Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Karyopharm Therapeutics Inc. | d596784d8k.htm |

Exhibit 99.1

Targeting Disease at the Nuclear Pore

Corporate Presentation

June 2018

Forward-looking Statements

This presentation contains forward-looking statements within the meaning of the “safe harbor” provisions of The Private Securities Litigation Reform Act

of 1995. Such forward-looking statements include those regarding the therapeutic potential of and potential clinical development plans and commercialization for Karyopharm’s drug candidates, including the timing of

initiation of certain trials, of the reporting of data from such trials, of the submissions to regulatory authorities and of potential commercial launches, the potential availability of accelerated approval pathways, the potential size of the

markets for multiple myeloma drugs and multiple myeloma drugs for treatment of patients with relapsed multiple myeloma and Karyopharm’s strategic and financial plans and expectations as well as financial projections for Karyopharm. Such

statements are subject to numerous important factors, risks and uncertainties that may cause actual events or results to differ materially from Karyopharm’s current expectations. For example, there can be no guarantee that regulators will agree

that selinexor qualifies for accelerated approval in the U.S. or conditional approval in the E.U. as a result of the data from the STORM study in patients with penta-refractory myeloma or SADAL study in patients with relapsed/refractory DLBCL or

that any of Karyopharm’s drug candidates, including selinexor (KPT-330) and eltanexor (KPT-8602), Karyopharm’s second generation SINE compound, or KPT-9274, Karyopharm’s first-in-class oral dual inhibitor of PAK4 and NAMPT, or any other drug candidate Karyopharm is developing,

will successfully complete necessary preclinical and clinical development phases or that development of any of Karyopharm’s drug candidates will continue. Further, there can be no guarantee that any positive developments in Karyopharm’s

drug candidate portfolio will result in stock price appreciation. In addition, even if Karyopharm receives marketing approval for selinexor or another drug candidate, there can be no assurance that Karyopharm will be able to successfully

commercialize that drug candidate. Management’s expectations and, therefore, any forward-looking statements in this presentation could also be affected by risks and uncertainties relating to a number of other factors, many of which are beyond

Karyopharm’s control, including the following: Karyopharm’s results of clinical trials and preclinical studies, including subsequent analysis of existing data and new data received from ongoing and future studies; the content and timing of

decisions made by the FDA and other regulatory authorities, investigational review boards at clinical trial sites and publication review bodies, including with respect to the need for additional clinical studies; the ability of Karyopharm or its

third party collaborators or successors in interest to fully perform their respective obligations under the applicable agreement and the potential future financial implications of such agreement; unplanned cash requirements and expenditures;

development of drug candidates by Karyopharm’s competitors for diseases for which Karyopharm is currently developing its drug candidates; that the markets for multiple myeloma drugs will grow as predicted; and Karyopharm’s ability to

obtain, maintain and enforce patent and other intellectual property protection for any drug candidates it is developing. These and other risks, including those which may impact management’s expectations, are described in greater detail under

the heading “Risk Factors” in Karyopharm’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2018, which is on file with the SEC, and in subsequent filings filed by Karyopharm

with the SEC. Any forward-looking statements contained in this presentation are for informational purposes only and speak only as of the date hereof. Other than as is required by law, Karyopharm expressly disclaims any obligation to update any

forward-looking statements, whether as a result of new information, future events or otherwise. Karyopharm’s website is http://www.karyopharm.com. Karyopharm regularly uses its website to post information regarding its business, drug

development programs and governance. Karyopharm encourages investors to use www.karyopharm.com, particularly the information in the section entitled “Investors,” as a source of information about Karyopharm. References to www.karyopharm.com

in this presentation are not intended to, nor shall they be deemed to, incorporate information on www.karyopharm.com into this presentation by reference. Unless otherwise noted, this presentation contains data that are interim and unaudited based on

site reports. In addition, data included in this presentation have not been updated and are as of the cutoff date for the applicable medical conference presentation. Unless otherwise noted, all reference to market sizes are based on reports from

Global Data or Karyopharm internal estimates.

©2018 Karyopharm Therapeutics Inc. 2

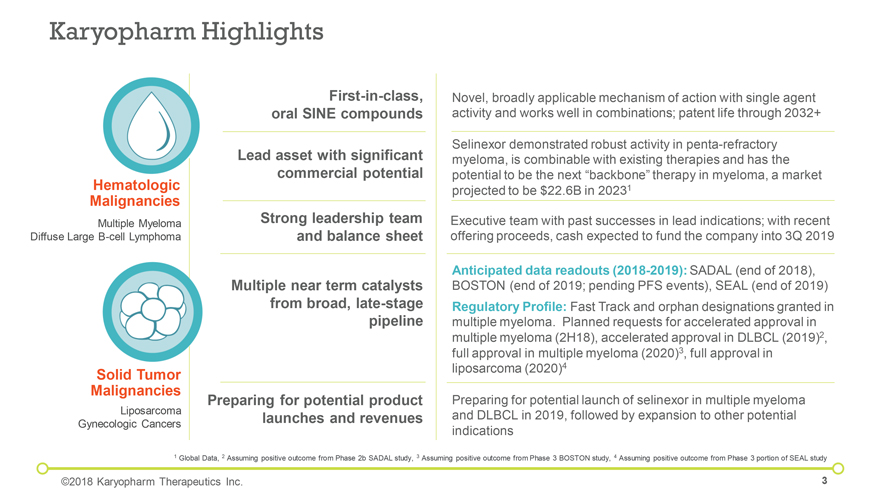

Karyopharm Highlights

Hematologic

Malignancies

Multiple Myeloma

Diffuse Large B-cell Lymphoma

Solid Tumor

Malignancies

Liposarcoma

Gynecologic Cancers

First-in-class, oral SINE compounds

Lead asset with significant commercial potential

Strong leadership team and balance sheet

Multiple near term catalysts from broad, late-stage pipeline

Preparing for

potential product launches and revenues

Novel, broadly applicable mechanism of action with single agent activity and works well in combinations; patent life

through 2032+

Selinexor demonstrated robust activity in penta-refractory myeloma, is combinable with existing therapies and has the potential to be the next

“backbone” therapy in myeloma, a market projected to be $22.6B in 20231

Executive team with past successes in lead indications; with recent offering

proceeds, cash expected to fund the company into 3Q 2019

Anticipated data readouts (2018-2019): SADAL (end of 2018),

BOSTON (end of 2019; pending PFS events), SEAL (end of 2019) Regulatory Profile: Fast Track and orphan designations granted in multiple myeloma. Planned requests for accelerated

approval in multiple myeloma (2H18), accelerated approval in DLBCL (2019)2, full approval in multiple myeloma (2020)3, full approval in liposarcoma (2020)4

Preparing for potential launch of selinexor in multiple myeloma and DLBCL in 2019, followed by expansion to other potential indications

1 Global Data, 2 Assuming positive outcome from Phase 2b SADAL study, 3 Assuming positive outcome from Phase 3 BOSTON study, 4 Assuming positive outcome from Phase 3 portion of

SEAL study

©2018 Karyopharm Therapeutics Inc.

3

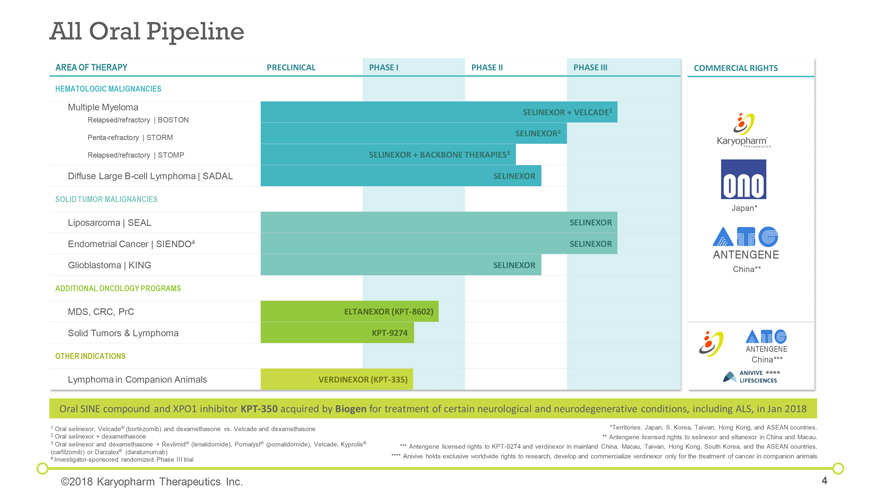

All Oral Pipeline

AREA OF

THERAPY

HEMATOLOGIC MALIGNANCIES

Multiple Myeloma

Relapsed/refractory | BOSTON Penta-refractory | STORM Relapsed/refractory | STOMP

Diffuse Large B-cell Lymphoma | SADAL

SOLID TUMOR

MALIGNANCIES

Liposarcoma | SEAL

Endometrial Cancer | SIENDO4

Glioblastoma | KING

ADDITIONAL ONCOLOGY PROGRAMS

MDS, CRC, PrC

Solid Tumors & Lymphoma

OTHER INDICATIONS

Lymphoma in Companion Animals

PRECLINICAL PHASE I PHASE II PHASE III COMMERCIAL RIGHTS

SELINEXOR + VELCADE1 SELINEXOR2

SELINEXOR + BACKBONE THERAPIES3 SELINEXOR

SELINEXOR

SELINEXOR

SELINEXOR

ELTANEXOR (KPT-8602)

KPT-9274

VERDINEXOR

(KPT-335)

Japan*

China**

China***

Oral SINE compound and XPO1 inhibitor KPT-350

acquired by Biogen for treatment of certain neurological and neurodegenerative conditions, including ALS, in Jan 2018

1 Oral selinexor, Velcade® (bortezomib)

and dexamethasone vs. Velcade and dexamethasone

2 Oral selinexor + dexamethasone

3 Oral selinexor and dexamethasone + Revlimid® (lenalidomide), Pomalyst® (pomalidomide), Velcade, Kyprolis® (carfilzomib) or Darzalex® (daratumumab)

4 Investigator-sponsored randomized Phase III trial

*Territories: Japan, S. Korea, Taiwan,

Hong Kong, and ASEAN countries.

** Antengene licensed rights to selinexor and eltanexor in China and Macau.

*** Antengene licensed rights to KPT-9274 and verdinexor in mainland China, Macau, Taiwan, Hong Kong, South Korea, and the ASEAN countries.

**** Anivive holds exclusive worldwide rights to research, develop and commercialize verdinexor only for the treatment of cancer in companion animals

©2018 Karyopharm Therapeutics Inc.

4

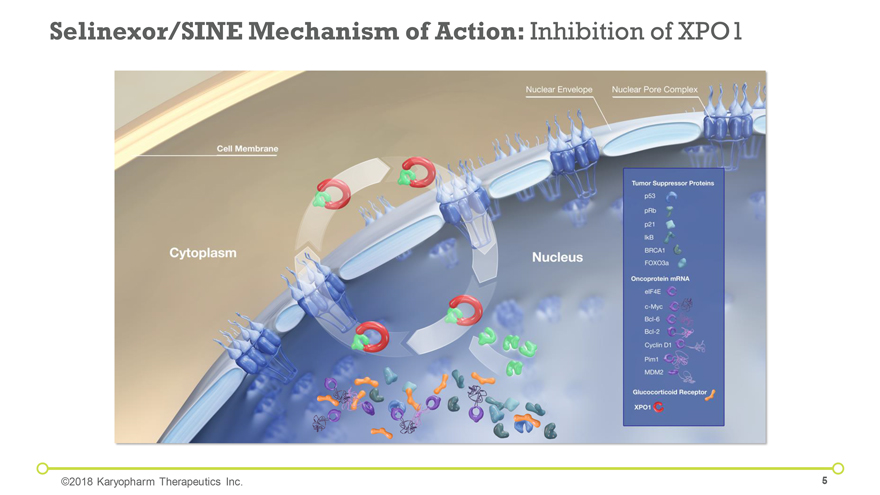

Selinexor/SINE Mechanism of Action: Inhibition of XPO1

©2018 Karyopharm Therapeutics Inc.

5

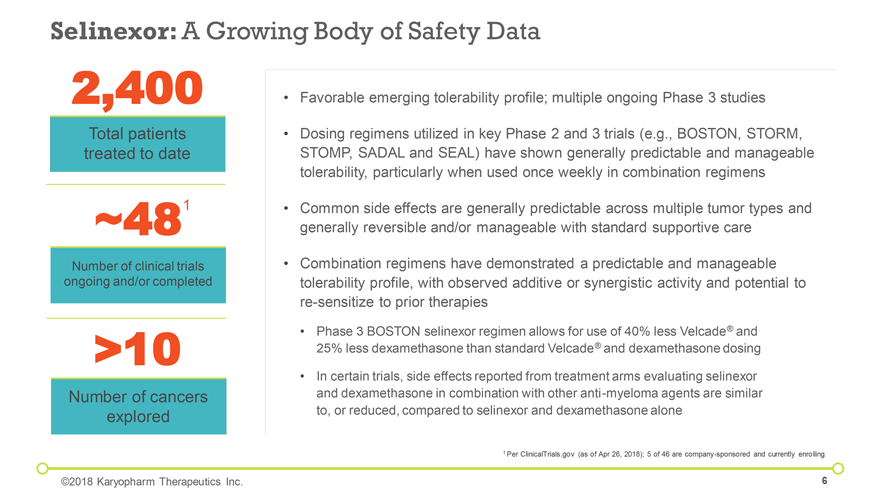

Selinexor: A Growing Body of Safety Data

2,400

Total patients treated to date

~481

Number of clinical trials ongoing and/or completed

>10

Number of cancers explored

• Favorable emerging tolerability profile; multiple ongoing Phase 3 studies

• Dosing

regimens utilized in key Phase 2 and 3 trials (e.g., BOSTON, STORM, STOMP, SADAL and SEAL) have shown generally predictable and manageable tolerability, particularly when used once weekly in combination regimens

• Common side effects are generally predictable across multiple tumor types and generally reversible and/or manageable with standard supportive care

• Combination regimens have demonstrated a predictable and manageable tolerability profile, with observed additive or synergistic activity and potential to re-sensitize to prior therapies

• Phase 3 BOSTON selinexor regimen allows for use of 40% less Velcade® and 25% less

dexamethasone than standard Velcade® and dexamethasone dosing

• In certain trials, side effects reported from treatment arms evaluating selinexor and

dexamethasone in combination with other anti-myeloma agents are similar to, or reduced, compared to selinexor and dexamethasone alone

1 Per ClinicalTrials.gov (as

of Apr 26, 2018); 5 of 46 are company-sponsored and currently enrolling

©2018 Karyopharm Therapeutics Inc.

6

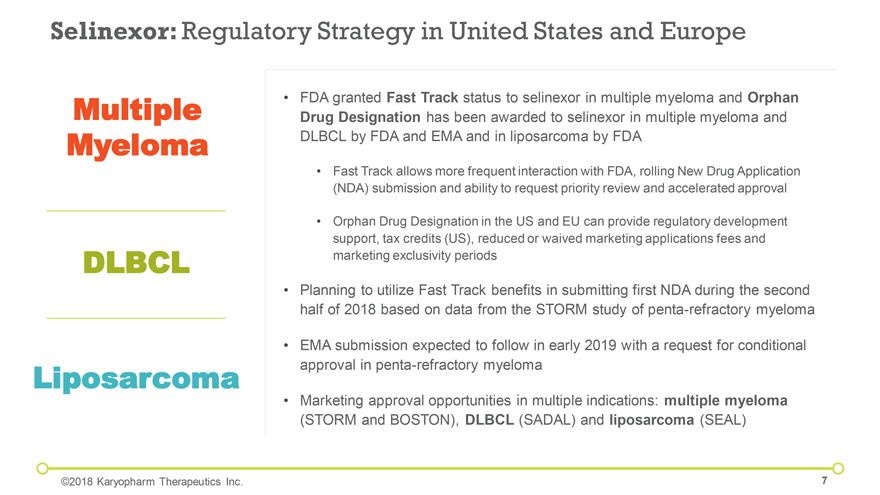

Selinexor: Regulatory Strategy in United States and Europe

Multiple Myeloma

DLBCL

Liposarcoma

• FDA granted Fast Track status to selinexor in multiple myeloma and Orphan

Drug Designation has been awarded to selinexor in multiple myeloma and

DLBCL

by FDA and EMA and in liposarcoma by FDA

• Fast Track allows more frequent interaction with FDA, rolling New Drug Application

(NDA) submission and ability to request priority review and accelerated approval

• Orphan

Drug Designation in the US and EU can provide regulatory development

support, tax credits (US), reduced or waived marketing applications fees and

marketing exclusivity periods

• Planning to utilize Fast Track benefits in submitting

first NDA during the second

half of 2018 based on data from the STORM study of penta-refractory myeloma

• EMA submission expected to follow in early 2019 with a request for conditional

approval

in penta-refractory myeloma

• Marketing approval opportunities in multiple indications: multiple myeloma

(STORM and BOSTON), DLBCL (SADAL) and liposarcoma (SEAL)

©2018 Karyopharm Therapeutics

Inc.

7

Selinexor in Hematologic Malignancies

Multiple Myeloma

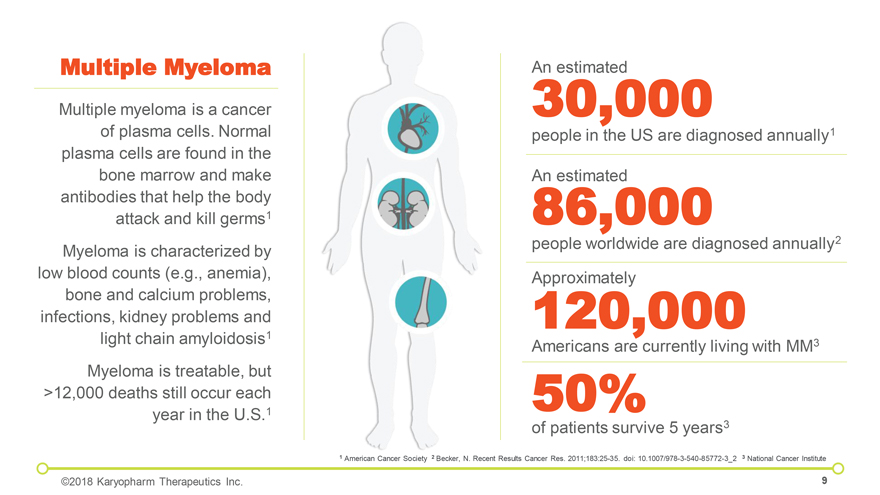

Multiple Myeloma

Multiple

myeloma is a cancer of plasma cells. Normal plasma cells are found in the bone marrow and make antibodies that help the body attack and kill germs1

Myeloma is

characterized by low blood counts (e.g., anemia), bone and calcium problems, infections, kidney problems and light chain amyloidosis1

Myeloma is treatable, but

>12,000 deaths still occur each year in the U.S.1

An 30,000 estimated people in the US are diagnosed annually1

An 86,000 estimated people worldwide are diagnosed annually2

Approximately 120,000

Americans are currently living with MM3

50%

of patients survive 5 years3

1 American Cancer Society 2 Becker, N. Recent Results Cancer Res.

2011;183:25-35. doi: 10.1007/978-3-540-85772-3_2 3 National Cancer Institute

©2018 Karyopharm Therapeutics Inc.

9

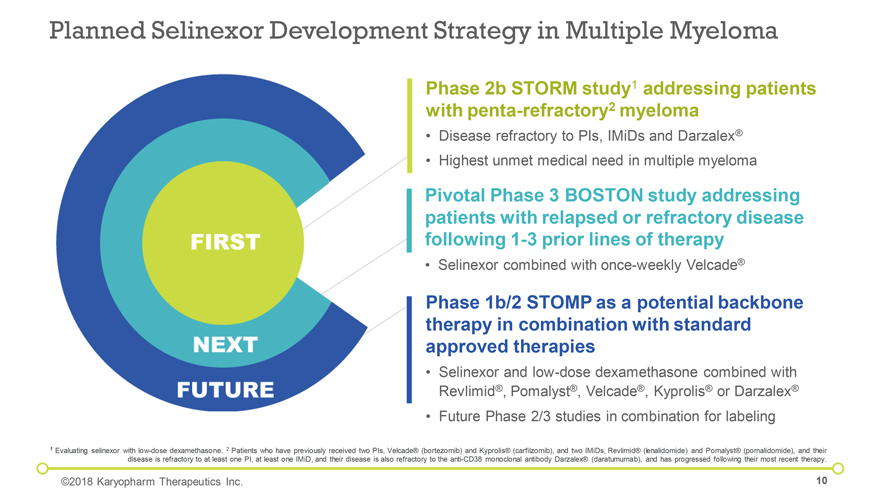

Planned Selinexor Development Strategy in Multiple Myeloma

Phase 2b STORM study1 addressing patients with penta-refractory2 myeloma

• Disease

refractory to PIs, IMiDs and Darzalex®

• Highest unmet medical need in multiple myeloma

Pivotal Phase 3 BOSTON study addressing patients with relapsed or refractory disease following 1-3 prior lines of therapy

• Selinexor combined with once-weekly Velcade®

Phase 1b/2 STOMP as a potential

backbone therapy in combination with standard approved therapies

• Selinexor and low-dose dexamethasone combined with

Revlimid®, Pomalyst®, Velcade®, Kyprolis® or Darzalex®

• Future Phase 2/3 studies in combination for labeling

1 Evaluating selinexor with low-dose dexamethasone. 2 Patients who have previously received two PIs, Velcade® (bortezomib) and

Kyprolis® (carfilzomib), and two IMiDs, Revlimid® (lenalidomide) and Pomalyst® (pomalidomide), and their disease is refractory to at least one PI, at least one IMiD, and their disease is also refractory to the anti-CD38 monoclonal

antibody Darzalex® (daratumumab), and has progressed following their most recent therapy.

©2018 Karyopharm Therapeutics Inc.

10

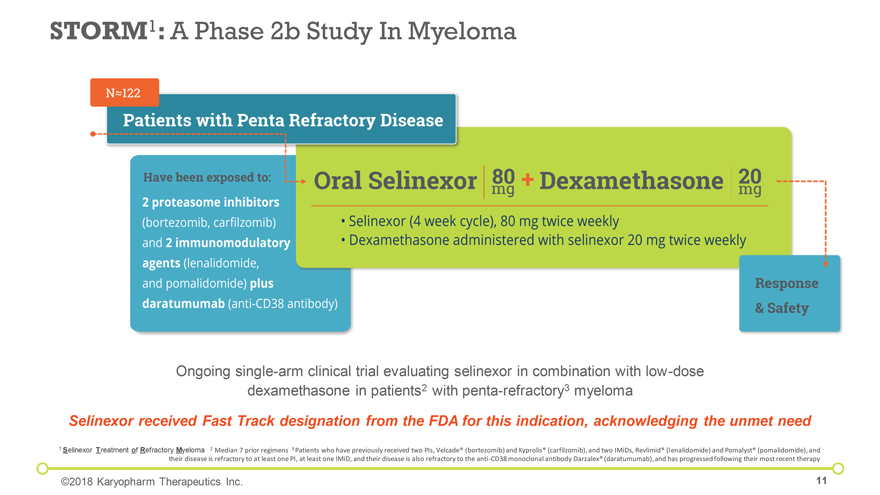

STORM1: A Phase 2b Study In Myeloma

Ongoing single-arm clinical trial evaluating selinexor in combination with low-dose dexamethasone in patients2 with penta-refractory3

myeloma

Selinexor received Fast Track designation from the FDA for this indication, acknowledging the unmet need

1 Selinexor Treatment of Refractory Myeloma 2 Median 7 prior regimens 3 Patients who have previously received two PIs, Velcade® (bortezomib) and Kyprolis® (carfilzomib),

and two IMiDs, Revlimid® (lenalidomide) and Pomalyst® (pomalidomide), and their disease is refractory to at least one PI, at least one IMiD, and their disease is also refractory to the anti-CD38 monoclonal antibody Darzalex®

(daratumumab), and has progressed following their most recent therapy

©2018 Karyopharm Therapeutics Inc.

11

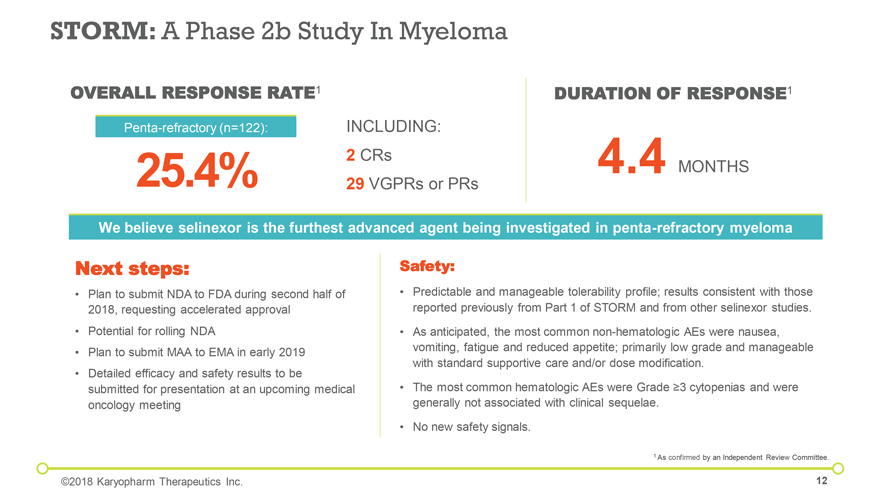

STORM: A Phase 2b Study In Myeloma

OVERALL RESPONSE RATE1

INCLUDING:

2 CRs

29 VGPRs or PRs

Penta-refractory (n=122):

25.4%

DURATION OF RESPONSE1

4.4 MONTHS

We believe selinexor is the furthest advanced agent being investigated in penta-refractory myeloma

Next steps:

• Plan to submit NDA to FDA during second half of 2018, requesting

accelerated approval

• Potential for rolling NDA

• Plan to submit

MAA to EMA in early 2019

• Detailed efficacy and safety results to be submitted for presentation at an upcoming medical oncology meeting

Safety:

• Predictable and manageable tolerability profile; results consistent with those

reported previously from Part 1 of STORM and from other selinexor studies.

• As anticipated, the most common

non-hematologic AEs were nausea, vomiting, fatigue and reduced appetite; primarily low grade and manageable with standard supportive care and/or dose modification.

• The most common hematologic AEs were Grade ³3 cytopenias and were generally not associated with clinical sequelae.

• No new safety signals.

1 As confirmed by an Independent Review Committee.

©2018 Karyopharm Therapeutics Inc.

12

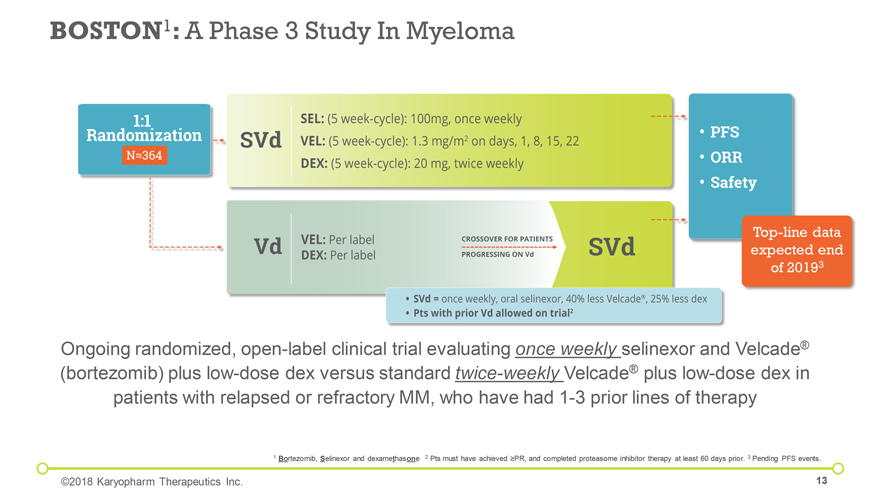

BOSTON1: A Phase 3 Study In Myeloma

Top-line data expected end of 20193

Ongoing

randomized, open-label clinical trial evaluating once weekly selinexor and Velcade

(bortezomib) plus low-dose dex versus

standard twice-weekly Velcade® plus low-dose dex in patients with relapsed or refractory MM, who have had 1-3 prior lines of therapy

1 Bortezomib, Selinexor and dexamethasone 2 Pts must have achieved ³PR, and completed proteasome inhibitor therapy at least 60 days

prior. 3 Pending PFS events.

©2018 Karyopharm Therapeutics Inc.

13

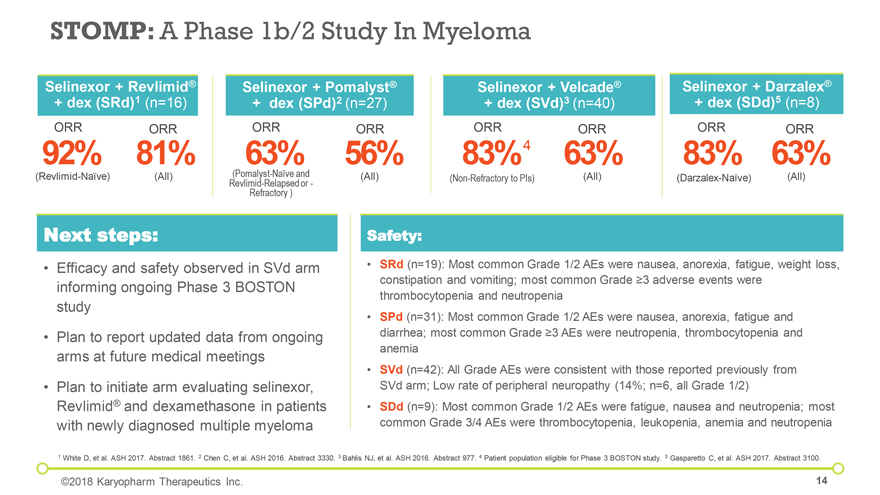

STOMP: A Phase 1b/2 Study In Myeloma

Selinexor + Revlimid® + dex (SRd)1 (n=16)

ORR ORR

92% 81%

(Revlimid-Naïve) (All)

Selinexor + Pomalyst®

+ dex (SPd)2 (n=27)

ORR ORR

63% 56%

Revlimid-Relapsed (Pomalyst-Naïve and or - (All)

Refractory )

Selinexor + Velcade® + dex (SVd)3 (n=40)

ORR ORR

83% 4 63%

(Non-Refractory to PIs) (All)

Selinexor + Darzalex® + dex (SDd)5 (n=8)

ORR ORR

83% 63%

(Darzalex-Naïve) (All)

Next steps:

• Efficacy and safety observed in SVd arm informing ongoing Phase 3 BOSTON

study

• Plan to report updated data from ongoing arms at future medical meetings

• Plan to initiate arm evaluating selinexor, Revlimid® and dexamethasone in patients with newly diagnosed multiple myeloma

Safety:

• SRd (n=19): Most common Grade 1/2 AEs were nausea, anorexia, fatigue, weight

loss, constipation and vomiting; most common Grade ³3 adverse events were thrombocytopenia and neutropenia

• SPd

(n=31): Most common Grade 1/2 AEs were nausea, anorexia, fatigue and diarrhea; most common Grade ³3 AEs were neutropenia, thrombocytopenia and anemia

• SVd (n=42): All Grade AEs were consistent with those reported previously from SVd arm; Low rate of peripheral neuropathy (14%; n=6, all Grade 1/2)

• SDd (n=9): Most common Grade 1/2 AEs were fatigue, nausea and neutropenia; most common Grade 3/4 AEs were thrombocytopenia, leukopenia, anemia and neutropenia

1 White D, et al. ASH 2017. Abstract 1861. 2 Chen C, et al. ASH 2016. Abstract 3330. 3 Bahlis NJ, et al. ASH 2016. Abstract 977. 4 Patient population eligible for Phase 3 BOSTON

study. 5 Gasparetto C, et al. ASH 2017. Abstract 3100.

©2018 Karyopharm Therapeutics Inc. 14

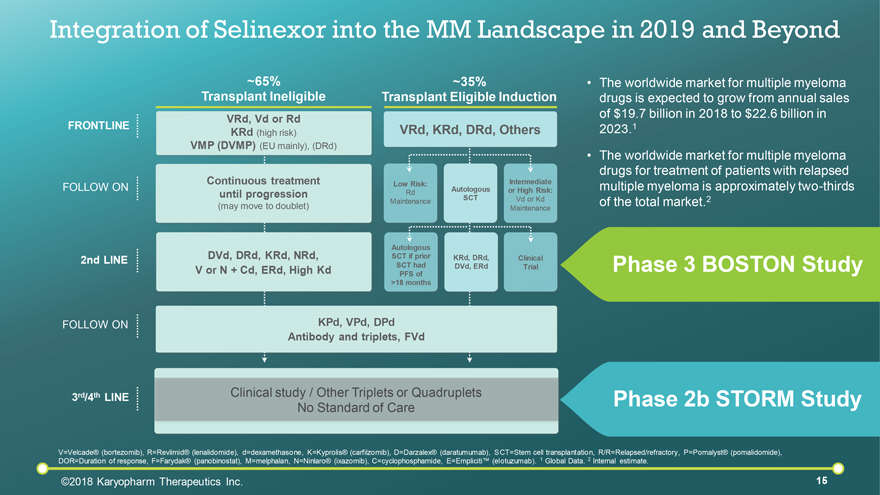

Integration of Selinexor into the MM Landscape in 2019 and Beyond

FRONTLINE

FOLLOW ON

2nd LINE

FOLLOW ON

3rd/4th LINE

~65%

Transplant Ineligible

VRd, Vd or Rd

KRd (high risk)

VMP (DVMP) (EU mainly), (DRd)

Continuous treatment until progression

(may move to doublet)

DVd, DRd, KRd, NRd, V or N + Cd, ERd, High Kd

~35%

Transplant Eligible Induction

VRd, KRd, DRd, Others

Low Risk: Intermediate Autologous or High Risk:

Rd

SCT Vd or Kd Maintenance Maintenance

Autologous

SCT if prior KRd, DRd, Clinical SCT had DVd, ERd Trial PFS of >18 months

KPd, VPd, DPd

Antibody and triplets, FVd

Clinical study / Other Triplets or Quadruplets No Standard of Care

• The worldwide market for multiple myeloma drugs is expected to grow from annual sales of $19.7 billion in 2018 to $22.6 billion in 2023.1

• The worldwide market for multiple myeloma drugs for treatment of patients with relapsed multiple myeloma is approximately two-thirds

of the total market.2

Phase 3 BOSTON Study

Phase 2b STORM Study

V=Velcade® (bortezomib), R=Revlimid® (lenalidomide), d=dexamethasone, K=Kyprolis® (carfilzomib), D=Darzalex® (daratumumab), SCT=Stem cell transplantation,

R/R=Relapsed/refractory, P=Pomalyst® (pomalidomide),

DOR=Duration of response, F=Farydak® (panobinostat), M=melphalan, N=Ninlaro® (ixazomib),

C=cyclophosphamide, E=Empliciti™ (elotuzumab). 1 Global Data. 2 Internal estimate.

©2018 Karyopharm Therapeutics Inc. 15

Selinexor in Hematologic Malignancies

Diffuse Large B-Cell Lymphoma

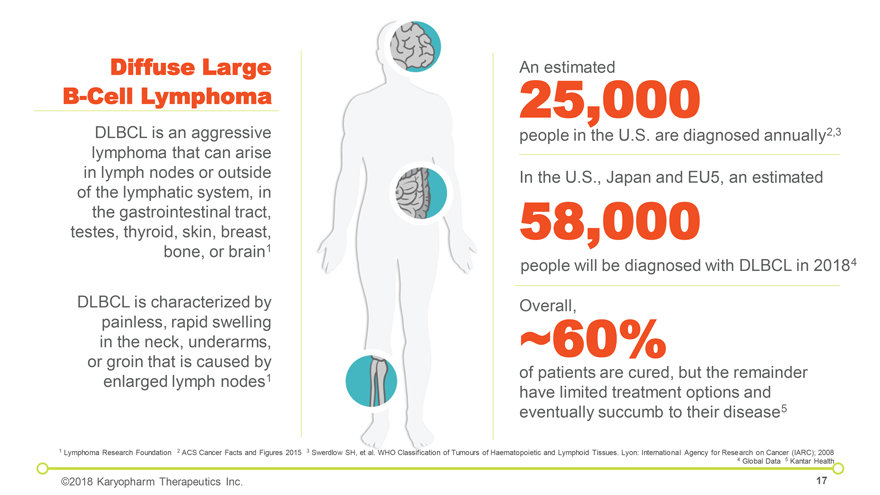

Diffuse Large B-Cell Lymphoma

DLBCL is an aggressive lymphoma that can arise in lymph nodes or outside of the lymphatic system, in the gastrointestinal tract, testes, thyroid, skin, breast, bone, or brain1

DLBCL is characterized by painless, rapid swelling in the neck, underarms, or groin that is caused by enlarged lymph nodes1

An 25,000 estimated people in the U.S. are diagnosed annually2,3

In the U.S., Japan and EU5,

an estimated

58,000

people will be diagnosed with DLBCL in 20184

Overall, ~60% of patients are cured, but the remainder have limited treatment options and eventually succumb to their disease5

1 Lymphoma Research Foundation 2 ACS Cancer Facts and Figures 2015 3 Swerdlow SH, et al. WHO Classification of Tumours of Haematopoietic and Lymphoid Tissues. Lyon: International

Agency for Research on Cancer (IARC); 2008

4 Global Data 5 Kantar Health

©2018 Karyopharm Therapeutics Inc. 17

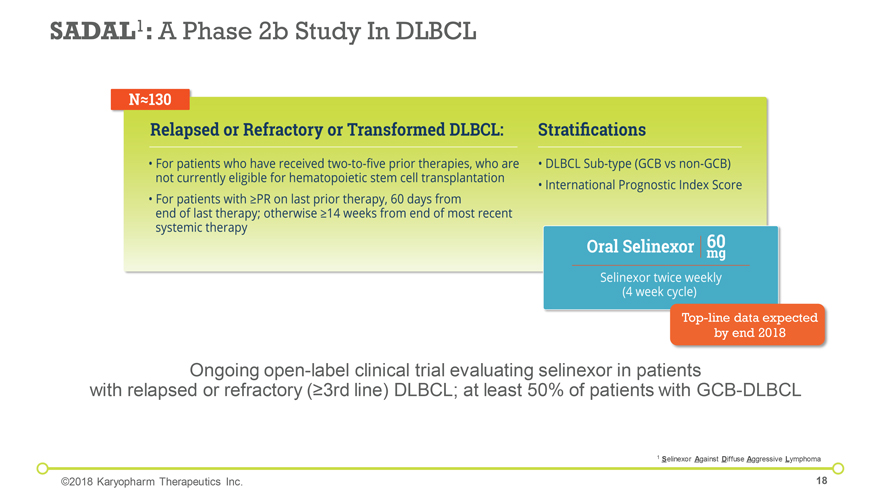

SADAL1: A Phase 2b Study In DLBCL

Top-line data expected

by end 2018

Ongoing open-label clinical trial evaluating selinexor in patients with relapsed or refractory (³3rd line) DLBCL; at least 50% of

patients with GCB-DLBCL

1 Selinexor Against Diffuse Aggressive Lymphoma

©2018 Karyopharm Therapeutics Inc. 18

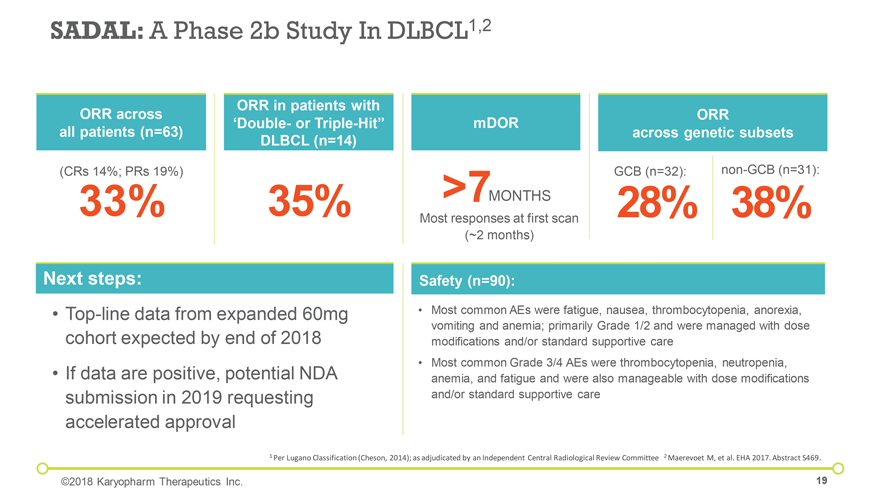

SADAL: A Phase 2b Study In DLBCL1,2

ORR in patients with

ORR across ORR ‘Double- or

Triple-Hit” mDOR all patients (n=63) across genetic subsets DLBCL (n=14)

(CRs 14%; PRs 19%) GCB (n=32): non-GCB (n=31):

33% 35% >7MONTHS 28% 38%

Most responses at first scan (~2 months)

Next steps:

• Top-line data from expanded 60mg cohort expected by end of 2018

• If data are positive, potential NDA submission in 2019 requesting accelerated approval

Safety (n=90):

• Most common AEs were fatigue, nausea, thrombocytopenia,

anorexia, vomiting and anemia; primarily Grade 1/2 and were managed with dose modifications and/or standard supportive care

• Most common Grade 3/4 AEs were

thrombocytopenia, neutropenia, anemia, and fatigue and were also manageable with dose modifications and/or standard supportive care

1 Per Lugano Classification

(Cheson, 2014); as adjudicated by an Independent Central Radiological Review Committee 2 Maerevoet M, et al. EHA 2017. Abstract S469.

©2018 Karyopharm

Therapeutics Inc. 19

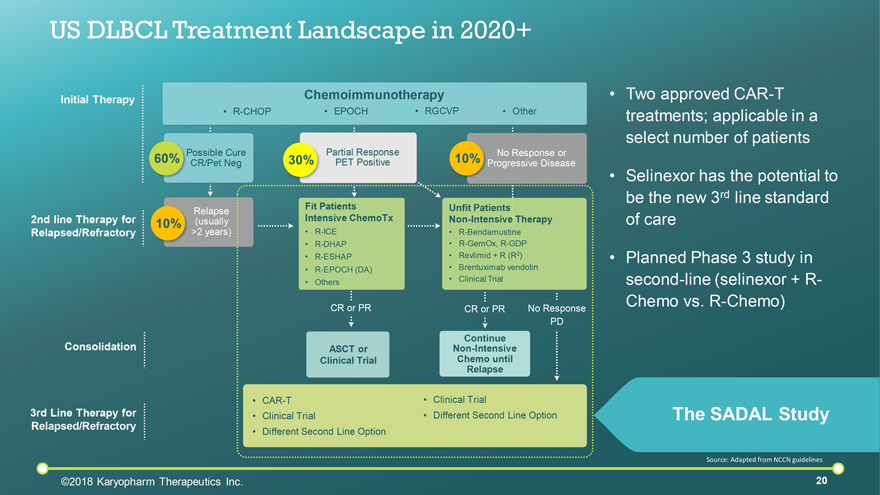

US DLBCL Treatment Landscape in 2020+

Initial Therapy

2nd line Therapy for

Relapsed/Refractory

Consolidation

3rd Line Therapy for

Relapsed/Refractory

Chemoimmunotherapy

• R-CHOP • EPOCH •

RGCVP • Other

60% Possible Cure CR/Pet Neg

Relapse 10% (usually >2

years)

Partial Response

30% PET

Positive

ASCT or Clinical Trial

Unfit Patients

Non-Intensive Therapy

• R-Bendamustine

• R-GemOx, R-GDP

• Revlimid

+ R (R2)

• Brentuximab vendotin

• Clinical Trial

CR or PR

No Response PD

Continue Non-Intensive Chemo until Relapse

CAR-T

Clinical Trial

Different Second Line Option

Clinical Trial

Different Second Line Option

Two approved CAR-T

treatments; applicable in a select number of patients

Selinexor has the potential to be the new 3rd line standard of care

Planned Phase 3 study in second-line (selinexor + R-

Chemo vs.

R-Chemo)

The SADAL Study

Source:

Adapted from NCCN guidelines

©2018 Karyopharm Therapeutics Inc.

20

Other Programs and Assets

• Selinexor in Solid Tumor Malignancies

• Eltanexor

• KPT-9274

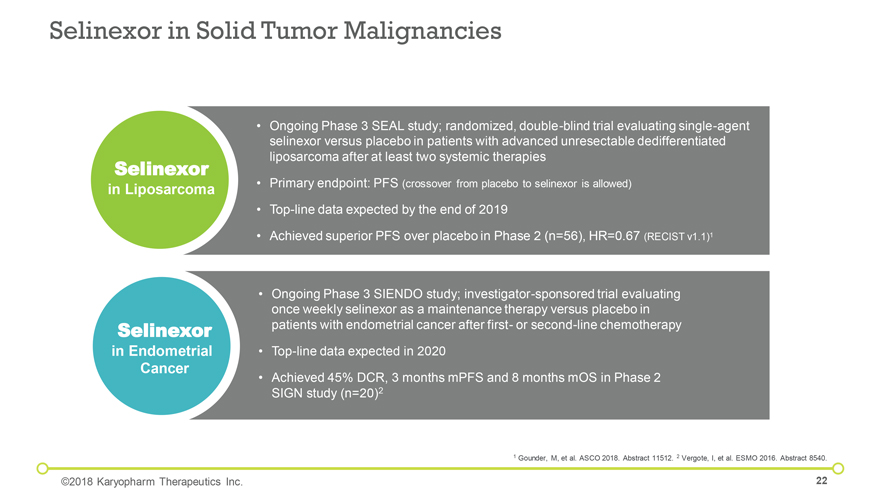

Selinexor in Solid Tumor Malignancies

Selinexor

in Liposarcoma

Selinexor

in Endometrial Cancer

• Ongoing Phase 3 SEAL study; randomized, double-blind trial evaluating single-agent

selinexor versus placebo in patients with advanced unresectable dedifferentiated

liposarcoma after at least two systemic therapies

• Primary endpoint: PFS (crossover from

placebo to selinexor is allowed)

• Top-line data expected by the end of 2019

• Achieved superior PFS over placebo in Phase 2 (n=56), HR=0.67 (RECIST v1.1)1

•

Ongoing Phase 3 SIENDO study; investigator-sponsored trial evaluating

once weekly selinexor as a maintenance therapy versus placebo in

patients with endometrial cancer after first- or second-line chemotherapy

• Top-line data expected in 2020

• Achieved 45% DCR, 3 months mPFS and 8 months mOS in Phase 2

SIGN study (n=20)2

1 Gounder, M, et al. ASCO 2018. Abstract 11512. 2 Vergote, I, et al. ESMO

2016. Abstract 8540.

©2018 Karyopharm Therapeutics Inc. 22

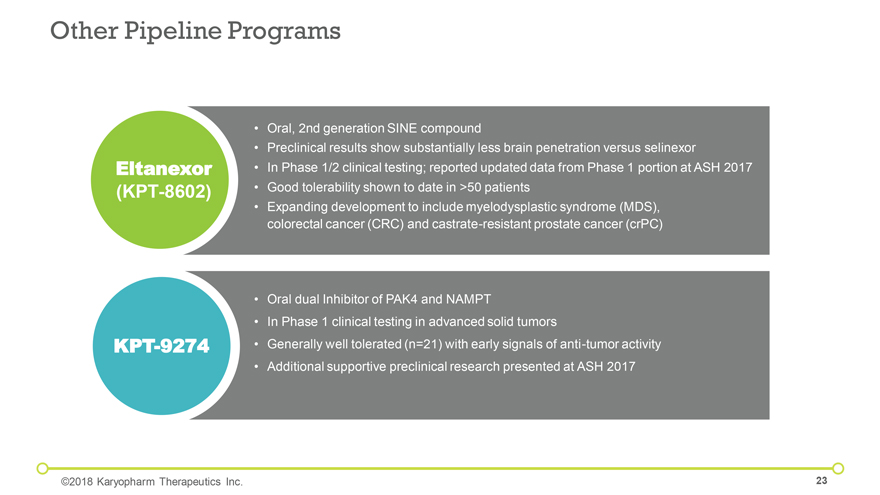

Other Pipeline Programs

Eltanexor

(KPT-8602)

• Oral, 2nd generation SINE compound

• Preclinical results show substantially less

brain penetration versus selinexor

• In Phase 1/2 clinical testing; reported updated data from Phase 1 portion at ASH 2017

• Good tolerability shown to date in >50 patients

• Expanding development to

include myelodysplastic syndrome (MDS),

colorectal cancer (CRC) and castrate-resistant prostate cancer (crPC)

KPT-9274

• Oral dual Inhibitor of PAK4 and NAMPT

• In Phase 1 clinical testing in advanced solid tumors

• Generally

well tolerated (n=21) with early signals of anti-tumor activity

• Additional supportive preclinical research presented at ASH 2017

©2018 Karyopharm Therapeutics Inc. 23

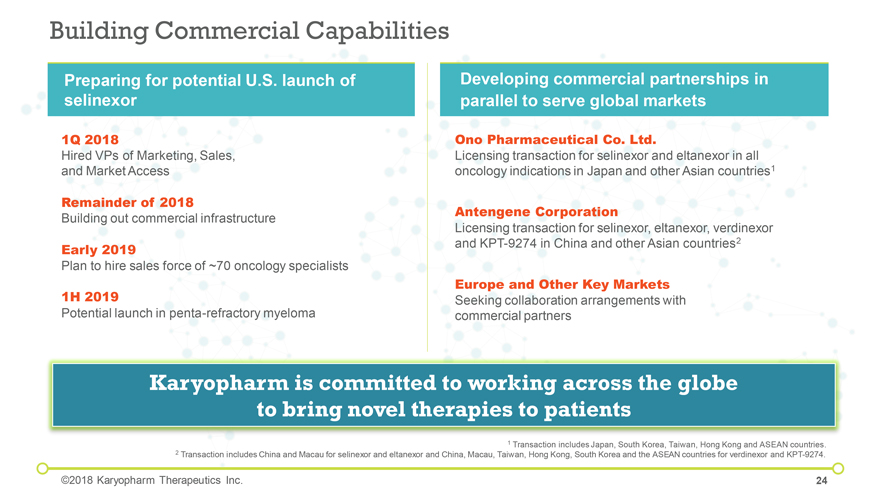

Building Commercial Capabilities

Preparing for potential U.S. launch of selinexor

1Q 2018

Hired VPs of Marketing, Sales, and Market Access

Remainder of 2018

Building out commercial infrastructure

Early 2019

Plan to hire sales force of ~70 oncology specialists

1H 2019

Potential launch in penta-refractory myeloma

Developing commercial partnerships in parallel to

serve global markets

Ono Pharmaceutical Co. Ltd.

Licensing transaction for

selinexor and eltanexor in all oncology indications in Japan and other Asian countries1

Antengene Corporation

Licensing transaction for selinexor, eltanexor, verdinexor and KPT-9274 in China and other Asian countries2

Europe and Other Key Markets

Seeking collaboration arrangements with commercial partners

Karyopharm is committed to working across the globe to bring novel therapies to patients

1 Transaction includes Japan, South Korea, Taiwan, Hong Kong and ASEAN countries.

2

Transaction includes China and Macau for selinexor and eltanexor and China, Macau, Taiwan, Hong Kong, South Korea and the ASEAN countries for verdinexor and KPT-9274.

©2018 Karyopharm Therapeutics Inc.

24

Significant Regulatory and Commercial Experience

Michael Kauffman Sharon Shacham Chris Primiano Mike Falvey Jatin Shah

Chief Executive Officer

President and Chief Business Officer Chief Financial Officer SVP, Clinical Development

Chief Scientific Officer

Bill Hatfield Joan Wood Ran Frankel Kevin Malobisky Brian Austad Ronit Milstein

SVP, Product

Strategy Chief Human Chief Development SVP, Regulatory Affairs, SVP, Pharmaceutical VP Operations

& Market Development Resources Officer Operations Officer

Quality, & Pharmacovigilance Sciences

©2018 Karyopharm Therapeutics Inc.

25

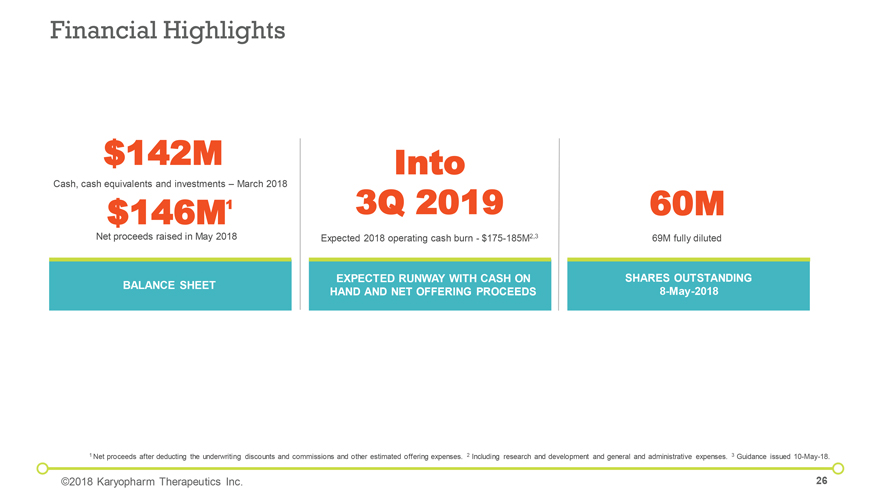

Financial Highlights

$142M

Cash, cash equivalents and investments – March 2018

$146M1

Net proceeds raised in May 2018

BALANCE SHEET

Into

3Q 2019

Expected 2018 operating cash burn -

$175-185M2,3

EXPECTED RUNWAY WITH CASH ON HAND AND NET OFFERING PROCEEDS

60M

69M fully diluted

SHARES OUTSTANDING 8-May-2018

1 Net proceeds after deducting the underwriting discounts and commissions and other estimated offering expenses. 2 Including research and development and general and administrative

expenses. 3 Guidance issued 10-May-18.

©2018 Karyopharm Therapeutics Inc. 26

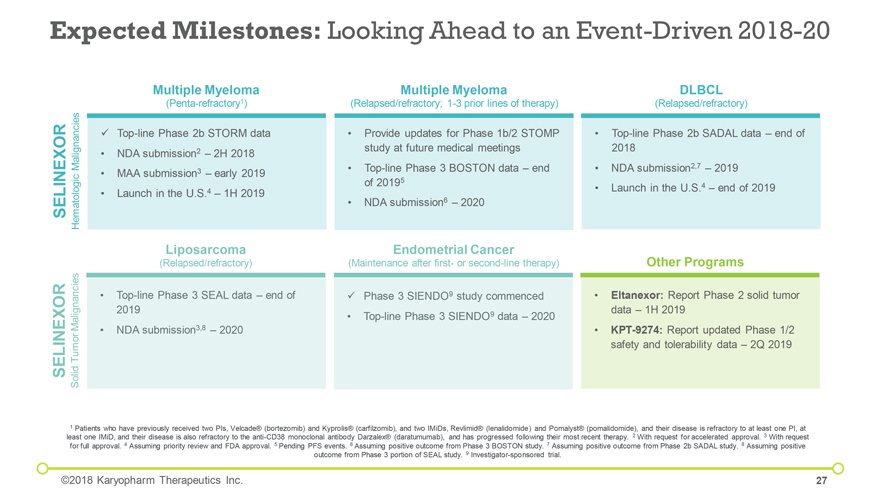

Expected Milestones: Looking Ahead to an Event-Driven 2018-20

SELINEXOR SELINEXOR

Solid Tumor Malignancies Hematologic Malignancies

Multiple Myeloma

(Penta-refractory1)

 Top-line Phase 2b STORM data

•

NDA submission2 – 2H 2018

• MAA submission3 – early 2019

• Launch in the U.S.4 – 1H 2019

Liposarcoma

(Relapsed/refractory)

Multiple Myeloma

(Relapsed/refractory; 1-3 prior lines of therapy)

• Provide updates for Phase 1b/2 STOMP study at future medical meetings

• Top-line Phase 3 BOSTON data – end of 20195

• NDA submission6 – 2020

Endometrial Cancer

(Maintenance after first- or second-line therapy)

DLBCL

(Relapsed/refractory)

Top-line Phase 2b SADAL data

– end of 2018 NDA submission2,7 – 2019 Launch in the U.S.4 – end of 2019

Other Programs

Eltanexor: Report Phase 2 solid tumor

data – 1H 2019

KPT-9274: Report updated Phase 1/2

safety and

tolerability data – 2Q 2019

1 Patients who have previously received two PIs, Velcade® (bortezomib) and Kyprolis® (carfilzomib), and two IMiDs,

Revlimid® (lenalidomide) and Pomalyst® (pomalidomide), and their disease is refractory to at least one PI, at least one IMiD, and their disease is also refractory to the anti-CD38 monoclonal antibody Darzalex® (daratumumab), and has

progressed following their most recent therapy. 2 With request for accelerated approval. 3 With request for full approval. 4 Assuming priority review and FDA approval. 5 Pending PFS events. 6 Assuming positive outcome from Phase 3 BOSTON study. 7

Assuming positive outcome from Phase 2b SADAL study. 8 Assuming positive outcome from Phase 3 portion of SEAL study. 9 Investigator-sponsored trial.

©2018

Karyopharm Therapeutics Inc.

27

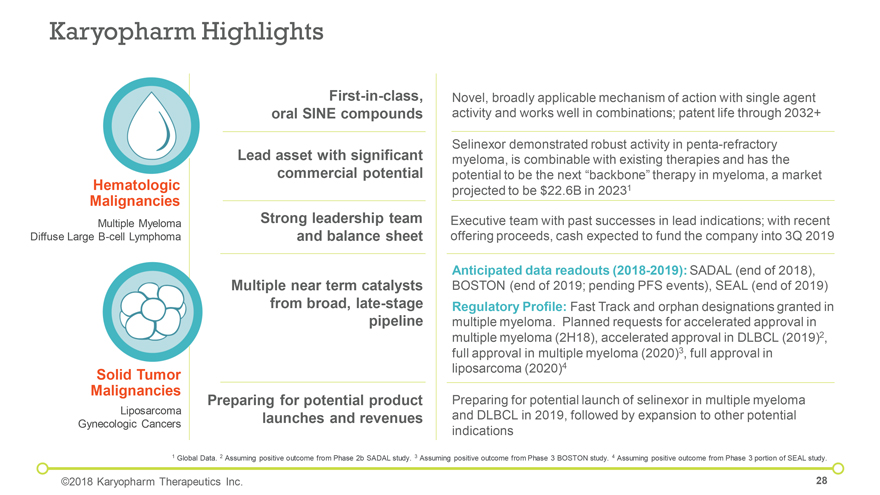

Karyopharm Highlights

Hematologic

Malignancies

Multiple Myeloma

Diffuse Large B-cell Lymphoma

Solid Tumor

Malignancies

Liposarcoma

Gynecologic Cancers

First-in-class, oral SINE compounds

Lead asset with significant commercial potential

Strong leadership team and balance sheet

Multiple near term catalysts from broad, late-stage pipeline

Preparing for

potential product launches and revenues

Novel, broadly applicable mechanism of action with single agent activity and works well in combinations; patent life

through 2032+

Selinexor demonstrated robust activity in penta-refractory myeloma, is combinable with existing therapies and has the potential to be the next

“backbone” therapy in myeloma, a market projected to be $22.6B in 20231

Executive team with past successes in lead indications; with recent offering

proceeds, cash expected to fund the company into 3Q 2019

Anticipated data readouts (2018-2019): SADAL (end of 2018),

BOSTON (end of 2019; pending PFS events), SEAL (end of 2019) Regulatory Profile: Fast Track and orphan designations granted in multiple myeloma. Planned requests for accelerated

approval in multiple myeloma (2H18), accelerated approval in DLBCL (2019)2, full approval in multiple myeloma (2020)3, full approval in liposarcoma (2020)4

Preparing for potential launch of selinexor in multiple myeloma and DLBCL in 2019, followed by expansion to other potential indications

1 Global Data. 2 Assuming positive outcome from Phase 2b SADAL study. 3 Assuming positive outcome from Phase 3 BOSTON study. 4 Assuming positive outcome from Phase 3 portion of

SEAL study.

©2018 Karyopharm Therapeutics Inc. 28

Thank You