Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ICAHN ENTERPRISES L.P. | tv496196_8k.htm |

Exhibit 99.1

Icahn Enterprises L.P. Investor Presentation June 2018

Forward - Looking Statements and Non - GAAP Financial Measures Forward - Looking Statements This presentation contains certain statements that are, or may be deemed to be, “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . All statements included herein, other than statements that relate solely to historical fact, are “forward - looking statements . ” Such statements include, but are not limited to, any statement that may predict, forecast, indicate or imply future results, performance, achievements or events, or any statement that may relate to strategies, plans or objectives for, or potential results of, future operations, financial results, financial condition, business prospects, growth strategy or liquidity, and are based upon management’s current plans and beliefs or current estimates of future results or trends . Forward - looking statements can generally be identified by phrases such as “believes,” “expects,” “potential,” “continues,” “may,” “should,” “seeks,” “predicts,” “anticipates,” “intends,” “projects,” “estimates,” “plans,” “could,” “designed,” “should be” and other similar expressions that denote expectations of future or conditional events rather than statements of fact . Our expectations, beliefs and projections are expressed in good faith and we believe that there is a reasonable basis for them . However, there can be no assurance that these expectations, beliefs and projections will result or be achieved . There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward - looking statements contained in this presentation . These risks and uncertainties are described in our Annual Report on Form 10 - K for the year ended December 31 , 2017 and our Quarterly Report on Form 10 - Q for the quarter ended March 31 , 2018 . There may be other factors not presently known to us or which we currently consider to be immaterial that may cause our actual results to differ materially from the forward - looking statements . All forward - looking statements attributable to us or persons acting on our behalf apply only as of the date of this presentation and are expressly qualified in their entirety by the cautionary statements included in this presentation . Except to the extent required by law, we undertake no obligation to update or revise forward - looking statements to reflect events or circumstances after the date such statements are made or to reflect the occurrence of unanticipated events . Non - GAAP Financial Measures This presentation contains certain non - GAAP financial measures, including EBITDA, Adjusted EBITDA and Indicative Net Asset Value . The non - GAAP financial measures contained herein have limitations as analytical tools and should not be considered in isolation or in lieu of an analysis of our results as reported under U . S . GAAP . These non - GAAP measures should be evaluated only on a supplementary basis in connection with our U . S . GAAP results, including those reported in our consolidated financial statements and the related notes thereto contained in our Annual Report on Form 10 - K for the year ended December 31 , 2017 and our Quarterly Report on Form 10 - Q for the quarter ended March 31 , 2018 . A reconciliation of these non - GAAP financial measures to the most directly comparable GAAP financial measures can be found in the back of this presentation .

Company Overview 3

Overview of Icahn Enterprises Icahn Enterprises L.P. is a diversified holding company with operating segments in Investment, Automotive, Energy, Gaming, Mi nin g, Railcar, Food Packaging, Metals, Real Estate and Home Fashion IEP is majority owned and controlled by Carl Icahn – Over many years, Carl Icahn has contributed most of his businesses to and executed transactions primarily through IEP – As of March 31, 2018, Carl Icahn and his affiliates owned approximately 91.0% of IEP’s outstanding depositary units IEP benefits from cash flows from its subsidiaries: – CVR Energy: $3.00 per share annualized dividend – American Railcar Inc: $1.60 per share annual dividend – Recurring cash flows from our Real Estate segment IEP has daily liquidity through its ability to redeem its investment in the funds on a daily basis IEP has a $7.00 annual distribution (10.2% yield as of May 31, 2018 ) (1) Investment segment total assets represents book value of equity 4 ($ millions) As of March 31, 2018 Segment Assets Revenue Net Income Attrib. to IEP Adj. EBITDA Attrib. to IEP Investment (1) $8,099 $868 $264 $319 Automotive 11,031 10,687 573 775 Energy 4,705 5,997 267 234 Metals 240 424 (42) 21 Railcar 1,487 2,234 1,177 158 Gaming 1,146 969 66 156 Mining 272 82 - 9 Food Packaging 533 395 (9) 45 Real Estate 887 594 526 53 Home Fashion 185 178 (22) (9) Holding Company 617 94 (215) 59 Total $29,202 $22,522 $2,585 $1,820 Twelve Months Ended March 31, 2018

66% CVR Energy Inc. (NYSE: CVI) Summary Corporate Organizational Chart WestPoint Home LLC PSC Metals Inc. AREP Real Estate Holdings, LLC Tropicana Entertainment Inc. (OTCPK:TPCA) Federal - Mogul LLC Icahn Enterprises G.P. Inc. Icahn Enterprises L.P. (NasdaqGS: IEP) Icahn Enterprises Holdings L.P. 1% 1% 99% LP Interest 34% 79% 100% 82% American Railcar Industries, Inc. (NasdaqGS:ARII) Icahn Capital LP Viskase Companies Inc. (OTCPK:VKSC) As of March 31, 2018, Icahn Enterprises had investments with a fair market value of approximately $3.2 billion in the Investment Funds One of the largest independent metal recycling companies in the US Consists of rental commercial real estate, property development and associated resort activities Provider of home textile products for nearly 200 years One of the worldwide leaders in cellulosic, fibrous and plastic casings for processed meat industry Holding company that owns substantial interests in two separate operating subsidiaries Multi - jurisdictional gaming company with eight casinos in New Jersey, Indiana, Nevada, Mississippi, Missouri, Louisiana and Aruba Leading North American manufacturer of hopper and tank railcars and provider of railcar repair and maintenance services 84% 100% 100% 62% Producer and distributer of nitrogen fertilizer products CVR Partners, LP (NYSE: UAN) CVR Refining, LP (NYSE: CVRR) 185k bpd capacity oil refining company in the mid - continent region of the United States 100% 100% 4% Leading global supplier to the automotive, aerospace, energy, heavy duty truck, industrial, marine, power generation and auto aftermarket industries Note: Percentages denote equity ownership as of March 31, 2018. Excludes intermediary and pass through entities. 5 Ferrous Resources Brazilian iron ore producer Icahn Automotive Group LLC Engaged in the distribution of automotive parts in the aftermarket as well as providing automotive services 100% 77%

Diversified Subsidiary Companies with Significant Inherent Value The Company’s diversification across multiple industries and geographies provides a natural hedge against cyclical and general economic swings Global market leader in each of its principal product categories with a long history of quality and strong brand names Geographically diverse, regional properties in major gaming markets with significant consolidation opportunities 200 year heritage with some of the best known brands in home fashion; consolidation likely in fragmented sector Leading global market position in non - edible meat casings poised to capture further growth in emerging markets Established regional footprint positioned to actively participate in consolidation of the highly fragmented scrap metal market A leading, vertically integrated manufacturer of railcars, railcar services and railcar leasing. Strategically located mid - continent petroleum refiner and nitrogen fertilizer producer generating record profitability Long - term real estate investment horizon with strong, steady cash flows AREP Real Estate Holdings, LLC IEP’s subsidiary companies possess key competitive strengths and / or leading market positions IEP seeks to create incremental value by investing in organic growth and targeting businesses that offer consolidation opport uni ties ─ Capitalize on attractive interest rate environment to pursue acquisitions and recognize meaningful synergies 6 A Brazilian iron ore mining operation that supplies iron ore products to the global steel industry Engaged in the distribution of automotive parts in the aftermarket as well as providing automotive services

IEP began as American Real Estate Partners, which was founded in 1987, and has grown its diversified portfolio to ten operati ng segments and approximately $30 billion of assets as of March 31, 2018 IEP has demonstrated a history of successfully acquiring undervalued assets and improving and enhancing their operations and fin ancial results IEP’s record is based on a long - term horizon that can enhance business value and facilitate a profitable exit strategy ─ In 2006, IEP sold its oil and gas assets for $1.5 billion, resulting in a net pre - tax gain of $0.6 billion ─ In 2008, IEP sold its investment in American Casino & Entertainment Properties for $1.2 billion, resulting in a pre - tax gain of $0.7 billion ─ In 2017, IEP sold American Railcar Leasing for $3.4 billion and recognized a pre - tax gain of $1.7 billion ─ In 2018, IEP announced the sale of Federal - Mogul for $5.4 billion and Tropicana for $1.85 billion Acquired partnership interest in Icahn Capital Management L.P. in 2007 ─ IEP and certain of Mr. Icahn's wholly owned affiliates are the sole investors in the Investment Funds IEP also has grown the business through organic investment and through a series of bolt - on acquisitions ─ Acquired Pep Boys in 2016 Evolution of Icahn Enterprises Timeline of Recent Acquisitions and Exits (1) Market capitalization as of March 31, 2018 and balance sheet data as of March 31, 2018. As of December 31, 2008 Mkt. Cap: $1.9bn Total Assets: $18.8bn Current (1) Mkt. Cap: $9.9bn Total Assets: $30.5bn American Railcar Industries 1/15/10: 54.4% of ARI’s shares outstanding were contributed by Carl Icahn in exchange for IEP depositary units Tropicana Entertainment 11/15/10: Received an equity interest as a result of a Ch.11 restructuring and subsequently acquired a majority stake CVR Energy 5/4/12: Acquired a majority interest in CVR via a tender offer to purchase all outstanding shares of CVR Viskase 1/15/10: 71.4% of Viskase’s shares outstanding were contributed by Carl Icahn in exchange for IEP depositary units Year: 7 CVR Refining & CVR Partners 2013: CVR Refining completed IPO and secondary offering. CVR Partners completed a secondary offering 2018 2009 2010 2011 2012 2013 American Railcar Leasing 10/2/13: Acquired 75% of ARL from companies wholly owned by Carl Icahn 2014 2015 IEH Auto Parts Holding 6/1/15: Acquired substantially all of the auto part assets in the U.S. of Uni - Select Inc. Ferrous Resources 6/8/15: IEP acquired a controlling interest in Ferrous Resources 2016 Pep Boys 2/4/16: IEP acquired Pep Boys 2017 American Railcar Leasing 2017: Sale of ARL for $3.4 billion and a pre - tax gain of $1.7 billion Federal - Mogul 4/10/18: Announced the sale of Federal - Mogul for approximately $5.4 billion Tropicana 4/16/18: Announced the sale of Tropicana for approximately $1.85 billion

IEP seeks undervalued companies and often becomes “actively” involved in the targeted companies Activist strategy requires significant capital, rapid execution and willingness to take control of companies Implement changes required to improve businesses Ability to Maximize Shareholder Value Through Proven Activist Strategy Purchase of Stock or Debt IEP pursues its activist strategy and seeks to promulgate change x Dealing with the board and management x Proxy fights x Tender offers x Taking control With over 300 years of collective experience, IEP’s investment and legal team is capable of unlocking a target’s hidden value x Financial / balance sheet restructuring x Operation turnarounds x Strategic initiatives x Corporate governance changes Mr. Icahn and Icahn Capital have a long and successful track record of generating significant returns employing the activist str ategy ─ IEP’s subsidiaries often started out as investment positions in debt or equity either directly by Icahn Capital or Mr. Icahn Putting Activism into Action 8

Situation Overview Historically, two businesses had a natural synergy ─ Motorparts benefitted from OEM pedigree and scale Review of business identified numerous dis - synergies by having both under one business ─ Different customers, methods of distribution, cost structures, engineering and R&D, and capital requirements Structured as a C - Corporation ─ Investors seeking more favorable alternative structures Review of business identifies opportunity for significant cash flow generation ─ High quality refiner in underserved market ─ Benefits from increasing North American oil production ─ Supported investment in Wynnewood refinery and UAN plant expansion Strong investor appetite for yield oriented investments Strategic / Financial Initiative Adjusted business model to separate Powertrain and Motorparts into two separate businesses Contributed assets to a separate MLP and subsequently launched CVR Refining IPO and secondary offerings; completed CVR Partners secondary offering Result Separation improved management focus for the respective segments CVR Energy stock up approximately 86.6%, including dividends, from tender offer price of $30.00 (1) Significant Experience Optimizing Business Strategy and Capital Structure IEP’s management team possesses substantial strategic and financial expertise ─ Maintains deep knowledge of capital markets, bankruptcy laws, mergers and acquisitions and transaction processes Active participation in the strategy and capital allocation for targeted companies ─ Not involved in day - to - day operations IEP will make necessary investments to ensure subsidiary companies can compete effectively Select Examples of Strategic and Financial Initiatives (1) Based on CVR Energy’s stock price as of March 31, 2018 and the $30 tender offer price which closed in May 2012. 9

Deep Team Led by Carl Icahn Led by Carl Icahn ─ Substantial investing history provides IEP with unique network of relationships and access to Wall Street Team consists of approximately 20 professionals with diverse backgrounds ─ Well rounded team with professionals focusing on different areas such as equity, distressed debt and credit Name Title Years at Icahn Years of Industry Experience Keith Cozza President & Chief Executive Officer , Icahn Enterprises L.P. 13 16 SungHwan Cho Chief Financial Officer , Icahn Enterprises L.P. 12 20 Courtney Mather Portfolio Manager, Icahn Capital 4 18 Richard Mulligan Portfolio Manager, Icahn Capital 1 38 Nick Graziano Portfolio Manager, Icahn Capital 3 23 Brett Icahn Consultant, Icahn Enterprises L.P. 13 13 Jesse Lynn General Counsel, Icahn Enterprises L.P. 14 22 Andrew Langham General Counsel, Icahn Enterprises L.P. 13 18 10

Overview of Operating Segments 11

Highlights and Recent Developments Since inception in 2004 through March 31, 2018, the Investment Funds’ cumulative return was approximately 132.0%, representing an annualized rate of return of approximately 6.5% Long history of investing in public equity and debt securities and pursuing activist agenda Employs an activist strategy that seeks to unlock hidden value through various tactics ─ Financial / balance sheet restructurings (e.g., CIT Group, Apple) ─ Operational turnarounds (e.g., Motorola, Navistar) ─ Strategic initiatives (e.g., Motorola, eBay, Manitowoc) ─ Corporate governance changes (e.g., eBay, Gannet) As of March 31, 2018, the Investment Funds’ had a net long notional exposure of 18% Segment: Investment Company Description IEP invests its proprietary capital through various private investment funds (the “Investment Funds”) managed by the Investment segment Fair value of IEP’s interest in the Investment Funds was approximately $3.2 billion as of March 31, 2018 IEP has daily liquidity through its ability to redeem its investment in the Investment Funds on a daily basis Historical Segment Financial Summary 12 (1) Balance Sheet data as of the end of each respective fiscal period. (2) Represents a weighted - average composite of the gross returns, net of expenses for the Investment Funds. (3) 2012 gross return assumes that IEP’s holdings in CVR Energy remained in the Investment Funds for the entire period. IEP obta ine d a majority stake in CVR Energy in May 2012. Investment Funds returns were approximately 6.6% when excluding returns on CVR Energy after it became a consolidated entity. (4) For the three months ended March 31, 2018 33.3% 15.2% 34.5% 20.2% 30.8% (7.4%) (18.0%) (20.3%) 2.1% 5.3% 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Historical Returns (2) (3) (4) Investment Segment LTM March 31, ($ millions) 2015 2016 2017 2018 Select Income Statement Data: Total revenues ($865) ($1,223) $297 $868 Net income (loss) (1,665) (1,487) 118 711 Net income (loss) attrib. to IEP (760) (604) 80 264 Select Balance Sheet Data (1) : Total equity $7,541 $5,396 $7,417 $8,099 Equity attributable to IEP 3,428 1,669 3,052 3,214 FYE December 31,

Highlights and Recent Developments Strategic location and complex refineries allows CVR to benefit from access to price advantaged crude oil CVR Partners acquired an additional fertilizer plant in April 2016, giving it geographic and feed stock diversity CVR Energy increased dividend to an annualized $3.00 per unit ─ CVR Refining declared distributions of $0.51 per common unit for the three months of operations in 2018 Segment: Energy Company Description CVR Energy, Inc. (NYSE:CVI) operates as a holding company that owns majority interests in two separate operating subsidiaries: CVR Refining, LP (NYSE:CVRR) and CVR Partners, LP ( NYSE:UAN ) ─ CVR Refining is an independent petroleum refiner and marketer of high - value transportation fuels in the mid - continent of the United States ─ CVR Partners is a manufacturer of ammonia and urea ammonium nitrate solution fertilizer products Historical Segment Financial Summary 13 (1) Balance Sheet data as of the end of each respective fiscal period. Energy Segment LTM March 31, ($ millions) 2015 2016 2017 2018 Select Income Statement Data: Total revenues $5,442 $4,764 $5,918 $5,997 Adjusted EBITDA 755 313 429 434 Net income (loss) 7 (604) 275 339 Adjusted EBITDA attrib. to IEP $436 $156 $229 $234 Net income (loss) attrib. to IEP 25 (327) 229 267 Select Balance Sheet Data (1) : Total assets $4,888 $5,013 $4,700 $4,705 Equity attributable to IEP 1,508 1,034 1,098 1,134 FYE December 31,

Segment: Automotive Company Description We conduct our Automotive segment through our wholly owned subsidiaries Federal - Mogul LLC ("Federal - Mogul") and Icahn Automotive Group LLC ("Icahn Automotive") Federal - Mogul is engaged in the manufacture and distribution of automotive parts Icahn Automotive provides automotive maintenance services as well as retail and wholesale sales of automotive parts Historical Segment Financial Summary Federal - Mogul: Powertrain Highlights Fuel economy and emissions content driving market growth – Combustion engines still #1 for foreseeable future – Regulations increasing demand for further improvement through 2025 – Engine downsizing creates higher content product mix Leading powertrain products with #1 or #2 position in most major product categories Extensive technology and intellectual property with focus on core product lines Investing in emerging markets where there are attractive opportunities for growth Continued restructuring to lower cost structure and improve manufacturing footprint Federal - Mogul: Motorparts Highlights Aftermarket benefits from the growing number of vehicles and the increasing age of vehicles Leader in most of its product categories with a long history of quality and strong brand names including Champion, Wagner, Ferodo, MOOG, Fel - Pro Investing in Growth – Global Expansion : L everage global capabilities in Asia and other emerging markets – Distribution and IT : Improve customer service and delivery, order and inventory management, on - line initiatives – Cost Structure : improve manufacturing footprint, optimize low - cost sourcing and operational performance – Product Line Growth : expand existing product lines and add new product lines – Product Differentiation and Brand Value : invest in product innovation and communicate brand value proposition to end customers 14 Recent Developments On April 10, 2018, IEP announced an agreement to sell Federal - Mogul to Tenneco Inc. in a transaction valued at approximately $5.4 billion – IEP to receive $800 million in cash and 29.5 million shares of Tenneco Inc. common stock (1) Balance Sheet data as of the end of each respective fiscal period. (2) Results include IEH Auto Parts Holding LLC beginning June 1, 2015 and Pep Boys beginning February 3, 2016 Icahn Automotive Group LLC Pep Boys and IEH Auto are operated together in order to grow their sales to DIFM distributors and DIFM service professionals, to grow their automotive service business, and to maintain their DIY customer bases by offering the broadest product assortment in the automotive aftermarket Automotive Segment LTM March 31, ($ millions) 2015 (2) 2016 (2) 2017 2018 Select Income Statement Data: Total revenues $7,853 $9,928 $10,528 $10,687 Adjusted EBITDA 682 862 825 786 Net income (loss) (352) 77 626 584 Adjusted EBITDA attrib. to IEP $557 $715 $814 $775 Net income (loss) attrib. to IEP (299) 53 615 573 Select Balance Sheet Data (1) : Total assets $7,943 $9,855 $10,709 $11,031 Equity attributable to IEP 1,270 2,292 3,234 3,419 FYE December 31,

Highlights and Recent Developments Sold American Railcar Leasing for $3.4 billion in 2017 Railcar manufacturing ─ Tank railcar demand impacted by volatile crude oil prices Approximately 13,100 railcars (2) in ARI’s lease fleet provide stable cash flows ARI annualized dividend is $1.60 per share Segment: Railcar Segment Description American Railcar Industries, Inc. (NASDAQ:ARII) operates in three business segments: manufacturing operations, railcar services and leasing Historical Segment Financial Summary . 15 (1) Balance Sheet data as of the end of each respective fiscal period. (2) As of March 31, 2018. Railcar Segment LTM March 31, ($ millions) 2015 2016 2017 2018 Net Sales/Other Revenues From Operations: Manufacturing $440 $430 $265 $268 Railcar leasing 452 471 300 215 Railcar services 47 51 70 74 Total $939 $952 $635 $557 Gross Margin: Manufacturing $102 $64 $16 $16 Railcar leasing 276 276 216 152 Railcar services 22 23 20 17 Total $400 $363 $252 $185 Adjusted EBITDA attrib. to IEP $318 $379 $223 $158 Net income (loss) attrib. to IEP 137 150 1,214 1,177 Total assets (1) $3,681 $3,332 $1,487 $1,487 Equity attributable to IEP (1) 742 444 428 419 FYE December 31,

Highlights and Recent Developments On April 16, 2018, IEP announced agreements to sell Tropicana's real estate to Gaming and Leisure Properties, Inc. and to merge Tropicana's gaming and hotel operations into Eldorado Resorts, Inc. in a transaction valued at approximately $1.85 billion Segment: Gaming Company Description We conduct our Gaming segment through our majority ownership in Tropicana and our wholly owned subsidiary, Trump Entertainment Resorts, Inc. Tropicana Entertainment Inc. (OTCPK:TPCA) operates eight casino facilities featuring approximately 392,000 square feet of gaming space with approximately 7,800 slot machines, 260 table games and 5,700 hotel rooms as of March 31, 2018 ─ Eight casino facilities located in New Jersey, Indiana, Nevada, Mississippi, Missouri, Louisiana and Aruba ─ Successful track record operating gaming companies, dating back to 2000 Trump Entertainment Resort, Inc. owns Trump Plaza Hotel and Casino, which ceased operations in September 2014 Historical Segment Financial Summary 16 (1) Balance Sheet data as of the end of each respective fiscal period. (2) Results include Trump Entertainment beginning February 26, 2016. Tropicana Entertainment Inc. Management uses a highly analytical approach to enhance marketing, improve utilization, optimize product mix and reduce expenses ─ Established measurable, property specific, customer service goals and objectives to meet customer needs ─ Utilize sophisticated customer analytic techniques to improve customer experience Selective reinvestment in core properties including upgraded hotel rooms, refreshed casino floor products tailored for each regional market and pursuit of strong brands for restaurant and retail opportunities ─ Evansville, IN land based casino opened in October 2017 Capital structure with ample liquidity for synergistic acquisitions in regional gaming markets ─ In April 2014, Tropicana acquired Lumière Place Casino in St. Louis, Missouri Trump Entertainment Resort, Inc. In Q1 2016, IEP obtained control and began consolidating the results of Trump Entertainment, which owned Trump Taj Mahal Casino Resort in Atlantic City, New Jersey ─ Trump Taj Mahal closed in October 2016 ─ In Q1 2017, IEP sold the Trump Taj Mahal Casino Resort Gaming Segment LTM March 31, ($ millions) 2015 2016 (2) 2017 2018 Select Income Statement Data: Total revenues $811 $948 $960 $969 Adjusted EBITDA 142 124 173 188 Net income (loss) 38 (95) 52 75 Adjusted EBITDA attrib. to IEP $96 $78 $130 $156 Net income (loss) attrib. to IEP 26 (109) 39 66 Select Balance Sheet Data (1) : Total assets $1,285 $1,402 $1,139 $1,146 Equity attributable to IEP 604 730 761 782 FYE December 31,

Highlights and Recent Developments Future growth expected to be driven by changing diets of a growing middle class in emerging markets ─ Majority of revenues from emerging markets ─ Acquired a plastic casing manufacturer in Poland in December 2016 and a fibrous casing manufacturer in January 2017 Developed markets remain a steady source of income ─ Distribution channels to certain customers spanning more than 50 years Significant barriers to entry ─ Technically difficult chemical production process ─ Significant environmental and food safety regulatory requirements ─ Substantial capital cost Rights offering completed in January 2018 raising $50 million Segment: Food Packaging Company Description Viskase Companies, Inc (OTCPK:VKSC) is a worldwide leader in the production and sale of cellulosic, fibrous and plastic casings for the processed meat and poultry industry Leading worldwide manufacturer of non - edible cellulosic casings for small - diameter meats (hot dogs and sausages) ─ Leading manufacturer of non - edible fibrous casings for large - diameter meats (sausages, salami, hams and deli meats) Historical Segment Financial Summary 17 (1) Balance Sheet data as of the end of each respective fiscal period . Food Packaging Segment LTM March 31, ($ millions) 2015 2016 2017 2018 Select Income Statement Data: Total revenues $337 $332 $393 $395 Adjusted EBITDA 59 55 62 61 Net income (loss) (3) 8 (6) (11) Adjusted EBITDA attrib. to IEP $43 $40 $45 $45 Net income (loss) attrib. to IEP (3) 6 (5) (9) Select Balance Sheet Data (1) : Total assets $416 $428 $487 $533 Equity attributable to IEP 23 25 28 69 FYE December 31,

Highlights and Recent Developments Increasing global demand for steel and other metals drives demand for U.S. scrap Results are currently impacted by headwinds from: ─ Low iron ore prices ─ Strong U.S. dollar ─ Increased steel imports Scrap recycling process is “greener” than virgin steel production ─ Electric arc furnace drive scrap demand and are significantly more energy efficient than blast furnaces ─ Electric arc furnace steel mills are approximately 60% of U.S. production Highly fragmented industry with potential for further consolidation ─ Capitalizing on consolidation and vertical integration opportunities ─ PSC is building a leading position in its markets Product diversification will reduce volatility through cycles ─ Expansion of non - ferrous share of total business Segment: Metals Company Description PSC Metals, Inc. is one of the largest independent metal recycling companies in the U.S. Collects industrial and obsolete scrap metal, processes it into reusable forms and supplies the recycled metals to its customers Strong regional footprint (Upper Midwest, St. Louis Region and the South) Historical Segment Financial Summary 18 (1) Balance Sheet data as of the end of each respective fiscal period. Metals Segment LTM March 31, ($ millions) 2015 2016 2017 2018 Select Income Statement Data: Total revenues $365 $269 $408 $424 Adjusted EBITDA (29) (15) 20 21 Net income (loss) (51) (20) (44) (42) Adjusted EBITDA attrib. to IEP ($29) ($15) $20 $21 Net income (loss) attrib. to IEP (51) (20) (44) (42) Select Balance Sheet Data (1) : Total assets $215 $193 $226 $240 Equity attributable to IEP 182 155 182 185 FYE December 31,

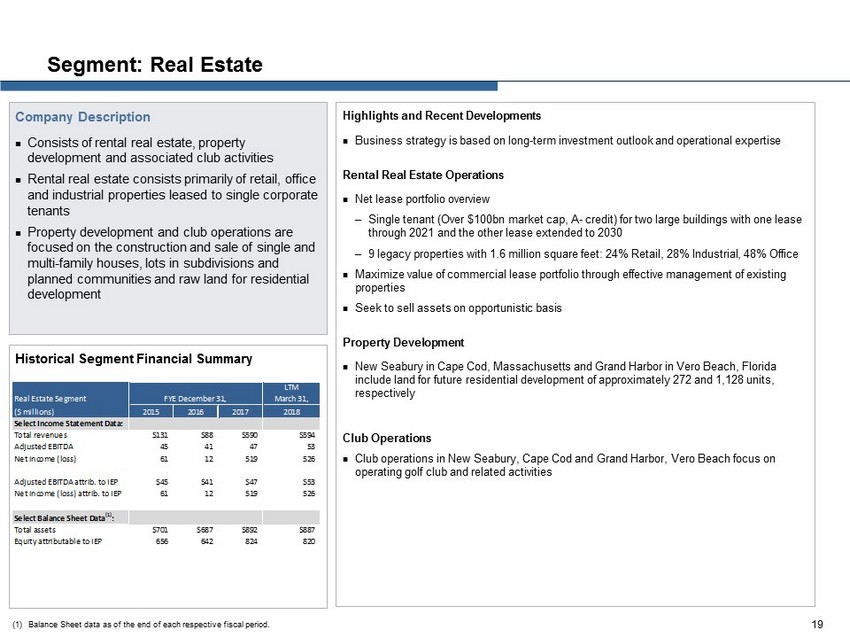

Highlights and Recent Developments Business strategy is based on long - term investment outlook and operational expertise Rental Real Estate Operations Net lease portfolio overview ─ Single tenant (Over $100bn market cap, A - credit) for two large buildings with one lease through 2021 and the other lease extended to 2030 ─ 9 legacy properties with 1.6 million square feet: 24% Retail, 28% Industrial, 48% Office Maximize value of commercial lease portfolio through effective management of existing properties Seek to sell assets on opportunistic basis Property Development New Seabury in Cape Cod, Massachusetts and Grand Harbor in Vero Beach, Florida include land for future residential development of approximately 272 and 1,128 units, respectively Club Operations Club operations in New Seabury, Cape Cod and Grand Harbor, Vero Beach focus on operating golf club and related activities Segment: Real Estate Company Description Consists of rental real estate, property development and associated club activities Rental real estate consists primarily of retail, office and industrial properties leased to single corporate tenants Property development and club operations are focused on the construction and sale of single and multi - family houses, lots in subdivisions and planned communities and raw land for residential development Historical Segment Financial Summary 19 (1) Balance Sheet data as of the end of each respective fiscal period. Real Estate Segment LTM March 31, ($ millions) 2015 2016 2017 2018 Select Income Statement Data: Total revenues $131 $88 $590 $594 Adjusted EBITDA 45 41 47 53 Net income (loss) 61 12 519 526 Adjusted EBITDA attrib. to IEP $45 $41 $47 $53 Net income (loss) attrib. to IEP 61 12 519 526 Select Balance Sheet Data (1) : Total assets $701 $687 $892 $887 Equity attributable to IEP 656 642 824 820 FYE December 31,

Highlights and Recent Developments IEP acquired a controlling interest in Ferrous Resources in June 2015 Mining segment has been concentrating on sales in Brazil, where the best margins are being captured Iron ore prices have recovered significantly due to increased demand from China Segment: Mining Company Description Ferrous Resources has rights to certain iron ore mineral resources in Brazil and develops mining operations and related infrastructure to produce and sell iron ore products to the global steel industry. ─ Significant iron ore assets in the State of Minas Gerais , Brazil, known as Viga , Viga Norte, Esperança , Serrinha and Santanense . ─ Mineral rights near Jacuípe in the State of Bahia, Brazil. Historical Segment Financial Summary 20 (1) Balance Sheet data as of the end of the fiscal period. (2) Icahn Enterprises acquired majority ownership of Ferrous Resources on June 8, 2015 Mining Segment Seven Months Ended December 31, 2015 (2) FYE December 31, 2016 FYE December 31, 2017 LTM March 31, 2018 ($ millions) Select Income Statement Data: Total Revenues $28 $63 $93 $82 Adjusted EBITDA (9) 2 22 10 Net income (loss) (195) (24) 10 (2) Adjusted EBITDA attrib. to IEP ($6) $1 $17 $9 Net income (loss) attrib. to IEP (150) (19) 9 - Select Balance Sheet Data (1) : Total assets $203 $219 $265 $272 Equity attributable to IEP 95 104 138 143

Highlights and Recent Developments One of the largest providers of home textile goods in the United States Transitioned majority of manufacturing to low cost plants overseas Streamlined merchandising, sales and customer service divisions Focus on core profitable customers and product lines ─ WPH has implemented a more customer - focused organizational structure with the intent of expanding key customer relationships and rebuilding the company’s sales backlog ─ Realizing success placing new brands with top retailers ─ Continued strength with institutional customers Consolidation opportunity in fragmented industry Segment: Home Fashion Company Description WestPoint Home LLC is engaged in manufacturing, sourcing, marketing, distributing and selling home fashion consumer products WestPoint Home owns many of the most well - known brands in home textiles including Martex, Grand Patrician, Luxor and Vellux WPH also licenses brands such as IZOD, Under the Canopy, Southern Tide and Portico Historical Segment Financial Summary 21 (1) Balance Sheet data as of the end of each respective fiscal period. Home Fashion Segment LTM March 31, ($ millions) 2015 2016 2017 2018 Select Income Statement Data: Total revenues $194 $196 $183 $178 Adjusted EBITDA 6 (1) (9) (9) Net income (loss) (4) (12) (20) (22) Adjusted EBITDA attrib. to IEP $6 ($1) ($9) ($9) Net income (loss) attrib. to IEP (4) (12) (20) (22) Select Balance Sheet Data (1) : Total assets $206 $193 $183 $185 Equity attributable to IEP 176 164 144 139 FYE December 31,

Financial Performance 22

Financial Performance Net Income (Loss) Attributable to Icahn Enterprises Adjusted EBITDA Attributable to Icahn Enterprises 23 ($1,194) ($1,128) $2,430 $2,585 FYE 2015 FYE 2016 FYE 2017 LTM 3/31/18 $956 $865 $1,690 $1,820 FYE 2015 FYE 2016 FYE 2017 LTM 3/31/18 ($Millions) LTM March 31, LTM March 31, ($ in millions) 2015 2016 2017 2018 ($ in millions) 2015 2016 2017 2018 Net Income (Loss) Attributable to Icahn Enterprises Adjusted EBITDA attributable to Icahn Enterprises Investment ($760) ($604) $80 $264 Investment ($500) ($528) $138 $319 Automotive (299) 53 615 573 Automotive 557 715 814 775 Energy 25 (327) 229 267 Energy 436 156 229 234 Metals (51) (20) (44) (42) Metals (29) (15) 20 21 Railcar 137 150 1,214 1,177 Railcar 318 379 223 158 Gaming 26 (109) 39 66 Gaming 96 78 130 156 Mining (150) (19) 9 - Mining (6) 1 17 9 Food Packaging (3) 6 (5) (9) Food Packaging 43 40 45 45 Real Estate 61 12 519 526 Real Estate 45 41 47 53 Home Fashion (4) (12) (20) (22) Home Fashion 6 (1) (9) (9) Holding Company (176) (258) (206) (215) Holding Company (10) (1) 36 59 Total ($1,194) ($1,128) $2,430 $2,585 Total $956 $865 $1,690 $1,820 FYE December 31,FYE December 31,

Consolidated Financial Snapshot ($Millions) 24 LTM March 31, 2015 2016 2017 2017 2018 2018 Net Income (Loss): Investment ($1,665) ($1,487) $118 ($192) $401 $711 Automotive (352) 77 626 30 (12) 584 Energy 7 (604) 275 28 92 339 Metals (51) (20) (44) 2 4 (42) Railcar 213 183 1,267 52 16 1,231 Gaming 38 (95) 52 (4) 19 75 Mining (195) (24) 10 6 (6) (2) Food Packaging (3) 8 (6) 2 (3) (11) Real Estate 61 12 519 2 9 526 Home Fashion (4) (12) (20) (3) (5) (22) Holding Company (176) (258) (206) (83) (92) (215) Net Income (Loss) ($2,127) ($2,220) $2,591 ($160) $423 $3,174 Less: net income (loss) attrib. to NCI (933) (1,092) 161 (142) 286 589 Net Income (Loss) attib. to IEP ($1,194) ($1,128) $2,430 ($18) $137 $2,585 Adjusted EBITDA: Investment ($1,100) ($1,257) $284 ($145) $427 $856 Automotive 682 862 825 232 193 786 Energy 755 313 429 133 138 434 Metals (29) (15) 20 7 8 21 Railcar 492 458 276 101 38 213 Gaming 142 124 173 32 47 188 Mining (9) 2 22 13 1 10 Food Packaging 59 55 62 12 11 61 Real Estate 45 41 47 9 15 53 Home Fashion 6 (1) (9) (1) (1) (9) Holding Company (10) (1) 36 (4) 19 59 Consolidated Adjusted EBITDA $1,033 $581 $2,165 $389 $896 $2,672 Less: Adjusted EBITDA attrib. to NCI (77) 284 (475) 32 (345) (852) Adjusted EBITDA attrib. to IEP $956 $865 $1,690 $421 $551 $1,820 Capital Expenditures $1,359 $826 $991 $231 $220 $980 Three Months Ended March 31, FYE December 31,

Strong Balance Sheet ($Millions) 25 InvestmentAutomotive Energy Railcar Gaming Metals Mining Food Packaging Real Estate Home Fashion Holding Company Consolidated Assets Cash and cash equivalents $20 $278 $420 $100 $119 $17 $13 $54 $29 $1 $199 $1,250 Cash held at consolidated affiliated partnerships and restricted cash 587 5 - 19 16 5 - 1 2 8 - 643 Investments 7,518 312 83 22 23 - - - - - 406 8,364 Accounts receivable, net - 1,511 179 33 10 60 8 76 3 34 - 1,914 Inventories, net - 2,776 424 73 - 29 30 99 - 66 - 3,497 Property, plant and equipment, net - 3,570 3,168 1,202 809 108 198 170 437 71 - 9,733 Goodwill and intangible assets, net - 1,952 293 7 74 3 - 36 26 - - 2,391 Other assets 1,270 627 138 31 95 18 23 97 390 5 12 2,706 Total Assets $9,395 $11,031 $4,705 $1,487 $1,146 $240 $272 $533 $887 $185 $617 $30,498 Liabilities and Equity Accounts payable, accrued expenses and other liabilities $959 $2,875 $1,085 $268 $86 $52 $49 $90 $46 $37 $490 $6,037 Securities sold, not yet purchased, at fair value 299 - - - - - - - - - - 299 Due to brokers 38 - - - - - - - - - - 38 Post-employment benefit liability - 1,072 - 8 - 2 - 79 - - - 1,161 Debt - 3,499 1,167 539 137 1 58 271 21 9 5,506 11,208 Total liabilities 1,296 7,446 2,252 815 223 55 107 440 67 46 5,996 18,743 Equity attributable to Icahn Enterprises 3,214 3,419 1,134 419 782 185 143 69 820 139 (5,379) 4,945 Equity attributable to non-controlling interests 4,885 166 1,319 253 141 - 22 24 - - - 6,810 Total equity 8,099 3,585 2,453 672 923 185 165 93 820 139 (5,379) 11,755 Total liabilities and equity $9,395 $11,031 $4,705 $1,487 $1,146 $240 $272 $533 $887 $185 $617 $30,498 As of March 31, 2018

IEP Summary Financial Information Significant Valuation demonstrated by market value of IEP’s public subsidiaries and Holding Company interest in Funds and boo k v alue or market comparables of other assets 26 ($ Millions) Note: Indicative net asset value does not purport to reflect a valuation of IEP. The calculated Indicative net asset value d oes not include any value for our Investment Segment other than the fair market value of our investment in the Investment Funds. A valuation is a subjective exercise and Indicative net asset value does not necessarily co nsider all elements or consider in the adequate proportion the elements that could affect the valuation of IEP. Investors may reasonably differ on what such elements are and their impact on IEP. No represen tat ion or assurance, express or implied is made as to the accuracy and correctness of indicative net asset value as of these dates or with respect to any future indicative or prospective results which may vary. (1) Represents equity attributable to us as of each respective date. (2) Based on closing share price on each date (or if such date was not a trading day, the immediately preceding trading day) and the number of shares owned by the Holding Company as of each respective date. (3) Amounts based on market comparables due to lack of material trading volume, valued at 9.0x Adjusted EBITDA for the twelve months ended March 31, 2017, June 30, 2 01 7, September 30, 2017 and December 31, 2017. March 31, 2018 value is pro - forma the announced sale of Tropicana. (4) Amounts based on market comparables due to lack of material trading volume, valued at 9.0x Adjusted EBITDA for the twelve months ended June 30, 2017, September 3 0, 2017, December 31, 2017 and March 31, 2018 (5) June 30, 2017, September 30, 2017 and December 31, 2017 based on the value of IEP’s tender offer during Q1 2017. March 31, 2 018 value is pro - forma the announced sale to Tenneco Inc. (6) June 30, 2017, September 30, 2017, December 31, 2017 and March 31, 2018 represents the option purchase price of the remainin g cars not sold in the initial ARL sale, plus working capital as of that date. (7) Holding Company’s balance as of each respective date. (8) Holding Company’s balance as of each respective date. For March 31, 2018, the distribution payable was adjusted to $24 milli on, which represents the actual distribution paid subsequent to March 31, 2018. June 30 Sept 30 Dec 31 March 31 2017 2017 2017 2018 Market-valued Subsidiaries: Holding Company interest in Funds (1) $2,742 $2,882 $3,052 $3,214 CVR Energy (2) 1,549 1,844 2,651 2,152 CVR Refining - direct holding (2) 55 57 95 75 American Railcar Industries (2) 455 458 494 444 Total market-valued subsidiaries $4,801 $5,241 $6,293 $5,885 Other Subsidiaries Tropicana (3) $1,099 $1,440 $1,439 $1,510 Viskase (4) 164 179 173 209 Federal-Mogul (5) 1,690 1,690 1,690 2,414 Real Estate Holdings (1) 643 851 824 820 PSC Metals (1) 169 169 182 185 WestPoint Home (1) 157 153 144 139 RemainCo (6) 557 537 18 3 Ferrous Resources (1) 125 123 138 143 Icahn Automotive Group LLC (1) 1,325 1,487 1,728 1,853 Trump Entertainment (1) 32 64 22 21 Total - other subsidiaries $5,961 $6,693 $6,359 $7,297 Add: Holding Company cash and cash equivalents (7) 653 484 526 199 Less: Holding Company debt (7) (5,507) (5,508) (5,507) (5,506) Add: Other Holding Company net assets (8) 93 175 189 226 Indicative Net Asset Value $6,000 $7,085 $7,860 $8,101 As of

Appendix — Adjusted EBITDA Reconciliations 27

Non - GAAP Financial Measures 28 The Company uses certain non - GAAP financial measures in evaluating its performance . These include non - GAAP EBITDA and Adjusted EBITDA . EBITDA represents earnings before interest expense, income tax (benefit) expense and depreciation and amortization . We define Adjusted EBITDA as EBITDA excluding the effects of impairment, restructuring costs, certain pension plan expenses, OPEB curtailment gains, purchase accounting inventory adjustments, certain share - based compensation, discontinued operations, gains/losses on extinguishment of debt, major scheduled turnaround expenses, FIFO adjustments and unrealized gains/losses on energy segment derivatives and certain other non - operational charges . We present EBITDA and Adjusted EBITDA a consolidated basis and attributable to Icahn Enterprises net of the effect of non - controlling interests . We conduct substantially all of our operations through subsidiaries . The operating results of our subsidiaries may not be sufficient to make distributions to us . In addition, our subsidiaries are not obligated to make funds available to us for payment of our indebtedness, payment of distributions on our depositary units or otherwise, and distributions and intercompany transfers from our subsidiaries to us may be restricted by applicable law or covenants contained in debt agreements and other agreements to which these subsidiaries currently may be subject or into which they may enter into in the future . The terms of any borrowings of our subsidiaries or other entities in which we own equity may restrict dividends, distributions or loans to us . We believe that providing EBITDA and Adjusted EBITDA to investors has economic substance as these measures provide important supplemental information of our performance to investors and permits investors and management to evaluate the core operating performance of our business without regard to interest, taxes and depreciation and amortization and the effects of impairment, restructuring costs, certain pension plan expenses, OPEB curtailment gains, purchase accounting inventory adjustments, certain share - based compensation, discontinued operations, gains/losses on extinguishment of debt, major scheduled turnaround expenses, FIFO adjustments and unrealized gains/losses on energy segment derivatives and certain other non - operational charges . Additionally, we believe this information is frequently used by securities analysts, investors and other interested parties in the evaluation of companies that have issued debt . Management uses, and believes that investors benefit from referring to these non - GAAP financial measures in assessing our operating results, as well as in planning, forecasting and analyzing future periods . Adjusting earnings for these charges allows investors to evaluate our performance from period to period, as well as our peers, without the effects of certain items that may vary depending on accounting methods and the book value of assets . Additionally, EBITDA and Adjusted EBITDA present meaningful measures of performance exclusive of our capital structure and the method by which assets were acquired and financed . EBITDA and Adjusted EBITDA have limitations as analytical tools, and you should not consider them in isolation, or as substitutes for analysis of our results as reported under generally accepted accounting principles in the United States, or U . S . GAAP . For example, EBITDA and Adjusted EBITDA : • do not reflect our cash expenditures, or future requirements for capital expenditures, or contractual commitments ; • do not reflect changes in, or cash requirements for, our working capital needs ; and • do not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments on our debt . Although depreciation and amortization are non - cash charges, the assets being depreciated or amortized often will have to be replaced in the future, and EBITDA and Adjusted EBITDA do not reflect any cash requirements for such replacements . Other companies in the industries in which we operate may calculate EBITDA and Adjusted EBITDA differently than we do, limiting their usefulness as comparative measures . In addition, EBITDA and Adjusted EBITDA do not reflect the impact of earnings or charges resulting from matters we consider not to be indicative of our ongoing operations . EBITDA and Adjusted EBITDA are not measurements of our financial performance under U . S . GAAP and should not be considered as alternatives to net income or any other performance measures derived in accordance with U . S . GAAP or as alternatives to cash flow from operating activities as a measure of our liquidity . Given these limitations, we rely primarily on our U . S . GAAP results and use EBITDA and Adjusted EBITDA only as a supplemental measure of our financial performance .

Adjusted EBITDA Reconciliation by Segment – Last Twelve Months Ended March 31, 2018 ($Millions) 29 Investment Automotive Energy Metals Railcar Gaming Mining Food Packaging Real Estate Home Fashion Holding Company Consolidated Adjusted EBITDA: Net income (loss) $711 $584 $339 ($42) $1,231 $75 ($2) ($11) $526 ($22) ($215) $3,174 Interest expense, net 145 167 109 - 29 8 5 14 3 - 321 801 Income tax (benefit) expense - (668) (330) 43 490 86 4 18 - - (51) (408) Depreciation, depletion and amortization - 514 279 20 62 74 6 26 20 8 - 1,009 EBITDA before non-controlling interests $856 $597 $397 $21 $1,812 $243 $13 $47 $549 ($14) $55 $4,576 Impairment of assets - 34 - - 68 - - 1 - 1 - 104 Restructuring costs - 14 - 1 - - - 2 - 3 - 20 Non-service cost of U.S. based pension - 31 - - - - - 12 - - - 43 FIFO impact unfavorable - - (50) - - - - - - - - (50) Major scheduled turnaround expense - - 70 - - - - - - - - 70 (Gains) losses on disposition of assets - (14) 3 - (1,668) 1 1 - (496) - (1) (2,174) Net loss on extinguishment of debt - 2 - - - - - - - - 12 14 Unrealized gain on certain derivatives - - 18 - - - - - - - - 18 Tax settlements - - - - - (61) - - - - - (61) Other - 122 (4) (1) 1 5 (4) (1) - 1 (7) 112 Adjusted EBITDA before non-controlling interests $856 $786 $434 $21 $213 $188 $10 $61 $53 ($9) $59 $2,672 Adjusted EBITDA attributable to IEP: Net income (loss) $264 $573 $267 ($42) $1,177 $66 $0 ($9) $526 ($22) ($215) $2,585 Interest expense, net 55 167 44 - 21 7 4 10 3 - 321 632 Income tax (benefit) expense - (668) (232) 43 520 73 3 13 - - (51) (299) Depreciation, depletion and amortization - 514 134 20 39 60 3 20 20 8 - 818 EBITDA attributable to Icahn Enterprises $319 $586 $213 $21 $1,757 $206 $10 $34 $549 ($14) $55 $3,736 Impairment of assets - 34 - - 68 - - 1 - 1 - 104 Restructuring costs - 14 - 1 - - - 1 - 3 - 19 Non-service cost of U.S. based pension - 31 - - - - - 9 - - - 40 FIFO impact unfavorable - - (30) - - - - - - - - (30) Major scheduled turnaround expense - - 41 - - - - - - - - 41 (Gains) losses on disposition of assets - (14) 3 - (1,668) 1 1 - (496) - (1) (2,174) Net loss on extinguishment of debt - 2 - - - - - - - - 12 14 Unrealized gain on certain derivatives - - 11 - - - - - - - - 11 Tax settlements - - - - - (57) - - - - - (57) Other - 122 (4) (1) 1 6 (2) - - 1 (7) 116 Adjusted EBITDA attributable to Icahn Enterprises $319 $775 $234 $21 $158 $156 $9 $45 $53 ($9) $59 $1,820

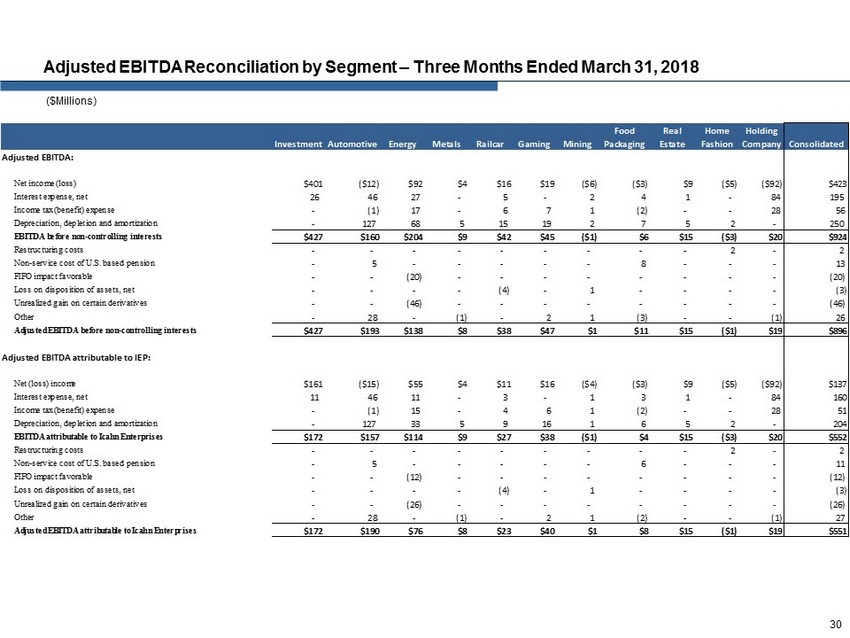

Adjusted EBITDA Reconciliation by Segment – Three Months Ended March 31, 2018 ($Millions) 30 Investment Automotive Energy Metals Railcar Gaming Mining Food Packaging Real Estate Home Fashion Holding Company Consolidated Adjusted EBITDA: Net income (loss) $401 ($12) $92 $4 $16 $19 ($6) ($3) $9 ($5) ($92) $423 Interest expense, net 26 46 27 - 5 - 2 4 1 - 84 195 Income tax (benefit) expense - (1) 17 - 6 7 1 (2) - - 28 56 Depreciation, depletion and amortization - 127 68 5 15 19 2 7 5 2 - 250 EBITDA before non-controlling interests $427 $160 $204 $9 $42 $45 ($1) $6 $15 ($3) $20 $924 Restructuring costs - - - - - - - - - 2 - 2 Non-service cost of U.S. based pension - 5 - - - - - 8 - - - 13 FIFO impact favorable - - (20) - - - - - - - - (20) Loss on disposition of assets, net - - - - (4) - 1 - - - - (3) Unrealized gain on certain derivatives - - (46) - - - - - - - - (46) Other - 28 - (1) - 2 1 (3) - - (1) 26 Adjusted EBITDA before non-controlling interests $427 $193 $138 $8 $38 $47 $1 $11 $15 ($1) $19 $896 Adjusted EBITDA attributable to IEP: Net (loss) income $161 ($15) $55 $4 $11 $16 ($4) ($3) $9 ($5) ($92) $137 Interest expense, net 11 46 11 - 3 - 1 3 1 - 84 160 Income tax (benefit) expense - (1) 15 - 4 6 1 (2) - - 28 51 Depreciation, depletion and amortization - 127 33 5 9 16 1 6 5 2 - 204 EBITDA attributable to Icahn Enterprises $172 $157 $114 $9 $27 $38 ($1) $4 $15 ($3) $20 $552 Restructuring costs - - - - - - - - - 2 - 2 Non-service cost of U.S. based pension - 5 - - - - - 6 - - - 11 FIFO impact favorable - - (12) - - - - - - - - (12) Loss on disposition of assets, net - - - - (4) - 1 - - - - (3) Unrealized gain on certain derivatives - - (26) - - - - - - - - (26) Other - 28 - (1) - 2 1 (2) - - (1) 27 Adjusted EBITDA attributable to Icahn Enterprises $172 $190 $76 $8 $23 $40 $1 $8 $15 ($1) $19 $551

Adjusted EBITDA Reconciliation by Segment – Three Months Ended March 31, 2017 ($Millions) 31 Investment Automotive Energy Metals Railcar Gaming Mining Food Packaging Real Estate Home Fashion Holding Company Consolidated Adjusted EBITDA: Net (loss) income ($192) $30 $28 $2 $52 ($4) $6 $2 $2 ($3) ($83) ($160) Interest expense, net 47 40 27 - 19 2 2 3 - - 82 222 Income tax expense (benefit) - (7) 9 - 12 14 - 1 - - (3) 26 Depreciation, depletion and amortization - 121 67 5 18 18 1 6 5 2 - 243 EBITDA before non-controlling interests ($145) $184 $131 $7 $101 $30 $9 $12 $7 ($1) ($4) $331 Impairment of assets - 6 - - - - - - 2 - - 8 Restructuring costs - 7 - - - - - - - - - 7 Non-service cost of U.S. based pension - 9 - - - - - - - - - 9 Major scheduled turnaround expense - - 13 - - - - - - - - 13 Loss on disposition of assets, net - 2 - - - 3 - - - - - 5 Net loss on extinguishment of debt - 2 - - - - - - - - - 2 Unrealized gain on certain derivatives - - (11) - - - - - - - - (11) Other - 22 - - (1) 4 - - - - 25 Adjusted EBITDA before non-controlling interests ($145) $232 $133 $7 $101 $32 $13 $12 $9 ($1) ($4) $389 Adjusted EBITDA attributable to IEP: Net (loss) income ($23) $27 $17 $2 $48 ($11) $5 $1 $2 ($3) ($83) ($18) Interest expense, net 14 40 11 - 17 1 1 2 - - 82 168 Income tax expense (benefit) - (7) 9 - 10 10 - 1 - - (3) 20 Depreciation, depletion and amortization - 121 32 5 13 13 - 4 5 2 - 195 EBITDA before non-controlling interests ($9) $181 $69 $7 $88 $13 $6 $8 $7 ($1) ($4) $365 Impairment of assets - 6 - - - - - - 2 - - 8 Restructuring costs - 7 - - - - - - - - - 7 Non-service cost of U.S. based pension - 9 - - - - - - - - - 9 Major scheduled turnaround expense - - 8 - - - - - - - - 8 Loss on disposition of assets, net - 2 - - 3 - - - - - 5 Net loss on extinguishment of debt - 2 - - - - - - - - - 2 Unrealized gain on certain derivatives - - (6) - - - - - - - - (6) Other - 22 - - (2) 3 - - - - 23 Adjusted EBITDA attributable to Icahn Enterprises ($9) $229 $71 $7 $88 $14 $9 $8 $9 ($1) ($4) $421

Adjusted EBITDA Reconciliation by Segment – Year Ended December 31, 2017 ($Millions) 32 Investment Automotive Energy Metals Railcar Gaming Mining Food Packaging Real Estate Home Fashion Holding Company Consolidated Adjusted EBITDA: Net income (loss) $118 $626 $275 ($44) $1,267 $52 $10 ($6) $519 ($20) ($206) $2,591 Interest expense, net 166 161 109 - 43 10 5 13 2 - 319 828 Income tax (benefit) expense - (674) (338) 43 496 93 3 21 - - (82) (438) Depreciation, depletion and amortization - 508 278 20 65 73 5 25 20 8 - 1,002 EBITDA before non-controlling interests $284 $621 $324 $19 $1,871 $228 $23 $53 $541 ($12) $31 $3,983 Impairment of assets - 40 - - 68 - - 1 2 1 - 112 Restructuring costs - 21 - 1 - - - 2 - 1 - 25 Non-service cost of U.S. based pension - 35 - - - - - 4 - - - 39 FIFO impact unfavorable - - (30) - - - - - - - - (30) Major scheduled turnaround expense - - 83 - - - - - - - - 83 (Gains) losses on disposition of assets - (12) 3 - (1,664) 4 - - (496) - (1) (2,166) Net loss on extinguishment of debt - 4 - - - - - - - - 12 16 Unrealized gain on certain derivatives - - 53 - - - - - - - - 53 Tax settlements - - - - - (61) - - - - - (61) Other - 116 (4) - 1 2 (1) 2 - 1 (6) 111 Adjusted EBITDA before non-controlling interests $284 $825 $429 $20 $276 $173 $22 $62 $47 ($9) $36 $2,165 Adjusted EBITDA attributable to IEP: Net income (loss) $80 $615 $229 ($44) $1,214 $39 $9 ($5) $519 ($20) ($206) $2,430 Interest expense, net 58 161 44 - 35 8 4 9 2 - 319 640 Income tax (benefit) expense - (674) (238) 43 526 77 2 16 - - (82) (330) Depreciation, depletion and amortization - 508 133 20 43 57 2 18 20 8 - 809 EBITDA attributable to Icahn Enterprises $138 $610 $168 $19 $1,818 $181 $17 $38 $541 ($12) $31 $3,549 Impairment of assets - 40 - - 68 - - 1 2 1 - 112 Restructuring costs - 21 - 1 - - - 1 - 1 - 24 Non-service cost of U.S. based pension - 35 - - - - - 3 - - - 38 FIFO impact unfavorable - - (18) - - - - - - - - (18) Major scheduled turnaround expense - - 49 - - - - - - - - 49 (Gains) losses on disposition of assets - (12) 3 - (1,664) 4 - - (496) - (1) (2,166) Net loss on extinguishment of debt - 4 - - - - - - - - 12 16 Unrealized gain on certain derivatives - - 31 - - - - - - - - 31 Tax settlements - - - - - (57) - - - - - (57) Other - 116 (4) - 1 2 - 2 - 1 (6) 112 Adjusted EBITDA attributable to Icahn Enterprises $138 $814 $229 $20 $223 $130 $17 $45 $47 ($9) $36 $1,690

Adjusted EBITDA Reconciliation by Segment – Year Ended December 31, 2016 ($Millions) 33 Investment Automotive Energy Metals Railcar Gaming Mining Food Packaging Real Estate Home Fashion Holding Company Consolidated Adjusted EBITDA: Net (loss) income ($1,487) $77 ($604) ($20) $183 ($95) ($24) $8 $12 ($12) ($258) ($2,220) Interest expense, net 230 153 82 - 83 12 5 12 2 - 288 867 Income tax expense (benefit) - 40 (45) (16) 57 24 2 8 - - (34) 36 Depreciation, depletion and amortization - 473 258 22 134 71 6 20 22 8 - 1,014 EBITDA before non-controlling interests ($1,257) $743 ($309) ($14) $457 $12 ($11) $48 $36 ($4) ($4) ($303) Impairment of assets - 18 574 1 - 106 - - 5 2 3 709 Restructuring costs - 27 - 2 - - - 3 - - - 32 Non-service cost of U.S. based pension - 41 - - - - - 5 - - - 46 FIFO impact unfavorable - - (52) - - - - - - - - (52) Certain share-based compensation expense - - - - 1 - - - - - - 1 Major scheduled turnaround expense - - 38 - - - - - - - - 38 (Gains) losses on disposition of assets - (9) - (1) - - - - (1) - - (11) Net loss on extinguishment of debt - - 5 - - - - - - - - 5 Unrealized gain on certain derivatives - - 56 - - - - - - - - 56 Other - 42 1 (3) - 6 13 (1) 1 1 - 60 Adjusted EBITDA before non-controlling interests ($1,257) $862 $313 ($15) $458 $124 $2 $55 $41 ($1) ($1) $581 Adjusted EBITDA attributable to IEP: Net (loss) income ($604) $53 ($327) ($20) $150 ($109) ($19) $6 $12 ($12) ($258) ($1,128) Interest expense, net 76 127 31 - 74 9 4 9 2 - 288 620 Income tax expense (benefit) - 30 (32) (16) 41 15 2 6 - - (34) 12 Depreciation, depletion and amortization - 406 127 22 113 52 4 14 22 8 - 768 EBITDA attributable to Icahn Enterprises ($528) $616 ($201) ($14) $378 ($33) ($9) $35 $36 ($4) ($4) $272 Impairment of assets - 15 334 1 - 106 - - 5 2 3 466 Restructuring costs - 22 - 2 - - - 2 - - - 26 Non-service cost of U.S. based pension - 33 - - - - - 4 - - - 37 FIFO impact unfavorable - - (31) - - - - - - - - (31) Certain share-based compensation expense - - - - 1 - - - - - - 1 Major scheduled turnaround expense - - 20 - - - - - - - - 20 (Gains) losses on disposition of assets - (7) - (1) - - - - (1) - - (9) Net loss on extinguishment of debt - - 1 - - - - - - - - 1 Unrealized gain on certain derivatives - - 32 - - - - - - - - 32 Other - 36 1 (3) - 5 10 (1) 1 1 - 50 Adjusted EBITDA attributable to Icahn Enterprises ($528) $715 $156 ($15) $379 $78 $1 $40 $41 ($1) ($1) $865

Adjusted EBITDA Reconciliation by Segment – Year Ended December 31, 2015 ($Millions) 34 Investment Automotive Energy Metals Railcar Gaming Mining Food Packaging Real Estate Home Fashion Holding Company Consolidated Adjusted EBITDA: Net (loss) income ($1,665) ($352) $7 ($51) $213 $38 ($195) ($3) $61 ($4) ($176) ($2,127) Interest expense, net 563 138 45 - 80 11 2 12 2 - 288 1,141 Income tax expense (benefit) - 50 59 (32) 69 27 1 10 - - (116) 68 Depreciation, depletion and amortization - 346 229 29 127 63 8 19 21 7 - 849 EBITDA before non-controlling interests ($1,102) $182 $340 ($54) $489 $139 ($184) $38 $84 $3 ($4) ($69) Impairment - 344 253 20 - - 169 - 2 - - 788 Restructuring - 89 - 2 - - - 5 - 1 - 97 Non-service cost of U.S. based pension - 30 - - - - - 3 - - - 33 FIFO impact unfavorable - - 60 - - - - - - - - 60 Certain share-based compensation expense - (1) 13 - 1 - - - - - - 13 Major scheduled turnaround expense - - 109 - - - - - - - - 109 Losses (gains) on disposition of assets - - 2 - - 1 - 1 (40) - - (36) Expenses related to certain acquisitions - 6 - - - - - - - - - 6 Net loss on extinguishment of debt - - - - 2 - - - - - - 2 Unrealized gains on certain derivatives - - 2 - - - - - - - - 2 Other 2 32 (24) 3 - 2 6 12 (1) 2 (6) 28 Adjusted EBITDA before non-controlling interests ($1,100) $682 $755 ($29) $492 $142 ($9) $59 $45 $6 ($10) $1,033 Adjusted EBITDA attributable to IEP: Net (loss) income ($760) ($299) $25 ($51) $137 $26 ($150) ($3) $61 ($4) ($176) ($1,194) Interest expense, net 259 113 25 - 57 7 2 9 2 - 288 762 Income tax expense (benefit) - 46 54 (32) 36 18 1 7 - - (116) 14 Depreciation, depletion and amortization - 285 125 29 86 43 6 14 21 7 - 616 EBITDA attributable to Icahn Enterprises ($501) $145 $229 ($54) $316 $94 ($141) $27 $84 $3 ($4) $198 Impairment - 282 110 20 - - 130 - 2 - - 544 Restructuring - 73 - 2 - - - 4 - 1 - 80 Non-service cost of U.S. based pension - 25 - - - - - 2 - - - 27 FIFO impact unfavorable - - 35 - - - - - - - - 35 Certain share-based compensation expense - (1) 11 - 1 - - - - - - 11 Major scheduled turnaround expense - - 62 - - - - - - - - 62 Losses (gains) on disposition of assets - - 1 - - 1 - 1 (40) - - (37) Expenses related to certain acquisitions - 5 - - - - - - - - - 5 Net loss on extinguishment of debt - - - - 1 - - - - - - 1 Unrealized gains on certain derivatives - - 2 - - - - - - - - 2 Other 1 28 (14) 3 - 1 5 9 (1) 2 (6) 28 Adjusted EBITDA attributable to Icahn Enterprises ($500) $557 $436 ($29) $318 $96 ($6) $43 $45 $6 ($10) $956