Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VEEVA SYSTEMS INC | veev-8k_20180607.htm |

ASC 606 Investor Presentation June 7, 2018 Exhibit 99.1

Multi-year contracts with ramping fees: In multi-year arrangements with ramping fees (e.g., Year 1 fees of $1M, Year 2 fees of $2M, and Year 3 fees of $3M), 606 dictates that revenue be recognized equally over each year of the arrangement. Relative to 605, more revenue (which will be unbilled) will be recognized in early years of the arrangement and less revenue in later years. Application of this treatment depends on the terms of the customers’ arrangements. Capitalized commissions: We previously expensed commissions the period in which they were incurred. Going forward, we will capitalize commissions and amortize them over a 3-year term. Calculated billings: Under 606, the billings calculation changes to account for unbilled receivables. New formula à Calculated billings = Revenue + change in deferred revenue – change in unbilled receivables. Using this formula, there is minimal change to calculated billings. No change to cash flows Primary impacts from 606 transition FY17 & FY18 have been restated under the full retrospective method

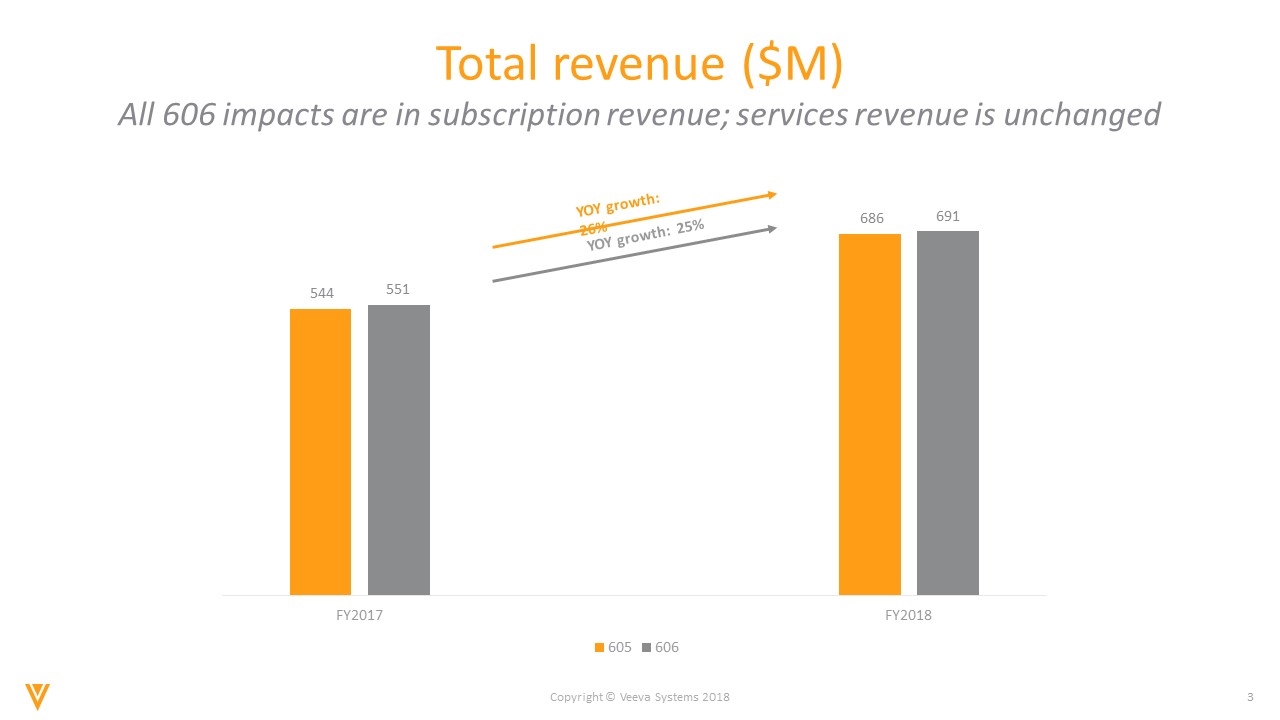

Total revenue ($M) YOY growth: 25% YOY growth: 26% All 606 impacts are in subscription revenue; services revenue is unchanged

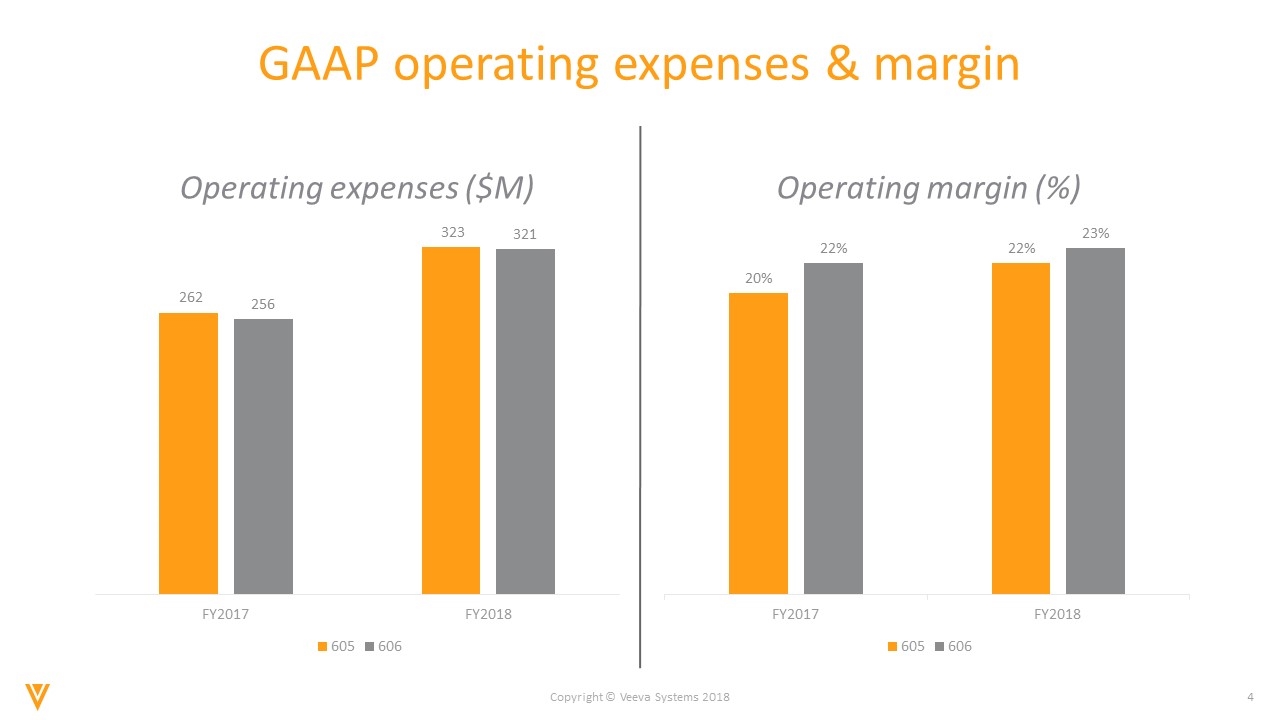

GAAP operating expenses & margin Operating expenses ($M) Operating margin (%)

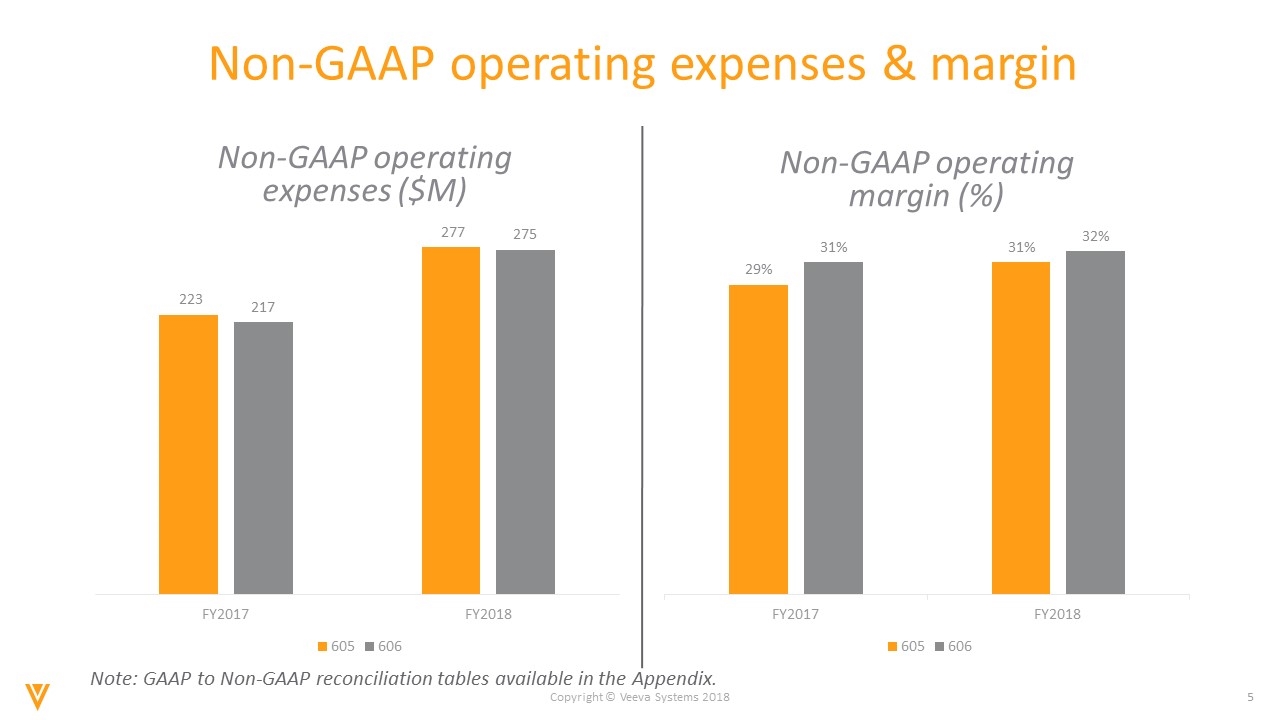

Non-GAAP operating expenses & margin Non-GAAP operating expenses ($M) Non-GAAP operating margin (%) Note: GAAP to Non-GAAP reconciliation tables available in the Appendix.

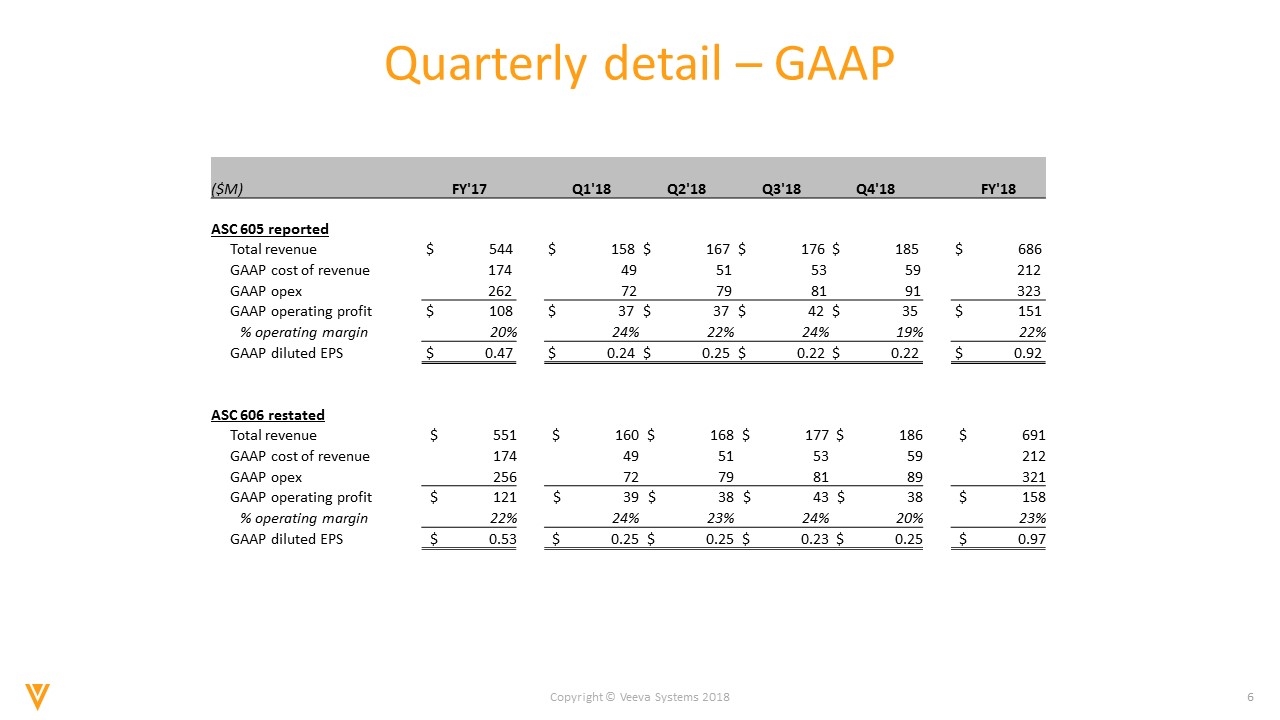

Quarterly detail – GAAP ($M) FY'17 Q1'18 Q2'18 Q3'18 Q4'18 FY'18 ASC 605 reported Total revenue $ 544 $ 158 $ 167 $ 176 $ 185 $ 686 GAAP cost of revenue 174 49 51 53 59 212 GAAP opex 262 72 79 81 91 323 GAAP operating profit $ 108 $ 37 $ 37 $ 42 $ 35 $ 151 % operating margin 20% 24% 22% 24% 19% 22% GAAP diluted EPS $ 0.47 $ 0.24 $ 0.25 $ 0.22 $ 0.22 $ 0.92 ASC 606 restated Total revenue $ 551 $ 160 $ 168 $ 177 $ 186 $ 691 GAAP cost of revenue 174 49 51 53 59 212 GAAP opex 256 72 79 81 89 321 GAAP operating profit $ 121 $ 39 $ 38 $ 43 $ 38 $ 158 % operating margin 22% 24% 23% 24% 20% 23% GAAP diluted EPS $ 0.53 $ 0.25 $ 0.25 $ 0.23 $ 0.25 $ 0.97

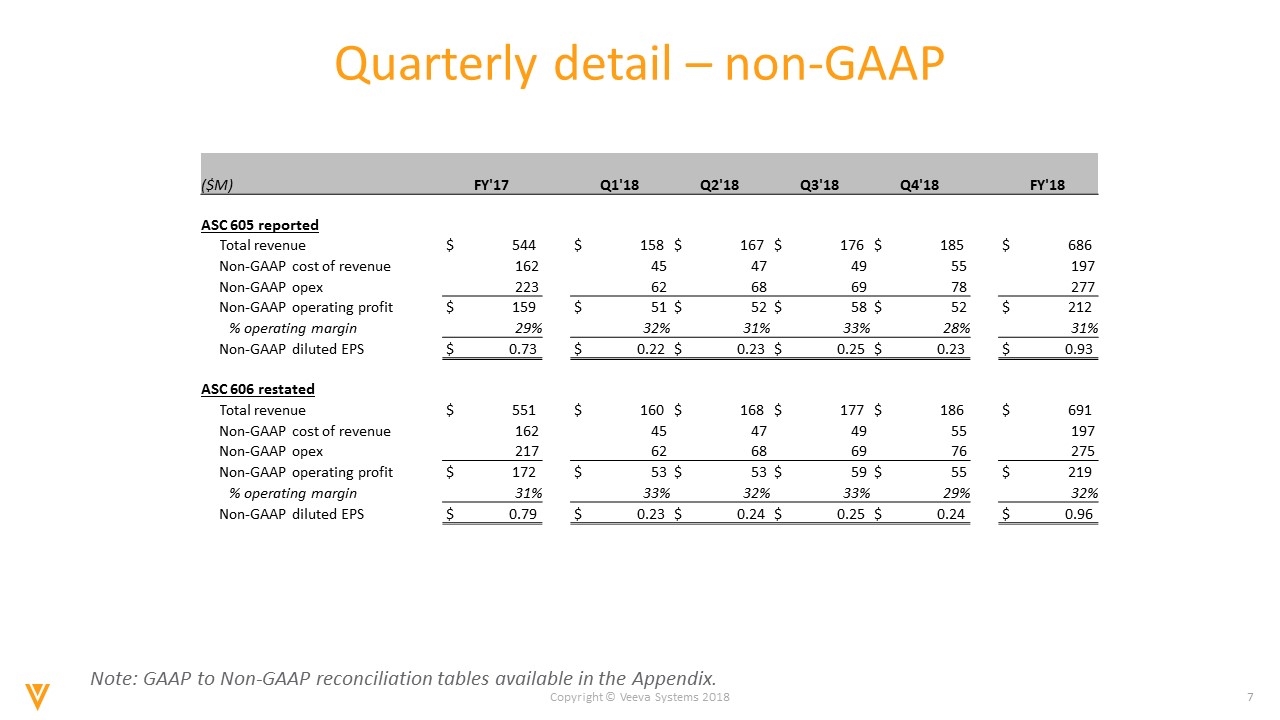

Quarterly detail – non-GAAP Note: GAAP to Non-GAAP reconciliation tables available in the Appendix. ($M) FY'17 Q1'18 Q2'18 Q3'18 Q4'18 FY'18 ASC 605 reported Total revenue $ 544 $ 158 $ 167 $ 176 $ 185 $ 686 Non-GAAP cost of revenue 162 45 47 49 55 197 Non-GAAP opex 223 62 68 69 78 277 Non-GAAP operating profit $ 159 $ 51 $ 52 $ 58 $ 52 $ 212 % operating margin 29% 32% 31% 33% 28% 31% Non-GAAP diluted EPS $ 0.73 $ 0.22 $ 0.23 $ 0.25 $ 0.23 $ 0.93 ASC 606 restated Total revenue $ 551 $ 160 $ 168 $ 177 $ 186 $ 691 Non-GAAP cost of revenue 162 45 47 49 55 197 Non-GAAP opex 217 62 68 69 76 275 Non-GAAP operating profit $ 172 $ 53 $ 53 $ 59 $ 55 $ 219 % operating margin 31% 33% 32% 33% 29% 32% Non-GAAP diluted EPS $ 0.79 $ 0.23 $ 0.24 $ 0.25 $ 0.24 $ 0.96

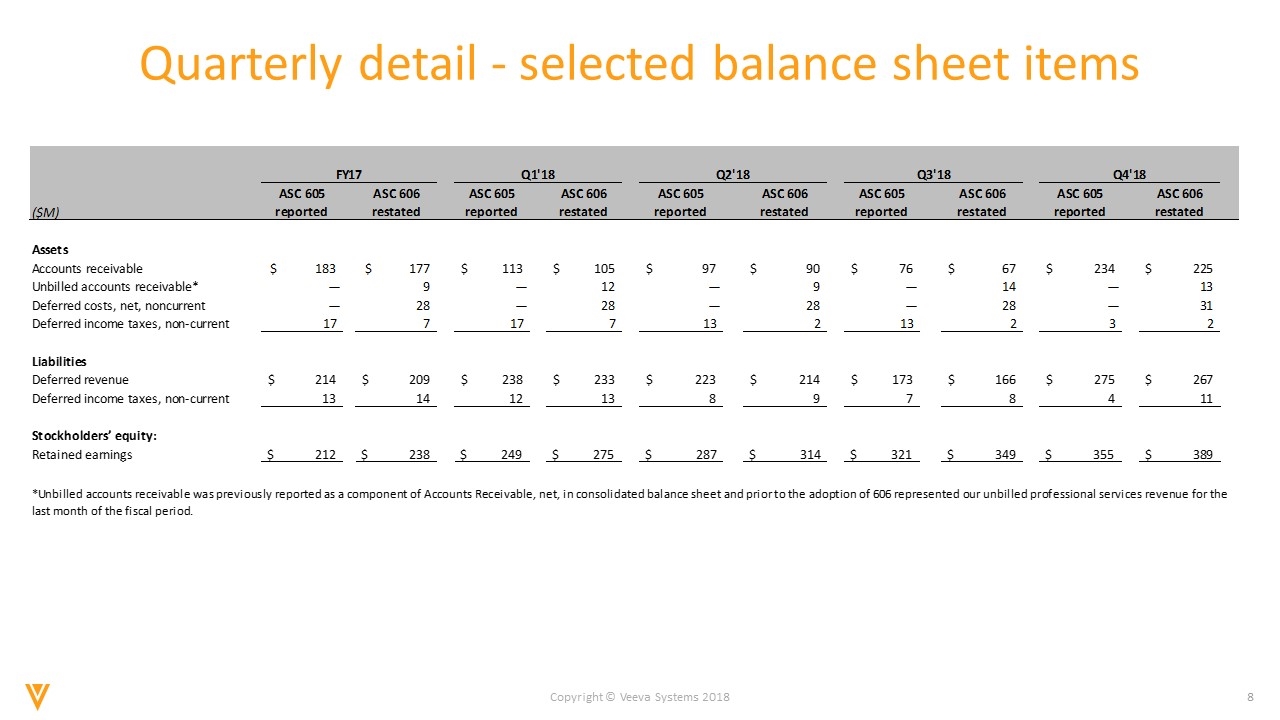

Quarterly detail - selected balance sheet items

Appendix

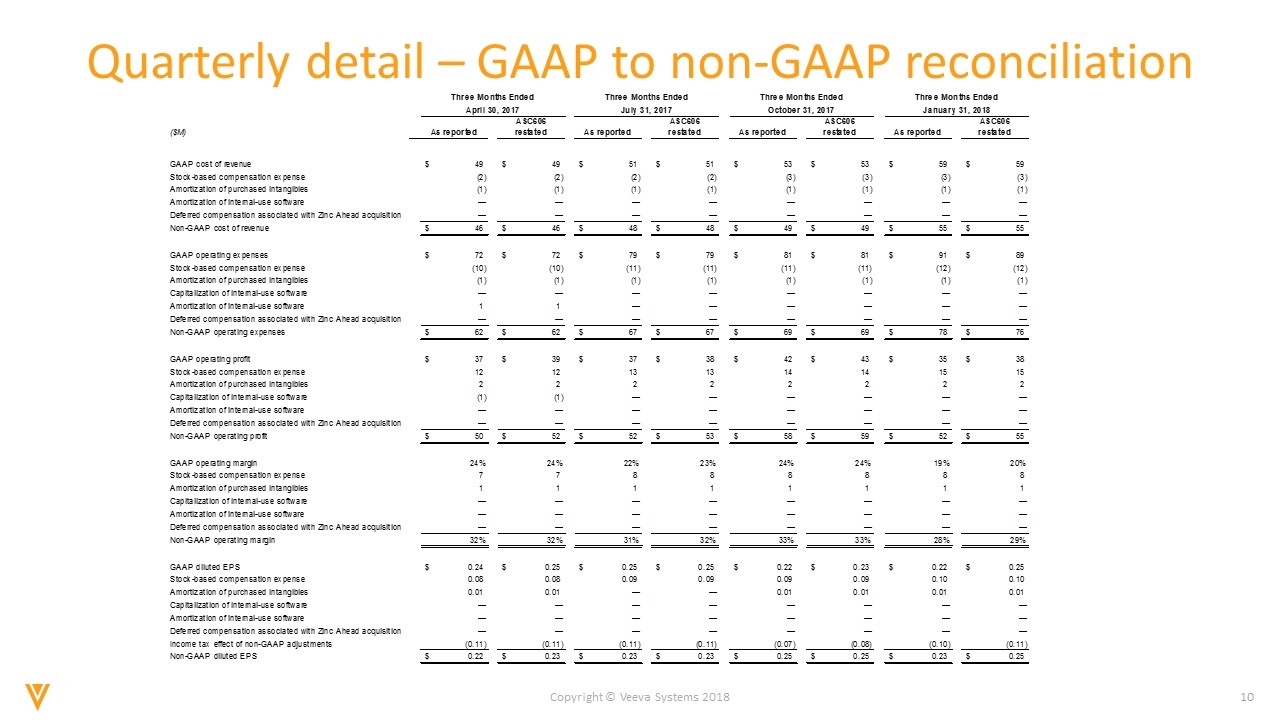

Quarterly detail – GAAP to non-GAAP reconciliation

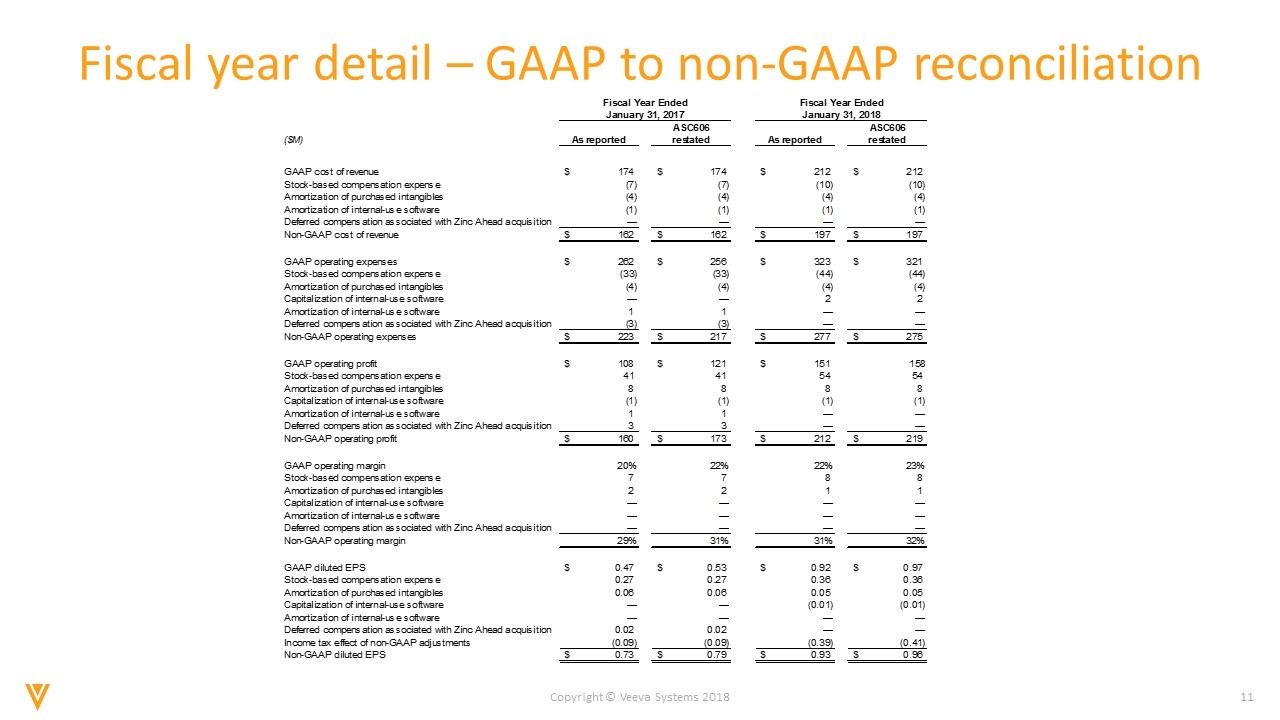

Fiscal year detail – GAAP to non-GAAP reconciliation