Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Lightstone Value Plus REIT V, Inc. | tv496936_8-k.htm |

Exhibit 99.1

LIGHTSTONE VALUE PLUS REIT V Investor Presentation June 21, 2018 1

Dial - in Information To listen to today’s call: +1 (914) 614 - 3221 Participant PIN Code: 476 - 364 - 176 2

Forward - Looking Statements 3 This presentation contains forward - looking statements, including discussion and analysis of the financial condition of us and our subsidiaries and other matters. These forward - looking statements are not historical facts but are the intent, belief or current expectations of our management based on their knowledge and understanding of our business and industry. Words such as “may,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “would,” “could,” “should” and variations of these words and similar expressions are intended to identify forward - looking statements. We intend that such forward - looking statements be subject to the safe harbor provisions created by Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward - looking statements. Forward - looking statements that were true at the time made may ultimately prove to be incorrect or false. We caution you not to place undue reliance on forward - looking statements, which reflect our management's view only as of the date of this presentation. We undertake no obligation to update or revise forward - looking statements to reflect changed assumptions the occurrence of unanticipated events or changes to future operating results.

Forward - Looking Statements 4 Factors that could cause actual results to differ materially from any forward - looking statements made in the presentation includ e but are not limited to: • market and economic challenges experienced by the U.S. and global economies or real estate industry as a whole and the local economi c conditions in the markets in which our investments are located; • the availability of cash flow from operating activities for distributions, if any; • conflicts of interest arising out of our relationships with our advisor and its affiliates; • our ability to retain our executive officers and other key individuals who provide advisory and property management services to u s; • our level of debt and the terms and limitations imposed on us by our debt agreements; • the availability of credit generally, and any failure to obtain debt financing at favorable terms or a failure to satisfy the con dit ions and requirements of that debt; • our ability to make accretive investments in a diversified portfolio of assets; • future changes in market factors that could affect the ultimate performance of our development or redevelopment projects, including but not limited to construction costs, plan or design changes, schedule delays, availability of construction financing, performan ce of developers, contractors and consultants, and growth in rental rates and operating costs; • our ability to secure leases at favorable rental rates; • our ability to sell our assets at a price and on a timeline consistent with our investment objectives; • impairment charges; • unfavorable changes in laws or regulations impacting our business, our assets or our key relationships; and • factors that could affect our ability to qualify as a real estate investment trust. The forward - looking statements should be read in light of these and other risk factors identified in the “Risk Factors” section of our Annual Report on Form 10 - K for the year ended December 31, 2017, as filed with the Securities and Exchange Commission on March 29, 2018.

Agenda Executive Summary • Overview • Operational Performance • Courtyard Kauai at Coconut Beach Sale • Flats at Fisher Marketplace acquisition • Refinance • Amendment of Share Redemption Program 5

Lightstone Group • Founded in 1988 • Assets in 23 States • > 400 Employees • $ 1.5B Net Worth • > $2 Billion in Assets • 13,000 Apartments • 6M Sq. Ft. Office/Retail • 27 Hotels • $2.1B Development • 858 Luxury Rentals • 255 Luxury Condos • 2,000 Hotel Rooms (NYC, L.A., Miami) E&Y Audited Financials, S&P A+/ Moody’s A1 Rated 6

Overview Year 1 – Transitional Year • Focus: – Portfolio restructuring – Debt refinance – Partnership relations Year 2 and Beyond • Focus: – Position for growth and asset deployment 7

Operational Performance 8

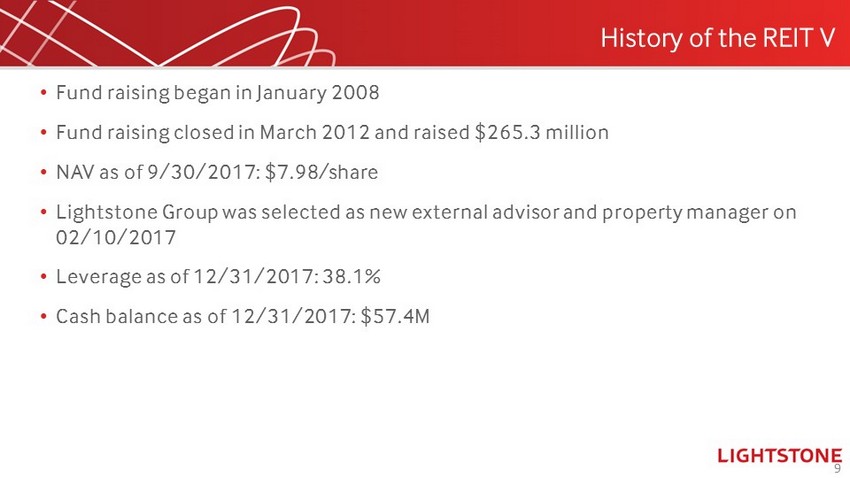

History of the REIT V 9 • Fund raising began in January 2008 • Fund raising closed in March 2012 and raised $265.3 million • NAV as of 9/30/2017: $7.98/share • Lightstone Group was selected as new external advisor and property manager on 02/10/2017 • Leverage as of 12/31/2017: 38.1% • Cash balance as of 12/31/2017: $ 57.4M

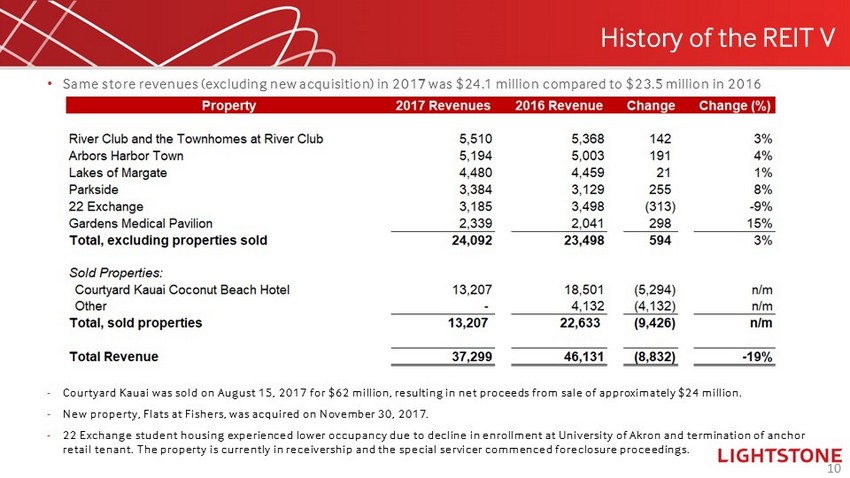

History of the REIT V 10 • Same store revenues (excluding new acquisition) in 2017 was $24.1 million compared to $23.5 million in 2016 - Courtyard Kauai was sold on August 15, 2017 for $62 million, resulting in net proceeds from sale of approximately $24 million . - New property, Flats at Fishers, was acquired on November 30, 2017. - 22 Exchange student housing experienced lower occupancy due to decline in enrollment at University of Akron and termination o f a nchor retail tenant. The property is currently in receivership and the special servicer commenced foreclosure proceedings.

River Club and the Townhomes at River Club 11 • The enrollment at University of Georgia increased by 10% in the past ten years and is projected to grow by 1.5% annually. The ma rket reports indicate a continued strong performance of the student housing properties despite increase in supply. • The market outlook is positive, with projected 5 - year avg. occupancy of 97% and rent growth of 2.7% for all student housing properties in the area. We anticipate the occupancy to remain high and rent per bed to continue to grow in the foreseeable fu tur e. Market data reports provided by AXIOMetrics , Inc.

Arbors Harbor Town 12 • The property continues to maintain strong occupancy of 94% and monthly rents that are consistent with the market. • The property is located on Mud Island, a popular residential neighborhood with minimal vacant sites for additional developmen t.

Prospect Park (The “Huron”) Mezz Loan 13 • We provided mezzanine loan of $15.2 million for construction of a multifamily property. The property was sold in 2017 for $100.5 million. • W e received the principal balance plus a profit of $17.3* million. Our investment in the property generated an attractive IRR of approximately 18%. * The $17.3 million is comprised of $10.9 million of minimum amount payable to us under the profit participation and $6.4 mil lio n interest income

Lake of Margate 14 • The monthly rents have increased year over year and we expect the occupancy to continue to grow, improving from a slight dec lin e experienced due to Hurricane Irma in the fall of 2017. • We expect the rates to continue to increase and vacancy to remain low as the demand for apartments in the area is expected to remain strong based on the latest market data. Market data provided by Capright

Parkside Apartments 15 • The property continues to maintain high occupancy driven by strong Houston market which has seen employment growth. However, concessions are currently required due to two new constructions in the area. • We anticipate limited new supply in the foreseeable future and expect monthly rents to continue to grow as the supply is absorbed. Market data provided by Capright

22 Exchange Student Housing 16 • The enrollment at University of Akron declined by 18% since 2013. The continued enrollment decline in 2017 resulted in a lowe r occupancy at the property and it was not generating sufficient revenue to make the debt service payments under the loan. • We have had discussions with the special servicer to restructure the terms of the loan. The lender did not provide amicable t erm s and restructuring would have resulted in significant capital infusion by the REIT with a limited upside. Subsequently, the sp eci al servicer placed the property in receivership and commenced foreclosure proceedings.

Gardens Medical Office Building 17 • The property had occupancy ranging of approximately 60% - 70% for the past several years. • We are in the process of selecting a new leasing company with medical office expertise and relationship with hospitals and lo cal medical community to help us implement aggressive leasing strategy to increase occupancy.

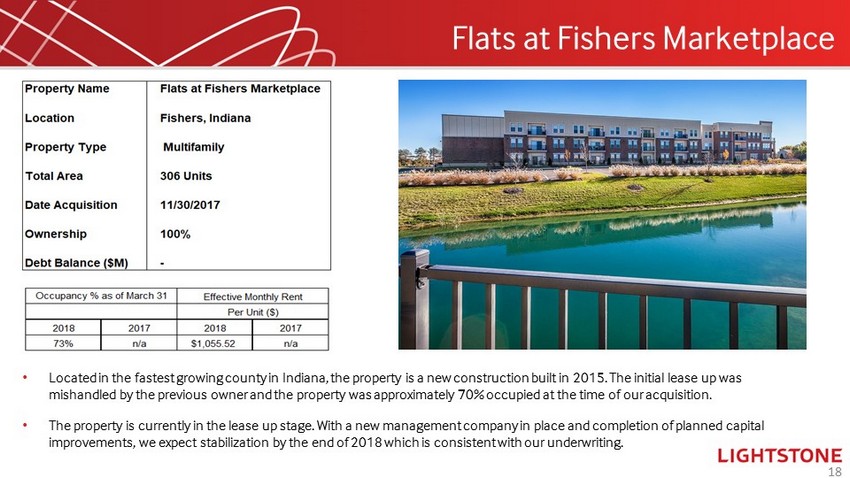

Flats at Fishers Marketplace 18 • Located in the fastest growing county in Indiana, the property is a new construction built in 2015. The initial lease up was mishandled by the previous owner and the property was approximately 70% occupied at the time of our acquisition. • The property is currently in the lease up stage. With a new management company in place and completion of planned capital improvements, we expect stabilization by the end of 2018 which is consistent with our underwriting.

Courtyard Kauai at Coconut Beach Sale 19

20 Courtyard Kauai at Coconut Beach Sale Kauai Sale • Sold Courtyard Kauai at Coconut Beach on August 15, 2017. • Contract sales price of $62.0 million. • Buyer assumed the existing outstanding mortgage of $36.0 million. • Net proceeds from the sale were approximately $ 24.0 million. • The sale resulted in an IRR of approximately 16%.

Flats at Fishers Marketplace Acquisition 21

22 Flats at Fishers Marketplace Acquisition Flats at Fishers Marketplace Acquisition • Acquired Flats at Fishers Marketplace on November 30, 2017. • A multifamily complex in Fishers, IN built in 2015. • Located in Indiana’s wealthiest and fastest growing county. • Contact purchase price of $36.9 million. • The acquisition was funded with proceeds from the sale of the Courtyard Kauai Coconut Beach and available cash.

Refinance 23

24 Refinance • We have successfully refinanced River Club and the Townhomes at River Club and Parkside Apartments with non - recourse loans from Freddie Mac. • The refinance resulted in lower interest rates and additional proceeds to the REIT of approximately $10 million. 30 Day Libor – 1.9% as of 5/1/2018 7 YR US Treasury Rate - 2.85% as of 6/1/2018

Amendment of Share Redemption Program 25

Amendment of Share Redemption Program • On August 9, 2017 the Board approved a new share redemption program effective July 1, 2018. 26 ‒ Beginning July 1, 2018 all redemptions will be redeemed on the same terms regardless of the reason for the request. ‒ Our new share redemption program will continue to be subject to 5 % limitation on the number of shares redeemed as well as a rolling 12 - month $10 million funding limitation.

Q&A • If you have any questions, please submit them to investorservices@lightstonegroup.com 27