Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Deciphera Pharmaceuticals, Inc. | d592942dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on June 6, 2018.

Registration No. 333-225411

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

DECIPHERA PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 30-1003521 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

500 Totten Pond Road

Waltham, MA 02451

(781) 209-6400

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Michael D. Taylor, Ph.D.

President & Chief Executive Officer

Deciphera Pharmaceuticals, Inc.

500 Totten Pond Road

Waltham, MA 02451

(781) 209-6400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Please send copies of all communications to:

| Richard A. Hoffman, Esq. Edwin M. O’Connor, Esq. Goodwin Procter LLP 100 Northern Avenue Boston, MA 02210 (617) 570-1000 |

Richard D. Truesdell, Jr., Esq. Marcel R. Fausten, Esq. Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York (212) 450-4000 |

Approximate date of commencement of the proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(3) | ||

| Common stock, $0.01 par value per share |

$165,211,875 | $20,569 | ||

|

| ||||

|

| ||||

| (1) | Includes additional shares of common stock that the underwriters have the option to purchase. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (3) | A registration fee of $13,912 was previously paid in connection with the Registration Statement. An additional $6,657 is paid herewith. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 6, 2018

PRELIMINARY PROSPECTUS

3,750,000 Shares

Common Stock

$ per share

This is an offering of 3,750,000 shares of common stock by Deciphera Pharmaceuticals, Inc.

Our common stock is listed on The Nasdaq Global Select Market under the symbol “DCPH.” The last reported sale price of our common stock on The Nasdaq Global Select Market on June 4, 2018 was $38.31 per share. The final public offering price will be determined through negotiation between us and the underwriters in the offering, and the recent market price used throughout this prospectus may not be indicative of the final public offering price.

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, have elected to comply with certain reduced public company reporting requirements and may elect to comply with reduced reporting requirements in future filings.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 18 and in the documents incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public Offering Price |

$ | $ | ||||||

| Underwriting Discounts and Commissions(1) |

$ | $ | ||||||

| Proceeds to Deciphera Pharmaceuticals, Inc. (before expenses) |

$ | $ | ||||||

| (1) | See “Underwriting” for a description of the compensation payable to the underwriters. |

To the extent that the underwriters sell more than 3,750,000 shares of our common stock, the underwriters have an option to purchase up to an additional 562,500 shares of common stock from us at the public offering price less the underwriting discounts and commissions.

The underwriters expect to deliver the shares against payment in New York, New York on , 2018.

| J.P. Morgan | Piper Jaffray |

Table of Contents

| 1 | ||||

| 18 | ||||

| 22 | ||||

| 24 | ||||

| 25 | ||||

| MARKET PRICE OF OUR COMMON STOCK AND RELATED STOCKHOLDER MATTERS |

26 | |||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 31 | ||||

| 34 | ||||

| MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS FOR NON-U.S. HOLDERS OF COMMON STOCK |

40 | |||

| 44 | ||||

| 46 | ||||

| 56 | ||||

| 56 | ||||

| 56 | ||||

| 57 | ||||

We are responsible for the information contained or incorporated by reference in this prospectus. We have not, and the underwriters have not, authorized anyone to provide you with any other information other than in this prospectus, and we take no responsibility for, and the underwriters have not taken responsibility for, any other information others may give you. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing or incorporated by reference in this prospectus is accurate only as of its date.

Through and including , 2018 (the 25th day after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

For investors outside the United States: Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus outside of the United States.

This prospectus and the documents incorporated by reference contain references to our trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

i

Table of Contents

This summary highlights information contained elsewhere and incorporated by reference in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should read the entire prospectus carefully, including the section entitled “Risk Factors” and the information in our filings with the U.S. Securities and Exchange Commission, or the SEC, incorporated by reference in this prospectus. Except where the context otherwise requires or where otherwise indicated, the terms “Deciphera,” “we,” “us,” “our,” “our company,” “the company,” and “our business” refer to Deciphera Pharmaceuticals, Inc. and its consolidated subsidiaries.

Deciphera Pharmaceuticals Overview

We are a clinical-stage biopharmaceutical company developing new drugs to improve the lives of cancer patients by addressing key mechanisms of drug resistance that limit the rate and durability of response of many cancer therapies. Our targeted, small molecule drug candidates, designed using our proprietary kinase switch control inhibitor platform, inhibit the activation of kinases, an important family of enzymes that, when mutated or over expressed, are known to be directly involved in the growth and spread of many cancers. We have built a diverse pipeline of wholly owned, orally administered drug candidates that includes three clinical-stage and two research-stage programs. We are studying our lead drug candidate DCC-2618 in an ongoing pivotal Phase 3 trial in fourth-line plus treatment of gastrointestinal stromal tumors, or GIST, where there are currently no approved therapies, and in an ongoing Phase 1 trial in patients with advanced malignancies. We presented interim results from this Phase 1 trial in September 2017 at the European Society for Medical Oncology 2017 Congress that demonstrate clinical proof-of-concept at well-tolerated doses in 57 heavily pre-treated GIST patients, of which 51 had KIT- or PDGFRα-driven GIST. We are currently enrolling expansion cohorts in this Phase 1 trial to study DCC-2618 in patients with different stages of GIST, as well as in patients with advanced systemic mastocytosis gliomas, including glioblastoma multiforme, and other solid tumors driven by KIT or PDGFRα. We expect to report initial data from some of these expansion cohorts in 2018. We expect to initiate enrollment in a second pivotal Phase 3 trial in second-line GIST comparing DCC-2618 to sunitinib in the second half of 2018. We are also developing two other clinical-stage, small molecule drug candidates, DCC-3014 and rebastinib, as immuno-oncology kinase, or immunokinase, switch control inhibitors targeting colony stimulating factor receptor 1, or CSF1R, and TIE2 kinase, respectively. Both drug candidates are in Phase 1 trials. We believe our proprietary kinase switch control inhibitor platform, supported by our experienced management team, enables us to develop advanced, differentiated kinase inhibitors that may provide significant benefits to cancer patients.

Corporate Update

DCC-2618

Ongoing Phase 1 Trial Update

We are studying DCC-2618 in an ongoing Phase 1 trial in patients with advanced malignancies. As of January 18, 2018, we had enrolled 169 total patients with 113 patients receiving 150 mg of DCC-2618 once daily, or QD. Sixty-eight patients were enrolled in the dose escalation portion and 101 patients were enrolled in the dose expansion portion of the Phase 1 trial. Of these 169 total patients, 142 were gastrointestinal stromal tumor, or GIST, patients, 100 of whom received 150 mg of DCC-2618 QD. We are enrolling patients with select advanced malignancies, including fourth- and fourth-line plus GIST, second- and third-line GIST, advanced systemic mastocytosis, or ASM, and gliomas, including glioblastoma multiforme, or GBM, in expansion cohorts of this Phase 1 trial.

1

Table of Contents

2018 American Society of Clinical Oncology Annual Meeting and Additional Interim Results

In June 2018, at the 2018 American Society of Clinical Oncology Annual Meeting, or ASCO 2018, we presented an update to the interim results from our ongoing Phase 1 trial of DCC-2618 in 150 GIST patients shown to harbor a broad range of KIT and PDGFRa mutations who received at least one dose at or above 100 mg of DCC-2618 daily, on or before February 26, 2018, with an efficacy cut-off date of April 18, 2018.

In the data presented at ASCO 2018 and as part of our additional interim update, we observed that 83% (115 of 138) of evaluable patients, defined as those patients with at least a baseline and one follow-up tumor assessment as of the efficacy cut-off date, had a best response of stable disease or partial response (defined as tumor size reduction of 30% or more), or PR, by Response Evaluation Criteria in Solid Tumors, or RECIST. In addition, we observed a disease control rate, or DCR, defined as the proportion of patients with either stable disease or a PR at a point in time, of 70% at three months in 145 evaluable patients, which excluded five patients that were on study at the efficacy cut-off date, but had not received a first tumor assessment. Disease control includes stable disease, PRs and complete responses, or CRs, measured by computerized tomography, or CT scan, or magnetic resonance imaging, or MRI scan, and assessed locally by RECIST. We also observed an objective response rate, or ORR, which is the proportion of patients with either CRs or PRs by RECIST of 15% in 145 patients. In 54 second- and third-line GIST patients, we also observed an ORR of 24%, a best response of 83% and a DCR of 80% at 3 months.

Interim results, including those presented at ASCO 2018, are summarized in the below table.

| Line of Therapy |

Total Patients(1) |

Active(1) | Best(2) Response (CR/PR/SD) |

DCR at 3 Months(2) |

ORR(2) | |||||||||||||||

| 2nd Line |

25 | 68 | % | 84 | % | 79 | % | 24 | % | |||||||||||

| 3rd Line |

29 | 76 | % | 83 | % | 82 | % | 24 | % | |||||||||||

|

³4th Line |

96 | 53 | % | 77 | %(3) | 64 | %(3) | 9 | %(3) | |||||||||||

| Total | 150 | 60 | % | 79 | %(3) | 70 | %(3) | 15 | %(3) | |||||||||||

| (1) | Reflects total number of GIST patients in the Phase 1 trial that received at least 100 mg of DCC-2618 daily and that began cycle one day one, or C1D1, on or before February 26, 2018. |

| (2) | Patients with C1D1 on or before February 2, 2018, or enrolled later with an available tumor assessment, based on the April 18, 2018 efficacy cut-off date. |

| (3) | Excludes five patients with C1D1 after February 2, 2018 and no assessment. |

RECIST Responses in KIT- or PDGFRa-driven GIST Patients in Phase 1 Trial

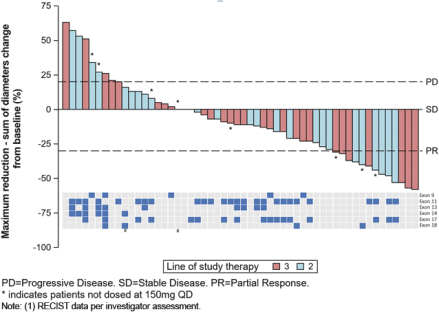

At ASCO 2018, for the second- and third-line GIST patients in our Phase 1 trial of DCC-2618 who received both a baseline and post-treatment CT scan by the efficacy cut-off date (n = 54), we presented the greatest reduction or smallest increase in tumor size from baseline as measured by CT or MRI scan, or best response, for solid malignancies per RECIST as shown in the following figure.

2

Table of Contents

Best Response per RECIST(1)

In Second- and Third-Line KIT & PDGFRa GIST Patients Receiving

³ 100 mg DCC-2618 Daily (n = 54)

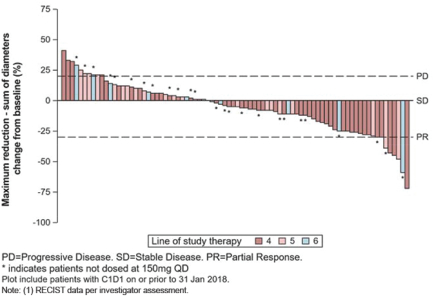

In addition to the data presented at ASCO 2018, for the fourth- and fourth-line plus GIST patients in our Phase 1 trial of DCC-2618 who received both a baseline and post-treatment CT scan by the efficacy cut-off date (n = 82), we also evaluated the best response for solid malignancies per RECIST as shown in the following figure.

Best Response per RECIST(1)

In Fourth- and Fourth-Line Plus KIT & PDGFRa GIST Patients Receiving

³ 100 mg DCC-2618 Daily (n = 82)

3

Table of Contents

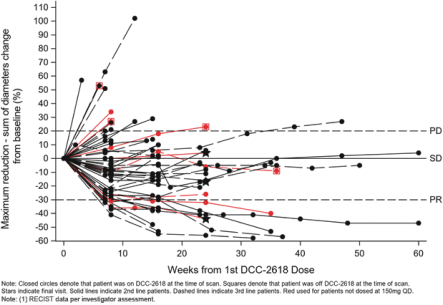

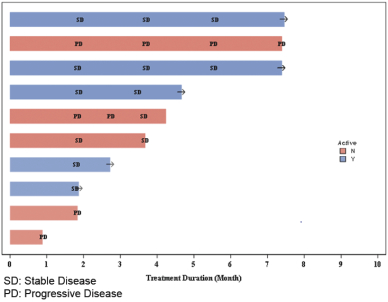

Disease Control Rate in KIT- and PDGFRa-driven GIST Patients

As presented at ASCO 2018, for the second- and third-line GIST patients in our Phase 1 trial of DCC-2618, we observed a DCR at three months of 79% and 82%, respectively. The chart below shows durability of response in 54 second- and third-line GIST patients receiving DCC-2618 at doses of at least 100 mg daily, where each cycle has a duration of 4 weeks.

Duration of Disease Control(1)

In Second- and Third-Line KIT & PDGFRa GIST Patients Receiving

³ 100 mg DCC-2618 Daily (n = 54)

4

Table of Contents

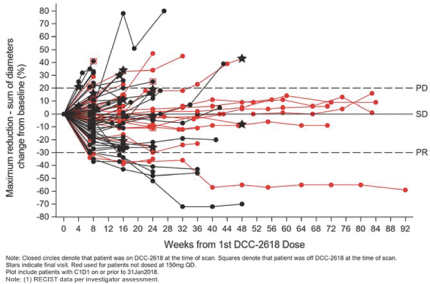

We also observed a DCR at three months of 64% in fourth- and fourth-line plus GIST patients in our Phase 1 trial of DCC-2618. In addition to the data presented at ASCO 2018, we evaluated the durability of response in 89 fourth- and fourth-line plus GIST patients receiving DCC-2618 at doses of at least 100 mg daily, where each cycle has a duration of 4 weeks as shown in the chart below.

Duration of Disease Control(1)

In Fourth- and Fourth-Line Plus KIT & PDGFRa GIST Patients Receiving

³ 100 mg DCC-2618 Daily (n = 89)

5

Table of Contents

Additional Interim Observations

In addition to the data presented at ASCO 2018, we also observed clinical activity in patients who were previously treated with the investigational drug avapritinib (BLU-285). Of the 150 patients in our ongoing Phase 1 trial of DCC-2618, there were 10 evaluable patients with KIT-driven GIST who previously received avapritinib and who were enrolled and being treated with DCC-2618 as of January 31, 2018. Six out of 10, or 60%, of these patients achieved stable disease as best response as of the efficacy cut-off date. One additional patient achieved stable disease following intra-patient dose escalation to 150 mg of DCC-2618 twice daily from 150 mg QD. As of the efficacy cut-off date, five out of 10, or 50%, of these patients remained on study and three out of 10, or 30%, of these patients had received DCC-2618 for at least six months. As of the efficacy cut-off date, of the three patients who had received DCC-2618 for at least six months, two achieved continued stable disease and remained on study. The third patient with progressive disease was dose escalated and reported as off-study as of the efficacy cut-off date. The chart below summarizes the treatment duration of the 10 evaluable patients who previously received avapritinib and the responses observed.

Treatment Duration of Evaluable Patients Who Previously Received Avapritinib

(n = 10)

The evaluable patients in our ongoing Phase 1 clinical trial of DCC-2618 who were previously treated with avapritinib are limited in number. We are not able to draw any conclusions about why such patients were no longer enrolled in clinical trials for avapritinib. As a result, any clinical activity observed in these patients may not be representative of future results for these patients or indicative of results for other patients who were previously treated with avapritinib. References to such patients are not intended to be comparisons between avapritinib and DCC-2618.

6

Table of Contents

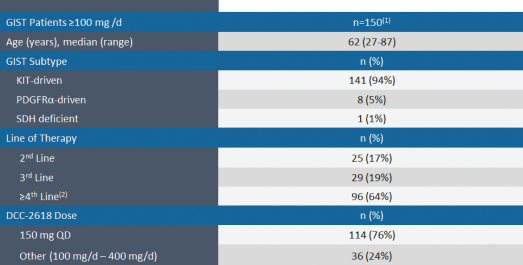

The chart below summarizes the demographic profile of the patients for whom data was presented at ASCO 2018 and the other additional interim data described above.

Demographic Profile of GIST Patients in Phase 1 Trial

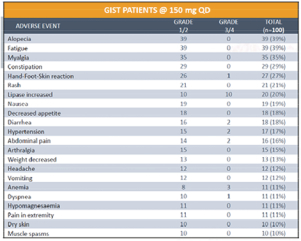

AACR Annual Meeting 2018

In April 2018, at the AACR Annual Meeting 2018, or AACR 2018, we reported updated safety on 100 patients with GIST who were treated at our recommended Phase 2 dose of 150 mg of DCC-2618 QD. The data showed that in the ongoing Phase 1 trial DCC-2618 continues to be generally well-tolerated at the dose of 150 mg QD as summarized in the table below.

Treatment Emergent Adverse Events

7

Table of Contents

At AACR 2018, we also reported that as of January 1, 2018, 137 GIST patients were enrolled in the Phase 1 trial of DCC-2618 at doses of at least 100 mg of DCC-2618 daily. As of March 19, 2018, 81 of the 137 patients remained on study, with 46, 21, 10 and seven of the patients on study for at least six, nine, 12 and 15 months, respectively.

Ongoing and Planned Phase 3 Trials for DCC-2618 in GIST

In January 2018, we initiated a pivotal Phase 3 trial, or INVICTUS, comparing treatment with DCC-2618 to placebo in 120 fourth-line plus GIST patients, 80 of whom will be treated with 150 mg of DCC-2618 QD and 40 of whom will receive placebo. We expect to initiate a second pivotal Phase 3 trial comparing treatment with DCC-2618 to sunitinib in up to 350 second-line GIST patients in 2018. We expect half of the patients enrolled in this trial will be treated with 150 mg of DCC-2618 QD and the other will be treated with 50 mg of sunitinib QD, with median PFS as the primary endpoint.

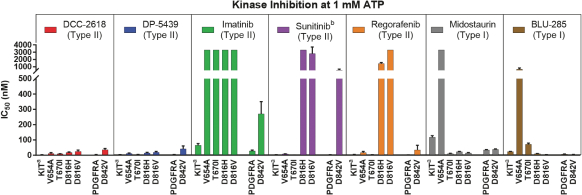

Preclinical Update

In April 2018, we presented preclinical data at AACR 2018 that describes the breadth of inhibition achieved with DCC-2618 and its active metabolite, DP-5439, across both primary and secondary KIT mutations and primary PDGFRa mutations compared to the in vitro profiles of the FDA-approved kinase inhibitors, imatinib, sunitinib, regorafenib, midostaurin and the investigational drug, avapritinib (BLU-285). Potency is measured by the concentration of DCC-2618 or DP-5439 required to inhibit kinase activity by 50%, or the inhibitory concentration 50%, or IC50. The lower the bar in the following graphs, the greater the potency. Compared to the approved and investigational compounds tested, DCC-2618 and its active metabolite, DP-5439, exhibited the broadest profile of inhibition across primary and secondary drug-resistant KIT mutations, and primary mutations in PDGFRa.

8

Table of Contents

In enzyme assays at relevant cellular levels of adenosine triphosphate, or ATP, DCC-2618 broadly inhibited primary and drug-resistant KIT mutations and primary PDGFRa mutations. DCC-2618 also broadly inhibited KIT and PDGFRa mutations in a panel of GIST, mastocytosis, leukemia, lung cancer, and transfected cell assays.

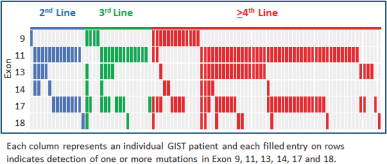

One of the exploratory objectives of our Phase 1 trial of DCC-2618 was to understand the KIT and PDGFRa mutation status at baseline identified in plasma ctDNA of GIST patients and their association with study drug response. At ASCO 2018, we presented data on the mutational status of 131 GIST patients, of which 95 had KIT-driven mutations in ctDNA, by exon, as summarized in the following figure.

KIT Mutations in ctDNA (n = 95)

In 131 GIST Patients by Line of Therapy

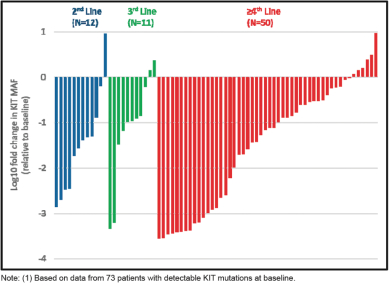

The following figure, which was also included in our ASCO 2018 presentation, shows the maximum change in ctDNA mutant allele frequency, or MAF, by exon in 73 patients with circulating KIT mutations observed at baseline and having data from at least one sample following treatment with DCC-2618. We observed in this group of KIT-positive GIST patients that treatment with DCC-2618 resulted in reductions of least 50% in the

9

Table of Contents

frequency of circulating ctDNA mutant KIT alleles in 78% (57 of 73) of patients, with 48% (35 of 73) of patients becoming KIT-negative on treatment.

Cumulative Reductions in Circulating MAF of KIT Exons 9, 11,

13, 14, 17 and 18 by Lines of Therapy (n = 73)(1)

(Note log scale: -1 = 10-fold reduction, -2 = 100-fold reduction)

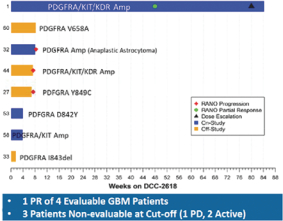

Development of DCC-2618 in Gliomas, including GBM

In November 2017, we presented data at the 22nd Annual Scientific Meeting and Education Day of the Society for Neuro-Oncology, or SNO 2018, from eight patients diagnosed with malignant gliomas treated with DCC-2618. Of the five evaluable patients, four had GBM. Among these four GBM patients, we observed one PR, as defined by RANO, and three patients with progressive disease. In addition, of the three patients who were non-evaluable, two patients remained on study and one had progressive disease. DCC-2618 produced an encouraging partial response in a GBM patient with triple amplification of PDGFRa, KIT and KDR (4q12 amplicon). There was an observed tumor reduction from baseline of 94% on Cycle 23 Day 1 per RANO. However, other patients with similar amplifications or PDGFRa alterations did not derive similar benefit from treatment with DCC-2618. This patient population is very heterogeneous, and patients often exhibit multiple genetic alterations in addition to PDGFRa alterations. We believe that this single exceptional responder warrants

10

Table of Contents

further testing of DCC-2618 in patients with KIT- and PDGFRa-driven gliomas, and there is an open cohort in the ongoing expansion phase of the Phase 1 study.

Activity Observed in GBM

Rebastinib—TIE2 Inhibitor

Rebastinib is in clinical development for the treatment of multiple solid tumors and in combination with chemotherapy in an investigator-sponsored Phase 1b trial. The investigators presented preliminary clinical data at AACR 2018 from their ongoing Phase 1b trial of rebastinib. Based on data combining rebastinib with anti-PD1 antibodies or anti-tubulin chemotherapy in preclinical studies, we are evaluating opportunities for further development of these drug candidates in combination with other immuno-oncology therapies or chemotherapy. We expect to initiate a company-sponsored Phase 1b trial of rebastinib with chemotherapy in 2018.

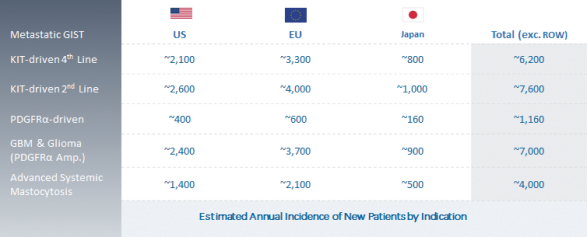

Market Opportunity for our Drug Candidates

We are continuing to focus on our strategy to expand the market opportunity for DCC-2618 by pursuing development in second-line GIST, gliomas, including GBM, ASM and other solid tumors driven by KIT or PDGFRa. The chart below summarizes our estimates of the annual incidence of these diseases.

Estimated Market Opportunity

11

Table of Contents

Risks Associated with Our Business

Our ability to execute on our business strategy is subject to a number of risks, which are discussed more fully in the section of this prospectus entitled “Risk Factors.” You should carefully consider these risks before making an investment in our common stock. These risks include, among others, the following:

| • | We have incurred significant operating losses since our inception and have not generated any revenue from product sales. We expect to incur continued losses for the foreseeable future and may never achieve or maintain profitability. |

| • | We will require substantial additional funding. If we are unable to raise capital when needed, or on attractive terms, we could be forced to delay, reduce or eliminate our research or drug development programs or any future commercialization efforts. |

| • | We have a limited operating history, have not successfully completed late-stage clinical trials for any drug candidate, have not generated revenue from product sales or profits and do not expect to generate revenue or profits for the foreseeable future. We may never obtain approval for any of our drug candidates or achieve or sustain profitability. |

| • | All of our drug candidates target inhibition of the activation switch in kinases. If we are unable to commercialize our drug candidates or experience significant delays in doing so, our business will be materially harmed. |

| • | Clinical drug development involves a lengthy and expensive process. We may incur additional costs or experience delays in completing, or ultimately be unable to complete, the development and commercialization of DCC-2618 and our other drug candidates. |

| • | If we experience delays or difficulties in the enrollment of patients in clinical trials, including in our planned second pivotal Phase 3 clinical trial for DCC-2618 in GIST, our receipt of necessary marketing approvals could be delayed or prevented. |

| • | The incidence and prevalence for target patient populations of our drug candidates have not been established with precision. If the market opportunities for our drug candidates are smaller than we estimate or if any approval that we obtain is based on a narrower definition of the patient population, our revenue potential and ability to achieve profitability will be adversely affected. |

| • | We face substantial competition, which may result in others discovering, developing or commercializing products before or more successfully than we do. |

| • | We may enter into collaborations with third parties for the development and commercialization of our drug candidates. If those collaborations are not successful, we may not be able to capitalize on the market potential of these drug candidates. |

| • | Manufacturing pharmaceutical products is complex and subject to product loss for a variety of reasons. We contract with third parties for the manufacture of our drug candidates for preclinical testing and clinical trials and expect to continue to do so for commercialization. This reliance on third parties increases the risk that we will not have sufficient quantities of our drug candidates or products or such quantities at an acceptable cost or quality, which could delay, prevent or impair our development or commercialization efforts. |

| • | If we are unable to obtain and maintain sufficient patent protection for our drug candidates, or if the scope of the patent protection is not sufficiently broad, third parties, including our competitors, could develop and commercialize products similar or identical to ours, and our ability to commercialize our drug candidates successfully may be adversely affected. |

12

Table of Contents

Corporate Information

Deciphera Pharmaceuticals, LLC was formed and commenced operations in 2003. Deciphera Pharmaceuticals, Inc. was incorporated under the laws of Delaware on August 1, 2017 for the sole purpose of completing an initial public offering and related transactions in order to carry on the business of Deciphera Pharmaceuticals, LLC. We are the sole managing member of Deciphera Pharmaceuticals, LLC and conduct all our business through, operate and control all of the businesses and affairs of Deciphera Pharmaceuticals, LLC, our wholly owned subsidiary, directly or through blocker entities that are also wholly owned by us.

On October 2, 2017, we completed the initial public offering of our common stock, or IPO. On October 2, 2017, immediately prior to the completion of the IPO, we engaged in a series of transactions whereby Deciphera Pharmaceuticals, LLC became a wholly owned subsidiary of Deciphera Pharmaceuticals, Inc., a Delaware corporation. As part of the transactions, shareholders of Deciphera Pharmaceuticals, LLC exchanged their shares of Deciphera Pharmaceuticals, LLC for shares of Deciphera Pharmaceuticals, Inc. on a one-for-5.65 basis. We refer to these transactions as the Conversion.

Our principal executive offices are located at 500 Totten Pond Road, Waltham, MA 02451, and our telephone number is (781) 209-6400. Our corporate website address is www.deciphera.com. Information contained on or accessible through our website is not a part of this prospectus, and the inclusion of our website address in this prospectus is an inactive textual reference only.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and we may remain an emerging growth company for up to five years from December 31, 2017. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions from certain disclosure and other requirements that are applicable to other public companies that are not emerging growth companies. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

13

Table of Contents

THE OFFERING

| Common stock we are offering |

3,750,000 shares |

| Common stock outstanding after giving effect to this offering |

36,344,128 shares |

| Underwriters’ option to purchase additional shares |

562,500 shares |

| Use of proceeds |

We estimate that our net proceeds from this offering will be approximately $134.3 million (or $154.6 million if the underwriters exercise their option to purchase additional shares in full), based upon an assumed public offering price of $38.31 per share, the last reported sale price of our common stock on The Nasdaq Global Select Market on June 4, 2018, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| We intend to use the net proceeds from this offering, together with our existing cash and cash equivalents, as follows: |

| • | approximately $75 million to fund clinical trials for DCC-2618, including the dose escalation and expansion stages of our current Phase 1 clinical trial, a pivotal clinical trial in fourth-line GIST and additional clinical trials, including a pivotal clinical trial in second-line GIST, as well as clinical research outsourcing and manufacturing of clinical trial material, and pre-commercialization manufacturing process development and validation; |

| • | approximately $5 million to fund clinical trials for DCC-3014, including the dose escalation stage of our Phase 1 clinical trial, as well as clinical research outsourcing and manufacturing of clinical trial material; |

| • | approximately $9 million to fund clinical trials for rebastinib, as well as clinical research outsourcing and manufacturing of clinical trial material; |

| • | approximately $10 million to fund new and ongoing research activities for future drug candidates using our proprietary kinase switch control inhibitor platform; and |

| • | the remainder for working capital purposes, including general operating expenses. |

| See “Use of Proceeds” for additional information. |

| Risk factors |

See “Risk Factors” beginning on page 18 and the other information included in, or incorporated by reference into, this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| Nasdaq Global Select Market symbol |

“DCPH” |

14

Table of Contents

The number of shares of our common stock to be outstanding after this offering is based on 32,594,128 shares of our common stock outstanding as of March 31, 2018, and excludes the following:

| • | 5,374,080 shares of common stock issuable upon the exercise of options outstanding as of March 31, 2018 under our 2015 Equity Incentive Plan and our 2017 Stock Option and Incentive Plan, at a weighted average exercise price of $8.55 per share; |

| • | 2,675,686 shares of our common stock available for future issuance under our 2017 Stock Option and Incentive Plan; and |

| • | 632,666 shares of our common stock reserved for issuance under our 2017 Employee Stock Purchase Plan. |

Except as otherwise indicated, all information in this prospectus assumes no exercise by the underwriters of their option to purchase a maximum of 562,500 additional shares of our common stock from us in this offering at the public offering price, less the underwriting discounts and commissions.

15

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

You should read the following summary consolidated financial data together with the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included in our Annual Report on Form 10-K for the year ended December 31, 2017 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2018, each of which is incorporated by reference in this prospectus. We have derived the consolidated statement of operations data for the years ended December 31, 2017, 2016 and 2015 from our audited consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2017, which is incorporated by reference in this prospectus. We have derived the consolidated statement of operations data for three months ended March 31, 2018 and 2017 and the consolidated balance sheet data as of March 31, 2018 from our unaudited interim consolidated financial statements included in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2018, which is incorporated by reference in this prospectus. The unaudited interim financial statements have been prepared on the same basis as the audited financial statements and reflect, in the opinion of management, all adjustments of a normal, recurring nature that are necessary for a fair statement of the financial information included in those unaudited interim financial statements. Our historical results are not necessarily indicative of the results that may be expected in the future, and interim results are not necessarily indicative of results to be expected for the full year or any other period.

| Year Ended December 31, | Three Months Ended March 31, | |||||||||||||||||||

| 2017 | 2016 | 2015 | 2018 | 2017 | ||||||||||||||||

| (in thousands, except share and per share data) | ||||||||||||||||||||

| Consolidated Statement of Operations Data: |

||||||||||||||||||||

| Revenue |

$ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating expenses: |

||||||||||||||||||||

| Research and development |

39,514 | 20,163 | 12,475 | 16,925 | 5,659 | |||||||||||||||

| General and administrative |

11,421 | 5,675 | 5,135 | 5,026 | 2,067 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

50,935 | 25,838 | 17,610 | 21,951 | 7,726 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss from operations |

(50,935 | ) | (25,838 | ) | (17,610 | ) | (21,951 | ) | (7,726 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Other income (expense): |

||||||||||||||||||||

| Interest expense |

(95 | ) | (106 | ) | (2,209 | ) | (22 | ) | (25 | ) | ||||||||||

| Interest and other income, net |

746 | 4 | 3 | 543 | 42 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total other income (expense), net |

651 | (102 | ) | (2,206 | ) | 521 | 17 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

$ | (50,284 | ) | $ | (25,940 | ) | $ | (19,816 | ) | $ | (21,430 | ) | $ | (7,709 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss per share—basic and diluted |

$ | (2.99 | ) | $ | (2.23 | ) | $ | (4.67 | ) | $ | (0.66 | ) | $ | (0.66 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average common shares outstanding—basic and diluted(1) |

16,792,179 | 11,626,287 | 4,245,698 | 32,594,074 | 11,626,287 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | We did not have any common shares outstanding during the years ended December 31, 2016 and 2015 or for the period from January 1, 2017 through the closing of our IPO on October 2, 2017. To determine the weighted average shares outstanding for purposes of calculating net loss per share during those periods, we used the weighted average number of Series A convertible preferred shares outstanding because such shares represented the most subordinated share class outstanding during those periods. Share amounts for periods prior to the IPO have been retrospectively adjusted to give effect to the exchange of Series A convertible |

16

Table of Contents

| preferred shares into shares of common stock upon the Conversion (see Note 10 to our audited consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2017 and Note 2 to our unaudited consolidated financial statements included in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2018, each of which is incorporated by reference in this prospectus, for further details on the calculation of basic and diluted net loss per share). |

| As of March 31, 2018 | ||||||||

| Actual | As Adjusted(2) | |||||||

| (in thousands) | ||||||||

| Consolidated Balance Sheet Data: |

||||||||

| Cash and cash equivalents |

$ | 179,873 | $ | 314,216 | ||||

| Working capital(1) |

164,819 | 299,162 | ||||||

| Total assets |

182,141 | 316,484 | ||||||

| Notes payable to related party, including current portion |

1,435 | 1,435 | ||||||

| Total stockholders’ equity |

164,590 | 298,933 | ||||||

| (1) | We define working capital as current assets less current liabilities. |

| (2) | The as adjusted data reflects the sale by us of 3,750,000 shares of our common stock in this offering at an assumed public offering price of $38.31 per share, the last reported sale price of our common stock on The Nasdaq Global Select Market on June 4, 2018, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

A $1.00 increase (decrease) in the assumed public offering price of $38.31 per share, the last reported sale price of our common stock on The Nasdaq Global Select Market on June 4, 2018, would increase (decrease) the as adjusted amount of each of cash and cash equivalents, working capital, total assets and total stockholders’ equity by $3.5 million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. An increase (decrease) of 1,000,000 shares in the number of shares offered by us, as set forth on the cover page of this prospectus, would increase (decrease) the as adjusted amount of each of cash and cash equivalents, working capital, total assets and total stockholders’ equity by $36.0 million, assuming no change in the assumed public offering price per share and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. The as adjusted information discussed above is illustrative only and will be adjusted based on the actual public offering price and other terms of this offering determined at pricing.

17

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below together with all of the other information contained in this prospectus, or incorporated by reference, including our financial statements and the related notes and the risks and uncertainties discussed under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2017 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2018, each of which is incorporated by reference herein in its entirety, before deciding to invest in our common stock. If any of these risks actually occur, our business, prospects, operating results and financial condition could suffer materially. In such event, the trading price of our common stock could decline and you might lose all or part of your investment.

Risks Related to this Offering

After this offering, our executive officers, directors and principal stockholders, if they choose to act together, will continue to have the ability to control or significantly influence all matters submitted to stockholders for approval.

Upon the closing of this offering, and disregarding any shares of common stock that they may purchase in the offering, our executive officers and directors, combined with our stockholders who owned more than 5% of our outstanding capital stock before this offering will, in the aggregate, beneficially own shares representing approximately 70.7% of our capital stock. As a result, if these stockholders were to choose to act together, they would be able to control all matters submitted to our stockholders for approval, as well as our management and affairs. For example, these persons, if they choose to act together, would control the election of directors and approval of any merger, consolidation or sale of all or substantially all of our assets. This concentration of ownership control may:

| • | delay, defer or prevent a change in control; |

| • | entrench our management and the board of directors; or |

| • | impede a merger, consolidation, takeover or other business combination involving us that other stockholders may desire. |

If you purchase shares of common stock in this offering, you will suffer immediate dilution of your investment.

The public offering price of our common stock will be substantially higher than the as adjusted net tangible book value per share of our common stock. Therefore, if you purchase shares of our common stock in this offering, you will pay a price per share that substantially exceeds our as adjusted net tangible book value per share after this offering. To the extent shares subsequently are issued under outstanding options, you will incur further dilution. Based on an assumed public offering price of $38.31 per share, the last reported sale price of our common stock on The Nasdaq Global Select Market on June 4, 2018, you will experience immediate dilution of $30.08 per share, representing the difference between our as adjusted net tangible book value per share after giving effect to this offering and the public offering price. See the “Dilution” section for a more detailed description of the dilution to new investors in this offering.

An active trading market for our common stock may not be sustained.

Our shares of common stock began trading on The Nasdaq Global Select Market on September 28, 2017. Given the limited trading history of our common stock, there is a risk that an active trading market for our shares will not be sustained, which could put downward pressure on the market price of our common stock and thereby affect the ability of our stockholders to sell their shares.

18

Table of Contents

Future sales of common stock by stockholders may have an adverse effect on the then prevailing market price of our common stock.

In the event a public market for our common stock is sustained in the future, sales of our common stock may be made by holders of our public float or by holders of restricted securities in compliance with the provisions of Rule 144 of the Securities Act of 1933, as amended, or the Securities Act. In general, under Rule 144, a non-affiliated person who has satisfied a six-month holding period in a company registered under the Securities Exchange Act of 1934, as amended, or the Exchange Act, as amended, may, sell their restricted common stock without volume limitation, so long as the issuer is current with all reports under the Exchange Act in order for there to be adequate common public information. Affiliated persons may also sell their common shares held for at least six months, but affiliated persons will be required to meet certain other requirements, including manner of sale, notice requirements and volume limitations. Non-affiliated persons who hold their common shares for at least one year will be able to sell their common stock without the need for there to be current public information in the hands of the public. Future sales of shares of our public float or by restricted common stock made in compliance with Rule 144 may have an adverse effect on the then prevailing market price, if any, of our common stock.

The market prices for our common stock may be adversely impacted by future events.

Our common stock is currently quoted on The Nasdaq Global Select Market under the symbol “DCPH.” Market prices for our common stock will be influenced by a number of factors, including:

| • | the issuance of new equity securities pursuant to this offering or a future offering, including issuances of preferred stock; |

| • | changes in interest rates; |

| • | significant dilution caused by the anti-dilutive clauses in our financial agreements; |

| • | competitive developments, including announcements by competitors of new products or services or significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments; |

| • | variations in quarterly operating results; |

| • | change in financial estimates by securities analysts; |

| • | the depth and liquidity of the market for our common stock; |

| • | investor perceptions of our company and the pharmaceutical and biotech industries generally; and |

| • | general economic and other national conditions. |

The price of our common stock may be volatile and fluctuate substantially, which could result in substantial losses for purchasers of our common stock in this offering.

If you purchase shares in this offering, you may not be able to resell those shares at or above the public offering price. The trading price of the shares has fluctuated, and is likely to continue to fluctuate substantially. The trading price of our securities depends on a number of factors, including those described or incorporated by reference in this “Risk Factors” section, many of which are beyond our control and may not be related to our operating performance.

Since our common stock began trading on The Nasdaq Global Select Market on September 28, 2017, our stock has traded at prices as low as $15.15 per share and as high as $38.43 per share through June 4, 2018. The stock market in general and the market for smaller biopharmaceutical companies in particular have experienced extreme volatility that has often been unrelated to the operating performance of particular companies. As a result

19

Table of Contents

of this volatility, you may not be able to sell your common stock at or above the public offering price. The market price for our common stock may be influenced by many factors, including:

| • | the degree of success of competitive products or technologies; |

| • | results of clinical trials and preclinical studies, of our drug candidates or those of our competitors; |

| • | regulatory or legal developments in the United States and other countries; |

| • | receipt of, or failure to obtain, regulatory approvals; |

| • | developments or disputes concerning patent applications, issued patents or other proprietary rights; |

| • | the recruitment or departure of key personnel; |

| • | the level of expenses related to any of our drug candidates or clinical development programs; |

| • | the results of our efforts to discover, develop, acquire or in-license additional technologies or drug candidates; |

| • | actual or anticipated changes in estimates as to financial results, development timelines or recommendations by securities analysts; |

| • | variations in our financial results or those of companies that are perceived to be similar to us; |

| • | rumors or announcements regarding transactions involving our company or drug candidates; |

| • | changes in the structure of healthcare payment systems; |

| • | market conditions in the pharmaceutical and biotechnology sectors; |

| • | general economic, industry and market conditions; and |

| • | the other factors described or incorporated by reference in this “Risk Factors” section. |

We have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

Our management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our common stock. The failure by our management to apply these funds effectively could result in financial losses that could have a material adverse effect on our business, cause the price of our common stock to decline and delay the development of our drug candidates. Pending their use, we may invest the net proceeds from this offering in a manner that does not produce income or that loses value.

A significant portion of our total outstanding shares are eligible to be sold into the market in the near future, which could cause the market price of our common stock to drop significantly, even if our business is doing well.

Sales of a substantial number of shares of our common stock in the public market, or the perception in the market that the holders of a large number of shares intend to sell shares, could reduce the market price of our common stock. After this offering, we will have 36,344,128 outstanding shares of common stock based on the number of shares outstanding as of March 31, 2018. Shares issued and sold in this offering may be resold in the public market immediately without restriction, unless purchased by our affiliates, officers, directors and certain stockholders subject to Rule 144 under the Securities Act or lock-up agreements. However, J.P. Morgan Securities LLC and Piper Jaffray & Co., as representatives of the underwriters, may, in their sole discretion, permit our officers, directors and stockholders who are subject to these lock-up agreements to sell shares prior to the expiration of the lock-up agreements. Any shares purchased by our existing stockholders through the underwriters in this offering would not be subject to these lock-up agreements. A significant portion of our shares outstanding prior to the completion of this offering will be subject to lock-up agreements as described in

20

Table of Contents

“Underwriting.” If, after the end of such lock-up agreements, these stockholders sell substantial amounts of our securities in the public market, or the market perceives that such sales may occur, the market price of our shares and our ability to raise capital through an issuance of equity securities in the future could be adversely affected. Moreover, holders of an aggregate of approximately 24.3 million shares of our common stock have rights, subject to specified conditions, to require us to file registration statements covering their shares or to include their shares in registration statements that we may file for ourselves or other stockholders.

21

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference contain forward-looking statements, which reflect our current views with respect to, among other things, our operations and financial performance. All statements other than statements of historical facts contained in this prospectus, including statements regarding this offering and the use of proceeds from this offering, our strategy, future operations, future financial position, future revenue, projected costs, prospects, plan, objectives of management and expected market growth are forward-looking statements. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. We believe these factors include but are not limited to those described under “Risk Factors” and include, among other things:

| • | this offering and our anticipated use of proceeds from this offering; |

| • | the success, cost and timing of our product development activities and clinical trials, including the timing of our planned second pivotal Phase 3 trial for DCC-2618 in GIST; |

| • | our ability to obtain and maintain regulatory approval for DCC-2618 or any of our other current or future drug candidates, and any related restrictions, limitations, and/or warnings in the label of an approved drug candidate; |

| • | our expectations regarding the size of target patient populations for our drug candidates, if approved for commercial use, and any additional drug candidates we may develop; |

| • | our ability to obtain funding for our operations; |

| • | our ability to manufacture sufficient quantities of DCC-2618 to support our planned clinical trials and, if approved, commercialization; |

| • | the commercialization of our drug candidates, if approved; |

| • | our plans to research, develop and commercialize our drug candidates, including the timing of our second planned Phase 3 trial for DCC-2618 in GIST; |

| • | our ability to attract collaborators with development, regulatory and commercialization expertise; |

| • | our expectations regarding our ability to obtain, maintain, enforce and defend our intellectual property protection for our drug candidates; |

| • | future agreements with third parties in connection with the commercialization of DCC-2618, or any of our other current or future drug candidates; |

| • | the size and growth potential of the markets for our drug candidates, and our ability to serve those markets; |

| • | the rate and degree of market acceptance of our drug candidates, as well as the reimbursement coverage for our drug candidates; |

| • | regulatory and legal developments in the United States and foreign countries; |

| • | the performance of our third-party suppliers and manufacturers; |

| • | the success of competing therapies that are or may become available; |

| • | our ability to attract and retain key scientific or management personnel; |

| • | the accuracy of our estimates regarding expenses, future revenues, capital requirements and needs for additional financing; |

22

Table of Contents

| • | our expectations regarding the period during which we qualify as an emerging growth company under the JOBS Act; and |

| • | our use of the proceeds from our IPO. |

These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this prospectus and the documents incorporated by reference. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

23

Table of Contents

MARKET, INDUSTRY AND OTHER DATA

This prospectus and the documents incorporated by reference include market, industry and other data and forecasts that we have derived from independent consultant reports, publicly available information, various industry publications, other published industry sources and our internal data and estimates. Independent consultant reports, industry publications and other published industry sources generally indicate that the information contained therein was obtained from sources believed to be reliable.

Our internal data and estimates are based upon information obtained from trade and business organizations and other contacts in the markets in which we operate and our management’s understanding of industry conditions. Although we believe that such information is reliable, we have not had this information verified by any independent sources.

24

Table of Contents

We estimate that the net proceeds to us from the sale of the shares of our common stock offered by us in this offering will be approximately $134.3 million, based on an assumed public offering price of $38.31 per share, the last reported sale price of our common stock on The Nasdaq Global Select Market on June 4, 2018, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. If the underwriters’ option to purchase 562,500 additional shares in this offering is exercised in full, we estimate that our net proceeds from this offering will be approximately $154.6 million, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

A $1.00 increase (decrease) in the assumed public offering price of $38.31 per share, the last reported sale price of the our common stock on The Nasdaq Global Select Market on June 4, 2018, would increase (decrease) the net proceeds to us from this offering by approximately $3.5 million, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, an increase (decrease) of 1,000,000 shares in the number of shares offered by us, as set forth on the cover page of this prospectus, would increase (decrease) the net proceeds to us from this offering by approximately $36.0 million, assuming no change in the assumed public offering price and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

As of March 31, 2018, we had cash and cash equivalents of $179.9 million. We intend to use the net proceeds from this offering, together with our existing cash and cash equivalents, as follows:

| • | approximately $75 million to fund clinical trials for DCC-2618, including the dose escalation and expansion stages of our current Phase 1 clinical trial, a pivotal clinical trial in fourth-line GIST and additional clinical trials, including a pivotal clinical trial in second-line GIST, as well as clinical research outsourcing and manufacturing of clinical trial material, and pre-commercialization manufacturing process development and validation; |

| • | approximately $5 million to fund clinical trials for DCC-3014, including the dose escalation stage of our Phase 1 clinical trial, as well as clinical research outsourcing and manufacturing of clinical trial material; |

| • | approximately $9 million to fund clinical trials for rebastinib, as well as clinical research outsourcing and manufacturing of clinical trial material; |

| • | approximately $10 million to fund new and ongoing research activities for future drug candidates using our proprietary kinase switch control inhibitor platform; and |

| • | the remainder for working capital purposes, including general operating expenses. |

Our expected use of net proceeds from this offering represents our current intentions based upon our present plans and business condition. As of the date of this prospectus, we cannot predict with certainty all of the particular uses for the net proceeds to be received upon the closing of this offering or the amounts that we will actually spend on the uses set forth above. The amounts and timing of our actual use of the net proceeds from this offering will vary depending on numerous factors, including the progress of our clinical trials and other development efforts for DCC-2618 and other factors described in “Risk Factors” beginning on page 18 or incorporated by reference herein, as well as the amount of cash we use in our operations. As a result, our management will have broad discretion in the application of the net proceeds, and investors will be relying on our judgment regarding the application of the net proceeds from this offering. In addition, we might decide to postpone or not pursue clinical trials or preclinical activities if the net proceeds from this offering and the other sources of cash are less than expected.

Pending application of the net proceeds, we intend to invest the net proceeds from this offering in short- and intermediate-term, interest-bearing obligations, investment-grade instruments, certificates of deposit or direct or guaranteed obligations of the U.S. government.

25

Table of Contents

MARKET PRICE OF OUR COMMON STOCK AND RELATED STOCKHOLDER MATTERS

Our common stock trades under the symbol “DCPH” on The Nasdaq Global Select Market and has been publicly traded since September 28, 2017. Prior to this time, there was no public market for our common stock. The following table sets forth the high and low sales price of our common stock as reported on The Nasdaq Global Select Market for the periods indicated:

| High | Low | |||||||

| Year Ended December 31, 2017 |

||||||||

| Third Quarter (from September 28, 2017) |

$ | 20.53 | $ | 16.11 | ||||

| Fourth Quarter |

$ | 24.50 | $ | 15.15 | ||||

| High | Low | |||||||

| Year Ending December 31, 2018 |

||||||||

| First Quarter |

$ | 29.98 | $ | 19.74 | ||||

| Second Quarter (through June 4, 2018) |

$ | 38.43 | $ | 19.19 | ||||

On June 4, 2018, the last reported sale price of our common stock on The Nasdaq Global Select Market was $38.31 per share.

As of June 4, 2018, there were approximately 16 holders of record of shares of our common stock. This number does not include stockholders for whom shares are held in “nominee” or “street” name.

26

Table of Contents

We currently intend to retain all available funds and any future earnings for use in the operation of our business and do not anticipate paying any dividends on our common stock in the foreseeable future. Any future determination to declare dividends will be made at the discretion of our board of directors and will depend on our financial condition, operating results, capital requirements, general business conditions and other factors that our board of directors may deem relevant.

27

Table of Contents

The following table sets forth our cash and cash equivalents and our capitalization as of March 31, 2018:

| • | on an actual basis; and |

| • | on an as adjusted basis to give effect to the sale by us of 3,750,000 shares of our common stock in this offering at an assumed public offering price of $38.31 per share, the last reported sale price of our common stock on The Nasdaq Global Select Market on June 4, 2018, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

The as adjusted information below is illustrative only, and our capitalization following the completion of this offering will be adjusted based on the actual public offering price and other terms of this offering determined at pricing. You should read this table together with the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included in our Annual Report on Form 10-K for the year ended December 31, 2017 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2018, each of which is incorporated by reference in this prospectus.

| As of March 31, 2018 | ||||||||

| Actual | As Adjusted | |||||||

| (in thousands, except share data) |

||||||||

| Cash and cash equivalents |

$ | 179,873 | $ | 314,216 | ||||

|

|

|

|

|

|||||

| Notes payable to related party, including current portion |

$ | 1,435 | $ | 1,435 | ||||

| Stockholders’ equity: |

||||||||

| Preferred stock, $0.01 par value; 5,000,000 shares authorized, actual and as adjusted; no shares issued or outstanding, actual and as adjusted |

— | — | ||||||

| Common stock, $0.01 par value; 125,000,000 shares authorized, actual and as adjusted; 32,594,128 shares issued and outstanding, actual; 36,344,128 shares issued and outstanding, as adjusted |

326 | 363 | ||||||

| Additional paid-in capital |

381,563 | 515,869 | ||||||

| Accumulated deficit |

(217,299 | ) | (217,299 | ) | ||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

164,590 | 298,933 | ||||||

|

|

|

|

|

|||||

| Total capitalization |

$ | 166,025 | $ | 300,368 | ||||

|

|

|

|

|

|||||

A $1.00 increase (decrease) in the assumed public offering price of $38.31 per share, the last reported sale price of our common stock on The Nasdaq Global Select Market on June 4, 2018, would increase (decrease) the as adjusted amount of each of cash and cash equivalents, total stockholders’ equity and total capitalization by $3.5 million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. An increase (decrease) of 1,000,000 shares in the number of shares offered by us, as set forth on the cover page of this prospectus, would increase (decrease) the as adjusted amount of each of cash and cash equivalents, total stockholders’ equity and total capitalization by $36.0 million, assuming no change in the assumed public offering price per share and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

The table above does not include:

| • | 5,374,080 shares of common stock issuable upon the exercise of options outstanding as of March 31, 2018 under our 2015 Equity Incentive Plan and our 2017 Stock Option and Incentive Plan, at a weighted average exercise price of $8.55 per share; |

| • | 2,675,686 shares of our common stock available for future issuance under our 2017 Stock Option and Incentive Plan; and |

| • | 632,666 shares of our common stock reserved for issuance under our 2017 Employee Stock Purchase Plan. |

28

Table of Contents

If you invest in our common stock in this offering, your ownership interest will be diluted immediately to the extent of the difference between the public offering price per share of our common stock and the as adjusted net tangible book value per share of our common stock immediately after this offering.

As of March 31, 2018, our historical net tangible book value was $164.6 million, or $5.05 per share of common stock. Our historical net tangible book value per share is equal to our total tangible assets, less total liabilities, divided by the number of outstanding shares of our common stock. After giving effect to the sale by us of 3,750,000 shares of our common stock in this offering at an assumed public offering price of $38.31 per share, the last reported sale price of our common stock on The Nasdaq Global Select Market on June 4, 2018, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, our as adjusted net tangible book value as of March 31, 2018 would have been approximately $298.9 million, or approximately $8.23 per share of common stock. This represents an immediate increase in as adjusted net tangible book value of $3.18 per share to our existing stockholders and immediate dilution of $30.08 per share to new investors purchasing common stock in this offering. Dilution per share to new investors is determined by subtracting the as adjusted net tangible book value per share after this offering from the assumed public offering price per share paid by new investors. The following table illustrates this dilution on a per share basis:

| Assumed public offering price per share |

$ | 38.31 | ||||||

| Historical net tangible book value per share as of March 31, 2018 |

$ | 5.05 | ||||||

| Increase in as adjusted net tangible book value per share attributable to new investors purchasing common stock in this offering |

3.18 | |||||||

|

|

|

|||||||

| As adjusted net tangible book value per share after this offering |

8.23 | |||||||

|

|

|

|||||||

| Dilution per share to new investors purchasing common stock in this offering |

$ | 30.08 | ||||||

|

|

|

A $1.00 increase (decrease) in the assumed public offering price of $38.31 per share, the last reported sale price of our common stock on The Nasdaq Global Select Market on June 4, 2018, would increase (decrease) our as adjusted net tangible book value per share after this offering by $0.10 and dilution per share to new investors purchasing common stock in this offering by $0.90, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. An increase of 1,000,000 shares in the number of shares offered by us, as set forth on the cover page of this prospectus, would increase our as adjusted net tangible book value per share after this offering by $0.74 and decrease the dilution per share to new investors purchasing common stock in this offering by $0.74, assuming no change in the assumed public offering price per share and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. A decrease of 1,000,000 shares in the number of shares offered by us, as set forth on the cover page of this prospectus, would decrease our as adjusted net tangible book value per share after this offering by $0.79 and increase the dilution per share to new investors purchasing common stock in this offering by $0.79, assuming no change in the assumed public offering price per share and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

If the underwriters fully exercise their option to purchase additional shares of common stock in this offering, our as adjusted net tangible book value per share after this offering would be $8.65 and the dilution in as adjusted net tangible book value per share to new investors purchasing common stock in this offering would be $29.66, assuming no change in the assumed public offering price per share and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

The following table summarizes, as of March 31, 2018, on the as adjusted basis described above, the total number of shares of common stock purchased from us, the total consideration paid or to be paid, and the average price per share paid or to be paid by existing stockholders and by new investors in this offering at an assumed

29

Table of Contents

public offering price of $38.31 per share, the last reported sale price of our common stock on The Nasdaq Global Select Market on June 4, 2018, before deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. As the table shows, new investors purchasing common stock in this offering will pay an average price per share substantially higher than our existing stockholders paid.

| Shares Purchased | Total Consideration | Average Price Per Share |

||||||||||||||||||

| Number | Percent | Amount | Percent | |||||||||||||||||

| Existing stockholders |

32,594,128 | 89.7 | % | $ | 385,817,684 | 72.9 | % | $ | 11.84 | |||||||||||

| New investors |

3,750,000 | 10.3 | 143,662,500 | 27.1 | $ | 38.31 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

36,344,128 | 100.0 | % | $ | 529,480,184 | 100.0 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||