Attached files

| file | filename |

|---|---|

| EX-99.5 - EXHIBIT 99.5 - BOK FINANCIAL CORP | a20180618ex995votingagreem.htm |

| EX-99.4 - EXHIBIT 99.4 - BOK FINANCIAL CORP | a20180618ex994votingagreem.htm |

| EX-99.2 - EXHIBIT 99.2 - BOK FINANCIAL CORP | a20180618ex992bokfpressrel.htm |

| EX-99.1 - EXHIBIT 99.1 - BOK FINANCIAL CORP | a20180618ex991agreementand.htm |

| 8-K - 8-K - BOK FINANCIAL CORP | a20180618bokfpressrelease8.htm |

IBDROOT\PROJECTS\IBD-NY\RHIN O2018\616995_1\1.0 COBZ Opportunity\Investor Presentation & Press Release\Investor Presentation\Investor Presentation vDraft (6.15.2018).pptx Combination with Investor Presentation June 18, 2018 1

IBDROOT\PROJECTS\IBD-NY\RHIN O2018\616995_1\1.0 COBZ Opportunity\Investor Presentation & Press Release\Investor Presentation\Investor Presentation vDraft (6.15.2018).pptx Important Additional Information And Where To Find It In connection with the proposed merger, BOK Financial Corporation will file with the SEC a Registration Statement on Form S-4 that will include the Proxy Statement of CoBiz Financial Inc. and a Prospectus of BOK Financial Corporation, as well as other relevant documents concerning the proposed transaction. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. A free copy of the Proxy Statement/Prospectus, as well as other filings containing information about BOK Financial Corporation and CoBiz Financial Inc., may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from CoBiz Financial Inc. at ir.cobizfinancial.com or from BOK Financial Corporation by accessing BOK Financial Corporation’s website at www.bokf.com. Copies of the Proxy Statement/Prospectus can also be obtained, free of charge, by directing a request to CoBiz Financial Inc. Investor Relations at CoBiz Financial Inc. Investor Relations, 1401 Lawrence Street, Suite 1200, Denver, CO, by calling (303) 312-3412, or by sending an e-mail to info@cobizfinancial.com or to BOK Financial Corporation Investor Relations at Bank of Oklahoma Tower, Boston Avenue at Second Street, Tulsa, Oklahoma, by calling (918) 588-6000 or by sending an e-mail to investorrelations@BOKF.com. CoBiz Financial Inc. and BOK Financial Corporation and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of CoBiz Financial Inc. in respect of the transaction described in the Proxy Statement/Prospectus. Information regarding CoBiz Financial Inc.’s directors and executive officers is contained in CoBiz Financial Inc.’s Annual Report on Form 10-K for the year ended December 31, 2017 and its Proxy Statement on Schedule 14A, dated March 9, 2018, which are filed with the SEC. Information regarding BOK Financial Corporation’s directors and executive officers is contained in BOK Financial Corporation’s Annual Report on Form 10-K for the year ended December 31, 2017 and its Proxy Statement on Schedule 14A, dated March 15, 2018, which are filed with the SEC. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Proxy Statement/Prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. 2

IBDROOT\PROJECTS\IBD-NY\RHIN O2018\616995_1\1.0 COBZ Opportunity\Investor Presentation & Press Release\Investor Presentation\Investor Presentation vDraft (6.15.2018).pptx Forward Looking Statements This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, CoBiz Financial Inc.’s and BOK Financial Corporation’s expectations or predictions of future financial or business performance or conditions. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “plan,” “predict,” “project,” “forecast,” “guidance,” “goal,” “objective,” “prospects,” “possible” or “potential,” by future conditional verbs such as “assume,” “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. These forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made and we assume no duty to update forward-looking statements. Actual results may differ materially from current projections. In addition to factors previously disclosed in CoBiz Financial Inc.’s and BOK Financial Corporation’s reports filed with the SEC and those identified elsewhere in this communication, the following factors, among others, could cause actual results to differ materially from forward-looking statements or historical performance: the ability to obtain regulatory approvals and meet other closing conditions to the merger, including approval by CoBiz Financial Inc.’s shareholders on the expected terms and schedule, including the risk that regulatory approvals required for the merger are not obtained or are obtained subject to conditions that are not anticipated; delay in closing the merger; difficulties and delays in integrating CoBiz Financial Inc.’s business or fully realizing cost savings and other benefits; business disruption following the merger; changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of BOK Financial Corporation’s products and services; customer borrowing, repayment, investment and deposit practices; customer disintermediation; the introduction, withdrawal, success and timing of business initiatives; competitive conditions; the inability to realize cost savings or revenues or to implement integration plans and other consequences associated with mergers, acquisitions and divestitures; economic conditions; and the impact, extent and timing of technological changes, capital management activities, and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. 3

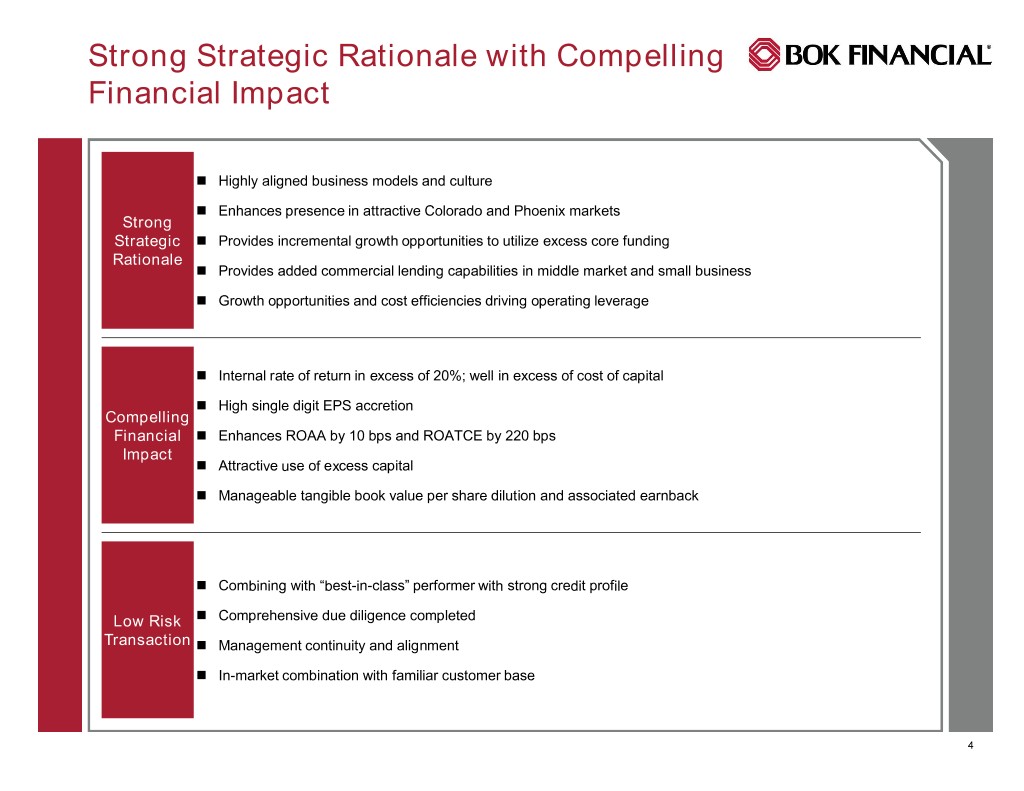

IBDROOT\PROJECTS\IBD-NY\RHIN O2018\616995_1\1.0 COBZ Opportunity\Investor Presentation & Press Release\Investor Presentation\Investor Presentation vDraft (6.15.2018).pptx Strong Strategic Rationale with Compelling Financial Impact Highly aligned business models and culture Enhances presence in attractive Colorado and Phoenix markets Strong Strategic Provides incremental growth opportunities to utilize excess core funding Rationale Provides added commercial lending capabilities in middle market and small business Growth opportunities and cost efficiencies driving operating leverage Internal rate of return in excess of 20%; well in excess of cost of capital High single digit EPS accretion Compelling Financial Enhances ROAA by 10 bps and ROATCE by 220 bps Impact Attractive use of excess capital Manageable tangible book value per share dilution and associated earnback Combining with “best-in-class” performer with strong credit profile Low Risk Comprehensive due diligence completed Transaction Management continuity and alignment In-market combination with familiar customer base 4

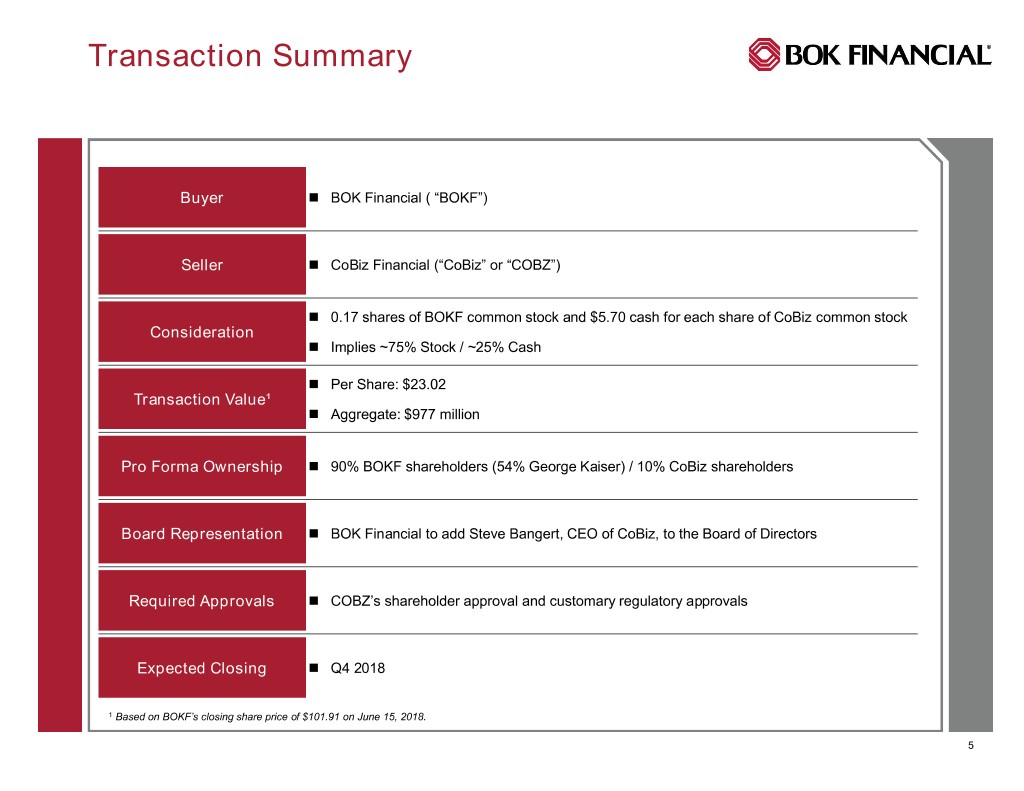

IBDROOT\PROJECTS\IBD-NY\RHIN O2018\616995_1\1.0 COBZ Opportunity\Investor Presentation & Press Release\Investor Presentation\Investor Presentation vDraft (6.15.2018).pptx Transaction Summary Buyer BOK Financial ( “BOKF”) Seller CoBiz Financial (“CoBiz” or “COBZ”) 0.17 shares of BOKF common stock and $5.70 cash for each share of CoBiz common stock Consideration Implies ~75% Stock / ~25% Cash Per Share: $23.02 Transaction Value¹ Aggregate: $977 million Pro Forma Ownership 90% BOKF shareholders (54% George Kaiser) / 10% CoBiz shareholders Board Representation BOK Financial to add Steve Bangert, CEO of CoBiz, to the Board of Directors Required Approvals COBZ’s shareholder approval and customary regulatory approvals Expected Closing Q4 2018 1 Based on BOKF’s closing share price of $101.91 on June 15, 2018. 5

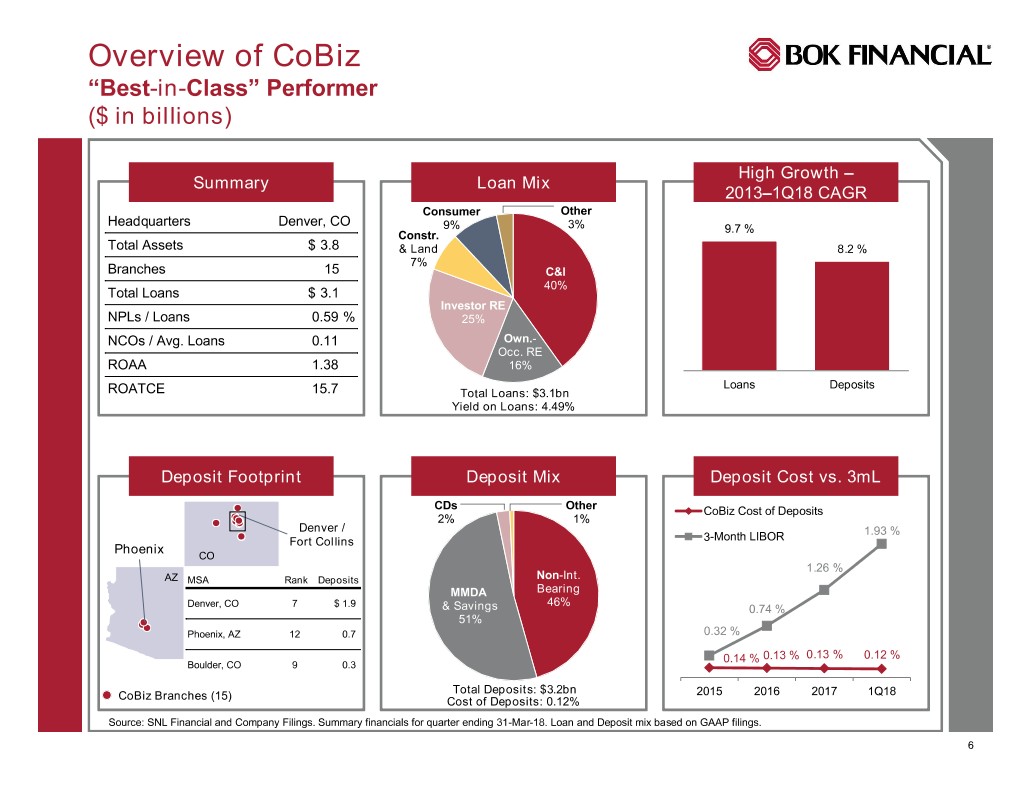

IBDROOT\PROJECTS\IBD-NY\RHIN O2018\616995_1\1.0 COBZ Opportunity\Investor Presentation & Press Release\Investor Presentation\Investor Presentation vDraft (6.15.2018).pptx Overview of CoBiz “Best-in-Class” Performer ($ in billions) High Growth – Summary Loan Mix 2013–1Q18 CAGR Consumer Other Headquarters Denver, CO 9% 3% 9.7 % Constr. Total Assets $ 3.8 & Land 8.2 % 7% Branches 15 C&I 40% Total Loans $ 3.1 Investor RE NPLs / Loans 0.59 % 25% NCOs / Avg. Loans 0.11 Own.- Occ. RE ROAA 1.38 16% 1.93 % Loans 1.26 % Deposits ROATCE 15.7 Total Loans: $3.1bn 0.74 % Yield on Loans: 4.49% 0.32 % 0.14 % 0.13 % 0.13 % 0.12 % 2015 2016 2017 1Q18 Deposit Footprint Deposit Mix Deposit Cost vs. 3mL CDs Other CoBiz Cost of Deposits 2% 1% Denver / 1.93 % Fort Collins 3-Month LIBOR Phoenix CO 1.26 % AZ MSA Rank Deposits Non-Int. MMDA Bearing 46% Denver, CO 7 $ 1.9 & Savings 0.74 % 51% Phoenix, AZ 12 0.7 0.32 % 0.14 % 0.13 % 0.13 % 0.12 % Boulder, CO 9 0.3 Total Deposits: $3.2bn CoBiz Branches (15) 2015 2016 2017 1Q18 Cost of Deposits: 0.12% Source: SNL Financial and Company Filings. Summary financials for quarter ending 31-Mar-18. Loan and Deposit mix based on GAAP filings. 6

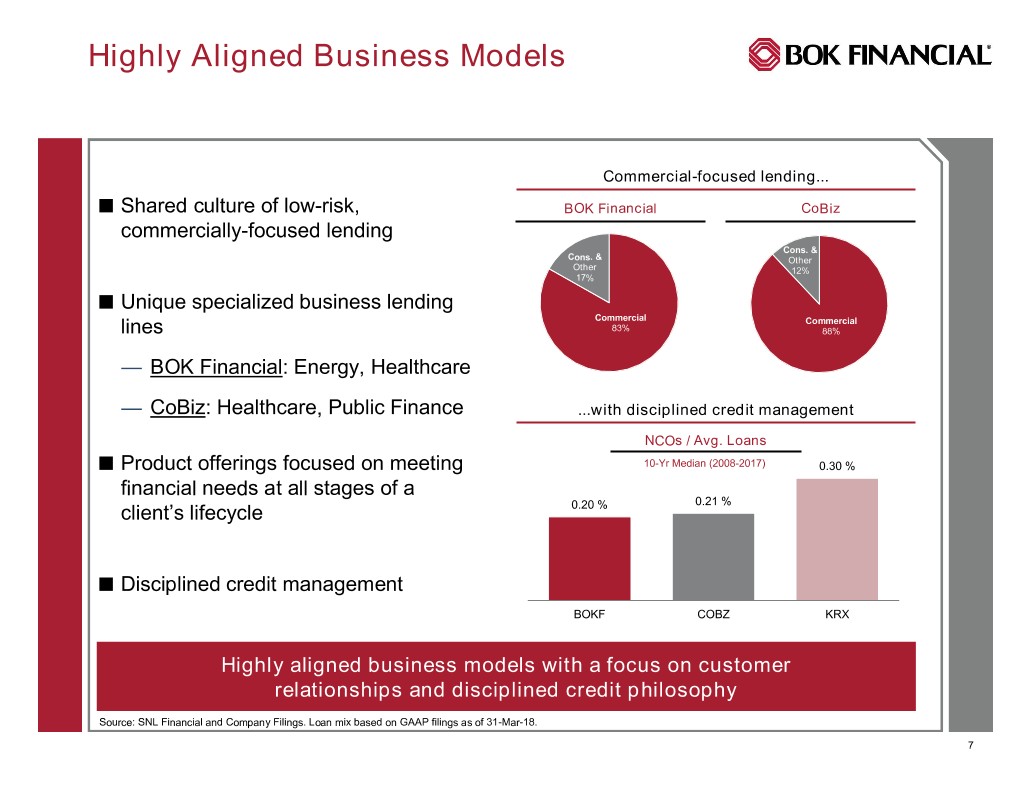

IBDROOT\PROJECTS\IBD-NY\RHIN O2018\616995_1\1.0 COBZ Opportunity\Investor Presentation & Press Release\Investor Presentation\Investor Presentation vDraft (6.15.2018).pptx Highly Aligned Business Models Commercial-focused lending... Shared culture of low-risk, BOK Financial CoBiz commercially-focused lending Cons. & Cons. & Other Other 12% 17% Unique specialized business lending Commercial Commercial lines 83% 88% — BOK Financial: Energy, Healthcare — CoBiz: Healthcare, Public Finance ...with disciplined credit management NCOs / Avg. Loans Product offerings focused on meeting 10-Yr Median (2008-2017) 0.30 % financial needs at all stages of a 0.21 % client’s lifecycle 0.20 % Disciplined credit management BOKF COBZ KRX Highly aligned business models with a focus on customer relationships and disciplined credit philosophy Source: SNL Financial and Company Filings. Loan mix based on GAAP filings as of 31-Mar-18. 7

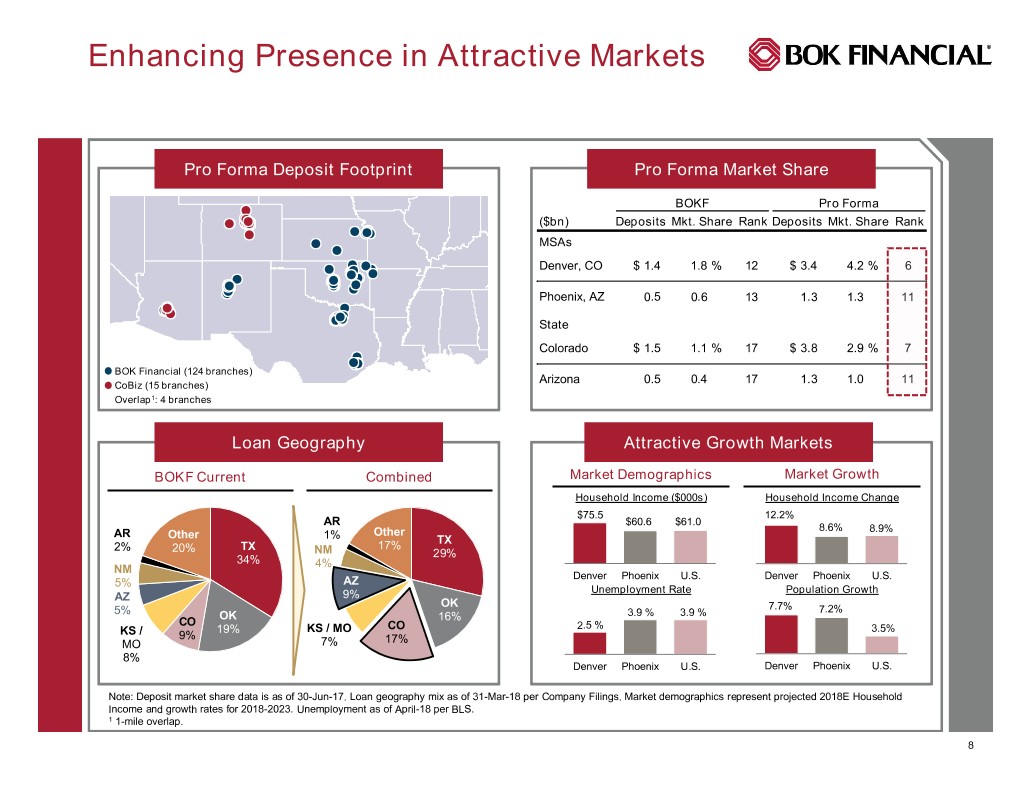

IBDROOT\PROJECTS\IBD-NY\RHIN O2018\616995_1\1.0 COBZ Opportunity\Investor Presentation & Press Release\Investor Presentation\Investor Presentation vDraft (6.15.2018).pptx Enhancing Presence in Attractive Markets Pro Forma Deposit Footprint Pro Forma Market Share BOKF Pro Forma ($bn) Deposits Mkt. Share Rank Deposits Mkt. Share Rank MSAs Denver, CO $ 1.4 1.8 % 12 $ 3.4 4.2 % 6 Phoenix, AZ 0.5 0.6 13 1.3 1.3 11 State Colorado $ 1.5 1.1 % 17 $ 3.8 2.9 % 7 BOK Financial (124 branches) Arizona 0.5 0.4 17 1.3 1.0 11 CoBiz (15 branches) Overlap1: 4 branches Loan Geography Attractive Growth Markets BOKF Current Combined Market Demographics Market Growth Household Income ($000s) Household Income Change $75.5 12.2% AR $60.6 $61.0 8.6% AR Other 8.9% Other 1% TX 2% TX 17% 20% NM 29% 34% 4% NM Denver Phoenix U.S. Denver Phoenix U.S. 5% AZ Unemployment Rate Population Growth AZ 9% OK 7.7% 7.2% 5% OK 3.9 % 3.9 % CO 16% 19% KS / MO CO 2.5 % 3.5% KS / 9% MO 7% 17% 8% Denver Phoenix U.S. Denver Phoenix U.S. Note: Deposit market share data is as of 30-Jun-17. Loan geography mix as of 31-Mar-18 per Company Filings. Market demographics represent projected 2018E Household Income and growth rates for 2018-2023. Unemployment as of April-18 per BLS. 1 1-mile overlap. 8

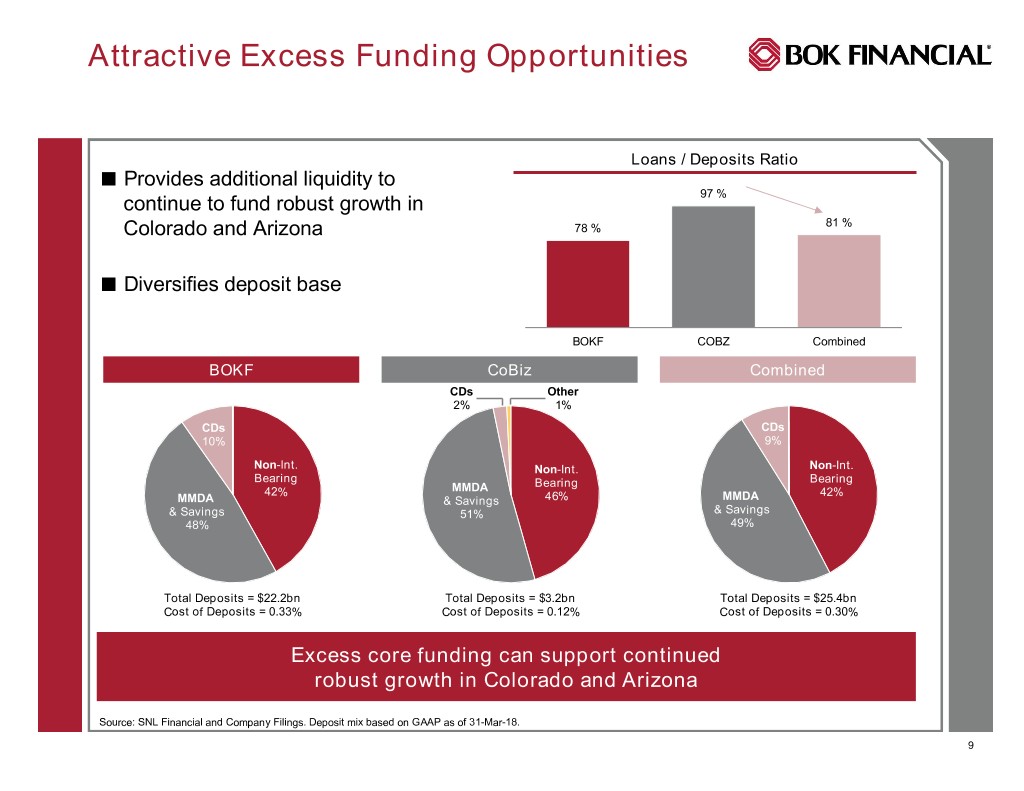

IBDROOT\PROJECTS\IBD-NY\RHIN O2018\616995_1\1.0 COBZ Opportunity\Investor Presentation & Press Release\Investor Presentation\Investor Presentation vDraft (6.15.2018).pptx Attractive Excess Funding Opportunities Loans / Deposits Ratio Provides additional liquidity to continue to fund robust growth in 97 % Colorado and Arizona 78 % 81 % Diversifies deposit base BOKF COBZ Combined BOKF CoBiz Combined CDs Other 2% 1% CDs CDs 10% 9% Non-Int. Non-Int. Non-Int. Bearing Bearing Bearing 42% MMDA 42% MMDA & Savings 46% MMDA & Savings 51% & Savings 48% 49% Total Deposits = $22.2bn Total Deposits = $3.2bn Total Deposits = $25.4bn Cost of Deposits = 0.33% Cost of Deposits = 0.12% Cost of Deposits = 0.30% Excess core funding can support continued robust growth in Colorado and Arizona Source: SNL Financial and Company Filings. Deposit mix based on GAAP as of 31-Mar-18. 9

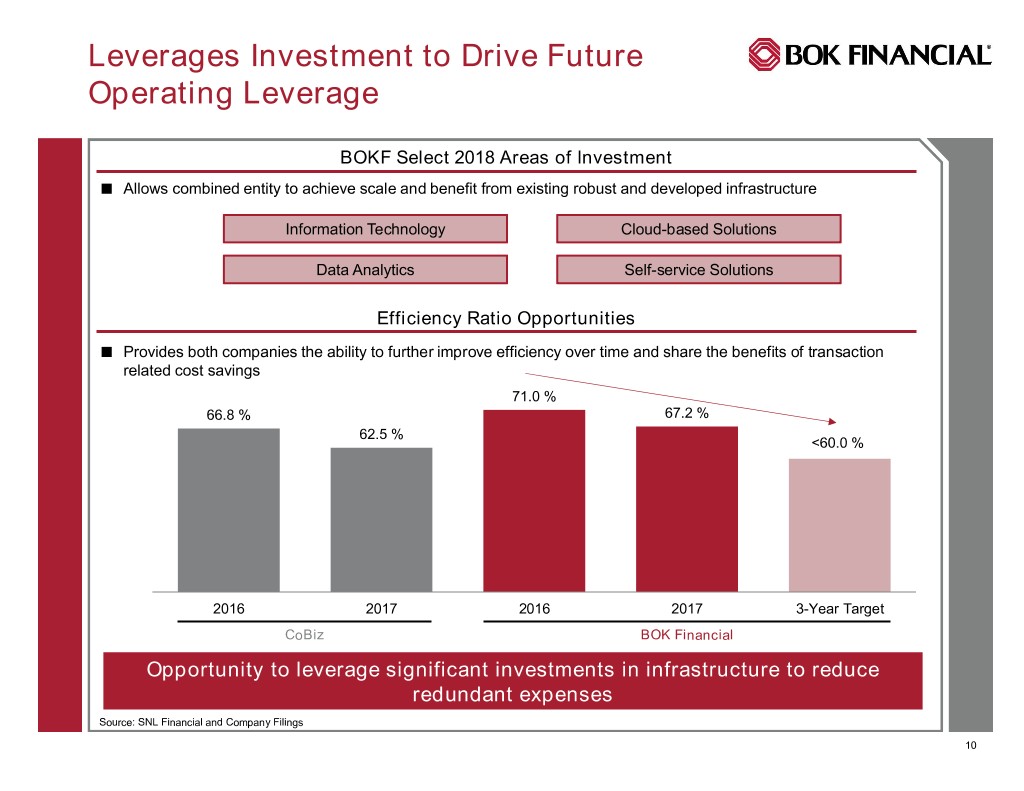

IBDROOT\PROJECTS\IBD-NY\RHIN O2018\616995_1\1.0 COBZ Opportunity\Investor Presentation & Press Release\Investor Presentation\Investor Presentation vDraft (6.15.2018).pptx Leverages Investment to Drive Future Operating Leverage BOKF Select 2018 Areas of Investment Allows combined entity to achieve scale and benefit from existing robust and developed infrastructure Information Technology Cloud-based Solutions Data Analytics Self-service Solutions Efficiency Ratio Opportunities Provides both companies the ability to further improve efficiency over time and share the benefits of transaction related cost savings 71.0 % 66.8 % 67.2 % 62.5 % <60.0 % 2016 2017 2016 2017 3-Year Target CoBiz BOK Financial Opportunity to leverage significant investments in infrastructure to reduce redundant expenses Source: SNL Financial and Company Filings 10

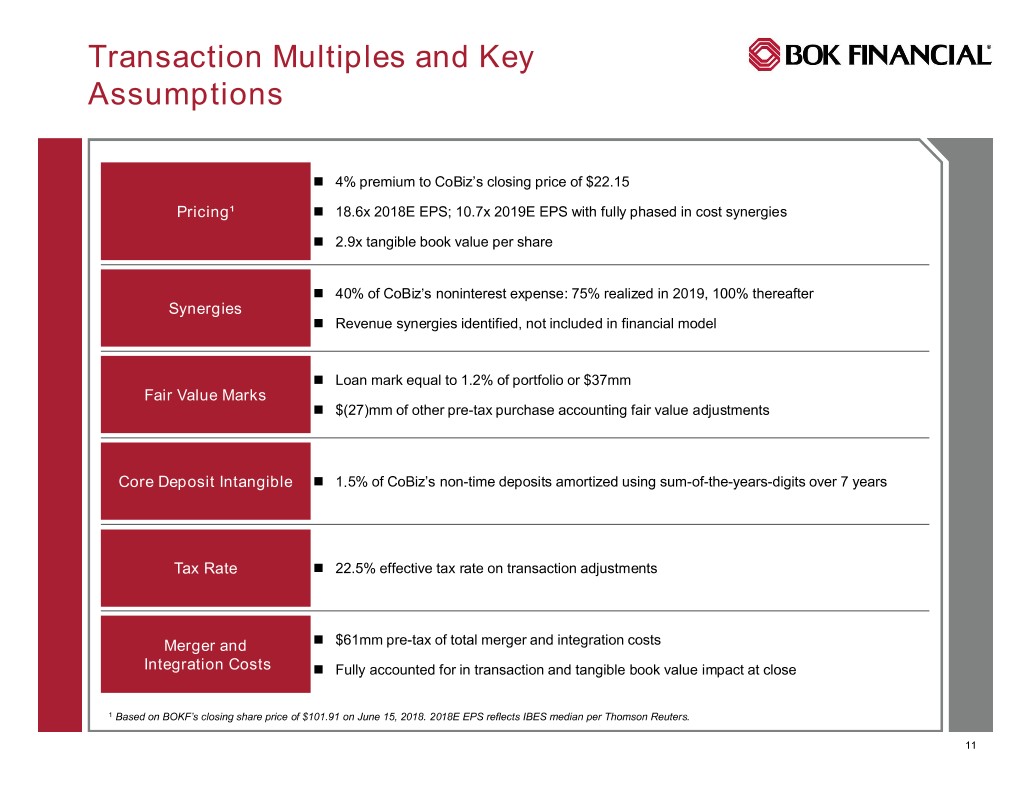

IBDROOT\PROJECTS\IBD-NY\RHIN O2018\616995_1\1.0 COBZ Opportunity\Investor Presentation & Press Release\Investor Presentation\Investor Presentation vDraft (6.15.2018).pptx Transaction Multiples and Key Assumptions 4% premium to CoBiz’s closing price of $22.15 Pricing¹ 18.6x 2018E EPS; 10.7x 2019E EPS with fully phased in cost synergies 2.9x tangible book value per share 40% of CoBiz’s noninterest expense: 75% realized in 2019, 100% thereafter Synergies Revenue synergies identified, not included in financial model Loan mark equal to 1.2% of portfolio or $37mm Fair Value Marks $(27)mm of other pre-tax purchase accounting fair value adjustments Core Deposit Intangible 1.5% of CoBiz’s non-time deposits amortized using sum-of-the-years-digits over 7 years Tax Rate 22.5% effective tax rate on transaction adjustments Merger and $61mm pre-tax of total merger and integration costs Integration Costs Fully accounted for in transaction and tangible book value impact at close 1 Based on BOKF’s closing share price of $101.91 on June 15, 2018. 2018E EPS reflects IBES median per Thomson Reuters. 11

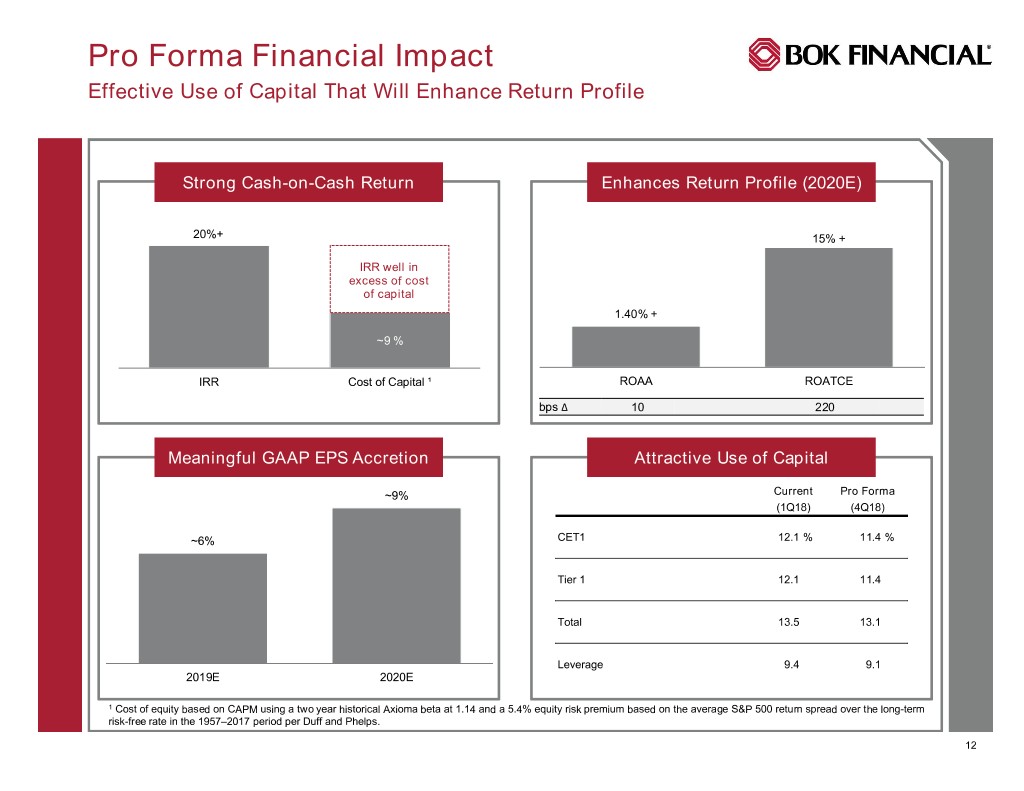

IBDROOT\PROJECTS\IBD-NY\RHIN O2018\616995_1\1.0 COBZ Opportunity\Investor Presentation & Press Release\Investor Presentation\Investor Presentation vDraft (6.15.2018).pptx Pro Forma Financial Impact Effective Use of Capital That Will Enhance Return Profile Strong Cash-on-Cash Return Enhances Return Profile (2020E) 20%+ 15% + IRR well in excess of cost of capital 1.40% + ~9 % IRR Cost of Capital ¹ ROAA ROATCE bps ∆ 10 220 Meaningful GAAP EPS Accretion Attractive Use of Capital ~9% Current Pro Forma (1Q18) (4Q18) ~6% CET1 12.1 % 11.4 % Tier 1 12.1 11.4 Total 13.5 13.1 Leverage 9.4 9.1 2019E 2020E 1 Cost of equity based on CAPM using a two year historical Axioma beta at 1.14 and a 5.4% equity risk premium based on the average S&P 500 return spread over the long-term risk-free rate in the 1957–2017 period per Duff and Phelps. 12

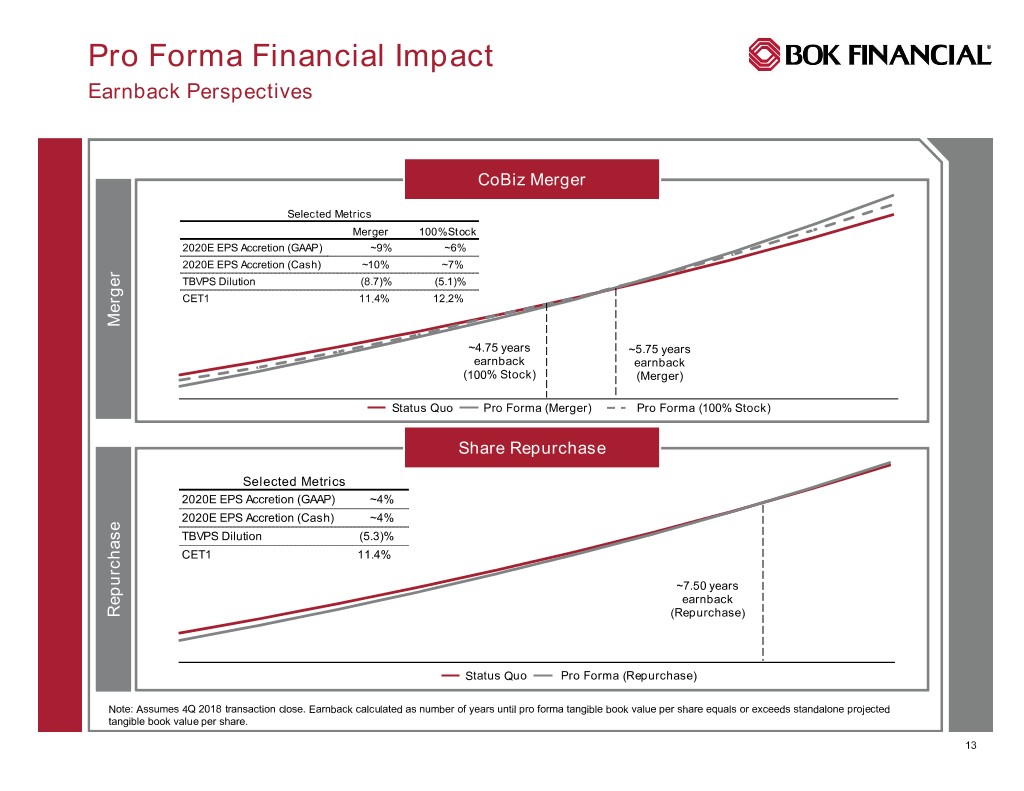

IBDROOT\PROJECTS\IBD-NY\RHIN O2018\616995_1\1.0 COBZ Opportunity\Investor Presentation & Press Release\Investor Presentation\Investor Presentation vDraft (6.15.2018).pptx Pro Forma Financial Impact Earnback Perspectives CoBiz Merger Selected Metrics Merger 100% Stock 2020E EPS Accretion (GAAP) ~9% ~6% 2020E EPS Accretion (Cash) ~10% ~7% TBVPS Dilution (8.7)% (5.1)% CET1 11.4% 12.2% Merger ~4.75 years ~5.75 years earnback earnback (100% Stock) (Merger) Status Quo Pro Forma (Merger) Pro Forma (100% Stock) Share Repurchase Selected Metrics 2020E EPS Accretion (GAAP) ~4% 2020E EPS Accretion (Cash) ~4% TBVPS Dilution (5.3)% CET1 11.4% ~7.50 years earnback Repurchase (Repurchase) Status Quo Pro Forma (Repurchase) Note: Assumes 4Q 2018 transaction close. Earnback calculated as number of years until pro forma tangible book value per share equals or exceeds standalone projected tangible book value per share. 13

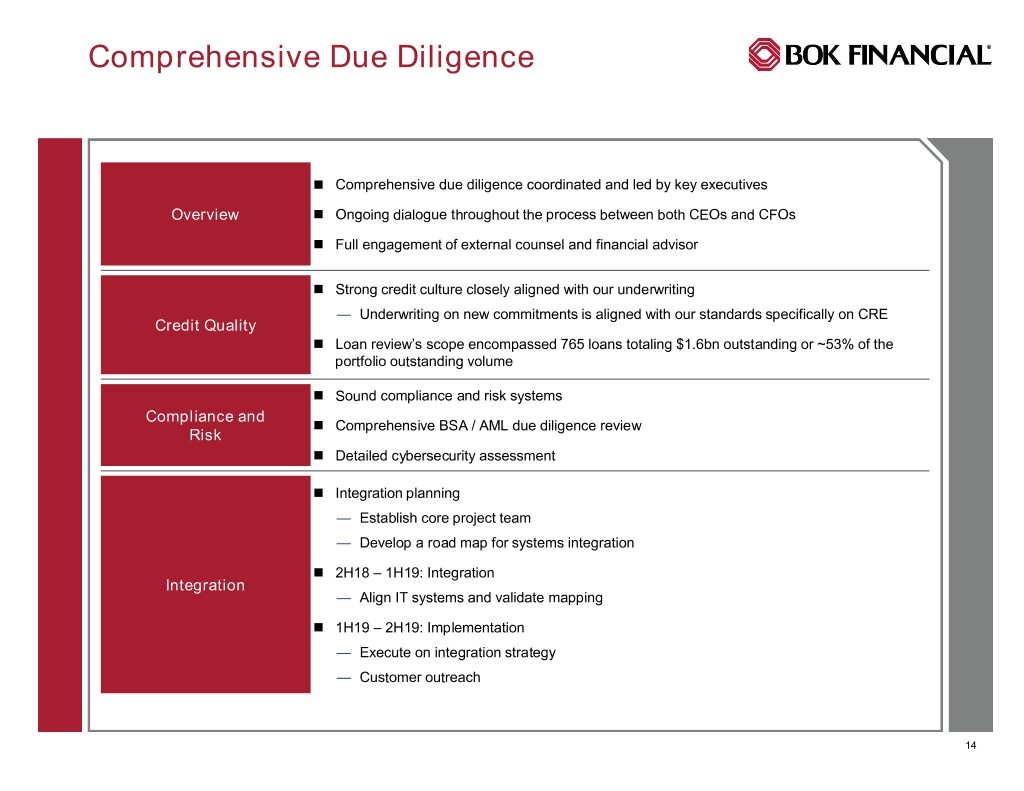

IBDROOT\PROJECTS\IBD-NY\RHIN O2018\616995_1\1.0 COBZ Opportunity\Investor Presentation & Press Release\Investor Presentation\Investor Presentation vDraft (6.15.2018).pptx Comprehensive Due Diligence Comprehensive due diligence coordinated and led by key executives Overview Ongoing dialogue throughout the process between both CEOs and CFOs Full engagement of external counsel and financial advisor Strong credit culture closely aligned with our underwriting — Underwriting on new commitments is aligned with our standards specifically on CRE Credit Quality Loan review’s scope encompassed 765 loans totaling $1.6bn outstanding or ~53% of the portfolio outstanding volume Sound compliance and risk systems Compliance and Comprehensive BSA / AML due diligence review Risk Detailed cybersecurity assessment Integration planning — Establish core project team — Develop a road map for systems integration 2H18 – 1H19: Integration Integration — Align IT systems and validate mapping 1H19 – 2H19: Implementation — Execute on integration strategy — Customer outreach 14

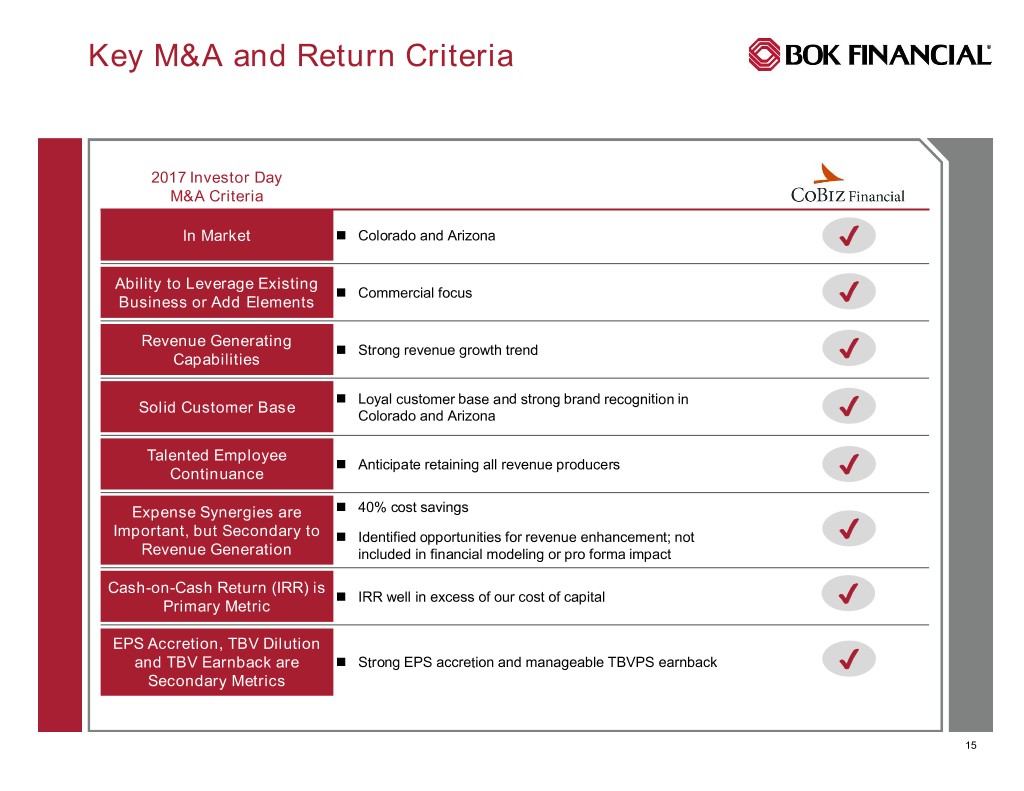

IBDROOT\PROJECTS\IBD-NY\RHIN O2018\616995_1\1.0 COBZ Opportunity\Investor Presentation & Press Release\Investor Presentation\Investor Presentation vDraft (6.15.2018).pptx Key M&A and Return Criteria 2017 Investor Day M&A Criteria In Market Colorado and Arizona ✔ Ability to Leverage Existing Commercial focus Business or Add Elements ✔ Revenue Generating Strong revenue growth trend Capabilities ✔ Loyal customer base and strong brand recognition in Solid Customer Base Colorado and Arizona ✔ Talented Employee Anticipate retaining all revenue producers Continuance ✔ Expense Synergies are 40% cost savings Important, but Secondary to Identified opportunities for revenue enhancement; not ✔ Revenue Generation included in financial modeling or pro forma impact Cash-on-Cash Return (IRR) is IRR well in excess of our cost of capital Primary Metric ✔ EPS Accretion, TBV Dilution and TBV Earnback are Strong EPS accretion and manageable TBVPS earnback ✔ Secondary Metrics 15