Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Invitae Corp | d605751d8k.htm |

When the question is genetics, the answer is Invitae. William Blair 2018 Growth Stock Conference Sean George, chief executive Officer Exhibit 99.1

Safe Harbor Statement This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements relating to the company’s business model, business strategy and momentum in its business; future plans, prospects and opportunities; future financial and business results; reimbursement by Medicare; future test and service offerings; and market and industry predictions. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially, and reported results should not be considered as an indication of future performance. These risks and uncertainties include, but are not limited to: the company’s history of losses; the company’s ability to compete; the company’s failure to manage growth effectively; the company’s need to scale its infrastructure in advance of demand for its tests and to increase demand for its tests; the risk that the company may not obtain or maintain sufficient levels of reimbursement for its tests; the company’s failure to successfully integrate or fully realize the anticipated benefits of acquired businesses; the company’s ability to use rapidly changing genetic data to interpret test results accurately and consistently; security breaches, loss of data and other disruptions; laws and regulations applicable to the company’s business; and the other risks set forth in the company’s filings with the Securities and Exchange Commission, including the risks set forth in the company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2018. These forward-looking statements speak only as of the date hereof, and Invitae Corporation disclaims any obligation to update these forward-looking statements.

Bring comprehensive genetic information into mainstream medical practice to improve the quality of healthcare for billions of people Genetic information is more valuable when shared Driving down the cost of genetic information will increase its personal and clinical utility Healthcare professionals are fundamental in ordering and interpreting genetic information People should own and control their own genetic information Core principles

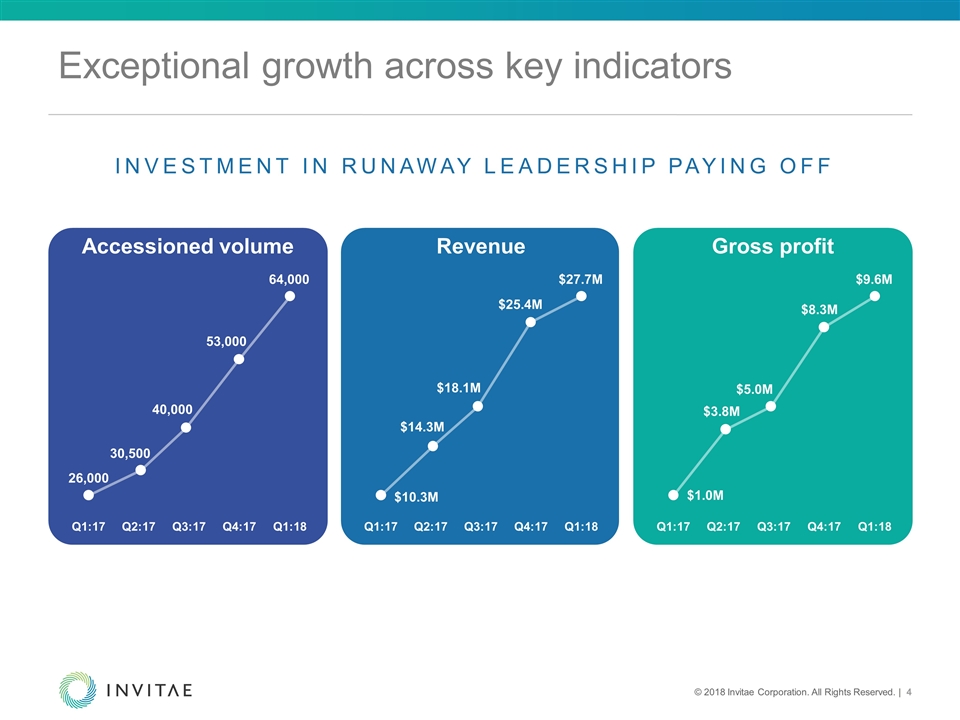

Exceptional growth across key indicators Gross profit $9.6M $5.0M $3.8M $1.0M Q1:17 Q2:17 Q3:17 Q4:17 $8.3M Q1:18 Accessioned volume 64,000 40,000 30,500 26,000 Q1:17 Q2:17 Q3:17 Q4:17 53,000 Q1:18 Revenue Q1:17 Q2:17 Q3:17 Q4:17 $27.7M $18.1M $14.3M $10.3M $25.4M Q1:18 investment in runaway leadership Paying off

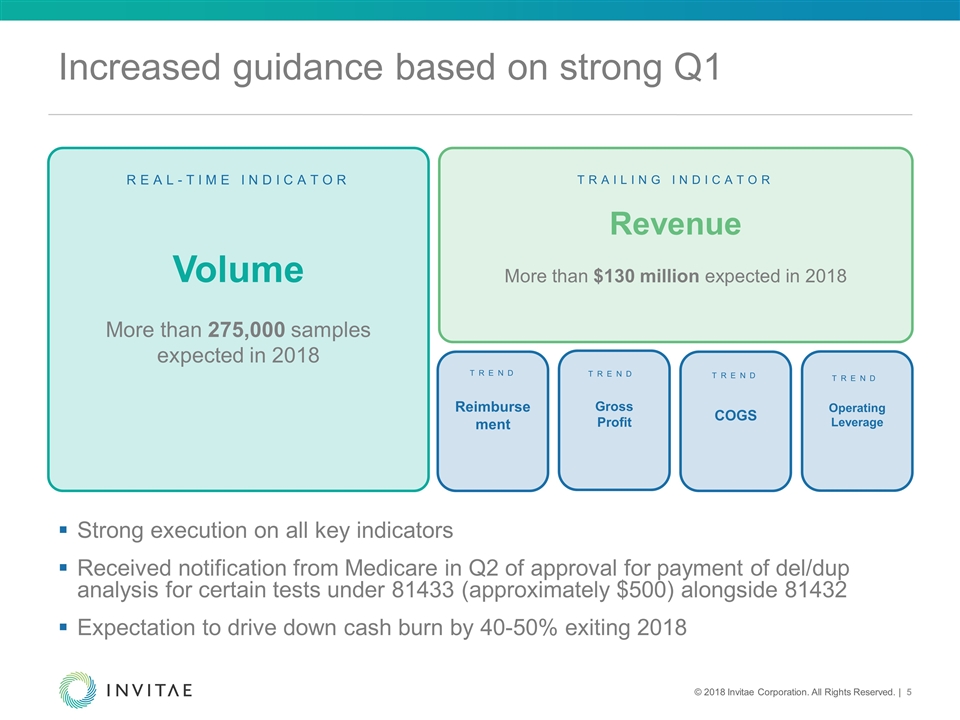

COGS Trend Reimbursement Trend Gross Profit Trend Operating Leverage Trend Revenue More than $130 million expected in 2018 Trailing indicator Increased guidance based on strong Q1 Volume More than 275,000 samples expected in 2018 REAL-TIME Indicator Strong execution on all key indicators Received notification from Medicare in Q2 of approval for payment of del/dup analysis for certain tests under 81433 (approximately $500) alongside 81432 Expectation to drive down cash burn by 40-50% exiting 2018

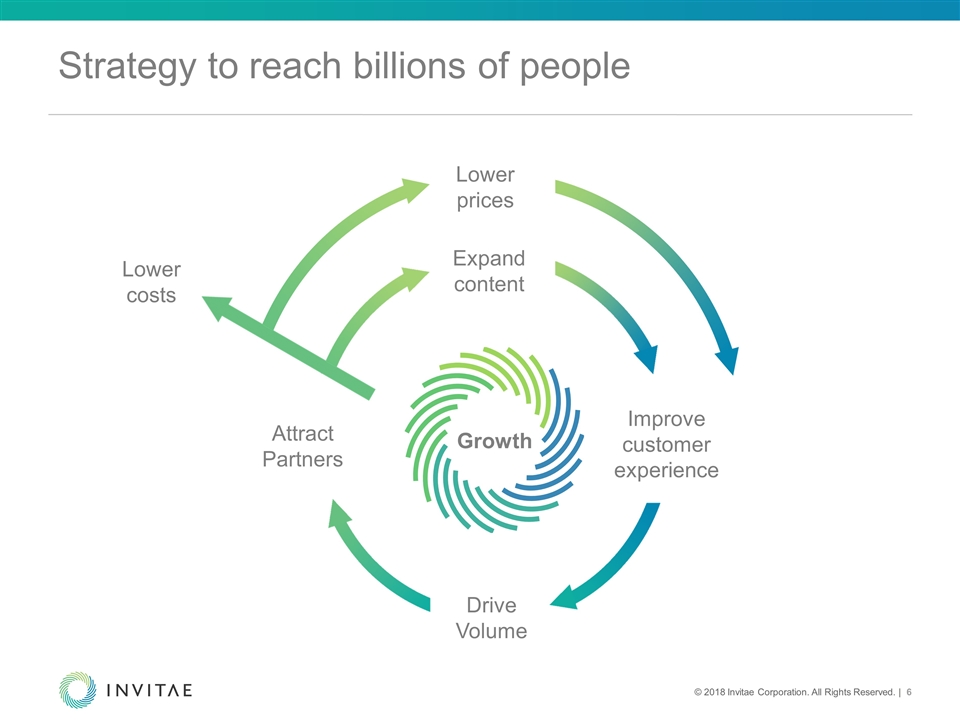

Strategy to reach billions of people Expand content Improve customer experience Drive Volume Attract Partners Growth Lower costs Lower prices

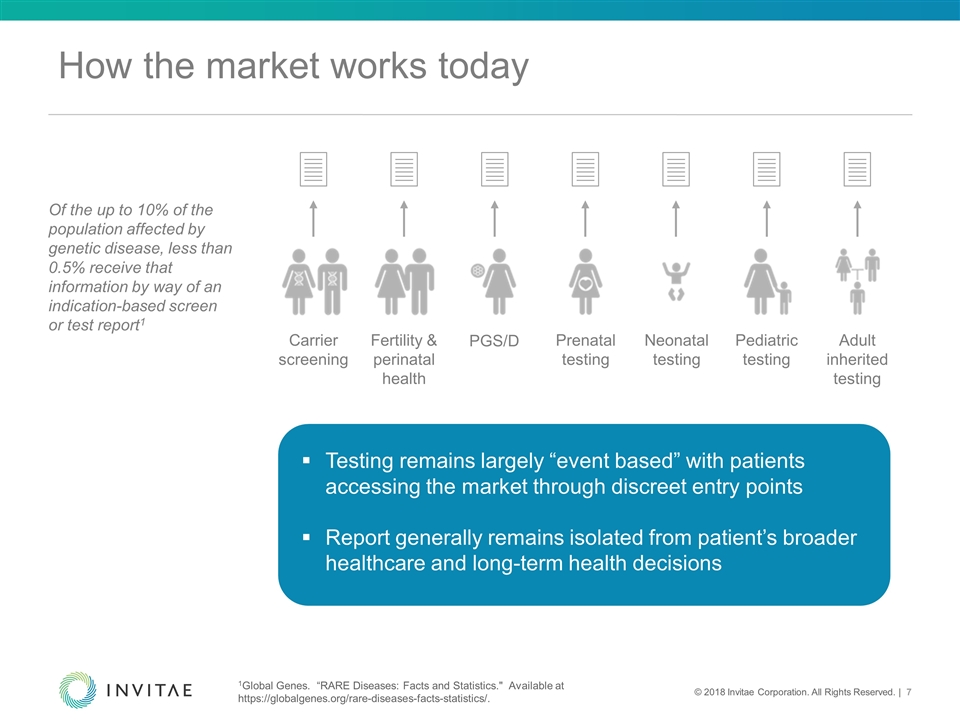

How the market works today Fertility & perinatal health PGS/D Prenatal testing Neonatal testing Pediatric testing Adult inherited testing Carrier screening Of the up to 10% of the population affected by genetic disease, less than 0.5% receive that information by way of an indication-based screen or test report1 Testing remains largely “event based” with patients accessing the market through discreet entry points Report generally remains isolated from patient’s broader healthcare and long-term health decisions 1Global Genes. “RARE Diseases: Facts and Statistics." Available at https://globalgenes.org/rare-diseases-facts-statistics/.

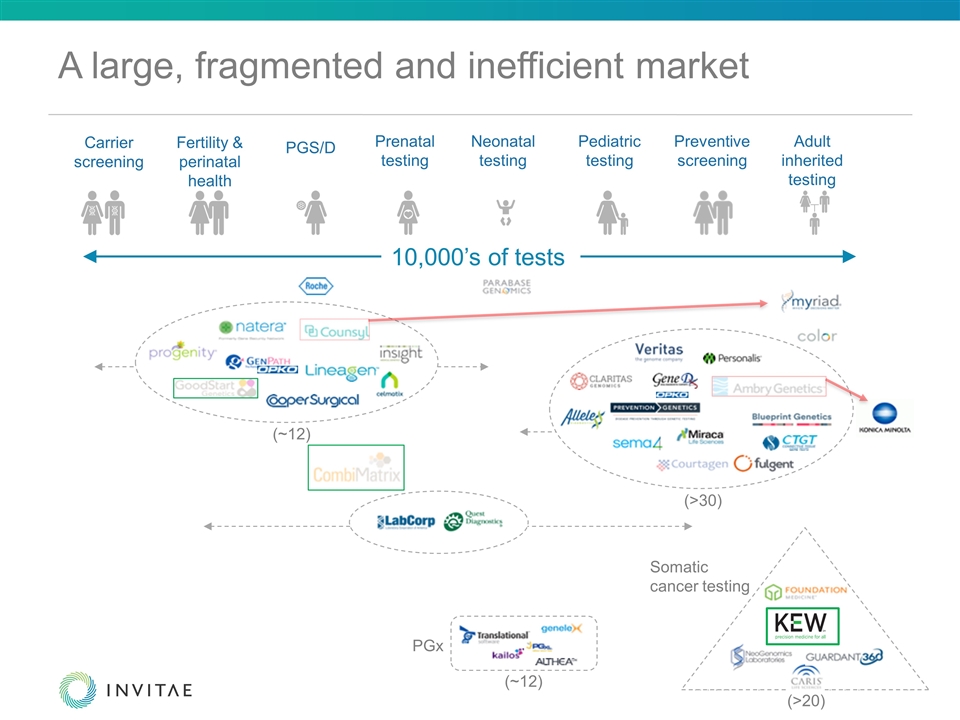

A large, fragmented and inefficient market (>30) (>20) (~12) (~12) Carrier screening PGS/D Prenatal testing Neonatal testing Pediatric testing Adult inherited testing Preventive screening Fertility & perinatal health Somatic cancer testing PGx 10,000’s of tests

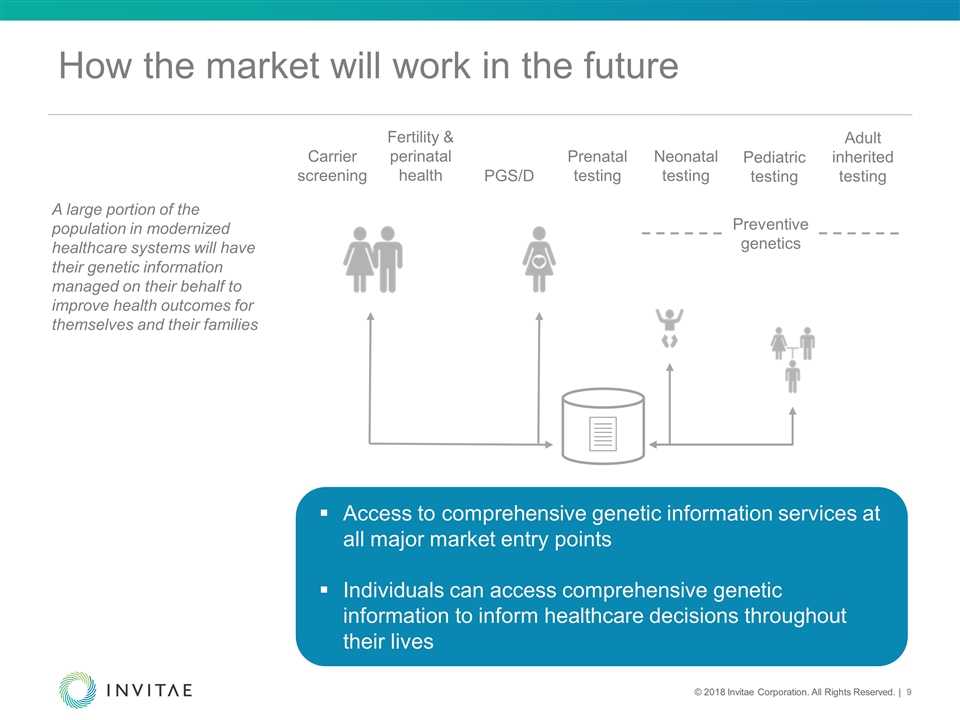

How the market will work in the future Fertility & perinatal health PGS/D Prenatal testing Neonatal testing Pediatric testing Carrier screening A large portion of the population in modernized healthcare systems will have their genetic information managed on their behalf to improve health outcomes for themselves and their families Preventive genetics Access to comprehensive genetic information services at all major market entry points Individuals can access comprehensive genetic information to inform healthcare decisions throughout their lives Adult inherited testing

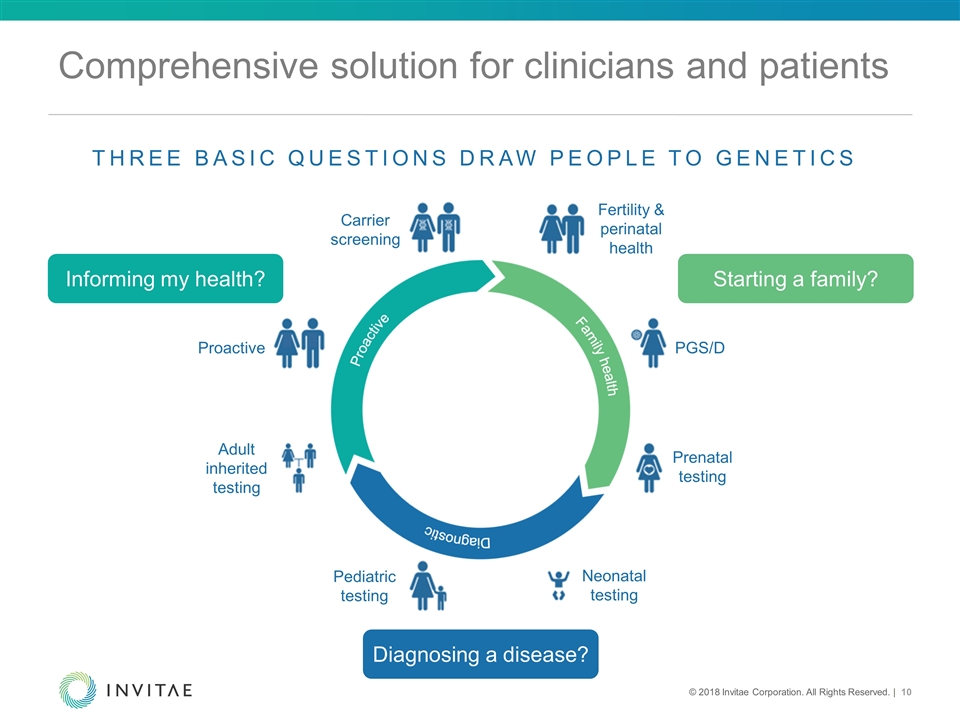

three basic questions draw people to genetics Starting a family? Diagnosing a disease? Informing my health? Fertility & perinatal health PGS/D Prenatal testing Neonatal testing Pediatric testing Carrier screening Adult inherited testing Proactive Comprehensive solution for clinicians and patients

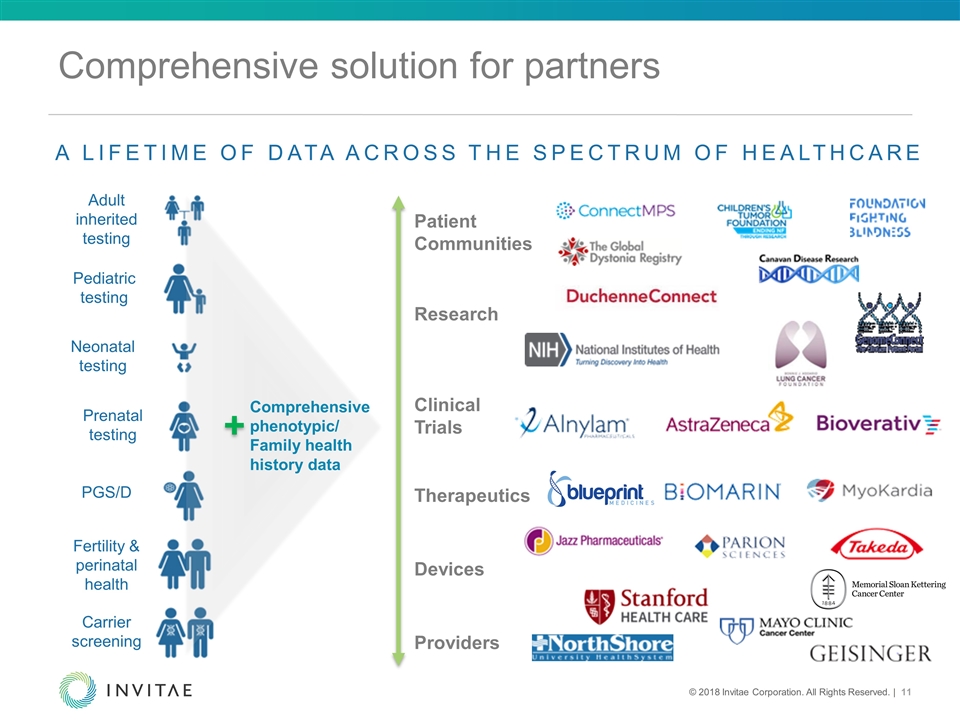

Clinical Trials Therapeutics Providers Patient Communities Devices Research A lifetime of data across the spectrum of healthcare Fertility & perinatal health PGS/D Prenatal testing Neonatal testing Pediatric testing Carrier screening Adult inherited testing + Comprehensive phenotypic/ Family health history data Comprehensive solution for partners

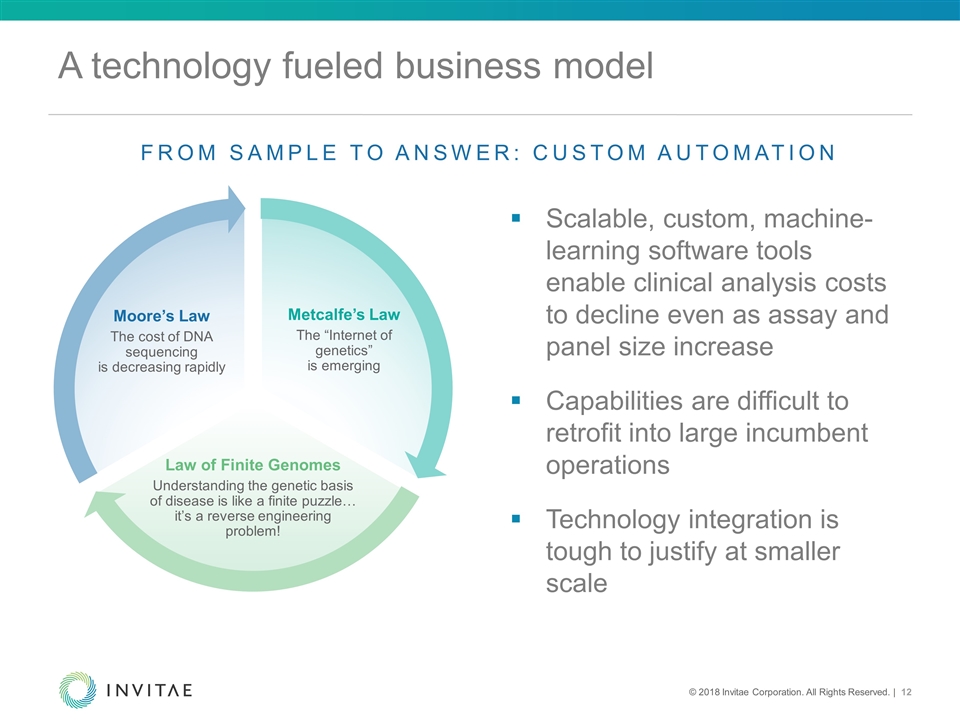

Scalable, custom, machine-learning software tools enable clinical analysis costs to decline even as assay and panel size increase Capabilities are difficult to retrofit into large incumbent operations Technology integration is tough to justify at smaller scale Moore’s Law The cost of DNA sequencing is decreasing rapidly Law of Finite Genomes Understanding the genetic basis of disease is like a finite puzzle… it’s a reverse engineering problem! Metcalfe’s Law The “Internet of genetics” is emerging A technology fueled business model From sample to answer: custom automation

Executed in the most exacting of industries Many companies deploying technology to lower costs remain naïve about the complexity of biology Applying world-class clinical expertise to results that inform critical healthcare decisions

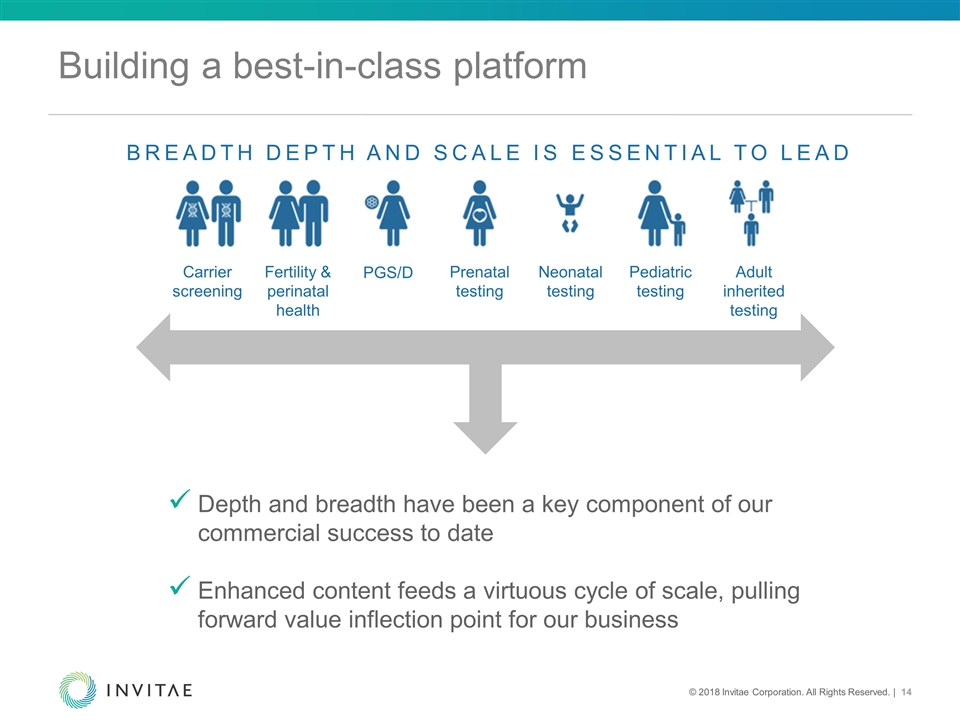

Building a best-in-class platform Fertility & perinatal health PGS/D Prenatal testing Neonatal testing Pediatric testing Carrier screening Adult inherited testing Depth and breadth have been a key component of our commercial success to date Enhanced content feeds a virtuous cycle of scale, pulling forward value inflection point for our business Breadth depth and scale is essential to lead

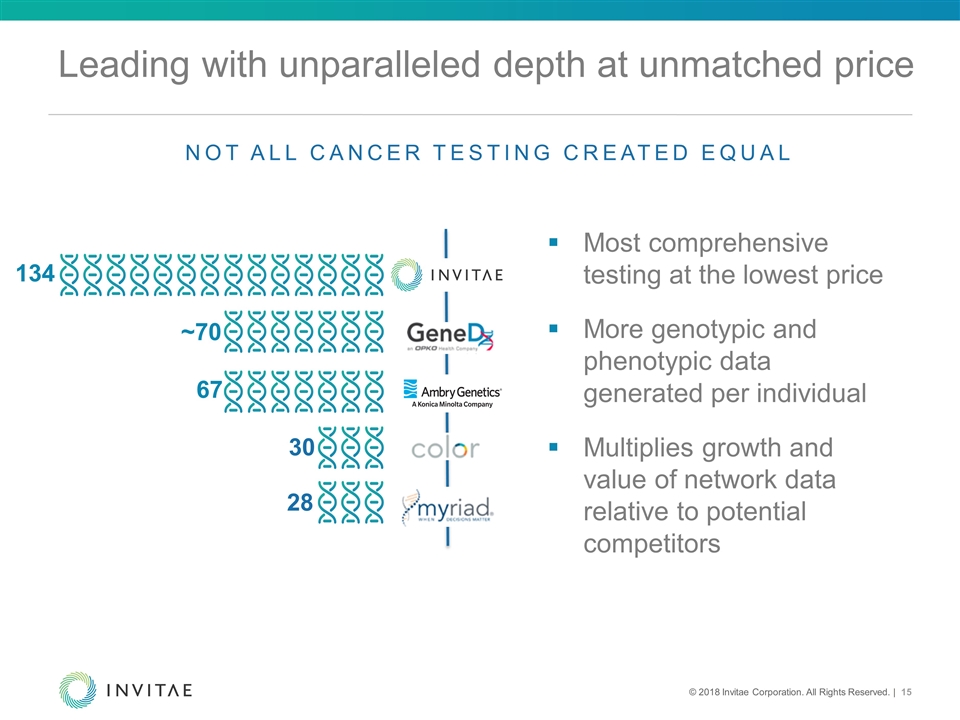

Leading with unparalleled depth at unmatched price Most comprehensive testing at the lowest price More genotypic and phenotypic data generated per individual Multiplies growth and value of network data relative to potential competitors 134 ~70 67 30 28 Not all cancer testing created equal

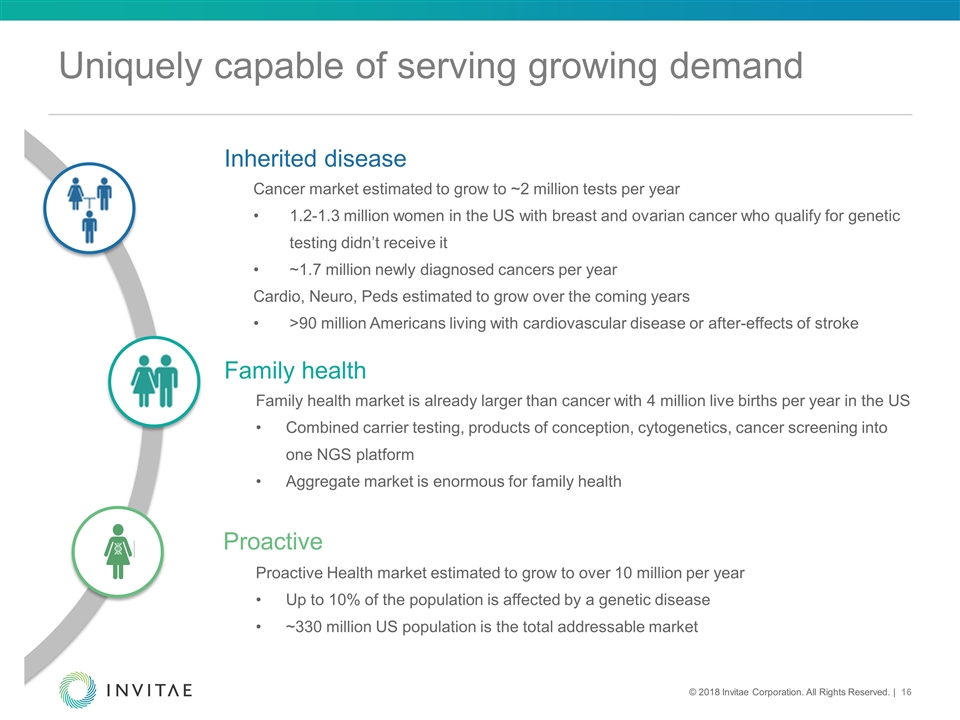

Uniquely capable of serving growing demand Inherited disease Family health Proactive Cancer market estimated to grow to ~2 million tests per year 1.2-1.3 million women in the US with breast and ovarian cancer who qualify for genetic testing didn’t receive it ~1.7 million newly diagnosed cancers per year Cardio, Neuro, Peds estimated to grow over the coming years >90 million Americans living with cardiovascular disease or after-effects of stroke Family health market is already larger than cancer with 4 million live births per year in the US Combined carrier testing, products of conception, cytogenetics, cancer screening into one NGS platform Aggregate market is enormous for family health Proactive Health market estimated to grow to over 10 million per year Up to 10% of the population is affected by a genetic disease ~330 million US population is the total addressable market

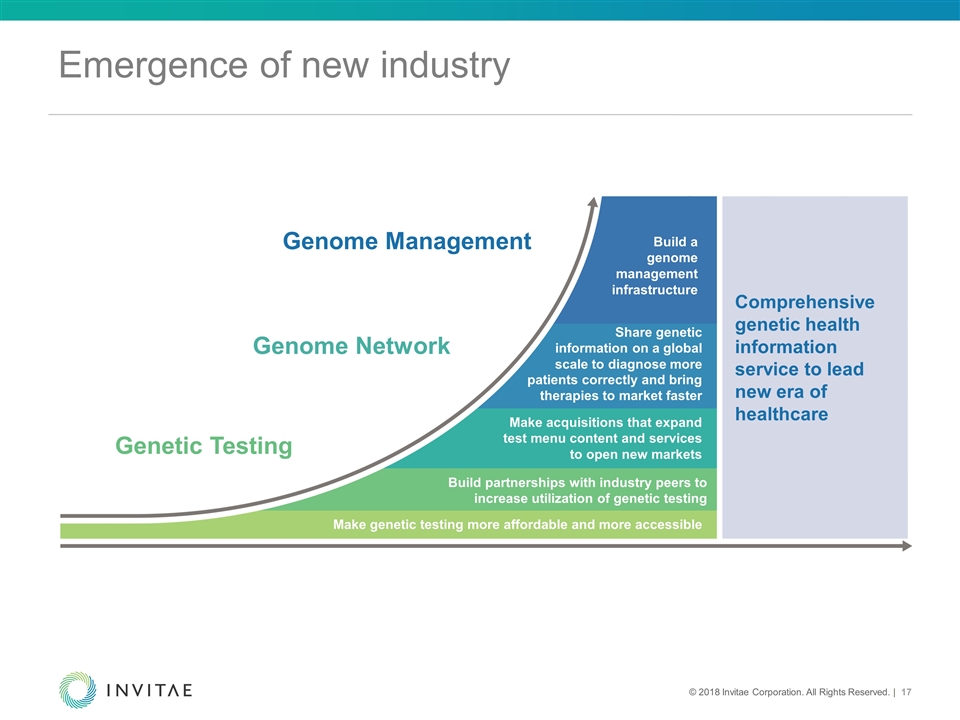

Emergence of new industry Comprehensive genetic health information service to lead new era of healthcare Build a genome management infrastructure Make genetic testing more affordable and more accessible Build partnerships with industry peers to increase utilization of genetic testing Share genetic information on a global scale to diagnose more Genome Network Genetic Testing Genome Management Make acquisitions that expand test menu content and services to open new markets patients correctly and bring therapies to market faster

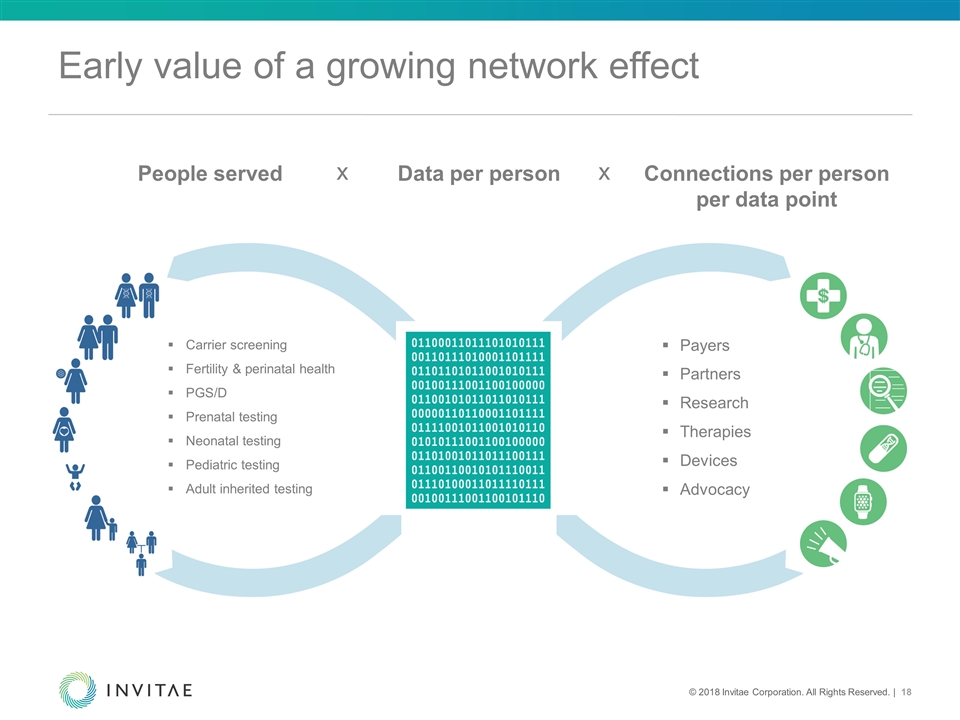

Early value of a growing network effect Data per person x x Payers Partners Research Therapies Devices Advocacy Carrier screening Fertility & perinatal health PGS/D Prenatal testing Neonatal testing Pediatric testing Adult inherited testing People served Connections per person per data point

Q&A: General discussion