Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - UNITED BANCORP INC /OH/ | d591231dex991.htm |

| EX-2.1 - EX-2.1 - UNITED BANCORP INC /OH/ | d591231dex21.htm |

| 8-K - FORM 8-K - UNITED BANCORP INC /OH/ | d591231d8k.htm |

. United Bancorp, Inc. AcoUNDER CONSTRUCTION Powhatan Point Community Bancshares, Inc. a May ____, 2018 Exhibit 99.2

United Bancorp, Inc. Acquisition of Powhatan Point Community Bancshares, Inc. June 14, 2018

Additional Information about the transaction United Bancorp, Inc. (“UBCP”) intends to file a registration statement on Form S-4 with the Securities and Exchange Commission (SEC), which will include a prospectus relating to the UBCP shares to be issued in the transaction, a proxy statement for a shareholder meeting of Powhatan Point Community Bancshares, Inc. (“Powhatan Point”) at which shareholders will be asked to approve the transaction, and certain other documents regarding the proposed transaction. Before making any voting or investment decision, investors are urged to carefully read the entire registration statement and related documents filed with the SEC, when they become available, because they will contain important information about the proposed transaction. Investors will be able to obtain these documents free of charge at the SEC’s website at www.sec.gov or by making a written request to United Bancorp, Inc., Attn: CFO, 201 South Fourth Street, Martins Ferry, OH 43935, or by calling (740) 633-0445.

Cautionary Note Regarding Forward-looking statements This presentation may contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Any statements about our expectations, beliefs, plans, strategies, predictions, forecasts, objectives or assumptions of future events or performance are not historical facts and may be forward-looking. These statements include, but are not limited to, the expected completion date, financial benefits and other effects of the proposed merger of UBCP and Powhatan Point. These statements are often, but not always, made through the use of words or phrases such as “anticipates,” “believes,” “expects,” “can,” “could,” “may,” “predicts,” “potential,” “opportunity,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “seeks,” “intends” and similar words or phrases. Accordingly, these statements involve estimates, known and unknown risks, assumptions and uncertainties that could cause actual strategies, actions or results to differ materially from those expressed in them, and are not guarantees of timing, future results or other events or performance. Because forward-looking statements are necessarily only estimates of future strategies, actions or results, based on management’s current expectations, assumptions and estimates on the date hereof, and there can be no assurance that actual strategies, actions or results will not differ materially from expectations, readers are cautioned not to place undue reliance on such statements. Factors that may cause such a difference include, but are not limited to, the reaction to the transaction of the companies’ customers, employees and counterparties; customer disintermediation; inflation; expected synergies, cost savings and other financial benefits of the proposed transaction might not be realized within the expected timeframes or might be less than projected; the requisite shareholder and regulatory approvals for the proposed transaction might not be obtained; credit and interest rate risks associated with UBCP’s and Powhatan Point’s respective businesses, customers, borrowings, repayment, investment, and deposit practices; general economic conditions, either nationally or in the market areas in which UBCP and Powhatan Point operate or anticipate doing business, are less favorable than expected; new regulatory or legal requirements or obligations; and other risks; certain risks and important factors that could affect UBCP’s future results are identified in its Annual Report on Form10-K for the year ended December 31, 2017 and other reports filed with the SEC, including among other things under the heading “Risk Factors” in such Annual Report on Form 10-K. Any forward-looking statement speaks only as of the date on which it is made, and UBCP undertakes no obligation to update any forward-looking statement, whether to reflect events or circumstances after the date on which the statement is made, to reflect new information or the occurrence of unanticipated events, or otherwise.

United Bancorp, Inc. to acquire First National Bank of Powhatan Point Transaction overview United Bancorp, Inc. (“UBCP”) will acquire Powhatan Point Community Bancshares, Inc. (“Powhatan Point”), the bank holding company for First National Bank of Powhatan Point (“First NB”), a community bank based in Powhatan Point, Ohio Pricing metrics, deal structure and conservative modeling assumptions reflect UBCP’s disciplined approach to acquisitions Each share of Powhatan Point will receive 6.9233 shares of UBCP common stock and $38.75 in cash Powhatan Point has 52,955 common shares outstanding Based on UBCP closing price of $13.05 on June 13, 2018, the implied aggregate transaction value is $6.8 million First NB operates from a single location in Belmont County and reported $58.8 million in total assets and $53.6 million in deposits at March 31, 2018; provides a very attractive deposit mix with ~ 35% in noninterest bearing, 11% in time deposits and cost of funds at 0.23% for the 1Q-2018 First NB has 7 full time equivalent employees. The noninterest expense of First NB is approximately 1.56% of average assets for the last 12-month period ending March 31, 2018. Natural extension of UBCP’s community bank footprint, complementary fit with UBCP’s recent LPO opening in Wheeling and balance sheet funding strategy.

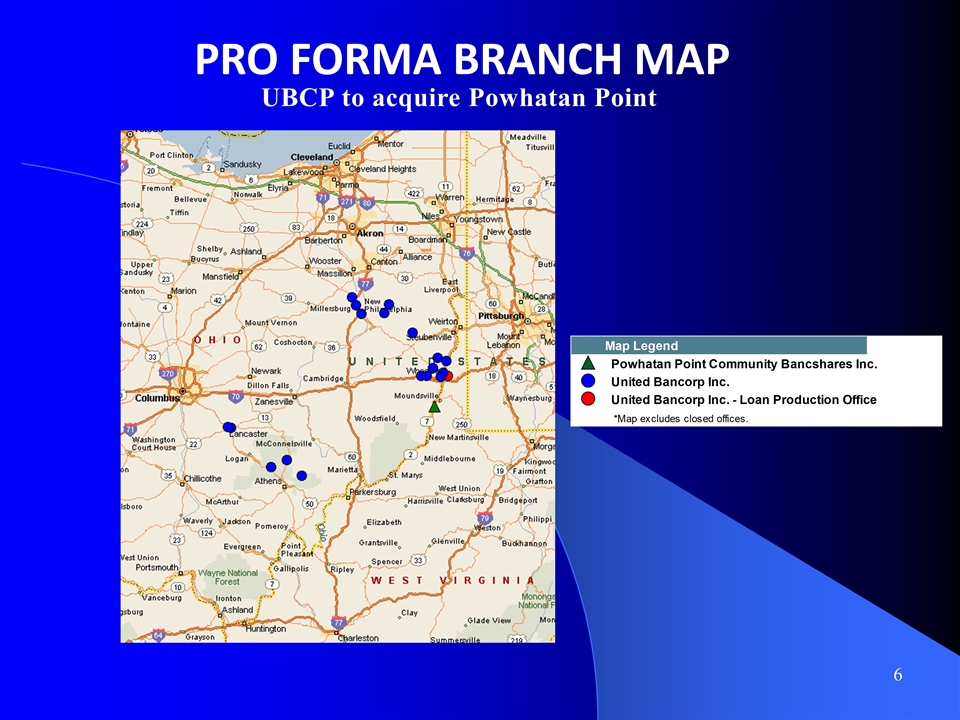

UBCP to acquire Powhatan Point Pro Forma Branch Map

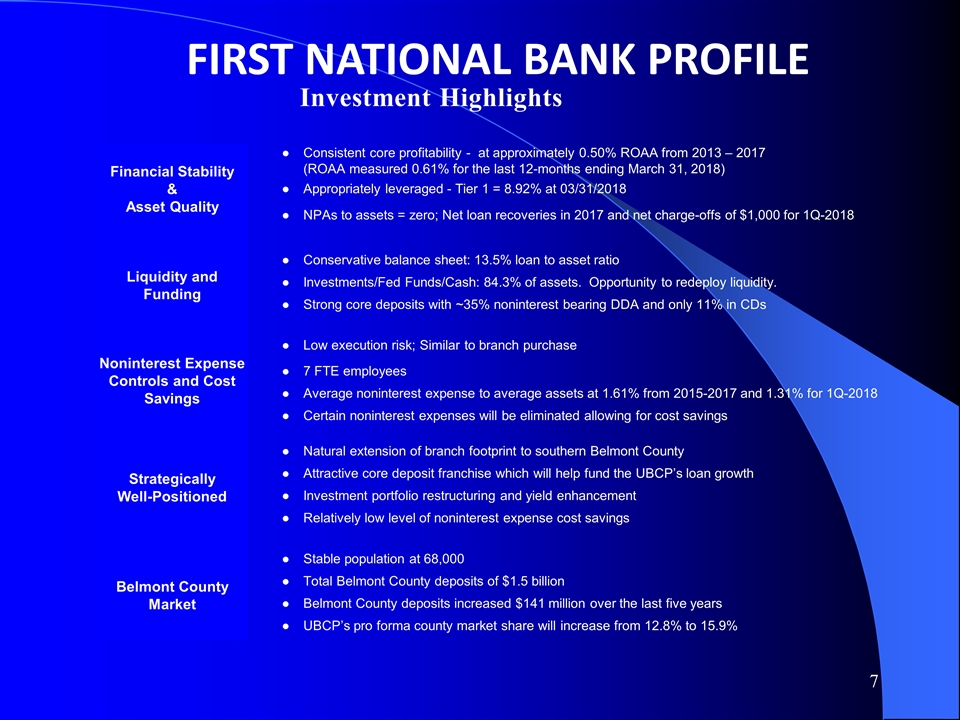

Investment Highlights First National bank PROFILE Financial Stability & Asset Quality ● Consistent core profitability - at approximately 0.50% ROAA from 2013 – 2017 (ROAA measured 0.61% for the last 12-months ending March 31, 2018) ● Appropriately leveraged - Tier 1 = 8.92% at 03/31/2018 ● NPAs to assets = zero; Net loan recoveries in 2017 and net charge-offs of $1,000 for 1Q-2018 Liquidity and Funding ● Conservative balance sheet: 13.5% loan to asset ratio ● Investments/Fed Funds/Cash: 84.3% of assets. Opportunity to redeploy liquidity. ● Strong core deposits with ~35% noninterest bearing DDA and only 11% in CDs Noninterest Expense Controls and Cost Savings ● Low execution risk; Similar to branch purchase ● 7 FTE employees ● Average noninterest expense to average assets at 1.61% from 2015-2017 and 1.31% for 1Q-2018 ● Certain noninterest expenses will be eliminated allowing for cost savings Strategically Well-Positioned ● Natural extension of branch footprint to southern Belmont County ● Attractive core deposit franchise which will help fund the UBCP’s loan growth ● Investment portfolio restructuring and yield enhancement ● Relatively low level of noninterest expense cost savings Belmont County Market ● Stable population at 68,000 ● Total Belmont County deposits of $1.5 billion ● Belmont County deposits increased $141 million over the last five years ● UBCP’s pro forma county market share will increase from 12.8% to 15.9%

Regional Economic Developments OHIO VALLEY REGION Overall the past decade, the Marcellus and Utica shales area (located in the Appalachian Basin) has increased gross natural gas output in Eastern Ohio, Western Pennsylvania and the Northern Panhandle of West Virginia. The petrochemical industry is growing consumer of natural gas in the region and the Marcellus/Utica natural gas is rich in liquids (including ethane) making the region attractive for chemical manufacturers. PTT Global Chemical purchased approximately 500 acres in Belmont County as the potential future home of a proposed $10 billion ethane cracker plant Officials estimate the ethane cracker plant would bring thousands of construction jobs, as well as hundreds of permanent jobs once the plant enters operation Hundreds/thousands of “spin-off” jobs could also result from the plant’s presence Announced in March 2018, PTT Global partnered with South Korean industrial plan developer Daelim on the Belmont ethane cracker project In November 2017, the West Virginia Department of Commerce announced an agreement with China Energy to invest nearly $84 billion in projects throughout the state over the next 20 years The first phase of the project is slated to begin in 6 – 8 months and include a proposed natural gas power plant in Brooke County (Wellsburg, WV) In total, three new ethylene cracker plants have been proposed for this region, one each in Pennsylvania, Ohio and West Virginia. The Shell Chemicals facility, currently under construction in Pennsylvania, is planned to consume 90,000 to 100,000 barrels/day of ethane.

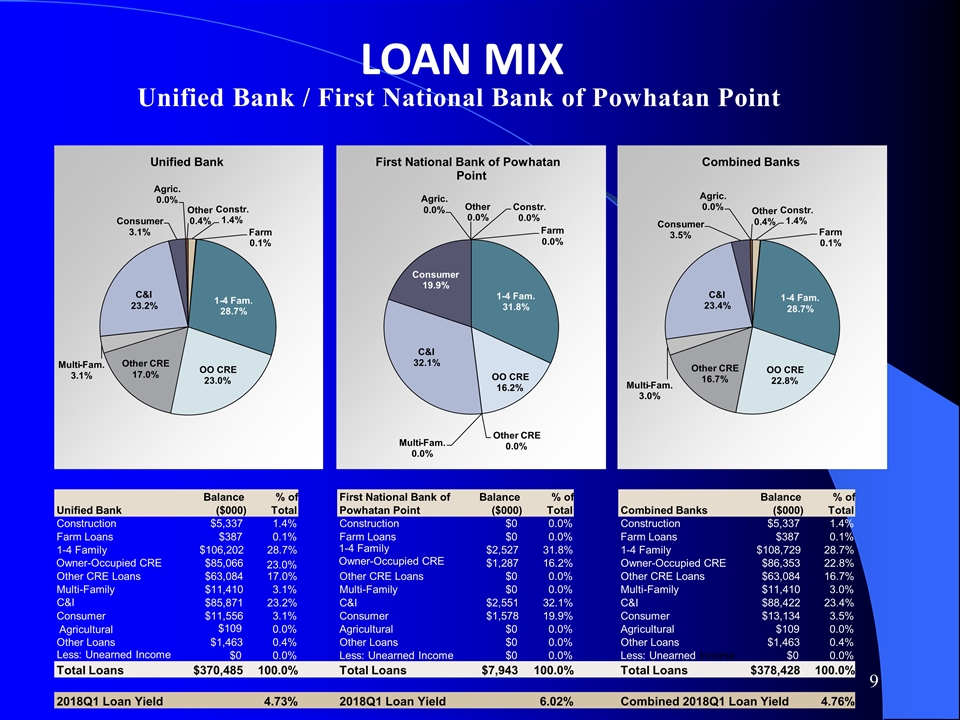

Unified Bank / First National Bank of Powhatan Point Loan Mix Balance % of Balance % of Balance % of ($000) Total ($000) Total Combined Banks ($000) Total Construction $5,337 1.4% Construction $0 0.0% Construction $5,337 1.4% Farm Loans $387 0.1% Farm Loans $0 0.0% Farm Loans $387 0.1% 1-4 Family $106,202 28.7% 1-4 Family $2,527 31.8% 1-4 Family $108,729 28.7% Owner-Occupied CRE $85,066 23.0% Owner-Occupied CRE $1,287 16.2% Owner-Occupied CRE $86,353 22.8% Other CRE Loans $63,084 17.0% Other CRE Loans $0 0.0% Other CRE Loans $63,084 16.7% Multi-Family $11,410 3.1% Multi-Family $0 0.0% Multi-Family $11,410 3.0% C&I $85,871 23.2% C&I $2,551 32.1% C&I $88,422 23.4% Consumer $11,556 3.1% Consumer $1,578 19.9% Consumer $13,134 3.5% Agricultural $109 0.0% Agricultural $0 0.0% Agricultural $109 0.0% Other Loans $1,463 0.4% Other Loans $0 0.0% Other Loans $1,463 0.4% Less: Unearned Income $0 0.0% Less: Unearned Income $0 0.0% Less: Unearned Income $0 0.0% Total Loans $370,485 100.0% Total Loans $7,943 100.0% Total Loans $378,428 100.0% 2018Q1 Loan Yield 4.73% 2018Q1 Loan Yield 6.02% Combined 2018Q1 Loan Yield 4.76% First National Bank of Powhatan Point Unified Bank Constr. 1.4% Farm 0.1% 1 - 4 Fam. 28.7% OO CRE 23.0% Other CRE 17.0% Multi - Fam. 3.1% C&I 23.2% Consumer 3.1% Agric. 0.0% Other 0.4% Unified Bank Constr. 0.0% Farm 0.0% 1 - 4 Fam. 31.8% OO CRE 16.2% Other CRE 0.0% Multi - Fam. 0.0% C&I 32.1% Consumer 19.9% Agric. 0.0% Other 0.0% First National Bank of Powhatan Point Constr. 1.4% Farm 0.1% 1 - 4 Fam. 28.7% OO CRE 22.8% Other CRE 16.7% Multi - Fam. 3.0% C&I 23.4% Consumer 3.5% Agric. 0.0% Other 0.4% Combined Banks

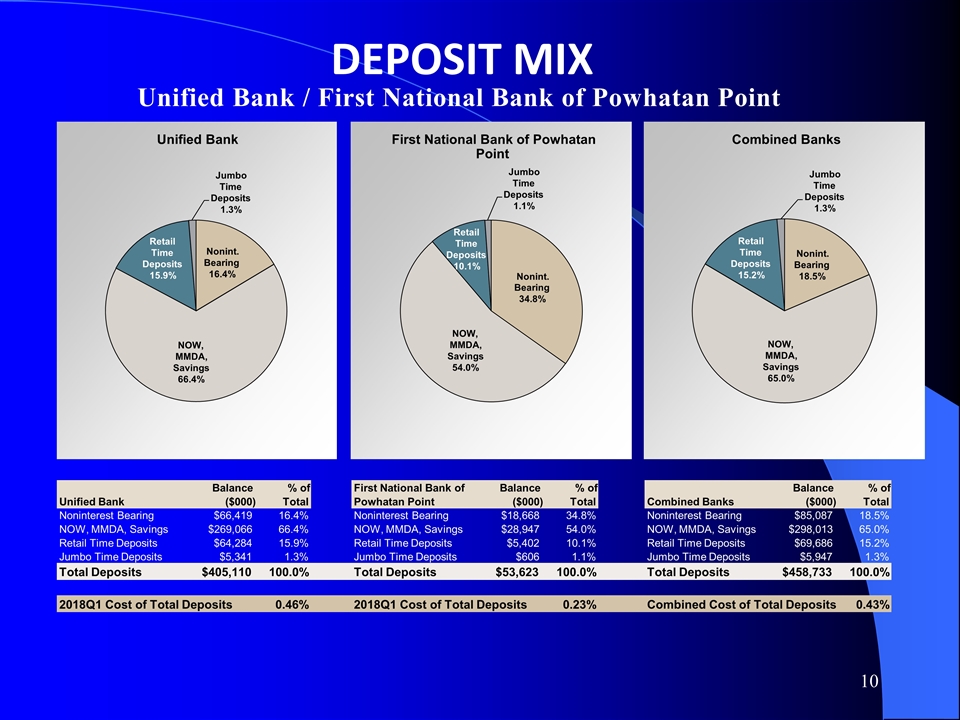

Unified Bank / First National Bank of Powhatan Point Deposit Mix Balance % of Balance % of Balance % of ($000) Total ($000) Total Combined Banks ($000) Total Noninterest Bearing $66,419 16.4% Noninterest Bearing $18,668 34.8% Noninterest Bearing $85,087 18.5% NOW, MMDA, Savings $269,066 66.4% NOW, MMDA, Savings $28,947 54.0% NOW, MMDA, Savings $298,013 65.0% Retail Time Deposits $64,284 15.9% Retail Time Deposits $5,402 10.1% Retail Time Deposits $69,686 15.2% Jumbo Time Deposits $5,341 1.3% Jumbo Time Deposits $606 1.1% Jumbo Time Deposits $5,947 1.3% Total Deposits $405,110 100.0% Total Deposits $53,623 100.0% Total Deposits $458,733 100.0% 2018Q1 Cost of Total Deposits 0.46% 2018Q1 Cost of Total Deposits 0.23% Combined Cost of Total Deposits 0.43% First National Bank of Powhatan Point Unified Bank Nonint. Bearing 16.4% NOW, MMDA, Savings 66.4% Retail Time Deposits 15.9% Jumbo Time Deposits 1.3% Unified Bank Nonint. Bearing 34.8% NOW, MMDA, Savings 54.0% Retail Time Deposits 10.1% Jumbo Time Deposits 1.1% First National Bank of Powhatan Point Nonint. Bearing 18.5% NOW, MMDA, Savings 65.0% Retail Time Deposits 15.2% Jumbo Time Deposits 1.3% Combined Banks

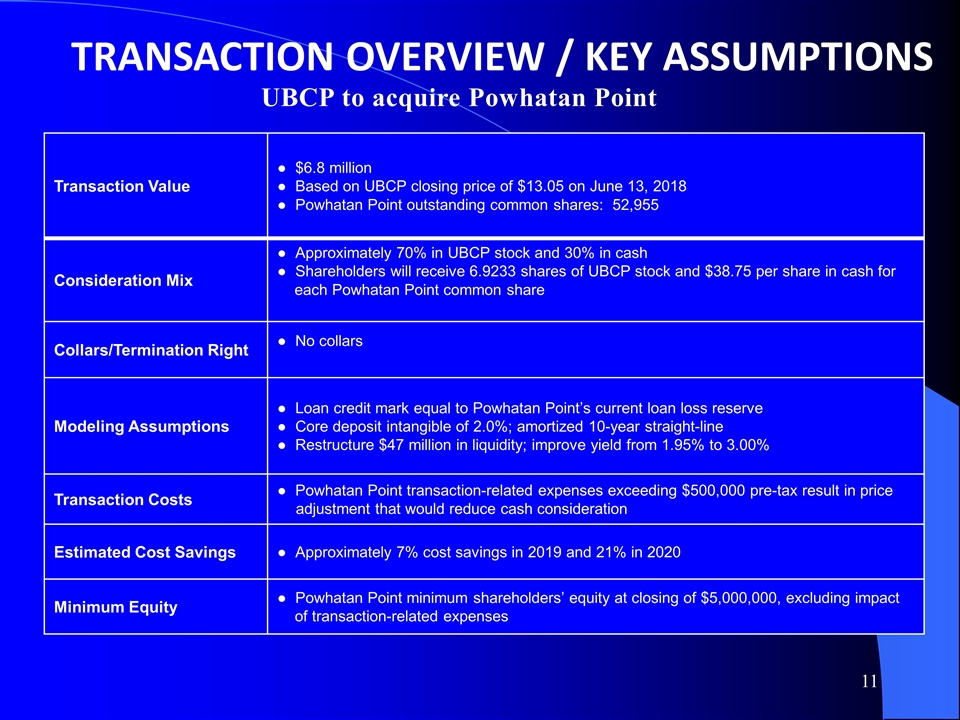

Transaction Value ● $6.8 million ● Based on UBCP closing price of $13.05 on June 13, 2018 ● Powhatan Point outstanding common shares: 52,955 Consideration Mix ● Approximately 70% in UBCP stock and 30% in cash ● Shareholders will receive 6.9233 shares of UBCP stock and $38.75 per share in cash for each Powhatan Point common share Collars/Termination Right ● No collars Modeling Assumptions ● Loan credit mark equal to Powhatan Point’s current loan loss reserve ● Core deposit intangible of 2.0%; amortized 10-year straight-line ● Restructure $47 million in liquidity; improve yield from 1.95% to 3.00% Transaction Costs ● Powhatan Point transaction-related expenses exceeding $500,000 pre-tax result in price adjustment that would reduce cash consideration Estimated Cost Savings ● Approximately 7% cost savings in 2019 and 21% in 2020 Minimum Equity ● Powhatan Point minimum shareholders’ equity at closing of $5,000,000, excluding impact of transaction-related expenses UBCP to acquire Powhatan Point Transaction Overview / Key Assumptions

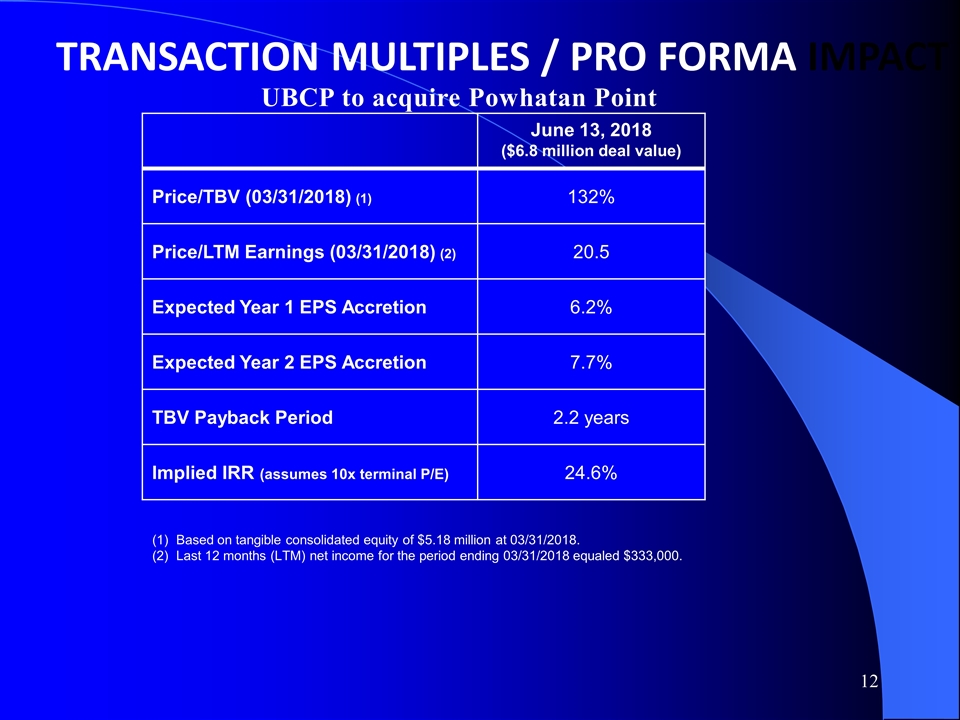

June 13, 2018 ($6.8 million deal value) Price/TBV (03/31/2018) (1) 132% Price/LTM Earnings (03/31/2018) (2) 20.5 Expected Year 1 EPS Accretion 6.2% Expected Year 2 EPS Accretion 7.7% TBV Payback Period 2.2 years Implied IRR (assumes 10x terminal P/E) 24.6% Based on tangible consolidated equity of $5.18 million at 03/31/2018. Last 12 months (LTM) net income for the period ending 03/31/2018 equaled $333,000. UBCP to acquire Powhatan Point Transaction Multiples / Pro Forma Impact

UBCP to acquire Powhatan Point Summary observations Geographic Fit: Natural extension of UBCP’s footprint in Belmont County improving pro forma deposit market share to 15.9% Low Execution Risk: Management continuity Both UBCP and Powhatan Point use same core data processing vendor Single office, traditional community bank model Minimal position eliminations Strong customer relationships Balance Sheet Restructuring Opportunity: Strong liquidity and core deposit funding Cash, Fed Funds, Investments equal 84.3% of assets Investment yield enhancement opportunity 34.8% in noninterest bearing demand deposits; only 11.2% in time deposits Attractive Pricing Metrics: Disciplined approach to valuation Meaningful consolidated EPS accretion Low 2.2 year TBV dilution earnback Low cost savings assumption No cross-sell revenue enhancements included in modeling