Attached files

| file | filename |

|---|---|

| EX-99.1 - INTERFACE INC | exhibit991q2.htm |

| 8-K - INTERFACE INC | q28knorasystems.htm |

Interface Announces Planned Acquisition of nora JUNE 2018

Except for historical information contained herein, the other matters set forth in this presentation and the accompanying conference are forward looking statements. Forward-looking statements include, without limitation, the Company’s expectations regarding the closing, and timing of closing, of the nora acquisition, the Company’s expectations regarding the effect of the nora acquisition on the Company’s results and estimates of future growth in the global commercial flooring industry. Forward-looking statements may be identified by words such as “may,” “expect,” “forecast,” “anticipate,” “intend,” “plan,” “believe,” “could,” “seek,” “project,” “estimate,” “target,” “will” and similar expressions. The forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from any such statement, including: the risk that the closing conditions in the nora acquisition will not be satisfied or waived on a timely basis, or at all; the risk that the Company may have overestimated the future contribution of the nora business to the Company’s combined results; risks related to integration of the combined businesses; risks related to the increased indebtedness the Company will incur to complete the acquisition; risks related to the increased reliance on international business the Company will experience if the acquisition closes; and risks and uncertainties associated with economic conditions in the commercial interiors industry.Risk and uncertainties that may cause actual results to differ materially from those predicted in forward-looking statements also include, but are not limited to, the discussion of specific risks and uncertainties under the following subheadings in “Risk Factors” in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2017: “Sales of our principal products have been and may continue to be affected by adverse economic cycles in the renovation and construction of commercial and institutional buildings”; “We compete with a large number of manufacturers in the highly competitive floorcovering products market, and some of these competitors have greater financial resources than we do. We may face challenges competing on price, making investments in our business or on product design”; “Our success depends significantly upon the efforts, abilities and continued service of our senior management executives, our principal design consultant and other key personnel (including sales personnel), and our loss of any of them could affect us adversely”; “Our substantial international operations are subject to various political, economic and other uncertainties that could adversely affect our business results, including by restrictive taxation or other government regulation and by foreign currency fluctuations”; “Concerns regarding the European sovereign debt and market perceptions about the instability of the euro, the potential re-introduction of individual currencies within the Eurozone, the potential dissolution of the euro entirely, or the U.K. exiting the European Union, could adversely affect our business, results of operations or financial condition”; “Large increases in the cost of petroleum-based raw materials could adversely affect us if we are unable to pass these cost increases through to our customers”; “Unanticipated termination or interruption of any of our arrangements with our primary third party suppliers of synthetic fiber or our sole third party supplier for luxury vinyl tile (“LVT”) could have a material adverse effect on us”; “We have a significant amount of indebtedness, which could have important negative consequences to us”; “The market price of our common stock has been volatile and the value of your investment may decline”; “Our earnings in a future period could be adversely affected by non-cash adjustments to goodwill, if a future test of goodwill assets indicates a material impairment of those assets”; “Changes to our facilities could disrupt our operations”; “Our business operations could suffer significant losses from natural disasters, catastrophes, fire or other unexpected events”; and “Disruptions to or failures of our information technology systems could adversely effect on our business.” Any forward-looking statements are made pursuant to the Private Securities Litigation Reform Act of 1995 and, as such, speak only as of the date made. The Company assumes no responsibility to update or revise forward-looking statements made in this presentation and accompanying conference and cautions readers not to place undue reliance on any such forward-looking statements. Forward Looking Statements

Investment Highlights: Who We Are a leadingglobal provider of commercial flooring solutions the most valuable brand in the flooring category strongest global sales & marketing capabilities global manufacturing footprint and industry-leading gross margins an engaged, customer-centric culture, focused on performance and galvanized around our sustainability mission

Grow the CoreCarpet Tile Business Build a Modular Resilient Flooring Business ExecuteSupply ChainProductivity Optimize SG&AResources Interface’s Growth and Value Creation Strategy Lead a World-Changing Sustainability MovementCentered Around Mission Zero and Climate Take Back Interface’s vision is to become the world’s most valuable interior products & services company

nora is a Premium Commercial Brand nora is a leading global manufacturer of commercial rubber floorcovering systems for healthcare, education, life sciences, public buildings and other end markets

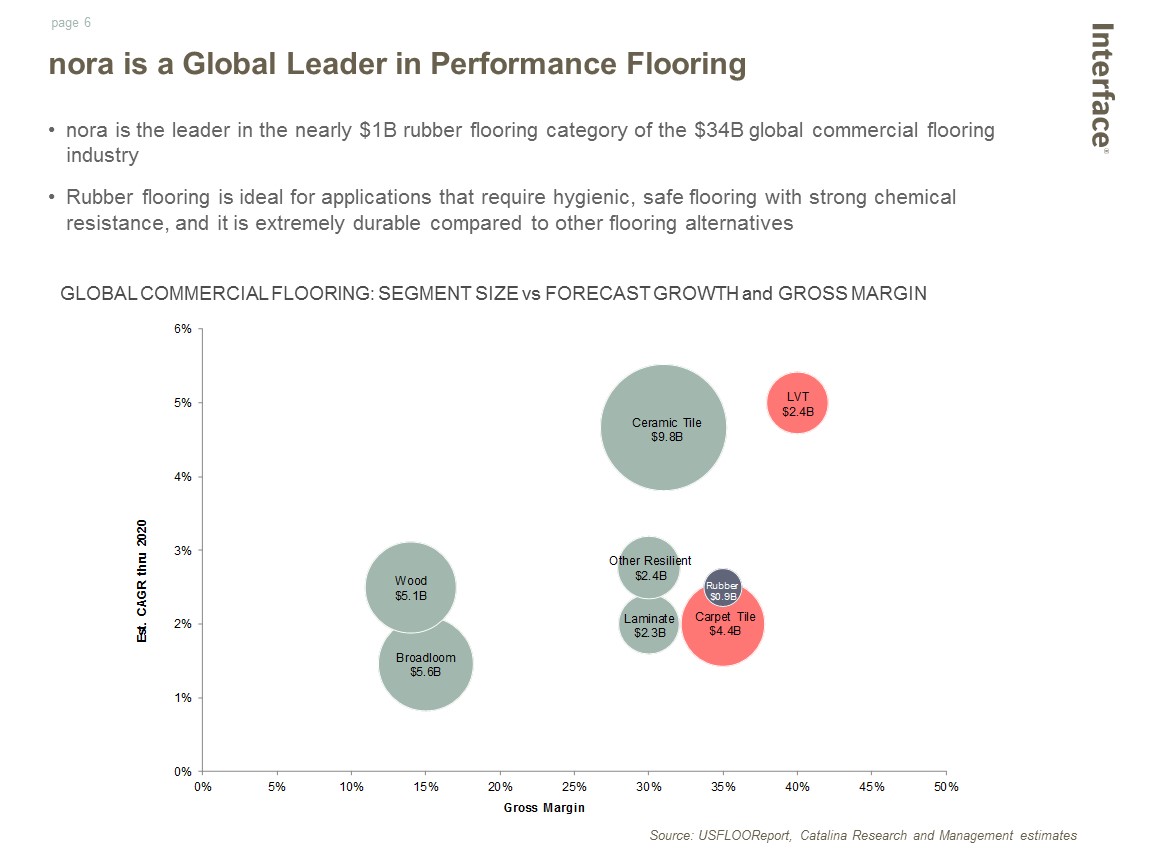

GLOBAL COMMERCIAL FLOORING: SEGMENT SIZE vs FORECAST GROWTH and GROSS MARGIN Source: USFLOOReport, Catalina Research and Management estimates nora is a Global Leader in Performance Flooring nora is the leader in the nearly $1B rubber flooring category of the $34B global commercial flooring industryRubber flooring is ideal for applications that require hygienic, safe flooring with strong chemical resistance, and it is extremely durable compared to other flooring alternatives

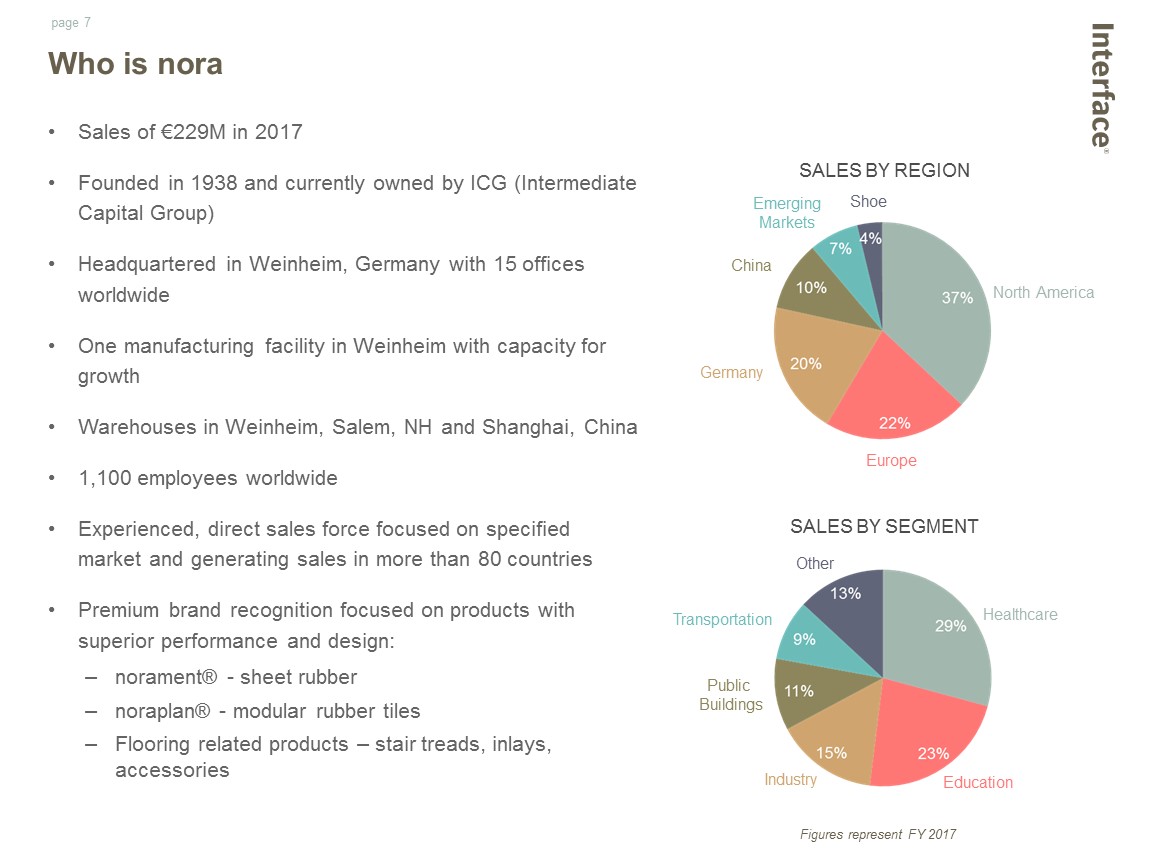

Sales of €229M in 2017Founded in 1938 and currently owned by ICG (Intermediate Capital Group)Headquartered in Weinheim, Germany with 15 offices worldwide One manufacturing facility in Weinheim with capacity for growthWarehouses in Weinheim, Salem, NH and Shanghai, China1,100 employees worldwideExperienced, direct sales force focused on specified market and generating sales in more than 80 countriesPremium brand recognition focused on products with superior performance and design:norament® - sheet rubbernoraplan® - modular rubber tilesFlooring related products – stair treads, inlays, accessories Who is nora SALES BY REGION SALES BY SEGMENT North America Europe Germany China EmergingMarkets Shoe Healthcare Education Industry Public Buildings Transportation Other Figures represent FY 2017

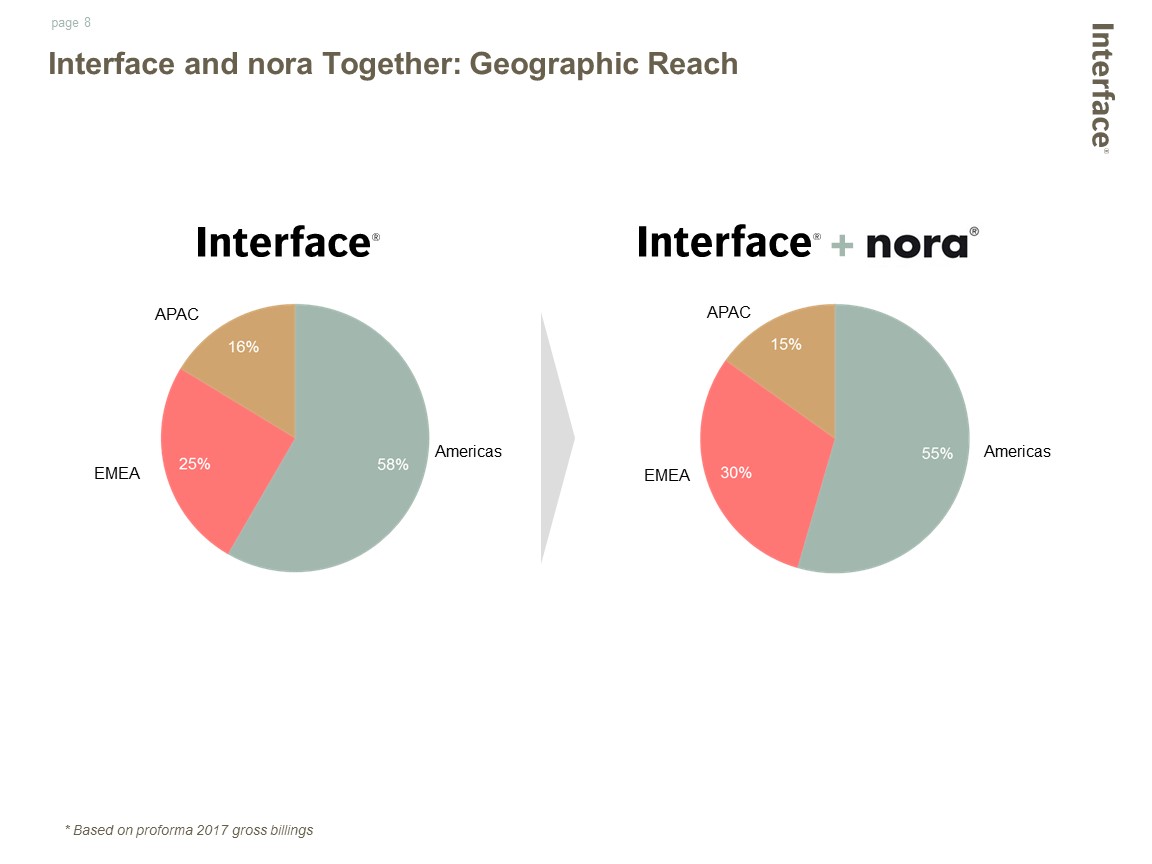

Interface and nora Together: Geographic Reach * * * * * * * Based on proforma 2017 gross billings +

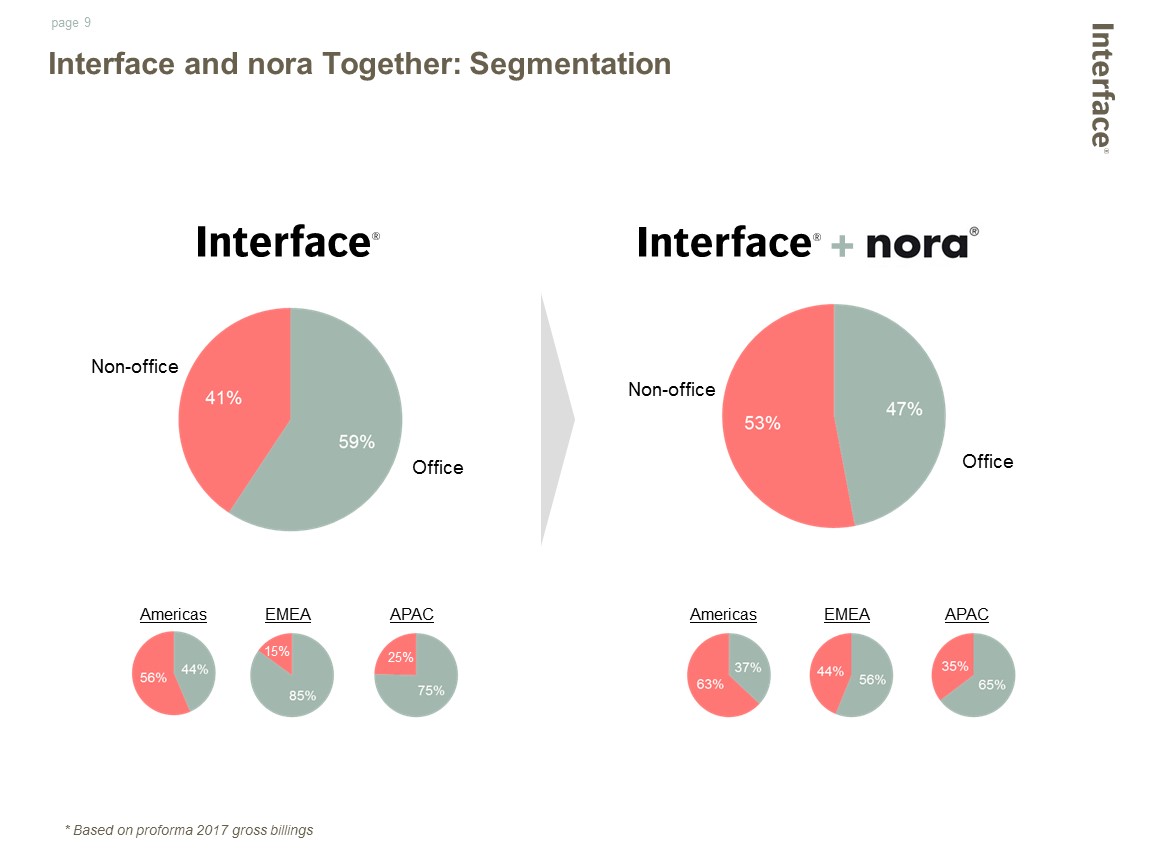

Interface and nora Together: Segmentation * Based on proforma 2017 gross billings * * * Americas EMEA APAC Americas EMEA APAC + * * *

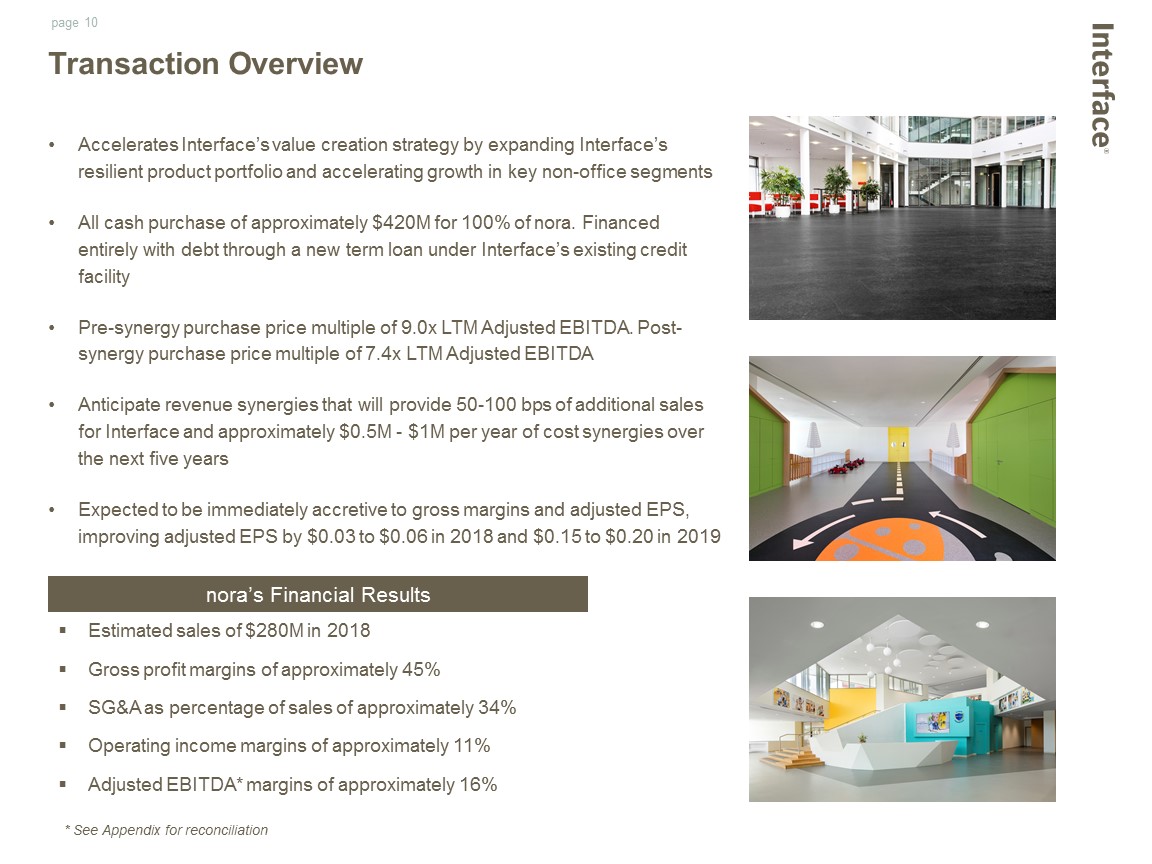

Transaction Overview Accelerates Interface’s value creation strategy by expanding Interface’s resilient product portfolio and accelerating growth in key non-office segments All cash purchase of approximately $420M for 100% of nora. Financed entirely with debt through a new term loan under Interface’s existing credit facilityPre-synergy purchase price multiple of 9.0x LTM Adjusted EBITDA. Post-synergy purchase price multiple of 7.4x LTM Adjusted EBITDAAnticipate revenue synergies that will provide 50-100 bps of additional sales for Interface and approximately $0.5M - $1M per year of cost synergies over the next five yearsExpected to be immediately accretive to gross margins and adjusted EPS, improving adjusted EPS by $0.03 to $0.06 in 2018 and $0.15 to $0.20 in 2019 Estimated sales of $280M in 2018Gross profit margins of approximately 45%SG&A as percentage of sales of approximately 34%Operating income margins of approximately 11%Adjusted EBITDA* margins of approximately 16% nora’s Financial Results * See Appendix for reconciliation

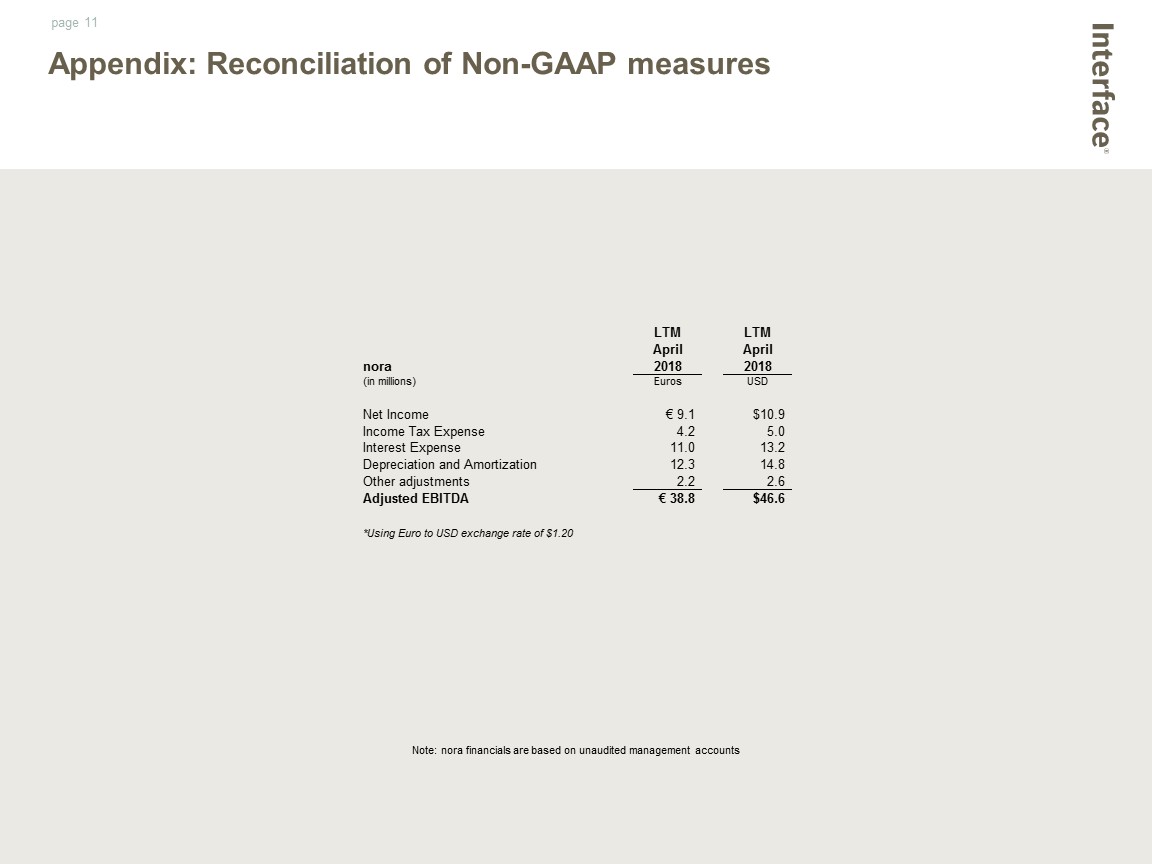

Appendix: Reconciliation of Non-GAAP measures Note: nora financials are based on unaudited management accounts

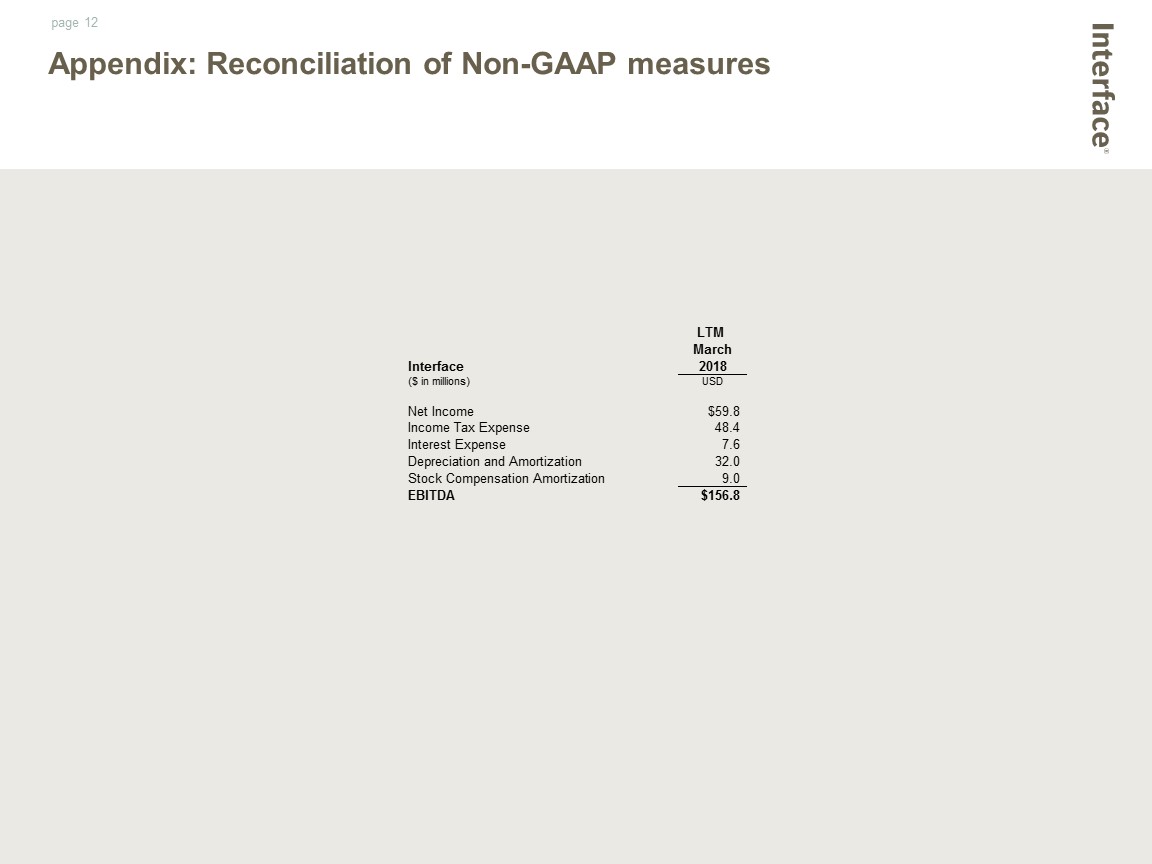

Appendix: Reconciliation of Non-GAAP measures