Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Healthcare Trust, Inc. | tv495997_8k.htm |

Exhibit 99.1

HEALTHCARE TRUST, INC. 1 st Quarter 2018 Investor Presentation

2 2 Executive Summary » HTI showed growth in NOI and MFFO in Q1 2018, driven by improvement in the existing portfolio and new property acquisitions (1)(2)(3) ▪ NOI - $36.3 million, 18% growth from Q4 2017 ▪ MFFO - $13.8 million, 95% growth from Q4 2017 » The Company has begun implementing several asset management initiatives to bolster the portfolio, including the following portfolios ▪ 12 property senior housing portfolio in Michigan transitioned to a new operator in June 2017 ▪ 7 property skilled nursing facility portfolio in Illinois was leased to a new tenant in Q4 2017 » Management continues to actively manage the portfolio and has identified additional initiatives to further drive growth in earnings ▪ Incremental leasing activity, including new leases and lease extensions ▪ Replacement of underperforming operators ▪ Selective acquisitions and dispositions » On March 29, 2018, the Company’s independent directors unanimously approved an Estimated Per - Share NAV equal to $20.25 as of December 31, 2017 » Effective as of March 1, 2018, the Company will pay a monthly distribution per share at a rate of $0.85 per annum decreased from $1.45 per annum previously, which was authorized by the Company’s board of directors Healthcare Trust Inc.’s (“HTI” or the “Company”) performance improved in Q1 2018 as compared to Q4 2017, and the Company is focused on continuing this positive momentum through the rest of 2018 (1) NOI, or net operating income, is a non - GAAP measure. See page 11 of this presentation for a detailed reconciliation schedule of NOI. (2) MFFO, or modified funds from operation, is a non - GAAP measure. See page 12 of this presentation for a detailed reconciliation schedule of MFFO. (3) There were one - time items related to receivership of a six - property triple - net portfolio which impacted NOI and MFFO in Q4 2017 and Q1 2018. This one - time item had an unfavorable impact of negative $2.8 million in Q4 2017, and a favorable impact of $0.5 million in Q1 2018.

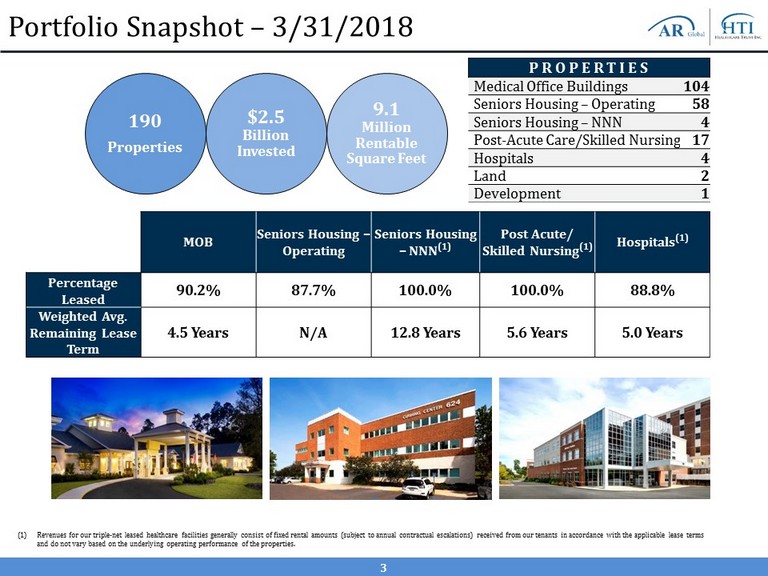

3 PROPERTIES Medical Office Buildings 104 Seniors Housing – Operating 58 Seniors Housing – NNN 4 Post - Acute Care/Skilled Nursing 17 Hospitals 4 Land 2 Development 1 MOB Senior s Housing – Operating Senior s Housing – NNN (1) Post Acute/ Skilled Nursing (1) Hospitals (1) Percentage Leased 90.2% 87.7% 100.0% 100.0% 88.8% Weighted Avg. Remaining Lease Term 4.5 Years N/A 12.8 Years 5.6 Years 5.0 Years 190 Properties $2.5 Billion Invested 9.1 Million Rentable Square Feet (1) Revenues for our triple - net leased healthcare facilities generally consist of fixed rental amounts (subject to annual contractua l escalations) received from our tenants in accordance with the applicable lease terms and do not vary based on the underlying operating performance of the properties. 3 Portfolio Snapshot – 3 /31/2018

46% 43% 11% MOB SHOP NNN $36.3 million $30.9 $36.3 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 Q4 2017 Q1 2018 NOI 4 Review of HTI’s Portfolio HTI NOI by Asset Type (1)(2) Q1 2018 NOI Split by Asset Type (1)(2)(3) MOB Portfolio ▪ Q1 2018 NOI is up 8% as compared to Q4 2017 ▪ High occupancy, good tenant retention and continued strong performance SHOP Portfolio ▪ Management has transitioned some of its NNN seniors housing properties to an operating SHOP structure NNN Portfolio ▪ Q1 2018 NOI is up $5.9 million as compared to Q4 2017 ▪ Management has successfully replaced tenants in the skilled nursing facility portfolio (“SNF”) (1) NOI, or net operating income, is a non - GAAP measure. See page 11 of this presentation for a detailed reconciliation schedule of NOI. (2) There were one - time items related to receivership of a six - property triple - net portfolio which impacted NOI in Q4 2017 and Q1 20 18. This one - time item had an unfavorable impact of negative $2.8 million in Q4 2017, and a favorable impact of $0.5 million in Q1 2018. (3) MOB – Medical Office Building; SHOP – Seniors Housing Operating Property; NNN – Triple - Net Lease Property. Portfolio Commentary (1)(2)(3)

5 Debt Capitalization ($mm) MOB Loan $250 Other Mortgage Loans $103 Total Mortgage Debt $353 Fannie Mae Master Credit Facilities $359 Revolving Credit Facility $240 Credit Facilities $599 Total Debt $952 Key Capitalization Metrics ($mm) Total Debt $952 Less: Cash $61 Net Debt (1) $891 Real Estate Assets (2) $2,544 Net Debt / Real Estate Assets 35.0% Credit Facilities ▪ The Revolving Credit Facility allows for committed borrowing of up to $565 million − As of March 31, 2018, the unused borrowing capacity under the Revolving Credit Facility was $34 million ▪ The Fannie Mae Master Credit Facilities are made up of two facilities provided by KeyBank and Capital One, and the combined facility is secured by mortgages on 22 seniors housing properties ▪ The Credit Facilities’ weighted - average interest rate in Q1 2018 was 3.95% Mortgage Debt ▪ HTI’s largest mortgage loan is its $250 million MOB Loan which was closed on June 30, 2017 ▪ The Company has several other mortgage loans with an aggregate balance of $103 million, which are secured by individual or pools of properties ▪ The weighted - average interest rate of the mortgage debt in Q1 2018 was 4.35% HTI believe it has a conservative capital structure that is capable of supporting further acquisitions to help grow the Company’s earnings (1) Net Debt is defined as total debt minus cash and cash equivalents. (2) Total real estate assets at cost plus assets held for sale. Capital Structure Overview – March 31, 2018

Corporate Initiatives Deploy Additional Capital (on - going) : ▪ HTI will continue to focus on the sectors in healthcare we find most attractive, particularly medical office and seniors housing, and is actively pursuing the acquisition of high - quality properties Actively Manage Assets to Optimize Profitability (on - going) : Management continues to actively manage the portfolio, which includes: ▪ Incremental leasing activity ▪ Where possible, replacing under performing managers ▪ Replacing tenants for improved earnings and value HT III Asset Purchase (completed) : On December 22, 2017, HTI purchased all of the membership interests in indirect subsidiaries of American Realty Capital Healthcare Trust III, Inc. (“HT III”) that own 19 properties that comprised substantially all of HT III’s assets (1)(2) ▪ The HT III portfolio consists of 17 MOB properties, one Seniors Housing – Net Lease property, and one Seniors Housing – Operating property 6 (1) HT III is sponsored and advised by an affiliate of HTI’s Advisor. (2) Pursuant to a purchase agreement dated June 16, 2017.

Q1 2018 Portfolio Activity (by Asset Type) Medical Office Building Portfolio: ▪ HTI has completed the acquisition of five MOB properties in Q1 2018 for an aggregate contract purchase price of $17 million ▪ Continue to negotiate and execute lease extensions with existing tenants and LOIs with new tenants Seniors Housing Portfolio: ▪ During 1Q 2018, the Company converted six net - leased assets to RIDEA structure with new operators ▪ Additionally during Q1 2018, 12 existing properties were transitioned to five new operators ▪ Continue to work with operators to improve performance of the seniors housing portfolio, including meetings with senior management ▪ Evaluating properties for potential dispositions Skilled Nursing Portfolio: ▪ Continue focused management of skilled nursing assets – 7% of Gross Asset Value (1) 7 (1) Gross Asset Value represents the total real estate investments, at cost, and assets held for sale at carrying value, net of g ros s market lease intangible liabilities.

Healthcare Market Overview Green Street Advisors: Health Care Sector Update, March 12, 2018 8 ▪ Medical office fundamentals remain healthy . Green Street expects 2 . 5 % annual NOI growth for medical office properties between 2018 and 2022 . ▪ Medical office remains an attractive sector with stable cap rates, no direct government reimbursement exposure and growing demand from tenants and investors . ▪ Seniors housing segment is expecting some growth in supply, however, acceleration in aging demographics should provide a strong tailwind to this segment along with all other Healthcare REIT segments . ▪ HTI continues to focus on local markets where supply/demand fundamentals are attractive . ▪ We remain cautious on skilled nursing facilities as many operators are struggling with Medicaid reimbursement .

Organizational Leadership W. Todd Jensen Chief Executive Officer and President Mr . Jensen currently serves as Chief Executive Officer and President of the Company . He is also Chief Investment Officer of our advisor, Healthcare Trust Advisors, LLC (the “Advisor”) . He has over 25 years of executive experience in healthcare real estate and has acquired, developed, financed, leased or managed more than $ 5 billion of healthcare property . He earned an MBA in Finance from the Wharton Graduate School of the University of Pennsylvania and a B . A . from Kalamazoo College . Katie Kurtz Chief Financial Officer, Secretary, and Treasurer Ms . Kurtz currently serves as the Chief Financial Officer, Treasurer and Secretary of the Company . Ms . Kurtz is also Senior Vice President, Finance for AR Global Investments, LLC (“AR Global”), the parent of the Company’s sponsor . She is a certified public accountant in New York State, holds a B . S . in Accountancy and a B . A . in German from Wake Forest University and a Master of Science in Accountancy from Wake Forest University . Leslie D. Michelson Non - Executive Chairman, Audit Committee Chair Mr . Michelson has served as the chairman and chief executive officer of Private Health Management, a retainer - based primary care medical practice management company since April 2007 . Mr . Michelson served as Vice Chairman and Chief Executive Officer of the Prostate Cancer Foundation, the world’s largest private source of prostate cancer research funding, from April 2002 until December 2006 and served on its board of directors from January 2002 until April 2013 . Sean Leahy Senior Vice President, Asset Management Mr . Leahy currently serves as Vice President with a focus on asset management of the medical office portfolio . Mr . Leahy served as a member of the management team of American Realty Capital Healthcare Trust, Inc . , which was sold to Ventas, Inc . (NYSE : VTR) in January 2015 . Prior to joining AR Global, Mr . Leahy was a Regional Vice President of Asset Management for Healthcare Trust of America, Inc . and Director of Portfolio Management and Director of Real Estate for Cole Real Estate Investments . Janet Pirello Senior Vice President, Asset Management Ms . Pirrello currently serves as Senior Vice President with a primary focus on asset management of the seniors housing portfolio . Ms . Pirrello brings to the Company over 25 years of real estate experience, with a particular emphasis on seniors housing properties . Recent positions held include Managing Director of Blue Moon Capital Partners LLC, a strategic capital source to seniors housing operating partners, and Senior Vice President for Bay North Capital . She holds a B . S from Bentley University . David Ruggiero Vice President, Acquisitions Mr . Ruggiero currently serves as Vice President with a primary focus on acquisitions . Mr . Ruggiero has over 20 years of commercial real estate experience and has advised on over $ 3 billion in healthcare real estate dispositions, acquisitions and financings . He earned an MS in Finance from Kellstadt Graduate School of Business at DePaul University and a BA from DePaul University . Andy Diebold Vice President, Asset Management Mr . Diebold currently serves as Vice President, focusing on asset management and acquisitions . Mr . Diebold has over 14 years of finance, healthcare, and real estate experience, having served most recently in asset management and corporate development roles at Ventas and Kindred Healthcare . He earned a BA in Economics and Business Administration from Vanderbilt University . 9 Trent Taylor Vice President, Asset Management Mr . Taylor currently serves as Vice President with a primary focus on asset management and leasing . Mr . Taylor has over 12 years of commercial real estate and development experience . He earned an MS in Real Estate from New York University and BA in Accounting & Finance from the University of Central Florida .

Supplemental Information Share Repurchase Program (“SRP”) : ▪ Under the Company’s amended and restated SRP, subject to certain conditions, only repurchase requests made following the death or qualifying disability of stockholders that purchased shares of the Company’s common stock or received their shares from the Company (directly or indirectly) through one or more non - cash transactions would be considered for repurchase . In cases of requests for death and disability, the repurchase price is equal to then - current Estimated Per - Share NAV at the time of repurchase . ▪ Under the SRP, repurchases of shares of the Company's common stock, when requested, are at the sole discretion of the Board and generally are made semiannually (each six - month period ending June 30 or December 31 , a “fiscal semester”) . Repurchases for any fiscal semester are limited to a maximum of 2 . 5 % of the weighted average number of shares of common stock outstanding during the previous fiscal year (the "Prior Year Outstanding Shares"), with a maximum for any fiscal year of 5 . 0 % of the Prior Year Outstanding Shares . In addition, the Company is only authorized to repurchase shares in a given fiscal semester up to the amount of proceeds received from its DRIP in that same fiscal semester . The Company’s SRP and any share repurchases are at the sole discretion of the board . ▪ On January 23 , 2018 , as permitted under the SRP, the Board authorized the repurchase of shares validly submitted for repurchase in an amount equal to 100 % of the repurchase requests made following the death or qualifying disability of stockholders during the period from July 1 , 2017 to December 31 , 2017 . Accordingly, 373 , 967 shares for approximately $ 8 . 0 million at an average price per share of $ 21 . 45 (including all shares submitted for death or disability) were approved for repurchase, and were completed in January 2018 . ▪ On March 13 , 2018 , the Company announced a tender offer (the "Tender Offer") to purchase up to 2 . 0 million shares of the Company’s common stock for cash at a purchase price equal to $ 13 . 15 per share with the proration period and withdrawal rights expiring on April 12 , 2018 . The Company made the Tender Offer in response to an unsolicited offer to stockholders commenced on February 27 , 2018 . On April 4 , 2018 and April 16 , 2018 the Tender Offer was amended to reduce the number of shares the Company was offering to purchase to 230 , 000 shares and extend the expiration date to May 1 , 2018 . The Tender Offer expired in accordance with its terms on May 1 , 2018 . In accordance with the terms of the Tender Offer, we accepted for purchase 229 , 999 shares for a total cost of approximately $ 3 . 0 million . The purchase was finalized on May 9 , 2018 . ▪ The SRP is currently suspended due to the Tender Offer and the Company will not accept any repurchase requests until such time that the Board of Directors reinstates the SRP . Note, the Tender Offer expired on May 1 , 2018 , and the Offer was not extended . 10

Reconciliation of Non - GAAP Metrics: NOI 11 Net Operating Income (NOI) Reconciliation Schedule 3 months ended 3 months ended ($ in thousands) MOB NNN SHOP 12/31/2017 MOB NNN SHOP 3/31/2018 Rental income $17,514 $3,796 $2,621 $23,931 $19,355 $5,928 $3 $25,286 Operating expense reimbursements 3,877 833 (1) 4,709 4,634 337 - 4,971 Resident services and fee income - - 53,080 53,080 - - 59,181 59,181 Total Revenues 21,391 4,629 55,700 81,720 23,989 6,265 59,184 89,438 Less: Property operating and maintenance 5,918 6,689 38,256 50,863 7,216 2,426 43,464 53,106 Net Operating Income (NOI) $15,473 ($2,060) $17,444 $30,857 $16,773 $3,839 $15,720 $36,332 Impairment charges - (733) Operating fees to related parties (5,684) (5,727) Acquisitions and transaction related 1,341 (173) General and administrative (4,557) (3,652) Depreciation and amortization (18,730) (20,769) Interest expense (9,356) (11,157) Interest and other income 1 3 Gain (loss) on non-designated derivatives (69) 178 Gain on sale of real estate investments - - Gain on asset acquisition 307 - Income tax expense (1,696) (309) Net income attributable to non-controlling interests 29 16 Net loss attributable to stockholders ($7,557) ($5,991)

Reconciliation of Non - GAAP Metrics: MFFO 12 Modified Funds from Operations (MFFO) Reconciliation Schedule (1) Net of non - real estate depreciation and amortization . (2) Represents the portion of the adjustments allocable to non - controlling interests. 3 months ended 3 months ended ($ in thousands) 12/31/2017 3/31/2018 Net loss attributable to stockholders ($7,557) ($5,991) Depreciation and amortization (1) 18,441 20,458 Impairment charges - 733 Gain on asset acquisition (307) - Adjustments for non-controlling interests (2) (92) (103) FFO 10,485 15,097 Acquisition and transaction related (1,341) 173 Amortization of market lease and other intangibles, net 14 86 Straight-line rent adjustments (1,243) (628) Amortization of mortgage premiums and discounts, net (297) (69) (Gain) loss on non-designated derivative instruments 69 (178) Capitalized construction interest costs (617) (670) Adjustments for non-controlling interests (2) 16 6 MFFO $7,086 $13,817

Important Information Risk Factors For a discussion of the risks which should be considered in connection with our company, see the section entitled “Risk Factors” in our most recent Annual Report on Form 10 - K filed with the SEC on March 20 , 2018 . Forward - Looking Statements This presentation may contain forward - looking statements . You can identify forward - looking statements by the use of forward looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “intends,” “plans,” “projects,” “estimates,” “anticipates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases . Please review the end of this presentation and the Company’s Annual Report on Form 10 - K and Quarterly Report on Form 10 - Q for a more complete list of risk factors, as well as a discussion of forward - looking statements . 13

Risk Factors Our potential risks and uncertainties are presented in the section titled “Item 1 A . Risk Factors” disclosed in our Annual Report on Form 10 - K for the year ended December 31 , 2017 and updated in our Quarterly Reports on Form 10 - Q from time to time . The following are some of the risks and uncertainties, although not all risks and uncertainties, that could cause our actual results to differ materially from those presented in our forward looking statements : ▪ Certain of our executive officers and directors are also officers, managers, employees or holders of a direct or indirect controlling interest in Healthcare Trust Advisors, LLC (our "Advisor") and other entities affiliated with AR Global Investments, LLC (the successor business to AR Capital, LLC, "AR Global"), the parent of our sponsor, American Realty Capital VII, LLC (the "Sponsor") . As a result, certain of our executive officers and directors, our Advisor and its affiliates face conflicts of interest, including significant conflicts created by our Advisor's compensation arrangements with us and other investment programs advised by affiliates of AR Global and conflicts in allocating time among these investment programs and us . These conflicts could result in unanticipated actions that adversely affect us . ▪ Because investment opportunities that are suitable for us may also be suitable for other investment programs advised by affiliates of AR Global, our Advisor and its affiliates face conflicts of interest relating to the purchase of properties and other investments and such conflicts may not be resolved in our favor, meaning that we could invest in less attractive assets, which could reduce the investment return to our stockholders . ▪ Although we intend to seek a listing of our shares of common stock on a national stock exchange when we believe market conditions are favorable to do so, there is no assurance that our shares of common stock will be listed . No public market currently exists, or may ever exist, for shares of our common stock and our shares are, and may continue to be, illiquid . ▪ We focus on acquiring and owning a diversified portfolio of healthcare - related assets located in the United States and are subject to risks inherent in concentrating investments in the healthcare industry . ▪ If our Advisor loses or is unable to obtain qualified personnel, our ability to continue to achieve our investment strategies could be delayed or hindered. ▪ The healthcare industry is heavily regulated, and new laws or regulations, changes to existing laws or regulations, loss of licensure or failure to obtain licensure could result in the inability of tenants to make lease payments to us . ▪ We are depending on our Advisor to select investments and conduct our operations . Adverse changes in the financial condition of our Advisor and its affiliates or our relationship with our Advisor could adversely affect us . ▪ We are obligated to pay fees, which may be substantial, to our Advisor and its affiliates . 14

Risk Factors (Continued) ▪ We depend on tenants for our revenue and, accordingly, our revenue is dependent upon the success and economic viability of our tenants . ▪ We may not be able to achieve our rental rate objectives on new and renewal leases and our expenses could be greater, which may impact our results of operations . ▪ Increases in interest rates could increase the amount of our debt payments and limit our ability to pay distributions . ▪ We have not generated, and in the future may not generate, operating cash flows sufficient to fund all of the distributions we pay to our stockholders, and, as such, we may be forced to fund distributions from other sources, including borrowings, which may not be available on favorable terms, or at all . ▪ There can be no assurance we will continue to pay distributions at our current level or at all . ▪ Any distributions, especially those not covered by our cash flows from operations, may reduce the amount of capital available for other purposes included investment in properties and other permitted investments and may negatively impact the value of our stockholders' investment . ▪ We are subject to risks associated with any dislocations or liquidity disruptions that may exist or occur in the credit markets of the United States from time to time . ▪ We are subject to risks associated with changes in general economic, business and political conditions including the possibility of intensified international hostilities, acts of terrorism, and changes in conditions of United States or international lending, capital and financing markets . ▪ We may fail to continue to qualify to be treated as a real estate investment trust for U . S . federal income tax purposes, which would result in higher taxes, may adversely affect our operations and would reduce the value of an investment in our common stock and the cash available for distributions . ▪ The offering price and repurchase price for our shares under the DRIP and our share repurchase program may not, among other things, accurately reflect the value of our assets and may not represent what a stockholder may receive on a sale of the shares, what they may receive upon a liquidation of our assets and distribution of the net proceeds or what a third party may pay to acquire the Company . 15

HealthcareTrustInc.com ▪ For account information, including balances and the status of submitted paperwork, please call us at (866) 902 - 0063 ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com ▪ Shareholders may access their accounts at www.ar - global.com