Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Armour Residential REIT, Inc. | a8-kjune2018investorpresen.htm |

ARMOUR RESIDENTIAL REIT, Inc. Investor Presentation 06/06/2018 ARMOUR seeks to create shareholder value through thoughtful investment and risk management that produces current yield and superior risk adjusted returns over the long term. Our focus on residential real estate finance supports home ownership for a broad and diverse spectrum of Americans by bringing private capital into the mortgage markets.

PLEASE READ: Important Regulatory and Yield Estimate Risk Disclosures 2 • Certain statements made in this presentation regarding ARMOUR Residential REIT, Inc. (“ARMOUR” or the “Company”), and any other statements regarding ARMOUR’s future expectations, beliefs, goals or prospects constitute forward-looking statements made within the meaning of Section 21E of the Securities Exchange Act of 1934. Any statements that are not statements of historical fact (including statements containing the words “believes,” “plans,” “anticipates,” “expects,” “estimates” and similar expressions) should also be considered forward-looking statements. Forward- looking statements include but are not limited to statements regarding the projections for ARMOUR’s business and plans for future growth and operational improvements. A number of important factors could cause actual results or events to differ materially from those indicated by such forward-looking statements. ARMOUR assumes no obligation to update the information in this communication, except as otherwise required by law. Readers are cautioned not to place undue reliance on these forward- looking statements, which speak only as of the date hereof. • This material is for information purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation for any securities or financial instruments. The statements, information and estimates contained herein are based on information that the company believes to be reliable as of today's date unless otherwise indicated, but cannot be represented that such statements, information or estimates are complete or accurate. • Actual realized yields, durations and net durations described herein will depend on a number of factors that cannot be predicted with certainty. Estimated yields do not reflect any of the costs of operation of ARMOUR. • THE INFORMATION PRESENTED HEREIN IS UNAUDITED AND UNREVIEWED.

ARMOUR Overview 3 1 Capitalization • Total capitalization of $1,211.1 million composed of: ◦ Estimated book value of common stock of $997.4 million. ◦ Preferred stock par value of $213.7 million. 2 Common Stock Dividend Policy • ARMOUR pays common stock dividends monthly. • Dividends are typically announced on a monthly basis. • Since inception, ARR has paid out $1.4 billion in dividends through March 2018. (1) 3 Shareholder Alignment • $250 million in share repurchases between May 2013 and December 2015. • $123 million additional "return of capital" to shareholders between 2013 and 2015. • Senior management made open market purchases of $2.5 million of stock in 2016-18. 4 Transparency and Governance • Updated portfolio and liability details can be found at www.armourreit.com. • Agency premium amortization is expensed monthly as it occurs.(2) • Hedge positions are marked-to-market daily (GAAP/Tax differences). • Non-Executive Board Chairman and separate Lead Independent Director. 5 ARMOUR REIT Manager • ARMOUR REIT is externally managed by ARMOUR Capital Management LP. (1) Includes both common and preferred stock dividends. (2) Due to the prepayment lockout feature of our Agency multifamily securities, premium is amortized using a level yield methodology. Information as of 05/31/18

ARMOUR Balance Sheet Metrics 4 1 Equity Allocation • ARMOUR invests in mortgage-related assets and U.S. government securities. Allocation of equity in repo is: ◦ 57.1% in Agency securities. ◦ 42.1% in Credit Risk and Non-Agency securities. ◦ 0.7% in US Treasuries. 2 Duration • (0.06) net balance sheet duration. ◦ 3.68 gross asset duration. ◦ (3.74) hedge duration. 3 Hedging • $6.8 billion in interest rate swaps. ◦ 90.4% of Agency fixed rate and TBA assets hedged. ◦ 114.4% of Agency fixed rate asset repurchase agreements hedged. 4 Liquidity • $668.7 million in total liquidity. ◦ $273.4 million in cash. ◦ $395.3 million in unlevered securities. 5 Leverage • 5.5x estimated shareholder's equity.(1) ◦ $6.6 billion in net REPO borrowings. (1) Leverage does not include TBA dollar rolls or forward settling transactions. Information as of 05/31/18

ARMOUR Portfolio Strategy and Investment Methodology 5 1 Non-Agency Structure Analysis • Seniority, subordination model. • Model completeness and accuracy. • Litigation and policy risks. 2 Agency & Non-Agency Class Analysis • Prepayment history. • Prepayment expectations. • Premium/discount. • Liquidity. 3 Agency & Non-Agency Loan Analysis • Original and current loan balance. • Year of origination and originating company/third-party originators. • Loan seasoning. • Principal amortization schedule. • Original loan-to-value ratio. • Geography. 4 Agency Pool Analysis • Prepayment history and expectations. • Premium over par. • Hedgability and liquidity. • Diversify broadly to limit idiosyncratic pool risk.

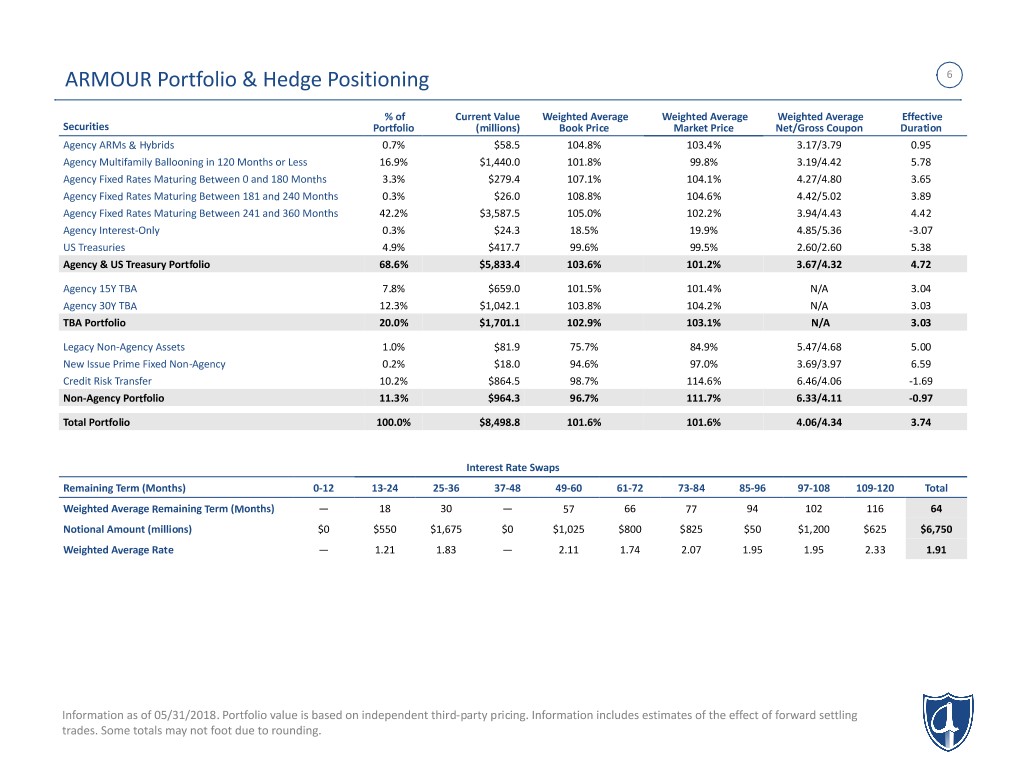

ARMOUR Portfolio & Hedge Positioning 6 % of Current Value Weighted Average Weighted Average Weighted Average Effective Securities Portfolio (millions) Book Price Market Price Net/Gross Coupon Duration Agency ARMs & Hybrids 0.7% $58.5 104.8% 103.4% 3.17/3.79 0.95 Agency Multifamily Ballooning in 120 Months or Less 16.9% $1,440.0 101.8% 99.8% 3.19/4.42 5.78 Agency Fixed Rates Maturing Between 0 and 180 Months 3.3% $279.4 107.1% 104.1% 4.27/4.80 3.65 Agency Fixed Rates Maturing Between 181 and 240 Months 0.3% $26.0 108.8% 104.6% 4.42/5.02 3.89 Agency Fixed Rates Maturing Between 241 and 360 Months 42.2% $3,587.5 105.0% 102.2% 3.94/4.43 4.42 Agency Interest-Only 0.3% $24.3 18.5% 19.9% 4.85/5.36 -3.07 US Treasuries 4.9% $417.7 99.6% 99.5% 2.60/2.60 5.38 Agency & US Treasury Portfolio 68.6% $5,833.4 103.6% 101.2% 3.67/4.32 4.72 Agency 15Y TBA 7.8% $659.0 101.5% 101.4% N/A 3.04 Agency 30Y TBA 12.3% $1,042.1 103.8% 104.2% N/A 3.03 TBA Portfolio 20.0% $1,701.1 102.9% 103.1% N/A 3.03 Legacy Non-Agency Assets 1.0% $81.9 75.7% 84.9% 5.47/4.68 5.00 New Issue Prime Fixed Non-Agency 0.2% $18.0 94.6% 97.0% 3.69/3.97 6.59 Credit Risk Transfer 10.2% $864.5 98.7% 114.6% 6.46/4.06 -1.69 Non-Agency Portfolio 11.3% $964.3 96.7% 111.7% 6.33/4.11 -0.97 Total Portfolio 100.0% $8,498.8 101.6% 101.6% 4.06/4.34 3.74 Interest Rate Swaps Remaining Term (Months) 0-12 13-24 25-36 37-48 49-60 61-72 73-84 85-96 97-108 109-120 Total Weighted Average Remaining Term (Months) — 18 30 — 57 66 77 94 102 116 64 Notional Amount (millions) $0 $550 $1,675 $0 $1,025 $800 $825 $50 $1,200 $625 $6,750 Weighted Average Rate — 1.21 1.83 — 2.11 1.74 2.07 1.95 1.95 2.33 1.91 Information as of 05/31/2018. Portfolio value is based on independent third-party pricing. Information includes estimates of the effect of forward settling trades. Some totals may not foot due to rounding.

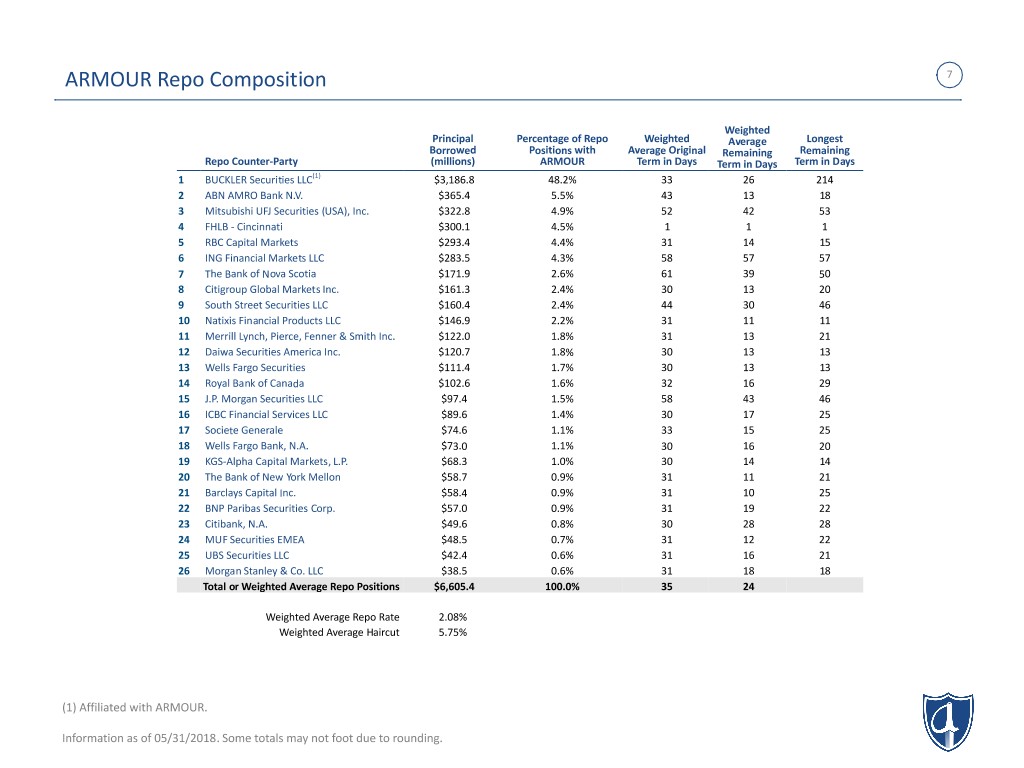

ARMOUR Repo Composition 7 Weighted Principal Percentage of Repo Weighted Average Longest Borrowed Positions with Average Original Remaining Remaining Repo Counter-Party (millions) ARMOUR Term in Days Term in Days Term in Days 1 BUCKLER Securities LLC(1) $3,186.8 48.2% 33 26 214 2 ABN AMRO Bank N.V. $365.4 5.5% 43 13 18 3 Mitsubishi UFJ Securities (USA), Inc. $322.8 4.9% 52 42 53 4 FHLB - Cincinnati $300.1 4.5% 1 1 1 5 RBC Capital Markets $293.4 4.4% 31 14 15 6 ING Financial Markets LLC $283.5 4.3% 58 57 57 7 The Bank of Nova Scotia $171.9 2.6% 61 39 50 8 Citigroup Global Markets Inc. $161.3 2.4% 30 13 20 9 South Street Securities LLC $160.4 2.4% 44 30 46 10 Natixis Financial Products LLC $146.9 2.2% 31 11 11 11 Merrill Lynch, Pierce, Fenner & Smith Inc. $122.0 1.8% 31 13 21 12 Daiwa Securities America Inc. $120.7 1.8% 30 13 13 13 Wells Fargo Securities $111.4 1.7% 30 13 13 14 Royal Bank of Canada $102.6 1.6% 32 16 29 15 J.P. Morgan Securities LLC $97.4 1.5% 58 43 46 16 ICBC Financial Services LLC $89.6 1.4% 30 17 25 17 Societe Generale $74.6 1.1% 33 15 25 18 Wells Fargo Bank, N.A. $73.0 1.1% 30 16 20 19 KGS-Alpha Capital Markets, L.P. $68.3 1.0% 30 14 14 20 The Bank of New York Mellon $58.7 0.9% 31 11 21 21 Barclays Capital Inc. $58.4 0.9% 31 10 25 22 BNP Paribas Securities Corp. $57.0 0.9% 31 19 22 23 Citibank, N.A. $49.6 0.8% 30 28 28 24 MUF Securities EMEA $48.5 0.7% 31 12 22 25 UBS Securities LLC $42.4 0.6% 31 16 21 26 Morgan Stanley & Co. LLC $38.5 0.6% 31 18 18 Total or Weighted Average Repo Positions $6,605.4 100.0% 35 24 Weighted Average Repo Rate 2.08% Weighted Average Haircut 5.75% (1) Affiliated with ARMOUR. Information as of 05/31/2018. Some totals may not foot due to rounding.

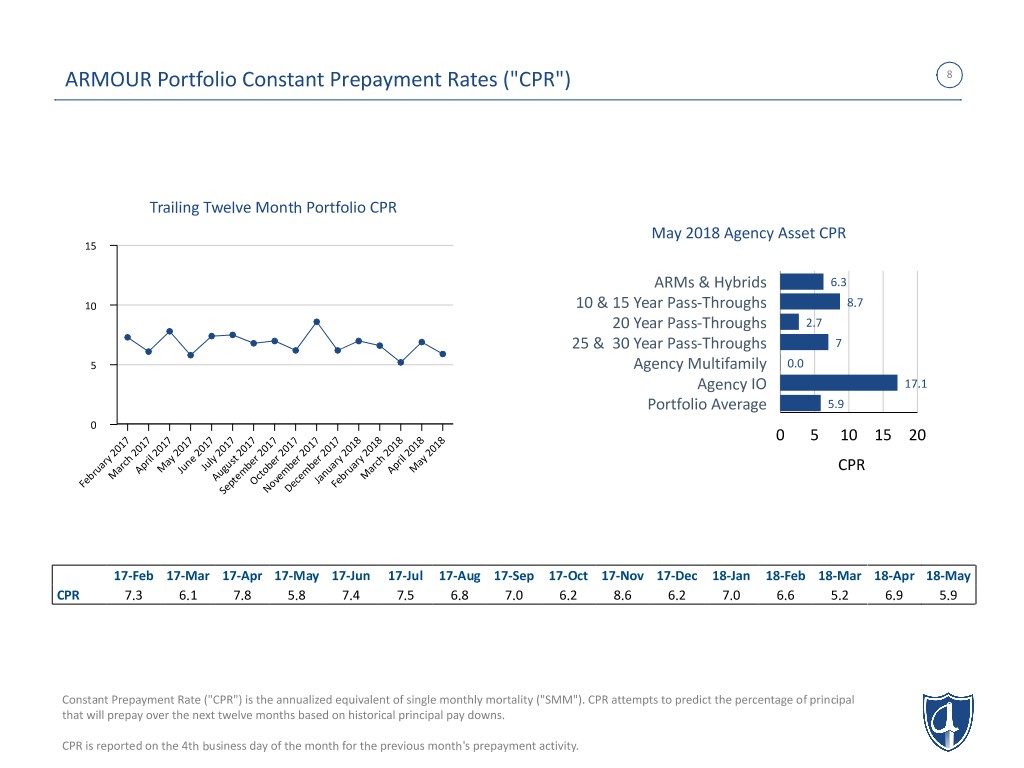

ARMOUR Portfolio Constant Prepayment Rates ("CPR") 8 Trailing Twelve Month Portfolio CPR May 2018 Agency Asset CPR 15 ARMs & Hybrids 6.3 10 10 & 15 Year Pass-Throughs 8.7 20 Year Pass-Throughs 2.7 25 & 30 Year Pass-Throughs 7 5 Agency Multifamily 0.0 Agency IO 17.1 Portfolio Average 5.9 0 7 7 7 7 7 7 7 7 7 7 7 8 8 8 8 8 0 5 10 15 20 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 y h il y e ly st r r r r y y h il y ar rc r a n u u e e e e ar ar rc r a u a p M u J g b b b b u u a p M CPR r A J u m to m m n r A b M A te c ve ce a b M Fe p O o e J Fe Se N D 17-Feb 17-Mar 17-Apr 17-May 17-Jun 17-Jul 17-Aug 17-Sep 17-Oct 17-Nov 17-Dec 18-Jan 18-Feb 18-Mar 18-Apr 18-May CPR 7.3 6.1 7.8 5.8 7.4 7.5 6.8 7.0 6.2 8.6 6.2 7.0 6.6 5.2 6.9 5.9 Constant Prepayment Rate ("CPR") is the annualized equivalent of single monthly mortality ("SMM"). CPR attempts to predict the percentage of principal that will prepay over the next twelve months based on historical principal pay downs. CPR is reported on the 4th business day of the month for the previous month's prepayment activity.

ARMOUR Residential REIT, Inc. 3001 Ocean Drive Suite 201 Vero Beach, FL 32963 armourreit.com 772-617-4340