Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Cornerstone Building Brands, Inc. | a2018q2exhibit991.htm |

| 8-K - 8-K - Cornerstone Building Brands, Inc. | ncs201806058-k.htm |

Our Mission & Vision 2Q Supplemental Presentation June 5, 2018

Forward-looking Statements Certain statements and information in this presentation may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “anticipate,” “plan,” “intend,” “foresee,” “guidance,” “potential,” “expect,” “should,”Our“will” Mission“continue,” “could,” “estimate,” & Vision“forecast,” “goal,” “may,” “objective,” “predict,” “projection,” or similar expressions are intended to identify forward-looking statements (including those contained in certain visual depictions) in this presentation. These forward-looking statements reflect the Company's current expectations and/or beliefs concerning future events. The Company believes the information, estimates, forecasts and assumptions on which these statements are based are current, reasonable and complete. Our expectations with respect to the third quarter of fiscal 2018 that are contained in this presentation are forward looking statements based on management’s best estimates, as of the date of this presentation. These estimates are unaudited, and reflect management’s current views with respect to future results. However, the forward-looking statements in this presentation are subject to a number of risks and uncertainties that may cause the Company's actual performance to differ materially from that projected in such statements. Among the factors that could cause actual results to differ materially include, but are not limited to, industry cyclicality and seasonality and adverse weather conditions; challenging economic conditions affecting the nonresidential construction industry; volatility in the U.S. economy and abroad, generally, and in the credit markets; substantial indebtedness and our ability to incur substantially more indebtedness; our ability to generate significant cash flow required to service our existing debt, including our secured term loan facility, and obtain future financing; our ability to comply with the financial tests and covenants in our existing and future debt obligations; operational limitations or restrictions in connection with our debt; increases in interest rates; recognition of asset impairment charges; commodity price increases and/or limited availability of raw materials, including steel; interruptions in our supply chain; our ability to make strategic acquisitions accretive to earnings; retention and replacement of management and other key personnel; enforcement and obsolescence of intellectual property rights; fluctuations in customer demand; costs related to environmental clean-ups and liabilities; competitive activity and pricing pressure; increases in energy prices; volatility of the Company's stock price; dilutive effect on the Company's common stockholders of potential future sales of the Company's common stock held by our sponsor; substantial governance and other rights held by our sponsor; breaches of our information system security measures and damage to our major information management systems; hazards that may cause personal injury or property damage, thereby subjecting us to liabilities and possible losses, which may not be covered by insurance; changes in laws or regulations, including the Dodd–Frank Act; the timing and amount of our stock repurchases; and costs and other effects of legal and administrative proceedings, settlements, investigations, claims and other matters. See also the “Risk Factors” in the Company's Annual Report on Form 10-K for the fiscal year ended October 29, 2017, and other risks described in documents subsequently filed by the Company from time to time with the SEC, which identify other important factors, though not necessarily all such factors, that could cause future outcomes to differ materially from those set forth in the forward-looking statements. The Company expressly disclaims any obligation to release publicly any updates or revisions to these forward-looking statements, whether as a result of new information, future events, or otherwise. 2

2Q 2018 Financial Overview (Page 1 of 2) Our. Sales Mission were $457.1 million, & Vision an increase of $36.6 million or 8.7% from $420.5 million in the prior year’s second quarter • Revenues for the quarter benefited from continued commercial discipline in the pass- through of higher material costs across the segments, combined with volume growth in both Metal Components and the Insulated Metal Panels (“IMP”) segments, as well as growth in package volumes in the Metal Coil Coating segment . Gross profit margins for the quarter were 22.8% compared to 24.0% in the prior year period and up 100 basis points sequentially from the first quarter of 2018. Gross margins were lower primarily as a result of: • The strong mix of higher margin architectural products that shipped in the IMP segment during the second quarter of fiscal 2017 • Lower manufacturing leverage as the Company began adding incremental shifts to manage expected demand during the second half of fiscal 2018 . ESG&A Costs decreased to $74.4 million (16.3% of sales) from $75.1 million (17.9% of sales) in the prior year’s second quarter . Operating income was $19.0 million, compared to $32.5 million in the prior year period • The second quarter of fiscal 2018 included a $6.7 million charge related to the sale of CENTRIA’s China operations 3

2Q 2018 Financial Overview (Page 2 of 2) Our. Adjusted Mission Operating & Income Vision(1) was $27.3 million, compared to $23.6 million in the prior year’s second quarter . Net loss applicable to common shares was $5.7 million, or $0.09 per diluted common share this quarter compared to net income of $16.9 million, or $0.24 per diluted common share in the second quarter of fiscal 2017. On an adjusted basis(1), diluted earnings were $0.25 per share this quarter compared to $0.16 in the prior year’s second quarter • Net Income for the quarter was impacted by several special items including a $21.9 million charge related to the extinguishment and refinancing of a portion of the Company’s debt and a $6.7 million charge related to the disposition of CENTRIA’s China operations . Adjusted EBITDA (1) was $39.7 million compared to $37.0 million in the prior year period . Consolidated backlog grew 10.8% year-over-year to $631.6 million (1) Reconciliations of non-GAAP financial measures to the nearest GAAP measure are included in the Company’s financial tables beginning on Slide 15 4

2Q 2018 Operational Overview Our. Commercial Mission & Vision • Backlog in the Engineered Building Systems segment at the end of the quarter increased 14.3% to $421.5 million • Engineered Building Systems backlog for IMP orders are up 21% year-over-year • Total door sales increased 63.3% year-over-year . Steel Costs • Steel costs continue to be elevated and recent announcements regarding possible tariffs is likely to lead to continued price increases • The Company has successfully navigated similar events in fiscal 2002, 2004 and 2008 . Manufacturing • There were lower volumes in the Engineered Building Systems segment and incremental manufacturing costs in the Metal Coil Coating segment related to ramping-up of additional shifts in preparation for higher volumes expected in the second half of fiscal 2018, both of which reduced manufacturing utilization during the period 5

2Q 2018 Segment Overview (1) . Engineered Building Systems Our• MissionRevenues increased & 2.8% Vision to $167.2 million from $162.6 million in the prior year period, primarily as a result of commercial discipline passing through higher input costs, partially offset by lower tonnage volumes • Operating margin improved to 5.5% in the quarter as a result of lower ESG&A costs and an emphasis on order profitability over volumes . Metal Components • Revenue grew 8.8% to $168.5 million from $154.9 million in the prior year period, primarily as a result of higher external volumes and the disciplined pass-through of increasing input costs • Operating margins improved to 13.1% in the quarter, as a result of improved operating leverage on higher volumes . Insulated Metal Panels (IMP) • Revenue increased 10.2% to $113.4 million from $102.9 million in the prior year period, primarily as a result of commercial discipline in emphasizing project profitability over volume in a period of increasing input costs • Operating margins decreased as a result of the change in product mix, which was expected due to the unusually large amount of higher margin architectural panels shipped in the prior year period and a special charge of $6.7 million for the disposition of CENTRIA’s China operations . Metal Coil Coating • Revenues were $95.2 million, an increase of 9.8%, from $86.7 million in the prior year period. Operating margins improved as a result of lower ESG&A costs, partially offset by lower manufacturing efficiency due to ramping-up additional shifts in advance of anticipated increases in activity levels in the second half of fiscal 2018 (1) Segment revenue includes intersegment sales 6

2Q 2018 Financial Summary Our Mission & Vision (Dollars in millions, except per share amounts) Fiscal Three Months Ended Six Months Ended April 29, April 30, April 29, April 30, 2018 2017 % Chg. 2018 2017 % Chg. Sales $ 457.1 $ 420.5 8.7% $ 878.4 $ 812.2 8.2% Gross Profit $ 104.1 $ 100.8 3.2% $ 196.0 $ 184.8 6.1% Gross Profit Margin 22.8% 24.0% -5.0% 22.3% 22.8% -2.2% Income from Operations $ 19.0 $ 32.5 -41.6% $ 31.9 $ 42.4 -24.8% Net Income (Loss) $ (5.7) $ 17.0 -133.5% $ (0.4) $ 19.0 -102.3% Diluted EPS $ (0.09) $ 0.24 -137.5% $ (0.01) $ 0.27 -103.7% Adjusted Operating Income1 $ 27.3 $ 23.6 15.3% $ 46.6 $ 36.1 28.9% Adjusted EBITDA1 $ 39.7 $ 37.0 7.3% $ 72.5 $ 63.1 14.9% 1 Adjusted Diluted EPS $ 0.25 $ 0.16 56.3% $ 0.39 $ 0.21 85.7% (1) Reconciliations of non-GAAP financial measures to the nearest GAAP measure are included in the Company’s financial tables beginning on Slide 15 7

2Q 2018 Revenues and Volumes – by Segment ($ in millions) EngineeredOur Building Mission Systems &Metal Vision Components Insulated Metal Panels Metal Coil Coating % Vol. % Vol. % Vol. 1 1 1 2Q-'18 2Q-'17 % Chg. Chg. 2Q-'18 2Q-'17 % Chg. Chg. 2Q-'18 2Q-'17 % Chg. 2Q-'18 2Q-'17 % Chg. Chg. Third-Party $ 157.1 $ 154.5 1.7% -4.4% Third-Party $ 147.7 $ 133.3 10.8% 4.5% Third-Party $ 99.8 $ 86.8 15.0% Third-Party $ 52.5 $ 45.9 14.2% -10.2% Internal 10.1 8.2 23.7% 21.7% Internal 20.8 21.6 -3.7% -13.2% Internal 13.6 16.2 -15.7% Internal 42.7 40.8 4.7% 2.9% Total Sales $ 167.2 $ 162.6 2.8% -2.4% Total Sales $ 168.5 $ 154.9 8.8% 1.0% Total Sales $ 113.4 $ 102.9 10.2% Total Sales $ 95.2 $ 86.7 9.8% -4.1% Engineered Building Metal Components Insulated Metal Panels Metal Coil Coating Systems $180.0 $180.0 $120.0 $100.0 $160.0 $160.0 $90.0 $100.0 $140.0 $140.0 $80.0 $70.0 $120.0 $120.0 $80.0 $60.0 $100.0 $100.0 $60.0 $50.0 $80.0 $80.0 $40.0 $60.0 $60.0 $40.0 $30.0 $40.0 $40.0 $20.0 $20.0 $20.0 $20.0 $10.0 $- $- $- $- 2Q-'18 2Q-'17 2Q-'18 2Q-'17 2Q-'18 2Q-'17 2Q-'18 2Q-'17 Third-Party Internal Third-Party Internal Third-Party Internal Third-Party Internal Consolidated 3rd Party Revenue Consolidated 3rd Party Revenue 2Q 2018 2Q 2017 Metal Coil Metal Coil Coating Coating 12% 11% Insulated Insulated Metal Panels Metal Panels 22% 20% Engineered Building Systems Engineered Building Syste ms 34% Metal Metal 37% Components Components 32% 32% (1) Calculated as the year-over-year change in the tonnage volumes shipped. 8

2Q 2018 Business Segment Results (Dollars in millions) OurThird Party Revenue Operating Income Mission & Vision$457.1 $420.5 $32.5 $22.1 $20.0 $19.4 $19.0 $157.1 $154.5 $147.7 $133.3 $9.3 $99.8 $86.8 $7.1 $6.9 $6.2 $45.9 $52.5 $1.5 Buildings Components IMP Coatings Consolidated Buildings Components IMP Coatings Consolidated 2017 Adjusted Operating Income(1) Adjusted EBITDA(1) 2018 $27.3 $39.7 $37.0 $23.6 $22.2 $19.7 $23.7 $21.1 $10.4 $9.6 $15.0 $8.4 $12.9 $7.2 $7.1 $11.8 $6.2 $9.4 $8.2 $9.2 Buildings Components IMP Coatings Consolidated Buildings Components IMP Coatings Consolidated (1) Reconciliation of non-GAAP financial measures to the nearest GAAP measure are included in the Company’s financial tables beginning on Slide 15 9

Gross Margin Reconciliation OurGross Mission Margin 2Q 2017 & Vision 24.0% Commercial sales discipline 0.30% Lower plant utilization (0.60%) Product Mix, IMP (0.50%) Freight, predominately IMP (0.40%) Gross Margin 2Q 2018 22.8% Note: Basis point attributions in the above tables are approximate . For the second quarter, gross profit was $104.1 million compared to $100.8 million in the second quarter of fiscal 2017 . The favorable commercial sales discipline was executed across all the business segments . Lower volumes in the Engineered Building Systems segment and incremental manufacturing costs in the Metal Coil Coating segment related to ramping-up additional shifts in preparation for higher volumes expected in the second half of fiscal 2018 led to lower plant utilization . The reduction in year-over-year margins in the IMP product mix was expected due to the unusually large amount of higher margin architectural panels shipped in the prior year period 10

2Q 2018 Net Income(Loss) and Adjusted EBITDA Net Income: OurNet loss Mission was $5.7 million in& the Visionsecond quarter of fiscal 2018 compared to net income of $17.0 million in the prior year’s second quarter Adjusted EBITDA(1): (Dollars in millions) $41.0 $0.4 $3.3 $40.0 $(0.5) $39.7 $(0.5) $39.0 $38.0 $37.0 $37.0 $36.0 $35.0 Adjusted EBITDA 2Q Volume Net Other Product Mix and Margin ESG&A Costs Adjusted EBITDA 2Q 2017 Contraction 2018 (1) Reconciliations of non-GAAP financial measures to the nearest GAAP measure are included in the Company’s financial tables beginning on Slide 15 11

2Q 2018 Cash Flow Summary (Dollars in thousands) CashOurand Mission Cash Equivalents, & asVision of 2Q 2018 1Q 2018 4Q 2017 3Q 2017 2Q 2017 Beginning balance $ 12,420 $ 65,658 $ 45,923 $ 49,682 $ 15,789 Cash provided by (used in) operating activities 46,566 (6,580) 63,277 (7,294) 38,254 Cash provided by (used in) investing activities (12,774) (5,860) (5,781) 4,100 (4,483) Cash provided by (used in) financing activities (10,616) (41,035) (37,622) (961) 271 Exchange rate effects (261) 237 (139) 396 (149) Ending balance $ 35,335 $ 12,420 $ 65,658 $ 45,923 $ 49,682 . Financing Activities • During the second quarter, the Company entered into a new $415 million secured term loan facility and used the proceeds, together with cash on hand, to redeem and repay the Company’s existing 8.25% senior notes and refinance its existing term loan credit facility. This included the payment of related premiums, fees and expenses, including accrued and unpaid interest 12

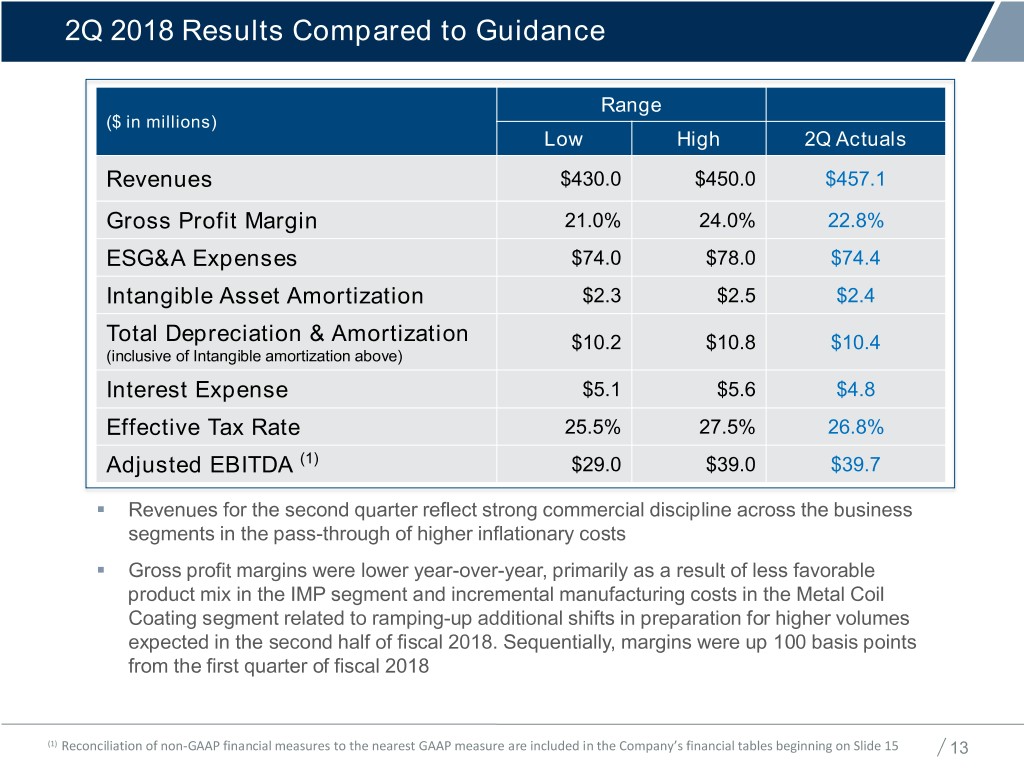

2Q 2018 Results Compared to Guidance Range Our($ inMissionmillions) & Vision Low High 2Q Actuals Revenues $430.0 $450.0 $457.1 Gross Profit Margin 21.0% 24.0% 22.8% ESG&A Expenses $74.0 $78.0 $74.4 Intangible Asset Amortization $2.3 $2.5 $2.4 Total Depreciation & Amortization $10.2 $10.8 $10.4 (inclusive of Intangible amortization above) Interest Expense $5.1 $5.6 $4.8 Effective Tax Rate 25.5% 27.5% 26.8% Adjusted EBITDA (1) $29.0 $39.0 $39.7 . Revenues for the second quarter reflect strong commercial discipline across the business segments in the pass-through of higher inflationary costs . Gross profit margins were lower year-over-year, primarily as a result of less favorable product mix in the IMP segment and incremental manufacturing costs in the Metal Coil Coating segment related to ramping-up additional shifts in preparation for higher volumes expected in the second half of fiscal 2018. Sequentially, margins were up 100 basis points from the first quarter of fiscal 2018 (1) Reconciliation of non-GAAP financial measures to the nearest GAAP measure are included in the Company’s financial tables beginning on Slide 15 13

3Q 2018 Guidance (1) 3Q Range ($ in million) Our Mission & Vision Low High Revenues $525.0 $545.0 Gross Profit Margin 23.3% 25.5% ESG&A Expenses $77.0 $82.0 Intangible Asset Amortization $2.3 $2.5 Total Depreciation & Amortization $10.0 $10.5 (inclusive of Intangible Asset Amortization above) Interest Expense $4.7 $5.2 Effective Tax Rate 25.5% 27.5% Adjusted EBITDA $56.0 $66.0 . Guidance for ESG&A excludes the amortization of intangible assets, which is shown as a separate line item above . Total Depreciation & Amortization includes the intangible amortization and is reported on the Company’s Statements of Operations within Cost of Goods Sold, ESG&A Expense and Intangible Asset Amortization . Weighted average diluted common shares is expected to be 66.4 million for 3Q 2018 . Total capital expenditures for fiscal 2018 are expected to be in the range of $45.0 million to $55.0 million. Year-to-date spend, as of end of the second quarter 2018, is $16.9 million (1) See “Forward Looking Statements” on Slide 2 14

Reconciliation of Net Income (Loss) and Adjusted Net Income (Loss) per Diluted Common Share (Dollars in thousands, except per share amounts) Our Mission & Vision Fiscal Three Months Ended Fiscal Six Months Ended April 29, April 30, April 29, April 30, 2018 2017 2018 2017 Net income (loss) per diluted common share, GAAP basis $ (0.09) $ 0.24 $ (0.01) $ 0.27 Loss on extinguishment of debt 0.33 0.00 0.33 - Loss on disposition of business 0.10 0.00 0.10 - Restructuring and impairment charges 0.01 0.00 0.02 0.04 Strategic development and acquisition related costs 0.02 0.00 0.03 0.01 Acceleration of CEO retirement benefits - - 0.07 - Gain on insurance recovery - (0.13) - (0.14) (1) Tax effect of applicable non-GAAP adjustments (0.12) 0.05 (0.15) 0.03 (2) Adjusted net income per diluted common share $ 0.25 $ 0.16 $ 0.39 $ 0.21 Fiscal Three Months Ended Fiscal Six Months Ended April 29, April 30, April 29, April 30, 2018 2017 2018 2017 Net income (loss) applicable to common shares, GAAP basis $ (5,684) $ 16,859 $ (435) $ 18,882 Loss on extinguishment of debt 21,875 - 21,875 - Loss on disposition of business 6,686 - 6,686 - Restructuring and impairment charges 488 315 1,582 2,578 Strategic development and acquisition related costs 1,134 124 1,861 481 Acceleration of CEO retirement benefits - - 4,600 - Gain on insurance recovery - (9,601) - (9,601) Other, net - 328 (323) 328 Tax effect of applicable non-GAAP adjustments (1) (8,059) 3,445 (9,883) 2,423 (2) Adjusted net income applicable to common shares $ 16,440 $ 11,470 $ 25,963 $ 15,091 #DIV/0! #DIV/0! (1) The Company calculated the tax effect of non-GAAP adjustments by applying the applicable statutory tax rate for the period to each applicable non-GAAP item. (2) The Company discloses a tabular comparison of Adjusted net income per diluted common share and Adjusted net income applicable to common shares, which are non-GAAP measures, because they are referred to in the text of our press releases and are instrumental in comparing the results from period to period. Adjusted net income per diluted common share and Adjusted net income applicable to common shares should not be considered in isolation or as a substitute for net income per diluted common share and net income applicable to common shares as reported on the face of our consolidated statements of operations. 15

Business Segments (Page 1 of 2) (Dollars in thousands) Our MissionFiscal Three& MonthsVision Ended Fiscal Six Months Ended April 29, April 30, April 29, April 30, 2018 2017 2018 2017 % of % of % of % of Total Total % Total Total % Sales Sales Change Sales Sales Change Total Sales Engineered Building Systems $ 167,240 31 $ 162,624 32 2.8% $ 324,204 31 $ 313,887 32 3.3% Metal Components 168,456 31 154,895 31 8.8% 315,288 30 289,068 30 9.1% Insulated Metal Panels 113,413 21 102,937 20 10.2% 224,207 21 198,132 20 13.2% Metal Coil Coating 95,190 17 86,729 17 9.8% 183,533 18 175,069 18 4.8% Total sales 544,299 100 507,185 100 7.3% 1,047,232 100 976,156 100 7.3% Less: Intersegment sales (87,230) 16 (86,721) 17 0.6% (168,814) 16 (163,989) 17 2.9% Total net sales $ 457,069 84 $ 420,464 83 8.7% $ 878,418 84 $ 812,167 83 8.2% % of % of % of % of External Sales Sales Sales Sales Sales Engineered Building Systems $ 157,136 34 $ 154,456 37 1.7% $ 305,424 35 $ 299,477 37 2.0% Metal Components 147,661 32 133,290 31 10.8% 275,189 31 248,847 30 10.6% Insulated Metal Panels 99,792 22 86,773 21 15.0% 197,305 23 169,214 21 16.6% Metal Coil Coating 52,480 12 45,945 11 14.2% 100,500 11 94,629 12 6.2% Total extermal sales $ 457,069 100 $ 420,464 100 8.7% $ 878,418 100 $ 812,167 100 8.2% % of % of % of % of Operating Income Sales Sales Sales Sales Engineered Building Systems $ 9,271 6 $ 6,894 4 34.5% $ 17,534 5 $ 13,397 4 30.9% Metal Components 22,082 13 19,997 13 10.4% 39,171 12 32,373 11 21.0% Insulated Metal Panels 1,540 1 19,377 19 -92.1% 8,611 4 21,569 11 -60.1% Metal Coil Coating 7,129 7 6,227 7 14.5% 12,505 7 12,933 7 -3.3% Corporate (21,066) - (20,023) - 5.2% (45,967) - (37,914) - 21.2% Total operating income $ 18,956 4 $ 32,472 8 -41.6% $ 31,854 4 $ 42,358 5 -24.8% 16

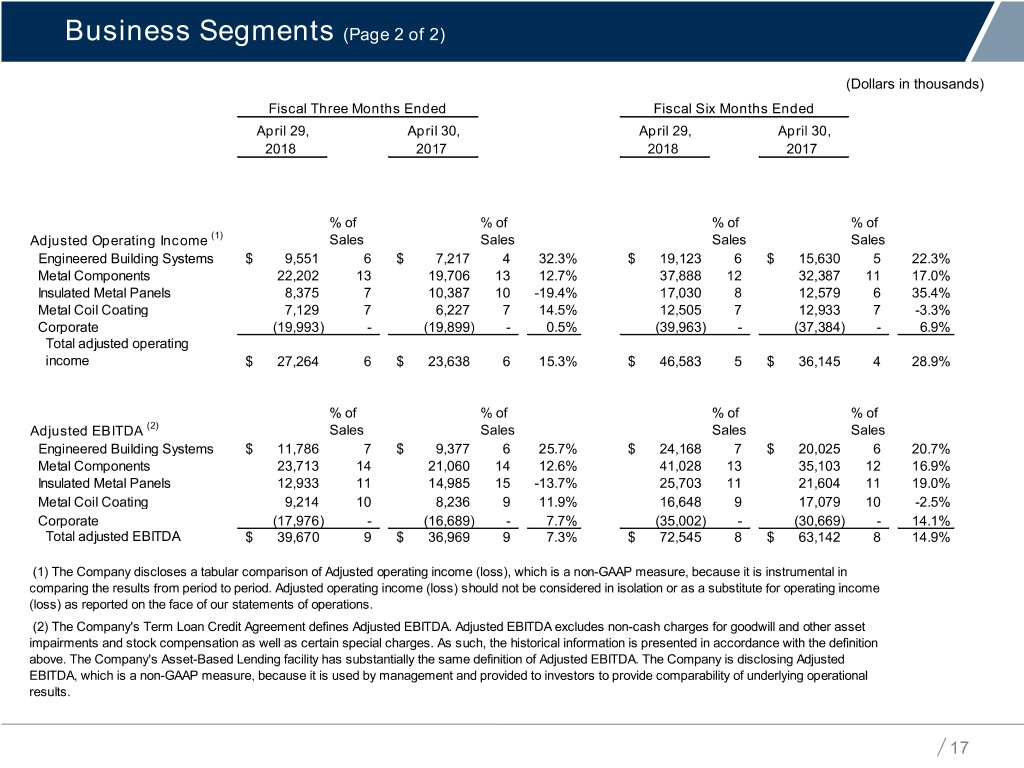

Business Segments (Page 2 of 2) (Dollars in thousands) Our MissionFiscal Three& MonthsVision Ended Fiscal Six Months Ended April 29, April 30, April 29, April 30, 2018 2017 2018 2017 % of % of % of % of Adjusted Operating Income (1) Sales Sales Sales Sales Engineered Building Systems $ 9,551 6 $ 7,217 4 32.3% $ 19,123 6 $ 15,630 5 22.3% Metal Components 22,202 13 19,706 13 12.7% 37,888 12 32,387 11 17.0% Insulated Metal Panels 8,375 7 10,387 10 -19.4% 17,030 8 12,579 6 35.4% Metal Coil Coating 7,129 7 6,227 7 14.5% 12,505 7 12,933 7 -3.3% Corporate (19,993) - (19,899) - 0.5% (39,963) - (37,384) - 6.9% Total adjusted operating income $ 27,264 6 $ 23,638 6 15.3% $ 46,583 5 $ 36,145 4 28.9% % of % of % of % of Adjusted EBITDA (2) Sales Sales Sales Sales Engineered Building Systems $ 11,786 7 $ 9,377 6 25.7% $ 24,168 7 $ 20,025 6 20.7% Metal Components 23,713 14 21,060 14 12.6% 41,028 13 35,103 12 16.9% Insulated Metal Panels 12,933 11 14,985 15 -13.7% 25,703 11 21,604 11 19.0% Metal Coil Coating 9,214 10 8,236 9 11.9% 16,648 9 17,079 10 -2.5% Corporate (17,976) - (16,689) - 7.7% (35,002) - (30,669) - 14.1% Total adjusted EBITDA $ 39,670 9 $ 36,969 9 7.3% $ 72,545 8 $ 63,142 8 14.9% (1) The Company discloses a tabular comparison of Adjusted operating income (loss), which is a non-GAAP measure, because it is instrumental in comparing the results from period to period. Adjusted operating income (loss) should not be considered in isolation or as a substitute for operating income (loss) as reported on the face of our statements of operations. (2) The Company's Term Loan Credit Agreement defines Adjusted EBITDA. Adjusted EBITDA excludes non-cash charges for goodwill and other asset impairments and stock compensation as well as certain special charges. As such, the historical information is presented in accordance with the definition above. The Company's Asset-Based Lending facility has substantially the same definition of Adjusted EBITDA. The Company is disclosing Adjusted EBITDA, which is a non-GAAP measure, because it is used by management and provided to investors to provide comparability of underlying operational results. 17

Consolidated – Non-GAAP Financial Measures and Reconciliations (Dollars in thousands) Fiscal Six Trailing Fiscal Three Months Ended Months Ended Twelve Months Our Mission & VisionJuly 30, October 29, January 28, April 29, April 29, April 29, 2017 2017 2018 2018 2018 2018 Total Net Sales $ 469,385 $ 488,726 $ 421,349 $ 457,069 $ 878,418 $ 1,836,529 Operating Income, GAAP 34,097 33,325 12,898 18,956 31,854 99,276 Restructuring and impairment 1,009 1,709 1,094 488 1,582 4,300 Strategic development and acquisition related costs 1,297 193 727 1,134 1,861 3,351 Loss on disposition of business - - - 6,686 6,686 6,686 Acceleration of CEO retirement benefits - - 4,600 - 4,600 4,600 Gain on insurance recovery (148) - - - - (148) Unreimbursed business interruption costs 235 28 - - - 263 Goodwill impairment - 6,000 - - - 6,000 Adjusted Operating Income 36,490 41,255 19,319 27,264 46,583 124,328 Other income and expense 1,322 (62) 928 (34) 894 2,154 Depreciation and amortization 10,278 10,664 10,358 10,442 20,800 41,742 Share-based compensation expense 2,284 2,084 2,270 1,998 4,268 8,636 Adjusted EBITDA $ 50,374 $ 53,941 $ 32,875 $ 39,670 $ 72,545 $ 176,860 Year over year growth, Total Net Sales 1.5 % 1.8 % 7.6 % 8.7 % 8.2 % 4.7 % Operating Income Margin 7.3 % 6.8 % 3.1 % 4.1 % 3.6 % 5.4 % Adjusted Operating Income Margin 7.8 % 8.4 % 4.6 % 6.0 % 5.3 % 6.8 % Adjusted EBITDA Margin 10.7 % 11.0 % 7.8 % 8.7 % 8.3 % 9.6 % Fiscal Six Trailing Fiscal Three Months Ended Months Ended Twelve Months July 31, October 30, January 29, April 30, April 30, April 30, 2016 2016 2017 2017 2017 2017 Total Net Sales $ 462,353 $ 480,314 $ 391,703 $ 420,464 $ 812,167 $ 1,754,834 Operating Income, GAAP 43,535 39,391 9,886 32,472 42,358 125,284 Restructuring and impairment 778 815 2,264 315 2,579 4,172 Strategic development and acquisition related costs 819 590 357 124 481 1,890 (Gain) loss on sale of assets and asset recovery (52) 62 - 137 137 147 Gain on insurance recovery - - - (9,601) (9,601) (9,601) Unreimbursed business interruption costs - - - 191 191 191 Adjusted Operating Income 45,080 40,858 12,507 23,638 36,145 122,083 Other income and expense (508) (192) 309 449 758 58 Depreciation and amortization 10,595 9,815 10,315 10,062 20,377 40,787 Share-based compensation expense 2,661 3,181 3,042 2,820 5,862 11,704 Adjusted EBITDA $ 57,828 $ 53,662 $ 26,173 $ 36,969 $ 63,142 $ 174,632 Operating Income Margin 9.4 % 8.2 % 2.5 % 7.7 % 5.2 % 7.1 % Adjusted Operating Income Margin 9.8 % 8.5 % 3.2 % 5.6 % 4.5 % 7.0 % Adjusted EBITDA Margin 12.5 % 11.2 % 6.7 % 8.8 % 7.8 % 10.0 % 18

Engineered Building Systems – Non-GAAP Financial Measures and Reconciliations (Dollars in thousands) Fiscal Six Trailing Our Mission & VisionFiscal Three Months Ended Months Ended Twelve Months July 30, October 29, January 28, April 29, April 29, April 29, 2017 2017 2018 2018 2018 2018 Total Sales $ 191,910 $ 188,183 $ 156,964 $ 167,240 $ 324,204 $ 704,297 External Sales 182,164 178,222 148,288 157,136 305,424 665,810 Operating Income, GAAP 14,948 13,043 8,263 9,271 17,534 45,525 Restructuring and impairment 941 695 1,136 280 1,416 3,052 Strategic development and acquisition related costs - - 173 - 173 173 Adjusted Operating Income 15,889 13,738 9,572 9,551 19,123 48,750 Other income and expense 1,291 (694) 733 (88) 645 1,242 Depreciation and amortization 2,255 2,198 2,077 2,323 4,400 8,853 Adjusted EBITDA $ 19,435 $ 15,242 $ 12,382 $ 11,786 $ 24,168 $ 58,845 Year over year growth, Total sales 6.0 % (7.8)% 3.8 % 2.8 % 3.3 % 0.7 % Year over year growth, External Sales 3.8 % (9.3)% 2.3 % 1.7 % 2.0 % (0.9)% Operating Income Margin 7.8 % 6.9 % 5.3 % 5.5 % 5.4 % 6.5 % Adjusted Operating Income Margin 8.3 % 7.3 % 6.1 % 5.7 % 5.9 % 6.9 % Adjusted EBITDA Margin 10.1 % 8.1 % 7.9 % 7.0 % 7.5 % 8.4 % Fiscal Six Trailing Fiscal Three Months Ended Months Ended Twelve Months July 31, October 30, January 29, April 30, April 30, April 30, 2016 2016 2017 2017 2017 2017 Total Sales $ 181,029 $ 204,208 $ 151,263 $ 162,624 313,887 $ 699,124 External Sales 175,471 196,596 145,021 154,456 299,477 671,544 Operating Income, GAAP 19,561 22,830 6,503 6,894 13,397 55,788 Restructuring and impairment 106 211 1,910 186 2,096 2,413 (Gain) loss on sale of assets and asset recovery (52) 62 - 137 137 147 Adjusted Operating Income 19,615 23,103 8,413 7,217 15,630 58,348 Other income and expense (931) (362) (41) (125) (166) (1,459) Depreciation and amortization 2,438 2,399 2,276 2,285 4,561 9,398 Adjusted EBITDA $ 21,122 $ 25,140 $ 10,648 $ 9,377 $ 20,025 $ 66,287 Operating Income Margin 10.8 % 11.2 % 4.3 % 4.2 % 4.3 % 8.0 % Adjusted Operating Income Margin 10.8 % 11.3 % 5.6 % 4.4 % 5.0 % 8.3 % Adjusted EBITDA Margin 11.7 % 12.3 % 7.0 % 5.8 % 6.4 % 9.5 % 19

Metal Components– Non-GAAP Financial Measures and Reconciliations (Dollars in thousands) Fiscal Six Trailing Our Fiscal Three Months Ended Months Ended Twelve Months Mission & VisionJuly 30, October 29, January 28, April 29, April 29, April 29, 2017 2017 2018 2018 2018 2018 Total Sales $ 166,305 $ 181,288 $ 146,832 $ 168,456 $ 315,288 $ 662,881 External Sales 140,639 155,183 127,528 147,661 275,189 571,011 Operating Income, GAAP 23,276 23,119 17,089 22,082 39,171 85,566 Restructuring and impairment 60 69 (1,403) 120 (1,283) (1,154) Gain on insurance recovery (148) - - - - (148) Adjusted Operating Income 23,188 23,188 15,686 22,202 37,888 84,264 Other income and expense 55 84 53 67 120 259 Depreciation and amortization 1,266 1,422 1,576 1,444 3,020 5,708 Adjusted EBITDA $ 24,509 $ 24,694 $ 17,315 $ 23,713 $ 41,028 $ 90,231 Year over year growth, Total sales (0.1)% 8.9 % 9.4 % 8.8 % 9.1 % 6.6 % Year over year growth, External Sales 0.1 % 10.9 % 10.4 % 10.8 % 10.6 % 7.9 % Operating Income Margin 14.0 % 12.8 % 11.6 % 13.1 % 12.4 % 12.9 % Adjusted Operating Income Margin 13.9 % 12.8 % 10.7 % 13.2 % 12.0 % 12.7 % Adjusted EBITDA Margin 14.7 % 13.6 % 11.8 % 14.1 % 13.0 % 13.6 % Fiscal Six Trailing Fiscal Three Months Ended Months Ended Twelve Months July 31, October 30, January 29, April 30, April 30, April 30, 2016 2016 2017 2017 2017 2017 Total Sales $ 166,512 $ 166,532 $ 134,173 $ 154,895 $ 289,068 $ 622,112 External Sales 140,560 139,968 115,557 133,290 248,847 529,375 Operating Income, GAAP 26,803 21,254 12,376 19,997 32,373 80,430 Restructuring and impairment 202 103 305 129 434 739 Gain on insurance recovery - - - (420) (420) (420) Adjusted Operating Income 27,005 21,357 12,681 19,706 32,387 80,749 Other income and expense 92 (27) 28 52 80 145 Depreciation and amortization 1,365 1,406 1,334 1,302 2,636 5,407 Adjusted EBITDA $ 28,462 $ 22,736 $ 14,043 $ 21,060 $ 35,103 $ 86,301 Operating Income Margin 16.1 % 12.8 % 9.2 % 12.9 % 11.2 % 12.9 % Adjusted Operating Income Margin 16.2 % 12.8 % 9.5 % 12.7 % 11.2 % 13.0 % Adjusted EBITDA Margin 17.1 % 13.7 % 10.5 % 13.6 % 12.1 % 13.9 % 20

Insulated Metal Panels – Non-GAAP Financial Measures and Reconciliations (Dollars in thousands) Fiscal Six Trailing Fiscal Three Months Ended Months Ended Twelve Months Our Mission & VisionJuly 30, October 29, January 28, April 29, April 29, April 29, 2017 2017 2018 2018 2018 2018 Total Sales $ 119,730 $ 123,542 $ 110,794 $ 113,413 $ 224,207 $ 467,479 External Sales 98,026 105,064 97,513 99,792 197,305 400,395 Operating Income, GAAP 11,468 14,895 7,071 1,540 8,611 34,974 Restructuring and impairment 8 683 1,284 88 1,372 2,063 Strategic development and acquisition related costs - 90 300 61 361 451 Loss on disposition of business - - - 6,686 6,686 6,686 Unreimbursed business interruption costs 235 28 - - - 263 Adjusted Operating Income 11,711 15,696 8,655 8,375 17,030 44,437 Other income and expense (211) 356 (273) 223 (50) 95 Depreciation and amortization 4,516 4,742 4,388 4,335 8,723 17,981 Adjusted EBITDA $ 16,016 $ 20,794 $ 12,770 $ 12,933 $ 25,703 $ 62,513 Year over year growth, Total sales 13.3 % 12.3 % 16.4 % 10.2 % 13.2 % 13.0 % Year over year growth, External Sales 4.2 % 13.4 % 18.3 % 15.0 % 16.6 % 12.5 % Operating Income Margin 9.6 % 12.1 % 6.4 % 1.4 % 3.8 % 7.5 % Adjusted Operating Income Margin 9.8 % 12.7 % 7.8 % 7.4 % 7.6 % 9.5 % Adjusted EBITDA Margin 13.4 % 16.8 % 11.5 % 11.4 % 11.5 % 13.4 % Fiscal Six Trailing Fiscal Three Months Ended Months Ended Twelve Months July 31, October 30, January 29, April 30, April 30, April 30, 2016 2016 2017 2017 2017 2017 Total Sales $ 105,694 $ 110,001 $ 95,195 $ 102,937 $ 198,132 $ 413,827 External Sales 94,059 92,648 82,441 86,773 169,214 355,921 Operating Income, GAAP 8,911 7,513 2,192 19,377 21,569 37,993 Restructuring and impairment 59 404 - - - 463 Strategic development and acquisition related costs 9 - - - - 9 Gain on insurance recovery - - - (9,181) (9,181) (9,181) Unreimbursed business interruption costs - - - 191 191 191 Adjusted Operating Income 8,979 7,917 2,192 10,387 12,579 29,475 Other income and expense 32 270 35 340 375 677 Depreciation and amortization 4,357 3,926 4,392 4,258 8,650 16,933 Adjusted EBITDA $ 13,368 $ 12,113 $ 6,619 $ 14,985 $ 21,604 $ 47,085 Operating Income Margin 8.4 % 6.8 % 2.3 % 18.8 % 10.9 % 9.2 % Adjusted Operating Income Margin 8.5 % 7.2 % 2.3 % 10.1 % 6.3 % 7.1 % Adjusted EBITDA Margin 12.6 % 11.0 % 7.0 % 14.6 % 10.9 % 11.4 % 21

Metal Coil Coating– Non-GAAP Financial Measures and Reconciliations (Dollars in thousands) Fiscal Six Trailing Our Mission & VisionFiscal Three Months Ended Months Ended Twelve Months July 30, October 29, January 28, April 29, April 29, April 29, 2017 2017 2018 2018 2018 2018 Total Sales $ 95,261 $ 98,550 $ 88,343 $ 95,190 $ 183,533 $ 377,344 External Sales 48,556 50,257 48,020 52,480 100,500 199,313 Operating Income, GAAP 7,107 1,419 5,376 7,129 12,505 21,031 Goodwill impairment - 6,000 - - - 6,000 Adjusted Operating Income 7,107 7,419 5,376 7,129 12,505 27,031 Depreciation and amortization 2,063 2,065 2,058 2,085 4,143 8,271 Adjusted EBITDA $ 9,170 $ 9,484 $ 7,434 $ 9,214 $ 16,648 $ 35,302 Year over year growth, Total sales (1.5)% 2.7 % 0.0% 9.8 % 4.8 % 2.6 % Year over year growth, External Sales (7.1)% (1.7)% (1.4)% 14.2 % 6.2 % 0.7 % Operating Income Margin 7.5 % 1.4 % 6.1 % 7.5 % 6.8 % 5.6 % Adjusted Operating Income Margin 7.5 % 7.5 % 6.1 % 7.5 % 6.8 % 7.2 % Adjusted EBITDA Margin 9.6 % 9.6 % 8.4 % 9.7 % 9.1 % 9.4 % Fiscal Six Trailing Fiscal Three Months Ended Months Ended Twelve Months July 31, October 30, January 29, April 30, April 30, April 30, 2016 2016 2017 2017 2017 2017 Total Sales $ 96,684 $ 95,987 $ 88,340 $ 86,729 $ 175,069 $ 367,740 External Sales 52,263 51,102 48,684 45,945 94,629 197,994 Operating Income, GAAP 10,531 9,310 6,706 6,227 12,933 32,774 Adjusted Operating Income 10,531 9,310 6,706 6,227 12,933 32,774 Other income and expense 2 - 31 - 31 33 Depreciation and amortization 2,214 1,849 2,106 2,009 4,115 8,178 Adjusted EBITDA $ 12,747 $ 11,159 $ 8,843 $ 8,236 $ 17,079 $ 40,985 Operating Income Margin 10.9 % 9.7 % 7.6 % 7.2 % 7.4 % 8.9 % Adjusted Operating Income Margin 10.9 % 9.7 % 7.6 % 7.2 % 7.4 % 8.9 % Adjusted EBITDA Margin 13.2 % 11.6 % 10.0 % 9.5 % 9.8 % 11.1 % 22

Our Mission & Vision K. DARCEY MATTHEWS Vice President, Investor Relations E: darcey.matthews@ncigroup.com 281.897.7785 ncibuildingsystems.com