Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Northwest Bancshares, Inc. | tv496253_ex99-1.htm |

| EX-2.1 - EXHIBIT 2.1 - Northwest Bancshares, Inc. | tv496253_ex2-1.htm |

| 8-K - FORM 8-K - Northwest Bancshares, Inc. | tv496253_8k.htm |

Exhibit 99.2

June 12, 2018 NASDAQ GS:NWBI Acquisition of Donegal Financial Services Corporation (parent of Union Community Bank )

William J. Wagner – Chairman & CEO Ronald J. Seiffert – President & COO William W. Harvey, Jr. – Senior EVP & CFO Presented By

Disclosures Forward - Looking Statement This presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 . These forward - looking statements include, but are not limited to, statements about (1) the benefits of the merger between Northwest Ba ncshares, Inc. (“Northwest”) and Donegal Financial Services Corporation (“Donegal”), including anticipated future results, cost savings an d accretion to reported earnings that may be realized from the merger; (2) Northwest’s and Donegal’s plans, objectives, expectations and int ent ions and other statements contained in this presentation that are not historical facts; and (3) other statements identified by words s uch as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” or words of similar meaning. Forward - looking statements involve risks and uncertainties that may cause actual results to differ materially from those in such statements. The following factors, among others, could cause actual results to differ materially from the anticipated results expressed i n t he forward - looking statements: the businesses of Northwest and Donegal may not be combined successfully, or such combination may take lo nge r than expected; the cost savings from the merger may not be fully realized or may take longer than expected; operating costs, custo mer loss and business disruption following the merger may be greater than expected; governmental approvals of the merger may not be obtain ed, or adverse regulatory conditions may be imposed in connection with governmental approvals of the merger or otherwise; the stockh old ers of Donegal may revise their approval of the merger; credit and interest rate risks associated with Northwest’s and Donegal’s res pec tive businesses; and difficulties associated with achieving expected future financial results. Additional factors that could cause ac tual results to differ materially from those expressed in the forward - looking statements are discussed in Northwest’s reports (such as the Annua l Report on Form 10 - K, Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K) filed with the SEC and available at the SEC’s Interne t website ( www.sec.gov ). All subsequent written and oral forward - looking statements concerning the proposed transaction or other matters attributable to Northwest or Donegal or any person acting on their behalf are expressly qualified in their entirety by the ca uti onary statements above. Except as required by law, Northwest and Donegal do not undertake any obligation to update any forward - looking statement to reflect circumstances or events that occur after the date the forward - looking statement is made. 3

4 Initial Transaction Appeal First opportunity we have seen in our footprint in 2 ½ years. ▪ Best opportunity for a whole - bank acquisition in our Eastern Region in over 20 years. Market dynamics – Lancaster County is one of the fastest growing counties in Pennsylvania. With the $10 billion threshold looming, it was an opportunity to effectively offset the loss of transaction income mandated by the Durbin Amendment to the Dodd - Frank Act. Solid network of community based offices strategically located primarily in western Lancaster County which complement Northwest’s six locations. Caters to Northwest’s strength as a small - town bank. Commercial bank balance sheet – diversified loan portfolio + good deposit mix = strong net interest margin. Simple business model – banking and brokerage. No unusual products or services. Strong oversight and support provided by Donegal ownership group – very well managed and conservative institution.

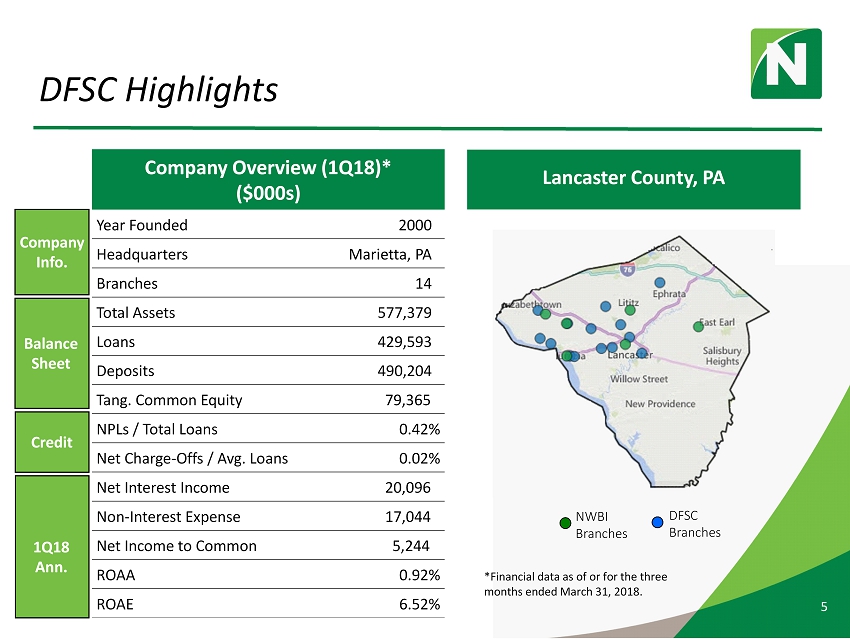

DFSC Highlights 5 *Financial data as of or for the three months ended March 31, 2018. Company Overview (1Q18)* ($000s) Year Founded 2000 Headquarters Marietta, PA Branches 14 Total Assets 577,379 Loans 429,593 Deposits 490,204 Tang. Common Equity 79,365 NPLs / Total Loans 0.42% Net Charge - Offs / Avg. Loans 0.02% Net Interest Income 20,096 Non - Interest Expense 17,044 Net Income to Common 5,244 ROAA 0.92% ROAE 6.52% Company Info. Balance Sheet Credit 1Q18 Ann. DFSC Branches NWBI Branches Lancaster County, PA

Transaction Summary 6 100% of shares owned by Donegal Group Inc. (NASDAQ:DGICA) and Donegal Mutual Insurance Company. Consideration: Fixed exchange of 50% stock/50% cash. 137.84 shares of NWBI stock and $2,379.09 in cash for each share of DFSC stock. Deal value = $4,758.21 per DFSC share, or $85 million in the aggregate. Exchange ratio based on NWBI’s average closing price of $17.26. Protective collars equal to 10% stock consideration to the upside and downside. Deal value range of $80.75 million to $89.25 million. Northwest has the ability to alter stock/cash mix if our stock price decreases by more than 10%. Tangible book value dilution of less than 3% with an earn back period of less than 4 years. Note: Exchange ratio is calculated using the 10 day average closing stock price of Northwest Bancshares, Inc. ending June 4, 2018 (the fifth trading day immediately preceding the date of the merger agreement). Key Terms

Transaction Summary 7 Transaction anticipated to close in the 1st quarter of 2019, subject to regulatory approval and other customary closing conditions. (Required approvals: FDIC, PA Department of Banking, Federal Reserve Bank of Cleveland) Pro forma ownership: [97.7% NWBI / 2.3% Donegal Group] No capital raise necessary. No Board representation. Cost saves of 40% which includes 4 office consolidations. Northwest's tangible common equity post - merger will remain over 9% providing a capital cushion to support future acquisition opportunities. No restrictions on Donegal Group’s ongoing ownership. Sophisticated investor who knows how to rebalance portfolios. Key Terms

8 Transaction Pricing Strategic Financial Bottom Collar $80.75 million Base Case $ 85 million Upper Collar $89.25 million All Cash $80.75 million Cash % / Stock % 53% / 47% 50% / 50% 48% / 52% 100% / 0% Price to tangible book value 164% 172% 181% 164% Price to current earnings* 15.4x 16.2x 17.0x 15.4x Price to last 12 months earnings 19.3x 20.3x 21.3x 19.3x Price to earnings after cost saves 10.1x 10.6x 11.2x 10.1x Tangible book value dilution 2.8% 2.8% 2.8% 4.8% Earnings per share accretion 5.1% 5.1% 5.1% 7.2% Earn back period 3.9 years 3.9 years 3.9 years 4.9 years Core Deposit Premium 6.5% 7.4% 8.3% 6.5% *1Q18 earnings annualized

$76.50 $80.75 $85.00 $89.25 $93.50 $10.00 $12.00 $14.00 $16.00 $18.00 $20.00 $22.00 $24.00 Deal Value (millions) NWBI Stock Price Pricing Collar 9 Deal Value Range Scenario NWBI Stock Price Deal Value (millions) A $15.53 $80.75 B $17.26 $85.00 C $18.99 $89.25 A B C Northwest can alter the exchange ratio or consideration mix if trading below $15.53 NWBI has the ability to change the form of consideration to any percentage of cash and stock in its sole discretion if the average trading price for our common stock for the designated period prior to closing is below $15.53. We intend to utilize up to 100% cash for the deal consideration such that our payback period is capped at 4.9 years. Northwest will alter the exchange ratio on the stock portion of the deal if trading above $18.99

Attractively Priced Relative to Comparable Transactions 10 *Median is comprised of deals announced since 2012 in Pennsylvania and Maryland with $250 - $800 million in total assets. **Includes impact of pre - close dividend of approximately $30 million. ***Prior to pre - close dividend of approximately $30 million. ($ in millions) DFSC Median* Deal Value $85.0 $73.0 Price / TBV 172%** 160% Price / LTM Earnings 20.3x 28.6x Price / Estimated 2018 Earnings with Cost Savings 10.6x N/A Core Deposit Premium 7.4% 9.3% Target Composite Financials*** Assets $577 $402 TE / Assets 13.77% 9.11% LTM ROAA 0.74% 0.52% LTM ROAE 5.19% 5.34%

Overview of Companies DFSC Branches NWBI Branches Financial information as of March 31, 2018. Stock prices as of June 8, 2018. 11 ($000s) Northwest DFSC Assets $9,520,979 $577,379 Loans $7,827,056 $429,593 Deposits $7,985,489 $490,204 Common Equity $1,215,254 $80,452 Intangibles $331,569 $1,087 Market Capitalization $1.8 billion N/A Last Market Close $17.81 N/A Shares Outstanding 102.6 million 17,864 Offices 172 14

A Diversified Loan Mix • A diverse, high - quality loan portfolio provides additional balance to Northwest’s current portfolio mix. • Northwest’s size and capital strength will allow DFSC’s existing customers to gain access to expanded borrowing capabilities. • DFSC’s loan to deposit ratio is 87.6%. 12 ($millions) Northwest % ($millions) DFSC % ($millions) Combined % Residential RE 2,772.1 35.2% Residential RE 4.5 1.0% Residential RE 2,776.6 33.4% Home Equity 1,288.4 16.3% Home Equity 91.4 21.0% Home Equity 1,379.8 16.6% Consumer 686.0 8.7% Consumer 1.6 0.4% Consumer 687.6 8.3% Commercial RE 2,512.3 31.9% Commercial RE 275.3 63.4% Commercial RE 2,787.6 33.5% Commercial 623.5 7.9% Commercial 61.7 14.2% Commercial 685.2 8.2% 7,882.3 100% 434.5 100.0% 8,316.8 100.0% Portfolio Yield 4.51% Portfolio Yield 4.82% Portfolio Yield 4.53% Residential RE 35.2% Home Equity 16.3% Consumer 8.7% Comm. RE 31.9% Comm. 7.9% Northwest Residential RE 1.0% Home Equity 21.0% Consumer 0.4% Comm. RE 63.4% Comm. 14.2% DFSC Residential RE 33.4% Home Equity 16.6% Consumer 8.3% Comm. Re 33.5% Comm. 8.2% Combined

An Attractive Deposit Mix • Northwest’s and DFSC’s deposit mixes are similar with a solid base of checking accounts and strong core deposits. • The core deposit premium being paid, based on deal pricing, is 7.4%. 13 ($millions) Northwest % ($millions) DFSC % ($millions) Combined % Non - Int. & Int. Checking 3,156.0 39.5% Non - Int. & Int. Checking 212.6 43.3% Non - Int. & Int. Checking 3,368.6 39.7% Money market 1,707.8 21.4% Money market 90.8 18.5% Money market 1,798.6 21.2% Savings 1,701.0 21.3% Savings 53.6 10.9% Savings 1,754.6 20.7% Time 1,420.6 17.8% Time 133.5 27.2% Time 1,554.1 18.3% 7,985.5 100% 490.4 100.0% 8,475.9 100.0% Cost of Int. Bearing Deposits 0.41% Cost of Int. Bearing Deposits 0.56% Cost of Int. Bearing Deposits 0.42% Non - Int. & Int. Checking 39.5% Money Market 21.4% Savings 21.3% Time 17.8% Northwest Non - Int. & Int. Checking 43.3% Money Market 18.5% Savings 10.9% Time 27.2% DFSC Non - Int. & Int. Checking 39.7% Money Market 21.2% Savings 20.7% Time 18.3% Combined

Lancaster Market Dynamics Pennsylvania’s fifth most populous county. ▪ Total residents of 542,000 ▪ Projected 2.16% annual population growth rate for 2018 - 2023 Median household income of $64,287 with projected 9.7% growth rate for 2018 - 2023. Diverse economy near several large metropolitan areas. ▪ Key industries include agriculture, education, finance, healthcare, manufacturing, and pharmaceutical. ▪ Major employers include Donegal Mutual Insurance Company, Eurofins Lancaster Laboratories, Johnson & Johnson, Lancaster General Health Penn Medicine, QVC, Turkey Hill Dairy. Unemployment rate of 3.4% for Lancaster County vs. 4.7% for Pennsylvania and 3.8% for U.S. 14 Source: S&P Global Market Intelligence, U.S. Bureau of Labor Statistics

Excellent Banking Opportunity 15 Source: S&P Global Market Intelligence *June 30, 2017 vs. June 30, 2016 **Not included in totals Lancaster County Deposit Market Share as of June 30, 2017 Rank Institution Ticker Branches Deposits ($000s) Market Share (%) LTM* Deposit Growth (%) Deposits per Branch 1 Fulton Financial Corporation FULT 28 3,130,912 28.28 7.4% 111,818 2 BB&T Corporation BBT 27 2,249,541 20.32 - 6.8% 83,316 3 PNC Financial Services Group, Inc. PNC 22 1,358,689 12.27 5.1% 61,759 4 Wells Fargo & Company WFC 14 885,690 8.00 5.1% 63,264 5 ENB Financial Corp ENBP 14 803,036 7.25 7.1% 57,360 6 Pro Forma** NWBI 16 606,033 5.48 N/A 37,877 6 Donegal Financial Services Corp. N/A 14 457,856 4.14 9.0% 32,704 7 M&T Bank Corporation MTB 9 399,091 3.60 3.3% 44,343 8 Citizens Financial Group, Inc. CFG 6 327,694 2.96 12.7% 54,616 9 Banco Santander, SA SAN 8 309,392 2.79 - 0.5% 38,674 10 F.N.B. Corporation FNB 5 260,542 2.35 3.4% 52,108 11 S&T Bancorp, Inc. STBA 3 245,571 2.22 0.2% 81,857 12 Bank of Bird - in - Hand N/A 2 205,367 1.85 58.6% 102,684 13 Northwest Bancshares, Inc. NWBI 6 148,177 1.34 1.4% 24,696 Other 25 290,865 2.63 11,635 Lancaster County Total: 183 11,072,423 60,505 Deposits per Branch Increase: +53%

Crossing $10 Billion Asset Threshold Northwest’s assets are expected to exceed $10 billion in 2019 after the transaction closes. At March 31, 2018, total assets were $9.5 billion and were expected to cross the $10 billion threshold organically in 2019. With Durbin becoming effective July 1, 2020, the 2020 estimated interchange revenue loss in that year after - tax is expected to be approximately $3 million. Northwest has prepared for this event over the past seven years through significant investment in audit, compliance, risk management and technological resources. Earnings accretion from this transaction expected to exceed costs associated with crossing $10 billion in assets by $5 million in 2020 and $2 million in 2021. 16