Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LABORATORY CORP OF AMERICA HOLDINGS | form8-k61218pr.htm |

WILLIAM BLAIR GROWTH STOCK CONFERENCE JUNE 12, 2018 | CHICAGO, IL

FORWARD LOOKING STATEMENT AND USE OF ADJUSTED MEASURES This presentation contains forward-looking statements including but not limited to statements with respect to estimated 2018 guidance and the related assumptions, the impact of various factors on operating and financial results, expected savings and synergies (including from the LaunchPad initiative and as a result of acquisitions), and the opportunities for future growth. This presentation contains forward-looking statements which are subject to change based on various important factors, including without limitation, competitive actions and other unforeseen changes and general uncertainties in the marketplace, changes in government regulations, including health care reform, customer purchasing decisions, including changes in payer regulations or policies, other adverse actions of governmental and third-party payers, changes in testing guidelines or recommendations, adverse results in material litigation matters, the impact of changes in tax laws and regulations, failure to maintain or develop customer relationships, our ability to develop or acquire new products and adapt to technological changes, failures in information technology systems or data security, challenges in implementing business process changes, employee relations, and the effect of exchange rate fluctuations on international operations. Actual results could differ materially from those suggested by these forward-looking statements. The Company has no obligation to provide any updates to these forward-looking statements even if its expectations change. Further information on potential factors, risks and uncertainties that could affect the operating and financial results of Laboratory Corporation of America Holdings (the “Company”) is included in the Company’s Form 10-K for the year ended December 31, 2017, and Forms 10-Q, including in each case under the heading risk factors, and in the Company’s other filings with the SEC. This presentation contains “adjusted” financial information that has not been prepared in accordance with GAAP, including Adjusted EPS, and Free Cash Flow, and certain segment information. The Company believes these adjusted measures are useful to investors as a supplement to, but not as a substitute for, GAAP measures, in evaluating the Company’s operational performance. The Company further believes that the use of these non- GAAP financial measures provides an additional tool for investors in evaluating operating results and trends, and growth and shareholder returns, as well as in comparing the Company’s financial results with the financial results of other companies. However, the Company notes that these adjusted measures may be different from and not directly comparable to the measures presented by other companies. Reconciliations of these non-GAAP measures to the most comparable GAAP measures are included in this presentation. 1

LABCORP OVERVIEW A Leading Global Life Sciences Company Consolidated Financial Summary(2) (3) • $11.4B revenue in 2018(1) Year Ended 2017 2016 Change • Global footprint with business in ~125 countries; Revenue $10,308 $9,553 7.9% ~60,000 employees Adj. O.I. $1,673 $1,548 8.0% • Unmatched real-world data and patient intelligence Adj. O.I. % 16.2% 16.2% Adj. EPS $9.25 $8.63 7.2% • Deep scientific and therapeutic experience Free Cash Flow (4) $1,138 $897 26.8% • Leader in Companion Diagnostics (CDx) • Innovative technology-enabled solutions for customers 1. Based on the midpoint of guidance issued on April 25, 2018. 2. Adjusted operating income, margin and earnings per share exclude amortization, restructuring charges and other special items; dollars in millions, except per share data. See Appendix for non-GAAP reconciliation. 3. Restated for ASC 606, the FASB-issued converged standard on revenue recognition, and ASU 2017-17. 4. Operating cash flow in 2017 has been reduced by $8.7 million as the result of implementation of ASU 2016-18. This amount represents the 2 amount of historical payments made on the Company’s zero-coupon subordinated notes deemed to be accreted interest.

LABCORP DIAGNOSTICS SEGMENT OVERVIEW Leading National Clinical Laboratory Segment Financial Summary(2) (3) Year Ended • $7.2B revenue in 2018(1) 2017 2016 Change • Patient database reaching ~50% of U.S. population Revenue $6,858 $6,308 8.7% Adj. O.I. $1,449 $1,317 10.0% • Proprietary data sets with >30 billion lab test results Adj. O.I. % 21.1% 20.9% 20 bps across a growing menu of nearly 5,000 assays • Broad physician, health system and managed care relationships • Consumer engagement through ~1,900 PSC/retail locations, 5,000+ in-office phlebotomists • Proprietary decision-support and reporting tools 1. Based on the midpoint of guidance issued on April 25, 2018. 2. Adjusted operating income, margin and earnings per share exclude amortization, restructuring charges and other special items; dollars in millions. 3 3. Restated for ASC 606, the FASB-issued converged standard on revenue recognition, and ASU 2017-17.

COVANCE DRUG DEVELOPMENT OVERVIEW Leading CRO / Drug Development Services Provider Segment Financial Summary(3) (4) • $4.2B revenue in 2018(1) Year Ended • Serving the top 20 biopharma 2017 2016 Change • Serving high-growth emerging and mid-market Revenue $3,452 $3,246 6.3% segments through Chiltern Adj. O.I. $361 $377 (4.2%) • Working on ~50% of clinical trials Adj. O.I. % 10.5% 11.6% (110 bps) (4) • >175,000 unique investigators TTM Book-to-Bill 1.36x 1.11x • Involved in all top 50 best-selling drugs on the market(2) • Supported ~70% of all CDx on the market today • Robust technology suite for trial planning and execution 1. Based on the midpoint of guidance issued on April 25, 2018. 2. Ranking based on 2017 net sales. 3. Adjusted operating income, margin and earnings per share exclude amortization, restructuring charges and other special items; dollars in millions. 4. Restated for ASC 606 (except Book-to-Bill), the FASB-issued converged standard on 4 revenue recognition, and ASU 2017-17.

ATTRACTIVE GROWTH OPPORTUNITIES ACROSS MULTIPLE GLOBAL MARKETS (1) Leadership in Large, Growing, Fragmented Markets U.S. Clinical Lab Global Addressable Ex-U.S. Clinical Global Addressable Market Testing Market Outsourced R&D Spend Lab Testing Market ~$200 billion ~$80 billion ~$35 billion ~$100 billion ~9% ~10% ~5% (2) LH LH(2) LH U.S. Clinical Lab Global CRO Ex-U.S. Clinical Lab LabCorp Enterprise Opportunity Opportunity Opportunity Growth Opportunity Source: Industry reports and company estimates 1. Excludes the impact from ASC 606. 5 2. Includes 12-month estimate of Chiltern revenue on a proforma basis.

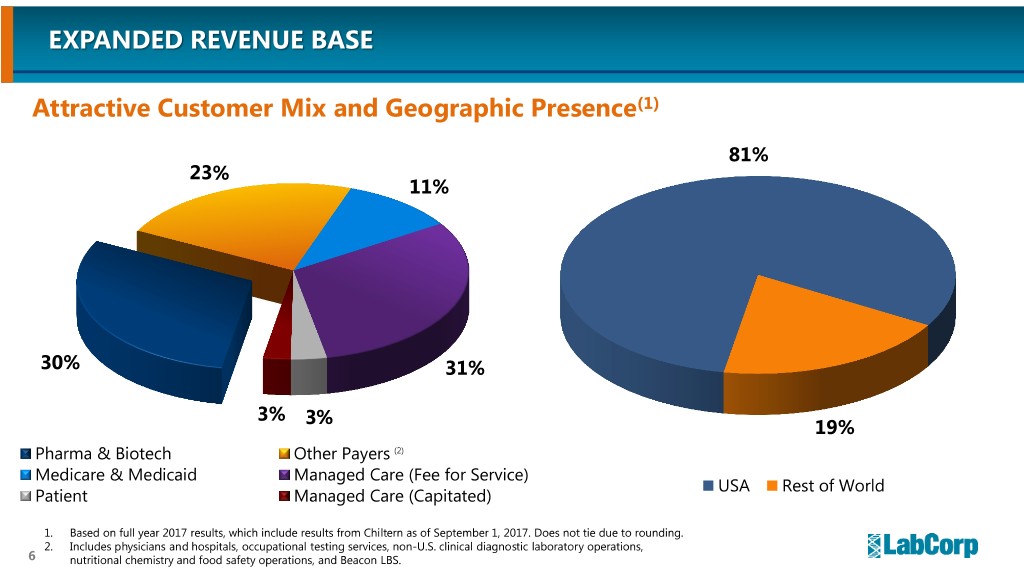

EXPANDED REVENUE BASE Attractive Customer Mix and Geographic Presence(1) 81% 23% 11% 30% 31% 3% 3% 19% Pharma & Biotech Other Payers (2) Medicare & Medicaid Managed Care (Fee for Service) USA Rest of World Patient Managed Care (Capitated) 1. Based on full year 2017 results, which include results from Chiltern as of September 1, 2017. Does not tie due to rounding. 2. Includes physicians and hospitals, occupational testing services, non-U.S. clinical diagnostic laboratory operations, 6 nutritional chemistry and food safety operations, and Beacon LBS.

OUR 2018 PRIORITIES Optimize Drive Profitable Integrate Key Enterprise Growth Acquisitions Margins 7

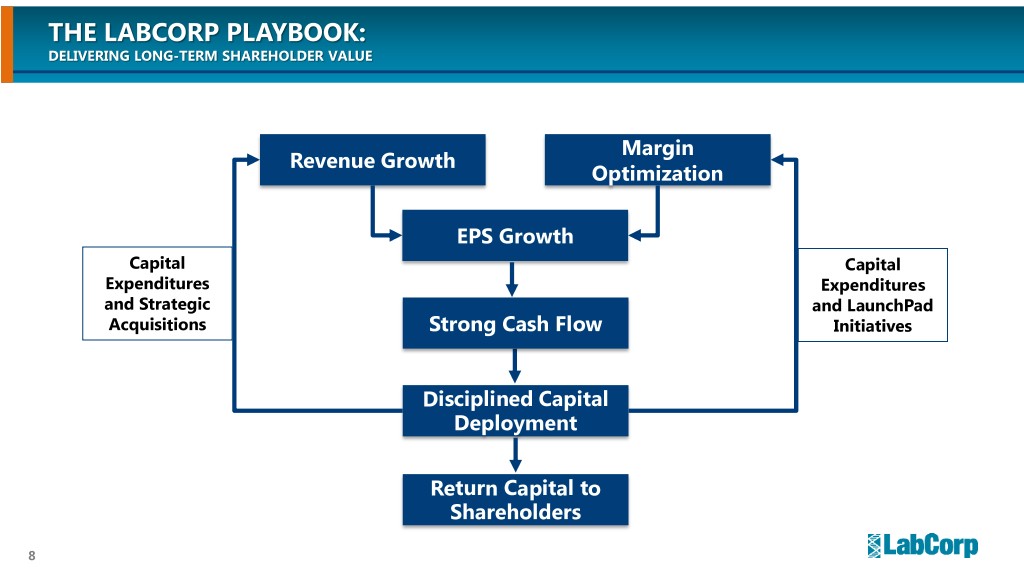

THE LABCORP PLAYBOOK: DELIVERING LONG-TERM SHAREHOLDER VALUE Margin Revenue Growth Optimization EPS Growth Capital Capital Expenditures Expenditures and Strategic and LaunchPad Acquisitions Strong Cash Flow Initiatives Disciplined Capital Deployment Return Capital to Shareholders 8

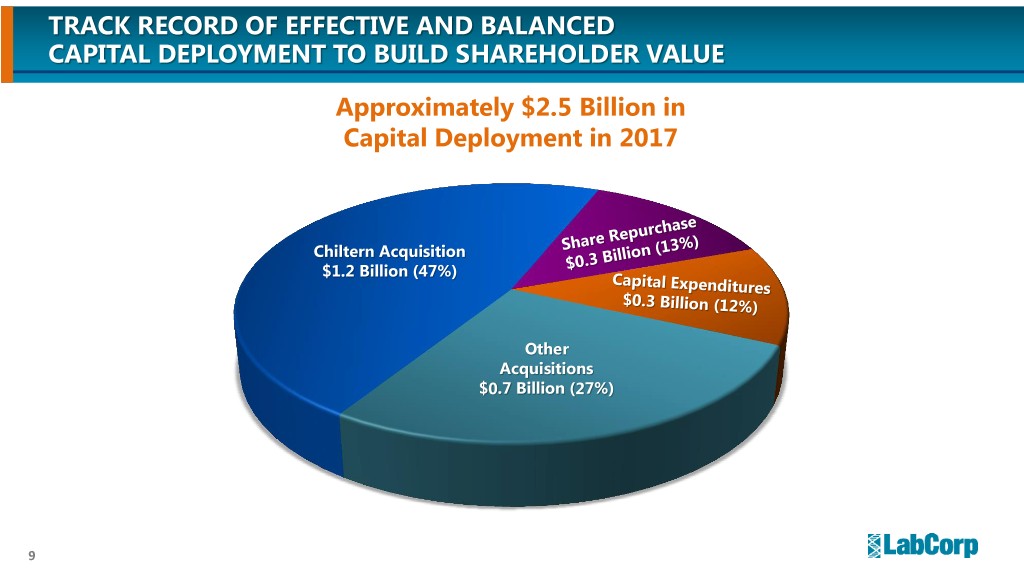

TRACK RECORD OF EFFECTIVE AND BALANCED CAPITAL DEPLOYMENT TO BUILD SHAREHOLDER VALUE Approximately $2.5 Billion in Capital Deployment in 2017 Chiltern Acquisition $1.2 Billion (47%) Other Acquisitions $0.7 Billion (27%) 9

TARGETED CAPITAL EXPENDITURES THAT STRENGTHEN CAPABILITIES AND SUPPORT GROWTH 2017 Capital Expenditures ► Investments in 2018 to support future growth include: • Capacity and automation for 23andMe collaboration IT • Patient service centers in Walgreens stores 45% • Genomics and immunotoxicology capabilities in drug development Facilities Lab/Operations • Expanded capacity in Raritan, New Jersey regional 24% 31% laboratory, medical drug monitoring, and Shanghai drug development facilities ► Investment in LaunchPad initiatives, such as technology and automation 10

TRACK RECORD OF ACQUISITIONS THAT DRIVE GROWTH AND A DIFFERENTIATED OFFERING Target Acquisition Criteria • Businesses that leverage our core competencies • Market leader • Strong management team • International presence • Accretive to earnings and cash flow year 1 • Earn cost of capital by year 3 11

OPTIMIZING THE PORTFOLIO Definitive Agreement to Sell Covance Food Solutions for $670 Million “Over the three years LabCorp has owned Covance, • Global provider of innovative product design and it has become clear that the greatest opportunities product integrity services for end-user segments for us to create lasting value come from the core that span the global food supply chain lab business, the Contract Research Organization, and the enterprise-wide combination that is • All-cash transaction announced in April 2018, beyond lab and beyond CRO.” and expected to close in the third quarter of 2018 • Covance Food Solutions is part of the LabCorp Diagnostics segment • Pro-forma revenue of approximately $150 million in 2017, with adjusted operating margin in-line with the LabCorp Diagnostics segment 12

STRONG BALANCE SHEET ENABLES RETURN OF CAPITAL TO SHAREHOLDERS Covance Debt and Leverage: Acquisition Date: Feb. 19, 2015 Leverage = 4.2x • Investment grade philosophy with targeted Share Repurchases Chiltern Acquisition (In Millions) leverage of 2.5x – 3.0x gross debt to EBITDA Date: Sept. 1, 2017 Leverage Leverage = 3.5x $1,200 • Strong liquidity including ~$1 billion in 4.0x $1,000 unutilized revolving credit facility $800 3.0x • Attractive debt profile – ~80% is fixed interest $600 rate debt and ~75% of the debt matures in 2.0x 2022 or later $400 1.0x Share Repurchases: $200 • Repurchased total of $1.7 billion between $0 0.0x 2013 $1,2002014 2015 2016 2017 20134.0x and 2017 3.5x $1,000 • Board authorized an increase in share 3.0x $800 repurchase program to a total of $1.0 billion Share Buyback Leverage 2.5x $600 on2.0x April 24, 2018 1.5x $400 • Expect to repurchase shares throughout 2018 1.0x $200 0.5x 13 $0 0.0x 2013 2014 2015 2016 2017

REVENUE(1) GROWTH (DOLLARS IN BILLIONS) – ASC 605 10-Year CAGR : 10% $12.0 $3.6 $10.2 $10.0 $9.4 $3.0 $8.5 $2.8 $8.0 $2.3 Drug $2.3 Development $5.8 $6.0 $7.2 $6.0 $5.5 $5.7 $6.6 Diagnostics $5.0 $6.2 $4.5 $4.7 $4.1 $4.0 $2.0 $0.0 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 1. 2007-2014 revenues excludes Covance results. 2008 revenue includes a $7.5 million adjustment relating to certain historic overpayments made 14 by Medicare for claims submitted by a subsidiary of the Company.

ADJUSTED EPS(1)(2) GROWTH – ASC 605 10-Year CAGR : 8% $10.00 $9.60 $8.83 $7.91 $8.00 $6.82 $6.95 $6.80 $6.37 $6.00 $5.98 $5.24 $4.91 $4.45 $4.00 $2.00 $0.00 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 1. EPS, as presented, represents an adjusted, non-GAAP financial measure (excludes amortization, restructuring and other special charges). See Appendix for non-GAAP reconciliation. 15 2. 2007-2014 figures exclude Covance results.

STRONG FREE CASH FLOW(1) (DOLLARS IN MILLIONS) 10-Year Average Free Cash Flow: $747 million $1,200 $1,138 $1,000 $897 $800 $758 $759 $748 $727 $668 $624 $617 $600 $536 $400 $200 $0 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 (2) 1. Free Cash Flow represents Operating Cash Flow less Capital Expenditures in each of the years presented. 2008-2014 figures exclude Covance results, and other items discussed in the Appendix. 2. Operating cash flow in 2017 has been reduced by $8.7 million as the result of implementation of ASU 2016-18. This amount represents the amount 16 of historical payments made on the Company’s zero-coupon subordinated notes deemed to be accreted interest.

FINANCIAL PERFORMANCE UNDER ASC 606 Revenue Adjusted EPS(2) Free Cash Flow(3) 2018 Guidance(1) 2018 Guidance(1) 2018 Guidance(1) Midpoint Midpoint Midpoint (In Billions) (In Millions) $11.4 $12.00 $11.50 $1,200 $1,138 $1,150 $12.0 $10.3 $9.6 $10.00 $9.25 $1,000 $10.0 $4.2 $8.63 $897 $3.5 $8.0 $3.2 $8.00 $800 $6.0 $7.2 $6.00 $600 $6.3 $6.9 $4.0 $4.00 $400 $2.0 $2.00 $200 $0.0 $0.00 $0 2016 2017 2018 2016 2017 2018 2016 2017 (4) 2018 Drug Diagnostics Development 1. Based on guidance issued on April 25, 2018. 2. EPS, as presented, represents an adjusted, non-GAAP financial measure (excludes amortization, restructuring and other special charges). See Appendix for non-GAAP reconciliation. 3. Free Cash Flow represents Operating Cash Flow less Capital Expenditures in each of the years presented. See Appendix for non-GAAP reconciliation. 4. Operating cash flow in 2017 has been reduced by $8.7 million as the result of implementation of ASU 2016-18. This amount represents the amount of 17 historical payments made on the Company’s zero-coupon subordinated notes deemed to be accreted interest.

KEY TAKEAWAYS Multi-faceted platform for profitable growth through organic initiatives, strategic acquisitions, and margin optimization Track record of strong and reliable free cash flow, and disciplined capital deployment Execution of the LabCorp playbook continues to generate long-term shareholder value 18

WILLIAM BLAIR GROWTH STOCK CONFERENCE JUNE 12, 2018 | CHICAGO, IL

Appendix 20

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES – ASC 605 Twelve Months Ended December 31, Adjusted EPS 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Diluted earnings per common share $ 3.93 $ 4.16 $ 4.98 $ 5.29 $ 5.11 $ 5.99 $ 6.25 $ 5.91 $ 4.35 $ 7.02 $ 12.21 One-time benefit from Tax Cuts and Jobs Act - - - - - - - - - - (5.00) Restructuring and special items 0.25 0.44 (0.09) 0.26 0.72 0.29 0.15 0.34 2.44 0.64 0.98 Loss on the divestiture of assets - - - - 0.03 - - - - - - Amortization expense 0.27 0.31 0.35 0.43 0.51 0.54 0.55 0.55 1.12 1.17 1.41 Adjusted EPS $ 4.45 $ 4.91 $ 5.24 $ 5.98 $ 6.37 $ 6.82 $ 6.95 $ 6.80 $ 7.91 $ 8.83 $ 9.60 21

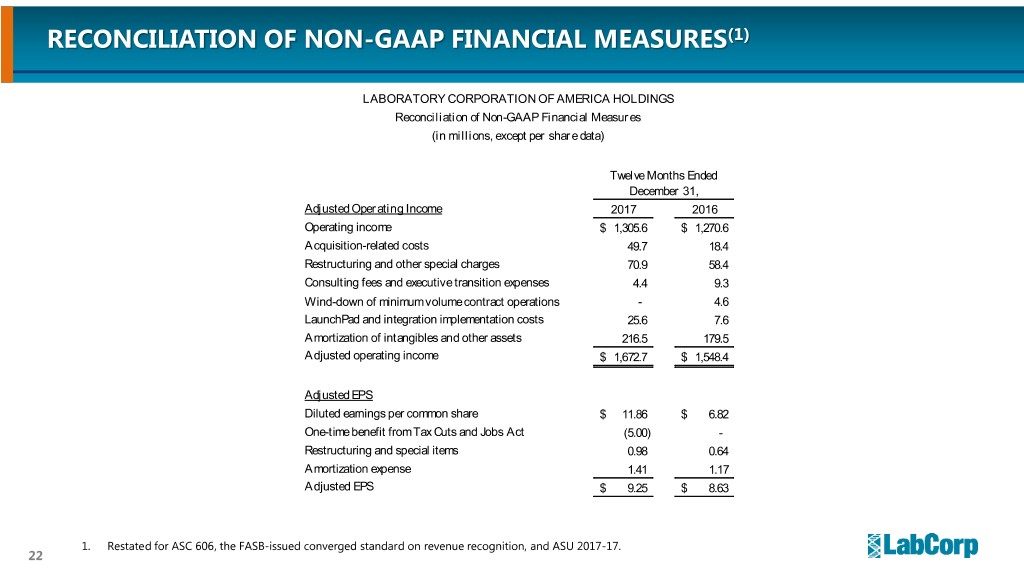

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES(1) LABORATORY CORPORATION OF AMERICA HOLDINGS Reconciliation of Non-GAAP Financial Measures (in millions, except per share data) Twelve Months Ended December 31, Adjusted Operating Income 2017 2016 Operating income $ 1,305.6 $ 1,270.6 Acquisition-related costs 49.7 18.4 Restructuring and other special charges 70.9 58.4 Consulting fees and executive transition expenses 4.4 9.3 Wind-down of minimum volume contract operations - 4.6 LaunchPad and integration implementation costs 25.6 7.6 Amortization of intangibles and other assets 216.5 179.5 Adjusted operating income $ 1,672.7 $ 1,548.4 Adjusted EPS Diluted earnings per common share $ 11.86 $ 6.82 One-time benefit from Tax Cuts and Jobs Act (5.00) - Restructuring and special items 0.98 0.64 Amortization expense 1.41 1.17 Adjusted EPS $ 9.25 $ 8.63 1. Restated for ASC 606, the FASB-issued converged standard on revenue recognition, and ASU 2017-17. 22

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES(1) (in millions) Twelve Months Ended December 31, Free Cash Flow 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Net cash provided by operating activities $ 781 $ 862 $ 884 $ 905 (2) $ 841 $ 819 $ 739 $ 982 $ 1,176 $ 1,451(3) Less: Capital expenditures $ (157) $ (115) $ (126) $ (146) $ (174) $ (202) $ (204) $ (256) $ (279) $ (313) Free cash flow $ 624 $ 748 $ 758 $ 759 (2) $ 668 $ 617 $ 536 $ 727 $ 897 $ 1,138(3) 1. 2008-2014 figures exclude Covance results. 2. Operating Cash Flow and Free Cash Flow in 2011 exclude the $49.5 million Hunter Labs settlement. 3. Operating cash flow in 2017 has been reduced by $8.7 million as the result of implementation of ASU 2016-18. This amount represents the amount of historical payments made on the Company’s zero-coupon subordinated notes deemed to be accreted interest. 23