Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - J M SMUCKER Co | sjm43018-10kex32.htm |

| EX-31.2 - EXHIBIT 31.2 - J M SMUCKER Co | sjm43018-10kex312.htm |

| EX-31.1 - EXHIBIT 31.1 - J M SMUCKER Co | sjm43018-10kex311.htm |

| EX-24 - EXHIBIT 24 - J M SMUCKER Co | sjm43018-10kex24.htm |

| EX-23 - EXHIBIT 23 - J M SMUCKER Co | sjm43018-10kex23.htm |

| EX-21 - EXHIBIT 21 - J M SMUCKER Co | sjm43018-10kex21.htm |

| EX-12.1 - EXHIBIT 12.1 - J M SMUCKER Co | sjm43018-10kex121.htm |

| EX-10.30 - EXHIBIT 10.30 - J M SMUCKER Co | sjm43018-10kex1030.htm |

| EX-2.2 - EXHIBIT 2.2 - J M SMUCKER Co | sjm43018-10kex22.htm |

| 10-K - 10-K - J M SMUCKER Co | sjm43018-10xk.htm |

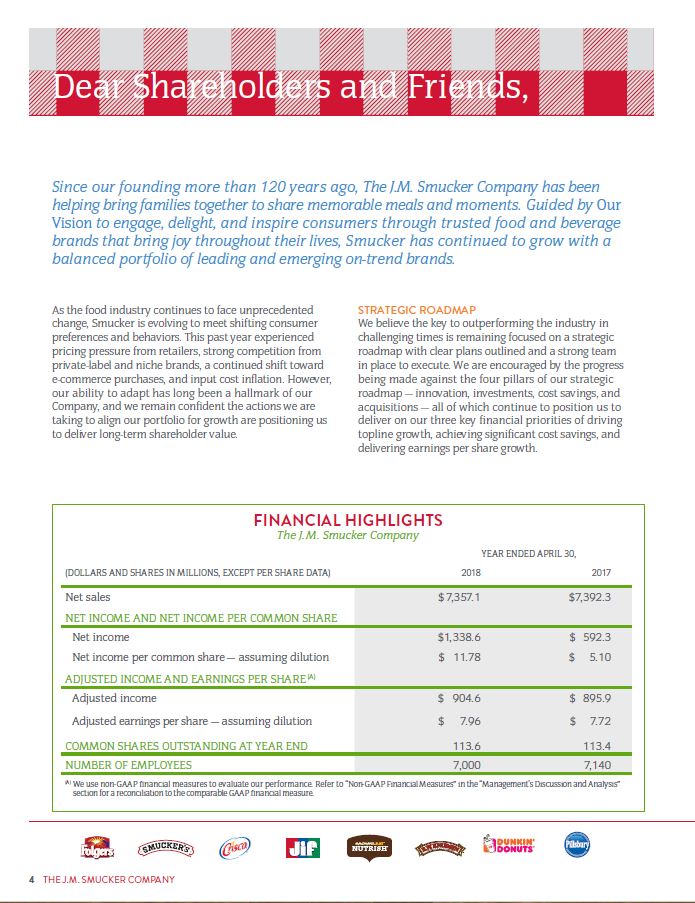

2018 FINANCIAL REVIEW

The J. M. Smucker Company

FIVE-YEAR SUMMARY OF SELECTED FINANCIAL DATA

The following table presents selected financial data for each of the five years in the period ended April 30, 2018. The selected financial data should be read in conjunction with the “Results of Operations” and “Liquidity and Capital Resources” sections of “Management’s Discussion and Analysis” and the consolidated financial statements and notes thereto.

Year Ended April 30, | ||||||||||||||||||||||||||

(Dollars and shares in millions, except per share data) | 2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||||||||

Statements of Income: | ||||||||||||||||||||||||||

Net sales | $ | 7,357.1 | $ | 7,392.3 | $ | 7,811.2 | $ | 5,692.7 | $ | 5,610.6 | ||||||||||||||||

Gross profit | $ | 2,836.1 | $ | 2,835.3 | $ | 2,967.8 | $ | 1,968.7 | $ | 2,031.0 | ||||||||||||||||

% of net sales | 38.5 | % | 38.4 | % | 38.0 | % | 34.6 | % | 36.2 | % | ||||||||||||||||

Operating income | $ | 1,036.1 | $ | 1,031.5 | $ | 1,145.3 | $ | 772.0 | $ | 919.0 | ||||||||||||||||

% of net sales | 14.1 | % | 14.0 | % | 14.7 | % | 13.6 | % | 16.4 | % | ||||||||||||||||

Net income | $ | 1,338.6 | $ | 592.3 | $ | 688.7 | $ | 344.9 | $ | 565.2 | ||||||||||||||||

Financial Position: | ||||||||||||||||||||||||||

Cash and cash equivalents | $ | 192.6 | $ | 166.8 | $ | 109.8 | $ | 125.6 | $ | 153.5 | ||||||||||||||||

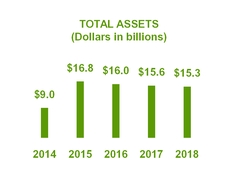

Total assets | 15,301.2 | 15,639.7 | 15,984.1 | 16,806.3 | 9,041.4 | |||||||||||||||||||||

Total debt | 4,832.0 | 5,398.5 | 5,430.0 | 6,170.9 | 2,216.3 | |||||||||||||||||||||

Total shareholders’ equity | 7,891.1 | 6,850.2 | 7,008.5 | 7,086.9 | 5,029.6 | |||||||||||||||||||||

Liquidity: | ||||||||||||||||||||||||||

Net cash provided by operating activities | $ | 1,218.0 | $ | 1,059.0 | $ | 1,461.0 | $ | 739.1 | $ | 863.3 | ||||||||||||||||

Additions to property, plant, and equipment | 321.9 | 192.4 | 201.4 | 247.7 | 279.5 | |||||||||||||||||||||

Free cash flow (A) | 896.1 | 866.6 | 1,259.6 | 491.4 | 583.8 | |||||||||||||||||||||

Quarterly dividends paid | 350.3 | 339.3 | 316.6 | 254.0 | 238.0 | |||||||||||||||||||||

Purchase of treasury shares | 7.0 | 437.6 | 441.1 | 24.3 | 508.5 | |||||||||||||||||||||

EBITDA (as adjusted) (A) | 1,625.1 | 1,593.7 | 1,579.1 | 871.3 | 1,185.5 | |||||||||||||||||||||

Share Data: | ||||||||||||||||||||||||||

Weighted-average shares outstanding | 113.6 | 116.0 | 119.4 | 103.7 | 104.3 | |||||||||||||||||||||

Weighted-average shares outstanding – assuming dilution | 113.6 | 116.1 | 119.5 | 103.7 | 104.3 | |||||||||||||||||||||

Dividends declared per common share | $ | 3.12 | $ | 3.00 | $ | 2.68 | $ | 2.56 | $ | 2.32 | ||||||||||||||||

Earnings per Common Share: | ||||||||||||||||||||||||||

Net income | $ | 11.79 | $ | 5.11 | $ | 5.77 | $ | 3.33 | $ | 5.42 | ||||||||||||||||

Net income – assuming dilution | 11.78 | 5.10 | 5.76 | 3.33 | 5.42 | |||||||||||||||||||||

Other Non-GAAP Measures: (A) | ||||||||||||||||||||||||||

Adjusted gross profit | $ | 2,802.7 | $ | 2,868.2 | $ | 2,968.0 | $ | 1,999.4 | $ | 2,035.1 | ||||||||||||||||

% of net sales | 38.1 | % | 38.8 | % | 38.0 | % | 35.1 | % | 36.3 | % | ||||||||||||||||

Adjusted operating income | $ | 1,431.8 | $ | 1,481.8 | $ | 1,489.8 | $ | 970.2 | $ | 1,047.6 | ||||||||||||||||

% of net sales | 19.5 | % | 20.0 | % | 19.1 | % | 17.0 | % | 18.7 | % | ||||||||||||||||

Adjusted income and earnings per share: | ||||||||||||||||||||||||||

Adjusted income | $ | 904.6 | $ | 895.9 | $ | 931.3 | $ | 475.6 | $ | 650.8 | ||||||||||||||||

Adjusted earnings per share – assuming dilution | $ | 7.96 | $ | 7.72 | $ | 7.79 | $ | 4.59 | $ | 6.24 | ||||||||||||||||

(A) | We use non-GAAP financial measures to evaluate our performance. Refer to “Non-GAAP Financial Measures” in the “Management’s Discussion and Analysis” section for a reconciliation to the comparable GAAP financial measure. |

2018 ANNUAL REPORT 27

SUMMARY OF QUARTERLY RESULTS OF OPERATIONS

The J. M. Smucker Company

The following is a summary of unaudited quarterly results of operations for the years ended April 30, 2018 and 2017.

(Dollars in millions, except per share data) | Quarter Ended | Net Sales | Gross Profit | Net Income | Net Income per Common Share | Net Income per Common Share – Assuming Dilution | |||||||||||||||

2018 | July 31, 2017 | $ | 1,748.9 | $ | 662.1 | $ | 126.8 | $ | 1.12 | $ | 1.12 | ||||||||||

October 31, 2017 | 1,923.6 | 755.0 | 194.6 | 1.71 | 1.71 | ||||||||||||||||

January 31, 2018 | 1,903.3 | 728.5 | 831.3 | 7.32 | 7.32 | ||||||||||||||||

April 30, 2018 | 1,781.3 | 690.5 | 185.9 | 1.64 | 1.64 | ||||||||||||||||

2017 | July 31, 2016 | $ | 1,815.8 | $ | 722.7 | $ | 170.0 | $ | 1.46 | $ | 1.46 | ||||||||||

October 31, 2016 | 1,913.9 | 742.9 | 177.3 | 1.52 | 1.52 | ||||||||||||||||

January 31, 2017 | 1,878.8 | 722.9 | 134.6 | 1.16 | 1.16 | ||||||||||||||||

April 30, 2017 | 1,783.8 | 646.8 | 110.4 | 0.96 | 0.96 | ||||||||||||||||

Annual net income per common share may not equal the sum of the individual quarters due to differences in the average number of shares outstanding during the respective periods, primarily due to share repurchases.

STOCK PRICE DATA

Our common shares are listed on the New York Stock Exchange – ticker symbol SJM. The table below presents the high and low market prices for the shares and the quarterly dividends declared. There were approximately 319,849 shareholders of record as of June 12, 2018,

of which approximately 39,362 were registered holders of common shares.

Quarter Ended | High | Low | Dividends | ||||||||||

2018 | July 31, 2017 | $ | 134.12 | $ | 114.31 | $ | 0.78 | ||||||

October 31, 2017 | 123.83 | 101.82 | 0.78 | ||||||||||

January 31, 2018 | 132.76 | 99.57 | 0.78 | ||||||||||

April 30, 2018 | 133.38 | 113.16 | 0.78 | ||||||||||

2017 | July 31, 2016 | $ | 154.97 | $ | 125.67 | $ | 0.75 | ||||||

October 31, 2016 | 157.31 | 128.75 | 0.75 | ||||||||||

January 31, 2017 | 136.13 | 122.05 | 0.75 | ||||||||||

April 30, 2017 | 143.68 | 125.77 | 0.75 | ||||||||||

28 THE J. M. SMUCKER COMPANY

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL SHAREHOLDER RETURN

The J. M. Smucker Company

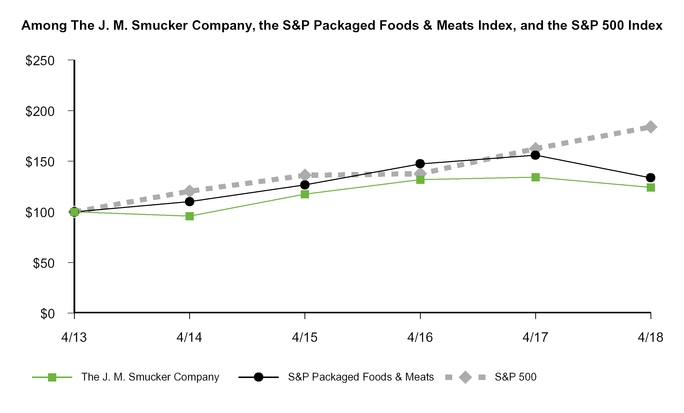

April 30, | |||||||||||||||||||||||

2013 | 2014 | 2015 | 2016 | 2017 | 2018 | ||||||||||||||||||

The J. M. Smucker Company | $ | 100.00 | $ | 95.71 | $ | 117.56 | $ | 131.72 | $ | 134.25 | $ | 124.10 | |||||||||||

S&P Packaged Foods & Meats | 100.00 | 110.04 | 126.53 | 147.44 | 155.95 | 133.61 | |||||||||||||||||

S&P 500 | 100.00 | 120.44 | 136.07 | 137.71 | 162.39 | 183.93 | |||||||||||||||||

The above graph compares the cumulative total shareholder return for the five years ended April 30, 2018, for our common shares, the S&P Packaged Foods & Meats Index, and the S&P 500 Index. These figures assume all dividends are reinvested when received and are based on $100 invested in our common shares and the referenced index funds on April 30, 2013.

Copyright © 2018 Standard & Poor’s, a division of S&P Global. All rights reserved.

www.researchdatagroup.com/standards-poors/

2018 ANNUAL REPORT 29

MANAGEMENT’S DISCUSSION AND ANALYSIS

The J. M. Smucker Company

(Dollars and shares in millions, unless otherwise noted, except per share data)

COMPANY BACKGROUND

For more than 120 years, The J. M. Smucker Company (“Company,” “we,” “us,” or “our”) headquartered in Orrville, Ohio, has brought families together to share memorable meals and moments. Guided by a vision to engage, delight, and inspire consumers through trusted food and beverage brands that bring joy throughout their lives, the Company has grown to be a well-respected North American marketer and manufacturer with a balanced portfolio of leading and emerging, on-trend brands. In consumer foods and beverages, our brands include Smucker’s®, Folgers®, Jif ®, Dunkin’ Donuts®, Crisco®, Café Bustelo®,

R.W. Knudsen Family®, Sahale Snacks®, Smucker’s Uncrustables®, Robin Hood®, and Bick’s®. In pet food and pet snacks, our brands include Rachael Ray® Nutrish®, Meow Mix®, Milk-Bone®,

Kibbles ’n Bits®, Natural Balance®, and Nature’s Recipe®.

We have four reportable segments: U.S. Retail Coffee, U.S. Retail Consumer Foods, U.S. Retail Pet Foods, and International and Away From Home. The U.S. retail market segments in total comprised approximately 85 percent of net sales in 2018 and represent a major portion of our strategic focus – the sale of branded food and beverage products with leadership positions to consumers through retail outlets in North America. In the U.S. retail market segments, our products are sold primarily to food retailers, food wholesalers, club stores, pet specialty stores, discount and dollar stores, drug stores, military commissaries, mass merchandisers, natural foods stores and distributors, and online retailers. The products included in the International and Away From Home segment are distributed domestically and in foreign countries through retail channels and foodservice distributors and operators (e.g., restaurants, lodging, schools and universities, health care operators).

STRATEGIC OVERVIEW

We remain rooted in our Basic Beliefs of Quality, People, Ethics, Growth, and Independence established by our founder and namesake, Jerome Smucker, more than a century ago. Today, these Basic Beliefs are the core of our unique corporate culture and serve as a foundation for decision-making and actions. We have been led by five generations of family leadership, having had only six chief executive officers in 121 years. This continuity of management and thought extends to the broader leadership team that embodies the values and embraces the business practices that have contributed to our consistent growth.

Our strategic vision is to own and market a portfolio of food and beverage brands that combines number one and leading brands with emerging, on-trend brands to drive balanced, long-term growth, primarily in North America.

Our strategic long-term growth objectives are to increase net sales by 3 percent and earnings per share, measured on a non-GAAP

basis, by 8 percent annually on average. We expect organic growth,

including new products, to drive much of our top-line growth,

while the contribution from acquisitions will vary from year

to year.

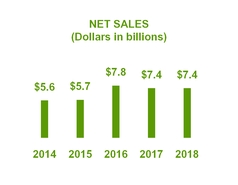

Net sales has increased at a compound annual growth rate of

5 percent over the past five years, driven by the acquisition of

Big Heart Pet Brands (“Big Heart”) in 2015, while income per diluted share excluding non-GAAP adjustments (“adjusted earnings per share”) has increased at a rate of 6 percent over the same period. Our non-GAAP adjustments include amortization expense and impairment charges related to intangible assets, integration and restructuring costs, unallocated gains and losses on commodity and foreign currency exchange derivatives, and, beginning in 2018, certain one-time tax adjustments. Refer to “Non-GAAP Financial Measures” in this discussion and analysis for further information.

During the fourth quarter of 2018, we announced a definitive agreement to acquire the stock of Ainsworth Pet Nutrition, LLC (“Ainsworth”). On May 14, 2018, we completed the all-cash transaction, which was funded by debt and valued at $1.9 billion. Ainsworth is a leading producer, distributor, and marketer of premium pet food and pet snacks, predominantly within the U.S. Approximately two-thirds of Ainsworth’s sales are generated by its Rachael Ray Nutrish brand, which is driving significant growth in the premium pet food category. We anticipate the acquired business to contribute net sales of approximately $800.0 in 2019. Annual cost synergies of approximately $55.0 are expected to be fully realized within three years after the closing, with approximately $25.0 anticipated in 2019.

Net cash provided by operating activities has increased at a compound annual growth rate of 7 percent over the past five years. Our cash deployment strategy is to balance reinvesting in our business through acquisitions and capital expenditures with returning cash to our shareholders through the payment of dividends and share repurchases. Our strategy also includes a significant focus on debt repayment as a result of the additional debt we incurred to finance the Ainsworth acquisition subsequent to year-end.

RESULTS OF OPERATIONS

All comparisons presented in this discussion and analysis are to the corresponding period of the prior year, unless otherwise noted. On December 31, 2015, we sold our U.S. canned milk brands and operations to Eagle Family Foods Group LLC, a subsidiary of

funds affiliated with Kelso & Company. The transaction included

canned milk products that were primarily sold in U.S. retail and

foodservice channels with annual net sales of approximately $200.0. The operating results for this business were primarily included in the U.S. Retail Consumer Foods segment prior to the sale. We received proceeds from the divestiture of $193.7, which were net of transaction costs and a working capital adjustment, and recognized a pre-tax gain of $25.3.

30 THE J. M. SMUCKER COMPANY

MANAGEMENT’S DISCUSSION AND ANALYSIS

The J. M. Smucker Company

Year Ended April 30, | ||||||||||||||||||||||

2018 | 2017 | 2016 | 2018 % Increase (Decrease) | 2017 % Increase (Decrease) | ||||||||||||||||||

Net sales | $ | 7,357.1 | $ | 7,392.3 | $ | 7,811.2 | — | % | (5 | )% | ||||||||||||

Gross profit | $ | 2,836.1 | $ | 2,835.3 | $ | 2,967.8 | — | (4 | ) | |||||||||||||

% of net sales | 38.5 | % | 38.4 | % | 38.0 | % | ||||||||||||||||

Operating income | $ | 1,036.1 | $ | 1,031.5 | $ | 1,145.3 | — | (10 | ) | |||||||||||||

% of net sales | 14.1 | % | 14.0 | % | 14.7 | % | ||||||||||||||||

Net income: | ||||||||||||||||||||||

Net income | $ | 1,338.6 | $ | 592.3 | $ | 688.7 | 126 | (14 | ) | |||||||||||||

Net income per common share – assuming dilution | $ | 11.78 | $ | 5.10 | $ | 5.76 | 131 | (11 | ) | |||||||||||||

Adjusted gross profit (A) | $ | 2,802.7 | $ | 2,868.2 | $ | 2,968.0 | (2 | ) | (3 | ) | ||||||||||||

% of net sales | 38.1 | % | 38.8 | % | 38.0 | % | ||||||||||||||||

Adjusted operating income (A) | $ | 1,431.8 | $ | 1,481.8 | $ | 1,489.8 | (3 | ) | (1 | ) | ||||||||||||

% of net sales | 19.5 | % | 20.0 | % | 19.1 | % | ||||||||||||||||

Adjusted income: (A) | ||||||||||||||||||||||

Income | $ | 904.6 | $ | 895.9 | $ | 931.3 | 1 | (4 | ) | |||||||||||||

Earnings per share – assuming dilution | $ | 7.96 | $ | 7.72 | $ | 7.79 | 3 | (1 | ) | |||||||||||||

(A) | We use non-GAAP financial measures to evaluate our performance. Refer to “Non-GAAP Financial Measures” in this discussion and analysis for a reconciliation to the comparable GAAP financial measure. |

Summary of 2018

Net sales were flat in 2018, reflecting declines within the U.S. Retail Consumer Foods and U.S. Retail Coffee segments, offset by gains in the U.S. Retail Pet Food and International and Away From Home segments. The overall net sales change was driven by unfavorable volume/mix, which was mostly offset by the impacts of higher net price realization and favorable foreign currency exchange in the current year. Operating income was flat, as lower special project costs and selling, distribution, and administrative (“SD&A”) expenses were mostly offset by a $43.7 increase in noncash impairment charges related to intangible assets. Net income per diluted share increased $6.68, reflecting a provisional nonrecurring income tax benefit of $765.8 related to U.S. tax reform legislation, which was enacted during the third quarter of 2018, and a decrease in weighted-average common shares outstanding as a result of our share repurchase activities during the fourth quarter of 2017.

Operating income excluding non-GAAP adjustments (“adjusted operating income”) decreased 3 percent in 2018. Adjusted earnings per share increased 3 percent, with the primary differences from the change in GAAP results being the exclusion of the impacts of our one-time tax adjustments, a favorable change in the impact of unallocated derivative gains and losses as compared to the prior year, and lower special project costs. The impairment charges in 2018 and 2017 were also excluded from our non-GAAP results.

Summary of 2017

Net sales decreased 5 percent in 2017, driven by the non-comparable impact from the U.S. canned milk business, which

was divested during the third quarter of 2016, as well as lower net

price realization and unfavorable volume/mix in 2017. Operating

income decreased 10 percent, primarily due to the impact of noncash impairment charges of $133.2 recognized during 2017 and the net sales decline. Additionally, 2016 results benefited from the recognition of a $25.3 pre-tax gain on the divestiture of the U.S. canned milk business and the related profits prior to the divestiture. SD&A expenses and Big Heart integration costs were lower in 2017 as compared to 2016. Net income per diluted share decreased

11 percent in 2017 and reflects the benefit of a decrease in weighted-average common shares outstanding as a result of our share repurchase activities during the fourth quarters of 2017 and 2016. However, this benefit was more than offset by the impact of an increase in the effective tax rate in 2017 as compared to the prior year.

Adjusted operating income and adjusted earnings per share both decreased 1 percent in 2017 and excluded the impact of the impairment charges and the reduction in integration costs.

Net Sales

2018 Compared to 2017

Net sales were flat in 2018, reflecting a 1 percentage point impact from unfavorable volume/mix, which was offset by the impact of higher net pricing and favorable foreign currency exchange. The unfavorable volume/mix was driven by declines in the oils and baking categories, which were partially offset by gains in pet food. Net price realization contributed 1 percentage point to net sales, as higher net pricing for peanut butter, the Smucker’s brand, and oils was partially offset by lower net pricing for pet food and pet snacks.

2018 ANNUAL REPORT 31

MANAGEMENT’S DISCUSSION AND ANALYSIS

The J. M. Smucker Company

2017 Compared to 2016

Year Ended April 30, | ||||||||||||||

2017 | 2016 | Increase (Decrease) | % | |||||||||||

Net sales | $ | 7,392.3 | $ | 7,811.2 | $ | (418.9 | ) | (5 | )% | |||||

Divestiture | — | (153.5 | ) | 153.5 | 2 | |||||||||

Foreign currency exchange | 3.8 | — | 3.8 | — | ||||||||||

Net sales excluding divestiture and foreign currency exchange (A) | $ | 7,396.1 | $ | 7,657.7 | $ | (261.6 | ) | (3 | )% | |||||

Amounts may not add due to rounding.

(A) | Net sales excluding divestiture and foreign currency exchange is a non-GAAP measure used to evaluate performance internally. This measure provides useful information to investors because it enables comparison of results on a year-over-year basis. Net sales excluding divestiture and foreign currency exchange in the table above excludes the impact of the U.S. canned milk business, which was divested on December 31, 2015, and foreign currency exchange. |

Net sales decreased $418.9, or 5 percent, in 2017, partially due to the impact of the divested U.S. canned milk business. Excluding the non-comparable divested business and foreign currency exchange, net sales decreased 3 percent, driven by the U.S. Retail Coffee segment, specifically the Folgers brand, and the U.S. Retail Pet Foods segment. The decline reflected lower net price realization and unfavorable volume/mix, which contributed somewhat equally to lower net sales.

Operating Income

The following table presents the components of operating income as a percentage of net sales.

Year Ended April 30, | ||||||||

2018 | 2017 | 2016 | ||||||

Gross profit | 38.5 | % | 38.4 | % | 38.0 | % | ||

Selling, distribution, and administrative expenses: | ||||||||

Marketing | 3.2 | % | 3.4 | % | 3.5 | % | ||

Advertising | 2.6 | 2.3 | 2.2 | |||||

Selling | 3.3 | 3.4 | 4.0 | |||||

Distribution | 3.2 | 3.3 | 2.9 | |||||

General and administrative | 6.3 | 6.5 | 6.7 | |||||

Total selling, distribution, and administrative expenses | 18.6 | % | 18.8 | % | 19.3 | % | ||

Amortization | 2.8 | 2.8 | 2.7 | |||||

Goodwill impairment charge | 2.0 | — | — | |||||

Other intangible assets impairment charges | 0.4 | 1.8 | — | |||||

Other special project costs | 0.6 | 1.0 | 1.7 | |||||

Other operating expense (income) – net | — | (0.1 | ) | (0.4 | ) | |||

Operating income | 14.1 | % | 14.0 | % | 14.7 | % | ||

Amounts may not add due to rounding.

2018 Compared to 2017

Gross profit was flat in 2018, as the impact of unfavorable volume/mix was offset by the favorable impact of higher pricing and slightly lower costs. Gross profit excluding non-GAAP adjustments (“adjusted gross profit”) decreased $65.5, or 2 percent, with the primary difference from the change in GAAP results being the exclusion of a $64.5 favorable change in the impact of unallocated derivative gains and losses as compared to the prior year.

SD&A expenses decreased $19.9, or 1 percent, primarily due to the benefits from our cost savings initiatives and lower selling expense, which more than offset an increase in advertising expense, driven by the U.S. Retail Pet Foods segment. Special project costs decreased $33.3, primarily due to a reduction in

Big Heart integration costs.

Operating income was flat, reflecting a $43.7 increase in noncash impairment charges, driven by the U.S. Retail Pet Foods segment. Adjusted operating income decreased $50.0, or 3 percent. The primary differences from the change in GAAP results were the exclusion of the favorable change in the impact of unallocated derivative gains and losses as compared to the prior year and the impacts of impairment charges and special project costs.

2017 Compared to 2016

Gross profit decreased $132.5, or 4 percent, in 2017, primarily reflecting unfavorable volume/mix and the loss of U.S. canned milk profits. The impact of lower net price realization was offset by a reduction in commodity and manufacturing overhead costs and incremental synergy realization related to the Big Heart acquisition. Adjusted gross profit decreased $99.8, or 3 percent, and excluded a $39.2 unfavorable change in the impact of unallocated derivative gains and losses as compared to 2016.

SD&A expenses decreased $119.6, or 8 percent, primarily driven by incremental synergy realization. Additionally, Big Heart integration costs decreased by $81.1, or 56 percent.

Operating income decreased $113.8, or 10 percent, reflecting noncash impairment charges of $133.2 related to certain indefinite-lived trademarks, primarily within the U.S. Retail Pet Foods segment. Additionally, 2016 results benefited from the recognition of the $25.3 gain related to the divestiture of the U.S. canned milk business. Adjusted operating income decreased $8.0, or 1 percent, with the primary differences from GAAP results being the exclusion of the impairment charges, integration costs, and the unfavorable change in the impact of unallocated derivative gains and losses as compared to 2016.

Interest Expense and Other Income

2018 Compared to 2017

Net interest expense increased $11.0 in 2018, primarily due to financing fees we incurred in 2018 in connection with the Ainsworth acquisition. For additional information, see Note 8: Debt and Financing Arrangements.

32 THE J. M. SMUCKER COMPANY

MANAGEMENT’S DISCUSSION AND ANALYSIS

The J. M. Smucker Company

An $11.0 unfavorable change in net other income (expense) was primarily due to an increase in foreign currency exchange loss in 2018 and a favorable legal settlement in 2017.

2017 Compared to 2016

Net interest expense decreased $8.0 in 2017, primarily due to a lower outstanding balance on the $1.8 billion term loan due

March 23, 2020, in 2017 as compared to 2016.

Income Taxes

On December 22, 2017, the U.S. government enacted “An Act to Provide for Reconciliation Pursuant to Titles II and V of the Concurrent Resolution on the Budget for Fiscal Year 2018”

(the “Act”), which reduces the U.S. federal statutory corporate tax rate from 35.0 percent to 21.0 percent effective January 1, 2018, broadens the U.S. federal income tax base, requires companies to pay a one-time repatriation tax on earnings of certain foreign subsidiaries that were previously tax deferred (“transition tax”), and creates new taxes on certain foreign-sourced earnings. Having an April 30 fiscal year-end, the lower corporate income tax rate is administratively phased in, resulting in a blended U.S. federal statutory tax rate of approximately 30.4 percent for our fiscal year ended April 30, 2018.

The U.S. Securities and Exchange Commission (“SEC”) and Financial Accounting Standards Board (“FASB”) have issued rules to allow a measurement period of up to 12 months following the enactment of the Act for registrants to finalize their accounting for the related income tax effects. The income tax benefit of $477.6 for 2018 reflects a provisional net benefit of $765.8 related to our one-time adjustments resulting directly from the Act, partially offset by additional income tax expense related to the Pet Foods reporting unit goodwill impairment charge. Income tax expense was $286.1 for 2017. Within our calculations of the income tax effects of the Act, we used assumptions and estimates that may change as a result of future guidance and interpretation from the Internal Revenue Service (“IRS”), the SEC, the FASB, and various taxing jurisdictions. All of these potential legislative and interpretive actions could result in adjustments to any of the provisional estimates when the accounting for the income tax effects of the Act is completed, which we expect to be no later than the third quarter of 2019. For further information on the Act’s impact on our consolidated financial statements, refer to Note 13: Income Taxes.

We anticipate that the effective tax rate in 2019 and in future years will be favorably impacted by the lower federal statutory corporate

tax rate of 21.0 percent, offset to some extent by the base broadening changes, such as the elimination of the domestic manufacturing deduction. Furthermore, U.S. state jurisdictions have started, and are expected to continue, taking legislative actions to conform or decouple from the Act, either in its entirety or with respect to specific provisions. We are also evaluating the impact of the Ainsworth acquisition on our future consolidated effective tax rate.

Income taxes decreased 1 percent in 2017, due to a decrease in income before income taxes, mostly offset by the impact of a higher effective tax rate in 2017 of 32.6 percent. The 2016

effective tax rate of 29.6 percent was impacted by the recognition of a $50.5 noncash deferred tax benefit related to the integration of Big Heart into the Company, partially offset by the impact of higher deferred state income tax expense, which was a result of state tax law changes.

Integration Activities

We incurred total cumulative costs of $271.9 related to the integration of Big Heart, including $26.6 during 2018, which primarily consisted of employee-related costs, outside service and consulting costs, and other costs related to the acquisition. We have fully realized our goal of $200.0 in annual synergies.

We expect to incur approximately $50.0 in one-time costs related to the Ainsworth acquisition, of which the majority are expected to be cash charges. Approximately two-thirds of these one-time costs are expected to be recognized in 2019.

Restructuring Activities

An organization optimization program was approved by the Board of Directors (the “Board”) during the fourth quarter of 2016. Under this program, we identified opportunities to reduce costs and optimize the organization. Related projects include an organizational redesign and the optimization of our manufacturing footprint. In addition, the program was recently expanded to include the restructuring of our geographic footprint, which includes the centralization of our pet food and pet snacks business, as well as certain International non-manufacturing functions, to our corporate headquarters in Orrville, Ohio, furthering collaboration and enhanced agility, while improving cost efficiency. As a result, we plan to close the San Francisco and Burbank, California, offices by the end of 2019, and our international offices in China and Mexico during the first half of 2019. The majority of these costs are expected to be incurred through the end of 2019.

During 2017, we exited two leased facilities in Livermore, California, and consolidated all ancient grains and pasta production into our facility in Chico, California. During 2018, we consolidated all of our coffee produced at our Harahan, Louisiana, facility into one of our facilities in New Orleans, Louisiana, and this portion of the optimization program is nearly complete. To date, the organization optimization program has resulted in total headcount reductions of approximately 275 full-time positions. We do not anticipate significant headcount reductions associated with the expansion of the program.

Upon completion of this program, total restructuring costs are expected to be approximately $75.0, of which the majority represents employee-related costs, while the remainder primarily consists of site preparation, equipment relocation, and production start-up costs at the impacted facilities. We have incurred total cumulative restructuring costs of $42.6, of which $22.7 was incurred during 2018. We achieved approximately $50.0 of annual cost reductions related to our organization optimization program, mainly during 2018, and have invested these savings in our businesses. For further information, refer to Note 3: Integration and Restructuring Costs.

2018 ANNUAL REPORT 33

MANAGEMENT’S DISCUSSION AND ANALYSIS

The J. M. Smucker Company

Cost Management Program

In addition to our organization optimization program, we announced a separate cost management program during 2017, which is comprised of various cost reduction initiatives, including SKU rationalization, revenue growth management, and our Right Spend zero-based budgeting initiative. We expect to realize approximately $200.0 of cost reductions annually by the end of 2020 as a result of these initiatives.

Commodities Overview

The raw materials we use are primarily commodities, agricultural-based products, and packaging materials. The most significant of these materials, based on 2018 annual spend, are green coffee, peanuts, oils and fats, protein meals, and plastic containers. Green coffee, certain oils, and certain protein meals are traded on active regulated exchanges, and the price of these commodities fluctuates based on market conditions. Derivative instruments, including futures and options, are used to minimize the impact of price volatility for these commodities.

We source green coffee from more than 20 coffee-producing countries. Its price is subject to high volatility due to factors such as weather, global supply and demand, plant disease, investor speculation, and political and economic conditions in the source countries.

We source peanuts, oils and fats, and protein meals mainly from North America. We are one of the largest procurers of peanuts in the U.S. and frequently enter into long-term purchase contracts for various periods of time to mitigate the risk of a shortage of this commodity. The oils we purchase are mainly soybean and canola.

The price of peanuts, oils, and protein meals are driven primarily

by weather, which impacts crop sizes and yield, as well as global

demand, especially from large importing countries such as China

and India. In addition, the price of oils has been impacted by demand from the biofuels industry.

We frequently enter into long-term contracts to purchase plastic containers, which are sourced mainly from within the U.S. Plastic

resin is made from petrochemical feedstock and natural gas

feedstock, and the price can be influenced by feedstock, energy, and crude oil prices as well as global economic conditions.

In 2018, our overall commodity costs were slightly higher than

in 2017, primarily due to higher costs for green coffee and oils.

Segment Results

We have four reportable segments: U.S. Retail Coffee, U.S. Retail Consumer Foods, U.S. Retail Pet Foods, and International and Away From Home. During 2018, we added International and Away From Home as a reportable segment because a single segment manager was named to oversee the entire operating segment. Prior year segment results have not been modified, as the new reportable segment represents the previously reported combination of the International and Away From Home strategic business areas, which were previously managed separately and not individually significant.

The U.S. Retail Coffee segment primarily includes the domestic sales of Folgers, Dunkin’ Donuts, and Café Bustelo branded coffee; the U.S. Retail Consumer Foods segment primarily includes domestic sales of Jif, Smucker’s, Crisco, and Pillsbury® branded products; and the U.S. Retail Pet Foods segment primarily includes domestic sales of Meow Mix, Milk-Bone, Natural Balance,

Kibbles ’n Bits, 9Lives®, Pup-Peroni®, and Nature’s Recipe branded products. The International and Away From Home segment is comprised of products distributed domestically and in foreign countries through retail channels and foodservice distributors and operators (e.g., restaurants, lodging, schools and universities, health care operators).

Year Ended April 30, | ||||||||||||||||||||||

2018 | 2017 | 2016 | 2018 % Increase (Decrease) | 2017 % Increase (Decrease) | ||||||||||||||||||

Net sales: | ||||||||||||||||||||||

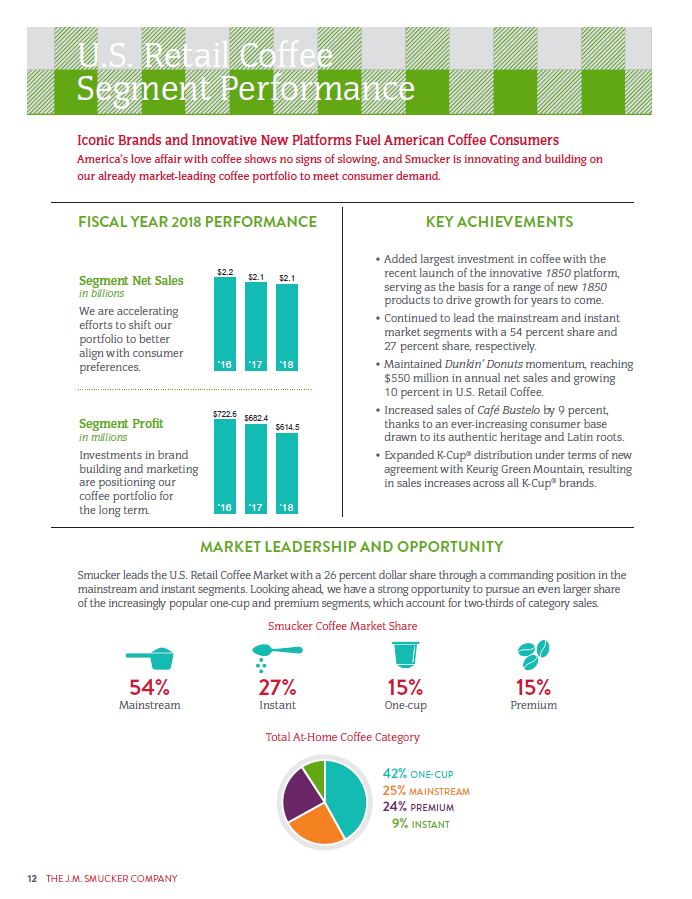

U.S. Retail Coffee | $ | 2,092.2 | $ | 2,108.6 | $ | 2,239.2 | (1 | )% | (6 | )% | ||||||||||||

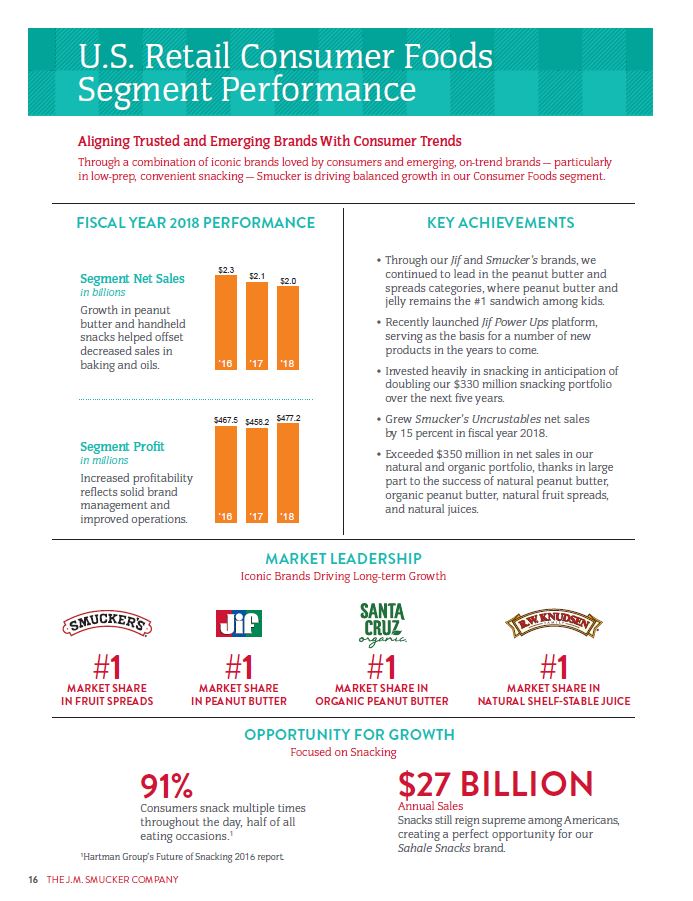

U.S. Retail Consumer Foods | 2,000.8 | 2,085.4 | 2,269.7 | (4 | ) | (8 | ) | |||||||||||||||

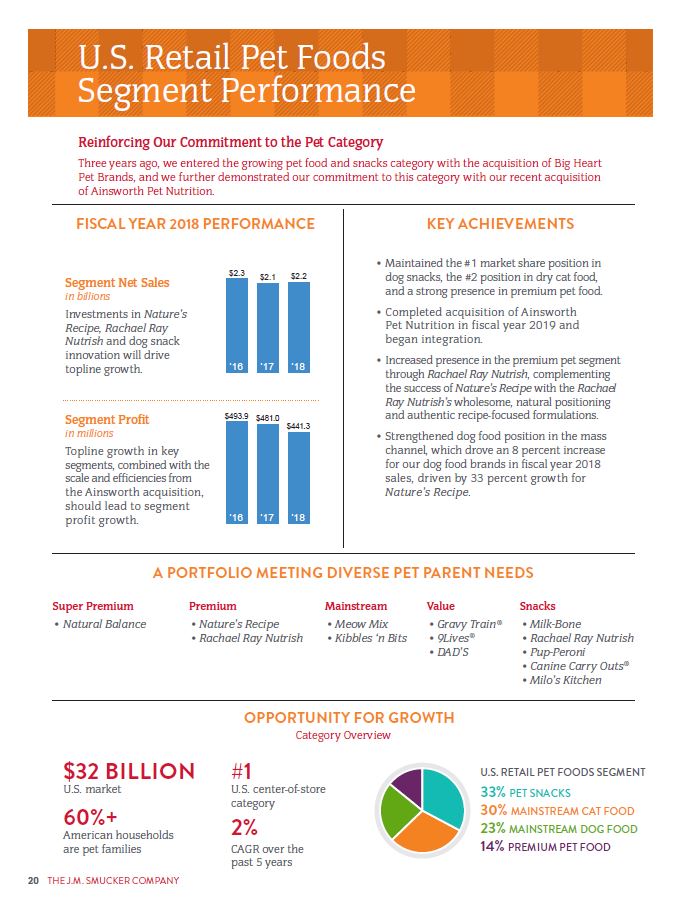

U.S. Retail Pet Foods | 2,169.3 | 2,135.9 | 2,250.4 | 2 | (5 | ) | ||||||||||||||||

International and Away From Home | 1,094.8 | 1,062.4 | 1,051.9 | 3 | 1 | |||||||||||||||||

Segment profit: | ||||||||||||||||||||||

U.S. Retail Coffee | $ | 614.5 | $ | 682.4 | $ | 722.6 | (10 | )% | (6 | )% | ||||||||||||

U.S. Retail Consumer Foods | 477.2 | 458.2 | 467.5 | 4 | (2 | ) | ||||||||||||||||

U.S. Retail Pet Foods | 441.3 | 481.0 | 493.9 | (8 | ) | (3 | ) | |||||||||||||||

International and Away From Home | 194.2 | 185.1 | 179.0 | 5 | 3 | |||||||||||||||||

Segment profit margin: | ||||||||||||||||||||||

U.S. Retail Coffee | 29.4 | % | 32.4 | % | 32.3 | % | ||||||||||||||||

U.S. Retail Consumer Foods | 23.9 | 22.0 | 20.6 | |||||||||||||||||||

U.S. Retail Pet Foods | 20.3 | 22.5 | 21.9 | |||||||||||||||||||

International and Away From Home | 17.7 | 17.4 | 17.0 | |||||||||||||||||||

34 THE J. M. SMUCKER COMPANY

MANAGEMENT’S DISCUSSION AND ANALYSIS

The J. M. Smucker Company

U.S. Retail Coffee

The U.S. Retail Coffee segment net sales decreased $16.4 in 2018. Unfavorable volume/mix and lower net price realization each reduced net sales by less than 1 percentage point. Unfavorable volume/mix for the Folgers brand was mostly offset by gains for Dunkin’ Donuts K-Cup® pods and the Café Bustelo brand. Lower net price realization was also driven by the Folgers brand. Although 2018 results include a full-year benefit of a list price increase implemented in January 2017, the benefit was more than offset by increased promotional spending in the current year. Segment profit decreased $67.9, primarily due to the unfavorable impacts of volume/mix, higher green coffee costs, and lower net pricing, which were partially offset by improvements in K-Cup® pod profitability. The improved profitability resulted from new contract terms with Keurig Green Mountain, which became effective at the end of the second quarter of 2018. During 2019, we expect to realize the full-year benefits of lower green coffee costs and K-Cup® pod cost savings as compared to 2018.

The U.S. Retail Coffee segment net sales decreased $130.6 in 2017, primarily due to lower net price realization, which was mainly attributed to the net impact of pricing actions taken in 2016 and 2017, and unfavorable volume/mix, which reduced net sales by 3 percentage points. The unfavorable volume/mix was driven by the Folgers brand and was partially offset by favorable volume/mix for the Café Bustelo and Dunkin’ Donuts brands. Segment profit decreased $40.2, primarily due to the unfavorable volume/mix, as well as the impact of lower net price realization, which was partially offset by lower commodity and manufacturing overhead costs and incremental synergy realization.

U.S. Retail Consumer Foods

The U.S. Retail Consumer Foods segment net sales decreased$84.6 in 2018. Volume/mix reduced net sales by 8 percentage points, primarily driven by the Crisco, Pillsbury, and Jif brands. Net price realization contributed 4 percentage points to net sales, primarily related to the Jif, Smucker’s, and Crisco brands. Segment profit increased $19.0, as the net favorable impact of higher prices and higher costs, as well as reduced marketing expense, were partially offset by the unfavorable impact of volume/mix.

The U.S. Retail Consumer Foods segment net sales decreased $184.3 in 2017, primarily reflecting noncomparable net sales of $138.9 in 2016 related to the divested U.S. canned milk business. Excluding the impact of the divestiture, net sales decreased

2 percent, which was entirely driven by unfavorable volume/mix, primarily related to Smucker’s fruit spreads and the Jif and truRoots® brands, partially offset by growth in Smucker’s Uncrustables frozen sandwiches. Segment profit decreased $9.3; however, excluding the $25.3 gain related to the U.S. canned milk divestiture and canned milk profits in 2016, segment profit increased 10 percent, as lower manufacturing overhead costs and incremental synergy realization more than offset an increase in marketing expense.

U.S. Retail Pet Foods

The U.S. Retail Pet Foods segment net sales increased $33.4 in 2018. Favorable volume/mix, primarily driven by the Nature’s Recipe and Meow Mix brands, increased net sales by 2 percentage points. We expanded distribution of the Nature’s Recipe brand into grocery and mass merchandise outlets during the third quarter of 2017. The impact of volume/mix was partially offset by lower net price realization, which reduced net sales by 1 percentage point,

driven by the Meow Mix brand. Segment profit decreased $39.7, primarily due to the unfavorable impacts of lower prices and higher costs and increased advertising expense, mainly related to the Nature’s Recipe and Natural Balance brands. Although not reflected in segment profit, impairment charges of $176.9 were recognized in 2018 related to the goodwill of the Pet Foods reporting unit and certain indefinite-lived trademarks within the U.S. Retail Pet Foods segment.

The U.S. Retail Pet Foods segment net sales decreased $114.5 in 2017, primarily due to unfavorable volume/mix, which reduced net sales by 3 percentage points. This was driven by the

Kibbles’n Bits, Meow Mix, Natural Balance, and 9Lives brands. Net price realization was also lower, driven by the Natural Balance and Milk-Bone brands. Segment profit decreased $12.9, as the impact of unfavorable volume/mix, lower net price realization, and higher distribution costs more than offset the impact of lower commodity costs, incremental synergy realization, and a decrease in marketing expense. Although not reflected in segment profit, impairment charges of $128.5 were recognized in 2017 related to certain indefinite-lived trademarks within the U.S. Retail Pet Foods segment.

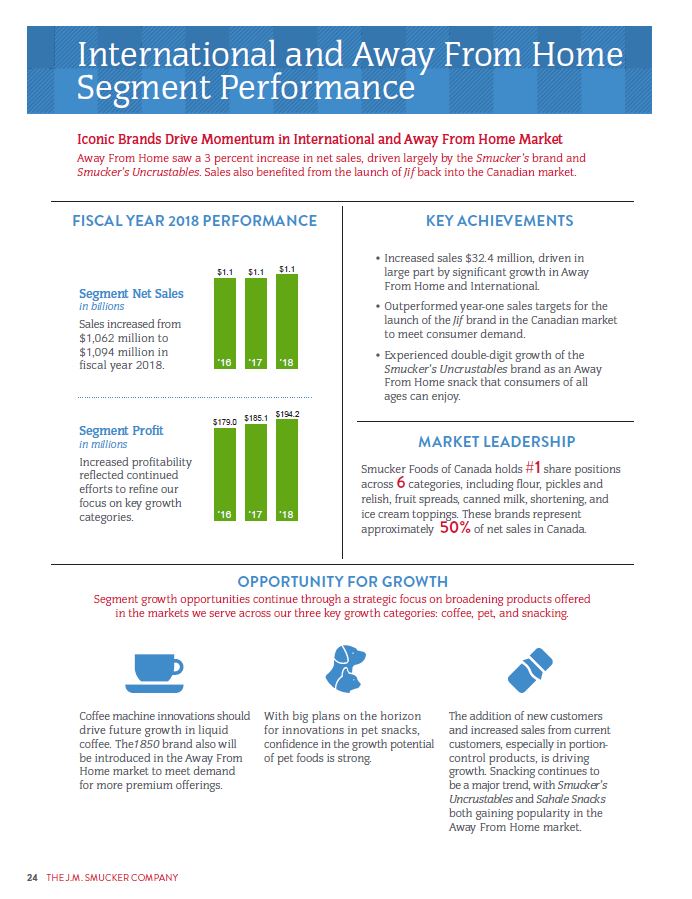

International and Away From Home

The International and Away From Home segment net sales increased $32.4 in 2018, reflecting favorable volume/mix, which increased net sales by 2 percentage points, driven by the Jif and Smucker’s brands. In addition, foreign currency exchange contributed $14.0 to net sales. Segment profit increased $9.1, primarily due to the contributions from favorable volume/mix, foreign currency exchange, and reduced marketing expense.

International and Away From Home net sales increased $10.5 in 2017, as favorable volume/mix, which contributed 4 percentage points of growth to net sales, more than offset the impacts of lower net price realization and $14.6 of noncomparable net sales in the prior year related to the divested U.S. canned milk business. Segment profit increased $6.1, primarily due to favorable volume/mix, incremental synergy realization, and a $3.8 pre-tax gain on the sale of our equity interest in Guilin Seamild Biologic Technology Development Co., Ltd. (“Seamild”), which more than offset the unfavorable net impact of lower prices and lower costs, and the loss of profits from the divested canned milk business.

2018 ANNUAL REPORT 35

MANAGEMENT’S DISCUSSION AND ANALYSIS

The J. M. Smucker Company

LIQUIDITY AND CAPITAL RESOURCES

Liquidity

Our principal source of funds is cash generated from operations, supplemented by borrowings against our commercial paper program and revolving credit facility. Total cash and cash equivalents increased to $192.6 at April 30, 2018, compared to $166.8 at April 30, 2017.

Within the U.S. Retail Coffee and U.S. Retail Consumer Foods segments, we generally expect a significant use of cash to fund working capital requirements during the first half of each fiscal

year, primarily due to the buildup of inventories to support the Fall Bake and Holiday period, the additional increase of coffee inventory in advance of the Atlantic hurricane season, and seasonal fruit procurement. In these businesses, we expect cash provided by operations in the second half of the fiscal year to significantly exceed the amount in the first half of the year, upon completion of the Fall Bake and Holiday period. However, the impact of seasonality on our overall working capital requirements is partially reduced by the U.S. Retail Pet Foods segment, which does not experience significant seasonality. Cash provided by operating activities in the second half of 2018 was $783.4, compared to $434.6 provided through the first half of 2018.

The following table presents selected cash flow information.

Year Ended April 30, | |||||||||||

2018 | 2017 | 2016 | |||||||||

Net cash provided by (used for) operating activities | $ | 1,218.0 | $ | 1,059.0 | $ | 1,461.0 | |||||

Net cash provided by (used for) investing activities | (277.6 | ) | (189.7 | ) | 21.7 | ||||||

Net cash provided by (used for) financing activities | (922.0 | ) | (806.1 | ) | (1,498.9 | ) | |||||

Net cash provided by (used for) operating activities | $ | 1,218.0 | $ | 1,059.0 | $ | 1,461.0 | |||||

Additions to property, plant, and equipment | (321.9 | ) | (192.4 | ) | (201.4 | ) | |||||

Free cash flow (A) | $ | 896.1 | $ | 866.6 | $ | 1,259.6 | |||||

(A) | Free cash flow is a non-GAAP measure used by management to evaluate the amount of cash available for debt repayment, dividend distribution, acquisition opportunities, share repurchases, and other corporate purposes. |

Cash provided by operating activities increased $159.0 in 2018 mainly due to a decrease in working capital during 2018, as compared to an increase in the prior year. The working capital change was driven by inventory, accrued liabilities, and trade receivables. Net income adjusted for noncash items was also higher in 2018, partially driven by the reduction in the U.S. federal statutory corporate tax rate in 2018, which resulted from the Act.

Cash provided by operating activities decreased $402.0 in 2017

as a result of a significant decrease in working capital in the prior year, while working capital at the end of the current year was comparable to beginning of the year levels. The decrease in

working capital in 2016 was driven by a reduction in inventory levels, which resulted from a working capital reduction initiative, and the timing of tax payments, including the realization of a

$49.6 one-time tax refund in the first quarter of the prior year.

Cash used for investing activities in 2018 consisted primarily of $321.9 in capital expenditures, partially offset by a $30.9 reduction in our derivative cash margin account balances. Cash used for investing activities in 2017 consisted primarily of $192.4

in capital expenditures and a $38.4 increase in our derivative cash

margin account balances, partially offset by $40.6 in proceeds from the sale of our investment in Seamild. The increase in capital

expenditures in 2018 was driven by the construction of our new manufacturing facility in Longmont, Colorado, as further described below, and product innovation. In 2016, cash provided by investing activities consisted primarily of $193.7 in proceeds from the divestiture of the U.S. canned milk business and a $34.8 reduction in our derivative cash margin account balances, mostly offset by $201.4 in capital expenditures.

Cash used for financing activities in 2018 consisted primarily of$1,050.3 in long-term debt repayments, dividend payments of $350.3, and a $310.0 decrease in short-term borrowings during 2018, which were partially offset by $799.6 in long-term debt proceeds. For additional information on our new borrowings and debt repayments, see “Capital Resources” in this discussion and analysis. In 2017, cash used for financing activities consisted primarily of the purchase of treasury shares for $437.6, mainly representing the repurchase of 3.0 million common shares available under the Board’s authorizations, dividend payments of $339.3, and long-term debt repayments of $200.0, partially offset by a $170.0 increase in short-term borrowings during the year. In 2016, cash used for financing activities consisted primarily of $800.0 in long-term debt repayments, the purchase of treasury shares for $441.1, mainly representing the repurchase of 3.4 million common shares available under the Board’s authorizations, and dividend payments of $316.6.

We, like other food manufacturers, are from time to time subject to legal proceedings arising in the ordinary course of business that could have a material adverse effect on our financial position, results of operations, or cash flows. In particular, we are currently a defendant in Council for Education and Research on Toxics v. Brad Barry LLC, et al., which alleges that we, in addition to nearly eighty other defendants who manufacture, package, distribute, or sell coffee, failed to provide warnings for our coffee products of exposure to the chemical acrylamide as required under California Health and Safety Code Section 25249.5, the California Safe Drinking Water and Toxic Enforcement Act of 1986, better known as “Proposition 65.” As part of a joint defense group organized to defend against the lawsuit, we dispute these claims. Acrylamide is not added to coffee, but is present in all coffee in small amounts (measured in parts per billion) as a byproduct of the coffee bean roasting process. The outcome and the financial impact of the case, if any, cannot be predicted at this time. Accordingly, no loss contingency has been recorded for this matter as of April 30, 2018, as the likelihood of loss is not considered probable or estimable.

36 THE J. M. SMUCKER COMPANY

MANAGEMENT’S DISCUSSION AND ANALYSIS

The J. M. Smucker Company

However, if we are required to pay significant statutory penalties or to add warning labels to any of our products or place warnings in certain locations where our products are sold as a result of Proposition 65, our business and financial results could be adversely impacted, and sales of those products could suffer not only in those locations but elsewhere. For additional information, see Note 15: Contingencies.

Capital Resources

The following table presents our capital structure.

April 30, | |||||||

2018 | 2017 | ||||||

Current portion of long-term debt | $ | — | $ | 499.0 | |||

Short-term borrowings | 144.0 | 454.0 | |||||

Long-term debt, less current portion | 4,688.0 | 4,445.5 | |||||

Total debt | $ | 4,832.0 | $ | 5,398.5 | |||

Shareholders’ equity | 7,891.1 | 6,850.2 | |||||

Total capital | $ | 12,723.1 | $ | 12,248.7 | |||

On April 27, 2018, we entered into a senior unsecured delayed-draw Term Loan Credit Agreement (“Term Loan”) with a syndicate of banks and an available commitment amount of $1.5 billion. Borrowings under the Term Loan bear interest on the prevailing U.S. Prime Rate or London Interbank Offered Rate (“LIBOR”), based on our election, and is payable either on a quarterly basis or at the end of the borrowing term. The Term Loan does not require scheduled amortization payments. Voluntary prepayments are permitted without premium or penalty. As of April 30, 2018, no balance was drawn on the Term Loan. The full amount of the Term Loan was drawn on May 14, 2018, at an interest rate of

3.04 percent, to partially finance the Ainsworth acquisition. The Term Loan matures on May 14, 2021.

In December 2017, we completed an offering of $800.0 in Senior Notes due December 6, 2019, and December 15, 2027. The net proceeds from the offering were used to prepay the $500.0 in principal amount of the Senior Notes due March 15, 2018. In addition, we prepaid, in full, the remaining outstanding balance of the $1.8 billion term loan due March 23, 2020.

In September 2017, we entered into an unsecured revolving credit facility with a group of 11 banks, which provides for a revolving credit line of $1.8 billion and matures in September 2022. Additionally, we terminated the previous $1.5 billion credit facility. Borrowings under the revolving credit facility bear interest on the prevailing U.S. Prime Rate, LIBOR, or Canadian Dealer Offered Rate, based on our election. Interest is payable either on a quarterly basis or at the end of the borrowing term. We did not have a balance outstanding under the revolving credit facility at April 30, 2018.

We participate in a commercial paper program under which we can issue short-term, unsecured commercial paper not to exceed

$1.8 billion at any time, which was increased from the previous limit of $1.0 billion in conjunction with entering into the new unsecured revolving credit facility in September 2017. The

commercial paper program is backed by our revolving credit facility and reduces what we can borrow under the revolving credit facility by the amount of commercial paper outstanding. Commercial paper will be used as a continuing source of short-term financing for general corporate purposes. As of April 30, 2018, we had $144.0 of short-term borrowings outstanding, all of which were issued under our commercial paper program, at a weighted-average interest rate of 2.20 percent. On May 14, 2018, we issued $400.0 of commercial paper at a weighted-average interest rate of 2.27 percent to partially finance the Ainsworth acquisition.

We are in compliance with all of our debt covenants. For additional information on our long-term debt, sources of liquidity, and debt covenants, see Note 8: Debt and Financing Arrangements.

During 2018, we did not repurchase any common shares under a repurchase plan authorized by the Board. At April 30, 2018, approximately 3.6 million common shares remain available for repurchase pursuant to the Board’s authorizations. There is no guarantee as to the exact number of shares that may be repurchased or when such purchases may occur.

In June 2017, we began construction of a Smucker’s Uncrustables frozen sandwich manufacturing facility in Longmont, Colorado. The new facility will help meet growing demand for Smucker’s Uncrustables frozen sandwiches and will complement our existing facility in Scottsville, Kentucky. The Longmont facility will be constructed in two phases, with a total potential investment of $340.0. Phase 1 includes up to an initial $210.0 investment to construct and equip the new facility, with an opportunity to invest an additional $130.0 for phase 2 expansion, dependent on product demand. Production is expected to begin at the new facility during 2020.

The following table presents certain cash requirements related

to 2019 investing and financing activities based on our current expectations. Although no principal payments are required on our debt obligations in 2019, we may utilize a portion of cash provided by operations for debt repayment. Additionally, in 2020, a portion of our Senior Notes will mature, and $800.0 in principal payments will be required that year.

Projection Year Ending April 30, 2019 | ||||

Capital expenditures | $ | 360.0 | ||

Dividend payments – based on current rates and common shares outstanding | 350.0 | |||

Interest payments – includes indebtedness related to Ainsworth | 220.0 | |||

On March 5, 2018, the U.S. Federal Trade Commission announced an administrative complaint challenging the proposed transaction to acquire the Wesson® oil brand from Conagra Brands, Inc. (“Conagra”). As a result, we mutually determined with Conagra to terminate the definitive agreement to acquire the Wesson brand.

2018 ANNUAL REPORT 37

MANAGEMENT’S DISCUSSION AND ANALYSIS

The J. M. Smucker Company

Absent any additional material acquisitions or other significant investments, we believe that cash on hand, combined with cash provided by operations and borrowings available under our commercial paper program and revolving credit facility, will be sufficient to meet our cash requirements for the next 12 months, including capital expenditures, the payment of quarterly dividends, interest payments on debt outstanding, and share repurchases.

As of April 30, 2018, total cash and cash equivalents of $177.5 was held by our international subsidiaries. We recorded a provisional one-time transition tax of $26.1 in 2018 on the undistributed earnings of certain foreign subsidiaries that were previously deferred from U.S. income taxes, as required by the Act. This tax liability is expected to be paid over an eight-year period, which began in 2018. As of April 30, 2018, the undistributed earnings of our foreign subsidiaries continue to be permanently reinvested, and we do not intend to repatriate any of the amounts to meet our cash requirements. For further information, refer to Note 13: Income Taxes.

NON-GAAP FINANCIAL MEASURES

We use non-GAAP financial measures including: net sales excluding divestiture and foreign currency exchange; adjusted gross profit, operating income, income, and earnings per share; earnings before interest, taxes, depreciation, amortization, and impairment charges related to intangible assets (“EBITDA (as adjusted)”); and free cash flow, as key measures for purposes of evaluating performance internally. We believe that investors’ understanding of our performance is enhanced by disclosing these performance measures. Furthermore, these non-GAAP financial measures are used by management in preparation of the annual budget and for the monthly analyses of our operating results. The Board also utilizes the adjusted earnings per share and free cash flow measures as components for measuring performance for incentive compensation purposes.

Non-GAAP measures exclude certain items affecting comparability, that can significantly affect the year-over-year assessment of operating results, which include amortization expense and impairment charges related to intangible assets, integration and restructuring costs (“special project costs”), and unallocated gains and losses on commodity and foreign currency exchange derivatives (“unallocated derivative gains and losses”). The special project costs in the following table relate to specific integration and restructuring projects, and the unallocated derivative gains and losses reflect the changes in fair value of our commodity and foreign currency exchange contracts. During 2018, we expanded our non-GAAP measures to also exclude certain one-time tax adjustments. These adjustments include the provisional effect of the one-time items associated with the Act, which includes certain adjustments related to the U.S. deferred tax assets and liabilities remeasurement and the transition tax. Also included in these one-time tax adjustments is the permanent tax difference related to the goodwill impairment charge that was recorded during 2018. For further details on these adjustments, refer to Note 13: Income Taxes, and Note 7: Goodwill and Other Intangible Assets. We believe that excluding these one-time tax adjustments in our non-GAAP measures provides comparability across the periods presented and better reflects the benefit of a lower blended U.S. statutory tax rate on our current year earnings as a result of the Act.

These non-GAAP financial measures are not intended to replace the presentation of financial results in accordance with U.S. generally accepted accounting principles (“GAAP”). Rather, the presentation of these non-GAAP financial measures supplements other metrics we use to internally evaluate our businesses and facilitate the comparison of past and present operations and liquidity. These non-GAAP financial measures may not be comparable to similar measures used by other companies and may exclude certain nondiscretionary expenses and cash payments.

38 THE J. M. SMUCKER COMPANY

MANAGEMENT’S DISCUSSION AND ANALYSIS

The J. M. Smucker Company

The following table reconciles certain non-GAAP financial measures to the comparable GAAP financial measure. See page 32 for a reconciliation of net sales adjusted for certain noncomparable items to the comparable GAAP financial measure.

Year Ended April 30, | |||||||||||||||||||||

2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||||

Gross profit reconciliation: | |||||||||||||||||||||

Gross profit | $ | 2,836.1 | $ | 2,835.3 | $ | 2,967.8 | $ | 1,968.7 | $ | 2,031.0 | |||||||||||

Unallocated derivative losses (gains) | (37.3 | ) | 27.2 | (12.0 | ) | 24.5 | (5.3 | ) | |||||||||||||

Cost of products sold – special project costs | 3.9 | 5.7 | 12.2 | 6.2 | 9.4 | ||||||||||||||||

Adjusted gross profit | $ | 2,802.7 | $ | 2,868.2 | $ | 2,968.0 | $ | 1,999.4 | $ | 2,035.1 | |||||||||||

Operating income reconciliation: | |||||||||||||||||||||

Operating income | $ | 1,036.1 | $ | 1,031.5 | $ | 1,145.3 | $ | 772.0 | $ | 919.0 | |||||||||||

Amortization | 206.8 | 207.3 | 208.4 | 109.7 | 98.9 | ||||||||||||||||

Goodwill impairment charge | 145.0 | — | — | — | — | ||||||||||||||||

Other intangible assets impairment charges | 31.9 | 133.2 | — | 1.2 | — | ||||||||||||||||

Unallocated derivative losses (gains) | (37.3 | ) | 27.2 | (12.0 | ) | 24.5 | (5.3 | ) | |||||||||||||

Cost of products sold – special project costs | 3.9 | 5.7 | 12.2 | 6.2 | 9.4 | ||||||||||||||||

Other special project costs | 45.4 | 76.9 | 135.9 | 56.6 | 25.6 | ||||||||||||||||

Adjusted operating income | $ | 1,431.8 | $ | 1,481.8 | $ | 1,489.8 | $ | 970.2 | $ | 1,047.6 | |||||||||||

Net income reconciliation: | |||||||||||||||||||||

Net income | $ | 1,338.6 | $ | 592.3 | $ | 688.7 | $ | 344.9 | $ | 565.2 | |||||||||||

Income tax expense (benefit) | (477.6 | ) | 286.1 | 289.2 | 178.1 | 284.5 | |||||||||||||||

Amortization | 206.8 | 207.3 | 208.4 | 109.7 | 98.9 | ||||||||||||||||

Goodwill impairment charge | 145.0 | — | — | — | — | ||||||||||||||||

Other intangible assets impairment charges | 31.9 | 133.2 | — | 1.2 | — | ||||||||||||||||

Unallocated derivative losses (gains) | (37.3 | ) | 27.2 | (12.0 | ) | 24.5 | (5.3 | ) | |||||||||||||

Cost of products sold – special project costs | 3.9 | 5.7 | 12.2 | 6.2 | 9.4 | ||||||||||||||||

Other special project costs | 45.4 | 76.9 | 135.9 | 56.6 | 25.6 | ||||||||||||||||

Adjusted income before income taxes | $ | 1,256.7 | $ | 1,328.7 | $ | 1,322.4 | $ | 721.2 | $ | 978.3 | |||||||||||

Income taxes, as adjusted (A) | 352.1 | 432.8 | 391.1 | 245.6 | 327.5 | ||||||||||||||||

Adjusted income | $ | 904.6 | $ | 895.9 | $ | 931.3 | $ | 475.6 | $ | 650.8 | |||||||||||

Weighted-average shares – assuming dilution | 113.6 | 116.1 | 119.5 | 103.7 | 104.3 | ||||||||||||||||

Adjusted earnings per share – assuming dilution | $ | 7.96 | $ | 7.72 | $ | 7.79 | $ | 4.59 | $ | 6.24 | |||||||||||

EBITDA (as adjusted) reconciliation: | |||||||||||||||||||||

Net income | $ | 1,338.6 | $ | 592.3 | $ | 688.7 | $ | 344.9 | $ | 565.2 | |||||||||||

Income tax expense (benefit) | (477.6 | ) | 286.1 | 289.2 | 178.1 | 284.5 | |||||||||||||||

Interest expense – net | 174.1 | 163.1 | 171.1 | 79.9 | 79.4 | ||||||||||||||||

Depreciation | 206.3 | 211.7 | 221.7 | 157.5 | 157.5 | ||||||||||||||||

Amortization | 206.8 | 207.3 | 208.4 | 109.7 | 98.9 | ||||||||||||||||

Goodwill impairment charge | 145.0 | — | — | — | — | ||||||||||||||||

Other intangible assets impairment charges | 31.9 | 133.2 | — | 1.2 | — | ||||||||||||||||

EBITDA (as adjusted) | $ | 1,625.1 | $ | 1,593.7 | $ | 1,579.1 | $ | 871.3 | $ | 1,185.5 | |||||||||||

Free cash flow reconciliation: | |||||||||||||||||||||

Net cash provided by (used for) operating activities | $ | 1,218.0 | $ | 1,059.0 | $ | 1,461.0 | $ | 739.1 | $ | 863.3 | |||||||||||

Additions to property, plant, and equipment | (321.9 | ) | (192.4 | ) | (201.4 | ) | (247.7 | ) | (279.5 | ) | |||||||||||

Free cash flow | $ | 896.1 | $ | 866.6 | $ | 1,259.6 | $ | 491.4 | $ | 583.8 | |||||||||||

(A) Income taxes, as adjusted, is based upon our GAAP effective tax rate and reflects the impact of items excluded from GAAP net income to derive

adjusted income. Income taxes, as adjusted also reflects the exclusion of certain one-time tax adjustments during 2018.

2018 ANNUAL REPORT 39

MANAGEMENT’S DISCUSSION AND ANALYSIS

The J. M. Smucker Company

OFF-BALANCE SHEET ARRANGEMENTS

We do not have material off-balance sheet arrangements, financings, or other relationships with unconsolidated entities or other persons, also known as variable interest entities. Transactions with related parties are in the ordinary course of business and are not material to our results of operations, financial condition, or cash flows.

CONTRACTUAL OBLIGATIONS

The following table summarizes our contractual obligations by fiscal year at April 30, 2018.

Total | 2019 | 2020–2021 | 2022–2023 | 2024 and beyond | |||||||||||||||

Long-term debt obligations, including current portion (A) | $ | 4,700.0 | $ | — | $ | 800.0 | $ | 1,150.0 | $ | 2,750.0 | |||||||||

Interest payments (B) | 1,770.6 | 163.5 | 307.1 | 236.6 | 1,063.4 | ||||||||||||||

Operating lease obligations (C) | 208.1 | 42.8 | 70.8 | 59.0 | 35.5 | ||||||||||||||

Purchase obligations (D) | 1,376.0 | 1,163.8 | 181.4 | 21.5 | 9.3 | ||||||||||||||

Other liabilities (E) | 288.3 | 22.1 | 38.3 | 24.9 | 203.0 | ||||||||||||||

Total | $ | 8,343.0 | $ | 1,392.2 | $ | 1,397.6 | $ | 1,492.0 | $ | 4,061.2 | |||||||||

(A) | Excludes the impact of offering discounts, make-whole payments, and debt issuance costs. |

(B) | Includes interest payments on our long-term debt. |

(C) | Includes the minimum rental commitments under non-cancelable operating leases. |

(D) | Includes agreements that are enforceable and legally bind us to purchase goods or services, including certain obligations related to normal, ongoing purchase obligations in which we have guaranteed payment to ensure availability of raw materials, packaging supplies, and co-pack arrangements. We expect to receive consideration for these purchase obligations in the form of materials and services. These purchase obligations do not represent the entire anticipated purchases in the future, but represent only those items for which we are contractually obligated. |

(E) | Mainly consists of projected commitments associated with our defined benefit pension and other postretirement benefit plans. The liability for unrecognized tax benefits and tax-related net interest of $36.4 under FASB Accounting Standards Codification 740, Income Taxes, is excluded, since we are unable to reasonably estimate the timing of cash settlements with the respective taxing authorities. |

CRITICAL ACCOUNTING ESTIMATES

AND POLICIES

The preparation of financial statements in conformity with U.S. GAAP requires that we make estimates and assumptions that in certain circumstances affect amounts reported in the accompanying consolidated financial statements. In preparing these financial statements, we have made our best estimates and judgments of certain amounts included in the financial statements, giving due consideration to materiality. We do not believe there is a great likelihood that materially different amounts would be reported under different conditions or using different assumptions related to the accounting policies described below. However, application of these accounting policies involves the exercise of judgment and use of assumptions as to future uncertainties and, as a result, actual results could differ from these estimates.

Trade Marketing and Merchandising Programs: In order to support our products, various promotional activities are conducted through retail trade, distributors, or directly with consumers, including in-store display and product placement programs, feature price discounts, coupons, and other similar activities. The costs of these programs are classified as a reduction of sales. We regularly review and revise, when we deem necessary, estimates of costs for these promotional programs based on estimates of what will be redeemed by retail trade, distributors, or consumers. These estimates are made using various techniques, including historical data on performance of similar promotional programs. Differences

between estimated expenditures and actual performance are

recognized as a change in estimate in a subsequent period. During 2018, 2017, and 2016, subsequent period adjustments approximated less than 2 percent of both consolidated pre-tax income and cash provided by operating activities. These promotional expenditures, including amounts classified as a reduction of sales, represented 35 percent of net sales in 2018. The possibility exists that reported results could be different if factors such as the level and success of the promotional programs or other conditions differ from expectations.

Income Taxes: We account for income taxes using the liability method. In the ordinary course of business, we are exposed to uncertainties related to tax filing positions and periodically assess the technical merits of these tax positions for all tax years that remain subject to examination, based upon the latest information available. For material uncertain tax positions, we have recognized a liability for unrecognized tax benefits, including any applicable interest and penalty charges.

We routinely evaluate the likelihood of realizing the benefit of our deferred tax assets and may record a valuation allowance if, based on all available evidence, we determine that it is more likely than not that all or some portion of such assets will not be realized. Valuation allowances related to deferred tax assets can be affected by changes in tax laws, statutory tax rates, and projected future taxable income levels. Changes in estimated realization of deferred tax assets would result in an adjustment to income in the period in which that determination is made, unless such changes are

40 THE J. M. SMUCKER COMPANY

MANAGEMENT’S DISCUSSION AND ANALYSIS

The J. M. Smucker Company

determined to be an adjustment to goodwill within the allowable measurement period under the acquisition method of accounting.

The future tax benefit arising from the net deductible temporary differences and tax carryforwards is $129.1 and $227.3 at

April 30, 2018 and 2017, respectively. The decrease in the future tax benefit from the prior year reflects the reduction in the federal

income tax rate from the enactment of U.S. comprehensive tax

reform legislation. In evaluating our ability to recover our deferred tax assets within the jurisdiction from which they arise, we consider all available positive and negative evidence, including scheduled reversals of deferred tax liabilities, projected future taxable income, tax planning strategies, and results of operations. For those jurisdictions where the expiration date of tax carry-forwards or the projected operating results indicate that realization is not likely, a valuation allowance would have been provided.

As of April 30, 2018, the undistributed earnings of our foreign subsidiaries, primarily in Canada, continue to be indefinitely reinvested.

Long-Lived Assets: Long-lived assets, other than goodwill and other indefinite-lived intangible assets, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of the assets to future net undiscounted cash flows estimated to be generated by such assets. If such assets are considered to be impaired, the impairment to be recognized is the amount by which the carrying amount of the assets exceeds the estimated fair value of the assets. However, determining fair value is subject to estimates of both cash flows and discount rates, and different estimates could yield different results. There are no events or changes in circumstances of which we are aware that indicate the carrying value of our long-lived assets may not be recoverable at April 30, 2018.

Goodwill and Other Indefinite-Lived Intangible Assets:

A significant portion of our assets is goodwill and other intangible assets, the majority of which are not amortized but are reviewed at least annually for impairment and more often if indicators of impairment exist. At April 30, 2018, the carrying value of goodwill and other intangible assets totaled $11.9 billion, compared to total assets of $15.3 billion and total shareholders’ equity of

$7.9 billion. If the carrying value of these assets exceeds the current estimated fair value, the asset is considered impaired, and this would result in a noncash charge to earnings. Any such impairment charge would reduce earnings and could be material. Events and conditions that could result in impairment include a sustained drop in the market price of our common shares, increased competition or loss of market share, obsolescence, product claims that result in a significant loss of sales or profitability over the product life, deterioration in macroeconomic conditions, or declining financial performance in comparison to projected results.

To test for goodwill impairment, we estimate the fair value of each of our reporting units using both a discounted cash flow valuation technique and a market-based approach. The impairment test incorporates estimates of future cash flows; allocations of certain assets, liabilities, and cash flows among reporting units; future growth rates; terminal value amounts; and the applicable weighted-average cost of capital used to discount those estimated cash flows. The estimates and projections used in the calculation of fair value are consistent with our current and long-range plans, including anticipated changes in market conditions, industry trends, growth rates, and planned capital expenditures. Changes in forecasted operations and other estimates and assumptions could impact the assessment of impairment in the future.

At April 30, 2018, goodwill totaled $5.9 billion. Goodwill is substantially concentrated within the U.S. Retail Coffee, U.S. Retail Pet Foods, and U.S. Retail Consumer Foods segments. During 2018, we recognized goodwill impairment charges of $145.0 related to the goodwill of the Pet Foods reporting unit, which was a result of the evaluation performed during the year.

As of April 30, 2018, the estimated fair value of each of our seven reporting units was substantially in excess of its carrying value, with the exception of the Pet Foods reporting unit, for which its fair value exceeded its carrying value by less than 1 percent. A sensitivity analysis was performed for the Pet Foods reporting unit, assuming a hypothetical 50-basis-point decrease in the expected long-term growth rate or a hypothetical 50-basis-point increase in the weighted-average cost of capital, and both scenarios independently yielded an estimated fair value for the Pet Foods reporting unit below carrying value.

Other indefinite-lived intangible assets, consisting entirely of trademarks, are also tested for impairment at least annually and more often if events or changes in circumstances indicate their carrying value may not be recoverable. To test these assets for impairment, we estimate the fair value of each asset based on a discounted cash flow model using various inputs, including projected revenues, an assumed royalty rate, and a discount rate. Changes in these estimates and assumptions could impact the assessment of impairment in the future.

At April 30, 2018, other indefinite-lived intangible assets totaled $2.9 billion. Trademarks that represent our leading brands comprise more than 90 percent of the total carrying value of other indefinite-lived intangible assets. As of April 30, 2018, each of these leading brand trademarks had an estimated fair value substantially in excess of its carrying value, with the exception of the indefinite-lived trademarks within the U.S. Retail Pet Foods segment. During 2018, we recognized impairment charges of $31.9 related to certain indefinite-lived trademarks within the U.S. Retail Pet Foods segment, to the extent that the carrying value exceeded the estimated fair value.

2018 ANNUAL REPORT 41

MANAGEMENT’S DISCUSSION AND ANALYSIS

The J. M. Smucker Company

The goodwill and indefinite-lived trademarks within the U.S. Retail Pet Foods segment remain susceptible to future impairment charges as the carrying values approximate estimated fair values at April 30, 2018. In addition, any meaningful adverse change to our near or long-term projections or macro-economic conditions could result in future impairment charges.

Pension and Other Postretirement Benefit Plans: To determine the ultimate obligation under our defined benefit pension and other postretirement benefit plans, we must estimate the future cost of benefits and attribute that cost to the time period during which each covered employee works. Various actuarial assumptions must be made in order to predict and measure costs and obligations many years prior to the settlement date, the most significant being the interest rates used to discount the obligations of the plans, the long-term rates of return on the plans’ assets, mortality assumptions, assumed pay increases, and the health care cost trend rates. We, along with third-party actuaries and investment managers, review all of these assumptions on an ongoing basis to ensure that the most reasonable information available is being considered.

During 2017, we changed the approach utilized to estimate the service and interest cost components of net periodic benefit cost for our defined benefit pension and other postretirement benefit plans. Historically, we estimated the service and interest cost components using a single weighted-average discount rate derived from the yield curve used to measure the benefit obligation at the beginning of the period. As of April 30, 2017, we utilized a spot rate approach for the estimation of service and interest cost for our plans by applying specific spot rates along the yield curve to the relevant projected cash flows, to provide a better estimate of service and interest costs. This approach does not affect the measurement of the total benefit obligations, and has been accounted for as a change in estimate that is effected by a change in accounting principle. As such, we accounted for this change in methodology on a prospective basis beginning May 1, 2017.

For 2019 expense recognition, we will continue to use a spot rate methodology, determined using the method described above. This methodology will result in weighted-average discount rates for the U.S. defined benefit pension plans of 4.17 percent to determine benefit obligation, 4.29 percent to determine service cost, and

3.87 percent to determine interest cost, and a rate of compensation increase of 3.59 percent. For the Canadian defined benefit pension plans, it will result in weighted-average discount rates of

3.57 percent to determine benefit obligation, 3.64 percent to determine service cost, and 3.23 percent to determine interest cost. In addition, we anticipate using an expected rate of return on plan assets of 5.66 percent and 5.25 percent for the U.S. and Canadian defined benefit pension plans, respectively.

DERIVATIVE FINANCIAL INSTRUMENTS AND MARKET RISK

The following discussions about our market risk disclosures involve forward-looking statements. Actual results could differ from those projected in the forward-looking statements. We are

exposed to market risk related to changes in interest rates, foreign currency exchange rates, and commodity prices.