Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AMERICOLD REALTY TRUST | form8-k_60618.htm |

DRAFT REITweek Investor Presentation June 2018 – New York, NY

Disclaimer This presentation contains statements about future events and expectations that constitute forward-looking statements. Forward-looking statements are based on our beliefs, assumptions and expectations of our future financial and operating performance and growth plans, taking into account the information currently available to us. These statements are not statements of historical fact. Forward-looking statements involve risks and uncertainties that may cause our actual results to differ materially from the expectations of future results we express or imply in any forward-looking statements, and you should not place undue reliance on such statements. Factors that could contribute to these differences include adverse economic or real estate developments in our geographic markets or the temperature-controlled warehouse industry; general economic conditions; risks associated with the ownership of real estate and temperature- controlled warehouses in particular; defaults or non-renewals of contracts with customers; potential bankruptcy or insolvency of our customers; uncertainty of revenues, given the nature of our customer contracts; increased interest rates and operating costs; our failure to obtain necessary outside financing; risks related to, or restrictions contained in, our debt financing; decreased storage rates or increased vacancy rates; difficulties in identifying properties to be acquired and completing acquisitions; risks related to expansions of existing properties and developments of new properties, including failure to meet budgeted or stabilized returns in respect thereof; acquisition risks, including the failure of such acquisitions to perform in accordance with projections; difficulties in expanding our operations into new markets, including international markets; our failure to maintain our status as a REIT; uncertainties and risks related to natural disasters and global climate change; possible environmental liabilities, including costs, fines or penalties that may be incurred due to necessary remediation of contamination of properties presently or previously owned by us; financial market fluctuations; actions by our competitors and their increasing ability to compete with us; labor and power costs; changes in real estate and zoning laws and increases in real property tax rates; the competitive environment in which we operate; our relationship with our employees, including the occurrence of any work stoppages or any disputes under our collective bargaining agreements; liabilities as a result of our participation in multi-employer pension plans; the cost and time requirements as a result of our operation as a publicly traded REIT; the concentration of ownership by funds affiliated with The Yucaipa Companies, The Goldman Sachs Group, Inc., and Fortress Investment Group, LLC; changes in foreign currency exchange rates; and the impact of anti-takeover provisions in our constituent documents and under Maryland law, which could make an acquisition of us more difficult, limit attempts by our shareholders to replace our trustees and affect the price of our common shares. Words such as “anticipates,” “believes,” “continues,” “estimates,” “expects,” “goal,” “objectives,” “intends,” “may,” “opportunity,” “plans,” “potential,” “near- term,” “long-term,” “projections,” “assumptions,” “projects,” “guidance,” “forecasts,” “outlook,” “target,” “trends,” “should,” “could,” “would,” “will” and similar expressions are intended to identify such forward-looking statements. Examples of forward-looking statements included in this presentation include, among others, statements about our expected expansion and development pipeline and our targeted return on invested capital on expansion and development opportunities. We qualify any forward-looking statements entirely by these cautionary factors. Other risks, uncertainties and factors, including those discussed under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2017 and our other reports filed with the Securities and Exchange Commission, could cause our actual results to differ materially from those projected in any forward-looking statements we make. We assume no obligation to update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future. 2

Key Investment Highlights 1 Important First Mover Advantage as the Only Publicly Traded REIT Focused on Temperature-Controlled Warehouses 2 Global Market Leader with Integrated Network of Strategically-Located, High-Quality, “Mission-Critical” Warehouses 3 Infrastructure Supported by Best-in-Class IT and Operating Platforms Provides a Significant Competitive Advantage 4 Strong and Stable Food Industry Fundamentals Drive Growing Demand 5 Substantial Internal and External Growth Opportunities Expected to Drive Attractive Risk-Adjusted Returns 6 Strong, Flexible Balance Sheet Positioned for Growth 7 Experienced Management Team, Alignment of Interest and Best-In-Class Corporate Governance 3

Company Snapshot Largest global and U.S. REIT focused on the ownership, operation, development and acquisition of temperature-controlled warehouses Portfolio Overview Financial Overview ($ in millions) Warehouses 158 2016A 2017A LTM 3/31/18 120 Owned (1), Revenue $1,490 $1,544 $1,562 Ownership Type 26 capital / operating leased, 12 managed Segment Contribution / $346 $374 $383 NOI Total Capacity 934mm cubic feet / 40mm square feet Core EBITDA $261 $287 $291 Average Facility Size 5.9mm cubic feet / 253K square feet LTM 3/31/18 Segment Breakdown (3) U.S., Australia, New Zealand, Argentina and Countries of Operation Canada Revenue Contribution / NOI (4) Estimate of Warehouse 23% (2) Warehouse U.S. Market Share 93% 74% Number of Customers Approx. 2,400 16% Third-Party Managed Number of Pallet 10% 4% 3.2mm 3% Third-Party Positions Transportation Managed Transportation Note: Figures as of March 31, 2018, unless otherwise indicated (1) Includes seven ground leased assets (2) Data as of May 2018. As of January 2018, USDA has changed the definition surrounding the capacity of domestic refrigerated warehouses. Warehouses must meet additional criteria to be included in the publication. (3) Figures exclude quarry business segment (4) Segment contribution refers to a segment’s revenues less segment specific operating expenses (excludes any depreciation, depletion and amortization, impairment charges and corporate level SG&A) Contribution for our warehouse segment equates to net operating income (“NOI”) 4

Temperature-Controlled Warehouses: An Attractive Asset Class Uniquely designed to maintain the temperature of frozen and refrigerated products in the cold chain and represent a growing, attractive niche of the industrial warehouse real estate sector Automated Storage Engine Room with & Retrieval System Refrigeration Compressors Pallet Racking System Battery Charging Rooms Office Areas Insulated Walls Rail Dock Specialized Dock Aprons High-Speed Doors Insulated and Heated Floors 5

Temperature-Controlled vs Dry Industrial Warehouses Temperature-controlled warehouses are mission-critical real estate that serve as a specialized, integral component of the temperature-controlled supply chain infrastructure Refrigeration Customized Racking Commoditized Non-Specialized VS (1) Characteristic Temperature-Controlled Dry Industrial Commentary (2) The temperature-controlled industry uses cubic feet Average Size ~5.9mm cu ft Clear Heights ~200K+ sf as space is leased by pallet positions; floor to ceiling volume is (~253K+ sf) more relevant for storage capacity New Temperature-controlled infrastructure is typically reusable for $130-$180+ psfClar(2) Heights$75-$100+ psf future customers (racking, refrigeration, insulation Construction Costs and specialized slabs) Supply Cold storage has higher barriers to entry given construction costs, High Clear Heights Low location requirements and operational expertise; and is more Constraints disciplined and usually driven by customer and market demand Cold storage facilities feature temperature flexibility that is Temperature -20° – AmbientClear Heights Ambient dependent on customer needs Optimal Optimal physical occupancy across temperature-controlled (2) Clear Heights Occupancy ~85% ~95% warehouse portfolio is ~85%; varies depending on facility purpose Average Average customer relationship w/ top 25 warehouse customers ~5 years (2)(3)Clear Heights 5-7 years is 33 years – high customer retention with increased customer Lease Terms stability and utilization; build-to-suits 10-20 years Key logistics and Network located in key logistics and production corridors, in close food production corridors, Primary, Secondary Location Clear Heights proximity to customer requirements and commodity flows adjacent to customer facilities (1) Green Street Advisors Research, Cushman & Wakefield Outlook Report and public company filings (2) Figures represent Americold specific metrics (3) Represents weighted average of initial lease term for contracts featuring fixed storage commitments and leases as of March 31, 2018 6

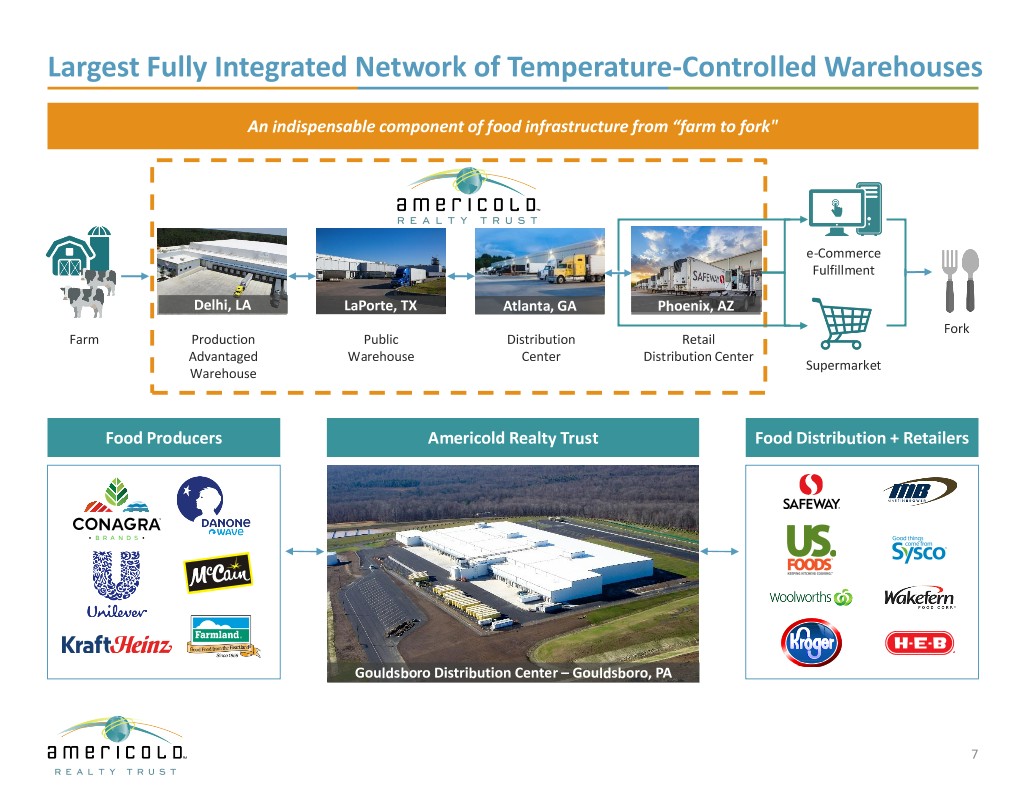

Largest Fully Integrated Network of Temperature-Controlled Warehouses An indispensable component of food infrastructure from “farm to fork" e-Commerce Fulfillment Delhi, LA LaPorte, TX Atlanta, GA Phoenix, AZ Fork Farm Production Public Distribution Retail Advantaged Warehouse Center Distribution Center Supermarket Warehouse Food Producers Americold Realty Trust Food Distribution + Retailers Gouldsboro Distribution Center – Gouldsboro, PA 7

Integrated Operations Overview Real estate value is driven by the critical nature of the Company’s infrastructure, strategic locations and integrated, full-service strategy Overview Select Customers % of Contribution (1) . Mission-critical, temperature-controlled real estate infrastructure generates rent and storage income Warehouse . Comprehensive value-add services NOI . Strategic locations, network breadth, scale, reliable temperature integrity and best-in-class customer IT interface distinguish COLD’s warehouses from competitors 93% Warehouse Third-Party Managed (Storage and Handling) (Storage Transportation Tradewater Distribution Facility – Atlanta, Georgia Warehouse . Management of customer-owned warehouses . Party Warehouse management services provided at customer- - owned facilities 4% Third-Party Managed . Third Operating costs passed through to customers Managed . Asset-light consolidation, management and brokerage services . Complements warehouse segment . Enhances customer retention and drives warehouse storage 3% and occupancy . Supplementary offering that improves supply chain efficiency Transportation and reduces cost by leveraging Americold’s scale Transportation (1) LTM figures as of March 31, 2018 and excludes the quarry business segment 8

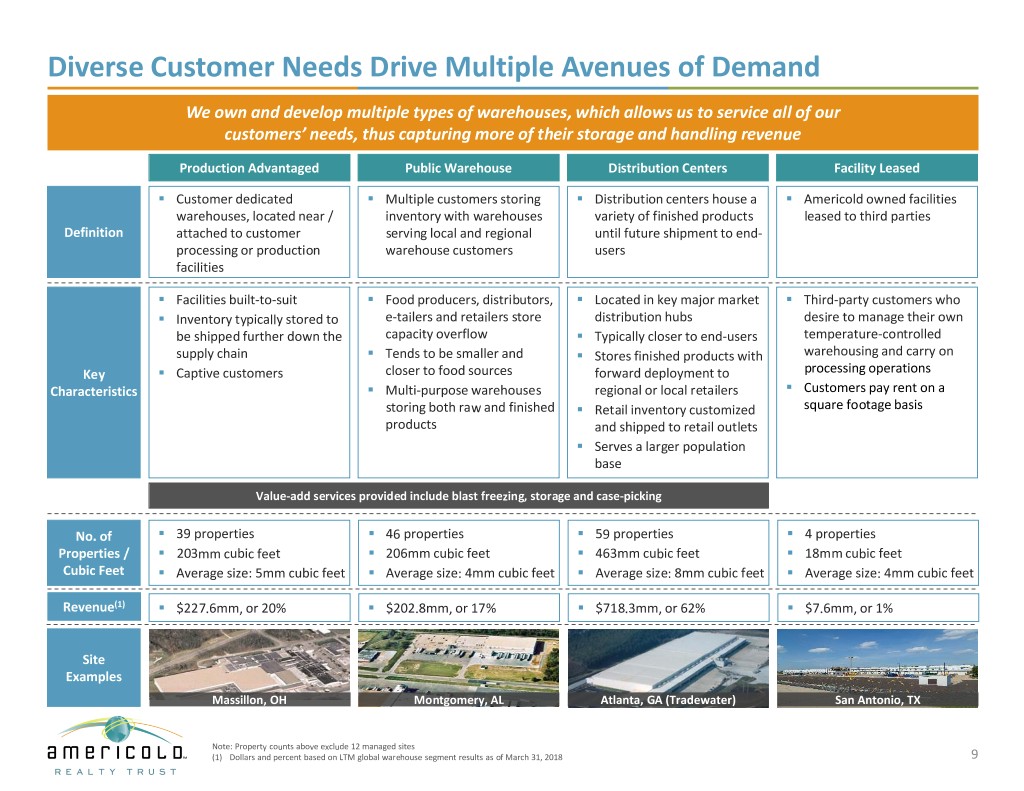

Diverse Customer Needs Drive Multiple Avenues of Demand We own and develop multiple types of warehouses, which allows us to service all of our customers’ needs, thus capturing more of their storage and handling revenue Production Advantaged Public Warehouse Distribution Centers Facility Leased . Customer dedicated . Multiple customers storing . Distribution centers house a . Americold owned facilities warehouses, located near / inventory with warehouses variety of finished products leased to third parties Definition attached to customer serving local and regional until future shipment to end- processing or production warehouse customers users facilities . Facilities built-to-suit . Food producers, distributors, . Located in key major market . Third-party customers who . Inventory typically stored to e-tailers and retailers store distribution hubs desire to manage their own be shipped further down the capacity overflow . Typically closer to end-users temperature-controlled . supply chain Tends to be smaller and . Stores finished products with warehousing and carry on . Key Captive customers closer to food sources forward deployment to processing operations . . Characteristics Multi-purpose warehouses regional or local retailers Customers pay rent on a storing both raw and finished . Retail inventory customized square footage basis products and shipped to retail outlets . Serves a larger population base Value-add services provided include blast freezing, storage and case-picking . . . . No. of 39 properties 46 properties 59 properties 4 properties Properties / . 203mm cubic feet . 206mm cubic feet . 463mm cubic feet . 18mm cubic feet Cubic Feet . Average size: 5mm cubic feet . Average size: 4mm cubic feet . Average size: 8mm cubic feet . Average size: 4mm cubic feet Revenue(1) . $227.6mm, or 20% . $202.8mm, or 17% . $718.3mm, or 62% . $7.6mm, or 1% Site Examples Massillon, OH Montgomery, AL Atlanta, GA (Tradewater) San Antonio, TX Note: Property counts above exclude 12 managed sites (1) Dollars and percent based on LTM global warehouse segment results as of March 31, 2018 9

AKAK Strategically Located, “Mission-Critical” Temperature-Controlled Warehouses Strategic locations and extensive geographic presence provide an integrated warehouse network that is fundamental to customers’ ability to optimize their distribution networks BCBC ABAB SKSK MBMB PEPE WAWA NBNB ONON NSNS QCQC NSNS MEME MTMT NDND MNMN OROR VTVT IDIDID WIWI NHNH NYNY MAMA SDSD NYNY MIMI WYWY RIRI CTCT PAPA NJNJ NENE IAIAIA NJNJ NENE INININ NVNV INININ OHOH DEDE UTUT ILILIL MDMD COCO WVWV VAVA CACA KSKS VAVA DCDC KSKS MOMO KYKY 962500_1.WOR962500_1.WOR962500_1.WOR (NY008MZK)(NY008MZK)(NY008MZK) NCNC TNTN AZAZ TNTN OKOK ARAR NMNM SCSC GAGA MSMS MSMS ALAL TXTX TXTX LALALA FLFL Distribution Public Production Advantaged NY008MZK / 957094_1 962500_1.WOR962500_1.WOR962500_1.WOR (NY008MZK)(NY008MZK)(NY008MZK) NY008MZK / 957094_1 Facility Leased Third-Party Managed Canada United States Argentina Australia (1) New Zealand # facilities 3 # facilities 140 # facilities 2 # facilities 6 # facilities 7 Square feet (000s) 471 Square feet (000s) 37,042 Square feet (000s) 232 Square feet (000s) 1,644 Square feet (000s) 604 Cubic feet (mm) 14.3 Cubic feet (mm) 839.5 Cubic feet (mm) 9.7 Cubic feet (mm) 47.6 Cubic feet (mm) 22.8 Note: Americold portfolio figures as of March 31, 2018 (1) Figures include ambient facility, except for cubic feet metric 10

U.S. Portfolio Located in Key Logistics Corridors Strategically located, “mission-critical” temperature-controlled warehouses serve the country’s population centers within a one day drive Map Key Population per Square Mile 250 or more 50–249.9 10–49.9 Less than 10 Facilities Key logistics corridor 500 mile radius Corridor Region Covered Mid-Atlantic, Tri-State Lehigh Valley and New England Great Lakes and Chicago Midwest Atlanta Southeast Texas, Oklahoma, Dallas Louisiana and Arkansas California, Arizona and So. California Nevada Seattle/Tacoma Pacific Northwest Utah, Colorado and Salt Lake City Mountain West Source: U.S. Census Bureau 2015 11

Global Portfolio to Support an International Customer Base Australia People per sq km 101 or more Brisbane 10.1–100 1.1–10.0 0.1–1 Sydney Less than 0.1 Facilities Key logistics corridor Melbourne Perth Adelaide Source: Australian Bureau of Statistics June 2015 New Zealand Argentina People per sq km Density Auckland 109–257 (Pop. per km2) 59–108.9 22–58.9 20.1–100.0 Buenos 16–21.9 10.1–20.0 Palmerston North Aires 12–15.9 4.1–10.0 Pilar 10–11.9 0.0–4.0 5–9.9 Facilities 3–4.9 Key logistics Less than 2.9 corridor Facilities Key logistics corridors 500 Kilometer radius Christchurch Source: INDEC. National Census of Population and Source: Statistics New Zealand Census 2015 Housing 2015 (IGN) National Geographic Institute 12

Global Market Leader in Temperature-Controlled Warehousing Position as the U.S. and global market leader allows for realization of economies of scale, reduced operating costs and lower overall cost of capital. Ideally positioned to compete for customers and external growth opportunities U.S. Market Leader (1) Global Market Leader (2) Market Cubic Ft Market Cubic Ft Rank Share(3) (mm) Rank Share (mm) #1 23.3% 839 #1 4.4% 934 Lineage Logistics #2 18.7% 672 Lineage Logistics #2 3.6% 767 Preferred Freezer Services #3 8.4% 304 Swire Cold Storage #3 1.7% 358 US Cold Storage, Inc. #4 7.8% 280 Preferred Freezer Services #4 1.7% 352 AGRO Merchants Group #5 3.2% 115 AGRO Merchants Group #5 1.2% 263 Interstate Warehousing, Inc. #6 2.8% 100 Nichirei Logistics Group, Inc. #6 0.8% 174 Cloverleaf Cold Storage Co. #7 2.3% 84 Kloosbeheer B.V. #7 0.8% 165 NewCold Advanced Cold Henningsen Cold Storage Co. #8 1.8% 65 #8 0.7% 140 Logistics Burris Logistics #9 1.6% 58 VersaCold Logistics Services #9 0.6% 133 Hanson Logistics #10 1.2% 44 Interstate Warehousing, Inc. #10 0.5% 100 Note: Americold portfolio figures provided by the Company as of March 31, 2018 (1) IARW Top Companies in USA and North America, May 2018 and USDA National Agricultural Statistics Service, “Refrigerated Space: By Type of Warehouse” chart (2) GCCA and IARW Top Companies in USA and North America, May 2018 (3) As of January 2018, USDA has changed the definition surrounding the capacity of domestic refrigerated warehouses. Warehouses must meet additional criteria to be included in the publication. 13

Industry-Leading, Integrated IT & Operating Platforms Proprietary IT system has revolutionized how COLD interfaces with customers, makes business decisions and manages warehouses Integrated IT Platform Americold Operating System Customer-Facing IT Systems – Proprietary system provides customers with ability to manage their inventory worldwide via a single online portal – Ability for customers to integrate systems into their own systems for seamless data transfer SC Decision Making Tool Innovation – Ability to harvest proprietary “Big Data” in order to identify business trends and leasing opportunities en-View Enabled – Ability to review actual results vs. contracted terms Warehouse Management 5-Habits LEAN-Based Labor Continuous – Organize reporting of key metrics Optimization Improvement – Review of standardized Key Performance Indicators Risk Management Leader/Associate Best-in-Class Platform Based Safety Development Cycle – Invested ~$62mm over the last six years and three months SQF Based Energy ended March 31, 2018 to develop an industry-leading IT Product Quality Maintenance Excellence Excellence Refrigeration platform Loss Prevention Excellence – Centralized IT customer interface integrated across a broad network is unique to the sector – Proprietary platform is a key competitive differentiator AMERICOLD OPERATING SYSTEM / 14

Highly Diversified Business Model Produces Stable Cash Flows Diversification helps reduce revenue volatility associated with seasonality and changing commodity trends Commodity (1) Global Geographic Diversity (1) Global Warehouse U.S. Warehouse United States Central Dairy Fruits & Argentina Southeast Vegetables 25% Poultry New Zealand 1% 3% 9% LTM 3/31/18 LTM 3/31/18 WAREHOUSE 83% TOTAL U.S. 22% 7% Other 14% WAREHOUSE REVENUE 26% 10% Australia East REVENUE 7% $1,156mm $939mm Potatoes Bakery 4% 27% 11% LTM 3/31/18 WAREHOUSE 4% Pork West REVENUE 3% Beef $1,156mm 2% Warehouse Type (1) 2% Seafood 16% Distributors ⁽⁴⁾ Distribution Packaged Production Foods ⁽³⁾ 25% Advantaged 20% LTM 3/31/18 Retail ⁽²⁾ 62% WAREHOUSE REVENUE $1,156mm 17% Public 1% Warehouse Facility Leased Note: Figures may not sum due to rounding (1) Diversification based on warehouse segment revenues for the twelve months ended March 31, 2018 (2) Retail reflects a broad variety of product types from retail customers (3) Packaged food reflects a broad variety of temperature-controlled meals and foodstuffs (4) Distributors reflects a broad variety of product types from distribution customers 15

Long Standing Relationships with Top 25 Customers Scope and scale of network coupled with long-standing relationships position the Company to grow market share organically and through acquisitions Food Producers / CPG Companies Top 25 Customers Have been with Americold for an average of 33 years 100% utilize multiple facilities 100% utilize technology integration 88% utilize value-add services 72% utilize committed contracts or leases Retailers / Distributors 68% are investment grade or equivalent 60% are in fully dedicated sites 44% utilize transportation and consolidation services 25 largest customers account for approximately 62% (1) of warehouse revenues, with no one customer generating more than 8.9% (1) of revenues (1) Based on warehouse revenues for the last twelve months ended March 31, 2018 (2) Represents long-term issuer ratings as of October 31, 2017 16

Economic Occupancy Driving Improved Returns Implementation of standard underwriting procedures has contributed to consistent occupancy growth over the last three years Physical Occupancy Average Physical Occupancy . Optimal physical occupancy across temperature-controlled 1Q 2Q 3Q 4Q Annual warehouse portfolio is ~85%, but can vary based on several 81%81% 82% factors, including 78% 77% 78%78% 76% 77% 76% 75% 76% 75% 75% 72% 74% – Intended customer base 71% – Throughput maximization – Seasonality – Leased but unoccupied pallets '15 '16 '17 '18 '15 '16 '17 '15 '16 '17 '15 '16 '17 '15 '16 '17 LTM 3/31/18 Illustrative Economic Occupancy (1) Warehouse Pallets 10,000 Physical Occupancy Economic Occupancy 9,000 X X X X 8,800 9,000 8,500 8,500 7,850 X X 8,000 7,600 8,300 8,300 7,350 7,000 7,000 7,100 6,800 X X 7,000 Illustrative Economic Occupancy: 85% X X X X 6,000 vs. Illustrative Physical Occupancy: 78% X Currently Occupied 5,000 Contractually Reserved Pallets (1) Example assumes 10,000 pallet positions and is for illustrative purposes only; we do not yet calculate economic occupancy 17

Growing Committed Revenue in Warehouse Portfolio Significant improvement transitioning from as-utilized, on demand contracts to fixed storage committed contracts and leases Rent & Storage Warehouse Revenue . Fixed storage committed contracts and leases currently represent: Annualized Committed Rent & Storage Revenue ⁽¹⁾ – 39% of warehouse rent and storage revenues (1) and $198mm LTM 3/31/18 39% WAREHOUSE – 43% of total warehouse segment revenues (2) RENT & STORAGE REVENUE 61% $508mm . 5-year weighted average stated term (3) $310mm . 3-year weighted average remaining term (3) Other Rent & Storage Revenue Total Warehouse Segment Revenue . As of March 31, 2018, COLD had entered into at least one fixed commitment contract or lease with 18 of top 25 Warehouse Segment warehouse customers Revenue Generated by Fixed Commitment Contracts or Leases ⁽²⁾ . The scope and breadth of network positions COLD to $494mm LTM 3/31/18 43% continue to increase fixed storage commitments WAREHOUSE REVENUE 57% $1,156mm $662mm Other Warehouse Segment Revenue (1) Based on the annualized committed rent and storage revenues attributable to fixed storage commitment contracts and leases as of LTM March 31, 2018 (2) Based on total warehouse segment revenue generated by contracts with fixed storage commitments and leases for LTM March 31, 2018 (3) Represents weighted average term for contracts featuring fixed storage commitments and leases as of March 31, 2018 18

Substantially All Warehouse NOI Driven by Rental & Storage Revenue + = Rent & Storage Warehouse Services Total Warehouse Commentary REIT: Rent & Storage $0.44 $0.56 $1.00 TRS: Warehouse Services Revenues Power ($0.06) -- ($0.06) Power and utilities Other Real Estate Related Costs: facility Facility ($0.09) -- ($0.09) maintenance, property taxes, insurance, Costs rent, security, sanitation, etc. Direct labor, overtime, contract labor, Expenses Labor -- ($0.44) ($0.44) indirect labor, workers’ compensation and benefits Other MHE (1), warehouse operations Services -- ($0.09) ($0.09) (pallets, shrink wrap, OS&D and D&D (2)) Costs and warehouse administration $0.28 $0.02 $0.31 Margin: 65% 4% 31% NOI + = % WH Total: 93% 7% 100% Note: Based on LTM warehouse segment as of March 31, 2018. Future results may vary. Figures may not sum due to rounding (1) Material Handling Equipment (2) OS&D and D&D refer to Over Short & Damaged and Detentioned & Demurrage, respectively 19

Warehouse Financial Summary Warehouse Revenue ($mm) Warehouse NOI ($mm) Actual $ CC $ Actual $ CC $ Rent and Storage Revenue CAGR: 2.8% 3.9% Rent and Storage NOI CAGR: 4.6% 5.8% Warehouse Services Revenue CAGR: 3.7% 5.0% Warehouse Services NOI CAGR: 31.9% 28.1% Total 2014A – 2017A CAGR: 3.6% 4.5% Total 2014A – 2017A CAGR: 5.8% 6.8% $348 $308 $314 $24 $1,146 $294 $1,057 $1,081 $11 $1,039 $10 $14 $644 $577 $588 $604 $324 $284 $294 $303 $462 $469 $477 $502 2014A 2015A 2016A 2017A 2014A 2015A 2016A 2017A Rent & Storage Warehouse Services Rent & Storage Warehouse Services Same Store Rent & Storage Revenue per Occupied Pallet Growth Contribution (NOI) Margin -- 0.9% 2.5% 4.1% 28% 29% 29% 30% 2015A – 2017A Average Growth: 2.5% 2014A – 2017A margin expansion: 208 bps Margin expansion has been driven by contractual rate increases and occupancy growth Note: Constant currency (CC) growth rate based on 2014 foreign exchange rates 20

Positioned for Multiple Avenues of Growth Global warehouse network, operating systems, scalable information technology platform and economies of scale provide a significant advantage over competitors with respect to organic and external growth opportunities Organic Growth Opportunities Development and External Growth and Expansion Redevelopment Opportunities 8 Expand Presence 7 in Other Temperature Global Food Sensitive Products 6 Producers in the Cold Chain Outsourcing & Sale-Leaseback 5 Industry Opportunities Consolidation Redevelopment 4 & Existing Site Build-to-Suit 3 Customer-Specific Expansion & Market-Driven Operational Development 2 Efficiencies & Cost 1 Underwriting Containment & Contract Standardization Rate Escalations / Occupancy Increases 21

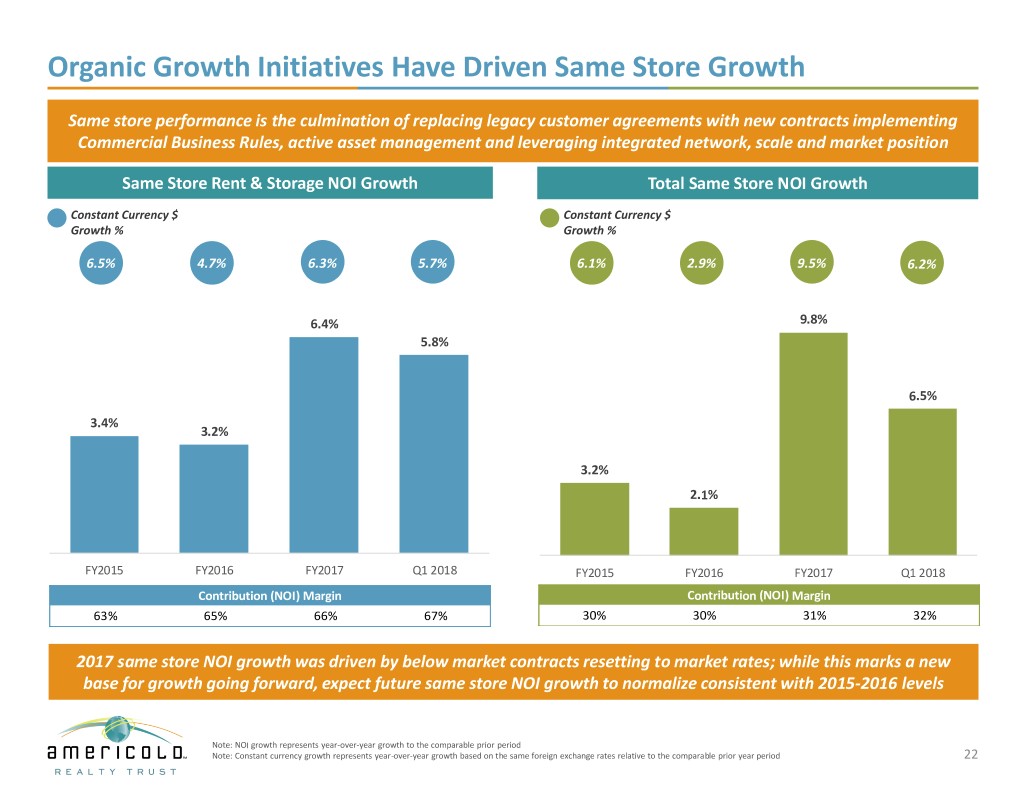

Organic Growth Initiatives Have Driven Same Store Growth Same store performance is the culmination of replacing legacy customer agreements with new contracts implementing Commercial Business Rules, active asset management and leveraging integrated network, scale and market position Same Store Rent & Storage NOI Growth Total Same Store NOI Growth Constant Currency $ Constant Currency $ Growth % Growth % 6.5% 4.7% 6.3% 5.7% 6.1% 2.9% 9.5% 6.2% 6.4% 9.8% 5.8% 6.5% 3.4% 3.2% 3.2% 2.1% FY2015 FY2016 FY2017 Q1 2018 FY2015 FY2016 FY2017 Q1 2018 Contribution (NOI) Margin Contribution (NOI) Margin 63% 65% 66% 67% 30% 30% 31% 32% 2017 same store NOI growth was driven by below market contracts resetting to market rates; while this marks a new base for growth going forward, expect future same store NOI growth to normalize consistent with 2015-2016 levels Note: NOI growth represents year-over-year growth to the comparable prior period Note: Constant currency growth represents year-over-year growth based on the same foreign exchange rates relative to the comparable prior year period 22

Growth Strategy – Expansion, Development and Acquisitions Completed 15.7mm Cu Ft $70mm 4 Completed Since 2014 44,000 Pallets Cost Expansion and Development Opportunities (1) Estimated Costs Return on Invested Capital (1) (2) Under 20.9mm Cu Ft ~$103.0mm Construction 86,000 Pallets 1 Expansion & 1 Development 8% – 15% Target completion date: 4Q17 to 4Q18 Estimated Investment Return on Invested Capital (2) (3) Future $1.2bn+ 85+ acres land (3) adjacent to 10% – 15% 10% – 13% Pipeline Includes both customer-specific 9 warehouses Expansion Development and market-demand Development Customer- Market- Existing Sites 600+ acres land of New for Future adjacent to Sites Specific Demand + Expansion 60+ warehouses Expect to initiate 2 to 3 expansion / development opportunities annually, with aggregate invested capital of $75 million to $200 million with unlevered stabilized returns expected to range from 10% to 15% Fragmented Consolidation Cost of Capital Attractive Acquisitions Operational Industry Opportunity Synergies Advantage Currency (1) As of Mach 31, 2018; no assurance can be given that the actual cost or completion dates of any expansions or developments will not exceed our estimate, or that our targeted returns will be achieved (2) For projects under construction, represents budgeted stabilized returns on invested capital. For projects in our future pipeline, represents budgeted unlevered stabilized return on invested capital (3) These future pipeline opportunities are at various stages of discussion and consideration and, based on historical experiences, many of them may not be pursued or completed as contemplated or at all and there is no assurance that our budgeted unlevered stabilized returns will be achieved 23

Growth Strategy – Recently Completed / Under Construction ($ in millions) Opportunity Facility Cubic Pallet Cost of Expansion / Development Completion Facility Type Type Feet (mm) Positions ('000) Total Cost ROIC Date Phoenix, AZ Development Distribution 3.5 12 $18 18.0% Q1 2014 Leesport, PA Expansion Distribution 2.2 2 12 20.4% Q3 2014 {1) East Point, GA Redevelopment Distribution 4.2 9 11 9.0% - 11.0% Q4 2016 Completed Since 2014Since Completed Clearfield, UT Expansion Distribution 5.8 21 29 12.0% - 15.0% Q4 2017 Total 15.7 44 $70 ($ in millions) Cost of Expansion / Development (1) Opportunity Facility Cubic Pallet Cost Estimated to Estimated Expected Target Facility Type Type Feet (mm) Positions ('000) to Date Completion (2) Cost (2) ROIC Completion Date (1) Production Middleboro, MA Development 5.2 28 15 9 24 8.0% - 12.0% Q3 2018 Advantaged Rochelle, IL Expansion Distribution 15.7 58 32 47 79 12.0% - 15.0% Q4 2018 Under Construction Under Total 20.9 86 $47 $56 $103 Rochelle, IL Middleboro, MA Note: Assumes stabilization occurs in year two (1) No assurance can be given that the actual cost or completion dates of any expansions or developments will not exceed our estimates or that our budgeted stabilized returns will be achieved (2) Reflects management’s estimate of cost of completion as of March 31, 2018 24

Flexible Balance Sheet Positioned for Growth Significant Liquidity: ~$610mm (1)(2) % of – $194mm of cash Debt 1% 1% 12% 22% 25% 39% Maturing – $450mm New Senior Secured Revolving Credit Facility (2) 2010 Mortgage Debt Minimal near term debt maturities 2013 Mortgage Debt Weighted average cost of debt of 5.4% Senior Secured Term Loan A (2) Debt to total capitalization of 37.5% New Zealand Term Loan Australian Term Loan Net debt to Core EBITDA of 4.7x Undrawn Revolver (2) $475 ~$610mm of Liquidity (1) $7 Cash $194mm 32% $450 $406 $159 $262 68% $31 $6 $7 $7 Revolver $18 $18 $19 $7 Availability 2018 2019 2020 2021 2022 2023 $416mm Note: Dollars in millions. Balances as of March 31, 2018 (1) Figure reflects pro forma cash and the capacity available under the New Senior Secured Revolving Credit Facility less ~$34mm in letters of credit (2) In connection with the IPO, the Company closed on its new $925.0 million senior secured credit facility, consisting of a five-year, $525.0 million senior secured term loan A facility and a three- year, $400.0 million senior secured revolving credit facility. Subsequently, the Company used the proceeds to repay its term loan B facility and outstanding construction loan debt aggregating $827.5 million and repaid $50 million of its outstanding term loan A facility while increasing its revolver capacity by $50 million. 25

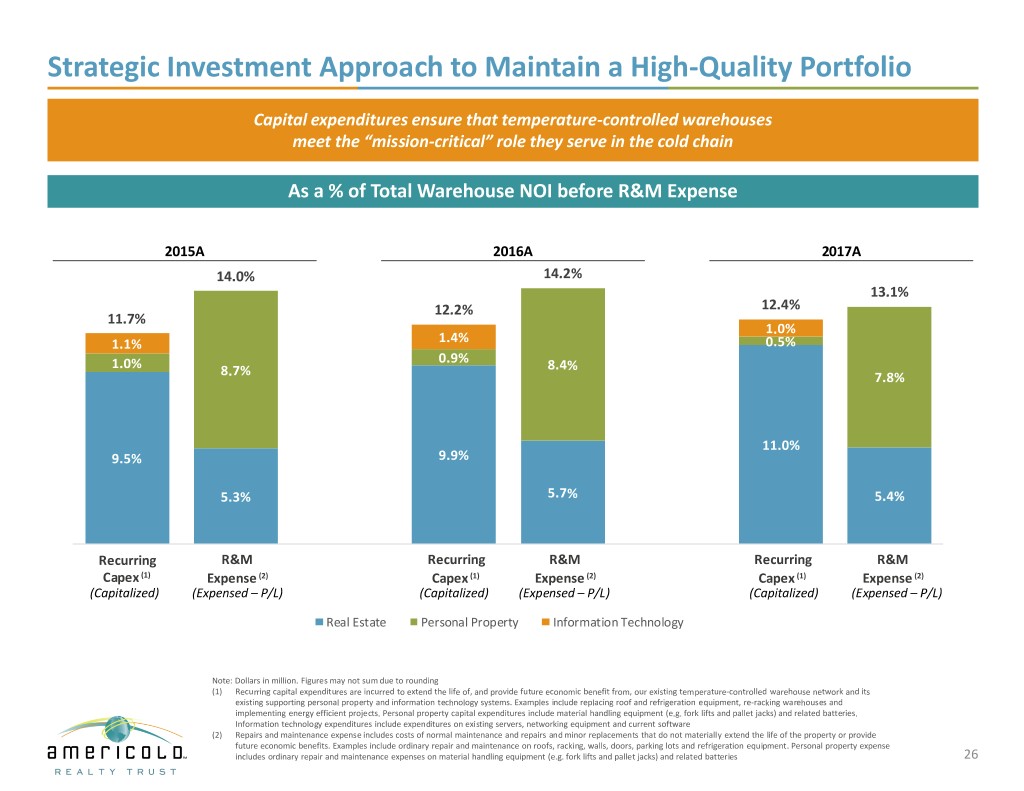

Strategic Investment Approach to Maintain a High-Quality Portfolio Capital expenditures ensure that temperature-controlled warehouses meet the “mission-critical” role they serve in the cold chain As a % of Total Warehouse NOI before R&M Expense 2015A 2016A 2017A 14.0% 14.2% 13.1% 12.2% 12.4% 11.7% 1.0% 1.1% 1.4% 0.5% 1.0% 0.9% 8.4% 8.7% 7.8% 11.0% 9.5% 9.9% 5.3% 5.7% 5.4% Recurring1A R&M2A 3A Recurring4A R&M5A 6A Recurring7A R&M8A Capex (1) Expense (2) Capex (1) Expense (2) Capex (1) Expense (2) (Capitalized) (Expensed – P/L) (Capitalized) (Expensed – P/L) (Capitalized) (Expensed – P/L) Real Estate Personal Property Information Technology Note: Dollars in million. Figures may not sum due to rounding (1) Recurring capital expenditures are incurred to extend the life of, and provide future economic benefit from, our existing temperature-controlled warehouse network and its existing supporting personal property and information technology systems. Examples include replacing roof and refrigeration equipment, re-racking warehouses and implementing energy efficient projects. Personal property capital expenditures include material handling equipment (e.g. fork lifts and pallet jacks) and related batteries. Information technology expenditures include expenditures on existing servers, networking equipment and current software (2) Repairs and maintenance expense includes costs of normal maintenance and repairs and minor replacements that do not materially extend the life of the property or provide future economic benefits. Examples include ordinary repair and maintenance on roofs, racking, walls, doors, parking lots and refrigeration equipment. Personal property expense includes ordinary repair and maintenance expenses on material handling equipment (e.g. fork lifts and pallet jacks) and related batteries 26

Experienced Management Team Driving Accelerated Growth Years with Years of Management team averages over 25 years Americold Experience of experience in the: Real estate Fred Boehler, Chief Executive Officer, President and Trustee 5 29 Temperature-controlled warehouse Logistics Marc Smernoff, Chief Financial Officer 3 (1) 22 Manufacturing Food industries Team assembled to bring best practices Thomas Novosel, Chief Accounting Officer 4 35 from across multiple industries to improve operations Less than Jim Snyder, Chief Legal Officer 29 1 Experience Across Industry-Leading Firms Andrea Darweesh, Chief Human Resources Officer 2 24 Thomas Musgrave, Chief Information Officer 6 24 Bill Sanders, Head of North American Operations 2 29 David Stuver, Distribution Support and Engineering 5 28 Current management team has driven accelerated same store growth (1) Years with Americold does not include tenure served as Yucaipa shareholder representative from 2004 until joining the Company in 2014 27

Shareholder-Friendly Corporate Governance Independent Trustees / Trustee Key Highlights George Alburger ─ Former CFO, Liberty Property Trust Majority independent trustees Bradley Gross ─ Partner, Goldman Sachs & Co. Committees comprised of independents James Heistand ─ President & CEO, Parkway Properties Each trustee subject to annual re-election Michelle MacKay ─ Senior Advisor, iStar Inc. No staggered board Mark Patterson ─ President, MP Realty Advisors Andrew Power ─ CFO, Digital Realty Trust Elected to opt out of MUTA Insiders Cannot opt into MUTA without shareholder vote (1) Fred Boehler ─ President & CEO, Americold No poison pill Ronald Burkle ─ Founder, The Yucaipa Companies Jeffrey Gault ─ Non-Executive Chairman (1) On any such vote, sponsor will vote for and against the matter in the same proportion as the number of votes cast for and against the proposal by other shareholders until its collective ownership percentage decreases to less than 20% of the outstanding voting power 28

Building Blocks of Net Asset Value Our Business Segments Tangible Assets LTM Total NOI: $354mm Cash and Cash Warehouse and Equivalents $194mm Related Services Rent & Storage: $329mm + Warehouse Services: $25mm + Accounts Receivable $179mm + Third-Party Managed LTM Contribution: $14mm Restricted Cash $19mm + + Investments in Partially Owned Entities $16mm Transportation LTM Contribution: $13mm + + Other Assets $42mm = Quarry LTM Contribution: $2mm Total Tangible Assets $450mm = Total Business Segments $383mm Tangible Liabilities Total Debt (2) $1,571mm Construction in Progress and Land + Accounts Payable $233mm Spent to Date(1): $47mm + Construction in Progress $103mm of projects under construction Pension Benefits and $25mm $56mm remaining to complete Related Liabilities (Refer to Slide 24 for ROIC) + Unearned Revenue $18mm = Land 600+ acres available for future expansion Total Tangible Liabilities $1,847mm Note: Figures as of LTM March 31, 2018 unless otherwise indicated. Figures may not sum due to rounding (1) Figure as of March 31, 2018 and excludes $29mm attributable to Clearfield, UT expansion, which was completed in Q4 2017 (2) Gross of discounts and deferred financing costs 29

Strong Cash Flow from Growing Demand for Temperature Sensitive Products Well-positioned to take advantage of favorable industry dynamics Population growth, global food shortages, urbanization and fresh, Continued Growth in Outsourcing (1) chilled and frozen food consumption drive demand for temperature- controlled warehouse space and services (in million cubic feet) 3,028 3,077 3,138 2,901 2,830 Customers continue to outsource their temperature-controlled 2,436 2,498 warehousing needs to increase efficiency, reduce costs and redeploy capital into their core businesses 931 978 1,030 772 822 894 767 Inelastic demand in the food industry creates consistent cold chain (2) demand even during economic downturns 2005 2007 2009 2011 2013 2015 2017 In-House Outsourced U.S. Temperature-Controlled Warehouse Industry Revenues (2006A – 2017E) (3) (in millions) $5,287 $5,081 $4,900 $4,946 $4,702 $4,769 $4,666 $4,587 $4,237 $4,269 $4,238 $4,069 2006A 2007A 2008A 2009A 2010A 2011A 2012A 2013A 2014A 2015A 2016A 2017E Global Financial Crisis Global Recession Continues (1) USDA National Agricultural Statistics Service. Numbers from “Refrigerated Space: By Type of Warehouse” chart. In-house data is not comprehensive with respect to space owned by distributors and retailers. Note: Gross space. Apple and pear storage capacity not included. Frozen juice tanks included (2) In 2017, the USDA updated methodology in calculating the domestic capacity of refrigerated warehouse. Historical data has not been recast to reflect this change in definition (3) IBIS Report as of February 2017 30