $0 $0 2010 2011 2012 2013 2014 2015 2016 2017 1Q fulfillment process to be completed 6/30/18. 2018 Net Gains on Sale of Residential Mortgage Loans Mortgage Loans Originated Mortgage Loan Servicing Portfolio 37 As of March 31, 2018

Revenue Enhancement: Private Client Services Private Client Service Fees $25 Private Client Services • Trust Assets under management as of $19.9 $20 $18.7 3/31/18 were $2.40 billion $18.1 • Operating in eight of ten $15 Heartland markets In Millions • Sophisticated investment platform $10 • Focus on sales and enhancing the $5.6 client experience $5 $0 2010 2011 2012 2013 2014 2015 2016 2017 1Q 2018 Trust Fees Brokerage & Insurance Commision 38 As of March 31, 2018

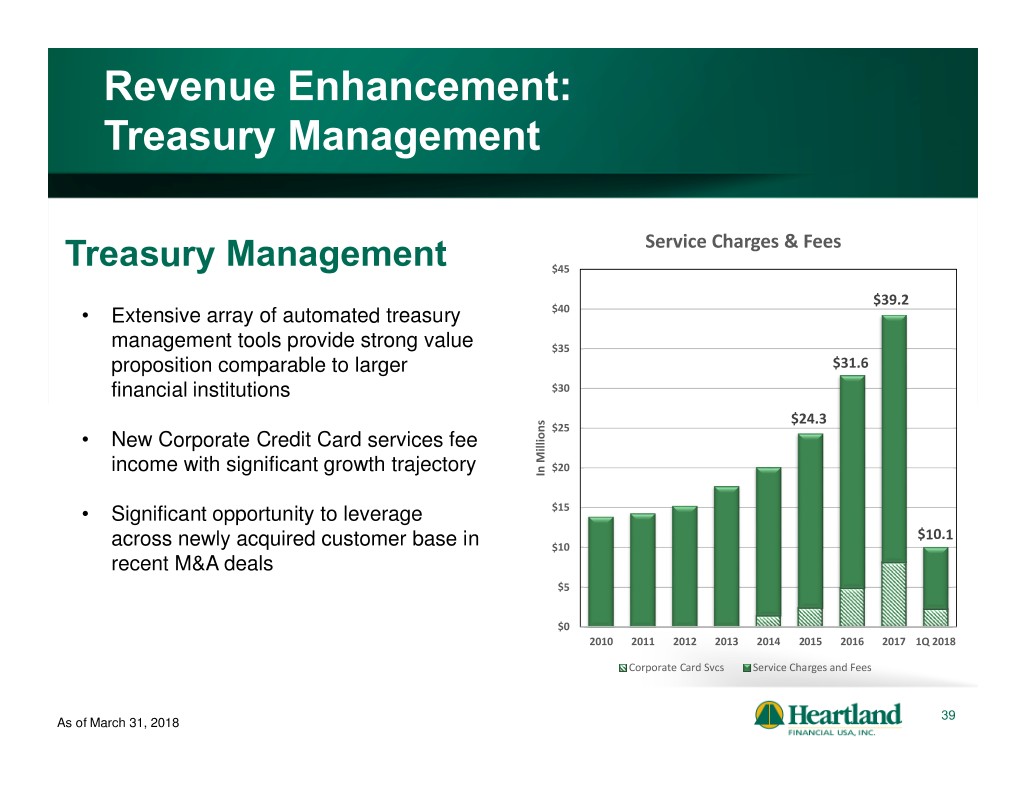

Revenue Enhancement: Treasury Management Service Charges & Fees Treasury Management $45 $39.2 • Extensive array of automated treasury $40 management tools provide strong value $35 proposition comparable to larger $31.6 financial institutions $30 $24.3 $25 • New Corporate Credit Card services fee income with significant growth trajectory $20 In Millions • Significant opportunity to leverage $15 $10.1 across newly acquired customer base in $10 recent M&A deals $5 $0 2010 2011 2012 2013 2014 2015 2016 2017 1Q 2018 Corporate Card Svcs Service Charges and Fees 39 As of March 31, 2018

Efficiency Ratio Fully Tax Equivalent (1) 80% 75% 70% 68.21% 65% 60.52% 60% 55% 56.55% 50% 2010 2011 2012 2013 2014 2015 2016 2017 1Q 2018 Heartland Financial USA, Inc. BHC $1 to $10 Billion Peers in 10 State Footprint High Performance Peer Group As of March 31, 2018 40 (1) See Appendix for Non-GAAP Reconciliation Source: SNL Financial for Peer / As reported for Heartland

Tangible Common Equity TCE Ratio (1) 9.00% 8.00% 7.53% 7.59% 7.28% 7.00% 6.16% 6.09% 5.78% 6.00% 5.60% 5.63% 5.29% 5.00% 4.00% 3.00% 2010 2011 2012 2013 2014 2015 2016 2017 1Q 2018 (1) See Appendix for Non-GAAP Reconciliation 41 As of March 31, 2018

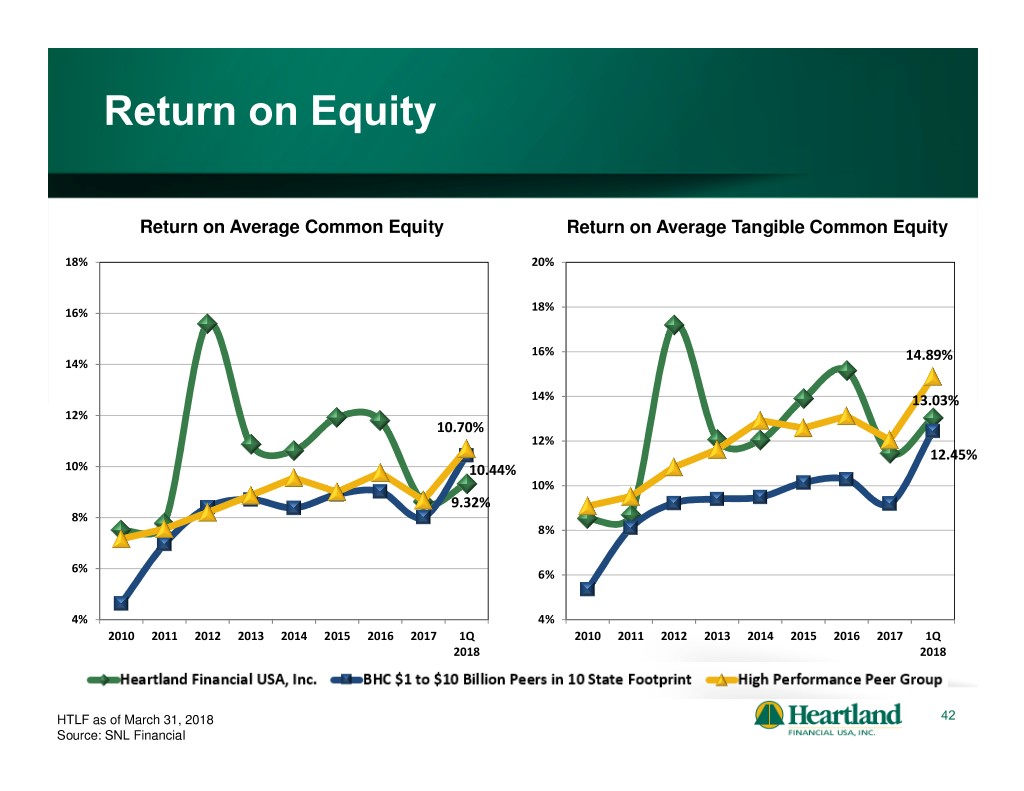

Return on Equity Return on Average Common Equity Return on Average Tangible Common Equity 18% 20% 16% 18% 16% 14.89% 14% 14% 13.03% 12% 10.70% 12% 12.45% 10% 10.44% 10% 9.32% 8% 8% 6% 6% 4% 4% 2010 2011 2012 2013 2014 2015 2016 2017 1Q 2010 2011 2012 2013 2014 2015 2016 2017 1Q 2018 2018 HTLF as of March 31, 2018 42 Source: SNL Financial

Analyst Ratings (May 2018) Coverage Rating Price Target D.A. DAVIDSON Neutral $59.00 Jeff Rulis KEEFE, BRUYETTE & WOODS Market Perform $59.00 Damon DelMonte RAYMOND JAMES Outperform $58.00 Daniel Cardenas SANDLER O’NEILL PARTNERS Hold $56.00 Andrew Liesch PIPER JAFFRAY Overweight $62.00 Nathan Race (1) FBR & Co. Neutral $59.00 Steven Ross 43 (1) Rating & Price Target reflect the analyst research report from February 2018

Investment Summary Master strategy of balanced growth and profit Solid Midwest franchise balanced with a Western franchise which enhances growth potential and provides diversification of risk Sound balance sheet with strong capital and low non-performing asset levels Strong, stable net interest margin Diverse and growing sources of non-interest income Never a loss year 44

Contact Information 45

Appendix – Non-GAAP Reconcilements 1Q 2018 Full Yr 2017 Full Yr 2016 Full Yr 2015 Full Yr 2014 Full Yr 2013 (1) Reconciliation of Return on Average Tangible Common Equity Net income available to common shareholders(non-GAAP) (GAAP)$ 23,255 $ 75,226 $ 80,108 $ 59,225 $ 41,083 $ 35,696 Average common stockholders' equity (GAAP)$ 1,011,580 $ 871,683 $ 678,989 $ 496,877 $ 386,844 $ 328,454 Less average goodwill 250,172 184,554 125,724 56,781 35,688 30,833 Less average other intangibles, net 37,510 30,109 24,553 14,153 10,022 4,117 Average tangible common equity (non-GAAP) $ 723,898 $ 657,020 $ 528,712 $ 425,943 $ 341,134 $ 293,504 Annualized return on average common equity (GAAP) 9.32%(2) 8.63% 11.80% 11.92% 10.62% 10.87% Net interest income $ 91,584 $ 330,308 $ 294,666 $ 233,998 $ 203,073 $ 163,828 Annualized return on average tangible (3)common equity (non-GAAP) 13.03% 11.45% 15.15% 13.90% 12.04% 12.16% Tax equivalent adjustment 1,544 15,139 12,919 10,216 10,298 9,465 Fully tax-equivalent net interest income 93,128 345,447 307,585 244,214 213,371 173,293 Reconciliation of Non-GAAP Measure-EfficiencyNoninterest income Ratio 24,716 102,022 113,601 110,685 82,224 89,618 Securities gains, net (1,441) (6,973) (11,340) (13,143) (3,668) (7,121) Impairment loss on securities 28 (1,280) - 769 - - Adjusted income $ 116,431 $ 439,216 $ 409,846 $ 342,525 $ 291,927 $ 255,790 Total noninterest expenses $ 83,646 $ 297,675 $ 279,668 $ 251,046 $ 215,800 $ 196,561 Less: Intangible assets amortization 1,863 6,077 5,630 2,978 2,223 1,063 Partnership investment in historic rehabilitation tax credits - 1,860 1,051 4,357 2,436 596 (Gain)/loss on sales/valuations of assets, net 2,367 2,475 1,478 6,821 2,105 3,034 Adjusted noninterest expenses $ 79,416 $ 287,263 $ 271,509 $ 236,890 $ 209,036 $ 191,868 Efficiency ratio, fully tax-equivalent 68.21% 65.40% 66.25% 69.16% 71.61% 75.01% (1) Return on average tangible common equity is net income available to common stockholders divided by average common stockholders' equity less goodwill and core deposit intangibles and customer relationship intangibles, net. This financial measure is included as it is considered to be a critical metric to analyze and evaluate the financial condition 46 and capital strength of Heartland. This measure should not be considered a substitute for operating results determined in accordance with GAAP (2) Efficiency ratio, fully tax-equivalent, expresses noninterest expenses as a percentage of fully tax-equivalent net interest income and noninterest income. This efficiency ratio is presented on a tax-equivalent basis, which adjusts net interest income and noninterest expenses for the tax favored status of certain loans, securities and historic rehabilitation tax credits. Management believes the presentation of this non-GAAP measure provides supplemental useful information for proper understanding of the financial results of Heartland as it enhances the comparability of income and expenses arising from taxable and nontaxable sources and excludes specific items, as noted in the table. This measure should not be considered a substitute for operating results determined in accordance with GAAP. (3) Computed on a tax-equivalent basis using an effective tax rate of 21% for the quarter ended March 31, 2018, and 35% for all prior periods.

Appendix – Non-GAAP Reconcilements (Cont.) 1Q 2018 Full Yr 2017 Full Yr 2016 Full Yr 2015 Full Yr 2014 Full Yr 2013 Reconciliation of Tangible Book Value Per Common Share (non-GAAP) (1) Common stockholders' equity (GAAP) $ 1,050,567 $ 990,518 $ 739,559 $ 581,475 $ 414,619 $ 357,762 Less goodwill 270,305 236,615 127,699 97,852 35,583 35,583 Less other intangible assets, net 41,063 35,203 22,775 22,019 8,947 11,171 Tangible common stockholders' equity (non-GAAP) $ 739,199 $ 718,700 $ 589,085 $ 461,604 $ 370,089 $ 311,008 Common shares outstanding, net of treasury stock 31,068,239 29,953,356 26,119,929 22,435,693 18,511,125 18,399,156 Common stockholders' equity (book value) per share (GAAP)$ 33.81 $ 33.07 $ 28.31 $ 25.92 $ 22.40 $ 19.44 Tangible book value per common share (non-GAAP) $ 23.79 $ 23.99 $ 22.55 $ 20.57 $ 19.99 $ 16.90 Reconciliation of Tangible Common Equity Ratio (non-GAAP) (2) Total assets (GAAP) $ 10,055,863 $ 9,810,739 $ 8,247,079 $ 7,694,754 $ 6,052,362 $ 5,923,716 Less goodwill 270,305 236,615 127,699 97,852 35,583 35,583 Less other intangible assets, net 41,063 35,203 22,775 22,019 8,947 11,171 Total tangible assets (non-GAAP) $ 9,744,495 $ 9,538,921 $ 8,096,605 $ 7,574,883 $ 6,007,832 $ 5,876,962 Tangible common equity ratio (non-GAAP) 7.59% 7.53% 7.28% 6.09% 6.16% 5.29% (1) Tangible book value per common share is total common stockholders' equity less goodwill and core deposit and customer relationship intangibles, net, divided by common shares outstanding, net of treasury. This amount is a non-GAAP financial measure but has been included as it is considered to be a critical metric with which to analyze and evaluate the financial condition and capital strength of Heartland. This measure should not be considered a substitute for operating results determined in accordance with GAAP (2) The tangible common equity ratio is total common stockholders' equity less goodwill and core deposit intangibles, net divided by total assets less goodwill and core deposit intangibles, net. This ratio is a non-GAAP financial measure but has been included as it is considered to be a critical metric with which to analyze and evaluate the financial condition and capital strength of Heartland. This measure should not be considered a substitute for operating results determined in accordance with GAAP. 47

Appendix – Non-GAAP Reconcilements (Cont.) 1Q 2018 Full Yr 2017 Full Yr 2016 Full Yr 2015 Full Yr 2014 Full Yr 2013 Reconciliation of Annualized Net Interest Margin, Fully Tax- Equivalent (non-GAAP) (1) Net Interest Income (GAAP) $ 91,584 $ 330,308 $ 294,666 $ 233,998 $ 203,073 $ 163,826 (2) Plus tax-equivalent adjustment 1,544 15,139 12,919 10,216 10,298 9,467 Net interest income - tax-equivalent (non-GAAP)$ 93,128 $ 345,447 $ 307,585 $ 244,214 $ 213,371 $ 173,293 Average earning assets $ 8,857,801 $ 8,181,914 $ 7,455,217 $ 6,152,090 $ 5,384,275 $ 4,582,296 Annualized net interest margin (GAAP) 4.19% 4.04% 3.95% 3.80% 3.77% 3.58% Annualized net interest margin, fully tax-equivalent (non-GAAP) 4.26% 4.22% 4.13% 3.97% 3.96% 3.78% (1) Annualized net interest margin, fully tax-equivalent is a non-GAAP measure, which adjusts net interest income for the tax-favored status of certain loans and securities. Management believes this measure enhances the comparability of net interest income arising from taxable and tax-exempt sources. This measure should not be considered a substitute for operating results determined in accordance with GAAP. (2) Computed on a tax-equivalent basis using an effective tax rate of 21% for the quarter ended March 31, 2018, and 35% for all prior periods. 48

Mission Statement: Through excellence In customer service and Respect for the individual , EVERYONE PROFITS Trading Symbol: HTLF | www.htlf.com