Attached files

| file | filename |

|---|---|

| 10-Q - 10-Q - Stitch Fix, Inc. | sfix-10q_20180428.htm |

| EX-32.1 - EX-32.1 - Stitch Fix, Inc. | sfix-ex321_7.htm |

| EX-31.2 - EX-31.2 - Stitch Fix, Inc. | sfix-ex312_10.htm |

| EX-31.1 - EX-31.1 - Stitch Fix, Inc. | sfix-ex311_9.htm |

| EX-10.4 - EX-10.4 - Stitch Fix, Inc. | sfix-ex104_229.htm |

| EX-10.3 - EX-10.3 - Stitch Fix, Inc. | sfix-ex103_230.htm |

Exhibit 10.2

FOURTH AMENDMENT

THIS FOURTH AMENDMENT (this “Amendment”) is made and entered into as of June 4, 2018, by and between POST-MONTGOMERY ASSOCIATES, a California general partnership (“Landlord”), and STITCH FIX, INC., a Delaware corporation (“Tenant”).

RECITALS

|

A. |

Landlord and Tenant are parties to that certain Office Lease dated November 10, 2015 (the “Original Lease”), which Original Lease has been previously amended by that certain First Amendment dated February 22, 2016, that certain Second Amendment dated September 6, 2017 and that certain Third Amendment (the “Third Amendment”) dated January 29, 2018 (collectively, the “Lease”). Pursuant to the Lease, Landlord has leased to Tenant space currently containing approximately 95,250 square feet of rentable area in the building (the “Original Premises”) located at One Montgomery Street, San Francisco, California (the “Building”), comprised of (i) approximately 19,063 square feet of rentable area described as Suite 1100 on the eleventh (11th) floor of the Building; (ii) approximately 19,064 square feet of rentable area described as Suite 1200 on the twelfth (12th) floor of the Building; (iii) approximately 19,068 square feet of rentable area described as Suite 1300 on the thirteenth (13th) floor of the Building; (iv) approximately 18,953 square feet of rentable area described as Suite 1400 on the fourteenth (14th) floor of the Building; and (v) approximately 19,102 square feet of rentable area described as Suite 1500 on the fifteenth (15th) floor of the Building. |

|

B. |

Pursuant to the Third Amendment, additional space containing approximately 38,701 square feet of rentable area in the Building, comprised of (i) approximately 19,351 square feet of rentable area described as Suite 800 (“Suite 800”) on the eighth (8th) floor of the Building; and (ii) approximately 19,350 square feet of rentable area described as Suite 900 (“Suite 900”) on the ninth (9th) floor of the Building, was scheduled to be added to the Original Premises as of June 1, 2018 (the “Existing Expansion Effective Date”). |

|

C. |

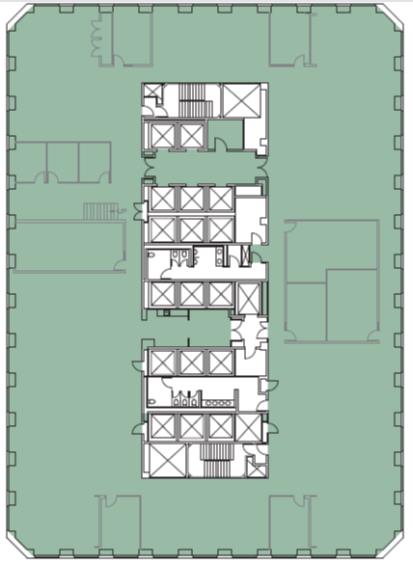

Tenant has requested to (i) remove Suite 800 from the Expansion Space and replace it with Suite 1000 (“Suite 1000”) on the tenth (10th) floor of the Building (as shown on Exhibit A attached hereto), containing approximately 19,379 square feet of rentable area; and (ii) retroactively adjust the Existing Expansion Effective Date with respect to Suite 900 and Suite 1000, and Landlord is willing to do the same on the following terms and conditions. |

NOW, THEREFORE, in consideration of the mutual covenants and agreements herein contained and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Landlord and Tenant agree as follows:

|

1. |

Substitution. |

|

|

1.1 |

Effective as of full execution and delivery of this Amendment (the “Substitution Effective Date”), Suite 1000 is substituted for Suite 800 and, from and after the Substitution Effective Date, the “Expansion Space”, as defined in the Third Amendment, shall be deemed to mean approximately 38,729 rentable square feet in the Building comprised of (i) approximately 19,350 square feet of rentable area described as Suite 900 on the ninth (9th) floor of the Building; and (ii) approximately 19,379 square feet of rentable area described as Suite 1000 on the tenth (10th) floor of the Building. Accordingly, as of the Substitution Effective Date, the terms and conditions of Section 1 of the Third Amendment, as amended by this Section 1 and Section 2 below, shall apply to Suite 1000. Effective as of the Substitution Effective Date, the Lease shall be terminated with respect to Suite 800. |

{2119-01801/00809716;6}

Exhibit 10.2

|

|

1.2 |

The reference to “133,951” in Section 1.1 of the Third Amendment is hereby deleted in its entirety and replaced with “133,979”. |

|

|

1.3 |

Landlord has granted Tenant early access to Suite 800 pursuant to Section 8 of the Third Amendment. Tenant shall vacate Suite 800 as of the Substitution Effective Date and return the same to Landlord in “broom clean” condition, free of debris and Tenant’s personal property and otherwise in accordance with the terms and conditions of the Lease, as amended hereby. |

|

2. |

Adjustment of Expansion Effective Date. Notwithstanding anything to the contrary contained in the Lease, as amended hereby, the Expansion Effective Date for the Expansion Space (i.e., Suite 900 and Suite 1000) is hereby retroactively adjusted to July 16, 2018. Accordingly, all references in the Lease, as amended hereby, to the “Expansion Effective Date” are hereby amended to mean and refer to “July 16, 2018”. |

|

3. |

Base Rent. Section 3.3 of the Third Amendment is hereby deleted in its entirety and replaced with the following: |

“Expansion Space From Expansion Effective Date Through Extended Expiration Date. As of the Expansion Effective Date, the schedule of Base Rent payable with respect to the Expansion Space for the balance of the original Term and the Extended Term is the following:

|

Period |

Rentable Square Footage |

Annual Base Rent |

Monthly Base Rent |

|

7/16/2018 – 7/31/2019 |

38,729 |

$2,876,131.73 |

$239,677.64 |

|

8/1/2019 – 7/31/2020 |

38,729 |

$2,962,415.68 |

$246,867.97 |

|

8/1/2020 – 7/31/2021 |

38,729 |

$3,051,288.15 |

$254,274.01 |

|

8/1/2021 – 7/31/2022 |

38,729 |

$3,142,826.79 |

$261,902.23 |

|

8/1/2022 – 7/31/2023 |

38,729 |

$3,237,111.60 |

$269,759.30 |

|

8/1/2023 – 7/31/2024 |

38,729 |

$3,334,224.95 |

$277,852.08 |

|

8/1/2024 – 7/31/2025 |

38,729 |

$3,434,251.69 |

$286,187.64 |

|

8/1/2025 – 7/31/2026 |

38,729 |

$3,537,279.24 |

$294,773.27 |

|

8/1/2026 – 7/31/2027 |

38,729 |

$3,643,397.62 |

$303,616.47 |

|

8/1/2027 – 5/31/2028 |

38,729 |

$3,752,699.55 |

$312,724.96 |

All such Base Rent shall be payable by Tenant in accordance with the terms of the Lease, as amended hereby, except that an amount equal to $182.95 (i.e., the Base Rent payable for Suite 1000 for the third (3rd) full calendar month after the Expansion Effective Date, less the prepaid Base Rent that Tenant previously delivered to Landlord for Suite 800 for such month pursuant to the Third Amendment) shall be paid by Tenant (the “Prepaid Rent”) concurrent with Tenant’s execution and delivery of this Amendment to Landlord. Notwithstanding anything in the Lease, as amended hereby, to the contrary, so long as Tenant is not in default beyond applicable notice and cure periods under the Lease, as amended hereby, Tenant shall be entitled to an abatement of Base Rent as follows: (i) with respect to Suite 1000, in the amount of $119,933.39 for the months of August and September of 2018; and (ii) with respect to Suite 900, in the amount of $119,744.25 for the months of August, September, October and November of 2018 (the period commencing August 1, 2018 and continuing through November 30, 2018 is hereinafter referred to as the “Rent Abatement Period”). The maximum total amount of Base Rent abated in accordance with the foregoing shall equal $718,843.78 (the “Abated Base Rent”). If Tenant defaults beyond applicable notice and cure periods under the Lease, as amended hereby, at any time during the Rent Abatement Period and fails to cure such default within any applicable cure period under the Lease, as amended

{2119-01801/00809716;6}

Exhibit 10.2

hereby, then Tenant’s right to receive the Abated Base Rent shall toll (and Tenant shall be required to pay Base Rent during such period of any Tenant default) until Tenant has cured, to Landlord’s reasonable satisfaction, such default and at such time Tenant shall be entitled to receive any unapplied Abated Base Rent until fully applied. Only Base Rent shall be abated pursuant to this Section, as more particularly described herein, and Escalation Rent and all other rent and other costs and charges specified in the Lease, as amended hereby, shall remain as due and payable pursuant to the provisions of the Lease, as amended hereby.”.

|

4. |

Tenant’s Percentage Share. Section 5 of the Third Amendment is hereby deleted in its entirety and replaced with the following: |

“For the period commencing with the Expansion Effective Date and ending on the Extended Expiration Date, Tenant’s Percentage Share for the Expansion Space will be adjusted to be 5.73% of the Building (i.e., 38,729/675,432). Tenant’s Percentage Share for the Expansion Space and the Original Premises is, collectively, 19.84% of the Building (i.e., 133,979/675,432).”.

|

5. |

Condition of Suite 1000; Tenant Alterations. |

|

|

5.1 |

Condition of Suite 1000. Tenant has inspected Suite 1000 and agrees to accept the same “as is” without any agreements, representations, understandings or obligations on the part of Landlord to perform any alterations, repairs or improvements, except as may be expressly provided otherwise in this Amendment. However, notwithstanding the foregoing, Landlord agrees that Suite 1000 shall be broom clean and free of personal property and debris and that the Building Systems located in or serving Suite 1000 shall be in good working order as of the date Landlord delivers possession of Suite 1000 to Tenant. Except to the extent caused by the acts or omissions of Tenant or any of the other Tenant Parties or by any alterations or improvements performed by or on behalf of Tenant, if such Building Systems are not in good working order as of the date possession of Suite 1000 is delivered to Tenant and Tenant provides Landlord with notice of the same within sixty (60) days following the date Landlord delivers possession of Suite 1000, Landlord shall be responsible for repairing or restoring the same and will proceed to do so promptly upon receipt of notice tendered to Landlord within such sixty (60) day period; provided, however, the foregoing shall not limit or relieve Landlord of its express repair and maintenance obligations under the Lease, as amended hereby. As of the date hereof, to Landlord’s actual knowledge, Landlord has no actual knowledge that Suite 1000 is in violation of Requirements. For purposes of this Section, “Landlord’s actual knowledge” and “knowledge” shall be deemed to mean and limited to the current actual knowledge of the Property Manager at the time of execution of this Amendment and not any implied, imputed, or constructive knowledge of said individual or of Landlord or any Landlord of Landlord’s agents, employees or related entities and without any independent investigation or inquiry having been made or any implied duty to investigate or make any inquiries; it being understood and agreed that such individual shall have no personal liability in any manner whatsoever hereunder or otherwise related to the transactions contemplated hereby. |

|

|

5.2 |

Tenant Alterations. |

|

|

5.2.1 |

Exhibit “B” to the Third Amendment (the “Work Letter”) shall apply to Tenant’s performance of the Tenant Alterations (as defined in the Work Letter) in the Original Premises, Suite 900 and Suite 1000 (and not Suite 800). Notwithstanding the foregoing or anything to the contrary contained in Exhibit B to the Third Amendment, the Compliance Allowance shall not be applicable to Suite 1000 (it being agreed that the Compliance Allowance shall be allocable solely towards ADA Restroom Work and Fountain Installation Work in Suite 900). |

{2119-01801/00809716;6}

Exhibit 10.2

|

|

5.2.2 |

The first sentence of Section 3.2 of the Work Letter is hereby deleted in its entirety and replaced with the following: |

|

|

“Provided no Event of Default on the part of Tenant then exists, Landlord agrees to contribute (i) the sum of up to $2,226,555.00 (representing the sum of (i) $70.00 per rentable square foot of Suite 900; and (ii) $45.00 per rentable square foot of Suite 1000) (the “Expansion Space Allowance”) toward the cost of performing the Tenant Alterations in preparation of Tenant’s occupancy of the Expansion Space; and (ii) the sum of up to $952,500.00 (representing $10.00 per rentable square foot of the Original Premises) toward the cost of performing the Tenant Alterations in the Original Premises and/or the Expansion Space (the “Refurbishment Allowance” and, together with the Expansion Space Allowance, the “Allowance”).”. |

|

6. |

Early Access to Suite 1000. Subject to the terms of this Section 6 and provided that this Amendment has been fully executed by all parties and Tenant has delivered the Prepaid Rent and insurance certificates required hereunder, as of the date that is one (1) business day following the date on which Landlord recovers actual and legal possession of Suite 1000 from the prior tenant thereof, Landlord grants Tenant the right to enter Suite 1000, at Tenant’s sole risk, solely for the purpose of performing the Tenant Alterations, installing telecommunications and data cabling, equipment, furnishings and other personalty and, in the event Tenant substantially completes the Tenant Alterations prior to the Expansion Effective Date (as amended by Section 2 above), for the Permitted Use. Such possession prior to the Expansion Effective Date shall be subject to all of the terms and conditions of the Lease, as amended hereby, except that Tenant shall not be required to pay Base Rent or Escalation Rent or for the use of the elevators located in the Building with respect to the period of time prior to the Expansion Effective Date during which Tenant occupies Suite 1000 solely for such purposes. However, Tenant shall be liable for any utilities or special services provided to Tenant in Suite 1000 during such period. Said early possession shall not advance the Extended Expiration Date. |

|

7. |

Other Pertinent Provisions. Landlord and Tenant agree that, effective as of the date of this Amendment (unless different effective date(s) is/are specifically referenced in this Section), the Lease shall be amended in the following additional respects: |

|

|

7.1 |

Landlord’s Notice Address. Landlord’s notice address, set forth in the Basic Lease Information of the Original Lease is hereby deleted in its entirety and replaced with the following: |

“Post-Montgomery Associates

c/o PGIM Real Estate

101 California Street, 40th Floor

San Francisco, California 94111

Attention: PRISA Asset Manager

with a copy by the same method to:

Post-Montgomery Associates

c/o The Prudential Insurance Company of America

7 Giralda Farms

Madison, New Jersey 07940

Attention: PGIM Real Estate Legal Department

With a copy by the same method to:

{2119-01801/00809716;6}

Exhibit 10.2

Jones Lang LaSalle Americas, Inc.

Post Montgomery Center

50 Post Street, Suite 50

San Francisco, California 94104”.

|

|

7.2 |

Insurance. Tenant’s insurance required under Article 14 of the Original Lease (“Tenant’s Insurance”) shall include Suite 1000. Tenant shall provide Landlord with a certificate of insurance, in form and substance satisfactory to Landlord and otherwise in compliance with Article 14 of the Original Lease, evidencing that, on or before the date on which Landlord tenders possession of Suite 1000 to Tenant pursuant to the terms of this Amendment, Tenant’s Insurance also covers Suite 1000, and thereafter as necessary to assure that Landlord always has current certificates evidencing Tenant’s Insurance. |

|

|

7.3 |

Stairs. |

|

|

7.3.1 |

Fire Stairs. Landlord consents to the use of the Building fire stairs, subject to and in accordance with Section 31.3(h) of the Original Lease, by Tenant for travel only by Tenant’s employees between the ninth (9th) through fifteenth (15th) floors of the Building, so long as Tenant occupies the entirety of said floors. |

|

|

7.3.2 |

Internal Stairwell. In addition to Tenant’s right to use the fire stairs as described in Section 31.3(h) of the Original Lease, as amended by Section 7.3.1 above, Tenant shall have the right to use the internal stairwell connecting the tenth (10th), eleventh (11th) and twelfth (12th) floors of the Premises (the “Internal Stairwell”); provided that, if one or more drop-down gates or other similar barriers must be installed to isolate any floor(s) of the Premises in order for Tenant to use the Internal Stairwell in compliance with Requirements, the same shall be installed by Tenant, at Tenant’s sole cost and expense, subject to and in accordance with the terms and conditions of the Lease, as amended hereby. |

|

8. |

Miscellaneous. |

|

|

8.1 |

This Amendment, including Exhibit A (Outline and Location of Suite 1000) attached hereto, sets forth the entire agreement between the parties with respect to the matters set forth herein. There have been no additional oral or written representations or agreements. Under no circumstances shall Tenant be entitled to any Rent abatement, improvement allowance, leasehold improvements, or other work to the Premises, or any similar economic incentives that may have been provided Tenant in connection with entering into the Lease, unless specifically set forth in this Amendment. |

|

|

8.2 |

Except as herein modified or amended, the provisions, conditions and terms of the Lease shall remain unchanged and in full force and effect. In the case of any inconsistency between the provisions of the Lease and this Amendment, the provisions of this Amendment shall govern and control. The capitalized terms used in this Amendment shall have the same definitions as set forth in the Lease to the extent that such capitalized terms are defined therein and not redefined in this Amendment. |

|

|

8.3 |

Submission of this Amendment by Landlord is not an offer to enter into this Amendment but rather is a solicitation for such an offer by Tenant. Neither Landlord nor Tenant shall be bound by this Amendment until Landlord and Tenant have fully executed and delivered this Amendment. |

{2119-01801/00809716;6}

Exhibit 10.2

|

|

8.5 |

Each signatory of this Amendment represents hereby that he or she has the authority to execute and deliver the same on behalf of the party hereto for which such signatory is acting. |

|

|

8.6 |

Tenant represents, warrants and covenants to Landlord that, as of the date hereof and throughout the Term (as the same may be further extended), Tenant is not, and is not entering into the Amendment on behalf of, (i) an employee benefit plan, (ii) a trust holding assets of such a plan or (iii) an entity holding assets of such a plan. Notwithstanding any terms to the contrary in the Lease, as amended hereby, in no event may Tenant assign or transfer its interest under the Lease to a third party who is, or is entering into the Lease on behalf of, (i) an employee benefit plan, (ii) a trust holding assets of such a plan or (iii) an entity holding assets of such a plan if such transfer would could cause Landlord to incur any prohibited transaction excise tax penalties or other materially adverse consequences under the Employee Retirement Income Security Act of 1974, as amended, Section 4975 of the Internal Revenue Code of 1986, as amended or similar law. Tenant represents and warrants to Landlord that (i) neither Tenant nor any of its “affiliates” has the authority (A) to appoint or terminate PGIM as investment manager of the Prudential separate account PRISA, (B) to negotiate the terms of a management agreement between PGIM and the Prudential separate account PRISA or (C) to cause an investment in or withdrawal from the Prudential separate account PRISA and (ii) Tenant is not “related” to PGIM (within the meaning of Part VI(h) of Department of Labor Prohibited Transaction Exemption 84-14). |

{2119-01801/00809716;6}

Exhibit 10.2

|

|

Control at its official website, http://www.treas.gov/ofac/t11sdn.pdf, or at any replacement website or other official publication of such list. |

|

|

8.8 |

Pursuant to California Civil Code Section 1938, Landlord hereby notifies Tenant that as of the date of this Amendment, the Premises have not undergone inspection by a “Certified Access Specialist” (“CASp”) to determine whether the Premises meet all applicable construction-related accessibility standards under California Civil Code Section 55.53. Landlord hereby discloses pursuant to California Civil Code Section 1938 as follows: “A Certified Access Specialist (CASp) can inspect the subject premises and determine whether the subject premises comply with all of the applicable construction-related accessibility standards under state law. Although state law does not require a CASp inspection of the subject premises, the commercial property owner or lessor may not prohibit the lessee or tenant from obtaining a CASp inspection of the subject premises for the occupancy or potential occupancy of the lessee or tenant, if requested by the lessee or tenant. The parties shall mutually agree on the arrangements for the time and manner of the CASp inspection, the payment of the fee for the CASp inspection, and the cost of making any repairs necessary to correct violations of construction-related accessibility standards within the premises.” Landlord and Tenant hereby acknowledge and agree that in the event that Tenant elects to perform a CASp inspection of the Premises hereunder (the “Inspection”), such Inspection shall be (a) performed at Tenant’s sole cost and expense, (b) limited to the Premises (as then defined under the Lease, as amended hereby) and (c) performed by a CASp who has been approved or designated by Landlord prior to the Inspection. Any Inspection must be performed in a manner which minimizes the disruption of business activities in the Building, and at a time reasonably approved by Landlord. Landlord reserves the right to be present during the Inspection. Tenant agrees to: (i) promptly provide to Landlord a copy of the report or certification prepared by the CASp inspector upon request (the “Report”), (ii) keep the information contained in the Report confidential, except to the extent required by Requirements, or to the extent disclosure is needed in order to complete any necessary modifications or improvements required to comply with all applicable accessibility standards under state or federal Requirements, as well as any other repairs, upgrades, improvements, modifications or alterations required by the Report or that may be otherwise required to comply with applicable Requirements or accessibility requirements (the “Access Improvements”). In the event Tenant elects to perform an Inspection (it being agreed that if Tenant does not elect to perform an Inspection, the terms and conditions of this Lease shall control with respect to Landlord’s and Tenant’s respective maintenance and repair obligations), Tenant shall be solely responsible for the cost of Access Improvements to the Premises or the Building necessary to correct any such violations of construction-related accessibility standards identified by such Inspection as required by Requirements, which Access Improvements may, at Landlord’s option, be performed in whole or in part by Landlord at Tenant’s expense, payable as additional rent within thirty (30) days following Landlord’s demand. The terms of this Section 8.8 with respect to CASp inspections shall only apply in the event Tenant exercises its right to perform a CASp inspection of the Premises. Otherwise, the terms of the Lease, as amended hereby, with respect to compliance, repairs and maintenance obligations of the parties shall apply. |

{2119-01801/00809716;6}

Exhibit 10.2

|

|

independent contractor of Landlord or Landlord’s property manager (the “Service Provider”). If Tenant is subject to a charge under the Lease, as amended hereby, for any such service, then, at Landlord’s direction, Tenant will pay such charge either to Landlord for further payment to the Service Provider or directly to the Service Provider, and, in either case, (i) Landlord will credit such payment against additional Rent due from Tenant under the Lease, as amended hereby, for such service, and (ii) such payment to the Service Provider will not relieve Landlord from any obligation under the Lease, as amended hereby, concerning the provisions of such service. |

|

|

8.10 |

Redress for any claim against Landlord under the Lease and this Amendment shall be limited to and enforceable only against and to the extent of Landlord’s interest in the Building. The obligations of Landlord under the Lease are not intended to and shall not be personally binding on, nor shall any resort be had to the private properties of, any of its trustees or board of directors and officers, as the case may be, its investment manager, the general partners thereof, or any beneficiaries, stockholders, employees, or agents of Landlord or the investment manager, and in no case shall Landlord be liable to Tenant hereunder for any lost profits, damage to business, or any form of special, indirect or consequential damages. |

[Signature Page Follows]

{2119-01801/00809716;6}

Exhibit 10.2

IN WITNESS WHEREOF, Landlord and Tenant have entered into and executed this Amendment as of the date first written above.

|

LANDLORD: |

TENANT: |

|

|

|

|

POST-MONTGOMERY ASSOCIATES, a California general partnership

By:PR Post Montgomery LLC, Its:Partner

By:PRISA LHC, LLC, Its:Managing Member

By: /s/ Kristin Paul

By:The Prudential Insurance Company of America, a New Jersey corporation, acting solely on behalf of and for the benefit of, and with its liability limited to the assets of, its insurance company separate account, PRISA Its:Partner

By: /s/ Kristin Paul Name: Kristin Paul Title: Vice President |

STITCH FIX, INC., a Delaware corporation

By: /s/ Paul Yee Name: Paul Yee Title: CFO

|

{2119-01801/00809716;6}

EXHIBIT A – OUTLINE AND LOCATION OF SUITE 1000

attached to and made a part of the Amendment dated as of June 4, 2018, between

POST-MONTGOMERY ASSOCIATES, a California general partnership, as Landlord

and STITCH FIX, INC., a Delaware corporation, as Tenant

Exhibit A is intended only to show the general layout of the Suite 1000 as of the beginning of Expansion Effective Date. It does not in any way supersede any of Landlord’s rights set forth in the Lease with respect to arrangements and/or locations of public parts of the Building and changes in such arrangements and/or locations. It is not to be scaled; any measurements or distances shown should be taken as approximate.

SUITE 1000

{2119-01801/00809716;6}

A-