Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Stitch Fix, Inc. | sfix-ex991_7.htm |

| 8-K - 8-K - Stitch Fix, Inc. | sfix-8k_20180607.htm |

JUNE 7, 2018 Exhibit 99.2

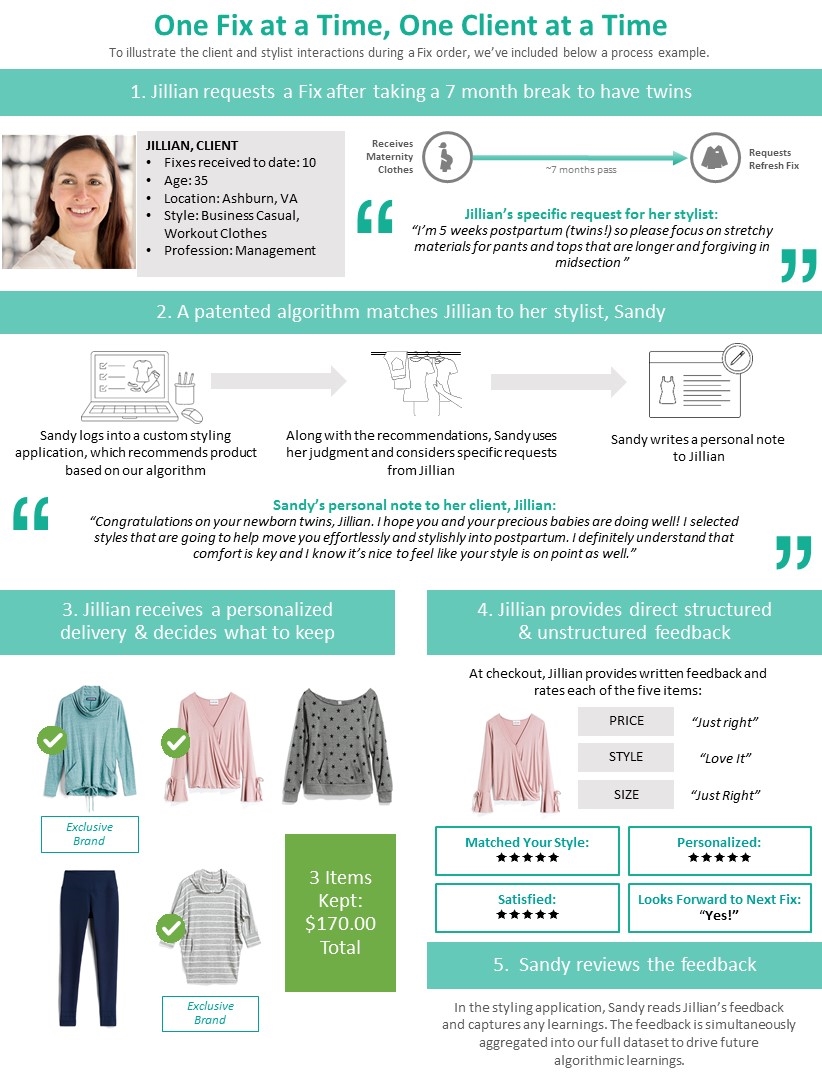

Exclusive Brand Looks Forward to Next Fix: “Yes!” 1. Jillian requests a Fix after taking a 7 month break to have twins JILLIAN, CLIENT Fixes received to date: 10 Age: 35 Location: Ashburn, VA Style: Business Casual, Workout Clothes Profession: Management 2. A patented algorithm matches Jillian to her stylist, Sandy 3. Jillian receives a personalized delivery & decides what to keep Sandy logs into a custom styling application, which recommends product based on our algorithm Along with the recommendations, Sandy uses her judgment and considers specific requests from Jillian Sandy writes a personal note to Jillian 4. Jillian provides direct structured & unstructured feedback 3 Items Kept: $170.00 Total At checkout, Jillian provides written feedback and rates each of the five items: One Fix at a Time, One Client at a Time 5. Sandy reviews the feedback In the styling application, Sandy reads Jillian’s feedback and captures any learnings. The feedback is simultaneously aggregated into our full dataset to drive future algorithmic learnings. To illustrate the client and stylist interactions during a Fix order, we’ve included below a process example. Matched Your Style: êêêêê Satisfied: êêêêê Personalized: êêêêê Sandy’s personal note to her client, Jillian: “Congratulations on your newborn twins, Jillian. I hope you and your precious babies are doing well! I selected styles that are going to help move you effortlessly and stylishly into postpartum. I definitely understand that comfort is key and I know it’s nice to feel like your style is on point as well.” Jillian’s specific request for her stylist: “I’m 5 weeks postpartum (twins!) so please focus on stretchy materials for pants and tops that are longer and forgiving in midsection ” PRICE SIZE “Just Right” “Just right” “ “ “ “ Exclusive Brand Receives Maternity Clothes Requests Refresh Fix ~7 months pass STYLE “Love It”

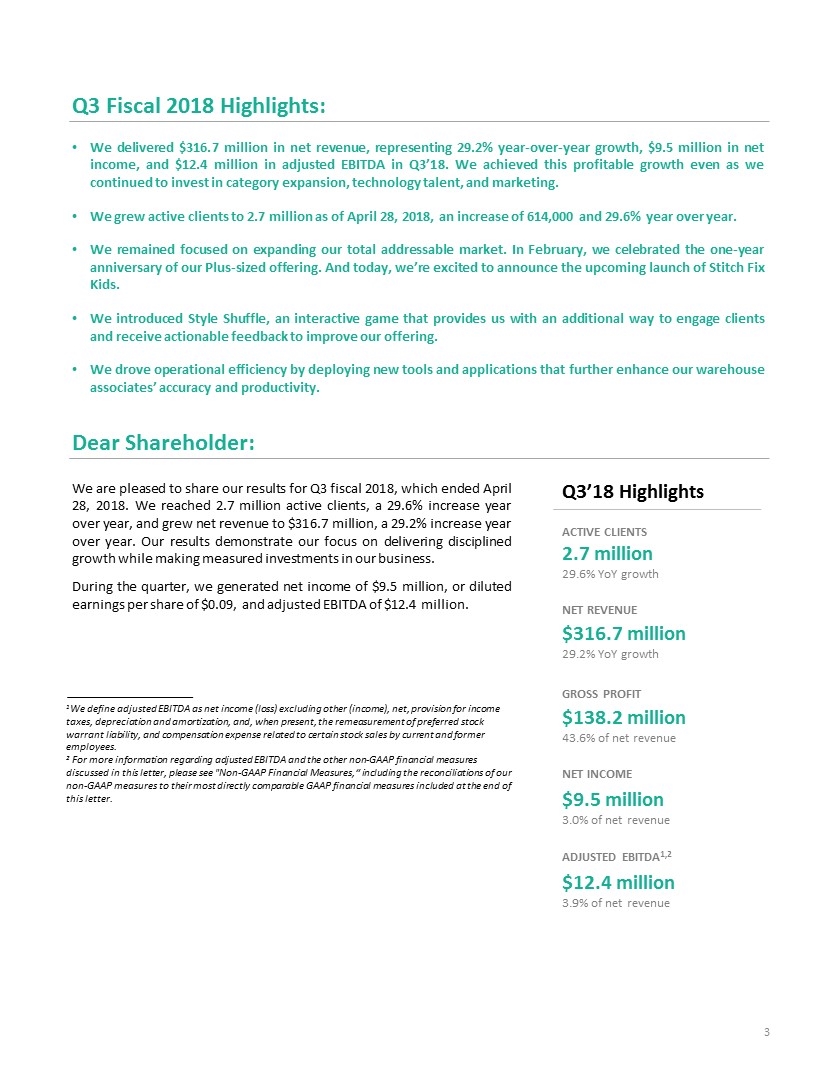

We delivered $316.7 million in net revenue, representing 29.2% year-over-year growth, $9.5 million in net income, and $12.4 million in adjusted EBITDA in Q3’18. We achieved this profitable growth even as we continued to invest in category expansion, technology talent, and marketing. We grew active clients to 2.7 million as of April 28, 2018, an increase of 614,000 and 29.6% year over year. We remained focused on expanding our total addressable market. In February, we celebrated the one-year anniversary of our Plus-sized offering. And today, we’re excited to announce the upcoming launch of Stitch Fix Kids. We introduced Style Shuffle, an interactive game that provides us with an additional way to engage clients and receive actionable feedback to improve our offering. We drove operational efficiency by deploying new tools and applications that further enhance our warehouse associates’ accuracy and productivity. Q3 Fiscal 2018 Highlights: Dear Shareholder: Q3’18 Highlights ACTIVE CLIENTS 2.7 million 29.6% YoY growth NET REVENUE $316.7 million 29.2% YoY growth GROSS PROFIT $138.2 million 43.6% of net revenue NET INCOME $9.5 million 3.0% of net revenue ADJUSTED EBITDA1,2 $12.4 million 3.9% of net revenue We are pleased to share our results for Q3 fiscal 2018, which ended April 28, 2018. We reached 2.7 million active clients, a 29.6% increase year over year, and grew net revenue to $316.7 million, a 29.2% increase year over year. Our results demonstrate our focus on delivering disciplined growth while making measured investments in our business. During the quarter, we generated net income of $9.5 million, or diluted earnings per share of $0.09, and adjusted EBITDA of $12.4 million. 1We define adjusted EBITDA as net income (loss) excluding other (income), net, provision for income taxes, depreciation and amortization, and, when present, the remeasurement of preferred stock warrant liability, and compensation expense related to certain stock sales by current and former employees. 2 For more information regarding adjusted EBITDA and the other non-GAAP financial measures discussed in this letter, please see "Non-GAAP Financial Measures,“ including the reconciliations of our non-GAAP measures to their most directly comparable GAAP financial measures included at the end of this letter.

We remained focused on expanding our total addressable market. In February, we celebrated the one-year anniversary of our Plus-sized offering. And today, we’re excited to announce the upcoming launch of Stitch Fix Kids. Plus In February 2017, we launched our Plus-sized Women’s category to address a historically underserved market, which is estimated to comprise over 50% of U.S. women (size 14 or higher)3. Even prior to our launch of Plus, we had over 75,000 women on our waitlist for the offering. As we celebrate our first anniversary, we continue to see a large market opportunity for further growth and personalization. In the past year, we’ve increased our knowledge of Plus preferences and styles while building a diverse brand portfolio. Our assortment includes third-party brands as well as our own exclusive brands, and has enabled us to effectively serve a variety of client preferences. As evidence of our ability to learn quickly about new client segments, the number of items Plus clients purchased per Fix has already reached parity with what we’ve historically seen in our Women’s offering. Our personalization capabilities are powered by our ability to leverage client feedback to more closely align inventory with client preferences. Similar to our Men’s clients, Plus-sized clients have shared that fit is one of the most important attributes they consider when buying clothes. For this reason, we’ve increasingly used our exclusive brands to effectively serve these clients’ fit needs. In the last 12 months, this strategy resulted in an increase in the percent of clients who “like” or “love” the fit of their Plus apparel. Over this same period, we’ve also driven improvements in client satisfaction across both size and price. We believe that we are uniquely positioned to serve Plus-sized clients because of the combination of our broader business and many years of learning, paired with the insights our clients share with us. For example, we know that approximately 15% of our Plus clients crossover sizes, meaning that they wear either Plus-sized tops or bottoms, but not both. This insight gives us an advantage to deliver exactly what each of our clients needs and further reinforces our ability to serve a wide range of clients with our broad inventory mix. Kids Today, we announced our upcoming launch of Stitch Fix Kids just in time for back-to-school. This category is a natural extension given that we already serve so many men and women who have children, offering parents an effortless way to shop for the entire family. Stitch Fix Kids will offer unique, affordable clothing—in sizes 2T-14—across a diverse range of style aesthetics to give kids the freedom to express themselves in clothing that they feel great wearing. Using our data science capabilities, Stitch Fix stylists will curate head-to-toe outfits that kids will love. Kids Fixes will include 8 to 12 items, and will comprise both market and exclusive brands. Q3’18 Business Highlights: 3 Source: McCall, Tyler. “Luxury Fashion Has a Plus Size Problem.” Fashionista. May 2018.

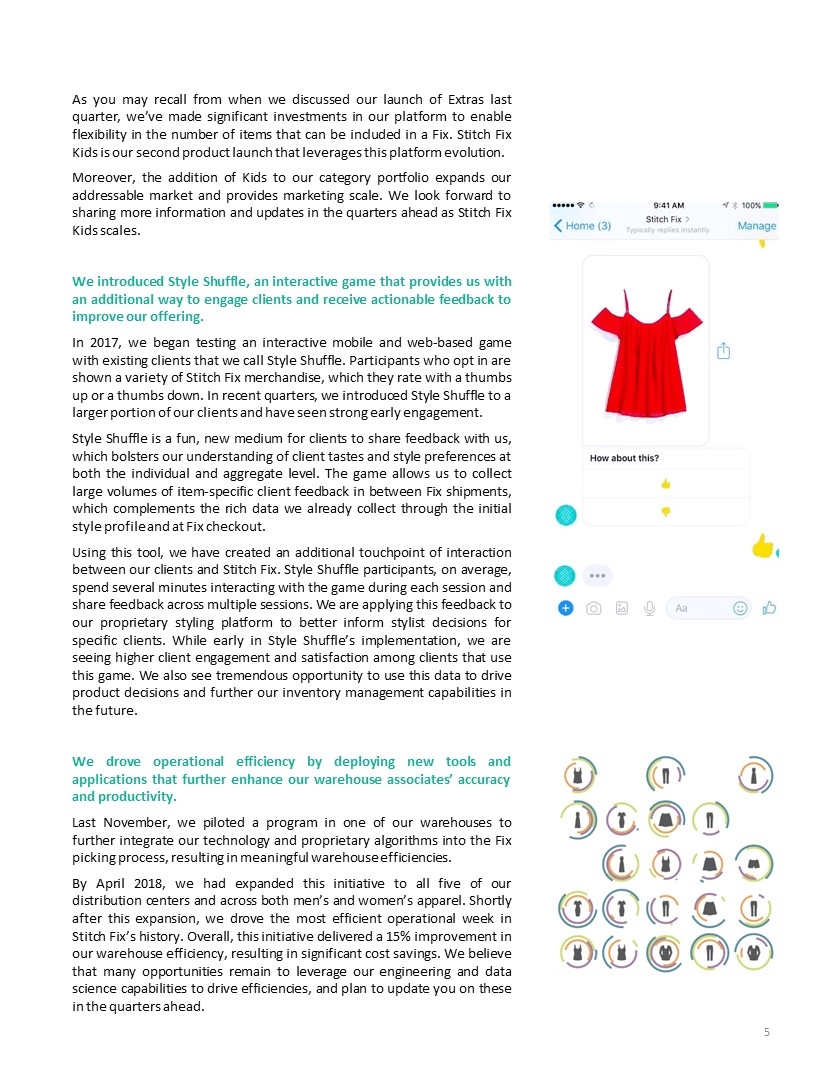

As you may recall from when we discussed our launch of Extras last quarter, we’ve made significant investments in our platform to enable flexibility in the number of items that can be included in a Fix. Stitch Fix Kids is our second product launch that leverages this platform evolution. Moreover, the addition of Kids to our category portfolio expands our addressable market and provides marketing scale. We look forward to sharing more information and updates in the quarters ahead as Stitch Fix Kids scales. We introduced Style Shuffle, an interactive game that provides us with an additional way to engage clients and receive actionable feedback to improve our offering. In 2017, we began testing an interactive mobile and web-based game with existing clients that we call Style Shuffle. Participants who opt in are shown a variety of Stitch Fix merchandise, which they rate with a thumbs up or a thumbs down. In recent quarters, we introduced Style Shuffle to a larger portion of our clients and have seen strong early engagement. Style Shuffle is a fun, new medium for clients to share feedback with us, which bolsters our understanding of client tastes and style preferences at both the individual and aggregate level. The game allows us to collect large volumes of item-specific client feedback in between Fix shipments, which complements the rich data we already collect through the initial style profile and at Fix checkout. Using this tool, we have created an additional touchpoint of interaction between our clients and Stitch Fix. Style Shuffle participants, on average, spend several minutes interacting with the game during each session and share feedback across multiple sessions. We are applying this feedback to our proprietary styling platform to better inform stylist decisions for specific clients. While early in Style Shuffle’s implementation, we are seeing higher client engagement and satisfaction among clients that use this game. We also see tremendous opportunity to use this data to drive product decisions and further our inventory management capabilities in the future. We drove operational efficiency by deploying new tools and applications that further enhance our warehouse associates’ accuracy and productivity. Last November, we piloted a program in one of our warehouses to further integrate our technology and proprietary algorithms into the Fix picking process, resulting in meaningful warehouse efficiencies. By April 2018, we had expanded this initiative to all five of our distribution centers and across both men’s and women’s apparel. Shortly after this expansion, we drove the most efficient operational week in Stitch Fix’s history. Overall, this initiative delivered a 15% improvement in our warehouse efficiency, resulting in significant cost savings. We believe that many opportunities remain to leverage our engineering and data science capabilities to drive efficiencies, and plan to update you on these in the quarters ahead.

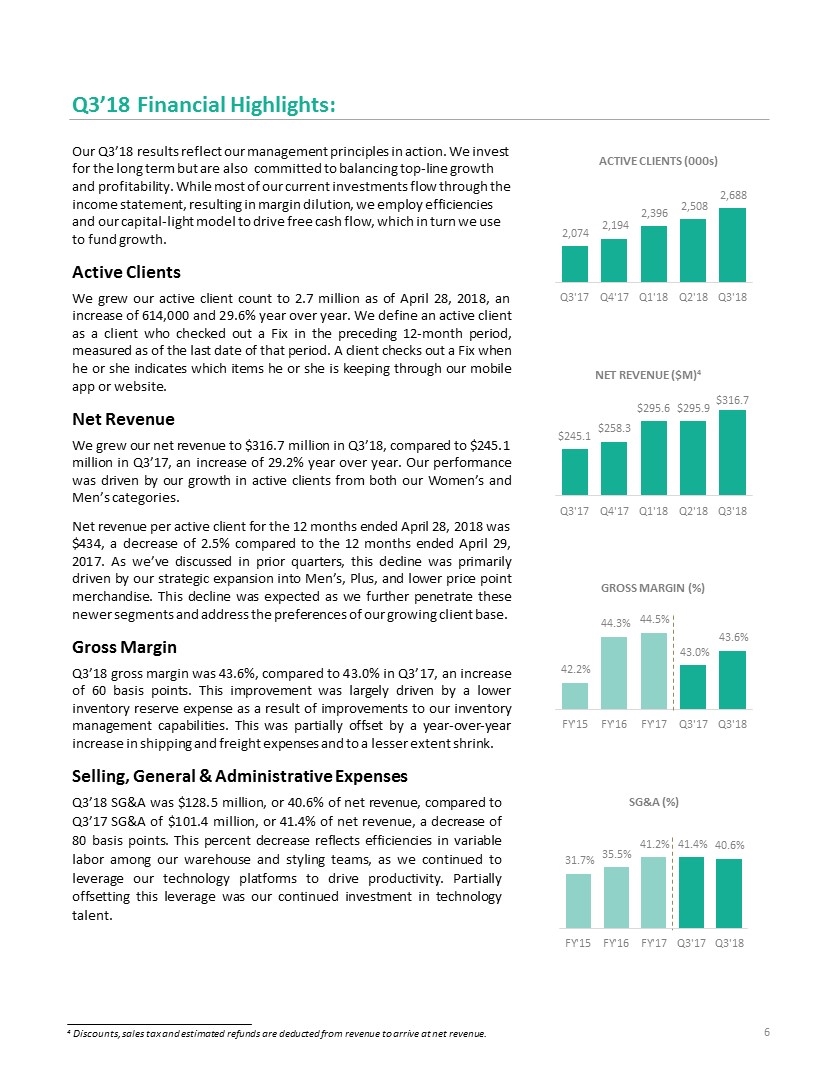

GROSS MARGIN (%) Our Q3’18 results reflect our management principles in action. We invest for the long term but are also committed to balancing top-line growth and profitability. While most of our current investments flow through the income statement, resulting in margin dilution, we employ efficiencies and our capital-light model to drive free cash flow, which in turn we use to fund growth. Active Clients We grew our active client count to 2.7 million as of April 28, 2018, an increase of 614,000 and 29.6% year over year. We define an active client as a client who checked out a Fix in the preceding 12-month period, measured as of the last date of that period. A client checks out a Fix when he or she indicates which items he or she is keeping through our mobile app or website. Net Revenue We grew our net revenue to $316.7 million in Q3’18, compared to $245.1 million in Q3’17, an increase of 29.2% year over year. Our performance was driven by our growth in active clients from both our Women’s and Men’s categories. Net revenue per active client for the 12 months ended April 28, 2018 was $434, a decrease of 2.5% compared to the 12 months ended April 29, 2017. As we’ve discussed in prior quarters, this decline was primarily driven by our strategic expansion into Men’s, Plus, and lower price point merchandise. This decline was expected as we further penetrate these newer segments and address the preferences of our growing client base. Gross Margin Q3’18 gross margin was 43.6%, compared to 43.0% in Q3’17, an increase of 60 basis points. This improvement was largely driven by a lower inventory reserve expense as a result of improvements to our inventory management capabilities. This was partially offset by a year-over-year increase in shipping and freight expenses and to a lesser extent shrink. Selling, General & Administrative Expenses Q3’18 SG&A was $128.5 million, or 40.6% of net revenue, compared to Q3’17 SG&A of $101.4 million, or 41.4% of net revenue, a decrease of 80 basis points. This percent decrease reflects efficiencies in variable labor among our warehouse and styling teams, as we continued to leverage our technology platforms to drive productivity. Partially offsetting this leverage was our continued investment in technology talent. 4 Discounts, sales tax and estimated refunds are deducted from revenue to arrive at net revenue. Q3’18 Financial Highlights: ACTIVE CLIENTS (000s) NET REVENUE ($M)4 SG&A (%)

Advertising. We continue to make strategic and measured marketing investments designed to achieve near-term payback. In Q3’18, advertising expense was $25.2 million, or 8.0% of net revenue.5 Our Q3’18 advertising spend increased relative to our Q3’17 expense of $21.3 million, or 8.7% of net revenue. In Q3’18, we generated additional cost savings that resulted from our decision to bring more of our marketing capabilities in-house. This strategy also provided us additional flexibility and learnings for our marketing initiatives. Moreover, we continued to drive favorable efficiencies resulting from our referral program. Net Income and Earnings Per Share Q3’18 net income was $9.5 million, or 3.0% of net revenue, compared to Q3’17 net income of $(9.6) million, or (3.9)% of net revenue, an increase in margin of 690 basis points. Q3’18 diluted earnings per share was $0.09, compared to $(0.38) in Q3’17, which included the dilutive impact of the preferred stock warrant liability. Non-GAAP diluted EPS attributable to common stockholders was $0.03 in Q3’17.6 Adjusted EBITDA Q3’18 adjusted EBITDA was $12.4 million, or 3.9% of net revenue, compared to Q3’17 adjusted EBITDA of $6.1 million, or 2.5% of net revenue, an increase in margin of 140 basis points. This margin expansion was the result of our strong revenue growth and our disciplined expense management. Note that we do not exclude stock-based compensation expense, which we consider to be a real cost of running the business, from our adjusted EBITDA calculation. Inventory and Free Cash Flow Our capital-light business model and efficient inventory management capabilities have allowed us to deliver strong free cash flow. In fiscal 2018 year-to-date, our capital expenditures totaled $12.0 million, or 1.3% of net revenue, while we generated free cash flow of $49.5 million.8 In addition, our inventory management practices, which are informed by data science, continue to drive healthy inventory turns of over 6 times annually on a merchandise cost basis. 5 Advertising expenses include the costs associated with the production of advertising, television, radio and online advertising. 6 We define non-GAAP diluted EPS as diluted EPS excluding the per share impact, when present, of the remeasurement of preferred stock warrant liability, compensation expense related to certain stock sales by current and former employees, and their related tax impacts, if any, as well as the per share impact of the remeasurement of our net deferred tax assets in relation to the adoption of the Tax Act. 7 We define adjusted EBITDA as net income (loss) excluding other (income), net, provision for income taxes, depreciation and amortization, and, when present, the remeasurement of preferred stock warrant liability, and compensation expense related to certain stock sales by current and former employees. 8 We define free cash flow as cash flow from operations reduced by purchases of property and equipment which is included in cash flow from investing activities. For more information regarding the non-GAAP financial measures discussed in this letter, please see "Non-GAAP Financial Measures," below, including the reconciliations of our non-GAAP measures to their most directly comparable GAAP financial measures included at the end of this letter. NET INCOME (LOSS) ($M) ADJUSTED EBITDA ($M)7

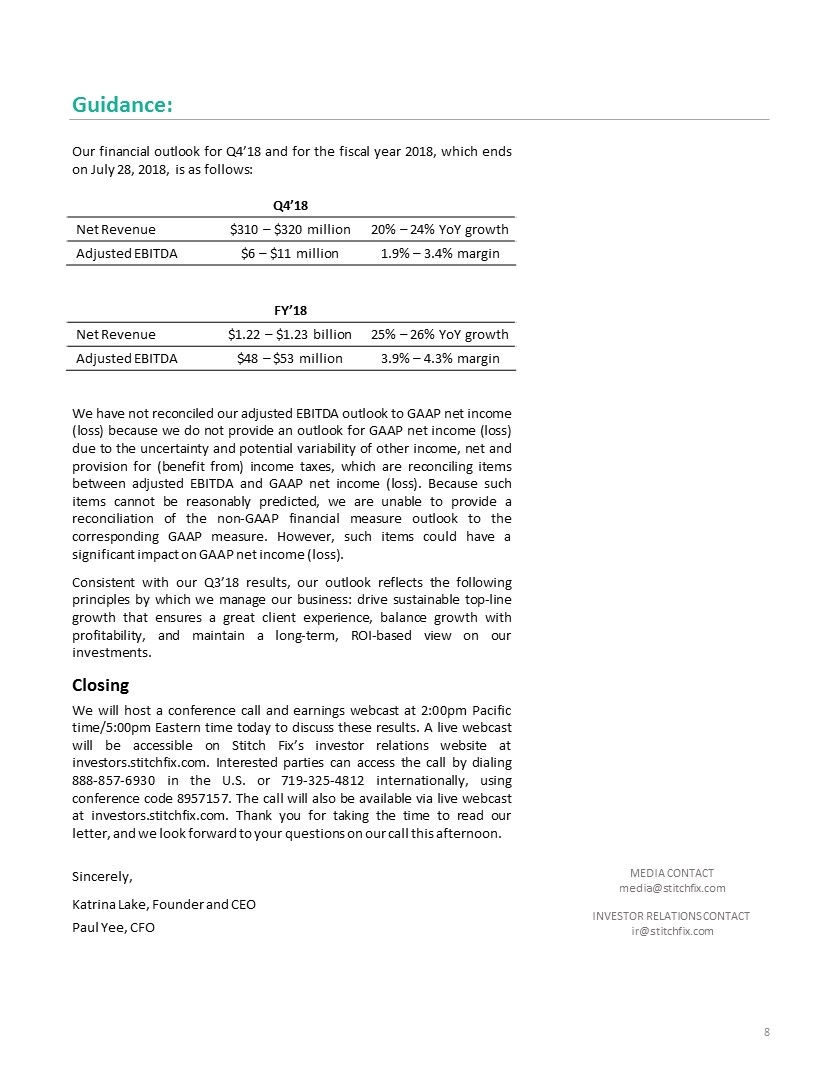

Guidance: Our financial outlook for Q4’18 and for the fiscal year 2018, which ends on July 28, 2018, is as follows: Q4’18 Net Revenue $310 – $320 million 20% – 24% YoY growth Adjusted EBITDA $6 – $11 million 1.9% – 3.4% margin We have not reconciled our adjusted EBITDA outlook to GAAP net income (loss) because we do not provide an outlook for GAAP net income (loss) due to the uncertainty and potential variability of other income, net and provision for (benefit from) income taxes, which are reconciling items between adjusted EBITDA and GAAP net income (loss). Because such items cannot be reasonably predicted, we are unable to provide a reconciliation of the non-GAAP financial measure outlook to the corresponding GAAP measure. However, such items could have a significant impact on GAAP net income (loss). Consistent with our Q3’18 results, our outlook reflects the following principles by which we manage our business: drive sustainable top-line growth that ensures a great client experience, balance growth with profitability, and maintain a long-term, ROI-based view on our investments. Closing We will host a conference call and earnings webcast at 2:00pm Pacific time/5:00pm Eastern time today to discuss these results. A live webcast will be accessible on Stitch Fix’s investor relations website at investors.stitchfix.com. Interested parties can access the call by dialing 888-857-6930 in the U.S. or 719-325-4812 internationally, using conference code 8957157. The call will also be available via live webcast at investors.stitchfix.com. Thank you for taking the time to read our letter, and we look forward to your questions on our call this afternoon. Sincerely, Katrina Lake, Founder and CEO Paul Yee, CFO FY’18 Net Revenue $1.22 – $1.23 billion 25% – 26% YoY growth Adjusted EBITDA $48 – $53 million 3.9% – 4.3% margin MEDIA CONTACT media@stitchfix.com INVESTOR RELATIONS CONTACT ir@stitchfix.com

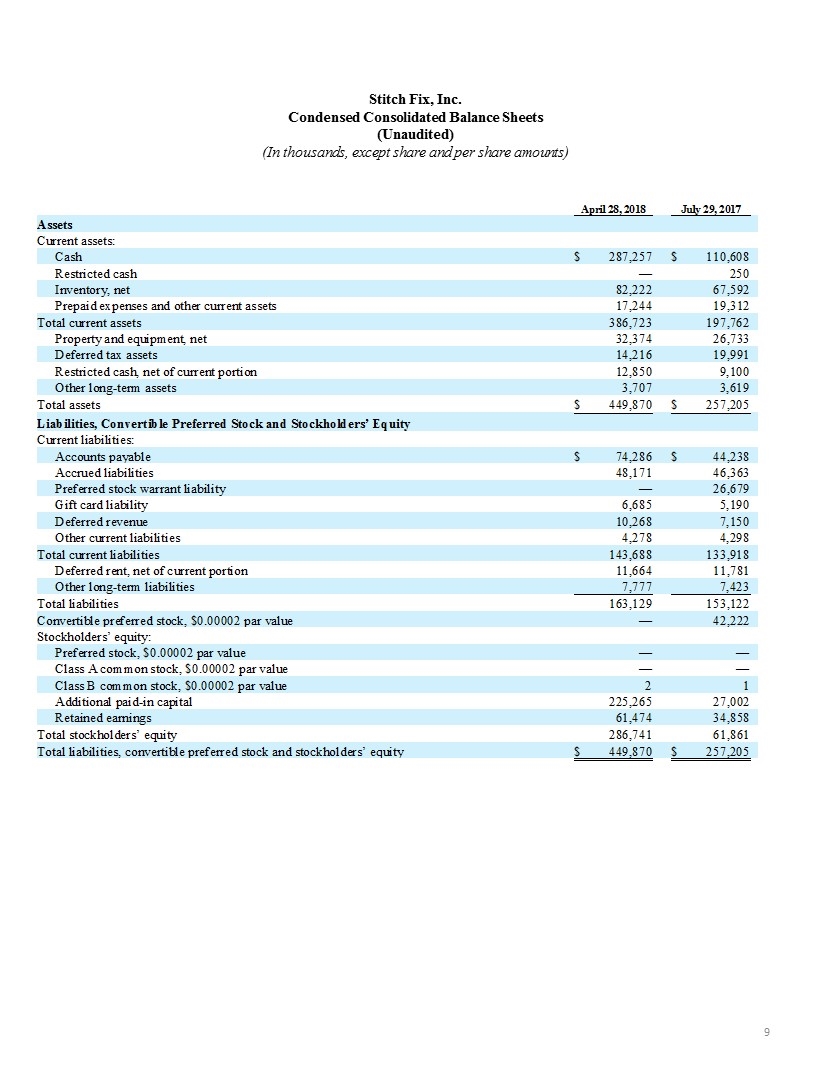

Stitch Fix, Inc. Condensed Consolidated Balance Sheets (Unaudited) (In thousands, except share and per share amounts)

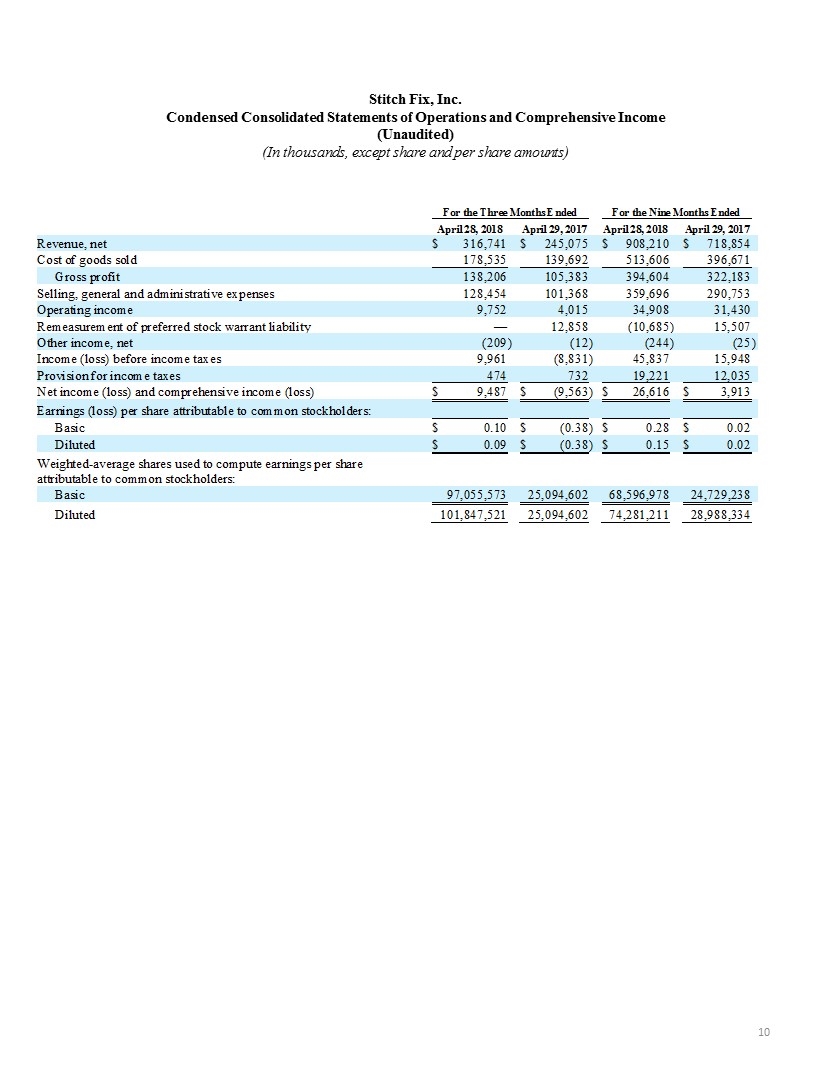

Stitch Fix, Inc. Condensed Consolidated Statements of Operations and Comprehensive Income (Unaudited) (In thousands, except share and per share amounts)

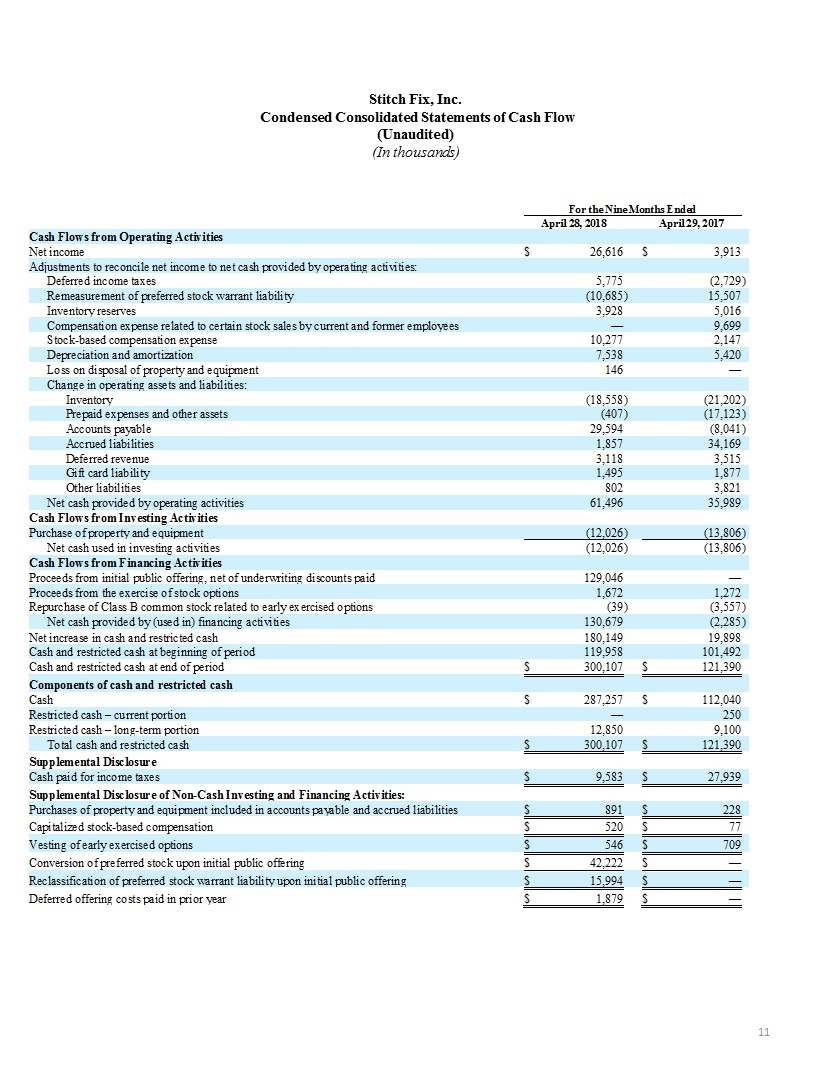

Stitch Fix, Inc. Condensed Consolidated Statements of Cash Flow (Unaudited) (In thousands)

Non-GAAP Financial Measures We report our financial results in accordance with generally accepted accounting principles in the United States, or GAAP. However, management believes that certain non-GAAP financial measures provide users of our financial information with additional useful information in evaluating our performance. Management believes that excluding certain items that may vary substantially in frequency and magnitude period-to-period from net income (loss) and earnings (loss) per share (“EPS”) provides useful supplemental measures that assist in evaluating our ability to generate earnings and to more readily compare these metrics between past and future periods. Management also believes that adjusted EBITDA is frequently used by investors and securities analysts in their evaluations of companies, and that such supplemental measure facilitates comparisons between companies. We believe free cash flow is an important metric because it represents a measure of how much cash from operations we have available for discretionary and non-discretionary items after the deduction of capital expenditures. These non-GAAP financial measures may be different than similarly titled measures used by other companies. For instance, we do not exclude stock-based compensation expense from adjusted EBITDA or non-GAAP net income. Stock-based compensation is an important part of how we attract and retain our employees, and we consider it to be a real cost of running the business. Our non-GAAP financial measures should not be considered in isolation from, or as substitutes for, financial information prepared in accordance with GAAP. There are several limitations related to the use of our non-GAAP financial measures as compared to the closest comparable GAAP measures. Some of these limitations include: our non-GAAP net income, adjusted EBITDA and non-GAAP EPS – diluted measures exclude compensation expense that we recognized related to certain stock sales by current and former employees; our non-GAAP net income and non-GAAP EPS – diluted measures exclude the impact of the remeasurement of our net deferred tax assets following the adoption of the Tax Cuts and Jobs Act (“Tax Act”); our non-GAAP net income, adjusted EBITDA and non-GAAP EPS – diluted measures exclude the remeasurement of the preferred stock warrant liability, which is a non-cash expense incurred in the periods prior to the completion of our initial public offering; adjusted EBITDA also excludes the recurring, non-cash expenses of depreciation and amortization of property and equipment and, although these are non-cash expenses, the assets being depreciated and amortized may have to be replaced in the future; adjusted EBITDA does not reflect our tax provision, which reduces cash available to us; and free cash flow does not represent the total residual cash flow available for discretionary purposes and does not reflect our future contractual commitments.

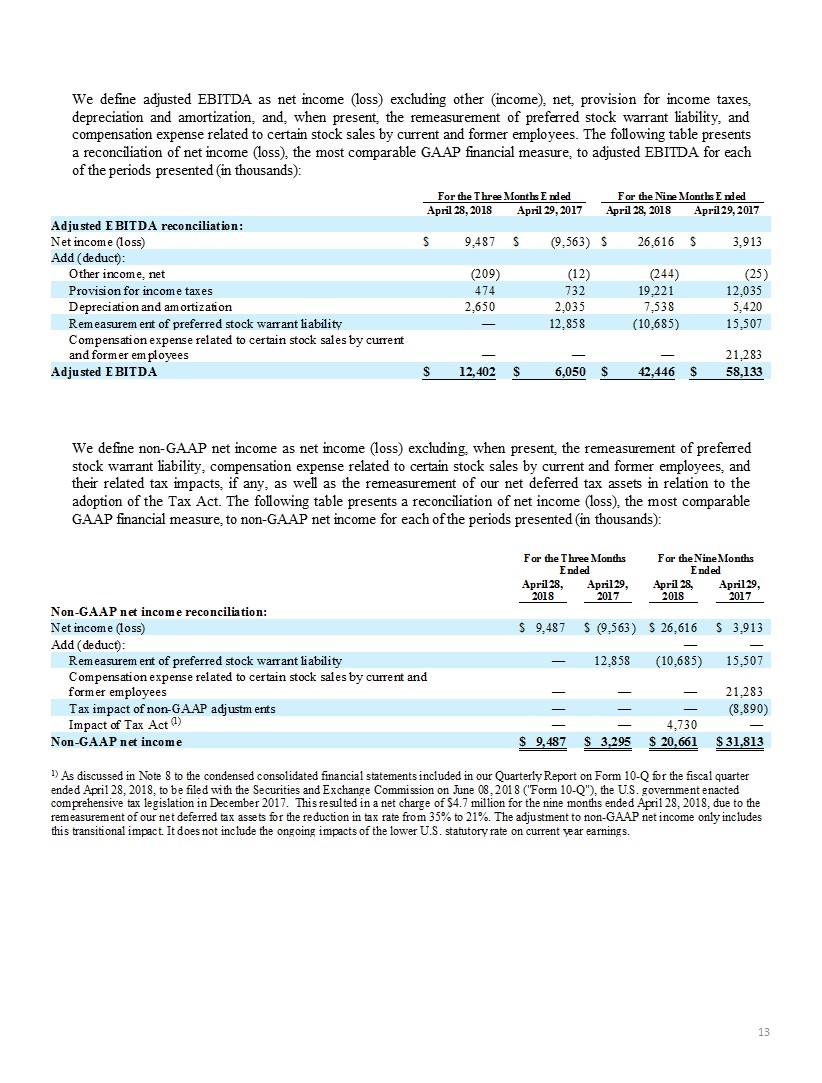

We define non-GAAP net income as net income (loss) excluding, when present, the remeasurement of preferred stock warrant liability, compensation expense related to certain stock sales by current and former employees, and their related tax impacts, if any, as well as the remeasurement of our net deferred tax assets in relation to the adoption of the Tax Act. The following table presents a reconciliation of net income (loss), the most comparable GAAP financial measure, to non-GAAP net income for each of the periods presented (in thousands): We define adjusted EBITDA as net income (loss) excluding other (income), net, provision for income taxes, depreciation and amortization, and, when present, the remeasurement of preferred stock warrant liability, and compensation expense related to certain stock sales by current and former employees. The following table presents a reconciliation of net income (loss), the most comparable GAAP financial measure, to adjusted EBITDA for each of the periods presented (in thousands):

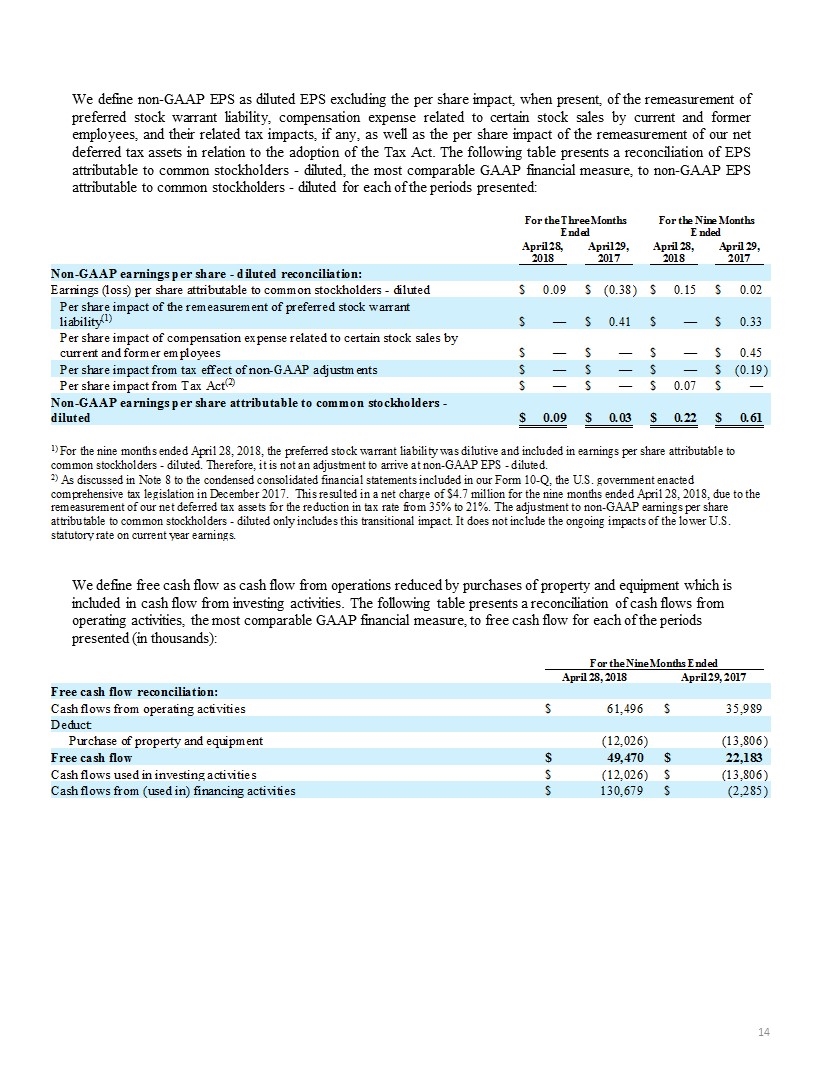

We define free cash flow as cash flow from operations reduced by purchases of property and equipment which is included in cash flow from investing activities. The following table presents a reconciliation of cash flows from operating activities, the most comparable GAAP financial measure, to free cash flow for each of the periods presented (in thousands): We define non-GAAP EPS as diluted EPS excluding the per share impact, when present, of the remeasurement of preferred stock warrant liability, compensation expense related to certain stock sales by current and former employees, and their related tax impacts, if any, as well as the per share impact of the remeasurement of our net deferred tax assets in relation to the adoption of the Tax Act. The following table presents a reconciliation of EPS attributable to common stockholders - diluted, the most comparable GAAP financial measure, to non-GAAP EPS attributable to common stockholders - diluted for each of the periods presented:

Forward-Looking Statements This shareholder letter contains forward-looking statements within the meaning of the federal securities laws. All statements other than statements of historical fact could be deemed forward looking, including but not limited to statements regarding our future financial performance, including our guidance on financial results for the fourth quarter and full year of fiscal 2018; market trends, growth and opportunity; competition; the timing and success of expansions to our offering and penetration of our target markets, such as the launch of Stitch Fix Kids; our ability to leverage our engineering and data science capabilities to drive efficiencies in our business; our plans related to client acquisition, including any impact on our costs and margins; and our ability to successfully acquire, engage and retain clients. These statements involve substantial risks and uncertainties, including risks and uncertainties related to our ability to generate sufficient net revenue to offset our costs; the growth of our market and consumer behavior; our ability to acquire, engage and retain clients; our ability to provide offerings and services that achieve market acceptance; our data science and technology, stylists, operations, marketing initiatives, and other key strategic areas; and other risks described in the filings we make with the Securities and Exchange Commission, or SEC. Further information on these and other factors that could cause our financial results, performance and achievements to differ materially from any results, performance or achievements anticipated, expressed or implied by these forward-looking statements is included in filings we make with the SEC from time to time, including in the section titled “Risk Factors” in our Quarterly Report on Form 10-Q for the fiscal quarter ended April 28, 2018. These documents are available on the SEC Filings section of the Investor Relations section of our website at: http://investors.stitchfix.com. We undertake no obligation to update any forward-looking statements made in this letter to reflect events or circumstances after the date of this letter or to reflect new information or the occurrence of unanticipated events, except as required by law. The achievement or success of the matters covered by such forward-looking statements involves known and unknown risks, uncertainties and assumptions. If any such risks or uncertainties materialize or if any of the assumptions prove incorrect, our results could differ materially from the results expressed or implied by the forward-looking statements we make. You should not rely upon forward-looking statements as predictions of future events. Forward-looking statements represent our management’s beliefs and assumptions only as of the date such statements are made.