Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FULTON FINANCIAL CORP | a8-k6x5x18.htm |

INVESTOR PRESENTATION D A T A AS OF M A R C H 3 1 , 2 0 1 8 U N L E S S O T H E R W I S E N O T E D

FORWARD-LOOKING STATEMENTS This presentation may contain forward-looking statements with respect to the Corporation’s financial condition, results of operations and business. Do not unduly rely on forward-looking statements. Forward-looking statements can be identified by the use of words such as "may," "should," "will," "could," "estimates," "predicts," "potential," "continue," "anticipates," "believes," "plans," "expects," "future," "intends," “projects,” the negative of these terms and other comparable terminology. These forward looking statements may include projections of, or guidance on, the Corporation’s future financial performance, expected levels of future expenses, anticipated growth strategies, descriptions of new business initiatives and anticipated trends in the Corporation’s business or financial results. Forward-looking statements are neither historical facts, nor assurance of future performance. Instead, they are based on current beliefs, expectations and assumptions regarding the future of the Corporation’s business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward- looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Corporation’s control, and actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not unduly rely on any of these forward-looking statements. Any forward-looking statement is based only on information currently available and speaks only as of the date when made. The Corporation undertakes no obligation, other than as required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. A discussion of certain risks and uncertainties affecting the Corporation, and some of the factors that could cause the Corporation’s actual results to differ materially from those described in the forward-looking statements, can be found in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2017 which has been filed with the Securities and Exchange Commission (the “SEC”) and is available in the Investor Relations section of the Corporation’s website (www.fult.com) and on the SEC’s website (www.sec.gov) and in the Corporation’s subsequent filings with the SEC. The Corporation uses certain non-GAAP financial measures in this presentation. These non-GAAP financial measures are reconciled to the most comparable GAAP measures at the end of this presentation. 2

WHY FULTON? • Risk Management Foundation • Management Depth and Experience • Stability of Geographic Markets / Franchise Value • Strong Capital & Reserves • Commitment to Enhancing Shareholder Value • Relationship Banking Strategy / Customer Experience • Quality Loan Growth / Solid Asset Quality • Attractive Core Deposit Profile • Prudent Expense Management • Balance Sheet Is Positioned for Rising Interest Rates 3

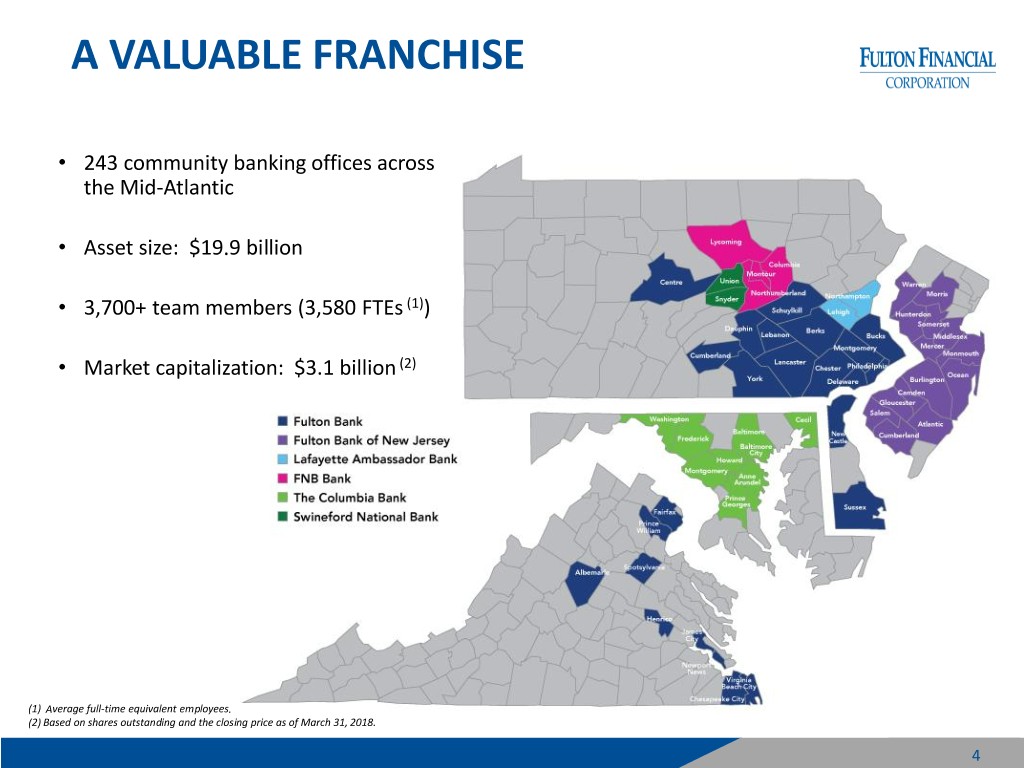

A VALUABLE FRANCHISE • 243 community banking offices across the Mid-Atlantic • Asset size: $19.9 billion • 3,700+ team members (3,580 FTEs (1)) • Market capitalization: $3.1 billion (2) (1) Average full-time equivalent employees. (2) Based on shares outstanding and the closing price as of March 31, 2018. 4

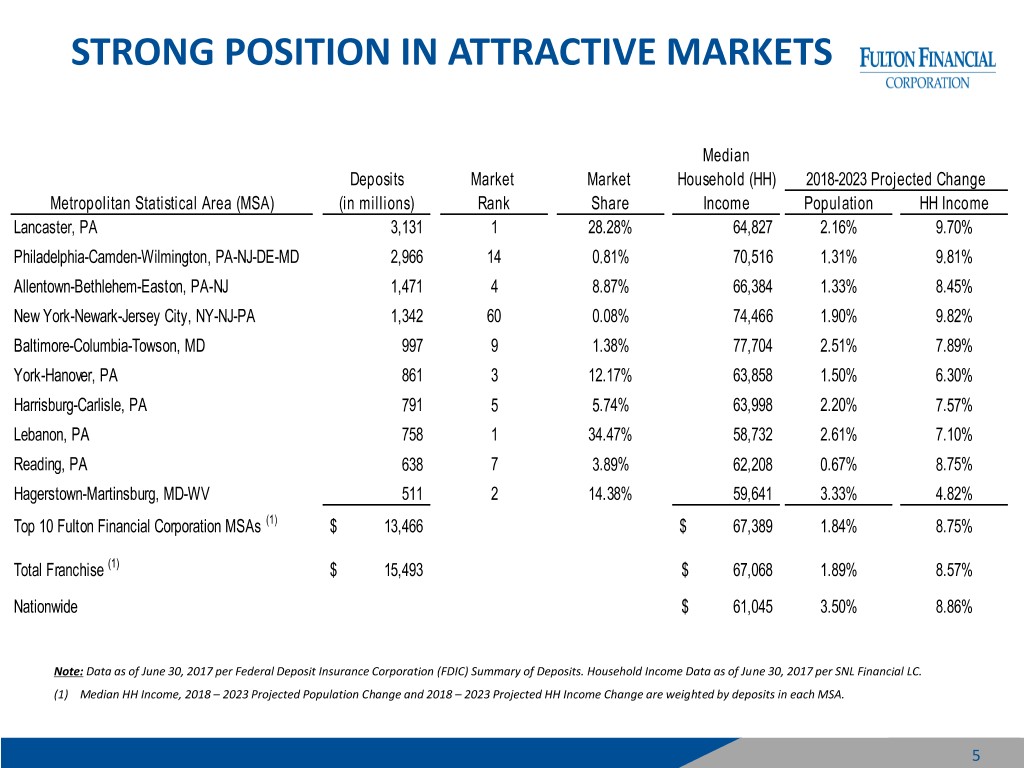

STRONG POSITION IN ATTRACTIVE MARKETS Median Deposits Market Market Household (HH) 2018-2023 Projected Change Metropolitan Statistical Area (MSA) (in millions) Rank Share Income Population HH Income Lancaster, PA 3,131 1 28.28% 64,827 2.16% 9.70% Philadelphia-Camden-Wilmington, PA-NJ-DE-MD 2,966 14 0.81% 70,516 1.31% 9.81% Allentown-Bethlehem-Easton, PA-NJ 1,471 4 8.87% 66,384 1.33% 8.45% New York-Newark-Jersey City, NY-NJ-PA 1,342 60 0.08% 74,466 1.90% 9.82% Baltimore-Columbia-Towson, MD 997 9 1.38% 77,704 2.51% 7.89% York-Hanover, PA 861 3 12.17% 63,858 1.50% 6.30% Harrisburg-Carlisle, PA 791 5 5.74% 63,998 2.20% 7.57% Lebanon, PA 758 1 34.47% 58,732 2.61% 7.10% Reading, PA 638 7 3.89% 62,208 0.67% 8.75% Hagerstown-Martinsburg, MD-WV 511 2 14.38% 59,641 3.33% 4.82% Top 10 Fulton Financial Corporation MSAs (1) $ 13,466 $ 67,389 1.84% 8.75% Total Franchise (1) $ 15,493 $ 67,068 1.89% 8.57% Nationwide $ 61,045 3.50% 8.86% Note: Data as of June 30, 2017 per Federal Deposit Insurance Corporation (FDIC) Summary of Deposits. Household Income Data as of June 30, 2017 per SNL Financial LC. (1) Median HH Income, 2018 – 2023 Projected Population Change and 2018 – 2023 Projected HH Income Change are weighted by deposits in each MSA. 5

DEEP EXECUTIVE BENCH WITH CONTINUITY Years in Years at Prior Financial Name Position Fulton Services Experience E. Philip Wenger Chairman and CEO 38 38 Various roles since joining in 1979 President/COO of Fulton Curtis Myers Financial Corporation and 27 27 Various roles since joining in 1990 Fulton Bank PwC, Banking and Investment Banking. Mark McCollom (1) Senior EVP/CFO 1 31 Joined Fulton in November 2017. Senior EVP/ Head – Meg Mueller 21 31 Various roles since joining in 1996 Commercial Banking Senior EVP/Head – Angela Snyder 15 31 Various roles since joining in 2002 Consumer Banking Angela Sargent Senior EVP/ CIO 25 25 Various roles since joining in 1992 Betsy Chivinski (1) Senior EVP/ CRO 23 35 Various roles since joining in 1994 (1) Includes years of service in public accounting as a financial services industry specialist 6

FIRST QUARTER 2018 HIGHLIGHTS Net income per diluted share: $0.28 in 1Q18, 47.4% increase from 4Q17 and 12.0% increase from 1Q17. 4Q17 included a $15.6 million, or $0.09 per share, charge related to the re-measurement of net deferred tax assets. Pre-Provision Net Revenue(1): $62.2 million, 10.4% decrease from 4Q17 and 0.5% increase from 1Q17 Linked Quarter Loan and Core Deposit Growth: 0.6% increase in average loans, while average demand and savings deposits decreased 4.1% Net Interest Income & Margin: Net interest income increased 1.3%, reflecting the impact of a 6 basis point increase in net interest margin Non-Interest Income(2) & Non-Interest Expense: 16.7% decrease in non-interest income and 1.3% decrease in non- interest expense Asset Quality: $2.8 million decrease in provision for credit losses. Overall credit metrics stable to improving. Year-over-Year Loan and Core Deposit Growth: 5.4% increase in average loans and 4.5% increase in average demand and savings deposits Net Interest Income & Margin: 10.0% increase in net interest income, reflecting the impact of loan growth and a 9 basis point increase in net interest margin Non-Interest Income(2) & Non-Interest Expense: 0.6% increase in non-interest income and 11.8% increase in non- interest expense Asset Quality: $0.8 million decrease in provision for credit losses (1) Non-GAAP based financial measure. Please refer to the calculation and management’s reason for using the measure on the slide titled “Non-GAAP Reconciliation” at the end of this presentation. (2) Excluding investment securities gains. 7

INCOME STATEMENT SUMMARY Change from 1Q18 4Q17(1) 1Q17 Net Income of $49.5 million, 45.5% increase from 4Q17 and 14.1% increase from 1Q17. 4Q17 included a $15.6 million, or $0.09 per share, (dollars in thousands, except per-share data) charge related to the re-measurement of net deferred tax assets Net Interest Income 151,318 $ 1,905 $ 13,739 Net Interest Income Provision for Credit Losses 3,970 (2,760) (830) . From 4Q17: Increase of 1.3%, reflecting the impact of a six basis point increase in net interest margin (NIM) Non-Interest Income 45,856 (9,168) 289 . From 1Q17: Increase of 10.0%, driven by loan growth and the impact of a Securities Gains 19 (1,913) (1,087) nine basis point increase in NIM Non-Interest Expense 136,661 (1,791) 14,386 Provision for Credit Losses Income before Income Taxes 56,562 (4,625) (615) $4.0 million provision in 1Q18. Overall credit metrics stable to improving. Income Taxes 7,082 (20,104) (6,715) Non-Interest Income . Net Income $ 49,480 $ 15,479 $ 6,100 From 4Q17: 16.7% decrease driven by decreases in commercial loan interest rate swap fees, debit card and Small Business Administration income. 4Q17 included a $5.1 million litigation settlement. . From 1Q17: 0.6% increase driven by higher investment management and Net income per share (diluted) $ 0.28 $ 0.09 $ 0.03 trust services income, merchant and cash management fee income, partially offset by decreases in commercial loan swap fee income. ROA (2) 1.01% 0.34% 0.09% Non-Interest Expenses . From 4Q17: 1.3% decrease driven by decreases in amortization of tax credit investments and FDIC insurance expense. Partially offsetting these (3) decreases, were increases in salaries and benefits, professional fees and ROE 9.02% 2.99% 0.80% occupancy costs. . From 1Q17: 11.8% increase driven by salaries and benefits, other outside services, professional fees and FDIC insurance expense (4) ROE (tangible) 11.85% 3.94% 0.92% Income Taxes 12.5% effective tax rate (ETR) in 1Q18 vs. 44.4% in 4Q17 and 24.1% in 1Q17. Excluding the Tax Charge, ETR for 4Q17 was 18.9%. Efficiency ratio (4) 67.5% 3.3% 3.3% (1) Includes the impact of the $15.6 million charge for the re-measurement of net deferred tax assets (“Tax Charge”). Refer to slide 28 for additional information. (2) ROA is return an average assets determined by dividing net income for the period indicated by average assets, annualized. (3) ROE is return on average shareholders’ equity determined by dividing net income for the period indicated by average shareholders’ equity, annualized. (4) Non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on the slide titled “Non-GAAP Reconciliation” at the end of this presentation. 8

NET INTEREST INCOME AND MARGIN Net Interest Income & Net Interest Margin Average Interest-Earning Assets & Yields ($ IN MILLIONS) ($ IN BILLIONS) 3.83% 3.93% 3.74% 3.78% 3.80% $20.0 4.00% $160.0 4.00% $15.0 $140.0 3.50% $15.4 $15.6 $15.7 $10.0 $14.9 $15.1 2.00% 3.35% 3.29% 3.27% 3.29% ~ $730 $120.0 3.26% 3.00% $5.0 million $2.9 $2.9 $3.1 $3.2 $2.9 $100.0 2.50% $- 0.00% 1Q17 2Q17 3Q17 4Q17 ~1Q18 $610 million $80.0 2.00% Securities & Other Loans Earning Asset Yield (FTE) $146.8 $149.4 $151.3 $137.6 $141.6 $60.0 1.50% Average Liabilities & Rates $40.0 1.00% ($ IN BILLIONS) $20.0 1.00% $20.0 0.50% $1.9 $1.4 $1.7 $1.4 0.80% $15.0 $1.7 $- 0.00% 0.77% 0.78% 0.82% 0.72% 0.60% 1Q17 2Q17 3Q17 4Q17 1Q18 0.69% $10.0 0.40% Net Interest Income $5.0 $16.1 Net Interest Margin (Fully-taxable equivalent basis, or FTE) $14.9 $15.1 $15.9 $15.4 0.20% $- 0.00% 1Q17 2Q17 3Q17 4Q17 1Q18 Deposits Borrowings Cost of Interest-bearing Liabilities 9

LOAN PORTFOLIO COMPOSITION & YIELD Average loans for the first quarter of 2018 are up 5.4% compared to the first quarter of 2017. $16.0 $15.7 12.00% $15.2 $0.6 $0.4 $1.0 $14.1 $0.9 $14.0 $13.3 $0.4 $12.9 $0.8 10.00% $1.8 $2.0 $0.4 $0.7 $12.0 $0.6 $1.5 $1.4 $1.4 $1.6 $1.5 $1.7 8.00% $10.0 $1.7 (1) Yield Loan Portfolio Total $1.7 $4.2 $4.3 $8.0 $4.1 6.00% $3.7 $3.9 4.21% 4.07% 4.19% $6.0 4.04% 3.95% 4.00% $4.0 $6.2 $6.3 $5.6 Average Loan PortfolioLoan Average Balances,in billions $5.1 $5.2 2.00% $2.0 $- 0.00% 2014 2015 2016 2017 Mar 2018 Comm'l Mtg Comm'l Home Equity Res Mtg Construction Consumer/Other FTE loan yield (1) Note: Loan portfolio composition is based on average balances for the years ended December 31, 2014 to 2017, and quarter ended March 31, 2018. (1) Presented on a fully-taxable equivalent basis. 10

DEPOSIT PORTFOLIO COMPOSITION Average demand and savings are up 4.5% compared to the first quarter of 2017; total average deposits are up 3.6%. Year Ended December 31, 2016 Three Months Ended March 31, 2017 Three Months Ended March 31, 2018 19% 9% 17% 28%10% 18% 20% 19% 29% 28% 26% 24%24% 29% 10% 18% Time Deposits Non-Int DDA Int DDA Time Deposits Non-Int DDA Int DDA Time Deposits Non-Int DDA Int DDA Wholesale Money Mkt Savings Money Mkt Savings Money Mkt Savings Note: Deposit composition is based on average balances for the periods indicated. Average brokered deposits were $74.0 million and $0 as of the three months ended March 31, 2018 and 2017, respectively; the percentage balance in both comparative periods was 0%. 11

POSITIONED FOR RISING INTEREST RATE ENVIRONMENT MARCH 31, 2018 Rate Annual Change in % Change in Change (1) Net Interest Income (2) Net Interest Income (2) +300 bps $ 84.5 million 13.1% +200 bps $ 57.8 million 9.0% +100 bps $ 29.0 million 4.5% - 100 bps $ (49.0) million -7.6% 1) A variety of interest rate scenarios are used to measure the effects of sudden and gradual movements upward and downward in the yield curve. These results are compared to the results obtained in a flat or unchanged interest rate scenario. Simulation of net interest income is used primarily to measure the Corporation’s short- term earnings exposure to rate movements. The Corporation’s policy limits the potential exposure of net interest income, in a non-parallel instantaneous shock, to 10% of the base case net interest income for a 100 basis point shock in interest rates, 15% for a 200 basis point shock and 20% for a 300 basis point shock. A "shock" is an immediate upward or downward movement of interest rates. The shocks do not take into account changes in customer behavior that could result in changes to mix and/or volumes in the balance sheet, nor do they account for competitive pricing over the forward 12-month period. These results include the effect of implicit and explicit floors that limit further reduction in interest rates. 2) The actual impact of changes in interest rates on the Corporation’s net interest income may differ materially from the anticipated amounts presented above. 12

ASSET QUALITY ($ IN MILLIONS) Provision for Credit Losses Non-Performing Loans (NPLs) & NPLs to Loans $6.7 $6.7 $7.0 $160.0 2.00% $135.7 $136.5 $134.8 $134.6 $6.0 $131.5 $5.1 $4.8 $120.0 1.50% $5.0 $4.0 $4.0 $80.0 1.00% $3.0 0.88% 0.88% 0.88% 0.85% 0.86% $2.0 $40.0 0.50% $1.0 $0.0 0.00% $- 1Q17 2Q17 3Q17 4Q17 1Q18 1Q17 2Q17 3Q17 4Q17 1Q18 NPL NPLs/Loans Net Charge-offs (NCOs) and NCOs to Average Loans Allowance for Credit Losses (Allowance) to NPLs & Loans 150.0% 3.00% $6.0 0.50% 131% 129% 128% 131% 131% $5.3 $5.4 125.0% $4.3 0.40% $4.0 100.0% 2.00% $4.0 $3.5 0.30% 75.0% 0.11% 0.14% 0.14% 0.20% $2.0 0.09% 0.10% 50.0% 1.00% 1.15% 1.14% 1.13% 1.12% 1.12% 0.10% 25.0% $- 0.00% 0.0% 0.00% 1Q17 2Q17 3Q17 4Q17 1Q18 1Q17 2Q17 3Q17 4Q17 1Q18 NCOs NCOs/Average Loans (annualized) Allowance/NPLs Allowance/Loans 13

NON-INTEREST INCOME ($ IN MILLIONS) Non-Interest Income, Excluding Securities Gains Mortgage Banking Income & Spreads $7.0 4.00% $6.1 $6.0 3.50% $4.8 3.00% $60.0 $5.0 $4.6 $4.4 $4.2 2.50% $4.0 2.00% $3.0 $50.0 1.50% $2.0 1.62% 1.62% 1.44% ~ $730 1.36% 1.00% 1.11% $1.0 million 0.50% $40.0 $- 0.00% 1Q17 2Q17(2) 3Q17 4Q17 1Q18~ $610 million $55.0 Gains on Sales Servicing Income Spread on Sales (1) $30.0 $50.9 Other Non-Interest Income $45.6 $47.4 $45.9 $20.0 $50.6 $50.0 $44.8 $42.6 $41.0 $41.7 $10.0 $40.0 $30.0 $- $20.0 1Q17 2Q17 3Q17 4Q17 1Q18 $10.0 $- 1Q17 2Q17 3Q17 4Q17 1Q18 (1) Represents Gains on Sales divided by total new commitments to originate residential mortgage loans for customers. Invt Mgmt & Trust Srvs Deposit Srv Chgs Oth Srv Chgs Other (2) Servicing income includes $1.3 million mortgage servicing rights recovery in 2Q17. 14

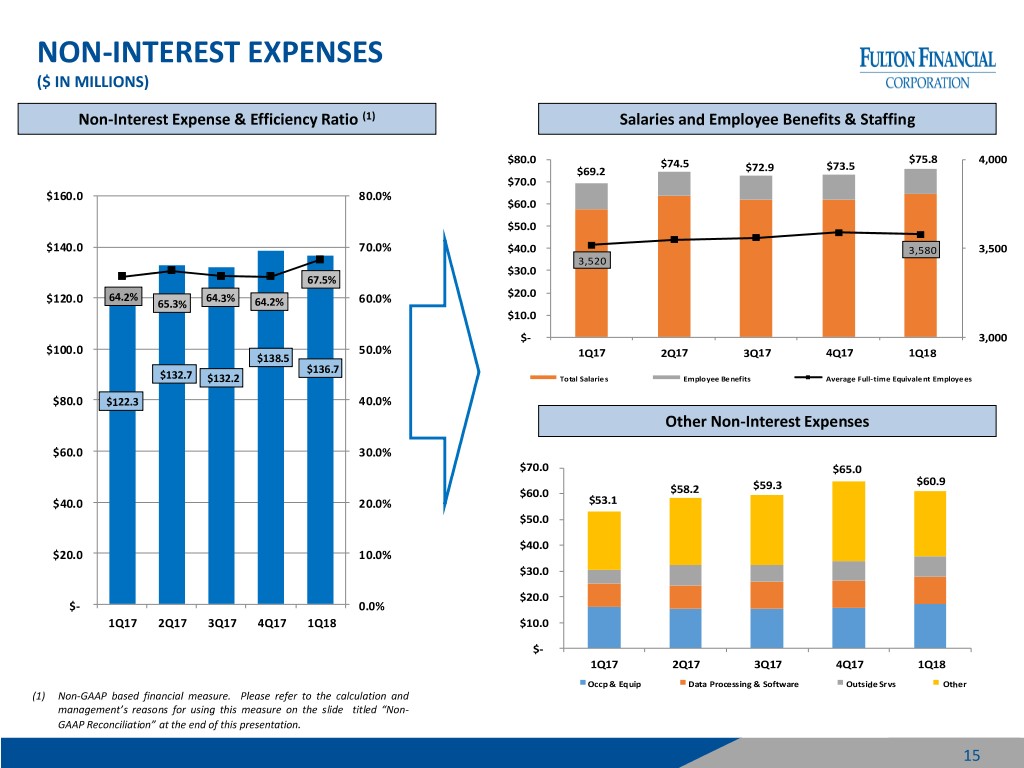

NON-INTEREST EXPENSES ($ IN MILLIONS) Non-Interest Expense & Efficiency Ratio (1) Salaries and Employee Benefits & Staffing $80.0 $74.5 $75.8 4,000 $69.2 $72.9 $73.5 $70.0 $160.0 80.0% $60.0 $50.0 $140.0 70.0% $40.0 3,580 3,500 3,520 $30.0 67.5% $20.0 ~ $730 $120.0 64.2% 64.3% 64.2% 60.0% 65.3% million $10.0 $- 3,000 ~ $610 $100.0 50.0% 1Q17 2Q17 3Q17 4Q17 1Q18 $138.5 million $136.7 $132.7 $132.2 Total Salaries Employee Benefits Average Full-time Equivalent Employees $80.0 $122.3 40.0% Other Non-Interest Expenses $60.0 30.0% $70.0 $65.0 $59.3 $60.9 $60.0 $58.2 $40.0 20.0% $53.1 $50.0 $40.0 $20.0 10.0% $30.0 $20.0 $- 0.0% 1Q17 2Q17 3Q17 4Q17 1Q18 $10.0 $- 1Q17 2Q17 3Q17 4Q17 1Q18 Occp & Equip Data Processing & Software Outside Srvs Other (1) Non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on the slide titled “Non- GAAP Reconciliation” at the end of this presentation. 15

PROFITABILITY & CAPITAL ROA(1) ROE and ROE (tangible)(2) 1.20% 11.52% 11.85% 12.00% 10.93% 11.06% 0.98% 1.01% 1.00% 0.92% 0.94% 8.76% 9.02% 8.22% 8.36% 7.91% 0.80% 8.00% 0.67% 6.03% 0.60% 4.00% 0.40% 0.20% 0.00% 1Q17 2Q17 3Q17 4Q17(3) 1Q18 0.00% 1Q17 2Q17 3Q17 4Q17(3) 1Q18 ROE ROE (tangible) Tangible Common Equity Ratio(2) Net Income Per Diluted Share 12.0% $0.30 $0.28 $0.28 $0.26 $0.25 8.7% 8.7% 8.7% 8.7% 8.8% $0.25 8.0% $0.19 $0.20 $0.15 4.0% $0.10 $0.05 0.0% $- 1Q17 2Q17 3Q17 4Q17 1Q18 1Q17 2Q17 3Q17 4Q17(3) 1Q18 (1) ROA is return an average assets determined by dividing net income for the period indicated by average assets, annualized. (2) Non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on the slide titled “Non-GAAP Reconciliation” at the end of this presentation. (3) 4Q17 reflects the impact of the $15.6 million Tax Charge. 16

2018 OUTLOOK Changes from original outlook have been underlined. • Loans & Deposits: Average annual loan and core deposit growth rates in the mid single digits • Asset Quality: Provision will reflect loan growth and previously disclosed 2Q18 individual credit loss • Non-Interest Income(1): Low single-digit growth • Non-Interest Expense: Including amortization of tax free investments, low single-digit growth rate • Capital: Focus on utilizing capital to support loan growth and provide appropriate returns to shareholders • Net Interest Margin: For the full year 2018, the outlook for NIM is an increase of 5 to 10 basis points over 2017, including the impact of tax reform on tax equivalent net interest income. • Effective Tax Rate: Anticipated to range between 11% to 14% depending on level of tax credits realized (1) Excluding securities gains and the litigation settlement of $5.1 million recognized in the fourth quarter of 2017 17

APPENDIX

AVERAGE LOAN PORTFOLIO AND YIELDS Change in 1Q 2018 Balance From Yield From Balance Yield 4Q 2017 1Q 2017 4Q 2017 1Q 2017 (dollars in millions) Comm'l Mort $ 6,306 4.16% $ 73 $ 267 0.07% 0.18% Commercial 4,289 4.15% 26 84 0.10% 0.26% Resid Mort 1,958 3.85% 32 320 0.02% 0.09% Home Equity 1,539 4.65% (22) (74) 0.13% 0.47% Construction 984 4.22% (20) 143 (0.05%) 0.25% Consumer 316 4.67% 4 32 (0.08%) (0.59%) Leasing 261 4.53% 8 28 0.05% 0.10% Other 8 - % - 4 - % - % - Total Loans $ 15,661 4.19% $ 101 $ 804 0.05% 0.19% Note: Three months ended March 31, 2018 is presented on a fully taxable-equivalent basis using a 21% Federal tax rate and statutory interest expense disallowances. Prior periods are presented on a fully taxable-equivalent basis using a 35% Federal tax rate and statutory interest expense disallowances. Average loan portfolio and yield are for the three months ended March 31, 2018, December 31, 2017 and March 31, 2017. 19

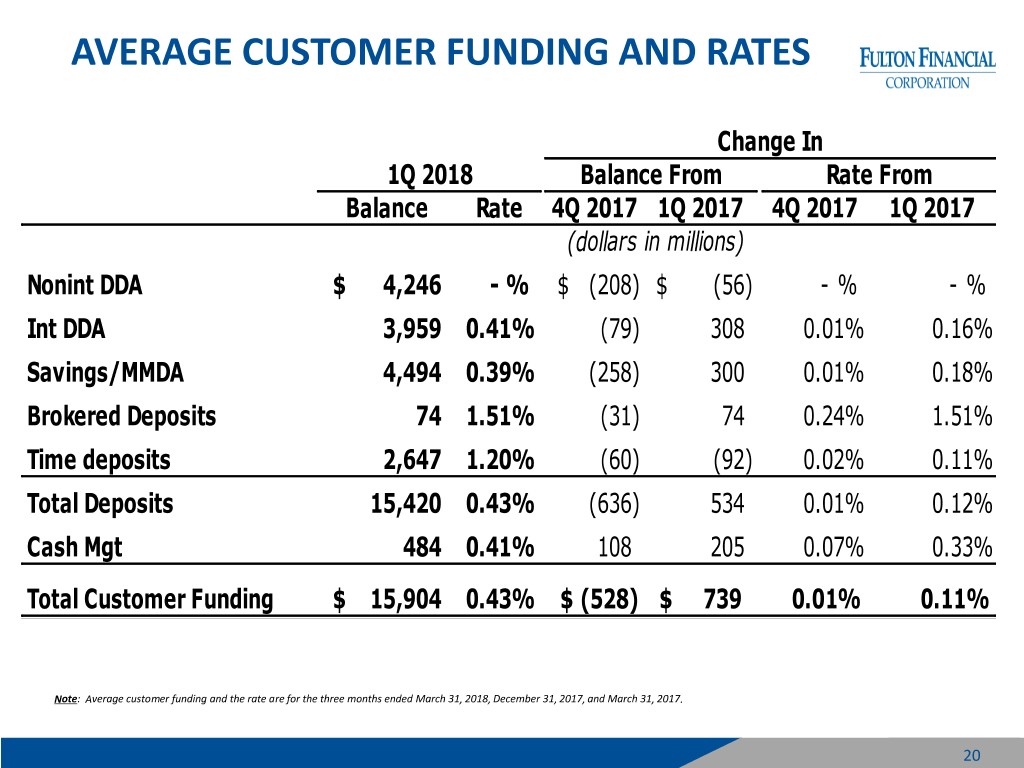

AVERAGE CUSTOMER FUNDING AND RATES Change In 1Q 2018 Balance From Rate From Balance Rate 4Q 2017 1Q 2017 4Q 2017 1Q 2017 (dollars in millions) Nonint DDA $ 4,246 - % $ (208) $ (56) - % - % Int DDA 3,959 0.41% (79) 308 0.01% 0.16% Savings/MMDA 4,494 0.39% (258) 300 0.01% 0.18% Brokered Deposits 74 1.51% (31) 74 0.24% 1.51% Time deposits 2,647 1.20% (60) (92) 0.02% 0.11% Total Deposits 15,420 0.43% (636) 534 0.01% 0.12% Cash Mgt 484 0.41% 108 205 0.07% 0.33% Total Customer Funding $ 15,904 0.43% $ (528) $ 739 0.01% 0.11% Note: Average customer funding and the rate are for the three months ended March 31, 2018, December 31, 2017, and March 31, 2017. 20

LOAN DISTRIBUTION BY STATE AS OF MARCH 31, 2018 Comm'l Consumer Comm'l Mortgage Constr. Res. Mtg. & Other Total (in thousands) Pennsylvania $ 3,176,454 $ 3,305,385 $ 471,864 $ 730,699 $ 1,271,875 $ 8,956,277 New Jersey 541,364 1,444,925 180,339 268,378 402,727 2,837,733 Maryland 340,814 693,090 159,478 439,473 276,677 1,909,532 Virginia 108,865 532,932 79,783 454,068 59,022 1,234,670 Delaware 131,575 356,176 84,667 83,906 101,748 758,072 $ 4,299,072 $ 6,332,508 $ 976,131 $ 1,976,524 $ 2,112,049 $ 15,696,284 21

NON-PERFORMING LOANS(1) AS OF MARCH 31, 2018 Comm'l Consumer Ending Loans NPLs/Loans Comm'l Mortgage Constr. Res. Mtg. & Other Total NPLs by State by State (dollars in thousands) Pennsylvania $ 33,582 $ 13,689 $ 4,113 $ 7,885 $ 5,711 $ 64,980 $ 8,956,277 0.73% New Jersey 6,359 13,147 1,763 4,648 4,759 30,676 2,837,733 1.08% Maryland 5,707 905 33 827 1,117 8,589 1,909,532 0.45% Virginia 5,265 2,735 1,567 5,815 702 16,084 1,234,670 1.30% Delaware 4,002 5,707 3,455 994 155 14,313 758,072 1.89% $ 54,915 $ 36,183 $ 10,931 $ 20,169 $ 12,444 $ 134,642 $ 15,696,284 0.86% Ending Loans $ 4,299,072 $ 6,332,508 $ 976,131 $ 1,976,524 $ 2,112,049 $ 15,696,284 Non-performing Loan % (3/31/18) 1.28% 0.57% 1.12% 1.02% 0.59% 0.86% Non-performing Loan % (3/31/17) 1.05% 0.60% 1.53% 1.42% 0.65% 0.88% (1) Includes loans ≥ 90 days past due and accruing, and non-accrual loans. 22

NET CHARGE-OFFS (RECOVERIES) THREE MONTHS ENDED MARCH 31, 2018 Annualized Comm'l Consumer Average Loans Charge-Offs to Comm'l Mortgage Constr. Res. Mtg. & Other Total by State Average Loans (dollars in thousands) Pennsylvania $ 2,707 $ 142 $ 148 $ 26 $ 481 $ 3,504 $ 8,967,781 0.16% New Jersey 204 (147) (83) 47 465 486 2,830,017 0.07% Maryland 19 (1) (213) 18 250 73 1,887,274 0.02% Virginia - - - (30) - (30) 1,220,704 -0.01% Delaware - (6) - (6) 14 2 755,256 0.00% $ 2,930 $ (12) $ (148) $ 55 $ 1,210 $ 4,035 $ 15,661,032 0.10% Average Loans $ 4,288,634 $ 6,305,821 $ 984,242 $ 1,958,505 $ 2,123,830 $ 15,661,032 Annualized Net Charge-offs (Recoveries) to Average Loans 0.27% 0.00% (0.06%) 0.01% 0.23% 0.10% 23

INVESTMENT PORTFOLIO MARCH 31, 2018 Weighted Avg. Remaining Life Amortized Unrealized Estimated (in years) Cost Gain (Loss) Fair Value (dollars in millions) Residential mortgage-backed securities 5.0 $ 1,085 $ (31) $ 1,054 Collateralized mortgage obligations 3.7 696 (16) 680 State and municipal securities 8.0 414 (8) 406 Commercial mortgage-backed securities 3.7 231 (4) 227 Auction rate securities 5.0 107 (4) 103 Corporate debt securities 9.1 101 1 102 U.S. Government sponsored agency securities 5.4 21 - 21 Total Investments 5.7 $ 2,655 $ (62) $ 2,593 24

NON-INTEREST INCOME (EXCLUDING SECURITIES GAINS) Change From 1Q 2018 4Q 2017 1Q 2017 4Q 2017 1Q 2017 (in thousands) Other service charges and fees: Merchant fees $ 4,115 $ 4,308 $ 3,607 $ (193) $ 508 Debit card income 2,817 3,526 2,665 (709) 152 Commercial loan interest rate swap fees 1,291 2,914 3,058 (1,623) (1,767) Letter of credit fees 992 1,037 1,200 (45) (208) Foreign exchange incomce 533 510 334 23 199 Other 1,671 1,534 1,573 137 98 Total 11,419 13,829 12,437 (2,410) (1,018) Service charges on deposit accounts: Overdraft fees 5,145 5,609 5,469 (464) (324) Cash management fees 4,317 3,669 3,537 648 780 Other 2,500 3,392 3,394 (892) (894) Total 11,962 12,670 12,400 (708) (438) Investment management and trust services 12,871 13,152 11,808 (281) 1,063 Mortgage banking income 4,193 4,386 4,596 (193) (403) Other: Credit card income 2,816 2,778 2,648 38 168 Small business administration lending income 357 1,355 429 (998) (72) Other income 2,238 6,854 1,249 (4,616) 989 Total 5,411 10,987 4,326 (5,576) 1,085 Total Non-Interest Income $ 45,856 $ 55,024 $ 45,567 $ (9,168) $ 289 25

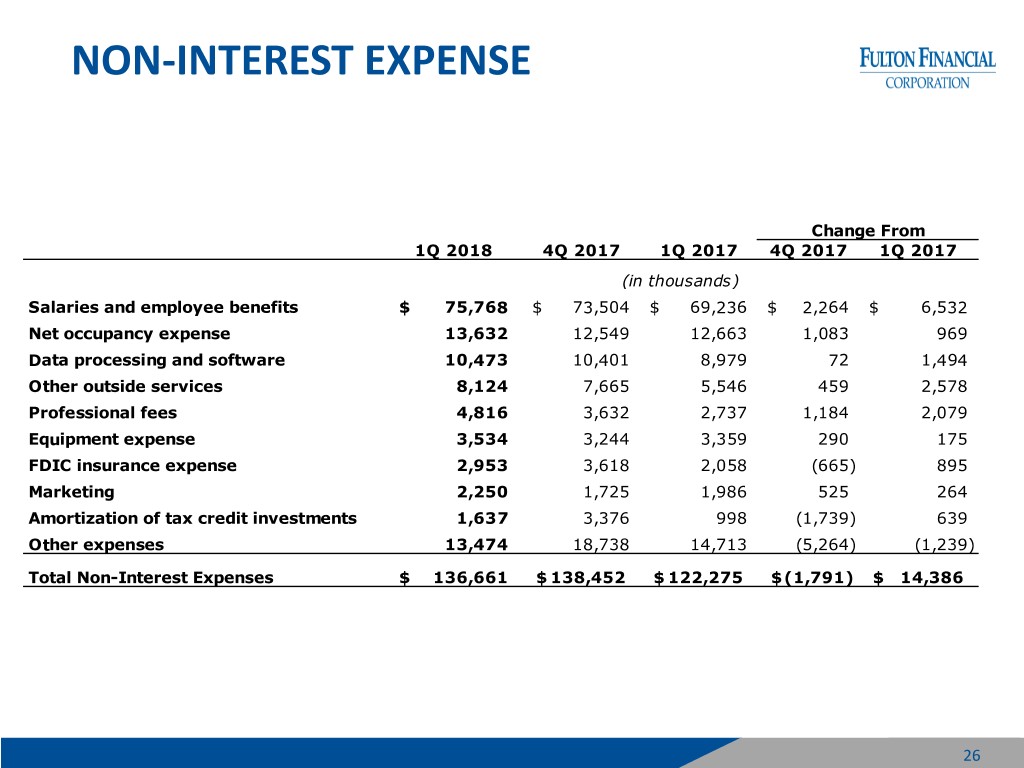

NON-INTEREST EXPENSE Change From 1Q 2018 4Q 2017 1Q 2017 4Q 2017 1Q 2017 (in thousands) Salaries and employee benefits $ 75,768 $ 73,504 $ 69,236 $ 2,264 $ 6,532 Net occupancy expense 13,632 12,549 12,663 1,083 969 Data processing and software 10,473 10,401 8,979 72 1,494 Other outside services 8,124 7,665 5,546 459 2,578 Professional fees 4,816 3,632 2,737 1,184 2,079 Equipment expense 3,534 3,244 3,359 290 175 FDIC insurance expense 2,953 3,618 2,058 (665) 895 Marketing 2,250 1,725 1,986 525 264 Amortization of tax credit investments 1,637 3,376 998 (1,739) 639 Other expenses 13,474 18,738 14,713 (5,264) (1,239) Total Non-Interest Expenses $ 136,661 $ 138,452 $ 122,275 $ (1,791) $ 14,386 26

A SUSTAINABLE PAYOUT Cash Dividend Per Common Share & Yield $0.52 4.5% $0.47 $0.48 (2) CAGR = 8.4% 4.0% $0.44 $0.41 $0.40 $0.38 3.5% $0.36 $0.34 (1) YieldDividend 3.0% $0.32 2.63% $0.32 2.92% $0.28 2.75% 2.70% 2.5% 2.44% $0.24 2.0% 2.18% $0.20 1.5% $0.16 $0.12 Cash Dividend Dividend Cash PerCommon Share $0.12 1.0% $0.08 0.5% $0.04 $0.00 0.0% 2013 2014 2015 2016 2017 1Q18 Cash Dividend Yield(1) (1) Annual dividend per share (1Q18 annualized) divided by period-end stock price. (2) Compounded annual growth rate from December 31, 2013 to annualized March 31, 2018. 27

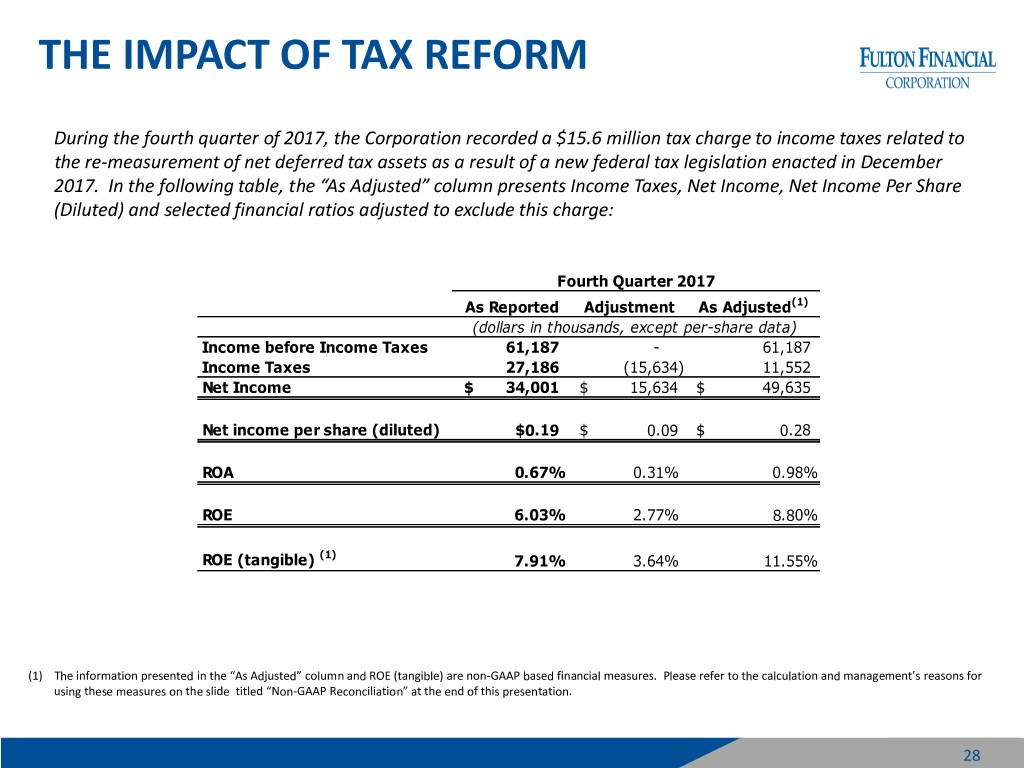

THE IMPACT OF TAX REFORM During the fourth quarter of 2017, the Corporation recorded a $15.6 million tax charge to income taxes related to the re-measurement of net deferred tax assets as a result of a new federal tax legislation enacted in December 2017. In the following table, the “As Adjusted” column presents Income Taxes, Net Income, Net Income Per Share (Diluted) and selected financial ratios adjusted to exclude this charge: Fourth Quarter 2017 As Reported Adjustment As Adjusted(1) (dollars in thousands, except per-share data) Income before Income Taxes 61,187 - 61,187 Income Taxes 27,186 (15,634) 11,552 Net Income $ 34,001 $ 15,634 $ 49,635 Net income per share (diluted) $0.19 $ 0.09 $ 0.28 ROA 0.67% 0.31% 0.98% ROE 6.03% 2.77% 8.80% ROE (tangible) (1) 7.91% 3.64% 11.55% (1) The information presented in the “As Adjusted” column and ROE (tangible) are non-GAAP based financial measures. Please refer to the calculation and management’s reasons for using these measures on the slide titled “Non-GAAP Reconciliation” at the end of this presentation. 28

NON-GAAP RECONCILIATION Note: The Corporation has presented the following non-GAAP (Generally Accepted Accounting Principles) financial measures because it believes that these measures provide useful and comparative information to assess trends in the Corporation's results of operations and financial condition. Presentation of these non-GAAP financial measures is consistent with how the Corporation evaluates its performance internally and these non- GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Corporation's industry. Investors should recognize that the Corporation's presentation of these non-GAAP financial measures might not be comparable to similarly-titled measures of other companies. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures and the Corporation strongly encourages a review of its condensed consolidated financial statements in their entirety. Three Months Ended Mar 31 Jun 30 Sep 30 Dec 31 Mar 31 2017 2017 2017 2017 2018 Efficiency ratio Non-interest expense $ 122,275 $ 132,695 $ 132,157 $ 138,452 $ 136,661 Less: Amortization of tax credit investments (998) (3,151) (3,503) (3,376) (1,637) Non-interest expense (numerator) $ 121,277 $ 129,544 $ 128,654 $ 135,076 $ 135,024 Net interest income (fully taxable-equivalent) $ 143,243 $ 147,349 $ 152,721 $ 155,253 $ 154,232 Plus: Total Non-interest income 46,673 52,371 51,974 56,956 45,875 Less: Investment securities gains (1,106) (1,436) (4,597) (1,932) (19) Net interest income (denominator) $ 188,810 $ 198,284 $ 200,098 $ 210,277 $ 200,088 Efficiency ratio 64.2% 65.3% 64.3% 64.2% 67.5% Three Months Ended Mar 31 Jun 30 Sep 30 Dec 31 Mar 31 2017 2017 2017 2017 2018 Return on Average Shareholders' Equity (ROE) (Tangible) Net income (numerator) $ 43,380 $ 45,467 $ 48,905 $ 34,001 $ 49,480 Average shareholders' equity $ 2,140,547 $ 2,181,189 $ 2,215,389 $ 2,237,031 $ 2,224,615 Less: Average goodwill and intangible assets (531,556) (531,556) (531,556) (531,556) (531,556) Average tangible shareholders' equity (denominator) $ 1,608,991 $ 1,649,633 $ 1,683,833 $ 1,705,475 $ 1,693,059 Return on average shareholders' equity (tangible), annualized 10.93% 11.06% 11.52% 7.91% 11.85% 29

NON-GAAP RECONCILIATION (CONTINUED) Mar 31 Jun 30 Sep 30 Dec 31 Mar 31 2017 2017 2017 2017 2018 Tangible Common Equity to Tangible Assets (TCE Ratio) (dollars in thousands) Shareholders' equity $ 2,154,683 $ 2,191,770 $ 2,225,786 $ 2,229,857 $ 2,235,493 Less: Intangible assets (531,556) (531,556) (531,556) (531,556) (531,556) Tangible shareholders' equity (numerator) $ 1,623,127 $ 1,660,214 $ 1,694,230 $ 1,698,301 $ 1,703,937 Total assets $ 19,178,576 $ 19,647,435 $ 20,062,860 $ 20,036,905 $ 19,948,941 Less: Intangible assets (531,556) (531,556) (531,556) (531,556) (531,556) Total tangible assets (denominator) $ 18,647,020 $ 19,115,879 $ 19,531,304 $ 19,505,349 $ 19,417,385 Tangible Common Equity to Tangible Assets 8.7% 8.7% 8.7% 8.7% 8.8% Three Months Ended Mar 31 Jun 30 Sep 30 Dec 31 Mar 31 2017 2017 2017 2017 2018 Pre-Provision Net Revenue (in thousands) Net interest income $ 137,579 $ 141,563 $ 146,809 $ 149,413 $ 151,318 Non-interest income 46,673 52,371 51,974 56,956 45,875 Less: Investment securities gains (1,106) (1,436) (4,597) (1,932) (19) Total Revenue 183,146 192,498 194,186 204,437 197,174 Non-interest expense 122,275 132,695 132,157 138,452 136,661 Less: Amortization of tax credit investments (998) (3,151) (3,503) (3,376) (1,637) 121,277 129,544 128,654 135,076 135,024 Pre-Provision Net Revenue $ 61,869 $ 62,954 $ 65,532 $ 69,361 $ 62,150 30

NON-GAAP RECONCILIATION (CONTINUED) Reconciliation of Net Income; Net Income per share, diluted; and Selected Financial Ratios, adjusted to exclude the charge recognized in the fourth quarter of 2017 related to the re-measurement of net deferred tax assets: T hree M o nths Ended D ec 31, 2017 Diluted earnings per share Net income $ 34,001 Plus: Re-measurement of net deferred tax assets 15,634 Net Income, adjusted (numerator) $ 49,635 Weighted average shares (diluted) (denominator) 176,374 Net income per share, diluted $ 0.28 Return on average assets Net income $ 34,001 Plus: Re-measurement of net deferred tax assets 15,634 Net Income, adjusted (numerator) $ 49,635 Average assets (denominator) $ 20,072,579 Return on average assets, annualized 0.98% Return on average shareholders' equity Net income $ 34,001 Plus: Re-measurement of net deferred tax assets 15,634 Net Income, adjusted (numerator) $ 49,635 Average shareholders' equity (denominator) $ 2,237,031 Return on average shareholders' equity, annualized 8.80% Return on average shareholders' equity (tangible) Net Income, as reported $ 34,001 Plus: Re-measurement of net deferred tax assets 15,634 Net Income, adjusted (numerator) $ 49,635 Average shareholders' equity $ 2,237,031 Less: Average goodw ill and intangible assets (531,556) Average tangible shareholders' equity (denominator) $ 1,705,475 Return on average shareholders' equity (tangible), annualized 11.55% 31

www.fult.com