Attached files

| file | filename |

|---|---|

| EX-32.02 - Discovery Energy Corp. | ex32-01.htm |

| EX-31.02 - Discovery Energy Corp. | ex31-02.htm |

| EX-31.01 - Discovery Energy Corp. | ex31-01.htm |

| EX-21.1 - Discovery Energy Corp. | ex21-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(MARK ONE)

| [X] | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended February 28, 2018

| [ ] | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-53520

DISCOVERY ENERGY CORP.

(Exact name of registrant as specified in its charter)

| Nevada | 98-0507846 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| One Riverway Drive, Suite 1700, Houston, Texas | 77056 | |

| (Address of principal executive offices) | (Zip Code) |

Issuer’s telephone number: (713) 840-6495

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, par value $.001 per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [ ] | Smaller reporting company | [X] |

| Emerging growth company | [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $8,240,243.

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: 143,040,396 as of June 5, 2018

DOCUMENTS INCORPORATED BY REFERENCE

None.

DISCOVERY ENERGY CORP.

FORM 10-K

FOR THE FISCAL YEAR ENDED FEBRUARY 28, 2018

TABLE OF CONTENTS

| 2 |

CAUTIONARY STATEMENT FOR FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We have based these forward-looking statements on our current expectations and projections about future events. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about us that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “continue,” or the negative of such terms or other similar expressions. Factors that might cause or contribute to such a discrepancy include, but are not limited to, those described in this Annual Report on Form 10-K and in our other Securities and Exchange Commission filings.

General

Discovery Energy Corp., (the “Company“ or ”Discovery”) was incorporated under the laws of the state of Nevada on May 24, 2006 under the name “Santos Resource Corp”. The Company’s current business plan is to explore and develop the 584,651 gross acres (the “Prospect”) in the State of South Australia covered by Petroleum Exploration License PEL 512 (the “License”). The License grants a 100% working interest in the preceding acreage, which overlies portions of the Cooper and Eromanga basins. The Company adopted this business plan near its fiscal 2012-year end, after having previously abandoned its initial business plan involving mining claims in Quebec, Canada and after it had been dormant, from a business perspective, for a period of time. In connection with the adoption of the current business plan, it had a change of control, a change of management, a change of corporate name, and a change of status from a “shell” company, as that term is defined in Rule 405 of the Securities Act of 1933 and Rule 12b-2 under the Securities Exchange Act of 1934.

In its 2018 fiscal year, the Company primarily focused on the following activities:

| ● | The Company continued its efforts to complete a major financing so that the Company could commence its initial drilling program. Although the Company was not able to complete such a financing, it was able to raise additional funds in fiscal 2018 in the approximate aggregate amount of $1.54 million through the Company’s on-going debenture financing (the “Debenture Financing”) and in private placements of its common shares. | |

| ● | The Company further analyzed and identified initial drill sites based on a 3D seismic survey (the Nike 3D Seismic Survey, which is referred to herein as the “Survey”) covering an approximately 179 square kilometers section of the southwest portion of the Prospect. The Survey was conducted by Terrex Pty Ltd. (“Terrex”) on the Prospect’s South Block. Terrex completed the Survey fieldwork on October 30, 2016. For Terrex’s services, the Company paid a “turnkey price” of approximately AU$3,057,000 (approximately US$2,379,000 based on the average exchange rate actually received on US$ funds advanced to pay Terrex). After completing the Survey, the Company suspended the License on its own initiative to preserve the end date for the third year of its work commitment and beyond. Subsequent to completion of the Survey fieldwork, the data gathered was delivered to a geophysical processor in Dallas, Texas. Through a series of technical steps, the raw data was converted to analytical quality information and delivered to its geophysical advisor just prior to the end of 2016. Interpretation of the processed data included advanced technical analysis by specialized consultants. The ongoing work has developed an inventory of more than 30 leads judged to be potential areas of crude oil accumulations, and the Company has prioritized these initial prospective locations for presentations to potential sources of significant capital. | |

| ● | In three transactions, the Company acquired portions of an original 7.0% royalty interest relating to the Prospect retained by the person who, in effect, transferred and sold the License to the Company. Added to the portion of such royalty interest that the Company previously acquired, the Company now owns an aggregate 5.0% royalty interest, while the previous holders of the original 7.0% interest continue to hold a 2.0% royalty interest. |

During fiscal 2018, the Company, unfortunately, experienced some project funding setbacks. As part of the Debenture Financing, the Company granted to the purchaser (the “Original Investor”) of the largest portion of the debentures (the “Debentures”) comprising this financing, options to purchase additional Debentures having an aggregate original principal amount of up to $20.0 million. These options were exercisable in two tranches, each involving $10.0 million of Debentures, one on or before January 31, 2018 and (provided that the first tranche was timely exercised) the other on or before July 31, 2018. The Original Investor declined to exercise the option with respect to the first tranche by its January 31, 2018 deadline. Accordingly, options for both tranches have now expired. Despite the expirations of these options, the Company is engaged in continuing discussions with the Original Investor and other potential investors regarding a possible financing transaction of which the Original Investor would be a significant participant. The option arrangement that the Company had with the Original Investor was the primary targeted source of funds to finance its License work commitments. With this arrangement no longer in force, the Company needs to complete an alternative major capital raising transaction (involving or not involving the Original Investor) or obtain a joint venture partner, or both, to continue moving forward on its work commitments. While alternative investors and potential joint venture partners continue to express interest in establishing a relationship with the Company, to date no alternative investor or joint venture partner has entered into any agreement in principle much less a binding agreement. If an adequate alternative investor or joint venture partner is not secured, the Company’s strategy would be to attempt to suspend and extend its petroleum exploration license until adequate funds and/or joint venture partner are obtained. There is no assurance that this will be achieved. Moreover, any joint venture arrangement would need to be approved by each Debenture holder.

| 3 |

In the remainder of this Report, Australian dollar amounts are prefaced by “AU$” while United States dollar amounts are prefaced simply by “$” or (when used in close proximity to Australian dollar amounts) by “US$.” When United States dollar amounts are given as equivalents of Australian dollar amounts, such United States dollar amounts are approximations only and not exact figures. During the past year, the exchange rate has varied from a low of US$1.00/AU$1.23 to a high of US$1.00/AU$1.36. On February 28, 2018 the exchange rate was US$1.00/AU$1.28.

Debenture Financing

General. Beginning in May 2016 and since then, the Company has closed on a series of placements of Senior Secured Convertible Debentures due May 27, 2021 (singly a “Debenture” and collectively the “Debentures”). The Debentures were issued pursuant to a securities purchase agreement (the “Securities Agreement”) dated May 27, 2016 and related documentation. The Securities Agreement has since been amended twice. Pursuant to the Securities Agreement, the following securities have been issued through the date of this Report:

| * | Debentures having an aggregate original principal amount of $6,850,000, and | |

| * | warrants to purchase up to a maximum of 19,125,000 shares (prior to any required adjustment) of the Company’s common stock at an initial per-share exercise price of $0.20. |

The first closing of the Debenture placement involved the issuance to a single investor (the “Original Investor”) of a Debenture having an original principal amount of $3,500,000. Subsequent to this first closing, the Company has conducted nine additional closings of additional Debenture issuances to the Original Investor or an additional investor (the “New Investor”) or both. The Original Investor has received all of the Warrants heretofore issued.

The proceeds from the Debenture placements have generally been used to fund the Survey, its interpretation and payment of Company expenses. Some of these proceeds were used for the payment of the Company’s and the Debenture holders’ costs of these transactions (including legal fees), general and administrative expenses, the retirement of all of the theretofore outstanding indebtedness (including all amounts owed to Liberty for allowing the Company to be issued the License in place of Liberty, and all amounts owed on loans made by management), and the acquisition of an aggregate 5.0% royalty interest relating to and burdening the Prospect. In addition to the preceding, $250,000 of the proceeds from the issuance of Debentures to the New Investor were effectively used to pay amounts owed to Rincon Energy, LLC (“Rincon”) pursuant to a geophysical consulting agreement among Rincon, the New Investor, the Company and its subsidiary, as the New Investor became entitled to its Debentures as it paid such amounts to Rincon.

In the future, the Company will need significant additional funds to undertake the development of the Prospect. The Debentures heretofore issued will not be sufficient for this. Additional funds will need to be raised to develop the Prospect. As stated above, options in favor of the Original Investor to purchase additional Debentures having an aggregate original principal amount of up to $20.0 million have expired. The Company is currently attempting to complete a significant financing, and in this connection might (a) place a significant amount of additional Debentures through sales to the Original Investor as well as others, (b) secure an alternative financing arrangement, possibly involving the Company’s equity securities, or (c) some combination of (a) and (b). The Company has no assurance that it will be able to raise significant additional funds to develop the Project or the additional funds needed for general corporate purposes.

The remainder of this Section contains descriptions of the legally operative documents governing the Debenture Financing. These descriptions are qualified in their entirety by reference to the actual documents that the Company has previously filed with the U.S. Securities and Exchange Commission.

Per Rule 135c under the Securities Act of 1933, nothing contained herein shall be construed to be an offer to sell, or a solicitation of an offer to buy, any of securities.

Description of the Debentures. The material terms, provisions and conditions of the Debentures are as follows:

| * | As of date of this Report, Debentures having an aggregate original principal amount of $6,850,000 have been issued. | |

| * | The Debentures bear interest at a rate of eight percent (8%) per annum, compounded quarterly. However, upon the occurrence and during the continuance of a stipulated event of default, the Debentures will bear interest at a rate of twelve percent (12%) per annum. | |

| * | Interest need not be paid on the Debentures until the principal amount of the Debentures becomes due and payable. Instead, accrued interest is added to the outstanding principal amount of the Debentures quarterly. Nevertheless, the Company may elect to pay accrued interest in cash at the time that such interest would otherwise be added to the outstanding principal amount of the Debentures. |

| 4 |

| * | The principal amount of, and accrued interest on, the Debentures are due and payable in a single balloon payment on or before May 27, 2021. | |

| * | The Company is not entitled to prepay the Debentures prior to their maturity. | |

| * | The Debentures are convertible, in whole or in part, into Common Shares at the option of Holder, at any time and from time to time. The conversion price for Debentures having an aggregate original principal amount of $5,887,500 is $0.16, while the conversion price for a Debenture with an original principal amount of $962,500 is $0.20. All conversion prices are subject to certain adjustments that are believed to be customary in transactions of this nature, including so-called “down round” financing adjustments. The Company would be subject to certain liabilities and liquidated damages for its failure to honor timely a conversion of the Debentures, and these liabilities and liquidated damages are believed to be customary in transactions of this nature. | |

| * | The holders of the Debentures are entitled to have them redeemed completely or partially upon certain events (such as a change of control transaction involving the Company or the sale of a material portion of its assets) at a redemption price equal to 120% of the then outstanding principal amount of the Debenture and 100% of accrued and unpaid interest on the outstanding principal amount of the Debenture, plus all liquidated damages and other amounts due hereunder in respect of the Debenture. | |

| * | The Debentures feature negative operating covenants, events of default and remedies upon such events of default that are believed to be customary in transactions of this nature. One of the remedies upon an event of default is a Debenture holders ability to accelerate the maturity of the Debenture such that all amounts owing under the Debenture become immediately due and payable. Debenture holders would then be able to resort to the collateral securing the Debentures, if the Company did not pay the amount outstanding, which is likely to be the case. | |

| * | The Debentures are secured by virtually all of the Company’s assets owned directly or indirectly but for the License, which is held by its Australian subsidiary, Discovery Energy SA Pty Limited (the “Subsidiary”). |

Material Terms and Provisions of the Security Documents. The security documents relating to the Debentures (the “Security Documents”) include the following:

| * | A Specific Security Agreement (Shares) executed by the Company in favor of the Debenture holders pursuant to which it pledged all of the shares in the Subsidiary, to secure the Debentures. | |

| * | A Security Agreement executed by the Subsidiary in favor of the Debenture holders pursuant to which the Subsidiary pledged all of its assets (other than the License) to secure the foregoing Deed of Guarantee and Indemnity. | |

| * | A Deed of Guarantee and Indemnity executed by the Subsidiary in favor of the Debenture holders pursuant to which the Subsidiary guarantees the Debentures. |

The Security Documents contain agreements, representations, warranties, events of default and remedies that are believed to be customary in transactions of this nature. The essential effect of the Security Documents is that, if the Company defaults on or experiences an event of default with respect to the Debentures, the holders of the Debentures could exercise the rights of a secured creditor, which could result in the partial or total loss of nearly all of the Company’s assets, in which case its business could cease and all or substantially all shareholders’ equity could be lost. For more information about this, see the Risk Factors captioned “THE EXERCISE OF SECURED CREDITOR RIGHTS COULD RESULT IN A SIGNIFICANT OR COMPLETE LOSS TO US” herein.

Description of the Warrants. The material terms, provisions and conditions of the Warrants are as follows:

| * | The aggregate number of common shares to be purchased pursuant to exercises of the warrants is 19,125,000. | |

| * | The initial per-share exercise price of the warrants is $0.20 and is subject to certain adjustments that are generally believed to be customary in transactions of this nature. Subject to certain exceptions, the exercise price of the warrants involves possible adjustments downward to the price of any common shares or their equivalents sold by the Company during the term of the Warrants for less than the then applicable exercise price of the Warrants. Upon the adjustment of the exercise price, the number of shares issuable upon exercise of the warrants is proportionately adjusted so the aggregate exercise price of the warrants remains unchanged. | |

| * | All of the warrants are currently exercisable and remain so until their expiration date of May 27, 2019 with respect to 13,875,000 warrant shares or February 15, 2020 with respect to 3,750,000 warrant shares. |

| 5 |

| * | The Company is subject to certain liabilities and liquidated damages for failure to honor timely an exercise of the warrants, and these liabilities and liquidated damages are believed to be customary in transactions of this nature. |

Other Material Terms and Provisions of the Securities Agreement. Certain material terms, provisions and conditions of the Securities Agreement (as amended) that are not described elsewhere herein are as follows:

| * | The Securities Agreement basically contains representations, warranties, indemnities, events of default and remedies that are believed to be customary in transactions of this nature. | |

| * | The Securities Agreement provides that the Original Investor may have elected to the Company’s Board of Directors one nominee. The Original Investor has not exercised the right to nominate or have one director elected. | |

| * | The Securities Agreement contains the following material agreements that are believed to be customary in transactions of this nature: |

| * | Agreements regarding the transferability and transfer of the Debentures, the common shares into which they can be converted, the warrants, and the common shares that can be acquired upon their exercise. | |

| * | Agreements regarding the Company’s obligation to make filings with the U.S. Securities and Exchange Commission (the “SEC”) so that the securities described immediately above can be legally resold. | |

| * | Agreements regarding the use of the proceeds from the Company’s sale of the Debentures. See the section captioned “General” above for a discussion of the use of these proceeds. | |

| * | Agreements regarding the reservation of Common Shares to be issued upon conversions of the Debentures and exercises of the warrants. | |

| * | Agreements prohibiting the sale of Company securities having conversion prices, exercise prices or exchange rates tied to the trading prices of the common shares. |

Material Terms and Provisions of Other Related Agreements - Registration Rights Agreement. The Company entered into a Registration Rights Agreement in favor of the Debenture holders pursuant to which the Company agreed to register with the SEC the resale of the Common Shares into which the Debentures can be converted and the Common Shares that can be acquired upon the exercise of the warrants. Certain material terms, provisions and conditions of the Registration Rights Agreement are as follows:

| * | The Debenture holders have the right, commencing six months after the issuance of the Debentures, to require the Company to register with the SEC the resale of the common shares into which Debentures can be converted, the common shares that can be acquired upon the exercise of the Warrants and possibly other Common Shares, which the Company does not currently believe will be significant, if any. This preceding right is generally referred to as “demand” registration rights. | |

| * | The Company has the obligation to file a registration statement to effect the registration within certain periods of time, and the obligation to cause such registration statement to become effective within certain other periods of time. It will be liable for stipulated monetary damages if it fails in these obligations. The size of these damages is significant, although they are believed to be customary. Once a registration statement is declared effective, the Company must maintain it as effective and current until such time as the registered common shares are sold or become eligible to be sold pursuant to an exemption under certain circumstances, which it believes will never occur. Thus, the Company believes that it will be required to maintain the registration statement effective and current indefinitely after it becomes effective. | |

| * | In addition to the Debenture holders’ “demand” registration rights, the Debenture holders have “piggyback” registration rights whereby they can participate (without a demand) in most registrations that the Company might proposes. | |

| * | The Registration Rights Agreement contains other agreements and indemnities that are believed to be customary in transactions of this nature. |

Potential Change in Control Situation. The Company believes that the Debenture Financings have created a situation, whereby, a change in control of the Company in favor of the Original Investor could (but would not necessarily) occur under the following circumstances:

| * | the Original Investor fully converts all of its Debentures, and the Original Investor fully exercises all of the Warrants that have been issued in its favor; and | |

| * | The Company does not issue a significant number of equity securities prior to the two preceding events. |

| 6 |

Under the circumstance listed above and assuming that the Company does not elect to pay any interest on any Debentures in cash, but allow all such interest to be added to principal, an aggregate of 65,586,759 of its common shares would be issued to the Original Investor, representing approximately 31.44% of the Company’s outstanding common shares after the issuance based on the number of shares currently outstanding and assuming the Original Investor acquires no additional common shares of the Company. An affiliate of the Original Investor also owns 2,600,000 of the Company’s common shares. Combining these shares with those that the Original Investor may acquire per the conversion of its Debentures and the exercise of its warrants, the Original Investor and such affiliate would own approximately 32.28% of the outstanding Common Shares after the Original Investor fully converts of all of its Debentures and fully exercises all of its Warrants. In such event, the Original Investor would become the Company’s largest shareholder, assuming no significant purchases of its common shares by other persons. This development in itself will not give control of the Company to the Original Investor, as the current members of management collectively own a significantly greater number of shares than this. However, this number of common shares would allow the Original Investor to have substantial sway with respect to the Company’s affairs and would give to the Original Investor shared control of the Company if the Original Investor and one or more large shareholders were to agree to act as a group. Whether or not this would ever occur cannot be known at this time.

Description of Prospect

Geology of the Cooper and Eromanga Basins

Granted on October 26, 2012, the License accords to Discovery Energy SA Pty Limited a 100% working interest (87% net revenue interest) in the Prospect. The Prospect covers 584,651 gross acres in the State of South Australia that overlays portions of geological systems commonly referred to as the Cooper and Eromanga Basins. This geologic system, which covers the northeast corner of South Australia and the southwest corner of Queensland State (see location map below), is the most prolific producing onshore region in Australia.

The Cooper Basin is comprised of 32 million acres. It developed in the late Carboniferous Period to the early Permian Period, and features a maximum thickness of sediments of about 9,000 feet. This basin is divided into several depo-centers by faulted anticlinal trends. The Permian Period formations within the Cooper Basin are characterized by alternating fluvial sandstones/floodplain siltstones. Overlaying the Permian Period are Triassic Period formations characterized by fluvial/floodplain sediments. The Eromanga Basin is comprised of 250 million acres, which developed as an interior sag over the central and eastern region of Australia during the Jurassic and Cretaceous Periods. In the south, the depo-centers coincide with underlying Cooper Basin synclines. The younger Eromanga Basin covers the entire Cooper Basin. The geological characteristics of these two basins cause them in effect to form a basin system that for many purposes can best be thought of in terms of a single geological phenomenon rather than two.

Historical Production of Hydrocarbons from the Cooper and Eromanga Basins

In South Australia, where the Prospect is located, hydrocarbons were first produced in 1963 when the Gidgealpa 2 discovery well was completed. The prolific Moomba gas field was discovered in 1966. The first commercial oil was discovered in 1970 in the Tirrawarra field. To date this localized system has grown to approximately 820 gas wells and more than 400 oil wells. These wells feed into approximately 5,600 km of pipelines and flowlines via 15 major satellite facilities.

A Basin-wide assessment by the South Australia Government’s Department for Manufacturing, Innovation, Trade, Resources and Energy (“DMITRE”) estimates two trillion barrels of oil has been generated from Permian Source Rocks. Industry estimates suggest that 640 million barrels (stock tank oil initially in place) are still in place and that the estimated ultimate recovery (EUR) for the South Australia Cooper basin is approximately 200 million barrels. Through August 2015, exploration and development drilling in the South Australia portion of the Copper/Eromanga Basins consisted of more than 3,040 exploration, appraisal and development wells. Source: PEPS database – August 2015

Cumulative production in the Basins is estimated, to the end of June 2016, at 5.3 trillion cubic feet of natural gas since 1970, consisting of more than 195 million barrels of crude oil (“mmbo”), over 81 million barrels oil equivalent of condensate production (“mmboe”) since 1983 and LPG production of 83 mmboe since 1984 (Source: DMITRE - May 2017). While natural gas production and associated liquids at the giant Moomba gas field have been in decline, crude oil production has seen a resurgence largely due to the award of new exploration licenses under the South Australia Government bid process, greater drilling activity fueled by higher oil prices, and the use of new 3D seismic data, which has resulted in higher exploration and development drilling success rates.

| 7 |

Since the early 1980s, the Western Flank area of the Cooper Basin on which the Prospect sits has produced in excess of 35 million barrels of oil. Drilling activity has recently increased in licensed areas bordering or in close proximity to the Prospect. Wells in the areas adjacent to the Prospect are vertical or near vertical and do not require lateral drilling or “fracking” for commercial completion.

The Prospect – Petroleum Exploration License (PEL) 512

The Prospect comprises 584,651 gross acres overlaying portions of the Cooper and Eromanga basins. The Prospect is located in what is generally referred to as the Western Oil Flank of the Cooper Basin and is directly adjacent to PRL permits 85-104 and 151-172 (previously known as on PEL 92 and PEL 91) operated by Beach Energy.

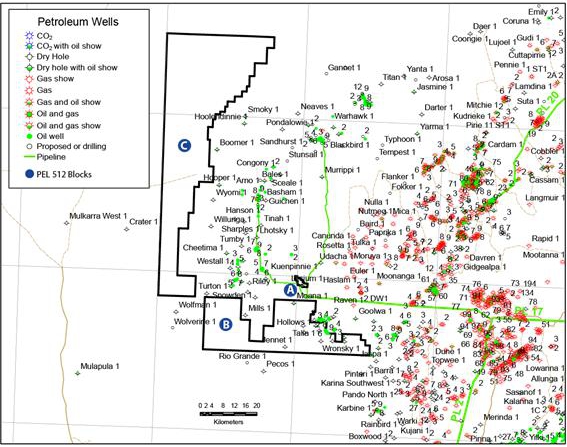

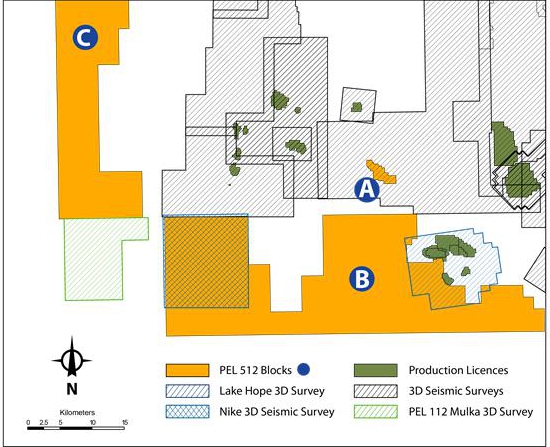

The PEL 512 Lycium area (Area A ~4,000 Acres) is the smallest portion of the Prospect, the PEL 512 South area (Area B ~181,000 acres) is the next largest portion of the Prospect, and the PEL 512 West area (Area C ~400,000 acres) is the largest portion of the Prospect. The Permit and Recent Drilling Activity Map set forth below indicates the three areas of the Prospect in black outline and labelled A, B, and C. The Permit and Recent Drilling Activity Map below also indicates the locations of nearby producing oil and gas fields, and new oil discoveries since 2011. Source: PEPS database – March 2016

Permit and Recent Drilling Activity

During the late 1980s and again during 2005 and 2006, various Cooper Basin operators drilled 10 wells in the southeast corner of Area B. Reports filed with the South Australian government indicate that some of these wells exhibited “oil shows” but none were completed as commercial producers. Previous operators also conducted extensive seismic surveys on the licensed area and produced 5,153 km of 2D and 141 sq. km of 3D seismic data, which was acquired with the License.

The use of 3D seismic interpretation and control combined with a greater understanding of the geology and producing formations has been a critical factor in the increase of recent exploration drilling success rates.

The Prospect features ready access to markets via existing infrastructure including short haul trucking and expanding pipeline capacity including a main Trunk Line with 20,000 barrels per day capacity running from the Moomba Processing Facility to the Lycium Hub, located on the Company’s Lycium block shown as Area A below.

| Permit and Recent Drilling Activity Map | Permit and Seismic Activity Map |

|

|

Permit and Seismic Activity

Since 2012, the Company has assembled a significant technical database consisting of geological, geophysical and engineering data, well logs, completion reports, drilling reports, research reports, production data, raw and processed 2D/3D seismic data, maps and other related materials. The Company’s initial technical focus has been to evaluate the potential of the Prospect’s Area B. The Company engaged Apex Engineering based in Calgary, Alberta on March 21, 2012, to complete an NI 51-101 compliant report, which resulted in the identification of over 110 seismic generated leads over approximately 30% of the approximately 585,000-acre block. This was complimented by the reinterpretation of 5,153 km of 2D seismic and the reprocessing and reinterpretation of 141 sq. km of 3D seismic over the Lake Hope area in the eastern portion of the Prospect’s Area B by Hardin International Processing, Inc. and Bell & Murphy and Associates, LLC, both located in Dallas, Texas.

The South Australia Government approved an Associated Activities License (“AAL”) in early 2013 to construct a 30 km rig access road thru the western corner of Area B and into the adjoining PEL 112. This block is operated by Terra Nova, which completed the Mulka 3D seismic survey in September 2012 and subsequently drilled the Wolverine #1 well in May/June 2013. The road provides direct access to the area and resulted in reduced costs for the Nike 3D seismic program conducted in 2016.

During the fall of 2016, the Company conducted a 179 sq. km 3D seismic survey in the western portion of Area B, which is directly on trend and in close proximity to mature producing areas and recent discoveries on Beach Energy’s operated properties (formerly the PEL 92 License) to the north. Subsequent to completion of the Survey fieldwork, the data gathered was delivered to a geophysical processor in Dallas, Texas. Through a series of technical steps, the raw data was converted into analytical quality information and delivered to the Company’s geophysical advisor just prior to the end of 2016. Interpretation of the processed data, led by the Company’s advisor, included advanced technical analysis by the geotechnical consultant Rincon Energy. At the time of this Annual Report, the ongoing interpretation work has developed an inventory of more than 30 leads judged to be potential areas of crude oil accumulations. These initial opportune locations were prioritized and were presented to a potential source of significant capital to fund the initial drilling program. In addition to the prospect in the Nike area, drill-ready locations have also been identified in the Lake Hope 3D survey area, which is also in Area B of PEL 512.

| 8 |

Recent Exploration of and Production from the Cooper and Eromanga Basins

A total of 176 gas fields and 131 oil fields have been discovered and brought online since 1963. Total conventional wells drilled: 773 exploration, 528 appraisals and 1,045 development wells. Since January 2002 through November 2016, the new explorers in the Cooper Basin have drilled 265 conventional exploration wells and 151 appraisal/development wells. Most have targeted oil; however both oil and gas have been discovered. The new entrants found new pools in 123 of these wells (46% technical success rate) and 110 were cased and suspended as future producers (42% commercial success rate).

Raw gas production commenced from the Cooper Basin in 1970 and from the Otway Basin in 1991. At 31 June 2016, 100 gas fields were on stream with a total of 633 gas wells on stream in the Cooper Basin. The first crude oil production began in December 1983 from the Strzelecki Field. At 31 June 2016, Santos, Beach Energy and Senex Energy had 80 oil fields on stream with a total of 294 oil wells. Source: DMITRE Cooper Basin Factsheet– May 2017

Cooper Basin cumulative production ending June 30, 2017 totaled 5.4 tcf of gas, 197 mmbbls of oil, 84 mmboe of LPG and 80 mmboe of condensate. Cooper Basin annual production for the year ending June 30, 2017 totaled approximately 82 bcf of gas (including some ethane), 11 mmbbls of oil, 1 mmboe of LPG and 1.2 mmboe of condensate. Source: Government of SA, Department of State Development – April 2018

Western Flank Production

In the licensed areas immediately adjacent to the Prospect the operator reported as of December 31, 2017 cumulative oil production of 2.6 mmboe (net) which accounted for approximately 51% of total production and was 14% lower than the prior corresponding period. Half year performance benefited from the merger with Drillsearch, new wells brought online and various field development activities.

During the half year ended December 31, 2016, Beach Energy, the operator for PRLs 151 to 172 (formerly PEL 91), reported oil production of 1.7 mmboe, which was 18% lower than the prior corresponding period, with natural field decline partially offset by field development and production optimization activities and commissioning of the Bauer facility expansion in Q4 FY17. Seven vertical wells and Beach’s first Western Flank horizontal well, Bauer–26, were connected. Bauer–26 commenced production in August 2017 at an initial free-flow, water-free rate of approximately 450 bopd. A beam pump was commissioned in mid-December and resulted in incremental daily oil production of approximately 600 bbl. Production optimization projects included installation of a further five beam pumps, five electric submersible pumps, a flowline connecting the Hanson Field to the Bauer to Lycium pipeline, and completion of the Bauer flowline enhancement project.

During the half year ended December 31, 2017, Beach Energy, the operator for PRLs 85 to 104 (formerly PEL 92), reported oil production of 387 mboe (net), which was 7% higher than the prior corresponding period due to connection of five development wells in the Callawonga Field. Callawonga–15, –16 and –18 were brought online as free flow Namur Sandstone producers with initial combined production of up to 1,400 bopd. Callawonga–14 and –17 were brought online in mid-December as McKinlay Member producers following installation of artificial lift.

During the same period, Beach successfully drilled its first operated horizontal well in the Western Flank. Bauer–26 comprised a lateral section of approximately 400 metres and targeted the McKinlay Member, a thin sandstone overlaying the Namur Sandstone, with accumulations covering areas larger than the Namur fields. The well commenced production in August 2017. Source: Beach Energy Half Yearly Report – December 31, 2017

| 9 |

Terms of the License

On October 26, 2012, Discovery Energy SA Pty Ltd, the Company’s Australian subsidiary (the “Subsidiary”), received the formal grant of the License from the South Australian Minister for Mineral Resources and Energy. The License is a “Petroleum Exploration License” regarding all regulated resources (including petroleum and any other substance that naturally occurs in association with petroleum) relating to the 584,651 gross acres comprising the Prospect land, provided, however, that the License does not permit using the Prospect land as a source of geothermal energy or a natural reservoir for the purpose of gas storage. The term of the License is for five years, with two further, five-year renewal terms, subject to the provisions of the South Australian Petroleum and Geothermal Energy Act 2000.

The License is subject to a five-year work commitment that is described in “Item 1. Business - Plan of Operation - Proposed Initial Activities.” Failure to comply with the work program requirements could lead to the cancellation of the License.

Throughout the term of the License, the Subsidiary is obligated to pay to the State of South Australia production royalty payments in amounts equal to 10% of the value at the wellhead of petroleum produced and sold from the lands covered by the License. Moreover, the License requires that, prior to commencing any fieldwork, the Subsidiary post a security deposit of AU$50,000 (approximately US$38,100). Moreover, the License requires the Subsidiary to maintain insurance of the types and amounts of coverage that management believes are reasonable, customary and are the industry standard throughout Australia.

The License requires the Subsidiary to pay certain fees and production payments equal to 1% royalty to the native titleholders in accordance with the native title agreement and a similar agreement, both of which are discussed immediately below. The License contains provisions regarding environmental matters and liabilities that management also believes are reasonable, customary and are the industry standard throughout Australia.

In addition to the preceding, the company that in effect transferred and sold the License to the Company was allowed to retain a 7.0% royalty interest relating to the Prospect. In three transactions the Company acquired portions of this royalty interest so that the Company now owns an aggregate 5.0% royalty interest, while the previous holders of the original 7.0% interest continue to hold a 2.0% royalty interest.

Native Title Agreement

As a precondition to the issuance of the License, on September 3, 2012, the Subsidiary entered into an agreement (the “Native Title Agreement”) with (a) the State of South Australia, (b) representatives of the Dieri Native Title Holders (the “Native Title Holders”) on behalf of the Native Title Holders, and (c) the Dieri Aboriginal Corporation (the “Association”). The Native Title Holders have certain historic rights on the lands covered by the License.

The term of the Native Title Agreement commenced upon its execution and will terminate on the completion of the operations proposed or which may be undertaken by the Subsidiary in connection with the License and all subsequent licenses resulting from the License. By entering into the Native Title Agreement, the Native Title Holders agreed to the grant of the License and all subsequent licenses to the Subsidiary, and they also covenanted not to lodge or make any objection to any grant of licenses to the Subsidiary in respect of the License area unless the Subsidiary is in breach of an essential term under the Native Title Agreement. The Native Title Agreement provides that it will not terminate in the event of a breach of a payment obligation, but the parties may avail themselves of all other remedies available at law, which would involve recourse to the non-exclusive jurisdiction of the courts of the Commonwealth of Australia and the State of South Australia. Recourse for breach of operational obligations of the Subsidiary in favor of the Native Title Holders and the Association would be subject to the stipulated dispute resolution procedure involving negotiation and mediation before any party may commence court proceedings or arbitration.

In consideration of the Native Title Holders’ entering into the Native Title Agreement, the Subsidiary remitted to them a one-time payment in the amount of AUS$75,000 (or US$80,377 based on the exchange rate charged to the Company in late November 2012 when the payment was made). Moreover, throughout the term of the License, the Subsidiary is obligated to pay to the State of South Australia for the benefit of the Native Title Holders production royalty payments in amounts equal to 1% of the value at the wellhead of petroleum produced and sold from the lands covered by the License. Furthermore, for facilitating the administration of this Native Title Agreement, the Subsidiary will pay in advance to the Association an annual fee comprising 12% of a maximum administration fee (the “Maximum Administration Fee”), which is AUS$150,000 (or approximately US$117,000 based on exchange rates in on February 28, 2018) (subject to adjustment for inflation). This 12% payment will be made for each year of the first five-year term of the License. After the first five-year term of the License, the payment will be four percent 4% of the Maximum Administration Fee for each year of the second and third five-year terms of the License. The Administrative Fee is not payable during times when the License is suspended.

The Subsidiary has virtually unlimited ability to assign and transfer (partially or entirely) its rights in the Native Title Agreement, provided certain procedural requirements are met. This ability should enhance the Subsidiary’s ability to procure an industry joint venture partner.

| 10 |

The Native Title Agreement features extensive provisions governing aboriginal heritage protection in connection with the Subsidiary’s activities relating to the License. Management believes that these provisions (as well as the other provisions of the Native Title Agreement) are reasonable, customary and are the industry standard throughout Australia. Under the Native Title Agreement, the Native Title Holders authorize the Subsidiary to enter upon the License area at all times and to commence and proceed with petroleum operations, and, while the provisions governing aboriginal heritage protection could adversely affect operational strategy and could increase costs, the Native Title Holders and the Association covenant that they will not interfere with the conduct of those operations; will actively support the Subsidiary in procuring all approvals, consents and other entitlements and rights as are necessary to support the interests of the Subsidiary in furthering the project; will refrain from doing any act which would impeded or prevent the Subsidiary from exercising or enjoying any of the rights granted or consented to under the Native Title Agreement; and will observe all applicable laws in performing their obligations under the Native Title Agreement.

In connection with the entry into the Native Title Agreement, the Subsidiary entered into a similar agreement with other Aboriginal native titleholders and claimants with respect to a comparatively small amount of land also covered by the License. For all practical purposes, the terms of this additional agreement are the same as those contained in the Native Title Agreement. Payments made under this second agreement will reduce payments under the Native Title Agreement on a dollar-for-dollar basis, so that each of the two groups of native title holders and claimants will receive payments proportionately based on the amount of land that their respective claims represent relative to the total area covered by the License.

Plan of Operation

General

The Company intends to engage primarily in the exploration and development of oil and gas on the Prospect in an effort to develop oil and gas reserves. The Company’s principal products will be crude oil and natural gas. The Company’s development strategy will be directed in the multi-pay target areas of South Australia, with principal focus on the prolific Cooper/Eromanga Basin, towards initiating and rapidly expanding production rates and proving up significant reserves primarily through exploratory drilling. The Company’s mission will be to generate superior returns for the Company’s shareholders by working with industry partners, suppliers and the community to build a focused exploration and production company with strong development assets in the oil and gas sector.

In the right circumstances, the Company might assume the entire risk of the drilling and development of the Prospect. More likely, the Company will determine that the drilling and development of the Prospect can be more effectively pursued by inviting industry participants to share the risk and the reward of the Prospect by financing some or all of the costs of drilling wells. Such arrangements are frequently referred to as “farm-outs.” In such cases, the Company may retain a carried working interest or a reversionary interest, and the Company may be required to finance all or a portion of its proportional interest in the Prospect. Although this approach will reduce the Company’s potential return should the drilling operations prove successful, it will also reduce the Company’s risk and financial commitment to a particular prospect. Prospective participants regarding possible “farm-out” arrangements have already approached the Company.

There can be no assurance that the Company will be successful in its exploratory and production activities. The oil and gas business involve numerous risks, the principal ones of which are listed in “Item 1A. Risk Factors - RISKS RELATING TO OUR INDUSTRY.”

Although its primary focus is on the exploration and development of the Prospect, the Company has received information about, and has had discussion regarding possible acquisition of or participation in, other oil or gas opportunities. None of these discussions has led to any agreement in principle. Nevertheless, given an attractive opportunity and its ability to consummate the same, the Company could acquire one or more other crude oil and natural gas properties, or participant in one or more other crude oil and natural gas opportunities.

Proposed Initial Activities

The Company is in the initial phase of its plan of operation. To date, the Company has not commenced any drilling or other exploration activities on the Prospect, and thus the Company does not have any estimates of oil and gas reserves. Consequently, the Company has not reported any reserve estimates to any governmental authority. The Company cannot assure anyone that it will find commercially producible amounts of oil and gas. Moreover, at the present time, the Company cannot finance the initial phase of its plan of operation solely through its own current resources. Therefore, the Company has undertaken certain financing activities described in “Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources” below. The success of the initial phase of the Company’s plan of operation depends upon the Company’s ability to obtain additional capital to acquire seismic data with respect to the Prospect, and to drill exploratory and developmental wells. The Company cannot assure anyone that it will obtain the necessary capital.

The License is subject to a five-year work program commitment. The five-year work commitment relating to the License imposes certain financial obligations. The Company has received from the South Australian Energy Resources Division (“SAERD”) several extensions of the annual work commitments relating to the License.

The one-year License suspension granted in February 2016 by the South Australian government was lifted in late June 2016 in order to conduct the Survey. The fieldwork portion of the project was scheduled for completion at the end of September 2016. However, weather delayed the completion until October 30, 2016, when the License was again suspended.

| 11 |

The Survey report was submitted to the South Australian government on November 24, 2016. In management’s view, the geotechnical work completed in the first and second years was sufficient to satisfy the License work requirements, and the Company’s reports in connection with these activities were filed in a timely manner with the South Australian government. The Company has received no comments from the government relating to work described in those reports.

On June 20, 2017, the Company completed its archeological, environmental and operational surveys of the prospective drilling locations identified as a result of the interpretation work associated with the Survey. Initial reports from this Work Area Clearance (“WAC”) survey identified minor issues that will not materially affect operational planning, well design or estimated costs.

Subsequent to completing the WAC, management requested that the government suspend the License for a period of nine months to allow sufficient time to finalize drilling plans, complete financing arrangements and contract the services required to drill multiple exploratory wells in the southern portion of the License area. This request was granted on July 17, 2017, resulting in a six-month extension from SAERD effective from July 5, 2017 to January 4, 2018, resulting in a new expiration date of October 28, 2020. The preceding suspension ended after January 4, 2018, and thus the time during which the work commitment must be completed began running after such date. After the Company has completely formulated its drilling plans and has procured financing to pursue the same, the Company expects to request another suspension until such time as conditions are favorable for the commencement of drilling.

In view of the activity, modifications and suspensions, the remaining work commitments involve the following:

| * | Year 3 ending October 28, 2018 - Acquire additional 2D seismic data totaling at least 100 kilometers and acquire 3D seismic data totaling at least 200 square kilometers, and drill two wells. | |

| * | Year 4 ending October 28, 2019 - Acquire additional 3D seismic data totaling at least 200 square kilometers and drill two wells. | |

| * | Year 5 ending October 28, 2020 - Drill three wells. |

The prices of the equipment and services that the Company must employ to fulfill the work commitment vary based on both local and international demand for such products by others involved in exploration for and production of oil and gas. The prevailing prices of the equipment and services can be subject to significant fluctuations. Until the significant decline in the price of oil that started in June 2014, high worldwide energy prices had resulted in growing demand for equipment and services, which led to higher prices being charged by suppliers and service providers. As a result of the significant decline in the price of oil, supplier and service provider prices have also declined significantly. The Company would like to take advantage of these lower costs. However, the Company has no assurance that it will be able to raise sufficient funds in a timely manner to take advantage of this opportunity, and such prices and costs could begin to rise, perhaps significantly.

In October of 2016, the Company completed a 3D seismic survey comprised of approximately 179 square kilometers (approximately 69 sq. miles) on the southwest portion of the Prospect. This operation was funded with a large portion of the proceeds from the Debenture Financing (the “Survey”). The Survey was conducted by Terrex Pty Ltd. (“Terrex”) at a “turnkey price” of approximately AU$3,057,000 (approximately US$2,379,000 based on the average exchange rate actually received on US$ funds advanced to pay Terrex). Subsequent to completion of the Survey fieldwork, the data gathered was delivered to a geophysical processor in Dallas, Texas. Through a series of technical steps, the raw data was converted in analytical quality information and delivered to the Company’s geophysical advisor just prior to the end of 2016.

During the fiscal year ended February 28, 2018, the processed Survey data was the subject of substantial interpretation work aimed at identifying potential areas of oil accumulation and prospective drill sites. Also, during the past year, the Company conducted environmental and archeological field surveys of a number of prospective drill sites identified from its interpretation program. The potential issues identified by the independent assessment teams are consider minor and can be managed with proper planning and operational diligence. By completing this field work and the attendant reports complete, the Company is positioned to move forward to obtain drilling permits once funding has been secured.

The results of the Company’s interpretation, analysis and field work are being presented to prospective investors with a view to securing the capital to commence the Company’s initial drilling program and meeting the Company’s seismic survey commitments for License Year 3. The Company needs to complete a major capital raising transaction to continue moving its business plan forward. In the interim, the Company is continuing efforts to raise comparably smaller amounts to cover general and administrative expenses. The Company has no assurance that it will be able to raise any required funds. The Company has also re-commenced efforts to secure one or more joint venture partners.

Once the Company is in a position to commence drilling, it intends to engage the services of a third-party contractor. Management foresees no problem in procuring the services of one or more qualified operators and drillers in connection with the initial phase of the Company’s plan of operation, although a considerable increase in drilling activities in the area of its properties could make difficult (and perhaps expensive) the procurement of operating and drilling services. In all cases, the operator will be responsible for all regulatory compliance regarding the well, including any necessary permitting for the well. In addition to regulatory compliance, the operator will be responsible for hiring the drilling contractor, geologist and petroleum engineer to make final decisions relative to the zones to be targeted, well design, and bore-hole drilling and logging. Should the well be successful, the operator would thereafter be responsible for completing the well, installing production facilities and interconnecting with gathering or transmission pipelines if economically appropriate. The Company expects to pay third party operators (i.e. not joint venture partner with the Company) commercially prevailing rates.

| 12 |

The operator will be the caretaker of the well once production has commenced. Additionally, the operator will formulate and deliver to all interest owners an operating agreement establishing each participant’s rights and obligations in that particular well based on the location of the well and the ownership. The operator will also be responsible for paying bills related to the well, billing working interest owners for their proportionate expenses in drilling and completing the well and selling the production from the well. Unless each interest owner sells its production separately, the operator will collect sale proceeds from oil and gas purchasers, and, once a division order has been established and confirmed by the interest owners, the operator will issue the checks to each interest owner in accordance with its appropriate interest. The operator will not perform these functions when each interest owner sells its production separately, in which case the interest owners will undertake these activities separately. After production commences on a well, the operator also will be responsible for maintaining the well and the wellhead site during the entire term of the production or until such time as the operator has been replaced.

The principal oil, natural gas and gas liquids transportation hub for the region of South Australia surrounding the Prospect is located in the vicinity of Moomba. This processing and transportation center is approximately 60 km (36 miles) due east of the Prospect’s eastern boundary and about 40 miles from the Company’s expected initial drill sites. The Company’s expected initial drill sites are located about 20 miles from a privately-owned terminal for trucking oil in Lycium. The Lycium Hub is also the terminal point for a main Trunk Line with 20,000 barrels per day capacity, which delivers oil to the Moomba Processing Facility. If the Company is unable to enter into a suitable contractual relationship with the owner of the truck terminal in Lycium, the Company would be required to truck its oil directly to Moomba, where the pipeline system is managed by a regional carrier who is required to transport the Company’s produced oil to market. Large diameter pipelines deliver oil and gas liquids from Moomba south to Port Bonython (Whyalla). Natural gas is also moved south to Adelaide or east to Sydney. A gas transmission pipeline also connects Moomba to Ballera, which is located northeastward in the State of Queensland. From Ballera gas can be moved to Brisbane and Gladstone, where a liquefied natural gas (LNG) project is under development. The Moomba treating and transportation facilities and the southward pipelines were developed and are operated by a producer consortium led by Santos Limited.

The Company cannot accurately predict the costs of transporting its production until it locates its first successful well. The cost of installing infrastructure to deliver the Company’s production to Moomba or elsewhere will vary depending upon distance traversed, negotiated handling/treating fees, and pipeline tariffs.

Markets and Marketing

The petroleum industry has been characterized historically by crude oil and natural gas commodity prices that fluctuate (sometimes dramatically), and supplier costs can rise significantly during industry booms. For example, crude oil and natural gas prices increased to an historical high of US$143 per barrel in July 2008 and then declined significantly during the last half of 2008 to a low of US$34 per barrel. After this period, prices generally improved steadily with occasional reversals, without returning to historical highs, although they had generally been higher than pre-2007 levels. Another price decline cycle started in June 2014 when the price of Brent oil was above US$110 per barrel and continued to a low of US$29 per barrel in Jan 2016. Since early 2016 prices have steadily recovered with the average Brent closing price during April 2018 was $72 per barrel. Crude oil and gas prices and markets are likely to remain volatile in the future. Crude oil and natural gas are commodities and their prices are subject to wide fluctuations in response to relatively minor changes in supply and demand for oil and gas, market uncertainty, and a variety of additional factors beyond the Company’s control. Those factors include:

| * | international political conditions (including wars and civil unrest, such as the recent unrest in the Middle East); | |

| * | the domestic and foreign supply of oil and gas; | |

| * | the level of consumer demand; | |

| * | weather conditions; | |

| * | domestic and foreign governmental regulations and other actions; | |

| * | actions taken by the Organization of Petroleum Exporting Countries (“OPEC”); | |

| * | the price and availability of alternative fuels; and | |

| * | overall economic conditions. |

Lower oil and natural gas prices may not only decrease the Company’s revenues on a per unit basis, but may also reduce the amount of oil and natural gas the Company can produce economically, if any. A sustained decline in oil and natural gas prices may materially affect the Company’s future business, financial condition, results of operations, liquidity and borrowing capacity, and may require a reduction in the carrying value of the Company’s oil and gas properties. While the Company’s revenues may increase if prevailing oil and gas prices increase significantly, exploration and production costs and acquisition costs for additional properties and reserves may also increase. The Company may or may not enter into hedging arrangements or use derivative financial instruments such as crude oil forward and swap contracts to hedge in whole or in part its risk associated with fluctuations in commodity prices.

The Company does not expect to refine any of its production, although it may have to treat or process some of its production to meet the quality standards of purchasing or transportation companies. Instead, the Company expects that all or nearly all of its production will be sold to a relatively small number of customers. Production from the Company’s properties will be marketed consistent with industry practices. The Company does not now have any long-term sales contracts for any crude oil and natural gas production that it may realize, but the Company expects that it will generally sell any production that it develops pursuant to these types of contracts. The Company does not believe that it will have any difficulty in entering into long-term sales contracts for its production, although there can be no assurance in this regard.

| 13 |

The availability of a ready market for the Company’s production will depend upon a number of factors beyond the Company’s control, including the availability of other production in the Prospect’s region, the proximity and capacity of oil and gas pipelines, and fluctuations in supply and demand. Although the effect of these factors cannot be accurately predicted or anticipated, the Company does not anticipate any unusual difficulty in contracting to sell its production of oil and gas to purchasers at prevailing market prices and under arrangements that are usual and customary in the industry. However, there can be no assurance that market, economic and regulatory factors will not in the future materially adversely affect the Company’s ability to sell its production.

The Company expects that most of oil and natural gas that it is able to find (if any) will be transported through gas trucking systems, gathering systems and gas pipelines that are not owned by it. The Prospect is in fairly close proximity to gas pipelines suitable for carrying the Company’s production. Transportation capacity on gas gathering systems and pipelines is occasionally limited and at times unavailable due to repairs or improvements being made to the facilities or due to use by other gas shippers with priority transportation agreements or who own or control the relevant pipeline. If transportation space is restricted or is unavailable, the Company’s cash flow could be adversely affected.

Sales prices for oil and gas production are negotiated based on factors normally considered in the industry, such as the reported trading prices for oil and gas on local or international commodity exchanges, distance from the well to the pipeline, well pressure, estimated reserves, commodity quality and prevailing supply conditions. Historically, crude oil and natural gas market prices have experienced high volatility, which is a result of ever changing perceptions throughout the industry centered on supply and demand. The Company cannot predict the occurrence of events that may affect oil and gas prices or the degree to which such prices will be affected. However, the oil or gas prices realized by the Company should be equivalent to current market prices in the geographic region of the Prospect. Typically, oil prices in Australia reflect or are “benchmarked” against European commodity market trading settlement prices, namely Brent Crude. Recent price levels in this market have been at a premium to those settled in the United States, or (in other words) those “benchmarked” against West Texas Intermediate Crude. During certain periods, the differential has been substantial, although during the past few years the differential has been relatively modest.

As of May 31, 2018, WTI Crude Oil was priced at US$67.04 per barrel and Brent Crude Oil was priced at US$77.59 per barrel. The Company cannot predict the future level of the price differential between WTI Crude Oil and Brent Crude Oil or be assured that such differential will reflect a favorable premium for the Company in the future.

The Company will strive to obtain the best price in the area of its production. The Company’s revenues, profitability and future growth will depend substantially on prevailing prices for crude oil and natural gas. Decreases in the prices of oil and gas would likely adversely affect the carrying value of any proved reserves the Company is successful in establishing and its prospects, revenues, profitability and cash flow.

Competition

The Company expects to operate in the highly competitive areas of oil and gas exploration, development and production. The Company believes that the level of competition in these areas will continue into the future and may even intensify. In the areas of oil and gas exploration, development and production, competitive advantage is gained through superior capital investment decisions, technological innovation and costs management. The Company’s competitors include major oil and gas firms and a large number of independent oil and gas companies. Because the Company expects to have control over acreage sufficient for its exploration and production efforts for the foreseeable future, the Company does not expect to compete for the acquisitions of properties for the exploration for oil and gas. However, the Company will compete for the equipment, services and labor required to operate and to develop its properties and to transport its production. Many of the Company’s competitors have substantially larger operating staffs and greater financial and other resources. In addition, larger competitors may be able to absorb the burden of any changes in laws and regulations more easily than the Company can, which would adversely affect its competitive position. Moreover, most of the Company’s competitors have been operating for a much longer time than the Company has and they have demonstrated the ability to operate through a number of industry cycles. The effect of the intense competition that the Company will face cannot now be determined.

Regulation

Our operations in South Australia and within the area of the Prospect are subject to the laws and regulations of the State of South Australia and the Commonwealth of Australia. The License was granted under the Petroleum and Geothermal Energy Act 2000 (SA) and the Company’s operations within and with respect to the License are governed by this Act and by the Petroleum and Geothermal Energy Regulations 2013 (SA). This legislation covers all phases of the Company’s operations including exploration, appraisal, development and production of oil and gas from the License area. Other legislation which the Company will be required to comply with at various stages of its operations include: Environment Protection Act 1993 (SA); Aboriginal Heritage Act 1988 (SA); Native Title (South Australia) Act 1994 (SA) and Native Title Act 1993 (Cth). As its oil and gas exploration and production operations in South Australia proceed, the Company will provide more detailed information regarding the material features and effects of these laws and regulations and such other legislation with which the Company will be required to comply.

| 14 |

Legal Proceedings

The Company is not now involved in any legal proceedings. There can be no assurance, however, that it will not be in the future involved in litigation incidental to the conduct of its business.

Employees

As of the date of this filing, the Company had no employees. The Company expects that it will not have employees for the foreseeable future, although it expects to enter into consulting agreements with members of management at some time in the future. The market for qualified oil and gas professionals and craftsmen can be very competitive during periods of strong commodity prices. The Company anticipates offering compensation and an interesting work environment that will enable it to attract employees to meet the Company’s labor needs, once fully funded.

Facilities

The Company maintains its principal executive offices at One Riverway Drive, Suite 1700, Houston, Texas 77056 through an office rental package on essentially a month to month basis. Management believes that any needed additional or alternative office space can be readily obtained.

An investment in shares of our common stock is highly speculative and involves a high degree of risk. You should carefully consider all of the risks discussed below, as well as the other information contained in this Annual Report. If any of the following risks develop into actual events, our business, financial condition or results of operations could be materially adversely affected and the trading price of our common stock could decline.

RISKS RELATING TO OUR COMPANY

WE ARE AN EARLY-STAGE COMPANY WITH NO PROVED RESERVES, AND WE MAY NOT BECOME PROFITABLE.

Our Company was incorporated on May 24, 2006 for the purpose of trying to develop commercially certain mineral claims. This business did not move forward. We have decided to focus our business on the exploration, development and production of oil and gas on a particular crude oil and natural gas prospect that is described in “Item 1 Business” (the “Prospect”). The Prospect is considered “undeveloped acreage,” which the U.S. Securities and Exchange Commission (the “Commission”) defines as “lease acreage on which wells have not been drilled or completed to a point that would permit the production of commercial quantities of oil and gas regardless of whether such acreage contains proved reserves.” We have no proved reserves. In view of our extremely limited history in the oil and gas exploration business, you may have difficulty in evaluating us and our business and prospects. You must consider our business and prospects in light of the risks, expenses and difficulties frequently encountered by companies in their early stage of development. For our business plan to succeed, we must successfully undertake most of the following activities:

| * | Complete a financing or similar transaction that will provide us with sufficient funds; | |

| * | Drill successful exploratory test wells on the Prospect to determine the presence of oil and gas in commercially viable quantities; | |

| * | Develop the Prospect to a stage at which oil and gas are being produced in commercially viable quantities; | |

| * | Procure purchasers of our commercial production of oil and gas upon such commencement; | |

| * | Comply with applicable laws and regulations; | |

| * | Identify and enter into binding agreements with suitable third parties (such as joint venture partners and contractors) for the Prospect; | |

| * | Implement and successfully execute our business strategy; | |

| * | Respond to competitive developments and market changes; and | |

| * | Attract, retain and motivate qualified personnel. |

There can be no assurance that we will be successful in undertaking such activities. Our failure to undertake successfully most of the activities described above could materially and adversely affect our business, prospects, financial condition and results of operations. In addition, there can be no assurance that our exploration and production activities will produce oil and gas in commercially viable quantities, if any at all. Moreover, even if we succeed in producing oil and gas, we expect to incur operating losses until such time (if ever) as we produce and sell a sufficient volume of our commercial production to cover direct production costs as well as corporate overhead. There can be no assurance that sales of our oil and gas production will ever generate significant revenues, that we will ever generate positive cash flow from our operations or that (if ever attained) we will be able to sustain profitability in any future period.

| 15 |

WE ARE SIGNIFICANTLY LEVERAGED.

During our recent fiscal years, we took on a significant amount of indebtedness through the sale of the Debentures. The Debentures are secured by all of our assets owned directly or indirectly but for the License. The use of secured indebtedness to finance our business is referred to as leveraging. Leveraging increases the risk of loss to us if and to the extent we have insufficient revenue to pay our debt obligations. In such event, cash from other sources will be required. The Debentures must be repaid on or before May 27, 2021. Unless we generate such cash, we may not have sufficient funds to pay the Debentures when due and other indebtedness. In such event, we might be required to sell our assets and properties to meet our obligations, or to seek an extension to the Debentures, or alternative debt or equity financing. If sale, extension or refinancing is not obtained or consummated, we could default in our obligations.

THE EXERCISE OF SECURED CREDITOR RIGHTS COULD RESULT IN A SIGNIFICANT OR COMPLETE LOSS.

If we default on the Debentures, the remedy of the Debenture holders would be (among other things) to institute proceedings against our assets and properties to sell them to satisfy the amounts owed pursuant to the Debentures. This could result in the partial or total loss of our assets and properties. We have no assurance that, upon the exercise of the Debenture holders’ secured creditor rights, we would receive a return of anything on our assets and properties. The loss of our assets and properties by the exercise of the Debenture holders’ secured creditor rights would most likely materially adversely affect our business, financial condition or results, and could result in a total loss to our shareholders.

THE DEBENTURES FEATURE CERTAIN OPERATING COVENANTS THAT COULD ADVERSELY AFFECT THE COMPANY.