Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Encompass Health Corp | a2018williamblairconferenc.htm |

William Blair 38th Annual Growth Stock Conference Mark Tarr, President and Chief Executive Officer June 12, 2018

Forward-Looking Statements The information contained in this presentation includes certain estimates, projections and other forward-looking information that reflect Encompass Health’s current outlook, views and plans with respect to future events, including legislative and regulatory developments, strategy, capital expenditures, acquisition and other development activities, cyber security, dividend strategies, repurchases of securities, effective tax rates, financial performance, financial assumptions, business model, balance sheet and cash flow plans, disintermediation, and shareholder value-enhancing transactions. These estimates, projections and other forward-looking information are based on assumptions the Company believes, as of the date hereof, are reasonable. Inevitably, there will be differences between such estimates and actual events or results, and those differences may be material. There can be no assurance any estimates, projections or forward-looking information will be realized. All such estimates, projections and forward-looking information speak only as of the date hereof. Encompass Health undertakes no duty to publicly update or revise the information contained herein. You are cautioned not to place undue reliance on the estimates, projections and other forward-looking information in this presentation as they are based on current expectations and general assumptions and are subject to various risks, uncertainties and other factors, including those set forth in the Form 10-K for the year ended December 31, 2017, Form 10-Q for the quarter ended March 31, 2018, and in other documents Encompass Health previously filed with the SEC, many of which are beyond Encompass Health’s control, that may cause actual events or results to differ materially from the views, beliefs and estimates expressed herein. Note Regarding Presentation of Non-GAAP Financial Measures This presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934, including Adjusted EBITDA, leverage ratios, adjusted earnings per share, and adjusted free cash flow. The Company’s Form 8-K, dated June 11, 2018, to which the following presentation is attached as Exhibit 99.1, provides further explanation and disclosure regarding Encompass Health’s use of non-GAAP financial measures and should be read in conjunction with this presentation. Schedules that reconcile the non-GAAP financial measures included in the following presentation to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States are included in that Form 8-K. Encompass Health 2

Company Overview - Encompass Health National leader of inpatient rehabilitation hospitals and home-based care 127 268 36 IRFs Home Health States and and Hospice Puerto Rico Agencies Committed to delivering high-quality, cost-effective care across the post-acute continuum Encompass Health 3

Company Overview - Inpatient Rehabilitation Largest owner and operator of IRFs 127 Inpatient Rehabilitation Hospitals 22% 30% 42 Operate as joint ventures of Licensed beds of Medicare with acute care hospitals patients served 31 105 States and Puerto Rico Hospitals hold one or more disease-specific certifications ~29,700 ~174,800 ~$3.2 billion employees patients revenues Encompass Health 4

Company Overview - Home Health and Hospice th 4 largest provider of Medicare-certified skilled home health services 96% Home health agencies ≥ 3 stars for quality of care 212 56 30 Home Health Hospice States 95% Locations Locations Home health agencies ≥ 3 stars in patient satisfaction ~8,800 ~128,000 ~5,300 ~$800 million employees home health hospice revenues admissions admissions Encompass Health 5

Market Overlap Inpatient Rehabilitation and Home Health ~60% of EHC's IRFs have an EHC home health location within an approximate 30-mile radius. Encompass Health 6

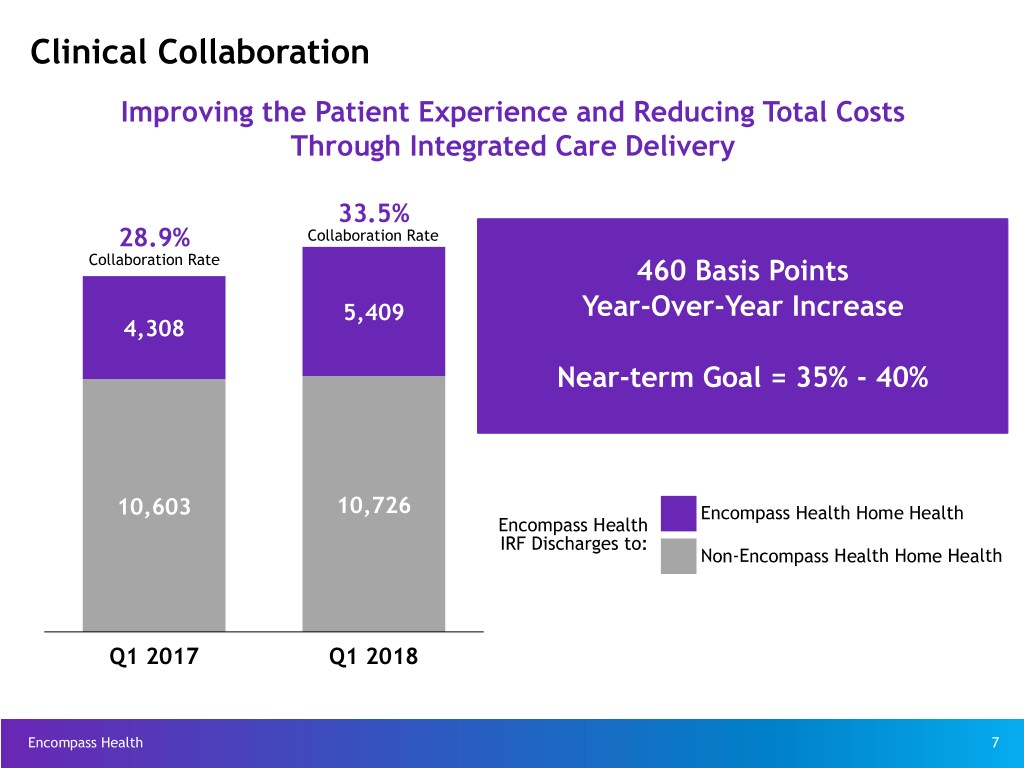

Clinical Collaboration Improving the Patient Experience and Reducing Total Costs Through Integrated Care Delivery 33.5% 28.9% Collaboration Rate Collaboration Rate 460 Basis Points 5,409 Year-Over-Year Increase 4,308 Near-term Goal = 35% - 40% 10,603 10,726 Encompass Health Home Health Encompass Health IRF Discharges to: Non-Encompass Health Home Health Q1 2017 Q1 2018 Encompass Health 7

Strategy The Company’s strategy is to expand its network of inpatient rehabilitation hospitals and home health and hospice agencies, further strengthen its relationships with healthcare systems, provider networks, and payors in order to connect patient care across the healthcare continuum, and to deliver superior outcomes. Elements of Strategy Clinical Expertise Financial Advanced Sustained Post-Acute and High-Quality Resources Technology Growth Innovation Outcomes Encompass Health 8

Quality Inpatient Home Health Rehabilitation Discharge to 30-day hospital community readmission 320 bps better 90 bps 79.2% 16.9% better 76.0% 16.0% Industry Average Encompass Health Industry Average Encompass Health 280 certified clinical programs Developed programs to create including 103 hospitals with stroke- physician-specific custom treatment specific certifications protocols for higher acuity patients Encompass Health 9

Cost Effectiveness Inpatient Rehabilitation Average Average Average Average Medicare Case Cost Payment Beds Discharges Mix per per per IRF per IRF Index Discharge Discharge Encompass Health 67 950 1.28 $13,505 $20,300 Industry Average 34 357 1.25 $18,507 $21,160 (27.0)% Home Health Average Average Average Revenue Visits Average Revenue 2017 per per Cost per Visit Episodes Episode Episode per Visit (all payors) Encompass Health 211,743 $2,998 17.9 $75 $161 Public Peer Average 283,366 $2,835 17.4 $81 $148 (7.4)% Encompass Health 10

Technology Working together to improve efficiency and outcomes homecare POST-ACUTE INNOVATION CENTER homebaseTM Encompass Health 11

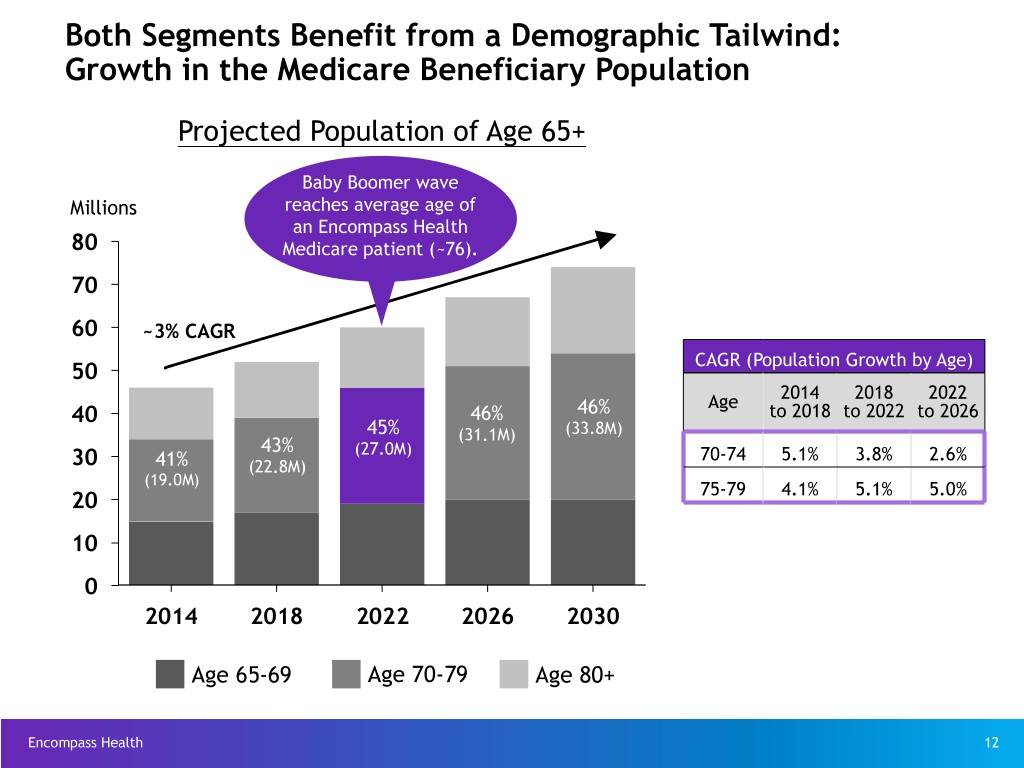

Both Segments Benefit from a Demographic Tailwind: Growth in the Medicare Beneficiary Population Projected Population of Age 65+ Baby Boomer wave Millions reaches average age of an Encompass Health 80 Medicare patient (~76). 70 60 ~3% CAGR CAGR (Population Growth by Age) 50 Age 2014 2018 2022 40 46% 46% to 2018 to 2022 to 2026 45% (31.1M) (33.8M) 43% (27.0M) 70-74 5.1% 3.8% 2.6% 30 41% (22.8M) (19.0M) 75-79 4.1% 5.1% 5.0% 20 10 0 2014 2018 2022 2026 2030 Age 65-69 Age 70-79 Age 80+ Encompass Health 12

Multi-faceted Growth Strategy Track record of consistent market share gains IRF organic growth supplemented by bed additions De novos and acquisitions complement organic growth Maturation of acquired home health locations Home health acquisitions and new-store growth prioritized in Encompass Health IRF markets without current overlap Build additional scale in hospice via acquisitions and de novos Encompass Health 13

IRF Growth Target 4 to 6 new IRFs per year Inpatient Rehabilitation Facilities # of New Beds... 2018 2019 De Novo: 1) Shelby County, AL 34 — 2) Hilton Head, SC 38 — 3) Murrieta, CA — 50 4) Katy, TX — 40 Joint Ventures: 5) Murrells Inlet, SC 29 — 6) Winston-Salem, NC 68 — 7) Lubbock, TX — 40 8) Boise, ID — 40 Bed Additions ~100 ~100 ~269 ~270 Encompass Health 14

Home Health and Hospice Growth Target $50 to $100 million in home health and hospice acquisitions per year Camellia Healthcare 18 hospice 14 home health 2 private duty Completed acquisition May 1, 2018 Encompass Health 15

Adjusted Free Cash Flow and Priorities 2018 Assumptions (In Millions) 2018 Adjusted Free Cash Flow $340 to $440 Assumptions Priorities Growth in Core Business IRF bed expansions $30 to $40 New IRFs - De novos 80 to 110 - Acquisitions opportunistic - Replacement IRFs and other 40 to 50 Home health and hospice acquisitions 160 to 185 (includes Camellia in 2018) $310 to $385, excluding IRF acquisitions Debt Reduction Debt redemptions (borrowings), net opportunistic Shareholder Distributions Cash dividends on common stock ~$100 Purchase of Home Health Holdings Rollover Shares ~65 Common stock repurchases opportunistic Encompass Health 16

Strong and Sustainable Business Fundamentals Attractive Healthcare Sectors Industry Leading Positions Cost-Effectiveness Real Estate Ownership Financial Strength Growth Opportunities Encompass Health 17

Committed to Delivering High-Quality, Cost-Effective Care Across the Post-Acute Continuum