Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PARETEUM Corp | tv496141_8k.htm |

Exhibit 99.1

Proposed Acquisition of Artilium by Pareteum® June 8 th 2018 Cloud Connectivity Content

2 Pareteum® Corporation ( NYSE American: TEUM) © 2018 All rights reserved 2 Safe Harbor Statement Additional Information and Where to Find It INVESTORS AND STOCKHOLDERS OF THE COMPANY ARE URGED TO READ CAREFULLY THE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) FILED OR TO BE FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, THE ACQUISITION OF ARTILIUM (THE “ACQUISITION”), THE PROPOSED SHARE ISSUANCE AND RELATED MATTERS . Investors and stockholders will be able to obtain free copies of the Proxy Statement and other documents filed by the Company with the SEC at the SEC’s website at http : //www . sec . gov or at the Company’s website at https : //www . Pareteum . com/financial - reports - and - sec - filings . Participants in the Solicitation The Company and its directors, officers, employees and agents may be considered participants in the solicitation of proxies from the Company’s stockholders in respect of the Acquisition, including the issuance of shares of the Company’s Common Stock in relation to the Acquisition . Information about the Company’s directors and executive officers is set forth in the Company’s Annual Report on Form 10 - K for the year ended December 31 , 2017 which was filed with the SEC on March 30 , 2018 , and the Company’s proxy statement for its 2017 annual meeting of stockholders, which was filed with the SEC on July 27 , 2017 . Other information regarding potential participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement and other relevant documents when they become available . Forward - Looking Statements This presentation includes forward - looking statements within the meaning of Section 27 A of the Securities Act and Section 21 E of the Exchange Act . These forward - looking statements are based on current expectations and projections about future events . The Company’s actual results may differ materially from those discussed herein, or implied by, these forward - looking statements . Forward - looking statements are generally identified by words such as “believe,” “expect,” “anticipate,” “intend,” “estimate,” “plan,” “project,” “should,” “will,” “would,” “could,” “continue,” “likely” or the negative or plural of such words and other similar expressions . In addition, any statements that refer to expectations or other characterizations of future events or circumstances are forward - looking statements . The statements that contain these or similar words should be read carefully because these statements discuss the Company’s future expectations, contain projections of the Company’s future results of operations or of the Company’s financial position, business strategy, short - term and long - term business operations and objectives, financial needs and other “forward - looking” information . These forward - looking statements are subject to a number of risks, uncertainties and assumptions, including, without limitation : the risk that the Acquisition is not completed on a timely basis or at all ; the ability to integrate Artilium into the Company’s business successfully and the amount of time and expense spent and incurred in connection with the integration ; the possibility that competing offers will be made ; the risk that the economic benefits and other synergies that the Company’s management anticipates as a result of the Acquisition are not fully realized or take longer to realize than expected ; the risk that certain risks and liabilities associated with the Acquisition have not been discovered ; the risk that the approval of Artilium shareholders of the Acquisition or the requisite approval by the Company’s stockholders of the issuance of the new shares of Common Stock in relation to the Acquisition may not be obtained or that other conditions of the Acquisition will not be satisfied ; changes in global or local political, economic, business, competitive, market and regulatory forces ; changes in exchange and interest rates ; changes in tax and other laws or regulations ; future business combinations or disposals ; operating costs, customer loss and business disruption (including difficulties in maintaining relationships with employees, customers or suppliers) occurring prior to completion of the Acquisition or if the Acquisition is not completed at all ; changes in the market price of shares of the Company or Artilium ; and changes in the economic and financial conditions of the businesses of the Company or Artilium . The foregoing does not represent an exhaustive list of risks . Additional factors are described in the Company’s public filings with the SEC, and other factors will be described in the Proxy Statement . Moreover, the Company operates in a very competitive and rapidly changing environment . New risks emerge from time to time . It is not possible for the Company’s management to predict all risks, nor can the Company assess the impact of all factors on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward - looking statements the Company may make . In light of these risks, uncertainties and assumptions, the future events and trends discussed in this presentation may not occur and actual results could differ materially and adversely from those anticipated or implied in the information in this presentation . Any forward - looking statements in this presentation are not guarantees of future performance, and actual results, developments and business decisions may differ from those contemplated by those forward - looking statements, possibly materially . Accordingly, you should not place undue reliance on any such forward - looking statements . All forward - looking statements included in this presentation are based on information available to the Company management on the date of such information . Except to the extent required by applicable laws or rules, the Company undertakes no obligation to publicly update or revise any forward - looking statement, whether as a result of new information, future events or otherwise . All subsequent written and oral forward - looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by the cautionary statements contained throughout this presentation . No Profit Forecast Other than in respect of the Pareteum profit forecast as expressly set forth in the Rule 2 . 7 announcement, no statement in this presentation is intended as a profit forecast or estimate for any period and no statement in this presentation should be interpreted to mean that earnings or earnings per ordinary share for Artilium or the Company for the current or future financial years would necessarily match or exceed the historical published earnings or earnings per ordinary share for Artilium or the Company . Responsibility Statement Required by the UK Takeover Code Each of the Company’s directors accepts responsibility for the information contained in this report relating to the Company and the Company’s directors and their respective immediate families and related trusts . To the best of the knowledge and belief of the Company’s directors (who have taken all reasonable care to ensure that such is the case), the information contained in this report for which they are responsible is in accordance with the facts and does not omit anything likely to affect the import of such information .

3 Pareteum® Corporation ( NYSE American: TEUM) © 2018 All rights reserved 3 UK Takeover Code Statement & Glossary UK Takeover Code Statement Glossary • An acquisition of a UK public company is subject to the rules of The City Code on Takeovers and Mergers (the “ Code ”) issued by the UK Panel on Takeovers and Mergers. • This presentation in relation to the proposed acquisition of Artilium by Pareteum (the “ Acquisition ”) complies with the Code. • Rule 28 of the Code requires that any profit forecasts or quantified financial benefits statements (as defined in the “ Code ”) made in connection with a takeover offer must be supported by public reports from a reporting accountant and financial adviser. • In this presentation Pareteum will not make any profit forecasts or quantified financial benefits statements that require suc h p ublic third party reports under Rule 28 of the Code. Scheme of Arrangement: • A scheme of arrangement is a mechanism provided by the UK Companies Act 2006 (sections 895 to 899) under which a takeover can be effected by the passing of resolutions by target shareholders and with the approval of the High Court. • A scheme must be sanctioned by the High Court and also approved by a majority in number of each class of shareholders whose s har es are the subject of a proposed scheme and who are voting at the meeting. That majority must also represent 75% or more of those shares. • Once approved by shareholders and the High Court, a scheme will be binding on the company and all shareholders, regardless of wh ether or not they voted in favor, once a copy of the court order is filed at Companies House. Proxy Statement: • The proxy statement on Schedule 14A, otherwise known as a Form DEF 14A (Definitive Proxy Statement), is filed with the U.S. S ecu rities and Exchange Commission (“ SEC ”) in advance of a stockholder meeting. • The Company expects to file and mail a proxy statement to its stockholders in connection with a proposal for stockholder appr ova l of the proposed issuance of shares of the Company’s Common Stock in relation to the Acquisition.

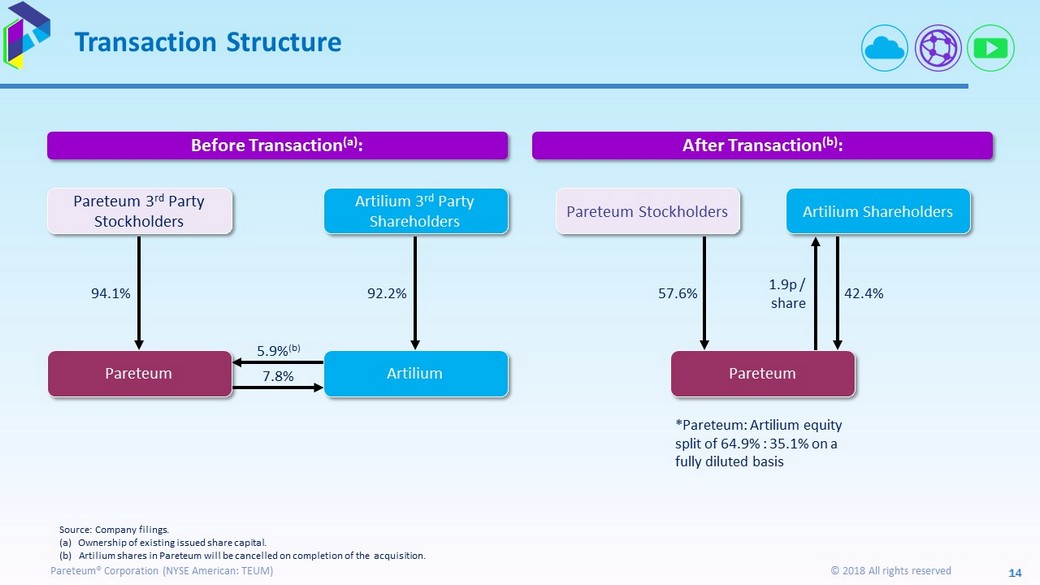

4 Pareteum® Corporation ( NYSE American: TEUM) © 2018 All rights reserved 4 Transaction Overview Recommended Acquisition of Artilium PLC by Pareteum Corporation • Fixed exchange ratio of 0.1016 Pareteum Common Stock per Artilium Share and 1.9p in cash per Artilium Share held by shareholders other than Pareteum, representing an implied offer price of 19.55p per Artilium Share (1) and a fully diluted equity value for Artilium of approximately $104.7 million (or £78.0 million) (2) • Pareteum stockholders to own 57.6% and Artilium shareholders to own 42.4% of Pareteum’s issued Common Stock on completion • Pareteum stockholders to own 64.9% and Artilium shareholders to own 35.1% of Pareteum’s fully diluted share capital on completion • Artilium’s existing shareholding in Pareteum will be cancelled upon completion • Implied offer price of 19.55p represents a premium of 18.5% to Artilium’s closing price of 16.50p on 6 June 2018 and 4.3x Enterprise Value / LTM 31 - Dec - 17 revenue (3) Purchase Price Fully Financed • Cash portion of consideration fully funded with cash on hand • No external financing Financial Impact • Expected to be significantly accretive to Pareteum Non - GAAP EPS in FY2019 (4) • Strong growth in pro - forma operating cashflow generation • Material cost and revenue synergies Uniting Two Leading Cloud Technology Companies

5 Pareteum® Corporation ( NYSE American: TEUM) © 2018 All rights reserved 5 Transaction Overview (Continued) Recommended Acquisition of Artilium by Pareteum Management Implementation, Approvals & Closing • Robert ‘Hal’ Turner continues as Executive Chairman & Principal Executive Officer • Vic Bozzo continues as Chief Executive Officer • Bart Weijermars to become Chief Executive Officer of Pareteum Europe & Artilium • Transaction to be implemented by way of a UK Scheme of Arrangement ; expected completion in September 2018 • Transaction subject to Pareteum stockholder and Artilium shareholder approvals and other customary conditions • Pareteum has received irrevocable undertakings from Artilium shareholders to vote in favor of the Scheme of Arrangement in respect of 215,433,992 shares (60.7% of issued Ordinary Shares) Exchange Listing • Pareteum will maintain listing on the NYSE American under the symbol TEUM; Artilium’s UK AIM listing will be cancelled Uniting Two Leading Cloud Technology Companies

6 Pareteum® Corporation ( NYSE American: TEUM) © 2018 All rights reserved 6 Compelling Strategic Rationale A Transformational and Value Enhancing Combination • Enhanced ability to acquire new customers with expanded product set • Significant potential to monetize customer bases through cross - sell and upsell • A larger platform from which to expand into new markets Expansion • Carrier fee and cloud cost economies of scale • Reduction in corporate overheads and capital expenditures • Reinvestment of cost savings to support further growth Scale • Enhanced financial profile with which to access the capital markets • Greater visibility with the investor community • Enhanced liquidity for Artilium shareholders Capital • Strong platform for acquisitions and market consolidation • Significant pipeline of potential add - on M&A • Combined company will be the buyer of choice for many sellers Platform

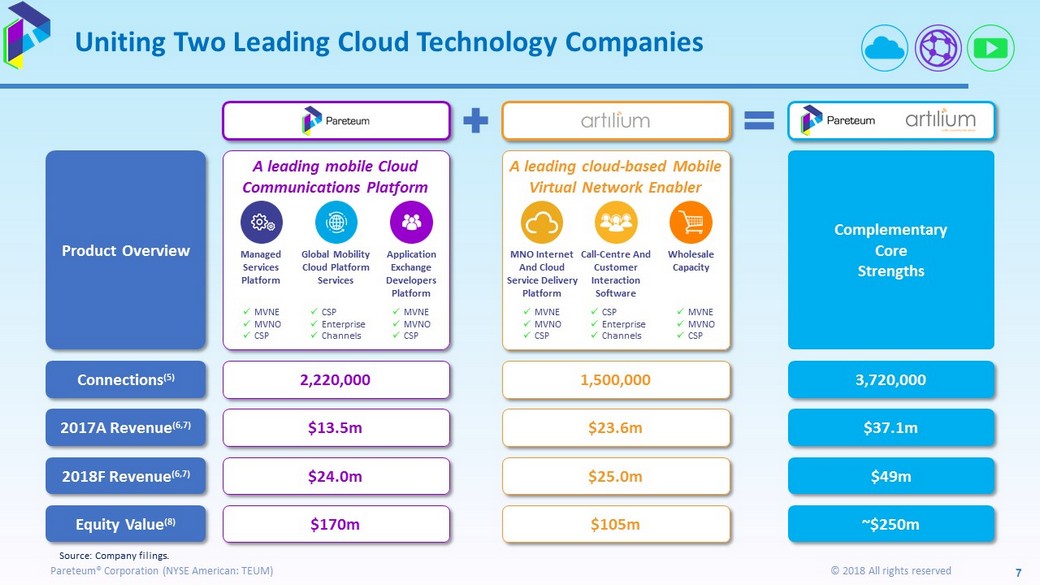

7 Pareteum® Corporation ( NYSE American: TEUM) © 2018 All rights reserved 7 Uniting Two Leading Cloud Technology Companies Connections (5) 3,720,000 1,500,000 2,220,000 2017A Revenue (6,7) $37.1m $23.6m $13.5m Equity Value (8) ~$250m $105m $170m 2018F Revenue (6,7) $49m $25.0m $24.0m Product Overview Complementary Core Strengths A leading mobile Cloud Communications Platform Managed Services Platform Global Mobility Cloud Platform Services Application Exchange Developers Platform x MVNE x MVNO x CSP x CSP x Enterprise x Channels x MVNE x MVNO x CSP A leading cloud - based Mobile Virtual Network Enabler MNO Internet And Cloud Service Delivery Platform Call - Centre And Customer Interaction Software Wholesale Capacity x MVNE x MVNO x CSP x CSP x Enterprise x Channels x MVNE x MVNO x CSP Source: Company filings.

8 Pareteum® Corporation ( NYSE American: TEUM) © 2018 All rights reserved 8 Combination to Create a Global Leader in Mobile Cloud Communications Solutions Asia Pacific 4,820m Africa 1,770m Latin America 770m North America 430m Europe 1,190m LIBERTY GLOBAL $ 18 B Revenue 50.8 M Homes Passed 24.7 M Fixed - line Subs. 59.6 M Video, Internet, and Fixed - line Telephony Subs 10.1 M WIFI Access Points 10.1 M Mobile Subs. 41,002 Employees $62 . 5 B Revenue 50 Add. Countries Partnerships 26 Country Operations 25 M Mobile Money Subs. 38 M IoT Connections 9.5 M TV Subscribers 13 M Fixed Broadband 469.7 M Connections 111,556 Employees 8.8bn Worldwide Mobile Subscriptions By 2023; 31.6bn Worldwide IoT Connections By 2023 (9)

9 Pareteum® Corporation ( NYSE American: TEUM) © 2018 All rights reserved 9 Pareteum - Artilium Alliance: Q4 2017 - Q1 2018: 24 weeks so far… Closed Transactions… Joint Sales… Always Be Closing… $108M 36M - CRB (10) value $68.4M 36M - CRB (10) value $39.6M 36M - CRB (10) value 18 Opportunities 11 Pending Sales 7 Sales Wins Service Suite Customer Application Case MSP + Connectivity + WIFI Global CSP Global Traveler Tracker: CSP Productivity Efficiency “ware” GCSP + Connectivity + e - commerce Full Service Virtual Mobile Provider Multi - use for Chinese Nationals taking their brand to anywhere in the world GCSP + Connectivity + WIFI Rural Wireless Internet Service Provider Untethering their customers from the cable company GCSP + Connectivity + Messaging Marketing Platform Company Helping retail enterprises to target customer needs based on location GCSP + Connectivity + WIFI + e - commerce Streaming Media Content and Cable Company Taking a powerful cable station brand directly to wireless subscribers GCSP + Connectivity Social Media and Gaming Portal Enabling developers to add mobile communication services with simple super API GCSP + Connectivity + WIFI National Mobile Virtual Network Enabler Speed to market for instant mobile plans for consumers 3 Managed Service Platform • Mobile Network Operators – launching branded cellular, triple/quad play media & enterprise broadband services 15 Global Cloud Services • CSP’s, Businesses, and Developers: Internet of Things; Banks, Industrial and IT managing wireless devices requiring connectivity and messaging capabilities • Affinity Marketing Branded Services: requiring connectivity and messaging • Social media & computer gaming: requiring connectivity and messaging • New opportunities added to pipeline regularly and with increasing frequency • Highly qualified/advanced sales cycle stages: • 3 Managed Services Platform • 4 Global Cloud Services • 4 Social media & computer gaming

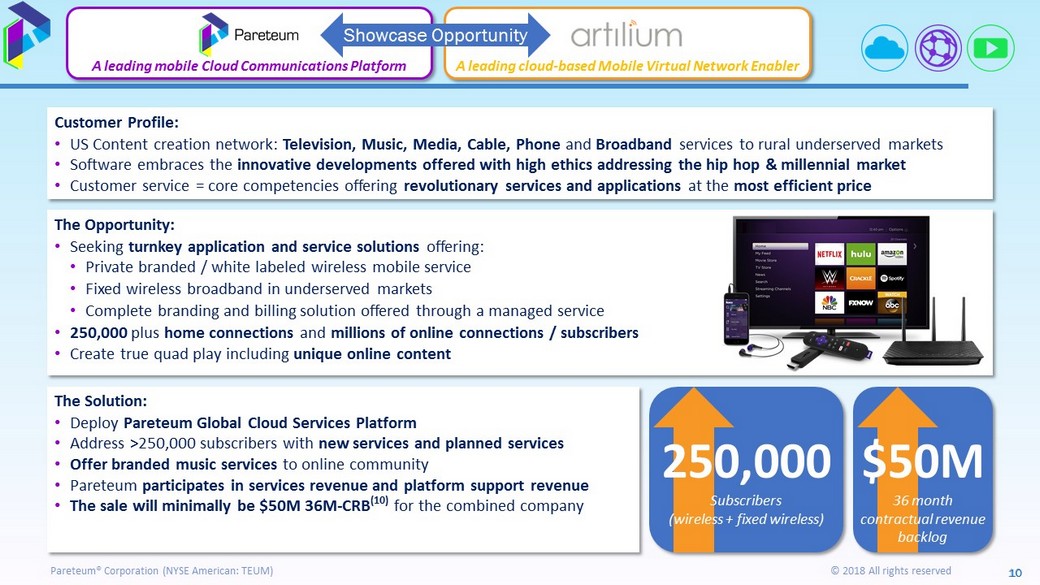

10 Pareteum® Corporation ( NYSE American: TEUM) © 2018 All rights reserved 10 Project Bird Use Case A leading mobile Cloud Communications Platform A leading cloud - based Mobile Virtual Network Enabler Showcase Opportunity Customer Profile: • US Content creation network: Television, Music, Media, Cable, Phone and Broadband services to rural underserved markets • Software embraces the innovative developments offered with high ethics addressing the hip hop & millennial market • Customer service = core competencies offering revolutionary services and applications at the most efficient price The Opportunity: • Seeking turnkey application and service solutions offering: • Private branded / white labeled wireless mobile service • Fixed wireless broadband in underserved markets • Complete branding and billing solution offered through a managed service • 250,000 plus home connections and millions of online connections / subscribers • Create true quad play including unique online content 250,000 Subscribers (wireless + fixed wireless) $50M 36 month contractual revenue backlog The Solution: • Deploy Pareteum Global Cloud Services Platform • Address >250,000 subscribers with new services and planned services • Offer branded music services to online community • Pareteum participates in services revenue and platform support revenue • The sale will minimally be $50M 36M - CRB (10) for the combined company

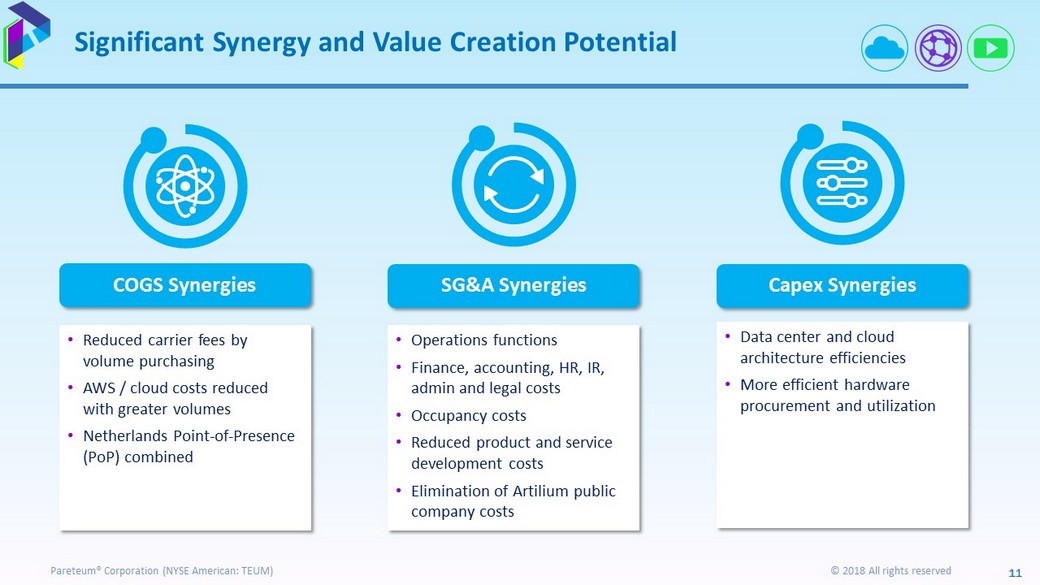

11 Pareteum® Corporation ( NYSE American: TEUM) © 2018 All rights reserved 11 Significant Synergy and Value Creation Potential • Reduced carrier fees by volume purchasing • AWS / cloud costs reduced with greater volumes • Netherlands Point - of - Presence (PoP) combined COGS Synergies • Operations functions • Finance, accounting, HR, IR, admin and legal costs • Occupancy costs • Reduced product and service development costs • Elimination of Artilium public company costs SG&A Synergies • Data center and cloud architecture efficiencies • More efficient hardware procurement and utilization Capex Synergies

12 Pareteum® Corporation ( NYSE American: TEUM) © 2018 All rights reserved 12 Highly Experienced Management Team Significant Experience in Innovative Communications Technologies • Current Executive Chairman and Principal Executive Officer of Pareteum, Founder of the business • Founder of Turner Telecom Holdings Group • Senior positions at AT&T; NeoNova Network Services; Pac West Telecomm; Panterra Networks; PTT Telecom Netherlands (now KPN); and BellSouth Communications (now AT&T) Robert H. Turner: Executive Chairman & Principal Executive Officer • Current Chief Executive Officer of Pareteum, co - founder of the business • Previously Senior Vice President, Worldwide Sales and Marketing for Telarix • Former President and General Manager of Pac - West’s Emerging Technologies division Victor Bozzo: CEO • Current Chief Executive Officer of Artilium • Previously CEO of T - Mobile Netherlands • Prior roles at Eircom and KPN Mobile Bart Weijermars: CEO of Pareteum Europe BV & Artilium

13 Pareteum® Corporation ( NYSE American: TEUM) © 2018 All rights reserved 13 Financially Compelling Transaction • Estimated combined company FY2018F revenues of $49.0m (6,7) • Expected to be significantly accretive to Pareteum projected Non - GAAP EPS in FY2019 (3) • Strong growth in pro - forma operating cashflow generation • COGS: Reduced carrier fees and cloud costs • SG&A: Operations and central costs reduction; public company costs • Capex: Hardware usage / procurement efficiencies • Opening net cash position Increased Scale 1 Significant Earnings Accretion 2 Material Cost Synergy Opportunities 3 Strong Capital Structure, Post Transaction 4

14 Pareteum® Corporation ( NYSE American: TEUM) © 2018 All rights reserved 14 Transaction Structure Source: Company filings. (a) Ownership of existing issued share capital. (b) Artilium shares in Pareteum will be cancelled on completion of the acquisition. Before Transaction (a) : After Transaction (b) : 5.9% (b) 7.8% 94.1% Pareteum 3 rd Party Stockholders Pareteum 92.2% Artilium 3 rd Party Shareholders Artilium Pareteum Pareteum Stockholders *Pareteum: Artilium equity split of 64.9% : 35.1% on a fully diluted basis 57.6% 42.4% 1.9p / share Artilium Shareholders

15 Pareteum® Corporation ( NYSE American: TEUM) © 2018 All rights reserved 15 Transaction Financing Pareteum to Acquire Artilium for 0.1016x Pareteum Shares plus 1.9p per Artilium Share (a) Uses Amount ($’m) Pareteum e quity to Artilium 3 rd party shareholders 86.9 Cash to Artilium 3 rd party shareholders 8.9 Pareteum existing ownership of Artilium 7.3 Roll Artilium debt (b) 0.4 Combined f ees and expenses (c) 6.6 Total 110.1 Source: Company filings. (a) GBP; Offer excludes 27.7 million Artilium shares already owned by Pareteum . (b) Artilium debt estimated as of 31/08/2018. (c) Estimated as at 6 June 2018. Sources Amount ($’m) Pareteum equity to Artilium 3 rd party shareholders 86.9 Pareteum existing ownership of Artilium 7.3 Cash from combined balance sheet 15.5 Roll Artilium debt (b) 0.4 Total 110.1

16 Pareteum® Corporation ( NYSE American: TEUM) © 2018 All rights reserved 16 Conclusion Complements and extends Pareteum’s geographic footprint in Europe Combination Enables Pareteum to Cement its Leadership Position in Cloud Communications 1 Enhances product set to better serve both Pareteum and Artilium customers 2 Significant potential to monetize customer bases through cross - sell and upsell 3 A larger platform from which to expand into new markets and pursue further acquisition opportunities 4 Significant synergy and value creation potential which will enhance stockholder value 5

Appendix

18 Pareteum® Corporation ( NYSE American: TEUM) © 2018 All rights reserved 18 Bases Item Bases Comments: Pareteum stock price $2.33 As at 6 th June 2018 Artilium share price £0.1650 As at 6 th June 2018 Pareteum basic number of Common Stock 54,664,827 Pareteum fully diluted number of Common Stock 73,061,783 Artilium existing holding of Pareteum Common Stock 3,200,332 Artilium existing basic number of Ordinary Shares 354,891,582 Artilium existing fully diluted number of Ordinary Shares 399,109,292 Pareteum existing holding of Artilium Ordinary Shares 27,695,177 Pareteum consideration stock to be issued 37,314,805 USD : EUR 0.8493 As at 6 th June 2018 USD : GBP 0.7455 As at 6 th June 2018 EUR : GBP 0.8778 As at 6 th June 2018 USD : EUR Parrot long - term business plan rate 0.8000 Used to convert Albatross financials into USD

19 Pareteum® Corporation ( NYSE American: TEUM) © 2018 All rights reserved 19 Footnotes (1) GBP ; based on Pareteum closing share price of $ 2 . 33 and USD : GBP of 0 . 7455 on 6 June 2018 . (2) The Equity Value of the acquisition is based on the fully diluted share capital of Artilium of 399 , 109 , 292 multiplied by the implied offer price . This amount is then converted into USD at USD : GBP 0 . 7455 which represents the spot rate for 6 June 2018 . (3) Calculated by dividing the implied Enterprise Value of the acquisition of £ 70 . 63 m by Artilium’s pro forma revenue for the twelve months ended 31 December 2017 of £ 16 . 54 m . The Enterprise Value of the acquisition is based on the fully diluted share capital of Artilium of 399 , 109 , 292 multiplied by the implied offer price, plus total debt of £ 0 . 73 m as at 31 December 2017 , minus cash of £ 2 . 56 m as at 31 December 2017 , minus £ 5 . 56 m, being the value of Artilium’s investment in Pareteum as at 6 June 2018 . Artilium’s pro forma revenue for the twelve months ended 31 December 2017 is stated pro forma for the Interactive Digital Media GmbH acquisition and is converted into GBP at EUR : GBP fx rate of 0 . 8765 which represents the average exchange rate for 2017 . (4) Based on Pareteum projected Non - GAAP earnings per share for the financial year ended 31 December 2019 and onwards . Non - GAAP EPS excludes stock compensation expense, amortization of intangible assets, restructuring charges, acquisition, integration, other one - time items and their related income tax effect . The statement that the Acquisition is expected to be earnings accretive is not intended as a profit forecast and should not be construed as such, and is not subject to the requirements of Rule 28 of the Takeover Code . The statement should not be interpreted to mean that the earnings per share in any future financial period will necessarily match or be greater than those for the relevant preceding financial period . (5) Data as of 31 March 2018 for Pareteum ; Data as of 27 May 2018 for Artilium (6) Pareteum financials presented for the financial year ended 31 December . 2018 F based on management estimates . (7) Artilium financials calendarized to 31 December and excluding impact of purchase accounting adjustments ; 2017 A financials presented on pro - forma basis, inclusive of IDM acquisition ; financials converted into USD at Parrot long term business plan rate of USD : EUR = 0 . 8000 . 2018 F based on management estimates . (8) Pareteum equity value calculated on a fully diluted basis ; Artilium equity value calculated on a fully diluted basis based on offer terms ; combined equity value presented based on fully diluted shares outstanding pro forma for the transaction . (9) June 2018 Ericsson Mobility Report . (10) 36 M - CRB denotes 36 - month contractual revenue backlog .