Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - NAVIGANT CONSULTING INC | d494088dex991.htm |

| 8-K - FORM 8-K - NAVIGANT CONSULTING INC | d494088d8k.htm |

JUNE 25, 2018 NAVIGANT Divests DFLT & Transaction Advisory Businesses Exhibit 99.2

DISCLOSURE STATEMENT Statements included in this presentation which are not historical in nature are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements may generally be identified by words such as “anticipate,” “believe,” “may,” “could,” “intend,” “estimate,” “expect,” “plan,” “outlook” and similar expressions. These statements are based upon management’s current expectations and speak only as of the date of this press release. The Company cautions readers that there may be events in the future that the Company is not able to accurately predict or control and the information contained in the forward-looking statements is inherently uncertain and subject to a number of risks that could cause actual results to differ materially from those contained in or implied by the forward-looking statements including, without limitation: the consummation of the sale transaction with Ankura Consulting Group, LLC; the execution of the Company’s long-term growth objectives and margin improvement initiatives; risks inherent in international operations, including foreign currency fluctuations; ability to make acquisitions and divestitures; pace, timing and integration of acquisitions and separation of divestitures; operational risks associated with new or expanded service areas, including business process management services; impairments; changes in accounting standards or tax rates, laws or regulations; management of professional staff, including dependence on key personnel, recruiting, retention, attrition and the ability to successfully integrate new consultants into the Company’s practices; utilization rates; conflicts of interest; potential loss of clients or large engagements and the Company’s ability to attract new business; brand equity; competition; accurate pricing of engagements, particularly fixed fee and multi-year engagements; clients’ financial condition and their ability to make payments to the Company; risks inherent with litigation; higher risk client assignments; government contracting; professional liability; information security; the adequacy of our business, financial and information systems and technology; maintenance of effective internal controls; potential legislative and regulatory changes; continued and sufficient access to capital; compliance with covenants in our credit agreement; interest rate risk; and market and general economic and political conditions. Further information on these and other potential factors that could affect the Company’s financial results are included under the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2017, and elsewhere in the Company’s filings with the Securities and Exchange Commission (SEC), which are available on the SEC’s website or at investors.navigant.com. The Company cannot guarantee any future results, levels of activity, performance or achievement and undertakes no obligation to update any of its forward-looking statements.

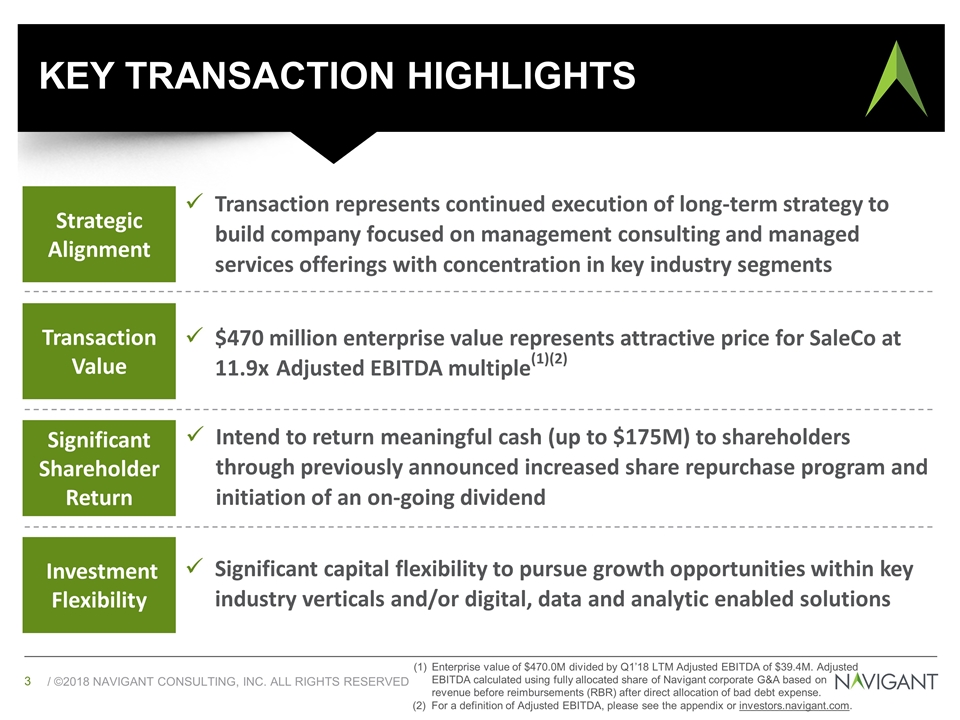

KEY TRANSACTION HIGHLIGHTS Strategic Alignment Transaction Value Investment Flexibility Significant Shareholder Return Transaction represents continued execution of long-term strategy to build company focused on management consulting and managed services offerings with concentration in key industry segments $470 million enterprise value represents attractive price for SaleCo at 11.9x Adjusted EBITDA multiple(1)(2) Significant capital flexibility to pursue growth opportunities within key industry verticals and/or digital, data and analytic enabled solutions Enterprise value of $470.0M divided by Q1’18 LTM Adjusted EBITDA of $39.4M. Adjusted EBITDA calculated using fully allocated share of Navigant corporate G&A based on revenue before reimbursements (RBR) after direct allocation of bad debt expense. (2) For a definition of Adjusted EBITDA, please see the appendix or investors.navigant.com. Intend to return meaningful cash (up to $175M) to shareholders through previously announced increased share repurchase program and initiation of an on-going dividend

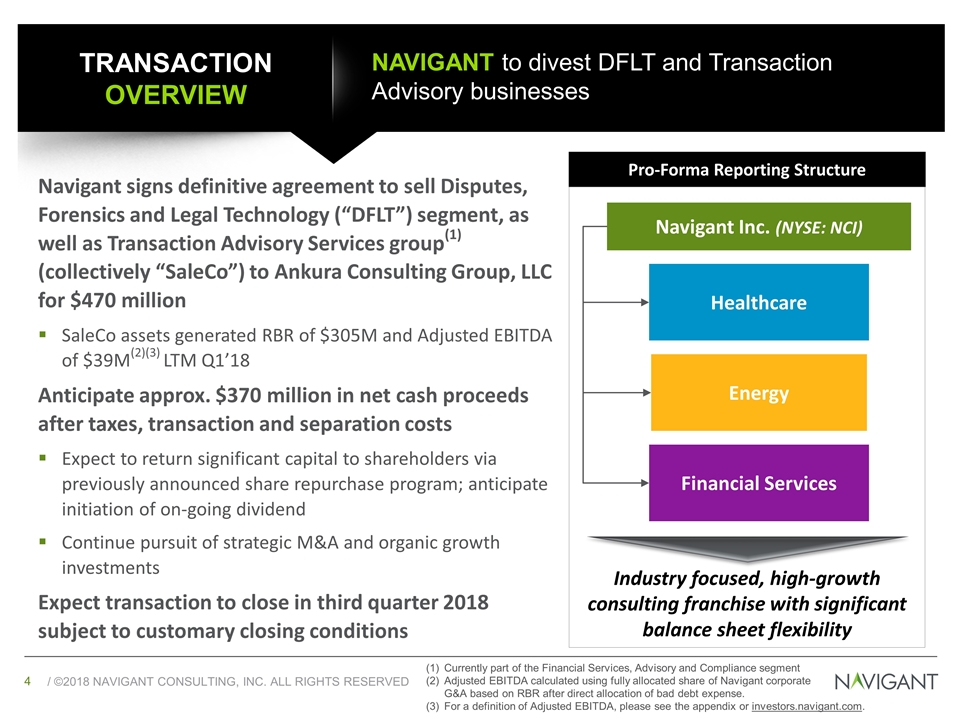

TRANSACTION OVERVIEW Pro-Forma Reporting Structure Navigant Inc. (NYSE: NCI) Healthcare Energy Financial Services Industry focused, high-growth consulting franchise with significant balance sheet flexibility Navigant signs definitive agreement to sell Disputes, Forensics and Legal Technology (“DFLT”) segment, as well as Transaction Advisory Services group(1) (collectively “SaleCo”) to Ankura Consulting Group, LLC for $470 million SaleCo assets generated RBR of $305M and Adjusted EBITDA of $39M(2)(3) LTM Q1’18 Anticipate approx. $370 million in net cash proceeds after taxes, transaction and separation costs Expect to return significant capital to shareholders via previously announced share repurchase program; anticipate initiation of on-going dividend Continue pursuit of strategic M&A and organic growth investments Expect transaction to close in third quarter 2018 subject to customary closing conditions NAVIGANT to divest DFLT and Transaction Advisory businesses Currently part of the Financial Services, Advisory and Compliance segment Adjusted EBITDA calculated using fully allocated share of Navigant corporate G&A based on RBR after direct allocation of bad debt expense. For a definition of Adjusted EBITDA, please see the appendix or investors.navigant.com.

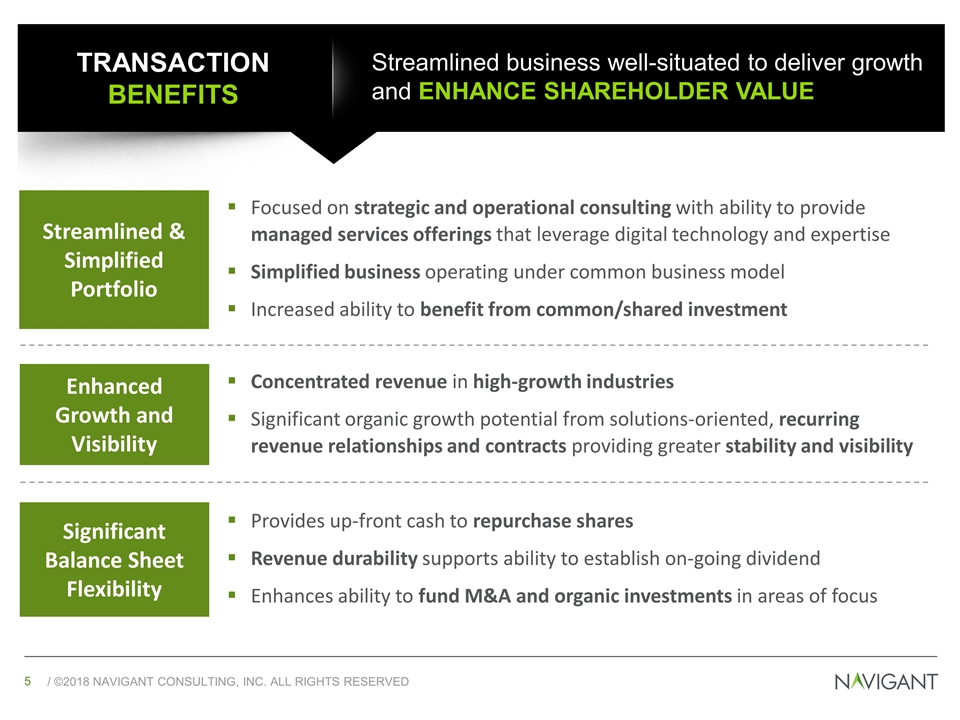

TRANSACTION BENEFITS Streamlined business well-situated to deliver growth and ENHANCE SHAREHOLDER VALUE Enhanced Growth and Visibility Streamlined & Simplified Portfolio Significant Balance Sheet Flexibility Focused on strategic and operational consulting with ability to provide managed services offerings that leverage digital technology and expertise Simplified business operating under common business model Increased ability to benefit from common/shared investment Concentrated revenue in high-growth industries Significant organic growth potential from solutions-oriented, recurring revenue relationships and contracts providing greater stability and visibility Provides up-front cash to repurchase shares Revenue durability supports ability to establish on-going dividend Enhances ability to fund M&A and organic investments in areas of focus

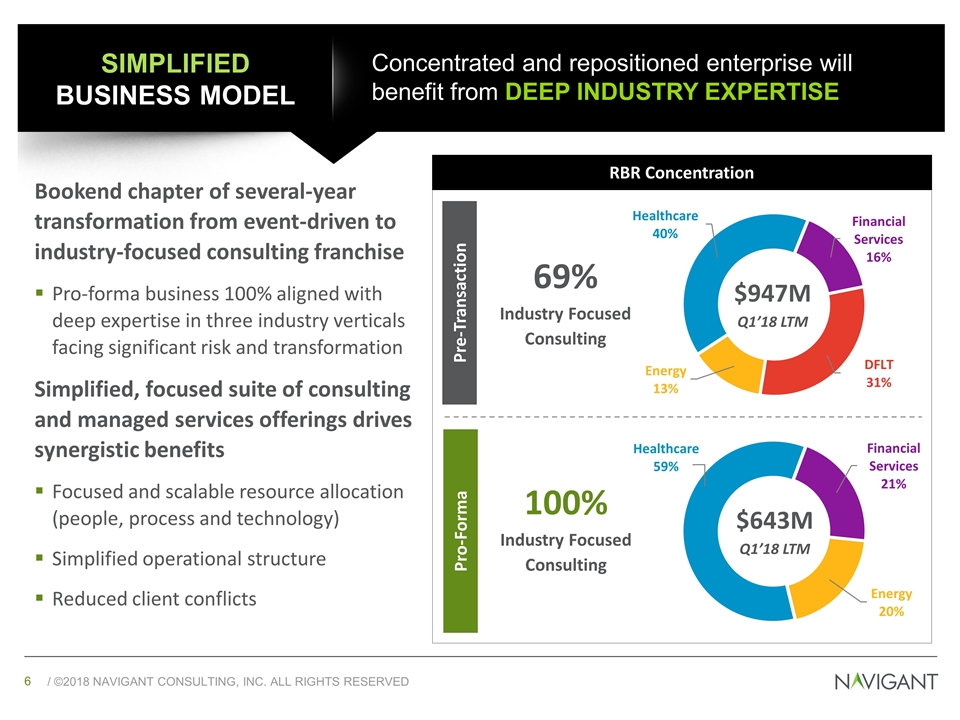

SIMPLIFIED BUSINESS MODEL Concentrated and repositioned enterprise will benefit from DEEP INDUSTRY EXPERTISE RBR Concentration 69% Industry Focused Consulting 100% Industry Focused Consulting $947M Q1’18 LTM $643M Q1’18 LTM Bookend chapter of several-year transformation from event-driven to industry-focused consulting franchise Pro-forma business 100% aligned with deep expertise in three industry verticals facing significant risk and transformation Simplified, focused suite of consulting and managed services offerings drives synergistic benefits Focused and scalable resource allocation (people, process and technology) Simplified operational structure Reduced client conflicts Pre-Transaction Pro-Forma

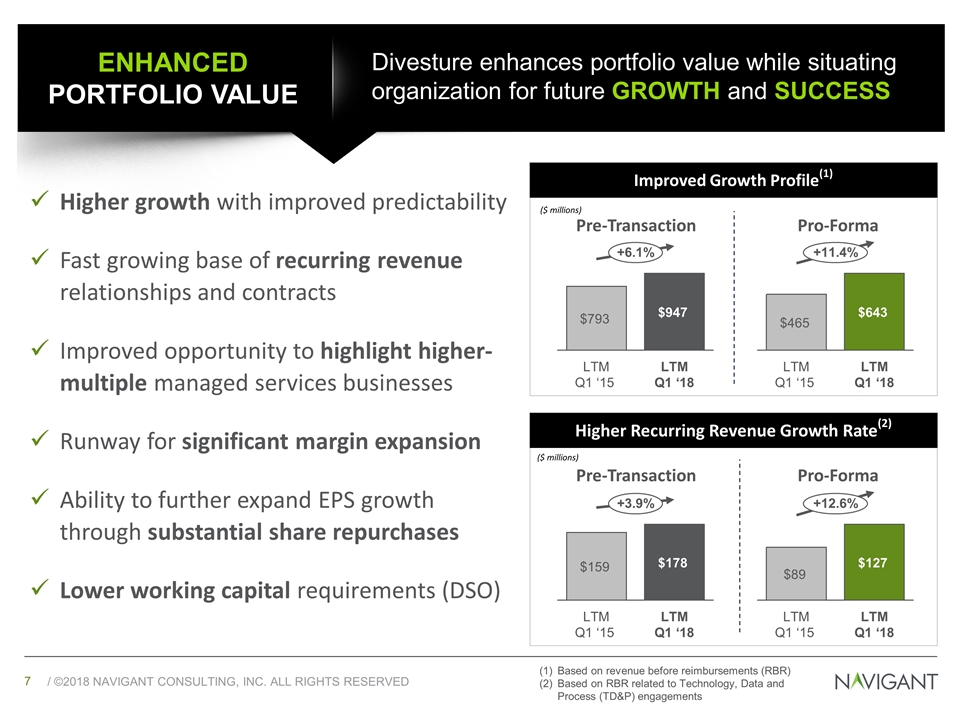

Divesture enhances portfolio value while situating organization for future GROWTH and SUCCESS Improved Growth Profile(1) Higher Recurring Revenue Growth Rate(2) ENHANCED PORTFOLIO VALUE ($ millions) ($ millions) Higher growth with improved predictability Fast growing base of recurring revenue relationships and contracts Improved opportunity to highlight higher-multiple managed services businesses Runway for significant margin expansion Ability to further expand EPS growth through substantial share repurchases Lower working capital requirements (DSO) +3.9% Pre-Transaction Pro-Forma Based on revenue before reimbursements (RBR) Based on RBR related to Technology, Data and Process (TD&P) engagements +12.6% +6.1% Pre-Transaction Pro-Forma +11.4%

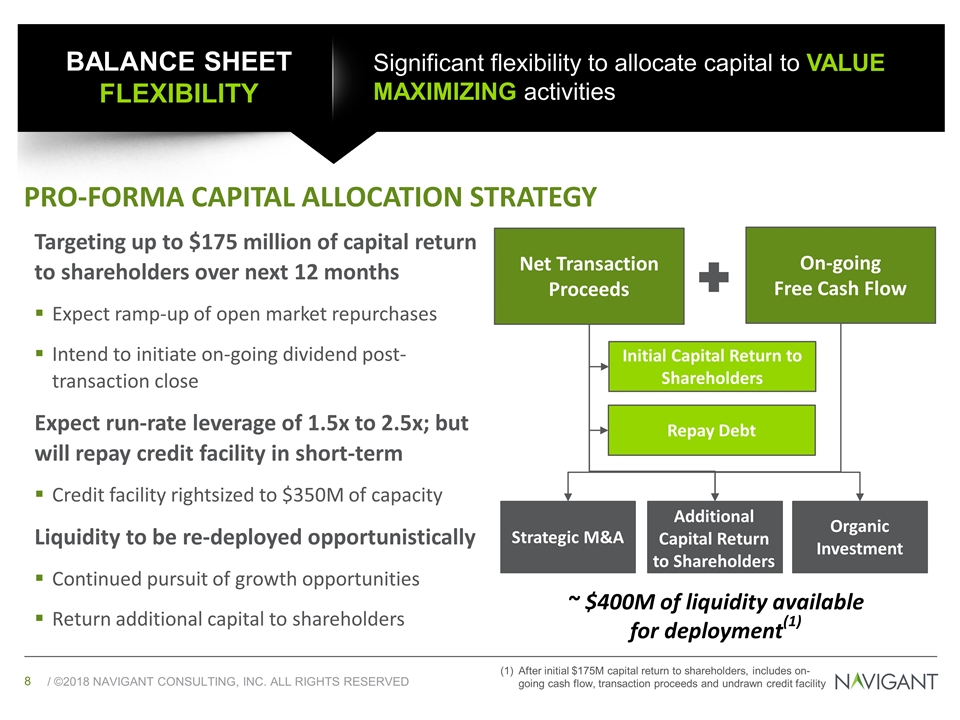

PRO-FORMA CAPITAL ALLOCATION STRATEGY Significant flexibility to allocate capital to VALUE MAXIMIZING activities Targeting up to $175 million of capital return to shareholders over next 12 months Expect ramp-up of open market repurchases Intend to initiate on-going dividend post-transaction close Expect run-rate leverage of 1.5x to 2.5x; but will repay credit facility in short-term Credit facility rightsized to $350M of capacity Liquidity to be re-deployed opportunistically Continued pursuit of growth opportunities Return additional capital to shareholders Net Transaction Proceeds On-going Free Cash Flow Strategic M&A Organic Investment Repay Debt BALANCE SHEET FLEXIBILITY Initial Capital Return to Shareholders ~ $400M of liquidity available for deployment(1) Additional Capital Return to Shareholders After initial $175M capital return to shareholders, includes on-going cash flow, transaction proceeds and undrawn credit facility

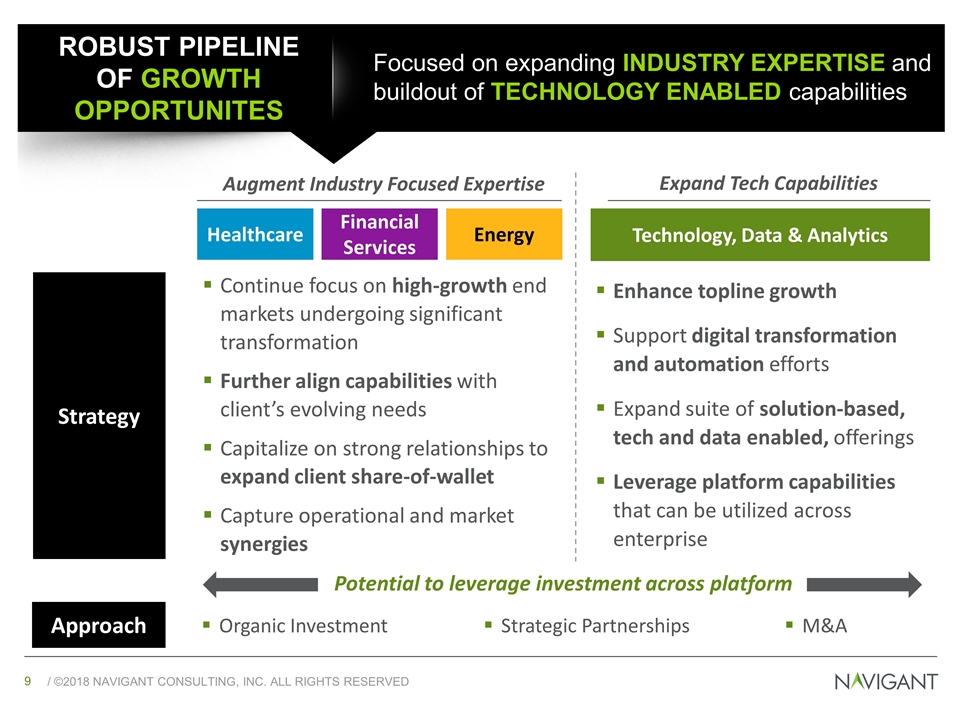

Focused on expanding INDUSTRY EXPERTISE and buildout of TECHNOLOGY ENABLED capabilities Healthcare ROBUST PIPELINE OF GROWTH OPPORTUNITES Strategy Financial Services Technology, Data & Analytics Augment Industry Focused Expertise Continue focus on high-growth end markets undergoing significant transformation Further align capabilities with client’s evolving needs Capitalize on strong relationships to expand client share-of-wallet Capture operational and market synergies Enhance topline growth Support digital transformation and automation efforts Expand suite of solution-based, tech and data enabled, offerings Leverage platform capabilities that can be utilized across enterprise Expand Tech Capabilities Energy Potential to leverage investment across platform Approach Organic Investment Strategic Partnerships M&A

LONG-TERM OUTLOOK Expect strong organic GROWTH and PROFTIABILITY Expect pro-forma Navigant to achieve significant organic RBR growth over next 5-year period Benefit from management consulting business aligned with fast growing industry sectors including strong growth in adjacent managed services offerings (primarily revenue cycle BPMS) Targeting run-rate Adjusted EBITDA margin of 12% to 14% Margin profile reflective of pro-forma revenue mix with higher concentration of recurring TD&P revenue Near-term margins will be lower than target partially due to absorption of expected stranded corporate G&A cost not transferring to SaleCo ($20M - $25M) and the impact of the Baptist JV start-up Expect to right-size G&A cost structure post-close; anticipate re-gaining cost leverage over time as business grows to return G&A to 17-18% of RBR Anticipate share repurchase activity to fuel additional EPS growth Will provide 2018 guidance for Continuing Operations in conjunction with Q2 Earnings SaleCo will be reclassified as Discontinued Operations; historical financials to be recast

THE NEW ATTRACTIVE SHAREHOLDER VALUE PROPOSITION We expect: Accelerated organic growth profile Increased visibility and durability of revenue base Enhanced leverage through simplified business mix Continued commitment to return capital to shareholders Significant balance sheet flexibility to pursue future growth opportunities

Q & A

APPENDIX

Presentation & Definitions PRESENTATION During the quarter ended March 31, 2018, we moved our life sciences regulatory and compliance related business from the Disputes, Forensics and Legal Technology reporting segment into our Healthcare segment. All prior period information has been restated to conform to current period presentation. DEFINITIONS Adjusted EBITDA, Adjusted Net Income and Adjusted Earnings per Share (EPS) Adjusted EBITDA is EBITDA – earnings from continuing operations before interest, taxes, depreciation, and amortization – excluding the impact of severance expense and other operating costs (benefit), as applicable. Adjusted Net Income and Adjusted Earnings per Share exclude the net income and per share net income impact of severance expense, other operating costs (benefit), and the benefit recognized in the fourth quarter 2017 related to the 2017 Tax Cuts and Jobs Act, as applicable. Severance expense and other operating costs (benefit) are not considered to be non-recurring, infrequent or unusual to our business. Management believes that these non-GAAP financial measures provide investors with enhanced comparability of Navigant’s results of operations across periods. Free Cash Flow is calculated as net cash provided by (used in) operations excluding the change in asset, liabilities and allowance for doubtful accounts less cash payment for property, equipment and deferred acquisition liabilities. Free Cash Flow does not represent cash available for spending as it excludes certain contractual obligations such as debt repayment. However, management believes that Free Cash Flow provides investors with an indicator of cash available for on-going business operations and long-term value creation. Leverage Ratio is calculated as bank debt at the end of the period divided by adjusted EBITDA for the prior twelve-month period. Management believes that leverage provides investors with an indicator of the cash flows available to repay the Company's debt obligations. Period End FTE is headcount at the end of the period adjusted for part-time status. Period End FTE is further split between the following categories: Client-Service FTE - combination of Consulting FTE and Technology, Data & Process FTE defined as follows: Consulting FTE - individuals assigned to client services who record time to client engagements; and Technology, Data & Process FTE - individuals in technology enabled professional services, including business process management services and data analytics, legal technology solutions and data services and insurance claims processing, market research and benchmarking. These FTEs are not included in Average Bill Rate and Average Utilization Rate metrics Non-billable FTE - individuals assigned to administrative and support functions, including office services, corporate functions and certain practice support functions. Average Bill Rate is calculated by dividing fee revenues before certain adjustments such as discounts and markups, by the number of hours associated with the fee revenues. Fee revenues and hours billed on performance-based services and those related to Technology, Data & Process FTE are excluded from average bill rate. Average Utilization Rate is calculated by dividing the number of hours of our Consulting FTE who recorded time to client engagements during a period by the total available working hours for these consultants during the same period (1,850 hours annually). Hours related to Technology, Data & Process FTE are excluded from average utilization rate.