Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CapStar Financial Holdings, Inc. | d587978dex991.htm |

| 8-K - FORM 8-K - CapStar Financial Holdings, Inc. | d587978d8k.htm |

Nasdaq: CSTR Creating a High Performing Tennessee Banking Franchise: CapStar Financial Holdings Partnership with Athens Bancshares Corporation June 11, 2018 Exhibit 99.2

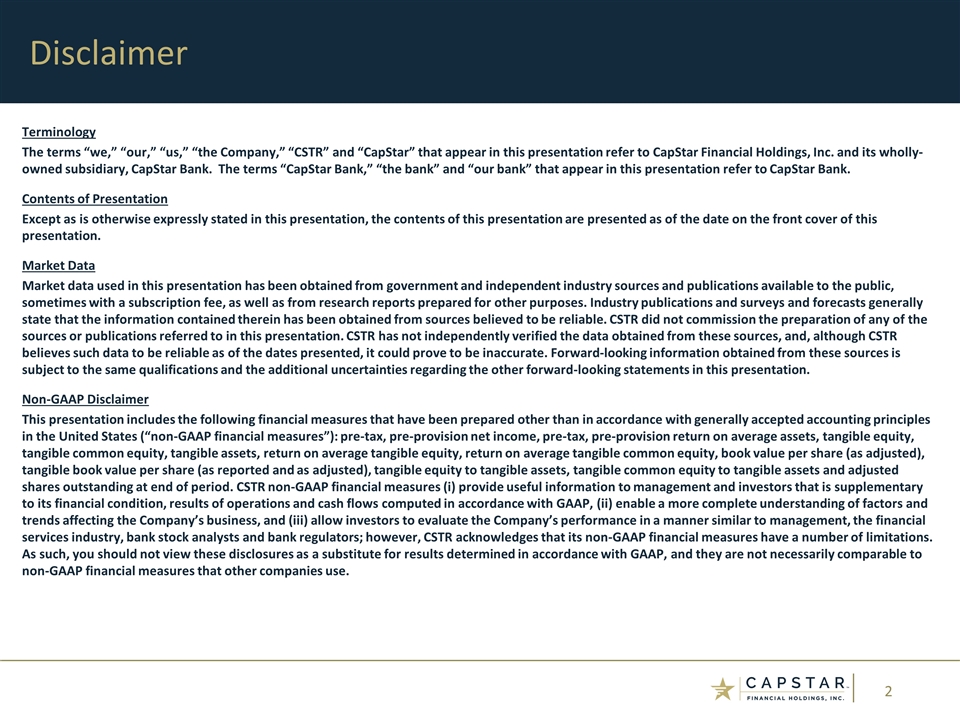

Terminology The terms “we,” “our,” “us,” “the Company,” “CSTR” and “CapStar” that appear in this presentation refer to CapStar Financial Holdings, Inc. and its wholly-owned subsidiary, CapStar Bank. The terms “CapStar Bank,” “the bank” and “our bank” that appear in this presentation refer to CapStar Bank. Contents of Presentation Except as is otherwise expressly stated in this presentation, the contents of this presentation are presented as of the date on the front cover of this presentation. Market Data Market data used in this presentation has been obtained from government and independent industry sources and publications available to the public, sometimes with a subscription fee, as well as from research reports prepared for other purposes. Industry publications and surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable. CSTR did not commission the preparation of any of the sources or publications referred to in this presentation. CSTR has not independently verified the data obtained from these sources, and, although CSTR believes such data to be reliable as of the dates presented, it could prove to be inaccurate. Forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements in this presentation. Non-GAAP Disclaimer This presentation includes the following financial measures that have been prepared other than in accordance with generally accepted accounting principles in the United States (“non-GAAP financial measures”): pre-tax, pre-provision net income, pre-tax, pre-provision return on average assets, tangible equity, tangible common equity, tangible assets, return on average tangible equity, return on average tangible common equity, book value per share (as adjusted), tangible book value per share (as reported and as adjusted), tangible equity to tangible assets, tangible common equity to tangible assets and adjusted shares outstanding at end of period. CSTR non-GAAP financial measures (i) provide useful information to management and investors that is supplementary to its financial condition, results of operations and cash flows computed in accordance with GAAP, (ii) enable a more complete understanding of factors and trends affecting the Company’s business, and (iii) allow investors to evaluate the Company’s performance in a manner similar to management, the financial services industry, bank stock analysts and bank regulators; however, CSTR acknowledges that its non-GAAP financial measures have a number of limitations. As such, you should not view these disclosures as a substitute for results determined in accordance with GAAP, and they are not necessarily comparable to non-GAAP financial measures that other companies use. Disclaimer

Forward Looking Statements This presentation contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements may include: management plans relating to the proposed transaction; the expected timing of the completion of the proposed transaction; the ability to complete the proposed transaction; the ability to obtain the required regulatory, shareholder or other approvals; any statements of the plans and objectives of management for future operations, products or services, including the execution of integration plans relating to the proposed transaction; any statements of expectation or belief; projections related to certain financial metrics or other benefits of the transaction; and any statements of assumptions underlying any of the foregoing. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “seek,” “plan,” “will,” “would,” “target,” “outlook,” “estimate,” “forecast,” “project” and other similar words and expressions or negatives of these words. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time and are beyond CapStar’s control. Because forward-looking statements are by their nature, to different degrees, uncertain and subject to assumptions, actual results or future events could differ, possibly materially, from those that CapStar anticipated in its forward-looking statements, and future results could differ materially from historical performance. Factors that could cause or contribute to such differences include, but are not limited to, those included under Item 1A “Risk Factors” in CapStar’s Annual Report on Form 10-K for the year ended December 31, 2017 and those disclosed in CapStar’s other periodic reports filed with the Securities and Exchange Commission (the “SEC”), as well as the possibility that expected benefits of the proposed transaction may not materialize in the time frame expected or at all, or may be more costly to achieve; the proposed transaction may not be timely completed, if at all; that prior to the completion of the proposed transaction or thereafter, CapStar’s and Athens’s respective businesses may not perform as expected due to transaction-related uncertainty or other factors; that the parties are unable to successfully implement integration strategies related to the proposed transaction; that required regulatory, shareholder or other approvals are not obtained or other customary closing conditions are not satisfied in a timely manner or at all; reputational risks and the reaction of the companies’ shareholders, customers, employees or other constituents to the proposed transaction; and diversion of management time on merger-related matters. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the joint proxy statement/prospectus that will be included in the registration statement on Form S-4 that will be filed with the SEC in connection with the proposed transaction. While the list of factors presented here is, and the list of factors presented in the registration statement on Form S-4 will be, considered representative, no such lists should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. For any forward-looking statements made in this presentation or in any documents, CapStar claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Forward-looking statements speak only as of the date they are made. CapStar does not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date on which the forward-looking statement is made. Important Additional Information and Where to Find It In connection with the proposed merger, CapStar will file with the SEC a registration statement on Form S-4 that will include a joint proxy statement of CapStar and Athens and a prospectus of CapStar, as well as other relevant documents concerning the proposed transaction. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. SHAREHOLDERS OF CAPSTAR AND ATHENS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. When filed, this document and other documents relating to the merger filed by CapStar with the SEC can be obtained free of charge from the SEC’s website at www.sec.gov. These documents also can be obtained free of charge by accessing CapStar’s website at https://ir.capstarbank.com/ under the tab “Financials & Filings.” Alternatively, these documents, when available, can be obtained free of charge from CapStar upon written request to CapStar Financials Holding, Inc., 1201 Demonbreun Street, Suite 700, Nashville, Tennessee 37203, Attention: Investor Relations or by calling (615) 732-6455. Participants in the Solicitation CapStar, Athens, and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding CapStar’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on March 19, 2018, and certain of its Current Reports on Form 8-K. Information about the directors and executive officers of Athens will be set forth in the joint proxy statement/prospectus when it is filed with the SEC. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials filed with the SEC. Free copies of this document may be obtained as described in the preceding paragraph. Safe Harbor Statements

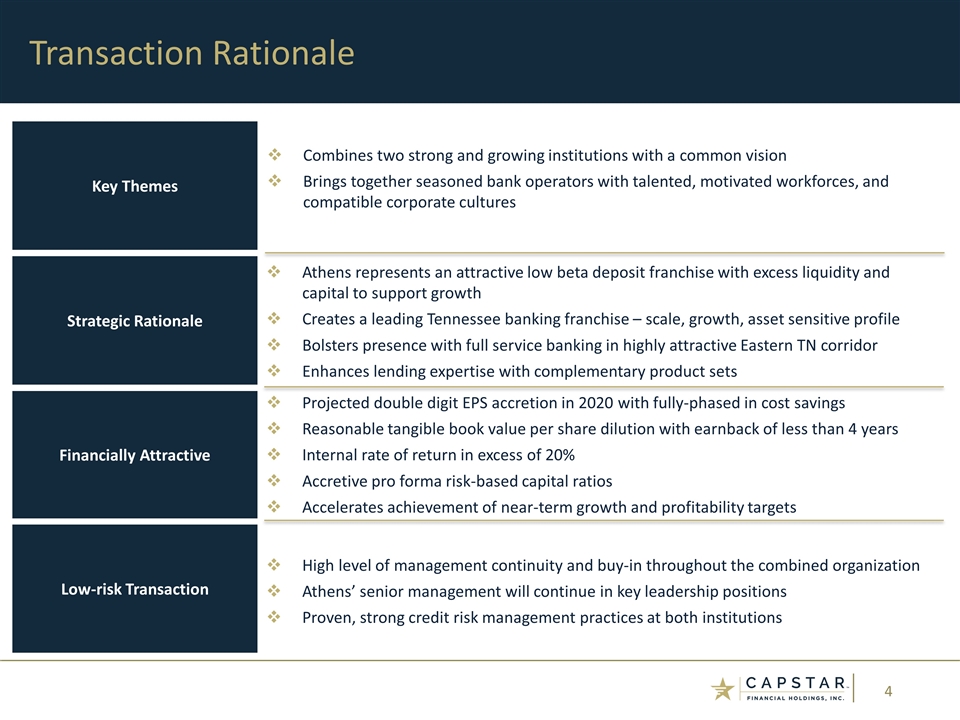

Transaction Rationale Key Themes Strategic Rationale Financially Attractive Low-risk Transaction Combines two strong and growing institutions with a common vision Brings together seasoned bank operators with talented, motivated workforces, and compatible corporate cultures Athens represents an attractive low beta deposit franchise with excess liquidity and capital to support growth Creates a leading Tennessee banking franchise – scale, growth, asset sensitive profile Bolsters presence with full service banking in highly attractive Eastern TN corridor Enhances lending expertise with complementary product sets Projected double digit EPS accretion in 2020 with fully-phased in cost savings Reasonable tangible book value per share dilution with earnback of less than 4 years Internal rate of return in excess of 20% Accretive pro forma risk-based capital ratios Accelerates achievement of near-term growth and profitability targets High level of management continuity and buy-in throughout the combined organization Athens’ senior management will continue in key leadership positions Proven, strong credit risk management practices at both institutions

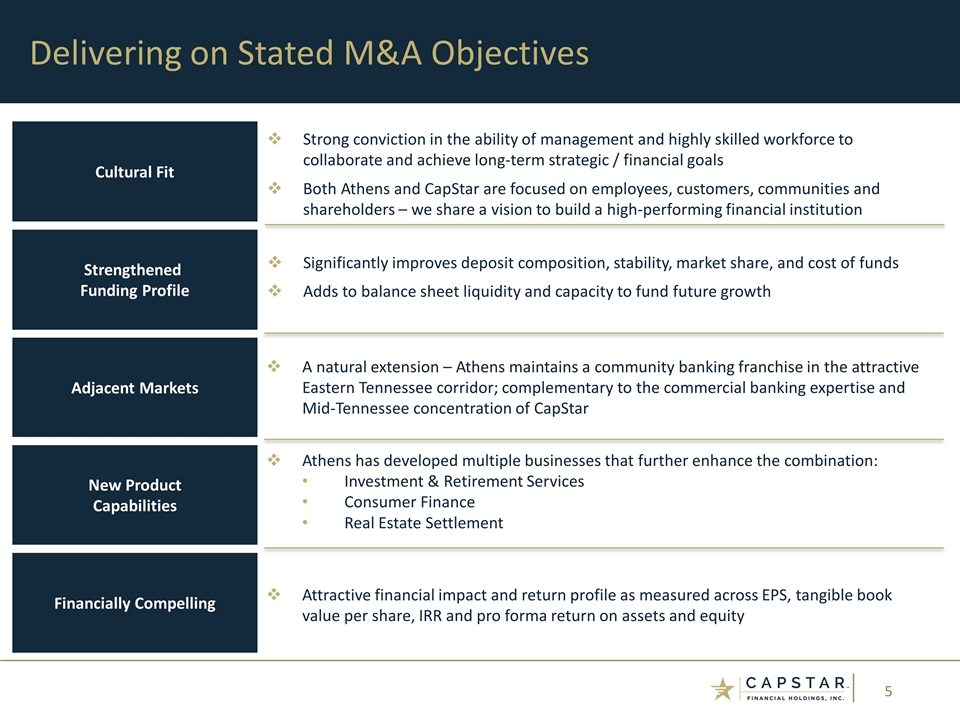

Delivering on Stated M&A Objectives Cultural Fit Strengthened Funding Profile Adjacent Markets New Product Capabilities Financially Compelling Strong conviction in the ability of management and highly skilled workforce to collaborate and achieve long-term strategic / financial goals Both Athens and CapStar are focused on employees, customers, communities and shareholders – we share a vision to build a high-performing financial institution Significantly improves deposit composition, stability, market share, and cost of funds Adds to balance sheet liquidity and capacity to fund future growth A natural extension – Athens maintains a community banking franchise in the attractive Eastern Tennessee corridor; complementary to the commercial banking expertise and Mid-Tennessee concentration of CapStar Athens has developed multiple businesses that further enhance the combination: Investment & Retirement Services Consumer Finance Real Estate Settlement Attractive financial impact and return profile as measured across EPS, tangible book value per share, IRR and pro forma return on assets and equity

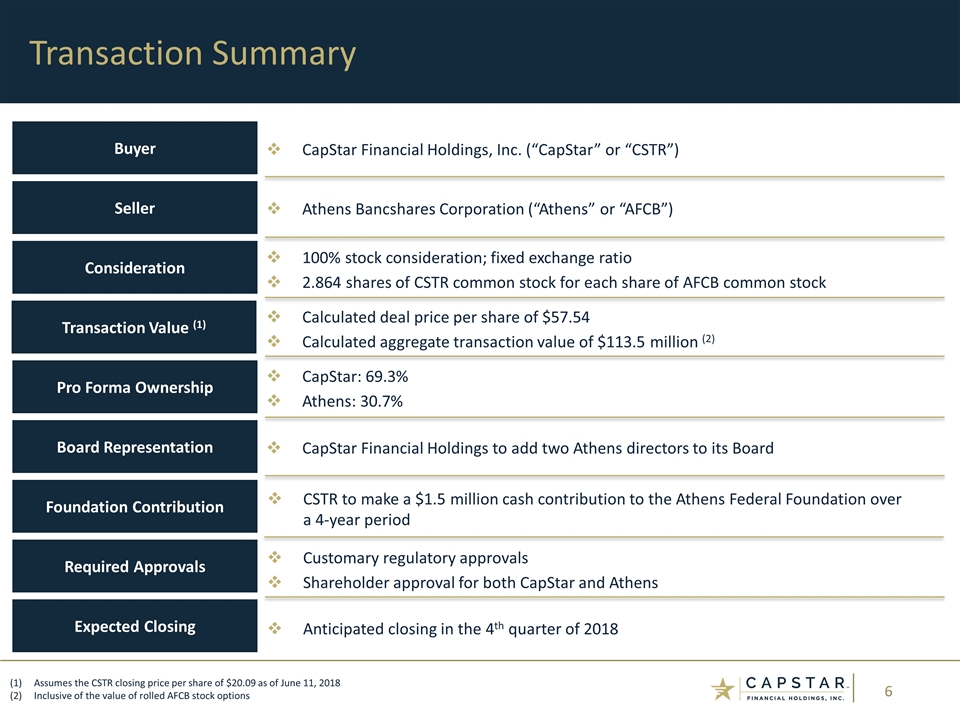

Transaction Summary Assumes the CSTR closing price per share of $20.09 as of June 11, 2018 Inclusive of the value of rolled AFCB stock options Buyer Seller Consideration Pro Forma Ownership Foundation Contribution Board Representation Required Approvals Expected Closing CapStar Financial Holdings, Inc. (“CapStar” or “CSTR”) Athens Bancshares Corporation (“Athens” or “AFCB”) 100% stock consideration; fixed exchange ratio 2.864 shares of CSTR common stock for each share of AFCB common stock Transaction Value (1) Calculated deal price per share of $57.54 Calculated aggregate transaction value of $113.5 million (2) CapStar: 69.3% Athens: 30.7% CSTR to make a $1.5 million cash contribution to the Athens Federal Foundation over a 4-year period CapStar Financial Holdings to add two Athens directors to its Board Customary regulatory approvals Shareholder approval for both CapStar and Athens Anticipated closing in the 4th quarter of 2018

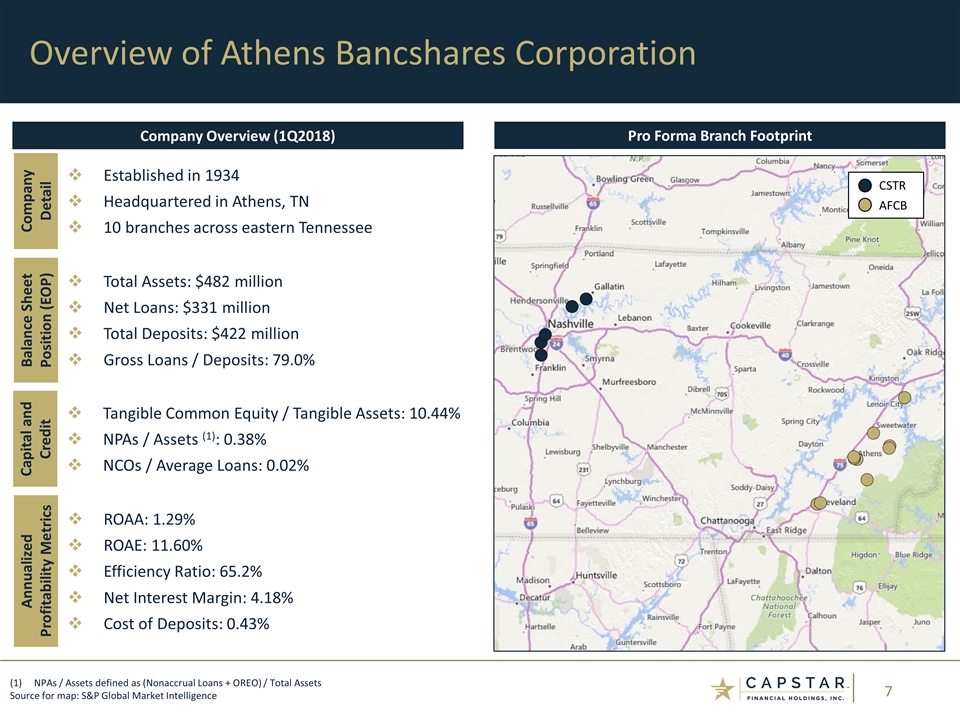

Overview of Athens Bancshares Corporation Company Overview (1Q2018) Pro Forma Branch Footprint NPAs / Assets defined as (Nonaccrual Loans + OREO) / Total Assets Source for map: S&P Global Market Intelligence CSTR AFCB Established in 1934 Headquartered in Athens, TN 10 branches across eastern Tennessee Company Detail Total Assets: $482 million Net Loans: $331 million Total Deposits: $422 million Gross Loans / Deposits: 79.0% Balance Sheet Position (EOP) Tangible Common Equity / Tangible Assets: 10.44% NPAs / Assets (1): 0.38% NCOs / Average Loans: 0.02% Capital and Credit ROAA: 1.29% ROAE: 11.60% Efficiency Ratio: 65.2% Net Interest Margin: 4.18% Cost of Deposits: 0.43% Annualized Profitability Metrics

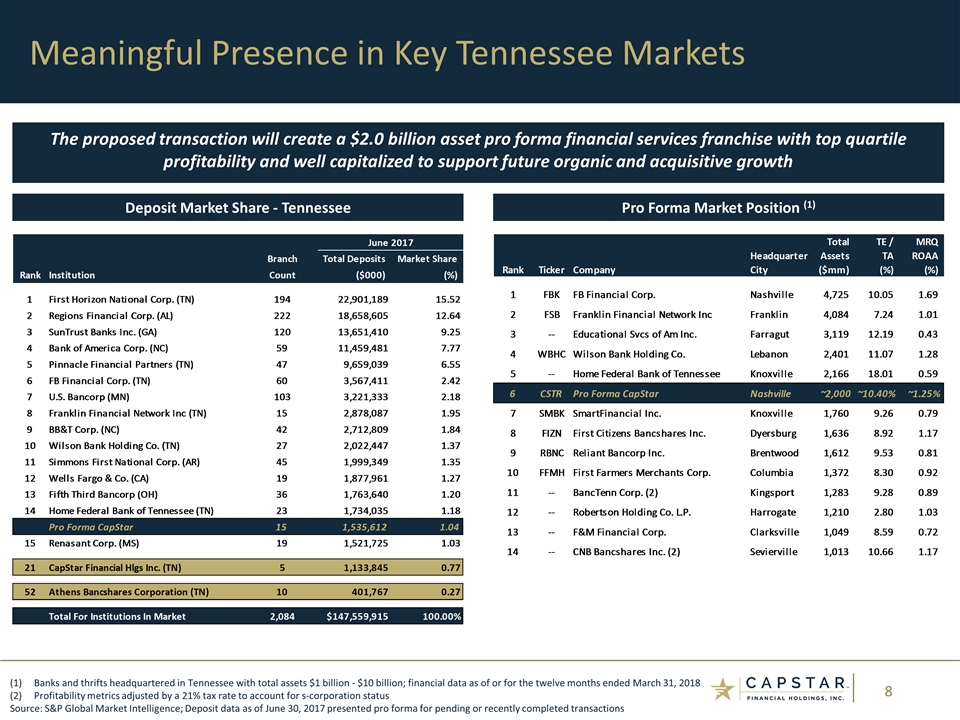

The proposed transaction will create a $2.0 billion asset pro forma financial services franchise with top quartile profitability and well capitalized to support future organic and acquisitive growth Meaningful Presence in Key Tennessee Markets Deposit Market Share - Tennessee Pro Forma Market Position (1) Banks and thrifts headquartered in Tennessee with total assets $1 billion - $10 billion; financial data as of or for the twelve months ended March 31, 2018 Profitability metrics adjusted by a 21% tax rate to account for s-corporation status Source: S&P Global Market Intelligence; Deposit data as of June 30, 2017 presented pro forma for pending or recently completed transactions

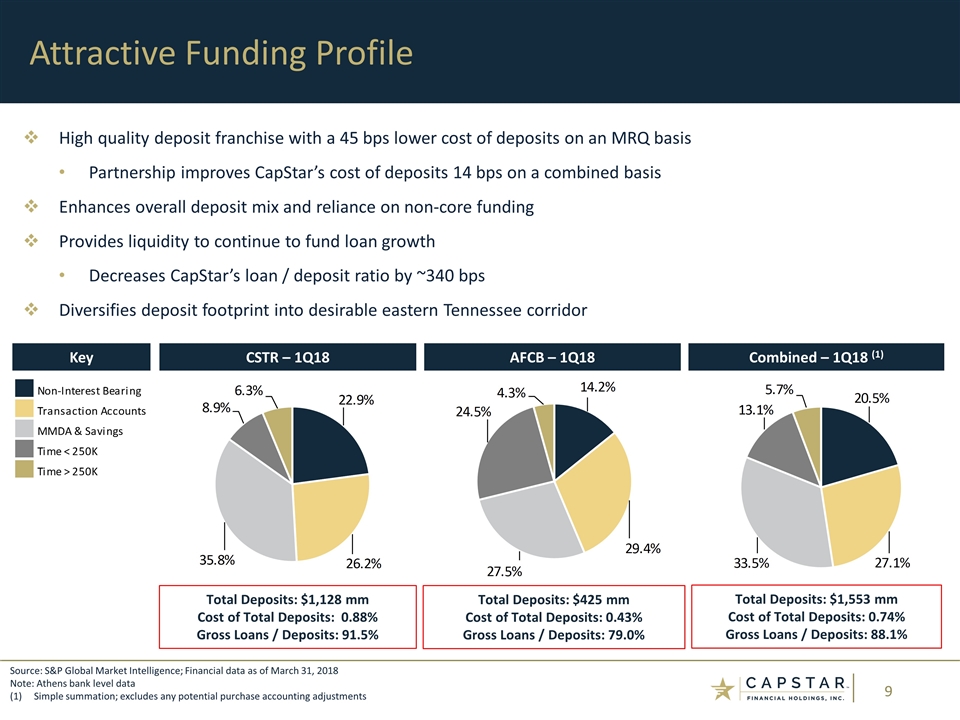

Attractive Funding Profile Source: S&P Global Market Intelligence; Financial data as of March 31, 2018 Note: Athens bank level data Simple summation; excludes any potential purchase accounting adjustments High quality deposit franchise with a 45 bps lower cost of deposits on an MRQ basis Partnership improves CapStar’s cost of deposits 14 bps on a combined basis Enhances overall deposit mix and reliance on non-core funding Provides liquidity to continue to fund loan growth Decreases CapStar’s loan / deposit ratio by ~340 bps Diversifies deposit footprint into desirable eastern Tennessee corridor CSTR – 1Q18 AFCB – 1Q18 Combined – 1Q18 (1) Total Deposits: $425 mm Cost of Total Deposits: 0.43% Gross Loans / Deposits: 79.0% Total Deposits: $1,553 mm Cost of Total Deposits: 0.74% Gross Loans / Deposits: 88.1% Key Total Deposits: $1,128 mm Cost of Total Deposits: 0.88% Gross Loans / Deposits: 91.5%

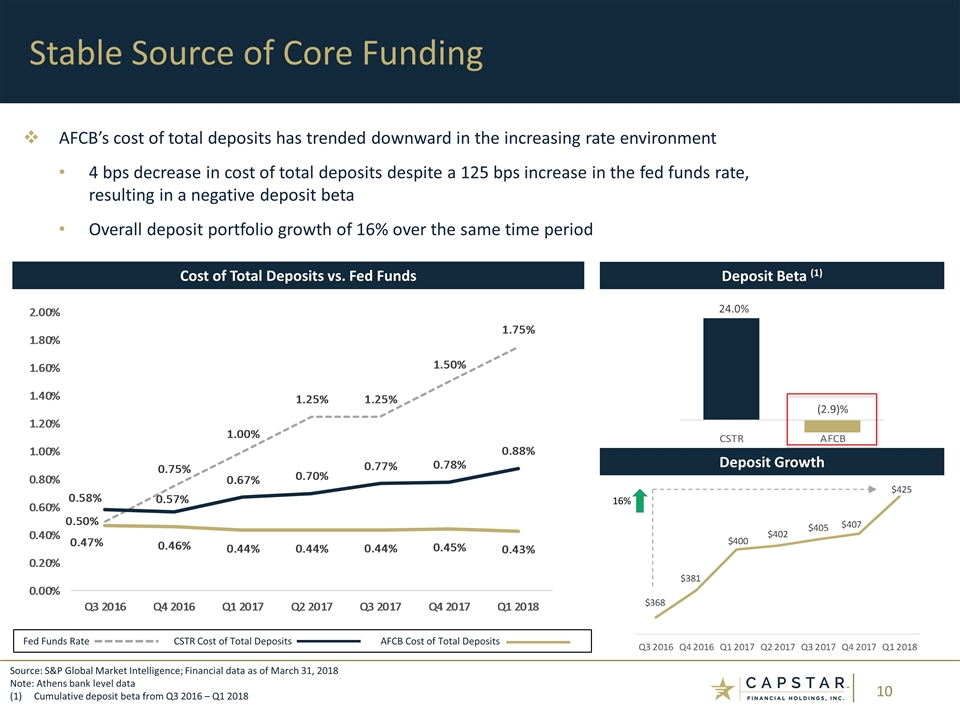

Stable Source of Core Funding Deposit Beta (1) Source: S&P Global Market Intelligence; Financial data as of March 31, 2018 Note: Athens bank level data Cumulative deposit beta from Q3 2016 – Q1 2018 Cost of Total Deposits vs. Fed Funds 24.0% (2.9)% Fed Funds Rate CSTR Cost of Total Deposits AFCB Cost of Total Deposits AFCB’s cost of total deposits has trended downward in the increasing rate environment 4 bps decrease in cost of total deposits despite a 125 bps increase in the fed funds rate, resulting in a negative deposit beta Overall deposit portfolio growth of 16% over the same time period Deposit Growth 16%

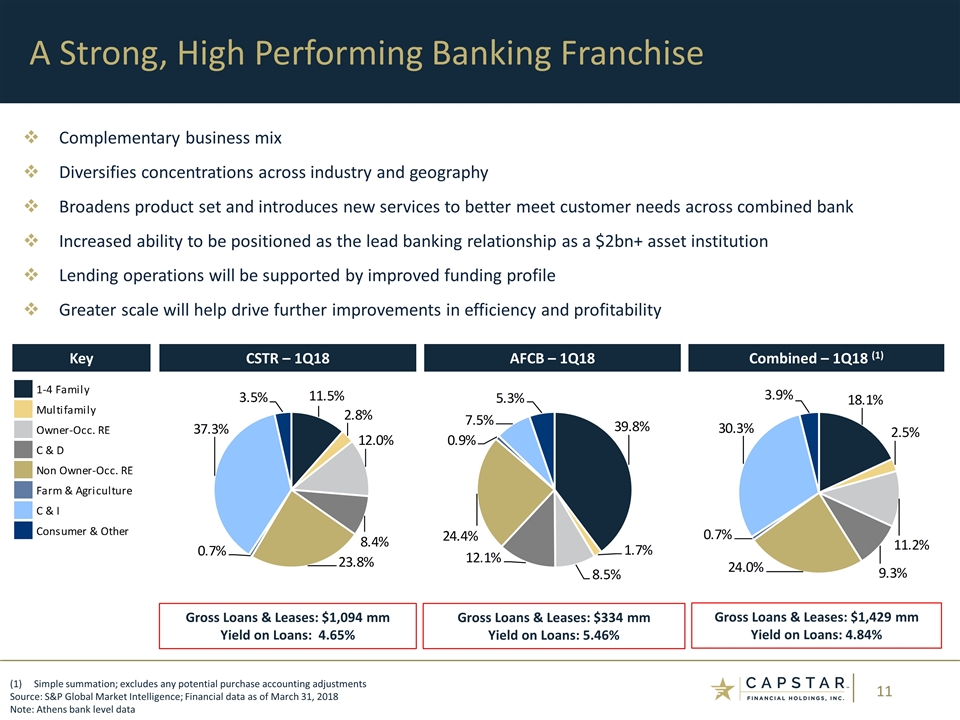

Complementary business mix Diversifies concentrations across industry and geography Broadens product set and introduces new services to better meet customer needs across combined bank Increased ability to be positioned as the lead banking relationship as a $2bn+ asset institution Lending operations will be supported by improved funding profile Greater scale will help drive further improvements in efficiency and profitability A Strong, High Performing Banking Franchise Simple summation; excludes any potential purchase accounting adjustments Source: S&P Global Market Intelligence; Financial data as of March 31, 2018 Note: Athens bank level data CSTR – 1Q18 AFCB – 1Q18 Combined – 1Q18 (1) Key Gross Loans & Leases: $334 mm Yield on Loans: 5.46% Gross Loans & Leases: $1,429 mm Yield on Loans: 4.84% Gross Loans & Leases: $1,094 mm Yield on Loans: 4.65%

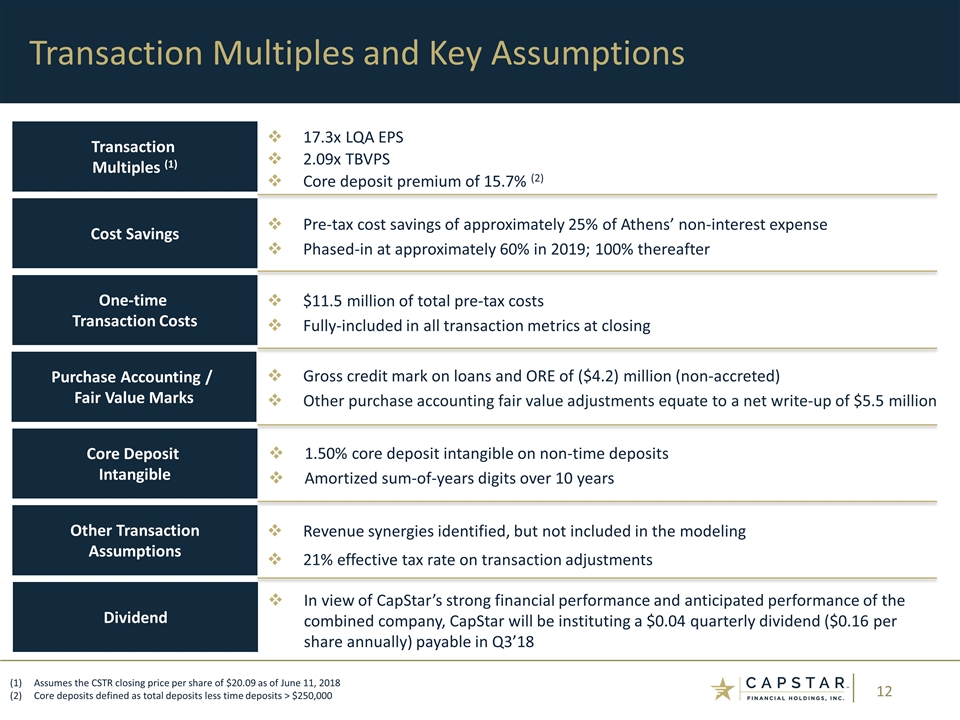

Transaction Multiples and Key Assumptions Assumes the CSTR closing price per share of $20.09 as of June 11, 2018 Core deposits defined as total deposits less time deposits > $250,000 Transaction Multiples (1) Cost Savings One-time Transaction Costs Core Deposit Intangible Other Transaction Assumptions Purchase Accounting / Fair Value Marks 17.3x LQA EPS 2.09x TBVPS Core deposit premium of 15.7% (2) Pre-tax cost savings of approximately 25% of Athens’ non-interest expense Phased-in at approximately 60% in 2019; 100% thereafter $11.5 million of total pre-tax costs Fully-included in all transaction metrics at closing Gross credit mark on loans and ORE of ($4.2) million (non-accreted) Other purchase accounting fair value adjustments equate to a net write-up of $5.5 million 1.50% core deposit intangible on non-time deposits Amortized sum-of-years digits over 10 years Revenue synergies identified, but not included in the modeling 21% effective tax rate on transaction adjustments Dividend In view of CapStar’s strong financial performance and anticipated performance of the combined company, CapStar will be instituting a $0.04 quarterly dividend ($0.16 per share annually) payable in Q3’18

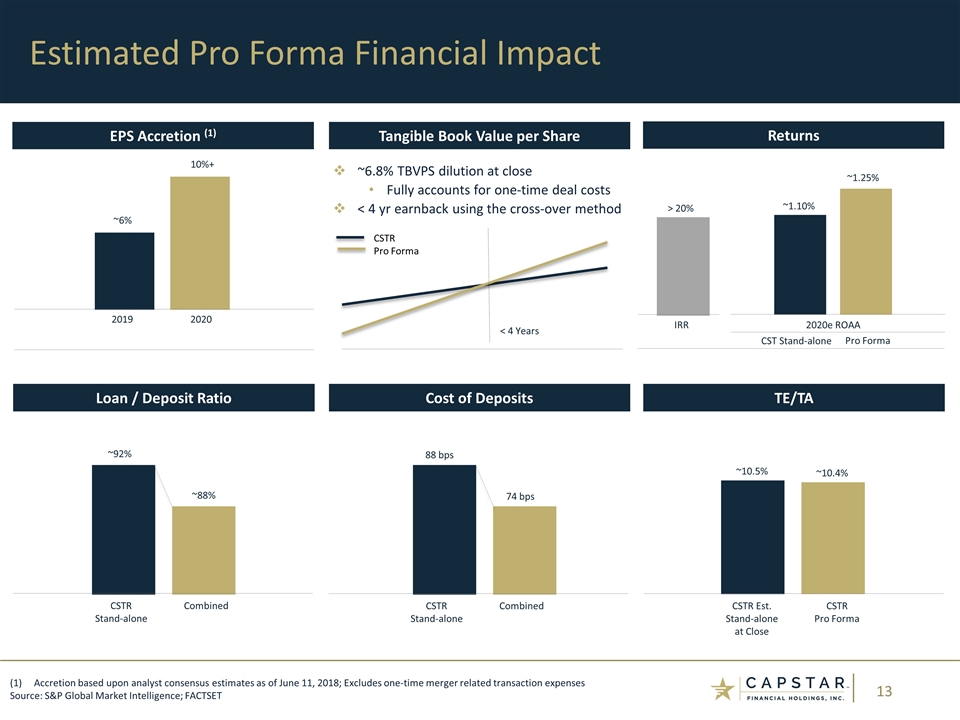

Estimated Pro Forma Financial Impact Tangible Book Value per Share Returns < 4 Years ~6.8% TBVPS dilution at close Fully accounts for one-time deal costs < 4 yr earnback using the cross-over method CSTR Pro Forma 2019 2020 ~6% 10%+ Accretion based upon analyst consensus estimates as of June 11, 2018; Excludes one-time merger related transaction expenses Source: S&P Global Market Intelligence; FACTSET IRR 2020e ROAA > 20% Loan / Deposit Ratio Cost of Deposits TE/TA ~92% ~88% CSTR Stand-alone Combined 88 bps 74 bps CSTR Stand-alone Combined ~10.5% ~10.4% CSTR Est. Stand-alone at Close CSTR Pro Forma ~1.10% ~1.25% CST Stand-alone Pro Forma EPS Accretion (1)

Summary Combines two institutions built on a common vision of creating a high performing financial institution across the State of Tennessee Significantly accretive to CapStar’s deposit base and overall funding needs Financially compelling transaction, resulting in double digit earnings accretion, manageable tangible book value dilution, and an enhanced pro forma capital position Adds diversity – industry, business mix and geography Athens is an established and highly profitable community bank with dominant deposit market share in its primary market Combination will create a strong financial institution with an expanded product set, attractive funding profile and enhanced scale to drive efficiency